Industrial Sensors Market by Sensor Type (Level Sensor, Temperature Sensor, Gas Sensor, Pressure Sensor, Position Sensor, Flow Sensor, and Humidity & Moisture Sensor), Type, End-user Industry and Region (2021-2026)

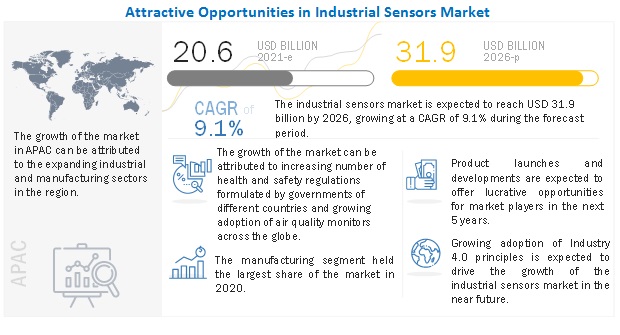

[263 Pages Report] The global Industrial sensors market report share is estimated to be USD 20.6 billion in 2021 and expected to reach USD 31.9 billion by 2026, at a CAGR of 9.1% from 2021 to 2026.

The key driving factors for the growth of this market include increase in adoption of Industrial 4.0 and IIoT (Industrial Internet of Things) in manufacturing sectors; surging demand for smart sensor-enabled wearable devices; and technological developments in industrial sensor industry. Adoption of predictive maintenance in various industries is expected to offer lucrative opportunities to market players in near future.

To know about the assumptions considered for the study, Request for Free Sample Report

Industrial Sensors Market Dynamics

DRIVERS: Growing technological advancements in industrial sensors

One of the advanced technologies is Micro-Electro-Mechanical Systems (MEMS) in industrial sensor applications. MEMS is a technology that in its most general form can be defined as miniaturized mechanical and electro-mechanical elements (i.e., devices and structures) that are made using the techniques of microfabrication. The critical physical dimensions of MEMS devices can vary from well below one micron on the lower end of the dimensional spectrum, all the way to several millimeters. MEMS technology in microsensors is allowing the manufacture of an increasing number of sensors on a microscopic scale. In most cases, microsensors can reach significantly higher speeds and sensitivity compared with macroscopic sensors.

RESTRAINT: High installation cost of sensor networks

Although the cost of sensor systems is declining, it is still high enough to affect the adoption rate in industries.Devices and a network of wires must be installed professionally and must follow the industry standards and owner-operator practices. Fly-by-night installations may be installed in a few non-industrial segments; however, industrial segments usually avoid these installations as they are considered having low quality and age quickly and require periodic maintenance.Hence, high quality installations are required, which incur high costof sensor networks.

OPPORTUNITIES: Predictive maintenance to offer lucrative opportunities to market players

Predictive maintenance is a subset of condition monitoring that focuses on determining when maintenance needs to be performed on industrial equipment and machinery. It enables uptime for manufacturing factories and allows for the continuous development of goods to confirm positive customer experiences and profitability.The three major solution enhancements of predictive maintenance over traditional maintenance schedule are capturing sensor data; facilitating data communications; and making predictions. Sensors are among the important parts of predictive maintenance solutions. The growth opportunities for the industrial sensors market are expected to be high in the near future.

CHALLENGES: Precise performance requirements from upcoming advanced sensors

The sensing capability of sensors varies based on end-user applications, leading to inaccurate measurement and sensing performance. For instance, temperature, pressure, flow, and position measurement parameters in the automotive end-user industry are different from those in the oil & gas end-user industry; therefore, the performance requirements of sensors become critical for advanced applications.

Industrial Sensor Market Ecosystem

Industrial sensor market for image sensors is expected to grow at the highest CAGR duringforecasted period

The growth of the industrial image sensors market is primarily driven by the machine vision application. Additionally, image sensors are estimated to form an essential part of emerging markets such as IoT, smart home, smart city, smart automation, smart car, and smart medical equipment. Moreover, the use of image sensors in some of the major biometric techniques, such as iris scanning and fingerprint recognition, is growing. A few industries where image sensors are used are manufacturing, pharmaceuticals, chemicals, oil & gas, and energy & power.

Industrial sensor market for non-contact type is expected to grow at the highest CAGR during forecasted period

Non-contact methods are considered as the best choice for servicing corrosive media. The type of sensor depends upon the technology used, for instance, in level sensors, the most widely used non-contact type level sensing technologies are ultrasonic, microwave/radar, optical, laser, MEMS, capacitive, conductivity, nuclear, and load cells. Non-contact temperature sensors work on the principle of convection and radiation to monitor temperature changes. They detect the thermal radiation transmitted from an object in the form of infrared radiation. Non-contact temperature sensors include infrared temperature sensors and fiber optic temperature sensors.

Industrial sensor market for North America is expected to hold the second largest market during the forecasted period

North America is expected to hold the second largest market for industrial sensors, owing to the high adoption of the Industrial Internet of Things (IIoT) and Industry 4.0 principles in factories, and the presence of sensor manufacturers in the region, specifically in the US. It is among the technologically advanced regions and has a huge market for industrial sensor devices as it houses numerous industrial sensor manufacturers such as Honeywell International Inc., Amphenol Corporation, Texas Instruments, Rockwell Automation, and Dwyer Instruments. The government of the US is taking numerous measures to promote Industry 4.0 in the country. One such effort is the National Network for Manufacturing Innovation (NNMI). Under this initiative, the country is building the NNMI, which will consist of regional hubs that will accelerate the development and adoption of cutting-edge manufacturing technologies for making new and globally competitive products.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Rockwell Automation (US), Honeywell International (US), Texas Instruments (US), Panasonic Corporation (Japan), STMicroelectronics (Switzerland), TE Connectivity (Switzerland), Siemens (Germany), Amphenol Corporation (US), Dwyer Instruments (US), and Bosch Sensortec (Germany) are a few major players dominating the Industrial Sensors Companies.

Industrial Sensor Market Report Scope :

|

Report Metric |

Details |

| Market Size Value in 2021 | USD 20.6 Billion |

| Revenue Forecast in 2026 | USD 31.9 Billion |

| Growth Rate | 9.1% |

|

Historical Data Available for Years |

2017–2026 |

|

Base Year Considered |

2020 |

|

Forecast period |

2021–2026 |

|

Forecast Unit |

Value (USD Million/Billion) |

|

Segments covered |

|

|

Region Covered |

|

|

Market Leaders |

|

| Key Market Driver | Growing technological advancements in industrial sensors |

| Key Market Opportunity | Predictive maintenance to offer lucrative opportunities to market players |

| Largest Growing Region | North America |

| Highest CAGR Segment | Image sensors and Non-contact type |

This report categorizes the industrial sensors market based on sensor type, type, end-user industry, and region.

