Laboratory Information Management System (LIMS) Market by Type (Broad), Component (Software & Services), Deployment (On premise, Cloud, SaaS, PaaS, IaaS), Industry (Life Sciences, Chemical, Agriculture, FnB, Oil, Gas), and Region - Global Forecast to 2028

Updated on : July 06, 2023

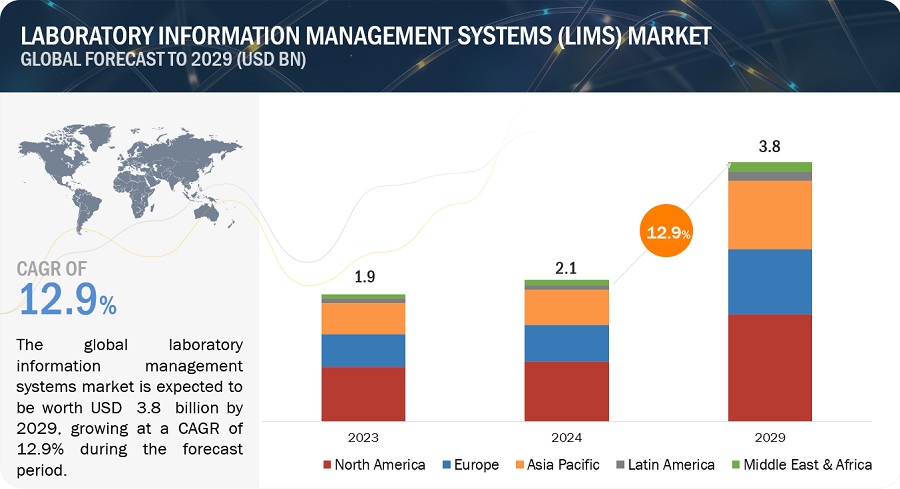

The global laboratory information management system market in terms of revenue was estimated to be worth $1.6 billion in 2023 and is poised to reach $3.3 billion by 2028, growing at a CAGR of 14.6% from 2023 to 2028. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. The significant growth potential in emerging markets such as China, India, Japan, Singapore, Brazil, and Middle Eastern countries, growing popularity of cloud-based LIMS pertaining to large volumes of data generated in laboratories & reduced total cost of ownership of laboratory informatics solutions are some of the critical factors offering opportunities to the market.

However, lack of technical expertise and interoperability issues are key factors challenging the growth of the laboratory information management systems market.

To know about the assumptions considered for the study, Request for Free Sample Report

Laboratory Information Management System Market Dynamics

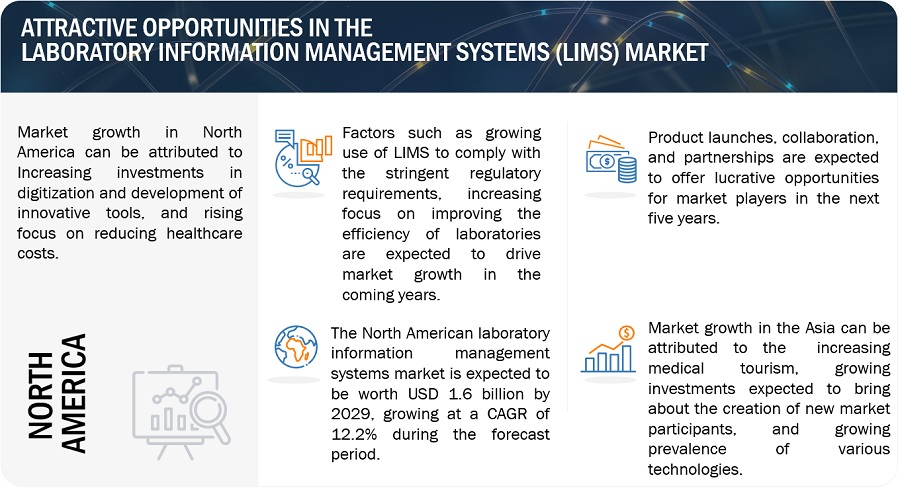

Driver: Increasing focus on improving the efficiency of laboratories

With the increasing number of biobanking applications, organizations face immense pressure to manage the ever-increasing number of biosamples (blood, tissue, and DNA samples) and comply with regulatory requirements. The growing focus on translational research has greatly impacted biobanking as a source of samples for researchers. The value of these repositories lies in the samples and the metadata associated with each specimen. Biobanking modules help researchers efficiently use biorepositories to understand complex diseases and facilitate their integration with LIMS. As research activity and data generation grow, researchers have begun looking for systems that can help them reduce manual intervention. In this regard, the adoption of LIMS for various database applications can help researchers collect, organize, and track information, increase productivity, and reduce errors in accessing research information. Currently, LIMS is being adopted in biobanks, academic research institutes, and CROs to manage laboratory processes better.

