TABLE OF CONTENTS

1INTRODUCTION (Page No. - 28)

1.1Study Objectives

1.2Market Definition and Scope

1.2.1Inclusions and exclusions

1.3Study Scope

1.3.1Markets covered

1.3.2Geographic scope

1.3.3Years considered

1.4Currency

1.5Limitations

1.6Stakeholders

2RESEARCH METHODOLOGY (Page No. - 33)

2.1Research Data

Figure 1Laser processing market: Research design

2.1.1Secondary and primary research

2.1.1.1Key industry insights

2.1.2Secondary Data

2.1.2.1List of major secondary sources

2.1.2.2Secondary sources

2.1.3Primary Data

2.1.3.1Primary interviews with experts

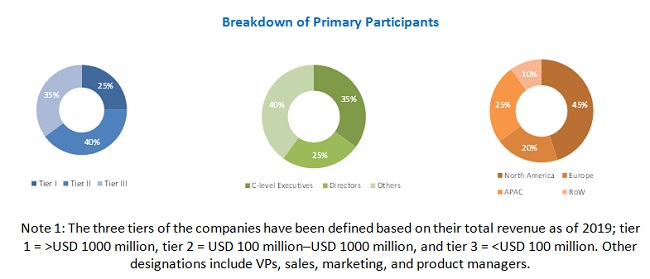

2.1.3.2Breakdown of primaries

2.1.3.3Primary sources

2.2Market Size Estimation

2.2.1Bottom-up approach

2.2.1.1Estimating market size through bottom-up approach (demand side)

Figure 2Market size estimation methodology: Bottom-up approach

2.2.2Top-Down Approach

Figure 3Market size estimation methodology: Approach 2 (supply side)—revenue generated from products in market

Figure 4Market size estimation methodology: Approach 2 (supply side)—illustration of revenue estimation for one company in laser processing market

Figure 5Market size estimation methodology: Top-down approach

2.3Market Breakdown and Data Triangulation

Figure 6Data triangulation

2.4Research Assumptions

Figure 7Assumptions for the research study

3EXECUTIVE SUMMARY (Page No. - 44)

Figure 8Global laser processing market (USD Million)

Figure 9Machine tools end-user industry accounted for largest share of market in 2019

Figure 10Solid lasers type accounted for largest market share in 2019

Figure 11Cutting application held largest share of market, by application, in 2019

Figure 12System revenue held larger share of market, by revenue, in 2019

Figure 13 market, by region, 2019

4PREMIUM INSIGHTS (Page No. - 50)

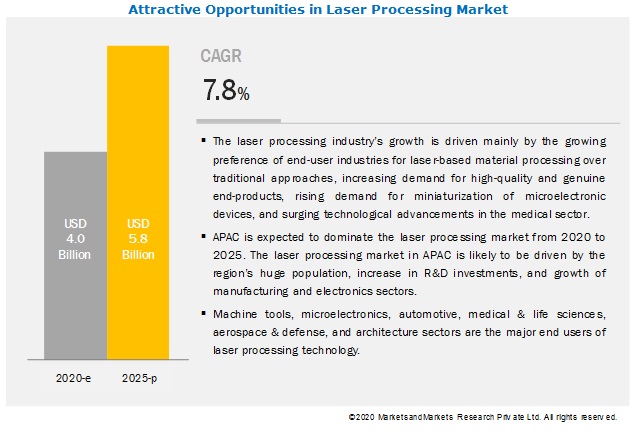

4.1Attractive Opportunities in Market

Figure 14Preference for laser-based material processing over traditional approaches drives growth of market

4.2 Market in APAC, By Country and End-User Industry

Figure 15China and machine tools end-user industry held largest share of APAC laser processing market in 2019

4.3 Market, By Laser Type

Figure 16Solid lasers to account for largest share of market based on laser type during 2020–2025

