IT Asset Disposition Market by Service Type, Asset Type (Computers/Laptops, Servers, Mobile Devices, Storage Devices, Peripherals), Organization Size (Small and Medium-sized Enterprises, Large Enterprises), End User and Region - Global forecast to 2027

Updated on : April 24, 2023

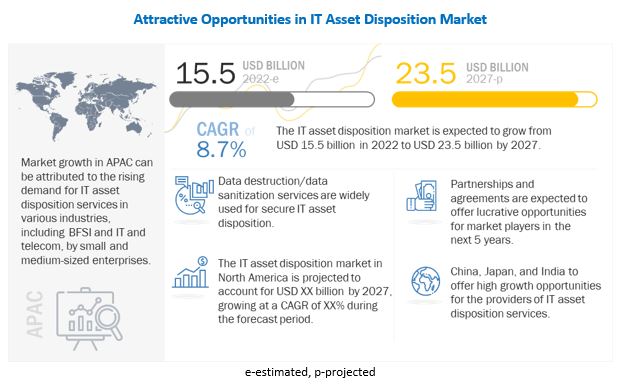

IT Asset Disposition market size is projected to reach USD 23.5 billion by 2027 at a CAGR of 8.7% during the forecast period. Factors such shift towards energy efficient products and consolidation of BYOD trend are fuelling the market growth for IT asset disposition industry.

To know about the assumptions considered for the study, Request for Free Sample Report

IT Asset Disposition Market Dynamics

Driver: Evolution of technologies and consolidation of BYOD trend

Organizations adopt new technologies to improve the efficiency and effectiveness of various work processes. Unfortunately, many technology-based products and services never reach their full potential and are replaced with the new version. Additionally, the consolidation of data centers, virtualization, and growing migration to the cloud create unwanted IT equipment that need to be disposed. Also, as remote work has become the norm, most businesses are embracing bring your own device (BYOD) in the workplace.

Restraint: Lack of comprehensive IT asset disposition policies

IT asset disposition market equipments, such as computers, tablet computers, mobile phones, and digital storage devices, are vital and valuable assets to any modern organization; thus, the disposal of such equipment, due to its need for replacement or upgrade, or merely because it has become obsolete, surplus, or redundant, is a complex process because it may contain data or information that must be protected. The equipment may also be reused or recycled; thus, it must be disposed off safely according to the law and in an environmentally sustainable way, which necessitates standard IT asset disposition policies. Organizations often lack the commitment to initiate the asset disposition process on priority due to budgetary problems.

Opportunity: Growing sales of old equipment on auction websites

Irrespective of an upswing or slowdown in global economies, the used equipment market is likely to remain resilient, provided that the growing inventory of assets that needs to be disposed off is visible to interested buyers worldwide. While the slowdown in China, India, and the Middle East has increased the supply of used assets in these markets, it is being matched by a growing demand from markets in Africa, South America, and other parts of the world. Thus, to sell old assets, various auction websites are created. These sites auction used assets through their auctioneering division. They have an extensive customer base of buyers from across the world in IT asset disposition market. They can set up an on-site auction or an online webcast depending on customer needs. Various online selling marketplaces include Facebook Marketplace, Amazon, eBay, Swappa, Gazelle, and NextWorth.

Challenge: Lack of budget for IT asset disposition

Most organizations do not assign any special budget for the disposition of IT assets, as the process or services might be too expensive or unmanageable for them. Another major reason for not providing special budget is the limited funds of the organization, especially small and medium-sized enterprises. Organizations focus on providing funds by prioritizing necessary equipment and services, as the value recovery from the old assets is quite low although not providing necessary funds or choosing low-cost provider and not disposing off assets in a correct way could end up costing significantly more. Also, this would harm the environmental and worker health and create safety threats.

Data Destruction/ Data Sanitization to capture highest market share during forecast period

The data destruction/data sanitization service segment is expected to continue to account for the largest size of the IT asset disposition market during the forecast period. The growing need for the proper disposal of IT assets and the risk of important information stored in old assets getting leaked are fueling the demand for data destruction/data sanitization services. The security of data and information is crucial for any company. Hence, before the physical destruction of the asset or before it is sent to another phase of asset disposition, all the data or information from the asset has to be destroyed completely to minimize the risk of data breach, financial risks, and threat to brand image.

Computers/laptops segment accounted for the largest share of the IT asset disposition market by asset during the forecast period

In the IT asset disposition market, the disposition of computers/laptops needs special care, and a number of safety measures have to be followed due to the presence of various recoverable materials such as aluminum, copper, gold, silver, plastics, and ferrous metals. Services such as recycling, recovery, and remarketing are generally used in the disposition of computers/laptops. For example, if a PC has no market value left, the outsourcer recycles it and sells the steel to a mill, where it is shredded for reuse.

Media and Entertainment segment by end user to hold the highest CAGR during the forecast period

The media and entertainment industry requires continuous and regular refresh and update cycle of IT asset disposition market to keep up with the demands of computer-assisted graphical and audio production programs and software. With increasing emphasis on building a culture of submissive environmental strategies, these conditions create a high demand for competent e-waste disposal and data sanitation. Moreover, advancements in technology have generated high demand in media and entertainment services. Thus, it requires a wide range of IT asset disposition services. The industry delivers television and radio programs, online games, and online advertisements. Thus, every segment heavily depends on technology. Therefore, with the ongoing technological developments, the industry has to constantly evolve.

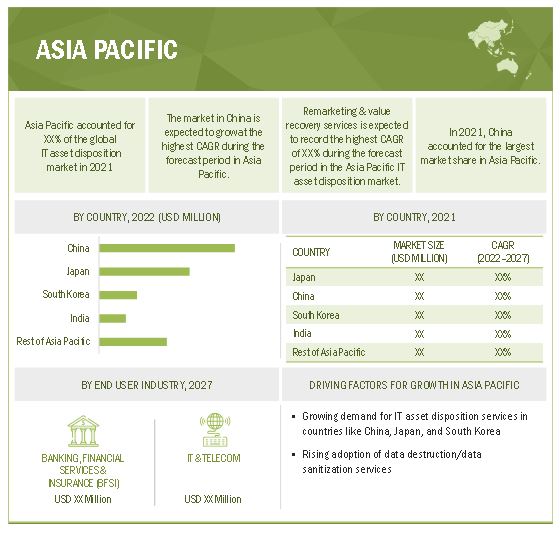

Asia Pacific region to witness the highest growth during the forecast period

The IT asset disposition market in Asia Pacific is expected to grow at the highest rate during the forecast period because of the formulation of regulatory policies for the proper disposal of IT assets and to safeguard the environment from the hazardous components of retired IT assets by restricting them from being disposed off in landfills. Currently, there are few IT asset disposition vendors operating in Asia Pacific. However, increasing awareness about environmental safety and regulatory norms for asset disposition drive the growth of the IT asset disposition market in Asia Pacific.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The IT asset disposition companies is dominated by a few globally established players such as Dell Technologies (US), Hewlett Packard Enterprise (US), IBM (US), Sims Limited (Australia), Iron Mountain (US), 3Step IT(Finland), TES (Singapore), and Apto Solutions (US).

