Learning Management System Market by Component, Delivery Mode (Distance Learning, Instructor-Led Training, and Blended Learning), Deployment Type, User Type (Academic and Corporate) and Region - Global Forecast to 2027

Learning Management System Market Size, Share, Statistics

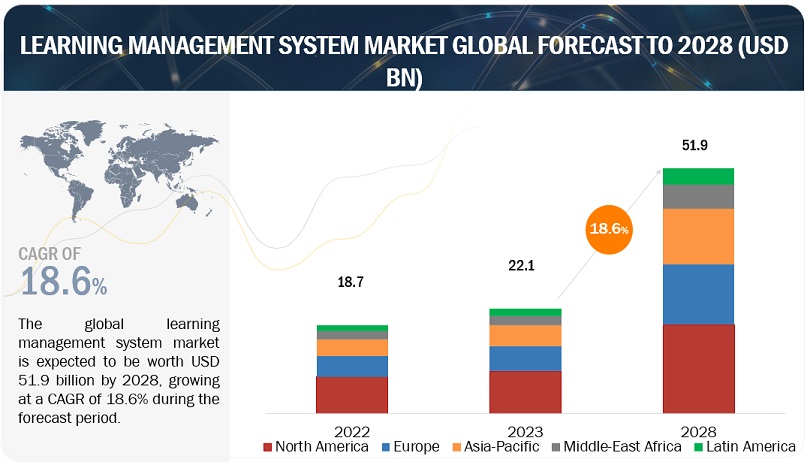

The global learning management system (LMS) market is expected to grow from $18.7 billion in 2022 to $43.6 billion by 2027, at a compound annual growth rate (CAGR) of 18.4%. Due to the ongoing recession, the worsening economic condition in Europe is likely to slow down the demand for PCs and laptops. Technologies such as software solutions are also expected to be impacted by the recession. According to the Bank of England, inflation in the UK is expected to reach a peak of over 13% and can stay above 10% in 2023. Consumer IT spending in Asia Pacific is also declining with the ongoing tight market conditions in the US and Europe. However, enterprise IT spending is expected to remain stable as organizations focus on IT security and digital transformation in the short run.

To know about the assumptions considered for the study, Request for Free Sample Report

Recession Impact: Learning Management System Market

The War in Ukraine, higher inflation, bad financial conditions, economic decelerations of key trading partners, and social discontent is slowing the growth prospects. The war in Ukraine is shaking the global economy and raising uncertainty about the outlook for Latin America and the Caribbean. The impact is felt in Latin America through higher inflation that is affecting real incomes, especially for the most vulnerable. The policymakers are reacting to this difficulty by tightening the monetary policy and implementing measures to soften the blow on the most susceptible and contain the risks of social unrest. As per The Harris Poll, 62% of Canadian organizations are confident that they can survive the upcoming recession. This is because many large capital projects were delayed due to the pandemic that have secured funding and will proceed as planned, even if there is a slowdown. Despite the uncertainty, some industry researchers and individual companies continue to forecast growth. For instance, Capgemini boosted its revenue growth objective for 2022 to 14% to 15% versus its previous forecast of 8% to 10%. Higher global and domestic financing costs can accelerate capital outflows and represent a challenge for the region, given large public and external financing needs in some countries and the limited resources to finance investments in the region. Even before the war, various regions’ recovery from the pandemic was losing momentum. After a sharp rebound last year, growth is returning to its pre-pandemic trend rate as policies shift, slowing to 2.5% for 2022. Exports and investment are resuming their role as main growth drivers, but central banks have had to tighten the monetary policy to combat an increase in inflation. As per the IMF, Gulf countries have strengthened their reform programs, which has supported increasing their sources of revenues and will assist them in facing the global recession. As per the report by the Central Bank of the United Arab Emirates, the UAE GDP is to grow by 5.4% and 4.2% in 2022 and 2023. This growth will be driven by higher oil production, with the growth of the manufacturing sector by 2031. Specifically, in the education industry, the threat of recession is resulting in a hike in tuition fees due to this student loan debt piling up. Even if colleges or universities have chosen not to increase fees, the qualitative costs of higher education will still be higher. The spiking inflation may lead to employers lowering salaries or reducing their staff nationwide. Students depending on their parents to repay loans or fund their education may struggle due to income cuts.

