Industrial Vehicles Market in terms of Vehicle Type (Forklifts, Aisle Trucks, Tow Tractors, Container Handlers), Drive Type (ICE, Battery-operated, Gas-powered), Application, Capacity, Level of Autonomy & Region - Global Forecast to 2028

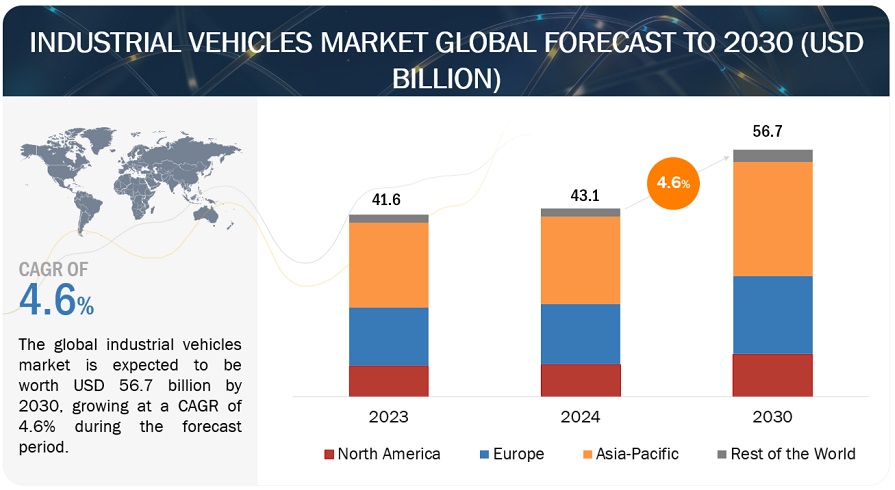

[333 Pages Report] The global industrial vehicles market size will grow to USD 49.2 billion by 2028 (forecast year) from USD 39.7 billion in 2023 (estimated year), at a CAGR of 4.4% during the 2023-2028 period. Parameters such as steady growth of e-commerce industry, paired with the rising need/demand for autonomous solutions in material handling across end-use industries are expected to augment revenues for the industrial vehicles market during the forecast period. Increasing focus towards battery-operated industrial vehicles from end-users for material handling, in conjunction with increasing trends of hydrogen-powered forklifts will create new opportunities for this market. Companies operating in the industrial vehicles market are focusing on new product development, especially electric industrial vehicles, hydrogen-powered industrial vehicles. For instance, in January 2023, Crown Equipment Corporation expanded its counterbalance forklift portfolio with the launch of four-wheel forklifts available in electric, diesel, and LPG propulsion types. These lifts have load capacities ranging from 2.0 up to 5.5 tons and are capable enough of tackling a wide variety of material handling tasks in indoor as well as outdoor applications.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics:

Driver: Increasing focus on AGVs across end-use industries

The overall need for high efficiency in the e-commerce, healthcare, automotive, and food & beverages industries is increasing the demand for industrial vehicles (forklifts, tow tractors, etc.) as well as industrial automation. AGV-enabled automation of industrial facilities can help meet the requirements related to material handling capacity, along with reducing production time, lessening the chances of human errors, enhancing safety, increasing accuracy, and ensuring high production volumes. The use of industrial vehicles such as AGVs enables just-in-time (JIT) delivery of raw materials, computerized control of received assembled parts, and tracking of shipped articles. AGVs help store, distribute, and transport materials without human intervention, thereby ruling out the possibilities of injuries to workers and damage to products and also with greater accuracy. Further, these industrial vehicles reduce labor costs for long-term perspective in warehouses in many ways. For instance, by replacing a human worker with an AGV, a company pays a one-time expense for the equipment—the initial investment—contrary to various ongoing costs relevant to labor. Furthermore, the deployment of AGVs enables companies in various industries to apply new technologies that would deliver immediate value and long-term returns. This trend is driving the need for information-enabled systems, such as AGVs, that can help industries to manage plant assets and make better operational decisions.