IT Asset Disposition Market Report Scope

|

Report Metric |

Details |

| Estimated Market Size | USD 15.5 Billion |

| Projected Market Size | USD 23.5 Billion |

| Growth Rate | 8.7% |

|

Market size available for years |

2022–2027 |

|

On Demand Data Available |

2030 |

|

Segments covered |

|

|

Geographies covered |

|

|

Companies covered |

|

| Key Market Driver | Evolution of Technologies and Consolidation of BYOD Trend |

| Largest Growing Region | Asia Pacific (APAC) |

| Largest Market Share Segment | Computers/laptops Segment |

| Highest CAGR Segment | Media and Entertainment Segment |

The study categorizes the IT Asset disposition market based on Service, Asset Type, Organisation Size, End User and Region

By Service:

- De-Manufacturing and Recycling

- Remarketing and Value Recovery

- Data Destruction/Data Sanitation

- Logistics Management and Reverse Logistics

- Other Services (On-site Audit solutions and Clients’ Online Portals)

By Asset type:

- Computers/Laptops

- Servers

- Mobile Devices

- Storage Devices

- Peripherals

By Organisation size:

- Small and Medium-sized Enterprises

- Large Enterprises

End-User:

- Banking, Financial Services and Insurance (BFSI)

- IT and Telecom

- Education

- Healthcare

- Aerospace and Defense

- Public Sector and Government Ofiices

- Manufacturing

- Media and Entertainment

- Others (Energy and Utility, Construction and Real Estate, Logistics and Transportation)

By Region:

- North America

- Europe

- Asia Pacific

- RoW

Recent Developments

- In February 2022, IBM, Worley, ABB three companies signed a memorandum of understanding for energy companies to build and operate green hydrogen facilities. Worley will provide engineering and construction expertise; ABB will offer electrical infrastructure and IBM will offer system integration services.

- In November 2020, Sims Lifecycle Services partnered with Dutch Data Center Association to be a high-quality supplier of data center services. This partnership strengthened the economic growth and presence of the data center sector within the European region.

- In October 2020, Sims Lifecycle Services partnered with local schools and educational institutions in Poland to offer used IT equipment. In these unprecedented times, many schools have adopted distance learning programs where every student must learn using a computer or laptop, causing disruptions to the availability of computing devices. Device, a trademark of Sims Lifecycle Services in Poland, is helping bridge the gap by providing alternative sources to students to obtain IT equipment.

Frequently Asked Questions (FAQ):

What is the current size of the global IT asset disposition market?

The IT asset disposition market is projected to grow from USD 15.5 billion in 2022 to USD 23.5 billion by 2027; it is expected to grow at a CAGR of 8.7% from 2022 to 2027.

What is IT asset disposition?

IT asset disposition (ITAD) is the process of disposing of unwanted electronic equipment in a responsible manner. Various proper IT asset disposition programs enable organizations to mitigate risks associated with the data stored in assets, minimize cost, and maximize value recovery from old assets. Many third-party IT asset disposition service vendors help organizations manage the retirement, remarketing, and recycling of assets to avoid legal risks, environmental concerns, and unnecessary costs.

What are the restraints in the IT asset disposition market?

Low awareness and high service costs, lack of comprehensive IT asset disposition policies and negligible recovery value from e-waste are some of the restraints face by the IT asset disposition market.

What are the technological trends going in the IT asset disposition market?

The rising penetration of the Internet of Things (IoT) has led to an increase in demand for electronics such as smartphones, wearables, and smart entertainment devices in both consumer and business sectors. This also has a positive impact on the IT asset disposition market as there is a surging requirement from customers to dispose off their old electronic products, such as smartphones, medical equipment, and wearables. Companies such as Baidu and the United Nations Development Program are working to streamline the recycling of e-waste in China with a new AI-based app that helps users sell their old electronics. Also, AI robots are developed for e-waste management; these robots can sort tons of garbage daily.

Which are the major companies in the IT asset disposition market?

Dell Technologies (US), Hewlett Packard Enterprise (US), IBM (US), Sims Limited (Australia), Iron Mountain (US), 3Step IT(Finland), TES (Singapore), and Apto Solutions (US). are the players dominating the IT asset disposition market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 26)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 IT ASSET DISPOSITION MARKET SEGMENTATION

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 31)

2.1 RESEARCH DATA

FIGURE 2 PROCESS FLOW: IT ASSET DISPOSITION INDUSTRY SIZE ESTIMATION

FIGURE 3 RESEARCH DESIGN

2.1.1 SECONDARY AND PRIMARY RESEARCH

2.1.2 SECONDARY DATA

2.1.2.1 Secondary sources

2.1.2.2 Key secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Key data from primary sources

2.1.3.2 Key industry insights

2.1.3.3 Primary interviews with experts

2.1.3.4 List of key primary respondents

2.1.3.5 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for arriving at market size by bottom-up analysis

FIGURE 4 IT ASSET DISPOSITION MARKET: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for capturing market size by top-down analysis

FIGURE 5 IT ASSET DISPOSITION SHARE : TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION

2.4 ASSUMPTIONS FOR RESEARCH STUDY

3 EXECUTIVE SUMMARY (Page No. - 41)

FIGURE 7 LARGE ENTERPRISES, BY ORGANIZATION SIZE, TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

FIGURE 8 REMARKETING & VALUE RECOVERY SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 9 SERVERS TO HOLD LARGEST SHARE OF MARKET DURING FORECAST PERIOD

