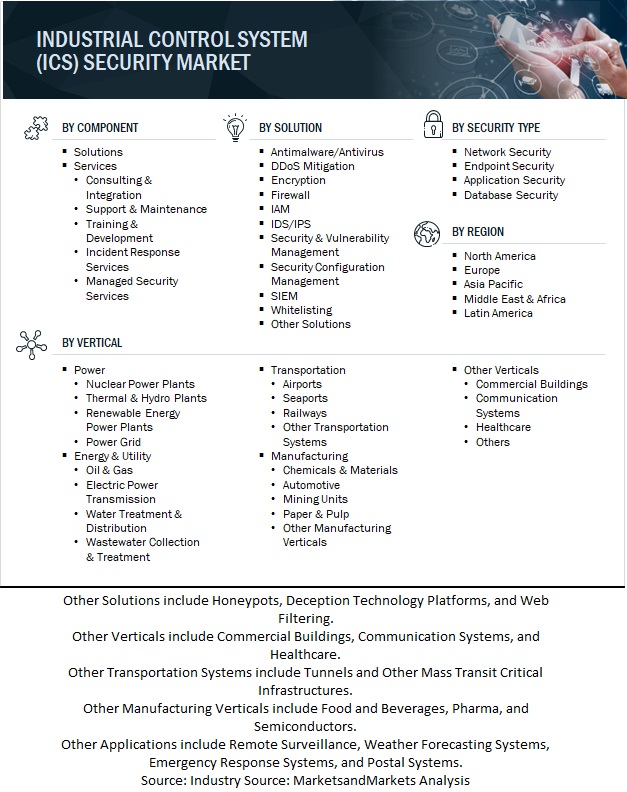

Industrial Control Systems (ICS) Security Market by Component (Solutions and Services), Solution, Service, Security Type (Network Security, Endpoint Security, Application Security, and Database Security), Vertical and Region - Global Forecast to 2027

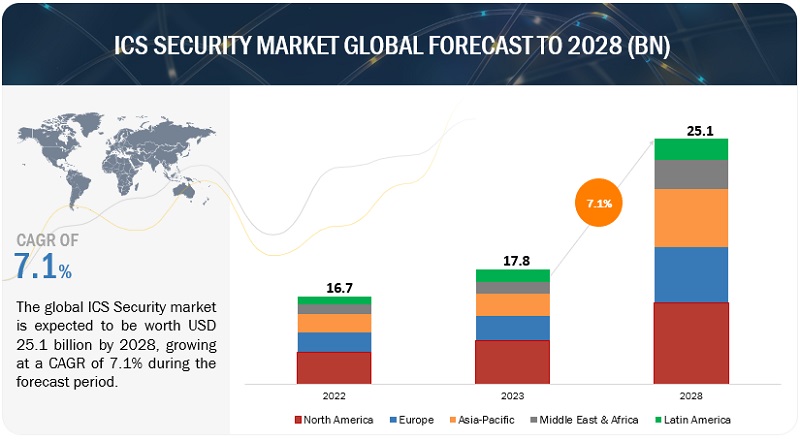

[374 Pages Report] The global ICS security market is projected to grow from USD 16.7 billion in 2022 to USD 23.7 billion by 2027, at a Compound Annual Growth Rate (CAGR) of 7.2% from 2022 to 2027. The rise in stringent government regulations related to CIP is the major factor driving the ICS security market growth. On the other hand, the lack of awareness about ICS security techniques may hinder the market's growth.

To know about the assumptions considered for the study, Request for Free Sample Report

ICS Security Market Dynamics

Driver: Stringent government regulations related to CIP to boost adoption of ICS security solutions

Disruptions in critical infrastructures, such as power grid, manufacturing, IT, and transportation, severely impact economic stability, national security, safety, and health. Thus, several governments have established federal laws and policies to develop cybersecurity standards to protect ICS for critical infrastructure. On November 16, 2018, the Cyber Security and Infrastructure Security Agency (CISA) was commissioned by Donald Trump, the then-President of the United States, to identify vulnerabilities in the nation’s critical infrastructure. Public Safety Canada, a cybersecurity organization, collaborated with critical infrastructure stakeholders to strengthen the security and resilience of vital assets, such as food supply, energy and utilities, public safety systems, and ICT.

Similarly, the Critical Infrastructure Act 2018 of Australia maintains a register of critical infrastructure assets to manage risks related to Australia’s critical infrastructure in cooperation with the government, regulators, and operators of critical infrastructure.

Restraint: High procurement costs of ICS security solutions

A company-wide coverage for smooth and secure operations to implement industrial control systems security solutions. Due to which the infrastructure cost increases which becomes expensive for several operators. A strong multi-factor authentication is required for current ICS security standards to ensure that only authorized individuals have physical and logical access to critical assets. Critical infrastructure organizations finds it difficult to bear the cost of licenses, hardware requirements, help desk costs, and maintenance and renewal activities. specially SMEs, which have limited or no budget to build a secure critical infrastructure. But the organizations are reluctant to adopt ICS solutions in their environment as ICS security landscape consists of security solutions, such as IAM, DDoS mitigation, IDPS, and encryption and risk and compliance management, which makes it costly for enterprises.

Opportunity: Increase in demand for professional and managed security services

Industrial control systems security services are devided as managed and professional services. Demand for these services is increasing with the increasing adoption of ICS security solutions. Several basic cyber infrastructures are lacked in SMEs for moderately safe operations. However, large corporations need seasoned professionals and managed security services. Lack of awareness among the employees on security policies and best practices to extract the sensitive properties of the organization is benefitting the cybercriminals and hackers. Organizations have several setups in place like workforce to manage a Security Operations Center (SOC) for the company, the laborious task is to enable the employees to share the same thought process toward cybersecurity practices. Most of the workforce consider cybersecurity training, handling issues and incidents, and procedures as a burden. Even if having a robust infrastructure companies will be exposed in some way or other unless employees are self-aware of security policies and procedures as business imperatives. That is driving the demand of professional and managed security services to deal with complex vulnerabilities in the ICS ecosystem and it can also help to open up rewarding opportunities for ICS security providers in the near future.

Challenge: Lack of trained security analysts to analyze ICS systems

Lack of security professionals is one of the biggest obstacle in protecting the infrastructure of industries. Computer systems known as ICS that require trained cybersecurity professionals to protect large networks is powering the Industrial infrastructure sectors. The workforce shortage has been also enlarged due to the interconnectivity of ICS. Recently it has been very difficult to find competent cybersecurity experts that’s why countries such as Japan and the UK are struggling to find it. A research paper from the Australian Strategic Policy Institute (ASPI) published in 2019 stated that Australian critical infrastructure providers lack OT security skills and are underprepared to respond to a critical infrastructure incident. Despite the growing digital marketplace expansion, shortage of security professionals to manage critical infrastructure is increasing. Leading to the increased need for trained and skilled security professionals to operate the ICS security solutions effectively.

By vertical, energy and utilities segment to account for largest market share during forecast period

In the past two decades, renewable energy power plants have seen substantial market growth due to their renewability, pollution-free, resource amplitude, and relatively safe characteristics. It has been estimated that around 20% of wind power plants are projected to grow in the future. It also has been estimated that 15-16% of global power is extracted from renewable energy sources. These sources are spread across large areas and require comprehensive solutions for monitoring and controlling operations. The types of power generation plants listed in this segment are solar power plants, geothermal power plants, biomass power plants, tidal power plants, and wind power plants.

ICS Security Market Ecosystem

To know about the assumptions considered for the study, download the pdf brochure

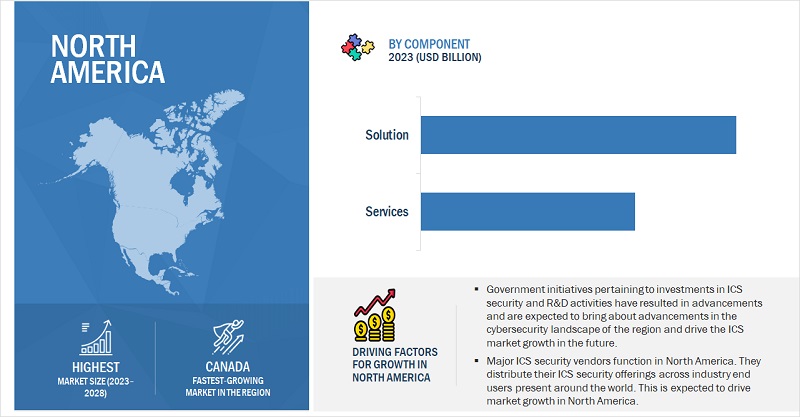

By region, North America accounts for the largest market share during the forecast period

North America has been at the forefront of the adoption of ICS security solutions in lieu of the rising number of cyberattacks on critical infrastructure. Thus, ICS security solutions are being widely used in a variety of industries, particularly manufacturing, chemicals, energy, and utilities. This region has also been extremely responsive toward the latest technological advancements, such as the integration of cloud and IoT with ICS security solutions, to establish a holistic secure access mechanism and enforce a security governance framework. With the growing awareness of ICS security among small and medium-sized businesses and the widespread use of data-driven methods in manufacturing operations, the adoption of emerging technologies opens the door to the substantial market share held by the North American region. Public-Private Partnerships (PPP) and international collaborations have led to effective ICS security and resilience in the region.

Guidance on how to protect industrial control systems (ICSs) and operational technology (OT) as part of the United States critical infrastructure has been issued by the CISA and the National Security Agency (NSA). The joint advisory provided details of all the methods malicious actors use to compromise IT-enabled OT and ICS assets, providing a larger attack surface and highlighting security professionals' options for defending themselves.

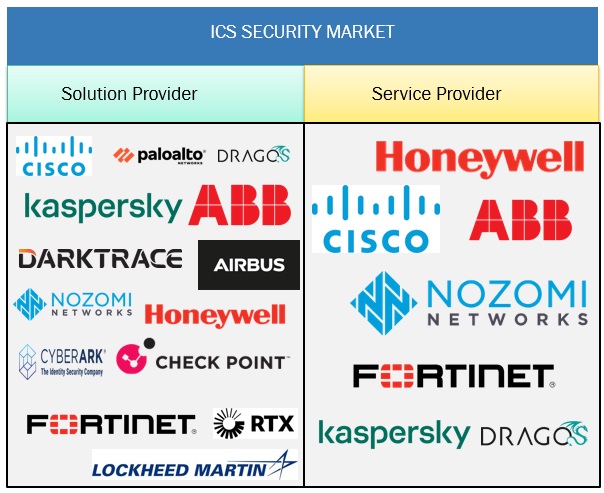

Key Market Players:

The key players in the global industrial control systems security market include Cisco (US), ABB (Switzerland), Lockheed Martin (US), Fortinet (US), Honeywell (US), Palo Alto Networks (US), BAE Systems (UK), Raytheon (US), Trellix (US), Darktrace (UK), Check Point (US and Israel), Kaspersky Labs (Russia), Airbus (France), Belden (US), Sophos (US), CyberArk (US), Claroty (US), Dragos (US), Nozomi Network (US), Cyberbit (Israel), Forescout (US), Radiflow (Israel), Verve Industrial Protection (US), Applied Security (Netherland), and Positive Technology (Russia).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size value in 2022 |

USD 16.7 billion |

|

Market size value in 2027 |

USD 23.7 billion |

|

Growth rate |

CAGR of 7.2% |

| Period for which Market size has been studied | 2016–2027 |

| Base year considered | 2021 |

| Forecast period | 2022–2027 |

| Forecast units | Value (USD Million/USD Billion) |

| Segments covered | By component, solution, service, security type, vertical |

| Geographies covered | North America, Europe, Asia Pacific, Middle East & Africa (MEA), and Latin America |

| Major companies covered | Cisco (US), ABB (Switzerland), Lockheed Martin (US), Fortinet (US), Honeywell (US), Palo Alto Networks (US), BAE Systems (UK), Raytheon (US), Trellix (US), Darktrace (UK), Check Point (US and Israel), Kaspersky Labs (Russia), Airbus (France), Belden (US), Sophos (US), CyberArk (US), Claroty (US), Dragos (US), Nozomi Network (US), Cyberbit (Israel), Forescout (US), Radiflow (Israel), Verve Industrial Protection (US), Applied Security (Netherland), Positive Technology (Russia) |

Market Segmentation:

Recent Developments:

- In September 2022, Cisco partnered with Radiflow for its OT security expertise. Radiflow would provide IDS in Cisco-run OT facilities.

