Immersion Cooling Fluids Market by Type (Mineral oil, Fluorocarbon-based fluids, Synthetic fluids), End Use (Transformers, Data Center, EV batteries, Solar PV), Technology (Single-phase cooling, Two-phase cooling) & Region - Global Forecast to 2027

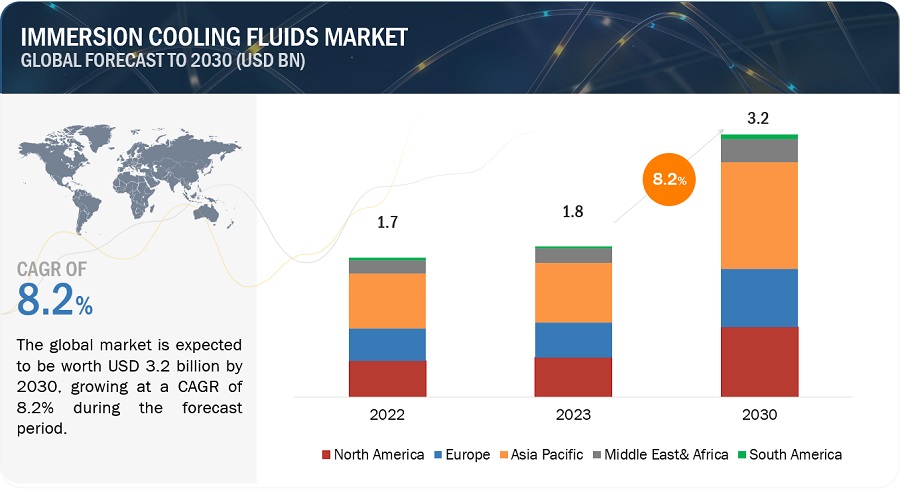

[238 Pages Report] The immersion cooling fluids is estimated to grow from USD 1.7 billion in 2022 to USD 2.6 billion by 2027, at a CAGR of 8.1% during the forecast period. Immersion cooling fluids are used as a cooling or heat transfer fluids for equipment such as transformer, data center and EV battery. This help to increase the performance of these equipment.

Global Immersion Cooling Fluids Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Immersion cooling fluids Market Dynamics

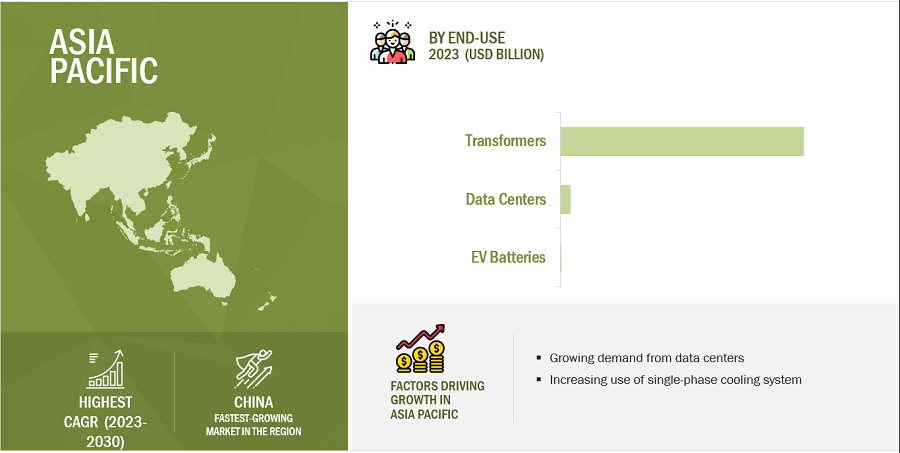

Driver: Expansion of electric grids in Asia Pacific

Asia Pacific is estimated to received investment in T&D systems in 2020 around USD 250 billion and is expected to record a CAGR of 4.15% to reach USD 386 billion by 2030. This investment is said to be done for both development and expansion of electric grid. Developing economies in the Asia Pacific region are expecting an increase in power demand due to the rapid industrialization and urbanization. This gives rise to requirement for effective transformers. The heat in the transformer has adverse effect on its efficiency. The effective cooling is required for these transformers to work efficiently. This will fuel the need of immersion cooling fluids in Asia Pacific region.

Restraints: Environmental concerns regarding use of mineral oil in transformers

Mineral oil has long been the preferred transformer cooling oil due to its high cooling efficiency, easy availability, and useful chemical properties such as good pour point at low temperature and exceptional thermal cooling capacity. But as these oils are processed and purified, they are highly non-biodegradable. This creates issue of recycling and disposing these oils after the use. Thus, the environmental concern regarding use of mineral oil will impact the growth of the immersion cooling fluids market, which will cause a negative impact on the demand for immersion cooling fluids.

Opportunity: Rising demand for bio-based oils for immersion cooling

Bio-based transformer oil is produced from vegetable oil feedstock. Bio-based transformer oil has a high fire resistance and is biodegradable due to the absence of, silicone, petroleum hydrocarbons, and halogens. The bio-based oil also has higher dielectric breakdown as compared to mineral oil. Also, it is an eco-friendly immersion cooling fluid. This gives bio-based oil an opportunity to be used as an immersion cooling fluid in end-use such as, transformer and data center.

Challenge: Fluctuation in crude oil prices

Crude oil is an important resource to create oils which is used as immersion cooling fluids. Immersion cooling fluids such as transformer oil are highly refined, processed, and purified products of crude oil. The fluctuation in the price of crude oil will directly impact price of immersion cooling fluids. The crude oil prices were constantly fluctuating since 2014. This creates a challenge for use of mineral oil in transformer immersion cooling solution.

Based on type, synthetic fluids segment is the fastest growing market during the forecast period

The synthetic fluids segment is expected to be the fastest growing segment in the forecast period in terms of value. Synthetic fluids are used as immersion cooling fluids in data center and EV batteries. Synthetic fluids also overcome disadvantages of mineral oil such as corrosiveness and flammability. All these factors are fueling the growth of this segment. These are the factors due to which demand for this segment is expected to boost during the forecast period.

Based on technology, single-phase immersion cooling segment accounted for the largest market during the forecast period

The single-phase immersion cooling accounted for the largest segment, by technology in 2021, in terms of value. Single-phase immersion cooling involves the equipment completely submerged into the immersion cooling fluid. The fluid remains in liquid state in the cooling process for the equipment. This makes the single-phase immersion cooling system are maintenance free and cost effective as there is no loss of immersion cooling fluids. These are some factors which will drive the market for the segment.

Based on end use, transformer segment is expected to have largest market during the forecast period

The market has been driven by increasing demand for electric grid infrastructure such as transformers. In regions like Asia Pacific, North America, and Europe there is increasing demand for electricity and countries in these regions are taking all possible initiative to build power efficient and sustainable infrastructure. This includes immersion cooling systems for transformers as it increases the efficiency and effectiveness of transformers. This fuel the demand for immersion cooling fluids used in transformers.

Asia Pacific is the largest immersion cooling fluids market in terms of value

Asia Pacific accounted for the largest share followed by North America, in terms of value, in 2021.

The region is witnessing a growth in energy demand which will need power transmission infrastructure. This will give rise to requirement of effective immersion cooling solutions for transformers. The region has also seen a rising demand for and sales for electric vehicle and constant R&D for the batteries used in electric vehicles creates an opportunity for immersion cooling fluids used for EV batteries. The growing demand for data center is also one of the reasons that market for immersion cooling fluids is growing in the region.

will propel the growth of the immersion cooling fluids market in the region.