FIGURE 10 BFSI SEGMENT TO ACCOUNT FOR LARGEST SHARE OF IT ASSET DISPOSITION MARKET DURING FORECAST PERIOD

FIGURE 11 NORTH AMERICA ACCOUNTED FOR LARGEST MARKET SHARE IN 2021

4 PREMIUM INSIGHTS (Page No. - 45)

4.1 BRIEF OVERVIEW OF IT ASSET DISPOSITION MARKET

FIGURE 12 INCREASING ADOPTION OF IT ASSET DISPOSITION IN ASIA PACIFIC TO DRIVE MARKET

4.2 MARKET, BY ORGANIZATION SIZE

FIGURE 13 SMALL AND MEDIUM-SIZED ENTERPRISES TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

4.3 MARKET, BY ASSET TYPE

FIGURE 14 COMPUTERS/LAPTOPS DOMINATED IT ASSET DISPOSITION MARKET SIZE IN 2021

4.4 NORTH AMERICA: MARKET, BY COUNTRY AND END-USER

FIGURE 15 NORTH AMERICA: US AND BFSI TO HOLD LARGEST SHARES OF IT ASSET DISPOSITION SHARE IN 2027

4.5 MARKET, BY SERVICE

FIGURE 16 REMARKETING AND VALUE RECOVERY SEGMENT TO REGISTER HIGHEST CAGR FROM 2022 TO 2027

4.6 MARKET, BY COUNTRY (2021)

FIGURE 17 US TO HOLD LARGEST SHARE OF IT ASSET DISPOSITION SHARE IN 2021

5 MARKET OVERVIEW (Page No. - 48)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 18 NEED TO ENSURE REGULATORY COMPLIANCE DRIVES MARKET FOR IT ASSET DISPOSITION

5.2.1 DRIVERS

FIGURE 19 IMPACT ANALYSIS: DRIVERS

5.2.1.1 Need to comply with regulatory compliances meant for environment safety

5.2.1.2 Requirement for data and information security in old assets

5.2.1.3 Evolution of technologies and consolidation of BYOD trend

5.2.1.4 Shift toward energy-efficient products

5.2.2 RESTRAINTS

FIGURE 20 IMPACT ANALYSIS: RESTRAINTS

5.2.2.1 Low awareness and high service costs

5.2.2.2 Lack of comprehensive IT asset disposition policies

5.2.2.3 Negligible value recovery from e-waste

TABLE 1 E-WASTE GENERATED IN 2020, BY COUNTRY (KILO TONNES [KT])

5.2.3 OPPORTUNITIES

FIGURE 21 IMPACT ANALYSIS: OPPORTUNITIES

5.2.3.1 Strategic partnerships and acquisitions

5.2.3.2 Rise in demand for IT asset disposition from small and medium-sized enterprises

5.2.3.3 Growing sales of old equipment on auction websites

5.2.4 CHALLENGES

FIGURE 22 IMPACT ANALYSIS: CHALLENGES

5.2.4.1 Presence of unauthorized service providers and unsustainable practices

5.2.4.2 Lack of budget for IT asset disposition

5.3 VALUE CHAIN ANALYSIS

FIGURE 23 VALUE CHAIN ANALYSIS: IT ASSET DISPOSITION MARKET

5.4 ECOSYSTEM

FIGURE 24 IT ASSET DISPOSITION SIZE: ECOSYSTEM

TABLE 2 MARKET: ECOSYSTEM

FIGURE 25 REVENUE SHIFT IN MARKET

5.5 TECHNOLOGY ANALYSIS

5.5.1 GROWING USE OF INTERNET OF THINGS (IOT) POSITIVELY IMPACTING IT ASSET DISPOSITION MARKET

5.5.2 INTEGRATION OF ARTIFICIAL INTELLIGENCE WITH IT ASSET DISPOSITION SOLUTIONS

5.6 PORTER’S FIVE FORCES ANALYSIS

TABLE 3 MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 4 IMPACT OF EACH FORCE ON MARKET

5.7 KEY STAKEHOLDER AND BUYING PROCESS AND/OR BUYING CRITERIA

5.7.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 26 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 SERVICES

TABLE 5 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 SERVICES (%)

5.7.2 BUYING CRITERIA

FIGURE 27 KEY BUYING CRITERIA FOR TOP 3 SERVICES

TABLE 6 KEY BUYING CRITERIA FOR TOP 3 SERVICES

5.8 CASE STUDY ANALYSIS

5.8.1 TOP HEALTH-TECH COMPANY FAST TRACKED DATA CENTER DECOMMISSIONING WITH IRON MOUNTAIN’S SERVICES

5.8.2 EXCESS LOGIC HELPED MEDIA TECHNOLOGY COMPANY WITH ASSET DISPOSITION

5.8.3 TES HELPED CLIENT ACHIEVE USD 8.4 BILLION NET FINANCIAL RETURN FOR RETIRED IT EQUIPMENT

5.8.4 INGRAM MICRO HELPED HEALTHCARE ORGANIZATION IN CORPORATE ASSET REFRESH

5.9 TRADE ANALYSIS

5.9.1 TRADE ANALYSIS FOR IT ASSET DISPOSITION MARKET

TABLE 7 AUTOMATIC & PORTABLE DATA-PROCESSING MACHINES: GLOBAL IMPORTS DATA, 2017–2021 (USD THOUSAND)

TABLE 8 AUTOMATIC & PORTABLE DATA-PROCESSING MACHINES, GLOBAL EXPORTS DATA, 2017–2021 (USD MILLION)

5.10 PATENT ANALYSIS

FIGURE 28 NUMBER OF PATENTS GRANTED FOR E-WASTE RECYCLING WORLDWIDE, 2012–2022

FIGURE 29 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS FOR E-WASTE RECYCLING WORLDWIDE, 2012–2022

TABLE 9 TOP 10 PATENT OWNERS FOR E-WASTE RECYCLING IN LAST 10 YEARS

5.11 KEY CONFERENCES AND EVENTS, 2022–2023

TABLE 10 IT ASSET DISPOSITION MARKET: DETAILED LIST OF CONFERENCES & EVENTS (2022–2023)

5.12 TARIFF AND REGULATORY LANDSCAPE

5.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 11 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.13 MARKET REGULATIONS AND STANDARDS

5.13.1 STANDARDS

5.13.2 REGULATIONS

5.13.2.1 Restriction of Hazardous Substances (ROHS) and Waste Electrical and Electronic Equipment (WEEE)

5.13.2.2 General Data Protection Regulation (GDPR)

5.13.2.3 Import–export laws

5.13.3 STANDARDS IN ITS/C-ITS

TABLE 12 SECURITY AND PRIVACY STANDARDS DEVELOPED BY EUROPEAN TELECOMMUNICATION STANDARDS INSTITUTE (ETSI)

6 IT ASSET DISPOSITION MARKET, BY SERVICE (Page No. - 77)

6.1 INTRODUCTION

FIGURE 30 DATA DESTRUCTION/DATA SANITIZATION SEGMENT TO ACCOUNT FOR LARGEST SIZE OF OVERALL IT ASSET DISPOSITION MARKET DURING FORECAST PERIOD

