Industrial Robotics Market by Type (Traditional, Collaborative Robots), Component, Payload, Application (Handling, Processing), Industry (Automotive, Food & Beverages) and Region (North America, Europe, APAC, RoW) - Global Forecast to 2027

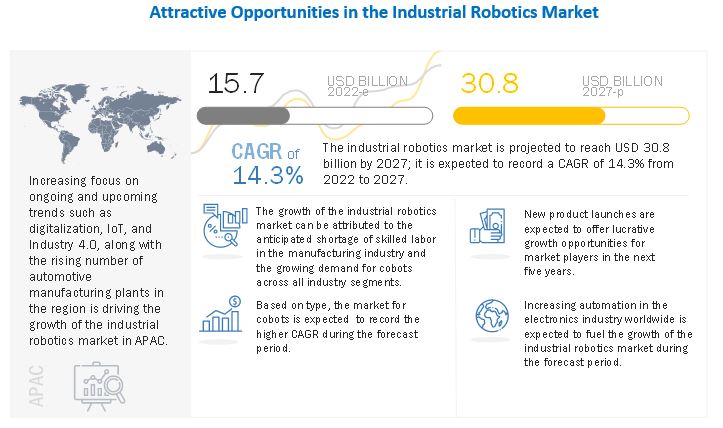

[383 Pages Report] The industrial robotics market is projected to reach USD 30.8 billion by 2027 from USD 17.68 billion by 2022 growing at a CAGR of 14.3% during the forecast period. Traditional industrial robots are used within cages or safety enclosures, whereas collaborative industrial robots (cobots) are designed for use along with workers and operators.

The growing demand for cobots across various industries and the increasing automation in the electronics industry are the key factors driving the industrial robotics industry

Currently, the growing demand for modular robotic systems poses a challenge for industrial robot OEMs and integrators in terms of interoperability between various robotic platforms. However, with the availability of the OPC UA cross-platform communication protocol, the interoperability challenge is expected to be mitigated by the end of 2022. Players in the industrial robotics market adopted growth strategies such as product launches, partnerships, collaborations, and strategic alliances. These strategies enabled them to efficiently cater to the growing demand for industrial robotic systems from end users and expand their global footprint to all the major regions.

The objective of the report is to define, describe, and forecast the industrial robotics market based on type, payload, component, application, end use industry, and region.

To know about the assumptions considered for the study, Request for Free Sample Report

Industrial robotics market Dynamics

Drivers: Rising demand for collaborative robots across industries

Cobots are becoming more affordable and easier to program for novice users. For instance, Universal Robots (Denmark) provides the UR+ platform to enable users to program the robot and use various robot end effectors, vision systems, and add-on software from other manufacturers, including Robotiq (Canada), Schunk (Germany), PIAB (Germany), OnRobot (Denmark), Cognex (US), and Energid (US). The peripherals and software offered by these companies are UR+ certified to minimize compatibility issues with the robots manufactured by Universal Robots (Denmark). Enterprises of all sizes and are adopting collaborative robots for new and existing applications. For instance, BMW (Germany) has deployed a UR10 robot from Universal Robots for gluing and other dispensing applications. These stronger, faster and more capable cobots will accelerate the company’s expansion in high-growth segments including electronics, healthcare, consumer goods, logistics and food and beverages, meeting the growing demand for automation across multiple industries.

Restraints: High cost of deployment for SMEs

A robotic automation project can be challenging, especially for companies with no prior experience. Replacing human workers may not always decrease the operational costs for an organization. A single collaborative robot system can cost anywhere from USD 3,000 to USD 100,000. The price of an industrial robotic system ranges from USD 15,000 to USD 150,000. The cost of industrial robots, coupled with integration costs and the cost of peripherals, such as end effectors and vision systems, makes automation a costly investment for SMEs, especially when they are engaged in low-volume production. The price issue is more severe for companies involved in seasonal or inconstant production schedules.

Opportunities: Emergence of Industry 5.0

The concept of Industry 5.0 is a relatively new one. According to the European Commission, Industry 5.0 provides a vision of industry that aims beyond efficiency and productivity as the sole goals and reinforces the role and the contribution of industry to society. It places the wellbeing of the worker at the center of the production process and uses new technologies to provide prosperity beyond jobs and growth while respecting the production limits of the planet. Industry 5.0 complements the industry 4.0 approach by specifically putting research and innovation at the service of the transition to a sustainable, human-centric and resilient European industry. Industrial robots will be a critical component of the fifth industrial revolution. They will help close the design loop. By fully and efficiently automating the entire production process, humans will be left free to create and innovate without having to worry about production constraints. In contrast to Industry 4.0, Industry 5.0 aims to put the human touch back into development and production. It is expected to utilize the creative intellectual capability of humans optimally. Thus, the emergence of industry 5.0 will create a lucrative opportunity for collaborative robots.

Challenges: Safety concerns related to industrial robotics systems

Numerous safety issues are associated with industrial robots. Some robots, notably those in a traditional industrial environment, are fast and powerful. This increases the potential for injury as one swing from a robotic arm, for instance, could cause serious bodily harm. There are additional risks when a robot malfunctions or requires maintenance. A malfunctioning robot is typically unpredictable and can cause injury to workers. For instance, a robotic arm that is part of a car assembly line may experience a jammed motor, and the worker fixing the jam may get hit by the arm when it becomes unjammed. Similarly, a worker standing in a zone overlapping with nearby robotic arms may get injured by other moving equipment. Several Indian companies have reported crushing and trapping accidents, and impact or collision accidents caused by malfunctioning mechanical parts of industrial robots. For instance, in 2020, a 44-year-old welding worker at Automotive Stampings & Assemblies Ltd (Asal) in Pune (India) was killed after being hit on the head and neck by the arm of a robotic machine.

Automotive to witness significant share in the industrial robotics market

Automotive hold a significant share in the industrial robotics end use industry segment. The automotive industry is one of the largest users of industrial robots, although it is gradually losing its share to other industries. Manufacturers such as BMW AG (Germany), Nissan (Japan), and Bajaj Auto (India) have either introduced or replaced traditional industrial robots with collaborative robots for applications such as material handling and dispensing. The Gestamp (Spain) plant in Bielefeld is using a fully automatic arc welding system from KUKA Systems to ensure quality manufacturing of metal automotive components. KUKA (Germany) provides at least 18 types of robots for the auto industry that do everything from laser welding and washing to creating seat elements for BMWs using 3D geometry. Acieta (US) has installed more than 4,400 of its industrial automotive manufacturing robots throughout plants in North America.

Robot Accessories to create lucrative growth opportunities for industrial robotics during the forecast period

Every industrial collaborative or traditional robot requires a set of accessories to enable efficient long-term productivity. The fundamental accessories of industrial robots include the controller, a series of mechanical parts, attachments, and sensors. The controller acts as the brain of the machine. The mechanical parts are designed to carry out pre-programmed articulations while the sensors help the robot fine-tune its performance in response to external stimuli.

Industrial Robotics market to witness highest demand in APAC region

According to the International Trade Centre, China is the world’s largest exporter and importer of manufactured goods. The once easily available labor has resulted in the growth of several labor-intensive industries, such as clothing, textiles, footwear, furniture, plastic products, bags, and toys. However, the aging population in recent years has created a shortage of labor, leading to a rise in wages. This is compelling companies to adopt automation and industrial robots to reduce costs. China is moving from labor-intensive simple industries toward high-tech manufacturing goods, such as semiconductors, through its Made in China 2025 policy.

With Chinese telecommunication equipment giant Huawei being placed on the US blacklist, China aimed to produce 40% of the semiconductors it uses by 2021 and 70% by 2025. Japan is one of the leading producers of electric vehicles in the world. The arrival of fully electric and hybrid vehicles in the coming years is expected to boost the market for industrial robots due to new assembly line processes.

Consumer electronics products have witnessed a decline due to fierce competition from global manufacturers in China and South Korea. However, the demand for electronic components such as sensors and displays in the export market is expected to be high. With FANUC (Japan) and Yaskawa (Japan) as the top players in the industrial robotics market, the market in Japan is expected to grow at a steady pace. The presence of some of the most prominent players in the industrial robotics market space, such as FANUC (Japan), Yaskawa (Japan), and Mitsubishi Electric (Japan), is another major factor driving the market in this region.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The industrial robotics companies such as FANUC Corporation (FANUC (Japan)), ABB (Switzerland), Yaskawa Electric (Yaskawa (Japan)), KUKA (Germany), Mitsubishi Electric (Japan), Kawasaki Heavy Industries (Japan), DENSO (Japan), Nachi-Fujikoshi (Japan), Seiko Epson (Japan), and Dürr (Germany), among others.

Industrial Robotics Market Report Scope

|

Report Metric |

Details |

|

Market Growth Rate |

CAGR of 14.3% |

|

Expected to Reach |

USD 30.8 billion by 2027 |

|

Projected Value |

USD 15.7 billion in 2022 |

|

Largest Share Region |

APAC |

|

Market size available for years |

2018 - 2027 |

|

Base year |

2021 |

|

Forecast period |

2022—2027 |

|

Units |

Value (USD Million/USD Billion), Volume (Thousand Units) |

|

Segments covered |

|

|

Geographic regions covered |

North America, Europe, APAC, and RoW |

|

Companies covered |

A total of 30 players are profiled in the report. |

This report categorizes the industrial robotics market based on type, payload, component, application, end use industry, region.

Industrial Robotics Market, by Type:

- Traditional Robots

- Collaborative Robots

Market, by Payload:

- Up to 16.00 kg

- 16.01–60.00 kg

- 60.01–225.00 KG

- More than 225.00 kg

Market, by Component:

- Robot Arm

- Robot Accessories (End Effectors, Controllers, etc.)

- Additional Robotic Hardware (Safety Fencing, Fixtures, Conveyors)

- System Engineering

- Software & Programming

Market, by Application:

- Handling

- Welding & Soldering

- Assembling & Disassembling

- Dispensing

- Processing

- Others

Market, by End Use Industry:

- Automotive

- Electrical & Electronics

- Metals & Machinery

- Plastics, Rubbers, & Chemicals

- Food & Beverages

- Precision Engineering & Optics

- Pharmaceuticals & Cosmetics

- Others

Industrial Robotics Market, by Region:

-

North America

- US

- Canada

- Mexico

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

-

APAC

- China

- Japan

- India

- South Korea

- Taiwan

- Rest of APAC

-

RoW

- Middle East

- South America

See Also:

- UK Industrial Robotics Market to Grow at a CAGR 35.9% from 2022 to 2027

- Germany Industrial Robotics Market to Grow at a CAGR 34.7% from 2022 to 2027

- France Industrial Robotics Market to Grow at a CAGR 37.2% from 2022 to 2027

- China Industrial Robotics Market to Grow at a CAGR 46.0% from 2022 to 2027

- Japan Industrial Robotics Market to Grow at a CAGR 45.5% from 2022 to 2027

- South Korea Industrial Robotics Market to Grow at a CAGR 44.5% from 2022 to 2027

Recent Developments

- In June 2022, ABB unveiled the next generation of flexible automation at Automatica 2022, launching two transformative products under the new OmniVance™ brand: the OmniVance™ FlexArc® Compact Cell and the OmniVance™ Machining Cell and Software.

