LED Lighting Market by Installation (New, Retrofit), Product Type (A-type, T-type, Decorative, Directional), Sales Channel (Retail, Direct, E-commerce), Application (Residential, Commercial, Industrial) and Geography - Global Forecast to 2027

Updated on : May 09, 2023

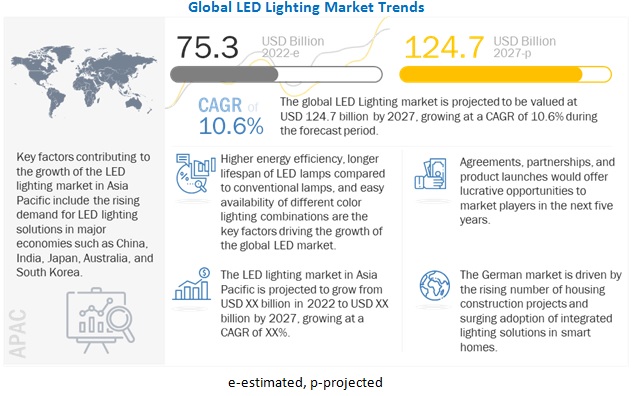

The LED Lighting Market in terms of revenue was estimated to be worth $75.3 billion in 2022 and is poised to reach $124.7 billion by 2027, growing at a CAGR of 10.6% from 2022 to 2027. The new research study consists of an industry trend analysis of the market.

Some of the major factors contributing to the high demand for LED lighting industry includes the increasing need for highly energy-efficient lighting systems with low maintenance costs, the enhanced average life span of LED lamps compared to conventional lamps, easy availability of LED lamps in different color lighting combinations, and high interest among consumers in high-lumen low-watt products as they save energy bills substantially.

To know about the assumptions considered for the study, Request for Free Sample Report

LED Lighting Manufactures

To know about the assumptions considered for the study, download the pdf brochure

LED Lighting Market Segment Overview

By Product Type

Lamp segment to dominate overall Market between 2022 to 2027

The lamps segment is expected to dominate the overall LED lighting market in 2022 and similar trend is expected to continue during the forecast period. A-type and T-type lamps are highly adopted in residential applications, which, in turn, leads to a larger market size of the lamps segment compared to luminaires.

The modern technology equipped with LED lamps enables improved efficiency with low maintenance costs. The warm light from the LED lamps allows for complete brightness without energy loss. Compared to the lifespan of average incandescent bulbs, the lifespan of an LED light is far superior. An LED lamp can last anywhere from 6 to 12 years before it needs to be replaced—40 times longer than an incandescent bulb or any other conventional bulb. Customers increasingly want environmentally friendly options and using an environmentally friendly light source to reduce energy consumption. Traditional lighting sources do not function well in cold weather. When the temperature drops, lighting sources, particularly fluorescent lamps, require a higher voltage to start, and light intensity diminishes.

Some major factors contributing to the growth of the market for LED lamps include higher energy efficiency with a low maintenance cost, the increased average life span of LED lamps than conventional lamps, easy availability of LED lamps in different color combinations, and high interest of consumers in high-lumen and low-wattage products due to substantial cost saving associated with them.

By Application

Residential segment is likely to capture majority of market during the forecast period

Residential buildings are expected to have a huge potential for LED lighting in the near future. The residential segment is likely to capture most of the market share throughout the forecast period. LEDs consume very low power and give an aesthetic feel to homes.

It enhances the comfort level as LED technology emits light for only 180 degrees, whereas other types of lighting solutions emit light 360 degrees around the source. 360-degree emissions necessitate accessory devices to reflect and/or redirect the light. Also, it provides a 60–75% improvement in the overall energy efficiency of the facility’s lighting. LEDs can operate at virtually any percentage of their rated power (0 to 100%), which adds to creating the perfect ambiance of the lighting. As homes are becoming smarter with IoT-based devices, smart LED lighting solutions are adopted well in the residential segment.

By Sales Channel

The retail/wholesale segment is likely to hold the largest market share between 2022 and 2027

The retail/wholesale segment is likely to hold the largest market share between 2022 and 2027 as it is likely to be the most preferred choice among consumers. Retail and wholesale distribution channels are the most popular in the LED lighting market.

Leading players have their sales and distributors networks spread across the world. These companies also have tied up with major retailers to reach out to customers in different geographies. The most popular channel is retail stores, which can be an individual stores or a chain of national retailers. The presence of many retail stores and various advantages associated with this option, such as high product quality, on-site product verification, and instant product availability, are some key factors driving the growth of this segment. Products are sold via retailers, dealers, and affiliates in the retail or wholesale option. These channel partners usually have an established presence in local markets and the ability to reach their customers at low costs.

New installations accounted for the larger market share owing to the surging demand for energy-efficient and easy-to-install lighting systems in new residential and commercial buildings.

New LED light fixtures can easily be installed into new construction projects like any other lighting technology. Unlike retrofit installation, which refers to partial replacement of lighting systems, new installation completely replaces a traditional lighting system after fully phasing out the lamp and its assorted controls and fixtures with the LED lamp and its associated controls and fixtures. When comparing LED lighting fixtures to retrofitting, one of the main areas where there is a significant difference is cost.

By Regional

Asia Pacific is likely to be the largest and fastest-growing market during the forecast period between 2022 and 2027.

Asia Pacific region is expected to witness the highest CAGR during the forecast period. The major factor contributing to the LED lighting market's growth in Asia Pacific includes the rising demand for LED lighting solutions from major economies such as China, India, Japan, Australia, and South Korea. Similarly, the increasing number of construction activities in residential, commercial, and industrial sectors of developing economies of Asia Pacific, including Southeast Asian countries, also drives the growth of the market in the region.

Moreover, with rapid industrialization, infrastructure development, and continuous improvement in the citizens' standard of living, China is expected to lead the market in Asia Pacific. Also, the increasing government expenditure on public infrastructure and a constant increase in commercial and industrial building construction projects is likely to fuel the growth of the market in China.

Top 5 Key Market Players in LED Lighting Manufactures

-

Signify Holding (Netherlands),

-

Acuity Brands (US),

-

OSRAM (Germany),

-

Savant Systems (GE Lighting) (US),

-

Hubbell Lighting (US) are among Others

Scope of the LED Lighting Report

|

Report Metric |

Detail |

|

Estimated Market Size |

USD 75.3 Billion |

| Projected Market Size | USD 124.7 Billion |

|

Growth Rate |

10.6% |

|

Market Size Availability for Years |

2018–2027 |

|

Base Year |

2021 |

|

Forecast Period |

2022–2027 |

|

Forecast Units |

Value (USD Billion) and Volume (Million Units) |

|

Segments Covered |

By Product Type, Installation, Sales Channel, Application, And Geography |

|

Largest and fastest-growing Region |

Asia Pacific |

|

Browse in-depth TOC on "LED Lighting Market" |

|

LED Lighting Industry Dynamics

How goal of net-zero emissions by 2050 will have positive impact on LED lighting market ?

Global warming has created a huge need for conserving energy, especially for lighting, which represents roughly 15% of the world’s electricity annual consumption and 5% of global greenhouse gas (GHG) emissions.

