Immersion Cooling Market by Type (Single-Phase and Two-Phase), Application (High-Performance Computing, Edge Computing, Cryptocurrency Mining), Cooling Fluid, Components (Solutions, Services), and Geography - Global Forecast to 2030

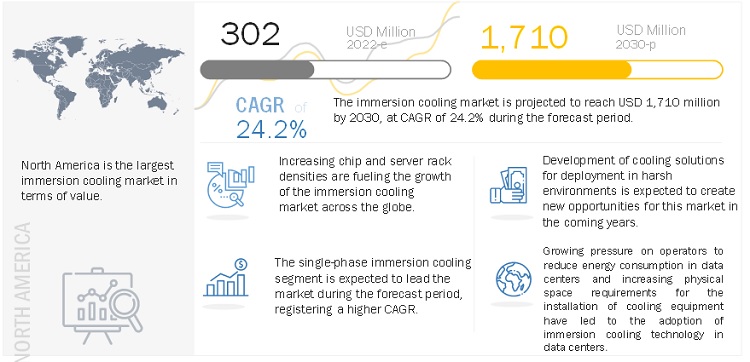

[241 Pages Report] The immersion cooling market is projected to grow from USD 244 million in 2021 to USD 1,710 million by 2030, at a CAGR of 24.2% from 2022 to 2030. The increased demand for immersion cooling solutions is propelled by the growing server density across the globe and high adoption in cryptocurrency mining and blockchain applications. Immersion cooling solutions not only provide high efficiency cooling but also have an advantage from operational expenditure perspective. The market is also expected to be driven by need for environmentally friendly data center cooling solutions.

Attractive Opportunities in the Immersion Cooling Market

*e-estimated, p-projected

To know about the assumptions considered for the study, Request for Free Sample Report

Immersion Cooling Market Dynamics

Driver: Adoption in cryptocurrency mining & blockchain

Cryptocurrency is an electronic currency which is stored in a ledger system called blockchain. Blockchain can be considered as a database wherein encrypted blocks of digital assets such as cryptocrrency data is stored and chained together. Thus, forming a single-source-of-truth for the data. Cryptocurrency mining is a algorithm solving process that verifies and adds new transactions to the blockchain for a cryptocurrency that uses the proof-of-work (PoW) method. The miner that wins the competition of solving the algorithm is rewarded with some amount of the currency and/or transaction fees. The algorithm that miners attempt to solve consumes a lot of electricity. For instance, according to Digiconomist, Bitcoin and Ethereum mining together consumed as much energy as Indonesia in 2021. With high electricity consumption, also arises the issue of heat generation. Immersion cooling solutions provides the optimal solution to the heat generation issue and there are practical worldwide use cases available.

Restraint: Air cooling remains dominant technology for data center cooling

Air cooling technology uses AHUs, fans, HVAC ducts, and air coolers for data center cooling. In this technology air is the primary medium of heat transfer and during requirement of high cooling the air flow to data servers and racks is increased. Air cooling technology has been ever present and it was easy to find new applications, such as data center cooling. Moreover, air cooling solutions are less complex, easy to install and require no additional knowledge to handle the working and maintenance. Air cooling uses components such as inverter-driven compressors, variable speed fans, and condensers. Companies such as Dell Technologies, Google, and Meta have air cooling technology for their data centers.

Opportunities: Development of data center cooling solutions for deployment in harsh conditions

Sometimes, data centers are built in harsh environments such as deserts, and regions where weather fluctuations and seismic events are regular occurrences. Traditional air cooling technology uses ambient temperature to cool the hardware. In harsh environments of deserts, it is difficult to maintain a low ambient temperature due to the outside temperature being high. In such cases cooled/ chilled water is used for maintaining the temperature of ambient air by means of a heat exchanger. However, in places of desert conditions and drought there is an issue of water scarcity. Such practical issues have been noted around the globe. On the other hand, immersion cooling systems require negligible amount of water compared to traditional air-cooling systems. As a result, vendors of immersion cooling solutions are developing customized solutions that can withstand harsh environments in industries such as military, oil & gas, shipping, and aeronautics. Developing immersion cooling solutions that can sustain in harsh environments is anticipated to provide new avenues for the growth of the immersion cooling market.