- In June 2022, Epson introduced the GX Series SCARA Robots to deliver next-level performance and flexibility. The GX4 and GX8 SCARA robots offer high throughput, smooth motion control and heavy payloads with advanced Epson GYROPLUS technology. Offering multiple arm configurations, a 250-350 mm reach with the GX4 and a 450-650 mm reach with the GX8, the robots can achieve ultra-high precision with tasks including assembly, pick and place, and intricate small-parts handling processes.

- In January 2022, Yaskawa Electric Corporation acquired additional shares of Doolim-Yaskawa Co., Ltd., a Korean robotic painting and sealing system integrator, through Yaskawa Electric Korea Corporation. Yaskawa Electric and Yaskawa Korea have been working to establish a business in the robotic painting and sealing system market by leveraging synergies with Doolim-Yaskawa.

- In March 2022, FANUC introduced the new CRX-5iA, CRX-20iA/L and CRX-25iA collaborative robots. The latest CRX cobots complement FANUC’s existing line of CR and CRX cobots that now comprises 11 cobot model variations to handle products from 4 kg to 35 kg.

Frequently Asked Questions (FAQ):

How big industrial robotics market?

The industrial robotics market size is expected to reach USD 30.8 billion by 2027 from USD 15.7 billion in 2022 to grow at a CAGR of 14.3% from 2022 to 2027.

Which is the potential market for handling application in terms of the type?

Traditional robot is the type with high growth opportunities owing to advancements in material handling. Major companies that provide material handling applications are FANUC Corporation (FANUC (Japan)), ABB (Switzerland), Yaskawa Electric (Yaskawa (Japan)), among others.

What are the opportunities for new market entrants?

Factors such as increasing automation in electronics industry and emergence of Industry 5.0 are creating opportunities for the players in the market

Which application are expected to drive the growth of the market in the next six years?

Handling is expected to remain the major application driving significant demand for industrial robotics. the handling application is expected to hold the largest share of the industrial robotics market for collaborative industrial robots in 2021. Because collaborative robots are easy to program and can be taught movement through manual hand guiding, they are ideally suited for human-robot-collaboration (HRC) handling applications. The handling application segment of the industrial robotics market for traditional robots, in terms of shipment, shows a trend similar to that of the market; it is expected to account for the largest market size and highest growth rate in the forecast period owing to the integration of low-weight traditional industrial robots with automated guided vehicles (AGVs) to make them mobile.

What are some robot companies that started from scratch?

Yaskawa Electric Corporation, ABB, Mitsubishi Electric Corporation, are few of the companies that started from scratch (follow vertical integration). They offer both robots components such as drives, controller, motors, etc, along with their industrial robots.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 49)

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

FIGURE 1 INDUSTRIAL ROBOTICS MARKET SEGMENTATION

1.3.1 YEARS CONSIDERED

1.4 CURRENCY AND PRICING

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 54)

2.1 RESEARCH DATA

FIGURE 2 INDUSTRIAL ROBOTICS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Major secondary sources

2.1.1.2 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primaries

2.1.3 SECONDARY AND PRIMARY RESEARCH

2.1.3.1 Key industry insights

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1– BOTTOM-UP (DEMAND-SIDE): DEMAND FOR INDUSTRIAL ROBOTS IN US

FIGURE 4 INDUSTRIAL ROBOTICS MARKET: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (SUPPLY-SIDE): REVENUE GENERATED FROM PRODUCTS IN INDUSTRIAL ROBOTICS MARKET (EXCLUDING PRICES OF PERIPHERALS, SOFTWARE, AND SYSTEM ENGINEERING)

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (SUPPLY-SIDE): ILLUSTRATION OF REVENUE ESTIMATION FOR ONE COMPANY IN INDUSTRIAL ROBOTICS MARKET

FIGURE 7 INDUSTRIAL ROBOTICS MARKET: TOP-DOWN APPROACH

2.2.3 MARKET PROJECTION

TABLE 1 MARKET GROWTH ASSUMPTIONS

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

2.4.1 ASSUMPTIONS

2.5 LIMITATIONS

2.6 RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 69)

FIGURE 9 ARTICULATED ROBOTS TO DOMINATE TRADITIONAL INDUSTRIAL ROBOTICS MARKET, IN TERMS OF VOLUME, THROUGH FORECAST PERIOD

FIGURE 10 MARKET FOR 16.01–60.00 KG SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 11 TRADITIONAL INDUSTRIAL ROBOTICS MARKET FOR ROBOT ACCESSORIES EXPECTED TO GROW AT SIGNIFICANT RATE DURING FORECAST PERIOD

FIGURE 12 HANDLING APPLICATIONS TO HOLD LARGEST SHARE OF INDUSTRIAL ROBOTICS MARKET IN 2021

FIGURE 13 MARKET FOR FOOD & BEVERAGES INDUSTRY TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 14 ASIA PACIFIC ACCOUNTED FOR LARGEST MARKET SHARE IN 2021

4 PREMIUM INSIGHTS (Page No. - 74)

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN INDUSTRIAL ROBOTICS MARKET

FIGURE 15 ANTICIPATED SHORTAGE OF SKILLED LABOR IN MANUFACTURING INDUSTRY TO FUEL MARKET GROWTH

4.2 INDUSTRIAL ROBOTICS MARKET, BY TYPE

FIGURE 16 TRADITIONAL ROBOTS TO HOLD LARGER SHARE OF MARKET IN 2022

4.3 INDUSTRIAL ROBOTICS MARKET, BY APPLICATION

FIGURE 17 HANDLING APPLICATION TO ACCOUNT FOR LARGEST SHARE OF INDUSTRIAL ROBOTICS MARKET IN 2022

4.4 TRADITIONAL INDUSTRIAL ROBOTS MARKET IN ASIA PACIFIC, BY INDUSTRY V/S BY COUNTRY

FIGURE 18 AUTOMOTIVE INDUSTRY AND CHINA ESTIMATED TO HOLD LARGEST SHARES OF TRADITIONAL INDUSTRIAL ROBOTS MARKET IN 2022

4.5 INDUSTRIAL ROBOTICS MARKET, BY COUNTRY

FIGURE 19 CHINA TO HOLD LARGEST SHARE OF GLOBAL INDUSTRIAL ROBOTICS MARKET IN 2022

5 MARKET OVERVIEW (Page No. - 77)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 20 INDUSTRIAL ROBOTICS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Rising demand for collaborative robots across industries

FIGURE 21 INCREASED ADOPTION OF COLLABORATIVE ROBOTS EXPECTED DURING FORECAST PERIOD

5.2.1.2 Anticipated shortage of skilled labor in manufacturing industries

5.2.1.3 Growing adoption of Industry 4.0

FIGURE 22 DRIVERS FOR INDUSTRIAL ROBOTICS MARKET AND THEIR IMPACT

5.2.2 RESTRAINTS

5.2.2.1 High cost of deployment for SMEs

FIGURE 23 RESTRAINTS FOR INDUSTRIAL ROBOTICS MARKET AND THEIR IMPACT

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing automation in electronics industry

5.2.3.2 Emergence of Industry 5.0

FIGURE 24 OPPORTUNITIES FOR INDUSTRIAL ROBOTICS MARKET AND THEIR IMPACT

5.2.4 CHALLENGES

5.2.4.1 Interoperability and integration issues

5.2.4.2 Safety concerns related to industrial robotics systems

FIGURE 25 CHALLENGES FOR INDUSTRIAL ROBOTICS MARKET AND THEIR IMPACT

5.3 VALUE CHAIN ANALYSIS

FIGURE 26 VALUE CHAIN ANALYSIS: MAJOR VALUE ADDED TO INDUSTRIAL ROBOTICS MARKET

5.3.1 SUPPLY CHAIN PARTICIPANTS

5.3.1.1 OEMs

TABLE 2 INDUSTRIAL ROBOT OEMS

5.3.1.2 Suppliers

5.3.1.3 Robot integrators

5.3.1.4 Distributors

5.3.1.5 IT/Big data companies

5.3.1.6 Research centers

5.4 ECOSYSTEM/MARKET MAP

FIGURE 27 INDUSTRIAL ROBOTICS ECOSYSTEM

TABLE 3 COMPANIES AND THEIR ROLE IN INDUSTRIAL ROBOTICS ECOSYSTEM

5.5 PRICING ANALYSIS

5.5.1 AVERAGE SELLING PRICE (ASP) OF VARIOUS INDUSTRIAL ROBOTS

TABLE 4 AVERAGE SELLING PRICE OF VARIOUS INDUSTRIAL ROBOTS BASED ON PAYLOAD CAPACITY

FIGURE 28 AVERAGE SELLING PRICE OF KEY PLAYERS, BY PRODUCT

TABLE 5 AVERAGE SELLING PRICE OF KEY PLAYERS, BY PRODUCT (USD)

5.5.2 AVERAGE SELLING PRICE TREND

FIGURE 29 INDUSTRIAL ROBOTICS MARKET: AVERAGE PRICE BASED ON PAYLOAD CAPACITY

5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

5.6.1 REVENUE SHIFT & NEW REVENUE POCKETS FOR INDUSTRIAL ROBOTICS PROVIDERS

FIGURE 30 REVENUE SHIFT FOR INDUSTRIAL ROBOTICS MARKET

5.7 TECHNOLOGY ANALYSIS

5.7.1 KEY TECHNOLOGY TRENDS

5.7.1.1 Integration of industrial robots and vision systems

5.7.2 COMPLEMENTARY TECHNOLOGIES

5.7.2.1 Penetration of Industrial Internet of Things (IIoT) and AI in industrial manufacturing

5.7.2.2 Adoption of safety sensors in industrial robotics

5.7.3 ADJACENT TECHNOLOGIES

5.7.3.1 Introduction of 5G into industrial manufacturing

5.8 PORTER’S FIVE FORCES ANALYSIS

TABLE 6 IMPACT OF PORTER’S FIVE FORCES ON INDUSTRIAL ROBOTICS MARKET

FIGURE 31 PORTER’S FIVE FORCES ANALYSIS: INDUSTRIAL ROBOTICS MARKET

5.8.1 INTENSITY OF COMPETITIVE RIVALRY

5.8.2 BARGAINING POWER OF SUPPLIERS

5.8.3 BARGAINING POWER OF BUYERS

5.8.4 THREAT OF SUBSTITUTES

5.8.5 THREAT OF NEW ENTRANTS

5.9 KEY STAKEHOLDERS & BUYING CRITERIA

5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 32 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 END USE INDUSTRIES

TABLE 7 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 END USE INDUSTRIES (%)

5.9.2 BUYING CRITERIA

FIGURE 33 KEY BUYING CRITERIA FOR TOP 3 END USE INDUSTRIES

TABLE 8 KEY BUYING CRITERIA FOR TOP 3 END USE INDUSTRIES

5.10 CASE STUDY ANALYSIS

TABLE 9 USE OF HRC SAFETY SOLUTION ENHANCES PRODUCTIVITY

TABLE 10 ROBOTIC INTEGRATION PROJECT REDUCES TIME TO MARKET

TABLE 11 ABB ROBOT HELPS INCREASE PRODUCTION OF RESPIRATORY PROTECTION MASKS

TABLE 12 ROBOTICS TECHNOLOGY FACILITATES BULK PALLETIZING

TABLE 13 SCARA ROBOT ELIMINATES HUMAN ERROR AT PRODUCTION SITE

5.11 TRADE ANALYSIS AND TARIFF ANALYSIS

5.11.1 TRADE ANALYSIS

5.11.1.1 Trade data for HS code 847950

FIGURE 34 IMPORT DATA, BY COUNTRY, 2017−2021 (USD BILLION)

