Industrial Metrology Market by Offering, Equipment, Application (Quality Control & Inspection, Reverse Engineering, Mapping & Modeling), End-User Industry (Aerospace & Defense, Automotive, Manufacturing, Semiconductor), Region - Global Forecast to 2027

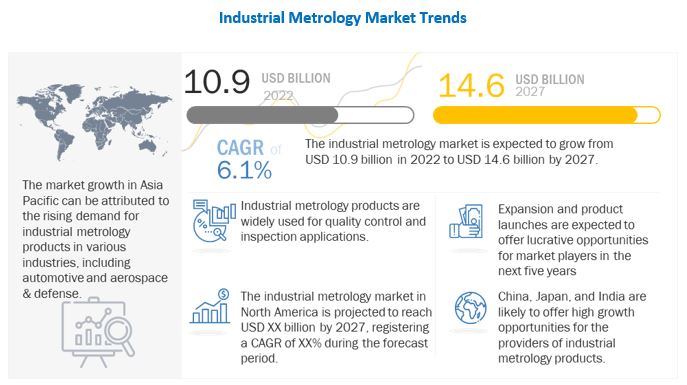

[316 Pages Report] The industrial metrology market is expected to grow from USD 10.9 billion in 2022 to USD 14.6 billion by 2027, at a CAGR of 6.1%. The most significant factor driving the growth of the industrial metrology industry include rising demand for big data analytics, growing demand for quality and inspection equipment in precision manufacturing industry, increasing demand for automobiles in emerging economies, surging adoption of hybrid and electric vehicles (EVs), and increasing focus on manufacturing superior- and uniform-quality products.

To know about the assumptions considered for the study, Request for Free Sample Report

Industrial Metrology Market Dynamics

Driver: Surging adoption of hybrid and electric vehicles (EVs)

Electric vehicles (EVs) are becoming commonplace on roads; almost all automotive companies are announcing plans where EVs will eventually dominate their product portfolio. The number of drivetrain components will drastically decrease as the transition from internal combustion (IC) to electric continues. And the remaining parts, which can be found in all kinds of cars, will be more crucial to how well and how long the car lasts. In electric vehicles, industrial metrology solutions find applications majorly in batteries, fuel cell systems, power electronics, and electric motors. Sales of electric vehicles nearly tripled to 3.3 million in China in 2021, making up about half of the global total. Sales increased significantly in both Europe (by 65% to 2.3 million) and the United States (more than doubling to 6,30,000). Thus, the increase in the adoption of EVs drives the market for industrial metrology products.

Restraint: Integration of industrial metrology process

Interfaces in terms of mechanical, electrical, and information technology are crucial at the sensor level. The interfaces can only be standardized to a limited extent because they differ significantly depending on the various measurement technologies used. It is difficult for existing manufacturing units to reconfigure their manufacturing systems and business processes. Other significant obstacles to the implementation of in-process measurement include data transfer and data processing. Particularly, the enormous amount of data that can be generated with high-resolution fast sensing technologies and the associated difficulties with handling big data frequently prevent the adoption of integrated metrology. Although optical technologies may be able to acquire data in a matter of seconds, if processing that data results in large volumes of data that must be stored for long periods of time and requires hours of computation per measurement, an initially appealing measurement solution may quickly become unworkable. Big data can be both a challenge and an opportunity, as long as advanced data handling, analysis, and learning techniques are used to address the problems they pose.

Opportunity: Rise in demand for industry 4.0

Industry 4.0 or smart factory is a new phase of the industrial revolution, linking the manufacturing industry and information technology, as well as all associated activities. It is being adopted in manufacturing facilities with an aim to improve productivity by maximizing asset utilization, minimizing downtime, and enhancing labor efficiency. This is expected to enhance operations at all levels of the value chain, starting from the R&D stage to the end-user stage. The evolution of smart factories has led to the growing demand for metrology systems. Additionally, robots used in manufacturing plants are now being integrated with in-line inspection systems for real-time analysis of measurement data. This reduces the need for arduous measuring in the measuring room and also enables frequent quality testing. The Industrial Internet of Things (IIoT) drives the adoption of automation and in-line metrology, owing to which the industrial metrology market is expected to grow over the forecast period.

Challenge: Reduction in demand for manufacturing products due to uncertain global market conditions

Reduced global demand for new types of machinery, along with weakness in important industries like aerospace, automotive, consumer electronics, and oil and gas had an impact on the significant machine tool market. Many metrology product lines were impacted by this, including calibration products and machine tool probe systems, which are typically installed on new machines and saw decreased demand as a result of lower sales and less use of production equipment. There has been a significant impact of supply-side constraints on the auto industry. Despite high global demand, shortages of semiconductors and other intermediate goods, long supplier delivery times, and bottlenecks in container shipping have forced car manufacturers worldwide to cut production. Motor vehicle production in the euro area fell by 26% in the first ten months of 2021 compared to the same period in 2019, with shortfalls in Japan and the US of 24% and 9%, respectively. In many nations, inventory levels have also dropped significantly. In contrast to the long-term average of between 2 to 2.5, the inventory-to-sales ratio (the number of motor vehicles in stock relative to monthly sales) for the auto industry in the United States fell to a low of 0.4 in October 2021. Global car sales fell by over 20% between April and September 2021 as a result of the limited supply of new vehicles and low inventory levels, a rate of decline previously only seen during severe recessions. Apart from the above mentioned factors, the Ukraine-Russia War and US–China tension are causing supply chain disruptions, leading to a rise in inflation and decrease in demand, which is having a major impact on manufacturing industries. This is likely to impact the demand for industrial metrology products.

Automotive Industry to hold the largest share of industrial metrology market for end used industry during the forecast period

In 2021, the automotive segment accounted for the largest share of the industrial metrology market and is expected to hold its dominant position throughout the forecast period. Automotive manufacturers are increasingly adopting 3D solutions and optical inspection techniques. 3D measurement technologies benefit the auto industry greatly because production teams can scan a part or sub-assembly in real time and get a precise image of the root cause of quality issues. 3D scanning solutions can be used anywhere in the design process, including product development and design, reverse engineering, and quality control and quality assurance. In the automotive industry, CMM is the most used type of industrial metrology equipment, especially for quality control and inspection application. Various companies operating in this market are offering CMM solutions for the same.

Quality Control And Inspection to hold the largest share of industrial metrology market for application during the forecast period

The need to increase productivity and achieve accuracy has led to a rise in demand for high-precision metrology and inline inspection in several industries. The increasing competition and need for improving safety have resulted in the high adoption of quality control and inspection systems in various industries, including automotive, aerospace & defense, and semiconductors. In these industries, maintaining and enhancing the quality of a product is of high importance. As industrial metrology equipment are the best available options in the market for quality control and inspection applications, their adoption has increased at a significant rate.

Hardware offering to hold the largest share of industrial metrology market during the forecast period

The hardware segment of the industrial metrology market includes coordinate measuring machines (CMMs), optical digitizers and scanners (ODS), measuring instruments, X-ray & computed tomography, automated optical inspection systems, form measurement equipment, and 2D equipment. Companies offering hardware in the industrial metrology market are continuously working on updating their product portfolio. The high demand for industrial metrology equipment, especially 3D metrology equipment, in the manufacturing industries for quality control and inspection applications is one of the major drivers for the growth of the industrial metrology market for hardware.