Restraint: High maintenance of industrial vehicles and lack of R&D facilities

Industrial vehicles such as tow tractors, forklifts, and aisle trucks, among others, require a significant amount of innovation and research & development (R&D). Manufacturers need to invest heavily in R&D activities in order to enhance the ability of these vehicles to lift heavy loads to improve efficiency and reduce turnaround time. This is important to prevent industrial vehicles such as forklifts, aisle trucks, etc., from tipping over, falling sideways, or dropping their load. Additionally, industrial vehicle also requires high maintenance in order to operate safely. For instance, industrial vehicle owners/operators must do routine checks and preventive maintenance tasks. These routine checks should be done by skilled maintenance technicians in order to keep an industrial vehicle in safe/working conditions. In addition to this, one should keep a record of this maintenance and any repairs that were made in the past. Adhering to all these mentioned tasks requires a high cost. Hence, the high cost pertaining to the maintenance level of an industrial vehicle and the lack of R&D facilities are major parameters that are anticipated to restrain potential opportunities for industrial vehicles market to certain extent.

Opportunity: Increasing demand for battery-operated industrial vehicles

Increasing focus on battery-operated industrial vehicles by end-use industries is likely to support the revenue growth of the industrial vehicles market during the forecast period. For instance, the demand for battery-operated industrial vehicles such as forklifts, aisle trucks, etc., has increased owing to their superior performance levels as well as high productivity levels. In addition, electric lift trucks provide better emission control and are typically more economical than internal combustion engine industrial vehicles. End users/end-use industries typically tend to prefer electric industrial vehicles, as these vehicles meet Tier 4 emission requirements and generate zero in-plant emissions.

Developed regions such as North America and Europe have seen steady increase in the demand for electric forklifts. Most companies, such as Jungheinrich AG, KION GROUP AG, Hyster-Yale Group, Inc., CLARK and Toyota Material Handling, are offering electric forklifts for various end-use industries. In addition, key players operating in the industrial vehicles market are focusing on new product development, especially electric industrial vehicles. For instance, in October 2022, Toyota Material Handling (TMH), North America’s leading manufacturer of forklifts and warehousing solutions, launched an updated version of its 3-Wheel Electric Forklift. In this updated version, new features and technology were added to its top-selling forklift in the segment. The updated forklifts are versatile, with more than 30 advance features, including operator assist features, improved ergonomics, and onboard programming and diagnostics, among others. These factors are anticipated to create lucrative opportunities for the industrial vehicles market during the forecast period.

Challenge: Low labor costs in emerging economies

Low labor wage rates in emerging economies such as Bangladesh, India, and Tanzania restrict the adoption/penetration of automated technologies across end-use industries in these countries. The automation of industrial facilities makes little or no economic sense in these aforementioned countries where cheap labor is available in abundance. The average daily wage of a semiskilled worker in India is ~USD 3. In these emerging economies, automation in manufacturing facilities is less prevalent than in other developed countries since the cost advantage in labor trade-off with robots is less due to the availability of cheap labor. Bangladesh, Cuba, and Tanzania have very low average daily wages. Thus, companies in emerging countries are reluctant to invest in industrial vehicles such as Automated Guided Vehicles, electric lift trucks, etc. Several operations in the manufacturing sector of emerging economies are carried out by human laborers as the combination of manual efforts with precise and semiautomatic machines proves to be profitable.

Industrial Vehicles Market Ecosystem

The ecosystem analysis highlights various players in the industrial vehicles market, which is primarily represented by industrial vehicle manufacturers, sales networks, and part/component manufacturers. Prominent companies in this market include Toyota Industries Corporation (Japan), KION Group AG (Germany), Mitsubishi Logisnext Co., Ltd. (Japan), Jungheinrich AG (Germany), and Crown Equipment Corporation (US).

Container handler segment is estimated to be the fastest-growing market during the forecast period

Container handler is expected to be the fastest-growing segment by vehicle type during the forecast period. Container handlers offer several advantages, such as superior performance and energy efficiency. These handlers have robust frames as well as wide drive axles, which provide superior stability and long-term durability when handling empty containers at full height. Container handlers find applications in ports, terminals, and shipping yards, among others. Toyota Industries Corporation, Hyster–Yale Materials Handling, Inc., Konecranes, and Hangcha Group Co., Ltd. offer container handlers for end-users. All these aforementioned parameters are expected to support the revenue growth of the container handler segment of the industrial vehicles market during the forecast period.

