Laser Technology Market by Type (Solid, Liquid, Gas), Product (Laser, System), Application (Laser Processing, Optical Communication, Optoelectronic Devices), Vertical (Telecommunications, Industrial) and Region - Global Forecast to 2027

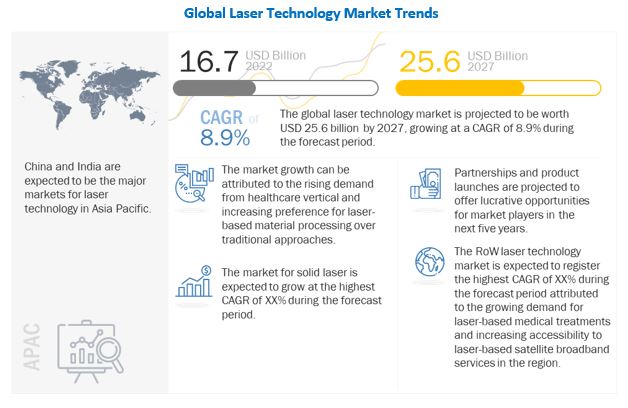

The global laser technology market size is projected to reach USD 25.6 billion by 2027, at a CAGR of 8.9% during the forecast period.

Rising demand from healthcare vertical and increasing production of nanodevices and micro devices are the major factors driving the growth of the market. Moreover, better performance of laser-based techniques over traditional material processing methods is another key factor for the growth of the laser technology industry.

To know about the assumptions considered for the study, Request for Free Sample Report

Latest Technological Trends in Laser Technology Market

Locus Beam Control (LBC) technology to improve the performance of laser systems without increasing the engine’s overall power

One of the major challenges faced in the laser technology market in recent years is the need to find a solution to improve the performance of solid-state laser machines without increasing the engine’s overall power.

Increasing power might not be the best solution as it might lead to various unexpected and adverse effects that might increase costs and lead to hazards. Earlier, several beam control technologies were developed by different manufacturers, but all of them were static beam control solutions, compromising the energy density of the laser beam.

Moreover, extensive research on conceptualizing a dynamic beam oscillation control solution revealed their ability to improve processing in the mid-range power band while keeping power consumption and cost-per-part as low as possible. This led to the development of the LBC technology, which offers similar cutting results without increasing the engine’s overall power. With LBC, there is no change in the power density of the laser beam, and it stays sharp and dense.

The beam is moved dynamically in pre-defined patterns depending on the material and the thickness being processed. This independent movement of the beam provides the necessary cutting width, allows removal of the materials in the cutting front with high efficiency, and still maintains the high-power dense profile of the beam.

Laser Technology Market Segment Overview

Solid laser held the largest share of the laser technology market in 2021

Solid lasers prevent the wastage of materials in the active medium, owing to which they are used extensively across medical and research applications like spectroscopy and imaging etc.

Solid lasers produce both continuous and pulsed output at a higher efficiency than He-Ne (Helium-Neon) and Argon lasers by about 2–3%, making them suitable for multiple applications across several domains such as telecommunications and automotive.

System segment held the largest share of the laser technology market in 2021

The ability of laser systems to perform a wide range of functions such as scribing, cutting, engraving, welding, and marking etc. is increasing their use across various verticals, such as industrial, commercial, automotive, and medical.

Moreover, increasing adoption by mid-sized and small manufacturers worldwide to expand their product lines and increase productivity is driving the demand for laser systems.

Laser processing held the largest share of the laser technology market in 2021

The laser processing segment is driven by its ability to provide higher quality, more reliable, and more precise output than conventional mechanical methods.

Increasing necessity for techniques to improve accuracy of material processing techniques and rising demand to reduce turn-around time is driving the adoption of laser technology for material processing applications across verticals such as automotive and semiconductor & electronics.

Telecommunications vertical held the largest share of the laser technology market in 2021

Laser communication provides high data transfer rates with low power consumption and is a highly secure medium for data transmission, thus driving their adoption in the telecommunications vertical. In the telecommunications vertical, laser technology is also used for signal strength optimization.

Asia Pacific held the largest share of the laser technology market in 2021

The market in Asia Pacific held the largest share (41.4%) of the overall market in 2021. Asia Pacific has been ahead in the adoption of laser technology products and solutions compared with other regions.

Growing manufacturing owing to increasing industrialization in the region is a key factor driving the adoption of laser technology for industrial processes such as drilling, welding, and cutting etc. Moreover, increasing R&D investments has resulted in development of laser systems which enable effective signal transmission over large distances.

To know about the assumptions considered for the study, download the pdf brochure

Top Laser Technology Companies - Key Market Players

The market is dominated by a few globally established players such as

-

Coherent (US),

-

IPG Photonics (US),

-

TRUMPF (Germany),

-

Han’s Laser (China), and

-

Jenoptik (Germany).

Laser Technology Market Report Scope

|

Report Metric |

Details |

| Estimated Market Size | USD 16.7 billion |

| Projected Market Size | USD 25.6 billion |

| Growth Rate | CAGR of 8.9%. |

|

Market Size Available for Years |

2018–2027 |

|

Base Year |

2021 |

|

Forecast Period |

2022–2027 |

|

Units |

Value (USD Million/Billion) |

|

Segments Covered |

Type, Product, Application, and Vertical |

|

Geographic Regions Covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies Covered |

Major Players: Coherent (US), IPG Photonics (US), Han’s Laser (China), Jenoptik (Germany), TRUMPF (Germany), Gravotech (France), Lumentum (US), Novanta (US), Bystronic Lasers (Switzerland), and Lumibrid (France), among other – Total 25 players have been covered. |

Laser Technology Market Dynamics

DRIVERS: Increasing demand for laser technology in healthcare vertical

In the healthcare vertical, laser technology finds applications in urology, dermatology, dentistry, and ophthalmology. With continuous technological advancements, the use of laser technology has broadened to treat various health issues, such as kidney stones, cancers, tumors, knee injuries, prostate problems, varicose veins, heart diseases, and glaucoma.

Ophthalmic laser assists in treating eye-related disorders such as glaucoma, retinal disorder, cataract, and macular degeneration. Laser technology is also being used in noninvasive medical treatments, such as hair removal, skin rejuvenation, tattoo removal, photodynamic therapy, selective laser trabeculoplasty, and low-level laser therapy. The sales of medical laser systems have increased, driven by the growing aging population, improving medical infrastructure, rising number of cosmetic surgeries, and increasing incidence of eye-related disorders.

