IoT Integration Market by Service (Device and Platform Management, System Design and Architecture, Network Management, Advisory), Organization Size, Application (Smart Building and Home Automation, Smart Healthcare) and Region - Global Forecast to 2027

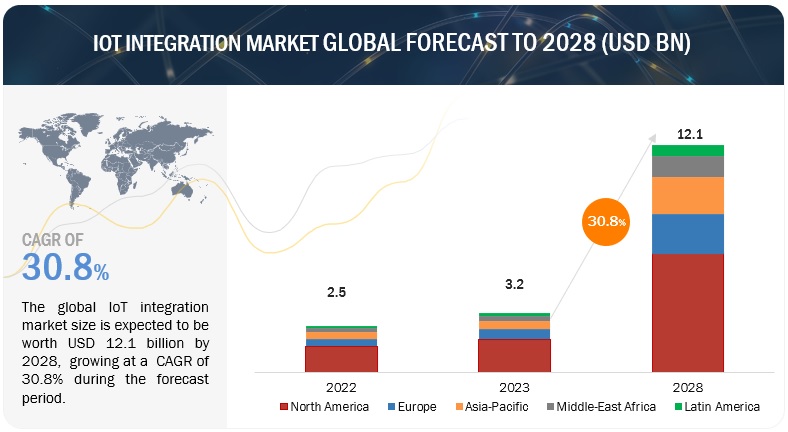

[284 Pages Report] The global IoT integration market size to grow from USD 2.4 billion in 2022 to USD 9.2 billion by 2027, at a Compound Annual Growth Rate (CAGR) of 30.2% during the forecast period. A major driver of the IoT integration market is the increased operational efficiency; this is achieved by maintaining huge amounts of data, providing enhanced data security and privacy, and optimizing the overall operational processes. IoT integration services enable companies to increase the operational efficiency of the overall business processes through continued real-time monitoring.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact

The rise in the tailored demand of customers during the pandemic resulted in the increased adoption of IoT integration services. The shift of companies towards business critical tasks and the adoption of work from home strategy has stimulated the demand for IoT integration services in the market. For instance, according to data provided by HCL Technologies, on 30th March 2020, 76% of HCL India-based employees and 92% of HCL employees in other geographies were asked to work from home by following the safety guidelines of the government and local authorities during the COVID-19 outbreak.

Market Dynamics

Driver: Development of wireless technologies

Wireless technology plays a key role in communication, and emerging technologies, such as robots, drones, self-driving vehicles, and new medical devices. The increasing adoption of Low Power Wide Area Network (LPWAN), Long Range Wide Area Network (LoRaWAN), 5G, wireless sensor networks, and IPV6 is expected to drive the demand for IoT devices, which would increase the requirements for wireless technologies over the next two years.

These emerging technologies offer features, such as low-power consumption and long-range communication, to build appropriate foundations and platforms for innovations in the IoT landscape. For instance, in 2018, Senet partnered with Inland Cellular to help Inland Cellular provide a range of IoT use cases, such as tank monitoring, water metering, and management, with the help of the LPWAN technologies. With the growing development of wireless technologies, such as LPWAN and LoRaWAN, both companies offer an excellent fit for applications in the IoT space, specifically in smart cities, smart agriculture, environmental monitoring, and industrial applications.

Restraint: Lack of standardization in IoT protocols

To share data or form an intelligent network among IoT-enabled devices, a common protocol and communication standard is required. Interoperability and easy exchange of information among connected devices are of utmost importance. However, the current technical and market scenarios related to IoT integration services do not provide a promising architectural service or a universal standard for solving the interoperability issues among different connected devices. Interoperability plays an important role to the growth and success of the products and services leveraging IoT integration. The biggest restraining factors for all industries and clientele is the IoT connectivity between devices and products, as their systems do not meet the global connectivity and integration standards.

Opportunity: Increasing demand for automation in business processes

Business functions such as IT, finance, marketing and sales, operations, and Human Resources (HR) are currently experiencing rapid growth. Thus, there is a huge potential for automation across verticals, owing to its ability to perform efficiently. Automation is highly useful in verticals, such as BFSI, healthcare, telecommunications, and IT, as these verticals follow defined, repeated, and rule-based processes. However, for automation, enterprises cannot rely on in-house service managers as it keeps evolving with the help of advanced technology solutions. As a result, most organizations are outsourcing their services to multiple vendors. IoT integration service providers can provide a single platform for managing multiple automation service vendors. Moreover, for many enterprises, managing multiple vendors is a complex task due to the requirement of high-end infrastructure and IT systems. Thus, IoT integration service providers can capitalize on this opportunity to provide enhanced services.

Challenge: Lack of skills and expertise

The biggest factor challenging the IoT integration market is the lack of skilled labor and expertise, hampering an enterprises ability to deliver service management, consulting, and advisory services. Modern IT infrastructure is changing rapidly, as organizations are rapidly deploying and using technologies, such as the cloud, containers, and IoT. These technologies are incrementally more complex, and they depend on their platforms in the operating environment of enterprises. Many enterprises hire service consultants and service professionals who lack the right skill to visualize, analyze, and identify advanced vulnerabilities in IT infrastructure and fail to correctly diagnose the problems or outages in IT services. However, this challenge can be overcome by providing IoT integration training to professionals so that they can aid organizations in building a secure IT infrastructure and offering reliable and superior expertise to their commercial clientele.

Large enterprises are expected account for the largest market share during 2022

The large enterprises segment uses the IoT integration services platform to ensure efficient integration and management of IoT devices for business processes. Large enterprises are early adopters of IoT integration services. The adoption of IoT integration services in large enterprises is said to be higher as compared to SMEs. Large enterprises have the necessary resources but face issues regarding deployment type due to the variety of solutions and applications available. Hence, large enterprises outsource the management of their IT and network infrastructure to IoT integration service providers so that the service providers can optimize and secure the overall infrastructure

Smart healthcare application segment is expected to account for a higher CAGR during the forecast period

Smart healthcare is an interconnected system of medical devices and sensors that healthcare organizations use for patient management, chronic disease management, remote monitoring of various parameters of patients, and preventive care. The connected devices enable healthcare organizations to streamline their operations and business processes and offer real-time patient care remotely. The smart healthcare application area is rapidly adopting IoT integration services to leverage IoT benefits. These services integrate IoT capabilities into medical devices to improve the quality and effectiveness of services and offer high value for elderly patients with chronic conditions and those who require constant supervision. IoT integration services play a vital role in the smart healthcare application area to integrate and interoperate the smart devices in the smart healthcare ecosystem.

