Image Recognition Market by Technology (Digital Image Processing, Facial Recognition, Pattern Recognition), Component (Hardware, Software, and Services), Deployment Mode (On-premises & Cloud), Application, Vertical, and Region - Global Forecast to 2025

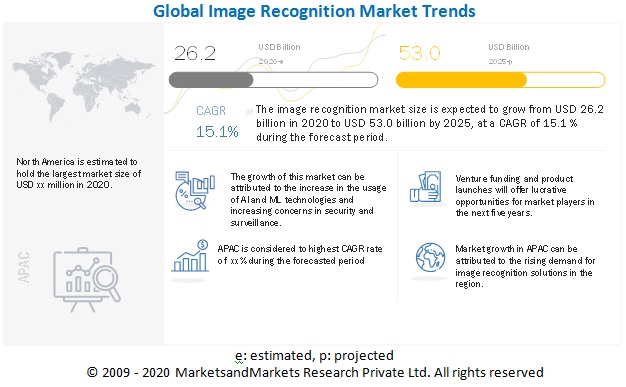

[243 Pages Report] The image recognition market is projected to grow at a CAGR of 15.1% during the forecast period to reach USD 53.0 billion by 2025 from an estimated USD 26.2 billion in 2020. Increased in the need for efficient and profitable retail execution processes with adherence to compliance standards is one of the major factors expected to drive the growth of this market.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Driver: Need for efficient and profitable retail execution processes with adherence to compliance standards

Image recognition solutions are revolutionizing the way companies manage customer interactions, market products online and offline, and manage store inventory. Image recognition technology is increasingly being used to search for products online for purchase. For example, Snapchats parent company, Snap, is currently working on developing a visual product feature in Snapchat that will leverage image recognition technology and help users to take pictures of products in the real world; and identify, browse, and purchase items on Amazon. With the boom in the e-commerce industry, even more so during the COVID-19 pandemic, entrepreneurs and retailers have realized that conventional strategies of sales promotions, marketing, and visual merchandising will not be sustainable in the industry in the long term. Hence, retailers are quickly adapting to the new era of AI and image recognition to deliver next level customer experience. The use of image recognition for shelf recognition, product placement, and maintaining compliance with merchandising standards is quickly gaining momentum. Image recognition technology is assisting manufacturers, retailers, and marketers to understand their market and react dynamically.

Restraint: High installation cost of image recognition services

The high cost involved in making image recognition systems could be a hindrance to the growth of the market. Most of the enabling technologies, such as face recognition, deep learning, computer vision, AI, ML, and gesture recognition, have huge development costs. Thus, companies that lack financial resources do not opt for image recognition offerings even if they are interested in such solutions to increase productivity. Well-known vendor solutions in the market such as Microsoft Computer Vision API, Microsoft Emotion API, Amazon Rekognition, Google Cloud Vision API, and IBM Watson Visual Recognition are highly priced, making it difficult for small companies to deploy them. The huge cost of implementing image recognition solutions and training AI enablers to execute a specific task will act as a deterrent for small retail and e-commerce businesses; this could prove to be a restraint for image recognition solution vendors during the forecast period.

Opportunity: Accelerating demand for cloud-powered image recognition solutions to aid representatives in smooth retail execution

Major cloud companies such as AWS, Microsoft, and Google are heavily investing in enhancing their image recognition market offerings to optimize in-store and online retail execution. The demand for cloud-based services has soared even more due to the outbreak of COVID-19. Intelligence Retail, a computer vision and AI provider for merchandising solutions, leverages the IBM cloud and analytics solution featuring cutting-edge Graphic Processing Units (GPUs) to help companies drive sales, decrease audit costs, boost performance, and drive customer loyalty. Microsoft is leveraging its Microsoft Azure stack to rapidly process huge data volumes for store shelf management and to empower representatives to gain real-time visibility into the retail execution process. In early 2019, Trax partnered with Google Cloud to leverage Googles cloud and edge computing technology combined with Traxs image recognition and ML capabilities to effectively manage in-store inventory and every SKU present on the shelf with actionable real-time insights. In 2019, Salesforce, an American cloud-based CRM company, launched Consumer Goods Cloud to elevate the in-store experience using AI. The Consumer Goods Cloud enables field representatives to ensure optimum shelf stock levels and ensure an image recognition and object detection solution for easy inventory management, and planogram compliance checks. Such organic and inorganic strategies supported by underlying cloud infrastructure would promote the future growth of the image recognition market.

Challenge: COVID-19 impact on supply chain

The COVID-19 outbreak and spread have impacted the world. It has severely affected the global manufacturing vertical due to supply chain disruptions. The pandemic has significantly affected all end users of image recognition. The decline in the production of smartphones and automobiles has resulted in decreased global demand for image sensors. This has led to the less manufacturing of image sensors, thereby acting as a challenge for the market growth.

To know about the assumptions considered for the study, download the pdf brochure

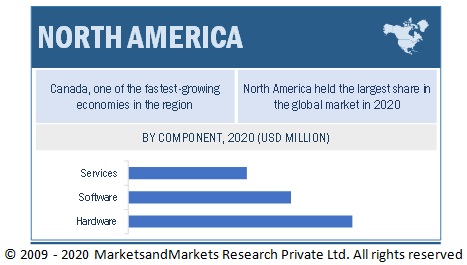

North America to hold the largest market size during the forecast period

North America is expected to hold the largest market size in the global image recognition market, while Asia Pacific (APAC) is likely to grow at the highest CAGR during the forecast period. North America is a major IT hub in terms of technology adoption and IT infrastructure. In terms of market size, North America is a significant contributor to the global image recognition market. The US and Canada are the major contributors to the North American market. Canada and the US are increasingly witnessing the merging of artificial intelligence with image recognition and augmented reality; this is expected to drive market growth in the region. Due to the COVID-19 impact, North America is going through tremendous strain, due to which major countries such as the US and Canada are bearing huge losses. The privacy of customers is mostly being affected during this unprecedented time. In October 2020, countries such as Canada updated their regulations to protect customer privacy. The rise in the integration of AI with image recognition and AR is expected to drive the market growth in the US and Canada.

The United States is home to major AI-based image recognition companies, leading to increasing adoption of the technology across the region. As a result, many companies are making their move towards the US market, intending to develop an assemblage of AI capabilities. There has been a growing demand for image recognition sector in Canada to improve product placements and assist in object identification. Enterprises in the region are most progressive in the adoption of AI, computer vision, deep learning, and the cloud, thereby boosting the growth of the market. This, coupled with the regions strong financial position, enables significant investments in leading tools and technologies for effective business operations.