RESTRAINT: High deployment cost

The applications of lasers are increasing in the automotive, semiconductor, industrial, medical, research, and defense, among many other verticals. Lasers required for varying processes, systems, and applications are in the range of a few hundred to thousands of watts.

High-power lasers are used in large-scale laser displays, medical, military, research, laser-induced nuclear fusion, and material processing (welding, cutting, drilling, soldering, marking, and surface modification) applications. Although laser processing helps reduce workforce and related costs in the automotive and manufacturing verticals, its deployment involves a high investment. Lasers are supported by various software, design files, durable parts, and laser sources. Additionally, they come with service packages and warranties to protect against expensive repairs in case of a malfunction. Hence, the growing demand for lasers for processing generates a requirement for low-cost solutions so that the technology can be adopted on a wide scale.

OPPORTUNITIES: Increasing use of lasers for optical communication

Optical communication uses light as a platform for transmission. Laser technology provides advantages over radio waves as light waves are packed tightly compared to sound waves.

Laser fiber optics have many fibers wrapped inside a cable, in which each cable contains many laser beams. Every laser beam has the potential to carry billions of bits of data. Thus, laser technology can transfer more data per second with strong signal quality.

The deployment of laser technology helps develop efficient communication systems with enhanced bandwidth and speed, compact size, and reduced price. Diode laser is used in almost every broadband communication system. The use of laser technology is increasing in optical communications as it provides wireless connectivity using air as the medium of communication. As the speed of light is faster than any other wave, it encourages using laser technology in verticals where air can be used as a medium.

CHALLENGES: Environmental concerns associated with use of rare-earth elements

The use of rare-earth metals such as neodymium, chromium, erbium, or ytterbium involves processing and refining using solid-state and fiber lasers, which poses a major threat of radioactive pollution caused by slurry tailings.

The refining processes use toxic acids, which, if mishandled, may result in severe environmental damage. Also, the use of rare-earth metals poses the risk of supply disruptions in the short term, and supply challenges for these metals may affect the deployment of clean energy technology in the years to come.

Prospects for the Laser Technology Market

Laser Technology Market Categorization

This research report categorizes the market based on type, product, application, vertical, and region.

By Type:

- Solid

- Liquid

- Gas

- Others (photonic crystal and industrial short pulse)

By Product:

- Laser

- System

By Application:

- Laser Processing

- Optical Communication

- Optoelectronic Devices

- Others (gyroscopes, rangefinders, and security systems)

By Vertical

- Telecommunications

- Semiconductor & Electronics

- Industrial

- Commercial

- Automotive

- Aerospace & Defense

- Medical

- Research

- Others (oil & gas, iron & steel, wood, retail, glass, tobacco, and plastics)

Laser Technology MarketBy Region:

- North America

- Europe

- Asia Pacific (APAC)

- Rest of the World (RoW)

Recent Developments in Laser Technology Market

- In June 2022, Coherent has introduced the OBIS XT Series of compact smart ultraviolet lasers aimed at expanding power capacity up to 150 milliwatts and features 320 nm wavelength. The compact size, low heat dissipation, and integrated controller abilities of the OBIS XT series offer simplified integration, thereby reducing time and costs.

- In June 2022, TRUMPF has introduced an automated loading solution for laser tube-cutting machines at the Tube trade fair in Dusseldorf, Germany. The new solution automatically transfers tubes from the storage system to the tube-cutting machine. Through this, they allow to reduce downtime and improve productivity.

- In May 2022, Gravotech has introduced the LW2 laser marking system, which has a compact design and is available in several versions depending on the laser source, such as fiber or hybrid. It is suitable for different types of permanent marking and identification needs, such as various metals (aluminum, steel, and copper) and plastics.

- In April 2022, Lumentum introduced the FemtoBlade laser system, the second generation of the company’s portfolio of high-precision ultrafast industrial lasers. The new system features a modular design that offers high power at high repetition rates, thus ensuring high flexibility and fast processing speed.

Frequently Asked Questions (FAQs):

What is the total CAGR expected to be recorded for the laser technology market during 2022-2027?

The global laser technology market is expected to record a CAGR of 8.9% from 2022–2027.

What are the driving factors for the laser technology market?

Increasing demand for laser technology in healthcare vertical and increasing preference for laser-based material processing over traditional approaches are key driving factors.

Which are the significant players operating in the laser technology market?

Coherent (US), IPG Photonics (US), TRUMPF (Germany), Han’s Laser (China), and Jenoptik (Germany) are some of the major companies operating in the laser technology market.

Which region will lead the laser technology market in the future?

Asia Pacific is expected to lead the laser technology market during the forecast period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 32)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 INCLUSIONS AND EXCLUSIONS

TABLE 1 LASER TECHNOLOGY MARKET: INCLUSIONS AND EXCLUSIONS

1.4 STUDY SCOPE

1.4.1 MARKETS COVERED

FIGURE 1 MARKET: SEGMENTATION

FIGURE 2 MARKET: REGIONAL SCOPE

1.4.2 YEARS CONSIDERED

1.5 CURRENCY CONSIDERED

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 37)

2.1 RESEARCH DATA

FIGURE 3 LASER TECHNOLOGY MARKET: RESEARCH DESIGN

2.1.1 SECONDARY AND PRIMARY RESEARCH

2.1.2 SECONDARY DATA

2.1.2.1 List of major secondary sources

2.1.2.2 Key data from secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Primary interviews with experts

2.1.3.2 Key data from primary sources

2.1.3.3 Key insights

2.1.3.4 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE): REVENUE GENERATED BY COMPANIES FROM MARKET

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Deriving market size through bottom-up approach (demand side)

FIGURE 5 BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Deriving market size through top-down approach (supply side)