By Sensor Type:

- Pressure Sensors

- Position Sensors

- Level Sensors

- Gas Sensors

- Temperature Sensors

- Image Sensors

- Humidity & Moisture Sensors

- Flow Sensors

- Force Sensors

By Type:

- Contact

- Non-contact

By End-user Industry:

- Oil & Gas

- Pharmaceuticals

- Chemicals

- Manufacturing

- Mining

- Energy & Power

By Geography:

- North America

- Europe

- Asia Pacific (APAC)

- Rest of the World (RoW)

Recent Developments

- In October 2021, Texas Instruments introduced the 3D Hall-effect position sensor. With the TMAG5170, engineers can achieve uncalibrated ultra-high precision at speeds up to 20 kSPS for faster and more accurate real-time control in factory automation and motor-drive applications.

- In June 2021, Rockwell Automation has launched a new brand: LifecycleIQ Services. The new brand represents the expanding ways that customers can engage with Rockwell Automation technology and highly trained professionals to improve their performance and reimagine what’s possible across their industrial value chain.

- In May 2021,Honeywell announced that dnata US introduced Honeywell ThermoRebellion temperature monitoring solution to support domestic and international passengers at Boston Logan International Airport.

Frequently Asked Questions (FAQs):

What is the market sizing for the industrial sensors market? How rising adoption of industrial sensors can help grasp this opportunity?

The industrial sensors market size is projected to grow from USD 20.6 billion in 2021 to USD 31.9 billion by 2026, at a CAGR of 9.1%. Growing popularity of industrial 4.0 and IoT and increasing demand of industrial robotics will help in the adoption of industrial sensors.

Who are the key players operating in the industrial sensors market? Which companies are the front runners?

Few major players dominates the industrial sensor market includes Rockwell Automation (US), Honeywell (US), Texas Instruments (US), Siemens (Germany), Bosch Sensortec (US), Panasonic (Japan), and STMicroelectronics (Switzerland).

What are the major industries of industrial sensors market?

Manufacturing, oil & gas, pharmaceutical, energy & power, chemical and mining are major industries of Industrial Sensors market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 31)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION AND SCOPE

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

FIGURE 1 INDUSTRIAL SENSORS MARKET: SEGMENTATION

1.3.1 GEOGRAPHIC SCOPE

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 VOLUME UNIT CONSIDERED

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 36)

2.1 RESEARCH DATA

FIGURE 2 INDUSTRIAL SENSORS MARKET: RESEARCH DESIG

2.1.1 SECONDARY DATA

2.1.1.1 Major secondary sources

2.1.1.2 Secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Primary interviews with experts

2.1.2.2 Key data from primary sources

2.1.2.3 Key industry insights

2.1.2.4 Breakdown of primaries

2.1.3 SECONDARY AND PRIMARY RESEARCH

2.2 MARKET SIZE ESTIMATION

FIGURE 3 RESEARCH FLOW OF MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Estimating market size by bottom-up approach (demand side)

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Estimating market size by top-down approach (supply side)

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (SUPPLY SIDE)—REVENUE GENERATED FROM INDUSTRIAL SENSORS

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (SUPPLY SIDE)—ILLUSTRATION OF REVENUE ESTIMATION FOR ONE OF COMPANIES IN INDUSTRIAL SENSORS MARKET

2.2.3 MARKET PROJECTIONS

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

FIGURE 9 ASSUMPTION FOR THE STUDY

2.5 RISK ASSESSMENT

TABLE 1 LIMITATIONS & ASSOCIATED RISKS

3 EXECUTIVE SUMMARY (Page No. - 51)

FIGURE 10 COVID-19 IMPACT ANALYSIS ON INDUSTRIAL SENSORS MARKET, 2017–2026 (USD BILLION)

3.1 PRE-COVID-19 SCENARIO

3.2 POST-COVID-19 SCENARIO

FIGURE 11 LEVEL SENSOR SEGMENT, BY SENSOR TYPE, TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

FIGURE 12 INDUSTRIAL SENSORS MARKET, BY TYPE, 2021 VS. 2026

FIGURE 13 MANUFACTURING SEGMENT TO REGISTER HIGHEST CAGR FROM 2021 TO 2026

FIGURE 14 INDUSTRIAL SENSORS MARKET TO EXHIBIT HIGHEST GROWTH RATE IN APAC DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 56)

4.1 ATTRACTIVE OPPORTUNITIES IN INDUSTRIAL SENSORS MARKET

FIGURE 15 GROWING ADOPTION OF INDUSTRY 4.0 PRINCIPLES TO BOOST GROWTH OF MARKET

4.2 INDUSTRIAL SENSORS MARKET, BY TYPE

FIGURE 16 NON-CONTACT SENSORS SEGMENT TO REGISTER HIGHER CAGR FROM 2021 TO 2026

4.3 INDUSTRIAL SENSORS MARKET, BY SENSOR TYPE

FIGURE 17 LEVEL SENSORS SEGMENT TO HOLD LARGEST SIZE OF MARKET BY 2026

4.4 INDUSTRIAL SENSORS MARKET IN APAC, BY END-USER INDUSTRY AND COUNTRY

FIGURE 18 MANUFACTURING SEGMENT AND CHINA HELD LARGEST SHARES OF ASIA PACIFIC MARKET IN 2020

4.5 INDUSTRIAL SENSORS MARKET, BY COUNTRY

FIGURE 19 MARKET TO EXHIBIT HIGHEST CAGR IN INDIA FROM 2021 TO 2026

5 MARKET OVERVIEW (Page No. - 59)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 20 INDUSTRIAL SENSORS MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Rising adoption of Industry 4.0 and IIoT in manufacturing

5.2.1.2 Surging demand for smart sensor-enabled wearable devices

TABLE 2 COMPANIES OFFERING WEARABLE DEVICES, BY SHIPMENT, VOLUME, MARKET SHARE, AND YEAR-OVER-YEAR-GROWTH (SHIPMENTS IN MILLIONS)