Learning Management System Market Dynamics

Drivers: Enterprises focusing more on human capital development

Training and development are important parts of workforce development and organizational growth & effective employee learning and development positively impact employee performance and organizational competitiveness. Training enables employees to develop a positive attitude toward learning and improving proficiency, which results in enhanced productivity and competitiveness in the workplace and the organization. It involves content development, method of delivery, and integration of technology. LMS helps enterprises prepare practical training modules for employees to understand and grasp the information. Employees can access the modules at any time, which helps employees be more productive and deliver value to the company.

Restraints: Reluctance of enterprises to convert existing training content into microcontent

Many organizations rely on full-fledged training and development programs and already have detailed training and development content, which is difficult to convert into microcontent. Globally, organizations do not invest a significant amount in transforming their existing training content into microcontent due to its tediousness and costliness. It becomes quite difficult for an organization to organize and manage content into the micro-framework and the organization might need require building training content from scratch to implement microlearning-based training, which can be expensive.

Opportunities: Incorporation of advanced technologies for a better training environment

The LMS vendors are constantly trying to implement modern technologies to improve their offerings due to the increasing adoption of LMS solutions. LMS solutions enable educators to adapt to reducing attention spans, with more visuals and less text, more engaging themes and expressions, emphasis on immersive virtual learning, and, eventually, gamification to captivate learners. Artificial Intelligence (AI) can be implemented to create an AI-based mentor who can help understand concepts, suggest courses, and provide feedback to improve student performance. Other technologies. The technologies such as AI, data analysis, helps user to provide tailored courses for them to provide a personalized learning experience and also enable learners to acquire knowledge in the way that suits them best technologies help improve student performance, provide personalized programs, and reduce dropouts.

Challenges: Lack of LMS solutions with multi-language support

Language can be a barrier for students whose first language is not English. According to a study by Pearson in 2015, around 75% of the world’s population does not speak English at all. In cases such as this, LMS vendors need to provide multiple-language support for different regions. Limited vocabulary and language skills might become a hurdle for some students to actively participate in class, socialize with peers, and learning to their full potential. Thus, LMS vendors need to overcome this challenge to help put students at ease and empower them to have an efficient learning experience.

To know about the assumptions considered for the study, Request for Free Sample Report

Based on component, the solutions segment holds the largest market size during the forecast period

The number of solution providers has increased considerably in the past few years due to the low entry cost in the LMS market. LMS can work as a standalone solution and is used by several clients as a standalone LMS. However, in several other organizations, the learning suite works as an integrated system that also comprises other solutions. LMS providers are competing to increase their market coverage and expand their presence in newer markets. The urge of organizations to have customized modules to train their employees is driving the growth in the LMS solutions segment

Based on the services, the implementation services to be one of the larger contributors to the LMS market growth during the forecast period

Implementation services in the LMS market enable enterprises to customize, implement, configure, and deploy an LMS solution according to their business needs. The appropriate implementation of LMS solutions enables the best utilization of the LMS suite, irrespective of the learning type, such as synchronous learning or asynchronous learning. These services enable organizations to customize an LMS solution to match the organization-specific training workflow and user hierarchy, thereby improving the delivery and effectiveness of the training imparted.

Based on delivery mode, the instructor-led training segment to be a larger contributor to the LMS market growth during the forecast period

When Instructor-led training is conducted over LMS, the trainer can build assessment sections into the training program. These assessment sections are electronically conducted, storing all learners’ responses in the backend of the LMS, which is processed into a meaningful report and presented to trainers. LMS can also store the training content, which means trainers can provide learners with a repository or supporting training content, which simplifies and engages learners.

Based on user type, the academic user segment is to be a large contributor to the LMS market during the forecast period

LMS is used in academics to improve the efficiency of the learning process. This helps streamline education by enabling mobility, interaction, and real-time teaching. Nowadays, various universities are using LMS to improve academic performance. The use of mobile phones and smart devices has increased significantly in the young generation, thus boosting the LMS market for academic users to grow. LMS solutions in the academic sector open up new doors for sharing knowledge without boundaries of time and distance. This segmentation is based on the nature or level of education provided by institutes.