FIGURE 6 TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.4 ASSUMPTIONS

FIGURE 8 ASSUMPTIONS

2.5 LIMITATIONS AND RISK ASSESSMENT

TABLE 2 LIMITATIONS AND ASSOCIATED RISKS

3 EXECUTIVE SUMMARY (Page No. - 48)

FIGURE 9 SOLID LASER SEGMENT TO HOLD LARGEST SHARE OF LASER TECHNOLOGY MARKET, BY TYPE, DURING FORECAST PERIOD

FIGURE 10 SYSTEM SEGMENT TO ACCOUNT FOR LARGER SHARE OF MARKET, BY PRODUCT, DURING FORECAST PERIOD

FIGURE 11 LASER PROCESSING SEGMENT TO HOLD LARGEST SHARE OF MARKET, BY APPLICATION, DURING FORECAST PERIOD

FIGURE 12 TELECOMMUNICATIONS SEGMENT TO ACCOUNT FOR LARGEST SHARE OF LASER TECHNOLOGY MARKET, BY VERTICAL, DURING FORECAST PERIOD

FIGURE 13 ASIA PACIFIC MARKET TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 52)

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN LASER TECHNOLOGY MARKET

FIGURE 14 RISING DEMAND FOR LASER TECHNOLOGY-BASED DEVICES IN HEALTHCARE VERTICAL

4.2 MARKET, BY TYPE

FIGURE 15 SOLID LASER SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

4.3 MARKET, BY PRODUCT

FIGURE 16 LASER SEGMENT TO EXHIBIT HIGHER CAGR DURING FORECAST PERIOD

4.4 LASER TECHNOLOGY MARKET, BY APPLICATION

FIGURE 17 OPTICAL COMMUNICATION SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4.5 MARKET, BY VERTICAL

FIGURE 18 TELECOMMUNICATIONS VERTICAL TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

4.6 MARKET, BY REGION

FIGURE 19 GERMANY TO ACCOUNT FOR LARGEST SHARE OF GLOBAL LASER TECHNOLOGY MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 56)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 20 LASER TECHNOLOGY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Increasing demand for laser technology in healthcare vertical

5.2.1.2 Better performance of laser-based techniques compared with traditional material processing methods

5.2.1.3 Rising preference for laser-based material processing over traditional approaches

5.2.1.4 Shift toward production of nanodevices and microdevices

FIGURE 21 GLOBAL SEMICONDUCTOR SILICON MATERIAL SALES IN MILLION SQUARE INCH (MSI), 2018–2021

5.2.1.5 Growing adoption of smart manufacturing techniques

FIGURE 22 LASER TECHNOLOGY MARKET: DRIVERS AND THEIR IMPACT

5.2.2 RESTRAINTS

5.2.2.1 High deployment cost

FIGURE 23 MARKET: RESTRAINTS AND THEIR IMPACT

5.2.3 OPPORTUNITIES

5.2.3.1 Growing use of laser technology for quality checks in various verticals

5.2.3.2 Increasing use of laser technology for optical communication

FIGURE 24 ORGANIZATION FOR ECONOMIC CO-OPERATION AND DEVELOPMENT (OECD) FIBER BROADBAND SUBSCRIPTION STATISTICS FOR TOP 10 COUNTRIES (AS OF JUNE 2021)

FIGURE 25 MARKET: OPPORTUNITIES AND THEIR IMPACT

5.2.4 CHALLENGES

5.2.4.1 Environmental concerns associated with use of rare-earth elements

5.2.4.2 Technical complexities related to high-power lasers

5.2.4.3 Contamination of materials during laser welding process

FIGURE 26 LASER TECHNOLOGY MARKET: CHALLENGES AND THEIR IMPACT

5.3 VALUE CHAIN ANALYSIS

FIGURE 27 VALUE CHAIN ANALYSIS: MAJOR VALUE ADDED BY ORIGINAL EQUIPMENT MANUFACTURERS AND LASER SYSTEM INTEGRATORS

5.3.1 RAW MATERIAL SUPPLIERS

5.3.2 MANUFACTURERS

5.3.3 DISTRIBUTORS

5.3.4 END USERS

5.3.5 AFTER-SALES SERVICE PROVIDERS

5.4 ECOSYSTEM ANALYSIS

FIGURE 28 GLOBAL LASER TECHNOLOGY MARKET: ECOSYSTEM

TABLE 3 MARKET: ECOSYSTEM

5.5 PRICING ANALYSIS

5.5.1 AVERAGE SELLING PRICE OF LASER SYSTEMS OFFERED BY TOP 3 MARKET PLAYERS, BY APPLICATION

FIGURE 29 AVERAGE SELLING PRICE OF LASER SYSTEMS OFFERED BY TOP 3 MARKET PLAYERS, BY APPLICATION

TABLE 4 AVERAGE SELLING PRICE OF LASER SYSTEMS OFFERED BY TOP 3 MARKET PLAYERS, BY APPLICATION

5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER’S BUSINESSES

FIGURE 30 TRENDS/DISRUPTIONS IMPACTING CUSTOMER’S BUSINESSES

5.7 TECHNOLOGY ANALYSIS

5.7.1 ALL-SILICON LASER

5.7.2 HOLMIUM-DOPED LASER

5.7.3 VERTICAL CAVITY SURFACE-EMITTING LASER (VCSEL)

5.7.4 LOCUS BEAM CONTROL (LBC)

5.8 PORTER’S FIVE FORCES ANALYSIS

TABLE 5 LASER TECHNOLOGY MARKET: PORTER’S FIVE FORCES ANALYSIS

5.8.1 THREAT OF NEW ENTRANTS

5.8.2 THREAT OF SUBSTITUTES

5.8.3 BARGAINING POWER OF SUPPLIERS

5.8.4 BARGAINING POWER OF BUYERS

5.8.5 INTENSITY OF COMPETITIVE RIVALRY

5.9 KEY STAKEHOLDERS AND BUYING CRITERIA

5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 31 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS, BY TOP 3 VERTICALS

TABLE 6 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS, BY TOP 3 VERTICALS (%)

5.9.2 BUYING CRITERIA

FIGURE 32 KEY BUYING CRITERIA FOR TOP 3 VERTICALS

TABLE 7 KEY BUYING CRITERIA FOR TOP 3 VERTICALS

5.10 CASE STUDIES

5.10.1 SHIM SHACK ADOPTS IPG PHOTONICS FIBER LASERS TO REDUCE TIME AND COST OF ITS METAL FABRICATION PROCESS

5.10.2 PAPER SUSHI AND GUERILLA OUTFITTERS ADOPT EPILOG LASER’S LASER CUTTING AND ENGRAVING MACHINE TO EXPAND THEIR PRODUCT LINES

5.11 TRADE ANALYSIS

FIGURE 33 IMPORT DATA FOR HS CODE 901320, BY COUNTRY, 2017–2021 (USD MILLION)