Key Market Players

The image recognition market is dominated by a few globally established players such as, IBM (US), AWS (US), Trax (Singapore), Microsoft (US), and Google (US).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size value in 2020 |

USD 26.2 Billion |

|

Market size value in 2025 |

USD 53.0 Billion |

|

Growth rate |

CAGR of 15.1% |

|

Market size available for years |

20142025 |

|

Base year considered |

2019 |

|

Forecast period |

20202025 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

By Technology ,Component, Service, Type, Deployment Mode, Application, Vertical and Region |

|

Geographies covered |

North America, Europe, APAC, MEA, and Latin America |

|

Major companies covered |

IBM (US), Google (US), Qualcomm (US), Microsoft (US), AWS (US), Trax (Singapore),NEC Corporation (Japan), Catchoom (Spain), Slyce (US), LTU Tech (France), Vispera(Turkey), Blippar(UK), Clarifai(US), Wikitude (Austria), Huawei (China), Honeywell (US), Toshiba (Japan), Oracle (US), Trigo(Israel), INFFRD (US), AIRY3D(Canada), Standard Cognition (US), Unispectral LTD (Israel), Snap2Insight(US), restb.ai(Spain), Vize by Ximilar(Czech Republic), Mirror that Lock (US) |

This research report categorizes the image recognition market to forecast revenues and analyze trends in each of the following submarkets:

By Component:

- Hardware

- Software

- Services

By Application:

- Scanning and Imaging

- Security and Surveillance

- Image Search

- Augmented Reality

- Marketing and Advertising

By Deployment Mode:

- cloud

- On-premises

By Region:

- North America

- United States (US)

- Canada

- Europe

- United Kingdom (UK)

- Germany

- France

- Italy

- Russia

- Rest of Europe

- APAC

- China

- Japan

- India

- South Korea

- Australia

- Malaysia

- Rest of APAC

- MEA

- Kingdom of Saudi Arabia

- United Arab Emirates (UAE)

- Rest of Middle East and Africa

- Latin America

- Brazil

- Rest of Latin America

Recent Developments

- In June 2020, IBM launched Watson Works, a curated set of products that embed Watsons AI models and applications to help companies navigate many aspects of the return-to-workplace challenge due to lockdowns put in place to slow the spread of COVID-19.

- In April 2020, Microsoft partnered with Coca-Cola. The partnership aims to regulate its business operations on Microsoft Azure cloud and offer rich new digital experiences that will provide innovative solutions. These solutions will aid the Coca-Cola Company achieve new insights from data across the enterprise, enabling a 360-degree view of the business, and increases customer and employee experiences.

- In March 2020, Trax acquired Survey.com to combine both companies technologies, cater to needs of emerging grocery retailers, and strengthen its position in image recognition in retail market.

- In August 2019, AWS enhanced Amazon Rekognition. The enhanced solution provides high accuracy of gender identification and emotion detection; and improved functionality to its face analysis features.

Frequently Asked Questions (FAQ):

What is the current size of global image recognition market?

The image recognition market size is projected to grow from USD 26.0 billion in 2020 to USD 53.0 billion by 2025, at a Compound Annual Growth Rate (CAGR) of 15.1% during the forecast period.

What is image recognition?

Image recognition is a technology that assists users in identifying objects, logos, people, and places through digital images. The use of image recognition software and services offer several benefits, such as accurate identification of out-of-stock products on shelves, ensure planogram compliance, product recommendations, increased visibility of products, analysis of future requirements, and understanding region-wise product sales, and customer experience recognition.

Who are the key market players in the image recognition market?

IBM (US), Google (US), Qualcomm (US), Microsoft (US), AWS (US), Trax (Singapore), Catchoom (Spain), Slyce (US), LTU Tech (France), Imagga (Bulgaria), Vispera(Turkey), Blippar(UK), Ricoh innovations (US), Clarifai(US), Deepomatic (France), Wikitude (Austria), Huawei (China), Honeywell (US), Toshiba (Japan), Oracle (US).

What are the top trends in the in the image recognition market?

Following are the current market trends impacting the image recognition market:

Driving factors for the image recognition market:

- Need for efficient and profitable retail execution processes with adherence to compliance standards

- Technological advancements to boost demand for image recognition among various companies

Opportunities for the image recognition market:

- Integration of AI with image recognition solutions in various industries to improve store performance

- Accelerating demand for cloud-powered image recognition solutions to aid representatives in smooth retail execution

What is the COVID-19 impact on image recognition market?

The outbreak of the COVID-19 has led to a growth in the demand for the image recognition application for understanding the customers buying behaviour of essential and non-essential items. It can also help analyse the trend of the region-wise product sale as well as the in-store availability across traditional and small retail shops. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 36)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACTSCENARIO ASSESSMENT

FIGURE 4 FACTORS IMPACTING GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.4.1 MARKET DEFINITION

1.4.2 INCLUSIONS AND EXCLUSIONS

1.5 MARKET SCOPE

1.5.1 MARKET SEGMENTATION

1.5.2 YEARS CONSIDERED FOR THE STUDY

1.6 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2014-2019

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 45)

2.1 RESEARCH DATA

FIGURE 6 IMAGE RECOGNITION MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primary profiles

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGYAPPROACH 1 (SUPPLY SIDE): REVENUE FROM SOLUTIONS/SERVICES OF VENDORS

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: ILLUSTRATIVE EXAMPLE OF AMAZON WEB SERVICES

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGYAPPROACH 2, BOTTOM UP (SUPPLY SIDE): COLLECTIVE REVENUE FROM HARDWARE, SOFTWARE, AND SERVICES

FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGYAPPROACH 3, TOP DOWN (DEMAND SIDE): SHARE OF IMAGE RECOGNITION

2.4 MARKET FORECAST

TABLE 2 FACTOR ANALYSIS

2.5 COMPANY EVALUATION MATRIX METHODOLOGY

FIGURE 11 COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.6 STARTUP/SME EVALUATION MATRIX

FIGURE 12 STARTUP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.7 ASSUMPTIONS FOR THE STUDY

2.8 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 55)

FIGURE 13 GLOBAL IMAGE RECOGNITION MARKET TO WITNESS HIGH GROWTH DURING FORECAST PERIOD

FIGURE 14 LEADING SEGMENTS IN MARKET IN 2020

FIGURE 15 MARKET: REGIONAL SNAPSHOT

4 PREMIUM INSIGHTS (Page No. - 58)

4.1 ATTRACTIVE OPPORTUNITIES IN IMAGE RECOGNITION MARKET

FIGURE 16 INCREASING TECHNOLOGY DEVELOPMENTS TO BOOST ADOPTION OF IMAGE RECOGNITION SOLUTIONS

4.2 MARKET, BY SERVICE AND DEPLOYMENT MODE

FIGURE 17 PROFESSIONAL SERVICES AND ON-PREMISES SEGMENTS TO HOLD HIGHER MARKET SHARES IN 2020

4.3 MARKET, BY REGION

FIGURE 18 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4.4 MARKET: INVESTMENT SCENARIO

FIGURE 19 EUROPE AND ASIA PACIFIC TO EMERGE AS BEST MARKETS FOR INVESTMENTS IN NEXT FIVE YEARS

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 60)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: IMAGE RECOGNITION MARKET