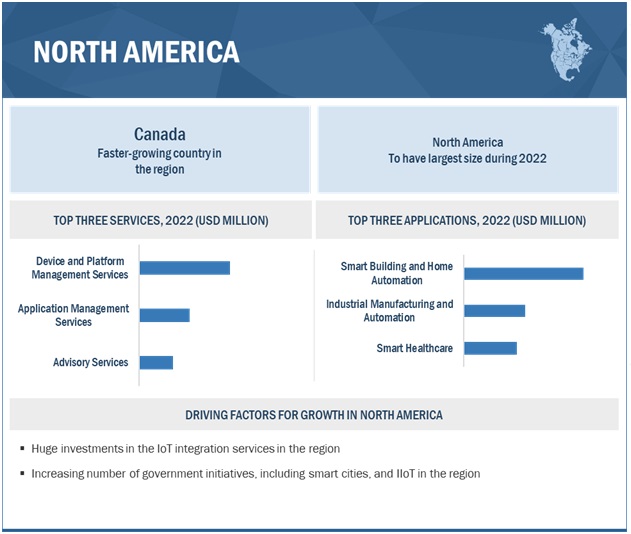

North America to account for the largest market share during the forecast period

North America is estimated to capture the largest share of the overall IoT integration market. Organizations in the region are the early adopters of IoT integration solutions and services. The region is technologically developed, and several government initiatives such as smart cities and IIoT have been adopted. The IoT integration market is steadily growing in North America, including the US and Canada. These countries are the early adopters of advanced technologies across various verticals, such as healthcare, manufacturing, and smart cities. These countries highly invest in R&D activities due to their sustainable and well-established economies, thereby contributing to the development of new technologies strongly. The advent of SMEs and increasing digitalization in the manufacturing sector among large organizations have also boosted the growth of the North American IoT integration market. Canada is also expected to witness a rise in the adoption of IoT integration due to the knowledge of the value propositions and relationship to the integration services infrastructure.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The IoT integration market vendors have implemented various types of organic and inorganic growth strategies, such as new product launches, product upgradations, partnerships and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. The major vendors in the global IoT integration market TCS Limited (India), Wipro Limited (India), Atos SE (France), Accenture (Ireland), Fujitsu Ltd. (Japan), Infosys Limited (India), Capgemini (France), HCL Technologies Limited (India), Tech Mahindra Limited (India), DXC Technology (US), IBM Corporation (US), Cognizant (US), NTT Data Corporation (Japan), Dell EMC (US), Deloitte (US), Salesforce (US), Allerin Tech Pvt Ltd (India), Softdel (US), Phitomas (Malaysia), eInfochips (US), Timesys Corporation (US), Tibbo Systems (Taiwan), Aeris (US), Macrosoft Inc. (US), Damco (US) and Meshed (Australia).

The study includes an in-depth competitive analysis of these key players in the IoT integration market with their company profiles, recent developments, and key market strategies.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2016-2027 |

|

Base year considered |

2022 |

|

Forecast period |

2022-2027 |

|

Forecast units |

Value (USD Million/ Billion) |

|

Segments covered |

By service, organization size, application, and region |

|

Regions covered |

North America, Europe, Asia Pacific, Latin America, and Middle East and Africa |

|

Companies covered |

TCS Limited (India), Wipro Limited (India), Atos SE (France), Accenture (Ireland), Fujitsu Ltd. (Japan), Infosys Limited (India), Capgemini (France), HCL Technologies Limited (India), Tech Mahindra Limited (India), DXC Technology (US), IBM Corporation (US), Cognizant (US), NTT Data Corporation (Japan), Dell EMC (US), Deloitte (US), Salesforce (US), Allerin Tech Pvt Ltd (India), Softdel (US), Phitomas (Malaysia), eInfochips (US), Timesys Corporation (US), Tibbo Systems (Taiwan), Aeris (US), Macrosoft Inc. (US), Damco (US) and Meshed (Australia). |

This research report categorizes the IoT integration market to forecast revenues and analyze trends in each of the following subsegments:

By Service:

- Device and Platform Management Services

- Application Management Services

- Advisory Services

- System Design and Architecture

- Testing Services

- Service Provisioning and Directory Management

- Third-party API Management Services

- Database and Block Storage Management Services

- Network Management Services

- Infrastructure and Workload Management Services

By Organization size:

- Small and medium sized enterprises

- Large enterprises

By Application:

- Smart building and home automation

- Smart healthcare

- Energy and utilities

- Industrial manufacturing and automation

- Smart retail

- Smart transportation, logistics and telematics

By Region:

- North America

- US

- Canada

- Europe

- UK

- Germany

- Rest of Europe

- APAC

- China

- Japan

- India

- Rest of APAC

- MEA

- Kingdom of Saudi Arabia

- United Arab Emirates

- Rest of Middle East and Africa

- Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In April 2022 Accenture acquired AFD.TECH, the proficiency of AFD.TECHs team merged with Accentures Cloud First capabilities provides a broad spectrum of proven practices, operational excellence and human ingenuity.

- In January 2022 DXC Technology partnered with ServiceNow to deliver market-leading, cost-efficient, resilient technology services that transform enterprise service operations, built on DXC Platform XTM.

- In August 2021 TCS partnered with Google Cloud, TCS is expanding its strategic partnership with Google Cloud by building experience centers for customers to evaluate cloud solutions, apart from co-developing new solutions that provide digital consumer experiences in retail, manufacturing and financial services.

- In July 2021 IBM acquired Bluetab Solutions Group, Bluetab will tuck into IBMs data services consulting practice for hybrid cloud and IT services.

Frequently Asked Questions (FAQ):

What is IoT integration?

As defined by Software AG, IoT integration is a critical IoT platform capability that enables enterprises to integrate data from connected things with other IT assets, such as SaaS. IoT can be defined as devices connected via the internet using sensors, actuators, and network communication technologies to interconnect people and machines. As per MnM, the IoT integration market refers to the market that incorporates integration services that are provided by the vendors for the efficient functioning of the IoT.

Which countries are considered in the European region?

The report includes an analysis of the UK, Germany in the European region.

Which are the key drivers supporting the growth of the IoT integration market?

The key drivers supporting the growth of the IoT integration market include the proliferation of connected devices to encourage BYOD and remote workplace management, development of wireless technologies, need to increase operational efficiency, maturing partner agreements of IoT vendors, and the development of Internet Protocol version 6 (IPv6).

Who are the key vendors in the IoT integration market?

The key vendors operating in the IoT integration market include. TCS Limited (India), Wipro Limited (India), Atos SE (France), Accenture (Ireland), Fujitsu Ltd. (Japan), Infosys Limited (India), Capgemini (France), HCL Technologies Limited (India), Tech Mahindra Limited (India), DXC Technology (US), IBM Corporation (US), Cognizant (US), NTT Data Corporation (Japan), Dell EMC (US), Deloitte (US), Salesforce (US), Allerin Tech Pvt Ltd (India), Softdel (US), Phitomas (Malaysia), eInfochips (US), Timesys Corporation (US), Tibbo Systems (Taiwan), Aeris (US), Macrosoft Inc. (US), Damco (US) and Meshed (Australia). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 37)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 GEOGRAPHIC SCOPE

1.3.3 INCLUSIONS AND EXCLUSIONS

1.3.4 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES, 20192021

1.5 SUMMARY OF CHANGES

1.6 STAKEHOLDERS

1.7 LIMITATIONS OF THE STUDY

2 RESEARCH METHODOLOGY (Page No. - 44)

2.1 RESEARCH DATA

FIGURE 1 GLOBAL IOT INTEGRATION MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Breakdown of primaries

FIGURE 2 BREAKDOWN OF PRIMARIES: BY COMPANY, DESIGNATION, AND REGION

2.1.2.2 Primary sources

2.1.2.3 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

2.3.1 TOP-DOWN APPROACH

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3.2 BOTTOM-UP APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE): REVENUE OF IOT INTEGRATION SERVICE PROVIDERS IN THE IOT INTEGRATION MARKET

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 - BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF ALL IOT INTEGRATION SERVICES IN THE MARKET

2.4 MARKET FORECAST

TABLE 2 FACTOR ANALYSIS

2.5 ASSUMPTIONS FOR THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 53)

FIGURE 7 IOT INTEGRATION MARKET, 2020-2027

FIGURE 8 DEVICE AND PLATFORM MANAGEMENT SERVICES SEGMENT EXPECTED TO LEAD THE MARKET IN 2022

FIGURE 9 SMALL AND MEDIUM-SIZED ENTERPRISES SEGMENT EXPECTED TO GROW AT A HIGHER RATE DURING THE FORECAST PERIOD

FIGURE 10 SMART BUILDING AND HOME AUTOMATION SEGMENT EXPECTED TO LEAD THE MARKET IN 2022

FIGURE 11 HIGH-GROWTH SEGMENTS IN THE MARKET, 20222027

FIGURE 12 MARKET: REGIONAL SNAPSHOT

4 PREMIUM INSIGHTS (Page No. - 58)

4.1 ATTRACTIVE OPPORTUNITIES IN THE IOT INTEGRATION MARKET

FIGURE 13 PROLIFERATION OF CONNECTED DEVICES TO ENCOURAGE BYOD AND REMOTE WORKPLACE MANAGEMENT TO DRIVE MARKET GROWTH

4.2 ASIA PACIFIC MARKET, BY SERVICE AND COUNTRY

FIGURE 14 DEVICE AND PLATFORM MANAGEMENT SERVICES SEGMENT AND CHINA EXPECTED TO ACCOUNT FOR SIGNIFICANT MARKET SHARES IN 2022