FIGURE 34 EXPORT DATA FOR HS CODE 901320, BY COUNTRY, 2017–2021 (USD MILLION)

5.12 PATENT ANALYSIS

FIGURE 35 ANALYSIS OF PATENTS GRANTED IN MARKET

TABLE 8 LIST OF MAJOR PATENTS RELATED TO MARKET

5.13 KEY CONFERENCES AND EVENTS, 2022–2023

TABLE 9 LASER TECHNOLOGY MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

5.14 LASER PROCESSING CONFIGURATIONS

5.14.1 TYPES OF LASER PROCESSING CONFIGURATIONS

5.14.1.1 Fixed beam

5.14.1.2 Moving beam

5.14.1.3 Hybrid

5.15 TARIFF AND REGULATORY LANDSCAPE

5.15.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 10 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 11 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 13 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.15.2 REGULATORY STANDARDS

5.15.2.1 IEC 60825-1:2014

5.15.2.2 ANSI Z136.1

5.15.2.3 Federal Laser Product Performance Standard (FLPPS)

5.15.2.4 International Commission on Non-Ionizing Radiation Protection (ICNIRP) (2013)

6 LASER TECHNOLOGY MARKET, BY TYPE (Page No. - 85)

6.1 INTRODUCTION

FIGURE 36 MARKET, BY TYPE

FIGURE 37 SOLID LASER SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 14 MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 15 MARKET, BY TYPE, 2022–2027 (USD MILLION)

6.2 SOLID LASER

6.2.1 GROWING ADOPTION OF SOLID LASERS TO PREVENT MATERIAL WASTAGE IN ACTIVE MEDIUM

TABLE 16 SOLID LASER: LASER TECHNOLOGY MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 17 SOLID LASER: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 18 SOLID LASER: MARKET, BY SUBTYPE, 2018–2021 (USD MILLION)

TABLE 19 SOLID LASER: MARKET, BY SUBTYPE, 2022–2027 (USD MILLION)

6.2.2 FIBER LASER

6.2.3 RUBY LASER

6.2.4 YTTRIUM ALUMINUM GARNET (YAG) LASER

6.2.5 SEMICONDUCTOR LASER

6.2.6 THIN-DISK LASER

6.3 LIQUID LASER

6.3.1 RISING DEMAND FOR LIQUID LASERS IN AEROSPACE & DEFENSE VERTICAL TO ELIMINATE SURFACE-TO-AIR RISKS

TABLE 20 LIQUID LASER: LASER TECHNOLOGY MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 21 LIQUID LASER: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 22 LIQUID LASER: MARKET, BY SUBTYPE, 2018–2021 (USD MILLION)

TABLE 23 LIQUID LASER: MARKET, BY SUBTYPE, 2022–2027 (USD MILLION)

6.3.2 X-RAY LASER

6.3.3 DYE LASER

6.4 GAS LASER

6.4.1 RISING GAS LASER DEMAND FOR REMOTE SENSING

TABLE 24 GAS LASER: LASER TECHNOLOGY MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 25 GAS LASER: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 26 GAS LASER: MARKET, BY SUBTYPE, 2018–2021 (USD MILLION)

TABLE 27 GAS LASER: MARKET, BY SUBTYPE, 2022–2027 (USD MILLION)

6.4.2 CO2 LASER

6.4.3 EXCIMER LASER

6.4.4 HELIUM-NEON (HE-NE) LASER

6.4.5 ARGON LASER

6.4.6 CHEMICAL LASER

6.5 OTHERS

TABLE 28 OTHERS: LASER TECHNOLOGY MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 29 OTHERS: MARKET, BY REGION, 2022–2027 (USD MILLION)

7 LASER TECHNOLOGY MARKET, BY PRODUCT (Page No. - 99)

7.1 INTRODUCTION

FIGURE 38 MARKET FOR LASER SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 30 MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 31 MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

7.2 SYSTEM

7.2.1 GROWING DEMAND FOR LASER SYSTEMS IN INDUSTRIAL, COMMERCIAL, AUTOMOTIVE, AND MEDICAL VERTICALS

TABLE 32 SYSTEM: LASER TECHNOLOGY MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 33 SYSTEM: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3 LASER

7.3.1 HIGH DEMAND FOR DIFFERENT LASER TYPES FROM VARIOUS VERTICALS

TABLE 34 LASER: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 35 LASER: MARKET, BY REGION, 2022–2027 (USD MILLION)

8 LASER TECHNOLOGY MARKET, BY APPLICATION (Page No. - 103)

8.1 INTRODUCTION

FIGURE 39 MARKET, BY APPLICATION

FIGURE 40 MARKET FOR OPTICAL COMMUNICATION TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 36 MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 37 MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

8.2 LASER PROCESSING

8.2.1 GROWING ADOPTION OF LASER TECHNOLOGY FOR MATERIAL PROCESSING

TABLE 38 LASER PROCESSING: LASER TECHNOLOGY MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 39 LASER PROCESSING: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.2.2 MACRO PROCESSING

8.2.2.1 Cutting

8.2.2.1.1 Fusion cutting

8.2.2.1.2 Flame cutting

8.2.2.1.3 Sublimation cutting

8.2.2.2 Drilling

8.2.2.2.1 Single-pulse drilling

8.2.2.2.2 Percussion drilling

8.2.2.2.3 Trepanning drilling

8.2.2.2.4 Helical drilling

8.2.2.3 Welding

8.2.2.4 Marking and engraving

8.2.3 MICROPROCESSING

8.2.4 ADVANCED PROCESSING

8.3 OPTICAL COMMUNICATION

8.3.1 RISING DEMAND FOR LASER TECHNOLOGY-BASED BROADBAND COMMUNICATION SYSTEMS

TABLE 40 OPTICAL COMMUNICATION: LASER TECHNOLOGY MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 41 OPTICAL COMMUNICATION: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.4 OPTOELECTRONIC DEVICES

8.4.1 GROWING DEMAND FOR OPTOELECTRONICS EQUIPMENT IN TELECOMMUNICATIONS AND HEALTHCARE VERTICALS

TABLE 42 OPTOELECTRONIC DEVICES: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 43 OPTOELECTRONIC DEVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.5 OTHERS

TABLE 44 OTHERS: LASER TECHNOLOGY MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 45 OTHERS: MARKET, BY REGION, 2022–2027 (USD MILLION)