The Paris agreement, which was signed by more than 190 countries to limit the temperature increase to below 2° and combat global warming, constitutes a frame for developing policies supporting the adoption of energy-efficient technologies. Because lighting is globally prevalent, implementing an efficient lighting program is a common way that a country can positively impact the global environment by reducing the generation of GHG emissions from fossil fuel-based electricity generation to meet clean energy and carbon neutrality goals.

The LED lighting segment has overtaken fluorescent purchases for residential and commercial applications, and the LED technology share is expected to increase in the coming years. To remain in line with the goal of net-zero emissions by 2050, the sales of LED bulbs and lighting fixtures need to reach 100% by 2025 globally. This is expected to further accelerate the adoption of LED lighting technology in the coming years, acting as one of the key growth drivers for the LED lighting market.

How US–China trade conflict and ongoing Russia–Ukraine war will be impacting LED lighting market in Short-to-medium-term ?

The US and China are hubs for giant manufacturers of lighting products, including lamps, luminaires, and fixtures. The US–China trade conflict impacted the import and export scenarios across the world. A sharp drop in imports from China drove the decline, with tariffs in place on about USD 370 billion in US-bound Chinese goods.

This has a significant impact on the lighting industry, including LED-based lighting products. Social and political tension created by the ongoing war between Russia and Ukraine is further expected to impact trades and businesses worldwide. In its Trade Forecast 2022–2023, the World Trade Organization (WTO) estimates that prospects for the global economy have darkened since the war started on February 24. WTO economists have downgraded their expectations for 2022 growth in merchandise trade volumes—the import and export of goods—from 4.7% to 3%. Sharply rising commodity prices have been the most immediate economic impact of the Russia–Ukraine conflict. This will act as a restraining factor in the short-to-medium term for the LED lighting market

Can government initiatives towards adoption of energy-efficient lighting technology offer better opportunity for LED lighting manufacturers ?

Energy efficiency has become one of the major priorities of many countries. The governments in the US, Canada, and Mexico have always been promoting a green environment, which has resulted in a large number of smart homes in North America. Over the past few years, the governments of European countries have also been taking initiatives to adopt energy-efficient measures across the region. Regulations stated by the government are in favor of home automation systems. The governments of China, India, Japan, and South Korea are also supporting digitalization and eco-friendly measures to reduce energy consumption.

A green building uses eco-friendly and resource-efficient equipment and processes throughout a building’s life cycle, i.e., design, construction, operation, maintenance, and renovation to demolition. Several key steps from using the right green building materials and generating on-site renewable energy are involved in designing sustainable buildings. Penetration of LED lighting systems is expected to gain further momentum due to the increasing construction of green buildings and smart cities across the globe.

How Constant threat of data/security breach in IoT-based lighting systems is challenging its adoption in commercial and Industrial application?

Wireless networks connect various lighting control system components in connected lighting. Connected lights are a sophisticated array of LED fixtures with built-in sensors and cameras connected to a wireless network.

All information is stored in the cloud to be accessed from anywhere. Usually, connected or smart lighting products are connected through the internet; hence, hackers can exploit them. This may have severe consequences. For example, a hacker can gain remote access to a wireless network and manipulate smart lighting control systems, door unlocking systems, security camera systems, etc.

Similarly, someone hacking a home’s smart systems would gain access to controlling the home, thereby unlocking doors and turning the monitoring cameras off. It is also possible for an intruder to remotely shut off the lights in locations such as hospitals and other public venues, thereby resulting in serious consequences. Thus, security and privacy breaches are the main areas of concern for smart lighting systems.

LED Lighting Market Categorization

This research report categorizes the LED Lighting market, by product type, installation, sales channel, application, and geography

Based on Product Type:

-

Lamps

- A-type

- T-type

- Others

-

Luminaires

- Downlighting

- Decorative

- Directional

- Others

Based on Application:

-

Indoor

- Residential

- Commercial

- Industrial

- Others

-

Outdoor

- Streets and Roads

- Architectural Buildings

- Sports Complexes

- Tunnels

- Others

Based on Installation:

- New

- Retrofit

Based on the Sales Channel :

- Retail/Wholesale

- Direct Sales

- E-Commerce

Lumens in LED Lighting:

- 1600 Lumens

- 1100 Lumens

- 800 Lumens

- 450 Lumens

- Lower-Power LED

- High-Power LED

Based on the Region

- Americas (North America, South America)

- Europe

- Asia Pacific

- RoW (Middle East & Africa)

Recent Developments

- In May 2022, Signify completed the acquisition of Fluence from ams OSRAM (SIX: AMS).

- In March 2022, ams OSRAM (SIX: AMS) agreed to sell its independent and dedicated AMLS (Automotive Lighting Systems GmbH) business to Plastic Omnium (Euronext:

- In March 2022, Acuity Brands, Inc. (NYSE: AYI) launched Verjure, a professional-grade horticulture LED lighting solution that offers efficacious and consistent performance for indoor horticulture applications.

- In Jan 2022, Signify (Euronext: LIGHT) unveiled a new range of Philips Hue smart lighting products designed to create the perfect ambiance outside and inside the home.

- In Nov 2021, Eureka, a brand of Acuity Brands, an established leader in decorative lighting solutions, announced the release of its Billie large-scale architectural luminaire.

- In July 2021, Signify (Euronext: LIGHT) acquired Telensa Holdings Ltd, a UK-based expert in smart cities wireless monitoring and control systems.

- In May 2021, Luminis, an Acuity brand, announced the introduction of decorative shrouds and a 180-degree shield as options for its Lumistik family of luminaires.

Frequently Asked Questions (FAQ):

How big LED Lighting Market?

The LED lighting market size is expected to reach USD 124.7 billion by 2027 from USD 75.3 billion in 2022, at a CAGR of 10.6% during the forecast period.

What are the new opportunities for emerging players in LED LIghting market?

Decorative LED Lightings are expected to offer substantial opportunities to LED lighting manufacturers during the forecast period. The easy availability of decorative lights with a variety of color combinations in attractive shapes and sizes for interior decoration, coupled with the growing use of highly energy-efficient products to reduce energy bills, is the major factor propelling the growth of the market.

Which applications of LED LIghting are expected to drive the growth of the market in the next five years?

Outdoor application segment such as streets and roads, architectural buildings, sports complexes, and tunnel are expected to grow at higher rate during the forecast period. LED lights are a perfect choice for outdoor applications as these are brighter white than traditional halide street lamps, helping better illuminate streets, sidewalks, parking lots, etc. LEDs, depending on their usage, can last up to 50,000 hours. That’s nearly 25 years. Also, LEDs offer more lumens per watt, which means less burnt-out of streetlights. Streets and roadways are continuously illuminated; hence, there is a high requirement for energy. Therefore, switching to LED lighting is a better choice. Streets and roadways are expected to provide lucrative opportunities to LED lighting market players.

What are the new technology in LED LIghtings market offering higher growth potential?

LED lighting technology is increasingly adopted because of the growing need for energy conservation and modern décor. LED-based human-centric lighting is controllable and tunable across a spectrum of correlated color temperatures (CCTs) and can positively impact indoor environments. Such lighting can stimulate particular biological responses in us as it is based on our circadian rhythm. IoT smart lighting uses wireless switches, eliminating the need to wire light switches directly to fixtures. Those bulbs are then connected to a network, monitoring and controlled from the cloud. Via the web or a mobile app, the user can manage individual lights or groups of lights based on factors such as occupancy.