5.2.1 DRIVERS

5.2.1.1 Increasing need for image recognition in the automotive industry

5.2.1.2 Rising demand for security applications and products enabled with image recognition functions

5.2.1.3 Increasing use of high bandwidth data services

5.2.1.4 Technology advancements to boost the demand for image recognition among CPG and retail companies

5.2.2 RESTRAINTS

5.2.2.1 High installation cost of image recognition solutions

5.2.3 OPPORTUNITIES

5.2.3.1 Increase in the demand for big data analytics

5.2.3.2 Integration of AI capabilities with image recognition solutions

5.2.4 CHALLENGES

5.2.4.1 Low resolution image size and storage

5.2.4.2 COVID-19 impact on supply chain

5.3 COVID-19-DRIVEN MARKET DYNAMICS

5.3.1 DRIVERS AND OPPORTUNITIES

5.3.2 RESTRAINTS AND CHALLENGES

5.3.3 CUMULATIVE GROWTH ANALYSIS

TABLE 3 IMAGE RECOGNITION MARKET: COVID-19 IMPACT

5.4 VALUE CHAIN

FIGURE 21 MARKET: VALUE CHAIN

5.5 ECOSYSTEM

FIGURE 22 MARKET: ECOSYSTEM

5.6 AVERAGE SELLING PRICE/PRICING MODEL OF IMAGE RECOGNITION PLAYERS, 2019-2020

FIGURE 23 AVERAGE SELLING PRICE MODEL OF MARKET, 2019-2020

5.7 TECHNOLOGY ANALYSIS

5.8 USE CASES

5.8.1 USE CASE 1: PLANORAMA

5.8.2 USE CASE 2: LABSPHERE

5.8.3 USE CASE 3: CATCHOOM

5.8.4 USE CASE 4: SNAP2INSIGHT

5.8.5 USE CASE 5: INFRRD

5.8.6 USE CASE 6: VISPERA

5.8.7 USE CASE 7: TRAX

5.9 REVENUE SHIFT YC/YCC SHIFT FOR IMAGE RECOGNITION MARKET

FIGURE 24 MARKET: YC/YCC SHIFT

5.1 PORTERS FIVE FORCES ANALYSIS

FIGURE 25 MARKET: PORTERS FIVE FORCES ANALYSIS

5.10.1 THREAT OF NEW ENTRANTS

5.10.2 THREAT OF SUBSTITUTES

5.10.3 BARGAINING POWER OF SUPPLIERS

5.10.4 BARGAINING POWER OF BUYERS

5.10.5 INTENSITY OF COMPETITION RIVALRY

6 IMAGE RECOGNITION MARKET, BY TECHNOLOGY (Page No. - 73)

6.1 INTRODUCTION

6.1.1 TECHNOLOGIES: MARKET DRIVERS

6.1.2 TECHNOLOGIES: COVID-19 IMPACT

FIGURE 26 DIGITAL IMAGE PROCESSING SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 4 MARKET SIZE, BY TECHNOLOGY, 20142019 (USD MILLION)

TABLE 5 MARKET SIZE, BY TECHNOLOGY, 20192025 (USD MILLION)

6.2 CODE RECOGNITION

TABLE 6 CODE RECOGNITION: MARKET SIZE, BY REGION, 20142019 (USD MILLION)

TABLE 7 CODE RECOGNITION: MARKET SIZE, BY REGION, 20192025 (USD MILLION)

6.3 DIGITAL IMAGE PROCESSING

TABLE 8 DIGITAL IMAGE PROCESSING: IMAGE RECOGNITION MARKET SIZE, BY REGION, 20142019 (USD MILLION)

TABLE 9 DIGITAL IMAGE PROCESSING: MARKET SIZE, BY REGION, 20192025 (USD MILLION)

6.4 FACIAL RECOGNITION

TABLE 10 FACIAL RECOGNITION: MARKET SIZE, BY REGION, 20142019 (USD MILLION)

TABLE 11 FACIAL RECOGNITION: MARKET SIZE, BY REGION, 20192025 (USD MILLION)

6.5 OBJECT RECOGNITION

TABLE 12 OBJECT RECOGNITION: MARKET SIZE, BY REGION, 20142019 (USD MILLION)

TABLE 13 OBJECT RECOGNITION: MARKET SIZE, BY REGION, 20192025 (USD MILLION)

6.6 PATTERN RECOGNITION

TABLE 14 PATTERN RECOGNITION: MARKET SIZE, BY REGION, 20142019 (USD MILLION)

TABLE 15 PATTERN RECOGNITION: MARKET SIZE, BY REGION, 20192025 (USD MILLION)

6.7 OPTICAL CHARACTER RECOGNITION

TABLE 16 OPTICAL CHARACTER RECOGNITION: MARKET SIZE, BY REGION, 20142019 (USD MILLION)

TABLE 17 OPTICAL CHARACTER RECOGNITION: MARKET SIZE, BY REGION, 20192025 (USD MILLION)

7 IMAGE RECOGNITION MARKET, BY COMPONENT (Page No. - 82)

7.1 INTRODUCTION

7.1.1 COMPONENTS: MARKET DRIVERS

7.1.2 COMPONENTS: COVID-19 IMPACT

FIGURE 27 SERVICES SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 18 MARKET SIZE, BY COMPONENT, 20142019 (USD MILLION)

TABLE 19 MARKET SIZE, BY COMPONENT, 20192025 (USD MILLION)

7.2 HARDWARE

TABLE 20 HARDWARE: MARKET SIZE, BY REGION, 20142019 (USD MILLION)

TABLE 21 HARDWARE: MARKET SIZE, BY REGION, 20192025 (USD MILLION)

7.3 SOFTWARE

TABLE 22 SOFTWARE: MARKET SIZE, BY REGION, 20142019 (USD MILLION)

TABLE 23 SOFTWARE: MARKET SIZE, BY REGION, 20192025 (USD MILLION)

7.4 SERVICES

TABLE 24 SERVICES: MARKET SIZE, BY REGION, 20142019 (USD MILLION)

TABLE 25 SERVICES: MARKET SIZE, BY REGION, 20192025 (USD MILLION)

8 IMAGE RECOGNITION MARKET, BY SERVICE (Page No. - 87)

8.1 INTRODUCTION

FIGURE 28 PROFESSIONAL SERVICES SEGMENT TO GROW AT HIGHER CAGR FROM 2020 TO 2025

8.1.1 SERVICES: MARKET DRIVERS

8.1.2 SERVICES: COVID-19 IMPACT

TABLE 26 MARKET SIZE, BY SERVICE, 20142019 (USD MILLION)

TABLE 27 MARKET SIZE, BY SERVICE, 20192025 (USD MILLION)

8.1.3 PROFESSIONAL SERVICES

TABLE 28 PROFESSIONAL SERVICES: MARKET SIZE, BY REGION, 20142019 (USD MILLION)

TABLE 29 PROFESSIONAL SERVICES: MARKET SIZE, BY REGION, 20192025 (USD MILLION)

TABLE 30 PROFESSIONAL SERVICES: MARKET SIZE, BY TYPE, 20142019 (USD MILLION)

TABLE 31 PROFESSIONAL SERVICES: IMAGE RECOGNITION MARKET SIZE, BY TYPE, 20192025 (USD MILLION)

8.1.3.1 Integration and deployment

TABLE 32 INTEGRATION AND DEPLOYMENT MARKET SIZE, BY REGION, 20142019 (USD MILLION)

TABLE 33 INTEGRATION AND DEPLOYMENT MARKET SIZE, BY REGION, 20192025 (USD MILLION)

8.1.3.2 Support and Maintenance

TABLE 34 SUPPORT AND MAINTENANCE MARKET SIZE, BY REGION, 20142019 (USD MILLION)