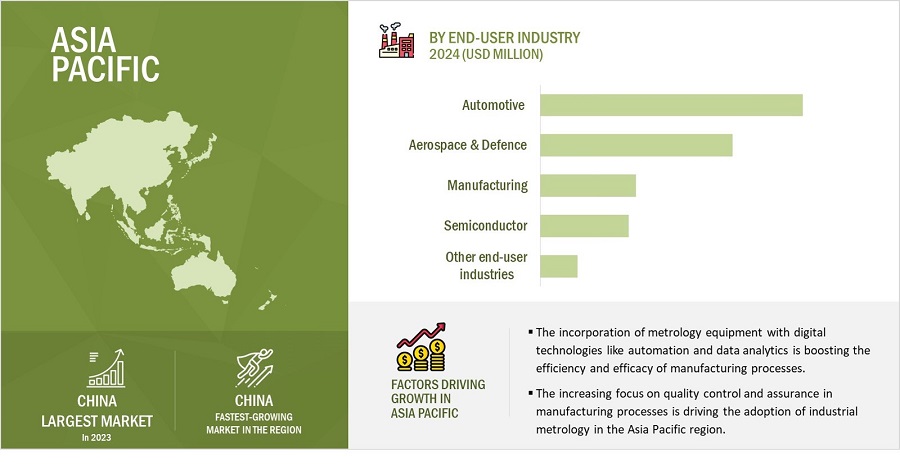

Asia Pacific is projected to register the highest CAGR in the industrial metrology market in 2027

The market in Asia Pacific continues to grow at a high rate, which can be attributed to the high economic growth witnessed by major countries such as China and Japan in this region. Asia Pacific accounted for ~31% of the global industrial metrology market in 2021. The key countries contributing to the growth of the industrial metrology market in Asia Pacific include Japan, China, India, and South Korea. The rest of the countries contributing to the market are considered in Rest of Asia Pacific and include Australia, New Zealand, Taiwan, Singapore, Indonesia, and the Philippines. Automobile and electronics manufacturers use industrial metrology systems during the production process for quality inspections; as the number of automobile manufacturing plants is more in Asia Pacific than other regions, the demand for industrial metrology offerings is expected to grow rapidly in this region.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The industrial metrology manufactures such as Hexagon (Sweden), Nikon (Japan), FARO Technologies (US), Carl Zeiss (Germany), Jenoptik (Germany), KLA Corporation (US), Renishaw (UK), Mitutoyo Corporation (Japan), KEYENCE CORPORATION (Japan), Creaform (Canada), Precision Products (US), CARMAR ACCURACY (Taiwan), Baker Hughes (US), CyberOptics (US), Cairnhill Metrology (Singapore), ATT Metrology Services (US), SGS Group (Switzerlands), TriMet (US), Automated Precision (US), Applied Materials (US), Perceptron (US), JLM Advance Technical Service (US), Intertek Group (UK), Bruker (US), and Metrologic Group (France). These companies have adopted both organic and inorganic growth strategies such as product launches and developments, partnerships, contracts, expansions, and acquisitions to strengthen their position in the market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market Size Available for Years |

2018–2027 |

|

Base Year |

2021 |

|

Forecast Period |

2022–2027 |

|

Forecast Unit |

Value (USD Million/Billion) |

|

Segments Covered |

Offering, Equipment, Application, End-User Industry, and Region |

|

Geographic Regions Covered |

North America, Asia Pacific, Europe, and RoW |

|

Companies Covered |

Hexagon (Sweden), Nikon (Japan), FARO Technologies (US), Carl Zeiss (Germany), Jenoptik (Germany), KLA Corporation (US), Renishaw (UK), Mitutoyo Corporation (Japan), KEYENCE CORPORATION (Japan), Creaform (Canada), Precision Products (US), CARMAR ACCURACY (Taiwan), Baker Hughes (US), CyberOptics (US), Cairnhill Metrology (Singapore), ATT Metrology Services (US), SGS Group (Switzerlands), TriMet (US), Automated Precision (US), Applied Materials (US), Perceptron (US), JLM Advance Technical Service (US), Intertek Group (UK), Bruker (US), and Metrologic Group (France). |

This report categorizes the industrial metrology market based on offering, equipment, application, end-user industry and region

Industrial Metrology Market, by Offering

- Hardware

- Software

- Services

Industrial Metrology Market, by Equipment

- Coordinate Measuring Machine (CMM)

- Optical Digitizer and Scanner (ODS)

- Measuring Instruments

- X-ray and Computed Tomography

- Automated Optical Inspection

- Form Measurement Equipment

- 2D Equipment

Industrial Metrology Market, by Application

- Quality Control & Inspection

- Reverse Engineering

- Mapping and Modeling

- Others

Industrial Metrology Market, by End-User Industry

- Aerospace & Defense

- Automotive

- Semiconductor

- Manufacturing

- Others

Industrial Metrology Market, by Region

-

North America

- US

- Canada

- Mexico

-

Europe

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe)

-

Asia Pacific

- China

- Japan

- South Korea

- India

- Rest of APAC

-

RoW

- South America

- Middle East and Africa

Recent Developments

- In June 2022, Nexus, an open platform for smart manufacturing announced by Hexagon's Manufacturing Intelligence division, will revolutionize how technology professionals collaborate and innovate. Nexus will enable real-time data sharing between design, simulation, and manufacturing applications. It will connect various applications to create workflows and combine technologies to create one-of-a-kind solutions to engineering and manufacturing problems, from concept to delivery. It will enable cross-functional teams to leverage fragmented digital data by improving visibility and connectivity, allowing them to gain unprecedented insight, bring their ideas to life more quickly, and produce higher-quality results.

- In April 2022, FARO has launched a ground-breaking, ultra-efficient data capture and collaboration platform. The platform, which makes use of cutting-edge technology, offers the industry's most efficient cloud-based workflow by combining three innovative new solutions: the FARO Sphere digital ecosystem for the most efficient data exchange possible; the FARO Focus Premium Laser Scanner for fast, accurate, and complete field capture; and the FARO Stream mobile app for real-time data verification.

- In January 2022, ZEISS and Vision Engineering, a leading designer and manufacturer of high-quality non-contact measurement, digital 3D visualization, and ergonomic inspection technologies in the United Kingdom, partnered to make DeepFocus 1 which is a real-time extended depth of focus imaging for microscope. DeepFocus 1 combines the ZEISS Visioner 1 digital microscope with the Micro-mirror Array Lens System (MALSTM) and the technical and design expertise of Vision Engineering.

- In May 2022, ZEISS CALYPSO 2022 improves data acquisition and result evaluation performance in particular. Productivity is increased by the updated ZEISS CALYPSO 2022 software version. The updated version has features like CAD and PMI enhancements, new optics features, and displaying defects automatically in an interactive report.

- In April 2021, Morf3D Inc., a trusted leader in metal additive manufacturing (AM) specializing in AM and engineering for the aerospace, space, and defense industries, was acquired by Nikon. Morf3D has a track record of success in the field of metal additive manufacturing (AM), a robust innovation pipeline, and highly specialized aerospace manufacturing credentials. It brings a group of experts who are accustomed to working alongside clients to meet their particular needs. The acquisition brings innovative next-generation AM solutions and is in line with Nikon's vision for accelerating the industrialization of additive manufacturing through innovation.

- In May 2022, Jenoptik’s industrial metrology portfolio will in future be presented under the familiar brand name HOMMEL ETAMIC with a new market appearance, enabling a more focused customer approach. HOMMEL ETAMIC offers complete metrology solutions for industrial manufacturing processes. The product portfolio remains unchanged and includes high-precision production metrology for the inspection of roughness, contours, form and the determination of dimensions in every phase of the production process as well as in measuring room.

Frequently Asked Questions (FAQs):

How big industrial metrology market?

The industrial metrology market size is expected to reach USD 14.6 billion by 2027from USD 10.9 billion in 2022 to grow at a CAGR of 6.1%.

Who are the key players in the global industrial metrology market?

Hexagon (Sweden), Nikon (Japan), Faro Technologies (US), Carl Zeiss (Germany), Jenoptik (Germany), Creaform (Canada), Renishaw (UK), KLA Corporation (US), Applied Materials (US), Perceptron (US), and Automated Precision (US). These companies cater to the requirements of their customers with presence in multiple countries.

What is the COVID-19 impact on industrial metrology suppliers?