- In April 2022, to increase the US government’s focus on the cybersecurity and resilience of industrial control systems and operational technology (ICS/OT), the Cybersecurity and Infrastructure Security Agency (CISA) expanded the Joint Cyber Defense Collaborative (JCDC) to include Industrial Control Systems (ICS) experts. For this, CISA partnered with Honeywell.

- In April 2021, Fortis partnered with Darktrace to help detect and respond to attacks across the entire digital infrastructure with Darktrace’s cyber-AI, including cloud, SaaS, corporate networks, IoT, and industrial control systems.

- In July 2020, Fortinet partnered with Dragos to provide improved visibility and detection of IT and ICS threats.

- In June 2020, to protect networks in critical infrastructure against all types of advanced Gen V cyber threats, Check Point launched the new 1570R rugged security gateway.

Frequently Asked Questions (FAQ):

What is the definition of ICS security?

According to Forcepoint, industrial control systems can consist of a complex network of interactive control systems or a small number of controllers. These systems receive information from remote sensors that measure and monitor process variables. From control valves to pressure gauges, an ICS sends commands and receives alerts from many different components. ICS security is a security framework that protects these systems against accidental or intentional breaches and risks.

ICS security solutions consist of a comprehensive array of technologies, such as Distributed Denial of Service (DDoS), Intrusion Detection and Prevention System (IDPS), antimalware/antivirus, firewall, virtualization security, Security Information and Event Management (SIEM), SCADA encryption, Unified Threat Management (UTM), Data Loss Prevention (DLP), and Identity and Access Management (IAM).

What is the projected market value of the global ICS security market?

The global ICS security market is projected to grow from USD 16,728 million in 2022 to USD 23,689 million by 2027 at a Compound Annual Growth Rate (CAGR) of 7.2% from 2022 to 2027.

Which are the key players influencing the market growth of ICS security?

Cisco (US), ABB (Switzerland), Lockheed Martin (US), Fortinet (US), and Honeywell (US) are the leaders in the ICS security market, recognized as star players. These companies account for a major share of the ICS security market. The vendors offer solutions as per user requirements and adopt growth strategies to consistently achieve the desired growth to make their presence in the market.

Which are the emerging SMEs supporting the market growth?

Forescout (US), Radiflow (Israel), Verve Industrial Protection (US), Applied Security (Netherlands), and Positive Technology (Russia) are a few of the emerging SMEs nurturing market growth with their technical skills and expertise. These startups focus on developing product/service portfolios and bringing innovations to the market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 59)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.4 YEARS CONSIDERED

1.5 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES, 2018–2021

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 64)

2.1 RESEARCH DATA

FIGURE 1 INDUSTRIAL CONTROL SYSTEM (ICS) SECURITY MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primary profiles

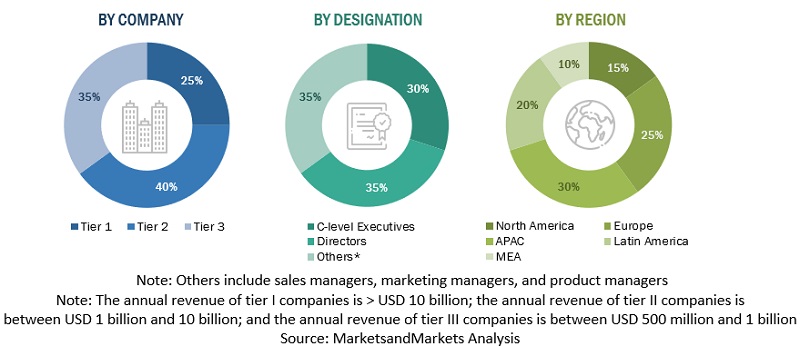

FIGURE 2 BREAKUP OF PRIMARY SOURCES, BY COMPANY, DESIGNATION, AND REGION

2.1.2.2 Key industry insights

FIGURE 3 KEY INDUSTRY INSIGHTS

2.2 DATA TRIANGULATION

FIGURE 4 DATA TRIANGULATION PROCESS

2.3 MARKET SIZE ESTIMATION

2.3.1 REVENUE ESTIMATES

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1

2.3.2 TOP-DOWN APPROACH

2.3.3 DEMAND-SIDE ANALYSIS

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 – BOTTOM-UP

2.4 MARKET FORECAST

TABLE 2 FACTOR ANALYSIS

2.5 ASSUMPTIONS

2.6 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 72)

TABLE 3 ICS SECURITY MARKET SIZE AND GROWTH RATE, 2016–2021 (USD MILLION, Y-O-Y %)

TABLE 4 MARKET SIZE AND GROWTH RATE, 2022–2027 (USD MILLION, Y-O-Y %)

FIGURE 7 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE IN 2022

4 PREMIUM INSIGHTS (Page No. - 75)

4.1 BRIEF OVERVIEW OF ICS SECURITY MARKET

FIGURE 8 INCREASED CYBERATTACKS ON CRITICAL INFRASTRUCTURE TO FUEL MARKET

4.2 MARKET, BY COMPONENT, 2022

FIGURE 9 SOLUTIONS SEGMENT TO ACCOUNT FOR LARGER SHARE DURING FORECAST PERIOD

4.3 MARKET, BY SOLUTIONS, 2022-2027

FIGURE 10 FIREWALL TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

4.4 MARKET, BY SERVICES, 2022-2027

FIGURE 11 CONSULTING & INTEGRATION SERVICES TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

4.5 MARKET, BY SECURITY TYPE, 2022

FIGURE 12 ENDPOINT SECURITY TO GAIN LARGEST SHARE DURING FORECAST PERIOD

4.6 INDUSTRIAL CONTROL SYSTEM (ICS) SECURITY MARKET SHARE OF TOP THREE VERTICALS AND REGIONS, 2022

FIGURE 13 ENERGY & UTILITIES AND NORTH AMERICA TO ACCOUNT FOR LARGEST SHARES IN 2022

4.7 MARKET INVESTMENT SCENARIO

FIGURE 14 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENT IN NEXT FIVE YEARS

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 79)

5.1 INTRODUCTION

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: ICS SECURITY MARKET

5.1.1 DRIVERS

5.1.1.1 Accretion in digital technologies and industrial systems

5.1.1.2 Stringent government regulations related to CIP

5.1.1.3 Convergence of IT and OT systems to fuel growth of ICS security

5.1.2 RESTRAINTS

5.1.2.1 High procurement cost of ICS security solutions

5.1.2.2 Emerging challenges related to maintenance and upgrade of ICS security solutions

5.1.3 OPPORTUNITIES

5.1.3.1 Rising demand for professional and managed security services

5.1.3.2 R&D investments by governments and enterprises to develop robust ICS security solutions

5.1.4 CHALLENGES

5.1.4.1 Low collaboration between public and private sectors

5.1.4.2 Lack of trained security analysts to analyze ICS systems

5.1.4.3 Lack of awareness about ICS security techniques

5.2 USE CASES

5.2.1 USE CASE: PALO ALTO NETWORKS HELPED WARREN ROGERS ASSOCIATES WITH ICS SECURITY

5.2.2 USE CASE: ICS SECURITY FOR A MAJOR POWER PROVIDER

5.2.3 USE CASE: ICS SECURITY FOR MULTINATIONAL GAS AND ELECTRICAL DISTRIBUTION COMPANY

5.3 VALUE CHAIN ANALYSIS

FIGURE 16 MARKET: VALUE CHAIN

5.4 MARKET ECOSYSTEM

FIGURE 17 ECOSYSTEM: MARKET

TABLE 5 MARKET: SUPPLY CHAIN ANALYSIS

5.5 PORTER’S FIVE FORCES MODEL ANALYSIS

FIGURE 18 PORTER’S FIVE FORCES ANALYSIS: ICS SECURITY MARKET

TABLE 6 PORTER’S FIVE FORCES IMPACT ANALYSIS

5.5.1 THREAT OF NEW ENTRANTS

5.5.2 THREAT OF SUBSTITUTES

5.5.3 BARGAINING POWER OF SUPPLIERS

5.5.4 BARGAINING POWER OF BUYERS

5.5.5 DEGREE OF COMPETITION

5.6 PRICING ANALYSIS

5.7 TECHNOLOGY ANALYSIS

5.7.1 IOT

5.7.2 ARTIFICIAL INTELLIGENCE

5.7.3 MACHINE LEARNING

5.8 PATENT ANALYSIS

FIGURE 19 LIST OF MAJOR PATENTS FOR INDUSTRIAL CONTROL SYSTEM (ICS) SECURITY MARKET

5.9 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

FIGURE 20 MARKET: TRENDS AND DISRUPTIONS IMPACTING CUSTOMER’S BUSINESS

5.10 REGULATORY LANDSCAPE

5.10.1 ISO 27001

5.10.2 GENERAL DATA PROTECTION REGULATION (GDPR)

5.10.3 SARBANES-OXLEY (SOX) ACT

5.10.4 SOC 2

5.10.5 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 7 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.11 KEY STAKEHOLDERS AND BUYING CRITERIA

5.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

TABLE 8 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

5.12 KEY CONFERENCES AND EVENTS IN 2022–2023

TABLE 9 MARKET: LIST OF CONFERENCES AND EVENTS, 2022–2023

6 ICS SECURITY MARKET, BY COMPONENT (Page No. - 94)

6.1 INTRODUCTION

FIGURE 22 SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

6.1.1 COMPONENT: MARKET DRIVERS

TABLE 10 MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 11 MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

6.2 SOLUTIONS

6.2.1 INTEGRATION OF ICS WITH INTERNET-ENABLED DEVICES INCREASING SYSTEM VULNERABILITY

TABLE 12 SOLUTIONS: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 13 SOLUTIONS: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3 SERVICES

6.3.1 ICS SECURITY SERVICES TO BECOME NECESSITY FOR INTEGRATING AND MANAGING SOLUTIONS

TABLE 14 SERVICES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 15 SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

7 ICS SECURITY MARKET, BY SOLUTIONS (Page No. - 99)

7.1 INTRODUCTION

FIGURE 23 ENCRYPTION TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

7.1.1 SOLUTIONS: MARKET DRIVERS

TABLE 16 MARKET, BY SOLUTIONS, 2016–2021 (USD MILLION)

TABLE 17 MARKET, BY SOLUTIONS, 2022–2027 (USD MILLION)

7.2 ANTIMALWARE/ANTIVIRUS

7.2.1 ICS/SCADA RUNNING ON VULNERABLE OR OLDER VERSIONS OF OPERATING SYSTEMS MORE LIKELY TO BE IMPACTED BY MALWARE

TABLE 18 ANTIMALWARE/ANTIVIRUS:MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 19 ANTIMALWARE/ANTIVIRUS: INDUSTRIAL CONTROL SYSTEM (ICS) SECURITY MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3 DDOS MITIGATION