Source: Secondary Research, Expert Interviews, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

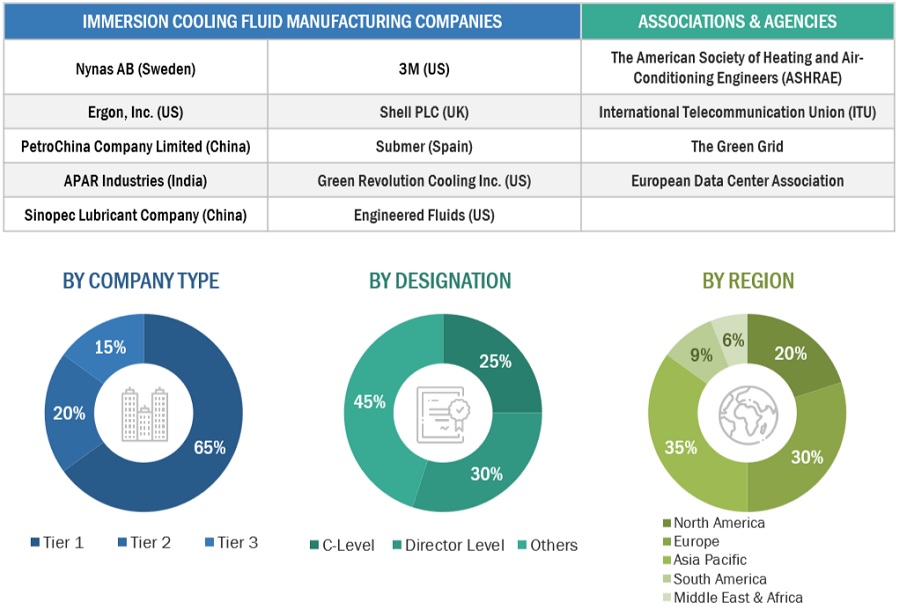

Major companies in the immersion cooling fluids market include Nynas AB (Sweden), Ergon, Inc. (US), PetroChina Company Limited (China), APAR Industries (India), and Sinopec Lubricant Company (China), among others. A total of 26 major players have been covered. These players have adopted joint ventures, new product launches and new product developments as the major strategies to consolidate their position in the market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market Size Available for Years |

20192027 |

|

Base Year Considered |

2021 |

|

Forecast Period |

20222027 |

|

Forecast Units |

Value (USD Thousand/Billion) and Volume (Thousand Liters) |

|

Segments Covered |

Type, Technology, End Use, and Region |

|

Geographies Covered |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies Covered |

The major market players include Nynas AB (Sweden), Ergon, Inc. (US), PetroChina Company Limited (China), APAR Industries (India), and Sinopec Lubricant Company (China), among others |

This research report categorizes the immersion cooling fluids market based on Type, Technology, End-User, and Region.

Based on Type, the immersion cooling fluids market has been segmented as follows:

- Mineral Oil

- Fluorocarbon-Based Fluids

- Synthetic Fluids

- Others

Based on Technology, the immersion cooling fluids market has been segmented as follows:

- Single-Phase Immersion Cooling

- Two-Phase Immersion Cooling

Based on End-Use, the immersion cooling fluids market has been segmented as follows:

- Transformers

- Data Centers

- EV Batteries

- Solar Photovoltaic

Based on Region, the immersion cooling fluids market has been segmented as follows:

- Asia Pacific

- North America

- Europe

- Middle East & Africa

- South America

Recent Developments

- In October 2020, Ergon, Inc. increased the storage capacity at Antwerp terminal in Belgium to 39000 m3. This expansion will help company to cater increasing demand for specialty oils. Immersion cooling fluids for transformer is one of the specialty oils.

- In September 2020, PetroChina Company Limited expanded its crude oil processing capacity at Daqing refinery, situated in the Heilongjiang province, China. The refinerys capacity was expanded to 10 million tons per annum from 6.5 million tons. The expansion was part of an RMB 4.45 billion (USD 651 million) investment. This will help the company to serve the growing demand for transformer oil.

- In March 2020, Nynas AB Nynas AB introduced NYTRO BIO 300X, a 100% renewable transformer oil. The oil has very low viscosity and has oxidation stability. The transformer oil has exceptional cooling properties.

Frequently Asked Questions (FAQ):

What is the current size of the global immersion cooling fluids market?

The immersion cooling fluids is estimated to grow from USD 1.7 Billion in 2022 to USD 2.6 Billion by 2027, at a CAGR of 8.1% during the forecast period.

Who are the leading players in the global immersion cooling fluids market?

Some of the key players operating in the immersion cooling fluids market are Nynas AB (Sweden), Ergon, Inc. (US), PetroChina Company Limited (China), APAR Industries (India), and Sinopec Lubricant Company (China), among others. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 26)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONAL SCOPE

1.4 INCLUSIONS & EXCLUSIONS

1.4.1 IMMERSION COOLING FLUIDS MARKET, BY REGION: INCLUSIONS & EXCLUSIONS

1.4.2 IMMERSION COOLING FLUIDS MARKET, BY TYPE: INCLUSIONS & EXCLUSIONS

1.4.3 IMMERSION COOLING FLUIDS MARKET, BY END USE: INCLUSIONS & EXCLUSIONS

1.4.4 IMMERSION COOLING FLUIDS MARKET, BY TECHNOLOGY: INCLUSIONS & EXCLUSIONS

1.4.5 YEARS CONSIDERED

1.5 CURRENCY

1.6 RESEARCH LIMITATIONS

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 31)

2.1 RESEARCH DATA

FIGURE 1 IMMERSION COOLING FLUIDS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primary interviews

2.2 DEMAND-SIDE MATRIX

FIGURE 2 MAIN MATRIX CONSIDERED FOR CONSTRUCTING AND ASSESSING DEMAND FOR IMMERSION COOLING FLUIDS

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3.3 DEMAND-SIDE APPROACH

2.3.4 SUPPLY-SIDE APPROACH

2.3.5 FORECAST

2.4 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

2.5 DATA TRIANGULATION

FIGURE 5 IMMERSION COOLING FLUIDS MARKET: DATA TRIANGULATION

2.6 KEY ASSUMPTIONS WHILE CALCULATING DEMAND-SIDE MARKET SIZE

2.7 LIMITATIONS

2.8 RISK ANALYSIS

3 EXECUTIVE SUMMARY (Page No. - 40)

TABLE 1 IMMERSION COOLING FLUIDS MARKET SNAPSHOT, 2022 & 2027

FIGURE 6 TRANSFORMERS SEGMENT ACCOUNTED FOR LARGEST SHARE OF IMMERSION COOLING FLUIDS MARKET IN 2021

FIGURE 7 MINERAL OIL ACCOUNTED FOR LARGER MARKET SIZE IN 2021

FIGURE 8 SINGLE-PHASE COOLING SEGMENT ACCOUNTED FOR LARGEST MARKET SIZE IN 2021

FIGURE 9 ASIA PACIFIC TO LEAD IMMERSION COOLING FLUIDS MARKET

4 PREMIUM INSIGHTS (Page No. - 44)

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN IMMERSION COOLING FLUIDS MARKET

FIGURE 10 RISING DEMAND FOR ENERGY-EFFICIENT AND ECO-FRIENDLY COOLING SOLUTIONS TO DRIVE IMMERSION COOLING FLUIDS MARKET

4.2 IMMERSION COOLING FLUIDS MARKET, BY REGION

FIGURE 11 IMMERSION COOLING FLUIDS MARKET IN ASIA PACIFIC PROJECTED TO RECORD HIGHEST GROWTH RATE DURING FORECAST PERIOD

4.3 ASIA PACIFIC IMMERSION COOLING FLUIDS MARKET, BY END USE AND COUNTRY

FIGURE 12 TRANSFORMERS SEGMENT AND CHINA TO DOMINATE ASIA PACIFIC IMMERSION COOLING FLUIDS MARKET IN 2022

4.4 IMMERSION COOLING FLUIDS MARKET: MAJOR COUNTRIES

FIGURE 13 IMMERSION COOLING FLUIDS MARKET IN CHINA TO RECORD HIGHEST GROWTH RATE DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 47)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN IMMERSION COOLING FLUIDS MARKET

5.2.1 DRIVERS

5.2.1.1 Increasing density of servers

FIGURE 15 NUMBER OF DATA CENTERS, 2017 & 2022

FIGURE 16 AVERAGE SERVER RACK DENSITY, 2016-2020

5.2.1.2 Expansion of electric grids in Asia Pacific

FIGURE 17 GLOBAL T&D INVESTMENT PROJECTION, 2020-2040 (USD BILLION)

5.2.1.3 Growing need for energy-efficient cooling systems

5.2.1.4 Demand for eco-friendly cooling solutions for data centers

5.2.2 RESTRAINTS

5.2.2.1 Toxicity of fluorocarbon-based fluids

5.2.2.2 Environmental concerns regarding use of mineral oil in transformers

5.2.3 OPPORTUNITIES

5.2.3.1 Rising demand for bio-based oils

5.2.3.2 Adoption of immersion cooling for EV batteries

5.2.3.3 Need for single-phase immersion cooling solutions for data center applications

5.2.4 CHALLENGES

5.2.4.1 Retrofitting of immersion cooling solutions in data centers

5.2.4.2 Fluctuations in crude oil price

FIGURE 18 CRUDE OIL PRICES, JANUARY 2019-JULY 2022 (USD/BARREL)

