IR Spectroscopy Market by Technology (Near-Infrared, Mid-Infrared, Far-Infrared), Product Type (Benchtop Spectroscope, Micro Spectroscope, Portable Spectroscope, Hyphenated Spectroscope), End-User Industry & Geography - Global Forecast to 2025

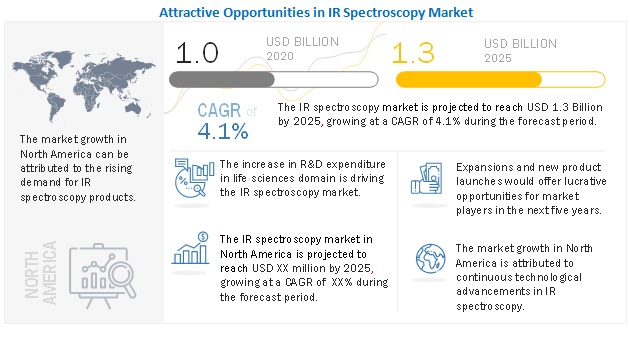

[174 Pages Report] The IR spectroscopy market is expected to grow at a CAGR% of 4.1%, from USD 1.0 billion in 2020 to USD 1.3 billion in 2025. The primary reasons for this rise in demand for spectropscpy products in healthcare & pharmaceuticals industry.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on global IR spectroscopy market, by end-user industry type, in 2020

The adoption of IR spectroscopy for testing applications is high in healthcare & pharmaceuticals, biological research, and food & beverages end-user industries. Stringent government regulations and increased demand for quality maintenance in these industries drive the adoption of IR spectroscopy. However, the outbreak and the spread of the COVID-19 have led to a decrease in demand for several products. Moreover, manufacturing plants in a number of countries have been shut down to contain the spread of the virus. The spread of COVID-19 led to the increased production of medicines and other medical equipment. This has increased the demand for IR spectroscopy in the healthcare & pharmaceuticals end-use industry, leading to surged demand for IR spectroscopy products and solutions.

IR spectroscopy Market Dynamics

Driver: Increase in R&D investments in healthcare & pharmaceuticals industry

Mid-IR spectroscopy is considered the most promising spectroscopic technique for biomedical research and diagnostics. The IR spectroscopy market is expected to benefit from the increased spending on R&D in the healthcare & pharmaceuticals industry.

In life sciences, optical spectroscopy, clinical and research instrumentation, and sensing play critical roles in various areas. Optical spectroscopy delivers an ideal means for non-destructive sampling and real-time analysis in the lab. The arrangement needs of these applications have changed rapidly in recent years with the advent of wearable diagnostic systems, point of care devices, and an upsurge in demand for lower detection limit systems. The performance, size, and cost of instruments are crucial for these applications, often with mutually exclusive specifications.

Restraint: Availability of used IR spectroscopy devices

IR spectroscopy devices have a life of around 5-7 years on average, and these products are expensive. In addition, it is observed that the ASP of these products has increased slightly in the last few years because of various technological advancements. These products have been available in the market for many years and are being used in various industries for multiple applications.

Currently, several used spectroscopy devices are available for resale; it has been observed that some of the industry segments prefer used devices instead of buying new ones. This would hamper the growth of the IR spectroscopy market.

Opportunity: Adoption of NIR spectroscopy in seed quality detection

Seeds are the most basic and vital agricultural capital goods, and the quality of seeds is essential for agricultural production. Traditional nucleic acid-based and immunodiagnostic methods used for detecting seed quality are destructive, slow, and need pre-treatment. NIR spectroscopy technology can not only identify healthy and infected seeds but can also classify the degree to which the seeds are infected, along with identifying parts of fungal pathogens. Several tests carried out by the International Seed Testing Association show that the NIR spectroscopy is an accurate, non-destructive detection method with significant potential for quality control and safety assessment of seeds. NIR (NIR) spectroscopy technology has developed rapidly in recent years due to its numerous advantages. It has been extensively used in many fields, such as chemicals, food, pharmacy, and agriculture industries. Seeds need to be detected for moisture, fatty acid, protein, and carotene content. NIR spectroscopes can sort the seeds on the basis of these factors. This technology can also sort the seeds with low potency. Worm-eaten and healthy seeds, too, can be sorted by NIR spectroscopes. This technology is providing opportunities for the IR spectroscopy market.

Challenge: High cost of IR spectroscopy products

The high cost of IR spectroscopy products compared with other substitute technologies has hindered their widespread adoption. Among NIR, Raman, and SWIR cameras, NIR spectroscopy products are usually the most expensive. Most NIR spectroscopy products are supported by indium gallium arsenide (InGaAs) sensors. InGaAs, being an expensive semiconductor material, accounts for a major share of the total price of a SWIR camera. Additionally, the glass lens supporting the InGaAs sensor is also expensive compared with the lenses used in other IR products. This adds to the total cost of NIR spectroscopy products, thus acting as a challenge for the IR spectroscopy market.

Mid-infrared technology expected to witness the largest market growth during the forecast period

MIR spectroscopy is a unique spectroscopy technique that identifies chemicals based on the interaction of molecules with electromagnetic radiation in the MIR region (4004000 cm-1). IR open-path arrangements send out a ray of IR light through open air that helps in noticing target gases along the track of the beam. This linear system is characteristically a few meters up to a few hundred meters in length.

The sampling technique that is used is named attenuated total reflection (ATR-MIR). It allows rapid examination of liquid and solid materials. MIR technology can be examined against big orientation spectral records, making this method an influential tool for identifying chemical unknowns.

The MIR region is categorized by the excitation of the molecules of components. The noteworthy benefit of MIR technology its high sensitivity with regard to molecules and their detection limits on the concentration scale. With MIR technology, important oscillations of the particles are scanned. The advantage of this is the possibility of noticing even small absorptions, down to the parts per million range. Current fiber technologies are very unstable and have an imperfect spectral range and no long-term steadiness in varying environments. The tremendously high absorption of water also proves to be detrimental. This technology can detect any foreign material in food and other liquid materials, such as juices and soft drinks. It can also be used to detect adulterants in edible oil. All these applications in the food industry are driving the market for MIR technology.