4.4 Market, By Revenue

Figure 17Laser revenue expected to exhibit higher CAGR in market during 2020–2025

4.5 Market, By End-User Industry

Figure 18Machine tools end-user industry expected to hold largest share of market by 2025

4.6 Market, By Application

Figure 19Cutting application expected to hold largest share of market by 2025

4.7 Market, By Country

Figure 20Germany accounted for largest share of market in 2019

5 MARKET OVERVIEW (Page No. - 54)

5.1Introduction

5.2Market Dynamics

Figure 21Impact of drivers and opportunities on market

Figure 22Impact of challenges and restraints on market

5.2.1Drivers

5.2.1.1Preference for laser-based material processing over traditional approaches

5.2.1.2Increasing demand for high-quality and genuine products

5.2.1.3Demand for miniaturization of microelectronic devices

5.2.1.4Technological advancements in medical sector

5.2.2Restraints

5.2.2.1High deployment cost and lack of personnel with required technical expertise

5.2.3Opportunities

5.2.3.1Growing number of application areas

Figure 23Global automotive sales, by vehicle type, 2012–2018 (Million Units)

5.2.3.2Surging demand for custom marking and engraving

5.2.3.3Increasing automation across manufacturing sector

Figure 24Annual shipment of industrial robots, by region, 2012–2017

5.2.4Challenges

5.2.4.1Technical complexities in high-power lasers

5.2.4.2Environmental concerns over use of rare earth elements

5.3Impact of COVID-19 on Laser Processing Market

5.4Value Chain Analysis

Figure 25Value chain analysis: Major value is added by original equipment manufacturers and laser system integrators

6 MARKET, BY LASER TYPE (Page No. - 64)

6.1Introduction

Figure 26market, by laser type

Figure 27market for solid lasers to grow at highest CAGR during forecast period

Table 1market, by laser type, 2017–2025 (USD Million)

6.2Solid Lasers

Figure 28APAC to hold largest share of solid lasers processing market during forecast period

Table 2Solid lasers processing market, by region, 2017–2025 (USD Million)

Table 3Solid lasers processing market, by subtype, 2017–2025 (USD Million)

6.2.1Fiber lasers

6.2.1.1Fiber lasers to hold largest share of solid lasers market during forecast period

6.2.2Ruby lasers

6.2.2.1Ruby lasers are used in science programs across various educational institutions, and for decoration and artistic purposes

6.2.3Yttrium Aluminum Garnet (YAG) Lasers

6.2.3.1ND:YAG lasers can reach deeper layers of skin tissues than other lasers

6.2.4Semiconductor lasers

6.2.4.1Semiconductor lasers are natural transmitters of digital data because they can be pulsed at variable rate and pulse widths

6.2.5Thin-disk lasers

6.2.5.1Due to their cooling properties, thin-disk lasers are used across several industrial applications and in scientific research

6.3Liquid Lasers

Table 4Liquid lasers processing market, by region, 2017–2025 (USD Million)

Table 5Liquid lasers processing market, by subtype, 2017–2025 (USD Million)

6.3.1X-ray lasers

6.3.1.1Major application areas of X-ray lasers are research related to dense plasmas, X-ray microscopy, medical imaging, military & defense, and surface research

6.3.2Dye lasers

6.3.2.1Dye lasers offer lesser beam diameter and beam divergence, ease of construction, and high efficiency

6.4Gas Lasers

Figure 29APAC to hold largest share of gas lasers processing market during forecast period

Table 6Gas lasers processing market, by region, 2017–2025 (USD Million)

Table 7Gas lasers processing market, by subtype, 2017–2025 (USD Million)

6.4.1CO2 lasers

6.4.1.1CO2 laser offers high power, performance, and compact size for a sealed laser

6.4.2Excimer/diode lasers

6.4.2.1Excimer/diode lasers operate in ultraviolet (UV) spectral region and generate nanosecond pulses