The shutdown of manufacturing facilities globally combined with strict restrictions over social movement in various COVID-19 affected countries impacted the operations of industrial metrology and related components manufacturing facilities. Additionally, the first quarter of 2020 also witnessed disruption in global industrial metrology supply chain operations and logistics-related services due to limited air and road movement. This is expected to have had a global impact on the industrial metrology market. Additionally, COVID-19 is expected to have led to a delay in the upcoming launches and developments in industrial metrology products. All these factors resulted in marginal dip of market size of the industrial metrology products. The supply chain disruptions have led to the procurement of raw materials or commodities from localized sources to ensure their continuous supply.

What are the opportunities for the existing players and for those who are planning to enter various stages of the industrial metrology value chain?

There are various opportunities for the existing players to enter the value chain of industrial metrology industry. Some of these Rising adoption of Industrial Metrology products in Food industry, Adoption of cloud services to integrate metrological data, and Rise in demand for industry 4.0.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 30)

1.1 STUDY OBJECTIVES

1.2 DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 INDUSTRIAL METROLOGY MARKET SEGMENTATION

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 36)

2.1 RESEARCH DATA

FIGURE 2 PROCESS FLOW: INDUSTRIAL METROLOGY MARKET SIZE ESTIMATION

FIGURE 3 RESEARCH DESIGN

2.1.1 SECONDARY AND PRIMARY RESEARCH

2.1.2 SECONDARY DATA

2.1.2.1 Secondary sources

2.1.2.2 Major secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Key data from primary sources

2.1.3.2 Key industry insights

2.1.3.3 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach to derive market size by bottom-up analysis (demand side)

FIGURE 4 INDUSTRIAL METROLOGY MARKET: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach to derive market share using top-down approach

FIGURE 5 INDUSTRIAL METROLOGY MARKET: TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

2.5 RESEARCH LIMITATIONS

2.6 RISK ASSESSMENTS

3 EXECUTIVE SUMMARY (Page No. - 47)

FIGURE 7 HARDWARE SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

FIGURE 8 QUALITY CONTROL & INSPECTION TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

FIGURE 9 CMM SEGMENT TO HOLD LARGEST SHARE OF INDUSTRIAL METROLOGY MARKET DURING FORECAST PERIOD

FIGURE 10 AUTOMOTIVE TO BE DOMINANT SEGMENT IN INDUSTRIAL METROLOGY MARKET DURING FORECAST PERIOD

FIGURE 11 NORTH AMERICA HELD LARGEST MARKET SHARE IN 2021

4 PREMIUM INSIGHTS (Page No. - 53)

4.1 ATTRACTIVE OPPORTUNITIES FOR INDUSTRIAL METROLOGY MARKET PLAYERS

FIGURE 12 INCREASING ADOPTION OF INDUSTRIAL METROLOGY IN ASIA PACIFIC TO DRIVE MARKET GROWTH

4.2 INDUSTRIAL METROLOGY MARKET, BY OFFERING

FIGURE 13 SERVICES SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

4.3 INDUSTRIAL METROLOGY MARKET, BY EQUIPMENT

FIGURE 14 COORDINATE MEASURING MACHINE SEGMENT DOMINATED INDUSTRIAL METROLOGY MARKET IN 2021

4.4 NORTH AMERICA: INDUSTRIAL METROLOGY MARKET, BY COUNTRY AND END-USER INDUSTRY

FIGURE 15 US AND AEROSPACE & DEFENSE TO HOLD LARGEST SHARES OF INDUSTRIAL METROLOGY MARKET IN NORTH AMERICA BY 2027

4.5 INDUSTRIAL METROLOGY MARKET, BY APPLICATION

FIGURE 16 QUALITY CONTROL & INSPECTION SEGMENT TO EXHIBIT HIGHEST CAGR FROM 2022 TO 2027

4.6 INDUSTRIAL METROLOGY MARKET, BY COUNTRY (2021)

FIGURE 17 US HELD LARGEST SHARE OF INDUSTRIAL METROLOGY MARKET IN 2021

5 MARKET OVERVIEW (Page No. - 56)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 18 INDUSTRIAL METROLOGY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Surging adoption of hybrid and electric vehicles (EVs)

FIGURE 19 GLOBAL ELECTRIC CARS REGISTRATION, 2017–2021

5.2.1.2 Rising demand for big data analytics

FIGURE 20 GLOBAL BIG DATA MARKET, 2021–2026

5.2.1.3 Growing demand for quality and inspection equipment in precision manufacturing

5.2.1.4 Increasing demand for automobiles in emerging economies

5.2.1.5 Increasing focus on manufacturing superior- and uniform-quality products

FIGURE 21 INDUSTRIAL METROLOGY MARKET DRIVERS AND THEIR IMPACT

5.2.2 RESTRAINTS

5.2.2.1 Requirement of high investment for setting up of metrology facilities

5.2.2.2 Integration of industrial metrology processes with existing manufacturing units

FIGURE 22 INDUSTRIAL METROLOGY MARKET RESTRAINTS AND THEIR IMPACT

5.2.3 OPPORTUNITIES

5.2.3.1 Rising adoption of metrology products in food industry

5.2.3.2 Adoption of cloud services to integrate metrological data

5.2.3.3 Rise in demand for industry 4.0

FIGURE 23 INDUSTRIAL METROLOGY MARKET OPPORTUNITIES AND THEIR IMPACT

5.2.4 CHALLENGES

5.2.4.1 Reduction in demand for manufacturing products due to uncertain global market conditions

5.2.4.2 Lack of expertise in handling metrological systems

FIGURE 24 INDUSTRIAL METROLOGY MARKET CHALLENGES AND THEIR IMPACT

5.3 VALUE CHAIN ANALYSIS

FIGURE 25 VALUE CHAIN ANALYSIS: INDUSTRIAL METROLOGY MARKET

5.4 PORTER’S FIVE FORCE ANALYSIS

TABLE 1 INDUSTRIAL METROLOGY MARKET: PORTER’S FIVE FORCES ANALYSIS

FIGURE 26 PORTER’S FIVE FORCES ANALYSIS

5.4.1 BARGAINING POWER OF SUPPLIERS

5.4.2 BARGAINING POWER OF BUYERS

5.4.3 THREAT OF NEW ENTRANTS

5.4.4 THREAT OF SUBSTITUTES

5.4.5 INTENSITY OF COMPETITIVE RIVALRY

5.5 PRICING ANALYSIS

FIGURE 27 AVERAGE SELLING PRICE OF METROLOGY EQUIPMENT (USD THOUSAND)

5.6 TRADE ANALYSIS

5.6.1 TRADE ANALYSIS FOR INDUSTRIAL METROLOGY PRODUCTS

TABLE 2 INSTRUMENTS, APPLIANCES, AND MACHINES FOR MEASURING/CHECKING FUNCTION: GLOBAL IMPORTS DATA, 2017–2021 (USD MILLION)

TABLE 3 INSTRUMENTS, APPLIANCES, AND MACHINES FOR MEASURING/CHECKING FUNCTION: GLOBAL EXPORTS DATA, 2017–2021 (USD MILLION)

TABLE 4 COMPUTED TOMOGRAPHY APPARATUS: GLOBAL IMPORTS DATA, 2017–2021 (USD MILLION)

TABLE 5 COMPUTED TOMOGRAPHY APPARATUS: GLOBAL EXPORTS DATA, 2017–2021 (USD MILLION)

5.7 ECOSYSTEM

FIGURE 28 INDUSTRIAL METROLOGY MARKET: ECOSYSTEM

TABLE 6 INDUSTRIAL METROLOGY MARKET: ECOSYSTEM

FIGURE 29 REVENUE SHIFTS IN INDUSTRIAL METROLOGY MARKET

5.8 CASE STUDY ANALYSIS

5.8.1 CREATION OF 3D PRINTED REPLICA OF MICHELANGELO’S FAMOUS DAVID SCULPTURE WITH HEXAGON’S INDUSTRIAL METROLOGY PRODUCTS