7.3.1 IOT-FOCUSED DDOS THREATS IN ICS TO WITNESS INCREASE

TABLE 20 DDOS MITIGATION: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 21 DDOS MITIGATION: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.4 ENCRYPTION

7.4.1 ENCRYPTION OF NETWORK TRAFFIC TO BE STANDARD FOR FUTURE ICS

TABLE 22 ENCRYPTION: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 23 ENCRYPTION: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.5 FIREWALL

7.5.1 FIREWALLS TO PLAY IMPORTANT ROLE IN MAINTAINING ICS NETWORK INTEGRITY

TABLE 24 FIREWALL: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 25 FIREWALL: ICS SECURITY MARKET, BY REGION, 2022–2027 (USD MILLION)

7.6 IDENTITY & ACCESS MANAGEMENT

7.6.1 IAM TO BE ESSENTIAL SECURITY SOLUTION FOR RESOURCE-DRIVEN ENVIRONMENTS

TABLE 26 IDENTITY & ACCESS MANAGEMENT: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 27 IDENTITY & ACCESS MANAGEMENT: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.7 INTRUSION DETECTION & PREVENTION SYSTEM

7.7.1 MACHINE LEARNING ALGORITHMS TO IMPROVE INTRUSION DETECTION OF ICS

TABLE 28 INTRUSION DETECTION & PREVENTION SYSTEM: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 29 INTRUSION DETECTION & PREVENTION SYSTEM: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.8 SECURITY & VULNERABILITY MANAGEMENT

7.8.1 EXISTING STAFF TO EFFECTIVELY MANAGE AND ADDRESS KEY THREATS BY AUTOMATING VULNERABILITY REMEDIATION WORKFLOWS

TABLE 30 SECURITY & VULNERABILITY MANAGEMENT: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 31 SECURITY & VULNERABILITY MANAGEMENT: INDUSTRIAL CONTROL SYSTEM (ICS) SECURITY MARKET, BY REGION, 2022–2027 (USD MILLION)

FIGURE 24 MATURITY AND EVOLUTION OF VULNERABILITY MANAGEMENT - FROM REACTIVE TO PROACTIVE APPROACH

7.9 SECURITY CONFIGURATION MANAGEMENT

7.9.1 ENSURING PROPER CONFIGURATION OF ALL ASSETS TO BE CRITICAL ELEMENT FOR OT/ICS CYBER SECURITY AND RELIABILITY

TABLE 32 SECURITY CONFIGURATION MANAGEMENT: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 33 SECURITY CONFIGURATION MANAGEMENT: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.10 SECURITY INFORMATION & EVENT MANAGEMENT

7.10.1 INTERNET CONNECTIVITY IN ICS MAKING SIEM SMART CHOICE FOR ICS ENVIRONMENT

TABLE 34 EVENT LOGS AND DESCRIPTIONS

TABLE 35 SECURITY INFORMATION & EVENT MANAGEMENT: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 36 SECURITY INFORMATION & EVENT MANAGEMENT: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.11 WHITELISTING

7.11.1 WHITELISTING TO MITIGATE TECHNOLOGY INTEROPERABILITY ISSUES AND DEPLOY MOST RELIABLE SOLUTION IN ICS

TABLE 37 WHITELISTING: ICS SECURITY MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 38 WHITELISTING: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.12 OTHER SOLUTIONS

TABLE 39 OTHER SOLUTIONS: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 40 OTHER SOLUTIONS: MARKET, BY REGION, 2022–2027 (USD MILLION)

8 ICS SECURITY MARKET, BY SERVICES (Page No. - 115)

8.1 INTRODUCTION

FIGURE 25 CONSULTING & INTEGRATION TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

8.1.1 SERVICES: MARKET DRIVERS

TABLE 41 MARKET, BY SERVICES, 2016–2021 (USD MILLION)

TABLE 42 MARKET, BY SERVICES, 2022–2027 (USD MILLION)

8.2 INCIDENT RESPONSE SERVICES

8.2.1 INCIDENT RESPONSE HELPS IDENTIFY, HALT, AND LIMIT ATTACKS AND POTENTIAL DAMAGE

TABLE 43 INCIDENT RESPONSE SERVICES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 44 INCIDENT RESPONSE SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.3 CONSULTING & INTEGRATION

8.3.1 INCREASING NEED FOR ADVANCED SKILLS TO FUEL DEMAND FOR CONSULTING SERVICES

TABLE 45 CONSULTING & INTEGRATION: INDUSTRIAL CONTROL SYSTEM (ICS) SECURITY MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 46 CONSULTING & INTEGRATION: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.4 SUPPORT & MAINTENANCE

8.4.1 ADOPTION OF COMPLEX SECURITY SOLUTIONS TO DRIVE DEMAND FOR SUPPORT & MAINTENANCE SERVICES

TABLE 47 SUPPORT & MAINTENANCE: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 48 SUPPORT & MAINTENANCE: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.5 TRAINING & DEVELOPMENT

8.5.1 INNOVATIVE EDUCATION PROGRAMS TO MITIGATE KNOWLEDGE GAPS IN ICS SECURITY SOLUTIONS

TABLE 49 TRAINING & DEVELOPMENT: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 50 TRAINING & DEVELOPMENT: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.6 MANAGED SECURITY SERVICES

8.6.1 MANAGED SECURITY SERVICES TO ALLOW MORE TIME TO FOCUS ON BUSINESSES

TABLE 51 MANAGED SECURITY SERVICES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 52 MANAGED SECURITY SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

9 ICS SECURITY MARKET, BY SECURITY TYPE (Page No. - 123)

9.1 INTRODUCTION

FIGURE 26 NETWORK SECURITY TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

9.1.1 SECURITY TYPE: MARKET DRIVERS

TABLE 53 MARKET, BY SECURITY TYPE, 2016–2021 (USD MILLION)

TABLE 54 MARKET, BY SECURITY TYPE, 2022–2027 (USD MILLION)

9.2 NETWORK SECURITY

9.2.1 ICS NETWORK MONITORING TO MAINTAIN RELIABILITY OF MISSION-CRITICAL EQUIPMENT

TABLE 55 NETWORK SECURITY: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 56 NETWORK SECURITY: INDUSTRIAL CONTROL SYSTEM (ICS) SECURITY MARKET, BY REGION, 2022–2027 (USD MILLION)

9.3 ENDPOINT SECURITY

9.3.1 ENDPOINTS TO SERVE AS DOORWAYS FOR CYBERCRIMINALS TO GAIN ACCESS TO ICS NETWORKS

FIGURE 27 ENDPOINT SECURITY: SOLUTION ARCHITECTURE

TABLE 57 ENDPOINT SECURITY: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 58 ENDPOINT SECURITY: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.4 APPLICATION SECURITY

9.4.1 PROTECTS ICS FUNCTIONS OPERATED VIA WEB AND MOBILE APPLICATIONS

TABLE 59 APPLICATION SECURITY: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 60 APPLICATION SECURITY: ICS SECURITY MARKET, BY REGION, 2022–2027 (USD MILLION)

9.5 DATABASE SECURITY

9.5.1 PRESENCE OF VARIOUS GOVERNMENT REGULATIONS FOR DATABASE PROTECTION

TABLE 61 OPERATIONAL TECHNOLOGY/CONTROL SYSTEM COMPONENTS SUPPORT OF VISIBILITY

TABLE 62 DATABASE SECURITY: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 63 DATABASE SECURITY: MARKET, BY REGION, 2022–2027 (USD MILLION)

10 ICS SECURITY MARKET, BY VERTICAL (Page No. - 131)

10.1 INTRODUCTION

FIGURE 28 MANUFACTURING TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

10.1.1 VERTICAL: MARKET DRIVERS

TABLE 64 MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 65 MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10.2 POWER

10.2.1 TARGETING ENERGY SECTOR COULD ALSO THREATEN COMMUNITY HEALTH AND SAFETY

TABLE 66 MARKET, BY POWER VERTICAL, 2016–2021 (USD MILLION)

TABLE 67 MARKET, BY POWER VERTICAL, 2022–2027 (USD MILLION)

TABLE 68 POWER: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 69 POWER: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.2.2 NUCLEAR POWER PLANTS

TABLE 70 NUCLEAR POWER PLANTS: INDUSTRIAL CONTROL SYSTEM (ICS) SECURITY MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 71 NUCLEAR POWER PLANTS: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.2.3 THERMAL & HYDRO PLANTS

TABLE 72 THERMAL & HYDRO PLANTS: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 73 THERMAL & HYDRO PLANTS: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.2.4 RENEWABLE ENERGY POWER PLANTS

TABLE 74 RENEWABLE ENERGY POWER PLANTS: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 75 RENEWABLE ENERGY POWER PLANTS: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.2.5 POWER GRID

TABLE 76 POWER GRID: ICS SECURITY MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 77 POWER GRID: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.3 ENERGY & UTILITIES

10.3.1 INCREASED GOVERNMENT FOCUS ON CYBERSECURITY AMONG ENERGY & UTILITIES ORGANIZATIONS

TABLE 78 MARKET, BY ENERGY & UTILITIES VERTICAL, 2016–2021 (USD MILLION)

TABLE 79 MARKET, BY ENERGY & UTILITIES VERTICAL, 2022–2027 (USD MILLION)

TABLE 80 ENERGY & UTILITIES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 81 ENERGY & UTILITIES: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.3.2 OIL & GAS

TABLE 82 OIL & GAS: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 83 OIL & GAS: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.3.3 ELECTRIC POWER TRANSMISSION

TABLE 84 ELECTRIC POWER TRANSMISSION: INDUSTRIAL CONTROL SYSTEM (ICS) SECURITY MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 85 ELECTRIC POWER TRANSMISSION: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.3.4 WATER TREATMENT & DISTRIBUTION

TABLE 86 WATER TREATMENT & DISTRIBUTION: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 87 WATER TREATMENT & DISTRIBUTION: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.3.5 WASTEWATER COLLECTION & TREATMENT

TABLE 88 WASTEWATER COLLECTION & TREATMENT: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 89 WASTEWATER COLLECTION & TREATMENT: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.4 TRANSPORTATION SYSTEMS

10.4.1 REPUTATION AND COMMERCIAL RISKS WHEN ATTACKS DIRECTLY AFFECT PASSENGERS OR PASSENGER SERVICES

TABLE 90 TRANSPORTATION SYSTEMS: ICS SECURITY MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 91 TRANSPORTATION VERTICAL: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 92 TRANSPORTATION SYSTEMS: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 93 TRANSPORTATION SYSTEMS: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.4.2 AIRPORTS

TABLE 94 AIRPORTS: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 95 AIRPORTS: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.4.3 SEAPORTS

TABLE 96 SEAPORTS: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 97 SEAPORTS: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.4.4 RAILWAYS

TABLE 98 RAILWAYS: INDUSTRIAL CONTROL SYSTEM (ICS) SECURITY MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 99 RAILWAYS: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.4.5 OTHER TRANSPORTATION SYSTEMS

TABLE 100 OTHER TRANSPORTATION SYSTEMS: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 101 OTHER TRANSPORTATION SYSTEMS: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.5 MANUFACTURING

10.5.1 OLD MANUFACTURING PLANTS TO UPDATE THEIR CYBERSECURITY FOR ADVANCED THREATS

TABLE 102 MARKET, BY MANUFACTURING VERTICAL, 2016–2021 (USD MILLION)