5.2.1.3 Growing technological advancements in industrial sensors

FIGURE 21 INDUSTRIAL SENSORS MARKET DRIVERS AND THEIR IMPACT

5.2.2 RESTRAINTS

5.2.2.1 Competitive pricing resulting in decline in average selling prices

5.2.2.2 High installation cost of sensor networks

FIGURE 22 INDUSTRIAL SENSORS MARKET RESTRAINTS AND THEIR IMPACT

5.2.3 OPPORTUNITIES

5.2.3.1 Predictive maintenance to offer lucrative opportunities to market players

5.2.3.2 Increasing demand from automobile manufacturers to deliver improved safety and comfort for smart sensors

FIGURE 23 INDUSTRIAL SENSORS MARKET OPPORTUNITIES AND THEIR IMPACT

5.2.4 CHALLENGES

5.2.4.1 Precise performance requirements from upcoming advanced/ technologically sensors

FIGURE 24 INDUSTRIAL SENSORS MARKET CHALLENGES AND THEIR IMPACT

5.3 VALUE CHAIN ANALYSIS

FIGURE 25 VALUE CHAIN ANALYSIS

5.4 INDUSTRIAL SENSOR ECOSYSTEM

FIGURE 26 SENSORS ECOSYSTEM

TABLE 3 ROLE OF COMPANIES IN ECOSYSTEM/VALUE CHAIN

5.5 TRENDS AND DISRUPTIONS IMPACTING BUSINESSES OF CUSTOMERS

FIGURE 27 REVENUE SHIFT IN MARKET

5.6 PORTER’S FIVE FORCES ANALYSIS

TABLE 4 IMPACT OF EACH FORCE ON MARKET

5.7 CASE STUDY ANALYSIS

5.7.1 FORBO USES ICENTA CONTROLS IC-LPM FLOW METER

5.7.2 MAJOR AGRICULTURAL MACHINERY COMPANY STARTED USING WIKA’S LEVEL SENSORS

5.7.3 PRESSURE SENSOR PACKAGE DEVELOPED WITH REDUCED FOOTPRINT

5.7.4 REFINERY IMPROVES VACUUM TOWER LEVEL MEASUREMENT WITH SIEMENS ROSEMOUNT 3051S ERS AND THERMAL RANGE EXPANDER

5.7.5 INNOVATIVE GAS SENSOR NETWORK MONITORS USING ALPHASENSE’S (UK) SO2 SENSORS IN HAWAII

5.7.6 CO2METER INC.(US) USES GAS SENSING SOLUTIONS’ (GSS) (US) SENSORS AS ITS CO2 ALARMS

5.8 TECHNOLOGY TRENDS

5.8.1 SEED TECHNOLOGY

5.8.2 UBIQUITOUS SENSOR NETWORKS

5.8.3 ELECTRONIC NOSE (E-NOSE)

5.8.4 PRINTED GAS SENSORS

5.8.5 MEMS TEMPERATURE SENSOR

5.8.6 MINIATURE FIBER OPTIC TEMPERATURE SENSOR

5.9 PATENT ANALYSIS

5.9.1 PATENT REGISTRATIONS, 2018–2021

TABLE 5 A FEW PATENT REGISTRATIONS, 2018–2021

5.9.2 INDUSTRIAL SENSOR: PATENT ANALYSIS

5.9.2.1 Methodology

5.9.2.2 Document type

TABLE 6 PATENTS FILED

FIGURE 28 PATENTS FILED BETWEEN 2018 AND 2020

5.9.2.3 Insight

FIGURE 29 TOP 10 OWNERS BY DOCUMENT COUNT, 2018–2020

5.1 AVERAGE SELLING PRICE ANALYSIS

TABLE 7 AVERAGE SELLING PRICE OF VARIOUS INDUSTRIAL SENSORS, 2020

TABLE 8 FEW GAS SENSOR SOLUTIONS AND THEIR COST

TABLE 9 AVERAGE SELLING PRICE OF GAS SENSORS, BY OUTPUT TYPE

5.11 TRADE ANALYSIS

5.11.1 IMPORT SCENARIO OF HS CODE 902690

TABLE 10 IMPORT DATA OF HS CODE 902690, BY COUNTRY, 2016–2020 (USD MILLION)

5.11.2 EXPORT SCENARIO OF HS CODE 902690

TABLE 11 EXPORT DATA OF HS CODE 902690, BY COUNTRY, 2016–2020 (USD MILLION)

5.12 TARIFF

5.12.1 TARIFFS

5.13 GOVERNMENT REGULATIONS AND STANDARDS

5.13.1 GOVERNMENT REGULATIONS

5.13.2 STANDARDS

5.13.2.1 International Electrotechnical Commission (IEC)

5.13.2.2 AS4641

5.13.2.3 ISO 19891-1

5.13.2.4 Atmosphere Explosible (ATEX)

5.13.2.5 Edison Testing Laboratories (ETL)

5.13.2.6 Safety Integrity Level 1 (SIL 1)

5.13.2.7 Material Safety Data Sheet (MSDS)

6 INDUSTRIAL SENSORS MARKET, BY TECHNOLOGY (Page No. - 85)

6.1 INTRODUCTION

6.2 MAJOR PACKAGING TYPES CONSIDERED IN INDUSTRIAL SENSORS MARKET

6.2.1 INTRODUCTION

6.2.2 SYSTEM-IN-PACKAGE (SIP)

6.2.2.1 Rising demand for miniaturization and higher functionality of devices to drive demand for SIP technology

6.2.3 SYSTEM-ON-CHIP (SOC)

6.2.3.1 Benefits associated with SOC such as compactness, portability, high reliability, fast circuit operation, and small form factor to propel market growth

TABLE 12 TECHNICAL FEATURES OF SYSTEM-IN-PACKAGE (SIP) AND SYSTEM-ON-CHIP (SOC)

6.3 MEMS TECHNOLOGY

6.3.1 INCREASING ADOPTION OF MEMS TECHNOLOGY-BASED INDUSTRIAL SENSORS IN VARIOUS PROCESS INDUSTRIES TO BOOST MARKET GROWTH

6.3.2 ROLE OF VERY-LARGE-SCALE INTEGRATION TECHNOLOGY (VLSI)

6.3.3 RELEVANCE OF NANOELECTROMECHANICAL SYSTEMS (NEMS)

6.3.4 MERITS AND DEMERITS OF MEMS TECHNOLOGY

6.4 CMOS TECHNOLOGY

6.4.1 CHARACTERISTICS SUCH AS LOW STATIC POWER CONSUMPTION AND HIGH NOISE IMMUNITY ARE DRIVING DEMAND FOR CMOS TECHNOLOGY