9 LASER TECHNOLOGY MARKET, BY VERTICAL (Page No. - 112)

9.1 INTRODUCTION

FIGURE 41 MARKET, BY VERTICAL

FIGURE 42 MARKET FOR TELECOMMUNICATIONS VERTICAL TO HOLD LARGEST SHARE DURING FORECAST PERIOD

TABLE 46 MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 47 MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

9.2 TELECOMMUNICATIONS

9.2.1 GROWING ADOPTION OF LASER TECHNOLOGY TO ACHIEVE HIGH DATA TRANSFER RATES

TABLE 48 TELECOMMUNICATIONS: LASER TECHNOLOGY MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 49 TELECOMMUNICATIONS: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.3 INDUSTRIAL

9.3.1 GROWING USE OF LASER TECHNOLOGY IN MANUFACTURING COMPANIES

TABLE 50 INDUSTRIAL: LASER TECHNOLOGY MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 51 INDUSTRIAL: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.4 SEMICONDUCTOR & ELECTRONICS

9.4.1 RISING USE OF LASER TECHNOLOGY TO MARK SEMICONDUCTOR MATERIALS

TABLE 52 SEMICONDUCTOR & ELECTRONICS: LASER TECHNOLOGY MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 53 SEMICONDUCTOR & ELECTRONICS: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.4.2 MEMORY

9.4.3 MICROPROCESSOR

9.4.4 PHOTONIC INTEGRATED CIRCUIT (PIC)

9.5 COMMERCIAL

9.5.1 GROWING ADOPTION OF LASER TECHNOLOGY FOR PROJECTING, MARKING, AND PRINTING APPLICATIONS

TABLE 54 COMMERCIAL: LASER TECHNOLOGY MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 55 COMMERCIAL: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.6 AEROSPACE & DEFENSE

9.6.1 GROWING ADOPTION OF LASER TECHNOLOGY TO DEVELOP ADVANCED DEFENSE SYSTEMS

TABLE 56 AEROSPACE & DEFENSE: LASER TECHNOLOGY MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 57 AEROSPACE & DEFENSE: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.6.2 AEROSPACE VERTICAL

9.6.3 MISSILE VERTICAL

9.6.4 SPACE VERTICAL

9.6.5 COMBAT VEHICLE VERTICAL

9.6.6 AMMUNITION & WEAPON VERTICAL

9.7 AUTOMOTIVE

9.7.1 RISING DEMAND FOR LASER MARKING SYSTEMS TO IMPRINT VEHICLE IDENTIFICATION NUMBERS (VINS)

TABLE 58 AUTOMOTIVE: LASER TECHNOLOGY MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 59 AUTOMOTIVE: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.8 MEDICAL

9.8.1 RISING USE OF LASER TECHNOLOGY IN FLOW CYTOMETRY, CELL SORTING, RETINAL SCANNING, AND PLASTIC JOINING

TABLE 60 MEDICAL: LASER TECHNOLOGY MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 61 MEDICAL: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.8.2 LASER VISION CORRECTION

9.8.3 CONFOCAL MICROSCOPE

9.8.4 OPTOGENETICS

9.9 RESEARCH

9.9.1 RISING DEMAND FOR LASER TECHNOLOGY IN SPACE COMMUNICATION RESEARCH

TABLE 62 RESEARCH: LASER TECHNOLOGY MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 63 RESEARCH: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.10 OTHERS

TABLE 64 OTHERS: LASER TECHNOLOGY MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 65 OTHERS: MARKET, BY REGION, 2022–2027 (USD MILLION)

10 LASER TECHNOLOGY MARKET, BY REGION (Page No. - 127)

10.1 INTRODUCTION

FIGURE 43 INDIA TO EXHIBIT HIGHEST CAGR IN GLOBAL MARKET, BY COUNTRY, DURING FORECAST PERIOD

FIGURE 44 ROW TO EXHIBIT HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

TABLE 66 LASER TECHNOLOGY MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 67 MARKET, BY REGION, 2022–2027 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 45 NORTH AMERICA: SNAPSHOT OF LASER TECHNOLOGY MARKET

TABLE 68 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 69 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 70 NORTH AMERICA: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 71 NORTH AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 72 NORTH AMERICA: LASER TECHNOLOGY MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 73 NORTH AMERICA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 74 NORTH AMERICA: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 75 NORTH AMERICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 76 NORTH AMERICA: MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 77 NORTH AMERICA: MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

10.2.1 US

10.2.1.1 Growing adoption of laser technology in defense vertical to develop laser-based weapons

10.2.2 CANADA

10.2.2.1 Rising applications of laser technology in aerospace & defense vertical

10.2.3 MEXICO

10.2.3.1 Rapid adoption of automation technologies in industrial and manufacturing sectors

10.3 EUROPE

FIGURE 46 EUROPE: SNAPSHOT OF LASER TECHNOLOGY MARKET

TABLE 78 EUROPE: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 79 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 80 EUROPE: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 81 EUROPE: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 82 EUROPE: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 83 EUROPE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 84 EUROPE: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 85 EUROPE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 86 EUROPE: MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 87 EUROPE: MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

10.3.1 GERMANY

10.3.1.1 Large presence of prominent automobile and medical device manufacturing companies

10.3.2 FRANCE

10.3.2.1 Growing demand for laser technology in automotive, telecommunications, and healthcare verticals

10.3.3 UK

10.3.3.1 Rising focus of companies on developing advanced electronics using laser technology

10.3.4 REST OF EUROPE

10.4 ASIA PACIFIC

FIGURE 47 ASIA PACIFIC: SNAPSHOT OF LASER TECHNOLOGY MARKET

TABLE 88 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 89 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 90 ASIA PACIFIC: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 91 ASIA PACIFIC: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 92 ASIA PACIFIC: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 93 ASIA PACIFIC: LASER TECHNOLOGY MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 94 ASIA PACIFIC: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 95 ASIA PACIFIC: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 96 ASIA PACIFIC: MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 97 ASIA PACIFIC: MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