Which Region To offer lucrative growth for LED lighting market By 2027?

Asia Pacific is likely to lead the LED lighting market during the forecast period. The region is also expected to witness the highest CAGR during the forecast period. The RoW region is expected to witness the second-highest growth rate between 2022 to 2027. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 21)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 LED LIGHTING MARKET SEGMENTATION

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 UNIT CONSIDERED

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 27)

2.1 RESEARCH DATA

FIGURE 2 LED LIGHTING MARKET: RESEARCH DESIGN

2.1.1 SECONDARY AND PRIMARY RESEARCH

2.1.2 SECONDARY DATA

2.1.2.1 Key data from secondary sources

2.1.2.2 List of key secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Key data from primary sources

2.1.3.2 Key industry insights

2.1.3.3 Breakdown of primaries

2.1.3.4 List of key primary interview participants

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.2.3 GROWTH RATE AND FORECASTING ASSUMPTIONS

TABLE 1 MARKET GROWTH ASSUMPTIONS

2.3 FACTOR ANALYSIS

2.3.1 LED LIGHTING MARKET: SUPPLY-SIDE ANALYSIS

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE)—REVENUE GENERATED BY COMPANIES FROM PRODUCTS OFFERED IN MARKET

2.3.2 MARKET: DEMAND-SIDE ANALYSIS

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (DEMAND SIDE) FOR MARKET

TABLE 2 US: LED LIGHTING INSTALLED BASE

2.4 MARKET BREAKDOWN & DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.5 RISK ASSESSMENT

TABLE 3 RISK ASSESSMENT: MARKET

2.6 ASSUMPTIONS

TABLE 4 KEY ASSUMPTIONS: MACRO- AND MICRO-ECONOMIC ENVIRONMENT

3 EXECUTIVE SUMMARY (Page No. - 41)

3.1 REALISTIC SCENARIO

3.2 OPTIMISTIC SCENARIO

3.3 PESSIMISTIC SCENARIO

FIGURE 8 LED LIGHTING MARKET: OPTIMISTIC, REALISTIC, AND PESSIMISTIC SCENARIO ANALYSIS, 2018–2027 (USD BILLION)

FIGURE 9 MARKET, 2018–2027 (USD BILLION)

FIGURE 10 LAMPS SEGMENT TO CAPTURE LARGER SHARE OF LED LIGHTING MARKET, IN TERMS OF VALUE, FROM 2022 TO 2027

FIGURE 11 MARKET FOR RETROFIT INSTALLATIONS TO GROW AT HIGHER CAGR THAN NEW INSTALLATIONS FROM 2022 TO 2027

FIGURE 12 RETAIL/WHOLESALE DISTRIBUTION CHANNELS TO COMMAND MARKET THROUGHOUT FORECAST PERIOD

FIGURE 13 INDOOR APPLICATIONS TO ACCOUNT FOR LARGER MARKET SHARE FROM 2022 TO 2027

FIGURE 14 ASIA PACIFIC LIKELY TO BE MOST POTENTIAL MARKET FOR LED LIGHTING FROM 2022 TO 2027

4 PREMIUM INSIGHTS (Page No. - 48)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN LED LIGHTING MARKET

FIGURE 15 INCREASING ADOPTION OF LED LAMPS AS SUBSTITUTES FOR CONVENTIONAL LAMPS TO DRIVE GROWTH OF MARKET

4.2 MARKET, BY PRODUCT TYPE

FIGURE 16 LAMPS TO ACCOUNT FOR LARGER SHARE THAN LUMINAIRES IN MARKET FROM 2022 TO 2027

4.3 LED LIGHTING MARKET, BY INSTALLATION

FIGURE 17 NEW INSTALLATIONS TO CAPTURE LARGER MARKET SHARE THAN RETROFIT INSTALLATIONS THROUGHOUT FORECAST PERIOD

4.4 MARKET, BY LAMP TYPE

FIGURE 18 A-TYPE LAMPS TO DOMINATE MARKET FROM 2022 TO 2027

4.5 ARKET, BY SALES CHANNEL

FIGURE 19 RETAIL/WHOLESALE SEGMENT TO ACCOUNT FOR LARGEST SHARE OF LED LIGHTING MARKET BETWEEN 2022 AND 2027

4.6 LED LIGHTING MARKET, BY APPLICATION

FIGURE 20 RESIDENTIAL APPLICATION TO COMMAND MARKET FROM 2022 TO 2027

5 MARKET OVERVIEW (Page No. - 52)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 21 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR LED LIGHTING MARKET

5.2.1 DRIVERS

5.2.1.1 Increasing utilization of smart lighting systems in several applications

5.2.1.2 Surging adoption of LED bulbs and luminaires to achieve goal of net-zero emissions by 2050

TABLE 5 LIGHTING TYPES, INSTALLED UNITS, AND ENERGY SAVINGS IN US (2018)

FIGURE 22 GLOBAL LIGHTING PENETRATION TREND, 2012 TO 2030

5.2.1.3 Rising demand for LED lighting systems in residential interior designing and home decorating applications

FIGURE 23 CONSTRUCTION INDUSTRY OUTPUT IN US, 2008 TO 2019 (USD BILLION)

5.2.1.4 Ongoing release of new innovative LED products due to constant technological advances

FIGURE 24 IMPACT ANALYSIS OF DRIVERS IN LED LIGHTING MARKET

5.2.2 RESTRAINTS

5.2.2.1 High installation cost of larger projects

5.2.2.2 Short-to-medium-term impact on market due to US–China trade conflict and ongoing Russia–Ukraine war

FIGURE 25 US IMPORTS OF ELECTRICAL AND ELECTRONIC EQUIPMENT FROM CHINA, 2012 TO 2021 (USD BILLION)

FIGURE 26 IMPACT ANALYSIS OF RESTRAINTS IN LED LIGHTING MARKET

5.2.3 OPPORTUNITIES

5.2.3.1 Government initiatives to reduce energy consumption and cut down GHG emissions from public electricity and heat production

