Video Analytics Market by Component (Software and Services), Application (Incident Detection, Intrusion Management, Traffic Monitoring), Deployment Model (Cloud and On-premises), Type, Vertical and Region - Global Forecast to 2027

Updated on : July 10, 2023

Video Analytics Market Statistics

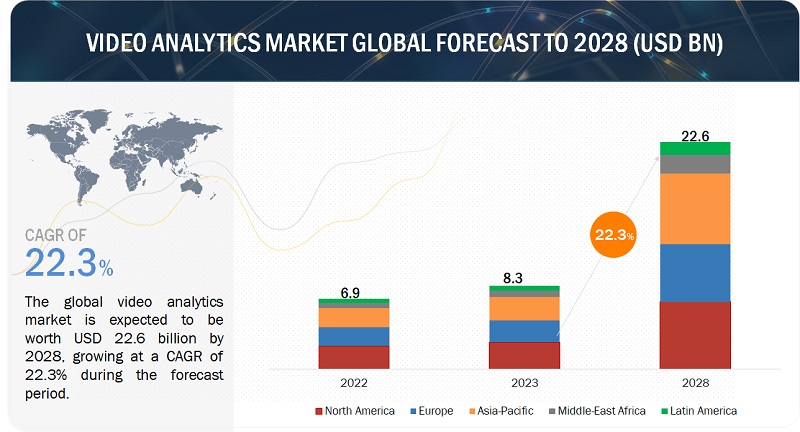

The global Video Analytics Market is projected to reach USD 7.1 billion in 2022 to USD 20.3 billion by 2027, at a compound annual growth rate (CAGR) of 23.4% during the forecast period. The limitations of manual video analysis is one of the primary factors driving the market growth. Moreover, the reduced cost of video surveillance equipment and long-term ROI are driving the adoption of video analytics solutions.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact Analysis

The impact of COVID-19 on the video analytics market has affected large and small enterprises across various industry verticals.

- According to the survey by CNBC, in early 2021, most Americans traveled domestically for vacations. As a result, the demand for advanced AI-based surveillance systems with COVID-protocol integration increased. For instance, the DV-2332 AI Box device from IDIS, Ltd. supports crowd detection, mask detection, occupancy control, and social distancing features, which are crucial for hotels, bars, restaurants, museums, and other hospitality and leisure centers.

- Major component and technology providers, such as Cisco and Honeywell, have faced supply chain disruption amidst the COVID-19 pandemic. In response, the companies shifted their focus to supply critical infrastructure to mission-critical end uses, such as telemedicine, first responders, healthcare providers, and laboratories.

- European countries are deploying GDPR-compliant AI-based video surveillance solutions amidst the COVID-19 pandemic to monitor the crowd for COVID-19 norm violations. For instance, Datakalab (France) provided software to detect mask and social distancing violations in the resort city of Cannes through cameras installed on the roads and buses.

- The local police from numerous cities, such as Madrid (Spain), Paris (France), and Rome (Italy), have effectively used drones to monitor the crowd amidst lockdowns. The police departments also collected valuable data on violators and crowd density to frame crowd control strategies and draft further regulations.

- The temporary closure of camera and hardware manufacturing facilities from major companies, such as Hikvision and Huawei, has disrupted the global supply chain, reducing the deployment of city surveillance and video analytics solutions across the region.

- Airports and train stations are upgrading their infrastructure with state-of-the-art video surveillance and analytics systems to monitor the passengers at check-in, entry, exits, security, immigration, and queues, thereby containing the spread of COVID-19. For instance, GMR Hyderabad International Airport (India) has installed a Queue Management System from AllGoVision to manage the crowd in the airport and frame effective strategies based on passenger density and crowd data collection.

- Amidst the COVID-19 pandemic, the stadiums and sports venues require an effective and advanced crowd management system. Qatar's 2022 FIFA World Cup has opened lucrative opportunities for video analytics and surveillance system companies. The stadiums across Doha and the rest of Qatar have been proposed to host the event. Some of these stadiums include Lusail Iconic Stadium, Al Bayt Stadium, Al Thumama Stadium, and Ras Abu Aboud Stadium.

- The football stadiums across the region have started opening for the major matches by following social distancing and installing advanced equipment to monitor the audience concerning COVID-19 norms. For instance, in July 2021, Maracanã Stadium from Rio de Janeiro opened with a 10% attendance from the total of 78 thousand seat stadium for the Copa America final match.