5.8.2 HEXAGON HELPED ALLOY SPECIALTIES IN IMPROVING PRODUCTION CAPACITY

5.8.3 RENISHAW REVO 5-AXIS SYSTEMS HELPED REDUCE DAILY INSPECTION TIME OF AUTO PARTS

5.8.4 DAWN MACHINERY INCREASED CUSTOM MACHINE TOOL PRODUCTION EFFICIENCY USING RENISHAW’S ALIGNMENT LASER SYSTEM

5.8.5 FORD MOTOR COMPANY ESTABLISHED DEPENDABLE SYSTEM TO MONITOR GEAR SURFACE PROCESSING

5.9 PATENT ANALYSIS

FIGURE 30 PATENTS GRANTED WORLDWIDE, 2012–2021

TABLE 7 TOP 20 PATENT OWNERS, 2012–2021

FIGURE 31 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS, 2012–2021

5.10 TECHNOLOGY ANALYSIS

5.10.1 COMBINING CMM WITH INDUSTRIAL INTERNET OF THINGS (IIOT)

5.10.2 ZEISS GROUP AND MICROSOFT CORP. PARTNERED TO ENHANCE DIGITAL EXPERIENCES

5.10.3 ADVANCED 3D SCANNERS BY FARO TECHNOLOGIES

5.10.4 NEW GENERATION LASER RADAR BY NIKON

5.10.5 SMART IN-LINE CT INSPECTION SYSTEMS

5.10.6 ARTIFICIAL INTELLIGENCE IN INDUSTRIAL METROLOGY

5.10.7 3D MEASUREMENT SENSORS

5.10.8 SMART SENSORS

5.10.9 VIDEO MEASUREMENT SYSTEMS

5.10.10 ROBOTICS

5.11 REGULATIONS AND STANDARDS

5.11.1 STANDARDS

5.11.2 REGULATIONS

5.11.2.1 Restriction of Hazardous Substances (ROHS) and Waste Electrical and Electronic Equipment (WEEE)

5.11.2.2 Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH)

5.11.2.3 Paris Agreement

5.11.3 GENERAL DATA PROTECTION REGULATION (GDPR)

5.11.4 IMPORT–EXPORT LAWS

5.12 KEY CONFERENCES AND EVENTS, 2022–2023

TABLE 8 INDUSTRIAL METROLOGY MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

6 INDUSTRIAL METROLOGY MARKET, BY OFFERING (Page No. - 92)

6.1 INTRODUCTION

FIGURE 32 INDUSTRIAL METROLOGY MARKET, BY OFFERING

FIGURE 33 HARDWARE SEGMENT TO ACCOUNT FOR LARGEST SIZE OF INDUSTRIAL METROLOGY MARKET DURING FORECAST PERIOD

TABLE 9 INDUSTRIAL METROLOGY MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 10 INDUSTRIAL METROLOGY MARKET, BY OFFERING, 2022–2027 (USD MILLION)

6.2 HARDWARE

6.2.1 HARDWARE SEGMENT TO DOMINATE INDUSTRIAL METROLOGY MARKET DURING FORECAST PERIOD

6.3 SOFTWARE

6.3.1 INCREASED ADOPTION OF CLOUD-BASED SOFTWARE IN METROLOGY TO FUEL GROWTH OF SOFTWARE MARKET

6.4 SERVICES

6.4.1 AFTER-SALES SERVICES

6.4.1.1 Need for regular system upgrades to drive growth of after-sales services segment

6.4.2 MEASUREMENT SERVICES

6.4.2.1 Part sourcing and outsourcing help reduce overall production costs

6.4.3 STORAGE-AS-A-SERVICE

6.4.3.1 Increasing focus of companies on achieving cost efficiency to boost adoption of Storage-as-a-Service

6.4.4 SOFTWARE-AS-A-SERVICE

6.4.4.1 Increasing usage of cloud-based metrology services to drive adoption of software-as-a-Service in industrial metrology market

7 INDUSTRIAL METROLOGY MARKET, BY EQUIPMENT (Page No. - 100)

7.1 INTRODUCTION

FIGURE 34 INDUSTRIAL METROLOGY MARKET FOR ODS TO REGISTER HIGHEST CAGR BETWEEN 2022 AND 2027

TABLE 11 INDUSTRIAL METROLOGY MARKET, BY EQUIPMENT, 2018–2021 (USD MILLION)

TABLE 12 INDUSTRIAL METROLOGY MARKET, BY EQUIPMENT, 2022–2027 (USD MILLION)

TABLE 13 INDUSTRIAL METROLOGY HARDWARE MARKET, BY EQUIPMENT, 2018–2021 (THOUSAND UNITS)

TABLE 14 INDUSTRIAL METROLOGY HARDWARE MARKET, BY EQUIPMENT, 2022–2027 (THOUSAND UNITS)

7.2 COORDINATE MEASURING MACHINE (CMM)

FIGURE 35 ARTICULATED ARM CMM MARKET TO EXHIBIT HIGHEST CAGR BETWEEN 2022 AND 2027

TABLE 15 COORDINATE MEASURING MACHINE: INDUSTRIAL METROLOGY MARKET, BY EQUIPMENT TYPE, 2018–2021 (USD MILLION)

TABLE 16 COORDINATE MEASURING MACHINE: INDUSTRIAL METROLOGY MARKET, BY EQUIPMENT TYPE, 2022–2027 (USD MILLION)

TABLE 17 COORDINATE MEASURING MACHINE: INDUSTRIAL METROLOGY MARKET, BY END-USER INDUSTRY, 2018–2021 (USD MILLION)

TABLE 18 COORDINATE MEASURING MACHINE: INDUSTRIAL METROLOGY MARKET, BY END-USER INDUSTRY, 2022–2027 (USD MILLION)

7.2.1 FIXED CMM

7.2.1.1 Bridge CMM

7.2.1.1.1 Offers excellent rigidity and higher accuracy

7.2.1.2 Gantry CMM

7.2.1.2.1 Used for measuring large objects

7.2.1.3 Horizontal arm CMM

7.2.1.3.1 Ideal for measuring large workpieces and parts that are hard to reach

7.2.1.4 Cantilever CMM

7.2.1.4.1 Smaller than other CMMs and offer high accuracy

7.2.2 PORTABLE CMM

7.2.2.1 Articulated arm CMM

7.2.2.1.1 Facilitate quick and accurate inspection of any object

7.3 OPTICAL DIGITIZER AND SCANNER (ODS)

7.3.1 LASER SCANNER AND STRUCTURED LIGHT SCANNER

7.3.1.1 Laser scanners offer fast and non-contact scanning

7.3.2 LASER TRACKER

7.3.2.1 Used for measuring large objects by determining position of optical target

TABLE 19 OPTICAL DIGITIZER & SCANNER: INDUSTRIAL METROLOGY MARKET, BY EQUIPMENT TYPE, 2018–2021 (USD MILLION)

TABLE 20 OPTICAL DIGITIZER & SCANNER: INDUSTRIAL METROLOGY MARKET, BY EQUIPMENT TYPE, 2022–2027 (USD MILLION)

TABLE 21 OPTICAL DIGITIZER & SCANNER: INDUSTRIAL METROLOGY MARKET, BY END-USER INDUSTRY, 2018–2021 (USD MILLION)

TABLE 22 OPTICAL DIGITIZER & SCANNER: INDUSTRIAL METROLOGY MARKET, BY END-USER INDUSTRY, 2022–2027 (USD MILLION)

7.4 MEASURING INSTRUMENT

7.4.1 MEASURING MICROSCOPE

7.4.1.1 Used for industrial measurement and image analysis

7.4.2 PROFILE PROJECTOR

7.4.2.1 Used to measure small objects and parts

7.4.3 AUTOCOLLIMATOR

7.4.3.1 Ideal for measuring small angular differences

7.4.4 VISION SYSTEM

7.4.4.1 Utilized for high-resolution measurements in millimeter to nanometer range

7.4.5 MULTISENSOR MEASURING SYSTEM

7.4.5.1 Suitable for use in hard-to-reach areas using touch probes

FIGURE 36 AEROSPACE & DEFENSE SEGMENT TO DOMINATE INDUSTRY METROLOGY MARKET FOR MEASURING INSTRUMENT DURING FORECAST PERIOD