TABLE 35 SUPPORT AND MAINTENANCE MARKET SIZE, BY REGION, 20192025 (USD MILLION)

8.1.3.3 Consulting

TABLE 36 CONSULTING MARKET SIZE, BY REGION, 20142019 (USD MILLION)

TABLE 37 CONSULTING MARKET SIZE, BY REGION, 20192025 (USD MILLION)

8.1.4 MANAGED SERVICES

TABLE 38 MANAGED SERVICES: IMAGE RECOGNITION MARKET SIZE, BY REGION, 20142019 (USD MILLION)

TABLE 39 MANAGED SERVICES: MARKET SIZE, BY REGION, 20192025 (USD MILLION)

9 IMAGE RECOGNITION MARKET, BY DEPLOYMENT MODE (Page No. - 95)

9.1 INTRODUCTION

FIGURE 29 ON-PREMISES SEGMENT TO HOLD HIGHER MARKET SHARE IN 2020

9.1.1 DEPLOYMENT MODES: MARKET DRIVERS

9.1.2 DEPLOYMENT MODES: COVID-19 IMPACT

TABLE 40 MARKET SIZE, BY DEPLOYMENT MODE, 20142019 (USD MILLION)

TABLE 41 MARKET SIZE, BY DEPLOYMENT MODE, 20192025 (USD MILLION)

9.2 CLOUD

TABLE 42 CLOUD: MARKET SIZE, BY REGION, 20142019 (USD MILLION)

TABLE 43 CLOUD: MARKET SIZE, BY REGION, 20192025 (USD MILLION)

9.3 ON-PREMISES

TABLE 44 ON-PREMISES: MARKET SIZE, BY REGION, 20142019 (USD MILLION)

TABLE 45 ON-PREMISES: MARKET SIZE, BY REGION, 20192025 (USD MILLION)

10 IMAGE RECOGNITION MARKET, BY APPLICATION (Page No. - 100)

10.1 INTRODUCTION

10.1.1 APPLICATIONS: MARKET DRIVERS

10.1.2 APPLICATIONS: COVID-19 IMPACT

FIGURE 30 SECURITY AND SURVEILLANCE SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 46 MARKET SIZE, BY APPLICATION, 20142019 (USD MILLION)

TABLE 47 MARKET SIZE, BY APPLICATION, 20192025 (USD MILLION)

10.2 SCANNING AND IMAGING

TABLE 48 SCANNING AND IMAGING: MARKET SIZE, BY REGION, 20142019 (USD MILLION)

TABLE 49 SCANNING AND IMAGING: MARKET SIZE, BY REGION, 20192025 (USD MILLION)

10.3 SECURITY AND SURVEILLANCE

TABLE 50 SECURITY AND SURVEILLANCE: IMAGE RECOGNITION MARKET SIZE, BY REGION, 20142019 (USD MILLION)

TABLE 51 SECURITY AND SURVEILLANCE: MARKET SIZE, BY REGION, 20192025 (USD MILLION)

10.4 IMAGE SEARCH

TABLE 52 IMAGE SEARCH: MARKET SIZE, BY REGION, 20142019 (USD MILLION)

TABLE 53 IMAGE SEARCH: MARKET SIZE, BY REGION, 20192025 (USD MILLION)

10.5 AUGMENTED REALITY

TABLE 54 AUGMENTED REALITY: MARKET SIZE, BY REGION, 20142019 (USD MILLION)

TABLE 55 AUGMENTED REALITY: MARKET SIZE, BY REGION, 20192025 (USD MILLION)

10.6 MARKETING AND ADVERTISING

TABLE 56 MARKETING AND ADVERTISING: MARKET SIZE, BY REGION, 20142019 (USD MILLION)

TABLE 57 MARKETING AND ADVERTISING: MARKET SIZE, BY REGION, 20192025 (USD MILLION)

11 IMAGE RECOGNITION MARKET, BY VERTICAL (Page No. - 107)

11.1 INTRODUCTION

11.1.1 VERTICALS: MARKET DRIVERS

11.1.2 VERTICALS: COVID-19 IMPACT

FIGURE 31 BFSI VERTICAL TO HOLD HIGHEST MARKET SHARE IN 2020

TABLE 58 MARKET SIZE, BY VERTICAL, 20142019 (USD MILLION)

TABLE 59 MARKET SIZE, BY VERTICAL, 20192025 (USD MILLION)

11.2 BANKING, FINANCIAL SERVICES, AND INSURANCE

TABLE 60 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET SIZE, BY REGION, 20142019 (USD MILLION)

TABLE 61 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET SIZE, BY REGION, 20192025 (USD MILLION)

11.3 RETAIL AND CPG

TABLE 62 RETAIL AND CPG: IMAGE RECOGNITION MARKET SIZE, BY REGION, 20142019 (USD MILLION)

TABLE 63 RETAIL AND CPG: MARKET SIZE, BY REGION, 20192025 (USD MILLION)

11.4 HEALTHCARE

TABLE 64 HEALTHCARE: MARKET SIZE, BY REGION, 20142019 (USD MILLION)

TABLE 65 HEALTHCARE: MARKET SIZE, BY REGION, 20192025 (USD MILLION)

11.5 MEDIA AND ENTERTAINMENT

TABLE 66 MEDIA AND ENTERTAINMENT: MARKET SIZE, BY REGION, 20142019 (USD MILLION)

TABLE 67 MEDIA AND ENTERTAINMENT: MARKET SIZE, BY REGION, 20192025 (USD MILLION)

11.6 GOVERNMENT

TABLE 68 GOVERNMENT: MARKET SIZE, BY REGION, 20142019 (USD MILLION)

TABLE 69 GOVERNMENT: MARKET SIZE, BY REGION, 20192025 (USD MILLION)

11.7 TRANSPORTATION AND LOGISTICS

TABLE 70 TRANSPORTATION AND LOGISTICS: IMAGE RECOGNITION MARKET SIZE, BY REGION, 20142019 (USD MILLION)

TABLE 71 TRANSPORTATION AND LOGISTICS: MARKET SIZE, BY REGION, 20192025 (USD MILLION)

11.8 AUTOMOTIVE

TABLE 72 AUTOMOTIVE: MARKET SIZE, BY REGION, 20142019 (USD MILLION)

TABLE 73 AUTOMOTIVE: MARKET SIZE, BY REGION, 20192025 (USD MILLION)

11.9 TELECOMMUNICATIONS

TABLE 74 TELECOMMUNICATIONS: MARKET SIZE, BY REGION, 20142019 (USD MILLION)

TABLE 75 TELECOMMUNICATIONS: MARKET SIZE, BY REGION, 20192025 (USD MILLION)

11.10 OTHERS

TABLE 76 OTHERS: MARKET SIZE, BY REGION, 20142019 (USD MILLION)

TABLE 77 OTHERS: MARKET SIZE, BY REGION, 20192025 (USD MILLION)

12 IMAGE RECOGNITION MARKET, BY REGION (Page No. - 119)

12.1 INTRODUCTION

FIGURE 32 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 78 MARKET SIZE, BY REGION, 20142019 (USD MILLION)