ICE-operated industrial vehicles estimated to be second-fastest growing segment during the forecast period

ICE-operated industrial vehicles are highly efficient, which makes them a preferred choice for many end-use industries. These vehicles can work for longer hours than electric industrial vehicles, which require recharging. Additionally, they can lift and move heavy loads with ease, which improves the efficiency of loading and unloading operations in warehouses, factories, and distribution centers. Their high power output, faster acceleration, and higher top speeds also contribute to their efficiency in transportation and material handling operations. All these aforementioned parameters are expected to support the growth of the ICE segment of the global industrial vehicles market during the forecast period.

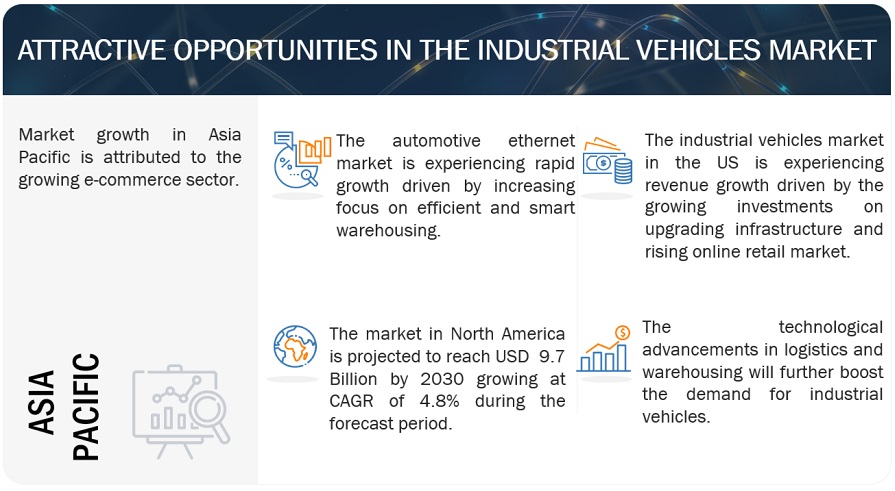

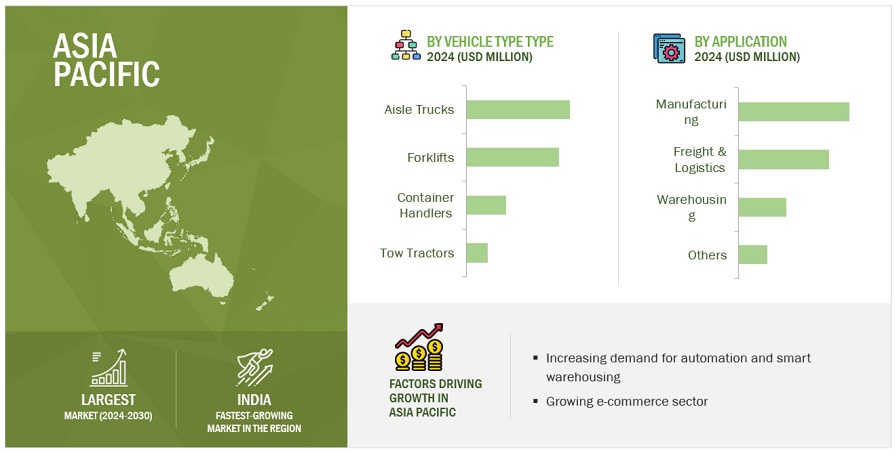

“Asia Pacific is expected to be the largest market in the forecast period.”

The Asia Pacific region has been segmented into China, Japan, India, South Korea, and the Rest of Asia Pacific. This region is the leading producer of industrial vehicles such as forklifts, aisle trucks, tow tractors, etc., and also comprises some of the fastest-developing economies in the world, including China and India. The market in China is witnessing increased investments by manufacturers and suppliers in automation systems for efficient operational tasks. Major industries in the country, including automotive, manufacturing, and aerospace, are expected to support the development of industrial vehicles in China. Additionally, state-of-the-art industrial infrastructure is attracting numerous new entrants to the Chinese industrial vehicles market. Japan is renowned for its automation. Daifuku is a key player in warehouse automation in Japan. Similarly, Mitsubishi Logisnext Co., Ltd. is a key player in material handling equipment in Japan. The Japanese economy constitutes a highly advanced manufacturing sector renowned for making highly durable and sophisticated products. Automotive, semiconductors & electronics, and aviation are a few of the major industries in Japan.