TABLE 23 MEASURING INSTRUMENT: INDUSTRIAL METROLOGY MARKET, BY END-USER INDUSTRY, 2018–2021 (USD MILLION)

TABLE 24 MEASURING INSTRUMENT: INDUSTRIAL METROLOGY MARKET, BY END-USER INDUSTRY, 2022–2027 (USD MILLION)

7.5 X-RAY AND COMPUTED TOMOGRAPHY

7.5.1 USED IN INDUSTRIES FOR DETECTION OF VOIDS AND CRACKS, AND ANALYZING PARTICLES IN MATERIALS

TABLE 25 X-RAY & COMPUTED TOMOGRAPHY: INDUSTRIAL METROLOGY MARKET, BY END-USER INDUSTRY, 2018–2021 (USD MILLION)

TABLE 26 X-RAY & COMPUTED TOMOGRAPHY: INDUSTRIAL METROLOGY MARKET, BY END-USER INDUSTRY, 2022–2027 (USD MILLION)

7.6 AUTOMATED OPTICAL INSPECTION (AOI)

7.6.1 EXTENSIVELY USED IN SEMICONDUCTOR INDUSTRY

TABLE 27 AUTOMATED OPTICAL INSPECTION: INDUSTRIAL METROLOGY MARKET, BY END-USER INDUSTRY, 2018–2021 (USD MILLION)

TABLE 28 AUTOMATED OPTICAL INSPECTION: INDUSTRIAL METROLOGY MARKET, BY END-USER INDUSTRY, 2022–2027(USD MILLION)

7.7 FORM MEASUREMENT EQUIPMENT

7.7.1 USED FOR SURFACE ANALYSIS AND CONTOUR MEASUREMENT

TABLE 29 FORM MEASUREMENT EQUIPMENT: INDUSTRIAL METROLOGY MARKET, BY END-USER INDUSTRY, 2018–2021 (USD MILLION)

TABLE 30 FORM MEASUREMENT EQUIPMENT: INDUSTRIAL METROLOGY MARKET, BY END-USER INDUSTRY, 2022–2027 (USD MILLION)

7.8 2D EQUIPMENT

7.8.1 MICROMETERS MOST COMMONLY USED 2D EQUIPMENT

FIGURE 37 CALIPER & MICROMETER SEGMENT TO DOMINATE INDUSTRY METROLOGY MARKET FOR 2D EQUIPMENT DURING FORECAST PERIOD

TABLE 31 2D EQUIPMENT: INDUSTRIAL METROLOGY MARKET, BY EQUIPMENT TYPE, 2018–2021 (USD MILLION)

TABLE 32 2D EQUIPMENT: INDUSTRIAL METROLOGY MARKET, BY EQUIPMENT TYPE, 2022–2027 (USD MILLION)

TABLE 33 2D EQUIPMENT: INDUSTRIAL METROLOGY MARKET, BY END-USER INDUSTRY, 2018–2021 (USD MILLION)

TABLE 34 2D EQUIPMENT: INDUSTRIAL METROLOGY MARKET, BY END-USER INDUSTRY, 2022–2027 (USD MILLION)

8 INDUSTRIAL METROLOGY MARKET, BY APPLICATION (Page No. - 123)

8.1 INTRODUCTION

FIGURE 38 INDUSTRIAL METROLOGY MARKET, BY APPLICATION

FIGURE 39 QUALITY CONTROL & INSPECTION SEGMENT TO REGISTER HIGHEST CAGR BETWEEN 2022 AND 2027

TABLE 35 INDUSTRIAL METROLOGY MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 36 INDUSTRIAL METROLOGY MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

8.2 QUALITY CONTROL AND INSPECTION

8.2.1 QUALITY CONTROL AND INSPECTION SEGMENT TO ACCOUNT FOR LARGEST SHARE OF INDUSTRIAL METROLOGY MARKET DURING FORECAST PERIOD

TABLE 37 QUALITY CONTROL & INSPECTION: INDUSTRIAL METROLOGY MARKET, BY END-USER INDUSTRY, 2018–2021 (USD MILLION)

TABLE 38 QUALITY CONTROL & INSPECTION: INDUSTRIAL METROLOGY MARKET, BY END-USER INDUSTRY, 2022–2027 (USD MILLION)

8.3 REVERSE ENGINEERING

8.3.1 AUTOMOTIVE AND AEROSPACE & DEFENSE INDUSTRIES KEY END-USERS OF REVERSE ENGINEERING

TABLE 39 REVERSE ENGINEERING: INDUSTRIAL METROLOGY, BY END-USER INDUSTRY, 2018–2021 (USD MILLION)

TABLE 40 REVERSE ENGINEERING: INDUSTRIAL METROLOGY MARKET, BY END-USER INDUSTRY, 2022–2027 (USD MILLION)

8.4 MAPPING AND MODELING

8.4.1 HELP MANUFACTURERS VISUALIZE AND CONSTRUCT VISUAL PROTOTYPES OF PRODUCTS

FIGURE 40 AUTOMOTIVE SEGMENT TO DOMINATE INDUSTRIAL METROLOGY MARKET FOR MAPPING AND MODELING BETWEEN 2022 AND 2027

TABLE 41 MAPPING & MODELING: INDUSTRIAL METROLOGY MARKET, BY END-USER INDUSTRY, 2018–2021 (USD MILLION)

TABLE 42 MAPPING & MODELING: INDUSTRIAL METROLOGY MARKET, BY END-USER INDUSTRY, 2022–2027 (USD MILLION)

8.5 OTHERS

TABLE 43 OTHERS: INDUSTRIAL METROLOGY MARKET, BY END-USER INDUSTRY, 2018–2021 (USD MILLION)

TABLE 44 OTHERS: INDUSTRIAL METROLOGY MARKET, BY END-USER INDUSTRY, 2022–2027 (USD MILLION)

9 INDUSTRIAL METROLOGY MARKET, BY END-USER INDUSTRY (Page No. - 133)

9.1 INTRODUCTION

FIGURE 41 INDUSTRIAL METROLOGY MARKET, BY END-USER INDUSTRY

FIGURE 42 AUTOMOTIVE INDUSTRY TO HOLD LARGEST SIZE OF INDUSTRIAL METROLOGY MARKET FROM 2022 TO 2027

TABLE 45 INDUSTRIAL METROLOGY MARKET, BY END-USER INDUSTRY, 2018–2021 (USD MILLION)

TABLE 46 INDUSTRIAL METROLOGY MARKET, BY END-USER INDUSTRY, 2022–2027 (USD MILLION)

9.2 AEROSPACE & DEFENSE

9.2.1 USES METROLOGY IN MANUFACTURING AND ASSEMBLY OF AIRCRAFT

TABLE 47 AEROSPACE & DEFENSE: INDUSTRIAL METROLOGY MARKET, BY EQUIPMENT, 2018–2021 (USD MILLION)

TABLE 48 AEROSPACE & DEFENSE: INDUSTRIAL METROLOGY MARKET, BY EQUIPMENT, 2022–2027 (USD MILLION)

TABLE 49 AEROSPACE & DEFENSE: INDUSTRIAL METROLOGY MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 50 AEROSPACE & DEFENSE: INDUSTRIAL METROLOGY MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 51 AEROSPACE & DEFENSE: INDUSTRIAL METROLOGY MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 52 AEROSPACE & DEFENSE: INDUSTRIAL METROLOGY MARKET, BY REGION, 2022–2027 (USD MILLION)

9.3 AUTOMOTIVE

9.3.1 METROLOGY SOLUTIONS USED FOR CONDUCTING INSPECTION, MEASUREMENT, AND QUALITY CHECKS OF VARIOUS COMPONENTS

TABLE 53 AUTOMOTIVE: INDUSTRIAL METROLOGY MARKET, BY EQUIPMENT, 2018–2021 (USD MILLION)

TABLE 54 AUTOMOTIVE: INDUSTRIAL METROLOGY MARKET, BY EQUIPMENT, 2022–2027 (USD MILLION)