The market for benchtop spectroscopes to hold the largest share IR spectroscopy market, by product type, in 2025

Benchtop spectrometers are systems that use nuclear magnetic resonance for the determination of the physical and chemical properties of atomic/molecular structures of samples. Nuclear magnetic resonance enables the determining of the entire structure of organic compounds with a single group of diagnostic tests. As soon as the basic structure of a sample is identified, its physical attributes and molecular conformation at the molecular level, including solubility, can also be determined. Many nuclei have a precise spin rate. They all are electrically charged. If a magnetic field is applied to a fixed nucleus, energy transfer can take place at a wavelength that matches a specific radio frequency. When the field is removed, the energy is released at the same frequency. The signal that links to this transfer is evaluated and processed to yield a nuclear magnetic resonance (NMR) spectrum. The seized resonant frequency is identified based on the magnetic field directed at the nucleus. This field is impacted by electrons, which, in turn, are dependent on their chemical surroundings. Subsequently, data on the tested chemical environments of the nucleus can be determined using a resonant frequency.

The market for the biological research industry to grow at highest CAGR during the forecast period

Advancements in the field of biological research in the form of proteomics and genomics have driven the demand for IR spectroscopy products and solutions. IR spectroscopy is used for the detection of level absorption by photons in a molecule. It is also used for fingerprint analysis. IR spectroscopy has been extensively used to detect the movements of various organisms in the human body. These factors are driving the demand for IR spectroscopy products and solutions for use in biological research.

North America to hold the largest share of ROADM Technology market in 2020

North America held a share of 34% of the overall IR spectroscopy market in 2019. The growth of the market in this region can be attributed to the increased investments in research and development activities being carried out in the healthcare & pharmaceuticals industry. IR spectroscopy products and solutions are used in these research and development activities. The food & beverages industry also uses IR spectroscopy products and solutions for detecting the presence of foreign particles in food items and beverages. The people in North America are highly concerned about the quality of food items and beverages. This is the prime reason contributing to the growth of the IR spectroscopy market in North America for food & beverages.

To know about the assumptions considered for the study, download the pdf brochure

Scope of Report

|

Report Metric |

Details |

|

Market size available for years |

20172025 |

|

Base year considered |

2019 |

|

Forecast period |

20202025 |

|

Forecast units |

USD |

|

Segments covered |

By technology, by product type and by end-user |

|

Geographies covered |

Asia Pacific, Europe, North America |

|

Companies covered |

PerkinElmer Inc., Horiba Ltd., Shimadzu corporation |

This research report categorizes the ROADM Technology market based on offering, end-use application, and region.

IR SPECTROSCOPY MARKET, BY TECHNOLOGY

- Near-infrared

- Mid-infrared

- Far-infrared

IR SPECTROSCOPY MARKET, BY PRODUCT TYPE

- Benchtop Spectroscopes

- Micro Spectroscopes

- Portable Spectroscopes

- Hyphenated Spectroscopes

IR SPECTROSCOPY MARKET, BY END_USER INDUSTRY

- Healthcare & pharmaceuticals

- Chemicals

- Biological Research

- Environmental

- Consumer Electronics

- Food & Beverages

IR SPECTROSCOPY MARKET, BY GEOGRAPHY

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Rest of Europe

- Asia Pacific (APAC)

- China

- Japan

- India

- South Korea

- Rest of APAC

- Rest of the World (RoW)

- Middle East and Africa (MEA)

- South America

Recent Developments

- September 2020- Bruker Corporation acquired Canopy Biosciences, LLC (Missouri, US), that deals in high multiplex biomarker imaging for immuno-oncology, immunology, and cell therapy. This acquisition enhanced Brukers product offerings in multi-omics and fluorescence-based imaging techniques.

- June 2020- Shimadzu Corporation and RIKEN Innovation Co., Ltd. joined hands to create new businesses based on brain and five senses measurement research results from RIKEN.

- August 2018- Horiba Ltd. announced the release of the Duetta absorbance and fluorescence spectrometer that performs non-destructive, non-contact analysis of properties and qualities of object substances.

Frequently Asked Questions (FAQ):

What is current size of global IR Spectroscopy market?

The global IR spectroscopy market is estimated to be around USD 1.0 billion in 2020 and projected to reach USD 1.3 billion by 2025 at a CAGR of 4.10%.

What is COVID-19 impact on global IR spectroscopy market?

The requirement of IR spectroscopy technique in different body temperature measuring sensors and COVID-19 diagnostic kits might drive the IR imaging market. However, companies might find it challenging to cope with increased business requirements and may have to increase the production of IR spectroscopic products. This sudden demand will require them to increase their production, which might hamper the quality of these products. It would be challenging for the IR imaging players to maintain the quality and production to meet the required demands.

Where will all these developments take the industry in the mid-to-long term?

Technology will continue to play a critical role in the IR spectroscopy ecosystem. Key players operating in the IR spectroscopy marketplace are integrating emerging technologies within their existing ecosystem, which has helped to improve ROADM products.

Who are the winners of global IR spectroscopy market?

Companies such as Shimadzu Corporation, Agilent technologies and Horiba Ltd. fall under the winners category. These companies cater to the requirements of their customers by providing IR spectroscopy products.

What are some features of IR Spectroscopy?

IR spectroscopes operate in the IR region of the electromagnetic spectrum used for the study and identification of chemical compounds in a sample, which can be either be in the gaseous, liquid, or solid form. In IR spectroscopy, IR light interacts with matter to identify the composition of the materials using three ways of measurement: reflection, emission, and absorption, for quality control and other applications. IR spectroscopy is used in various verticals, such as biological research, healthcare & pharmaceuticals, and food & beverages, to study and check the quality of materials produced during the manufacturing process. The instruments used for IR spectroscopy include IR spectrometers or spectrophotometers. IR spectroscopy works in the IR spectrum, which can be further divided into near-infrared (NIR), mid-infrared (MIR), and far-infrared (FIR). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 20)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION AND SCOPE

FIGURE 1 WAVELENGTHS OF DIFFERENT TECHNOLOGIES

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

1.3.2 MARKET SEGMENTATION

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

TABLE 1 CURRENCY CONVERSION RATES

1.5 PACKAGE SIZE

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 24)