6.4.3HE-NE lasers

6.4.3.1HE-NE are low-cost lasers providing good beam quality

6.4.4Argon lasers

6.4.4.1Application areas of argon lasers include scientific research and medical

6.4.5Chemical lasers

6.4.5.1Chemical lasers are capable of achieving high power by obtaining required energy levels from chemical reactions

6.5Others

6.5.1Photonic crystal laser and industrial short-pulse lasers are used for applications such as cutting, welding, drilling, and marking & engraving

Table 8Other market, by region, 2017–2025 (USD Million)

7 MARKET, BY REVENUE

7.1Introduction (Page No. - 77)

Figure 30market, by revenue

Figure 31market for laser revenue to grow at higher CAGR during forecast period

Table 9market, by revenue, 2017–2025 (USD Million)

7.2System Revenue

7.2.1Growing demand for laser systems across several end-user industries drives revenue from system sales

Figure 32APAC to hold largest share of market for system revenue during forecast period

Table 10market for system revenue, by region, 2017–2025 (USD Million)

7.3Laser Revenue

7.3.1Growing demand for several types of lasers drives laser revenue segment

Figure 33APAC to hold largest share of market for laser revenue during forecast period

Table 11market for laser revenue, by region, 2017–2025 (USD Million)

8MARKET, BY CONFIGURATION (Page No. - 82)

8.1Introduction

8.2Types of Configuration for Laser Processing

Figure 34market, by configuration

Figure 35market for moving beam to grow at highest CAGR during forecast period

Table 12market, by configuration, 2017–2025 (USD Million)

8.2.1Fixed beam

8.2.1.1Fixed-beam configuration has laser beam in stationary position and requires lesser optics

Figure 36APAC to hold largest share of fixed-beam configuration market during forecast period

Table 13Fixed-beam configuration market, by region, 2017–2025 (USD Million)

8.2.2Moving beam

8.2.2.1Moving beam configuration segment is expected to grow at highest CAGR

Figure 37APAC to hold largest share of moving beam configuration market during forecast period

Table 14Moving beam configuration market, by region, 2017–2025 (USD Million)

8.2.3Hybrid

8.2.3.1Hybrid laser processing systems are more efficient than moving beam systems

Figure 38APAC to hold largest share of hybrid configuration market during forecast period

Table 15Hybrid configuration market, by region, 2017–2025 (USD Million)

Table 16Comparison of different laser processing configurations

8.3Types of Configuration for Laser Cutting and Engraving

Figure 39market, by machine configuration

8.3.1Raster mode

8.3.1.1Raster mode is applicable for engraving of texts and graphics on wood, aluminum, and flooring materials

8.3.2Vector mode

8.3.2.1Vector mode allows for marking, scoring, or cutting of a material’s surface in a two-dimensional line

Table 17Result comparison of raster and vector modes

9MARKET, BY APPLICATION (Page No. - 90)

9.1Introduction

Figure 40Laser processing, by application

Figure 41market for advanced processing to grow at highest CAGR during forecast period

Table 18market, by application, 2017–2025 (USD Million)

9.2Cutting

Figure 42market for cutting application to capture largest size in APAC during forecast period

Table 19market for cutting application, by region, 2017–2025 (USD Million)

9.2.1Fusion cutting

9.2.1.1Fusion cutting provides oxide-free cut edges and requires no further treatment

9.2.2Flame cutting

9.2.2.1Flame cutting allows high-speed cutting of thick plates

9.2.3Sublimation cutting

9.2.3.1Sublimation cutting is an ideal choice for applications requiring delicate cutting work

9.3Welding

9.3.1The laser welding technique offers high processing speeds and a low power distortion

Table 20market by welding application, by region, 2017–2025 (USD Million)

9.4Drilling

Table 21market for drilling application, by region, 2017–2025 (USD Million)

9.4.1Single-pulse drilling

9.4.1.1Single-pulse drilling allows drilling of large number of holes in less time