Challenge: High investment in existing infrastructure

Many organization still use traditional air cooling and direct plate cooling solutions. Data center owners are reluctant to replace this existing infrastructure and invest additional funds in upgrading to immersion cooling solutions. The existing infrastructure has a cost which becomes redundant. This becomes a challenge to immersion cooling solution provider for capturing more market share.

Cryptocurrency mining segment to dominate the market in 2021

Cryptocurrency is a digital currency and is currently being used for transactions across the globe. However, this currency needs to be mined by solving complex algorithms, for which CPUs and GPUs must be clubbed together to increase the computing power. This causes a surge in electricity consumption leading to development of tremendous amount of heat. The optimal temperature for machines/rigs at which cryptocurrencies can be mined ranges between 15-35 ?C. Immersion cooling solutions are capable of providing and maintaining the said temperature by use of advanced dielectric coolant fluids. Currently, there are numerous practical use cases of cryptocurrency mining organizations using immersion cooling solutions.

Fluorocarbon-based fluids segment to hold second largest share of the immersion cooling market in 2021

Fluorocarbon-based fluids are basically fluorinated carbon-chain polymers. These fluids are extremely inert, non-reactive and do not conduct electricity. As a result, apart from synthetic fluids, fluorocarbon-based fluids are also witnessing increased demand. Currently, one of the largest producer of fluorocarbon-based fluids for the immersion cooling market is 3M. The company with its brand image and goodwill has been a strong advocate for adoption of these fluids. Fluorocarbon-based fluids are pre-dominantly used in two-phase immersion cooling systems.

Single-phase immersion cooling segment is expected to have the largest CAGR during the forecast period

Single-phase immersion cooling systems have a distinct advantage over two-phase immersion cooling systems in terms of lesser cost of maintenance and need for refilling of costly dielectric coolant fluids. In single-phase immersion cooling systems, there is no phase change of the dielectric coolant fluid. In this system, the boiling point of the dielectric coolant fluid is much higher than operating temperatures which allows the fluid to maintain its phase. Single-phase immersion cooling systems are also more efficient in terms of PUE effectiveness and the total cost of ownership.

Solutions component segment is expected to have the largest market share during the forecast period

The solutions segment comprises necessary equipment needed for the efficient functioning of an immersion cooling system. These equipment include immersion tank, heat exchangers, tubes, heat exchangers, and pumps. Currently, a majority companies opting for immersion cooling systems are more interested in getting customized solutions from current immersion cooling vendors. One of the primary causes is that current data centers are equipped with air cooling technology and hence a complete overhaul of cooling technology may be challenging and a costly affair.

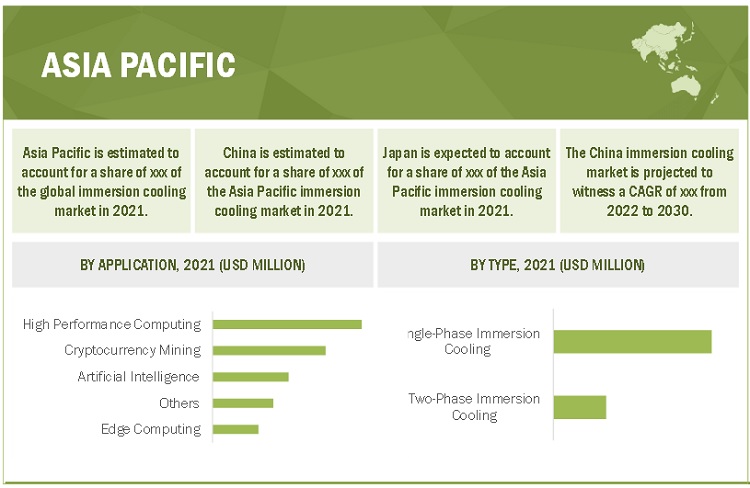

Asia Pacific is expected to be the fastest growing region during the forecast period

Data centers in the Asia Pacific region are undergoing significant changes in terms of increased server rack & chip densities, and power consumption. This region is also witnessing huge investments in the upgrade of existing data centers and the setting up of new data centers by companies such as Google, Microsoft, and Samsung and other companies such as Avent, Lenovo, and Dell Technologies. Many of the Asia Pacific countries are developing economies, and there is a large scope for investors to expand their business. Immersion cooling technologies are beneficial for hot climates as they do not emit any further heat.