FIGURE 35 EXPORT DATA, BY COUNTRY, 2017−2021 (USD BILLION)

5.11.2 TARIFF ANALYSIS

TABLE 14 TARIFF FOR INDUSTRIAL ROBOTS EXPORTED BY US, 2021

TABLE 15 TARIFF FOR INDUSTRIAL ROBOTS EXPORTED BY CHINA, 2021

5.12 PATENT ANALYSIS

FIGURE 36 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

TABLE 16 TOP 20 PATENT OWNERS IN LAST 10 YEARS

FIGURE 37 NUMBER OF PATENTS GRANTED PER YEAR, 2012−2022

5.12.1 MAJOR PATENTS

TABLE 17 MAJOR PATENTS IN INDUSTRIAL ROBOTICS MARKET

5.13 KEY CONFERENCES AND EVENTS, 2022–2023

TABLE 18 INDUSTRIAL ROBOTICS MARKET: CONFERENCES AND EVENTS

5.14 REGULATORY LANDSCAPE

5.14.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS RELATED TO INDUSTRIAL ROBOTICS

TABLE 19 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 20 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 21 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 22 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.14.2 STANDARDS AND REGULATIONS RELATED TO INDUSTRIAL ROBOTICS

TABLE 23 NORTH AMERICA: SAFETY STANDARDS FOR INDUSTRIAL ROBOTICS MARKET

TABLE 24 EUROPE: SAFETY STANDARDS FOR INDUSTRIAL ROBOTICS MARKET

TABLE 25 ASIA PACIFIC: SAFETY STANDARDS FOR INDUSTRIAL ROBOTICS MARKET

TABLE 26 ROW: SAFETY STANDARDS FOR INDUSTRIAL ROBOTICS MARKET

6 INDUSTRIAL ROBOTICS MARKET, BY TYPE (Page No. - 115)

6.1 INTRODUCTION

FIGURE 38 MARKET FOR COLLABORATIVE ROBOTS TO RECORD HIGHER CAGR DURING FORECAST PERIOD

TABLE 27 INDUSTRIAL ROBOTICS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 28 INDUSTRIAL ROBOTICS MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 29 INDUSTRIAL ROBOTICS MARKET, BY TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 30 INDUSTRIAL ROBOTICS MARKET, BY TYPE, 2022–2027 (THOUSAND UNITS)

6.2 TRADITIONAL INDUSTRIAL ROBOTS

FIGURE 39 MARKET FOR ARTICULATED ROBOTS TO REGISTER LARGEST SHIPMENT IN 2022

TABLE 31 INDUSTRIAL ROBOTS MARKET FOR TRADITIONAL ROBOTS, BY TYPE, 2018–2021 (USD MILLION)

TABLE 32 INDUSTRIAL ROBOTS MARKET FOR TRADITIONAL ROBOTS, BY TYPE, 2022–2027 (USD MILLION)

TABLE 33 INDUSTRIAL ROBOTS MARKET FOR TRADITIONAL ROBOTS, BY TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 34 INDUSTRIAL ROBOTS MARKET FOR TRADITIONAL ROBOTS, BY TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 35 INDUSTRIAL ROBOTICS MARKET FOR TRADITIONAL ROBOTS, BY TYPE, 2018–2021 (USD MILLION)

TABLE 36 INDUSTRIAL ROBOTICS MARKET FOR TRADITIONAL ROBOTS, BY TYPE, 2022–2027 (USD MILLION)

6.2.1 ARTICULATED ROBOTS

6.2.1.1 Expected to hold largest share of industrial robotics market during forecast period

FIGURE 40 REPRESENTATION OF 6-AXIS ARTICULATED ROBOT

TABLE 37 ARTICULATED ROBOTS: SUMMARY

FIGURE 41 ARTICULATED ROBOTS MARKET FOR PHARMACEUTICALS & COSMETICS INDUSTRY TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

TABLE 38 INDUSTRIAL ROBOTS MARKET FOR ARTICULATED ROBOTS, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 39 INDUSTRIAL ROBOTS MARKET FOR ARTICULATED ROBOTS, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 40 INDUSTRIAL ROBOTS MARKET FOR ARTICULATED ROBOTS, BY APPLICATION, 2018–2021 (THOUSAND UNITS)

TABLE 41 INDUSTRIAL ROBOTS MARKET FOR ARTICULATED ROBOTS, BY APPLICATION, 2022–2027 (THOUSAND UNITS)

TABLE 42 INDUSTRIAL ROBOTICS MARKET FOR ARTICULATED ROBOTS, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 43 INDUSTRIAL ROBOTICS MARKET FOR ARTICULATED ROBOTS, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 44 INDUSTRIAL ROBOTS MARKET FOR ARTICULATED ROBOTS, BY END USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 45 INDUSTRIAL ROBOTS MARKET FOR ARTICULATED ROBOTS, BY END USE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 46 INDUSTRIAL ROBOTS MARKET FOR ARTICULATED ROBOTS, BY END USE INDUSTRY, 2018–2021(THOUSAND UNITS)

TABLE 47 INDUSTRIAL ROBOTS MARKET FOR ARTICULATED ROBOTS, BY END USE INDUSTRY, 2022–2027(THOUSAND UNITS)

TABLE 48 INDUSTRIAL ROBOTICS MARKET FOR ARTICULATED ROBOTS, BY END USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 49 INDUSTRIAL ROBOTICS MARKET FOR ARTICULATED ROBOTS, BY END USE INDUSTRY, 2022–2027 (USD MILLION)

6.2.2 SCARA ROBOTS

6.2.2.1 Projected to witness highest growth during forecast period

FIGURE 42 REPRESENTATION OF 4-AXIS SCARA ROBOT

TABLE 50 SCARA ROBOTS: SUMMARY

FIGURE 43 SCARA ROBOTS TO BE PRIMARILY SHIPPED FOR HANDLING APPLICATIONS DURING FORECAST PERIOD

TABLE 51 INDUSTRIAL ROBOTS MARKET FOR SCARA ROBOTS, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 52 INDUSTRIAL ROBOTS MARKET FOR SCARA ROBOTS, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 53 INDUSTRIAL ROBOTS MARKET FOR SCARA ROBOTS, BY APPLICATION, 2018–2021 (THOUSAND UNITS)

TABLE 54 INDUSTRIAL ROBOTS MARKET FOR SCARA ROBOTS, BY APPLICATION, 2022–2027 (THOUSAND UNITS)

TABLE 55 INDUSTRIAL ROBOTICS MARKET FOR SCARA ROBOTS, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 56 INDUSTRIAL ROBOTICS MARKET FOR SCARA ROBOTS, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 57 INDUSTRIAL ROBOTS MARKET FOR SCARA ROBOTS, BY END USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 58 INDUSTRIAL ROBOTS MARKET FOR SCARA ROBOTS, BY END USE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 59 INDUSTRIAL ROBOTS MARKET FOR SCARA ROBOTS, BY END USE INDUSTRY, 2018–2021 (THOUSAND UNITS)

TABLE 60 INDUSTRIAL ROBOTS MARKET FOR SCARA ROBOTS, BY END USE INDUSTRY, 2022–2027 (THOUSAND UNITS)

TABLE 61 INDUSTRIAL ROBOTICS MARKET FOR SCARA ROBOTS, BY END USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 62 INDUSTRIAL ROBOTICS MARKET FOR SCARA ROBOTS, BY END USE INDUSTRY, 2022–2027 (USD MILLION)

6.2.3 PARALLEL ROBOTS

6.2.3.1 Ideal for moving small payloads at very high speeds

FIGURE 44 REPRESENTATION OF PARALLEL ROBOT

TABLE 63 PARALLEL ROBOTS: SUMMARY

FIGURE 45 PARALLEL ROBOTS MARKET FOR PRECISION ENGINEERING & OPTICS INDUSTRY TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

TABLE 64 INDUSTRIAL ROBOTS MARKET FOR PARALLEL ROBOTS, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 65 INDUSTRIAL ROBOTS MARKET FOR PARALLEL ROBOTS, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 66 INDUSTRIAL ROBOTS MARKET FOR PARALLEL ROBOTS, BY APPLICATION, 2018–2021 (THOUSAND UNITS)

TABLE 67 INDUSTRIAL ROBOTS MARKET FOR PARALLEL ROBOTS, BY APPLICATION, 2022–2027 (THOUSAND UNITS)

TABLE 68 INDUSTRIAL ROBOTICS MARKET FOR PARALLEL ROBOTS, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 69 INDUSTRIAL ROBOTICS MARKET FOR PARALLEL ROBOTS, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 70 INDUSTRIAL ROBOTS MARKET FOR PARALLEL ROBOTS, BY END USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 71 INDUSTRIAL ROBOTS MARKET FOR PARALLEL ROBOTS, BY END USE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 72 INDUSTRIAL ROBOTS MARKET FOR PARALLEL ROBOTS, BY END USE INDUSTRY, 2018–2021 (THOUSAND UNITS)

TABLE 73 INDUSTRIAL ROBOTS MARKET FOR PARALLEL ROBOTS, BY END USE INDUSTRY, 2022–2027 (THOUSAND UNITS)

TABLE 74 INDUSTRIAL ROBOTICS MARKET FOR PARALLEL ROBOTS, BY END USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 75 INDUSTRIAL ROBOTICS MARKET FOR PARALLEL ROBOTS, BY END USE INDUSTRY, 2022–2027 (USD MILLION)

6.2.4 CARTESIAN ROBOTS

6.2.4.1 Simple movements and ease of programmability

FIGURE 46 REPRESENTATION OF CARTESIAN ROBOT

TABLE 76 CARTESIAN ROBOTS: SUMMARY

FIGURE 47 PROCESSING APPLICATION TO WITNESS HIGHEST CAGR IN CARTESIAN ROBOTS MARKET DURING FORECAST PERIOD

TABLE 77 INDUSTRIAL ROBOTS MARKET FOR CARTESIAN ROBOTS, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 78 INDUSTRIAL ROBOTS MARKET FOR CARTESIAN ROBOTS, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 79 INDUSTRIAL ROBOTS MARKET FOR CARTESIAN ROBOTS, BY APPLICATION, 2018–2021 (THOUSAND UNITS)

TABLE 80 INDUSTRIAL ROBOTS MARKET FOR CARTESIAN ROBOTS, BY APPLICATION, 2022–2027 (THOUSAND UNITS)

TABLE 81 INDUSTRIAL ROBOTICS MARKET FOR CARTESIAN ROBOTS, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 82 INDUSTRIAL ROBOTICS MARKET FOR CARTESIAN ROBOTS, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 83 INDUSTRIAL ROBOTS MARKET FOR CARTESIAN ROBOTS, BY END USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 84 INDUSTRIAL ROBOTS MARKET FOR CARTESIAN ROBOTS, BY END USE INDUSTRY, 2022–2027(USD MILLION)

TABLE 85 INDUSTRIAL ROBOTS MARKET FOR CARTESIAN ROBOTS, BY END USE INDUSTRY, 2018–2021 (THOUSAND UNITS)

TABLE 86 INDUSTRIAL ROBOTS MARKET FOR CARTESIAN ROBOTS, BY END USE INDUSTRY, 2022–2027 (THOUSAND UNITS)