9.4.2Percussion drilling

9.4.2.1Percussion drilling method produces deeper and more precise holes than single-shot drilling

9.4.3Trepanning drilling

9.4.3.1Depth of up to 50mm is achievable through trepanning drilling

9.4.4Helical drilling

9.4.4.1Helical drilling facilitates easy drilling of large and deep holes

9.5Marking & Engraving

Figure 43market for marking & engraving application to capture largest size in APAC during forecast period

Table 22market by marking & engraving application, by region, 2017–2025 (USD Million)

9.5.1Direct laser engraving

9.5.1.1Direct laser engraving is ideal for extremely fast and highly accurate print runs of catalogs or magazines

9.5.2Subsurface laser engraving

9.5.2.1Subsurface laser engraving allows two- and three-dimensional designs inside glass

9.5.3Direct photopolymer laser imaging

9.5.3.1Direct photopolymer laser imaging process allows scanning electronically generated images

9.6Microprocessing

9.6.1Lasers are used for microprocessing in PCB layouts, semiconductor lithography, and micromachining parts

Table 23market for microprocessing application, by region, 2017–2025 (USD Million)

9.7Advanced Processing

9.7.1Advanced processing application is expected to grow at highest CAGR

Table 24market for advanced processing application, by region, 2017–2025 (USD Million)

9.8Others

9.8.1Other applications include laser perforating, laser soldering and welding, and laser structuring

Figure 44APAC to hold largest share of market for other applications during forecast period

Table 25market for other applications, by region, 2017–2025 (USD Million)

10MARKET, BY END-USER INDUSTRY (Page No. - 103)

10.1Introduction

Figure 45market, by end-user industry

Figure 46market for architecture end-user industry to grow at highest CAGR during forecast period

Table 26market, by end-user industry, 2017–2025 (USD Million)

10.2Machine Tools

Figure 47APAC to hold largest share of market for machine tools end-user industry during forecast period

Table 27market for machine tools end-user industry, by region, 2017–2025 (USD Million)

Table 28market for machine tools end-user industry in APAC, by country, 2017–2025 (USD Million)

Table 29market for machine tools end-user industry in Europe, by country, 2017–2025 (USD Million)

Table 30market for machine tools end-user industry in North America, by country, 2017–2025 (USD Million)

Table 31market for machine tools end-user industry in ROW, by region, 2017–2025 (USD Million)

10.3Microelectronics

Figure 48APAC to hold largest share of market for microelectronics end-user industry during forecast period

Table 32market for microelectronics end-user industry, by region, 2017–2025 (USD Million)

Table 33market for microelectronics end-user industry in APAC, by country, 2017–2025 (USD Million)

Table 34market for microelectronics end-user industry in Europe, by country, 2017–2025 (USD Million)

Table 35 market for microelectronics end-user industry in North America, by country, 2017–2025 (USD Million)

Table 36market for microelectronics end-user industry in ROW, by region, 2017–2025 (USD Million)

10.3.1Flat-panel display (FPD)

10.3.1.1Lasers enable high process speed, better yield, and improved battery life with higher resolution and brightness at low cost for FPDs

10.3.2Advanced packaging & interconnects

10.3.2.1Lasers are used for cutting and scribing of wafers in advanced packaging and interconnects

10.3.3Micromachining

10.3.3.1Excimer lasers are used to shape materials such as ceramics, glass, polymers, metals, and diamonds

10.3.4Semiconductor manufacturing

10.3.4.1Lasers can detect and locate defects as small as 0.01 micron

10.4Automotive

10.4.1Lasers are utilized for applications such as high-strength steel cutting, seam welding, and brazing

Figure 49APAC to hold largest share of market for automotive end-user industry during forecast period

Table 37market for automotive end-user industry, by region, 2017–2025 (USD Million)

Table 38market for automotive end-user industry in APAC, by country, 2017–2025 (USD Million)