5.2.3.2 Continuous decline in prices of LED chips and other components of lighting systems

FIGURE 27 IMPACT ANALYSIS OF OPPORTUNITIES IN LED LIGHTING MARKET

5.2.4 CHALLENGES

5.2.4.1 Slow rate of adoption of LED technology in developing countries

5.2.4.2 Constant threat of data/security breach in IoT-based lighting systems

FIGURE 28 IMPACT ANALYSIS OF CHALLENGES IN LED LIGHTING MARKET

5.3 VALUE CHAIN ANALYSIS

FIGURE 29 VALUE CHAIN ANALYSIS: MOST VALUE ADDED BY ORIGINAL EQUIPMENT MANUFACTURERS

5.4 LED LIGHTING MARKET ECOSYSTEM

FIGURE 30 MARKET ECOSYSTEM

TABLE 6 MARKET: ECOSYSTEM

5.5 PORTER’S FIVE FORCES ANALYSIS

TABLE 7 IMPACT OF EACH FORCE ON LED LIGHTING MARKET

FIGURE 31 IMPACT OF PORTER'S FIVE FORCES ON MARKET

5.5.1 INTENSITY OF COMPETITIVE RIVALRY

5.5.2 THREAT OF NEW ENTRANTS

5.5.3 THREAT OF SUBSTITUTES

5.5.4 BARGAINING POWER OF BUYERS

5.5.5 BARGAINING POWER OF SUPPLIERS

5.6 AVERAGE SELLING PRICE ANALYSIS

FIGURE 32 LED LIGHTING MARKET: MID- AND LOW-POWER LED PACKAGE PRICING TREND

FIGURE 33 MARKET: HIGH-POWER LED PACKAGE PRICING TREND

FIGURE 34 MARKET: LED LAMP (60 W EQUIVALENT) PRICING TREND

5.7 TRADE ANALYSIS

TABLE 8 IMPORT DATA FOR LAMPS AND LIGHTING FITTINGS, HS CODE: 9405 (USD MILLION)

FIGURE 35 IMPORT VALUES OF LAMPS AND LIGHTING FIXTURES, BY COUNTRY, 2016–2020

TABLE 9 EXPORT DATA FOR LAMPS AND LIGHTING FIXTURES, HS CODE: 9405 (USD MILLION)

FIGURE 36 EXPORT VALUES OF LAMPS AND LIGHTING FIXTURES, BY COUNTRY, 2016–2020

5.8 REVENUE SHIFT & NEW REVENUE POCKETS FOR LED LIGHTING MARKET

FIGURE 37 REVENUE SHIFT IN MARKET

5.9 CASE STUDY ANALYSIS

5.9.1 ULINE, SHIPPING SUPPLY COMPANY, SHIFTED TO LED LIGHTING SYSTEM FROM CONVENTIONAL LIGHTING SYSTEM

5.9.2 ABB ATLANTA INTERNATIONAL AIRPORT (ATL) WENT OVER COMPLETE MAKEOVER WITH LED LIGHTING

5.9.3 COMMERCIAL LED LIGHTING IMPLEMENTED AT FRANKLIN INSTITUTE

5.10 LED LIGHTING MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

5.11 PATENT ANALYSIS

5.11.1 PATENT REGISTRATIONS, 2018–2021

TABLE 10 KEY PATENT REGISTRATIONS, 2018–2021

5.11.2 LED LIGHTING: PATENT ANALYSIS

FIGURE 38 PATENTS FILED BETWEEN 2011 AND 2021

FIGURE 39 GRANTED PATENT TRENDS, BY COUNTRY, 2021

TABLE 11 LIST OF PATENTS BY SIGNIFY HOLDING BV

5.12 TECHNOLOGY TRENDS

5.12.1 LI-FI

5.12.2 HUMAN-CENTRIC LIGHTING

5.12.3 IOT LIGHTING

5.13 GOVERNMENT REGULATIONS AND STANDARDS

5.13.1 GOVERNMENT REGULATIONS

5.13.2 STANDARDS

5.13.2.1 IEEE 1789-2015 modulation frequencies for light-emitting diodes (LEDs)-

5.13.2.2 Energy Star - developed by US Department of Energy (DOE) and US Environmental Protection Agency (EPA)

5.13.2.3 NEMA - ANSI C78.51 - electric lamps - LED (light-emitting diode) lamps - method of designation

5.14 KEY REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.15 KEY STAKEHOLDERS IN BUYING PROCESS

TABLE 13 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 APPLICATIONS (%)

5.15.1 BUYING CRITERIA

FIGURE 40 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

6 LED LIGHTING MARKET, BY PRODUCT TYPE (Page No. - 81)

6.1 INTRODUCTION

TABLE 14 LED LIGHTING MARKET, BY PRODUCT TYPE, 2018–2021 (USD BILLION)

FIGURE 41 LUMINAIRES TO WITNESS HIGHER CAGR IN LED LIGHTING MARKET FROM 2022 TO 2027

TABLE 15 MARKET, BY PRODUCT TYPE, 2022–2027 (USD BILLION)

6.2 LAMPS

TABLE 16 LAMPS: LED LIGHTING MARKET, BY TYPE, 2018–2021 (USD BILLION)

FIGURE 42 A-TYPE LAMPS TO CAPTURE LARGEST MARKET SHARE BETWEEN 2022 AND 2027

TABLE 17 LAMPS: MARKET, BY TYPE, 2022–2027 (USD BILLION)

TABLE 18 LAMPS: MARKET, BY REGION, 2018–2021 (USD BILLION)

TABLE 19 LAMPS: MARKET, BY REGION, 2022–2027 (USD BILLION)

6.2.1 A-TYPE

6.2.1.1 A-type lamps are primarily used in residential buildings for energy saving

6.2.2 T-TYPE

6.2.2.1 T-type lamps are widely used in commercial and industrial applications as they are cheaper, more efficient, and long-lasting light source

6.2.3 OTHERS

6.3 LUMINAIRES

TABLE 20 LUMINAIRES: LED LIGHTING MARKET, 2018–2021 (MILLION UNITS)

TABLE 21 LUMINAIRES: LED LIGHTING MARKET, 2022–2027 (MILLION UNITS)

TABLE 22 LUMINAIRES: LED LIGHTING MARKET, BY TYPE, 2018–2021 (USD BILLION)

FIGURE 43 DECORATIVE LUMINAIRES TO WITNESS HIGHEST CAGR IN LED LIGHTING MARKET FROM 2022 TO 2027

TABLE 23 LUMINAIRES: LED LIGHTING MARKET, BY TYPE, 2022–2027 (USD BILLION)

TABLE 24 LUMINAIRES: LED LIGHTING MARKET, BY REGION, 2018–2021 (USD BILLION)

TABLE 25 LUMINAIRES: LED LIGHTING MARKET, BY REGION, 2022–2027 (USD BILLION)

6.3.1 DOWNLIGHTING

6.3.1.1 Downlighting to dominate luminaires segment due to increasing number of residential, construction, and industrial infrastructure projects

6.3.2 DECORATIVE LIGHTING

6.3.2.1 Commercial and hospitality applications contribute most to increasing demand for decorative lighting

6.3.3 DIRECTIONAL LIGHTING

6.3.3.1 Directional lighting is widely used for accentuating purpose

6.3.4 OTHERS

7 LED LIGHTING MARKET, BY APPLICATION (Page No. - 90)

7.1 INTRODUCTION

TABLE 26 LED LIGHTING MARKET, BY APPLICATION, 2018–2021 (USD BILLION)

FIGURE 44 OUTDOOR SEGMENT TO RECORD HIGHER CAGR IN LED LIGHTING MARKET FROM 2022 TO 2027

TABLE 27 LED LIGHTING MARKET, BY APPLICATION, 2022–2027 (USD BILLION)

7.2 INDOOR

TABLE 28 INDOOR: MARKET, BY TYPE, 2018–2021 (USD BILLION)

FIGURE 45 RESIDENTIAL SEGMENT TO CAPTURE LARGEST SHARE OF INDOOR LED LIGHTING MARKET DURING FORECAST PERIOD

TABLE 29 INDOOR: MARKET, BY TYPE, 2022–2027 (USD BILLION)