TABLE 79 MARKET SIZE, BY REGION, 20192025 (USD MILLION)

12.2 NORTH AMERICA

12.2.1 NORTH AMERICA: MARKET DRIVERS

12.2.2 NORTH AMERICA: IMAGE RECOGNITION VENDOR INITIATIVES AND DEVELOPMENTS

12.2.3 NORTH AMERICA: COVID-19 IMPACT

12.2.4 NORTH AMERICA: MARKET REGULATORY LANDSCAPE

FIGURE 33 NORTH AMERICA: MARKET SNAPSHOT

TABLE 80 NORTH AMERICA: IMAGE RECOGNITION MARKET SIZE, BY TECHNOLOGY, 20142019 (USD MILLION)

TABLE 81 NORTH AMERICA: MARKET SIZE, BY TECHNOLOGY, 20192025 (USD MILLION)

TABLE 82 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 20142019 (USD MILLION)

TABLE 83 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 20192025 (USD MILLION)

TABLE 84 NORTH AMERICA: MARKET SIZE, BY SERVICE, 20142019 (USD MILLION)

TABLE 85 NORTH AMERICA: MARKET SIZE, BY SERVICE, 20192025 (USD MILLION)

TABLE 86 NORTH AMERICA: MARKET SIZE, BY SERVICE TYPE, 20142019 (USD MILLION)

TABLE 87 NORTH AMERICA: MARKET SIZE, BY SERVICE TYPE, 20192025 (USD MILLION)

TABLE 88 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 20142019 (USD MILLION)

TABLE 89 NORTH AMERICA: IMAGE RECOGNITION MARKET SIZE, BY DEPLOYMENT MODE, 20192025 (USD MILLION)

TABLE 90 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 20142019 (USD MILLION)

TABLE 91 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 20192025 (USD MILLION)

TABLE 92 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 20142019 (USD MILLION)

TABLE 93 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 20192025 (USD MILLION)

TABLE 94 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 20142019 (USD MILLION)

TABLE 95 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 20192025 (USD MILLION)

12.2.5 UNITED STATES

TABLE 96 UNITED STATES: IMAGE RECOGNITION MARKET SIZE, BY TECHNOLOGY, 20142019 (USD MILLION)

TABLE 97 UNITED STATES: MARKET SIZE, BY TECHNOLOGY, 20192025 (USD MILLION)

TABLE 98 UNITED STATES: MARKET SIZE, BY COMPONENT, 20142019 (USD MILLION)

TABLE 99 UNITED STATES: MARKET SIZE, BY COMPONENT, 20192025 (USD MILLION)

TABLE 100 UNITED STATES: MARKET SIZE, BY SERVICE, 20142019 (USD MILLION)

TABLE 101 UNITED STATES: MARKET SIZE, BY SERVICE, 20192025 (USD MILLION)

TABLE 102 UNITED STATES: MARKET SIZE, BY SERVICE TYPE, 20142019 (USD MILLION)

TABLE 103 UNITED STATES: MARKET SIZE, BY SERVICE TYPE, 20192025 (USD MILLION)

TABLE 104 UNITED STATES: IMAGE RECOGNITION MARKET SIZE, BY DEPLOYMENT MODE, 20142019 (USD MILLION)

TABLE 105 UNITED STATES: MARKET SIZE, BY DEPLOYMENT MODE, 20192025 (USD MILLION)

TABLE 106 UNITED STATES: MARKET SIZE, BY APPLICATION, 20142019 (USD MILLION)

TABLE 107 UNITED STATES: MARKET SIZE, BY APPLICATION, 20192025 (USD MILLION)

TABLE 108 UNITED STATES: MARKET SIZE, BY VERTICAL, 20142019 (USD MILLION)

TABLE 109 UNITED STATES: MARKET SIZE, BY VERTICAL, 20192025 (USD MILLION)

12.2.6 CANADA

12.3 EUROPE

12.3.1 EUROPE: MARKET DRIVERS

12.3.2 EUROPE: MARKET VENDOR INITIATIVES AND DEVELOPMENTS

12.3.3 EUROPE: COVID-19 IMPACT

12.3.4 EUROPE: MARKET REGULATORY LANDSCAPE

TABLE 110 EUROPE: IMAGE RECOGNITION MARKET SIZE, BY TECHNOLOGY, 20142019 (USD MILLION)

TABLE 111 EUROPE: MARKET SIZE, BY TECHNOLOGY, 20192025 (USD MILLION)

TABLE 112 EUROPE: MARKET SIZE, BY COMPONENT, 20142019 (USD MILLION)

TABLE 113 EUROPE: MARKET SIZE, BY COMPONENT, 20192025 (USD MILLION)

TABLE 114 EUROPE: MARKET SIZE, BY SERVICE, 20142019 (USD MILLION)

TABLE 115 EUROPE: MARKET SIZE, BY SERVICE, 20192025 (USD MILLION)

TABLE 116 EUROPE: MARKET SIZE, BY SERVICE TYPE, 20142019 (USD MILLION)

TABLE 117 EUROPE: MARKET SIZE, BY SERVICE TYPE, 20192025 (USD MILLION)

TABLE 118 EUROPE: IMAGE RECOGNITION MARKET SIZE, BY DEPLOYMENT MODE, 20142019 (USD MILLION)

TABLE 119 EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 20192025 (USD MILLION)

TABLE 120 EUROPE: MARKET SIZE, BY APPLICATION, 20142019 (USD MILLION)

TABLE 121 EUROPE: MARKET SIZE, BY APPLICATION, 20192025 (USD MILLION)

TABLE 122 EUROPE: MARKET SIZE, BY VERTICAL, 20142019 (USD MILLION)

TABLE 123 EUROPE: MARKET SIZE, BY VERTICAL, 20192025 (USD MILLION)

TABLE 124 EUROPE: MARKET SIZE, BY COUNTRY, 20142019 (USD MILLION)

TABLE 125 EUROPE: MARKET SIZE, BY COUNTRY, 20192025 (USD MILLION)

12.3.5 UNITED KINGDOM

TABLE 126 UNITED KINGDOM: IMAGE RECOGNITION MARKET SIZE, BY TECHNOLOGY, 20142019 (USD MILLION)

TABLE 127 UNITED KINGDOM: MARKET SIZE, BY TECHNOLOGY, 20192025 (USD MILLION)

TABLE 128 UNITED KINGDOM: MARKET SIZE, BY COMPONENT, 20142019 (USD MILLION)

TABLE 129 UNITED KINGDOM: MARKET SIZE, BY COMPONENT, 20192025 (USD MILLION)

TABLE 130 UNITED KINGDOM: MARKET SIZE, BY SERVICE, 20142019 (USD MILLION)

TABLE 131 UNITED KINGDOM: MARKET SIZE, BY SERVICE, 20192025 (USD MILLION)

TABLE 132 UNITED KINGDOM: MARKET SIZE, BY SERVICE TYPE, 20142019 (USD MILLION)

TABLE 133 UNITED KINGDOM: IMAGE RECOGNITION MARKET SIZE, BY SERVICE TYPE, 20192025 (USD MILLION)

