In-vehicle Infotainment Market by Component (Display Unit, Control Panel, TCU, HUD), OS (Linux, QNX, MS), Service (Entertainment, Navigation, e-Call, Diagnostic), Connectivity, Form, Display Size, Location, Vehicle Type Region - Global Forecast to 2028

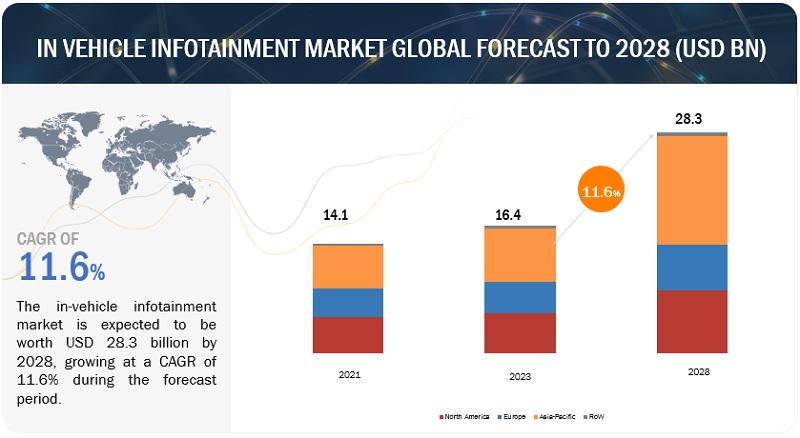

[370 Pages Report] The in-vehicle infotainment market is projected to grow from USD 18.8 billion in 2023 to USD 31.4 billion by 2028, at a CAGR of 10.9%. The in-vehicle Infotainment system aggregates all the vehicle's infotainment functions, including tuner reception, media connectivity, audio playback, navigation, and HMI. It offers solutions such as audio/video entertainment and information content, including radio, media player, TV and video, telephony, navigation, speech control, apps, and connectivity features, which bring digital life right on the road. Asia-Pacific remains the key market for in-vehicle infotainment, though the demand is also substantial in Europe and North America.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics

DRIVER: Growth of the smartphone industry and use of cloud technologies

By the end of 2030, it is estimated that half of the total car cost will be dedicated to automotive electronics only. The growth drivers would be electronics and sensors, along with infotainment systems. As the graph below depicts, smartphone sales were 4.4 billion units in 2017 and are expected to reach 6.6 billion units in 2022 and reach ~7.3 billion by 2025.

Further, the usage of Android-based smartphones has remarkably increased by 49.89% from 2017 to 2022. A similar trend is expected in the automotive sector because Android operating systems are one of the popular choices of most OEMs for mid-to-high-end car segments. The increase in sales of low-end cars has resulted in cost optimization of Android-based chipsets embedded in the infotainment system, thereby driving the Android OS market for automotive infotainment systems. Infotainment systems with advanced smartphone integration are trending in the automobile industry. Recently added to the list is the advanced technology available in Skoda Slavia. There is a choice of two advanced infotainment systems for the new Slavia. These allow smartphones to be paired via SmartLink technology and provide access to mobile online services. Both are operated entirely via the central color touchscreen, which measures 7 inches in the Active specification.

Thus, the growing integration of smartphones with in-vehicle infotainment systems in line with increasing smartphone sales would provide a significant way for OEMs to provide cost-efficient choices across all car segments and further spur the growth of in-vehicle infotainment.

Cloud technologies are present in cars in many forms. Using the cloud, cars can communicate with one another to prevent accidents and update traffic information and maps. Cloud technology in vehicles is not new but is evolving quickly due to the cooperation and partnership between the automotive industry and software developers. A remarkable example of how cloud services are applied to a car for essential purposes besides entertainment is what Volvo offers to its clients. Using the Volvo On-Call app and cloud-based services, the user can control the vehicle using a smartphone. The smartphone can then be a digital key to open and start the car. Also, it can generate and send temporary digital keys to the driver’s family and friends when they need to share the car, pre-heat, pre-cool the cabin remotely, send route directions, or check the fuel level from any device. Integration of Ford Motor Company with Microsoft Azure for creating Ford Services Network for providing automated software solutions is another instance where cloud technology is integrating with infotainment systems. Also, Invisible-to-Visible, or I2V, is a future Nissan Intelligent Mobility technology that merges the real and virtual worlds. Combining information from sensors outside and inside the vehicle with data from the cloud helps drivers “see the invisible” – such as what is farther down the road, behind a building, or around the corner.