4.3 MARKET: MAJOR COUNTRIES

FIGURE 15 INDIA EXPECTED TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 60)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: IOT INTEGRATION MARKET

5.2.1 DRIVERS

5.2.1.1 Proliferation of connected devices to encourage BYOD and remote workplace management

5.2.1.2 Development of wireless technologies

TABLE 3 PROJECTED PENETRATION OF 5G IN SOUTHEAST ASIA BY 2025

5.2.1.3 Need to increase operational efficiency

5.2.1.4 Maturing partner agreements of IoT vendors

5.2.1.5 Emergence of IPv6

5.2.2 RESTRAINTS

5.2.2.1 Lack of standardization in IoT protocols

5.2.3 OPPORTUNITIES

5.2.3.1 Growing need to align management strategies with organizations strategic initiatives

5.2.3.2 Need for reduced downtime and increased operational efficiency

5.2.3.3 Increasing demand for automation in business processes

5.2.3.4 Increasing adoption of iPaaS

5.2.4 CHALLENGES

5.2.4.1 Data security and privacy concerns

5.2.4.2 Lack of skills and expertise

5.3 IMPACT OF COVID-19 ON IOT INTEGRATION MARKET DYNAMICS

5.3.1 DRIVERS AND OPPORTUNITIES

5.3.2 RESTRAINTS AND CHALLENGES

5.3.3 CUMULATIVE GROWTH ANALYSIS

5.4 ECOSYSTEM

FIGURE 17 MARKET: ECOSYSTEM

TABLE 4 MARKET: ECOSYSTEM

5.5 VALUE CHAIN ANALYSIS

FIGURE 18 MARKET: VALUE CHAIN

5.6 IOT INTEGRATION MARKET: USE CASES

5.6.1 USE CASE 1: RETAIL

5.6.2 USE CASE 2: HEALTHCARE

5.6.3 USE CASE 3: GOVERNMENT

5.6.4 USE CASE 4: TRANSPORTATION AND LOGISTICS

5.7 DISRUPTIONS IMPACTING BUYERS/CLIENTS IN THE MARKET

FIGURE 19 MARKET: DISRUPTIONS IMPACTING BUYERS/CLIENTS

5.8 DISRUPTIVE TECHNOLOGIES

5.8.1 EDGE COMPUTING

5.8.2 5G

5.8.3 DIGITAL TWIN

5.8.4 ARTIFICIAL INTELLIGENCE

5.9 REGULATORY IMPACT

6 IOT INTEGRATION MARKET, BY SERVICE (Page No. - 78)

6.1 INTRODUCTION

6.1.1 SERVICE: COVID-19 IMPACT

FIGURE 20 DEVICE AND PLATFORM MANAGEMENT SERVICES SEGMENT EXPECTED TO ACCOUNT FOR THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

TABLE 5 MARKET, BY SERVICE, 20162021 (USD MILLION)

TABLE 6 MARKET, BY SERVICE, 20222027 (USD MILLION)

6.2 DEVICE AND PLATFORM MANAGEMENT SERVICES

6.2.1 TO FACILITATE HIGH DATA SECURITY AND SEAMLESS DATA EXCHANGE BETWEEN DEVICES

6.2.2 DEVICE AND PLATFORM MANAGEMENT SERVICES: MARKET DRIVERS

TABLE 7 DEVICE AND PLATFORM MANAGEMENT SERVICES: MARKET, BY REGION, 20162021 (USD MILLION)

TABLE 8 DEVICE AND PLATFORM MANAGEMENT SERVICES: MARKET, BY REGION, 20222027 (USD MILLION)

6.3 APPLICATION MANAGEMENT SERVICES

6.3.1 TO REDUCE COST AND COMPLEXITY FOR DEVELOPERS AND END-USERS

6.3.2 APPLICATION MANAGEMENT SERVICES: IOT INTEGRATION MARKET DRIVERS

TABLE 9 APPLICATION MANAGEMENT SERVICES: MARKET, BY REGION, 20162021 (USD MILLION)

TABLE 10 APPLICATION MANAGEMENT SERVICES: MARKET, BY REGION, 20222027 (USD MILLION)

6.4 ADVISORY SERVICES

6.4.1 TO ENHANCE DIGITAL TRANSFORMATION AND ADVANCEMENT IN BUSINESS PROCESSES

6.4.2 ADVISORY SERVICES: MARKET DRIVERS

TABLE 11 ADVISORY SERVICES: MARKET, BY REGION, 20162021 (USD MILLION)

TABLE 12 ADVISORY SERVICES: MARKET, BY REGION, 20222027 (USD MILLION)

6.5 SYSTEM DESIGN AND ARCHITECTURE SERVICES

6.5.1 TO DESIGN AND OFFER CLIENT REQUIREMENTS AND CUSTOMIZED SERVICES

6.5.2 SYSTEM DESIGN AND ARCHITECTURE SERVICES: MARKET DRIVER

TABLE 13 SYSTEM DESIGN AND ARCHITECTURE SERVICES: MARKET, BY REGION, 20162021 (USD MILLION)

TABLE 14 SYSTEM DESIGN AND ARCHITECTURE SERVICES: IOT INTEGRATION MARKET, BY REGION, 20222027 (USD MILLION)

6.6 TESTING SERVICES

6.6.1 TO ENHANCE USER EXPERIENCE AND SEAMLESS WORKING OF DEVICES AND APPLICATION

6.6.2 TESTING SERVICES: MARKET DRIVERS

TABLE 15 TESTING SERVICES: MARKET, BY REGION, 20162021 (USD MILLION)

TABLE 16 TESTING SERVICES: MARKET, BY REGION, 20222027 (USD MILLION)

6.7 SERVICES PROVISIONING AND DIRECTORY MANAGEMENT SERVICES

6.7.1 SERVICES TO MANAGE AND MAINTAIN COMPLEX AND HETEROGENEOUS DIRECTORY DATABASES

6.7.2 SERVICES PROVISIONING AND DIRECTORY MANAGEMENT SERVICES: MARKET DRIVERS

TABLE 17 SERVICES PROVISIONING AND DIRECTORY MANAGEMENT SERVICES: MARKET, BY REGION, 20162021 (USD MILLION)

TABLE 18 SERVICES PROVISIONING AND DIRECTORY MANAGEMENT SERVICES: MARKET, BY REGION, 20222027 (USD MILLION)

6.8 THIRD-PARTY API MANAGEMENT SERVICES

6.8.1 TO OFFER A SECURE EXPOSURE OF ENTERPRISE DATA TO MOBILE DEVICES, WEB APPLICATIONS, AND CONNECTED DEVICES

6.8.2 THIRD-PARTY API MANAGEMENT SERVICES: IOT INTEGRATION MARKET DRIVERS

TABLE 19 THIRD-PARTY API MANAGEMENT SERVICES: MARKET, BY REGION, 20162021 (USD MILLION)

TABLE 20 THIRD-PARTY API MANAGEMENT SERVICES: MARKET, BY REGION, 20222027 (USD MILLION)

6.9 DATABASE AND BLOCK STORAGE MANAGEMENT SERVICES

6.9.1 TO BOOST BUSINESS EFFICIENCY FOR STREAMLINED BUSINESS PROCESSES AND INCREASED ROI

6.9.2 DATABASE AND BLOCK STORAGE MANAGEMENT SERVICES: MARKET DRIVERS

TABLE 21 DATABASE AND BLOCK STORAGE MANAGEMENT SERVICES: MARKET, BY REGION, 20162021 (USD MILLION)

