Inverter Market by Type (Solar Inverters, Vehicle Inverter, others), Output Power Rating (Upto 10 kW, 10-50 kW, 51-100 kW, above 100 kW), End User (PV Plants, Residential, Automotive), Connection, Voltage, Sales Channel & Region - Global Forecast to 2027

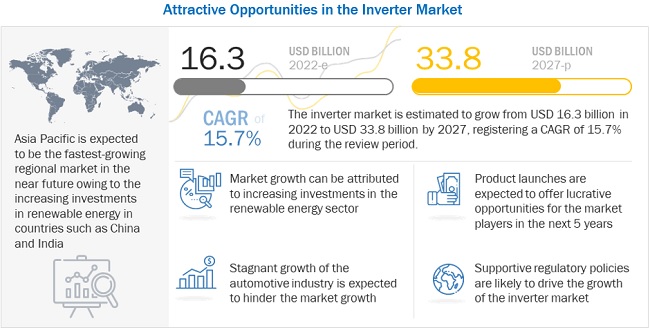

The global inverter market size was valued at USD 16.3 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 15.7% from 2022 to 2027. The growth of the inverter market can be attributed to growing investments in the renewable power generation technologies, green infrastructure. The rapidly usage of power backup systems in various sectors is also fueling demand for inverters.

To know about the assumptions considered for the study, Request for Free Sample Report

Inverter Market Dynamics

Driver: Rising number of solar installations attributed to government-led incentives and schemes

Rapid developments in the solar energy sector in terms of power generation and utilization are contributing to the increase in the number of solar PV installations for various applications across the world. According to the Global Market Outlook for Solar Power/2022–2026—a report published by SolarPower Europe— global solar capacity doubled in 3 years from 2018, bringing the global solar fleet to one Terawatt capacity in April 2022. Solar is the fastest-growing renewable energy, representing over half of the 302 GW of renewable capacity installed internationally in 2021. Countries such as China, the US, Germany, and Japan are major markets with the highest number of new solar installations in 2019 and 2020. Flourishing solar energy markets, including India, Brazil, and China, are expected to create growth opportunities for the solar inverter system market. Moreover, an increase in the number of global PV power plant installations is also creating potential growth opportunities for the solar inverter system market.

The governments of different countries undertake various schemes and initiatives to encourage the use of inverters in industrial applications. For instance, in 2020, China’s national energy administration (NEA) has set a target for renewable power to account for over half of total installed capacity by 2025 to help support the country’s emissions goals as a part of the 14th Five-year Plan (2021–2025). China was the largest PV market in the world in 2020. The Self-generation Incentive Program (SGIP – California only) and the US tax credits make solar and energy storage an attractive proposition for commercial end users. The demand for distributed PV in Europe has been driven by incentives provided by governments of different countries to promote residential and small commercial PV installations. The feed-in tariff (FiT) is a policy designed to encourage the adoption of all kinds of renewable sources of energy to reduce energy costs. The FiT policy typically includes three provisions: guaranteed grid access, a long-term fixed purchase price contract (generally of 20 years) for the electricity produced, and the decline in contract prices for new installations that are based on the cost of renewable energy generation with a downward trend toward grid parity. This policy was introduced in several major countries, including Germany, Italy, and the UK. Japan and China also have major PV FiT programs. These countries are expected to witness growth in the solar PV markets. With a guaranteed selling price of solar panels for 20 years, customers can make a reasonable return on their investments for a long time, thereby encouraging the installation of large systems on rooftops of buildings. These government incentives and schemes encourage solar companies to invest in solar projects. This, in turn, is acting as a growth driver for the market for inverters, especially solar inverters.

Restraint: Safety risks associated with high DC voltages

In traditional PV systems, PV panels, wires, and other equipment are energized with high DC voltages. These high DC voltages pose risks to installers, maintenance personnel, and firefighters. Solar inverters with PV arrays involve high DC voltages, making it difficult to isolate DC electric devices from PV arrays using DC isolation switches. When PV modules are connected in series, they create a high voltage, which can be dangerous for installers during the system installation. Under the condition of short-circuit current, there is a possibility of electric arcs, which can result in fire and a resulting threat to people in the vicinity of a PV system. These DC arcs are difficult to extinguish, posing a risk to firefighters. The fire can damage DC cables in PV arrays, thereby leading inverters to shut down automatically while manually isolating DC cables and other components. Safety mechanisms mandated by the National Electric Code (NEC) and the Electrical Safety Authority (ESA) of the US do not eliminate all risks, which hamper the growth of the inverter market.

Opportunities: Growing demand for electric vehicles

Inverters are used in automotive applications such as EV power trains. The DC power taken from vehicles’ batteries is converted to usable AC by these inverters. Vehicle inverters are used for operating onboard electronic systems and motors of vehicles. Continental (Germany), Delphi Technologies (UK), Toyota Industries (Japan), Sensata Technologies (US), Samlex Europe (Netherlands), and BESTEK (US) are some of the key manufacturers and providers of vehicle inverters.

Technological advancements in the automotive industry and the advent of trends such as connected, autonomous, and electric vehicles have increased the demand for electronic systems in vehicles. With the emphasis being laid on various environmental regulations, the electric vehicle market has witnessed decent growth globally. This, in turn, has led to the growth of its adjacent markets. The increasing propensity for electric vehicles among consumers is likely to drive the demand for vehicle inverters. Ambitious EV targets set by governments of different countries and required policy support have resulted in a decline in the costs of electric vehicles, extension in vehicle range, and improvements in charging infrastructures, which have further fueled the demand for electric vehicles globally. These factors are expected to create lucrative opportunities for the providers of vehicle inverters during the review period.

Challenges: Availability of low quality and cheap products in gray market and pricing pressure on manufacturers

The inverter market is highly fragmented, with many local and international players. Product quality is a primary parameter for differentiation in this market. The organized sector mainly targets industrial buyers and maintains higher product quality by following various industrial standards of the product. At the same time, the unorganized sector offers cheaper alternatives. The local manufacturers in most countries target the unorganized sector and compete strongly with global suppliers in the respective markets. The leading market players are currently facing stiff competition from the new players from the unorganized market, supplying cheap and low-quality products. These gray market players overpower the big players in terms of price competitiveness and local distribution network, which is a major challenge for the players operating in the inverter market.

Solar PV systems are witnessing increased global demand as they are used to generate green power to reduce dependence on grid power. With reduced prices of solar modules, inverters account for a large share of the overall installation costs of these modules. This results in downward price pressure on manufacturers of inverters. As the overall costs of residential, commercial, industrial, and utility-based solar systems are reducing, inverter companies are bound to reduce the prices of their products. Manufacturers of solar modules are enduring more pressure than the manufacturers of solar inverters in terms of reduction in the prices of their products. Manufacturers of solar inverters are finding it difficult to accommodate this change and allow price drops in their inverters. These price drops can be primarily attributed to the development of low-cost equipment and compressed profit margins, which are indicators of the overall price decline in inverters in the near future.