Most electric cars can exchange data with data centers to guide the driver and provide real-time information on weather conditions and road traffic. A recent example is the Tesla Model S. Tesla cloud receives all the information required to assist the driver remotely in real-time to fix almost any issue related to the car without requiring driver involvement. Customers can update features and services with a connected infotainment unit.

OEMs have developed software to offer customers a seamless experience between the cloud, vehicle, and smartphone. The automotive industry, specifically the infotainment market, is driving toward user-friendly trends, and cloud technologies are pivotal factors playing crucial roles in developments in in-vehicle infotainment.

RESTRAINT: Additional cost of annual subscriptions in infotainment systems

Infotainment services such as navigation, satellite radio, vehicle diagnostics, Wi-Fi hotspot, roadside assistance, and live traffic data require an annual subscription. Initially, those services start with a free trial, grow accustomed to these conveniences, and are chargeable later. Although the introductory subscription price is low, it can increase over time. Furthermore, upgrades of software and subscription models require additional costs as well. For instance, Audi Connect PLUS, including Wi-Fi hotspots, online radio, and Amazon Music, costs around USD 10 a month, while unlimited data is USD 25 per month. On the other hand, the next version, the Audi Connect PRIME, which includes Amazon Alexa, natural voice recognition, Google Earth, traffic information, traffic light information, myAudi Destinations, and parking information, costs around USD 199 for six months and USD 499 for 18 months.

Thus, the additional cost of annual service subscriptions and upgrading expenses related to software and subscription models is one of the critical restraints observed for the in-vehicle infotainment market.

OPPORTUNITY : Government mandates telematics and e-call services

Technologies such as telematics and in-vehicle infotainment are currently in their primary phase of development and deployment, and these technologies are expected to positively impact the safety and security of commuters in the future. The regulatory bodies are keen on imposing regulations to implement telematics solutions. Many developed, and developing countries such as the US, Brazil, Russia, and the EU have either launched or have planned to introduce telematics-related mandates for services such as emergency calls (e-call) and stolen vehicle tracking (SVT). Developing countries such as China and India also follow the trend of passenger safety and security laws, which will boost the market for telematics and infotainment solutions.

As mentioned, below table, governments of some countries have initiated mandatory safety measures in passenger vehicles, such as emergency assistance in case of accidents and e-calls, which include the vehicle making an emergency call to the state helpline and directing the precise GPS coordinates of the place where the accident has taken place.

Thus, implementing such government regulations for passenger cars and commercial vehicles to ensure the safety of drivers and passengers through features such as navigation, voice control, driver assistance, and other features is expected to offer growth opportunities in the in-vehicle infotainment market.

CHALLENGE: Cybersecurity

Despite significant developments in in-vehicle infotainment technology, cybersecurity remains a major challenge. In-vehicle infotainment comprises hardware, software, mobile apps, and Bluetooth, each vulnerable to cyberattacks. The automobile Information Sharing and Analysis Centre (Auto-NC), a group founded by the automobile industry to exchange and analyse information concerning new cybersecurity threats, was informed by Amico, a privacy and cybersecurity advocate for vehicles. Amico spent months collaborating with Auto-ISAC to educate its impacted members on how an attacker can gain access to data kept in automobile infotainment systems. Cybersecurity has caused annoyances in a variety of situations. Consider the Chrysler Jeep instance, in which two researchers were able to hack into a Jeep and upgrade the software in 1.4 million vehicles. In a similar vein, the Nissan Leaf and Tesla S serve as examples of the threat that cvberattack5 poses to in-vehicle entertainment systems. For example, Chrysler’s Jeep case where two researchers could hack into a Jeep, which led to upgrading software in 1.4 million vehicles. Similarly, Tesla S and Nissan Leaf are also examples of the threat of cyberattacks in-vehicle infotainment systems face.

According to a white paper study, data breaches have increased by 67%, with the US being the number one target for cyberattacks. Various stakeholders are working on cybersecurity systems to make them safer by integrating cybersecurity and threat detection systems with data analytics and AI.