Video Analytics Market Dynamics

Drivers: Limitations of manual video analysis

There are many disadvantages associated with the manual analysis of surveillance videos. Labor costs have been deterring the utilization of humans for the manual analysis of surveillance videos. Video analytics helps reduce labor costs by either increasing the surveillance capacity of monitoring individuals or re-deploying employees to perform non-monitoring duties in extreme cases of cost restructuring, removing the need for employees entirely. In the case of human employees, large amounts of video footage can prove to be a grave obstacle for quick and intelligent video analysis, and swift incident responses. Along with video analytics, the analysis of very large amounts of video footage and data can be done quickly, thus reducing the need for employees. Human fatigue is another issue that can be overcome with the help of video analytics solutions. Unlike humans, who miss out on over 90% of video activities after 20 minutes of continuous surveillance video monitoring, the video analytics software keeps up the efficiency level, thus greatly reducing the number of false positives. Human integrity also plays during manual analysis, whereas video analytics software achieves operational compliance by adhering to defined rules and response procedures.

Restraints: Government regulations related to CCTV surveillance

The vast applications of video analytics have encouraged governments, organizations, and enterprises to embed video analytics with their video surveillance systems. These systems capture and analyze video footage 24x7. It is used for different purposes, such as facial recognition, people counting, and ANPR. Despite its advantages, many questions have been raised over citizens' privacy. This has resulted in stringent regulations to control anti-social activities; countries such as the US and UK are imposing the use of video analytics in selected areas only with limited functionalities. For instance, in October 2021, the European Parliament passed a nonbinding resolution that bans the police use of facial recognition in public places and the creation of private facial recognition databases. In Oakland and Somerville, similar bans are expected to be applied to facial recognition and other remote biometric surveillance systems. General Data Protection Regulation (GDPR) has also given guidelines about the collected data via CCTV video footage. Organizations and businesses cannot install CCTV without a valid reason as per the instructions of the GDPR. Hence, stringent regulations are expected to hinder the growth of the global video analytics market.

Opportunities: Predictive information using video analytics

Predictive analytics is used to make predictions about future events. It uses statistics, modeling, data mining, ML, and AI techniques. The video system captures critical and valuable signals, which include unstructured streams, such as video, audio, and social media data containing key customer behavioral attributes. It can also capture atmospheric data as surveillance cameras are placed in open areas. All these parameters can be combined and used to generate predictions, but the prediction can be difficult. Storage requirements, time consumption, and review of each video clip are some factors that might challenge the generation of predictive information. Hence, the generation of predictive information through video analytics can act as an opportunity for the global video analytics market.

Challenges: Interoperability complexities and support for older equipment of surveillance systems

The interoperability of surveillance systems is one of the major issues that impact the growth of the video analytics market and user experience. It also makes the analysis of a large volume of CCTV difficult and time-consuming. The major reason for interoperability is the large number of vendors operating in the market. All vendors have their preferred video format for processing and unique encrypted casing. The lack of standardization makes integrating, viewing, and exchanging data from different systems difficult. The need to standardize video analytics is very important as many new futures are being introduced to enhance the system's capabilities in representing the properties of objects, events, and scene contents. Hence, the interoperability of video surveillance systems is expected to pose challenges for vendors in this market.

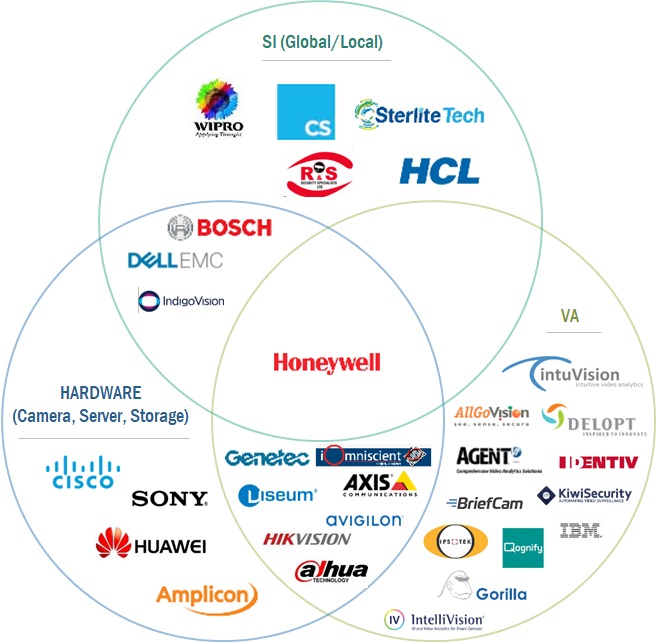

Video analytics Market Ecosystem

To know about the assumptions considered for the study, download the pdf brochure