5.3 PORTER'S FIVE FORCES ANALYSIS

FIGURE 19 PORTER'S FIVE FORCES ANALYSIS: IMMERSION COOLING FLUIDS MARKET

TABLE 2 IMMERSION COOLING FLUIDS MARKET: PORTER'S FIVE FORCES ANALYSIS

5.3.1 BARGAINING POWER OF SUPPLIERS

5.3.2 BARGAINING POWER OF BUYERS

5.3.3 THREAT OF SUBSTITUTES

5.3.4 THREAT OF NEW ENTRANTS

5.3.5 DEGREE OF COMPETITION

6 INDUSTRY TRENDS (Page No. - 57)

6.1 EVOLUTION OF IMMERSION COOLING FOR DATA CENTERS

FIGURE 20 EVOLUTION OF DATA CENTER COOLING AND IMMERSION COOLING

6.2 AVERAGE SELLING PRICE ANALYSIS

TABLE 3 AVERAGE SELLING PRICE ANALYSIS IMMERSION COOLING FLUIDS

6.3 ECOSYSTEM/MARKET MAP

FIGURE 21 ECOSYSTEM/MARKET MAP OF IMMERSION COOLING FLUIDS

TABLE 4 IMMERSION COOLING FLUIDS MARKET: ECOSYSTEM

6.4 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

FIGURE 22 REVENUE SHIFT FOR IMMERSION COOLING FLUIDS IN DATA CENTER AND EV BATTERY APPLICATIONS

6.5 PATENT ANALYSIS

FIGURE 23 NUMBER OF GRANTED PATENTS, PATENT APPLICATIONS, AND LIMITED PATENTS

FIGURE 24 PUBLICATION TRENDS - LAST 10 YEARS

6.5.1 INSIGHT

FIGURE 25 LEGAL STATUS OF PATENTS

FIGURE 26 TOP JURISDICTION, BY DOCUMENT

FIGURE 27 COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS

TABLE 5 TOP 10 PATENT OWNERS IN LAST 10 YEARS

6.6 REGULATORY LANDSCAPE

6.6.1 OPEN COMPUTE PROJECT (OCP) DIELECTRIC COOLING FLUID REQUIREMENTS FOR DATA CENTER APPLICATIONS

TABLE 6 DIELECTRIC COOLING FLUID SPECIFICATIONS

TABLE 7 DIELECTRIC COOLING FLUID MINIMUM REQUIREMENTS

TABLE 8 HYDROCARBON FLUIDS QUALITY MANAGEMENT

TABLE 9 FLUOROCARBON FLUIDS QUALITY MANAGEMENT

TABLE 10 REGULATIONS FOR USE OF MINERAL OIL IN TRANSFORMERS FOR COOLING PURPOSES

6.7 ORGANIZATIONS PROVIDING STANDARDS FOR DATA CENTERS

6.7.1 INTRODUCTION

6.7.2 AMERICAN NATIONAL STANDARDS INSTITUTE

6.7.3 AMERICAN SOCIETY OF HEATING, REFRIGERATING, AND AIR-CONDITIONING ENGINEERS

6.7.4 INSTITUTE FOR ENERGY AND TRANSPORT

6.7.5 DISTRIBUTED MANAGEMENT TASK FORCE

6.7.6 TELECOMMUNICATION INDUSTRY ASSOCIATION

6.7.7 NATIONAL ELECTRICAL MANUFACTURERS ASSOCIATION

6.7.8 CANADIAN STANDARDS ASSOCIATION GROUP

6.7.9 UNDERWRITERS LABORATORY

6.7.10 UNITED STATES DEPARTMENT OF ENERGY

6.7.11 UNITED STATES ENVIRONMENTAL PROTECTION AGENCY

6.7.12 STATEMENT ON STANDARDS FOR ATTESTATION ENGAGEMENTS NO. 16

6.7.13 INTERNATIONAL STANDARDS COMPLIANCE

6.8 CASE STUDY ANALYSIS

6.8.1 TATA POWER USES CARGILLS BIOFLUIDS IN PAD-MOUNTED DISTRIBUTION TRANSFORMER

6.8.2 BITFURY GROUP USES 3MS ENGINEERED FLUIDS TO ENHANCE DATA CENTER COOLING EFFICIENCY

6.8.3 DOWNUNDER GEOSOLUTIONS OPTS FOR GREEN REVOLUTION COOLINGS ELECTROSAFE LIQUID COOLANTS TO REDUCE DATA CENTER ENERGY SPENDING

6.8.4 MICROSOFT CHOOSES LIQUIDSTACKS IMMERSION COOLING TECHNOLOGY WITH 3MS ENGINEERED FLUIDS FOR ITS CLOUD SERVERS

6.9 TECHNOLOGY ANALYSIS

6.9.1 OVERVIEW

FIGURE 28 TYPES OF IMMERSION COOLING SOLUTIONS

6.9.2 SINGLE-PHASE

6.9.2.1 IT chassis

6.9.2.2 Tub/Open bath

6.9.3 TWO-PHASE

6.9.3.1 Tub/Open bath

6.9.4 HYBRID

6.10 SUPPLY CHAIN ANALYSIS

FIGURE 29 IMMERSION COOLING FLUIDS MARKET: SUPPLY CHAIN ANALYSIS

FIGURE 30 IMMERSION COOLING FLUIDS MARKET: KEY COMPANIES

6.11 PARTNERSHIPS

TABLE 11 PARTNERS OF MAJOR IMMERSION COOLING SOLUTION PROVIDERS

6.12 KEY CONFERENCES & EVENTS IN 2022 & 2023

TABLE 12 IMMERSION COOLING FLUIDS MARKET: CONFERENCES & EVENTS

7 IMMERSION COOLING FLUIDS MARKET, BY TECHNOLOGY (Page No. - 81)

7.1 INTRODUCTION

FIGURE 31 IMMERSION COOLING FLUIDS MARKET, BY TECHNOLOGY, 20222027 (USD THOUSAND)

TABLE 13 GLOBAL IMMERSION COOLING FLUIDS MARKET, BY TECHNOLOGY, 20192021 (USD THOUSAND)

TABLE 14 GLOBAL IMMERSION COOLING FLUIDS MARKET, BY TECHNOLOGY, 20222027 (USD THOUSAND)

TABLE 15 GLOBAL IMMERSION COOLING FLUIDS MARKET, BY TECHNOLOGY, 20192021 (THOUSAND LITERS)

TABLE 16 GLOBAL IMMERSION COOLING FLUIDS MARKET, BY TECHNOLOGY, 20222027 (THOUSAND LITERS)

7.2 SINGLE-PHASE COOLING

7.2.1 COST-EFFECTIVE METHOD REQUIRING LIMITED MAINTENANCE

TABLE 17 GLOBAL IMMERSION COOLING FLUIDS MARKET, SINGLE-PHASE COOLING, BY REGION, 20192021 (USD THOUSAND)

TABLE 18 GLOBAL IMMERSION COOLING FLUIDS MARKET, SINGLE-PHASE COOLING, BY REGION, 20222027 (USD THOUSAND)

TABLE 19 GLOBAL IMMERSION COOLING FLUIDS MARKET, SINGLE-PHASE COOLING, BY REGION, 20192021 (THOUSAND LITERS)

TABLE 20 GLOBAL IMMERSION COOLING FLUIDS MARKET, SINGLE-PHASE COOLING , BY REGION, 20222027 (THOUSAND LITERS)

7.3 TWO-PHASE COOLING

7.3.1 MORE COMPLEX AND EXPENSIVE IMMERSION COOLING SYSTEM

TABLE 21 GLOBAL IMMERSION COOLING FLUIDS MARKET, TWO-PHASE COOLING, BY REGION, 20192021 (USD THOUSAND)

TABLE 22 GLOBAL IMMERSION COOLING FLUIDS MARKET, TWO-PHASE COOLING, BY REGION, 20222027 (USD THOUSAND)

TABLE 23 GLOBAL IMMERSION COOLING FLUIDS MARKET, TWO-PHASE COOLING, BY REGION, 20192021 (THOUSAND LITERS)

TABLE 24 GLOBAL IMMERSION COOLING FLUIDS MARKET, TWO-PHASE COOLING, BY REGION, 20222027 (THOUSAND LITERS)

8 IMMERSION COOLING FLUIDS MARKET, BY TYPE (Page No. - 87)

8.1 INTRODUCTION

FIGURE 32 IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20222027(USD THOUSAND)

TABLE 25 GLOBAL IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20192021 (USD THOUSAND)