To know about the assumptions considered for the study, download the pdf brochure

Market expected to mature in the coming years as technology evolves

The immersion cooling market is still under development phase and new companies are coming with their own patents and custom solutions. Earlier, companies offering immersion cooling solutions provided complete immersion of processors into specialized tanks. However, there have been developments in recent years wherein companies have started providing rack-based immersion cooling. Rack-based immersion solutions are more cost-effective and complete integration of the system is possible within a few hours. The immersion cooling market is expected to evolve further as technology matures and new concepts of immersion cooling come into picture. However, it is clear that immersion cooling systems are the only viable solution in terms of controlling heat dissipation and maintaining the appropriate PUE.

Today, the dominant companies operating in the immersion cooling market are Green Revolution Cooling Inc. (US), Submer (Spain), Asperitas (Netherlands), Midas Green Technologies (US), and LiquidStack (Netherlands).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market Size Available for Years |

2017–2030 |

|

Base Year Considered |

2021 |

|

Forecast Period |

2022–2030 |

|

Forecast Units |

Value (USD Million) |

|

Segments Covered |

Application, Type, Cooling Fluid, Components and Region |

|

Geographies Covered |

North America, Asia Pacific, Europe, the Middle East & Africa, and South America |

|

Companies Covered |

LiquidStack (Netherlands), Fujitsu (Japan), Green Revolution Cooling Inc (US), Submer (Spain), Asperitas (Netherlands), Midas Green Technologies (US), Iceotope Technologies Ltd (US), LiquidCool Solutions (US), DUG Technology (Australia), DCX - The Liquid Cooling Company (Poland), ExaScaler Inc (Japan), SixtyOneC Technology Corporation (Canada), Engineered Fluids (US), TEIMMERS (Netherlands), TMGcore, Inc. (US), GIGA-BYTE Technology Co., Ltd. (Taiwan), Wiwynn (Taiwan), Hypertec (Canada), TAS (US), and Delta Power Solutions (Taiwan) |

This research report categorizes the immersion cooling market based on application, type, cooling fluid, and region and forecasts revenues as well as analyzes trends in each of these submarkets.

Based on application, the immersion cooling market has been segmented into:

- High-performance Computing

- Artificial Intelligence

- Edge Computing

- Cryptocurrency Mining

- Others (Cloud Computing, Enterprise Computing)

Based on type, the immersion cooling market has been segmented into:

- Single-Phase Immersion Cooling

- Two-Phase Immersion Cooling

- Based on the cooling fluid, the immersion cooling market has been segmented into:

- Mineral Oil

- Synthetic Fluids

- Fluorocarbon-based Fluids

- Other (Vegetable Oil, Bio-Oil, Silicone Oil, Deionized Water)

Based on the components, the immersion cooling market has been segmented into:

- Solutions

- Services

Based on the region, the immersion cooling market has been segmented into:

- Asia Pacific

- North America

- Europe

- Middle East & Africa

- South America

Recent Developments

- In June 2021, Submer announced its latest partnership with ASA Computers, a leading IT solution provider that has been delivering innovative systems to rack solutions across the globe for over 30 years. The agreement was forged out of a need to provide an alternative solution for the data center industry in decreasing energy usage and costs, increasing compute density, capacity (Power, Cooling, Space), reducing operating and capital expenses, and more.

- In June 2021, Schneider Electric and Iceotope Technologies Limited together have announced the launch of a liquid-cooled, EcoStruxure Modular Data Center, All-In-One Module. Integrated by Avnet and containing chassis-level precision immersion cooling from Iceotope, the new prefabricated module will allow the most CPU- and GPU-intensive high-performance computing (HPC) edge applications to be deployed with greater reliability in harsh and remote environments.

- In March 2021, LiquidStack, announced its launch with new deployments across vital sectors such as high-performance computing (HPC), cloud services, artificial intelligence (AI), and edge and telecommunications, backed by its first round of funding and a strong, experienced leadership team, with USD 10 million Series “A” investment and strategic partnership with Wiwynn, an innovative cloud IT infrastructure provider of server and storage system design, manufacturing, and rack integration for data centers.

Frequently Asked Questions (FAQ):

What are the different types of immersion cooling technologies?

Single-phase and two-phase are the two main types of immersion cooling technologies.

Which are the key countries expected to fuel the growth of immersion cooling market?

The immersion cooling market is expected to grow the fastest in India, China, the Netherlands, and the US.