Restraint: Limited adoption of LIMS in small and medium-sized companies

The shift to paperless informatics involves various stages of validation and complex documentation with high purchase and maintenance costs. Hence, it becomes challenging for small and medium-sized biopharma companies to implement such informatics solutions. Implementing informatics solutions requires information related to the proper software platform, integration with ERP, specific hardware configurations, and other necessary devices such as barcode scanners and label printers. Small and medium-sized companies lack such prerequisites for the implementation of informatics solutions. Also, most small and medium-sized companies do not have a dedicated budget allocated to purchasing these solutions. As a result, the adoption of LIMS solutions is low among small and medium-sized companies.

Opportunity: Significant growth in emerging markets

The significant growth of emerging countries presents a promising opportunity for the LIMS market. Emerging countries are experiencing rapid industrialization, advancements in healthcare infrastructure, and increased investment in research and development activities. These factors create a favorable environment for the adoption and growth of LIMS, opening up new avenues for market expansion. One of the key drivers for the LIMS market in emerging countries is the rising demand for improved quality control and regulatory compliance in various industries. As emerging economies witness growth in sectors such as pharmaceuticals, biotechnology, food and beverage, and environmental testing, there is a growing need for robust data management systems like LIMS to ensure accurate tracking, traceability, and compliance with regulatory standards. This demand creates a significant market opportunity for LIMS providers to offer their solutions in these regions.

Additionally, the expanding healthcare sector in emerging countries contributes to the growth of the LIMS market. As healthcare infrastructure develops and healthcare services become more accessible, there is a greater need for efficient laboratory operations and data management in hospitals, diagnostic laboratories, and research institutions. LIMS play a crucial role in managing patient data, tracking samples, and streamlining laboratory workflows, thereby improving efficiency and patient care. The increasing adoption of LIMS in the healthcare sector of emerging countries presents substantial growth potential for the market.

Challenge: A dearth of trained professionals

With the growing shift towards digitization, the adoption of IT solutions has increased significantly in the healthcare industry over the last decade. As a result, the demand for skilled IT professionals and personnel with advanced analytical skills to interpret data from HCIT solutions, including LIMS, is increasing; however, there is currently a huge demand-supply gap in the industry. This shortage of trained and skilled personnel may limit the adoption of LIMS, especially in pharmaceutical, biotechnology, and medical device companies, which account for over 50% of the LIMS market.

The US Department of Labor’s (DOL) Bureau of Labor Statistics has reported that the employment of medical laboratory technologists and technicians is expected to increase by 13%, from 335,700 in 2016 to 378,400 in 2026. However, according to the University of Minnesota, there is a shortfall of ~4,500 laboratory professionals annually; by 2018, a shortfall of ~9,000 laboratory professionals per year was expected. This shortage of skilled manpower is restricting the adoption and utilization of complex software solutions in laboratories. Moreover, CROs and pharmaceutical companies are reluctant to invest time and money in training their research employees due to severe time constraints and increasing budget cuts. Such factors are expected to limit the adoption of LIMS to a certain extent in the coming years.