Key Market Players

The industrial vehicles market is dominated by major players including Toyota Industries Corporation (Japan), KION Group AG (Germany), Mitsubishi Logisnext Co., Ltd. (Japan), Jungheinrich AG (Germany), and Crown Equipment Corporation (US). These companies offer industrial vehicles such as forklifts, aisle trucks, tow tractors, etc., and have strong distribution networks at the global level. These companies have adopted extensive expansion strategies; and undertaken collaborations, partnerships, and mergers & acquisitions to gain traction in the industrial vehicles market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2018–2028 |

|

Base year considered |

2021 |

|

Forecast period |

2023-2028 |

|

Forecast units |

Volume (Thousand Units) and Value (USD Million/USD Billion) |

|

Segments covered |

Vehicle Type, Drive Type, Application, Capacity, Level of Autonomy, Aerial Work Platform Type, and Region |

|

Geographies covered |

Asia Pacific, Europe, North America, and RoW |

|

Companies Covered |

Toyota Industries Corporation (Japan), KION Group AG (Germany), Mitsubishi Logisnext Co., Ltd. (Japan), Jungheinrich AG (Germany), and Crown Equipment Corporation (US). |

This research report categorizes the industrial vehicles market based on vehicle type, drive type, application, capacity, level of autonomy, aerial work platform and region.

Based on Vehicle Type:

-

Forklifts

- <5 Ton

- 5-10 Ton

- 11-36 Ton

- >36 Ton

-

Aisle Trucks

- <1 Ton

- 1-2 Ton

- >2 Ton

-

Tow Tractors

- <5 Ton

- 5-10 Ton

- 11-30 Ton

- >30 Ton

-

Container Handlers

- <30 Ton

- 30-40 Ton

- >40 Ton

Based on Drive Type:

- ICE

- Battery-operated

- Gas-powered

Based on Application:

- Manufacturing

- Warehousing

- Freight & Logistics

- Others

Based on Level of Autonomy:

- Non/Semi-Autonomous

- Autonomous

Based on Aerial Work Platform:

- Boom Lifts

- Scissor Lifts

Based on the Region:

-

Asia Pacific (APAC)

- China

- India

- South Korea

- Japan

- Rest of APAC

-

North America (NA)

- US

- Canada

- Mexico

-

Europe (EU)

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

-

Rest of the World (RoW)

- Brazil

- South Africa

- Others

Recent Developments

- In January 2023, Crown Equipment Corporation expanded its counterbalance forklift portfolio with the launch of four-wheel forklifts available in electric, diesel, and LPG propulsion types. These lifts have load capacities ranging from 2.0 up to 5.5 tons and are capable enough of tackling a wide variety of material handling tasks in indoor as well as outdoor applications.

- In December 2022, CLARK announced the launch of its SEC20-35 four-wheel electric forklift. This industrial vehicle (forklift) comes with capacities ranging from 4,000-7,000 pounds.

- In May 2022, CLARK launched the S40-60 IC Pneumatic forklift truck, which has built-in capacities of 8,000 to 12,000 pounds. This forklift offers safety features including an integrated backup camera, LED lights, and optional speed limit control, among others.

- In November 2021, Mitsubishi Logisnext Americas launched two new forklifts _ PF(D)80N and PF(D)120N model series of 4-wheel internal combustion mid-sized pneumatic tire forklifts. These engine-powered forklifts are available to all the dealers associated with the UniCarriers brand.

- In April 2020, Konecranes launched E-VER forklift in its existing product portfolio. This product offers advanced digital experience to the end users.

Frequently Asked Questions (FAQ):

What is the current size of the global industrial vehicles market?

The global industrial vehicles market is projected to grow from USD 39.7 billion in 2023 to USD 49.2 billion by 2028, at a CAGR of 4.4%

Who are the winners in the global industrial vehicles market?

The industrial vehicles market is dominated by key players including KION Group AG (Germany), Mitsubishi Logisnext Co., Ltd. (Japan), Toyota Industries Corporation (Japan), Jungheinrich AG (Germany), and Crown Equipment Corporation (US).

Which region will have the largest market for industrial vehicles during the forecast period?