TABLE 13 ITAD MARKET, BY SERVICE, 2018–2021 (USD MILLION)

TABLE 14 ITAD MARKET, BY SERVICE, 2022–2027 (USD MILLION)

6.2 DE-MANUFACTURING & RECYCLING

6.2.1 IMPROPER DISPOSAL OF SCRAP ASSETS AFFECTS ENVIRONMENT AND POSES DATA SECURITY RISK TO COMPANIES

TABLE 15 DE-MANUFACTURING & RECYCLING: ITAD MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 16 DE-MANUFACTURING & RECYCLING: ITAD MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 17 DE-MANUFACTURING & RECYCLING: ITAD MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 18 DE-MANUFACTURING & RECYCLING: ITAD MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3 REMARKETING AND VALUE RECOVERY

6.3.1 RESELLING END-OF-LIFE IT ASSETS ENABLES RECOVERY OF OPERATING CAPITAL AND REDUCING ELECTRONIC WASTE

FIGURE 31 DECISION TREE OF REMARKETING SERVICES

TABLE 19 REMARKETING & VALUE RECOVERY: ITAD MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 20 REMARKETING & VALUE RECOVERY: ITAD MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 21 REMARKETING & VALUE RECOVERY: ITAD MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 22 REMARKETING & VALUE RECOVERY: ITAD MARKET, BY REGION, 2022–2027 (USD MILLION)

6.4 DATA DESTRUCTION/DATA SANITIZATION

6.4.1 ON-SITE DATA DESTRUCTION

6.4.1.1 Ensures highest level of security

6.4.2 OFF-SITE DATA DESTRUCTION

6.4.2.1 Better option for organizations that need ongoing, verified destruction of sensitive documents

TABLE 23 DATA DESTRUCTION/DATA SANITIZATION: ITAD MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 24 DATA DESTRUCTION/DATA SANITIZATION: ITAD MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 25 DATA DESTRUCTION/DATA SANITIZATION: ITAD MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 26 DATA DESTRUCTION/DATA SANITIZATION: ITAD MARKET, BY REGION, 2022–2027 (USD MILLION)

6.5 LOGISTICS MANAGEMENT AND REVERSE LOGISTICS

6.5.1 INCLUDES VALUE RECOVERY, REPAIRS, REDISTRIBUTION, AND END-OF-LIFE RECYCLING

FIGURE 32 PROCESS OF LOGISTICS MANAGEMENT AND REVERSE LOGISTICS

TABLE 27 LOGISTICS MANAGEMENT & REVERSE LOGISTICS: ITAD MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 28 LOGISTICS MANAGEMENT & REVERSE LOGISTICS: ITAD MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 29 LOGISTICS MANAGEMENT & REVERSE LOGISTICS: ITAD MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 30 LOGISTICS MANAGEMENT & REVERSE LOGISTICS: ITAD MARKET, BY REGION, 2022–2027 (USD MILLION)

6.6 OTHER SERVICES

6.6.1 ON-SITE EQUIPMENT AUDIT SOLUTION

6.6.1.1 Records specifications of each data-bearing asset

6.6.2 CLIENTS’ ONLINE PORTALS

6.6.2.1 Allows monitoring of asset detail, location, status, and final disposition

TABLE 31 OTHER SERVICES: ITAD MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 32 OTHER SERVICES: ITAD MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 33 OTHER SERVICES: ITAD MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 34 OTHER SERVICES: ITAD MARKET, BY REGION, 2022–2027 (USD MILLION)

7 IT ASSET DISPOSITION MARKET, BY ASSET TYPE (Page No. - 90)

7.1 INTRODUCTION

FIGURE 33 SERVERS TO ACCOUNT FOR LARGEST SIZE OF IT ASSET DISPOSITION MARKET IN 2027

TABLE 35 ITAD MARKET, BY ASSET TYPE, 2018–2021 (USD MILLION)

TABLE 36 ITAD MARKET, BY ASSET TYPE, 2022–2027 (USD MILLION)

7.2 COMPUTERS/LAPTOPS

7.2.1 MAINLY REQUIRE RECYCLING, RECOVERY, AND REMARKETING SERVICES

TABLE 37 COMPUTERS/LAPTOPS: ITAD MARKET, BY REGION, 2018–2021(USD MILLION)

TABLE 38 COMPUTERS/LAPTOPS: ITAD MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3 SERVERS

7.3.1 SURGE IN DATA BREACHES FORCES DATA CENTER PROVIDERS TO OPT FOR DECOMMISSIONING

TABLE 39 SERVERS: ITAD MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 40 SERVERS: ITAD MARKET, BY REGION, 2022–2027 (USD MILLION)

7.4 MOBILE DEVICES

7.4.1 REQUIRE DATA DESTRUCTION/SANITIZATION SERVICES

TABLE 41 MOBILE DEVICES: ITAD MARKET, BY REGION, 2018–2021(USD MILLION)

TABLE 42 MOBILE DEVICES: ITAD MARKET, BY REGION, 2022–2027 (USD MILLION)

7.5 STORAGE DEVICES

7.5.1 REQUIRE DATA SANITIZATION TO PREVENT DATA LEAKAGE

TABLE 43 STORAGE DEVICES: ITAD MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 44 STORAGE DEVICES: ITAD MARKET, BY REGION, 2022–2027 (USD MILLION)

7.6 PERIPHERALS

7.6.1 NETWORKING DEVICES

7.6.1.1 Need various erasure methods to prevent misuse of data

7.6.2 I/O DEVICES

7.6.2.1 Require recycling

TABLE 45 PERIPHERALS: ITAD MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 46 PERIPHERALS: ITAD MARKET, BY REGION, 2022–2027 (USD MILLION)

8 IT ASSET DISPOSITION MARKET, BY ORGANIZATION SIZE (Page No. - 98)

8.1 INTRODUCTION

FIGURE 34 LARGE ENTERPRISES TO ACCOUNT FOR LARGER SIZE OF OVERALL IT ASSET DISPOSITION MARKET DURING FORECAST PERIOD

TABLE 47 ITAD MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 48 ITAD MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

8.2 SMALL AND MEDIUM-SIZED ENTERPRISES

8.2.1 OFTEN DISPOSE ASSETS IMPROPERLY TO REDUCE IT SPENDING

TABLE 49 SMALL & MEDIUM-SIZED ENTERPRISES: ITAD MARKET, BY SERVICE, 2018–2021 (USD MILLION)