2.1 RESEARCH DATA

FIGURE 2 MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 List of major secondary sources

2.1.1.2 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Primary interviews with experts

2.1.2.2 Key data from primary sources

2.1.3 SECONDARY AND PRIMARY RESEARCH

2.1.3.1 Key industry insights

2.1.3.2 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

FIGURE 3 PROCESS FLOW

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for estimating market size by bottom-up analysis (demand side)

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for estimating market size by top-down analysis (supply side)

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.2.2.2 Demand- and supply-side approach analysis

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

FIGURE 7 ASSUMPTIONS FOR THE RESEARCH STUDY

3 EXECUTIVE SUMMARY (Page No. - 34)

3.1 ASP TRENDS

FIGURE 8 ASP TRENDS (20172025)

FIGURE 9 MARKET FOR FAR-INFRARED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 10 BENCHTOP SPECTROSCOPES HELD LARGEST SHARE OF IR SPECTROSCOPY MARKET IN 2019

FIGURE 11 HEALTHCARE & PHARMACEUTICALS INDUSTRY TO ACCOUNT FOR LARGEST SIZE OF IR SPECTROSCOPY MARKET IN 2025

FIGURE 12 MARKET, BY REGION, 2020

4 PREMIUM INSIGHTS (Page No. - 38)

4.1 ATTRACTIVE OPPORTUNITIES IN IR SPECTROSCOPY MARKET

FIGURE 13 INCREASING GOVERNMENT EXPENDITURE IN LIFE SCIENCES TO DRIVE IR SPECTROSCOPY MARKET DURING FORECAST PERIOD

4.2 MARKET: BY END-USER INDUSTRY AND REGION, 2020

FIGURE 14 HEALTHCARE & PHARMACEUTICALS INDUSTRY TO ACCOUNT FOR LARGEST SHARE OF IR SPECTROSCOPY MARKET IN 2020

4.3 IR SPECTROSCOPY MARKET, BY TECHNOLOGY

FIGURE 15 MID-INFRARED TO CAPTURE LARGEST SHARE OF MARKET IN 2020

4.4 MARKET, BY REGION

FIGURE 16 NORTH AMERICA HELD LARGEST SHARE OF IR SPECTROSCOPY MARKET IN 2019

5 MARKET OVERVIEW (Page No. - 41)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

FIGURE 18 MARKET DRIVERS AND THEIR IMPACT

5.2.1.1 Increase in R&D investments in healthcare & pharmaceuticals industry

5.2.1.2 Continuous technological advancements in IR spectroscopy

5.2.2 RESTRAINTS

FIGURE 19 IR SPECTROSCOPY MARKET RESTRAINTS AND THEIR IMPACT

5.2.2.1 Technical limitations of IR spectroscopy

5.2.2.2 Availability of used IR spectroscopy devices

5.2.3 OPPORTUNITIES

FIGURE 20 MARKET OPPORTUNITIES AND THEIR IMPACT

5.2.3.1 Adoption of NIR spectroscopy in seed quality detection

5.2.3.2 Growing product development for biological research

5.2.4 CHALLENGES

FIGURE 21 MARKET CHALLENGES AND THEIR IMPACT

5.2.4.1 High cost of IR spectroscopy products

5.3 VALUE CHAIN ANALYSIS

FIGURE 22 MARKET: VALUE CHAIN

5.4 KEY TRENDS IN MARKET

FIGURE 23 KEY TRENDS IN IR SPECTROSCOPY MARKET

5.5 PORTERS FIVE FORCES ANALYSIS

FIGURE 24 PORTERS FIVE FORCES ANALYSIS FOR IR SPECTROSCOPY MARKET

5.5.1 INTRODUCTION

TABLE 2 IMPACT OF EACH FORCE ON THE MARKET

5.5.2 BARGAINING POWER OF BUYERS

5.5.3 BARGAINING POWER OF SUPPLIERS

5.5.4 THREAT OF NEW ENTRANTS

5.5.5 THREAT OF SUBSTITUTES

5.5.6 INTENSITY OF COMPETITIVE RIVALRY

5.6 COVID-19-RELATED DRIVERS

5.6.1 THERMAL IMAGING COULD BE USED TO DETECT COVID-19

5.6.2 COMPANIES ARE LAUNCHING SOFTWARE TO IMPROVE TEMPERATURE SCREENING FOR COVID-19

5.7 COVID-19-RELATED CHALLENGES

5.7.1 QUALITY-RELATED ISSUES DUE TO HIGH-VOLUME PRODUCTION

5.8 PATENTS

5.8.1 PATENT 1

5.8.2 PATENT 2

5.9 USE CASE

5.9.1 USE CASE 1: JEOL INC

5.10 TECHNOLOGICAL TRENDS IN IR SPECTROSCOPY

5.10.1 IR SPECTROSCOPY AS A RAPID TOOL TO ANALYZE ORGANIC COMPOSTS

5.10.2 VIBRATIONAL SPECTROSCOPIC TECHNIQUES FOR TEA QUALITY AND SAFETY ANALYSES

6 IR SPECTROSCOPY MARKET, BY TECHNOLOGY (Page No. - 52)

6.1 INTRODUCTION

FIGURE 25 MARKET FOR FAR-INFRARED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 3 MARKET, BY TECHNOLOGY, 20172019 (USD MILLION)

TABLE 4 MARKET, BY TECHNOLOGY, 20202025 (USD MILLION)

6.2 NEAR-INFRARED SPECTROSCOPY

6.2.1 VARIOUS APPLICATIONS IN DIFFERENT INDUSTRIES ARE DRIVING NEAR-INFRARED SPECTROSCOPY MARKET

6.2.2 WORKING METHODOLOGY OF NIR SPECTROSCOPES

6.2.3 BENEFITS OF NIR

TABLE 5 NIR SPECTROSCOPY MARKET, BY PRODUCT TYPE, 20172019 (USD MILLION)

TABLE 6 NIR SPECTROSCOPY MARKET, BY PRODUCT TYPE, 20202025 (USD MILLION)