Market Trends

Market Interconnection

Automotive segment, by end user, is expected to grow at the highest CAGR during forecast period

The automotive segment is expected to register the highest CAGR during the forecast period. The adoption of electric vehicles is growing substantially due to the implementation of emission regulations to limit the emissions from traditional vehicles. Apart from electric vehicles, the inverters are also used in conventional vehicles for on-board power appliances. These factors are thus responsible for the increased demand of vehicle inverters which is expected to fuel the growth for the automotive segment.

By output power rating, Below 10 kW segment is expected to be the most significant contributor to the global inverter market during the forecast period

By output power rating, the inverter market has been segmented into below 10 kW, 10 – 50 kW, 50 – 100 kW, Above 100 kW. Below 10 kW is expected to be the largest segment during the forecast period. These inverters with the power rating below 10 kW are commonly used in residential applications. The growth of the market can be mainly attributed to the increase the number of solar roof top installations in various countries. Mainly in Asia Pacific countries such as India and china, the government initiatives and schemes in developing solar pv systems is fuelling the growth of the below 10 kW segment.

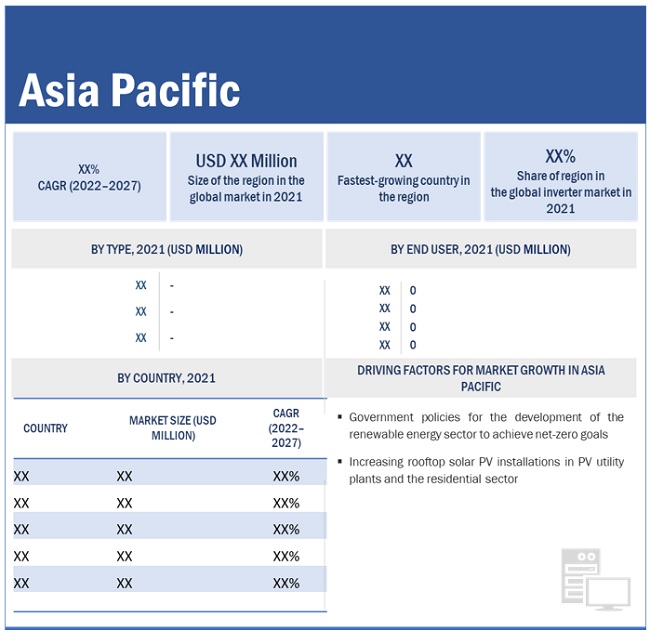

“Asia Pacific: The largest and fastest inverter market”

Asia Pacific is expected to dominate the global inverter market between 2022–2027, followed by North America and the Europe. The inverter market in Asia Pacific is witnessing significant developments in the renewable energy sector due to increased initiatives towards climate change and net zero targets, which has supported the demand for inverters across countries of the region. The increasing investments in the photovoltaic (pv) plants, rise of installations in the residential sector along with the shift in transportation towards electrical vehicles in countries such as China, India, Australia, and Japan.

To know about the assumptions considered for the study, download the pdf brochure

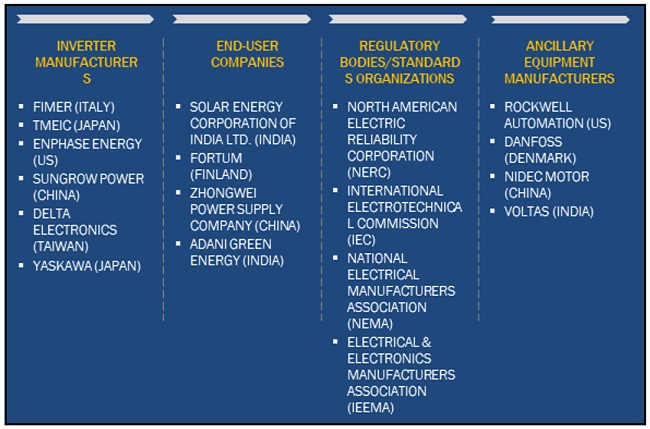

Key Market Players

The inverter market is dominated by a few major players that have a wide regional presence. The major players in the inverter market are Huawei Technologies (China), Sungrow Power Supply (China), SMA Solar Technology (Germany), Power Electronics (Spain), FIMER (Italy), SolarEdge Technologies (Israel), Fronius International (Austria), Altenergy Power System (US), Enphase Energy (US), Darfon Electronics Corporation (China), Schneider Electric (France). Between 2018 and 2022, the companies adopted growth strategies such as sales contracts to capture a larger share of the inverter market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Attributes |

Details |

|

Market size: |

from an estimated USD 16.3 billion in 2022 to USD 33.8 billion in 2027 |

|

Growth Rate: |

15.7% |

|

Largest Market: |

Asia Pacific |

|

Market Dynamics: |

Drivers, Restraints, Opportunities & Challenges |

|

Forecast Period: |

2022-2027 |

|

Forecast Units: |

Value (USD Billion) |

|

Report Coverage: |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered: |

Inverter type, output power rating, output voltage, sales channel, connection type, end user, and region |

|

Geographies Covered: |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Report Highlights:

|

Updated financial information / product portfolio of players |

|

Key Market Opportunities: |

Growing demand for electric vehicles |

|

Key Market Drivers: |

Rising number of solar installations attributed to government-led incentives and schemes |

This research report categorizes the inverter market inverter type, output power rating, output voltage, sales channel, connection type, end user, and region

On the basis of inverter type:

- Solar inverter

- Vehicle inverter

- Others (UPS and battery inverters)

On the basis of output power rating:

- Below 10 kW

- 10–50 kW

- 50–100 kW

- Above 100 kW

On the basis of output voltage:

- 100–300 V

- 300–500 V

- Above 500 V

On the basis of sales channel:

- Direct

- Indirect

On the basis of connection type:

- Standalone

- Grid-tied

On the basis of end user:

- Residential

- Automotive

- Photovoltaic (PV) Plants

- Others (Commercial, Industrial, and utilities)

On the basis of region:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In March 2022, Huawei Technologies has signed a strategic cooperation agreement with Meienergy Technology Co., Ltd for providing smart PV and energy storage system for the 1 GW utility PV plant and 500 MWh energy storage system in Ghana which is developed by Meienergy.

- In April 2022, Sungrow Power Supply has supplied string inverters to a 20.7 MW rooftop PV plant for electric vehicle manufacturing base of XPENG. The XPENG factory is now powered by 30% of clean electricity.

- In November 2019, SMA Solar Technology AG collaborated with South Korea-based LG Chem. Through this collaboration, the SUNNY BOY STORAGE battery inverters of SMA and RESU 10M batteries of LG Chem will be combined to form new home storage systems. The integration of SMA battery inverters with the RESU 10M batteries is expected to result in the development of integrated DC/DC converters, which can increase the operating voltage of batteries.

- In November 2021, FIMER made a contract with Indefol solar to supply inverter for Celadon sports & Resort Club project. this project comprises 1,677 solar panels across a total surface area of 4,800 square meters. powered by 6 of FIMER’s PVS-100-TL three-phase string inverter solution

Frequently Asked Questions (FAQ):

What is the current size of the inverter market?

The current market size of global inverter market is USD 14.2 billion in 2021.

What is the major drivers?

The growth of the inverter market can be attributed to growing investments in the renewable power generation technologies, green infrastructure. The rapidly usage of power backup systems in various sectors is also fueling demand for inverters.