By Application, the Facial Recognition segment is expected to account for the highest growth during the forecast period

The facial recognition segment is expected to account for the highest growth rate during the forecast period. Facial recognition enables the easy identification of people’s faces by comparing the live captured image with the digital image data stored in a data repository. The facial recognition application is aggressively adopted in brick-and-mortar stores to offer customized solutions based on customers’ earlier interactions with the company. It also comes in handy in effectively identifying and monitoring offenders inside stores, resulting in enhanced operational performance and improved monitoring without needing to increase the staff.

By Deployment Model, the On-premises segment is expected to account for a larger market size during the forecast period

The deployment model estimates the on-premises segment to account for a larger market share. On-premises is a delivery model where the software or solution is installed and operated from the customers’ in-house server and computing infrastructure. This approach is mostly adopted for applications that involve processing sensitive and confidential data volumes. Several large organizations are deploying on-premises video analytics due to privacy and security concerns related to confidential data.

By Region, Asia Pacific is expected to record the highest growth during the forecast period

The video analytics market in the Asia Pacific is expected to witness exponential growth, mainly because of the rising awareness about the potential security threats to individuals and the growing manufacturing industry. The rapid growth in mobile device manufacturing has considerably reduced the cost of camera components, making it cheaper for SMEs and private individuals to install surveillance cameras. Moreover, the rapid GDP growth in Asia Pacific countries has resulted in infrastructure modernization projects, such as smart city projects and mass public transit systems, which have increased the demand for video analytics. The Yinchuan city in China is one of the most advanced smart cities in the Asia Pacific, with almost all infrastructure integrated into a unified system. Singapore is also moving toward becoming a smart nation, leading to an increased demand for efficient video analytics.

Asia Pacific: Video analytics Market Snapshot

Key Market Players

The major vendors in the video analytics market include Avigilon (Canada), Axis Communications (Sweden), Cisco (US), Honeywell (US), IBM (US), AllGoVision (India), Genetec (Canada), IntelliVision (US), Gorilla Technology (Taiwan), and intuVision (US).

The study includes an in-depth competitive analysis of these key players in the video analytics industry, including their company profiles and strategies. The report includes the study of key players offering video analytics software and services.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size value in 2022 |

USD 7.1 billion |

|

Revenue forecast in 2027 |

USD 20.3 billion |

|

Growth Rate |

23.4% CAGR |

|

Quantitative units |

Value (USD Billion) |

|

Segments covered |

By Component, Application, Deployment Model, Type, Vertical, and Region |

|

Market Drivers |

|

|

Market Opportunities |

|

|

Regions covered |

North America, Europe, Asia Pacific, Middle East and Africa, and Latin America |

|

Companies covered |

Avigilon (Canada), Axis Communications (Sweden), Cisco (US), Honeywell (US), and IBM (US) |

This research report categorizes the video analytics market to forecast revenues and analyze trends in each of the following subsegments:

By Component:

- Software

-

Services

- Managed Services

- Professional Services

By Application:

- Incident Detection

- Intrusion Management

- People/Crowd Counting

- Traffic Monitoring

- Automatic Number Plate Recognition

- Facial Recognition

- Other Applications

By Deployment Model:

- Cloud

- On-premises

By Type:

- Server-based

- Edge-based

By Vertical:

- Banking, financial services, and insurance (BFSI)

- Critical Infrastructure

- Education

- Hospitality & Entertainment

- Manufacturing

- Government & Defense

- Retail

- Transportation & Logistics

- Other Verticals

By Region:

-

North America

- United States

- Canada

-

Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- China

- Japan

- Australia and New Zealand

- India

- South Korea

- Rest of Asia Pacific

-

Middle East & Africa

- United Arab Emirates

- Kingdom of Saudi Arabia

- South Africa

- Qatar

- Rest of Middle East & Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In May 2021, Cisco Meraki partnered with Kloudspot to help organizations offer safer and smarter workplaces for their employees and customers.