6.3 MID-INFRARED SPECTROSCOPY

6.3.1 USE OF MID-INFRARED TECHNOLOGY IN FOOD INDUSTRY DRIVES MIR SPECTROSCOPY MARKET

TABLE 7 MIR SPECTROSCOPY MARKET, BY PRODUCT TYPE, 20172019 (USD MILLION)

TABLE 8 MIR SPECTROSCOPY MARKET, BY PRODUCT TYPE, 20202025 (USD MILLION)

6.4 FAR-INFRARED

6.4.1 DEMAND FOR FIR SPECTROSCOPES WILL SURGE DUE TO INCREASED NUMBER OF APPLICATIONS IN HEALTHCARE & PHARMACEUTICALS INDUSTRY

6.4.2 KEY PROPERTIES OF FAR-INFRARED:

FIGURE 26 MICRO SPECTROSCOPES TO WITNESS HIGHEST CAGR IN FIR SPECTROSCOPY MARKET DURING FORECAST PERIOD

TABLE 9 FIR SPECTROSCOPY MARKET, BY PRODUCT TYPE, 20172019 (USD MILLION)

TABLE 10 FIR SPECTROSCOPY MARKET, BY PRODUCT TYPE, 20202025 (USD MILLION)

7 IR SPECTROSCOPY MARKET, BY PRODUCT TYPE (Page No. - 59)

7.1 INTRODUCTION

TABLE 11 MARKET, BY PRODUCT TYPE, 20172019 (USD MILLION)

TABLE 12 MARKET, BY PRODUCT TYPE, 20202025 (USD MILLION)

FIGURE 27 MARKET FOR PORTABLE SPECTROSCOPES TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

7.2 BENCHTOP SPECTROSCOPES

7.2.1 COMPACTNESS AND LIGHT WEIGHT OF BENCHTOP SPECTROSCOPES LEAD TO THEIR INCREASED GLOBAL DEMAND

7.2.2 ADVANTAGES OF BENCHTOP SPECTROSCOPES

TABLE 13 IR SPECTROSCOPY MARKET FOR BENCHTOP SPECTROSCOPES, BY TECHNOLOGY, 20172019 (USD MILLION)

TABLE 14IR SPECTROSCOPY MARKET FOR BENCHTOP SPECTROSCOPES, BY TECHNOLOGY, 20202025 (USD MILLION)

7.3 MICRO SPECTROSCOPES

7.3.1 EMERGENCE OF MICRO SPECTROSCOPES AS POWERFUL TOOLS IN TISSUE ENGINEERING

TABLE 15 MARKET FOR MICRO SPECTROSCOPES, BY TECHNOLOGY, 20172019 (USD MILLION)

TABLE 16 IR SPECTROSCOPY MARKET FOR MICRO SPECTROSCOPES, BY TECHNOLOGY, 20202025 (USD MILLION)

7.4 PORTABLE SPECTROSCOPES

7.4.1 UNIQUE ADVANTAGES OFFERED BY PORTABLE SPECTROSCOPES LEAD TO THEIR INCREASED GLOBAL DEMAND

TABLE 17 MARKET FOR PORTABLE SPECTROSCOPES, BY TECHNOLOGY, 20172019 (USD MILLION)

TABLE 18 MARKET FOR PORTABLE SPECTROSCOPES, BY TECHNOLOGY, 20202025 (USD MILLION)

7.5 HYPHENATED SPECTROSCOPES

7.5.1 NEW AND ADVANCED HYPHENATED SPECTROSCOPES COULD REPLACE OUTDATED SPECTROSCOPES

TABLE 19 IR SPECTROSCOPY MARKET FOR HYPHENATED SPECTROSCOPES, BY TECHNOLOGY, 20172019 (USD MILLION)

TABLE 20 IR SPECTROSCOPY MARKET FOR HYPHENATED SPECTROSCOPES, BY TECHNOLOGY, 20202025 (USD MILLION)

8 IR SPECTROSCOPY MARKET, BY END-USER INDUSTRY (Page No. - 66)

8.1 INTRODUCTION

8.2 COVID-19 IMPACT ON END-USER INDUSTRY

FIGURE 28 BIOLOGICAL RESEARCH SEGMENT OF IR SPECTROSCOPY MARKET TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

TABLE 21 MARKET, BY END-USER INDUSTRY, 20172019 (USD MILLION)

TABLE 22 IR SPECTROSCOPY MARKET, BY END-USER INDUSTRY, 20202025 (USD MILLION)

8.3 HEALTHCARE & PHARMACEUTICALS

8.3.1 INCREASING USE OF IR SPECTROSCOPY IN DIFFERENT DIAGNOSTIC AND THERAPEUTIC APPLICATIONS WOULD DRIVE MARKET GROWTH

8.3.2 CANCER DETECTION

TABLE 23 MARKET FOR HEALTHCARE & PHARMACEUTICALS, BY REGION, 20172019 (USD MILLION)

TABLE 24 MARKET FOR HEALTHCARE & PHARMACEUTICALS, BY REGION, 20202025 (USD MILLION)

TABLE 25 MARKET IN NORTH AMERICA FOR HEALTHCARE & PHARMACEUTICALS, BY COUNTRY, 20172019 (USD MILLION)

TABLE 26 MARKET IN NORTH AMERICA FOR HEALTHCARE & PHARMACEUTICALS, BY COUNTRY, 20202025 (USD MILLION)

TABLE 27 MARKET IN EUROPE FOR HEALTHCARE & PHARMACEUTICALS, BY COUNTRY, 20172019 (USD MILLION)

TABLE 28MARKET IN EUROPE FOR HEALTHCARE & PHARMACEUTICALS, BY COUNTRY, 20202025 (USD MILLION)

TABLE 29 MARKET IN ASIA PACIFIC FOR HEALTHCARE & PHARMACEUTICALS, BY COUNTRY, 20172019 (USD MILLION)

TABLE 30 MARKET IN ASIA PACIFIC FOR HEALTHCARE & PHARMACEUTICALS, BY COUNTRY, 20202025 (USD MILLION)

TABLE 31 MARKET IN ROW FOR HEALTHCARE & PHARMACEUTICALS, BY REGION, 20172019 (USD MILLION)

TABLE 32 MARKET IN ROW FOR HEALTHCARE & PHARMACEUTICALS, BY REGION, 20202025 (USD MILLION)