TABLE 26 GLOBAL IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20222027 (USD THOUSAND)

TABLE 27 GLOBAL IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20192021 (THOUSAND LITERS)

TABLE 28 GLOBAL IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20222027 (THOUSAND LITERS)

8.2 MINERAL OIL

8.2.1 EASY AVAILABILITY AND LOW PRICE EXPECTED TO FUEL DEMAND

TABLE 29 GLOBAL IMMERSION COOLING FLUIDS MARKET, MINERAL OIL, BY REGION, 20192021 (USD THOUSAND)

TABLE 30 GLOBAL IMMERSION COOLING FLUIDS MARKET, MINERAL OIL, BY REGION, 20222027 (USD THOUSAND)

TABLE 31 GLOBAL IMMERSION COOLING FLUIDS MARKET, MINERAL OIL, BY REGION, 20192021 (THOUSAND LITERS)

TABLE 32 GLOBAL IMMERSION COOLING FLUIDS MARKET, MINERAL OIL, BY REGION, 20222027 (THOUSAND LITERS)

8.3 FLUOROCARBON-BASED FLUIDS

8.3.1 INERT AND NON-REACTIVE NATURE OF FLUIDS EXPECTED TO PROPEL MARKET

TABLE 33 GLOBAL IMMERSION COOLING FLUIDS MARKET, FLUOROCARBON-BASED FLUIDS, BY REGION, 20192021 (USD THOUSAND)

TABLE 34 GLOBAL IMMERSION COOLING FLUIDS MARKET, FLUOROCARBON-BASED FLUIDS, BY REGION, 20222027 (USD THOUSAND)

TABLE 35 GLOBAL IMMERSION COOLING FLUIDS MARKET, FLUOROCARBON-BASED FLUIDS, BY REGION, 20192021 (THOUSAND LITERS)

TABLE 36 GLOBAL IMMERSION COOLING FLUIDS MARKET, FLUOROCARBON-BASED FLUIDS, BY REGION, 20222027 (THOUSAND LITERS)

8.4 SYNTHETIC FLUIDS

8.4.1 LOW CORROSION PROPERTY OF SYNTHETIC FLUIDS PROJECTED TO FUEL DEMAND

TABLE 37 GLOBAL IMMERSION COOLING FLUIDS MARKET, SYNTHETIC FLUIDS, BY REGION, 20192021 (USD THOUSAND)

TABLE 38 GLOBAL IMMERSION COOLING FLUIDS MARKET, SYNTHETIC FLUIDS, BY REGION, 20222027 (USD THOUSAND)

TABLE 39 GLOBAL IMMERSION COOLING FLUIDS MARKET, SYNTHETIC FLUIDS, BY REGION, 20192021 (THOUSAND LITERS)

TABLE 40 GLOBAL IMMERSION COOLING FLUIDS MARKET, SYNTHETIC FLUIDS, BY REGION, 20222027 (THOUSAND LITERS)

8.5 OTHERS

TABLE 41 GLOBAL IMMERSION COOLING FLUIDS MARKET, OTHERS, BY REGION, 20192021 (USD THOUSAND)

TABLE 42 GLOBAL IMMERSION COOLING FLUIDS MARKET, OTHERS, BY REGION, 20222027 (USD THOUSAND)

TABLE 43 GLOBAL IMMERSION COOLING FLUIDS MARKET, OTHERS, BY REGION, 20192021 (THOUSAND LITERS)

TABLE 44 GLOBAL IMMERSION COOLING FLUIDS MARKET, OTHERS, BY REGION, 20222027 (THOUSAND LITERS)

9 IMMERSION COOLING FLUIDS MARKET, BY END USE (Page No. - 97)

9.1 INTRODUCTION

FIGURE 33 IMMERSION COOLING FLUIDS MARKET, BY END USE, 20222027 (USD THOUSAND)

TABLE 45 GLOBAL IMMERSION COOLING FLUIDS MARKET, BY END USE, 20192021 (USD THOUSAND)

TABLE 46 GLOBAL IMMERSION COOLING FLUIDS MARKET, BY END USE, 20222027 (USD THOUSAND)

TABLE 47 GLOBAL IMMERSION COOLING FLUIDS MARKET, BY END USE, 20192021 (THOUSAND LITERS)

TABLE 48 GLOBAL IMMERSION COOLING FLUIDS MARKET, BY END USE, 20222027 (THOUSAND LITERS)

9.2 DATA CENTERS

TABLE 49 GLOBAL IMMERSION COOLING FLUIDS MARKET, DATA CENTERS, BY REGION, 20192021 (USD THOUSAND)

TABLE 50 GLOBAL IMMERSION COOLING FLUIDS MARKET, DATA CENTERS, BY REGION, 20222027 (USD THOUSAND)

TABLE 51 GLOBAL IMMERSION COOLING FLUIDS MARKET, DATA CENTERS, BY REGION, 20192021 (THOUSAND LITERS)

TABLE 52 GLOBAL IMMERSION COOLING FLUIDS MARKET, DATA CENTERS, BY REGION, 20222027 (THOUSAND LITERS)

9.2.1 HIGH-PERFORMANCE COMPUTING

9.2.1.1 Rising demand for immersion cooling fluids in IT industry

9.2.2 EDGE COMPUTING

9.2.2.1 Gaining traction in oil & gas and telecom industries

9.2.3 ARTIFICIAL INTELLIGENCE

9.2.3.1 Immersion cooling fluids suited to high-density server racks

9.2.4 CRYPTOCURRENCY MINING

9.2.4.1 Emerging technology finds use for immersion cooling solutions

9.2.5 OTHERS

9.3 EV BATTERIES

9.3.1 USE OF IMMERSION COOLING FLUIDS FOR EV BATTERY COOLING EXPECTED TO INCREASE

TABLE 53 GLOBAL IMMERSION COOLING FLUIDS MARKET, EV BATTERIES, BY REGION, 20192021 (USD THOUSAND)

TABLE 54 GLOBAL IMMERSION COOLING FLUIDS MARKET, EV BATTERIES, BY REGION, 20222027 (USD THOUSAND)

TABLE 55 GLOBAL IMMERSION COOLING FLUIDS MARKET, EV BATTERIES, BY REGION, 20192021 (THOUSAND LITERS)

TABLE 56 GLOBAL IMMERSION COOLING FLUIDS MARKET, EV BATTERIES, BY REGION, 20222027 (THOUSAND LITERS)

9.4 TRANSFORMERS

9.4.1 WIDESPREAD USE OF MINERAL OIL FOR COOLING TRANSFORMERS

TABLE 57 GLOBAL IMMERSION COOLING FLUIDS MARKET, TRANSFORMERS, BY REGION, 20192021 (USD THOUSAND)

TABLE 58 GLOBAL IMMERSION COOLING FLUIDS MARKET, TRANSFORMERS, BY REGION, 20222027 (USD THOUSAND)

TABLE 59 GLOBAL IMMERSION COOLING FLUIDS MARKET, TRANSFORMERS, BY REGION, 20192021 (THOUSAND LITERS)

TABLE 60 GLOBAL IMMERSION COOLING FLUIDS MARKET, TRANSFORMERS, BY REGION, 2019-2027 (THOUSAND LITERS)

9.5 SOLAR PHOTOVOLTAIC SYSTEMS

9.5.1 IMMERSION COOLING STILL IN R&D STAGE

10 IMMERSION COOLING FLUIDS MARKET, BY REGION (Page No. - 107)

10.1 INTRODUCTION

FIGURE 34 IMMERSION COOLING FLUIDS MARKET IN CHINA PROJECTED TO RECORD HIGHEST CAGR FROM 2022 TO 2027

TABLE 61 GLOBAL IMMERSION COOLING FLUIDS MARKET, BY REGION, 20192021 (USD THOUSAND)

TABLE 62 GLOBAL IMMERSION COOLING FLUIDS MARKET, BY REGION, 20222027 (USD THOUSAND)

TABLE 63 GLOBAL IMMERSION COOLING FLUIDS MARKET, BY REGION, 20192021 (THOUSAND LITERS)

TABLE 64 GLOBAL IMMERSION COOLING FLUIDS MARKET, BY REGION, 20222027 (THOUSAND LITERS)

10.2 ASIA PACIFIC

FIGURE 35 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 65 ASIA PACIFIC IMMERSION COOLING FLUIDS MARKET, BY COUNTRY, 20192021 (USD THOUSAND)

TABLE 66 ASIA PACIFIC IMMERSION COOLING FLUIDS MARKET, BY COUNTRY, 20222027 (USD THOUSAND)