TABLE 30 INDOOR: MARKET, BY REGION, 2018–2021 (USD BILLION)

TABLE 31 INDOOR: MARKET, BY REGION, 2022–2027 (USD BILLION)

7.2.1 RESIDENTIAL

7.2.1.1 Residential segment is likely to capture majority of market share during forecast period

7.2.2 COMMERCIAL

7.2.2.1 Offices

7.2.2.1.1 Recessed luminaires and downlighters are most commonly used lighting fixtures in offices

7.2.2.2 Retail stores

7.2.2.2.1 Retail shops and malls are expected to witness accelerated demand for LED lighting systems during post-COVID-19 scenario

7.2.2.3 Horticulture gardens

7.2.2.3.1 LED lighting systems are increasingly used as supplemental lighting sources in greenhouses and vertical farms

7.2.2.4 Others

7.2.3 INDUSTRIAL

7.2.3.1 Landscape lighting solutions, spotlights, LED tubes and panels, and floor panels are most commonly used industrial lighting solutions

7.2.4 OTHERS

7.3 OUTDOOR

TABLE 32 OUTDOOR: LED LIGHTING MARKET, BY TYPE, 2018–2021 (USD BILLION)

FIGURE 46 STREETS AND ROADS SEGMENT TO ACCOUNT FOR LARGEST SHARE OF OUTDOOR LED LIGHTING MARKET BETWEEN 2022 AND 2027

TABLE 33 OUTDOOR: MARKET, BY TYPE, 2022–2027 (USD BILLION)

TABLE 34 OUTDOOR: MARKET, BY REGION, 2018–2021 (USD BILLION)

TABLE 35 OUTDOOR: MARKET, BY REGION, 2022–2027 (USD BILLION)

7.3.1 STREETS AND ROADWAYS

7.3.1.1 Increasing number of road and street development projects in developing economies to drive market growth

7.3.2 ARCHITECTURAL BUILDINGS

7.3.2.1 LED lighting to witness increased demand from heritage buildings, historical buildings, and contemporary architectural landmarks

7.3.3 SPORTS COMPLEXES

7.3.3.1 Existing stadiums and sports complexes expected to switch to LED lighting in near future

7.3.4 TUNNELS

7.3.4.1 Upcoming tunnel construction projects worldwide to provide market opportunities to LED lighting system providers

7.3.5 OTHERS

8 LED LIGHTING MARKET, BY INSTALLATION (Page No. - 101)

8.1 INTRODUCTION

TABLE 36 MARKET, BY INSTALLATION, 2018–2021 (USD BILLION)

FIGURE 47 RETROFIT SEGMENT TO EXHIBIT HIGHER CAGR IN LED LIGHTING MARKET FROM 2022 TO 2027

TABLE 37 MARKET, BY INSTALLATION, 2022–2027 (USD BILLION)

8.2 NEW

8.2.1 NEW LED LIGHTING FIXTURES ARE LIKELY TO BE DEPLOYED IN VARIOUS UPCOMING CONSTRUCTION PROJECTS

TABLE 38 NEW: MARKET, BY REGION, 2018–2021 (USD BILLION)

TABLE 39 NEW: MARKET, BY REGION, 2022–2027 (USD BILLION)

8.3 RETROFIT

8.3.1 TRADITIONAL LIGHTING SOLUTIONS ARE WIDELY REPLACED WITH LED LIGHTING SOLUTIONS ACROSS SEVERAL APPLICATIONS

TABLE 40 RETROFIT: MARKET, BY REGION, 2018–2021 (USD BILLION)

TABLE 41 RETROFIT: MARKET, BY REGION, 2022–2027 (USD BILLION)

9 LED LIGHTING MARKET, BY SALES CHANNEL (Page No. - 105)

9.1 INTRODUCTION

TABLE 42 LED LIGHTING MARKET, BY SALES CHANNEL, 2018–2021 (USD BILLION)

FIGURE 48 E-COMMERCE SEGMENT TO RECORD HIGHEST CAGR IN LED LIGHTING MARKET, BY SALES CHANNEL, BETWEEN 2022 AND 2027

TABLE 43 MARKET, BY SALES CHANNEL, 2022–2027 (USD BILLION)

9.2 RETAIL/WHOLESALE

9.2.1 RETAIL/WHOLESALE DISTRIBUTION CHANNELS ACCOUNT FOR MAJOR MARKET SHARE

TABLE 44 RETAIL/WHOLESALE: MARKET, BY REGION, 2018–2021 (USD BILLION)

TABLE 45 RETAIL/WHOLESALE: MARKET, BY REGION, 2022–2027 (USD BILLION)

9.3 DIRECT SALES

9.3.1 DIRECT/CONTRACT-BASED SALES CHANNELS ELIMINATE THIRD-PARTY INTERFERENCE, THEREBY REDUCING PROCUREMENT COSTS

TABLE 46 DIRECT SALES: MARKET, BY REGION, 2018–2021 (USD BILLION)

TABLE 47 DIRECT SALES: MARKET, BY REGION, 2022–2027 (USD BILLION)

9.4 E-COMMERCE

9.4.1 E-COMMERCE-BASED LED LIGHTING SALES WILL INCREASE SIGNIFICANTLY UNTIL 2027

TABLE 48 E-COMMERCE: MARKET, BY REGION, 2018–2021 (USD BILLION)

TABLE 49 E-COMMERCE: MARKET, BY REGION, 2022–2027 (USD BILLION)

10 LUMENS IN LED LIGHTING (Page No. - 111)

10.1 INTRODUCTION

10.2 1,600 LUMENS

10.3 1,100 LUMENS

10.4 800 LUMENS

10.5 450 LUMENS

TABLE 50 LUMENS AND WATTAGE COMPARISON TABLE

10.6 LOW-POWER LED

10.7 HIGH-POWER LED

TABLE 51 LED LIGHT MEASUREMENT ATTRIBUTE

11 GEOGRAPHIC ANALYSIS (Page No. - 114)

11.1 INTRODUCTION

FIGURE 49 GEOGRAPHIC SNAPSHOT: INDIA WILL BE FASTEST-GROWING MARKET FOR LED LIGHTING FROM 2022 TO 2027

TABLE 52 LED LIGHTING MARKET, BY REGION, 2018–2021 (USD BILLION)

TABLE 53 MARKET, BY REGION, 2022–2027 (USD BILLION)

11.2 AMERICAS

TABLE 54 AMERICAS: MARKET, BY PRODUCT TYPE, 2018–2021 (USD BILLION)

TABLE 55 AMERICAS: MARKET, BY PRODUCT TYPE, 2022–2027 (USD BILLION)

TABLE 56 AMERICAS: MARKET, BY SALES CHANNEL, 2018–2021 (USD BILLION)

TABLE 57 AMERICAS: MARKET, BY SALES CHANNEL, 2022–2027 (USD BILLION)

TABLE 58 AMERICAS: MARKET, BY APPLICATION, 2018–2021 (USD BILLION)

TABLE 59 AMERICAS: MARKET, BY APPLICATION, 2022–2027 (USD BILLION)