6.4.2 MERITS AND DEMERITS OF CMOS TECHNOLOGY

6.5 OPTICAL SENSING

6.5.1 OPTICAL PRESSURE SENSORS ARE WIDELY USED IN HEALTHCARE INDUSTRY

6.6 OTHER TECHNOLOGIES

6.6.1 OPTICAL SPECTROSCOPY

6.6.2 MICROSYSTEMS TECHNOLOGY (MST)

6.6.3 INTEGRATED INDUSTRIAL SENSOR - HYBRID SENSOR

6.6.4 IC-COMPATIBLE 3D MICROSTRUCTURING

6.6.5 APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC)

7 INDUSTRIAL SENSORS MARKET, BY SENSOR TYPE (Page No. - 92)

7.1 INTRODUCTION

FIGURE 30 IMAGE SENSOR SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 13 MARKET, BY SENSOR TYPE, 2017–2020 (USD MILLION)

TABLE 14 MARKET, BY SENSOR TYPE, 2021–2026 (USD MILLION)

TABLE 15 MARKET, BY SENSOR TYPE, 2017–2020 (MILLION UNITS)

TABLE 16 MARKET, BY SENSOR TYPE, 2021–2026 (MILLION UNITS)

7.2 LEVEL SENSORS

7.2.1 GROWING USE OF LEVEL SENSORS IN PROCESSING INDUSTRIES

TABLE 17 LEVEL SENSORS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 18 LEVEL SENSORS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 19 LEVEL SENSORS MARKET, BY END-USER INDUSTRY, 2017–2020 (USD MILLION)

TABLE 20 LEVEL SENSORS MARKET, BY END-USER INDUSTRY, 2021–2026 (USD MILLION)

7.3 TEMPERATURE SENSORS

7.3.1 AUTOMOTIVE AND PHARMACEUTICALS INDUSTRIES TO PROPEL DEMAND FOR TEMPERATURE SENSORS

TABLE 21 TEMPERATURE SENSORS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 22 TEMPERATURE SENSORS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 23 TEMPERATURE SENSORS MARKET, BY END-USER INDUSTRY, 2017–2020 (USD MILLION)

TABLE 24 TEMPERATURE SENSORS MARKET, BY END-USER INDUSTRY, 2021–2026 (USD MILLION)

7.4 FLOW SENSORS

7.4.1 FLOW SENSORS ARE WIDELY USED IN AUTOMOTIVE, AEROSPACE, MEDICAL, AND BUILDING AUTOMATION INDUSTRIES TO MEASURE RATE OF FLUID FLOW

TABLE 25 UNITS OF FLOW IN TERMS OF MATERIALS

TABLE 26 FLOW SENSORS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 27 FLOW SENSORS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 28 FLOW SENSORS MARKET, BY END-USER INDUSTRY, 2017–2020 (USD MILLION)

TABLE 29 FLOW SENSORS MARKET, BY END-USER INDUSTRY, 2021–2026 (USD MILLION)

7.5 GAS SENSORS

7.5.1 RISING AIR POLLUTION LEVELS TO BOOST DEMAND FOR GAS SENSORS

TABLE 30 GAS SENSORS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 31 GAS SENSORS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 32 GAS SENSORS MARKET, BY END-USER INDUSTRY, 2017–2020 (USD MILLION)

TABLE 33 GAS SENSORS MARKET, BY END-USER INDUSTRY, 2021–2026 (USD MILLION)

7.6 POSITION SENSORS

TABLE 34 POSITION SENSORS MARKET, BY POSITION SENSOR TYPE, 2017–2020 (USD MILLION)

TABLE 35 POSITION SENSORS MARKET, BY POSITION SENSOR TYPE, 2021–2026 (USD MILLION)

7.6.1 MAJOR TYPES OF POSITION SENSORS

7.6.1.1 Linear position sensors

7.6.1.1.1 Linear position sensors held largest market share in 2020

7.6.1.2 Rotary position sensors

7.6.1.2.1 Rotary position sensors used to measure the rotational or angular movement of an object.

TABLE 36 POSITION SENSORS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 37 POSITION SENSORS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 38 POSITION SENSORS MARKET, BY END-USER INDUSTRY, 2017–2020 (USD MILLION)

TABLE 39 POSITION SENSORS MARKET, BY END-USER INDUSTRY, 2021–2026 (USD MILLION)

7.7 PRESSURE SENSORS

7.7.1 INCREASING APPLICATION OF PRESSURE SENSORS IN AUTOMOTIVE INDUSTRY TO DRIVE MARKET GROWTH

TABLE 40 PRESSURE SENSORS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 41 PRESSURE SENSORS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 42 PRESSURE SENSORS MARKET, BY END-USER INDUSTRY, 2017–2020 (USD MILLION)

TABLE 43 PRESSURE SENSORS MARKET, BY END-USER INDUSTRY, 2021–2026 (USD MILLION)

7.8 FORCE SENSORS

7.8.1 INCREASING USE OF FORCE SENSORS IN VARIOUS INDUSTRIAL APPLICATIONS TO BOOST MARKET GROWTH

TABLE 44 FORCE SENSORS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 45 FORCE SENSORS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 46 FORCE SENSORS MARKET, BY END-USER INDUSTRY, 2017–2020 (USD MILLION)

TABLE 47 FORCE SENSORS MARKET, BY END-USER INDUSTRY, 2021–2026 (USD MILLION)

7.9 HUMIDITY AND MOISTURE SENSORS

7.9.1 TYPES OF HUMIDITY SENSORS

7.9.1.1 Capacitive humidity sensors

7.9.1.1.1 Capacitive humidity sensors are suitable for operations in temporary high temperatures

7.9.1.2 Resistive humidity sensors

7.9.1.2.1 Resistive humidity sensors require more complex circuitry

TABLE 48 HUMIDITY AND MOISTURE SENSORS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 49 HUMIDITY AND MOISTURE SENSORS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 50 HUMIDITY AND MOISTURE SENSORS MARKET, BY END-USER INDUSTRY, 2017–2020 (USD MILLION)

TABLE 51 HUMIDITY AND MOISTURE SENSORS MARKET, BY END-USER INDUSTRY, 2021–2026 (USD MILLION)

7.1 IMAGE SENSORS

7.10.1 IMAGE SENSORS SEGMENT TO REGISTER HIGHEST CAGR FROM 2021 TO 2026

TABLE 52 IMAGE SENSORS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 53 IMAGE SENSORS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 54 IMAGE SENSORS MARKET, BY END-USER INDUSTRY, 2017–2020 (USD MILLION)

TABLE 55 IMAGE SENSORS MARKET, BY END-USER INDUSTRY, 2021–2026 (USD MILLION)

8 INDUSTRIAL SENSORS MARKET, BY TYPE (Page No. - 111)

8.1 INTRODUCTION

FIGURE 31 NON-CONTACT TYPE INDUSTRIAL SENSORS TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

TABLE 56 MARKET, BY TYPE, 2017–2020 (USD BILLION)