Moreover, as per the document published by National Renewable Energy Laboratory, researchers have demonstrated ways to take control of vehicle functionality through infotainment systems and unsecured telematics devices. Additionally, according to the latest research published by Privacy4Cars, car hackers exploit Bluetooth connectivity and target a car’s infotainment system. Using readily available and inexpensive software and hardware, hackers can completely access stored contacts, call logs, text logs, and sometimes even full-text messages without the vehicle’s owner/user being aware.

Thus, threats related to cybersecurity are expected to pose a challenge for in-vehicle infotainment as well as carmakers across the world.

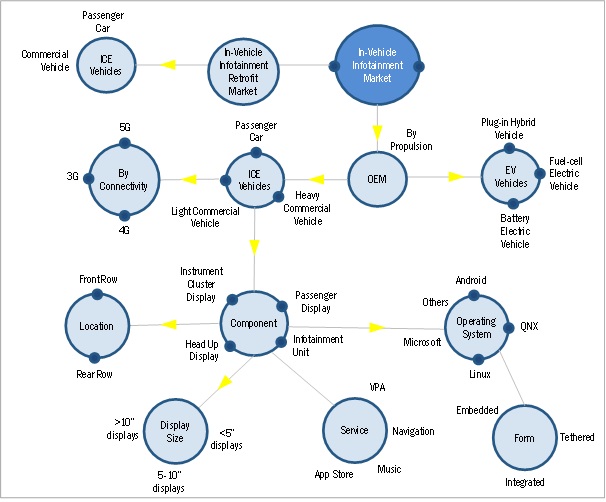

in-vehicle infotainment market Ecosystem.

The ecosystem of the in-vehicle infotainment market starts with component manufacturers/technology providers. Major players offering these products and systems include Harman International, Panasonic Corporation, etc. The automotive OEMs are critical players who enter into agreements and tie-ups with component manufacturers and technology providers to install advanced driver assist and supporting systems into their respective vehicle models

The front-row infotainment system segment will lead the in-vehicle infotainment market by location.

By location, the front-row infotainment system is anticipated to hold the largest share at a global level in 2023. The growth is mainly attributed to the increasing consumer inclination toward safety, comfort, and entertainment services. Consumers are spending more time in their vehicles while going on long road trips, and rising traffic congestion in urban areas; this leads to increased average commute time of passengers on roads around the world, resulting in more time spent in the vehicle. This has driven the necessity of passenger safety and essential entertainment services such as music, video streaming, navigation features, etc. Further, infotainment systems are offered various connectivity options via smartphones or tablets, voice commands, multimedia capabilities, and interactive touch screens.

Additionally, front-row infotainment systems are offered with large touchscreen displays, user-friendly interfaces, voice recognition capabilities, and advanced driver-assistance systems (ADAS). These features significantly improve the overall user experience, making it more convenient and safer for drivers and passengers. Thus, spending more time in the vehicle, boosting connectivity infrastructure, and lowering service costs would prompt automotive OEMs to offer factory-fitted front-row infotainment systems across all vehicle segments.

Navigation service leads the in-vehicle infotainment system market during the forecast period.

Navigation is the most used service in the in-vehicle infotainment market from 2023 to 2028. Navigation services help to provide real-time traffic information, route guidance, and point-of-interest recommendations, which help to navigate efficiently. Further, mapping technology advancements have improved navigation systems' accuracy and reliability, providing users with precise and up-to-date information. Integrating navigation services with other infotainment features, such as entertainment and connectivity, enhances the overall user experience and is offered by service providers as a bundled service at an affordable price. Additionally, the growing adoption of connected vehicles and IoT technologies allows for the seamless integration of navigation services with online platforms, offering users access to real-time data and services. These factors collectively drive the growth of the navigation service in the market.

The >10” display screen size is predicted to be the fastest-growing display size.