TABLE 67 ASIA PACIFIC IMMERSION COOLING FLUIDS MARKET, BY COUNTRY, 20192021 (THOUSAND LITERS)

TABLE 68 ASIA PACIFIC IMMERSION COOLING FLUIDS MARKET, BY COUNTRY, 20222027 (THOUSAND LITERS)

TABLE 69 ASIA PACIFIC IMMERSION COOLING FLUIDS MARKET, BY END USE, 20192021 (USD THOUSAND)

TABLE 70 ASIA PACIFIC IMMERSION COOLING FLUIDS MARKET, BY END USE, 20222027 (USD THOUSAND)

TABLE 71 ASIA PACIFIC IMMERSION COOLING FLUIDS MARKET, BY END USE, 20192021 (THOUSAND LITERS)

TABLE 72 ASIA PACIFIC IMMERSION COOLING FLUIDS MARKET, BY END USE, 20222027 (THOUSAND LITERS)

TABLE 73 ASIA PACIFIC IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20192021 (USD THOUSAND)

TABLE 74 ASIA PACIFIC IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20222027 (USD THOUSAND)

TABLE 75 ASIA PACIFIC IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20192021 (THOUSAND LITERS)

TABLE 76 ASIA PACIFIC IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20222027 (THOUSAND LITERS)

10.2.1 CHINA

10.2.1.1 Increasing requirement for efficient cooling solutions for transformers to drive market

TABLE 77 CHINA IMMERSION COOLING FLUIDS MARKET, BY END USE, 20192021 (USD THOUSAND)

TABLE 78 CHINA IMMERSION COOLING FLUIDS MARKET, BY END USE, 20222027 (USD THOUSAND)

TABLE 79 CHINA IMMERSION COOLING FLUIDS MARKET, BY END USE, 20192021 (THOUSAND LITERS)

TABLE 80 CHINA IMMERSION COOLING FLUIDS MARKET, BY END USE, 20222027 (THOUSAND LITERS)

TABLE 81 CHINA IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20192021 (USD THOUSAND)

TABLE 82 CHINA IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20222027 (USD THOUSAND)

TABLE 83 CHINA IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20192021 (THOUSAND LITERS)

TABLE 84 CHINA IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20222027 (THOUSAND LITERS)

10.2.2 INDIA

10.2.2.1 Significant deployment of data centers to propel market

TABLE 85 INDIA IMMERSION COOLING FLUIDS MARKET, BY END USE, 20192021 (USD THOUSAND)

TABLE 86 INDIA IMMERSION COOLING FLUIDS MARKET, BY END USE, 20222027 (USD THOUSAND)

TABLE 87 INDIA IMMERSION COOLING FLUIDS MARKET, BY END USE, 20192021 (THOUSAND LITERS)

TABLE 88 INDIA IMMERSION COOLING FLUIDS MARKET, BY END USE, 20222027 (THOUSAND LITERS)

TABLE 89 INDIA IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20192021 (USD THOUSAND)

TABLE 90 INDIA IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20222027 (USD THOUSAND)

TABLE 91 INDIA IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20192021 (THOUSAND LITERS)

TABLE 92 INDIA IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20222027 (THOUSAND LITERS)

10.2.3 JAPAN

10.2.3.1 Growing electronics industry to impact market

TABLE 93 JAPAN IMMERSION COOLING FLUIDS MARKET, BY END USE, 20192021 (USD THOUSAND)

TABLE 94 JAPAN IMMERSION COOLING FLUIDS MARKET, BY END USE, 20222027 (USD THOUSAND)

TABLE 95 JAPAN IMMERSION COOLING FLUIDS MARKET, BY END USE, 20192021 (THOUSAND LITERS)

TABLE 96 JAPAN IMMERSION COOLING FLUIDS MARKET, BY END USE, 20222027 (THOUSAND LITERS)

TABLE 97 JAPAN IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20192021 (USD THOUSAND)

TABLE 98 JAPAN IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20222027 (USD THOUSAND)

TABLE 99 JAPAN IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20192021 (THOUSAND LITERS)

TABLE 100 JAPAN IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20222027 (THOUSAND LITERS)

10.2.4 SOUTH KOREA

10.2.4.1 Advancements in data center technologies expected to drive market

TABLE 101 SOUTH KOREA IMMERSION COOLING FLUIDS MARKET, BY END USE, 20192021 (USD THOUSAND)

TABLE 102 SOUTH KOREA IMMERSION COOLING FLUIDS MARKET, BY END USE, 20222027 (USD THOUSAND)

TABLE 103 SOUTH KOREA IMMERSION COOLING FLUIDS MARKET, BY END USE, 20192021 (THOUSAND LITERS)

TABLE 104 SOUTH KOREA IMMERSION COOLING FLUIDS MARKET, BY END USE, 20222027 (THOUSAND LITERS)

TABLE 105 SOUTH KOREA IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20192021 (USD THOUSAND)

TABLE 106 SOUTH KOREA IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20222027 (USD THOUSAND)

TABLE 107 SOUTH KOREA IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20192021 (THOUSAND LITERS)

TABLE 108 SOUTH KOREA IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20222027 (THOUSAND LITERS)

10.2.5 AUSTRALIA

10.2.5.1 Growing transformer requirements to boost demand for cooling solutions

TABLE 109 AUSTRALIA IMMERSION COOLING FLUIDS MARKET, BY END USE, 20192021 (USD THOUSAND)

TABLE 110 AUSTRALIA IMMERSION COOLING FLUIDS MARKET, BY END USE, 20222027 (USD THOUSAND)

TABLE 111 AUSTRALIA IMMERSION COOLING FLUIDS MARKET, BY END USE, 20192021 (THOUSAND LITERS)

TABLE 112 AUSTRALIA IMMERSION COOLING FLUIDS MARKET, BY END USE, 20222027 (THOUSAND LITERS)

TABLE 113 AUSTRALIA IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20192021 (USD THOUSAND)

TABLE 114 AUSTRALIA IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20222027 (USD THOUSAND)

TABLE 115 AUSTRALIA IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20192021 (THOUSAND LITERS)

TABLE 116 AUSTRALIA IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20222027 (THOUSAND LITERS)

10.2.6 MALAYSIA

10.2.6.1 Big data and artificial intelligence trends to boost market

TABLE 117 MALAYSIA IMMERSION COOLING FLUIDS MARKET, BY END USE, 20192021 (USD THOUSAND)

TABLE 118 MALAYSIA IMMERSION COOLING FLUIDS MARKET, BY END USE, 20222027 (USD THOUSAND)

TABLE 119 MALAYSIA IMMERSION COOLING FLUIDS MARKET, BY END USE, 20192021 (THOUSAND LITERS)

TABLE 120 MALAYSIA IMMERSION COOLING FLUIDS MARKET, BY END USE, 20222027 (THOUSAND LITERS)

TABLE 121 MALAYSIA IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20192021 (USD THOUSAND)

TABLE 122 MALAYSIA IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20222027 (USD THOUSAND)

TABLE 123 MALAYSIA IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20192021 (THOUSAND LITERS)

TABLE 124 MALAYSIA IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20222027 (THOUSAND LITERS)

10.2.7 REST OF ASIA PACIFIC

TABLE 125 REST OF ASIA PACIFIC IMMERSION COOLING FLUIDS MARKET, BY END USE, 20192021 (USD THOUSAND)

TABLE 126 REST OF ASIA PACIFIC IMMERSION COOLING FLUIDS MARKET, BY END USE, 20222027 (USD THOUSAND)

TABLE 127 REST OF ASIA PACIFIC IMMERSION COOLING FLUIDS MARKET, BY END USE, 20192021 (THOUSAND LITERS)

TABLE 128 REST OF ASIA PACIFIC IMMERSION COOLING FLUIDS MARKET, BY END USE, 20222027 (THOUSAND LITERS)

TABLE 129 REST OF ASIA PACIFIC IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20192021 (USD THOUSAND)

TABLE 130 REST OF ASIA PACIFIC IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20222027 (USD THOUSAND)

TABLE 131 REST OF ASIA PACIFIC IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20192021 (THOUSAND LITERS)

TABLE 132 REST OF ASIA PACIFIC IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20222027 (THOUSAND LITERS)

10.3 NORTH AMERICA

FIGURE 36 NORTH AMERICA: MARKET SNAPSHOT

TABLE 133 NORTH AMERICA IMMERSION COOLING FLUIDS MARKET, BY COUNTRY, 20192021 (USD THOUSAND)