TABLE 55 AUTOMOTIVE: INDUSTRIAL METROLOGY MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 56 AUTOMOTIVE: INDUSTRIAL METROLOGY MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 57 AUTOMOTIVE: INDUSTRIAL METROLOGY MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 58 AUTOMOTIVE: INDUSTRIAL METROLOGY MARKET, BY REGION, 2022–2027 (USD MILLION)

9.4 SEMICONDUCTOR

9.4.1 MINIATURIZATION NECESSITATES USE OF METROLOGY SOLUTIONS FOR ACHIEVING HIGH ACCURACY, PRECISION, AND THROUGHPUT

TABLE 59 SEMICONDUCTOR: INDUSTRIAL METROLOGY MARKET, BY EQUIPMENT, 2018–2021 (USD MILLION)

TABLE 60 SEMICONDUCTOR: INDUSTRIAL METROLOGY MARKET, BY EQUIPMENT, 2022–2027 (USD MILLION)

TABLE 61 SEMICONDUCTOR: INDUSTRIAL METROLOGY MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 62 SEMICONDUCTOR: INDUSTRIAL METROLOGY MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 63 SEMICONDUCTOR: INDUSTRIAL METROLOGY MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 64 SEMICONDUCTOR: INDUSTRIAL METROLOGY MARKET, BY REGION, 2022–2027 (USD MILLION)

9.5 MANUFACTURING

9.5.1 INCREASING USE OF METROLOGY FOR COMPETITIVE EDGE, AND TO REDUCE TIME AND EFFORT

FIGURE 43 CMM SEGMENT TO HOLD LARGEST SIZE OF INDUSTRIAL METROLOGY MARKET FOR MANUFACTURING DURING FORECAST PERIOD

TABLE 65 MANUFACTURING: INDUSTRIAL METROLOGY MARKET, BY EQUIPMENT, 2018–2021 (USD MILLION)

TABLE 66 MANUFACTURING: INDUSTRIAL METROLOGY MARKET, BY EQUIPMENT, 2022–2027 (USD MILLION)

TABLE 67 MANUFACTURING: INDUSTRIAL METROLOGY MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 68 MANUFACTURING: INDUSTRIAL METROLOGY MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 69 MANUFACTURING: INDUSTRIAL METROLOGY MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 70 MANUFACTURING: INDUSTRIAL METROLOGY MARKET, BY REGION, 2022–2027 (USD MILLION)

9.6 OTHERS

TABLE 71 OTHERS: INDUSTRIAL METROLOGY MARKET, BY EQUIPMENT, 2018–2021 (USD MILLION)

TABLE 72 OTHERS: INDUSTRIAL METROLOGY MARKET, BY EQUIPMENT, 2022–2027 (USD MILLION)

TABLE 73 OTHERS: INDUSTRIAL METROLOGY MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 74 OTHERS: INDUSTRIAL METROLOGY MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 75 OTHERS: INDUSTRIAL METROLOGY MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 76 OTHERS: INDUSTRIAL METROLOGY MARKET, BY REGION, 2022–2027 (USD MILLION)

10 INDUSTRIAL METROLOGY MARKET, BY REGION (Page No. - 153)

10.1 AUTOMOTIVE: INDUSTRIAL METROLOGY MARKET, BY EQUIPMENT, 2022–2027 (USD MILLION)

FIGURE 44 GEOGRAPHIC ANALYSIS: INDUSTRIAL METROLOGY MARKET (2022–2027)

TABLE 77 INDUSTRIAL METROLOGY MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 78 INDUSTRIAL METROLOGY MARKET, BY REGION, 2022–2027(USD MILLION)

10.2 AUTOMOTIVE: INDUSTRIAL METROLOGY MARKET, BY REGION, 2022–2027 (USD MILLION)

FIGURE 45 NORTH AMERICA: INDUSTRIAL METROLOGY MARKET SNAPSHOT

TABLE 79 NORTH AMERICA: INDUSTRIAL METROLOGY MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 80 NORTH AMERICA: INDUSTRIAL METROLOGY MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 81 NORTH AMERICA: INDUSTRIAL METROLOGY MARKET, BY END-USER INDUSTRY, 2018–2021 (USD MILLION)

TABLE 82 NORTH AMERICA: INDUSTRIAL METROLOGY MARKET, BY END-USER INDUSTRY, 2022–2027 (USD MILLION)

10.2.1 US

10.2.1.1 US to dominate industrial metrology market in North America during forecast period

TABLE 83 US: INDUSTRIAL METROLOGY MARKET, BY END-USER INDUSTRY, 2018–2021 (USD MILLION)

TABLE 84 US: INDUSTRIAL METROLOGY MARKET, BY END-USER INDUSTRY, 2022–2027 (USD MILLION)

10.2.2 CANADA

10.2.2.1 Presence of automotive assembly plants to support market growth

TABLE 85 CANADA: INDUSTRIAL METROLOGY MARKET, BY END-USER INDUSTRY, 2018–2021 (USD MILLION)

TABLE 86 CANADA: INDUSTRIAL METROLOGY MARKET, BY END-USER INDUSTRY, 2022–2027 (USD MILLION)

10.2.3 MEXICO

10.2.3.1 Strong manufacturing base to fuel demand for metrology products

TABLE 87 MEXICO: INDUSTRIAL METROLOGY MARKET, BY END-USER INDUSTRY, 2018–2021 (USD MILLION)

TABLE 88 MEXICO: INDUSTRIAL METROLOGY MARKET, BY END-USER INDUSTRY, 2022–2027 (USD MILLION)

10.3 OTHERS

FIGURE 46 EUROPE: INDUSTRIAL METROLOGY MARKET SNAPSHOT

TABLE 89 EUROPE: INDUSTRIAL METROLOGY MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 90 EUROPE: INDUSTRIAL METROLOGY MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 91 EUROPE: INDUSTRIAL METROLOGY MARKET, BY END-USER INDUSTRY, 2018–2021 (USD MILLION)

TABLE 92 EUROPE: INDUSTRIAL METROLOGY MARKET, BY END-USER INDUSTRY, 2022–2027 (USD MILLION)

10.3.1 GERMANY

10.3.1.1 Germany to grow at highest CAGR in European industrial metrology market during forecast period

TABLE 93 GERMANY: INDUSTRIAL METROLOGY MARKET, BY END-USER INDUSTRY, 2018–2021 (USD MILLION)

TABLE 94 GERMANY: INDUSTRIAL METROLOGY MARKET, BY END-USER INDUSTRY, 2022–2027 (USD MILLION)

10.3.2 UK

10.3.2.1 Demand from aerospace industry to augment market growth

TABLE 95 UK: INDUSTRIAL METROLOGY MARKET, BY END-USER INDUSTRY, 2018–2021 (USD MILLION)

TABLE 96 UK: INDUSTRIAL METROLOGY MARKET, BY END-USER INDUSTRY, 2022–2027 (USD MILLION)

10.3.3 FRANCE

10.3.3.1 Automotive industry to drive growth of industrial metrology market

TABLE 97 FRANCE: INDUSTRIAL METROLOGY MARKET, BY END-USER INDUSTRY, 2018–2021 (USD MILLION)

TABLE 98 FRANCE: INDUSTRIAL METROLOGY MARKET, BY END-USER INDUSTRY, 2022–2027 (USD MILLION)

10.3.4 ITALY

10.3.4.1 Rising automobile production to generate demand for metrology solutions

TABLE 99 ITALY: INDUSTRIAL METROLOGY MARKET, BY END-USER INDUSTRY, 2018–2021 (USD MILLION)

TABLE 100 ITALY: INDUSTRIAL METROLOGY MARKET, BY END-USER INDUSTRY, 2022–2027 (USD MILLION)

10.3.5 SPAIN

10.3.5.1 High demand from automotive industry to drive market

TABLE 101 SPAIN: INDUSTRIAL METROLOGY MARKET, BY END-USER INDUSTRY, 2018–2021 (USD MILLION)