Based on academic user type, the higher education segment is to be a large contributor to the learning management system market during the forecast period

LMS is used in higher education to simplify the learning process. The popularity of online education or distance learning has been on the rise in recent years. Given the potential of e-learning in higher education and its broad range of possible implications for institutions and learners, governments might be expected to take a keen interest in it. Hybrid learning is now acquiring greater attention due to its time and place flexibility.

Based on corporate user type, the software & technology vertical to be a large contributor to LMS market during the forecast period

LMS in software and technology companies is vital for continuously improving the skills of employees. Players in this vertical require continuous and rigorous training for their employees and the companies have to be competitive as this vertical caters to a huge customer base and offers a comprehensive range of software, hardware, and services. This is the fastest-evolving vertical in economy which updates its information daily and it becomes important to keep employees informed about the latest developments. Corporate LMS solutions help these companies fulfill their training needs in lesser time and cost in an automated and centralized manner.

Based on deployment type, the cloud deployment to be a large contributor to LMS market during the forecast period

Cloud solutions are available in multiple service models, but Software as a Service is the most common; it offers simple service-based architecture. Moreover, the simplicity in connecting several applications and services is another factor that plays a crucial role in supplementing the growth of the cloud-based segment in the global learning management system market.

Asia Pacific to grow at the highest CAGR during the forecast period

LMs market by region is segmented into five regions such as North America, Europe, MEA, Latin America, and APAC. The APAC is expected to grow at highest CAGR suing the forecast period. The major growth factors for increasing adoption of LMs in APAC is increasing IT spending among organizations in the region which is fueling rising adoption of advanced technologies, such as cloud computing, AI, and IoT among others. In order to enhance skill set of individuals and employees across organizations are expected to drive the demand for LMS solution across the region. eLearning and distance learning are gaining traction owing to growing internet penetration. Highest student population, coupled with advancing technologies, is the major driving factor of LMS solution in the Asia Pacific region. Educational institutions in Asia Pacific are focusing on implementing digital solutions and encouraging the use of advanced technologies to make the learning process more engaging for young minds and help them retain the information longer. The Asia Pacific region has great growth opportunities for LMS solution providers.

Key Market Playes

The learning management system market is dominated by companies such as Blackboard Inc. (US), Cornerstone (US), Moodle (Australia), D2L Corporation (Canada), Instructure Inc. (US), PowerSchool (US), IBM (US), Infor (US), Adobe (US), LTG (UK), Google (US), Oracle (US), SAP SE (Germany), Docebo (Canada), LearningPool (UK), LearnWorlds (UK), TalentLMS (US), Acorn LMS (Australia), My Learning Hub (UK), LearnDash (US), Touvti LMS (US), 360Learning (France), Epignosis (US), LearnUpon (Ireland)], SkyPrep (Canada), Absorb LMS (Canada), CrossKnowledge (France), Lessonly (US), Axonify (Canada), BizLibrary (US), Thinkific (Canada), iSpring (US), Blue Sky eLearn (US), Trakstar (US), DigitalChalk (US), KMI Learning (US), and.These vendors have a large customer base and strong geographic footprint along with organized distribution channels, which helps them to increase revenues.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size value in 2022 |

USD 18.7 billion |

|

Market size value in 2027 |

USD 43.6 billion |

|

Growth rate |

CAGR of 18.4% |

|

Market size available for years |

2022-2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022-2027 |

|

Forecast units |

Value (USD Million/USD Billion) |

|

Segments covered |

By Component, Delivery Mode, Deployment Type, User Type, and Region |

|

Regions covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Companies covered |

Blackboard Inc. (US), Cornerstone (US), D2L Corporation (Canada), Moodle (Australia), Instructure Inc. (US), PowerSchool (US), IBM (US), Infor (US), Adobe (US), LTG (UK), Google (US), Oracle (US), SAP SE (Germany), Docebo (Canada), LearningPool (UK), LearnWorlds (UK), TalentLMS (US), Acorn LMS (Australia), and more. |

This research report categorizes the LMS market to forecast revenue and analyze trends in each of the following submarkets:

By Component:

- Solutions

-

Services

- Consulting

- Implementation

- Support Services

By Delivery Mode:

- Distance Learning

- Instructor-led Training

- Blended Learning

By Deployment Type:

- Cloud

- On-premises

By User Type:

-

Academic Users

- K-12

- Higher Education

-

Corporate Users

- Software & Technology

- Healthcare

- Retail

- Banking, Financial Services, and Insurance (BFSI)

- Manufacturing

- Government & Defense

- Telecom

- Other Corporate Users

By Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Nordic Countries

- Italy

- Spain

- Russia

- Rest of Europe

-

APAC

- China

- Japan

- Australia & New Zealand

- India

- South Korea

- Singapore

- Rest of APAC

-

MEA

- Kingdom of Saudi Arabia

- United Arab Emirates

- South Africa

- Israel

- Qatar

- Rest of MEA

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In November 2022, D2L Corporation launched D2L Brightspace Creator+ package, the package enables users to create an engaging digital course content using workflows integrated into Brightspace, which helps course creators in saving time, effort and money.

- In September 2022, Instructure entered into an agreement with its partner, Google, that bridges the integration gap for Google Classroom users with a robust and comprehensive solution. With the integration, educational institutions can now keep course data and rosters synchronized between their student information systems (SIS or MIS) and Google Classroom.

- In October 2022, Cornerstone released its new Talent Experience Platform (TXP) designed to help talent leaders unlock the limitless potential of their workforce and streamline the way they do it.

- In October 2022, a new feature was added to Google Classroom. Now, the teachers can save time by adding grading category information before exporting google assignments in google classroom.

- In July 2022, Anthology introduced Anthology Intelligent Experiences (iX)™, the company's vision for a connected ecosystem of products and services that use data to power meaningful interactions both in and outside the classroom. The Anthology iX approach will create interactive moments by breaking down data silos and combining insights across critical systems to inform more relevant engagement between staff, faculty and learners.

Frequently Asked Questions (FAQ):

What is the projected market value of the LMS market?

The CaaS market size is expected to grow from USD 18.7 billion in 2022 to USD 43.6 billion by 2027, at a Compound Annual Growth Rate (CAGR) of 18.4% during the forecast period.

Which region has the highest market share in the LMS market?

North American region has a higher market share in the LMS market.

Which service type is expected to witness high adoption in the coming years?

Support services is expected to witness the highest adoption rate in the coming five years.

Which are the major vendors in the LMS market?

Blackboard Inc., Cornerstone, Moodle, D2L Corporation, and Instructure Inc. are major vendors in LMS market.

What are some of the drivers in the LMS market?

High demand for innovative employee training services to spur growth.

Cost benefits associated with the use of cloud based LMS is one of the primary factors accounting for this trend.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

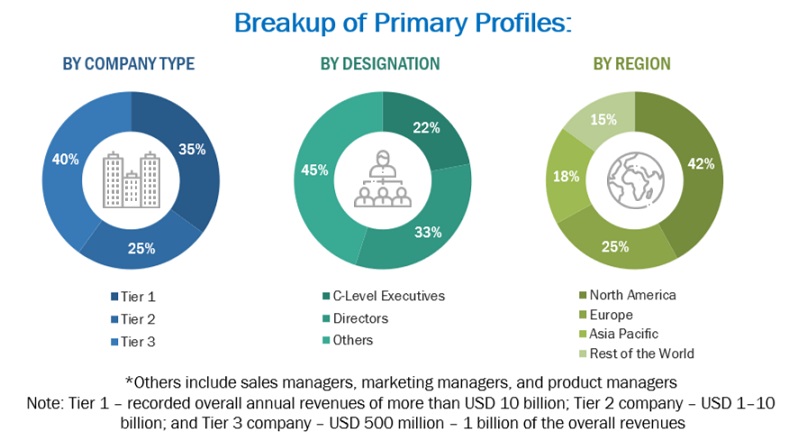

The study involved four major activities to estimate the current market size of LMS. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information for this study. The secondary sources included annual reports, press releases, and investor presentations of companies; whitepapers; certified publications; and articles from recognized associations, such as data center knowledge and government publishing sources. The research study involved the use of extensive secondary sources, directories, and databases, such as The Association of International Education Administrators, National Education Association, Association of American Educators, Association of North America Higher Education, European Association for International Education, Association for Teacher Education, and European Educational

Research Association to identify and collect information useful for this technical, market-oriented, and commercial study of the LMS market. Secondary research was mainly used to obtain key information about the industry’s value chain, the total pool of key players, market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply-side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations providing LMS solution. The primary sources from the demand side included the end-users of event management software solutions, which included Chief Information Officers (CIOs), IT technicians and technologists, and IT managers at public and investor-owned utilities.