TABLE 87 INDUSTRIAL ROBOTICS MARKET FOR CARTESIAN ROBOTS, BY END USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 88 INDUSTRIAL ROBOTICS MARKET FOR CARTESIAN ROBOTS, BY END USE INDUSTRY, 2022–2027(USD MILLION)

6.2.5 OTHERS

6.2.5.1 Cylindrical robots

6.2.5.1.1 Offer reduced repeatability and accuracy

TABLE 89 CYLINDRICAL ROBOTS: SUMMARY

6.2.5.2 Spherical robots

6.2.5.2.1 Forerunners of modern articulated industrial robots

TABLE 90 SPHERICAL ROBOTS: SUMMARY

6.2.5.3 Swing-arm robots

6.2.5.3.1 Simple operation suited to low-cost applications

TABLE 91 SWING-ARM ROBOTS: SUMMARY

FIGURE 48 OTHER ROBOTS TO BE PRIMARILY ADOPTED FOR HANDLING APPLICATIONS DURING FORECAST PERIOD

TABLE 92 INDUSTRIAL ROBOTS MARKET FOR OTHER ROBOTS, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 93 INDUSTRIAL ROBOTS MARKET FOR OTHER ROBOTS, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 94 INDUSTRIAL ROBOTS MARKET FOR OTHER ROBOTS, BY APPLICATION, 2018–2021 (THOUSAND UNITS)

TABLE 95 INDUSTRIAL ROBOTS MARKET FOR OTHER ROBOTS, BY APPLICATION, 2022–2027 (THOUSAND UNITS)

TABLE 96 INDUSTRIAL ROBOTICS MARKET FOR OTHER ROBOTS, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 97 INDUSTRIAL ROBOTICS MARKET FOR OTHER ROBOTS, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 98 INDUSTRIAL ROBOTS MARKET FOR OTHER ROBOTS, BY END USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 99 INDUSTRIAL ROBOTS MARKET FOR OTHER ROBOTS, BY END USE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 100 INDUSTRIAL ROBOTS MARKET FOR OTHER ROBOTS, BY END USE INDUSTRY, 2018–2021 (THOUSAND UNITS)

TABLE 101 INDUSTRIAL ROBOTS MARKET FOR OTHER ROBOTS, BY END USE INDUSTRY, 2022–2027 (THOUSAND UNITS)

TABLE 102 INDUSTRIAL ROBOTICS MARKET FOR OTHER ROBOTS, BY END USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 103 INDUSTRIAL ROBOTICS MARKET FOR OTHER ROBOTS, BY END USE INDUSTRY, 2022–2027 (USD MILLION)

6.3 COLLABORATIVE INDUSTRIAL ROBOTS

6.3.1 HUGE POTENTIAL DUE TO ABILITY TO WORK SAFELY ALONGSIDE HUMANS

TABLE 104 COLLABORATIVE INDUSTRIAL ROBOTS: SUMMARY

TABLE 105 INDUSTRIAL ROBOTS MARKET FOR COLLABORATIVE ROBOTS, BY VALUE AND VOLUME, 2018–2021

TABLE 106 INDUSTRIAL ROBOTS MARKET FOR COLLABORATIVE ROBOTS, BY VALUE AND VOLUME, 2022–2027

7 INDUSTRIAL ROBOTICS MARKET, BY PAYLOAD (Page No. - 159)

7.1 INTRODUCTION

FIGURE 49 INDUSTRIAL ROBOTS WITH PAYLOAD RANGE OF 16.01 KG–60.00 KG TO WITNESS HIGHEST GROWTH RATE DURING FORECAST PERIOD

TABLE 107 INDUSTRIAL ROBOTS MARKET, BY PAYLOAD, 2018–2021 (USD MILLION)

TABLE 108 INDUSTRIAL ROBOTS MARKET, BY PAYLOAD, 2022–2027 (USD MILLION)

TABLE 109 INDUSTRIAL ROBOTS MARKET, BY PAYLOAD, 2018–2021 (THOUSAND UNITS)

TABLE 110 INDUSTRIAL ROBOTS MARKET, BY PAYLOAD, 2022–2027 (THOUSAND UNITS)

7.2 UP TO 16.00 KG

7.2.1 EXPECTED TO HOLD LARGEST MARKET SHARE IN 2022

TABLE 111 TYPES OF INDUSTRIAL ROBOTS WITH UP TO 16.OO KG PAYLOAD CAPACITY

7.3 16.01–60.00 KG

7.3.1 FASTEST GROWTH RATE EXPECTED DURING FORECAST PERIOD

TABLE 112 TYPES OF INDUSTRIAL ROBOTS WITH 16.01–60.00 KG PAYLOAD CAPACITY

7.4 60.01–225.00 KG

7.4.1 AUTOMOTIVE AND FOOD & BEVERAGES INDUSTRIES TO DRIVE MARKET

TABLE 113 TYPES OF INDUSTRIAL ROBOTS WITH 60.01–225.00 KG PAYLOAD CAPACITY

7.5 MORE THAN 225.00 KG

7.5.1 INCREASING ADOPTION ACROSS INDUSTRIES EXPECTED TO DRIVE MARKET

TABLE 114 TYPES OF INDUSTRIAL ROBOTS WITH MORE THAN 225.00 KG PAYLOAD CAPACITY

8 INDUSTRIAL ROBOTICS MARKET, BY COMPONENT (Page No. - 165)

8.1 INTRODUCTION

FIGURE 50 ROBOT ACCESSORIES MARKET TO WITNESS HIGHEST GROWTH RATE DURING FORECAST PERIOD

TABLE 115 TRADITIONAL INDUSTRIAL ROBOTICS MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 116 INDUSTRIAL ROBOTICS MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

8.2 ROBOT ARMS

8.2.1 INCREASING FOCUS OF MARKET PLAYERS ON DEVELOPMENT OF ROBOT ARMS

8.3 ROBOT ACCESSORIES

8.3.1 RISING DEMAND TO FACILITATE LONG-TERM PRODUCTIVITY

8.3.2 END EFFECTOR

8.3.2.1 Growth in welding and painting applications to increase demand

8.3.2.2 Welding gun

8.3.2.2.1 Suited to high-volume production applications

8.3.2.3 Gripper

8.3.2.3.1 Safe option for collaborative applications

8.3.2.3.2 Mechanical

8.3.2.3.2.1 Popular across industries due to cost-effectiveness

8.3.2.3.3 Electric

8.3.2.3.3.1 Effective alternative to pneumatic grippers

8.3.2.3.4 Magnetic

8.3.2.3.4.1 Designed to handle ferromagnetic materials

TABLE 117 COMPARISON OF MECHANICAL, ELECTRIC, AND MAGNETIC GRIPPERS

8.3.2.4 Tool changer

8.3.2.4.1 Acts as locking mechanism between robot arm and tooling component

8.3.2.5 Clamp

8.3.2.5.1 Used in applications requiring low grip force

8.3.2.6 Suction cup

8.3.2.6.1 Inexpensive and versatile end effector

8.3.2.7 Others

8.3.2.7.1 Deburring tools

8.3.2.7.2 Milling tools

8.3.2.7.3 Soldering tools

8.3.2.7.4 Painting tools

8.3.2.7.5 Screwdrivers

8.3.3 CONTROLLER

8.3.3.1 Functions as brain of industrial robotic arm

8.3.4 DRIVE UNITS

8.3.4.1 Facilitate movement in robots

8.3.4.2 Hydraulic drive

8.3.4.2.1 Suited to applications requiring handling of heavy loads

8.3.4.3 Electric drive

8.3.4.3.1 Provides high speed and precision

8.3.4.4 Pneumatic drive

8.3.4.4.1 Designed to handle small to medium loads

8.3.5 VISION SYSTEMS

8.3.5.1 Provide vision-based guidance to industrial robotics systems

8.3.6 SENSORS

8.3.6.1 Feedback mechanism for industrial robots

8.3.7 POWER SUPPLY

8.3.7.1 Enables operations in industrial robotics systems

8.3.8 OTHERS

8.4 ADDITIONAL HARDWARE

8.4.1 SAFETY FENCING

8.4.1.1 Protective barrier between industrial robots and humans to prevent accidents

8.4.2 FIXTURES

8.4.2.1 Special-purpose tools to enhance functioning of industrial robots

8.4.3 CONVEYORS

8.4.3.1 Used with industrial robots to facilitate pick-and-place operations

8.5 SYSTEM ENGINEERING

8.5.1 FACILITATES INSTALLATION OF ROBOTIC SYSTEM INTO INDUSTRIAL ENVIRONMENT

8.6 SOFTWARE & PROGRAMMING

8.6.1 INVOLVES INSTALLATION OF DEDICATED SOFTWARE FOR INDUSTRIAL ROBOTICS APPLICATIONS

9 INDUSTRIAL ROBOTICS MARKET, BY APPLICATION (Page No. - 179)

9.1 INTRODUCTION

FIGURE 51 HANDLING APPLICATION TO HOLD LARGEST SHARE OF INDUSTRIAL ROBOTS MARKET IN 2027

TABLE 118 INDUSTRIAL ROBOTS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 119 INDUSTRIAL ROBOTS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 120 INDUSTRIAL ROBOTS MARKET, BY APPLICATION, 2018–2021 (THOUSAND UNITS)

TABLE 121 INDUSTRIAL ROBOTS MARKET, BY APPLICATION, 2022–2027 (THOUSAND UNITS)

TABLE 122 INDUSTRIAL ROBOTS MARKET FOR TRADITIONAL ROBOTS, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 123 INDUSTRIAL ROBOTS MARKET FOR TRADITIONAL ROBOTS, BY APPLICATION, 2022–2027 (USD MILLION)

FIGURE 52 HANDLING APPLICATION TO HOLD LARGEST SIZE OF TRADITIONAL INDUSTRIAL ROBOTS MARKET IN 2027

TABLE 124 INDUSTRIAL ROBOTS MARKET FOR TRADITIONAL ROBOTS, BY APPLICATION, 2018–2021 (THOUSAND UNITS)

TABLE 125 INDUSTRIAL ROBOTS MARKET FOR TRADITIONAL ROBOTS, BY APPLICATION, 2022–2027 (THOUSAND UNITS)

FIGURE 53 HANDLING APPLICATION TO HOLD LARGEST SIZE OF COLLABORATIVE INDUSTRIAL ROBOTS MARKET IN 2027

TABLE 126 INDUSTRIAL ROBOTS MARKET FOR COLLABORATIVE ROBOTS, BY APPLICATION 2018–2021 (USD MILLION)

TABLE 127 INDUSTRIAL ROBOTS MARKET FOR COLLABORATIVE ROBOTS, BY APPLICATION 2022–2027 (USD MILLION)

TABLE 128 INDUSTRIAL ROBOTS MARKET FOR COLLABORATIVE ROBOTS, BY APPLICATION, 2018–2021 (THOUSAND UNITS)

TABLE 129 INDUSTRIAL ROBOTS MARKET FOR COLLABORATIVE ROBOTS, BY APPLICATION, 2022–2027 (THOUSAND UNITS)

9.2 HANDLING

9.2.1 INCREASING DEMAND FOR PALLETIZING ROBOTS

TABLE 130 COMPANIES OFFERING INDUSTRIAL ROBOTS FOR HANDLING APPLICATION

TABLE 131 INDUSTRIAL ROBOTS MARKET FOR HANDLING APPLICATION, BY ROBOT TYPE, 2018–2021 (USD MILLION)