TABLE 134 NORTH AMERICA IMMERSION COOLING FLUIDS MARKET, BY COUNTRY, 20222027 (USD THOUSAND)

TABLE 135 NORTH AMERICA IMMERSION COOLING FLUIDS MARKET, BY COUNTRY, 20192021 (THOUSAND LITERS)

TABLE 136 NORTH AMERICA IMMERSION COOLING FLUIDS MARKET, BY COUNTRY, 20222027 (THOUSAND LITERS)

TABLE 137 NORTH AMERICA IMMERSION COOLING FLUIDS MARKET, BY END USE, 20192021 (USD THOUSAND)

TABLE 138 NORTH AMERICA IMMERSION COOLING FLUIDS MARKET, BY END USE, 20222027 (USD THOUSAND)

TABLE 139 NORTH AMERICA IMMERSION COOLING FLUIDS MARKET, BY END USE, 20192021 (THOUSAND LITERS)

TABLE 140 NORTH AMERICA IMMERSION COOLING FLUIDS MARKET, BY END USE, 20222027 (THOUSAND LITERS)

TABLE 141 NORTH AMERICA IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20192021 (USD THOUSAND)

TABLE 142 NORTH AMERICA IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20222027 (USD THOUSAND)

TABLE 143 NORTH AMERICA IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20192021 (THOUSAND LITERS)

TABLE 144 NORTH AMERICA IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20222027 (THOUSAND LITERS)

10.3.1 US

10.3.1.1 Expected to account for largest market share in North America

TABLE 145 US IMMERSION COOLING FLUIDS MARKET, BY END USE, 20192021 (USD THOUSAND)

TABLE 146 US IMMERSION COOLING FLUIDS MARKET, BY END USE, 20222027 (USD THOUSAND)

TABLE 147 US IMMERSION COOLING FLUIDS MARKET, BY END USE, 20192021 (THOUSAND LITERS)

TABLE 148 US IMMERSION COOLING FLUIDS MARKET, BY END USE, 20222027 (THOUSAND LITERS)

TABLE 149 US IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20192021 (USD THOUSAND)

TABLE 150 US IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20222027 (USD THOUSAND)

TABLE 151 US IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20192021 (THOUSAND LITERS)

TABLE 152 US IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20222027 (THOUSAND LITERS)

10.3.2 CANADA

10.3.2.1 Data centers to provide lucrative growth opportunities

TABLE 153 CANADA IMMERSION COOLING FLUIDS MARKET, BY END USE, 20192021 (USD THOUSAND)

TABLE 154 CANADA IMMERSION COOLING FLUIDS MARKET, BY END USE, 20222027 (USD THOUSAND)

TABLE 155 CANADA IMMERSION COOLING FLUIDS MARKET, BY END USE, 20192021 (THOUSAND LITERS)

TABLE 156 CANADA IMMERSION COOLING FLUIDS MARKET, BY END USE, 20222027 (THOUSAND LITERS)

TABLE 157 CANADA IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20192021 (USD THOUSAND)

TABLE 158 CANADA IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20222027 (USD THOUSAND)

TABLE 159 CANADA IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20192021 (THOUSAND LITERS)

TABLE 160 CANADA IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20222027 (THOUSAND LITERS)

10.3.3 MEXICO

10.3.3.1 Developing manufacturing industry to boost demand for mineral oil

TABLE 161 MEXICO IMMERSION COOLING FLUIDS MARKET, BY END USE, 20192021 (USD THOUSAND)

TABLE 162 MEXICO IMMERSION COOLING FLUIDS MARKET, BY END USE, 20222027 (USD THOUSAND)

TABLE 163 MEXICO IMMERSION COOLING FLUIDS MARKET, BY END USE, 20192021 (THOUSAND LITERS)

TABLE 164 MEXICO IMMERSION COOLING FLUIDS MARKET, BY END USE, 20222027 (THOUSAND LITERS)

TABLE 165 MEXICO IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20192021 (USD THOUSAND)

TABLE 166 MEXICO IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20222027 (USD THOUSAND)

TABLE 167 MEXICO IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20192021 (THOUSAND LITERS)

TABLE 168 MEXICO IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20222027 (THOUSAND LITERS)

10.4 EUROPE

FIGURE 37 EUROPE: MARKET SNAPSHOT

TABLE 169 EUROPE IMMERSION COOLING FLUIDS MARKET, BY COUNTRY, 20192021 (USD THOUSAND)

TABLE 170 EUROPE IMMERSION COOLING FLUIDS MARKET, BY COUNTRY, 20222027 (USD THOUSAND)

TABLE 171 EUROPE IMMERSION COOLING FLUIDS MARKET, BY COUNTRY, 20192021 (THOUSAND LITERS)

TABLE 172 EUROPE IMMERSION COOLING FLUIDS MARKET, BY COUNTRY, 20222027 (THOUSAND LITERS)

TABLE 173 EUROPE IMMERSION COOLING FLUIDS MARKET, BY END USE, 20192021 (USD THOUSAND)

TABLE 174 EUROPE IMMERSION COOLING FLUIDS MARKET, BY END USE, 20222027 (USD THOUSAND)

TABLE 175 EUROPE IMMERSION COOLING FLUIDS MARKET, BY END USE, 20192021 (THOUSAND LITERS)

TABLE 176 EUROPE IMMERSION COOLING FLUIDS MARKET, BY END USE, 20222027 (THOUSAND LITERS)

TABLE 177 EUROPE IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20192021 (USD THOUSAND)

TABLE 178 EUROPE IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20222027 (USD THOUSAND)

TABLE 179 EUROPE IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20192021 (THOUSAND LITERS)

TABLE 180 EUROPE IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20222027 (THOUSAND LITERS)

10.4.1 GERMANY

10.4.1.1 Improvements in IT infrastructure to drive market

TABLE 181 GERMANY IMMERSION COOLING FLUIDS MARKET, BY END USE, 20192021 (USD THOUSAND)

TABLE 182 GERMANY IMMERSION COOLING FLUIDS MARKET, BY END USE, 20222027 (USD THOUSAND)

TABLE 183 GERMANY IMMERSION COOLING FLUIDS MARKET, BY END USE, 20192021 (THOUSAND LITERS)

TABLE 184 GERMANY IMMERSION COOLING FLUIDS MARKET, BY END USE, 20222027 (THOUSAND LITERS)

TABLE 185 GERMANY IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20192021 (USD THOUSAND)

TABLE 186 GERMANY IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20222027 (USD THOUSAND)

TABLE 187 GERMANY IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20192021 (THOUSAND LITERS)

TABLE 188 GERMANY IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20222027 (THOUSAND LITERS)

10.4.2 FRANCE

10.4.2.1 Increased investments in renewable energy to power market

TABLE 189 FRANCE IMMERSION COOLING FLUIDS MARKET, BY END USE, 20192021 (USD THOUSAND)

TABLE 190 FRANCE IMMERSION COOLING FLUIDS MARKET, BY END USE, 20222027 (USD THOUSAND)

TABLE 191 FRANCE IMMERSION COOLING FLUIDS MARKET, BY END USE, 20192021 (THOUSAND LITERS)

TABLE 192 FRANCE IMMERSION COOLING FLUIDS MARKET, BY END USE, 20222027 (THOUSAND LITERS)

TABLE 193 FRANCE IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20192021 (USD THOUSAND)

TABLE 194 FRANCE IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20222027 (USD THOUSAND)

TABLE 195 FRANCE IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20192021 (THOUSAND LITERS)

TABLE 196 FRANCE IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20222027 (THOUSAND LITERS)

10.4.3 UK

10.4.3.1 Need for effective cooling solutions for transformers to boost market

TABLE 197 UK IMMERSION COOLING FLUIDS MARKET, BY END USE, 20192021 (USD THOUSAND)

TABLE 198 UK IMMERSION COOLING FLUIDS MARKET, BY END USE, 20222027 (USD THOUSAND)

TABLE 199 UK IMMERSION COOLING FLUIDS MARKET, BY END USE, 20192021 (THOUSAND LITERS)

TABLE 200 UK IMMERSION COOLING FLUIDS MARKET, BY END USE, 20222027 (THOUSAND LITERS)

TABLE 201 UK IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20192021 (USD THOUSAND)

TABLE 202 UK IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20222027 (USD THOUSAND)

TABLE 203 UK IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20192021 (THOUSAND LITERS)

TABLE 204 UK IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20222027 (THOUSAND LITERS)