TABLE 57 MARKET, BY TYPE, 2021–2026 (USD BILLION)

8.2 CONTACT SENSORS

8.2.1 CONTACT SENSORS REQUIRE PHYSICAL CONTACT WITH SUBSTANCE/OBJECT/SOURCE

TABLE 58 CONTACT MARKET, BY SENSOR TYPE, 2017–2020 (USD MILLION)

TABLE 59 CONTACT MARKET, BY SENSOR TYPE, 2021–2026 (USD MILLION)

8.3 NON-CONTACT SENSORS

8.3.1 NON-CONTACT SENSORS DO NOT REQUIRE PHYSICAL TOUCH BETWEEN SENSORS AND OBJECTS BEING MONITORED TO FUNCTION

TABLE 60 NON-CONTACT MARKET, BY SENSOR TYPE, 2017–2020 (USD MILLION)

TABLE 61 NON-CONTACT MARKET, BY SENSOR TYPE, 2021–2026 (USD MILLION)

9 INDUSTRIAL SENSORS MARKET, BY END-USER INDUSTRY (Page No. - 116)

9.1 INTRODUCTION

FIGURE 32 MANUFACTURING SEGMENT TO ACCOUNT FOR LARGEST MARKET SIZE BY 2026

TABLE 62 MARKET, BY END-USER INDUSTRY, 2017–2020 (USD MILLION)

TABLE 63 MARKET, BY END-USER INDUSTRY, 2021–2026 (USD MILLION)

9.2 MANUFACTURING

9.2.1 SURGE IN ADOPTION OF INDUSTRIAL AUTOMATION AND IIOT IN AUTOMOTIVE AND PROCESS INDUSTRIES TO DRIVE MARKET

TABLE 64 INDUSTRIAL SENSORS MARKET FOR MANUFACTURING, BY SENSOR TYPE, 2017–2020 (USD MILLION)

TABLE 65 MARKET FOR MANUFACTURING, BY SENSOR TYPE, 2021–2026 (USD MILLION)

TABLE 66 MARKET FOR MANUFACTURING, BY REGION, 2017–2020 (USD MILLION)

TABLE 67 MARKET FOR MANUFACTURING, BY REGION, 2021–2026 (USD MILLION)

TABLE 68 MARKET FOR MANUFACTURING IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 69 MARKET FOR MANUFACTURING IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 70 MARKET FOR MANUFACTURING IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 71 MARKET FOR MANUFACTURING IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 72 MARKET FOR MANUFACTURING IN APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 73 MARKET FOR MANUFACTURING IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 74 MARKET FOR MANUFACTURING IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 75 MARKET FOR MANUFACTURING IN ROW, BY REGION, 2021–2026 (USD MILLION)

9.3 OIL & GAS

9.3.1 NEED TO ENHANCE SAFETY AND IMPROVE PRODUCTION YIELDS TO BOOST USE OF INDUSTRIAL SENSORS IN OIL & GAS INDUSTRY

TABLE 76 SOME UPCOMING EPC PROJECTS THAT WILL CREATE GROWTH OPPORTUNITIES IN MARKET

TABLE 77 INDUSTRIAL SENSORS MARKET FOR OIL & GAS, BY SENSOR TYPE, 2017–2020 (USD MILLION)

TABLE 78 MARKET FOR OIL & GAS, BY SENSOR TYPE, 2021–2026 (USD MILLION)

TABLE 79 MARKET FOR OIL & GAS, BY REGION, 2017–2020 (USD MILLION)

TABLE 80 MARKET FOR OIL & GAS, BY REGION, 2021–2026 (USD MILLION)

TABLE 81 MARKET FOR OIL & GAS IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 82 MARKET FOR OIL & GAS IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 83 MARKET FOR OIL & GAS IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 84 MARKET FOR OIL & GAS IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 85 MARKET FOR OIL & GAS IN APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 86 MARKET FOR OIL & GAS IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 87 MARKET FOR OIL & GAS IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 88 MARKET FOR OIL & GAS IN ROW, BY REGION, 2021–2026 (USD MILLION)

9.4 CHEMICALS

9.4.1 SENSORS ARE USED IN CHEMICALS INDUSTRY TO ENSURE SAFETY AND FOR CONTINUOUS CHEMICAL PROCESS MONITORING

TABLE 89 INDUSTRIAL SENSORS MARKET FOR CHEMICALS, BY SENSOR TYPE, 2017–2020 (USD MILLION)

TABLE 90 MARKET FOR CHEMICALS, BY SENSOR TYPE, 2021–2026 (USD MILLION)

TABLE 91 MARKET FOR CHEMICALS, BY REGION, 2017–2020 (USD MILLION)

TABLE 92 MARKET FOR CHEMICALS, BY REGION, 2021–2026 (USD MILLION)

TABLE 93 MARKET FOR CHEMICALS IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 94 MARKET FOR CHEMICALS IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 95 MARKET FOR CHEMICALS IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 96 MARKET FOR CHEMICALS IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 97 MARKET FOR CHEMICALS IN APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 98 MARKET FOR CHEMICALS IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 99 MARKET FOR CHEMICALS IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 100 MARKET FOR CHEMICALS IN ROW, BY REGION, 2021–2026 (USD MILLION)

9.5 PHARMACEUTICALS

9.5.1 HEIGHETENED DEMAND FOR SENSORS BY PHARMACEUTICAL COMPANIES FOR SUPERVISION AND MANAGEMENT OF VARIOUS PROCESSES OCCURRING ON PRODUCTION FLOOR TO AUGMENT MARKET GROWTH

FIGURE 33 IMAGE SENSORS SEGMENT TO REGISTER HIGHEST CAGR IN INDUSTRIAL SENSORS MARKET FOR PHARMACEUTICAL DURING FORECAST PERIOD

TABLE 101 MARKET FOR PHARMACEUTICALS, BY SENSOR TYPE, 2017–2020 (USD MILLION)

TABLE 102 MARKET FOR PHARMACEUTICALS, BY SENSOR TYPE, 2021–2026 (USD MILLION)

TABLE 103 MARKET FOR PHARMACEUTICALS, BY REGION, 2017–2020 (USD MILLION)

TABLE 104 MARKET FOR PHARMACEUTICALS, BY REGION, 2021–2026 (USD MILLION)

TABLE 105 MARKET FOR PHARMACEUTICALS IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 106 MARKET FOR PHARMACEUTICALS IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 107 MARKET FOR PHARMACEUTICALS IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 108 MARKET FOR PHARMACEUTICALS IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 109 MARKET FOR PHARMACEUTICALS IN APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 110 MARKET FOR PHARMACEUTICALS IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 111 MARKET FOR PHARMACEUTICALS IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 112 MARKET FOR PHARMACEUTICALS IN ROW, BY REGION, 2021–2026 (USD MILLION)