Which is the fastest-growing region during the forecasted period?

Asia Pacific is witnessing significant developments in the renewable energy sector due to increased initiatives towards climate change and net zero targets, which has supported the demand for inverters across countries of the region. The increasing investments in the photovoltaic (pv) plants, rise of installations in the residential sector along with the shift in transportation towards electrical vehicles

Which is the fastest-growing segment, by end user during the forecasted period?

The automotive segment is expected to be the fastest-growing segment in the inverter market. The adoption of electric vehicles is growing substantially due to the implementation of emission regulations to limit the emissions from traditional vehicles. Apart from electric vehicles, the inverters are also used in conventional vehicles for on-board power appliances. These factors are thus responsible for the increased demand of vehicle inverters which is expected to fuel the growth for the automotive segment. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 29)

1.1 STUDY OBJECTIVES

1.2 DEFINITION

1.2.1 INVERTER MARKET, BY OUTPUT POWER RATING: INCLUSIONS AND EXCLUSIONS

1.2.2 MARKET, BY END USER: INCLUSIONS AND EXCLUSIONS

1.2.3 MARKET, BY TYPE: INCLUSIONS AND EXCLUSIONS

1.2.4 MARKET, BY OUTPUT VOLTAGE: INCLUSIONS AND EXCLUSIONS

1.2.5 MARKET, BY CONNECTION TYPE: INCLUSIONS AND EXCLUSIONS

1.2.6 MARKET, BY SALES CHANNEL: INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONAL SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 35)

2.1 RESEARCH DATA

FIGURE 1 INVERTER MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key data from primary insides

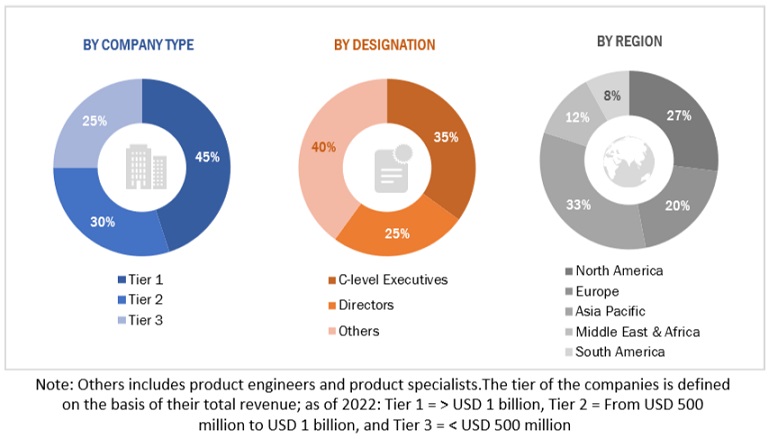

2.1.2.3 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for arriving at market size using bottom-up approach (demand side)

FIGURE 2 MARKET BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for arriving at market size using top-down approach (Supply side)

FIGURE 3 MARKET TOP-DOWN APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BASED ON SUPPLY SIDE ANALYSIS

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 5 DATA TRIANGULATION

2.4 KEY ASSUMPTIONS

FIGURE 6 ASSUMPTIONS FOR RESEARCH STUDY

2.5 FORECAST

3 EXECUTIVE SUMMARY (Page No. - 45)

TABLE 1 INVERTER MARKET SNAPSHOT

FIGURE 7 SOLAR INVERTER SEGMENT TO LEAD MARKET, BY TYPE, DURING FORECAST PERIOD

FIGURE 8 100–300 V SEGMENT TO LEAD MARKET, BY OUTPUT VOLTAGE, DURING FORECAST PERIOD

FIGURE 9 BELOW 10 KW SEGMENT TO LEAD MARKET, BY POWER RATING, DURING FORECAST PERIOD

FIGURE 10 GRID-TIED SEGMENT TO LEAD MARKET, BY CONNECTION TYPE, DURING FORECAST PERIOD

FIGURE 11 INDIRECT SEGMENT TO LEAD MARKET, BY SALES CHANNEL, DURING FORECAST PERIOD

FIGURE 12 RESIDENTIAL SEGMENT TO LEAD MARKET, BY END USER, DURING FORECAST PERIOD

FIGURE 13 ASIA PACIFIC TO DOMINATE MARKET DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 50)

4.1 ATTRACTIVE OPPORTUNITIES IN INVERTER MARKET

FIGURE 14 GOVERNMENT-LED INITIATIVES RELATED TO PV PLANTS AND AUTOMOTIVE INDUSTRY TO DRIVE GROWTH OF MARKET DURING FORECAST PERIOD

4.2 MARKET, BY REGION

FIGURE 15 ASIA PACIFIC MARKET TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

4.3 MARKET, BY TYPE

FIGURE 16 SOLAR INVERTER SEGMENT DOMINATED MARKET IN 2021

4.4 MARKET, BY OUTPUT VOLTAGE

FIGURE 17 100–300 V SEGMENT DOMINATED MARKET IN 2021

4.5 MARKET, BY POWER RATING

FIGURE 18 BELOW 10 KW SEGMENT HELD LARGEST SHARE OF MARKET IN 2021

4.6 MARKET, BY CONNECTION TYPE

FIGURE 19 GRID-TIED SEGMENT HELD LARGER SHARE OF MARKET IN 2021

4.7 MARKET, BY SALES CHANNEL

FIGURE 20 INDIRECT SALES SEGMENT HELD LARGER SHARE OF MARKET IN 2021

4.8 MARKET, BY END USER

FIGURE 21 RESIDENTIAL SEGMENT DOMINATED MARKET IN 2021

5 MARKET OVERVIEW (Page No. - 54)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 22 INVERTER MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Increasing investments in renewable energy sector

FIGURE 23 GLOBAL NET SOLAR CAPACITY ADDITION (GW)

FIGURE 24 GLOBAL INVESTMENTS IN RENEWABLE ENERGY SOURCES IN 2019 (USD BILLION)

5.2.1.2 Rising number of solar installations attributed to government-led incentives and schemes

5.2.1.3 Growing demand for residential solar rooftop installations and distributed energy resources (DERs)

5.2.2 RESTRAINTS

5.2.2.1 Safety risks associated with high DC voltages

5.2.2.2 Strain on batteries due to prolonged use of inverters

5.2.3 OPPORTUNITIES

5.2.3.1 Growing demand for electric vehicles

5.2.3.2 Increasing investments in development of smart grids

5.2.3.3 Technological innovations in inverters and development of high-power density inverters

5.2.4 CHALLENGES

5.2.4.1 Availability of low-quality and cheap products in gray market and pricing pressure on manufactures

5.2.4.2 Shortage of components and parts due to COVID-19 crisis

TABLE 2 REGION/COUNTRY-WISE PERCENTAGE DEVIATION FROM BENCHMARKS DUE TO COVID-19

5.3 PORTER’S FIVE FORCES ANALYSIS

TABLE 3 INVERTER MARKET: PORTER’S FIVE FORCES ANALYSIS

FIGURE 27 PORTER’S FIVE FORCES ANALYSIS

5.3.1 THREAT OF SUBSTITUTES

5.3.2 BARGAINING POWER OF SUPPLIERS

5.3.3 BARGAINING POWER OF BUYERS

5.3.4 THREAT OF NEW ENTRANTS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 KEY STAKEHOLDERS AND BUYING CRITERIA

5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 28 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS, BY END USER