TABLE 22 DATABASE AND BLOCK STORAGE MANAGEMENT SERVICES: MARKET, BY REGION, 20222027 (USD MILLION)

6.10 NETWORK MANAGEMENT SERVICES

6.10.1 TO ENHANCE PRODUCTIVITY AND EFFICIENCY OF EMPLOYEES AND REDUCE THE COST OF COMMUNICATIONS

6.10.2 NETWORK MANAGEMENT SERVICES: IOT INTEGRATION MARKET DRIVERS

TABLE 23 NETWORK MANAGEMENT SERVICES: MARKET, BY REGION, 20162021 (USD MILLION)

TABLE 24 NETWORK MANAGEMENT SERVICES: MARKET, BY REGION, 20222027 (USD MILLION)

6.11 INFRASTRUCTURE AND WORKLOAD MANAGEMENT SERVICES

6.11.1 TO PROVIDE COST SAVINGS AND OPERATIONAL EFFICIENCIES AND ENHANCE CUSTOMER EXPERIENCE

6.11.2 INFRASTRUCTURE AND WORKLOAD MANAGEMENT SERVICES: MARKET DRIVERS

TABLE 25 INFRASTRUCTURE AND WORKLOAD MANAGEMENT SERVICES: MARKET, BY REGION, 20162021 (USD MILLION)

TABLE 26 INFRASTRUCTURE AND WORKLOAD MANAGEMENT SERVICES: MARKET, BY REGION, 20222027 (USD MILLION)

7 IOT INTEGRATION MARKET, BY ORGANIZATION SIZE (Page No. - 95)

7.1 INTRODUCTION

7.2 ORGANIZATION SIZE: COVID-19 IMPACT

FIGURE 21 SMALL AND MEDIUM-SIZED ENTERPRISES SEGMENT EXPECTED TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 27 MARKET, BY ORGANIZATION SIZE, 20162021 (USD MILLION)

TABLE 28 MARKET, BY ORGANIZATION SIZE, 20222027 (USD MILLION)

7.3 LARGE ENTERPRISES

7.3.1 TO MANAGE COMPLEX IT AND NETWORK INFRASTRUCTURES

7.3.2 LARGE ENTERPRISES: MARKET DRIVERS

TABLE 29 LARGE ENTERPRISES: MARKET, BY REGION, 20162021 (USD MILLION)

TABLE 30 LARGE ENTERPRISES: MARKET, BY REGION, 20222027 (USD MILLION)

7.4 SMALL AND MEDIUM-SIZED ENTERPRISES

7.4.1 TO AUTOMATE BUSINESS OPERATIONS AND PROVIDE CUSTOMER-CENTRIC SERVICES

7.4.2 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET DRIVERS

TABLE 31 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 20162021 (USD MILLION)

TABLE 32 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 20222027 (USD MILLION)

8 IOT INTEGRATION MARKET, BY APPLICATION (Page No. - 101)

8.1 INTRODUCTION

FIGURE 22 SMART HEALTHCARE SEGMENT EXPECTED TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 33 MARKET, BY APPLICATION, 20162021 (USD MILLION)

TABLE 34 MARKET, BY APPLICATION, 20222027 (USD MILLION)

8.2 SMART BUILDING AND HOME AUTOMATION

8.2.1 TO DELIVER SUPERIOR QUALITY SOLUTIONS WITH ENHANCED FEATURES TO CONNECTED BUILDINGS

8.2.2 SMART BUILDING AND HOME AUTOMATION: COVID-19 IMPACT

8.2.3 SMART BUILDING AND HOME AUTOMATION: MARKET DRIVERS

TABLE 35 SMART BUILDING AND HOME AUTOMATION: MARKET, BY REGION, 20162021 (USD MILLION)

TABLE 36 SMART BUILDING AND HOME AUTOMATION: MARKET, BY REGION, 20222027 (USD MILLION)

8.3 SMART HEALTHCARE

8.3.1 TO ENHANCE THE PATIENT CARE LEVEL FROM ANY LOCATION

8.3.2 SMART HEALTHCARE: COVID-19 IMPACT

8.3.3 SMART HEALTHCARE: IOT INTEGRATION MARKET DRIVERS

TABLE 37 SMART HEALTHCARE: MARKET, BY REGION, 20162021 (USD MILLION)

TABLE 38 SMART HEALTHCARE: MARKET, BY REGION, 20222027 (USD MILLION)

8.4 ENERGY AND UTILITIES

8.4.1 TO PROMOTE EXPONENTIAL GROWTH ACROSS BUSINESS NETWORKS TO ECONOMICALLY SOURCE SUPPLIES AND SERVICES

8.4.2 ENERGY AND UTILITIES: COVID-19 IMPACT

8.4.3 ENERGY AND UTILITIES: MARKET DRIVERS

TABLE 39 ENERGY AND UTILITIES: MARKET, BY REGION, 20162021 (USD MILLION)

TABLE 40 ENERGY AND UTILITIES: MARKET, BY REGION, 20222027 (USD MILLION)

8.5 INDUSTRIAL MANUFACTURING AND AUTOMATION

8.5.1 ENHANCEMENT IN THE SPEED OF CONNECTIVITY NETWORKS LEADING TO ADOPTION OF IOT INTEGRATION SERVICES

8.5.2 INDUSTRIAL MANUFACTURING AND AUTOMATION: COVID-19 IMPACT

8.5.3 INDUSTRIAL MANUFACTURING AND AUTOMATION: IOT INTEGRATION MARKET DRIVERS

TABLE 41 INDUSTRIAL MANUFACTURING AND AUTOMATION: MARKET, BY REGION, 20162021 (USD MILLION)

TABLE 42 INDUSTRIAL MANUFACTURING AND AUTOMATION: MARKET, BY REGION, 20222027 (USD MILLION)

8.6 SMART RETAIL

8.6.1 TO ENABLE LARGE RETAIL CHAINS TO BE CONNECTED CENTRALLY TO IMPROVE ORDER AND INVENTORY MANAGEMENT

8.6.2 SMART RETAIL: COVID-19 IMPACT

8.6.3 SMART RETAIL: MARKET DRIVERS

TABLE 43 SMART RETAIL: MARKET, BY REGION, 20162021 (USD MILLION)

TABLE 44 SMART RETAIL: MARKET, BY REGION, 20222027 (USD MILLION)

8.7 SMART TRANSPORTATION, LOGISTICS, AND TELEMATICS

8.7.1 TO FACILITATE INTEGRATION ACROSS TRANSPORTATION SYSTEMS

8.7.2 SMART TRANSPORTATION, LOGISTICS, AND TELEMATICS: COVID-19 IMPACT

8.7.3 SMART TRANSPORTATION, LOGISTICS, AND TELEMATICS: IOT INTEGRATION MARKET DRIVERS

TABLE 45 SMART TRANSPORTATION, LOGISTICS, AND TELEMATICS: MARKET, BY REGION, 20162021 (USD MILLION)

TABLE 46 SMART TRANSPORTATION, LOGISTICS, AND TELEMATICS: MARKET, BY REGION, 20222027 (USD MILLION)

9 IOT INTEGRATION MARKET, BY REGION (Page No. - 114)

9.1 INTRODUCTION

FIGURE 23 ASIA PACIFIC EXPECTED TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 47 MARKET, BY REGION, 20162021 (USD MILLION)

TABLE 48 MARKET, BY REGION, 20222027 (USD MILLION)

9.2 NORTH AMERICA

9.2.1 NORTH AMERICA: COVID-19 IMPACT

9.2.2 NORTH AMERICA: MARKET DRIVERS

9.2.3 NORTH AMERICA: TARIFFS AND REGULATIONS

FIGURE 24 NORTH AMERICA: MARKET SNAPSHOT

TABLE 49 NORTH AMERICA: IOT INTEGRATION MARKET, BY SERVICE, 20162021 (USD MILLION)