9.6 ENERGY & POWER

9.6.1 INCREASING RENEWABLE POWER GENERATION IS POSITIVELY IMPACTING INDUSTRIAL SENSORS MARKET

TABLE 113 MARKET FOR ENERGY & POWER, BY SENSOR TYPE, 2017–2020 (USD MILLION)

TABLE 114 MARKET FOR ENERGY & POWER, BY SENSOR TYPE, 2021–2026 (USD MILLION)

TABLE 115 MARKET FOR ENERGY & POWER, BY REGION, 2017–2020 (USD MILLION)

TABLE 116 MARKET FOR ENERGY & POWER, BY REGION, 2021–2026 (USD MILLION)

TABLE 117 MARKET FOR ENERGY & POWER IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 118 MARKET FOR ENERGY & POWER IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 119 MARKET FOR ENERGY & POWER IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 120 MARKET FOR ENERGY & POWER IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 121 MARKET FOR ENERGY & POWER IN APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 122 MARKET FOR ENERGY & POWER IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 123 MARKET FOR ENERGY & POWER IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 124 MARKET FOR ENERGY & POWER IN ROW, BY REGION, 2021–2026 (USD MILLION)

9.7 MINING

9.7.1 INCREASING NEED FOR SAFETY IN MINING INDUSTRY IS DRIVING DEMAND FOR SENSORS

TABLE 125 INDUSTRIAL SENSORS MARKET FOR MINING, BY SENSOR TYPE, 2017–2020 (USD MILLION)

TABLE 126 MARKET FOR MINING, BY SENSOR TYPE, 2021–2026 (USD MILLION)

TABLE 127 MARKET FOR MINING SEGMENT, BY REGION, 2017–2020 (USD MILLION)

TABLE 128 MARKET FOR MINING, BY REGION, 2021–2026 (USD MILLION)

TABLE 129 MARKET FOR MINING IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 130 MARKET FOR MINING IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 131 MARKET FOR MINING IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 132 MARKET FOR MINING IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 133 MARKET FOR MINING IN APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 134 MARKET FOR MINING IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 135 MARKET FOR MINING IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 136 MARKET FOR MINING IN ROW, BY REGION, 2021–2026 (USD MILLION)

10 GEOGRAPHIC ANALYSIS (Page No. - 149)

10.1 INTRODUCTION

FIGURE 34 GEOGRAPHIC SNAPSHOT: INDUSTRIAL SENSORS MARKET TO WITNESS HIGHEST GROWTH IN APAC FROM 2021 TO 2026

FIGURE 35 APAC TO DOMINATE MARKET DURING FORECAST PERIOD

TABLE 137 MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 138 MARKET, BY REGION, 2021–2026 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 36 SNAPSHOT: INDUSTRIAL SENSORS MARKET IN NORTH AMERICA

TABLE 139 MARKET IN NORTH AMERICA, BY END-USER INDUSTRY, 2017–2020 (USD MILLION)

TABLE 140 MARKET IN NORTH AMERICA, BY END-USER INDUSTRY, 2021–2026 (USD MILLION)

TABLE 141 MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 142 MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

10.2.1 US

10.2.1.1 US to be largest market for industrial sensors during forecast period

TABLE 143 MARKET IN US, BY END-USER INDUSTRY, 2017–2020 (USD MILLION)

TABLE 144 MARKET IN US, BY END-USER INDUSTRY, 2021–2026 (USD MILLION)

10.2.2 CANADA

10.2.2.1 Demand from manufacturing and oil & gas industries to underpin market growth in Canada

TABLE 145 MARKET IN CANADA, BY END-USER INDUSTRY, 2017–2020 (USD MILLION)

TABLE 146 MARKET IN CANADA, BY END-USER INDUSTRY, 2021–2026 (USD MILLION)

10.2.3 MEXICO

10.2.3.1 Increasing industrialization in Mexico to drive growth of industrial sensor market

TABLE 147 MARKET IN MEXICO, BY END-USER INDUSTRY, 2017–2020 (USD MILLION)

TABLE 148 MARKET IN MEXICO, BY END-USER INDUSTRY, 2021–2026 (USD MILLION)

10.3 EUROPE

FIGURE 37 SNAPSHOT: INDUSTRIAL SENSORS MARKET IN EUROPE

TABLE 149 MARKET IN EUROPE, BY END-USER INDUSTRY, 2017–2020 (USD MILLION)

TABLE 150 MARKET IN EUROPE, BY END-USER INDUSTRY, 2021–2026 (USD MILLION)

TABLE 151 MARKET IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 152 MARKET IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

10.3.1 UK

10.3.1.1 Automotive, oil & gas, and pharmaceuticals End-user Industry to create new market opportunities in UK

TABLE 153 MARKET IN UK, BY END-USER INDUSTRY, 2017–2020 (USD MILLION)

TABLE 154 MARKET IN UK, BY END-USER INDUSTRY, 2021–2026 (USD MILLION)

10.3.2 GERMANY

10.3.2.1 Automotive industry to substantiate industrial sensors market growth in Germany

TABLE 155 MARKET IN GERMANY, BY END-USER INDUSTRY, 2017–2020 (USD MILLION)

TABLE 156 MARKET IN GERMANY, BY END-USER INDUSTRY, 2021–2026 (USD MILLION)

10.3.3 FRANCE

10.3.3.1 Strong automotive and manufacturing base to support growth of industrial sensors market in France

TABLE 157 MARKET IN FRANCE, BY END-USER INDUSTRY, 2017–2020 (USD MILLION)

TABLE 158 MARKET IN FRANCE, BY END-USER INDUSTRY, 2021–2026 (USD MILLION)

10.3.4 REST OF EUROPE

TABLE 159 MARKET IN REST OF EUROPE, BY END-USER INDUSTRY, 2017–2020 (USD MILLION)

TABLE 160 MARKET IN REST OF EUROPE, BY END-USER INDUSTRY, 2021–2026 (USD MILLION)

10.4 APAC

FIGURE 38 SNAPSHOT: INDUSTRIAL SENSORS MARKET IN APAC

TABLE 161 MARKET IN APAC, BY END-USER INDUSTRY, 2017–2020 (USD MILLION)

TABLE 162 MARKET IN APAC, BY END-USER INDUSTRY, 2021–2026 (USD MILLION)

TABLE 163 MARKET IN APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 164 MARKET IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