TABLE 50 SMALL & MEDIUM-SIZED ENTERPRISES: ITAD MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 51 SMALL & MEDIUM-SIZED ENTERPRISES: ITAD MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 52 SMALL & MEDIUM-SIZED ENTERPRISES: ITAD MARKET, BY REGION, 2022–2027 (USD MILLION)

8.3 LARGE ENTERPRISES

8.3.1 ADOPT IT ASSET DISPOSITION SERVICES TO REDUCE IMPACT OF E-WASTE ON ENVIRONMENT

TABLE 53 LARGE ENTERPRISES: ITAD MARKET, BY SERVICE, 2018–2021 (USD MILLION)

TABLE 54 LARGE ENTERPRISES: ITAD MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 55 LARGE ENTERPRISES: ITAD MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 56 LARGE ENTERPRISES: ITAD MARKET, BY REGION, 2022–2027 (USD MILLION)

9 IT ASSET DISPOSITION MARKET, BY END-USER (Page No. - 104)

9.1 INTRODUCTION

FIGURE 35 BFSI SEGMENT TO HOLD LARGEST SHARE OF IT ASSET DISPOSITION MARKET DURING FORECAST PERIOD

TABLE 57 IT ASSET DISPOSITION INDUSTRY, BY END-USER, 2018–2021 (USD MILLION)

TABLE 58 IT ASSET DISPOSITION MARKET, BY END-USER, 2022–2027 (USD MILLION)

9.2 BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI)

9.2.1 DATA DESTRUCTION INTEGRAL PART OF BFSI SECURITY

TABLE 59 BANKING, FINANCIAL SERVICES, & INSURANCE (BFSI): ITAD MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 60 BANKING, FINANCIAL SERVICES, & INSURANCE (BFSI): ITAD MARKET, BY REGION, 2022–2027 (USD MILLION)

9.3 IT AND TELECOM

9.3.1 USES DATA DESTRUCTION/DATA SANITATION, REMANUFACTURING, AND RECYCLING SERVICES

TABLE 61 IT & TELECOM: ITAD MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 62 IT & TELECOM: ITAD MARKET, BY REGION, 2022–2027 (USD MILLION)

9.4 EDUCATION

9.4.1 REFURBISHED OR USED DEVICES HOLD MAXIMUM POTENTIAL FOR REMARKETING AND VALUE RECOVERY SERVICES

TABLE 63 EDUCATION: ITAD MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 64 EDUCATION: ITAD MARKET, BY REGION, 2022–2027 (USD MILLION)

9.5 HEALTHCARE

9.5.1 DATA SECURITY CONCERNS PROMPT ADOPTION OF IT DISPOSITION SERVICES

TABLE 65 HEALTHCARE: ITAD MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 66 HEALTHCARE: ITAD MARKET, BY REGION, 2022–2027 (USD MILLION)

9.6 AEROSPACE AND DEFENSE

9.6.1 EMPLOY DECOMMISSIONING, RECYCLING, AND RECOVERY SERVICES

TABLE 67 AEROSPACE & DEFENSE: ITAD MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 68 AEROSPACE & DEFENSE: ITAD MARKET, BY REGION, 2022–2027 (USD MILLION)

9.7 PUBLIC SECTOR AND GOVERNMENT OFFICES

9.7.1 ADOPT IT ASSET DISPOSITION AND DESTRUCTION TO SAFEGUARD CLIENT DATA

TABLE 69 PUBLIC SECTOR & GOVERNMENT OFFICES: ITAD MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 70 PUBLIC SECTOR & GOVERNMENT OFFICES: ITAD MARKET, BY REGION, 2022–2027 (USD MILLION)

9.8 MANUFACTURING

9.8.1 USE LOGISTICS MANAGEMENT AND REVERSE LOGISTICS DUE TO LARGE VOLUME OF EQUIPMENT

TABLE 71 MANUFACTURING: ITAD MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 72 MANUFACTURING: ITAD MARKET, BY REGION, 2022–2027 (USD MILLION)

9.9 MEDIA AND ENTERTAINMENT

9.9.1 WIDELY EMPLOY DATA DESTRUCTION SERVICES

TABLE 73 MEDIA & ENTERTAINMENT: ITAD MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 74 MEDIA & ENTERTAINMENT: ITAD MARKET, BY REGION, 2022–2027 (USD MILLION)

9.10 OTHER END-USERS

9.10.1 ENERGY AND UTILITIES

9.10.1.1 Can extract maximum value from old and retired assets to invest in new equipment

9.10.2 CONSTRUCTION AND REAL ESTATE

9.10.2.1 Use IT asset disposition services to recover retired assets

9.10.3 LOGISTICS AND TRANSPORTATION

9.10.3.1 Adopt IT asset disposition services to ensure data security

TABLE 75 OTHERS: ITAD MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 76 OTHERS: ITAD MARKET, BY REGION, 2022–2027 (USD MILLION)

10 IT ASSET DISPOSITION MARKET, BY REGION (Page No. - 117)

10.1 INTRODUCTION

FIGURE 36 GEOGRAPHIC SNAPSHOT OF IT ASSET DISPOSITION SIZE

FIGURE 37 ITAD MARKET IN ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 77 ITAD MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 78 ITAD MARKET, BY REGION, 2022–2027 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 38 NORTH AMERICA: IT ASSET DISPOSITION MARKET SNAPSHOT

TABLE 79 NORTH AMERICA: ITAD MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 80 NORTH AMERICA: ITAD MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 81 NORTH AMERICA: ITAD MARKET, BY SERVICE, 2018–2021 (USD MILLION)

TABLE 82 NORTH AMERICA: ITAD MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 83 NORTH AMERICA: ITAD MARKET, BY ASSET TYPE, 2018–2021 (USD MILLION)

TABLE 84 NORTH AMERICA: ITAD MARKET, BY ASSET TYPE, 2022–2027 (USD MILLION)

TABLE 85 NORTH AMERICA: ITAD MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 86 NORTH AMERICA: ITAD MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 87 NORTH AMERICA: ITAD MARKET, BY END-USER, 2018–2021 (USD MILLION)

TABLE 88 NORTH AMERICA: ITAD MARKET, BY END-USER, 2022–2027 (USD MILLION)

10.2.1 US

10.2.1.1 Presence of reputed IT asset disposition vendors to augment market growth

TABLE 89 US: ITAD MARKET, BY SERVICE, 2018–2021 (USD MILLION)

TABLE 90 US: ITAD MARKET, BY SERVICE, 2022–2027 (USD MILLION)

10.2.2 CANADA

10.2.2.1 SMEs to fuel demand for IT asset disposition services

TABLE 91 CANADA: ITAD MARKET, BY SERVICE, 2018–2021 (USD MILLION)