TABLE 132 INDUSTRIAL ROBOTS MARKET FOR HANDLING APPLICATION, BY ROBOT TYPE, 2022–2027 (USD MILLION)

TABLE 133 INDUSTRIAL ROBOTS MARKET FOR HANDLING APPLICATION, BY ROBOT TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 134 INDUSTRIAL ROBOTS MARKET FOR HANDLING APPLICATION, BY ROBOT TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 135 INDUSTRIAL ROBOTS MARKET FOR HANDLING APPLICATION, BY TRADITIONAL ROBOT TYPE, 2018–2021 (USD MILLION)

TABLE 136 INDUSTRIAL ROBOTS MARKET FOR HANDLING APPLICATION, BY TRADITIONAL ROBOT TYPE, 2022–2027 (USD MILLION)

TABLE 137 INDUSTRIAL ROBOTS MARKET FOR HANDLING APPLICATION, BY TRADITIONAL ROBOT TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 138 INDUSTRIAL ROBOTS MARKET FOR HANDLING APPLICATION, BY TRADITIONAL ROBOT TYPE, 2022–2027 (THOUSAND UNITS)

9.3 ASSEMBLING & DISASSEMBLING

9.3.1 INCREASING DEMAND FOR ROBOTS OFFERING SPEED AND PRECISION

TABLE 139 COMPANIES OFFERING INDUSTRIAL ROBOTS FOR ASSEMBLING & DISASSEMBLING APPLICATION

TABLE 140 INDUSTRIAL ROBOTS MARKET FOR ASSEMBLING & DISASSEMBLING APPLICATION, BY ROBOT TYPE, 2018–2021 (USD MILLION)

TABLE 141 INDUSTRIAL ROBOTS MARKET FOR ASSEMBLING & DISASSEMBLING APPLICATION, BY ROBOT TYPE, 2022–2027 (USD MILLION)

TABLE 142 INDUSTRIAL ROBOTS MARKET FOR ASSEMBLING & DISASSEMBLING APPLICATION, BY ROBOT TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 143 INDUSTRIAL ROBOTS MARKET FOR ASSEMBLING & DISASSEMBLING APPLICATION, BY ROBOT TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 144 INDUSTRIAL ROBOTS MARKET FOR ASSEMBLING & DISASSEMBLING APPLICATION, BY TRADITIONAL ROBOT TYPE, 2018–2021 (USD MILLION)

TABLE 145 INDUSTRIAL ROBOTS MARKET FOR ASSEMBLING & DISASSEMBLING APPLICATION, BY TRADITIONAL ROBOT TYPE, 2022–2027 (USD MILLION)

TABLE 146 INDUSTRIAL ROBOTS MARKET FOR ASSEMBLING & DISASSEMBLING APPLICATION, BY TRADITIONAL ROBOT TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 147 INDUSTRIAL ROBOTS MARKET FOR ASSEMBLING & DISASSEMBLING APPLICATION, BY TRADITIONAL ROBOT TYPE, 2022–2027 (THOUSAND UNITS)

9.4 WELDING & SOLDERING

9.4.1 RISING DEMAND FOR ROBOTS WITH HOLLOW WRISTS

TABLE 148 COMPANIES OFFERING INDUSTRIAL ROBOTS FOR WELDING & SOLDERING APPLICATION

TABLE 149 INDUSTRIAL ROBOTS MARKET FOR WELDING & SOLDERING APPLICATION, BY ROBOT TYPE, 2018–2021 (USD MILLION)

TABLE 150 INDUSTRIAL ROBOTS MARKET FOR WELDING & SOLDERING APPLICATION, BY ROBOT TYPE, 2022–2027 (USD MILLION)

TABLE 151 INDUSTRIAL ROBOTS MARKET FOR WELDING & SOLDERING APPLICATION, BY ROBOT TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 152 INDUSTRIAL ROBOTS MARKET FOR WELDING & SOLDERING APPLICATION, BY ROBOT TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 153 INDUSTRIAL ROBOTS MARKET FOR WELDING & SOLDERING APPLICATION, BY TRADITIONAL ROBOT TYPE, 2018–2021 (USD MILLION)

TABLE 154 INDUSTRIAL ROBOTS MARKET FOR WELDING & SOLDERING APPLICATION, BY TRADITIONAL ROBOT TYPE, 2022–2027 (USD MILLION)

TABLE 155 INDUSTRIAL ROBOTS MARKET FOR WELDING & SOLDIERING APPLICATION, BY TRADITIONAL ROBOT TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 156 INDUSTRIAL ROBOTS MARKET FOR WELDING & SOLDIERING APPLICATION, BY TRADITIONAL ROBOT TYPE, 2022–2027 (THOUSAND UNITS)

9.5 DISPENSING

TABLE 157 COMPANIES OFFERING INDUSTRIAL ROBOTS FOR DISPENSING APPLICATION

9.5.1 GLUING

9.5.1.1 Demand for highly precise adhesive dispensers from automotive and electronics industries

9.5.2 PAINTING

9.5.2.1 Need for explosion- and contamination-proof robots

9.5.3 FOOD DISPENSING

9.5.3.1 Recent technological advances to result in rising use of robots in food processing

TABLE 158 INDUSTRIAL ROBOTS MARKET FOR DISPENSING APPLICATION, BY ROBOT TYPE, 2018–2021 (USD MILLION)

TABLE 159 INDUSTRIAL ROBOTS MARKET FOR DISPENSING APPLICATION, BY ROBOT TYPE, 2022–2027 (USD MILLION)

TABLE 160 INDUSTRIAL ROBOTS MARKET FOR DISPENSING APPLICATION, BY ROBOT TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 161 INDUSTRIAL ROBOTS MARKET FOR DISPENSING APPLICATION, BY ROBOT TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 162 INDUSTRIAL ROBOTS MARKET FOR DISPENSING APPLICATION, BY TRADITIONAL ROBOT TYPE, 2018–2021 (USD MILLION)

TABLE 163 INDUSTRIAL ROBOTS MARKET FOR DISPENSING APPLICATION, BY TRADITIONAL ROBOT TYPE, 2022–2027 (USD MILLION)

TABLE 164 INDUSTRIAL ROBOTS MARKET FOR DISPENSING APPLICATION, BY TRADITIONAL ROBOT TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 165 INDUSTRIAL ROBOTS MARKET FOR DISPENSING APPLICATION, BY TRADITIONAL ROBOT TYPE, 2022–2027 (THOUSAND UNITS)

9.6 PROCESSING

TABLE 166 COMPANIES OFFERING INDUSTRIAL ROBOTS FOR PROCESSING APPLICATION

9.6.1 GRINDING AND POLISHING

9.6.1.1 Need for automated grinding and polishing for consistent finish

9.6.2 MILLING

9.6.2.1 Growing adoption of robotic milling for large workpieces

9.6.3 CUTTING

9.6.3.1 Suited to applications in various industries

TABLE 167 INDUSTRIAL ROBOTS MARKET FOR PROCESSING APPLICATION, BY ROBOT TYPE, 2018–2021 (USD MILLION)

TABLE 168 INDUSTRIAL ROBOTS MARKET FOR PROCESSING APPLICATION, BY ROBOT TYPE, 2022–2027 (USD MILLION)

TABLE 169 INDUSTRIAL ROBOTS MARKET FOR PROCESSING APPLICATION, BY ROBOT TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 170 INDUSTRIAL ROBOTS MARKET FOR PROCESSING APPLICATION, BY ROBOT TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 171 INDUSTRIAL ROBOTS MARKET FOR PROCESSING APPLICATION, BY TRADITIONAL ROBOT TYPE, 2018–2021 (USD MILLION)

TABLE 172 INDUSTRIAL ROBOTS MARKET FOR PROCESSING APPLICATION, BY TRADITIONAL ROBOT TYPE, 2022–2027 (USD MILLION)

TABLE 173 INDUSTRIAL ROBOTS MARKET FOR PROCESSING APPLICATION, BY TRADITIONAL ROBOT TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 174 INDUSTRIAL ROBOTS MARKET FOR PROCESSING APPLICATION, BY TRADITIONAL ROBOT TYPE, 2022–2027 (THOUSAND UNITS)

9.7 OTHERS

TABLE 175 COMPANIES OFFERING INDUSTRIAL ROBOTS FOR OTHER APPLICATIONS

9.7.1 INSPECTION & QUALITY TESTING

9.7.1.1 Automated inspection enhances repeatability of inspection procedures

9.7.2 DIE-CASTING & MOLDING

9.7.2.1 Use of foundry and forging robots for die-casting & molding applications

TABLE 176 INDUSTRIAL ROBOTS MARKET FOR OTHER APPLICATIONS, BY ROBOT TYPE, 2018–2021 (USD MILLION)

TABLE 177 INDUSTRIAL ROBOTS MARKET FOR OTHER APPLICATIONS, BY ROBOT TYPE, 2022–2027 (USD MILLION)

TABLE 178 INDUSTRIAL ROBOTS MARKET FOR OTHER APPLICATIONS, BY ROBOT TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 179 INDUSTRIAL ROBOTS MARKET FOR OTHER APPLICATIONS, BY ROBOT TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 180 INDUSTRIAL ROBOTS MARKET FOR OTHER APPLICATIONS, BY TRADITIONAL ROBOTS TYPE, 2018–2021 (USD MILLION)

TABLE 181 INDUSTRIAL ROBOTS MARKET FOR OTHER APPLICATIONS, BY TRADITIONAL ROBOTS TYPE, 2022–2027 (USD MILLION)

TABLE 182 INDUSTRIAL ROBOTS MARKET FOR OTHER APPLICATIONS, BY TRADITIONAL ROBOTS TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 183 INDUSTRIAL ROBOTS MARKET FOR OTHER APPLICATIONS, BY TRADITIONAL ROBOTS TYPE, 2022–2027 (THOUSAND UNITS)

10 INDUSTRIAL ROBOTICS MARKET, BY END USE INDUSTRY (Page No. - 210)

10.1 INTRODUCTION

FIGURE 54 AUTOMOTIVE INDUSTRY TO ACCOUNT FOR LARGEST SIZE OF INDUSTRIAL ROBOTICS MARKET DURING FORECAST PERIOD

TABLE 184 INDUSTRIAL ROBOTS MARKET, BY END USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 185 INDUSTRIAL ROBOTS MARKET, BY END USE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 186 INDUSTRIAL ROBOTS MARKET, BY END USE INDUSTRY, 2018–2021 (THOUSAND UNITS)

TABLE 187 INDUSTRIAL ROBOTS MARKET, BY END USE INDUSTRY, 2022–2027 (THOUSAND UNITS)

FIGURE 55 AUTOMOTIVE TO ACCOUNT FOR LARGEST SIZE OF TRADITIONAL INDUSTRIAL ROBOTS MARKET DURING FORECAST PERIOD

TABLE 188 INDUSTRIAL ROBOTS MARKET FOR TRADITIONAL INDUSTRIAL ROBOTS, BY END USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 189 INDUSTRIAL ROBOTS MARKET FOR TRADITIONAL INDUSTRIAL ROBOTS, BY END USE INDUSTRY, 2022–2027(USD MILLION)

TABLE 190 INDUSTRIAL ROBOTS MARKET FOR TRADITIONAL INDUSTRIAL ROBOTS, BY END USE INDUSTRY, 2018–2021 (THOUSAND UNITS)