TABLE 134 UNITED KINGDOM: MARKET SIZE, BY DEPLOYMENT MODE, 20142019 (USD MILLION)

TABLE 135 UNITED KINGDOM: MARKET SIZE, BY DEPLOYMENT MODE, 20192025 (USD MILLION)

TABLE 136 UNITED KINGDOM: MARKET SIZE, BY APPLICATION, 20142019 (USD MILLION)

TABLE 137 UNITED KINGDOM: MARKET SIZE, BY APPLICATION, 20192025 (USD MILLION)

TABLE 138 UNITED KINGDOM: MARKET SIZE, BY VERTICAL, 20142019 (USD MILLION)

TABLE 139 UNITED KINGDOM: MARKET SIZE, BY VERTICAL, 20192025 (USD MILLION)

12.3.6 GERMANY

12.3.7 FRANCE

12.3.8 ITALY

12.3.9 RUSSIA

12.3.10 REST OF EUROPE

12.4 ASIA PACIFIC

12.4.1 ASIA PACIFIC: IMAGE RECOGNITION MARKET DRIVERS

12.4.2 ASIA PACIFIC: MARKET VENDOR INITIATIVES AND DEVELOPMENTS

12.4.3 ASIA PACIFIC: COVID-19 IMPACT

12.4.4 ASIA PACIFIC: MARKET REGULATORY LANDSCAPE

FIGURE 34 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 140 ASIA PACIFIC: MARKET SIZE, BY TECHNOLOGY, 20142019 (USD MILLION)

TABLE 141 ASIA PACIFIC: MARKET SIZE, BY TECHNOLOGY, 20192025 (USD MILLION)

TABLE 142 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 20142019 (USD MILLION)

TABLE 143 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 20192025 (USD MILLION)

TABLE 144 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 20142019 (USD MILLION)

TABLE 145 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 20192025 (USD MILLION)

TABLE 146 ASIA PACIFIC: MARKET SIZE, BY SERVICE TYPE, 20142019 (USD MILLION)

TABLE 147 ASIA PACIFIC: IMAGE RECOGNITION MARKET SIZE, BY SERVICE TYPE, 20192025 (USD MILLION)

TABLE 148 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 20142019 (USD MILLION)

TABLE 149 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 20192025 (USD MILLION)

TABLE 150 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 20142019 (USD MILLION)

TABLE 151 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 20192025 (USD MILLION)

TABLE 152 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 20142019 (USD MILLION)

TABLE 153 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 20192025 (USD MILLION)

TABLE 154 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 20142019 (USD MILLION)

TABLE 155 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 20192025 (USD MILLION)

12.4.5 AUSTRALIA

TABLE 156 AUSTRALIA: IMAGE RECOGNITION MARKET SIZE, BY TECHNOLOGY, 20142019 (USD MILLION)

TABLE 157 AUSTRALIA: MARKET SIZE, BY TECHNOLOGY, 20192025 (USD MILLION)

TABLE 158 AUSTRALIA: MARKET SIZE, BY COMPONENT, 20142019 (USD MILLION)

TABLE 159 AUSTRALIA: MARKET SIZE, BY COMPONENT, 20192025 (USD MILLION)

TABLE 160 AUSTRALIA: MARKET SIZE, BY SERVICE, 20142019 (USD MILLION)

TABLE 161 AUSTRALIA: MARKET SIZE, BY SERVICE, 20192025 (USD MILLION)

TABLE 162 AUSTRALIA: MARKET SIZE, BY SERVICE TYPE, 20142019 (USD MILLION)

TABLE 163 AUSTRALIA: MARKET SIZE, BY SERVICE TYPE, 20192025 (USD MILLION)

TABLE 164 AUSTRALIA: MARKET SIZE, BY DEPLOYMENT MODE, 20142019 (USD MILLION)

TABLE 165 AUSTRALIA: IMAGE RECOGNITION MARKET SIZE, BY DEPLOYMENT MODE, 20192025 (USD MILLION)

TABLE 166 AUSTRALIA: MARKET SIZE, BY APPLICATION, 20142019 (USD MILLION)

TABLE 167 AUSTRALIA: MARKET SIZE, BY APPLICATION, 20192025 (USD MILLION)

TABLE 168 AUSTRALIA: MARKET SIZE, BY VERTICAL, 20142019 (USD MILLION)

TABLE 169 AUSTRALIA: MARKET SIZE, BY VERTICAL, 20192025 (USD MILLION)

12.4.6 SOUTH KOREA

12.4.7 MALAYSIA

12.4.8 CHINA

12.4.9 JAPAN

12.4.10 INDIA

12.4.11 REST OF ASIA PACIFIC

12.5 MIDDLE EAST AND AFRICA

12.5.1 MIDDLE EAST AND AFRICA: IMAGE RECOGNITION MARKET DRIVERS

12.5.2 MIDDLE EAST AND AFRICA: MARKET VENDOR INITIATIVES AND DEVELOPMENTS

12.5.3 MIDDLE EAST AND AFRICA: COVID-19 IMPACT

12.5.4 MIDDLE EAST AND AFRICA: MARKET REGULATORY LANDSCAPE

TABLE 170 MIDDLE EAST AND AFRICA: MARKET SIZE, BY TECHNOLOGY, 20142019 (USD MILLION)

TABLE 171 MIDDLE EAST AND AFRICA: MARKET SIZE, BY TECHNOLOGY, 20192025 (USD MILLION)

TABLE 172 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 20142019 (USD MILLION)

TABLE 173 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 20192025 (USD MILLION)

TABLE 174 MIDDLE EAST AND AFRICA: IMAGE RECOGNITION MARKET SIZE, BY SERVICE, 20142019 (USD MILLION)

TABLE 175 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 20192025 (USD MILLION)

TABLE 176 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE TYPE, 20142019 (USD MILLION)

TABLE 177 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE TYPE, 20192025 (USD MILLION)

TABLE 178 MIDDLE EAST AND AFRICA: MARKET SIZE , BY DEPLOYMENT MODE, 20142019 (USD MILLION)

TABLE 179 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 20192025 (USD MILLION)

TABLE 180 MIDDLE EAST AND AFRICA: MARKET SIZE, BY APPLICATION, 20142019 (USD MILLION)

TABLE 181 MIDDLE EAST AND AFRICA: MARKET SIZE, BY APPLICATION, 20192025 (USD MILLION)

TABLE 182 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 20142019 (USD MILLION)

TABLE 183 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 20192025 (USD MILLION)

TABLE 184 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 20142019 (USD MILLION)

TABLE 185 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 20192025 (USD MILLION)

12.5.5 UNITED ARAB EMIRATES

12.5.6 KINGDOM OF SAUDI ARABIA

TABLE 186 KINGDOM OF SAUDI ARABIA: IMAGE RECOGNITION MARKET SIZE, BY TECHNOLOGY, 20142019 (USD MILLION)

TABLE 187 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY TECHNOLOGY, 20192025 (USD MILLION)

TABLE 188 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY COMPONENT, 20142019 (USD MILLION)

TABLE 189 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY COMPONENT, 20192025 (USD MILLION)

TABLE 190 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY SERVICE, 20142019 (USD MILLION)

TABLE 191 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY SERVICE, 20192025 (USD MILLION)