TABLE 33 MARKET IN SOUTH AMERICA FOR HEALTHCARE & PHARMACEUTICALS, BY COUNTRY, 20172019 (USD MILLION)

TABLE 34 SPECTROSCOPY MARKET IN SOUTH AMERICA FOR HEALTHCARE & PHARMACEUTICALS, BY COUNTRY, 20202025 (USD MILLION)

TABLE 35 MARKET IN MIDDLE EAST & AFRICA FOR HEALTHCARE & PHARMACEUTICALS, BY COUNTRY, 20172019 (USD THOUSAND)

TABLE 36 MARKET IN MIDDLE EAST & AFRICA FOR HEALTHCARE & PHARMACEUTICALS, BY COUNTRY, 20202025 (USD THOUSAND)

8.4 CHEMICALS

8.4.1 RISING DEMAND FOR IR SPECTROSCOPY FROM CHEMICALS INDUSTRY FOR DETERMINING MOLECULE STRUCTURES OF COMPOUNDS

TABLE 37 MARKET FOR CHEMICALS, BY REGION, 20172019 (USD MILLION)

TABLE 38 MARKET FOR CHEMICALS, BY REGION, 20202025 (USD MILLION)

TABLE 39 MARKET IN NORTH AMERICA FOR CHEMICALS, BY COUNTRY, 20172019 (USD MILLION)

TABLE 40 MARKET IN NORTH AMERICA FOR CHEMICALS, BY COUNTRY, 20202025 (USD MILLION)

TABLE 41 MARKET IN EUROPE FOR CHEMICALS, BY COUNTRY, 20172019 (USD MILLION)

TABLE 42 MARKET IN EUROPE FOR CHEMICALS, BY COUNTRY, 20202025 (USD MILLION)

TABLE 43 MARKET IN ASIA PACIFIC FOR CHEMICALS, BY COUNTRY, 20172019 (USD MILLION)

TABLE 44 MARKET IN ASIA PACIFIC FOR CHEMICALS, BY COUNTRY, 20202025 (USD MILLION)

TABLE 45MARKET IN ROW FOR CHEMICALS, BY REGION, 20172019 (USD MILLION)

TABLE 46 MARKET IN ROW FOR CHEMICALS, BY REGION, 20202025 (USD MILLION)

TABLE 47 MARKET IN SOUTH AMERICA FOR CHEMICALS, BY COUNTRY, 20172019 (USD MILLION)

TABLE 48 MARKET IN SOUTH AMERICA FOR CHEMICALS, BY COUNTRY, 20202025 (USD MILLION)

TABLE 49 IR SPECTROSCOPY MARKET IN MIDDLE EAST & AFRICA FOR CHEMICALS, BY COUNTRY, 20172019 (USD MILLION)

TABLE 50 IR SPECTROSCOPY MARKET IN MIDDLE EAST & AFRICA FOR CHEMICALS, BY COUNTRY, 20202025 (USD MILLION)

8.5 FOOD & BEVERAGES

8.5.1 SURGING USE OF IR SPECTROSCOPY FOR DETERMINING QUALITY OF FOOD ITEMS AND BEVERAGES

TABLE 51 MARKET FOR FOOD & BEVERAGES, BY REGION, 20172019 (USD MILLION)

TABLE 52 MARKET FOR FOOD & BEVERAGES, BY REGION, 20202025 (USD MILLION)

TABLE 53 MARKET IN NORTH AMERICA FOR FOOD & BEVERAGES, BY COUNTRY, 20172019 (USD THOUSAND)

TABLE 54 MARKET IN NORTH AMERICA FOR FOOD & BEVERAGES, BY COUNTRY, 20202025 (USD THOUSAND)

TABLE 55 MARKET IN EUROPE FOR FOOD & BEVERAGES, BY COUNTRY, 20172019 (USD MILLION)

TABLE 56 MARKET IN EUROPE FOR FOOD & BEVERAGES, BY COUNTRY, 20202025 (USD MILLION)

TABLE 57 MARKET IN ASIA PACIFIC FOR FOOD & BEVERAGES, BY COUNTRY, 20172019 (USD MILLION)

TABLE 58 MARKET IN ASIA PACIFIC FOR FOOD & BEVERAGES, BY COUNTRY, 20202025 (USD MILLION)

TABLE 59 MARKET IN ROW FOR FOOD & BEVERAGES, BY REGION, 20172019 (USD MILLION)

TABLE 60 IR SPECTROSCOPY MARKET IN ROW FOR FOOD & BEVERAGES, BY REGION, 20202025 (USD MILLION)

TABLE 61 IR SPECTROSCOPY MARKET IN SOUTH AMERICA FOR FOOD & BEVERAGES, BY COUNTRY, 20172019 (USD MILLION)

TABLE 62 MARKET IN SOUTH AMERICA FOR FOOD & BEVERAGES, BY COUNTRY, 20202025 (USD MILLION)

TABLE 63MARKET IN MIDDLE EAST & AFRICA FOR FOOD & BEVERAGES, BY COUNTRY, 20172019 (USD MILLION)

TABLE 64 MARKET IN MIDDLE EAST & AFRICA FOR FOOD & BEVERAGES, BY COUNTRY, 20202025 (USD MILLION)

8.5.2 GROWING USE OF IR SPECTROSCOPY TO DETECT PRESENCE OF PESTICIDES IN FOOD ITEMS

8.5.3 RISING USE OF SERS FOR DETECTION AND IDENTIFICATION OF BACTERIA IN FOOD ITEMS

8.6 ENVIRONMENTAL

8.6.1 SURGING ADOPTION OF IR SPECTROSCOPY FOR DETERMINING AIR QUALITY TO FUEL MARKET GROWTH

TABLE 65 MARKET FOR ENVIRONMENTAL, BY REGION, 20172019 (USD MILLION)

TABLE 66 MARKET FOR ENVIRONMENTAL, BY REGION, 20202025 (USD MILLION)

TABLE 67 MARKET IN NORTH AMERICA FOR ENVIRONMENTAL, BY COUNTRY, 20172019 (USD MILLION)