- In April 2021, IBM acquired myInvenio, an Italian process mining software company. The acquisition provides customers with a comprehensive suite of AI-powered automation capabilities for business automation.

- In March 2021, Honeywell signed an agreement to acquire a majority stake in Fiplex Communications to expand the in-building connectivity and communications solutions. Fiplex’s solutions have become a platform for Honeywell’s wireless technology.

- In April 2020, Axis Communications announced the expansion of its research and development office for software development in Linköping, Sweden.

- In March 2020, Avigilon announced the integration of video tag enterprise body-worn cameras and Avigilon Control Center (ACC) video management software. This enhances enterprise security efforts by making live body-worn audio and video that can be accessed through the ACC AI-powered platform.

Frequently Asked Questions (FAQ):

What is the projected market value of the global video analytics market?

The global video analytics market is projected to grow from USD 7.1 billion in 2022 to USD 20.3 billion by 2027, at a Compound Annual Growth Rate (CAGR) of 23.4% during the forecast period.

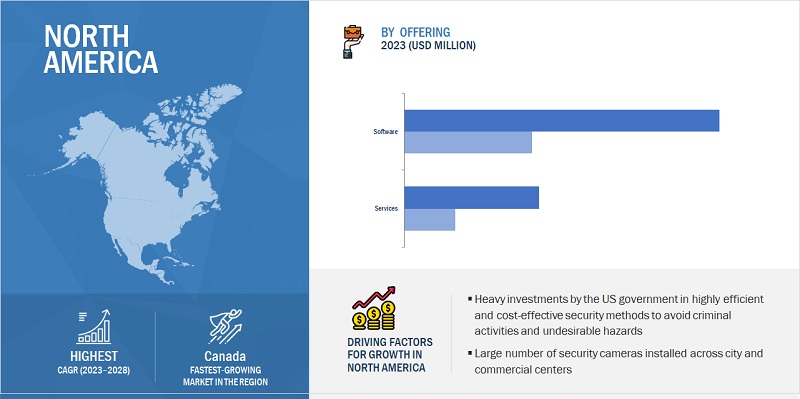

Which region has the largest market share in the video analytics market?

North America is estimated to account for the largest share of the video analytics market in 2022. North America’s stable economy and technological advancements positively impact the market, which is expected to drive its growth. North America also has the presence of most of the top market vendors, such as Honeywell, IBM, IntelliVision, Cisco, and intuVision.

Which component is expected to account for a higher growth during the forecast period?

By component, the services segment is expected to achieve higher growth during the forecast period due to the lack of security expertise required to maintain video analytics solutions.

Which vertical is expected to account for the largest market size during the forecast period?

By vertical, the Government & Defense segment is expected to account for the largest market size during the forecast period. This is due to the growing government initiatives to enhance public safety and reduce criminal activities.

Who are the major vendors in the video analytics market?

The major vendors in the video analytics market include Avigilon (Canada), Axis Communications (Sweden), Cisco (US), Honeywell (US), IBM (US), AllGoVision (India), Genetec (Canada), IntelliVision (US), Gorilla Technology (Taiwan), and intuVision (US). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

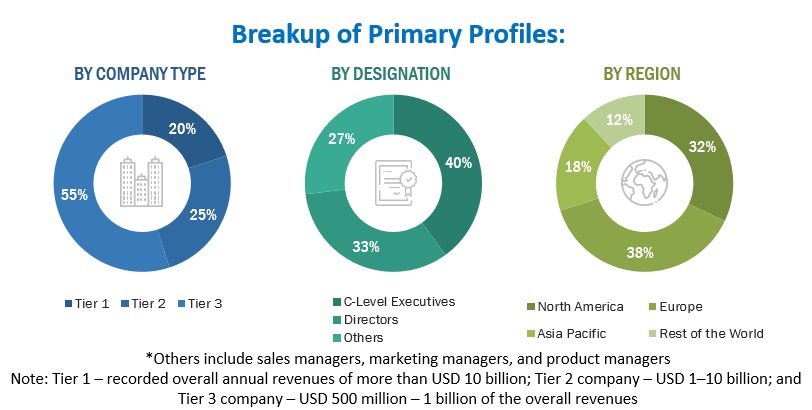

The study involves four major activities in estimating the current size of the video analytics market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and sub-segments of the video analytics market.