10.4.1 CHINA

10.4.1.1 Rising use of laser technology in automobile manufacturing

10.4.2 JAPAN

10.4.2.1 Growing demand for electric and hybrid cars

10.4.3 INDIA

10.4.3.1 Government-led initiatives to boost domestic manufacturing

10.4.4 SOUTH KOREA

10.4.4.1 Rising demand for lasers in semiconductor & electronics vertical

10.4.5 REST OF ASIA PACIFIC

10.5 ROW

FIGURE 48 SOUTH AMERICA TO REGISTER HIGHER CAGR IN ROW LASER TECHNOLOGY MARKET DURING FORECAST PERIOD

TABLE 98 ROW: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 99 ROW: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 100 ROW: LASER TECHNOLOGY MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 101 ROW: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 102 ROW: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 103 ROW: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 104 ROW: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 105 ROW: LASER TECHNOLOGY MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 106 ROW: MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 107 ROW: MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

10.5.1 MIDDLE EAST & AFRICA

10.5.1.1 Rising demand for laser processing systems in automotive industry

10.5.2 SOUTH AMERICA

10.5.2.1 Increasing use of laser technology in Chile and Argentina

11 COMPETITIVE LANDSCAPE (Page No. - 150)

11.1 INTRODUCTION

TABLE 108 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN LASER TECHNOLOGY MARKET

11.2 REVENUE ANALYSIS OF TOP 5 PLAYERS

FIGURE 49 TOP 5 PLAYERS INMARKET, 2017–2021

11.3 MARKET SHARE ANALYSIS

TABLE 109 MARKET: MARKET SHARE OF KEY COMPANIES

11.4 COMPANY EVALUATION QUADRANT, 2021

11.4.1 STARS

11.4.2 EMERGING LEADERS

11.4.3 PERVASIVE PLAYERS

11.4.4 PARTICIPANTS

FIGURE 50 LASER TECHNOLOGY MARKET (GLOBAL): COMPANY EVALUATION QUADRANT, 2021

11.5 SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION QUADRANT, 2021

11.5.1 PROGRESSIVE COMPANIES

11.5.2 RESPONSIVE COMPANIES

11.5.3 DYNAMIC COMPANIES

11.5.4 STARTING BLOCKS

FIGURE 51 MARKET (GLOBAL): SME EVALUATION QUADRANT, 2021

11.6 LASER TECHNOLOGY MARKET: COMPANY FOOTPRINT

TABLE 110 TYPE: COMPANY FOOTPRINT

TABLE 111 PRODUCT: COMPANY FOOTPRINT

TABLE 112 APPLICATION: COMPANY FOOTPRINT

TABLE 113 VERTICAL: COMPANY FOOTPRINT

TABLE 114 REGION: COMPANY FOOTPRINT

TABLE 115 COMPANY FOOTPRINT

11.7 COMPETITIVE BENCHMARKING

TABLE 116 MARKET: DETAILED LIST OF KEY STARTUPS/SMES

TABLE 117 MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

11.8 COMPETITIVE SITUATIONS AND TRENDS

11.8.1 PRODUCT LAUNCHES

TABLE 118 LASER TECHNOLOGY MARKET: PRODUCT LAUNCHES, FEBRUARY 2021– JUNE 2022

11.8.2 DEALS

TABLE 119 MARKET: DEALS, JANUARY 2021–APRIL 2022

11.8.3 OTHERS

TABLE 120 MARKET: OTHERS, MAY 2021–JUNE 2022

12 COMPANY PROFILES (Page No. - 174)

(Business overview, Products offered, Recent Developments, MNM view)*

12.1 INTRODUCTION

12.2 KEY PLAYERS

12.2.1 600 GROUP

TABLE 121 600 GROUP: BUSINESS OVERVIEW

FIGURE 52 600 GROUP: COMPANY SNAPSHOT

TABLE 122 600 GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

12.2.2 BYSTRONIC LASERS

TABLE 123 BYSTRONIC LASERS: BUSINESS OVERVIEW

FIGURE 53 BYSTRONIC LASERS: COMPANY SNAPSHOT

TABLE 124 BYSTRONIC LASERS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 125 BYSTRONIC LASERS: PRODUCT LAUNCHES

12.2.3 COHERENT

TABLE 126 COHERENT: BUSINESS OVERVIEW

FIGURE 54 COHERENT: COMPANY SNAPSHOT

TABLE 127 COHERENT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 128 COHERENT: PRODUCT LAUNCHES

12.2.4 EPILOG LASER

TABLE 129 EPILOG LASER: BUSINESS OVERVIEW

TABLE 130 EPILOG LASER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 131 EPILOG LASER: PRODUCT LAUNCHES

TABLE 132 EPILOG LASER: OTHERS

12.2.5 EUROLASER

TABLE 133 EUROLASER: BUSINESS OVERVIEW

TABLE 134 EUROLASER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

12.2.6 GRAVOTECH

TABLE 135 GRAVOTECH: BUSINESS OVERVIEW

TABLE 136 GRAVOTECH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 137 GRAVOTECH: PRODUCT LAUNCHES

12.2.7 HAN’S LASER

TABLE 138 HAN’S LASER: BUSINESS OVERVIEW

FIGURE 55 HAN’S LASER: COMPANY SNAPSHOT

TABLE 139 HAN’S LASER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

12.2.8 IPG PHOTONICS

TABLE 140 IPG PHOTONICS: BUSINESS OVERVIEW

FIGURE 56 IPG PHOTONICS: COMPANY SNAPSHOT

TABLE 141 IPG PHOTONICS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 142 IPG PHOTONICS: PRODUCT LAUNCHES

12.2.9 JENOPTIK

TABLE 143 JENOPTIK: BUSINESS OVERVIEW

FIGURE 57 JENOPTIK: COMPANY SNAPSHOT

TABLE 144 JENOPTIK: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 145 JENOPTIK: PRODUCT LAUNCHES

TABLE 146 JENOPTIK: OTHERS

12.2.10 LASERSTAR

TABLE 147 LASERSTAR: BUSINESS OVERVIEW

TABLE 148 PRODUCTS/SOLUTIONS/SERVICES OFFERED

12.2.11 LUMENTUM

TABLE 149 LUMENTUM: BUSINESS OVERVIEW

FIGURE 58 LUMENTUM: COMPANY SNAPSHOT

TABLE 150 LUMENTUM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 151 LUMENTUM: PRODUCT LAUNCHES

12.2.12 LUMIBIRD

TABLE 152 LUMIBIRD: BUSINESS OVERVIEW

FIGURE 59 LUMIBIRD: COMPANY SNAPSHOT

TABLE 153 LUMIBIRD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 154 LUMIBIRD: PRODUCT LAUNCHES

12.2.13 MKS INSTRUMENTS

TABLE 155 MKS INSTRUMENTS: BUSINESS OVERVIEW

FIGURE 60 MKS INSTRUMENTS: COMPANY SNAPSHOT

TABLE 156 MKS INSTRUMENTS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 157 MKS INSTRUMENTS: DEALS

12.2.14 NOVANTA

TABLE 158 NOVANTA: BUSINESS OVERVIEW

FIGURE 61 NOVANTA: COMPANY SNAPSHOT

TABLE 159 NOVANTA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 160 NOVANTA: PRODUCT LAUNCHES