TABLE 4 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS, BY END USER (%)

5.4.2 BUYING CRITERIA

FIGURE 29 KEY BUYING CRITERIA FOR END USERS

TABLE 5 KEY BUYING CRITERIA, BY END USER

5.5 COVID-19 IMPACT ANALYSIS

5.5.1 COVID-19 HEALTH ASSESSMENT

FIGURE 30 COVID-19 GLOBAL PROPAGATION

FIGURE 31 COVID-19 PROPAGATION IN SELECTED COUNTRIES

5.5.2 COVID-19 ECONOMIC ASSESSMENT

FIGURE 32 REVISED GDP FORECASTS FOR SELECTED G20 COUNTRIES IN 2020

5.6 AVERAGE SELLING PRICE TREND

FIGURE 33 AVERAGE SELLING PRICES OF INVERTERS OF DIFFERENT OUTPUT POWER RATINGS

TABLE 6 AVERAGE SELLING PRICES OF INVERTERS OF DIFFERENT OUTPUT POWER RATINGS (USD)

5.7 VALUE CHAIN ANALYSIS

FIGURE 34 INVERTER MARKET VALUE CHAIN

5.7.1 RESEARCH AND DEVELOPMENT

5.7.2 COMPONENT PROVIDERS

5.7.3 MANUFACTURERS/ASSEMBLERS

5.7.4 SYSTEM INTEGRATORS AND DISTRIBUTORS

5.7.5 END USERS

5.7.6 POST-SALES SERVICES

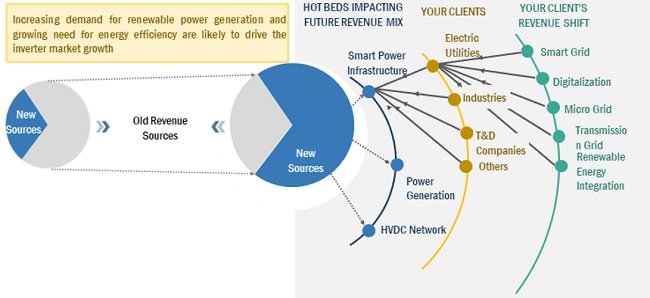

5.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

5.8.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR INVERTER MANUFACTURERS

FIGURE 35 REVENUE SHIFT FOR INVERTERS

5.9 TECHNOLOGY ANALYSIS

5.9.1 Z-SOURCE INVERTER

5.9.2 SOLAR MICRO-INVERTER

5.10 KEY CONFERENCES AND EVENTS BETWEEN 2022 AND 2023

TABLE 7 MARKET: DETAILED LIST OF CONFERENCES & EVENTS

5.11 MARKET MAP

FIGURE 36 MARKET MAP FOR INVERTER

5.12 INNOVATIONS AND PATENT REGISTRATIONS

TABLE 8 MARKET: PATENTS & INNOVATIONS

5.13 TRADE DATA STATISTICS

TABLE 9 ELECTRICAL STATIC CONVERTER MARKET: IMPORT STATISTICS, 2018–2021 (USD MILLION)

TABLE 10 ELECTRICAL STATIC CONVERTER MARKET: EXPORT STATISTICS, 2018–2021 (USD MILLION)

5.14 CASE STUDY ANALYSIS

5.14.1 SUNGROW PROVIDES TURNKEY SOLUTION TO SOLAR POWER PLANT IN BARGAS, SPAIN, 2021

5.14.2 MAN TRUCKS & BUSES, SOUTH AFRICA, DECIDED TO GO GREEN WITH GOODWE INVERTERS, 2021

5.14.3 FIMER PROVIDED INVERTER TO FIVE MID-LARGE SCALE SOLAR FARM PROJECTS IN REGIONAL SOUTH AUSTRALIA, 2021

5.15 TARIFFS, CODES, AND REGULATIONS

5.15.1 TARIFFS RELATED TO INVERTERS

TABLE 11 IMPORT TARIFFS FOR HS 850440, ELECTRICAL STATIC CONVERTERS

5.15.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 13 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 14 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 15 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 16 GLOBAL: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.15.3 CODES AND REGULATIONS RELATED TO INVERTERS

TABLE 17 GLOBAL: CODES AND REGULATIONS

6 INVERTER MARKET, BY OUTPUT POWER RATING (Page No. - 82)

6.1 INTRODUCTION

FIGURE 37 MARKET SHARE, BY OUTPUT POWER RATING, 2021

TABLE 18 MARKET, BY OUTPUT POWER RATING, 2020–2027 (USD MILLION)

6.2 BELOW 10 KW

6.2.1 RISING DEMAND FOR RESIDENTIAL INVERTORS IN RESIDENTIAL SECTOR TO FUEL MARKET GROWTH

TABLE 19 BELOW 10 KW: MARKET, BY REGION, 2020–2027 (USD MILLION)

6.3 10–50 KW

6.3.1 EXPANDING COMMERCIAL SECTOR TO FUEL DEMAND FOR INVERTERS WITH 10–50 KW OUTPUT POWER RATING

TABLE 20 10–50 KW: MARKET, BY REGION, 2020–2027 (USD MILLION)

6.4 50–100 KW

6.4.1 GROWING DEMAND FOR SOLAR INVERTERS IN PV PLANTS AND VARIOUS INDUSTRIES TO BOOST MARKET GROWTH

TABLE 21 50–100 KW: MARKET, BY REGION, 2020–2027 (USD MILLION)

6.5 ABOVE 100 KW

6.5.1 RISING NUMBER OF PV PLANTS AND EXPANDING AUTOMOTIVE INDUSTRY TO DRIVE MARKET GROWTH

TABLE 22 ABOVE 100 KW: MARKET, BY REGION, 2020–2027 (USD MILLION)

7 INVERTER MARKET, BY OUTPUT VOLTAGE (Page No. - 87)

7.1 INTRODUCTION

FIGURE 38 MARKET SHARE, BY OUTPUT VOLTAGE, 2021

TABLE 23 MARKET, BY OUTPUT VOLTAGE, 2020–2027 (USD MILLION)

7.2 100–300 V

7.2.1 RISING ELECTRICITY DEMAND TO DRIVE MARKET GROWTH

TABLE 24 100–300 V: MARKET, BY REGION, 2020–2027 (USD MILLION)

7.3 300–500 V

7.3.1 REQUIREMENT FOR UNINTERRUPTED POWER SUPPLY IN COMMERCIAL SECTOR AND VARIOUS INDUSTRIES TO DRIVE MARKET GROWTH

TABLE 25 300–500 V: MARKET, BY REGION, 2020–2027 (USD MILLION)

7.4 ABOVE 500 V

7.4.1 RISING INVESTMENTS IN DEVELOPMENT OF ON-GRID PV PLANTS TO DRIVE MARKET GROWTH

TABLE 26 ABOVE 500 V: MARKET, BY REGION, 2020–2027 (USD MILLION)