TABLE 103 MARKET, BY MANUFACTURING VERTICAL, 2022–2027 (USD MILLION)

TABLE 104 MANUFACTURING: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 105 MANUFACTURING: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.5.2 CHEMICALS & MATERIALS

TABLE 106 CHEMICALS & MATERIALS: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 107 CHEMICALS & MATERIALS: INDUSTRIAL CONTROL SYSTEM (ICS) SECURITY MARKET, BY REGION, 2022–2027 (USD MILLION)

10.5.3 AUTOMOTIVE

TABLE 108 AUTOMOTIVE: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 109 AUTOMOTIVE: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.5.4 MINING UNITS

TABLE 110 MINING UNITS: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 111 MINING UNITS:MARKET, BY REGION, 2022–2027 (USD MILLION)

10.5.5 PAPER & PULP

TABLE 112 PAPER & PULP: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 113 PAPER & PULP: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.5.6 OTHER MANUFACTURING APPLICATIONS

TABLE 114 OTHER MANUFACTURING APPLICATIONS: ICS SECURITY MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 115 OTHER MANUFACTURING APPLICATIONS: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.6 OTHER VERTICALS

TABLE 116 OTHER VERTICALS: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 117 OTHER VERTICALS: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 118 OTHER VERTICALS: INDUSTRIAL CONTROL SYSTEM (ICS) SECURITY MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 119 OTHER VERTICALS: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.6.1 COMMERCIAL BUILDINGS

TABLE 120 COMMERCIAL BUILDINGS: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 121 COMMERCIAL BUILDINGS: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.6.2 COMMUNICATION SYSTEMS

TABLE 122 COMMUNICATION SYSTEMS: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 123 COMMUNICATION SYSTEMS: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.6.3 HEALTHCARE

TABLE 124 HEALTHCARE: INDUSTRIAL CONTROL SYSTEM (ICS) SECURITY MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 125 HEALTHCARE: ICS SECURITY MARKET, BY REGION, 2022–2027 (USD MILLION)

10.6.4 OTHERS

TABLE 126 OTHERS: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 127 OTHERS: MARKET, BY REGION, 2022–2027 (USD MILLION)

11 ICS SECURITY MARKET, BY REGION (Page No. - 162)

11.1 INTRODUCTION

FIGURE 29 NORTH AMERICA ESTIMATED TO HAVE LARGEST MARKET SIZE DURING FORECAST PERIOD

TABLE 128 MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 129 MARKET, BY REGION, 2022–2027 (USD MILLION)

11.2 NORTH AMERICA

11.2.1 NORTH AMERICA: INDUSTRIAL CONTROL SYSTEM (ICS) SECURITY MARKET DRIVERS

11.2.2 NORTH AMERICA: REGULATORY LANDSCAPE

FIGURE 30 NORTH AMERICA: MARKET SNAPSHOT

TABLE 130 NORTH AMERICA: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 131 NORTH AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 132 NORTH AMERICA: MARKET, BY SOLUTIONS, 2016–2021 (USD MILLION)

TABLE 133 NORTH AMERICA: MARKET, BY SOLUTIONS, 2022–2027 (USD MILLION)

TABLE 134 NORTH AMERICA: MARKET, BY SERVICES, 2016–2021 (USD MILLION)

TABLE 135 NORTH AMERICA: MARKET, BY SERVICES, 2022–2027 (USD MILLION)

TABLE 136 NORTH AMERICA: MARKET, BY SECURITY TYPE, 2016–2021 (USD MILLION)

TABLE 137 NORTH AMERICA: MARKET, BY SECURITY TYPE, 2022–2027 (USD MILLION)

TABLE 138 NORTH AMERICA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 139 NORTH AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 140 NORTH AMERICA: ICS SECURITY MARKET, BY POWER VERTICAL, 2016–2021 (USD MILLION)

TABLE 141 NORTH AMERICA: MARKET, BY POWER VERTICAL, 2022–2027 (USD MILLION)

TABLE 142 NORTH AMERICA: MARKET, BY ENERGY & UTILITIES, 2016–2021 (USD MILLION)

TABLE 143 NORTH AMERICA: MARKET, BY ENERGY & UTILITIES, 2022–2027 (USD MILLION)

TABLE 144 NORTH AMERICA: MARKET, BY TRANSPORTATION SYSTEMS, 2016–2021 (USD MILLION)

TABLE 145 NORTH AMERICA: MARKET, BY TRANSPORTATION SYSTEMS, 2022–2027 (USD MILLION)

TABLE 146 NORTH AMERICA: MARKET, BY MANUFACTURING, 2016–2021 (USD MILLION)

TABLE 147 NORTH AMERICA: MARKET, BY MANUFACTURING, 2022–2027 (USD MILLION)

TABLE 148 NORTH AMERICA: MARKET, BY OTHER VERTICALS, 2016–2021 (USD MILLION)

TABLE 149 NORTH AMERICA: MARKET, BY OTHER VERTICALS, 2022–2027 (USD MILLION)

TABLE 150 NORTH AMERICA: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 151 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.2.3 US

11.2.3.1 Rising threats to ICS security

TABLE 152 US: ICS SECURITY MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 153 US: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 154 US: MARKET, BY SOLUTIONS, 2016–2021 (USD MILLION)

TABLE 155 US: MARKET, BY SOLUTIONS, 2022–2027 (USD MILLION)

TABLE 156 US: MARKET, BY SERVICES, 2016–2021 (USD MILLION)

TABLE 157 US: MARKET, BY SERVICES, 2022–2027 (USD MILLION)

TABLE 158 US: MARKET, BY SECURITY TYPE, 2016–2021 (USD MILLION)

TABLE 159 US: MARKET, BY SECURITY TYPE, 2022–2027 (USD MILLION)

TABLE 160 US: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 161 US: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 162 US: INDUSTRIAL CONTROL SYSTEM (ICS) SECURITY MARKET, BY POWER VERTICAL, 2016–2021 (USD MILLION)

TABLE 163 US: MARKET, BY POWER VERTICAL, 2022–2027 (USD MILLION)

TABLE 164 US: MARKET, BY ENERGY & UTILITIES, 2016–2021 (USD MILLION)

TABLE 165 US: MARKET, BY ENERGY & UTILITIES, 2022–2027 (USD MILLION)

TABLE 166 US: MARKET, BY TRANSPORTATION SYSTEMS, 2016–2021 (USD MILLION)

TABLE 167 US: MARKET, BY TRANSPORTATION SYSTEMS, 2022–2027 (USD MILLION)

TABLE 168 US: MARKET, BY MANUFACTURING, 2016–2021 (USD MILLION)

TABLE 169 US: MARKET, BY MANUFACTURING, 2022–2027 (USD MILLION)

TABLE 170 US: MARKET, BY OTHER VERTICALS, 2016–2021 (USD MILLION)

TABLE 171 US: MARKET, BY OTHER VERTICALS, 2022–2027 (USD MILLION)

11.2.4 CANADA

11.2.4.1 Government taking initiatives for ICS security

TABLE 172 CANADA: ICS SECURITY MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 173 CANADA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 174 CANADA: MARKET, BY SOLUTIONS, 2016–2021 (USD MILLION)

TABLE 175 CANADA: MARKET, BY SOLUTIONS, 2022–2027 (USD MILLION)

TABLE 176 CANADA: MARKET, BY SERVICES, 2016–2021 (USD MILLION)

TABLE 177 CANADA: MARKET, BY SERVICES, 2022–2027 (USD MILLION)

TABLE 178 CANADA: MARKET, BY SECURITY TYPE, 2016–2021 (USD MILLION)

TABLE 179 CANADA: MARKET, BY SECURITY TYPE, 2022–2027 (USD MILLION)

TABLE 180 CANADA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 181 CANADA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 182 CANADA: MARKET, BY POWER VERTICAL, 2016–2021 (USD MILLION)

TABLE 183 CANADA: INDUSTRIAL CONTROL SYSTEM (ICS) SECURITY MARKET, BY POWER VERTICAL, 2022–2027 (USD MILLION)

TABLE 184 CANADA: MARKET, BY ENERGY & UTILITIES, 2016–2021 (USD MILLION)

TABLE 185 CANADA: MARKET, BY ENERGY & UTILITIES, 2022–2027 (USD MILLION)

TABLE 186 CANADA: MARKET, BY TRANSPORTATION SYSTEMS, 2016–2021 (USD MILLION)

TABLE 187 CANADA: MARKET, BY TRANSPORTATION SYSTEMS, 2022–2027 (USD MILLION)

TABLE 188 CANADA: MARKET, BY MANUFACTURING, 2016–2021 (USD MILLION)

TABLE 189 CANADA: MARKET, BY MANUFACTURING, 2022–2027 (USD MILLION)

TABLE 190 CANADA: MARKET, BY OTHER VERTICALS, 2016–2021 (USD MILLION)

TABLE 191 CANADA: MARKET, BY OTHER VERTICALS, 2022–2027 (USD MILLION)

11.3 EUROPE

11.3.1 EUROPE: ICS SECURITY MARKET DRIVERS

11.3.2 EUROPE: REGULATORY LANDSCAPE

TABLE 192 EUROPE: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 193 EUROPE: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 194 EUROPE: MARKET, BY SOLUTIONS, 2016–2021 (USD MILLION)

TABLE 195 EUROPE: MARKET, BY SOLUTIONS, 2022–2027 (USD MILLION)

TABLE 196 EUROPE: MARKET, BY SERVICES, 2016–2021 (USD MILLION)

TABLE 197 EUROPE: MARKET, BY SERVICES, 2022–2027 (USD MILLION)

TABLE 198 EUROPE: MARKET, BY SECURITY TYPE, 2016–2021 (USD MILLION)

TABLE 199 EUROPE: MARKET, BY SECURITY TYPE, 2022–2027 (USD MILLION)

TABLE 200 EUROPE: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 201 EUROPE: INDUSTRIAL CONTROL SYSTEM (ICS) SECURITY MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 202 EUROPE: MARKET, BY POWER VERTICAL, 2016–2021 (USD MILLION)

TABLE 203 EUROPE: MARKET, BY POWER VERTICAL, 2022–2027 (USD MILLION)

TABLE 204 EUROPE: MARKET, BY ENERGY & UTILITIES, 2016–2021 (USD MILLION)

TABLE 205 EUROPE: MARKET, BY ENERGY & UTILITIES, 2022–2027 (USD MILLION)

TABLE 206 EUROPE: MARKET, BY TRANSPORTATION SYSTEMS, 2016–2021 (USD MILLION)

TABLE 207 EUROPE: MARKET, BY TRANSPORTATION SYSTEMS, 2022–2027 (USD MILLION)

TABLE 208 EUROPE: MARKET, BY MANUFACTURING, 2016–2021 (USD MILLION)

TABLE 209 EUROPE: MARKET, BY MANUFACTURING, 2022–2027 (USD MILLION)

TABLE 210 EUROPE: MARKET, BY OTHER VERTICALS, 2016–2021 (USD MILLION)

TABLE 211 EUROPE: MARKET, BY OTHER VERTICALS, 2022–2027 (USD MILLION)

TABLE 212 EUROPE: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 213 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.3.3 UK

11.3.3.1 Vendors focusing on UK to fulfill ICS security demand

TABLE 214 UK: ICS SECURITY MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 215 UK: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 216 UK: MARKET, BY SOLUTIONS, 2016–2021 (USD MILLION)

TABLE 217 UK: MARKET, BY SOLUTIONS, 2022–2027 (USD MILLION)

TABLE 218 UK: MARKET, BY SERVICES, 2016–2021 (USD MILLION)