TABLE 60 AMERICAS: MARKET, BY INSTALLATION, 2018–2021 (USD BILLION)

TABLE 61 AMERICAS: MARKET, BY INSTALLATION, 2022–2027 (USD BILLION)

TABLE 62 AMERICAS: MARKET, BY REGION, 2018–2021 (USD BILLION)

TABLE 63 AMERICAS: MARKET, BY REGION, 2022–2027 (USD BILLION)

11.2.1 NORTH AMERICA

FIGURE 50 NORTH AMERICA: SNAPSHOT OF LED LIGHTING MARKET

TABLE 64 NORTH AMERICA: MARKET, BY PRODUCT TYPE, 2018–2021 (USD BILLION)

TABLE 65 NORTH AMERICA: MARKET, BY PRODUCT TYPE, 2022–2027 (USD BILLION)

TABLE 66 NORTH AMERICA: MARKET, BY SALES CHANNEL, 2018–2021 (USD BILLION)

TABLE 67 NORTH AMERICA: MARKET, BY SALES CHANNEL, 2022–2027 (USD BILLION)

TABLE 68 NORTH AMERICA: MARKET, BY APPLICATION, 2018–2021 (USD BILLION)

TABLE 69 NORTH AMERICA: MARKET, BY APPLICATION, 2022–2027 (USD BILLION)

TABLE 70 NORTH AMERICA: MARKET, BY INSTALLATION, 2018–2021 (USD BILLION)

TABLE 71 NORTH AMERICA: MARKET, BY INSTALLATION, 2022–2027 (USD BILLION)

TABLE 72 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2021 (USD BILLION)

TABLE 73 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD BILLION)

11.2.1.1 US

11.2.1.1.1 Massive advancements in LED technology due to ideal environment in country for innovation

11.2.1.2 Canada

11.2.1.2.1 Considerable adoption of energy-efficient lighting systems by contractors and homeowners in Canada

11.2.1.3 Mexico

11.2.1.3.1 Increased use of automation solutions in several industries in Mexico to boost market growth

11.2.2 SOUTH AMERICA

FIGURE 51 SOUTH AMERICA: SNAPSHOT OF LED LIGHTING MARKET

TABLE 74 SOUTH AMERICA: MARKET, BY PRODUCT TYPE, 2018–2021 (USD BILLION)

TABLE 75 SOUTH AMERICA: MARKET, BY PRODUCT TYPE, 2022–2027 (USD BILLION)

TABLE 76 SOUTH AMERICA: MARKET, BY SALES CHANNEL, 2018–2021 (USD BILLION)

TABLE 77 SOUTH AMERICA: MARKET, BY SALES CHANNEL, 2022–2027 (USD BILLION)

TABLE 78 SOUTH AMERICA: MARKET, BY APPLICATION, 2018–2021 (USD BILLION)

TABLE 79 SOUTH AMERICA: MARKET, BY APPLICATION, 2022–2027 (USD BILLION)

TABLE 80 SOUTH AMERICA: MARKET, BY INSTALLATION, 2018–2021 (USD BILLION)

TABLE 81 SOUTH AMERICA: MARKET, BY INSTALLATION, 2022–2027 (USD BILLION)

TABLE 82 SOUTH AMERICA: MARKET, BY COUNTRY, 2018–2021 (USD BILLION)

TABLE 83 SOUTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD BILLION)

11.2.2.1 Brazil

11.2.2.1.1 Strong focus of country to manufacture LED lighting products locally to create lucrative opportunities for LED technology providers

11.2.2.2 Argentina

11.2.2.2.1 New resolution of Argentine government to adopt LED lighting products fosters market growth in country

11.2.2.3 Rest of South America

11.3 EUROPE

FIGURE 52 EUROPE: SNAPSHOT OF LED LIGHTING MARKET

TABLE 84 EUROPE: MARKET, BY PRODUCT TYPE, 2018–2021 (USD BILLION)

TABLE 85 EUROPE: MARKET, BY PRODUCT TYPE, 2022–2027 (USD BILLION)

TABLE 86 EUROPE: MARKET, BY SALES CHANNEL, 2018–2021 (USD BILLION)

TABLE 87 EUROPE: MARKET, BY SALES CHANNEL, 2022–2027 (USD BILLION)

TABLE 88 EUROPE: MARKET, BY APPLICATION, 2018–2021 (USD BILLION)

TABLE 89 EUROPE: MARKET, BY APPLICATION, 2022–2027 (USD BILLION)

TABLE 90 EUROPE: MARKET, BY INSTALLATION, 2018–2021 (USD BILLION)

TABLE 91 EUROPE: MARKET, BY INSTALLATION, 2022–2027 (USD BILLION)

TABLE 92 EUROPE: MARKET, BY COUNTRY, 2018–2021 (USD BILLION)

TABLE 93 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD BILLION)

11.3.1 UK

11.3.1.1 Rising environmental consciousness, coupled with enforcement of energy efficiency regulations, supports high demand for LED lighting systems in UK

11.3.2 GERMANY

11.3.2.1 Increasing number of smart homes to create opportunities for new and innovative lighting solutions in next five years

11.3.3 FRANCE

11.3.3.1 Surging demand for LED lighting systems due to formulation of environmental norms by French government

11.3.4 ITALY

11.3.4.1 Reviving residential and construction sectors to boost LED lighting adoption in Italy

11.3.5 SPAIN

11.3.5.1 Rebound of construction industry to boost demand for LED lighting products

11.3.6 REST OF EUROPE

11.4 ASIA PACIFIC

FIGURE 53 ASIA PACIFIC: SNAPSHOT OF LED LIGHTING MARKET

TABLE 94 ASIA PACIFIC: MARKET, BY PRODUCT TYPE, 2018–2021 (USD BILLION)

TABLE 95 ASIA PACIFIC: MARKET, BY PRODUCT TYPE, 2022–2027 (USD BILLION)

TABLE 96 ASIA PACIFIC: MARKET, BY SALES CHANNEL, 2018–2021 (USD BILLION)

TABLE 97 ASIA PACIFIC: MARKET, BY SALES CHANNEL, 2022–2027 (USD BILLION)

TABLE 98 ASIA PACIFIC: MARKET, BY APPLICATION, 2018–2021 (USD BILLION)

TABLE 99 ASIA PACIFIC: MARKET, BY APPLICATION, 2022–2027 (USD BILLION)

TABLE 100 ASIA PACIFIC: MARKET, BY INSTALLATION, 2018–2021 (USD BILLION)

TABLE 101 ASIA PACIFIC: MARKET, BY INSTALLATION, 2022–2027 (USD BILLION)

TABLE 102 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2021 (USD BILLION)

TABLE 103 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD BILLION)

11.4.1 CHINA

11.4.1.1 China is major producer and consumer of lighting fixtures and lamps globally

11.4.2 JAPAN

11.4.2.1 New building energy conservation law that aims to reduce energy consumption in residential and non-residential buildings in Japan expected to support market growth