The market for a>10-inch display screen is expected to grow rapidly during the forecast period. The growth can be attributed to several factors that contribute to an enhanced user experience, such as the ability to integrate advanced functionalities and features, improved visual appeal and design contributions, advancements in technology making larger screens more practical and cost-effective, and the competitive advantage of larger screens. The increasing sales of premium cars and the rising adoption of large central screen displays in mid-priced passenger cars have also significantly driven the demand for >10" display screens. Tier 1 suppliers are actively developing cost-effective touchscreens with larger sizes, enabling original equipment manufacturers (OEMs) to differentiate their products, particularly in the lower mid-priced car segment, where consumers seek more features to influence their purchase decisions. Moreover, larger screen displays enhance safety by providing larger icons, fonts, and touch targets, ensuring better readability and reducing driver distraction. Some examples of mid-priced passenger cars offering >10" display screens include the Volkswagen Golf, Kia Seltos, and LADA Priora. With the growing demand for high-end and mid-variant vehicles to elevate status and aesthetic appeal, the need for larger screen display sizes is expected to rise in the coming years.

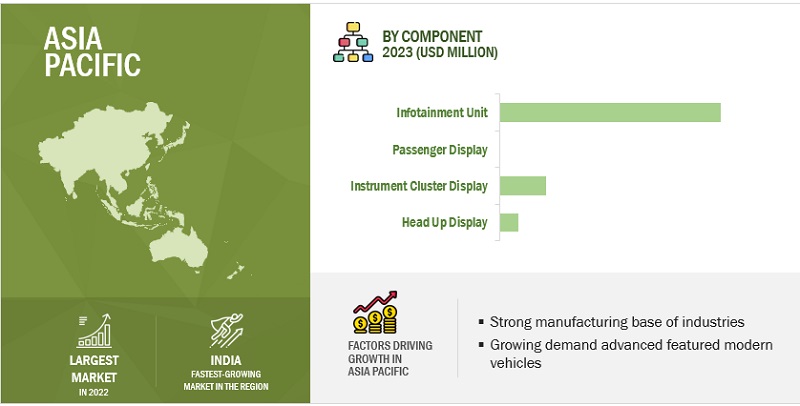

Asia Pacific is projected to be the largest regional market.

During the forecast period, Asia Pacific holds the largest share of the in-vehicle infotainment market. It witnessed higher growth in vehicle production than Europe and North America due to the availability of labor at lower wages, reduced production costs, lenient vehicle safety norms, and government initiatives for FDIs in the region. Vehicle production is driven mainly by countries such as China, South Korea, India, and Japan, which contribute ~88-90% of the total production of vehicles, and these countries within the region contributed ~59% of the global vehicle production in 2022. Thus, increasing vehicle production, changing consumer preferences, and growing per capita income of the middle-class population are driving the vehicle demand and encouraging automotive OEMs to increase production capacity and offer infotainment systems in lower-range cars as well.

Key Market Players

The in-vehicle Infotainment market is consolidated. Harman International (US), Panasonic Corporation (Japan), Alps Alpine Co Ltd (Japan), Robert Bosch GmbH (Germany), and Continental AG(Germany) are the key companies operating in the market.

These companies adopted new product launches, partnerships, and joint ventures to gain traction in the in-vehicle infotainment market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2018–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Volume (‘000 Units) and Value (USD Million/Billion) |

|

Segments Covered |

By Vehicle Type, Component, Operating System, Services, Location, Connectivity, Form, Display Size, Retrofit, Vehicle Type, Electric Vehicle By Vehicle Type, and region. |

|

Geographies covered |

Asia Pacific, North America, Europe, and the Rest of the World [RoW] |

|

Companies covered |

Harman International (US), Panasonic Corporation (Japan), Alps Alpine Co Ltd (Japan), Robert Bosch Gmbh (Germany), and Continental AG (Germany) |

Along with the given market data, MarketsandMarkets offers customizations in accordance with the company’s specific needs

The study segments the in-vehicle infotainment market :

By Vehicle Type

- Passenger Car

- Light Commercial Vehicle (LCV)

- Heavy Commercial Vehicle (HCV)

By Component

- Infotainment/Display Unit

- Control Panel

- Telematics Control Unit

- Head-Up Display

By Operating System

- Android

- Linux

- QNX

- Microsoft

- Android

- Others

By Services

- Entertainment Service

- Navigation Services

- E-call

- Vehicle Diagnostics

- Others

By Location

- Front Row

- Rear Row

By Connectivity

- 3G/4G

- 5G

By Form

- Embedded

- Tethered

- Integrated

By Display Size

- <5”

- 5-10”

- >10”

Retrofit, By Vehicle Type

- Passenger Cars

- Commercial Vehicles

Electric Vehicle, By Vehicle Type

- Battery Electric vehicle,

- Plug-in Hybrid Electric Vehicle

- Fuel-Cell Electric Vehicle

By Region

- Asia Pacific

- North Americ

- Europe

- Rest of the World [RoW]

Recent Developments

- In March 2023, Alps Alpine Co. Ltd. allied with FreeBit (Japan) to develop a Web 3.0 business model. This alliance is expected to boost Alps Alpine Co Ltd.’s automotive infotainment system business by supporting new architectures.