TABLE 219 UK: MARKET, BY SERVICES, 2022–2027 (USD MILLION)

TABLE 220 UK: MARKET, BY SECURITY TYPE, 2016–2021 (USD MILLION)

TABLE 221 UK: MARKET, BY SECURITY TYPE, 2022–2027 (USD MILLION)

TABLE 222 UK: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 223 UK: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 224 UK: INDUSTRIAL CONTROL SYSTEM (ICS) SECURITY MARKET, BY POWER VERTICAL, 2016–2021 (USD MILLION)

TABLE 225 UK: MARKET, BY POWER VERTICAL, 2022–2027 (USD MILLION)

TABLE 226 UK: MARKET, BY ENERGY & UTILITIES, 2016–2021 (USD MILLION)

TABLE 227 UK: MARKET, BY ENERGY & UTILITIES, 2022–2027 (USD MILLION)

TABLE 228 UK: MARKET, BY TRANSPORTATION SYSTEMS, 2016–2021 (USD MILLION)

TABLE 229 UK: MARKET, BY TRANSPORTATION SYSTEMS, 2022–2027 (USD MILLION)

TABLE 230 UK: MARKET, BY MANUFACTURING, 2016–2021 (USD MILLION)

TABLE 231 UK: MARKET, BY MANUFACTURING, 2022–2027 (USD MILLION)

TABLE 232 UK: MARKET, BY OTHER VERTICALS, 2016–2021 (USD MILLION)

TABLE 233 UK: MARKET, BY OTHER VERTICALS, 2022–2027 (USD MILLION)

11.3.4 GERMANY

11.3.4.1 Revision of security act

TABLE 234 GERMANY: ICS SECURITY MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 235 GERMANY: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 236 GERMANY: MARKET, BY SOLUTIONS, 2016–2021 (USD MILLION)

TABLE 237 GERMANY: MARKET, BY SOLUTIONS, 2022–2027 (USD MILLION)

TABLE 238 GERMANY: MARKET, BY SERVICES, 2016–2021 (USD MILLION)

TABLE 239 GERMANY: MARKET, BY SERVICES, 2022–2027 (USD MILLION)

TABLE 240 GERMANY: MARKET, BY SECURITY TYPE, 2016–2021 (USD MILLION)

TABLE 241 GERMANY: MARKET, BY SECURITY TYPE, 2022–2027 (USD MILLION)

TABLE 242 GERMANY: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 243 GERMANY: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 244 GERMANY: MARKET, BY POWER VERTICAL, 2016–2021 (USD MILLION)

TABLE 245 GERMANY: MARKET, BY POWER VERTICAL, 2022–2027 (USD MILLION)

TABLE 246 GERMANY: INDUSTRIAL CONTROL SYSTEM (ICS) SECURITY MARKET, BY ENERGY & UTILITIES, 2016–2021 (USD MILLION)

TABLE 247 GERMANY: MARKET, BY ENERGY & UTILITIES, 2022–2027 (USD MILLION)

TABLE 248 GERMANY: MARKET, BY TRANSPORTATION SYSTEMS, 2016–2021 (USD MILLION)

TABLE 249 GERMANY: MARKET, BY TRANSPORTATION SYSTEMS, 2022–2027 (USD MILLION)

TABLE 250 GERMANY: MARKET, BY MANUFACTURING, 2016–2021 (USD MILLION)

TABLE 251 GERMANY: MARKET, BY MANUFACTURING, 2022–2027 (USD MILLION)

TABLE 252 GERMANY: MARKET, BY OTHER VERTICALS, 2016–2021 (USD MILLION)

TABLE 253 GERMANY: MARKET, BY OTHER VERTICALS, 2022–2027 (USD MILLION)

11.3.5 REST OF EUROPE

TABLE 254 REST OF EUROPE: ICS SECURITY MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 255 REST OF EUROPE: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 256 REST OF EUROPE: MARKET, BY SOLUTIONS, 2016–2021 (USD MILLION)

TABLE 257 REST OF EUROPE: MARKET, BY SOLUTIONS, 2022–2027 (USD MILLION)

TABLE 258 REST OF EUROPE: MARKET, BY SERVICES, 2016–2021 (USD MILLION)

TABLE 259 REST OF EUROPE: MARKET, BY SERVICES, 2022–2027 (USD MILLION)

TABLE 260 REST OF EUROPE: MARKET, BY SECURITY TYPE, 2016–2021 (USD MILLION)

TABLE 261 REST OF EUROPE: MARKET, BY SECURITY TYPE, 2022–2027 (USD MILLION)

TABLE 262 REST OF EUROPE: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 263 REST OF EUROPE: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 264 REST OF EUROPE: MARKET, BY POWER VERTICAL, 2016–2021 (USD MILLION)

TABLE 265 REST OF EUROPE: MARKET, BY POWER VERTICAL, 2022–2027 (USD MILLION)

TABLE 266 REST OF EUROPE: INDUSTRIAL CONTROL SYSTEM (ICS) SECURITY MARKET, BY ENERGY & UTILITIES, 2016–2021 (USD MILLION)

TABLE 267 REST OF EUROPE: MARKET, BY ENERGY & UTILITIES, 2022–2027 (USD MILLION)

TABLE 268 REST OF EUROPE: MARKET, BY TRANSPORTATION SYSTEMS, 2016–2021 (USD MILLION)

TABLE 269 REST OF EUROPE: MARKET, BY TRANSPORTATION SYSTEMS, 2022–2027 (USD MILLION)

TABLE 270 REST OF EUROPE: MARKET, BY MANUFACTURING, 2016–2021 (USD MILLION)

TABLE 271 REST OF EUROPE: MARKET, BY MANUFACTURING, 2022–2027 (USD MILLION)

TABLE 272 REST OF EUROPE: MARKET, BY OTHER VERTICALS, 2016–2021 (USD MILLION)

TABLE 273 REST OF EUROPE: MARKET, BY OTHER VERTICALS, 2022–2027 (USD MILLION)

11.4 ASIA PACIFIC

11.4.1 ASIA PACIFIC: ICS SECURITY MARKET DRIVERS

11.4.2 ASIA PACIFIC: REGULATORY LANDSCAPE

FIGURE 31 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 274 ASIA PACIFIC: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 275 ASIA PACIFIC: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 276 ASIA PACIFIC: MARKET, BY SOLUTIONS, 2016–2021 (USD MILLION)

TABLE 277 ASIA PACIFIC: MARKET, BY SOLUTIONS, 2022–2027 (USD MILLION)

TABLE 278 ASIA PACIFIC: MARKET, BY SERVICES, 2016–2021 (USD MILLION)

TABLE 279 ASIA PACIFIC: MARKET, BY SERVICES, 2022–2027 (USD MILLION)

TABLE 280 ASIA PACIFIC: MARKET, BY SECURITY TYPE, 2016–2021 (USD MILLION)

TABLE 281 ASIA PACIFIC: MARKET, BY SECURITY TYPE, 2022–2027 (USD MILLION)

TABLE 282 ASIA PACIFIC: INDUSTRIAL CONTROL SYSTEM (ICS) SECURITY MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 283 ASIA PACIFIC: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 284 ASIA PACIFIC: MARKET, BY POWER VERTICAL, 2016–2021 (USD MILLION)

TABLE 285 ASIA PACIFIC: MARKET, BY POWER VERTICAL, 2022–2027 (USD MILLION)

TABLE 286 ASIA PACIFIC: MARKET, BY ENERGY & UTILITIES, 2016–2021 (USD MILLION)

TABLE 287 ASIA PACIFIC: MARKET, BY ENERGY & UTILITIES, 2022–2027 (USD MILLION)

TABLE 288 ASIA PACIFIC: MARKET, BY TRANSPORTATION SYSTEMS, 2016–2021 (USD MILLION)

TABLE 289 ASIA PACIFIC: MARKET, BY TRANSPORTATION SYSTEMS, 2022–2027 (USD MILLION)

TABLE 290 ASIA PACIFIC: MARKET, BY MANUFACTURING, 2016–2021 (USD MILLION)

TABLE 291 ASIA PACIFIC: MARKET, BY MANUFACTURING, 2022–2027 (USD MILLION)

TABLE 292 ASIA PACIFIC: MARKET, BY OTHER VERTICALS, 2016–2021 (USD MILLION)

TABLE 293 ASIA PACIFIC: MARKET, BY OTHER VERTICALS, 2022–2027 (USD MILLION)

TABLE 294 ASIA PACIFIC: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 295 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.4.3 CHINA

11.4.3.1 China taking preventive initiatives for ICS security

TABLE 296 CHINA: ICS SECURITY MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 297 CHINA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 298 CHINA: MARKET, BY SOLUTIONS, 2016–2021 (USD MILLION)

TABLE 299 CHINA: MARKET, BY SOLUTIONS, 2022–2027 (USD MILLION)

TABLE 300 CHINA: MARKET, BY SERVICES, 2016–2021 (USD MILLION)

TABLE 301 CHINA: MARKET, BY SERVICES, 2022–2027 (USD MILLION)

TABLE 302 CHINA: MARKET, BY SECURITY TYPE, 2016–2021 (USD MILLION)

TABLE 303 CHINA: MARKET, BY SECURITY TYPE, 2022–2027 (USD MILLION)

TABLE 304 CHINA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 305 CHINA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 306 CHINA: MARKET, BY POWER VERTICAL, 2016–2021 (USD MILLION)

TABLE 307 CHINA: MARKET, BY POWER VERTICAL, 2022–2027 (USD MILLION)

TABLE 308 CHINA: INDUSTRIAL CONTROL SYSTEM (ICS) SECURITY MARKET, BY ENERGY & UTILITIES, 2016–2021 (USD MILLION)

TABLE 309 CHINA: MARKET, BY ENERGY & UTILITIES, 2022–2027 (USD MILLION)

TABLE 310 CHINA: MARKET, BY TRANSPORTATION SYSTEMS, 2016–2021 (USD MILLION)

TABLE 311 CHINA: MARKET, BY TRANSPORTATION SYSTEMS, 2022–2027 (USD MILLION)

TABLE 312 CHINA: MARKET, BY MANUFACTURING, 2016–2021 (USD MILLION)

TABLE 313 CHINA: MARKET, BY MANUFACTURING, 2022–2027 (USD MILLION)

TABLE 314 CHINA: MARKET, BY OTHER VERTICALS, 2016–2021 (USD MILLION)

TABLE 315 CHINA: MARKET, BY OTHER VERTICALS, 2022–2027 (USD MILLION)

11.4.4 JAPAN

11.4.4.1 Japan to increase awareness about ICS security

TABLE 316 JAPAN: ICS SECURITY MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 317 JAPAN: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 318 JAPAN: MARKET, BY SOLUTIONS, 2016–2021 (USD MILLION)

TABLE 319 JAPAN: MARKET, BY SOLUTIONS, 2022–2027 (USD MILLION)

TABLE 320 JAPAN: MARKET, BY SERVICES, 2016–2021 (USD MILLION)

TABLE 321 JAPAN: MARKET, BY SERVICES, 2022–2027 (USD MILLION)

TABLE 322 JAPAN: MARKET, BY SECURITY TYPE, 2016–2021 (USD MILLION)

TABLE 323 JAPAN: MARKET, BY SECURITY TYPE, 2022–2027 (USD MILLION)

TABLE 324 JAPAN: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 325 JAPAN: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 326 JAPAN: MARKET, BY POWER VERTICAL, 2016–2021 (USD MILLION)

TABLE 327 JAPAN: ICS SECURITY MARKET, BY POWER VERTICAL, 2022–2027 (USD MILLION)