The following figure depicts the breakup of the primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the learning management system market. They were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakup procedures were employed, wherever applicable. The data was triangulated by studying several factors and trends from both, the demand and supply sides, in the LMS market.

Report Objectives

- To define, describe, and forecast the Learning Management System (LMS) market by component (solution and services), delivery mode, deployment type, user type (corporate users and academic users), and region.

- To forecast the market size of regional segments: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

- To strategically analyze the market’s subsegments with respect to individual growth trends, prospects, and contributions to the total market

- To provide detailed information related to major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for major players

- To comprehensively analyze the core competencies of key players

- To analyze the recession impact on regional segments: North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

- To track and analyze competitive developments, such as mergers and acquisitions, new product developments, and partnerships and collaborations, in the market.

eLearning and its impact on Learning Management System (LMS) Market

The delivery of educational materials and the facilitation of learning through the use of electronic technology, such as computers and the internet, is known as e-learning, also known as online learning. Software programs known as learning management systems (LMS) offer an online platform for organising and delivering instructional materials, monitoring student development, and streamlining teacher-student interactions.

Due to the importance of LMS in the online learning environment, the LMS industry is directly tied to e-learning. LMS gives teachers the ability to track student progress, give feedback, and communicate with students while giving students a central area to access course resources like lectures, videos, assignments, and quizzes.

E-learning has had significant effects on the LMS market, such as the demand for more adaptable and configurable systems. E-learning frequently involves students from many regions and racial and ethnic backgrounds, who need a more specialised educational experience. LMS manufacturers have created more adaptable and adjustable platforms that can be customised to match the special demands of various learners and organisations in order to satisfy this need.

Overall, the e-learning industry has had a big impact on the LMS market, resulting in the creation of platforms that are more sophisticated, adaptable, and configurable as well as the expansion of the cloud-based LMS market. The LMS market is anticipated to develop and change in response to the shifting needs of learners and companies as e-learning continues to advance.

Futuristic growth use-cases of eLearning:

- Personalized Learning: With the use of e-learning, each learner could have a customised educational experience that is catered to their own requirements and interests.

- Virtual and Augmented Reality: To create immersive and engaging learning environments, e-learning can make use of virtual and augmented reality technologies.

- Gamification: To boost motivation and engagement, e-learning can include gamification components like points, badges, and leaderboards. This is particularly useful for students who find typical teaching approaches dull or uninteresting.

- Collaborative Learning: By offering social learning tools and features like discussion forums, group projects, and video conferencing, e-learning may support collaborative learning.

- Microlearning: On-demand access to quick, bite-sized learning modules is possible with e-learning. This enables students to learn at their own pace and fit it into their busy lives.

- Continuous Learning: By giving students access to new learning opportunities and resources as they become available, e-learning may enable continuous learning.

Overall, e-learning has enormous potential for future growth, and the above use cases are just a few examples of how it can be used to enhance learning outcomes and provide learners with more engaging, personalized, and effective learning experiences.

Some of the Top players in the eLearning market are Coursera, Udemy, LinkedIn Learning, Skillsoft, Cornerstone OnDemand, Pluralsight, edX, and Blackboard.

Key industries affected by the expansion of the eLearning market:

- Education: Online learning has the potential to provide affordable and accessible education to people of all ages and backgrounds, which could help to reduce educational inequality.

- Corporate training: Online training modules can be accessed at any time and from any location, making it a convenient and cost-effective way for companies to provide training to their employees.

- Healthcare: E-learning can be used to train healthcare professionals, such as doctors, nurses, and medical students.

- Professional development: E-learning can be used for professional development in a wide range of industries, from finance and accounting to marketing and sales.

- Government: E-learning can be used by governments to provide training and education to their employees, as well as to provide citizen services.

- Non-profit organizations: E-learning can be a cost-effective way for non-profit organizations to provide training and education to their employees and volunteers.

Speak to our Analyst today to know more about "eLearning Market".

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs and on best effort basis for profiling of additional market players.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Learning Management System Market