TABLE 191 INDUSTRIAL ROBOTS MARKET FOR TRADITIONAL INDUSTRIAL ROBOTS, BY END USE INDUSTRY, 2022–2027 (THOUSAND UNITS)

FIGURE 56 PRECISION ENGINEERING & OPTICS INDUSTRY TO RECORD HIGHEST CAGR IN COLLABORATIVE ROBOTS MARKET DURING FORECAST PERIOD

TABLE 192 INDUSTRIAL ROBOTS MARKET FOR COLLABORATIVE ROBOTS, BY END USE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 193 INDUSTRIAL ROBOTS MARKET FOR COLLABORATIVE ROBOTS, BY END USE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 194 INDUSTRIAL ROBOTS MARKET FOR COLLABORATIVE ROBOTS, BY END USE INDUSTRY, 2018–2021 (THOUSAND UNITS)

TABLE 195 INDUSTRIAL ROBOTS MARKET FOR COLLABORATIVE ROBOTS, BY END USE INDUSTRY, 2022–2027 (THOUSAND UNITS)

10.2 AUTOMOTIVE

10.2.1 ACCOUNTED FOR LARGEST SHARE OF INDUSTRIAL ROBOTICS MARKET IN 2021

FIGURE 57 AUTOMOTIVE INDUSTRY IN ASIA PACIFIC TO MAINTAIN LARGEST SHARE DURING FORECAST PERIODC

TABLE 196 TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR AUTOMOTIVE INDUSTRY, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 197 TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR AUTOMOTIVE INDUSTRY, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 198 TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR AUTOMOTIVE INDUSTRY IN NORTH AMERICA, BY COUNTRY, 2018–2021 (THOUSAND UNITS)

TABLE 199 TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR AUTOMOTIVE INDUSTRY IN NORTH AMERICA, BY COUNTRY, 2022–2027 (THOUSAND UNITS)

TABLE 200 TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR AUTOMOTIVE INDUSTRY IN EUROPE, BY COUNTRY, 2018–2021 (THOUSAND UNITS)

TABLE 201 TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR AUTOMOTIVE INDUSTRY IN EUROPE, BY COUNTRY, 2022–2027 (THOUSAND UNITS)

TABLE 202 TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR AUTOMOTIVE INDUSTRY IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (THOUSAND UNITS)

TABLE 203 TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR AUTOMOTIVE INDUSTRY IN ASIA PACIFIC, BY COUNTRY, 2022–2027 (THOUSAND UNITS)

TABLE 204 TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR AUTOMOTIVE INDUSTRY IN ROW, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 205 TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR AUTOMOTIVE INDUSTRY IN ROW, BY REGION, 2022–2027 (THOUSAND UNITS)

10.3 ELECTRICAL & ELECTRONICS

10.3.1 EXTENSIVE USE OF SCARA ROBOTS FOR HANDLING APPLICATIONS

FIGURE 58 MARKET FOR ELECTRICAL & ELECTRONICS INDUSTRY IN ASIA PACIFIC TO RECORD HIGHEST CAGR, IN TERMS OF VOLUME, DURING FORECAST PERIOD

TABLE 206 TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR ELECTRICAL & ELECTRONICS INDUSTRY, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 207 TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR ELECTRICAL & ELECTRONICS INDUSTRY, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 208 TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR ELECTRICAL & ELECTRONICS INDUSTRY IN NORTH AMERICA, BY COUNTRY, 2018–2021 (THOUSAND UNITS)

TABLE 209 TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR ELECTRICAL & ELECTRONICS INDUSTRY IN NORTH AMERICA, BY COUNTRY, 2022–2027 (THOUSAND UNITS)

TABLE 210 TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR ELECTRICAL & ELECTRONICS INDUSTRY IN EUROPE, BY COUNTRY, 2018–2021 (THOUSAND UNITS)

TABLE 211 TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR ELECTRICAL & ELECTRONICS INDUSTRY IN EUROPE, BY COUNTRY, 2022–2027 (THOUSAND UNITS)

TABLE 212 TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR ELECTRICAL & ELECTRONICS INDUSTRY IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (THOUSAND UNITS)

TABLE 213 TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR ELECTRICAL & ELECTRONICS INDUSTRY IN ASIA PACIFIC, BY COUNTRY, 2022–2027 (THOUSAND UNITS)

TABLE 214 TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR ELECTRICAL & ELECTRONICS INDUSTRY IN ROW, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 215 TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR ELECTRICAL & ELECTRONICS INDUSTRY IN ROW, BY REGION, 2022–2027 (THOUSAND UNITS)

10.4 METALS & MACHINERY

10.4.1 INCREASING DEMAND FOR COST-EFFECTIVE PRODUCTION COMPONENTS

FIGURE 59 MARKET FOR METALS & MACHINERY INDUSTRY IN ASIA PACIFIC TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

TABLE 216 TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR METALS & MACHINERY INDUSTRY, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 217 TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR METALS & MACHINERY INDUSTRY, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 218 TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR METALS & MACHINERY INDUSTRY IN NORTH AMERICA, BY COUNTRY, 2018–2021 (THOUSAND UNITS)

TABLE 219 TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR METALS & MACHINERY INDUSTRY IN NORTH AMERICA, BY COUNTRY, 2022–2027 (THOUSAND UNITS)

TABLE 220 TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR METALS & MACHINERY INDUSTRY IN EUROPE, BY COUNTRY, 2018–2021 (THOUSAND UNITS)

TABLE 221 TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR METALS & MACHINERY INDUSTRY IN EUROPE, BY COUNTRY, 2022–2027 (THOUSAND UNITS)

TABLE 222 TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR METALS & MACHINERY INDUSTRY IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (THOUSAND UNITS)

TABLE 223 TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR METALS & MACHINERY INDUSTRY IN ASIA PACIFIC, BY COUNTRY, 2022–2027 (THOUSAND UNITS)

TABLE 224 TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR METALS & MACHINERY INDUSTRY IN ROW, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 225 TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR METALS & MACHINERY INDUSTRY IN ROW, BY REGION, 2022–2027 (THOUSAND UNITS)

10.5 PLASTICS, RUBBER & CHEMICALS

10.5.1 RISING USE OF ROBOTIC MOLDING AND HANDLING FOR VARIOUS PURPOSES

FIGURE 60 PLASTICS, RUBBER & CHEMICALS INDUSTRY IN ASIA PACIFIC TO MAINTAIN LARGEST MARKET SHARE DURING FORECAST PERIOD

TABLE 226 TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR PLASTICS, RUBBER & CHEMICALS INDUSTRY, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 227 TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR PLASTICS, RUBBER & CHEMICALS INDUSTRY, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 228 TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR PLASTICS, RUBBER & CHEMICALS INDUSTRY IN NORTH AMERICA, BY COUNTRY, 2018–2021 (THOUSAND UNITS)

TABLE 229 TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR PLASTICS, RUBBER & CHEMICALS INDUSTRY IN NORTH AMERICA, BY COUNTRY, 2022–2027 (THOUSAND UNITS)

TABLE 230 TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR PLASTICS, RUBBER & CHEMICALS INDUSTRY IN EUROPE, BY COUNTRY, 2018–2021 (THOUSAND UNITS)

TABLE 231 TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR PLASTICS, RUBBER & CHEMICALS INDUSTRY IN EUROPE, BY COUNTRY, 2022–2027 (THOUSAND UNITS)

TABLE 232 TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR PLASTICS, RUBBER & CHEMICALS INDUSTRY IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (THOUSAND UNITS)

TABLE 233 TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR PLASTICS, RUBBER & CHEMICALS INDUSTRY IN ASIA PACIFIC, BY COUNTRY, 2022–2027 (THOUSAND UNITS)

TABLE 234 TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR PLASTICS, RUBBER & CHEMICALS INDUSTRY IN ROW, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 235 TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR PLASTICS, RUBBER & CHEMICALS INDUSTRY IN ROW, BY REGION, 2022–2027 (THOUSAND UNITS)

10.6 FOOD & BEVERAGES

10.6.1 GROWING REQUIREMENT FOR FOOD-GRADE AND WATER-RESISTANT ROBOTS

FIGURE 61 ASIA PACIFIC TO BE FASTEST-GROWING REGION IN TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR FOOD & BEVERAGES INDUSTRY DURING FORECAST PERIOD

TABLE 236 TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR FOOD & BEVERAGES INDUSTRY, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 237 TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR FOOD & BEVERAGES INDUSTRY, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 238 TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR FOOD & BEVERAGES INDUSTRY IN NORTH AMERICA, BY COUNTRY, 2018–2021 (THOUSAND UNITS)

TABLE 239 TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR FOOD & BEVERAGES INDUSTRY IN NORTH AMERICA, BY COUNTRY, 2022–2027 (THOUSAND UNITS)

TABLE 240 TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR FOOD & BEVERAGES INDUSTRY IN EUROPE, BY COUNTRY, 2018–2021 (THOUSAND UNITS)

TABLE 241 TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR FOOD & BEVERAGES INDUSTRY IN EUROPE, BY COUNTRY, 2022–2027 (THOUSAND UNITS)

TABLE 242 TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR FOOD & BEVERAGES INDUSTRY IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (THOUSAND UNITS)

TABLE 243 TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR FOOD & BEVERAGES INDUSTRY IN ASIA PACIFIC, BY COUNTRY, 2022–2027 (THOUSAND UNITS)

TABLE 244 TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR FOOD & BEVERAGES INDUSTRY IN ROW, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 245 TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR FOOD & BEVERAGES INDUSTRY IN ROW, BY REGION, 2022–2027 (THOUSAND UNITS)

10.7 PRECISION ENGINEERING & OPTICS

10.7.1 RISING USE OF ROBOTS FOR BUFFING AND POLISHING TASKS

FIGURE 62 MARKET FOR PRECISION ENGINEERING & OPTICS INDUSTRY IN ASIA PACIFIC TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

TABLE 246 TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR PRECISION ENGINEERING & OPTICS INDUSTRY, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 247 TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR PRECISION ENGINEERING & OPTICS INDUSTRY, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 248 TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR PRECISION ENGINEERING & OPTICS INDUSTRY IN NORTH AMERICA, BY COUNTRY, 2018–2021 (THOUSAND UNITS)

TABLE 249 TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR PRECISION ENGINEERING & OPTICS INDUSTRY IN NORTH AMERICA, BY COUNTRY, 2022–2027 (THOUSAND UNITS)

TABLE 250 TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR PRECISION ENGINEERING & OPTICS INDUSTRY IN EUROPE, BY COUNTRY, 2018–2021 (THOUSAND UNITS)

TABLE 251 TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR PRECISION ENGINEERING & OPTICS INDUSTRY IN EUROPE, BY COUNTRY, 2022–2027 (THOUSAND UNITS)

TABLE 252 TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR PRECISION ENGINEERING & OPTICS INDUSTRY IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (THOUSAND UNITS)

TABLE 253 TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR PRECISION ENGINEERING & OPTICS INDUSTRY IN ASIA PACIFIC, BY COUNTRY, 2022–2027 (THOUSAND UNITS)

TABLE 254 TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR PRECISION ENGINEERING & OPTICS INDUSTRY IN ROW, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 255 TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR PRECISION ENGINEERING & OPTICS INDUSTRY IN ROW, BY REGION, 2022–2027 (THOUSAND UNITS)