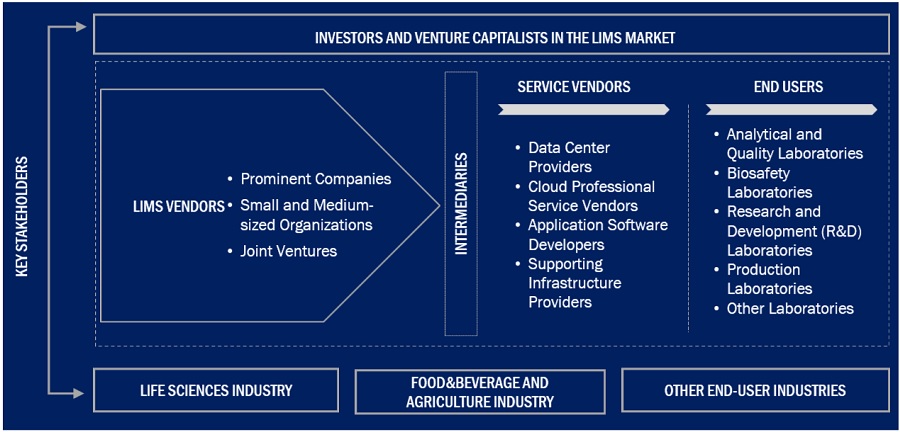

Laboratory Information Management System Market Ecosystem

The ecosystem of the LIMS market comprises data center providers, cloud professional service vendors, software developers, the life sciences industry (pharmaceutical & biotechnology companies, biobanks and biorepositories, contract service organizations, academic research institutes, clinical research laboratories, toxicology laboratories, and NGS labs), petrochemical refineries, oil & gas, chemicals, food & beverage, agriculture, environmental testing, forensic laboratories, and other industries.

Source: Secondary Literature, Interviews with Experts, and MarketsandMarkets Analysis

Software as a service (SAAS) segment of the laboratory information management system industry accounted to hold a significant share by the cloud-based deployment mode during the forecast period

Software as a service (SAAS) segment of the laboratory information management system market accounted to hold a significant share by the cloud-based deployment mode during the forecast period. The growth of SAAS segment is accounted to seamless integration of data from diverse cloud silos, unlimited users and provides access to users anytime and anywhere, low maintenance costs and increases the use of resources. The wide range of applications, including accounting, performance monitoring, and communicating via webmail and instant messengers served by SAAS model is also promoting the growth of this segment.

Biobanks & biorepositories segment accounted for a considerable share in the laboratory information management system industry, by the life sciences industry in 2022

In 2022, the biobanks & biorepositories segment accounted for a considerable share in the laboratory information management system market, by the life sciences industry. The large share of this segment can be attributed to the growing need for biobanks with the increasing focus of pharmaceutical companies on epidemiology research, biomedical research, personalized medicine, and cell-based research, which require more usable and well-maintained specimens, and the rising need for automated storage, preparation, and information management systems to obtain accurate, reliable, and standardized data.

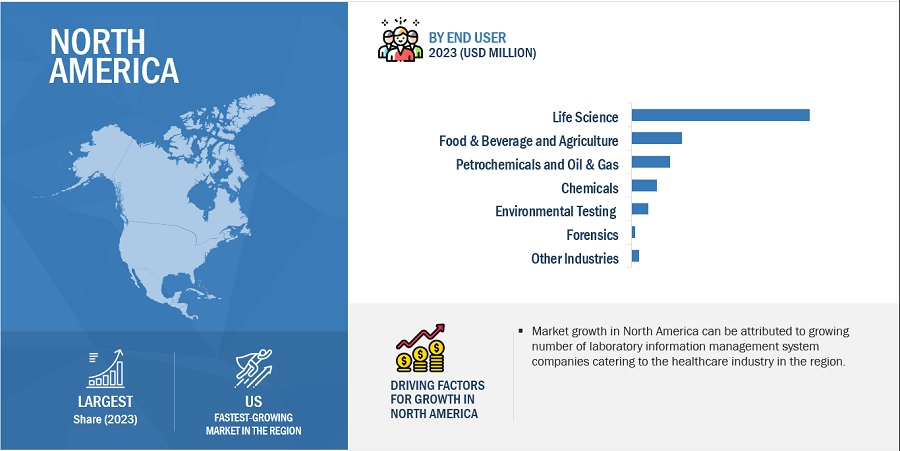

North America dominated the laboratory information management system industry in 2022

North America accounted for the largest share of the laboratory information management system market. The large share of North America can be attributed to the developed infrastructure and growth in the demand for digitalized technologies across North America drive the implementation of different analytical solutions among industries, and a growing number of laboratory information management system companies catering to the healthcare industry in the region.