8 INVERTER MARKET, BY END USER (Page No. - 92)

8.1 INTRODUCTION

FIGURE 39 MARKET SHARE, BY END USER, 2021

TABLE 27 MARKET, BY END USER, 2020–2027 (USD MILLION)

8.2 RESIDENTIAL

8.2.1 GOVERNMENT-LED INITIATIVES TO PROMOTE INSTALLATION OF ROOFTOP SOLAR SYSTEMS TO DRIVE MARKET GROWTH

TABLE 28 RESIDENTIAL: MARKET, BY REGION, 2020–2027 (USD MILLION)

8.3 AUTOMOTIVE

8.3.1 GROWING ADOPTION OF ELECTRIC VEHICLES AS NEW MODE OF TRANSPORTATION TO FUEL DEMAND FOR VEHICLE INVERTERS

TABLE 29 AUTOMOTIVE: MARKET, BY REGION, 2020–2027 (USD MILLION)

8.4 PHOTOVOLTAIC (PV) PLANTS

8.4.1 INCREASING RENEWABLE ENERGY POLICIES IN SEVERAL COUNTRIES TO FUEL MARKET GROWTH

TABLE 30 PHOTOVOLTAIC (PV) PLANT: MARKET, BY REGION, 2020–2027 (USD MILLION)

8.5 OTHERS

TABLE 31 OTHERS: MARKET, BY REGION, 2020–2027 (USD MILLION)

9 INVERTER MARKET, BY TYPE (Page No. - 97)

9.1 INTRODUCTION

FIGURE 40 INVERTER MARKET SHARE, BY TYPE, 2021

TABLE 32 MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 33 MARKET, BY TYPE, 2020–2027 (THOUSAND UNITS)

9.2 SOLAR INVERTER

TABLE 34 SOLAR INVERTER: MARKET, BY TYPE, 2020–2027 (USD MILLION)

9.2.1 CENTRAL INVERTER

9.2.1.1 Rising demand for central inverters in PV plants to drive market growth

TABLE 35 CENTRAL INVERTER: MARKET, BY REGION, 2020–2027 (USD MILLION)

9.2.2 STRING INVERTER

9.2.2.1 Rising installation of solar panels in residential and commercial sectors to boost market growth

TABLE 36 STRING INVERTER: MARKET, BY REGION, 2020–2027 (USD MILLION)

9.2.3 MICRO-INVERTER

9.2.3.1 Increasing demand for micro-inverters in residential sector to fuel market growth

TABLE 37 MICRO-INVERTER: MARKET, BY REGION, 2020–2027 (USD MILLION)

9.2.4 HYBRID INVERTER

9.2.4.1 High-performance feature of hybrid inverters is driving market growth

TABLE 38 HYBRID INVERTER: MARKET, BY REGION, 2020–2027 (USD MILLION)

9.3 VEHICLE INVERTER

TABLE 39 VEHICLE INVERTER: MARKET, BY TYPE, 2020–2027 (USD MILLION)

9.3.1 BATTERY ELECTRIC VEHICLE (BEV)

9.3.1.1 Favorable government policies regarding EV vehicles globally to drive market growth

TABLE 40 BATTERY ELECTRIC VEHICLE: MARKET, BY REGION, 2020–2027 (USD MILLION)

9.3.2 HYBRID ELECTRIC VEHICLE (HEV)

9.3.2.1 Multi-functional program in hybrid electric vehicles to drive market growth

TABLE 41 HYBRID ELECTRIC VEHICLE: MARKET, BY REGION, 2020–2027 (USD MILLION)

9.3.3 PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV)

9.3.3.1 Increasing demand for EV vehicles to fuel market growth

TABLE 42 PLUG-IN HYBRID ELECTRIC VEHICLE: MARKET, BY REGION, 2020–2027 (USD MILLION)

9.4 OTHERS

TABLE 43 OTHERS: MARKET, BY REGION, 2020–2027 (USD MILLION)

10 INVERTER MARKET, BY CONNECTION TYPE (Page No. - 107)

10.1 INTRODUCTION

FIGURE 41 MARKET SHARE, BY CONNECTION TYPE, 2021

TABLE 44 MARKET, BY CONNECTION TYPE, 2020–2027 (USD MILLION)

10.2 STANDALONE

10.2.1 INCREASING RURAL ELECTRIFICATION PROGRAMS IN SEVERAL REGIONS TO BOOST MARKET GROWTH

TABLE 45 STANDALONE: MARKET, BY REGION, 2020–2027 (USD MILLION)

10.3 GRID-TIED

10.3.1 GOVERNMENT-LED INITIATIVES TO INCREASE SOLAR ENERGY GENERATION TO DRIVE GROWTH OF GRID-TIED MARKET

TABLE 46 MARKET, BY GRID-TIED, 2020–2027 (USD MILLION)

10.3.2 CONVENTIONAL INVERTER

10.3.2.1 Rise in installation of solar pv systems in residential and commercial sectors to drive market growth

TABLE 47 CONVENTIONAL INVERTER: MARKET, BY REGION, 2020–2027 (USD MILLION)

10.3.3 SMART INVERTER

10.3.3.1 Technological advancements in grid-tied inverters to drive market growth

TABLE 48 SMART INVERTER: MARKET, BY REGION, 2020–2027 (USD MILLION)

11 INVERTER MARKET, BY SALES CHANNEL (Page No. - 112)

11.1 INTRODUCTION

FIGURE 42 INVERTER MARKET SHARE, BY SALES CHANNEL, 2021

TABLE 49 MARKET, BY SALES CHANNEL, 2020–2027 (USD MILLION)

11.2 DIRECT SALES CHANNEL

11.2.1 RISING PREFERENCE FOR DIRECTLY PROCURING VEHICLE INVERTERS AMONG AUTOMOBILE MANUFACTURERS TO DRIVE MARKET GROWTH

TABLE 50 DIRECT SALES CHANNEL: MARKET, BY REGION, 2020–2027 (USD MILLION)

11.3 INDIRECT SALES CHANNEL

11.3.1 INCREASING SALE OF INVERTERS IN RESIDENTIAL SECTOR AND PV PLANTS THROUGH INDIRECT CHANNELS TO DRIVE MARKET GROWTH

TABLE 51 INDIRECT SALES CHANNEL: MARKET, BY REGION, 2020–2027 (USD MILLION)

12 INVERTER MARKET, BY REGION (Page No. - 115)

12.1 INTRODUCTION

FIGURE 43 INVERTER MARKET, BY REGION, 2021 (%)

FIGURE 44 ASIA PACIFIC MARKET TO REGISTER HIGHEST CAGR FROM 2022 TO 2027

TABLE 52 MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 53 MARKET, BY REGION, 2020–2027 (THOUSAND UNITS)

12.2 ASIA PACIFIC

FIGURE 45 SNAPSHOT: MARKET IN ASIA PACIFIC

12.2.1 BY OUTPUT POWER RATING

TABLE 54 ASIA PACIFIC: MARKET, BY OUTPUT POWER RATING, 2020–2027 (USD MILLION)

12.2.2 BY OUTPUT VOLTAGE

TABLE 55 ASIA PACIFIC: MARKET, BY OUTPUT VOLTAGE, 2020–2027 (USD MILLION)