TABLE 50 NORTH AMERICA: MARKET, BY SERVICE, 20222027 (USD MILLION)

TABLE 51 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 20162021 (USD MILLION)

TABLE 52 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 20222027 (USD MILLION)

TABLE 53 NORTH AMERICA: MARKET, BY APPLICATION, 20162021 (USD MILLION)

TABLE 54 NORTH AMERICA: MARKET, BY APPLICATION, 20222027 (USD MILLION)

TABLE 55 NORTH AMERICA: MARKET, BY COUNTRY, 20162021 (USD MILLION)

TABLE 56 NORTH AMERICA: MARKET, BY COUNTRY, 20222027 (USD MILLION)

9.2.4 UNITED STATES

9.2.4.1 Industrial digitization and increased usage of connected devices

9.2.4.2 United States: IoT Integration Market Drivers

TABLE 57 UNITED STATES: MARKET, BY SERVICE, 20162021 (USD MILLION)

TABLE 58 UNITED STATES: MARKET, BY SERVICE, 20222027 (USD MILLION)

TABLE 59 UNITED STATES: MARKET, BY ORGANIZATION SIZE, 20162021 (USD MILLION)

TABLE 60 UNITED STATES: MARKET, BY ORGANIZATION SIZE, 20222027 (USD MILLION)

TABLE 61 UNITED STATES: MARKET, BY APPLICATION, 20162021 (USD MILLION)

TABLE 62 UNITED STATES: MARKET, BY APPLICATION, 20222027 (USD MILLION)

9.2.5 CANADA

9.2.5.1 Technological advancements and increasing adoption of smart grids

9.2.5.2 Canada: IoT Integration Market Drivers

TABLE 63 CANADA: MARKET, BY SERVICE, 20162021 (USD MILLION)

TABLE 64 CANADA: MARKET, BY SERVICE, 20222027 (USD MILLION)

TABLE 65 CANADA: MARKET, BY ORGANIZATION SIZE, 20162021 (USD MILLION)

TABLE 66 CANADA: MARKET, BY ORGANIZATION SIZE, 20222027 (USD MILLION)

TABLE 67 CANADA: MARKET, BY APPLICATION, 20162021 (USD MILLION)

TABLE 68 CANADA: MARKET, BY APPLICATION, 20222027 (USD MILLION)

9.3 EUROPE

9.3.1 EUROPE: COVID-19 IMPACT

9.3.2 EUROPE: IOT INTEGRATION MARKET DRIVERS

9.3.3 EUROPE: TARIFFS AND REGULATIONS

TABLE 69 EUROPE: MARKET, BY SERVICE, 20162021 (USD MILLION)

TABLE 70 EUROPE: MARKET, BY SERVICE, 20222027 (USD MILLION)

TABLE 71 EUROPE: MARKET, BY ORGANIZATION SIZE, 20162021 (USD MILLION)

TABLE 72 EUROPE: MARKET, BY ORGANIZATION SIZE, 20222027 (USD MILLION)

TABLE 73 EUROPE: MARKET, BY APPLICATION, 20162021 (USD MILLION)

TABLE 74 EUROPE: MARKET, BY APPLICATION, 20222027 (USD MILLION)

TABLE 75 EUROPE: MARKET, BY COUNTRY, 20162021 (USD MILLION)

TABLE 76 EUROPE: MARKET, BY COUNTRY, 20222027 (USD MILLION)

9.3.4 UNITED KINGDOM

9.3.4.1 Strong support from government agencies for the development of IoT and innovation

9.3.4.2 United Kingdom: IoT Integration Market Drivers

TABLE 77 UNITED KINGDOM: MARKET, BY SERVICE, 20162021 (USD MILLION)

TABLE 78 UNITED KINGDOM: MARKET, BY SERVICE, 20222027 (USD MILLION)

TABLE 79 UNITED KINGDOM: MARKET, BY ORGANIZATION SIZE, 20162021 (USD MILLION)

TABLE 80 UNITED KINGDOM: MARKET, BY ORGANIZATION SIZE, 20222027 (USD MILLION)

TABLE 81 UNITED KINGDOM: MARKET, BY APPLICATION, 20162021 (USD MILLION)

TABLE 82 UNITED KINGDOM: MARKET, BY APPLICATION, 20222027 (USD MILLION)

9.3.5 GERMANY

9.3.5.1 Government initiatives, such as Industrie 4.0

9.3.5.2 Germany: IoT Integration Market Drivers

TABLE 83 GERMANY: MARKET, BY SERVICE, 20162021 (USD MILLION)

TABLE 84 GERMANY: MARKET, BY SERVICE, 20222027 (USD MILLION)

TABLE 85 GERMANY: MARKET, BY ORGANIZATION SIZE, 20162021 (USD MILLION)

TABLE 86 GERMANY: MARKET, BY ORGANIZATION SIZE, 20222027 (USD MILLION)

TABLE 87 GERMANY: MARKET, BY APPLICATION, 20162021 (USD MILLION)

TABLE 88 GERMANY: MARKET, BY APPLICATION, 20222027 (USD MILLION)

9.3.6 REST OF EUROPE

TABLE 89 REST OF EUROPE: IOT INTEGRATION MARKET, BY SERVICE, 20162021 (USD MILLION)

TABLE 90 REST OF EUROPE: MARKET, BY SERVICE, 20222027 (USD MILLION)

TABLE 91 REST OF EUROPE: MARKET, BY ORGANIZATION SIZE, 20162021 (USD MILLION)

TABLE 92 REST OF EUROPE: MARKET, BY ORGANIZATION SIZE, 20222027 (USD MILLION)

TABLE 93 REST OF EUROPE: MARKET, BY APPLICATION, 20162021 (USD MILLION)

TABLE 94 REST OF EUROPE: MARKET, BY APPLICATION, 20222027 (USD MILLION)

9.4 ASIA PACIFIC

9.4.1 ASIA PACIFIC: COVID-19 IMPACT

9.4.2 ASIA PACIFIC: IOT INTEGRATION MARKET DRIVERS

9.4.3 ASIA PACIFIC: TARIFFS AND REGULATIONS

FIGURE 25 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 95 ASIA PACIFIC: MARKET, BY SERVICE, 20162021 (USD MILLION)

TABLE 96 ASIA PACIFIC: MARKET, BY SERVICE, 20222027 (USD MILLION)

TABLE 97 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 20162021 (USD MILLION)

TABLE 98 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 20222027 (USD MILLION)

TABLE 99 ASIA PACIFIC: MARKET, BY APPLICATION, 20162021 (USD MILLION)

TABLE 100 ASIA PACIFIC: MARKET, BY APPLICATION, 20222027 (USD MILLION)

TABLE 101 ASIA PACIFIC: MARKET, BY COUNTRY, 20162021 (USD MILLION)

TABLE 102 ASIA PACIFIC: MARKET, BY COUNTRY, 20222027 (USD MILLION)

9.4.4 CHINA

9.4.4.1 Heavy financial and strategic involvement of the government in R&D

9.4.4.2 China: IoT Integration Market Drivers

TABLE 103 CHINA: MARKET, BY SERVICE, 20162021 (USD MILLION)

TABLE 104 CHINA: MARKET, BY SERVICE, 20222027 (USD MILLION)

TABLE 105 CHINA: MARKET, BY ORGANIZATION SIZE, 20162021 (USD MILLION)

TABLE 106 CHINA: MARKET, BY ORGANIZATION SIZE, 20222027 (USD MILLION)

TABLE 107 CHINA: MARKET, BY APPLICATION, 20162021 (USD MILLION)

TABLE 108 CHINA: MARKET, BY APPLICATION, 20222027 (USD MILLION)

9.4.5 JAPAN

9.4.5.1 Increasing number of IoT devices

9.4.5.2 Japan: IoT Integration Market Drivers

TABLE 109 JAPAN: MARKET, BY SERVICE, 20162021 (USD MILLION)