TABLE 328 JAPAN: MARKET, BY ENERGY & UTILITIES, 2016–2021 (USD MILLION)

TABLE 329 JAPAN: MARKET, BY ENERGY & UTILITIES, 2022–2027 (USD MILLION)

TABLE 330 JAPAN: MARKET, BY TRANSPORTATION SYSTEMS, 2016–2021 (USD MILLION)

TABLE 331 JAPAN: MARKET, BY TRANSPORTATION SYSTEMS, 2022–2027 (USD MILLION)

TABLE 332 JAPAN: MARKET, BY MANUFACTURING, 2016–2021 (USD MILLION)

TABLE 333 JAPAN: MARKET, BY MANUFACTURING, 2022–2027 (USD MILLION)

TABLE 334 JAPAN: MARKET, BY OTHER VERTICALS, 2016–2021 (USD MILLION)

TABLE 335 JAPAN: MARKET, BY OTHER VERTICALS, 2022–2027 (USD MILLION)

11.4.5 INDIA

11.4.5.1 National Critical Information Infrastructure Protection Centre established as central authority

TABLE 336 INDIA: ICS SECURITY MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 337 INDIA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 338 INDIA: MARKET, BY SOLUTIONS, 2016–2021 (USD MILLION)

TABLE 339 INDIA: MARKET, BY SOLUTIONS, 2022–2027 (USD MILLION)

TABLE 340 INDIA: MARKET, BY SERVICES, 2016–2021 (USD MILLION)

TABLE 341 INDIA: MARKET, BY SERVICES, 2022–2027 (USD MILLION)

TABLE 342 INDIA: MARKET, BY SECURITY TYPE, 2016–2021 (USD MILLION)

TABLE 343 INDIA: MARKET, BY SECURITY TYPE, 2022–2027 (USD MILLION)

TABLE 344 INDIA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 345 INDIA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 346 INDIA: MARKET, BY POWER VERTICAL, 2016–2021 (USD MILLION)

TABLE 347 INDIA: MARKET, BY POWER VERTICAL, 2022–2027 (USD MILLION)

TABLE 348 INDIA: INDUSTRIAL CONTROL SYSTEM (ICS) SECURITY MARKET, BY ENERGY & UTILITIES, 2016–2021 (USD MILLION)

TABLE 349 INDIA: MARKET, BY ENERGY & UTILITIES, 2022–2027 (USD MILLION)

TABLE 350 INDIA: MARKET, BY TRANSPORTATION SYSTEMS, 2016–2021 (USD MILLION)

TABLE 351 INDIA: MARKET, BY TRANSPORTATION SYSTEMS, 2022–2027 (USD MILLION)

TABLE 352 INDIA: MARKET, BY MANUFACTURING, 2016–2021 (USD MILLION)

TABLE 353 INDIA: MARKET, BY MANUFACTURING, 2022–2027 (USD MILLION)

TABLE 354 INDIA: MARKET, BY OTHER VERTICALS, 2016–2021 (USD MILLION)

TABLE 355 INDIA: MARKET, BY OTHER VERTICALS, 2022–2027 (USD MILLION)

11.4.6 REST OF ASIA PACIFIC

TABLE 356 REST OF ASIA PACIFIC: ICS SECURITY MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 357 REST OF ASIA PACIFIC: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 358 REST OF ASIA PACIFIC: MARKET, BY SOLUTIONS, 2016–2021 (USD MILLION)

TABLE 359 REST OF ASIA PACIFIC: MARKET, BY SOLUTIONS, 2022–2027 (USD MILLION)

TABLE 360 REST OF ASIA PACIFIC: MARKET, BY SERVICES, 2016–2021 (USD MILLION)

TABLE 361 REST OF ASIA PACIFIC: MARKET, BY SERVICES, 2022–2027 (USD MILLION)

TABLE 362 REST OF ASIA PACIFIC: MARKET, BY SECURITY TYPE, 2016–2021 (USD MILLION)

TABLE 363 REST OF ASIA PACIFIC: MARKET, BY SECURITY TYPE, 2022–2027 (USD MILLION)

TABLE 364 REST OF ASIA PACIFIC: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 365 REST OF ASIA PACIFIC: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 366 REST OF ASIA PACIFIC: INDUSTRIAL CONTROL SYSTEM (ICS) SECURITY MARKET, BY POWER VERTICAL, 2016–2021 (USD MILLION)

TABLE 367 REST OF ASIA PACIFIC: MARKET, BY POWER VERTICAL, 2022–2027 (USD MILLION)

TABLE 368 REST OF ASIA PACIFIC: MARKET, BY ENERGY & UTILITIES, 2016–2021 (USD MILLION)

TABLE 369 REST OF ASIA PACIFIC: MARKET, BY ENERGY & UTILITIES, 2022–2027 (USD MILLION)

TABLE 370 REST OF ASIA PACIFIC: MARKET, BY TRANSPORTATION SYSTEMS, 2016–2021 (USD MILLION)

TABLE 371 REST OF ASIA PACIFIC: MARKET, BY TRANSPORTATION SYSTEMS, 2022–2027 (USD MILLION)

TABLE 372 REST OF ASIA PACIFIC: MARKET, BY MANUFACTURING, 2016–2021 (USD MILLION)

TABLE 373 REST OF ASIA PACIFIC: MARKET, BY MANUFACTURING, 2022–2027 (USD MILLION)

TABLE 374 REST OF ASIA PACIFIC: MARKET, BY OTHER VERTICALS, 2016–2021 (USD MILLION)

TABLE 375 REST OF ASIA PACIFIC: MARKET, BY OTHER VERTICALS, 2022–2027 (USD MILLION)

11.5 MIDDLE EAST & AFRICA

11.5.1 MIDDLE EAST & AFRICA: ICS SECURITY MARKET DRIVERS

11.5.2 MIDDLE EAST & AFRICA: REGULATORY LANDSCAPE

TABLE 376 MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 377 MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 378 MIDDLE EAST & AFRICA: MARKET, BY SOLUTIONS, 2016–2021 (USD MILLION)

TABLE 379 MIDDLE EAST & AFRICA: MARKET, BY SOLUTIONS, 2022–2027 (USD MILLION)

TABLE 380 MIDDLE EAST & AFRICA: MARKET, BY SERVICES, 2016–2021 (USD MILLION)

TABLE 381 MIDDLE EAST & AFRICA: MARKET, BY SERVICES, 2022–2027 (USD MILLION)

TABLE 382 MIDDLE EAST & AFRICA: MARKET, BY SECURITY TYPE, 2016–2021 (USD MILLION)

TABLE 383 MIDDLE EAST & AFRICA: MARKET, BY SECURITY TYPE, 2022–2027 (USD MILLION)

TABLE 384 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 385 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 386 MIDDLE EAST & AFRICA: INDUSTRIAL CONTROL SYSTEM (ICS) SECURITY MARKET, BY POWER VERTICAL, 2016–2021 (USD MILLION)

TABLE 387 MIDDLE EAST & AFRICA: MARKET, BY POWER VERTICAL, 2022–2027 (USD MILLION)

TABLE 388 MIDDLE EAST & AFRICA: MARKET, BY ENERGY & UTILITIES, 2016–2021 (USD MILLION)

TABLE 389 MIDDLE EAST & AFRICA: MARKET, BY ENERGY & UTILITIES, 2022–2027 (USD MILLION)

TABLE 390 MIDDLE EAST & AFRICA: MARKET, BY TRANSPORTATION SYSTEMS, 2016–2021 (USD MILLION)

TABLE 391 MIDDLE EAST & AFRICA: MARKET, BY TRANSPORTATION SYSTEMS, 2022–2027 (USD MILLION)

TABLE 392 MIDDLE EAST & AFRICA: MARKET, BY MANUFACTURING, 2016–2021 (USD MILLION)

TABLE 393 MIDDLE EAST & AFRICA: MARKET, BY MANUFACTURING, 2022–2027 (USD MILLION)

TABLE 394 MIDDLE EAST & AFRICA: MARKET, BY OTHER VERTICALS, 2016–2021 (USD MILLION)

TABLE 395 MIDDLE EAST & AFRICA: MARKET, BY OTHER VERTICALS, 2022–2027 (USD MILLION)

TABLE 396 MIDDLE EAST & AFRICA: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 397 MIDDLE EAST & AFRICA: MARKET, BY REGION, 2022–2027 (USD MILLION)

11.5.3 MIDDLE EAST

TABLE 398 MIDDLE EAST: ICS SECURITY MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 399 MIDDLE EAST: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 400 MIDDLE EAST: MARKET, BY SOLUTIONS, 2016–2021 (USD MILLION)

TABLE 401 MIDDLE EAST: MARKET, BY SOLUTIONS, 2022–2027 (USD MILLION)

TABLE 402 MIDDLE EAST: MARKET, BY SERVICES, 2016–2021 (USD MILLION)

TABLE 403 MIDDLE EAST: MARKET, BY SERVICES, 2022–2027 (USD MILLION)

TABLE 404 MIDDLE EAST: MARKET, BY SECURITY TYPE, 2016–2021 (USD MILLION)

TABLE 405 MIDDLE EAST: MARKET, BY SECURITY TYPE, 2022–2027 (USD MILLION)

TABLE 406 MIDDLE EAST: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 407 MIDDLE EAST: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 408 MIDDLE EAST: MARKET, BY POWER VERTICAL, 2016–2021 (USD MILLION)

TABLE 409 MIDDLE EAST: INDUSTRIAL CONTROL SYSTEM (ICS) SECURITY MARKET, BY POWER VERTICAL, 2022–2027 (USD MILLION)

TABLE 410 MIDDLE EAST: MARKET, BY ENERGY & UTILITIES, 2016–2021 (USD MILLION)

TABLE 411 MIDDLE EAST: MARKET, BY ENERGY & UTILITIES, 2022–2027 (USD MILLION)

TABLE 412 MIDDLE EAST: MARKET, BY TRANSPORTATION SYSTEMS, 2016–2021 (USD MILLION)

TABLE 413 MIDDLE EAST: MARKET, BY TRANSPORTATION SYSTEMS, 2022–2027 (USD MILLION)

TABLE 414 MIDDLE EAST: MARKET, BY MANUFACTURING, 2016–2021 (USD MILLION)

TABLE 415 MIDDLE EAST: MARKET, BY MANUFACTURING, 2022–2027 (USD MILLION)

TABLE 416 MIDDLE EAST: MARKET, BY OTHER VERTICALS, 2016–2021 (USD MILLION)

TABLE 417 MIDDLE EAST: MARKET, BY OTHER VERTICALS, 2022–2027 (USD MILLION)

11.5.4 AFRICA

TABLE 418 AFRICA: ICS SECURITY MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 419 AFRICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 420 AFRICA: MARKET, BY SOLUTIONS, 2016–2021 (USD MILLION)

TABLE 421 AFRICA: MARKET, BY SOLUTIONS, 2022–2027 (USD MILLION)

TABLE 422 AFRICA: MARKET, BY SERVICES, 2016–2021 (USD MILLION)

TABLE 423 AFRICA: MARKET, BY SERVICES, 2022–2027 (USD MILLION)

TABLE 424 AFRICA: MARKET, BY SECURITY TYPE, 2016–2021 (USD MILLION)

TABLE 425 AFRICA: MARKET, BY SECURITY TYPE, 2022–2027 (USD MILLION)

TABLE 426 AFRICA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 427 AFRICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 428 AFRICA: MARKET, BY POWER VERTICAL, 2016–2021 (USD MILLION)