The Asia Pacific region is expected to be the largest market for industrial during the forecast period owing to the rising e-commerce industry, and the revival of manufacturing industries in this region.

What are the major trends in the global industrial vehicles market?

Focus on hydrogen-powered industrial vehicles, electrification of industrial vehicles, and increasing focus on automated industrial vehicles are major trends witnessed in the global market.

Which are the major driving factors in the global industrial vehicles market?

Rising demand autonomous solutions in material handling across industries, growth of the e-commerce industry, and increasing focus on improving workplace safety are key drivers in this global market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

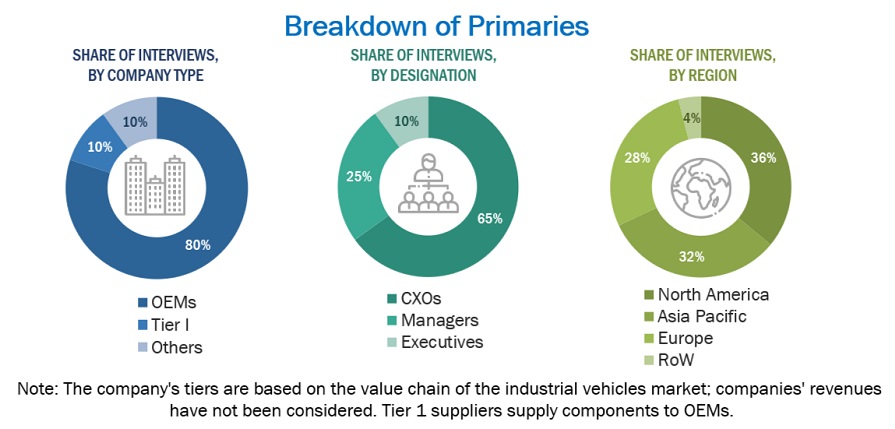

The study involves 4 main activities to estimate the current size of the industrial vehicles market. Exhaustive secondary research was done to collect information on the market. The next step was to validate these findings, assumptions, and market analysis with industry experts across value chains through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size of different segments considered in this study. Market breakdown and data triangulation were then used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as company annual reports/presentations, press releases, industry association publications [for example, Association of Professional Material Handling Consultants (APMHC), British Industrial Truck Association (BITA), European Materials Handling Federation (FEM), Industrial Truck Association (ITA), Material Handling Equipment Distributors Association (MHEDA), lift truck magazines, articles, directories, technical handbooks, trade websites, technical articles, and databases (for example, Marklines, and Factiva) have been used to identify and collect information useful for an extensive commercial study of the global industrial vehicles market.

Primary Research

Extensive primary research was conducted after acquiring an understanding of the industrial vehicles market scenarios through secondary research. Several primary interviews were conducted with market experts from both the demand (manufacturing industries, logistic companies, etc.) and supply (industrial vehicle manufacturers, and raw material/component manufacturers) sides across major regions, namely, North America, Europe, and Asia Pacific. Approximately 17% and 83% of primary interviews were conducted from the demand and supply sides, respectively. Primary data was collected through questionnaires, emails, and telephonic interviews.

In the canvassing of primaries, various departments within organizations, such as sales, operations, and marketing, were covered to provide a holistic viewpoint in the report. After interacting with industry experts, brief sessions were also conducted with highly experienced independent consultants to reinforce the findings from primaries. This, along with the in-house subject matter experts’ opinions, led to the findings described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down approach was used to estimate and validate the total size of the industrial vehicles market. These methods were also used extensively to estimate the size of various subsegments in the market. The top-down methodology has been followed to estimate the industrial vehicles market by drive type, capacity, application, and level of autonomy. To determine the market size by drive type and capacity type in terms of volume, model mapping was done to understand the penetration rates. For application segment, penetration was identified through secondary and primary research. For instance,

- The industrial vehicles market for drive type was derived using the top-down approach to estimate the subsegments: battery-operated, internal combustion engine, and gas-powered.

- Mapping was done at regional level to understand the penetration of different drive types.