TABLE 110 JAPAN: MARKET, BY SERVICE, 20222027 (USD MILLION)

TABLE 111 JAPAN: MARKET, BY ORGANIZATION SIZE, 20162021 (USD MILLION)

TABLE 112 JAPAN: MARKET, BY ORGANIZATION SIZE, 20222027 (USD MILLION)

TABLE 113 JAPAN: MARKET, BY APPLICATION, 20162021 (USD MILLION)

TABLE 114 JAPAN: MARKET, BY APPLICATION, 20222027 (USD MILLION)

9.4.6 INDIA

9.4.6.1 Government initiatives for the development of smart cities and smart manufacturing

9.4.6.2 India: IoT Integration Market Drivers

TABLE 115 INDIA: MARKET, BY SERVICE, 20162021 (USD MILLION)

TABLE 116 INDIA: MARKET, BY SERVICE, 20222027 (USD MILLION)

TABLE 117 INDIA: MARKET, BY ORGANIZATION SIZE, 20162021 (USD MILLION)

TABLE 118 INDIA: MARKET, BY ORGANIZATION SIZE, 20222027 (USD MILLION)

TABLE 119 INDIA: MARKET, BY APPLICATION, 20162021 (USD MILLION)

TABLE 120 INDIA: MARKET, BY APPLICATION, 20222027 (USD MILLION)

9.4.7 REST OF ASIA PACIFIC

TABLE 121 REST OF ASIA PACIFIC: IOT INTEGRATION MARKET, BY SERVICE, 20162021 (USD MILLION)

TABLE 122 REST OF ASIA PACIFIC: MARKET, BY SERVICE, 20222027 (USD MILLION)

TABLE 123 REST OF ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 20162021 (USD MILLION)

TABLE 124 REST OF ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 20222027 (USD MILLION)

TABLE 125 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 20162021 (USD MILLION)

TABLE 126 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 20222027 (USD MILLION)

9.5 MIDDLE EAST & AFRICA

9.5.1 MIDDLE EAST & AFRICA: COVID-19 IMPACT

9.5.2 MIDDLE EAST & AFRICA: MARKET DRIVERS

9.5.3 MIDDLE EAST & AFRICA: TARIFFS AND REGULATIONS

TABLE 127 MIDDLE EAST & AFRICA: IOT INTEGRATION MARKET, BY SERVICE, 20162021 (USD MILLION)

TABLE 128 MIDDLE EAST & AFRICA: MARKET, BY SERVICE, 20222027 (USD MILLION)

TABLE 129 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 20162021 (USD MILLION)

TABLE 130 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 20222027 (USD MILLION)

TABLE 131 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 20162021 (USD MILLION)

TABLE 132 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 20222027 (USD MILLION)

TABLE 133 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 20162021 (USD MILLION)

TABLE 134 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 20222027 (USD MILLION)

9.5.4 KINGDOM OF SAUDI ARABIA

9.5.4.1 Increasing smartphone and internet penetration contributing to the growth of the market

9.5.4.2 Kingdom of Saudi Arabia: IoT Integration Market Drivers

TABLE 135 KINGDOM OF SAUDI ARABIA: MARKET, BY SERVICE, 20162021 (USD MILLION)

TABLE 136 KINGDOM OF SAUDI ARABIA: MARKET, BY SERVICE, 20222027 (USD MILLION)

TABLE 137 KINGDOM OF SAUDI ARABIA: MARKET, BY ORGANIZATION SIZE, 20162021 (USD MILLION)

TABLE 138 KINGDOM OF SAUDI ARABIA: MARKET, BY ORGANIZATION SIZE, 20222027 (USD MILLION)

TABLE 139 KINGDOM OF SAUDI ARABIA: MARKET, BY APPLICATION, 20162021 (USD MILLION)

TABLE 140 KINGDOM OF SAUDI ARABIA: MARKET, BY APPLICATION, 20222027 (USD MILLION)

9.5.5 UNITED ARAB EMIRATES

9.5.5.1 Verticals, such as manufacturing, smart city, transportation, and hospitality, increasingly adopting IoT integration services

9.5.5.2 United Arab Emirates: IoT Integration Market Drivers

TABLE 141 UNITED ARAB EMIRATES: MARKET, BY SERVICE, 20162021 (USD MILLION)

TABLE 142 UNITED ARAB EMIRATES: MARKET, BY SERVICE, 20222027 (USD MILLION)

TABLE 143 UNITED ARAB EMIRATES: MARKET, BY ORGANIZATION SIZE, 20162021 (USD MILLION)

TABLE 144 UNITED ARAB EMIRATES: MARKET, BY ORGANIZATION SIZE, 20222027 (USD MILLION)

TABLE 145 UNITED ARAB EMIRATES: MARKET, BY APPLICATION, 20162021 (USD MILLION)

TABLE 146 UNITED ARAB EMIRATES: MARKET, BY APPLICATION, 20222027 (USD MILLION)

9.5.6 REST OF MIDDLE EAST & AFRICA

TABLE 147 REST OF MIDDLE EAST & AFRICA: IOT INTEGRATION MARKET, BY SERVICE, 20162021 (USD MILLION)

TABLE 148 REST OF MIDDLE EAST & AFRICA: MARKET, BY SERVICE, 20222027 (USD MILLION)

TABLE 149 REST OF MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 20162021 (USD MILLION)

TABLE 150 REST OF MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 20222027 (USD MILLION)

TABLE 151 REST OF MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 20162021 (USD MILLION)

TABLE 152 REST OF MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 20222027 (USD MILLION)

9.6 LATIN AMERICA

9.6.1 LATIN AMERICA: COVID-19 IMPACT

9.6.2 LATIN AMERICA: IOT INTEGRATION MARKET DRIVERS

9.6.3 LATIN AMERICA: TARIFFS AND REGULATIONS

TABLE 153 LATIN AMERICA: MARKET, BY SERVICE, 20162021 (USD MILLION)

TABLE 154 LATIN AMERICA: MARKET, BY SERVICE, 20222027 (USD MILLION)

TABLE 155 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 20162021 (USD MILLION)

TABLE 156 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 20222027 (USD MILLION)

TABLE 157 LATIN AMERICA: MARKET, BY APPLICATION, 20162021 (USD MILLION)

TABLE 158 LATIN AMERICA: MARKET, BY APPLICATION, 20222027 (USD MILLION)

TABLE 159 LATIN AMERICA: MARKET, BY COUNTRY, 20162021 (USD MILLION)

TABLE 160 LATIN AMERICA: MARKET, BY COUNTRY, 20222027 (USD MILLION)

9.6.4 BRAZIL

9.6.4.1 Large startup ecosystem and rapid urbanization

9.6.4.2 Brazil: IoT Integration Market Drivers

TABLE 161 BRAZIL: MARKET, BY SERVICE, 20162021 (USD MILLION)

TABLE 162 BRAZIL: MARKET, BY SERVICE, 20222027 (USD MILLION)

TABLE 163 BRAZIL: MARKET, BY ORGANIZATION SIZE, 20162021 (USD MILLION)

TABLE 164 BRAZIL: MARKET, BY ORGANIZATION SIZE, 20222027 (USD MILLION)

TABLE 165 BRAZIL: MARKET, BY APPLICATION, 20162021 (USD MILLION)

TABLE 166 BRAZIL: MARKET, BY APPLICATION, 20222027 (USD MILLION)

9.6.5 MEXICO

9.6.5.1 Increasing mobile broadband subscriptions and smartphone penetration rate

9.6.5.2 Mexico: IoT Integration Market Drivers

TABLE 167 MEXICO: MARKET, BY SERVICE, 20162021 (USD MILLION)

TABLE 168 MEXICO: MARKET, BY SERVICE, 20222027 (USD MILLION)

TABLE 169 MEXICO: MARKET, BY ORGANIZATION SIZE, 20162021 (USD MILLION)

TABLE 170 MEXICO: MARKET, BY ORGANIZATION SIZE, 20222027 (USD MILLION)