10.8 PHARMACEUTICALS & COSMETICS

10.8.1 USE OF ROBOTS IN HOSPITALS AND RESEARCH LABORATORIES FOR HANDLING AND DISPENSING APPLICATIONS

FIGURE 63 PHARMACEUTICALS & COSMETICS INDUSTRY IN ASIA PACIFIC TO MAINTAIN LARGEST SHARE DURING FORECAST PERIOD

TABLE 256 TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR PHARMACEUTICALS & COSMETICS INDUSTRY, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 257 TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR PHARMACEUTICALS & COSMETICS INDUSTRY, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 258 TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR PHARMACEUTICALS & COSMETICS INDUSTRY IN NORTH AMERICA, BY COUNTRY, 2018–2021 (THOUSAND UNITS)

TABLE 259 TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR PHARMACEUTICALS & COSMETICS INDUSTRY IN NORTH AMERICA, BY COUNTRY, 2022–2027 (THOUSAND UNITS)

TABLE 260 TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR PHARMACEUTICALS & COSMETICS INDUSTRY IN EUROPE, BY COUNTRY, 2018–2021 (THOUSAND UNITS)

TABLE 261 TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR PHARMACEUTICALS & COSMETICS INDUSTRY IN EUROPE, BY COUNTRY, 2022–2027 (THOUSAND UNITS)

TABLE 262 TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR PHARMACEUTICALS & COSMETICS INDUSTRY IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (THOUSAND UNITS)

TABLE 263 TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR PHARMACEUTICALS & COSMETICS INDUSTRY IN ASIA PACIFIC, BY COUNTRY, 2022–2027 (THOUSAND UNITS)

TABLE 264 TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR PHARMACEUTICALS & COSMETICS INDUSTRY IN ROW, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 265 TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR PHARMACEUTICALS & COSMETICS INDUSTRY IN ROW, BY REGION, 2022–2027 (THOUSAND UNITS)

10.9 OTHERS

FIGURE 64 OTHER INDUSTRIES IN ASIA PACIFIC TO MAINTAIN LARGEST SHARE DURING FORECAST PERIOD

TABLE 266 TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR OTHER INDUSTRIES, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 267 TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR OTHER INDUSTRIES, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 268 TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR OTHER INDUSTRIES IN NORTH AMERICA, BY COUNTRY, 2018–2021 (THOUSAND UNITS)

TABLE 269 TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR OTHER INDUSTRIES IN NORTH AMERICA, BY COUNTRY, 2022–2027 (THOUSAND UNITS)

TABLE 270 TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR OTHER INDUSTRIES IN EUROPE, BY COUNTRY, 2018–2021 (THOUSAND UNITS)

TABLE 271 TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR OTHER INDUSTRIES IN EUROPE, BY COUNTRY, 2022–2027 (THOUSAND UNITS)

TABLE 272 TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR OTHER INDUSTRIES IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (THOUSAND UNITS)

TABLE 273 TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR OTHER INDUSTRIES IN ASIA PACIFIC, BY COUNTRY, 2022–2027 (THOUSAND UNITS)

TABLE 274 TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR OTHER INDUSTRIES IN ROW, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 275 TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR OTHER INDUSTRIES IN ROW, BY REGION, 2022–2027 (THOUSAND UNITS)

11 INDUSTRIAL ROBOTICS MARKET, BY REGION (Page No. - 260)

11.1 INTRODUCTION

FIGURE 65 INDUSTRIAL ROBOTICS MARKET, BY REGION

TABLE 276 INDUSTRIAL ROBOTS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 277 INDUSTRIAL ROBOTS MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 278 INDUSTRIAL ROBOTS MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 279 INDUSTRIAL ROBOTS MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 280 TRADITIONAL INDUSTRIAL ROBOTS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 281 TRADITIONAL INDUSTRIAL ROBOTS MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 282 TRADITIONAL INDUSTRIAL ROBOTS MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 283 TRADITIONAL INDUSTRIAL ROBOTS MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 284 COLLABORATIVE INDUSTRIAL ROBOTS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 285 COLLABORATIVE INDUSTRIAL ROBOTS MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 286 COLLABORATIVE INDUSTRIAL ROBOTS MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 287 COLLABORATIVE INDUSTRIAL ROBOTS MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

11.2 NORTH AMERICA

FIGURE 66 NORTH AMERICA: INDUSTRIAL ROBOTICS MARKET SNAPSHOT

FIGURE 67 US TO DOMINATE TRADITIONAL INDUSTRIAL ROBOTS MARKET IN NORTH AMERICA IN 2027

TABLE 288 TRADITIONAL INDUSTRIAL ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2021 (THOUSAND UNITS)

TABLE 289 TRADITIONAL INDUSTRIAL ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2022–2027 (THOUSAND UNITS)

TABLE 290 TRADITIONAL INDUSTRIAL ROBOTS MARKET IN NORTH AMERICA, BY INDUSTRY, 2018–2021 (THOUSAND UNITS)

TABLE 291 TRADITIONAL INDUSTRIAL ROBOTS MARKET IN NORTH AMERICA, BY INDUSTRY, 2022–2027 (THOUSAND UNITS)

TABLE 292 COLLABORATIVE INDUSTRIAL ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 293 COLLABORATIVE INDUSTRIAL ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 294 COLLABORATIVE INDUSTRIAL ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2021 (THOUSAND UNITS)

TABLE 295 COLLABORATIVE INDUSTRIAL ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2022–2027 (THOUSAND UNITS)

11.2.1 US

11.2.1.1 Held largest share of traditional industrial robots market in 2021

11.2.2 CANADA

11.2.2.1 Increased foreign investments in industrial robotics to drive market

11.2.3 MEXICO

11.2.3.1 Traditional industrial robots market expected to record highest CAGR during forecast period

11.3 EUROPE

FIGURE 68 EUROPE: INDUSTRIAL ROBOTICS MARKET SNAPSHOT

FIGURE 69 GERMANY TO DOMINATE TRADITIONAL INDUSTRIAL ROBOTS MARKET IN EUROPE IN 2027

TABLE 296 TRADITIONAL INDUSTRIAL ROBOTS MARKET IN EUROPE, BY COUNTRY, 2018–2021 (THOUSAND UNITS)

TABLE 297 TRADITIONAL INDUSTRIAL ROBOTS MARKET IN EUROPE, BY COUNTRY, 2022–2027 (THOUSAND UNITS)

TABLE 298 TRADITIONAL INDUSTRIAL ROBOTS MARKET IN EUROPE, BY INDUSTRY, 2018–2021 (THOUSAND UNITS)

TABLE 299 TRADITIONAL INDUSTRIAL ROBOTS MARKET IN EUROPE, BY INDUSTRY, 2022–2027 (THOUSAND UNITS)

TABLE 300 COLLABORATIVE INDUSTRIAL ROBOTS MARKET IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 301 COLLABORATIVE INDUSTRIAL ROBOTS MARKET IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 302 COLLABORATIVE INDUSTRIAL ROBOTS MARKET IN EUROPE, BY COUNTRY, 2018–2021 (THOUSAND UNITS)

TABLE 303 COLLABORATIVE INDUSTRIAL ROBOTS MARKET IN EUROPE, BY COUNTRY, 2022–2027 (THOUSAND UNITS)

11.3.1 GERMANY

11.3.1.1 Growth of automobile industry expected to drive demand for industrial robots

11.3.2 ITALY

11.3.2.1 Increasing initiatives from players to propel market growth

11.3.3 FRANCE

11.3.3.1 Rising adoption of electric and hybrid vehicles expected to drive demand for robots

11.3.4 SPAIN

11.3.4.1 Pharmaceuticals and automotive industries expected to create huge demand for industrial robots

11.3.5 UK

11.3.5.1 Strong manufacturing industry expected to push demand for industrial robots

11.3.6 REST OF EUROPE

11.3.6.1 High labor costs expected to propel industrial robotics market growth

11.4 ASIA PACIFIC

FIGURE 70 ASIA PACIFIC: INDUSTRIAL ROBOTICS MARKET SNAPSHOT

FIGURE 71 CHINA TO DOMINATE TRADITIONAL INDUSTRIAL ROBOTS MARKET IN ASIA PACIFIC IN 2027

TABLE 304 TRADITIONAL INDUSTRIAL ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (THOUSAND UNITS)

TABLE 305 TRADITIONAL INDUSTRIAL ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2022–2027 (THOUSAND UNITS)

TABLE 306 TRADITIONAL INDUSTRIAL ROBOTS MARKET IN ASIA PACIFIC, BY INDUSTRY, 2018–2021 (THOUSAND UNITS)

TABLE 307 TRADITIONAL INDUSTRIAL ROBOTS MARKET IN ASIA PACIFIC, BY INDUSTRY, 2022–2027 (THOUSAND UNITS)

TABLE 308 COLLABORATIVE INDUSTRIAL ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 309 COLLABORATIVE INDUSTRIAL ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 310 COLLABORATIVE INDUSTRIAL ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (THOUSAND UNITS)

TABLE 311 COLLABORATIVE INDUSTRIAL ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2022–2027 (THOUSAND UNITS)

11.4.1 CHINA

11.4.1.1 Growth of automotive and electronics industries expected to drive market

11.4.2 SOUTH KOREA

11.4.2.1 Electrical & electronics industry expected to propel market growth

11.4.3 JAPAN

11.4.3.1 Rise in aging population to boost demand for industrial robots

11.4.4 TAIWAN

11.4.4.1 Growth of electrical & electronics industry expected to drive market

11.4.5 INDIA

11.4.5.1 Market for traditional industrial robots expected to record highest CAGR during forecast period

11.4.6 THAILAND

11.4.6.1 Government initiatives expected to boost demand for industrial robots

11.4.7 REST OF APAC

11.4.7.1 Increasing adoption of automation and robotics in manufacturing

11.5 ROW

FIGURE 72 ROW: INDUSTRIAL ROBOTICS MARKET SNAPSHOT

FIGURE 73 MIDDLE EAST & AFRICA TO DOMINATE TRADITIONAL INDUSTRIAL ROBOTS MARKET IN ROW IN 2027

TABLE 312 TRADITIONAL INDUSTRIAL ROBOTS MARKET IN ROW, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 313 TRADITIONAL INDUSTRIAL ROBOTS MARKET IN ROW, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 314 TRADITIONAL INDUSTRIAL ROBOTS MARKET IN ROW, BY INDUSTRY, 2018–2021 (THOUSAND UNITS)

TABLE 315 TRADITIONAL INDUSTRIAL ROBOTS MARKET IN ROW, BY INDUSTRY, 2022–2027 (THOUSAND UNITS)

TABLE 316 COLLABORATIVE INDUSTRIAL ROBOTS MARKET IN ROW, BY REGION, 2018–2021 (USD MILLION)

TABLE 317 COLLABORATIVE INDUSTRIAL ROBOTS MARKET IN ROW, BY REGION, 2022–2027 (USD MILLION)

TABLE 318 COLLABORATIVE INDUSTRIAL ROBOTS MARKET IN ROW, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 319 COLLABORATIVE INDUSTRIAL ROBOTS MARKET IN ROW, BY REGION, 2022–2027 (THOUSAND UNITS)