12.2.3 BY END USER

TABLE 56 ASIA PACIFIC: MARKET, BY END USER, 2020–2027 (USD MILLION)

12.2.4 BY TYPE

TABLE 57 ASIA PACIFIC: MARKET, BY TYPE, 2020–2027 (USD MILLION)

12.2.5 BY CONNECTION TYPE

TABLE 58 ASIA PACIFIC: MARKET, BY CONNECTION TYPE, 2020–2027 (USD MILLION)

12.2.6 BY SALES CHANNEL

TABLE 59 ASIA PACIFIC: MARKET, BY SALES CHANNEL, 2020–2027 (USD MILLION)

12.2.7 BY COUNTRY

TABLE 60 ASIA PACIFIC: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

12.2.7.1 China

12.2.7.1.1 Rising electricity demand in various sectors and presence of favorable government policies to fuel demand for solar inverters

TABLE 61 CHINA: MARKET, BY END USER, 2020–2027 (USD MILLION)

12.2.7.2 India

12.2.7.2.1 Rise in number of solar rooftop installations and increasing Power Shortage to fuel demand for Inverters in India

TABLE 62 INDIA: MARKET, BY END USER, 2020–2027 (USD MILLION)

12.2.7.3 Australia

12.2.7.3.1 Presence of favorable government policies for solar energy generation to boost growth of solar inverter market in Australia

TABLE 63 AUSTRALIA: MARKET, BY END USER, 2020–2027 (USD MILLION)

12.2.7.4 Japan

12.2.7.4.1 Increasing investments in residential and PV utility-scale sectors to drive market growth

TABLE 64 JAPAN: MARKET, BY END USER, 2020–2027 (USD MILLION)

12.2.7.5 Rest of Asia Pacific

TABLE 65 REST OF ASIA PACIFIC: MARKET, BY END USER, 2020–2027 (USD MILLION)

12.3 NORTH AMERICA

FIGURE 46 SNAPSHOT: MARKET IN NORTH AMERICA

12.3.1 BY OUTPUT POWER RATING

TABLE 66 NORTH AMERICA: MARKET, BY OUTPUT POWER RATING, 2020–2027 (USD MILLION)

12.3.2 BY OUTPUT VOLTAGE

TABLE 67 NORTH AMERICA: MARKET, BY OUTPUT VOLTAGE, 2020–2027 (USD MILLION)

12.3.3 BY END USER

TABLE 68 NORTH AMERICA: MARKET, BY END USER, 2020–2027 (USD MILLION)

12.3.4 BY TYPE

TABLE 69 NORTH AMERICA: MARKET, BY TYPE, 2020–2027 (USD MILLION)

12.3.5 BY CONNECTION TYPE

TABLE 70 NORTH AMERICA: MARKET, BY CONNECTION TYPE, 2020–2027 (USD MILLION)

12.3.6 BY SALES CHANNEL

TABLE 71 NORTH AMERICA: MARKET, BY SALES CHANNEL, 2020–2027 (USD MILLION)

12.3.7 BY COUNTRY

TABLE 72 NORTH AMERICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

12.3.7.1 US

12.3.7.1.1 Increasing developments in solar energy field and favorable government policies to drive growth of solar inverter market in US

TABLE 73 US: MARKET, BY END USER, 2020–2027 (USD MILLION)

12.3.7.2 Canada

12.3.7.2.1 Rise in residential PV installations and supportive government policies to drive market growth

TABLE 74 CANADA: MARKET, BY END USER, 2020–2027 (USD MILLION)

12.3.7.3 Mexico

12.3.7.3.1 Increased deployment of clean energy sources in Mexico to fuel market growth

TABLE 75 MEXICO: MARKET, BY END USER, 2020–2027 (USD MILLION)

12.4 EUROPE

12.4.1 BY OUTPUT POWER RATING

TABLE 76 EUROPE: MARKET, BY OUTPUT POWER RATING, 2020–2027 (USD MILLION)

12.4.2 BY OUTPUT VOLTAGE

TABLE 77 EUROPE: MARKET, BY OUTPUT VOLTAGE, 2020–2027 (USD MILLION)

12.4.3 BY END USER

TABLE 78 EUROPE: MARKET, BY END USER, 2020–2027 (USD MILLION)

12.4.4 BY TYPE

TABLE 79 EUROPE: MARKET, BY TYPE, 2020–2027 (USD MILLION)

12.4.5 BY CONNECTION TYPE

TABLE 80 EUROPE: MARKET, BY CONNECTION TYPE, 2020–2027 (USD MILLION)

12.4.6 BY SALES CHANNEL

TABLE 81 EUROPE: MARKET, BY SALES CHANNEL, 2020–2027 (USD MILLION)

12.4.7 BY COUNTRY

TABLE 82 EUROPE: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

12.4.7.1 Germany

12.4.7.1.1 Growing automotive industry and rising adoption of renewable energy to drive market growth in Germany

TABLE 83 GERMANY: MARKET, BY END USER, 2020–2027 (USD MILLION)

12.4.7.2 UK

12.4.7.2.1 Increasing investments in battery production and solar power generation to drive market growth

TABLE 84 UK: MARKET, BY END USER, 2020–2027 (USD MILLION)

12.4.7.3 ITALY

12.4.7.3.1 Rising establishment of large-scale PV plants to fuel market growth

TABLE 85 ITALY: MARKET, BY END USER, 2020–2027 (USD MILLION)

12.4.7.4 France

12.4.7.4.1 Rising demand for solar inverters in PV plants to propel market growth

TABLE 86 FRANCE: MARKET, BY END USER, 2020–2027 (USD MILLION)

12.4.7.5 Spain

12.4.7.5.1 Expanding automotive industry to drive market growth

TABLE 87 SPAIN: MARKET, BY END USER, 2020–2027 (USD MILLION)

12.4.7.6 Rest of Europe

TABLE 88 REST OF EUROPE: MARKET, BY END USER, 2020–2027 (USD MILLION)

12.5 MIDDLE EAST & AFRICA

12.5.1 BY OUTPUT POWER RATING

TABLE 89 MIDDLE EAST & AFRICA: MARKET, BY OUTPUT POWER RATING, 2020–2027 (USD MILLION)

12.5.2 BY OUTPUT VOLTAGE

TABLE 90 MIDDLE EAST & AFRICA: MARKET, BY OUTPUT VOLTAGE, 2020–2027 (USD MILLION)

12.5.3 BY END USER

TABLE 91 MIDDLE EAST & AFRICA: MARKET, BY END USER, 2020–2027 (USD MILLION)

12.5.4 BY TYPE

TABLE 92 MIDDLE EAST & AFRICA: MARKET, BY TYPE, 2020–2027 (USD MILLION)

12.5.5 BY CONNECTION TYPE

TABLE 93 MIDDLE EAST & AFRICA: MARKET, BY CONNECTION TYPE, 2020–2027 (USD MILLION)

12.5.6 BY SALES CHANNEL

TABLE 94 MIDDLE EAST & AFRICA: MARKET, BY SALES CHANNEL, 2020–2027 (USD MILLION)