12.2.15 TRUMPF

TABLE 161 TRUMPF: BUSINESS OVERVIEW

FIGURE 62 TRUMPF: COMPANY SNAPSHOT

TABLE 162 TRUMPF: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 163 TRUMPF: PRODUCT LAUNCHES

12.3 OTHER PLAYERS

12.3.1 ALPHALAS GMBH

TABLE 164 ALPHALAS GMBH: COMPANY OVERVIEW

12.3.2 APPLIED LASER TECHNOLOGY, INC.

TABLE 165 APPLIED LASER TECHNOLOGY, INC.: COMPANY OVERVIEW

12.3.3 ARIMA LASERS CORP.

TABLE 166 ARIMA LASERS CORP.: COMPANY OVERVIEW

12.3.4 FOCUSLIGHT TECHNOLOGIES

TABLE 167 FOCUSLIGHT TECHNOLOGIES: COMPANY OVERVIEW

12.3.5 INNO LASER TECHNOLOGY CO., LTD.

TABLE 168 INNO LASER TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

12.3.6 NKT PHOTONICS GMBH

TABLE 169 NKT PHOTONICS GMBH: COMPANY OVERVIEW

12.3.7 PHOTONICS INDUSTRIES

TABLE 170 PHOTONICS INDUSTRIES: COMPANY OVERVIEW

12.3.8 SFX LASER

TABLE 171 SFX LASER: COMPANY OVERVIEW

12.3.9 TOPTICA PHOTONICS

TABLE 172 TOPTICA PHOTONICS: COMPANY OVERVIEW

12.3.10 VESCENT PHOTONICS LLC

TABLE 173 VESCENT PHOTONICS LLC: COMPANY OVERVIEW

*Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

13 ADJACENT AND RELATED MARKETS (Page No. - 221)

13.1 INTRODUCTION

13.2 LIMITATIONS

13.3 INDUSTRIAL SENSORS MARKET, BY TYPE

13.3.1 INTRODUCTION

13.4 TERAHERTZ IMAGING AND SPECTROSCOPY APPLICATIONS

TABLE 174 TERAHERTZ TECHNOLOGY IMAGING AND SPECTROSCOPY MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 175 TERAHERTZ TECHNOLOGY IMAGING AND SPECTROSCOPY MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

13.4.1 LABORATORY RESEARCH

13.4.1.1 Terahertz technology is useful in experiments conducted for variety of purposes

13.4.1.2 Material characterization

13.4.1.3 Biochemistry

13.4.1.4 Plasma diagnostics

TABLE 176 LABORATORY RESEARCH: TERAHERTZ TECHNOLOGY MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 177 LABORATORY RESEARCH: TERAHERTZ TECHNOLOGY MARKET, BY REGION, 2022–2027 (USD MILLION)

13.4.2 MEDICAL AND HEALTHCARE

13.4.2.1 Unique features make terahertz imaging attractive for medical applications

13.4.2.2 Oncology

13.4.2.3 Dentistry

13.4.2.4 Dermatology

13.4.2.5 Tomography

TABLE 178 MEDICAL AND HEALTHCARE: TERAHERTZ TECHNOLOGY MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 179 MEDICAL AND HEALTHCARE: TERAHERTZ TECHNOLOGY MARKET, BY REGION, 2022–2027 (USD MILLION)

13.4.3 MILITARY AND HOMELAND SECURITY

13.4.3.1 Terahertz waves find applications in airport passenger and baggage screening

13.4.3.2 Passenger screening

13.4.3.3 Landmine and improvised explosive device detection

TABLE 180 MILITARY AND HOMELAND SECURITY: TERAHERTZ TECHNOLOGY MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 181 MILITARY AND HOMELAND SECURITY: TERAHERTZ TECHNOLOGY MARKET, BY REGION, 2022–2027 (USD MILLION)

13.4.4 INDUSTRIAL NON-DESTRUCTIVE TESTING (NDT)

13.4.4.1 Imaging and spectroscopic capabilities of terahertz technology make it suitable for investigating material integrity

13.4.4.2 Aerospace

13.4.4.3 Semiconductor and electronics

13.4.4.4 Pharmaceuticals

TABLE 182 INDUSTRIAL NDT: TERAHERTZ TECHNOLOGY MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 183 INDUSTRIAL NDT: TERAHERTZ TECHNOLOGY MARKET, BY REGION, 2022–2027 (USD MILLION)

13.5 TERAHERTZ COMMUNICATION SYSTEM APPLICATIONS

TABLE 184 TERAHERTZ TECHNOLOGY COMMUNICATION SYSTEMS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 185 TERAHERTZ TECHNOLOGY COMMUNICATION SYSTEMS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

13.5.1 SATELLITE COMMUNICATIONS

13.5.1.1 Use of terahertz technology facilitates users with larger bandwidth

TABLE 186 SATELLITE COMMUNICATIONS: TERAHERTZ TECHNOLOGY MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 187 SATELLITE COMMUNICATIONS: TERAHERTZ TECHNOLOGY MARKET, BY REGION, 2022–2027 (USD MILLION)

13.5.2 TACTICAL/MILITARY COMMUNICATIONS

13.5.2.1 Terahertz properties such as high frequency and short wavelength are suitable for military communication applications

TABLE 188 TACTICAL/MILITARY COMMUNICATIONS: TERAHERTZ TECHNOLOGY MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 189 TACTICAL/MILITARY COMMUNICATIONS: TERAHERTZ TECHNOLOGY MARKET, BY REGION, 2022–2027 (USD MILLION)