TABLE 68 MARKET IN NORTH AMERICA FOR ENVIRONMENTAL, BY COUNTRY, 20202025 (USD MILLION)

TABLE 69 MARKET IN EUROPE FOR ENVIRONMENTAL, BY COUNTRY, 20172019 (USD THOUSAND)

TABLE 70 MARKET IN EUROPE FOR ENVIRONMENTAL, BY COUNTRY, 20202025 (USD THOUSAND)

TABLE 71 IR SPECTROSCOPY MARKET IN ASIA PACIFIC FOR ENVIRONMENTAL, BY COUNTRY, 20172019 (USD THOUSAND)

TABLE 72 MARKET IN ASIA PACIFIC FOR ENVIRONMENTAL, BY COUNTRY, 20202025 (USD THOUSAND)

TABLE 73 MARKET IN ROW FOR ENVIRONMENTAL, BY REGION, 20172019 (USD MILLION)

TABLE 74 MARKET IN ROW FOR ENVIRONMENTAL, BY REGION, 20202025 (USD MILLION)

TABLE 75 MARKET IN SOUTH AMERICA FOR ENVIRONMENTAL, BY COUNTRY, 20172019 (USD THOUSAND)

TABLE 76MARKET IN SOUTH AMERICA FOR ENVIRONMENTAL, BY COUNTRY, 20202025 (USD THOUSAND)

TABLE 77 MARKET IN MIDDLE EAST & AFRICA FOR ENVIRONMENTAL, BY COUNTRY, 20172019 (USD THOUSAND)

TABLE 78 MARKET IN MIDDLE EAST & AFRICA FOR ENVIRONMENTAL, BY COUNTRY, 20202025 (USD THOUSAND)

8.7 BIOLOGICAL RESEARCH

8.7.1 INCREASING DEMAND FOR IR SPECTROSCOPY IN BIOLOGICAL RESEARCH FOR DETECTING ATOMIC STRUCTURES TO CONTRIBUTE TO MARKET GROWTH

TABLE 79 MARKET FOR BIOLOGICAL RESEARCH, BY REGION, 20172019 (USD MILLION)

TABLE 80 MARKET FOR BIOLOGICAL RESEARCH, BY REGION, 20202025 (USD MILLION)

TABLE 81 MARKET IN NORTH AMERICA FOR BIOLOGICAL RESEARCH, BY COUNTRY, 20172019 (USD MILLION)

TABLE 82 MARKET IN NORTH AMERICA FOR BIOLOGICAL RESEARCH, BY COUNTRY, 20202025 (USD MILLION)

TABLE 83 MARKET IN EUROPE FOR BIOLOGICAL RESEARCH, BY COUNTRY, 20172019 (USD MILLION)

TABLE 84 MARKET IN EUROPE FOR BIOLOGICAL RESEARCH, BY COUNTRY, 20202025 (USD MILLION)

TABLE 85 MARKET IN ASIA PACIFIC FOR BIOLOGICAL RESEARCH, BY COUNTRY, 20172019 (USD MILLION)

TABLE 86 MARKET IN ASIA PACIFIC FOR BIOLOGICAL RESEARCH, BY COUNTRY, 20202025 (USD MILLION)

TABLE 87 MARKET IN ROW FOR BIOLOGICAL RESEARCH, BY REGION, 20172019 (USD MILLION)

TABLE 88 MARKET IN ROW FOR BIOLOGICAL RESEARCH, BY REGION, 20202025 (USD MILLION)

TABLE 89 MARKET IN SOUTH AMERICA FOR BIOLOGICAL RESEARCH, BY COUNTRY, 20172019 (USD MILLION)

TABLE 90 IMARKET IN SOUTH AMERICA FOR BIOLOGICAL RESEARCH, BY COUNTRY, 20202025 (USD MILLION)

TABLE 91 MARKET IN MIDDLE EAST & AFRICA FOR BIOLOGICAL RESEARCH, BY COUNTRY, 20172019 (USD MILLION)

TABLE 92 IR SPECTROSCOPY MARKET IN MIDDLE EAST & AFRICA FOR BIOLOGICAL RESEARCH, BY COUNTRY, 20202025 (USD MILLION)

8.8 CONSUMER ELECTRONICS

8.8.1 RISING USE OF IR SPECTROSCOPY TO IDENTIFY OXIDATION STATE OF DIFFERENT COMPOUNDS

8.8.2 COVID-19 IMPACT

TABLE 93 MARKET FOR CONSUMER ELECTRONICS, BY REGION, 20172019 (USD MILLION)

TABLE 94 MARKET FOR CONSUMER ELECTRONICS, BY REGION, 20202025 (USD MILLION)

TABLE 95 MARKET IN NORTH AMERICA FOR CONSUMER ELECTRONICS, BY COUNTRY, 20172019 (USD MILLION)

TABLE 96 MARKET IN NORTH AMERICA FOR CONSUMER ELECTRONICS, BY COUNTRY, 20202025 (USD MILLION)

TABLE 97 MARKET IN EUROPE FOR CONSUMER ELECTRONICS, BY COUNTRY, 20172019 (USD MILLION)

TABLE 98 MARKET IN EUROPE FOR CONSUMER ELECTRONICS, BY COUNTRY, 20202025 (USD MILLION)

TABLE 99 MARKET IN ASIA PACIFIC FOR CONSUMER ELECTRONICS, BY COUNTRY, 20172019 (USD THOUSAND)

TABLE 100 MARKET IN ASIA PACIFIC FOR CONSUMER ELECTRONICS, BY COUNTRY, 20202025 (USD THOUSAND)

TABLE 101 MARKET IN ROW FOR CONSUMER ELECTRONICS, BY REGION, 20172019 (USD MILLION)

TABLE 102 MARKET IN ROW FOR CONSUMER ELECTRONICS, BY REGION, 20202025 (USD MILLION)

TABLE 103 MARKET IN SOUTH AMERICA FOR CONSUMER ELECTRONICS, BY COUNTRY, 20172019 (USD THOUSAND)

TABLE 104 MARKET IN SOUTH AMERICA FOR CONSUMER ELECTRONICS, BY COUNTRY, 20202025 (USD THOUSAND)