To know about the assumptions considered for the study, download the pdf brochure

Prominent companies in laboratory information management system market include LabWare (US), LabVantage Solutions Inc. (US), Thermo Fisher Scientific (US), Thermo Fisher Scientific Inc. (US), Agilent Technologies (US), LabLynx, Inc. (US), Dassault Systèmes (France), Labworks LLC (US), Autoscribe Informatics (a wholly owned subsidiary of Autoscribe Limited) (US), Accelerated Technology Laboratories (ATL) (US), CloudLIMS (US), Computing Solutions, Inc. (US), GenoLogics Inc. (an Illumina Company) (Canada), Siemens (Germany), Novatek International (Canada), Ovation (US), Clinsys (US).

Scope of the Laboratory Information Management System Industry

|

Report Metric |

Details |

|

Market Revenue in 2023 |

$1.6 billion |

|

Projected Revenue by 2028 |

$3.3 billion |

|

Revenue Rate |

Poised to Grow at a CAGR of 14.6% |

|

Market Driver |

Increasing focus on improving the efficiency of laboratories |

|

Market Opportunity |

Significant growth in emerging markets |

The study categorizes the laboratory information management system market to forecast revenue and analyze trends in each of the following submarkets:

By Type

- Broad-based LIMS

- Industry-specific LIMS

By Component

- Software

- Services

By Deployment Model

- On-premise LIMS

-

Cloud LIMS

- Software-as-a-service

- Infrastructure-as-a-service

- Platform-as-a-service Others

- Remotely Hosted LIMS

By Industry

-

Life Sciences

- Pharmaceutical & Biotechnology Companies

- Biobanks & Biorepositories

- Contract Service Organizations

- Academic Research Institutes

- Clinical Research Laboratories

- Toxicology Laboratories

- NGS Laboratories

- Food & Beverage And Agriculture

- Petrochemicals And Oil & Gas

- Chemicals

- Environmental Testing

- Forensics

- Other Industries

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- RoE

-

Asia

- Japan

- China

- India

- RoAPAC

- Rest of the World

Recent Developments of Laboratory Information Management System Industry

- In October 2022, LabVantage Solutions, Inc. (US) and Biomax Informatics AG (Germany) announced the closure of their merger agreement. The merger aims to enhance scientific data contextualization, accelerate product development, and provide innovative capabilities for the life science and bio-manufacturing industries.

- In March 2022, LabWare (US), acquired data analytics firm CompassRed (US). The merger aimed to create a LabWare Data Analytics Innovation Center and accelerate the transformation of data into actionable knowledge. The acquisition allowed LabWare to expand its services and establish a global presence.

- In March 2022, Thermo Fisher Scientific, Inc. (US) and Symphogen (Denmark) announced the continuation of their collaboration to provide innovative tools and workflows for the efficient characterization of complex therapeutic proteins in biopharmaceutical discovery and development laboratories

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global laboratory information management system market?

The global laboratory information management system market boasts a total revenue value of $3.3 billion by 2028.

What is the estimated growth rate (CAGR) of the global laboratory information management system market?

The global laboratory information management system market has an estimated compound annual growth rate (CAGR) of 14.6% and a revenue size in the region of $1.6 billion in 2023.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

This research study involved the extensive use of both primary and secondary sources. It involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, the competitive landscape of market players, and key market dynamics such as drivers, opportunities, challenges, restraints, and key player strategies.

Secondary Research

This research study involved the wide use of secondary sources, directories, databases such as Dun & Bradstreet, Bloomberg Businessweek, and Factiva, white papers, annual reports, and companies’ house documents, investor presentations; and the SEC filings of companies. Secondary research was used to identify and collect information useful for an extensive, technical, market-oriented, and commercial study of the LIMS market. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends to the bottom-most level and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources are mainly industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, technology developers, researchers, and organizations related to all segments of this industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify the critical qualitative and quantitative information as well as assess prospects.

Primary research was conducted to identify segmentation types; industry trends; key players; and key market dynamics such as drivers, restraints, opportunities, challenges, industry trends, and strategies adopted by key players.