Secondary Research

The market size of companies offering video analytics software and services was arrived at, based on the secondary data available through paid and unpaid sources, and by analyzing the product portfolios of major companies in the ecosystem and rating the companies based on their product capabilities and business strategies.

In the secondary research process, various sources were referred to, for identifying and collecting information for the study. The secondary sources included annual reports, press releases, investor presentations of companies, and product data sheets, white papers, journals, certified publications, and articles from recognized authors, government websites, directories, and databases.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market- and technology oriented perspectives, all of which were further validated by primary sources.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the video analytics market.

Primary interviews were conducted to gather insights, such as market statistics, latest trends disrupting the market, new use cases implemented, data of revenue collected from products and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped in understanding various trends related to technologies, segmentation types, industry trends, and regions. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Security Officers (CSOs); the installation teams of governments/end users using video analytics software and services; and digital initiatives project teams, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current use of software solutions, which would affect the overall video analytics market.

To know about the assumptions considered for the study, download the pdf brochure

Video Analytics Market Size Estimation

Top-down and bottom-up approaches were used to estimate and validate the size of the video analytics market and various other dependent subsegments. The research methodology used to estimate the market size included the following details:

- The key players in the market were identified through secondary research, and their revenue contributions in the respective countries were determined through primary and secondary research.

- This entire procedure included the study of the annual and financial reports of top market players and extensive interviews for key insights from industry leaders, such as Chief Executive Officers (CEOs), VPs, directors, and marketing executives.

- All percentage splits and breakups were determined using secondary sources and verified through primary sources.

In the bottom-up approach, the adoption trend of video analytics software and services among different industry verticals in key countries with respect to regions that contribute to most of the market share was identified. For cross-validation, the adoption trend of video analytics software and services, along with different use cases with respect to their business segments, was identified and extrapolated. Weightage was given to the use cases identified in different solution areas for the calculation. An exhaustive list of all vendors offering software and services in the video analytics market was prepared. The revenue contribution of all vendors in the market was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Vendors with video analytics software and services offerings were considered for the evaluation of the market size. Each vendor was evaluated on the basis of its software and service offerings across verticals. The aggregate of all companies’ revenue was extrapolated to reach the overall market size. Each subsegment was studied and analyzed for its market size and regional penetration. Based on these numbers, the region split was determined by primary and secondary sources.

In the top-down approach, an exhaustive list of all the vendors offering software and services in the video analytics market was prepared. The revenue contribution of all the vendors in the market was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Both types of vendors that offer video analytics as a standalone solution, as well as an integrated solution in the video surveillance systems, were considered for the evaluation of the market size. Each vendor was evaluated based on its product/solution offerings, services, and applications across verticals. The aggregate of all companies’ revenue was extrapolated to reach the overall market size. Furthermore, each subsegment was studied and analyzed for its market size and regional penetration. The markets were triangulated through both primary and secondary research. The primary procedure included extensive interviews for key insights from industry leaders, such as CEOs, VPs, directors, and marketing executives. These market numbers were further triangulated with the existing MarketsandMarkets’ repository for validation.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the global Video Analytics market on the basis of component (software and services), application, type, deployment model, organization size, vertical, and region

- To forecast the market size of the five major regional segments: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America

- To strategically analyze the market subsegments with respect to individual growth trends, prospects, and contributions to the total market

- To provide detailed information related to the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze macro and micromarkets1 with respect to growth trends, prospects, and their contributions to the overall market

- To analyze industry trends, patents & innovations, and pricing data related to the video analytics market

- To analyze the impact of COVID-19 on component, application, type, deployment model, organization size, vertical, and region across the globe

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for major players

- To profile key players in the market and comprehensively analyze their market share/ranking and core competencies2

- To track and analyze competitive developments, such as mergers and acquisitions, new product developments, and partnerships and collaborations in the market.

1. Micromarkets are defined as the further segments and subsegments of the Video Analytics market included in the report.

2. Core competencies of the companies are captured in terms of their key developments and key strategies adopted by them to sustain their position in the market.

Customization Options

Along with the market data, MarketsandMarkets offers customizations as per the company-specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the Middle Eastern and African market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Video Analytics Market