11.4.3 INDIA

11.4.3.1 Government-run smart city projects to boost demand for LED lighting and control solutions in India

11.4.4 AUSTRALIA

11.4.4.1 High penetration rate of LED lighting systems in major cities of Australia to foster market growth

11.4.5 SOUTH KOREA

11.4.5.1 Presence of major LED lighting manufacturers in South Korea supports market growth

11.4.6 REST OF ASIA PACIFIC

11.5 ROW

TABLE 104 ROW: LED LIGHTING MARKET, BY PRODUCT TYPE, 2018–2021 (USD BILLION)

TABLE 105 ROW: MARKET, BY PRODUCT TYPE, 2022–2027 (USD BILLION)

TABLE 106 ROW: MARKET, BY SALES CHANNEL, 2018–2021 (USD BILLION)

TABLE 107 ROW: MARKET, BY SALES CHANNEL, 2022–2027 (USD BILLION)

TABLE 108 ROW: MARKET, BY APPLICATION, 2018–2021 (USD BILLION)

TABLE 109 ROW: MARKET, BY APPLICATION, 2022–2027 (USD BILLION)

TABLE 110 ROW: MARKET, BY INSTALLATION, 2018–2021 (USD BILLION)

TABLE 111 ROW: MARKET, BY INSTALLATION, 2022–2027 (USD BILLION)

TABLE 112 ROW: MARKET, BY REGION, 2018–2021 (USD BILLION)

TABLE 113 ROW: MARKET, BY REGION, 2022–2027 (USD BILLION)

11.5.1 MIDDLE EAST

11.5.1.1 Eco-friendly green building regulations and streetlight retrofitting programs by regional governments to spur market growth in Middle East

11.5.2 AFRICA

11.5.2.1 Ongoing urbanization in Africa to significantly boost LED lighting market growth

12 COMPETITIVE LANDSCAPE (Page No. - 148)

12.1 INTRODUCTION

12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

TABLE 114 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS IN LED LIGHTING MARKET

12.2.1 PRODUCT PORTFOLIO

12.2.2 REGIONAL FOCUS

12.2.3 MANUFACTURING FOOTPRINT

12.2.4 ORGANIC/INORGANIC GROWTH STRATEGIES

12.3 MARKET SHARE ANALYSIS, 2021

TABLE 115 MARKET: DEGREE OF COMPETITION

12.4 REVENUE ANALYSIS OF TOP PLAYERS IN LED LIGHTING MARKET

FIGURE 54 FIVE-YEAR REVENUE ANALYSIS OF TOP PLAYERS IN LED LIGHTING MARKET

12.5 COMPANY EVALUATION QUADRANT

12.5.1 STAR

12.5.2 PERVASIVE

12.5.3 EMERGING LEADER

12.5.4 PARTICIPANT

FIGURE 55 LED LIGHTING MARKET (GLOBAL): COMPANY EVALUATION QUADRANT

12.6 COMPETITIVE BENCHMARKING

TABLE 116 LED LIGHTING MARKET: DETAILED LIST OF STARTUPS/SMES

TABLE 117 MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS [SMES]

TABLE 118 KEY STARTUPS IN LED LIGHTING MARKET

12.7 STARTUP/SME EVALUATION QUADRANT

12.7.1 PROGRESSIVE COMPANY

12.7.2 RESPONSIVE COMPANY

12.7.3 DYNAMIC COMPANY

12.7.4 STARTING BLOCK

FIGURE 56 MARKET (GLOBAL): STARTUP/SME EVALUATION QUADRANT, 2021

12.8 COMPANY FOOTPRINT

TABLE 119 OVERALL FOOTPRINT OF COMPANY

TABLE 120 COMPANY PRODUCT FOOTPRINT

TABLE 121 COMPANY APPLICATION FOOTPRINT

TABLE 122 REGIONAL FOOTPRINT OF COMPANIES

12.9 COMPETITIVE SITUATION AND TRENDS

12.9.1 PRODUCT LAUNCHES & DEVELOPMENTS

TABLE 123 LED LIGHTING MARKET: PRODUCT LAUNCHES & DEVELOPMENTS, JANUARY 2018– MARCH 2022

12.9.2 DEALS

TABLE 124 MARKET: DEALS, JANUARY 2019–MAY 2022

12.9.3 OTHERS

TABLE 125 MARKET: OTHERS, JANUARY 2019–JULY 2021

13 COMPANY PROFILES (Page No. - 180)

13.1 KEY PLAYERS

(Business Overview, Products & Solutions, Recent Developments, MnM View)*

13.1.1 SIGNIFY N.V.

TABLE 126 SIGNIFY N.V.: BUSINESS OVERVIEW

FIGURE 57 SIGNIFY N.V.: COMPANY SNAPSHOT

13.1.2 ACUITY BRANDS

TABLE 127 ACUITY BRANDS: BUSINESS OVERVIEW

FIGURE 58 ACUITY BRANDS: COMPANY SNAPSHOT

13.1.3 CREE LIGHTING (PART OF IDEAL INDUSTRIES, INC.)

TABLE 128 CREE LIGHTING: BUSINESS OVERVIEW

13.1.4 OSRAM LICHT AG (AMS OSRAM)

TABLE 129 AMS OSRAM: BUSINESS OVERVIEW

FIGURE 59 AMS OSRAM: COMPANY SNAPSHOT

13.1.5 LG ELECTRONICS

TABLE 130 LG ELECTRONICS: BUSINESS OVERVIEW

FIGURE 60 LG ELECTRONICS: COMPANY SNAPSHOT

13.1.6 DIALIGHT PLC

TABLE 131 DIALIGHT PLC: BUSINESS OVERVIEW

FIGURE 61 DIALIGHT PLC: COMPANY SNAPSHOT

13.1.7 PANASONIC CORPORATION

TABLE 132 PANASONIC CORPORATION: BUSINESS OVERVIEW

FIGURE 62 PANASONIC CORPORATION: COMPANY SNAPSHOT

13.1.8 HUBBELL LIGHTING, INC. (PART OF GE CURRENT)

TABLE 133 HUBBELL LIGHTING, INC.: BUSINESS OVERVIEW

FIGURE 63 HUBBELL LIGHTING, INC.: COMPANY SNAPSHOT

13.1.9 ZUMTOBEL GROUP

TABLE 134 ZUMTOBEL GROUP: BUSINESS OVERVIEW

FIGURE 64 ZUMTOBEL GROUP: COMPANY SNAPSHOT

13.1.10 SAVANT SYSTEMS, INC.

TABLE 135 SAVANT SYSTEMS, INC.: BUSINESS OVERVIEW

*Details on Business Overview, Products & Solutions, Recent Developments, MnM View might not be captured in case of unlisted companies.