12.5.7 BY COUNTRY

TABLE 95 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

12.5.7.1 Saudi Arabia

12.5.7.1.1 Increasing power generation from solar resources to fuel demand for inverters

TABLE 96 SAUDI ARABIA: MARKET, BY END USER, 2020–2027 (USD MILLION)

12.5.7.2 UAE

12.5.7.2.1 Rising efforts to develop electricity sector to create demand for inverters in UAE

TABLE 97 UAE: MARKET, BY END USER, 2020–2027 (USD MILLION)

12.5.7.3 South Africa

12.5.7.3.1 Expanding automotive industry and development of PV plants to fuel growth of inverter market in South Africa

TABLE 98 SOUTH AFRICA: MARKET, BY END USER, 2020–2027 (USD MILLION)

12.5.7.4 Rest of Middle East & Africa

TABLE 99 REST OF MIDDLE EAST & AFRICA: MARKET, BY END USER, 2020–2027 (USD MILLION)

12.6 SOUTH AMERICA

12.6.1 BY OUTPUT POWER RATING

TABLE 100 SOUTH AMERICA: MARKET, BY OUTPUT POWER RATING, 2020–2027 (USD MILLION)

12.6.2 BY OUTPUT VOLTAGE

TABLE 101 SOUTH AMERICA: MARKET, BY OUTPUT VOLTAGE, 2020–2027 (USD MILLION)

12.6.3 BY END USER

TABLE 102 SOUTH AMERICA: MARKET, BY END USER, 2020–2027 (USD MILLION)

12.6.4 BY TYPE

TABLE 103 SOUTH AMERICA: MARKET, BY TYPE, 2020–2027 (USD MILLION)

12.6.5 BY CONNECTION TYPE

TABLE 104 SOUTH AMERICA: MARKET, BY CONNECTION TYPE, 2020–2027 (USD MILLION)

12.6.6 BY SALES CHANNEL

TABLE 105 SOUTH AMERICA: MARKET, BY SALES CHANNEL, 2020–2027 (USD MILLION)

12.6.7 BY COUNTRY

TABLE 106 SOUTH AMERICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

12.6.7.1 Brazil

12.6.7.1.1 Increasing investments in solar energy technology to propel demand for inverters in Brazil

TABLE 107 BRAZIL: MARKET, BY END USER, 2020–2027 (USD MILLION)

12.6.7.2 Argentina

12.6.7.2.1 Government support to promote solar energy renewables to fuel market growth

TABLE 108 ARGENTINA: MARKET, BY END USER, 2020–2027 (USD MILLION)

12.6.7.3 Rest of South America

TABLE 109 REST OF SOUTH AMERICA: MARKET, BY END USER, 2020–2027 (USD MILLION)

13 COMPETITIVE LANDSCAPE (Page No. - 151)

13.1 KEY PLAYER’S STRATEGIES/RIGHT TO WIN

TABLE 110 OVERVIEW OF STRATEGIES ADOPTED BY TOP PLAYERS, JANUARY 2019 – MARCH 2022

13.2 MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS

TABLE 111 MARKET: DEGREE OF COMPETITION

FIGURE 47 MARKET SHARE ANALYSIS, 2021

13.3 REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS

FIGURE 48 TOP PLAYERS IN MARKET FROM 2017 TO 2021

13.4 COMPANY EVALUATION QUADRANT

13.4.1 STAR

13.4.2 PERVASIVE

13.4.3 EMERGING LEADER

13.4.4 PARTICIPANT

FIGURE 49 MARKET (GLOBAL) COMPANY EVALUATION MATRIX, 2021

13.5 STARTUP/SME EVALUATION QUADRANT, 2021

13.5.1 PROGRESSIVE COMPANY

13.5.2 RESPONSIVE COMPANY

13.5.3 DYNAMIC COMPANY

13.5.4 STARTING BLOCK

FIGURE 50 MARKET: STARTUP/SME EVALUATION QUADRANT, 2021

13.5.5 COMPETITIVE BENCHMARKING

TABLE 112 MARKET: DETAILED LIST OF KEY STARTUPS/SMES

TABLE 113 MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

13.6 INVERTER MARKET: COMPANY FOOTPRINT

TABLE 114 TYPE: COMPANY FOOTPRINT

TABLE 115 OUTPUT POWER RATING: COMPANY FOOTPRINT

TABLE 116 BY END USER: COMPANY FOOTPRINT

TABLE 117 REGION: COMPANY FOOTPRINT

TABLE 118 COMPANY FOOTPRINT

13.7 COMPETITIVE SCENARIO

TABLE 119 MARKET: NEW PRODUCT LAUNCHES, SEPTEMBER 2019–JANUARY 2022

TABLE 120 MARKET: DEALS, NOVEMBER 2019–MARCH 2022

TABLE 121 MARKET: OTHERS, NOVEMBER 2021–APRIL 2022

14 COMPANY PROFILES (Page No. - 169)

14.1 KEY PLAYERS

(Business and financial overview, Products/solutions/services offered, Recent Developments, MNM view)*

14.1.1 HUAWEI TECHNOLOGIES

TABLE 122 HUAWEI TECHNOLOGIES: BUSINESS OVERVIEW

FIGURE 51 HUAWEI TECHNOLOGIES: COMPANY SNAPSHOT, 2021

TABLE 123 HUAWEI TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 124 HUAWEI TECHNOLOGIES: PRODUCT LAUNCHES

TABLE 125 HUAWEI TECHNOLOGIES: DEALS

TABLE 126 HUAWEI TECHNOLOGIES: OTHERS

14.1.2 SUNGROW POWER SUPPLY CO., LTD

TABLE 127 SUNGROW POWER SUPPLY CO., LTD: BUSINESS OVERVIEW

FIGURE 52 SUNGROW POWER SUPPLY CO., LTD: COMPANY SNAPSHOT, 2021

TABLE 128 SUNGROW POWER SUPPLY CO., LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 129 SUNGROW POWER SUPPLY CO., LTD: PRODUCT LAUNCHES

TABLE 130 SUNGROW POWER SUPPLY CO., LTD: DEALS

TABLE 131 SUNGROW POWER SUPPLY CO., LTD: OTHERS

14.1.3 SMA SOLAR TECHNOLOGY AG

TABLE 132 SMA SOLAR TECHNOLOGY AG: BUSINESS OVERVIEW

FIGURE 53 SMA SOLAR TECHNOLOGY AG: COMPANY SNAPSHOT, 2021

TABLE 133 SMA SOLAR TECHNOLOGY AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 134 SMA SOLAR TECHNOLOGY AG: PRODUCT LAUNCHES

TABLE 135 SMA SOLAR TECHNOLOGY AG: DEALS

TABLE 136 SMA SOLAR TECHNOLOGY AG: OTHERS

14.1.4 POWER ELECTRONICS

TABLE 137 POWER ELECTRONICS: BUSINESS OVERVIEW

TABLE 138 POWER ELECTRONICS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 139 POWER ELECTRONICS: PRODUCT LAUNCHES

14.1.5 FIMER

TABLE 140 FIMER: BUSINESS OVERVIEW

TABLE 141 FIMER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 142 FIMER: PRODUCT LAUNCHES