- In January 2022, Alps Alpine Co Ltd entered a joint venture with Qualcomm Technologies, which is expected to develop a digital cabin that uses High-Performance Reference Architecture (HPRA), Alps Alpine’s original integrated electronic control unit (ECU) powered by the 3rd Generation Snapdragon Cockpit Platforms. This is aimed at enabling advanced infotainment and cockpit capabilities in the vehicle.

- In January 2023, Garmin recently demonstrated its latest in-cabin solutions for the Automotive OEM at CES 2023. This system features four infotainment touchscreens, an instrument cluster, a cabin monitoring system, wireless headphones, wireless gaming controllers, smartphones, and various entertainment options. It is designed to be unified with a single SoC (system on chip).

- In November 2022, Pioneer supplied its display audio units and the premium audio systems to be factory-installed in Toyota’s Yaris ATIV sedan. The Pioneer Display Audio offers a nine-inch screen that is Apple CarPlay and Android Auto compatible and the Pioneer Premium Sound System includes six Pioneer-branded speakers. These options were offered in the vehicle's premium luxury, premium, and smart segments.

- In February 2022, HARMAN International designed the MECWAVE to facilitate the deployment of vehicle-to-everything (V2X) communications through safety-critical applications such as hazard alerts, and increased connectivity experiences such as interactive infotainment and video streaming.

Frequently Asked Questions (FAQ):

What is the current size of the global in-vehicle infotainment market?

The in-vehicle infotainment market is projected to grow from USD 18.8 billion in 2023 to USD 31.4 billion by 2028, at a CAGR of 10.9%.

Which location is currently leading the in-vehicle infotainment market?

The front row is leading in the in-vehicle infotainment market.

Many companies are operating in the in-vehicle infotainment market space across the globe. Do you know who the front leaders are and what strategies they have adopted?

The in-vehicle Infotainment market is consolidated. Harman International, Panasonic Corporation, Alps Alpine Co Ltd, Robert Bosch GmbH, and Continental AG are the top players in the market.

How does the demand for in-vehicle infotainment vary by region?

Asia-Pacific is estimated to be the largest market for in-vehicle infotainment during the forecast period, followed by Europe. The growth of the in-vehicle infotainment market in Asia-Pacific is mainly attributed to the higher vehicle production in the region.

What are the growth opportunities for the in-vehicle infotainment supplier?

Government mandates on telematics and e-call services, and the emergence of various technologies such as 5G and AI would create growth opportunities for the in-vehicle infotainment market.

Which operating system is the fastest-growing segment?

The Android operating segment is the fastest growing segment with the highest growth rate of 34.4.% in terms of volume. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The study involves four main activities to estimate the current size of the in-vehicle infotainment market.

- Exhaustive secondary research was done to collect information on the market, such as vehicle type, component, operating system, services, location, connectivity, form, display size, retrofit, vehicle type, electric vehicle by vehicle type, and region.

- The next step was to validate these findings, assumptions, and market analysis with industry experts across value chains through primary research.

- Bottom-up and top-down approaches were employed to estimate the complete market size for different segments considered in this study.

- Thereafter, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

The secondary sources referred to the in-vehicle infotainment system market as directly dependent on vehicle production. Vehicle production volume is derived through secondary sources such as automotive industry organizations (Organisation Internationale des Constructeurs d'Automobiles (OICA), publications from government sources [such as country-level automotive associations and organizations, Organisation for Economic Co-operation and Development (OECD), World Bank, CDC, and Eurostat]; corporate filings (such as annual reports, investor presentations, and financial statements); and trade, paid repository. Historical production data has been collected and analyzed, and the industry trend is considered to arrive at the forecast, which is further validated by primary research.