Table 39market for automotive end-user industry in Europe, by country, 2017–2025 (USD Million)

Table 40market for automotive end-user industry in North America, by country, 2017–2025 (USD Million)

Table 41market for automotive end-user industry in ROW, by region, 2017–2025 (USD Million)

10.5Medical & Life Sciences

Figure 50APAC to hold largest share of market for medical & life sciences end-user industry during forecast period

Table 42market for medical & life sciences end-user industry, by region, 2017–2025 (USD Million)

Table 43market for medical & life sciences end-user industry in APAC, by country, 2017–2025 (USD Million)

Table 44market for medical & life sciences end-user industry in Europe, by country, 2017–2025 (USD Million)

Table 45market for medical & life sciences end-user industry in North America, by country, 2017–2025 (USD Million)

Table 46market for medical & life sciences end-user industry in ROW, by region, 2017–2025 (USD Million)

10.5.1Laser vision correction

10.5.1.1Excimer lasers offer extreme reliability and high repetition rate in vision correction procedure

10.5.2Confocal microscope

10.5.2.1Confocal microscopes offer high resolution, submicron microscopy, and magnification range of 100X to 10,000

10.5.3Optogenetics

10.5.3.1Ultrafast lasers are now being used for topological mapping and functional mapping of brain

10.5.4Others

10.5.4.1Other application segments in medical & life sciences include flow cytometry, biodetection and analysis, multiphoton excitation (MPE) microscopy, enhanced magnetic resonance imaging (MRI), and dermatological treatment

10.6Aerospace & Defense

Figure 51APAC to hold largest share of market for aerospace & defense end-user industry during forecast period

Table 47market for aerospace & defense end-user industry, by region, 2017–2025 (USD Million)

Table 48market for aerospace & defense end-user industry in APAC, by country, 2017–2025 (USD Million)

Table 49 market for aerospace & defense end-user INDUSTRY in Europe, by country, 2017–2025 (USD Million)

Table 50 market for aerospace & defense end-user industry in North America, by country, 2017–2025 (USD Million)

Table 51 market for aerospace & defense end-user industry in ROW, by region, 2017–2025 (USD Million)

10.6.1Laser defense system technology

10.6.1.1Lasers are used in anti-missile defense systems to dispose of energy of warheads

10.6.2Laser radar (LIDAR)

10.6.2.1Lasers used in radar applications provide details regarding dimension and distance of targets with high accuracy

10.7Architecture

10.7.1Lasers used in architecture sector help architects create precise models of structures

Figure 52APAC to hold largest share of market for architecture end-user industry during forecast period

Table 52market for architecture end-user industry, by region, 2017–2025 (USD Million)

Table 53market for architecture end-user industry in APAC, by country, 2017–2025 (USD Million)

Table 54market for architecture end-user industry in Europe, by country, 2017–2025 (USD Million)

Table 55market for architecture end-user industry in North America, by country, 2017–2025 (USD Million)

Table 56market for architecture end-user industry in ROW, by region, 2017–2025 (USD Million)

10.8Others

Figure 53APAC to hold largest share of market for other end-user industries during forecast period

Table 57market for other end-user industries, by region, 2017–2025 (USD Million)

Table 58market for other end-user industries in APAC, by country, 2017–2025 (USD Million)

Table 59 market for other end-user industries in Europe, by country, 2017–2025 (USD Million)

Table 60market for other end-user industries in North America, by country, 2017–2025 (USD Million)

Table 61market for other end-user industries in ROW, by region, 2017–2025 (USD Million)

10.8.1Glass

10.8.1.1CO2 and Nd: YAG lasers are an ideal choice for cutting, welding, and marking & engraving applications

10.8.2Wood

10.8.2.1All kinds of hardwoods, inlays, plywood, walnut wood, alder wood, and cherry wood can be engraved using laser systems

10.8.3Plastic

10.8.3.1Lasers are used for cutting, welding, and marking & engraving applications in plastics industry