10.4.4 NETHERLANDS

10.4.4.1 Rising number of data centers to drive market

TABLE 205 NETHERLANDS IMMERSION COOLING FLUIDS MARKET, BY END USE, 20192021 (USD THOUSAND)

TABLE 206 NETHERLANDS IMMERSION COOLING FLUIDS MARKET, BY END USE, 20222027 (USD THOUSAND)

TABLE 207 NETHERLANDS IMMERSION COOLING FLUIDS MARKET, BY END USE, 20192021 (THOUSAND LITERS)

TABLE 208 NETHERLANDS IMMERSION COOLING FLUIDS MARKET, BY END USE, 20222027 (THOUSAND LITERS)

TABLE 209 NETHERLANDS IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20192021 (USD THOUSAND)

TABLE 210 NETHERLANDS IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20222027 (USD THOUSAND)

TABLE 211 NETHERLANDS IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20192021 (THOUSAND LITERS)

TABLE 212 NETHERLANDS IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20222027 (THOUSAND LITERS)

10.4.5 SPAIN

10.4.5.1 Increasing demand for cloud computing and data centers to bolster market

TABLE 213 SPAIN IMMERSION COOLING FLUIDS MARKET, BY END USE, 20192021 (USD THOUSAND)

TABLE 214 SPAIN IMMERSION COOLING FLUIDS MARKET, BY END USE, 20222027 (USD THOUSAND)

TABLE 215 SPAIN IMMERSION COOLING FLUIDS MARKET, BY END USE, 20192021 (THOUSAND LITERS)

TABLE 216 SPAIN IMMERSION COOLING FLUIDS MARKET, BY END USE, 20222027 (THOUSAND LITERS)

TABLE 217 SPAIN IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20192021 (USD THOUSAND)

TABLE 218 SPAIN IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20222027 (USD THOUSAND)

TABLE 219 SPAIN IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20192021 (THOUSAND LITERS)

TABLE 220 SPAIN IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20222027 (THOUSAND LITERS)

10.4.6 RUSSIA

10.4.6.1 Power plant upgrades to generate demand for effective cooling solutions

TABLE 221 RUSSIA IMMERSION COOLING FLUIDS MARKET, BY END USE, 20192021 (USD THOUSAND)

TABLE 222 RUSSIA IMMERSION COOLING FLUIDS MARKET, BY END USE, 20222027 (USD THOUSAND)

TABLE 223 RUSSIA IMMERSION COOLING FLUIDS MARKET, BY END USE, 20192021 (THOUSAND LITERS)

TABLE 224 RUSSIA IMMERSION COOLING FLUIDS MARKET, BY END USE, 20222027 (THOUSAND LITERS)

TABLE 225 RUSSIA IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20192021 (USD THOUSAND)

TABLE 226 RUSSIA IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20222027 (USD THOUSAND)

TABLE 227 RUSSIA IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20192021 (THOUSAND LITERS)

TABLE 228 RUSSIA IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20222027 (THOUSAND LITERS)

10.4.7 REST OF EUROPE

TABLE 229 REST OF EUROPE IMMERSION COOLING FLUIDS MARKET, BY END USE, 20192021 (USD THOUSAND)

TABLE 230 REST OF EUROPE IMMERSION COOLING FLUIDS MARKET, BY END USE, 20222027 (USD THOUSAND)

TABLE 231 REST OF EUROPE IMMERSION COOLING FLUIDS MARKET, BY END USE, 20192021 (THOUSAND LITERS)

TABLE 232 REST OF EUROPE IMMERSION COOLING FLUIDS MARKET, BY END USE, 20222027 (THOUSAND LITERS)

TABLE 233 REST OF EUROPE IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20192021 (USD THOUSAND)

TABLE 234 REST OF EUROPE IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20222027 (USD THOUSAND)

TABLE 235 REST OF EUROPE IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20192021 (THOUSAND LITERS)

TABLE 236 REST OF EUROPE IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20222027 (THOUSAND LITERS)

10.5 MIDDLE EAST & AFRICA

TABLE 237 MIDDLE EAST & AFRICA IMMERSION COOLING FLUIDS MARKET, BY END USE, 20192021 (USD THOUSAND)

TABLE 238 MIDDLE EAST & AFRICA IMMERSION COOLING FLUIDS MARKET, BY END USE, 20222027 (USD THOUSAND)

TABLE 239 MIDDLE EAST & AFRICA IMMERSION COOLING FLUIDS MARKET, BY END USE, 20192021 (THOUSAND LITERS)

TABLE 240 MIDDLE EAST & AFRICA IMMERSION COOLING FLUIDS MARKET, BY END USE, 20222027 (THOUSAND LITERS)

TABLE 241 MIDDLE EAST & AFRICA IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20192021 (USD THOUSAND)

TABLE 242 MIDDLE EAST & AFRICA IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20222027 (USD THOUSAND)

TABLE 243 MIDDLE EAST & AFRICA IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20192021 (THOUSAND LITERS)

TABLE 244 MIDDLE EAST & AFRICA IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20222027 (THOUSAND LITERS)

10.6 SOUTH AMERICA

TABLE 245 SOUTH AMERICA IMMERSION COOLING FLUIDS MARKET, BY END USE, 20192021 (USD THOUSAND)

TABLE 246 SOUTH AMERICA IMMERSION COOLING FLUIDS MARKET, BY END USE, 20222027 (USD THOUSAND)

TABLE 247 SOUTH AMERICA IMMERSION COOLING FLUIDS MARKET, BY END USE, 20192021 (THOUSAND LITERS)

TABLE 248 SOUTH AMERICA IMMERSION COOLING FLUIDS MARKET, BY END USE, 20222027 (THOUSAND LITERS)

TABLE 249 SOUTH AMERICA IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20192021 (USD THOUSAND)

TABLE 250 SOUTH AMERICA IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20222027 (USD THOUSAND)

TABLE 251 SOUTH AMERICA IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20192021 (THOUSAND LITERS)

TABLE 252 SOUTH AMERICA IMMERSION COOLING FLUIDS MARKET, BY TYPE, 20222027 (THOUSAND LITERS)

11 COMPETITIVE LANDSCAPE (Page No. - 175)

11.1 OVERVIEW

11.2 STRATEGIES ADOPTED BY KEY PLAYERS

TABLE 253 OVERVIEW OF STRATEGIES ADOPTED BY IMMERSION COOLING FLUIDS MANUFACTURERS

11.3 MARKET SHARE AND REVENUE ANALYSIS

11.3.1 MARKET SHARE ANALYSIS

FIGURE 38 MARKET SHARE ANALYSIS

11.3.2 REVENUE ANALYSIS OF TOP PLAYERS IN IMMERSION COOLING FLUIDS MARKET

FIGURE 39 TOP PLAYERS REVENUE ANALYSIS (20172021)

11.4 COMPETITIVE LANDSCAPE MAPPING, 2021

11.4.1 STARS

11.4.2 EMERGING LEADERS

11.4.3 PERVASIVE PLAYERS

11.4.4 PARTICIPANTS

FIGURE 40 IMMERSION COOLING FLUIDS MARKET: COMPETITIVE LANDSCAPE MAPPING

11.5 START-UP/SME MATRIX, 2021

11.5.1 PROGRESSIVE COMPANIES

11.5.2 DYNAMIC COMPANIES

11.5.3 RESPONSIVE COMPANIES

11.5.4 STARTING BLOCKS

FIGURE 41 IMMERSION COOLING FLUIDS MARKET: COMPETITIVE LEADERSHIP MAPPING OF EMERGING COMPANIES

TABLE 254 COMPANY BY TYPE FOOTPRINT, 2021

TABLE 255 COMPANY END USE FOOTPRINT, 2021

TABLE 256 COMPANY REGION FOOTPRINT, 2021

TABLE 257 COMPANY TOTAL FOOTPRINT, 2020

TABLE 258 IMMERSION COOLING FLUIDS MARKET: DETAILED LIST OF KEY START-UPS/SMES

11.6 KEY MARKET DEVELOPMENTS

TABLE 259 IMMERSION COOLING FLUIDS MARKET: PRODUCT LAUNCHES, 2016-2022

TABLE 260 IMMERSION COOLING FLUID MARKET: DEALS, 2016-2022

TABLE 261 IMMERSION COOLING FLUID MARKET: OTHERS, 2016-2022

12 COMPANY PROFILES (Page No. - 190)

12.1 KEY PLAYERS

(Business Overview, Products, Solutions & Services offered, Recent Developments, SWOT Analysis, MnM View)*