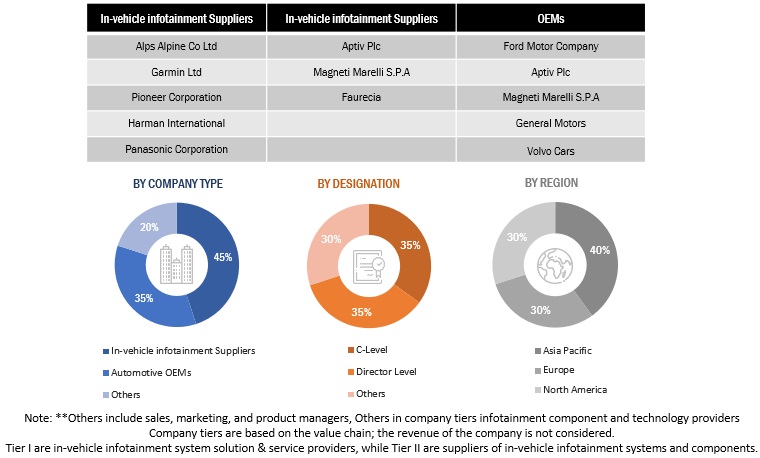

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as CXOs, Vice Presidents, Directors from business development, marketing, product development/innovation teams, and related key executives from various key companies. Various system integrators, industry associations, independent consultants/industry veterans, and key opinion leaders were also interviewed.

Primary interviews have been conducted to gather insights such as vehicle production forecast, in-vehicle infotainment system market forecast, future technology trends, and upcoming technologies in the in-vehicle infotainment system market. Data triangulation of all these points was done with the information gathered from secondary research as well as model mapping. Stakeholders from the demand and supply sides have been interviewed to understand their views on the aforementioned points.

Primary interviews have been conducted with market experts from both the demand- (OEMs) and supply-side (in-vehicle infotainment system solution and service providers) players across four major regions, namely, North America, Europe, Asia Pacific, and the Rest of the World. Approximately 20% and 80% of primary interviews have been conducted from the demand and supply sides, respectively. Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, we have strived to cover various departments within organizations, such as sales and operations, to provide a holistic viewpoint in our report.

After interacting with industry experts, we have also conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

A detailed market estimation approach was followed to estimate and validate the value of the in-vehicle infotainment system market and other dependent submarkets, as mentioned below.

- Key players in the in-vehicle infotainment system market were identified through secondary research, and their global market ranking was determined through primary and secondary research.

- The research methodology included a study of annual and quarterly financial reports and regulatory filings of major market players (public), as well as interviews with industry experts for detailed market insights.

- All vehicle level penetration rates, percentage shares, splits, and breakdowns for the in-vehicle infotainment system market were determined using secondary sources and verified through primary sources.

- All key macro indicators affecting the revenue growth of the market segments and subsegments were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain validated and verified quantitative and qualitative data.

- The gathered market data was consolidated, enhanced with detailed inputs, analyzed, and presented in this report.

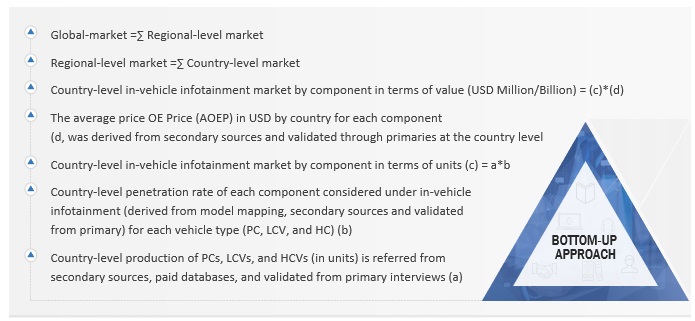

Bottom-Up Approach: In-Vehicle Infotainment Market, By Component, Vehicle Type & Country (Ice Vehicles)

To know about the assumptions considered for the study, Request for Free Sample Report