10.8.4Tobacco

10.8.4.1Lasers are used for perforation of cigarette tipping papers

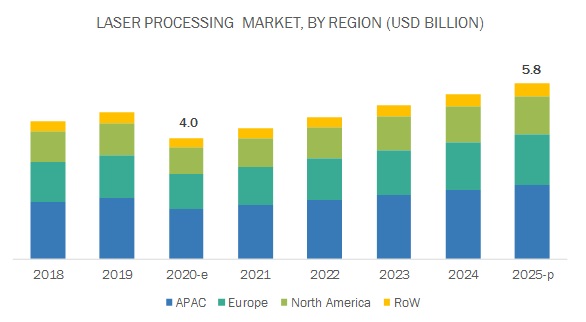

11GEOGRAPHIC ANALYSIS (Page No. - 129)

11.1Introduction

Figure 54Geographic snapshot: Laser processing market in India to grow at highest CAGR during forecast period

Figure 55APAC to procure largest share in market during forecast period

Table 62market, by region, 2017–2025 (USD Million)

11.2North America

Figure 56Snapshot of market in North America

Figure 57Mexico to record highest CAGR in market in North America during forecast period

Table 63market in North America, by country, 2017–2025 (USD Million)

Table 64market in North America, by laser type, 2017–2025 (USD Million)

Table 65market in North America, by application, 2017–2025 (USD Million)

Table 66market in North America, by configuration, 2017–2025 (USD Million)

Table 67market in North America, by revenue, 2017–2025 (USD Million)

Figure 58market in North America for architecture industry to witness highest CAGR during forecast period

Table 68market in North America, by end-user industry, 2017–2025 (USD Million)

11.2.1US

11.2.1.1US held largest share of market in North America

Table 69market in US, by end-user industry, 2017–2025 (USD Million)

Table 70market in US, by revenue, 2017–2025 (USD Million)

11.2.2Canada

11.2.2.1Demand from aerospace & defense and automotive end-user industries to foster market growth in US

Table 71market in Canada, by end-user industry, 2017–2025 (USD Million)

11.2.3Mexico

11.2.3.1Market in Mexico to grow at highest rate in North America

Table 72market in Mexico, by end-user industry, 2017–2025 (USD Million)

11.3Europe

Figure 59Snapshot of market in Europe

Figure 60ROE to capture highest CAGR in market in Europe during forecast period

Table 73market in Europe, by country, 2017–2027 (USD Million)

Table 74market in Europe, by laser type, 2017–2025 (USD Million)

Table 75market in Europe, by application, 2017–2025 (USD Million)

Table 76market in Europe, by configuration, 2017–2025 (USD Million)

Table 77market in Europe, by revenue, 2017–2025 (USD Million)

Figure 61market in Europe for architecture industry to register highest CAGR during forecast period

Table 78market in Europe, by end-user industry, 2017–2025 (USD Million)

11.3.1Germany

11.3.1.1Germany held largest share of market in Europe in 2019

Table 79market in Germany, by end-user industry, 2017–2025 (USD Million)

11.3.2France

11.3.2.1Increasing demand for solid and gas lasers to drive growth of market in France

Table 80market in France, by end-user industry, 2017–2025 (USD Million)

11.3.3UK

11.3.3.1Presence of solid, liquid, and gas laser manufacturers to foster growth of market in UK

Table 81market in UK, by end-user industry, 2017–2025 (USD Million)

11.3.4ROE

11.3.4.1market in ROE to grow at highest rate in Europe

Table 82market in ROE, by end-user industry, 2017–2025 (USD Million)

11.4APAC

Figure 62Snapshot of Laser processing market in APAC

Figure 63market in India to capture highest CAGR during forecast period

Table 83market in APAC, by country, 2017–2027 (USD Million)

Table 84market in APAC, by laser type, 2017–2025 (USD Million)