TABLE 92 CANADA: ITAD MARKET, BY SERVICE, 2022–2027 (USD MILLION)

10.2.3 MEXICO

10.2.3.1 Adoption of IT assets to generate demand for asset disposition services

TABLE 93 MEXICO: ITAD MARKET, BY SERVICE, 2018–2021 (USD MILLION)

TABLE 94 MEXICO: ITAD MARKET, BY SERVICE, 2022–2027 (USD MILLION)

10.3 EUROPE

FIGURE 39 EUROPE: IT ASSET DISPOSITION MARKET SNAPSHOT

TABLE 95 EUROPE: ITAD MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 96 EUROPE: ITAD MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 97 NORDIC COUNTRIES: ITAD MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 98 NORDIC COUNTRIES: ITAD MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 99 EUROPE: ITAD MARKET, BY SERVICE, 2018–2021 (USD MILLION)

TABLE 100 EUROPE: ITAD MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 101 EUROPE: ITAD MARKET, BY ASSET TYPE, 2018–2021 (USD MILLION)

TABLE 102 EUROPE: ITAD MARKET, BY ASSET TYPE, 2022–2027 (USD MILLION)

TABLE 103 EUROPE: ITAD MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 104 EUROPE: ITAD MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 105 EUROPE: ITAD MARKET, BY END-USER, 2018–2021 (USD MILLION)

TABLE 106 EUROPE: ITAD MARKET, BY END-USER, 2022–2027 (USD MILLION)

10.3.1 UK

10.3.1.1 High demand for hard drive disposition and data destruction services

TABLE 107 UK: ITAD MARKET, BY SERVICE, 2018–2021 (USD MILLION)

TABLE 108 UK: ITAD MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 109 UK: ITAD MARKET, BY ASSET TYPE, 2018–2021 (USD MILLION)

TABLE 110 UK: ITAD MARKET, BY ASSET TYPE, 2022–2027 (USD MILLION)

10.3.2 GERMANY

10.3.2.1 Heightened need for accessibility, safety, proper disposal, and security of IT assets

TABLE 111 GERMANY: ITAD MARKET, BY SERVICE, 2018–2021 (USD MILLION)

TABLE 112 GERMANY: ITAD MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 113 GERMANY: ITAD MARKET, BY ASSET TYPE, 2018–2021 (USD MILLION)

TABLE 114 GERMANY: ITAD MARKET, BY ASSET TYPE, 2022–2027 (USD MILLION)

10.3.3 FRANCE

10.3.3.1 Increasing awareness of social responsibility and environmental regulations driving market

TABLE 115 FRANCE: ITAD MARKET, BY SERVICE, 2018–2021 (USD MILLION)

TABLE 116 FRANCE: ITAD MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 117 FRANCE: ITAD MARKET, BY ASSET TYPE, 2018–2021 (USD MILLION)

TABLE 118 FRANCE: ITAD MARKET, BY ASSET TYPE, 2022–2027 (USD MILLION)

10.3.4 ITALY

10.3.4.1 Houses various major global ITAD service providers

TABLE 119 ITALY: ITAD MARKET, BY SERVICE, 2018–2021 (USD MILLION)

TABLE 120 ITALY: ITAD MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 121 ITALY: ITAD MARKET, BY ASSET TYPE, 2018–2021 (USD MILLION)

TABLE 122 ITALY: ITAD MARKET, BY ASSET TYPE, 2022–2027 (USD MILLION)

10.3.5 NETHERLANDS

10.3.5.1 Partnerships between regional and local players and major global players to drive market

TABLE 123 NETHERLANDS: ITAD MARKET, BY SERVICE, 2018–2021 (USD MILLION)

TABLE 124 NETHERLANDS: ITAD MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 125 NETHERLANDS: ITAD MARKET, BY ASSET TYPE, 2018–2021 (USD MILLION)

TABLE 126 NETHERLANDS: ITAD MARKET, BY ASSET TYPE, 2022–2027 (USD MILLION)

10.3.6 BELGIUM

10.3.6.1 Increased emphasis on maximizing reuse of old IT equipment fueling demand for ITAD services

TABLE 127 BELGIUM: ITAD MARKET, BY SERVICE, 2018–2021 (USD MILLION)

TABLE 128 BELGIUM: ITAD MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 129 BELGIUM: ITAD MARKET, BY ASSET TYPE, 2018–2021 (USD MILLION)

TABLE 130 BELGIUM: ITAD MARKET, BY ASSET TYPE, 2022–2027 (USD MILLION)

10.3.7 NORDIC COUNTRIES

10.3.7.1 IT regulations and national policies underpin market growth in Nordic countries

TABLE 131 NORDIC COUNTRIES: ITAD MARKET, BY SERVICE, 2018–2021 (USD MILLION)

TABLE 132 NORDIC COUNTRIES: ITAD MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 133 NORDIC COUNTRIES: ITAD MARKET, BY ASSET TYPE, 2018–2021 (USD MILLION)

TABLE 134 NORDIC COUNTRIES: ITAD MARKET, BY ASSET TYPE, 2022–2027 (USD MILLION)

10.3.8 REST OF EUROPE

TABLE 135 REST OF EUROPE: ITAD MARKET, BY SERVICE, 2018–2021 (USD MILLION)

TABLE 136 REST OF EUROPE: ITAD MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 137 REST OF EUROPE: ITAD MARKET, BY ASSET TYPE, 2018–2021 (USD MILLION)

TABLE 138 REST OF EUROPE: ITAD MARKET, BY ASSET TYPE, 2022–2027 (USD MILLION)

10.4 ASIA PACIFIC

FIGURE 40 ASIA PACIFIC: IT ASSET DISPOSITION MARKET SNAPSHOT

TABLE 139 ASIA PACIFIC: ITAD MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 140 ASIA PACIFIC: ITAD MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 141 ASIA PACIFIC: ITAD MARKET, BY SERVICE, 2018–2021 (USD MILLION)

TABLE 142 ASIA PACIFIC: ITAD MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 143 ASIA PACIFIC: ITAD MARKET, BY ASSET TYPE, 2018–2021 (USD MILLION)

TABLE 144 ASIA PACIFIC: ITAD MARKET, BY ASSET TYPE, 2022–2027 (USD MILLION)

TABLE 145 ASIA PACIFIC: ITAD MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 146 ASIA PACIFIC: ITAD MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 147 ASIA PACIFIC: ITAD MARKET, BY END-USER, 2018–2021 (USD MILLION)