TABLE 171 MEXICO: MARKET, BY APPLICATION, 20162021 (USD MILLION)

TABLE 172 MEXICO: MARKET, BY APPLICATION, 20222027 (USD MILLION)

9.6.6 REST OF LATIN AMERICA

TABLE 173 REST OF LATIN AMERICA: IOT INTEGRATION MARKET, BY SERVICE, 20162021 (USD MILLION)

TABLE 174 REST OF LATIN AMERICA: MARKET, BY SERVICE, 20222027 (USD MILLION)

TABLE 175 REST OF LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 20162021 (USD MILLION)

TABLE 176 REST OF LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 20222027 (USD MILLION)

TABLE 177 REST OF LATIN AMERICA: MARKET, BY APPLICATION, 20162021 (USD MILLION)

TABLE 178 REST OF LATIN AMERICA: MARKET, BY APPLICATION, 20222027 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 189)

10.1 INTRODUCTION

10.2 MARKET EVALUATION FRAMEWORK

FIGURE 26 MARKET EVALUATION FRAMEWORK

10.3 KEY PLAYER STRATEGIES

TABLE 179 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS IN THE IOT INTEGRATION MARKET

10.4 MARKET SHARE ANALYSIS OF TOP PLAYERS

TABLE 180 MARKET: DEGREE OF COMPETITION

10.5 HISTORICAL REVENUE ANALYSIS

FIGURE 27 HISTORICAL THREE-YEAR REVENUE ANALYSIS OF LEADING PLAYERS, 20192021 (USD MILLION)

10.6 MARKET RANKING OF KEY PLAYERS IN MARKET, 2022

FIGURE 28 MARKET RANKING OF KEY PLAYERS, 2022

10.7 COMPANY EVALUATION QUADRANT

10.7.1 STARS

10.7.2 EMERGING LEADERS

10.7.3 PERVASIVE PLAYERS

10.7.4 PARTICIPANTS

FIGURE 29 IOT INTEGRATION MARKET (GLOBAL), COMPANY EVALUATION MATRIX, 2022

10.8 STARTUP/SME EVALUATION QUADRANT

10.8.1 PROGRESSIVE COMPANIES

10.8.2 RESPONSIVE COMPANIES

10.8.3 DYNAMIC COMPANIES

10.8.4 STARTING BLOCKS

FIGURE 30 MARKET (STARTUP): COMPANY EVALUATION MATRIX, 2022

10.9 COMPETITIVE SCENARIO

10.9.1 PRODUCT LAUNCHES

TABLE 181 PRODUCT LAUNCHES, 20192021

10.9.2 DEALS

TABLE 182 DEALS, 20202022

10.9.3 OTHERS

TABLE 183 OTHERS, 2022

11 COMPANY PROFILES (Page No. - 200)

11.1 MAJOR PLAYERS

(Business overview, Solutions offered, Recent developments, Related COVID-19, MnM view, Key strengths/right to win, Strategic choices, Weaknesses and competitive threats)*

11.1.1 ACCENTURE

TABLE 184 ACCENTURE: BUSINESS OVERVIEW

FIGURE 31 ACCENTURE: FINANCIAL OVERVIEW

TABLE 185 ACCENTURE: PRODUCTS OFFERED

TABLE 186 ACCENTURE: DEALS

TABLE 187 ACCENTURE: CLOUD OSS BSS MARKET: OTHERS

11.1.2 DXC TECHNOLOGY

TABLE 188 DXC TECHNOLOGY: BUSINESS OVERVIEW

FIGURE 32 DXC TECHNOLOGY: FINANCIAL OVERVIEW

TABLE 189 DXC TECHNOLOGY: PRODUCTS OFFERED

TABLE 190 DXC TECHNOLOGY: DEALS

11.1.3 DELOITTE

TABLE 191 DELOITTE: BUSINESS OVERVIEW

FIGURE 33 DELOITTE: FINANCIAL OVERVIEW

TABLE 192 DELOITTE: PRODUCTS OFFERED

TABLE 193 DELOITTE: PRODUCT LAUNCHES

TABLE 194 DELOITTE: DEALS

11.1.4 ATOS

TABLE 195 ATOS: BUSINESS OVERVIEW

FIGURE 34 ATOS: FINANCIAL OVERVIEW

TABLE 196 ATOS: PRODUCTS OFFERED

TABLE 197 ATOS: PRODUCT LAUNCHES

TABLE 198 ATOS: DEALS

11.1.5 TCS

TABLE 199 TCS: BUSINESS OVERVIEW

FIGURE 35 TCS: FINANCIAL OVERVIEW

TABLE 200 TCS: PRODUCTS OFFERED

TABLE 201 TCS: DEALS

11.1.6 WIPRO

TABLE 202 WIPRO: BUSINESS OVERVIEW

FIGURE 36 WIPRO: FINANCIAL OVERVIEW

TABLE 203 WIPRO: PRODUCTS OFFERED

TABLE 204 WIPRO: PRODUCT LAUNCHES

TABLE 205 WIPRO: DEALS

11.1.7 CAPGEMINI

TABLE 206 CAPGEMINI: BUSINESS OVERVIEW

FIGURE 37 CAPGEMINI: FINANCIAL OVERVIEW

TABLE 207 CAPGEMINI: PRODUCTS OFFERED

TABLE 208 CAPGEMINI: DEALS

11.1.8 FUJITSU

TABLE 209 FUJITSU: BUSINESS OVERVIEW

FIGURE 38 FUJITSU: FINANCIAL OVERVIEW

TABLE 210 FUJITSU: PRODUCTS OFFERED

TABLE 211 FUJITSU: PRODUCT LAUNCHES

11.1.9 IBM

TABLE 212 IBM: BUSINESS OVERVIEW

FIGURE 39 IBM: FINANCIAL OVERVIEW

TABLE 213 IBM: PRODUCTS OFFERED

TABLE 214 IBM: DEALS

11.1.10 COGNIZANT

TABLE 215 COGNIZANT: BUSINESS OVERVIEW

FIGURE 40 COGNIZANT: FINANCIAL OVERVIEW

TABLE 216 COGNIZANT: PRODUCTS OFFERED

TABLE 217 COGNIZANT: DEALS

1.1.11 SALESFORCE

TABLE 218 SALESFORCE: BUSINESS OVERVIEW

FIGURE 41 SALESFORCE: FINANCIAL OVERVIEW

TABLE 219 SALESFORCE: PRODUCTS OFFERED

TABLE 220 SALESFORCE: DEALS

11.1.12 NTT DATA

TABLE 221 NTT DATA: BUSINESS OVERVIEW

FIGURE 42 NTT DATA: FINANCIAL OVERVIEW

TABLE 222 NTT DATA: PRODUCTS OFFERED

TABLE 223 NTT DATA: DEALS

11.1.13 INFOSYS

11.1.14 HCL

11.1.15 TECH MAHINDRA

11.1.16 DELL EMC

11.1.17 DAMCO

*Business overview, Solutions offered, Recent developments, Related COVID-19, MnM view, Key strengths/right to win, Strategic choices, Weaknesses and competitive threats might not be captured in case of unlisted companies.