11.5.1 MIDDLE EAST & AFRICA

11.5.1.1 Automation across industries expected to drive market

11.5.2 SOUTH AMERICA

11.5.2.1 Increasing use of robotics in various industries to fuel market growth

12 REFURBISHMENT OF INDUSTRIAL ROBOTS (QUALITATIVE) (Page No. - 295)

12.1 INTRODUCTION

12.2 KEY PARAMETERS

12.2.1 CYCLE TIME

12.2.2 PERFORMANCE & ACCURACY

12.2.3 WEAR & TEAR

12.3 REFURBISHMENT TRENDS FOR VARIOUS INDUSTRIAL ROBOTS

TABLE 320 REFURBISHMENT TRENDS FOR ARTICULATED, SCARA, AND COLLABORATIVE ROBOTS

12.4 TOP 5 INDUSTRIES ADOPTING REFURBISHED ROBOTS

12.4.1 AUTOMOTIVE

12.4.2 METALS & MACHINERY

12.4.3 ELECTRICAL & ELECTRONICS

12.4.4 SMALL WORKSHOPS

12.4.5 FOOD & BEVERAGES

12.5 KEY PRACTICES OF INDUSTRIAL ROBOT OEMS

12.5.1 FOCUS ON NEW ROBOTS

12.5.2 POST-SALES SERVICE

12.5.3 USE CASE: JACOBS DOUWE EGBERTS AND ABB

13 COMPETITIVE LANDSCAPE (Page No. - 299)

13.1 INTRODUCTION

13.2 STRATEGIES ADOPTED BY KEY PLAYERS/RIGHT TO WIN

TABLE 321 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS IN INDUSTRIAL ROBOTICS MARKET

13.2.1 PRODUCT PORTFOLIO

13.2.2 REGIONAL FOCUS

13.2.3 MANUFACTURING FOOTPRINT

13.2.4 ORGANIC/INORGANIC GROWTH STRATEGIES

13.3 REVENUE ANALYSIS OF TOP PLAYERS IN INDUSTRIAL ROBOTICS MARKET

FIGURE 74 5-YEAR REVENUE ANALYSIS OF TOP PLAYERS IN INDUSTRIAL ROBOTICS MARKET

13.4 MARKET SHARE ANALYSIS, 2021

TABLE 322 INDUSTRIAL ROBOTICS MARKET: DEGREE OF COMPETITION

13.5 COMPANY EVALUATION QUADRANT

13.5.1 STARS

13.5.2 PERVASIVE PLAYERS

13.5.3 EMERGING LEADERS

13.5.4 PARTICIPANTS

FIGURE 75 INDUSTRIAL ROBOTICS MARKET (GLOBAL): COMPANY EVALUATION QUADRANT, 2021

13.6 START-UP/SME EVALUATION QUADRANT

13.6.1 PROGRESSIVE COMPANIES

13.6.2 RESPONSIVE COMPANIES

13.6.3 DYNAMIC COMPANIES

13.6.4 STARTING BLOCKS

FIGURE 76 INDUSTRIAL ROBOTICS MARKET (GLOBAL): START-UP/SME EVALUATION QUADRANT, 2021

13.7 COMPANY PRODUCT FOOTPRINT

TABLE 323 COMPANY PRODUCT FOOTPRINT

TABLE 324 TYPE OFFERING FOOTPRINT OF COMPANIES

TABLE 325 END-USER INDUSTRY FOOTPRINT OF COMPANIES

TABLE 326 REGIONAL FOOTPRINT OF COMPANIES

13.8 COMPETITIVE BENCHMARKING

TABLE 327 INDUSTRIAL ROBOTICS MARKET: KEY START-UPS/SMES

TABLE 328 INDUSTRIAL ROBOTICS MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

13.9 COMPETITIVE SCENARIO AND TRENDS

13.9.1 PRODUCT LAUNCHES & DEVELOPMENTS

TABLE 329 INDUSTRIAL ROBOTICS MARKET: PRODUCT LAUNCHES & DEVELOPMENTS, JANUARY 2018– MAY 2022

13.9.2 DEALS

TABLE 330 INDUSTRIAL ROBOTICS MARKET: DEALS, JANUARY 2018–MAY 2022

13.9.3 OTHERS

TABLE 331 INDUSTRIAL ROBOTICS MARKET: OTHERS, JANUARY 2018–MAY 2022

14 COMPANY PROFILES (Page No. - 316)

(Business Overview, Products Offered, Recent Developments, MnM View Right to win, Strategic choices made, Weaknesses and competitive threats) *

14.1 KEY PLAYERS

14.1.1 ABB LTD

TABLE 332 ABB LTD: BUSINESS OVERVIEW

FIGURE 77 ABB LTD: COMPANY SNAPSHOT

TABLE 333 ABB LTD: PRODUCTS OFFERED

14.1.2 YASKAWA ELECTRIC CORPORATION

TABLE 334 YASKAWA ELECTRIC CORPORATION: BUSINESS OVERVIEW

FIGURE 78 YASKAWA ELECTRIC CORPORATION: COMPANY SNAPSHOT

TABLE 335 YASKAWA ELECTRIC CORPORATION: PRODUCTS OFFERED

14.1.3 FANUC

TABLE 336 FANUC: BUSINESS OVERVIEW

FIGURE 79 FANUC: COMPANY SNAPSHOT

TABLE 337 FANUC: PRODUCTS OFFERED

14.1.4 KUKA

TABLE 338 KUKA: BUSINESS OVERVIEW

FIGURE 80 KUKA: COMPANY SNAPSHOT

TABLE 339 KUKA: PRODUCTS OFFERED

14.1.5 MITSUBISHI ELECTRIC

TABLE 340 MITSUBISHI ELECTRIC: BUSINESS OVERVIEW

FIGURE 81 MITSUBISHI ELECTRIC: COMPANY SNAPSHOT

TABLE 341 MITSUBISHI ELECTRIC: PRODUCTS OFFERED

14.1.6 KAWASAKI HEAVY INDUSTRIES

TABLE 342 KAWASAKI HEAVY INDUSTRIES: BUSINESS OVERVIEW

FIGURE 82 KAWASAKI HEAVY INDUSTRIES: COMPANY SNAPSHOT

TABLE 343 KAWASAKI HEAVY INDUSTRIES: PRODUCTS OFFERED

14.1.7 DENSO

TABLE 344 DENSO: BUSINESS OVERVIEW

FIGURE 83 DENSO: COMPANY SNAPSHOT

TABLE 345 DENSO: PRODUCTS OFFERED

14.1.8 NACHI-FUJIKOSHI

TABLE 346 NACHI-FUJIKOSHI: BUSINESS OVERVIEW

FIGURE 84 NACHI-FUJIKOSHI: COMPANY SNAPSHOT

TABLE 347 NACHI-FUJIKOSHI: PRODUCTS OFFERED

14.1.9 SEIKO EPSON

TABLE 348 SEIKO EPSON: BUSINESS OVERVIEW

FIGURE 85 SEIKO EPSON: COMPANY SNAPSHOT

TABLE 349 SEIKO EPSON: PRODUCTS OFFERED

14.1.10 DÜRR

TABLE 350 DÜRR: BUSINESS OVERVIEW

FIGURE 86 DURR: COMPANY SNAPSHOT

TABLE 351 DURR: PRODUCTS OFFERED

14.2 OTHER COMPANIES

14.2.1 YAMAHA MOTORS CO.

14.2.2 ESTUN CORPORATION

14.2.3 SHIBAURA MACHINE CO LTD

14.2.4 DOVER CORPORATION

14.2.5 AUROTEK CORPORATION

14.2.6 HIRATA CORPORATION

14.2.7 RETHINK ROBOTICS

14.2.8 FRANKA EMIKA

14.2.9 TECHMAN ROBOT

14.2.10 BOSCH REXROTH AG

14.2.11 UNIVERSAL ROBOTS (TERADYNE)

14.2.12 OMRON ADEPT

14.2.13 STÄUBLI

14.2.14 COMAU

14.2.15 B+M SURFACE SYSTEMS

14.2.16 ICR SERVICES

14.2.17 IRS ROBOTICS

14.2.18 HYUNDAI ROBOTICS

14.2.19 SIASUN ROBOTICS

14.2.20 ROBOTWORX

*Details on Business Overview, Products Offered, Recent Developments, MnM View, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

15 APPENDIX (Page No. - 376)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 CUSTOMIZATION OPTIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

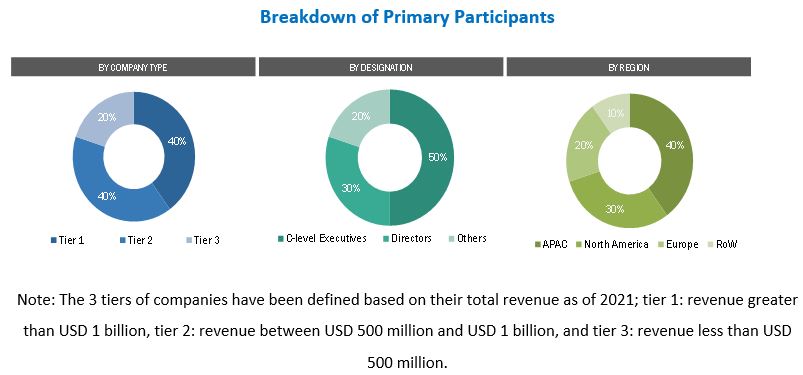

The research process for this study included the systematic gathering, recording, and analysis of data about customers and companies operating in the industrial robotics market. This research study involved the extensive use of secondary sources, directories, and databases (Factiva, Oanda, and OneSource) for identifying and collecting valuable information for this extensive, technical, market-oriented, and commercial study of the industrial robotics market. In-depth interviews were conducted with various primary respondents, including experts from core and related industries and preferred manufacturers, to obtain and verify critical qualitative and quantitative information as well as to assess growth prospects. Key players in the industrial robotics market were identified through secondary research, and their market rankings were determined through primary and secondary research. This research included studying annual reports of top players and interviewing key industry experts, such as CEOs, directors, and marketing executives.

Secondary Research

In the secondary research, various sources were referred to for identifying and collecting information important for this study. Secondary sources included corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers, Gas sensor products related journals, and certified publications; articles by recognized authors; directories; and databases.

Secondary research was conducted to obtain key information about the industry supply chain, market value chain, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, geographic markets, and key developments from both market- and technology-oriented perspectives. Data from secondary research was collected and analyzed to determine the overall market size, which was further validated by primary research.

Primary Research

In the primary research process, various primary sources from the supply and demand sides were interviewed to obtain the qualitative and quantitative information for this report. Primary sources from the supply side included industry experts such as CEOs, VPs, marketing directors, technology and innovation directors, and key executives from major companies and organizations operating in the industrial robotics market.

After going through the entire market engineering (which includes calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers obtained. Primary research was conducted to identify segmentation types, industry trends, key players, competitive landscape, and key market dynamics such as drivers, restraints, opportunities, and challenges, along with the key strategies adopted by players operating in the market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches were used, along with several data triangulation methods, to estimate and forecast the size of the market and its segments and subsegments listed in the report. Extensive qualitative and quantitative analyses were carried out on the complete market engineering process to list the key information/insights pertaining to the industrial robotics market.

The key players in the market were identified through secondary research, and their rankings in the respective regions were determined through primary and secondary research. This entire procedure involved the study of the annual and financial reports of top players, as well as interviews with industry experts such as chief executive officers, vice presidents, directors, and marketing executives for both quantitative and qualitative key insights. All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and enhanced with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Gas sensor Market: Bottom-Up Approach

Data Triangulation