TABLE 148 ASIA PACIFIC: ITAD MARKET, BY END-USER, 2022–2027 (USD MILLION)

10.4.1 JAPAN

10.4.1.1 Expansions and investments activities by ITAD businesses to propel market growth

TABLE 149 JAPAN: ITAD MARKET, BY SERVICE, 2018–2021 (USD MILLION)

TABLE 150 JAPAN: ITAD MARKET, BY SERVICE, 2022–2027 (USD MILLION)

10.4.2 CHINA

10.4.2.1 Data erasure, degaussing, and shredding among most commonly used services

TABLE 151 CHINA: ITAD MARKET, BY SERVICE, 2018–2021 (USD MILLION)

TABLE 152 CHINA: ITAD MARKET, BY SERVICE, 2022–2027 (USD MILLION)

10.4.3 SOUTH KOREA

10.4.3.1 Surplus amount of electronics and e-waste generated by multinational companies necessitates need for ITAD

TABLE 153 SOUTH KOREA: ITAD MARKET, BY SERVICE, 2018–2021 (USD MILLION)

TABLE 154 SOUTH KOREA: ITAD MARKET, BY SERVICE, 2022–2027 (USD MILLION)

10.4.4 INDIA

10.4.4.1 Presence of various small and medium-sized ITAD service providers boosts ITAD market

TABLE 155 INDIA: ITAD MARKET, BY SERVICE, 2018–2021 (USD MILLION)

TABLE 156 INDIA: ITAD MARKET, BY SERVICE, 2022–2027 (USD MILLION)

10.4.5 REST OF ASIA PACIFIC

TABLE 157 REST OF ASIA PACIFIC: ITAD MARKET, BY SERVICE, 2018–2021 (USD MILLION)

TABLE 158 REST OF ASIA PACIFIC: ITAD MARKET, BY SERVICE, 2022–2027 (USD MILLION)

10.5 REST OF THE WORLD (ROW)

TABLE 159 ROW: ITAD MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 160 ROW: ITAD MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 161 ROW: ITAD MARKET, BY SERVICE, 2018–2021 (USD MILLION)

TABLE 162 ROW: ITAD MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 163 ROW: ITAD MARKET, BY ASSET TYPE, 2018–2021 (USD MILLION)

TABLE 164 ROW: ITAD MARKET, BY ASSET TYPE, 2022–2027 (USD MILLION)

TABLE 165 ROW: ITAD MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 166 ROW: ITAD MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 167 ROW: ITAD MARKET, BY END-USER, 2018–2021 (USD MILLION)

TABLE 168 ROW: ITAD MARKET, BY END-USER, 2022–2027 (USD MILLION)

10.5.1 SOUTH AMERICA

10.5.1.1 Reverse logistics programs help increase demand for ITAD services

TABLE 169 SOUTH AMERICA: ITAD MARKET, BY SERVICE, 2018–2021 (USD MILLION)

TABLE 170 SOUTH AMERICA: ITAD MARKET, BY SERVICE, 2022–2027 (USD MILLION)

10.5.2 MIDDLE EAST AND AFRICA

10.5.2.1 High demand for data security and recycling services

TABLE 171 MIDDLE EAST AND AFRICA: ITAD MARKET, BY SERVICE, 2018–2021 (USD MILLION)

TABLE 172 MIDDLE EAST AND AFRICA: ITAD MARKET, BY SERVICE, 2022–2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 160)

11.1 OVERVIEW

11.2 FIVE-YEAR COMPANY REVENUE ANALYSIS

FIGURE 41 REVENUE ANALYSIS, 2016–2020 (USD BILLION)

11.3 MARKET SHARE ANALYSIS, 2021

TABLE 173 GLOBAL IT ASSET DISPOSITION MARKET: DEGREE OF COMPETITION

FIGURE 42 MARKET SHARE ANALYSIS: GLOBAL MARKET, 2021

11.4 COMPANY EVALUATION QUADRANT

11.4.1 STARS

11.4.2 EMERGING LEADERS

11.4.3 PERVASIVE PLAYERS

11.4.4 PARTICIPANTS

FIGURE 43 MARKET COMPETITIVE LEADERSHIP MAPPING, 2021

11.4.5 PRODUCT FOOTPRINT

TABLE 174 COMPANY PRODUCT FOOTPRINT: MARKET

TABLE 175 COMPANY INDUSTRY FOOTPRINT: MARKET

TABLE 176 COMPANY SERVICE FOOTPRINT: MARKET

TABLE 177 COMPANY REGION FOOTPRINT: MARKET

11.5 IT ASSET DISPOSITION MARKET STARTUP/SME/OTHER MAJOR PLAYERS EVALUATION QUADRANT, 2021

11.5.1 PROGRESSIVE COMPANIES

11.5.2 RESPONSIVE COMPANIES

11.5.3 DYNAMIC COMPANIES

11.5.4 STARTING BLOCKS

FIGURE 44 MARKET, STARTUP/SME/OTHER MAJOR PLAYERS EVALUATION QUADRANT, 2021

11.6 COMPETITIVE SITUATIONS AND TRENDS

11.6.1 DEALS

TABLE 178 IT ASSET DISPOSITION MARKET: DEALS, 2019–2021

12 COMPANY PROFILES (Page No. - 172)

(Business Overview, Products Offered, Recent Developments, MnM View Right to win, Strategic choices made, Weaknesses and competitive threats) *