What are the key driving factors for the immersion cooling market?

Increasing number of data centers, growing density of servers, rising need for cost-effective and eco-friendly cooling solutions, are expected to drive the immersion cooling market.

What are the new opportunities for the immersion cooling market?

Adoption in low-density data centers, and the emergence of AI, blockchain, and other technologies, are expected to provide new growth opportunities for the immersion cooling market.

Who are the major players in the immersion cooling market?

LiquidStack (Netherlands), Green Revolution Cooling Inc (US), Submer (Spain), Asperitas (Netherlands), and Midas Green Technologies (US) are the major players in the immersion cooling market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

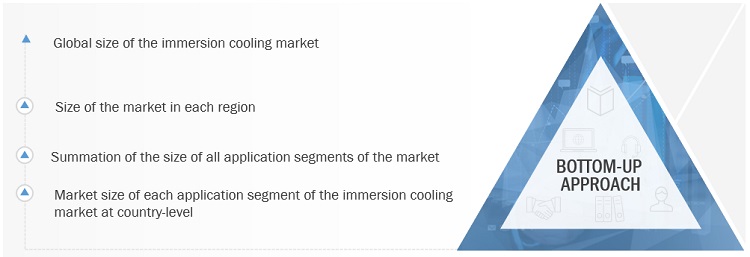

The study involved four major activities in estimating the current size of the immersion cooling market. Exhaustive secondary research was undertaken to collect information on the immersion cooling market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the immersion cooling value chain through primary research. Both, top-down and bottom-up approaches were employed to estimate the overall size of the market. Thereafter, the market breakdown and data triangulation procedures were used to estimate the sizes of different segments and sub segments of the immersion cooling market.

Secondary Research

As a part of the secondary research process, various secondary sources such as Hoovers, Bloomberg, BusinessWeek, and Dun & Bradstreet were referred to for identifying and collecting information for this study on the antifog additives market. Secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, and articles by recognized authors, authenticated directories, and databases.

Secondary research was mainly conducted to obtain key information about the supply chain of the industry, the monetary chain of the market, the total pool of players, and market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments undertaken from both, market- and technology oriented perspectives.

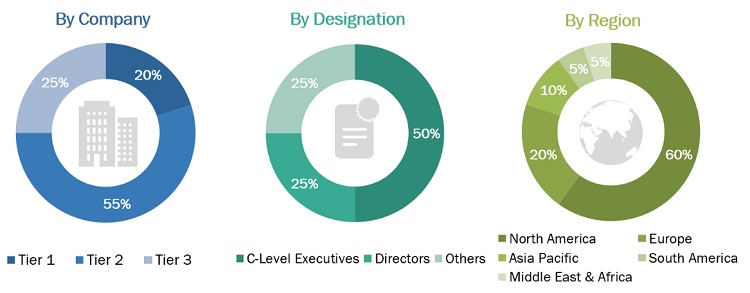

Primary Research

As a part of the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for this report on the immersion cooling market. Primary sources from the supply side included industry experts such as Chief Executive Officers (CEOs), vice presidents, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the immersion cooling market. Primary sources from the demand side included directors, marketing heads, and purchase managers from various end-use industries. Following is the breakdown of the primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the immersion cooling market. These methods were also used extensively to estimate the size of various segments and subsegments of the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The supply chain of the industry and the market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Global Immersion Cooling Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. Data triangulation and market breakdown procedures were used, wherever applicable to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments of the market. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition t this, the market size was validated using both top-down and bottom-up approaches.

Objectives of the Report

- To define, describe, and forecast the immersion cooling market based on application, type, cooling fluid, components and region

- To forecast the size of the market and its segments with respect to five main regions, namely, North America, Europe, Asia Pacific, the Middle East & Africa, and South America, along with their respective key countries

- To provide detailed information regarding the major factors such as drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze micro markets with respect to the individual growth trends, future prospects, and contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a detailed competitive landscape for market leaders

- To strategically profile key players and comprehensively analyze their market share and core competencies

- To track and analyze competitive developments such as expansions, product launches, partnerships, agreements, and joint ventures in the immersion cooling market

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Further breakdown of the Middle East & African, and South American immersion cooling markets

- Product matrix, which gives a detailed comparison of the product portfolio of each company

- Detailed analysis and profiles of additional market players (up to 3)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Immersion Cooling Market