Table 85market in APAC, by application, 2017–2025 (USD Million)

Table 86market in APAC, by configuration, 2017–2025 (USD Million)

Table 87market in APAC, by revenue, 2017–2025 (USD Million)

Figure 64market in APAC for architecture industry to witness highest CAGR during forecast period

Table 88market in APAC, by end-user industry, 2017–2025 (USD Million)

11.4.1China

11.4.1.1China held largest share of market in APAC in 2019

Table 89market in China, by end-user industry, 2017–2025 (USD Million)

Table 90market in China, by revenue, 2017–2025 (USD Million)

11.4.2Japan

11.4.2.1Heightened demand from automotive industry to foster market growth in Japan

Table 91market in Japan, by end-user industry, 2017–2025 (USD Million)

11.4.3South Korea

11.4.3.1Microelectronics and automotive industries to induce demand for laser processing systems in South Korea

Table 92market in South Korea, by end-user industry, 2017–2025 (USD Million)

11.4.4India

11.4.4.1market in India to capture highest CAGR during forecast period

Table 93market in India, by end-user industry, 2017–2025 (USD Million)

11.4.5Rest of APAC

11.4.5.1Growth in manufacturing activities to drive demand for laser processing systems in Rest of APAC

Table 94market in RoAPAC, by end-user industry, 2017–2025 (USD Million)

11.5ROW

Figure 65market in South America to record higher CAGR during forecast period

Table 95market in ROW, by region, 2017–2027 (USD Million)

Table 96market in ROW, by laser type, 2017–2025 (USD Million)

Table 97market in ROW, by application, 2017–2025 (USD Million)

Table 98market in ROW, by configuration, 2017–2025 (USD Million)

Table 99market in ROW, by revenue, 2017–2025 (USD Million)

Figure 66market in ROW for architecture industry to capture highest CAGR during forecast period

Table 100market in ROW, by end-user industry, 2017–2025 (USD Million)

11.5.1MEA

11.5.1.1MEA held larger share of laser processing market in ROW in 2019

Table 101Laser processing market in MEA, by end-user industry, 2017–2025 (USD Million)

11.5.2South America

11.5.2.1Laser processing market in South America to grow at higher CAGR in ROW

Table 102Laser processing market in South America, by end-user industry, 2017–2025 (USD Million)

12COMPETITIVE LANDSCAPE (Page No. - 162)

12.1Introduction

Figure 67Major players in laser processing market adopted product launches as key growth strategy from 2017 to 2019

12.2Ranking analysis of players in Laser processing Market

Figure 68Top 5 companies in laser processing market

12.3Competitive Leadership Mapping

Figure 69Laser processing market (global) competitive leadership mapping, 2019

12.3.1Visionary leaders

12.3.2Dynamic differentiators

12.3.3Innovators

12.3.4Emerging companies

12.4Competitive Benchmarking

12.4.1Strength of product portfolio (25 companies)

Figure 70Product portfolio analysis of top players in laser processing market

12.4.2Business strategy excellence (25 companies)

Figure 71Business strategy excellence of top players in laser processing market

12.5Competitive Scenario

Figure 72Market evolution framework: Product launches, followed by mergers & acquisitions, fueled laser processing market growth (2017–2019)

12.5.1Expansions

Table 103Expansions, 2017–2019

12.5.2Product Launches and developments

Table 104Product Launches and developments, 2017–2019

12.5.3Mergers & acquisitions

Table 105Acquisitions, 2017–2019

12.5.4Contracts, partnerships, agreements, and collaborations

Table 106Contracts, partnerships, agreements, and collaborations, 2017–2019

13COMPANY PROFILES (Page No. - 177)

13.1Key Players

(Business Overview, Products/Solutions/Services Offered, Recent Developments, SWOT Analysis, and MnM View)*