12.1 KEY PLAYERS

12.1.1 DELL TECHNOLOGIES

TABLE 179 DELL TECHNOLOGIES: COMPANY OVERVIEW

FIGURE 45 DELL TECHNOLOGIES: COMPANY SNAPSHOT

12.1.2 HEWLETT PACKARD ENTERPRISE

TABLE 180 HEWLETT PACKARD ENTERPRISE: COMPANY OVERVIEW

FIGURE 46 HEWLETT PACKARD ENTERPRISE: COMPANY SNAPSHOT

12.1.3 IBM

TABLE 181 IBM: COMPANY OVERVIEW

FIGURE 47 IBM: COMPANY SNAPSHOT

12.1.4 SIMS LIMITED

TABLE 182 SIMS LIMITED: COMPANY OVERVIEW

FIGURE 48 SIMS LIMITED: COMPANY SNAPSHOT

12.1.5 IRON MOUNTAIN

TABLE 183 IRON MOUNTAIN: COMPANY OVERVIEW

FIGURE 49 IRON MOUNTAIN: COMPANY SNAPSHOT

12.1.6 3STEPIT

TABLE 184 3STEPIT: COMPANY OVERVIEW

12.1.7 TES

TABLE 185 TES: COMPANY OVERVIEW

12.1.8 APTO SOLUTIONS

TABLE 186 MICROSOFT CORPORATION: COMPANY OVERVIEW

12.1.9 LIFESPAN INTERNATIONAL

TABLE 187 LIFESPAN INTERNATIONAL: COMPANY OVERVIEW

12.1.10 TOTAL IT GLOBAL

TABLE 188 TOTAL IT GLOBAL: COMPANY OVERVIEW

12.2 OTHER PLAYERS

12.2.1 OCEANTECH

12.2.2 BRP INFOTECH

12.2.3 CURVATURE

12.2.4 TBS INDUSTRIES

12.2.5 INGRAM MICRO

12.2.6 INREGO

12.2.7 ATEA

12.2.8 RENEWTECH

12.2.9 BLANCCO TECHNOLOGY

12.2.10 PROLIMAX

12.2.11 EOL IT SERVICES

12.2.12 FLEX IT DISTRIBUTION

12.2.13 CSI LEASING

12.2.14 CHG MERIDIAN GROUP

*Details on Business Overview, Products Offered, Recent Developments, MnM View, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 212)

13.1 INSIGHTS OF INDUSTRY EXPERTS

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.4 CUSTOMIZATION OPTIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

13.1 INSIGHTS OF INDUSTRY EXPERTS

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.4 CUSTOMIZATION OPTIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

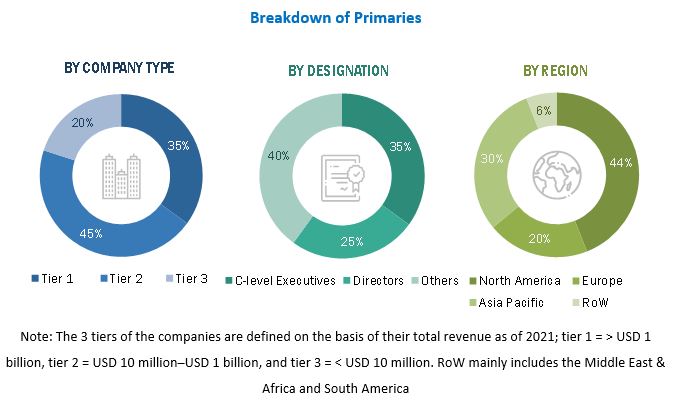

The study involved four major activities in estimating the size of the IT asset disposition market. Exhaustive secondary research has been done to collect information on the market, peer market, and parent market. Validation of these findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the global market size. After that, market breakdown and data triangulation have been used to estimate the market sizes of segments and subsegments.

Secondary Research

The secondary sources referred to for this research study includes corporate filings (such as annual reports, press releases, investor presentations, and financial statements); trade, business, and professional associations (such as Institute of Electrical and Electronics Engineers (IEEE), white papers, IT Asset Disposition related marketing journals, certified publications, and articles by recognized authors; gold and silver standard websites; directories; and databases.

Secondary research has been conducted to obtain key information about the supply chain of IT asset disposition market, monetary chain of the market, the total pool of key players, and market segmentation according to the industry trends to the bottommost level, regional markets, and key developments from both market- and technology oriented perspectives. The secondary data has been collected and analyzed to arrive at the overall market size, which has further been validated by primary research.

Primary Research

Extensive primary research has been conducted after acquiring an understanding of the IT asset disposition market scenario through secondary research. Several primary interviews have been conducted with market experts and players across four major regions, namely, North America, Europe, Asia Pacific, and Rest of the World (the Middle East & Africa). Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales, operations, and administration, were covered to provide a holistic viewpoint in our report.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the size of the IT asset disposition market and other dependent submarkets. Key players in the market were identified through secondary research, and their market ranking in the respective regions was determined through primary and secondary research. This entire research methodology included the study of annual and financial reports of the top market players and interviews with industry experts (CEOs, VPs, directors, and marketing executives) for key insights (both quantitative and qualitative) on the IT asset disposition market. All percentage shares and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that positively and negatively impact the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, supplemented with detailed inputs and analysis from MarketsandMarkets, and presented in this report. The research methodology used to estimate the market sizes includes the following:

- More than 30 companies offering IT asset disposition services were identified, and their offerings were mapped based on service, end user, and region.

- The global IT asset disposition market was derived through the data sanity method. The revenues of ITAD service providers were analyzed through annual reports and press releases and summed up to derive the overall market size.

- For each company, a percentage was assigned to the overall revenue to derive the revenues from the IT asset disposition segment.

- The percentage of each company was assigned after analyzing various factors, including the company’s product offerings, its range of IT asset disposition -related offerings, geographic presence, research & development expenditure and initiatives, and recent developments/strategies adopted for growth in the IT asset disposition market.

- For the CAGR, the market trend analysis of IT asset disposition was carried out by understanding the industry penetration rate and the demand for and supply of IT asset disposition services in different sectors.

- Estimates at every level were verified and crosschecked through discussions with key opinion leaders, including CXOs, directors, operation managers, and domain experts in MarketsandMarkets.

- Various paid and unpaid information sources, such as annual reports, press releases, white papers, and databases, were studied.

Market Size Estimation Methodology-Bottom-up approach

Data Triangulation

After arriving at the overall market size through the process explained earlier, the total market was split into several segments. The market breakdown and data triangulation procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. The market was validated using both the top-down and bottom-up approaches.

The main objectives of this study are as follows:

- To define, describe, and forecast the IT asset disposition (ITAD) market, by service, asset type, organization size, end user, and region, in terms of value

- To provide the market size for North America, Europe, Asia Pacific, and Rest of the World (RoW), along with their respective country-level market sizes, in terms of value

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges that influence market growth

- To provide a detailed overview of the IT asset disposition value chain

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To analyze key trends that shape and influence the global IT asset disposition market

- To profile key players and comprehensively analyze their ranking/share based on their revenues and core competencies.

- To analyze opportunities in the market for stakeholders and provide details about the competitive landscape of the market

- To analyze competitive developments in the IT asset disposition market, such as partnerships, contracts, and research and development (R&D)

Available Customizations:

MarketsandMarkets offers the following customizations for this market report:

- Further breakdown of the market in different regions to the country-level

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in IT Asset Disposition Market

Looking for detailed breakdown of ITAD market size by region and by asset type. Particular looking for laptops, notebooks, desktops, tablets etc...

Hi everybody. I am looking for information about the IT remarketing and I think this PDF could have interesting information about it.

I am very interested in learning more about the ITAD market and would like some additional market research info

I would like to know more about the stronger ITAD suppliers in the region (North America and Latin America).