TABLE 192 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY SERVICE TYPE, 20142019 (USD MILLION)

TABLE 193 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY SERVICE TYPE, 20192025 (USD MILLION)

TABLE 194 KINGDOM OF SAUDI ARABIA: IMAGE RECOGNITION MARKET SIZE, BY DEPLOYMENT MODE, 20142019 (USD MILLION)

TABLE 195 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY DEPLOYMENT MODE, 20192025 (USD MILLION)

TABLE 196 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY APPLICATION, 20142019 (USD MILLION)

TABLE 197 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY APPLICATION, 20192025 (USD MILLION)

TABLE 198 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY VERTICAL, 20142019 (USD MILLION)

TABLE 199 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY VERTICAL, 20192025 (USD MILLION)

12.5.7 REST OF MIDDLE EAST AND AFRICA

12.6 LATIN AMERICA

12.6.1 LATIN AMERICA: IMAGE RECOGNITION MARKET DRIVERS

12.6.2 LATIN AMERICA: MARKET VENDOR INITIATIVES AND DEVELOPMENTS

12.6.3 LATIN AMERICA: COVID-19 IMPACT

12.6.4 LATIN AMERICA: MARKET REGULATORY LANDSCAPE

TABLE 200 LATIN AMERICA: MARKET SIZE, BY TECHNOLOGY, 20142019 (USD MILLION)

TABLE 201 LATIN AMERICA: MARKET SIZE, BY TECHNOLOGY, 20192025 (USD MILLION)

TABLE 202 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 20142019 (USD MILLION)

TABLE 203 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 20192025 (USD MILLION)

TABLE 204 LATIN AMERICA: MARKET SIZE, BY SERVICE, 20142019 (USD MILLION)

TABLE 205 LATIN AMERICA: MARKET SIZE, BY SERVICE, 20192025 (USD MILLION)

TABLE 206 LATIN AMERICA: MARKET SIZE, BY SERVICE TYPE, 20142019 (USD MILLION)

TABLE 207 LATIN AMERICA: IMAGE RECOGNITION MARKET SIZE, BY SERVICE TYPE, 20192025 (USD MILLION)

TABLE 208 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 20142019 (USD MILLION)

TABLE 209 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 20192025 (USD MILLION)

TABLE 210 LATIN AMERICA: MARKET SIZE, BY APPLICATION, 20142019 (USD MILLION)

TABLE 211 LATIN AMERICA: MARKET SIZE, BY APPLICATION, 20192025 (USD MILLION)

TABLE 212 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 20142019 (USD MILLION)

TABLE 213 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 20192025 (USD MILLION)

TABLE 214 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 20142019 (USD MILLION)

TABLE 215 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 20192025 (USD MILLION)

12.6.5 BRAZIL

TABLE 216 BRAZIL: IMAGE RECOGNITION MARKET SIZE, BY TECHNOLOGY, 20142019 (USD MILLION)

TABLE 217 BRAZIL: MARKET SIZE, BY TECHNOLOGY, 20192025 (USD MILLION)

TABLE 218 BRAZIL: MARKET SIZE, BY COMPONENT, 20142019 (USD MILLION)

TABLE 219 BRAZIL: MARKET SIZE, BY COMPONENT, 20192025 (USD MILLION)

TABLE 220 BRAZIL: MARKET SIZE, BY SERVICE, 20142019 (USD MILLION)

TABLE 221 BRAZIL: MARKET SIZE, BY SERVICE, 20192025 (USD MILLION)

TABLE 222 BRAZIL: MARKET SIZE, BY SERVICE TYPE, 20142019 (USD MILLION)

TABLE 223 BRAZIL: MARKET SIZE, BY SERVICE TYPE, 20192025 (USD MILLION)

TABLE 224 BRAZIL: IMAGE RECOGNITION MARKET SIZE, BY DEPLOYMENT MODE, 20142019 (USD MILLION)

TABLE 225 BRAZIL: MARKET SIZE, BY DEPLOYMENT MODE, 20192025 (USD MILLION)

TABLE 226 BRAZIL: MARKET SIZE, BY APPLICATION, 20142019 (USD MILLION)

TABLE 227 BRAZIL: MARKET SIZE, BY APPLICATION, 20192025 (USD MILLION)

TABLE 228 BRAZIL: MARKET SIZE, BY VERTICAL, 20142019 (USD MILLION)

TABLE 229 BRAZIL: MARKET SIZE, BY VERTICAL, 20192025 (USD MILLION)

12.6.6 REST OF LATIN AMERICA

13 COMPETITIVE LANDSCAPE (Page No. - 183)

13.1 INTRODUCTION

13.2 MARKET EVALUATION FRAMEWORK

FIGURE 35 MARKET EVALUATION FRAMEWORK

13.3 REVENUE ANALYSIS OF LEADING PLAYERS

FIGURE 36 IMAGE RECOGNITION MARKET: REVENUE ANALYSIS

13.4 HISTORICAL REVENUE ANALYSIS

FIGURE 37 REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS

13.5 RANKING OF KEY PLAYERS IN MARKET, 2020

14 COMPANY EVALUATION MATRIX AND COMPANY PROFILES (Page No. - 186)

14.1 COMPANY EVALUATION MATRIX

14.1.1 COMPANY EVALUATION MATRIX DEFINITIONS AND METHODOLOGY

TABLE 230 EVALUATION CRITERIA

14.1.2 STAR

14.1.3 PERVASIVE

14.1.4 EMERGING LEADERS

14.1.5 PARTICIPANTS

FIGURE 38 IMAGE RECOGNITION MARKET (GLOBAL), COMPANY EVALUATION MATRIX, 2020

14.2 STRENGTH OF PRODUCT PORTFOLIO

14.3 BUSINESS STRATEGY EXCELLENCE

14.4 COMPANY PROFILES

(Business Overview, Solutions Offered, Recent Developments, MNM View, Key Strengths/Right to Win, Strategic Choices Made, Weakness and Competitive Threats and COVID-19-Related Developments)*

14.4.1 IBM

FIGURE 39 IBM: COMPANY SNAPSHOT

14.4.2 GOOGLE

FIGURE 40 GOOGLE: COMPANY SNAPSHOT

14.4.3 QUALCOMM

FIGURE 41 QUALCOMM: COMPANY SNAPSHOT

14.4.4 MICROSOFT

FIGURE 42 MICROSOFT: COMPANY SNAPSHOT

14.4.5 AMAZON WEB SERVICES

FIGURE 43 AWS: COMPANY SNAPSHOT

14.4.6 TRAX

14.4.7 NEC CORPORATION

FIGURE 44 NEC CORPORATION: COMPANY SNAPSHOT

14.4.8 PARTIUM

14.4.9 LTU TECH

14.4.10 HUAWEI

14.4.11 HONEYWELL

14.4.12 HITACHI

14.4.13 TOSHIBA

14.4.14 ORACLE

14.4.15 VISPERA

14.4.16 BLIPPAR

14.4.17 WIKITUDE

14.4.18 CLARIFAI

14.5 RIGHT TO WIN

14.6 STARTUP/SME EVALUATION MATRIX, 2020

14.6.1 PROGRESSIVE COMPANIES

14.6.2 RESPONSIVE COMPANIES

14.6.3 DYNAMIC COMPANIES

14.6.4 STARTING BLOCKS

FIGURE 45 IMAGE RECOGNITION MARKET (GLOBAL), STARTUP/SME EVALUATION MATRIX, 2020

14.6.5 TRIGO

14.6.6 INFFRD

14.6.7 AIRY3D

14.6.8 STANDARD COGNITION

14.6.9 UNISPECTRAL LTD.

14.6.10 SNAP2INSIGHT

14.6.11 RESTB.AI

14.6.12 VIZE BY XIMILAR

14.6.13 MIRROR THAT LOOK

*Details on Business Overview, Solutions Offered, Recent Developments, MNM View, Key Strengths/Right to Win, Strategic Choices Made, Weakness and Competitive Threats and COVID-19-Related Developments might not be captured in case of unlisted companies.