10.4.1 CHINA

10.4.1.1 China held largest share of industrial sensors market in APAC in 2020

TABLE 165 MARKET IN CHINA, BY END-USER INDUSTRY, 2017–2020 (USD MILLION)

TABLE 166 MARKET IN CHINA, BY END-USER INDUSTRY, 2021–2026 (USD MILLION)

10.4.2 JAPAN

10.4.2.1 Presence of leading sensor manufacturing companies in Japan to support market growth

TABLE 167 MARKET IN JAPAN, BY END-USER INDUSTRY, 2017–2020 (USD MILLION)

TABLE 168 MARKET IN JAPAN, BY END-USER INDUSTRY, 2021–2026 (USD MILLION)

10.4.3 INDIA

10.4.3.1 Strong government support for adoption of industrial automation to boost demand for industrial sensors in India

TABLE 169 MARKET IN INDIA, BY END-USER INDUSTRY, 2017–2020 (USD MILLION)

TABLE 170 MARKET IN INDIA, BY END-USER INDUSTRY, 2021–2026 (USD MILLION)

10.4.4 SOUTH KOREA

10.4.4.1 Increasing demand for advanced sensors from electronics and automotive industries driving demand for industrial sensors in South Korea

TABLE 171 MARKET IN SOUTH KOREA, BY END-USER INDUSTRY, 2017–2020 (USD MILLION)

TABLE 172 MARKET IN SOUTH KOREA, BY END-USER INDUSTRY, 2021–2026 (USD MILLION)

10.4.5 REST OF APAC

TABLE 173 MARKET IN REST OF APAC, BY END-USER INDUSTRY, 2017–2020 (USD MILLION)

TABLE 174 MARKET IN REST OF APAC, BY END-USER INDUSTRY, 2021–2026 (USD MILLION)

10.5 ROW

TABLE 175 INDUSTRIAL SENSORS MARKET IN ROW, BY END-USER INDUSTRY, 2017–2020 (USD MILLION)

TABLE 176 MARKET IN ROW, BY END-USER INDUSTRY, 2021–2026 (USD MILLION)

TABLE 177 MARKET IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 178 MARKET IN ROW, BY REGION, 2021–2026 (USD MILLION)

10.5.1 MIDDLE EAST & AFRICA

10.5.1.1 Growing mining industry in Middle East to create conducive environment for industrial sensors market during forecast period

TABLE 179 MARKET IN MIDDLE EAST & AFRICA, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 180 MARKET IN MIDDLE EAST & AFRICA, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

10.5.2 SOUTH AMERICA

10.5.2.1 Brazil to offer lucrative opportunities for growth of industrial sensors market in South America

TABLE 181 MARKET IN SOUTH AMERICA, BY END-USER INDUSTRY, 2017–2020 (USD MILLION)

TABLE 182 MARKET IN SOUTH AMERICA, BY END-USER INDUSTRY, 2021–2026 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 180)

11.1 INTRODUCTION

11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

TABLE 183 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS IN INDUSTRIAL SENSORS MARKET

11.2.1 PRODUCT PORTFOLIO

11.2.2 REGIONAL FOCUS

11.2.3 MANUFACTURING FOOTPRINT

11.2.4 ORGANIC/INORGANIC GROWTH STRATEGIES

11.3 MARKET SHARE ANALYSIS, 2020

TABLE 184 MARKET: DEGREE OF COMPETITION

11.4 REVENUE ANALYSIS OF TOP PLAYERS IN INDUSTRIAL SENSORS MARKET

FIGURE 39 5-YEAR REVENUE ANALYSIS OF TOP PLAYERS IN MARKET

11.5 COMPANY EVALUATION QUADRANT

11.5.1 STAR

11.5.2 PERVASIVE

11.5.3 EMERGING LEADER

11.5.4 PARTICIPANT

FIGURE 40 INDUSTRIAL SENSORS MARKET (GLOBAL): COMPANY EVALUATION QUADRANT, 2020

11.6 STARTUP/SME EVALUATION QUADRANT

TABLE 185 STARTUP/SME EVALUATION QUADRANT

11.6.1 PROGRESSIVE COMPANY

11.6.2 RESPONSIVE COMPANY

11.6.3 DYNAMIC COMPANY

11.6.4 STARTING BLOCK

FIGURE 41 INDUSTRIAL SENSORS MARKET (GLOBAL): STARTUP/SME EVALUATION QUADRANT, 2020

11.7 COMPANY FOOTPRINT

TABLE 186 COMPANY FOOTPRINT

TABLE 187 SENSOR OFFERING FOOTPRINT OF COMPANIES

TABLE 188 END-USER INDUSTRY FOOTPRINT OF COMPANIES

TABLE 189 REGIONAL FOOTPRINT OF COMPANIES

11.8 COMPETITIVE SITUATION AND TRENDS

11.8.1 PRODUCT LAUNCHES & DEVELOPMENTS

TABLE 190 INDUSTRIAL SENSORS MARKET: PRODUCT LAUNCHES & DEVELOPMENTS, JANUARY 2018– OCTOBER 2021

11.8.2 DEALS

TABLE 191 INDUSTRIAL SENSORS MARKET: DEALS, JANUARY 2018–SEPTEMBER 2021

11.8.3 OTHERS

TABLE 192 INDUSTRIAL SENSORS MARKET: OTHERS, JANUARY 2018– SEPTEMBER 2021

12 COMPANY PROFILES (Page No. - 201)

12.1 KEY PLAYERS

(Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments)*

12.1.1 ROCKWELL AUTOMATION

TABLE 193 ROCKWELL AUTOMATION: BUSINESS OVERVIEW

FIGURE 42 ROCKWELL AUTOMATION: COMPANY SNAPSHOT

12.1.2 HONEYWELL

TABLE 194 HONEYWELL: BUSINESS OVERVIEW

FIGURE 43 HONEYWELL: COMPANY SNAPSHOT

12.1.3 TEXAS INSTRUMENTS

TABLE 195 TEXAS INSTRUMENTS: BUSINESS OVERVIEW

FIGURE 44 TEXAS INSTRUMENTS: COMPANY SNAPSHOT

12.1.4 PANASONIC

TABLE 196 PANASONIC CORPORATION: BUSINESS OVERVIEW

FIGURE 45 PANASONIC: COMPANY SNAPSHOT

12.1.5 STMICROELECTRONICS

TABLE 197 STMICROELECTRONICS: BUSINESS OVERVIEW

FIGURE 46 STMICROELECTRONICS: COMPANY SNAPSHOT

12.1.6 TE CONNECTIVITY

TABLE 198 TE CONNECTIVITY: BUSINESS OVERVIEW

FIGURE 47 TE CONNECTIVITY: COMPANY SNAPSHOT

12.1.7 SIEMENS

TABLE 199 SIEMENS: BUSINESS OVERVIEW

FIGURE 48 SIEMENS: COMPANY SNAPSHOT

12.1.8 AMPHENOL CORPORATION

TABLE 200 AMPHENOL CORPORATION: BUSINESS OVERVIEW

FIGURE 49 AMPHENOL CORPORATION: COMPANY SNAPSHOT

12.1.9 DWYER INSTRUMENTS

TABLE 201 DWYER INSTRUMENTS: BUSINESS OVERVIEW

12.1.10 BOSCH SENSORTEC

TABLE 202 BOSCH SENSORTEC: BUSINESS OVERVIEW

*Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments might not be captured in case of unlisted companies.