The bottom-up approach has been used to estimate and validate the size of the global market. The market size for components, by volume, of the in-vehicle infotainment system market has been derived by multiplying the penetration rate of each component considered under in-vehicle infotainment systems for PC, LCV, and HCV production numbers. Country-level, model-wise mapping has been carried out to identify vehicle models with infotainment systems and related components and further validated by industry experts. The installation rate of in-vehicle infotainment components has been implemented on vehicle production, by vehicle type, for a particular country. This method will yield the volume of infotainment components at the country level. The next step involves multiplying the volume of components by vehicle type and their respective average OE pricing to generate the country-level market by vehicle type and component. The summation of volume and value of the country-level market provides a regional market and then global infotainment system market, by component in terms of volume and value. The findings are then verified with various industry participants. All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data is consolidated and added with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Top-Down Approach: In-Vehicle Infotainment System Market, By Connectivity And Operating System

The top-down approach has been used to calculate the market for in-vehicle infotainment systems by operating system and connectivity. The global market for infotainment systems has been broken down by region based on the penetration of the particular operating system, and connectivity, in the particular region. These findings are further discussed with primary respondents to validate the data, assumptions, penetrations, and future factors affecting the market.

Market Definition

The in-vehicle Infotainment system aggregates all the infotainment functions of the vehicle, including tuner reception, media connectivity, audio playback, navigation, and HMI. It offers solutions such as audio/video entertainment and information content, including radio, media player, TV and video, telephony, navigation, speech control, apps, and connectivity features, which bring digital life right on the road.

Key Stakeholders

- In-vehicle Infotainment system manufacturers

- Parts and component suppliers

- Automotive OEMs

- R&D Department

- Automotive Association and Regulatory bodies

- Infotainment service providers

- Fleet owners

- Telecom companies

Report Objectives

-

To define, describe, and forecast the in-vehicle infotainment market in terms of value (USD million) and volume (thousand units), which includes the following segments:

- By Vehicle Type {Passenger Car, Light Commercial Vehicle (LCV), and Heavy Commercial Vehicle (HCV)}

- By Component (Infotainment/Display Unit, Control Panel, Telematics Control Unit, and Head-Up Display)

- By Operating System (Android, Linux, QNX, Microsoft, and Others)

- By Services (Entertainment Services, Navigation Services, E-call, Vehicle Diagnostics, and Others)

- By Location (Front Row and Rear Row)

- By Connectivity (3G/4G and 5G)

- By Form (Embedded, Tethered, and Integrated)

- By Display Size (<5”, 5-10”, >10”)

- Retrofit, By Vehicle Type (Passenger Cars and Commercial Vehicles)

- Electric Vehicle, By Vehicle Type (Battery Electric vehicle, Plug-in Hybrid Electric Vehicle, and Fuel-Cell Electric Vehicle)

- By Region (Asia Pacific, Europe, North America, and RoW)

- To understand the dynamics (drivers, restraints, opportunities, and challenges) of the market

- To analyze the market ranking/share of key players operating in the market

- To understand the dynamics of market competitors in terms of hardware and software providers and distinguish them into visionary leaders, innovators, emerging companies, and dynamic differentiators according to their product portfolio and business strategy

- To analyze recent developments, collaborations, joint ventures, mergers & acquisitions, new product launches, and other activities carried out by key industry participants in the market

- To determine the average selling price (ASP) of in-vehicle infotainment and analyze revenue-missed scenarios

- To determine pessimistic scenarios, most likely scenarios, and optimistic scenarios related to the market

- To give a brief understanding of the in-vehicle infotainment market in the recommendations chapter

Available customizations

Along with the given market data, MarketsandMarkets offers customizations in accordance with a company’s specific needs

In-Vehicle Infotainment System Market, By Country And Components

-

Asia Pacific

- China

- India

- Japan

- South Korea

-

Europe

- Germany

- France

- Italy

- UK

- Spain

- Russia

-

North America

- US

- Canada

- Mexico

-

RoW

- Brazil

- South Africa

Electric Vehicle Infotainment Market, By Components

- Infotainment system

- Telematic control unit

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in In-vehicle Infotainment Market

Do we have Mobile Audio Aftermarket Retail Tracking? Data: Brand Item Features – Blue tooth, car size, compatible OS etc Price brands

Does the report have content like Market overview, PESTLE analysis, Porter Five Forces, In-car entertainment by prodcuts and applications

We are working on OEM and after market strategy. Looking for what we can get from this report which can help us to validate our strategy in this area.

I am trying to understand the spending trends on automotive between different functions/domains like ADAS, infotainment, telematics, etc

What are the upcoming trends in the market?