13.5.3 OUTDOOR/INDOOR WIRELESS COMMUNICATIONS

13.5.3.1 Terahertz waves can be used for short-distance outdoor/indoor wireless communication applications

TABLE 190 OUTDOOR/INDOOR WIRELESS COMMUNICATIONS: TERAHERTZ TECHNOLOGY MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 191 OUTDOOR/INDOOR WIRELESS COMMUNICATIONS: TERAHERTZ TECHNOLOGY MARKET, BY REGION, 2022–2027 (USD MILLION)

14 APPENDIX (Page No. - 235)

14.1 INSIGHTS FROM INDUSTRY EXPERTS

14.2 DISCUSSION GUIDE

14.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.4 CUSTOMIZATION OPTIONS

14.5 RELATED REPORTS

14.6 AUTHOR DETAILS

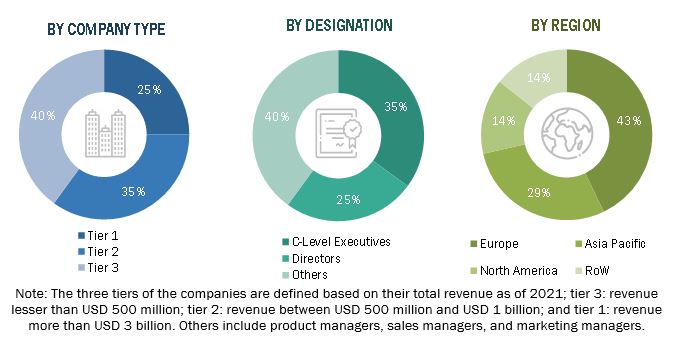

The study involved four major activities in estimating the current size of the laser technology market. Exhaustive secondary research has been done to collect information on the market, peer market, and parent market. To validate these findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Finally, both top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation methods have been used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to identify and collect information relevant to this study. The secondary sources include annual reports, press releases, and investor presentations of companies; white papers, certified publications, and articles from recognized authors; directories; and databases. Secondary research has been mainly conducted to obtain key information about the industry’s supply chain, value chain of the market, total pool of key players, market classification and segmentation according to industry trends, geographic markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both supply and demand sides have been interviewed to obtain the qualitative and quantitative information relevant to this report. Primary sources from the supply side include experts such as CEOs, VPs, marketing directors, technology and innovation directors, application developers, application users, and related executives from various key companies and organizations operating in the laser technology ecosystem. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches have been used to estimate and validate the size of the overall laser technology market and the market based on segments. The research methodology used to estimate the market size has been given below:

- Major players operating in the laser technology market have been identified and considered for the report through extensive secondary research.

- The supply chain and market size of the laser technology market, both in terms of value and units, have been estimated/determined through secondary and primary research processes.

- All estimations and calculations, including percentage share, revenue mix, splits, and breakdowns have been determined through use of secondary sources which are further verified through primary sources.

Global laser technology market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market has been validated using both top-down and bottom-up approaches.

Report Objectives:

- To describe and forecast the laser technology market, in terms of value, based on type, product, application, and vertical

- To forecast the market size, in terms of value, for four main regions—North America, Europe, Asia Pacific (APAC), and the Rest of World (RoW)

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the market growth

- To provide a detailed overview of the value chain of the laser technology ecosystem

- To strategically analyze micro markets with respect to individual growth trends, prospects, and contributions to the total market

- To analyze the opportunities in the market for stakeholders and details of the competitive landscape of the market

- To strategically profile the key players and comprehensively analyze their market position in terms of ranking and core competencies

- To analyze the major growth strategies implemented by key market players, such as contracts, agreements, acquisitions, product launches, expansions, and partnerships

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports according to the client’s specific requirements. The available customization options are as follows:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Laser Technology Market

As a medium industry player, we would like to get informative data regarding the prospects of laser application in the future market so that we can reach to our fruitful planning on the purpose of the best sales of laser equipment.

I need to learn detailed laser market share from 2019 to 2025 to use in my thesis. I would be very happy especially if it's about diode lasers that is used to pump doped fiber lasers (between 808 nm and 1060 nm).

I would like the Epilog and Universal Laser Systems and Xenetech and Gravograph and Trotec financial pages.

I would like to research out the market size well to classify the technical addressable market and commercial addressable Market via our products.

We are interested in marketing single crystals for nonlinear optics in solid state lasers especially in the UV and deep UV.

Will increase in adoption of fiber laser will affect demand of CO2 laser?

Over the years, fiber laser have witnessed an increase in demand due to its low cost, high output power, and compact size. Will these fiber laser replace the prominent laser been used today including CO2 laser?

Looking for specific information on the number of YAG and other garnets used in the USA and globally.

There are several harmful effects of laser medical devices such as mild skin burns, tissue damage, photochemical effects and more. These effects depends upon various factors including exposure duration, beam energy, beam wavelength, and area of exposure. In what terms, harmful effects of laser during medical treatment or surgery will affect market growth?

Do government regulation affect adoption of lasers for food items?

Do you have more recent data than this report, and can you provide access to analyst who wrote it for a Q&A to dig deeper into specific sectors: we are particularly dealing at medical, surface treatment, YAG, fiber and ultrafast. The project has some urgency and your quick response would be appreciated.

Dot peen marking offers several advantages in terms of low-stress marking, adjustable marking length, ability to mark through any coating, and dot peen marking can be programmable for fully automated marking. How dot peen marking affect adoption of laser for marketing and engraving application?

Hi, I am an analyst at CCMP Capital. We are currently researching the laser market and found your report, “Laser Technology Market by Type, Application, and Geography - Trends & Forecast to 2013 - 2020” online. Do you have a sample of the report you could send us? We are in the initial stages of our research and want to get some preliminary understanding of the market before we proceed.

Recent trade war between China and the US have resulted in decreasing industrial output growth from several countries and global slowdown. According to an estimate, the trade war is expected to lower world's GDP by 1%. Up to what extent, US China trade war will affect laser market growth?

I am working on a research based on laser technologies. I am trying to have a better overview on the market share/growth and competition, present in the laser technologies sector.

I'm writing a BSc thesis about VECSEL lasers and I'm looking for a source to cite regarding the current size of the laser technology market.

Solid and fiber laser uses rare earth elements such as chromium, erbium, neodymium and others. Extraction of these rare earth materials can cause hazardous environment impacts. Also the raw supply can be monopolized by few countries. How government regulation regarding raw material mining and extraction for laser raw material will affect the market growth?

We are working on Indian laser development to judge whether we can have some corporation on the engineer or academic problems with India university or company.