15 ADJACENT/RELATED MARKETS (Page No. - 229)

15.1 INTRODUCTION

15.2 IMAGE RECOGNITION IN RETAIL MARKET

15.2.1 MARKET DEFINITION

TABLE 231 IMAGE RECOGNITION IN RETAIL MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

TABLE 232 VISUAL PRODUCT SEARCH: IMAGE RECOGNITION IN RETAIL MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 233 SECURITY AND SURVEILLANCE: IMAGE RECOGNITION IN RETAIL MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 234 VISION ANALYTICS: IMAGE RECOGNITION IN RETAIL MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 235 MARKETING AND ADVERTISING: IMAGE RECOGNITION IN RETAIL MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 236 OTHER APPLICATIONS: IMAGE RECOGNITION IN RETAIL MARKET SIZE, BY REGION, 20182025 (USD MILLION)

15.3 IOT IN RETAIL MARKET

15.3.1 MARKET DEFINITION

TABLE 237 IOT IN RETAIL MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

TABLE 238 OPERATIONS MANAGEMENT: IOT IN RETAIL MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 239 ASSET MANAGEMENT: IOT IN RETAIL MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 240 CUSTOMER EXPERIENCE MANAGEMENT: IOT IN RETAIL MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 241 ADVERTISING AND MARKETING: IOT IN RETAIL MARKET SIZE, BY REGION, 20182025 (USD MILLION)

15.4 ARTIFICIAL INTELLIGENCE IN RETAIL MARKET

15.4.1 MARKET DEFINITION

TABLE 242 ARTIFICIAL INTELLIGENCE IN RETAIL MARKET SIZE, BY TYPE, 20152022 (USD MILLION)

TABLE 243 ARTIFICIAL INTELLIGENCE IN RETAIL MARKET SIZE, BY TECHNOLOGY, 20152022 (USD MILLION)

TABLE 244 ARTIFICIAL INTELLIGENCE IN RETAIL MARKET SIZE, BY SOLUTION, 20152022 (USD MILLION)

TABLE 245 ARTIFICIAL INTELLIGENCE IN RETAIL MARKET SIZE, BY SERVICE, 20152022 (USD MILLION)

TABLE 246 ARTIFICIAL INTELLIGENCE IN RETAIL MARKET SIZE, BY APPLICATION, 20152022 (USD MILLION)

TABLE 247 ARTIFICIAL INTELLIGENCE IN RETAIL MARKET SIZE, BY REGION, 20152022 (USD MILLION)

16 APPENDIX (Page No. - 236)

16.1 DISCUSSION GUIDE

16.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

16.3 AVAILABLE CUSTOMIZATIONS

16.4 RELATED REPORTS

16.5 AUTHOR DETAILS

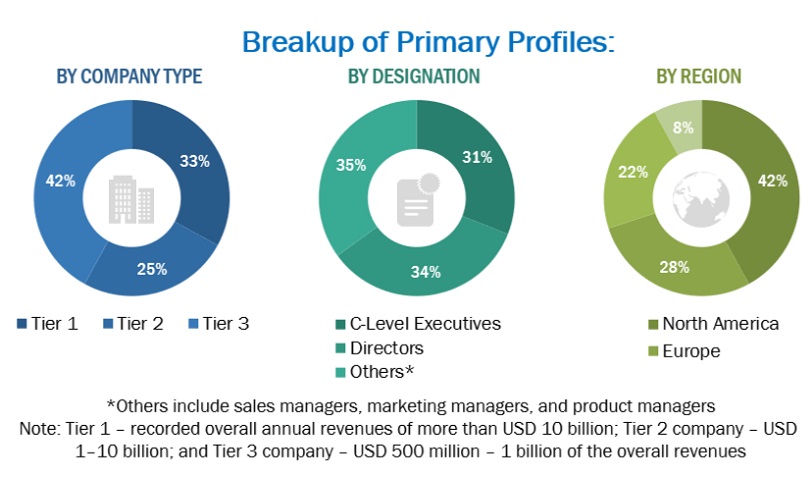

The study involved four major activities in estimating the current size of the image recognition market. Exhaustive secondary research was done to collect information the image recognition market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakup and data triangulation procedures were used to estimate the size of the market segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases, have been referred to identify and collect information for this study. The secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. Data was also collected from secondary sources such as the SANS Institute, Information Systems Security Association (ISSA), Information Security Forum (ISF), European Cyber Security Organization (ECSO), and the European Union Agency for Cybersecurity (ENISA).

Secondary research was mainly used to obtain key information about the industrys value chain and supply chain to identify key players according to their offerings and industry trends related to technology, application, and region, and key developments from both market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as Chief Experience Officers (CXOs), Vice Presidents (VPs), directors from business development, marketing, and product development/innovation teams, and related key executives from image recognition hardware, image recognition solution vendors, image recognition service providers, industry associations, independent image recognition consultants, and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, data of revenue collected from the products and services, market breakups, market size estimations, market forecasting, and data triangulation. Primary research also helped understand the various trends related to technology, application, deployment, and region. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), and Chief Security Officers (CSOs), and installation teams, of governments/end users using image recognition solutions, were interviewed to understand the buyers perspective on the suppliers, products, service providers, and their current use of IMAGE RECOGNITION solutions, which would affect the overall image recognition market.

Following is the breakup of the primary respondent:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the image recognition. These methods were also used extensively to estimate the size of various segments in the market. The research methodology used to estimate the market size includes the following:

- Key players in the market have been identified through extensive secondary research.

- In terms of value, the industrys supply chain and market size have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at each market segment's exact statistics and subsegment, data triangulation, and market breakup procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To determine and forecast the global image recognition market by technology, component (hardware, software, and services), deployment mode, application, vertical, and region from 2020 to 2025, and analyze the various macroeconomic and microeconomic factors that affect the market growth

- To forecast the market segments' size with respect to five main regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America.

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the overall image recognition

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the image recognition

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Geographic analysis

- Further breakup of the North America image recognition market into countries

- Further breakup of the Europe image recognition market into countries

- Further breakup of the APAC image recognition market into countries

- Further breakup of the MEA image recognition market into countries

- Further breakup of the Latin America image recognition market into countries

Company information

- Detailed analysis and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Image Recognition Market

I want to understand the market potential of Image Recognition solutions