11.2 STARTUP/SMES

11.2.1 ALLERIN

11.2.2 SOFTDEL

11.2.3 PHITOMAS

11.2.4 EINFOCHIPS

11.2.5 TIMESYS

11.2.6 TIBBO

11.2.7 AERIS

11.2.8 MACROSOFT

11.2.9 MESHED

12 ADJACENT/RELATED MARKETS (Page No. - 262)

12.1 IOT MIDDLEWARE MARKET

12.1.1 MARKET DEFINITION

12.1.2 MARKET OVERVIEW

12.1.2.1 IoT middleware market, by platform type

TABLE 224 IOT MIDDLEWARE MARKET, BY PLATFORM TYPE, 20142019 (USD MILLION)

TABLE 225 IOT MIDDLEWARE MARKET, BY PLATFORM TYPE, 20192025 (USD MILLION)

12.1.2.2 IoT middleware market, by organization size

TABLE 226 IOT MIDDLEWARE MARKET, BY ORGANIZATION SIZE, 20142019 (USD MILLION)

TABLE 227 IOT MIDDLEWARE MARKET, BY ORGANIZATION SIZE, 20192025 (USD MILLION)

12.1.2.3 IoT middleware market, by vertical

TABLE 228 IOT MIDDLEWARE MARKET, BY VERTICAL, 20142019 (USD MILLION)

TABLE 229 IOT MIDDLEWARE MARKET, BY VERTICAL, 20192025 (USD MILLION)

12.1.2.4 IoT middleware market, by region

TABLE 230 IOT MIDDLEWARE MARKET, BY REGION, 20142019 (USD MILLION)

TABLE 231 IOT MIDDLEWARE MARKET, BY REGION, 20192025 (USD MILLION)

12.2 IOT CLOUD PLATFORM MARKET

12.2.1 MARKET DEFINITION

12.2.2 MARKET OVERVIEW

12.2.2.1 IoT cloud platform market, by offering

TABLE 232 IOT CLOUD PLATFORM MARKET, BY OFFERING, 20182025 (USD MILLION)

12.2.2.1.1 Platform

TABLE 233 OFFERING: IOT CLOUD PLATFORM MARKET, BY PLATFORM, 20182025 (USD MILLION)

12.2.2.1.2 Services

TABLE 234 IOT CLOUD PLATFORM MARKET FOR SERVICES, BY TYPE, 20182025 (USD MILLION)

TABLE 235 SERVICES: IOT CLOUD PLATFORM MARKET, BY PROFESSIONAL SERVICE, 20182025 (USD MILLION)

12.2.2.2 IoT cloud platform market, by deployment mode

TABLE 236 IOT CLOUD PLATFORM MARKET, BY DEPLOYMENT MODE, 20182025 (USD MILLION)

12.2.2.2.1 Public cloud

TABLE 237 PUBLIC CLOUD: IOT CLOUD PLATFORM MARKET, BY REGION, 20182025 (USD MILLION)

12.2.2.2.2 Private cloud

TABLE 238 PRIVATE CLOUD: IOT CLOUD PLATFORM MARKET, BY REGION, 20182025 (USD MILLION)

12.2.2.2.3 Hybrid cloud

TABLE 239 HYBRID CLOUD: IOT CLOUD PLATFORM MARKET, BY REGION, 20182025 (USD MILLION)

12.2.2.3 IoT cloud platform market, by application area

TABLE 240 SMART TRANSPORTATION: IOT CLOUD PLATFORM MARKET, BY REGION, 20182025 (USD MILLION)

TABLE 241 SMART GRID AND UTILITIES: IOT CLOUD PLATFORM MARKET, BY REGION, 20182025 (USD MILLION)

12.2.2.4 IoT cloud platform market, by region

TABLE 242 IOT CLOUD PLATFORM MARKET, BY REGION, 20182025 (USD MILLION)

12.3 IOT PROFESSIONAL SERVICES MARKET

12.3.1 MARKET DEFINITION

12.3.2 MARKET OVERVIEW

12.3.2.1 IoT professional services market, by service type

TABLE 243 IOT PROFESSIONAL SERVICES MARKET, BY SERVICE TYPE, 20162019 (USD BILLION)

TABLE 244 IOT PROFESSIONAL SERVICES MARKET, BY SERVICE TYPE, 20202026 (USD BILLION)

12.3.2.2 IoT professional services market, by organization size

TABLE 245 IOT PROFESSIONAL MARKET, BY ORGANIZATION SIZE, 20162019 (USD BILLION)

TABLE 246 IOT PROFESSIONAL MARKET, BY ORGANIZATION SIZE, 20202026 (USD BILLION)

12.3.2.3 IoT professional services market, by deployment type

TABLE 247 IOT PROFESSIONAL SERVICES MARKET, BY DEPLOYMENT TYPE, 20162019 (USD BILLION)

TABLE 248 IOT PROFESSIONAL SERVICES MARKET, BY DEPLOYMENT TYPE, 20202026 (USD BILLION)

12.3.2.4 IoT professional services market, by application

TABLE 249 IOT PROFESSIONAL SERVICES MARKET, BY APPLICATION, 20162019 (USD BILLION)

TABLE 250 IOT PROFESSIONAL SERVICES MARKET, BY APPLICATION, 20202026 (USD BILLION)

12.3.2.5 IoT professional services market, by region

TABLE 251 IOT PROFESSIONAL SERVICES MARKET, BY REGION, 20162019 (USD BILLION)

TABLE 252 IOT PROFESSIONAL SERVICES MARKET, BY REGION, 20202026 (USD BILLION)

13 APPENDIX (Page No. - 278)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

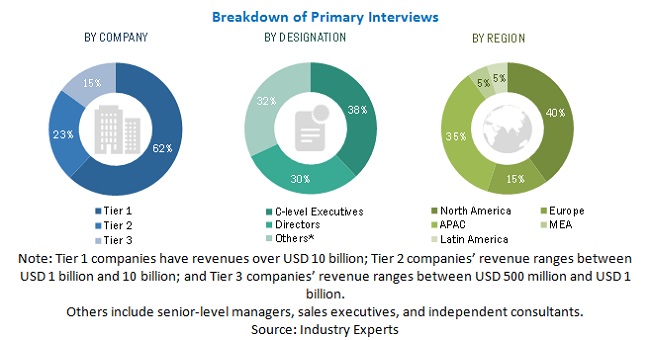

The study involved four major activities in estimating the current size of the IoT integration market. Exhaustive secondary research was done to collect information on the lending industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and sub segments of the IoT integration market.

Secondary Research

In the secondary research process, various secondary sources were referred to obtain key information about industry insights, the markets monetary chain, the overall pool of key players, market classification and segmentation, and key developments in the market. The secondary sources included annual reports, press releases of various companies TCS Limited, Wipro Limited, Atos SE, Accenture among others, white papers, journals, and certified publications and articles from recognized authors, directories, and databases.

Primary Research

Extensive primary research has been conducted after acquiring an understanding of the IoT integration market scenario through secondary research. Several primary interviews have been conducted with market experts from both demand side and supply side players across five major regions, namely North America, Europe, Asia Pacific, Middle East and Africa, and Latin America. Approximately 70% and 30% of primary interviews have been conducted from demand and supply side, respectively. Primary data has been collected through questionnaires email, and telephonic interviews. In the canvassing of primaries, various organizations, such as sales. Operations, and administration, were covered to provide holistic viewpoint in our report.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts opinions, has lead us to the findings as described in the remainder of this report

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the size of the global IoT integration market and various other dependent submarkets in the overall market. An exhaustive list of all the vendors offering solutions and services in the IoT integration market was prepared while using the top-down approach. The market share for all the vendors in the market was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor was evaluated based on its offering (solutions and services). The aggregate of all companies revenues was extrapolated to reach the overall market size.

IoT integration market: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To determine and forecast the global IoT integration market based on service, organization size, application, and regions from 2022 to 2027, and analyze various macro and microeconomic factors that affect the market growth.

- To forecast the size of the markets segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), Latin America, and Middle East and Africa (MEA).

- To provide detailed information about the major factors (drivers, opportunities, threats, and challenges) influencing the growth of the market.

- To analyze the impact of COVID-19 on the market.

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the total market.

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the IoT integration market.

- To profile key market players (top vendors and startups); provide a comparative analysis based on their business overviews, regional presence, product offerings, business strategies, and key financials; and illustrate the markets competitive landscape.

- To track and analyze competitive developments, such as mergers and acquisitions, a new product launched and product developments, partnerships, agreements, and collaborations, business expansions, and Research & Development (R&D) activities, in the market

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix which gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in IoT Integration Market