TABLE 429 AFRICA: INDUSTRIAL CONTROL SYSTEM (ICS) SECURITYMARKET, BY POWER VERTICAL, 2022–2027 (USD MILLION)

TABLE 430 AFRICA: MARKET, BY ENERGY & UTILITIES, 2016–2021 (USD MILLION)

TABLE 431 AFRICA: MARKET, BY ENERGY & UTILITIES, 2022–2027 (USD MILLION)

TABLE 432 AFRICA: MARKET, BY TRANSPORTATION SYSTEMS, 2016–2021 (USD MILLION)

TABLE 433 AFRICA: MARKET, BY TRANSPORTATION SYSTEMS, 2022–2027 (USD MILLION)

TABLE 434 AFRICA: MARKET, BY MANUFACTURING, 2016–2021 (USD MILLION)

TABLE 435 AFRICA: MARKET, BY MANUFACTURING, 2022–2027 (USD MILLION)

TABLE 436 AFRICA: MARKET, BY OTHER VERTICALS, 2016–2021 (USD MILLION)

TABLE 437 AFRICA: MARKET, BY OTHER VERTICALS, 2022–2027 (USD MILLION)

11.6 LATIN AMERICA

11.6.1 LATIN AMERICA: ICS SECURITY MARKET DRIVERS

11.6.2 LATIN AMERICA: REGULATORY LANDSCAPE

TABLE 438 LATIN AMERICA: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 439 LATIN AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 440 LATIN AMERICA: MARKET, BY SOLUTIONS, 2016–2021 (USD MILLION)

TABLE 441 LATIN AMERICA: MARKET, BY SOLUTIONS, 2022–2027 (USD MILLION)

TABLE 442 LATIN AMERICA: MARKET, BY SERVICES, 2016–2021 (USD MILLION)

TABLE 443 LATIN AMERICA: MARKET, BY SERVICES, 2022–2027 (USD MILLION)

TABLE 444 LATIN AMERICA: MARKET, BY SECURITY TYPE, 2016–2021 (USD MILLION)

TABLE 445 LATIN AMERICA: MARKET, BY SECURITY TYPE, 2022–2027 (USD MILLION)

TABLE 446 LATIN AMERICA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 447 LATIN AMERICA: INDUSTRIAL CONTROL SYSTEM (ICS) SECURITY MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 448 LATIN AMERICA: MARKET, BY POWER VERTICAL, 2016–2021 (USD MILLION)

TABLE 449 LATIN AMERICA: MARKET, BY POWER VERTICAL, 2022–2027 (USD MILLION)

TABLE 450 LATIN AMERICA: MARKET, BY ENERGY & UTILITIES, 2016–2021 (USD MILLION)

TABLE 451 LATIN AMERICA: MARKET, BY ENERGY & UTILITIES, 2022–2027 (USD MILLION)

TABLE 452 LATIN AMERICA: MARKET, BY TRANSPORTATION SYSTEMS, 2016–2021 (USD MILLION)

TABLE 453 LATIN AMERICA: MARKET, BY TRANSPORTATION SYSTEMS, 2022–2027 (USD MILLION)

TABLE 454 LATIN AMERICA: MARKET, BY MANUFACTURING, 2016–2021 (USD MILLION)

TABLE 455 LATIN AMERICA: MARKET, BY MANUFACTURING, 2022–2027 (USD MILLION)

TABLE 456 LATIN AMERICA: MARKET, BY OTHER VERTICALS, 2016–2021 (USD MILLION)

TABLE 457 LATIN AMERICA: MARKET, BY OTHER VERTICALS, 2022–2027 (USD MILLION)

TABLE 458 LATIN AMERICA: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 459 LATIN AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.6.3 MEXICO

11.6.3.1 Malicious programs to pose threat to critical systems

TABLE 460 MEXICO: ICS SECURITY MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 461 MEXICO: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 462 MEXICO: MARKET, BY SOLUTIONS, 2016–2021 (USD MILLION)

TABLE 463 MEXICO: MARKET, BY SOLUTIONS, 2022–2027 (USD MILLION)

TABLE 464 MEXICO: MARKET, BY SERVICES, 2016–2021 (USD MILLION)

TABLE 465 MEXICO: MARKET, BY SERVICES, 2022–2027 (USD MILLION)

TABLE 466 MEXICO: MARKET, BY SECURITY TYPE, 2016–2021 (USD MILLION)

TABLE 467 MEXICO: MARKET, BY SECURITY TYPE, 2022–2027 (USD MILLION)

TABLE 468 MEXICO: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 469 MEXICO: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 470 MEXICO: MARKET, BY POWER VERTICAL, 2016–2021 (USD MILLION)

TABLE 471 MEXICO: INDUSTRIAL CONTROL SYSTEM (ICS) SECURITYMARKET, BY POWER VERTICAL, 2022–2027 (USD MILLION)

TABLE 472 MEXICO: MARKET, BY ENERGY & UTILITIES, 2016–2021 (USD MILLION)

TABLE 473 MEXICO: MARKET, BY ENERGY & UTILITIES, 2022–2027 (USD MILLION)

TABLE 474 MEXICO: MARKET, BY TRANSPORTATION SYSTEMS, 2016–2021 (USD MILLION)

TABLE 475 MEXICO: MARKET, BY TRANSPORTATION SYSTEMS, 2022–2027 (USD MILLION)

TABLE 476 MEXICO: MARKET, BY MANUFACTURING, 2016–2021 (USD MILLION)

TABLE 477 MEXICO: MARKET, BY MANUFACTURING, 2022–2027 (USD MILLION)

TABLE 478 MEXICO: MARKET, BY OTHER VERTICALS, 2016–2021 (USD MILLION)

TABLE 479 MEXICO: MARKET, BY OTHER VERTICALS, 2022–2027 (USD MILLION)

11.6.4 BRAZIL

11.6.4.1 Brazil created cyberattack response network

TABLE 480 BRAZIL: ICS SECURITY MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 481 BRAZIL: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 482 BRAZIL: MARKET, BY SOLUTIONS, 2016–2021 (USD MILLION)

TABLE 483 BRAZIL: MARKET, BY SOLUTIONS, 2022–2027 (USD MILLION)

TABLE 484 BRAZIL: MARKET, BY SERVICES, 2016–2021 (USD MILLION)

TABLE 485 BRAZIL: MARKET, BY SERVICES, 2022–2027 (USD MILLION)

TABLE 486 BRAZIL: MARKET, BY SECURITY TYPE, 2016–2021 (USD MILLION)

TABLE 487 BRAZIL: MARKET, BY SECURITY TYPE, 2022–2027 (USD MILLION)

TABLE 488 BRAZIL: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 489 BRAZIL: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 490 BRAZIL: MARKET, BY POWER VERTICAL, 2016–2021 (USD MILLION)

TABLE 491 BRAZIL: INDUSTRIAL CONTROL SYSTEM (ICS) SECURITY MARKET, BY POWER VERTICAL, 2022–2027 (USD MILLION)

TABLE 492 BRAZIL: MARKET, BY ENERGY & UTILITIES, 2016–2021 (USD MILLION)

TABLE 493 BRAZIL: MARKET, BY ENERGY & UTILITIES, 2022–2027 (USD MILLION)

TABLE 494 BRAZIL: MARKET, BY TRANSPORTATION SYSTEMS, 2016–2021 (USD MILLION)

TABLE 495 BRAZIL: MARKET, BY TRANSPORTATION SYSTEMS, 2022–2027 (USD MILLION)

TABLE 496 BRAZIL: MARKET, BY MANUFACTURING, 2016–2021 (USD MILLION)

TABLE 497 BRAZIL: MARKET, BY MANUFACTURING, 2022–2027 (USD MILLION)

TABLE 498 BRAZIL: MARKET, BY OTHER VERTICALS, 2016–2021 (USD MILLION)

TABLE 499 BRAZIL: MARKET, BY OTHER VERTICALS, 2022–2027 (USD MILLION)

11.6.5 REST OF LATIN AMERICA

TABLE 500 REST OF LATIN AMERICA: ICS SECURITY MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 501 REST OF LATIN AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 502 REST OF LATIN AMERICA: MARKET, BY SOLUTIONS, 2016–2021 (USD MILLION)

TABLE 503 REST OF LATIN AMERICA: MARKET, BY SOLUTIONS, 2022–2027 (USD MILLION)

TABLE 504 REST OF LATIN AMERICA: MARKET, BY SERVICES, 2016–2021 (USD MILLION)

TABLE 505 REST OF LATIN AMERICA: MARKET, BY SERVICES, 2022–2027 (USD MILLION)

TABLE 506 REST OF LATIN AMERICA: MARKET, BY SECURITY TYPE, 2016–2021 (USD MILLION)

TABLE 507 REST OF LATIN AMERICA: MARKET, BY SECURITY TYPE, 2022–2027 (USD MILLION)

TABLE 508 REST OF LATIN AMERICA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 509 REST OF LATIN AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 510 REST OF LATIN AMERICA: MARKET, BY POWER VERTICAL, 2016–2021 (USD MILLION)

TABLE 511 REST OF LATIN AMERICA: MARKET, BY POWER VERTICAL, 2022–2027 (USD MILLION)

TABLE 512 REST OF LATIN AMERICA: INDUSTRIAL CONTROL SYSTEM (ICS) SECURITYMARKET, BY ENERGY & UTILITIES, 2016–2021 (USD MILLION)

TABLE 513 REST OF LATIN AMERICA: MARKET, BY ENERGY & UTILITIES, 2022–2027 (USD MILLION)

TABLE 514 REST OF LATIN AMERICA: MARKET, BY TRANSPORTATION SYSTEMS, 2016–2021 (USD MILLION)

TABLE 515 REST OF LATIN AMERICA: MARKET, BY TRANSPORTATION SYSTEMS, 2022–2027 (USD MILLION)

TABLE 516 REST OF LATIN AMERICA: MARKET, BY MANUFACTURING, 2016–2021 (USD MILLION)

TABLE 517 REST OF LATIN AMERICA: MARKET, BY MANUFACTURING, 2022–2027 (USD MILLION)

TABLE 518 REST OF LATIN AMERICA: MARKET, BY OTHER VERTICALS, 2016–2021 (USD MILLION)

TABLE 519 REST OF LATIN AMERICA: MARKET, BY OTHER VERTICALS, 2022–2027 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 309)

12.1 OVERVIEW

12.2 MARKET EVALUATION FRAMEWORK

FIGURE 32 MARKET EVALUATION FRAMEWORK, 2019–2022

12.3 REVENUE ANALYSIS OF LEADING PLAYERS

FIGURE 33 ICS SECURITY MARKET: REVENUE ANALYSIS

12.4 MARKET SHARE ANALYSIS OF TOP MARKET PLAYERS

TABLE 520 MARKET: DEGREE OF COMPETITION

12.5 HISTORICAL REVENUE ANALYSIS

FIGURE 34 SEGMENTAL REVENUE ANALYSIS OF TOP MARKET PLAYERS, 2018–2021 (USD MILLION)