13.2 OTHER COMPANIES

13.2.1 HONYAR

13.2.2 SAMSUNG

13.2.3 SHARP CORPORATION

13.2.4 SITECO GMBH (GE)

13.2.5 HAVELLS INDIA LIMITED

13.2.6 TRILUX GMBH& CO. KG

13.2.7 FAGERHULTS BELYSNING AB

13.2.8 SYSKA LED LIGHTS PRIVATE LIMITED

13.2.9 GO GREEN LED

13.2.10 FOREST LIGHTING

13.2.11 LIGHTING SCIENCE GROUP CORPORATION

13.2.12 WIPRO LIGHTING (PARENT COMPANY WIPRO LIMITED)

13.2.13 OPPLE LIGHTING CO. LIMITED

13.2.14 NVC LIGHTING TECHNOLOGY CORPORATION

13.2.15 SORAA

14 APPENDIX (Page No. - 240)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

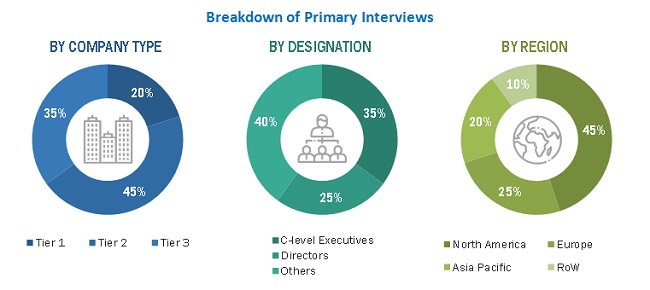

In order to estimate the size of the LED Lighting market, four major activities were performed. Secondary research has been conducted extensively to collect information regarding the market, the peer market, and the parent market. This was followed by a primary research study involving industry experts across the value chain to validate the findings, assumptions, and sizing. The total market size has been estimated using both top-down and bottom-up approaches. Then, market breakdown and data triangulation methods were used to estimate the market size of segments and subsegments.

Secondary Research

The secondary sources such as Hoovers, Bloomberg BusinessWeek, and Factiva were referred for this research study to identify and collect information. These secondary sources included annual reports, press releases and investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard and silver-standard websites, regulatory bodies, trade directories, and databases.

Primary Research

After understanding and analyzing the LED Lighting market through secondary research, extensive primary research was conducted. A number of primary interviews have been conducted with key opinion leaders from supply-side vendors and demand-side vendors in four major regions - North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW). The qualitative and quantitative information on the market has been obtained by interviewing a variety of sources on both the supply and demand sides. The breakdown of primary respondents is as follows—

To know about the assumptions considered for the study, download the pdf brochure

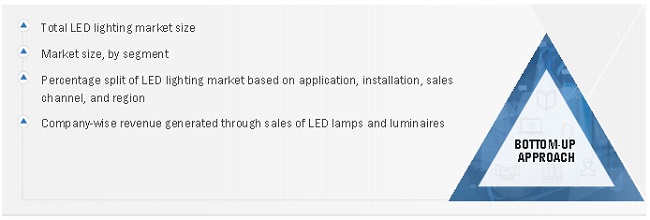

Market Size Estimation

The total size of the LED Lighting market has been estimated and validated using both top-down and bottom-up approaches. Furthermore, these methods have also been used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size is as follows:

- Identifying different LED lighting systems, including lamps and luminaires and analyzing their demand in various geographic regions and applications

- Analyzing the adoption rate of LED lighting solutions based on different product types, such as A-type, T-type, downlights, decorative lights, etc., in several applications

- Analyzing the trend of LED lighting solutions used in different geographic regions

- Referring to various paid and unpaid sources, such as annual reports, press releases, white papers, and databases, to validate the market estimations

- Conducting discussions with key opinion leaders about different technological trends, changing market environments, and emerging technologies to analyze the breakup of the scope of work by major LED lighting products providers

- Analyzing the pre- and post-COVID-19 scenarios and undertaking assumptions accordingly to build a forecasting model and estimate the market size

Global LED Lighting Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

With the overall market size derived from the estimation process described previously, the global market was divided into several segments and subsegments. In order to gather the exact statistics for segments and subsegments, the data triangulation and breakdown procedures have been applied, wherever possible. By analyzing various factors and trends from both the demand and supply sides, the data has been triangulated. Furthermore, the LED Lighting market has been validated using both top-down and bottom-up approaches.

Report Objectives

- To describe and forecast the size of the LED lighting market based on product type, application, installation, sales channel, and region, in terms of value

- To forecast the size of the LED lighting market based on installation and sales channel segments, in terms of value

- To forecast the size of the LED lighting market based on product type, in terms of volume

- To describe and forecast the market for four main regions, namely, the Americas, Asia Pacific, Europe, and Rest of the World (RoW), in terms of value

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the market

- To provide a detailed overview of the value chain of the LED lighting ecosystem, along with the average selling prices of product types

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contributions to the overall market

- To strategically analyze the ecosystem, Porter’s five forces, regulations, patent landscape, trade landscape, and case studies pertaining to the market under study

- To analyze opportunities in the market for the stakeholders by identifying high-growth segments in the market

- To strategically profile the key players and provide a detailed competitive landscape of the LED lighting market

- To analyze strategic approaches adopted by the leading players in the LED lighting market, including product launches/developments/collaborations/partnerships/expansions, and mergers & acquisitions

- To strategically profile key players and provide details of the current competitive landscape

- To analyze strategic approaches adopted by players in the LED Lighting market, such as product launches and developments, acquisitions, collaborations, contracts, expansions, and partnerships

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information:

- Detailed analysis and profiling of additional market players based on various blocks of the value chain.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in LED Lighting Market

I would like to know the total LED lighting market sector in South Africa. If possible in Rand value as well as percentage. Looking forward to your quick response.

Being in lighting field since more than 48 years interested to get more information which can help me in my role as consultant to lighting industry. Please let me know what all new trends, applications, technologies have been included in this report?

Hi. I am writing a story for the media on railroad industry adoption of LED lighting. I am hoping to ask an industry analyst a question and use the quote for my story, which will be placed with targeted news media. Should only take a few minutes, but can really use an expert. Thank you.

What product types make up the total lighting retrofit market by percentage (i.e. linear fixtures, downlighting, high bay, low bay, etc). Please elaborate.

We are a LED manufacturer based in Egypt, need to know how to compete with the Chinese companies in terms of pricing and exporting our products to other countries?

My specific interest id LED Lighting Market by Installation Type (New Installation and Retrofit Installation) in North America and Asia Pacific. Do you provide quantitative analysis for these 2 regions only?

I provide financing solutions for all types of energy efficiency projects, with a focus on LED lighting retrofits. Please let me know how I may be benefitted out of this report?

What would the pricing for all quantitative tables related to Asia Pacific regions and top company profiles in this region?

We are the manufacturer of LED lights, we are looking for the information on LED panel lights, LED downlights, LED track lights, LED linear lights, and LED Strips. Do you have any specific study on this?

I am doing my final thesis of the masters in LED lighitng. I am interested in this report, what would the best price for this? Thank you very much in advance.

Our interest is in the international LED High Bay market and the adoption of smart technologies such as sensors.

I am interested in Europre LED lighting market and want to understand, what is the current market size in Italy, France, Germany and UK in the European Market? What is the penetration of LED in the overall lighting in these countries?

I am interested to know how is the competition among the system integrators within LED lighting industry? Does the report include market stategies adopted by major players within the ecosystem to get competitive edge in the market?

Would like to understand the market potential for LED lighting in rural parts of India? Do you have such information qualitative or quantitative?

I am looking for the potential of LED Lighting across different indoor and outdoor applications. Does the report provide this information across prominent countries in all the regions?

I am looking to do business as a LED Lighting distributor. This is a completely new venture for me and I will love to receive more insight on what I need to do to becoming a distributor/marketer of this product. I look forward to receiving your response. Thanks.