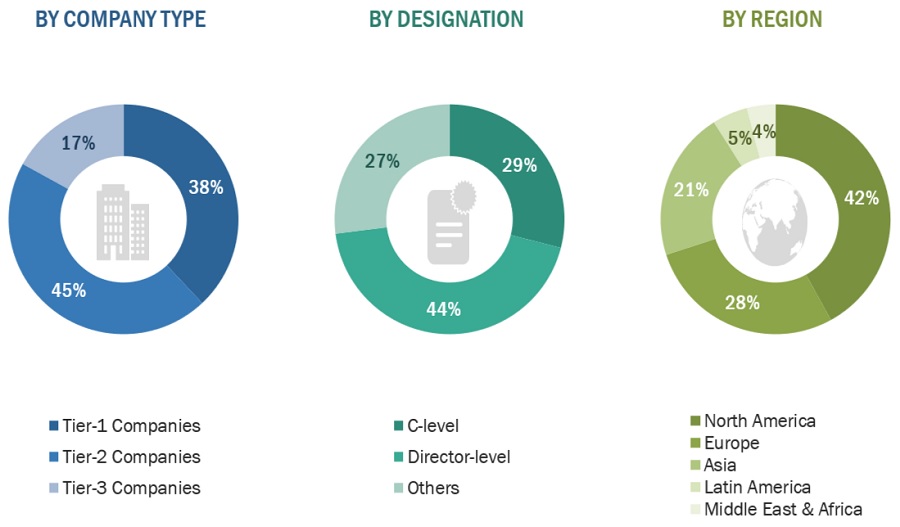

A breakdown of the primary respondents is provided below:

*Others include sales managers, marketing managers, and product managers.

Note: Tiers are defined based on a company’s total revenue, as of 2020: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = <USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The total size of the LIMS market was arrived at after data triangulation from three different approaches, as mentioned below. After each approach, the weighted average of the three approaches was taken based on the level of assumptions used in each approach. The market size estimates and forecasts provided in this study are derived through a mix of the bottom-up approach (revenue share analysis of leading players) and top-down approach (assessment of utilization/adoption/penetration trends, by deployment model, type, component, industry, and region).

Global Laboratory Information Management Systems Market Size: Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Supply Side Analysis (Revenue Share Analysis)

The size of the laboratory information management systems market was arrived at by using the revenue share analysis of leading players. The methodology used is as given below:

- Revenues for individual companies were gathered from public sources and databases.

- Shares of leading players in the laboratory information management systems market were gathered from secondary sources to the extent available. In some instances, shares of laboratory information management systems businesses have been ascertained after a detailed analysis of various parameters, including product portfolios, market positioning, selling price, and geographic reach & strength.

- Individual shares or revenue estimates were validated through interviews with experts.

The total revenue in the laboratory information management systems market was determined by extrapolating the Market share data of major companies.

Market Definition

A laboratory information management system (LIMS) is a software module used in industrial laboratories to acquire, analyze, store, and report laboratory data for research purposes. LIMS enables end users in various industries to track/manage samples and standardize workflows, ensuring compliance with laboratory standards and regulatory mandates.

Key Stakeholders

- LIMS vendors

- Healthcare IT service providers

- Research and consulting firms

- Pharmaceutical and biotechnology companies

- Process industries

- Venture capitalists

- Government agencies

- Academic research institutes

Objectives of the Study

- To define, describe, and forecast the global laboratory information management systems (LIMS) market based on type, component, deployment model, industry, and region

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze the opportunities in the market for stakeholders and provide details of

- the competitive landscape for market leaders

- To forecast the size of the market segments with respect to four main regions, namely,

- North America, Europe, Asia, and the Rest of the World (RoW)2

- To profile key market players and comprehensively analyze their product portfolios, market positions, and core competencies3

- To track and analyze competitive developments such as acquisitions; product launches and upgrades; expansions; agreements, partnerships, and acquisitions; and R&D activities in the LIMS market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Geographic Analysis

- Further breakdown of the Rest of Europe Laboratory information management systems Market into Denmark, Norway, and others

- Further breakdown of the Rest of Asian Laboratory information management systems Market into Vietnam, New Zealand, Australia, South Korea, and others

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Laboratory Information Management System (LIMS) Market

This is interesting to see how the LIMS industry breakdown throughout the world. Seeing its projected growth over the next few years is pretty cool as well.