12.6 RANKING OF KEY PLAYERS

FIGURE 35 MARKET: RANKING OF KEY PLAYERS, 2022

12.7 KEY COMPANY EVALUATION MATRIX

12.7.1 KEY COMPANY EVALUATION MATRIX: DEFINITIONS AND METHODOLOGY

FIGURE 36 MARKET: KEY PLAYER EVALUATION QUADRANT, 2022

12.7.2 STARS

12.7.3 EMERGING LEADERS

12.7.4 PERVASIVE PLAYERS

12.7.5 PARTICIPANTS

12.8 COMPETITIVE BENCHMARKING

12.8.1 EVALUATION CRITERIA OF KEY COMPANIES

TABLE 521 EVALUATION CRITERIA

TABLE 522 COMPANY FOOTPRINT

TABLE 523 COMPANY FOOTPRINT, BY REGION

12.9 START-UP/SME EVALUATION MATRIX

FIGURE 37 START-UP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

TABLE 524 DETAILED LIST OF SMES/START-UPS

TABLE 525 REGIONAL FOOTPRINT OF SMES/START-UPS

FIGURE 38 ICS SECURITY MARKET: START-UP/SME EVALUATION MATRIX, 2022

12.9.1 PROGRESSIVE COMPANIES

12.9.2 RESPONSIVE COMPANIES

12.9.3 DYNAMIC COMPANIES

12.9.4 STARTING BLOCKS

12.10 COMPETITIVE SCENARIO

12.10.1 PRODUCT/SOLUTION LAUNCHES

TABLE 526 MARKET: PRODUCT/SOLUTION LAUNCHES, 2019–2022

12.10.2 DEALS

TABLE 527 MARKET: DEALS, 2019–2022

13 COMPANY PROFILES (Page No. - 322)

13.1 INTRODUCTION

13.2 KEY PLAYERS

(Business overview, Products/Solutions/Services offered, Recent developments, MNM view, Right to win, Strategic choices made, and Weaknesses and competitive threats)*

13.2.1 CISCO

TABLE 528 CISCO: BUSINESS OVERVIEW

FIGURE 39 CISCO: COMPANY SNAPSHOT

TABLE 529 CISCO: SOLUTIONS OFFERED

TABLE 530 CISCO: SERVICES OFFERED

TABLE 531 CISCO: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 532 CISCO: DEALS

13.2.2 ABB

TABLE 533 ABB: BUSINESS OVERVIEW

FIGURE 40 ABB: COMPANY SNAPSHOT

TABLE 534 ABB: SOLUTIONS OFFERED

TABLE 535 ABB: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 536 ABB: DEALS

13.2.3 LOCKHEED MARTIN

TABLE 537 LOCKHEED MARTIN: BUSINESS OVERVIEW

FIGURE 41 LOCKHEED MARTIN: COMPANY SNAPSHOT

TABLE 538 LOCKHEED MARTIN: SOLUTIONS OFFERED

TABLE 539 LOCKHEED MARTIN: PRODUCT LAUNCHES AND ENHANCEMENTS

13.2.4 FORTINET

TABLE 540 FORTINET: BUSINESS OVERVIEW

FIGURE 42 FORTINET: COMPANY SNAPSHOT

TABLE 541 FORTINET: SOLUTIONS OFFERED

TABLE 542 FORTINET: SERVICES OFFERED

TABLE 543 FORTINET: DEALS

13.2.5 HONEYWELL

TABLE 544 HONEYWELL: BUSINESS OVERVIEW

FIGURE 43 HONEYWELL: COMPANY SNAPSHOT

TABLE 545 HONEYWELL: SOLUTIONS OFFERED

TABLE 546 HONEYWELL: SERVICES OFFERED

TABLE 547 HONEYWELL: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 548 HONEYWELL: DEALS

13.2.6 PALO ALTO NETWORKS

TABLE 549 PALO ALTO NETWORKS: BUSINESS OVERVIEW

FIGURE 44 PALO ALTO NETWORKS: COMPANY SNAPSHOT

TABLE 550 PALO ALTO NETWORKS: SOLUTIONS OFFERED

TABLE 551 PALO ALTO NETWORKS: DEALS

13.2.7 BAE SYSTEMS

TABLE 552 BAE SYSTEMS: BUSINESS OVERVIEW

FIGURE 45 BAE SYSTEMS: COMPANY SNAPSHOT

TABLE 553 BAE SYSTEMS: SOLUTIONS OFFERED

13.2.8 RAYTHEON

TABLE 554 RAYTHEON: BUSINESS OVERVIEW

FIGURE 46 RAYTHEON: COMPANY SNAPSHOT

TABLE 555 RAYTHEON: SOLUTIONS OFFERED

TABLE 556 RAYTHEON: DEALS

13.2.9 TRELLIX

TABLE 557 TRELLIX: BUSINESS OVERVIEW

TABLE 558 TRELLIX: SOLUTIONS OFFERED

TABLE 559 TRELLIX: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 560 TRELLIX: DEALS

13.2.10 DARKTRACE

TABLE 561 DARKTRACE: BUSINESS OVERVIEW

FIGURE 47 DARKTRACE: COMPANY SNAPSHOT

TABLE 562 DARKTRACE: SOLUTIONS OFFERED

TABLE 563 DARKTRACE: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 564 DARKTRACE: DEALS

13.2.11 CHECK POINT

TABLE 565 CHECK POINT: BUSINESS OVERVIEW

FIGURE 48 CHECK POINT: COMPANY SNAPSHOT

TABLE 566 CHECK POINT: SOLUTIONS OFFERED

TABLE 567 CHECK POINT: PRODUCT LAUNCHES AND ENHANCEMENTS

13.3 OTHER PLAYERS

13.3.1 KASPERSKY LABS

13.3.2 AIRBUS

13.3.3 BELDEN

13.3.4 SOPHOS

13.3.5 CYBERARK

13.3.6 CLAROTY

13.3.7 DRAGOS

13.3.8 NOZOMI NETWORKS

13.3.9 CYBERBIT

13.3.10 FORESCOUT

13.3.11 RADIFLOW

13.3.12 VERVE INDUSTRIAL PROTECTION

13.3.13 APPLIED SECURITY

13.3.14 POSITIVE TECHNOLOGIES

*Details on Business overview, Products/Solutions/Services offered, Recent developments, MNM view, Right to win, Strategic choices made, and Weaknesses and competitive threats might not be captured in case of unlisted companies.

14 ADJACENT MARKETS (Page No. - 360)

14.1 INTRODUCTION TO ADJACENT MARKETS

TABLE 568 ADJACENT MARKETS AND FORECASTS

14.2 LIMITATIONS

14.3 ICS SECURITY MARKET: ADJACENT MARKETS

14.3.1 CRITICAL INFRASTRUCTURE PROTECTION MARKET

TABLE 569 CRITICAL INFRASTRUCTURE PROTECTION MARKET, BY VERTICAL, 2016–2026 (USD MILLION)

TABLE 570 FINANCIAL INSTITUTIONS: CRITICAL INFRASTRUCTURE PROTECTION MARKET, BY REGION, 2016–2026 (USD MILLION)

TABLE 571 GOVERNMENT: CRITICAL INFRASTRUCTURE PROTECTION MARKET, BY REGION, 2016–2026 (USD MILLION)

TABLE 572 DEFENSE: CRITICAL INFRASTRUCTURE PROTECTION MARKET, BY REGION, 2016–2026 (USD MILLION)

TABLE 573 TRANSPORT AND LOGISTICS: CRITICAL INFRASTRUCTURE PROTECTION MARKET, BY REGION, 2016–2026 (USD MILLION)

TABLE 574 POWER GENERATION MARKET, BY POWER PLANT, 2016–2026 (USD MILLION)

TABLE 575 COMMERCIAL SECTOR: CRITICAL INFRASTRUCTURE PROTECTION MARKET, BY REGION, 2016–2026 (USD MILLION)

TABLE 576 TELECOM: CRITICAL INFRASTRUCTURE PROTECTION MARKET, BY REGION, 2016–2026 (USD MILLION)

TABLE 577 CHEMICALS AND MANUFACTURING: CRITICAL INFRASTRUCTURE PROTECTION MARKET, BY REGION, 2016–2026 (USD MILLION)

TABLE 578 OIL AND GAS: CRITICAL INFRASTRUCTURE PROTECTION MARKET, BY REGION, 2016–2026 (USD MILLION

TABLE 579 OTHER VERTICALS: CRITICAL INFRASTRUCTURE PROTECTION MARKET, BY REGION, 2016–2026 (USD MILLION)

14.3.2 OIL AND GAS SECURITY AND SERVICE MARKET

TABLE 580 OIL AND GAS SECURITY AND SERVICE MARKET, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 581 OIL AND GAS SECURITY AND SERVICE MARKET, BY COMPONENT, 2019–2025 (USD MILLION)

14.3.2.1 Oil and gas security and service market, by region

TABLE 582 OIL AND GAS SECURITY AND SERVICE MARKET, BY REGION, 2014–2019 (USD MILLION)

TABLE 583 OIL AND GAS SECURITY AND SERVICE MARKET, BY REGION, 2019–2025 (USD MILLION)

15 APPENDIX (Page No. - 367)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 CUSTOMIZATION OPTIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

The study involved major activities in estimating the current market size for the industrial control systems security market. Exhaustive secondary research was done to collect information on the ICS security industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches, such as top-down and bottom-up, were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and sub-segments of the ICS security market.

Secondary Research

Secondary research was mainly used to obtain key information about the industry’s supply chain, country-wise technology spending, the total pool of key players, market classification and segmentation, key developments from market- and technology-oriented perspectives, economic trends, and currency exchange rates. For instance, the market size of companies offering Industrial Control System (ICS) Security to various verticals is based on the secondary data available through paid databases and publicly available information.

In the secondary research process, various sources were referred to for identifying and collecting information. These include annual reports, press releases, and investor presentations of companies; white papers such as The State of Industrial Cybersecurity, A New Approach to cyber defense automation, and Examining the Industrial Control System Cyber Risk Gap; journals, such as International Journal of Industrial Control Systems Security and ICS and SCADA Cybersecurity; research papers, such as The ICS visibility imperative; and certified publications and articles from recognized authors, directories, and databases. The product portfolio of the major companies in the ecosystem was analyzed, and the companies were rated based on their performance and quality.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included various industry experts, including Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating on the Industrial Control System (ICS) Security market.

In the market engineering process, the top-down and bottom-up approaches were extensively used, along with several data triangulation methods, to perform the market estimation and market forecasting for the overall market segments and sub-segments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list key information/insights throughout the report.

After completing the market engineering process (including calculations for market statistics, market breakups, market size estimations, market forecasts, and data triangulation), extensive primary research was conducted to gather information and to verify and validate the critical numbers arrived at. The primary research was also conducted to identify the segmentation types; industry trends; the competitive landscape of Industrial Control System (ICS) Security market players; and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key strategies.

Following is the breakup of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

In the used approach for market estimation, the key companies offering the ICS security solutions and services, such as Cisco, ABB, Lockheed martin, Fortinet, and Honeywell, which contribute a major part of the ICS security market, were identified. After finalizing these companies, data validation was done by industry experts through primary interviews related to the leading vendors of the market. Furthermore, their total revenue through annual reports, US Securities and Exchange Commission (SEC) filings, and paid databases was identified.

Data Triangulation

After completing the market engineering process (including calculations for market statistics, market breakups, market size estimations, market forecasts, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. The primary research was also conducted to identify the segmentation types; industry trends; the competitive landscape of ICS security market players; and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key strategies.

Report Objectives

- To define, describe, and forecast the industrial control system (ICS) security market, by component (solutions and services), security type, vertical, and region

- The report includes a scenario to analyze the ICS security market. The study also shows an in-depth qualitative analysis along with the quantitative market estimates and forecasts for both scenarios.

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders by identifying the high-growth segments of the market

- To forecast the market size of the segments with respect to five major regions: North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and Latin America

- To profile the key players in the market and comprehensively analyze their market size and core competencies

- To track and analyze the competitive developments, such as new product launches; mergers and acquisitions; and partnerships, agreements, and collaborations, in the global ICS security market

Available customizations