TABLE 105 MARKET IN MIDDLE EAST & AFRICA FOR CONSUMER ELECTRONICS, BY COUNTRY, 20172019 (USD THOUSAND)

TABLE 106 MARKET IN MIDDLE EAST & AFRICA FOR CONSUMER ELECTRONICS, BY COUNTRY, 20202025 (USD THOUSAND)

9 GEOGRAPHIC ANALYSIS (Page No. - 98)

9.1 INTRODUCTION

FIGURE 29 MARKET IN NORTH AMERICA TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

TABLE 107 MARKET, BY REGION, 20172019 (USD MILLION)

TABLE 108 MARKET, BY REGION, 20202025 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 30 SNAPSHOT OF MARKET IN NORTH AMERICA

TABLE 109 \MARKET IN NORTH AMERICA, BY COUNTRY, 20172019 (USD MILLION)

TABLE 110 IR SPECTROSCOPY MARKET IN NORTH AMERICA, BY COUNTRY, 20202025 (USD MILLION)

9.2.1 US

9.2.1.1 US to hold major share of IR spectroscopy market in 2025

9.2.2 CANADA

9.2.2.1 Increased use of IR spectroscopy to analyze soil and water extracts

9.2.3 MEXICO

9.2.3.1 Extensive use of IR spectroscopy for monitoring air quality in Mexico to drive market growth

9.3 EUROPE

FIGURE 31 SNAPSHOT OF IR SPECTROSCOPY MARKET IN EUROPE

TABLE 111 MARKET IN EUROPE, BY COUNTRY, 20172019 (USD MILLION)

TABLE 112 MARKET IN EUROPE, BY COUNTRY, 20202025 (USD MILLION)

9.3.1 UK

9.3.1.1 Emergence of sports industry as key consumer of IR spectroscopy products and solutions in UK to monitor recovery from injuries

9.3.2 GERMANY

9.3.2.1 Adoption of IR spectroscopy products and solutions for diagnostic purposes in Germany

9.3.3 FRANCE

9.3.3.1 Increased awareness about maintenance of food quality to contribute to market growth in France

9.3.4 ITALY

9.3.4.1 Deployment of IR spectroscopy products and solutions to ensure precision in thermal screeners contribute would drive IR spectroscopy market

9.3.5 REST OF EUROPE

9.4 ASIA PACIFIC

FIGURE 32 SNAPSHOT OF IR SPECTROSCOPY MARKET IN ASIA PACIFIC

TABLE 113 MARKET IN ASIA PACIFIC, BY COUNTRY, 20172019 (USD MILLION)

TABLE 114 MARKET IN ASIA PACIFIC, BY COUNTRY, 20202025 (USD MILLION)

9.4.1 CHINA

9.4.1.1 Surged implementation of latest technologies in industrial plants to contribute to demand for IR spectroscopy products and solutions in China

9.4.2 JAPAN

9.4.2.1 IR spectroscopy products and solutions are widely used for measuring temperature, process monitoring, and controlling manufacturing processes

9.4.3 INDIA

9.4.3.1 Increased demand for IR spectroscopy products and solutions in biological research activities to fuel market growth in India

9.4.4 SOUTH KOREA

9.4.4.1 Surged deployment of IR spectroscopy products and solutions in consumer electronics industry to drive market growth in South Korea

9.4.5 REST OF ASIA PACIFIC

9.5 REST OF THE WORLD (ROW)

FIGURE 33 SNAPSHOT OF MARKET IN ROW

TABLE 115 MARKET IN ROW, BY REGION, 20172019 (USD MILLION)

TABLE 116 MARKET IN ROW, BY REGION, 20202025 (USD MILLION)

9.5.1 MIDDLE EAST & AFRICA (MEA)

9.5.1.1 Healthcare & pharmaceuticals industry to contribute significantly to growth of market in Middle East & Africa

TABLE 117 MARKET IN MIDDLE EAST & AFRICA, BY COUNTRY, 20172019 (USD MILLION)

TABLE 118 IR SPECTROSCOPY MARKET IN MIDDLE EAST & AFRICA, BY COUNTRY, 20202025 (USD MILLION)

9.5.2 SOUTH AMERICA

9.5.2.1 IR spectroscopy is being used to provide doctors with information to identify different kinds of pain syndromes

TABLE 119 MARKET IN SOUTH AMERICA, BY COUNTRY, 20172019 (USD MILLION)

TABLE 120 MARKET IN SOUTH AMERICA, BY COUNTRY, 20202025 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 113)

10.1 OVERVIEW

FIGURE 34 COMPANIES ADOPTED PRODUCT LAUNCHES AS THEIR KEY GROWTH STRATEGY BETWEEN 2017 AND 2020

10.2 MARKET SHARE ANALYSIS: MARKET, 2019

FIGURE 35 MARKET SHARE ANALYSIS OF KEY PLAYERS IN IR SPECTROSCOPY MARKET, 2019

10.3 COMPETITIVE LEADERSHIP MAPPING

FIGURE 36 MARKET (GLOBAL): COMPETITIVE LEADERSHIP MAPPING, 2019

10.3.1 STAR

10.3.2 PERVASIVE

10.3.3 PARTICIPANT

10.3.4 EMERGING LEADER

10.4 STRENGTH OF PRODUCT PORTFOLIO (12 PLAYERS)

FIGURE 37 STRENGTH OF PRODUCT PORTFOLIO OF TOP PLAYERS IN IR SPECTROSCOPY MARKET

10.5 BUSINESS STRATEGY EXCELLENCE (12 PLAYERS)

FIGURE 38 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN IR SPECTROSCOPY MARKET

10.6 COMPANY PRODUCT FOOTPRINT

10.7 START-UP EVALUATION MATRIX

10.7.1 PROGRESSIVE COMPANY

10.7.2 RESPONSIVE COMPANY

10.7.3 DYNAMIC COMPANY

10.7.4 STARTING BLOCK

FIGURE 39 MARKET (GLOBAL) COMPETITIVE LEADERSHIP MAPPING: START-UP ECOSYSTEM, 2019

10.8 COMPETITIVE SITUATIONS AND TRENDS

FIGURE 40 BATTLE FOR MARKET SHARE: PRODUCT LAUNCHES EMERGED AS KEY STRATEGY ADOPTED BY MARKET PLAYERS BETWEEN 2017 AND 2020