TABLE 143 FIMER: DEALS

TABLE 144 FIMER: OTHERS

14.1.6 SOLAREDGE TECHNOLOGIES

TABLE 145 SOLAREDGE TECHNOLOGIES: COMPANY OVERVIEW

FIGURE 54 SOLAREDGE TECHNOLOGIES: COMPANY SNAPSHOT, 2021

TABLE 146 SOLAREDGE TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 147 SOLAREDGE TECHNOLOGIES: PRODUCT LAUNCHES

14.1.7 FRONIUS INTERNATIONAL

TABLE 148 FRONIUS INTERNATIONAL: BUSINESS OVERVIEW

TABLE 149 FRONIUS INTERNATIONAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 150 FRONIUS INTERNATIONAL: PRODUCT LAUNCHES

TABLE 151 FRONIUS INTERNATIONAL: DEALS

14.1.8 ALTENERGY POWER SYSTEM

TABLE 152 ALTENERGY POWER SYSTEM: COMPANY OVERVIEW

TABLE 153 ALTENERGY POWER SYSTEM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 154 ALTENERGY POWER SYSTEM: PRODUCT LAUNCHES

14.1.9 ENPHASE ENERGY

TABLE 155 ENPHASE ENERGY: COMPANY OVERVIEW

FIGURE 55 ENPHASE ENERGY: COMPANY SNAPSHOT, 2021

TABLE 156 ENPHASE ENERGY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 157 ENPHASE ENERGY: PRODUCT LAUNCHES

TABLE 158 ENPHASE ENERGY: DEALS

14.1.10 DARFON ELECTRONICS CORPORATION

TABLE 159 DARFON ELECTRONICS CORPORATION: COMPANY OVERVIEW

FIGURE 56 DAFRON ELECTRONICS: COMPANY SNAPSHOT, 2020

TABLE 160 DARFON ELECTRONICS CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 161 DARFON ELECTRONICS CORPORATION: PRODUCT LAUNCHES

14.1.11 SCHNEIDER ELECTRIC

TABLE 162 SCHNEIDER ELECTRIC: BUSINESS OVERVIEW

FIGURE 57 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT, 2021

TABLE 163 SCHNEIDER ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 164 SCHNEIDER ELECTRIC: DEALS

TABLE 165 SCHNEIDER ELECTRIC: OTHERS

14.1.12 GENERAL ELECTRIC

TABLE 166 GENERAL ELECTRIC: COMPANY OVERVIEW

FIGURE 58 GENERAL ELECTRIC: COMPANY SNAPSHOT, 2021

TABLE 167 GENERAL ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 168 GENERAL ELECTRIC: PRODUCT LAUNCHES

TABLE 169 GENERAL ELECTRIC: OTHERS

14.1.13 DELTA ELECTRONICS

TABLE 170 DELTA ELECTRONICS: COMPANY OVERVIEW

FIGURE 59 DELTA ELECTRONICS: COMPANY SNAPSHOT, 2020

TABLE 171 DELTA ELECTRONICS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 172 DELTA ELECTRONICS: PRODUCT LAUNCHES

TABLE 173 DELTA ELECTRONICS: DEALS

TABLE 174 DELTA ELECTRONICS OTHERS

*Details on Business and financial overview, Products/solutions/services offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

14.2 OTHER PLAYERS

14.2.1 CONTINENTAL

14.2.2 DELPHI TECHNOLOGIES

14.2.3 SENSATA TECHNOLOGIES

14.2.4 SAMLEX EUROPE

14.2.5 BESTEK

14.2.6 GOODWE

14.2.7 TMEIC

14.2.8 YASKAWA SOLECTRIA SOLAR

14.2.9 KACO NEW ENERGY

14.2.10 GROWATT NEW ENERGY

14.2.11 TBEA XINJIANG SUNOASIS

15 APPENDIX (Page No. - 216)

15.1 INSIGHTS OF INDUSTRY EXPERTS

15.2 DISCUSSION GUIDE

15.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.4 AVAILABLE CUSTOMIZATIONS

15.5 RELATED REPORTS

15.6 AUTHOR DETAILS

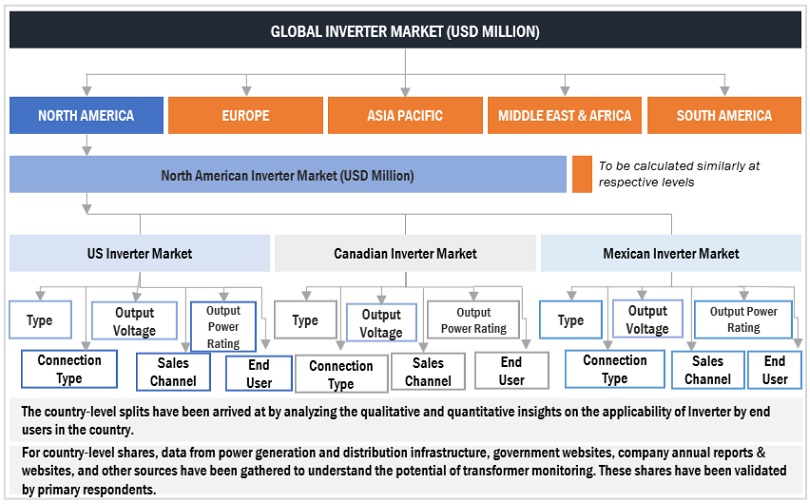

The study involved major activities in estimating the current size of the global inverter market. Exhaustive secondary research was done to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

This research study on the inverter market involved the use of extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg, Businessweek, Factiva, International Energy Agency, and BP Statistical Review of World Energy, to identify and collect information useful for a technical, market-oriented, and commercial study of the global inverter market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

The inverter market `comprises several stakeholders such as inverter manufacturers, manufacturing technology providers, and technology support providers in the supply chain. The demand side of this market is characterized by the rising demand for inverters in residential, automotive, photovoltaic (PV) plants, commerical, industrial, and utility end users. The supply side is characterized by rising demand for contracts from the industrial sector, and mergers & acquisitions among big players. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the global inverter market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market share in the respective regions have been determined through both primary and secondary research.

- The industry’s value chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Inverter Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments, the data triangulation and market breakdown processes have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand- and supply sides. Along with this, the market has been validated using both the top-down and bottom-up approaches.

Objectives of the Study

- To define, describe, segment, and forecast the inverter market size based on inverter type, output power rating, output voltage, sales channel, connection type, and end user

- To provide detailed information on the major drivers, restraints, opportunities, and industry-specific challenges influencing the growth of the market

- To strategically analyze the market with respect to individual growth trends, prospects, and contributions of each segment to the market

- To analyze market opportunities for stakeholders and provide a detailed competitive landscape for market leaders

- To forecast the revenue of the market segments with respect to 5 main regions (along with countries), namely, North America, Europe, Asia Pacific, South America, and the Middle East & Africa

- To strategically profile key players and comprehensively analyze their market ranking and core competencies

- To track and analyze competitive developments such as new product developments, contracts & agreements, investments & expansions, and mergers & acquisitions in the inverter market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the client’s specific needs. The following customization options are available for this report:

Geographic Analysis

- Further breakdown of region or country-specific analysis

Company Information

- Detailed analyses and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Inverter Market