12.2 OTHER KEY PLAYERS

12.2.1 OMEGA ENGINEERING

12.2.2 SENSIRION AG

12.2.3 AMS AG

12.2.4 MICROCHIP TECHNOLOGY INC.

12.2.5 ABB LTD.

12.2.6 NXP SEMICONDUCTORS N.V.

12.2.7 ENDRESS+HAUSER MANAGEMENT AG

12.2.8 FIGARO ENGINEERING INC.

12.2.9 SAFRAN COLIBRYS SA

12.2.10 ANALOG DEVICES, INC.

12.2.11 INFINEON TECHNOLOGIES AG

12.2.12 RENESAS ELECTRONICS CORPORATION (RENESAS)

12.2.13 BREEZE TECHNOLOGIES

12.2.14 ELICHENS

12.2.15 EDINBURGH SENSORS

13 APPENDIX (Page No. - 257)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

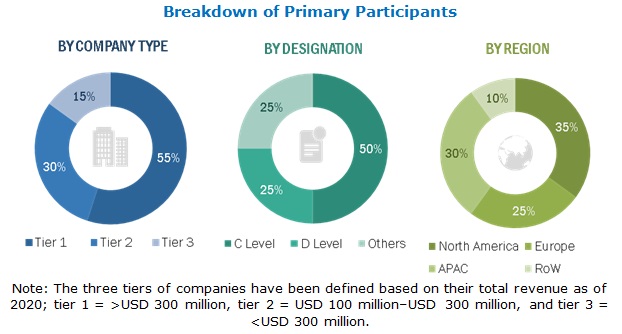

The study involved 4 major activities in estimating the current size of the Industrial Sensors market. Exhaustive secondary research has been done to collect information about the market, the peer markets, and the parent market. Validating findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation methods have been used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information pertinent to this study. Secondary sources include annual reports; press releases; investor presentations; white papers; journals and certified publications; and articles from recognized authors, directories, and databases. Secondary research has been conducted to obtain important information about the industry’s supply chain, value chain, total pool of key players, market segmentation according to the industry trends (to the bottommost level), geographic markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

Extensive primary research has been conducted after gaining knowledge about the Industrial Sensors market scenario through secondary research. Several primary interviews have been conducted with market experts from both demand (commercial application providers) and supply (equipment manufacturers and distributors) sides across four major regions: North America, Europe, APAC, and RoW. Approximately 20% and 80% of primary interviews have been conducted with parties from demand and supply sides, respectively. The primary data has been collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

- In the complete engineering process, both top-down and bottom-up approaches, along with several data triangulation methods, have been used to estimate and validate the size of the Industrial Sensors market and other dependent submarkets.

- The key players in the market have been determined through primary and secondary research. This entire research methodology involves the study of the annual and financial reports of the top market players and extensive interviews with industry experts such as CEOs, VPs, directors, and marketing executives for key insights (both qualitative and quantitative) into the Industrial Sensors market.

Data Triangulation

All the percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All the possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data has been consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in the report.

Report Objectives

- To describe and forecast the Industrial Sensors market, in terms of value and volume, by sensor type, type, end-user industry, and region

- To describe and forecast the market, in terms of value, by region—North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- To provide detailed information regarding major factors influencing growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, future prospects, and contributions to the overall market

- To provide detailed overview of value chain analysis in the Industrial Sensors market

- To analyze opportunities in the market for various stakeholders by identifying high-growth segments of the Industrial Sensors market

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing the competitive landscape for market leaders

- To analyze competitive developments such as product developments, expansions, mergers, and research & development in the Industrial Sensors market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Product Analysis:

- Product matrix that gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Critical Questions

- What are new application areas industrial sensor providers exploring?

- Who are the key market players, and how intense is the competition?

- Which applications and geographies would be the biggest markets for industrial sensor?

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Industrial Sensors Market

I am interested in the applications of radar systems, especially imaging radar systems for detailed object localization. Have you considered RADAR systems in the scope of your study?

As a student I want to identify which industry has the highest demand on sensors especially in combination of IoT-Applications in the overall industrial applications. Also which are the specific sensors that are required for industrial automation.

Looking for a report for the purpose of detailing information about competitors (size, SWOT, characteristics), industry (profitability, size, and growth), and market shares in the industrial sensors market. Could you provide me the details of the same?

IŽd like to read the report with the code 6767 (Industrial Sensor Market) as a sample. Please contact me if you have further questions.

Trying to understand the industrial sensors market to determine if the vertical is worth pursuing more aggressively at a broader fund level / making it a key industry of focus.

Humidity sensors market size and hygrometer market size in Pharma , F&B, semiconductor, pulp and paper and in harsh environments like oil and gas, petrochemical, refineries and fuel cells.

I am currently preparing estimates of commercial opportunity for a wide range of sensor types. I am seeking a report that estimates market size for sensors in relatively narrow selections across various industry verticals.

I am interested in the applications of radar systems, especially imaging radar systems for detailed object localization. Have you considered RADAR systems in the scope of your study?

I would like to collect information about Singapore Industrial Market, for a potential business opportunity in the future. Have you considered IIoT-based sensors in the scope of your report?

Looking to review the industrial sensor market report. I need to understand the research methodology which you have followed.

Primary interest in the growth of hydraulic cylinder position sensors in the mobile market. Of secondary interest would be new markets for our mobile oriented level sensors which would be aligned with industrial applications

Looking for market data to accomplish a market study for our current products which is aligned with sensors used in industrial applications and to help assess new product market.

My interest in specifically into Mobile Hydraulics and Industrial Automation. Does the industrial sensor market provide it? Also, what is the market scope? Could you provide me with the overview or a particular brochure for the same?

Does industrial sensor market report cover elemental analysis? Asset protection? Alternate technologies such as lab based Big Data?