TABLE 102 SPAIN: INDUSTRIAL METROLOGY MARKET, BY END-USER INDUSTRY, 2022–2027 (USD MILLION)

10.3.6 REST OF EUROPE

TABLE 103 REST OF EUROPE: INDUSTRIAL METROLOGY MARKET, BY END-USER INDUSTRY, 2018–2021 (USD MILLION)

TABLE 104 REST OF EUROPE: INDUSTRIAL METROLOGY MARKET, BY END-USER INDUSTRY, 2022–2027 (USD MILLION)

10.4 MEXICO: INDUSTRIAL METROLOGY MARKET, BY END-USER INDUSTRY, 2022–2027 (USD MILLION)

FIGURE 47 ASIA PACIFIC: INDUSTRIAL METROLOGY MARKET SNAPSHOT

TABLE 105 ASIA PACIFIC: INDUSTRIAL METROLOGY MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 106 ASIA PACIFIC: INDUSTRIAL METROLOGY MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 107 ASIA PACIFIC: INDUSTRIAL METROLOGY MARKET, BY END-USER INDUSTRY, 2018–2021 (USD MILLION)

TABLE 108 ASIA PACIFIC: INDUSTRIAL METROLOGY MARKET, BY END-USER INDUSTRY, 2022–2027 (USD MILLION)

10.4.1 CHINA

10.4.1.1 China to dominate Asia Pacific industrial metrology market during forecast period

TABLE 109 CHINA: INDUSTRIAL METROLOGY MARKET, BY END-USER INDUSTRY, 2018–2021 (USD MILLION)

TABLE 110 CHINA: INDUSTRIAL METROLOGY MARKET, BY END-USER INDUSTRY, 2022–2027 (USD MILLION)

10.4.2 JAPAN

10.4.2.1 Quality control and inspection application to boost market

TABLE 111 JAPAN: INDUSTRIAL METROLOGY MARKET, BY END-USER INDUSTRY, 2018–2021 (USD MILLION)

TABLE 112 JAPAN: INDUSTRIAL METROLOGY MARKET, BY END-USER INDUSTRY, 2022–2027 (USD MILLION)

10.4.3 SOUTH KOREA

10.4.3.1 Aerospace & defense and automotive key end-user sectors in industrial metrology market in South Korea

TABLE 113 SOUTH KOREA: INDUSTRIAL METROLOGY MARKET, BY END-USER INDUSTRY, 2018–2021 (USD MILLION)

TABLE 114 SOUTH KOREA: INDUSTRIAL METROLOGY MARKET, BY END-USER INDUSTRY, 2022–2027 (USD MILLION)

10.4.4 INDIA

10.4.4.1 Manufacturing sector to offer immense growth potential

TABLE 115 INDIA: INDUSTRIAL METROLOGY MARKET, BY END-USER INDUSTRY, 2018–2021 (USD MILLION)

TABLE 116 INDIA: INDUSTRIAL METROLOGY MARKET, BY END-USER INDUSTRY, 2022–2027 (USD MILLION)

10.4.5 REST OF ASIA PACIFIC

TABLE 117 REST OF ASIA PACIFIC: INDUSTRIAL METROLOGY MARKET, BY END-USER INDUSTRY, 2018–2021 (USD MILLION)

TABLE 118 REST OF ASIA PACIFIC: INDUSTRIAL METROLOGY MARKET, BY END-USER INDUSTRY, 2022–2027 (USD MILLION)

10.5 SPAIN: INDUSTRIAL METROLOGY MARKET, BY END-USER INDUSTRY, 2018–2021 (USD MILLION)

TABLE 119 REST OF THE WORLD: INDUSTRIAL METROLOGY MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 120 REST OF THE WORLD: INDUSTRIAL METROLOGY MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 121 REST OF THE WORLD: INDUSTRIAL METROLOGY MARKET, BY END-USER INDUSTRY, 2018–2021 (USD MILLION)

TABLE 122 REST OF THE WORLD: INDUSTRIAL METROLOGY MARKET, BY END-USER INDUSTRY, 2022–2027 (USD MILLION)

10.5.1 MIDDLE EAST & AFRICA

10.5.1.1 Various partnerships and collaborations to drive market

TABLE 123 MIDDLE EAST & AFRICA: INDUSTRIAL METROLOGY MARKET, BY END-USER INDUSTRY, 2018–2021 (USD MILLION)

TABLE 124 MIDDLE EAST & AFRICA: INDUSTRIAL METROLOGY MARKET, BY END-USER INDUSTRY, 2022–2027 (USD MILLION)

10.5.2 SOUTH AMERICA

10.5.2.1 High demand from Brazil, Chile, and Argentina to propel market

TABLE 125 SOUTH AMERICA: INDUSTRIAL METROLOGY MARKET, BY END-USER INDUSTRY, 2018–2021 (USD MILLION)

TABLE 126 SOUTH AMERICA: INDUSTRIAL METROLOGY MARKET, BY END-USER INDUSTRY, 2022–2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 188)

11.1 CHINA: INDUSTRIAL METROLOGY MARKET, BY END-USER INDUSTRY, 2022–2027 (USD MILLION)

11.2 JAPAN

TABLE 127 OVERVIEW OF STRATEGIES DEPLOYED BY KEY MARKET PLAYERS

11.2.1 PRODUCT PORTFOLIO

11.2.2 REGIONAL FOCUS

11.2.3 MANUFACTURING FOOTPRINT

11.2.4 ORGANIC/INORGANIC GROWTH STRATEGIES

11.3 SOUTH KOREA: INDUSTRIAL METROLOGY MARKET, BY END-USER INDUSTRY, 2018–2021 (USD MILLION)

TABLE 128 INDUSTRIAL METROLOGY MARKET: DEGREE OF COMPETITION, 2021

11.4 INDIA

FIGURE 48 FIVE-YEAR REVENUE ANALYSIS OF TOP FIVE PLAYERS IN INDUSTRIAL METROLOGY MARKET

11.5 INDIA: INDUSTRIAL METROLOGY MARKET, BY END-USER INDUSTRY, 2018–2021 (USD MILLION)

11.5.1 STARS

11.5.2 EMERGING LEADERS

11.5.3 PERVASIVE PLAYERS

11.5.4 PARTICIPANTS

FIGURE 49 INDUSTRIAL METROLOGY MARKET: COMPANY EVALUATION QUADRANT, 2021

11.5.5 PRODUCT FOOTPRINT

TABLE 129 COMPANY PRODUCT FOOTPRINT: INDUSTRIAL METROLOGY MARKET

TABLE 130 COMPANY INDUSTRY FOOTPRINT: INDUSTRIAL METROLOGY MARKET

TABLE 131 COMPANY APPLICATION FOOTPRINT: INDUSTRIAL METROLOGY MARKET

TABLE 132 COMPANY REGION FOOTPRINT: INDUSTRIAL METROLOGY MARKET

11.6 Various partnerships and collaborations to drive market

11.6.1 PROGRESSIVE COMPANIES

11.6.2 RESPONSIVE COMPANIES

11.6.3 DYNAMIC COMPANIES

11.6.4 STARTING BLOCKS

FIGURE 50 INDUSTRIAL METROLOGY MARKET: STARTUP/SME EVALUATION QUADRANT, 2021

11.7 SOUTH AMERICA: INDUSTRIAL METROLOGY MARKET, BY END-USER INDUSTRY, 2022–2027 (USD MILLION)

TABLE 133 INDUSTRIAL METROLOGY MARKET: LIST OF KEY STARTUPS/SMES

11.8 OVERVIEW

11.8.1 PRODUCT LAUNCHES

TABLE 134 PRODUCT LAUNCHES, 2020–2022

11.8.2 DEALS

TABLE 135 DEALS, 2020–2022

12 COMPANY PROFILES (Page No. - 222)

12.1 ORGANIC/INORGANIC GROWTH STRATEGIES

12.2 MARKET SHARE ANALYSIS: INDUSTRIAL METROLOGY MARKET, 2021

(Business overview, Products/Solutions/Services offered, Recent Developments, MNM view)* INDUSTRIAL METROLOGY MARKET: DEGREE OF COMPETITION, 2021