12.1.1 NYNAS AB

TABLE 262 NYNAS AB: COMPANY OVERVIEW

12.1.2 ERGON, INC.

TABLE 263 ERGON, INC.: COMPANY OVERVIEW

12.1.3 PETROCHINA COMPANY LIMITED

TABLE 264 PETROCHINA COMPANY LIMITED: COMPANY OVERVIEW

FIGURE 42 PETROCHINA COMPANY LIMITED: COMPANY SNAPSHOT

12.1.4 APAR INDUSTRIES

TABLE 265 APAR INDUSTRIES: COMPANY OVERVIEW

FIGURE 43 APAR INDUSTRIES: COMPANY SNAPSHOT

12.1.5 SINOPEC LUBRICANT COMPANY

TABLE 266 SINOPEC LUBRICANT COMPANY: COMPANY OVERVIEW

12.1.6 SOLVAY

TABLE 267 SOLVAY: COMPANY OVERVIEW

FIGURE 44 SOLVAY: COMPANY SNAPSHOT

12.1.7 LANXESS

TABLE 268 LANXESS: COMPANY OVERVIEW

FIGURE 45 LANXESS: COMPANY SNAPSHOT

12.1.8 3M

TABLE 269 3M: COMPANY OVERVIEW

FIGURE 46 3M: COMPANY SNAPSHOT

12.1.9 CHEMOURS

TABLE 270 CHEMOURS: COMPANY OVERVIEW

FIGURE 47 CHEMOURS: COMPANY SNAPSHOT

12.1.10 SHELL PLC

TABLE 271 SHELL PLC: COMPANY OVERVIEW

FIGURE 48 SHELL PLC: COMPANY SNAPSHOT

12.1.11 FUCHS PETROLUB SE

TABLE 272 FUCHS PETROLUB SE: COMPANY OVERVIEW

FIGURE 49 FUCHS PETROLUB SE: COMPANY SNAPSHOT

12.1.12 GREEN REVOLUTION COOLING INC.

TABLE 273 GREEN REVOLUTION COOLING INC.: COMPANY OVERVIEW

12.1.13 SUBMER

TABLE 274 SUBMER: COMPANY OVERVIEW

12.1.14 ENGINEERED FLUIDS

TABLE 275 ENGINEERED FLUIDS: COMPANY OVERVIEW

12.1.15 M&I MATERIALS LIMITED.

TABLE 276 M&I MATERIALS LIMITED: COMPANY OVERVIEW

12.1.16 ZHEJIANG NOAH FLUOROCHEMICAL CO., LTD.

TABLE 277 ZHEJIANG NOAH FLUOROCHEMICAL CO., LTD.: COMPANY OVERVIEW

12.1.17 SANMING HEXAFLUO CHEMICALS CO., LTD.

TABLE 278 SANMING HEXAFLUO CHEMICALS CO., LTD.: COMPANY OVERVIEW

12.1.18 THE LUBRIZOL CORPORATION

TABLE 279 THE LUBRIZOL CORPORATION: COMPANY OVERVIEW

12.1.19 CASTROL

TABLE 280 CASTROL: COMPANY OVERVIEW

12.1.20 CARGILL, INCORPORATED

TABLE 281 CARGILL, INCORPORATED: BUSINESS OVERVIEW

TABLE 282 CARGILL, INCORPORATED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

12.1.21 DOBER

TABLE 283 DOBER: BUSINESS OVERVIEW

TABLE 284 DOBER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

12.1.22 FLUOREZ TECHNOLOGY INC.

TABLE 285 FLUOREZ TECHNOLOGY INC.: BUSINESS OVERVIEW

TABLE 286 FLUOREZ TECHNOLOGY INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

12.1.23 TOTALENERGIES

TABLE 287 TOTALENERGIES: BUSINESS OVERVIEW

FIGURE 50 TOTALENERGIES: COMPANY SNAPSHOT

TABLE 288 TOTALENERGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

12.1.24 GUANGDONG GIANT FLUORINE ENERGY SAVING TECHNOLOGY CO., LTD

TABLE 289 GUANGDONG GIANT FLUORINE ENERGY SAVING TECHNOLOGY CO., LTD: BUSINESS OVERVIEW

TABLE 290 GUANGDONG GIANT FLUORINE ENERGY SAVING TECHNOLOGY CO., LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

12.1.25 HONEYWELL INTERNATIONAL INC.

TABLE 291 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

FIGURE 51 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

*Details on Business Overview, Products, Solutions, & Services offered, Recent Developments, MnM View might not be captured in case of unlisted companies.

12.2 OTHER PLAYERS

12.2.1 SHENZHEN HUAYI BROTHER TECHNOLOGY CO., LTD.

13 APPENDIX (Page No. - 232)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGESTORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

13.3 CUSTOMIZATION OPTIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

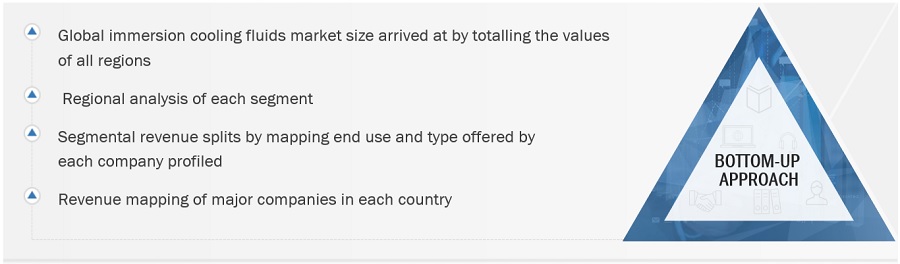

The study involved four major activities in estimating the current size of the immersion cooling fluids market. Exhaustive secondary research was done to collect information on the market, peer markets, and parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the immersion cooling fluids value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources for this research study include annual reports; press releases, and investor presentations of companies; white papers; certified publications; and articles by recognized authors, gold- and silver-standard websites, immersion cooling fluids manufacturing companies, regulatory bodies, trade directories, and databases. The secondary research was mainly used to obtain key information about the industrys supply chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. It has also been used to obtain information about key developments from a market-oriented perspective.

Primary Research

The immersion cooling fluids market comprises several stakeholders, such as raw material suppliers, processors, end-use industries, and regulatory organizations in the supply chain. The demand side of the market is characterized by the presence of immersion cooling fluids manufacturers, importers/exporters, and manufacturers engaged in the production of various products. The supply side is characterized by key technology providers for immersion cooling fluids, end-users, researchers, and service providers.

In the primary research process, various primary sources from the supply and demand sides of the market have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side included key opinion leaders, executives, vice presidents, and CEOs of manufacturing companies. The primary sources from the supply side included research institutions involved in R&D activities to introduce new technologies, key opinion leaders, distributors, and immersion cooling fluids manufacturing companies.

Breakdown of the Primary Interviews

Notes: Other designations include sales managers, engineers, and regional managers.

Tier 1 companyrevenue >USD 5 billion, tier 2 companyrevenue between USD 1 and USD 5 billion, and tier 3 companyrevenue <USD 1 billion

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches have been used to estimate and validate the total size of the immersion cooling fluids market. These approaches have also been used extensively to estimate the size of various dependent subsegments of the market. The research methodology used to estimate the market size included the following:

The following segments provide details about the overall market size estimation process employed in this study

- The key players in the market were identified through secondary research.

- The market shares in the respective regions were identified through primary and secondary research.

- The value chain and market size of the immersion cooling fluids market, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of annual and financial reports of the top market players and interviews with industry experts, such as CEOs, VPs, directors, sales managers, and marketing executives, for key insights, both quantitative and qualitative.

Global Immersion cooling fluids Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the estimation process explained below, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market was validated using both the top-down and bottom-up approaches.

Report Objectives

Market Intelligence

- To analyze and forecast the size of the immersion cooling fluids market in terms of value

- To define, describe, and forecast the market size by type, end use, technology, and region

- To forecast the market size with respect to five main regions, namely, North America, Europe, Asia Pacific, the Middle East & Africa, and South America

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze the market segments with respect to individual growth trends, prospects, and their contribution to the market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To analyze competitive developments, such as product launches, joint ventures and expansions in the immersion cooling fluids market

Competitive Intelligence

- To identify and profile the key players in the immersion cooling fluids market

- To determine the top players offering various products in the immersion cooling fluids market

- To provide a comparative analysis of the market leaders based on the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- To understand the competitive landscape of the market and identify the key growth strategies adopted by the leading players across key regions

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Immersion Cooling Fluids Market