10.8.1 PRODUCT LAUNCHES

TABLE 121 PRODUCT LAUNCHES, 20172020

10.8.2 PARTNERSHIPS

TABLE 122 PARTNERSHIPS, 20172020

10.8.3 ACQUISITIONS

TABLE 123 ACQUISITIONS, 20172020

11 COMPANY PROFILES (Page No. - 125)

11.1 INTRODUCTION

(Business Overview, Products, Key Insights, COVID-19 & Recent Developments, SWOT Analysis, MnM View)*

11.2 MAJOR PLAYERS

11.2.1 SHIMADZU CORPORATION

FIGURE 41 SHIMADZU CORPORATION: COMPANY SNAPSHOT

11.2.2 AGILENT TECHNOLOGIES

FIGURE 42 AGILENT TECHNOLOGIES: COMPANY SNAPSHOT

11.2.3 BRUKER CORPORATION

FIGURE 43 BRUKER CORPORATION: COMPANY SNAPSHOT

11.2.4 HORIBA LTD

FIGURE 44 HORIBA LTD: COMPANY SNAPSHOT

11.2.5 PERKINELMER, INC.

FIGURE 45 PERKINELMER, INC.: COMPANY SNAPSHOT

11.2.6 ZEISS

FIGURE 46 ZEISS: COMPANY SNAPSHOT

11.2.7 HITACHI HIGH-TECHNOLOGIES CORPORATION

FIGURE 47 HITACHI HIGH-TECHNOLOGIES CORPORATION: COMPANY SNAPSHOT

11.2.8 JASCO INC.

11.2.9 THERMO FISHER SCIENTIFIC

FIGURE 48 THERMO FISHER SCIENTIFIC: COMPANY SNAPSHOT

11.2.10 SARTORIUS AG

FIGURE 49 SARTORIUS AG: COMPANY SNAPSHOT

11.2.11 TELEDYNE PRINCETON INSTRUMENTS

11.2.12 FOSS

*Details on Business Overview, Products, Key Insights, COVID-19 & Recent Developments, SWOT Analysis, MnM View might not be captured in case of unlisted companies.

11.3 SME PLAYERS

11.3.1 LUMEX INSTRUMENTS

11.3.2 MICROPTIK BV

11.3.3 ISBEN PHOTONICS

11.3.4 BAYSPEC INC.

11.3.5 WASATCH PHOTONICS

11.3.6 BRISTOL INSTRUMENTS, INC

11.3.7 COLE-PARMER INDIA PVT. LTD.

11.3.8 SCIEX

12 ADJACENT AND RELATED MARKETS (Page No. - 163)

12.1 INTRODUCTION

12.2 LIMITATIONS

12.3 INFRARED IMAGING MARKET, BY APPLICATION

12.3.1 SECURITY AND SURVEILLANCE

TABLE 124 INFRARED IMAGING MARKET FOR SECURITY AND SURVEILLANCE, BY TECHNOLOGY, 20152023 (USD MILLION)

12.3.2 MONITORING AND INSPECTION

TABLE 125 INFRARED IMAGING MARKET FOR MONITORING AND INSPECTION, BY TECHNOLOGY, 20152023 (USD MILLION)

12.3.3 DETECTION

TABLE 126 INFRARED IMAGING MARKET FOR DETECTION, BY TECHNOLOGY, 20152023 (USD MILLION)

12.4 INFRARED IMAGING MARKET, BY REGION

12.4.1 NORTH AMERICA

TABLE 127 INFRARED IMAGING MARKET IN NORTH AMERICA, BY COUNTRY, 20152023 (USD MILLION)

12.4.2 EUROPE

TABLE 128 INFRARED IMAGING MARKET IN EUROPE, BY COUNTRY, 20152023 (USD MILLION)

12.4.3 ASIA PACIFIC

TABLE 129 INFRARED IMAGING MARKET IN ASIA PACIFIC, BY COUNTRY, 20152023 (USD MILLION)

12.4.4 ROW

TABLE 130 INFRARED IMAGING MARKET IN ROW, BY REGION, 20152023 (USD MILLION)

13 APPENDIX (Page No. - 167)

13.1 INSIGHTS FROM INDUSTRY EXPERTS

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

13.4 AVAILABLE CUSTOMIZATIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

The study involved four major activities in estimating the current size of the IR spectroscopy market. Exhaustive secondary research was done to collect information on the market and its peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation were employed to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information important for this study. These secondary sources include biometric technologies journals and magazines, IEEE journals; annual reports, press releases, and investor presentations of companies; white papers; certified publications and articles from recognized authors; and directories and databases such as Factiva, Hoovers, and OneSource.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information important for this report. The primary sources from the supply side included industry experts such as CEOs, VPs, marketing directors, technology and innovation directors, and related executives from key companies and organizations operating in the IR spectroscopy market. After complete market engineering (including calculations regarding market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information, as well as to verify and validate the critical numbers arrived at.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches were implemented, along with several data triangulation methods, to estimate and validate the size of the IR spectroscopy market and other dependent submarkets listed in this report.

- Key players in the industry and markets were identified through extensive secondary research.

- In terms of value, the industrys supply chain and market size were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Bottom Up approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the global market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at exact statistics for all segments and subsegments, market breakdown and data triangulation procedures have been employed wherever applicable. The data was triangulated by studying various factors and trends identified from both demand and supply sides in government, consumer electronics, healthcare, banking & finance, travel & immigration, automotive, and military & defense verticals, among others.

Report Objectives

The following are the primary objectives of the study.

- To define, describe, and forecast the IR spectroscopy market based on the technology, product type, end-user and geography

- To forecast the market size of various segments with respect to 4 main regions: North America, Europe, Asia Pacific, and Rest of the World

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To strategically profile the key players and comprehensively analyze their market ranking and core competencies, along with detailing the competitive landscape for market leaders

- To analyze the competitive developments such as agreements, contracts, partnerships, acquisitions, and product launches & developments carried out in the IR spectroscopy market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to a companys specific needs. The following customization options are available for the report:

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in IR Spectroscopy Market