- In terms of volume, the market size was derived at the country level. The total volume of the industrial vehicles market was multiplied by the adoption rate breakup percentage of drive type at the country level

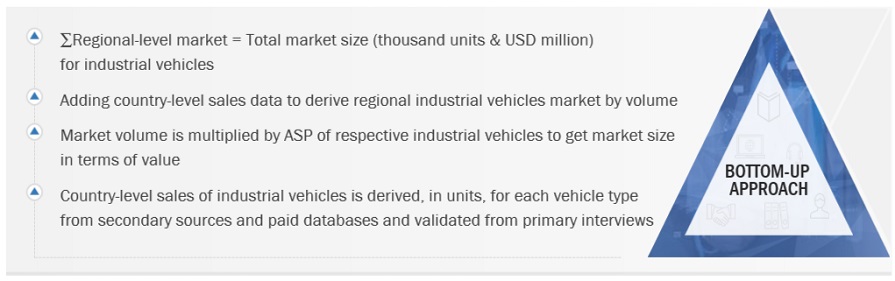

Global Industrial Vehicles Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Industrial vehicles covered in the study are forklifts, aisle trucks, tow tractors, and container handlers. As per Occupational Safety and Health Administration (OSHA), powered industrial trucks, commonly called forklifts or lift trucks, are used in many industries, primarily to move materials. They can also be used to raise, lower, or remove large objects or a number of smaller objects on pallets or in boxes, crates, or other containers. Forklifts can either be ridden by the operator or controlled by a walking operator.

Aisle trucks are often used to stack in narrow aisle environments. According to OSHA, Class II equipment include electric motor narrow aisle trucks. These trucks are electric powered by either a battery or a fuel cell and are operated by a seated or standing operator. These vehicles can also be called order picker trucks, turret trucks, side loader trucks, or straddle trucks. According to OSHA, Class VI equipment includes electric and ICE tow tractors. These machines are mostly used for towing loads rather than lifting. Trucks in this class are ideal for use at airports but are also commonly used in assembly line areas. A container handler is a vehicle used for handling intermodal cargo containers in small terminals or medium-sized ports. It is used to transport a container over short distances and pile containers in various rows.

Stakeholders

- Associations, forums, and alliances related to industrial vehicles

- Raw material suppliers

- Industrial vehicle distributors and dealers

- Manufacturers of industrial vehicles

- Manufacturers of industrial vehicle components

- Autonomous vehicle solution providers

- Technology vendors

- Industrial vehicle rental/leasing companies

- Material handling associations

- Standards organizations and regulatory authorities related to the material handling industry

Report Objectives

- To define, segment, and forecast the global industrial vehicles market (2018–2028) in terms of volume (000’ units) and value (USD Million)

- To segment the global industrial vehicles market and forecast its size by vehicle type & capacity, drive type, application, level of autonomy, type (aerial work platform), and region

- To segment the global industrial vehicles market and forecast the market size, by volume and value, based on vehicle type – forklifts, tow tractors, container handlers, aisle trucks, AGVs, and personnel carriers

- To segment the global industrial vehicles market and forecast the market size, by volume and value, based on drive type – ICE, battery-operated, and gas-powered

- To segment the global industrial vehicles market and forecast the market size, by volume and value, based on application – manufacturing, warehousing, freight & logistics, and others

- To segment the global industrial vehicles market and forecast the market size, by volume and value, based on level of autonomy – non/semi-autonomous and autonomous

- To segment the global aerial work platform market, and forecast the market size, by volume and value, based on type – scissor lifts, and boom lifts

- To forecast the market size with respect to key regions, namely, North America, Europe, Asia Pacific, and the Rest of the World

- To provide detailed information regarding major factors influencing market growth (drivers, challenges, restraints, and opportunities)

- To strategically analyze the market with respect to individual growth trends, prospects, and contributions to the total market

- To strategically profile key players and comprehensively analyze their market share and core competencies

- To analyze the opportunities for stakeholders and the competitive landscape for market leaders

- To track and analyze competitive developments such as manufacturing expansion, mergers & acquisitions, new product development, product enhancement (electrification), and joint ventures, and other activities carried out by key industry participants

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance with the company’s specific needs.

- By Capacity at regional level for each vehicle type

- By Drive Type at regional level for each vehicle type

- By Application at global level for each vehicle type

Company Information

- Profiling of Additional Market Players (Up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Industrial Vehicles Market

Which geography is expected to grow at the highest rate among others in the global Industrial Vehicles Market from 2022 to 2030?