12.2.1 HEXAGON

TABLE 136 HEXAGON: COMPANY OVERVIEW

FIGURE 51 HEXAGON: COMPANY SNAPSHOT

12.2.2 NIKON

TABLE 137 NIKON: COMPANY OVERVIEW

FIGURE 52 NIKON: COMPANY SNAPSHOT

12.2.3 FARO TECHNOLOGIES

TABLE 138 FARO TECHNOLOGIES: COMPANY OVERVIEW

FIGURE 53 FARO TECHNOLOGIES: COMPANY SNAPSHOT

12.2.4 CARL ZEISS

TABLE 139 CARL ZEISS: COMPANY OVERVIEW

FIGURE 54 CARL ZEISS: COMPANY SNAPSHOT

12.2.5 JENOPTIK

TABLE 140 JENOPTIK: COMPANY OVERVIEW

FIGURE 55 JENOPTIK: COMPANY SNAPSHOT

12.2.6 KEYENCE CORPORATION

TABLE 141 KEYENCE CORPORATION: COMPANY OVERVIEW

FIGURE 56 KEYENCE CORPORATION: COMPANY SNAPSHOT

12.2.7 CREAFORM

TABLE 142 CREAFORM: COMPANY OVERVIEW

12.2.8 KLA CORPORATION

TABLE 143 KLA CORPORATION: COMPANY OVERVIEW

FIGURE 57 KLA CORPORATION: COMPANY SNAPSHOT

12.2.9 RENISHAW

TABLE 144 RENISHAW: COMPANY OVERVIEW

FIGURE 58 RENISHAW: COMPANY SNAPSHOT

12.2.10 MITUTOYO CORPORATION

TABLE 145 MITUTOYO CORPORATION: COMPANY OVERVIEW

*Details on Business overview, Products/Solutions/Services offered, Recent Developments, MNM view might not be captured in case of unlisted companies. KEY PLAYERS

12.3

12.3.1 PRECISION PRODUCTS

12.3.2 CARMAR ACCURACY

12.3.3 BAKER HUGHES COMPANY

12.3.4 CYBEROPTICS

12.3.5 CAIRNHILL METROLOGY

12.3.6 ATT METROLOGY SERVICES

12.3.7 SGS GROUP

12.3.8 TRIMET

12.3.9 AUTOMATED PRECISION

12.3.10 APPLIED MATERIALS

12.3.11 PERCEPTRON

12.3.12 JLM ADVANCED TECHNICAL SERVICES

12.3.13 INTERTEK GROUP

12.3.14 BRUKER

12.3.15 METROLOGIC GROUP

13 APPENDIX (Page No. - 310)

13.1 KEYENCE CORPORATION: COMPANY OVERVIEW

13.2 KEYENCE CORPORATION: COMPANY SNAPSHOT

13.3 CREAFORM

13.4 CREAFORM: COMPANY OVERVIEW

13.5 KLA CORPORATION

The study involved four major activities for estimating the size of the Industrial metrology market. Exhaustive secondary research has been carried out to collect information relevant to the market, its peer markets, and its parent market. Primary research has been undertaken to validate key findings, assumptions, and sizing with the industry experts across the value chain of the industrial metrology market. Both top-down and bottom-up approaches have been employed to estimate the complete market size. It has been followed by the market breakdown and data triangulation methods to estimate the size of different segments and subsegments of the market.

Secondary Research

The research methodology that has been used to estimate and forecast the size of the industrial metrology market began with the acquisition of data related to the revenues of key vendors in the market through secondary research. The secondary research referred to for this research study involves magazines, journals, and associations. Moreover, the study involved extensive use of secondary sources, directories, and databases, such as Hoovers, Bloomberg Businessweek, Factiva, and OneSource, to identify and collect information useful for a technical, market-oriented, and commercial study of the industrial metrology market. Vendor offerings have been taken into consideration to determine the market segmentation. The entire research methodology included the study of annual reports, press releases, and investor presentations of companies; white papers; and certified publications and articles by recognized authors; directories; and databases.

Primary Research

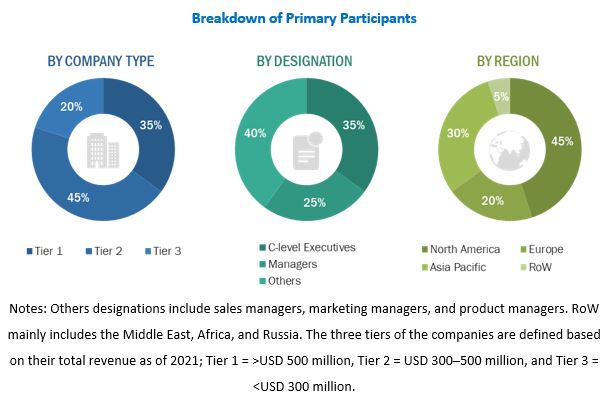

Extensive primary research has been conducted after acquiring an understanding of the industrial metrology market scenario through secondary research. Several primary interviews have been conducted with market experts from both the demand and supply-side players across key regions, namely, North America, Europe, Asia Pacific, and Middle East, Africa, and South America. Various primary sources from both the supply and demand sides of the market have been interviewed to obtain qualitative and quantitative information. Following is the breakdown of the primary respondents.

Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales, operations, and administration, were covered to provide a holistic viewpoint in our report. After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up approach was employed to arrive at the overall size of the industrial metrology market. The summation of the regional revenues was carried out to arrive at the overall size of the industrial metrology market.

- Identifying various industrial metrology products, software, and services provided or expected to be offered by players in the value chain

- Tracking the major manufacturers and providers of industrial metrology equipment and related services for different regions

- Tracking the ongoing and upcoming product launches and different inorganic strategies such as acquisitions, partnerships, and collaborations

- Estimating and forecasting the industrial metrology market in each country and thereby region based on trade data and GDP analysis

- Conducting multiple discussions with key opinion leaders to understand the types of equipment, software, and services deployed by industrial metrology players, and analyzing the break-up of the scope of work carried out by each major company

- Verifying and crosschecking the estimates at every level by discussing with key opinion leaders, including CEOs, directors, operation managers, and then finally with the domain experts at MarketsandMarkets

- Studying various paid and unpaid information sources such as annual reports, press releases, white papers, and others

Data Triangulation

After arriving at the overall market size-using the market size estimation process explained above-the market has been split into several segments and subsegments. Data triangulation and market breakdown procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for each segment and subsegment of the market. The data has been triangulated by studying various factors and trends from both demand and supply sides of the industrial metrology market.

Report Objectives

- To define, describe, and forecast the industrial metrology market, by offering, equipment, application, end-user industry, and region, in terms of value

- To forecast the industrial metrology market, by equipment, in terms of volume

- To provide the market size estimation for North America, Europe, Asia Pacific, and Rest of the World (RoW), along with their respective country-level market sizes, in terms of value

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges that influence market growth

- To provide a detailed overview of the industrial metrology value chain

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To analyze key trends related to components, connectivity technologies, and applications that shape and influence the global industrial metrology market

- To analyze opportunities in the market for stakeholders and provide a detailed competitive landscape of the market

- To provide information pertaining to key technology trends and patent analysis related to the industrial metrology market

- To provide information regarding trade data related to the industrial metrology market

- To strategically profile key players in the industrial metrology market and comprehensively analyze their market shares and core competencies

- To benchmark the market players using the proprietary company evaluation matrix framework, which analyzes the market players on various parameters within the broad categories of market rankings/shares and product portfolios

- To analyze competitive developments such as contracts, agreements, expansions, acquisitions, product launches, collaborations, and partnerships, along with research and development (R&D), in the industrial metrology market

Available Customizations

Along with the market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

- Additional country-level analysis of industrial metrology market

- Estimation of the market size of the segments of the industrial metrology market based on different subsegments

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Industrial Metrology Market