13.1.1COHERENT

Figure 73COHERENT: Company snapshot

13.1.2TRUMPF

Figure 74TRUMPF: Company snapshot

13.1.3HAN'S LASER

Figure 75HAN'S LASER: Company snapshot

13.1.4IPG PHOTONICS

Figure 76IPG PHOTONICS: Company snapshot

13.1.5JENOPTIK

Figure 77JENOPTIK: Company snapshot

13.1.6LUMENTUM

Figure 78LUMENTUM: Company snapshot

13.1.7GRAVOTECH

13.1.8LASERSTAR

13.1.9LUMIBIRD

Figure 79LUMIBIRD: Company snapshot

13.1.10EPILOG LASER

13.2Right to Win

13.2.1COHERENT

13.2.2HAN’S LASER

13.2.3TRUMPF

13.2.4IPG PHOTONICS

13.2.5JENOPTIK

13.3Other Companies

13.3.1NOVANTA

13.3.2MKS INSTRUMENTS

13.3.3EUROLASER

13.3.4600 GROUP

13.3.5BYSTRONIC LASER

13.3.6PHOTONICS INDUSTRIES

13.3.7PANASONIC

13.3.8DANAHER

13.3.9SINTEC OPTRONICS

13.3.10PRIMA INDUSTRIE

*Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, SWOT Analysis, and MnM View might not be captured in case of unlisted companies.

14APPENDIX (Page No. - 221)

14.1Insights of Industry Experts

14.2Discussion Guide

14.3Knowledge Store: MarketsandMarkets’ Subscription Portal

14.4Available Customizations

14.5Related Reports

14.6 Author Details

Growth opportunities and latent adjacency in Laser Processing Market

How dot peen marking affect adoption of laser for marketing and engraving application?

Dear Sir/Madam, I am working on a project involving femtosecond pulsed lasers for my master's thesis. The project focuses on laser microprocessing of silicon. Thus I would be really interested by having any information on the laser microprocessing market of silicon or the market of silicon in general. Unfortunately we don't have enough funding now to purchase your book without being sure we can find what we are looking for. This is why I am requesting a free sample report.

Dear Market research Team, Before buying I would like to have a summary of the study.

Hi, I am interested in evaluate the US laser processing market and their applications that best fit the using of small-medium Fiber laser machines, which have an high precision and can work for small/medium metal pieces.

Currently selling Nitrogen Gas generators throughout Eastern Europe and CIS and would be interested in what this report has to say, in relation to Laser Cutting.

Interested in each of the applications by the market size of Laser Diode, DPSSL, and Fiber Laser. We especially would like to make sure the application.

Will increase in adoption of fiber laser will affect demand of CO2 laser?

I am a polish student and involved in some project about ultrafast lasers. I have found that they are commonly used in micromachining so I am also really interested in this market. Can you share the summary for this market study?

I am specially interested in fiber laser latest developments. And market opportunity for high power cutting machine in South Asia and Middle East regions.

Trying to understand the market for ultra-short pulse lasers for the processing of ultra-hard materials .

Hard to tell what your definition of "Laser Processing Market" is - seems like this includes more than just annual system sales. Can you please define it a bit further - what the study covers in this $17.4 billion market by 2020?

I need to know which companies you have considered for the study, are these companies produces laser machines or the user of the machines?

Interested in laser marking and engraving applications as it relates to tooling and tube identification specifically in aerospace and automotive industry segments.

Can you provide the qualitative and quantitative data for laser marking and engraving applications particularly for growth in the fiber and decline in CO2 and other solid state lasers?

I'm one of the co-founders in a startup focused on distributed manufacturing. I've been struggling to find a decent total addressable market number, and I'm pretty sure you guys have some of the data I need in your report. We don't have the funds to buy the full report. I'm wondering if you would be willing to sell part of the data so I can build a market case for investors. We are focused specifically on the laser fabrication market for metals and non-metals. For the time being out customers are mainly prototyping parts. I appreciate any help or advice you can offer.