LED Packaging Market by Package Type (SMD, COB, CSP), Application (General Lighting, Automotive Lighting, Backlighting, Flash Lighting, Industrial), Wavelength, Power Range, and Region (2021-2026)

Updated on : March 06, 2023

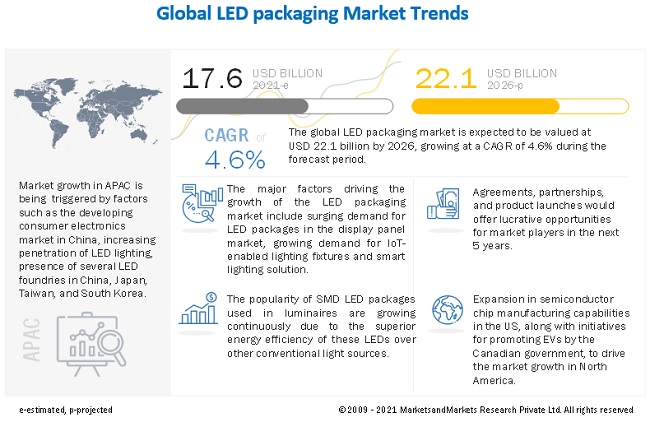

The global LED packaging market size is projected to reach USD 22.1 billion by 2026, at a CAGR of 4.6% during the forecast period.

Some of the major factor contributing towards growth of the LED packaging industry includes technological advancement in development of human-centric lighting solutions and horticulture lights, Surged adoption of CSP LEDs in automotive lighting applications, and Preference for UV LED-based curing systems for print label and packaging solutions. Increasing demand for bright and power-efficient display panels for use in smartwatches and mobile devices are some of the other key factors fueling the growth of the market.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global LED packaging Market

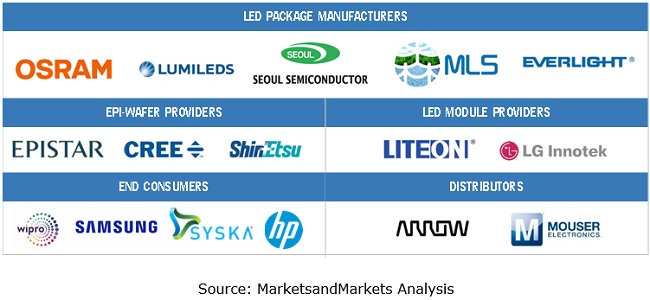

The LED packaging market includes major Tier 1 and 2 suppliers like Nichia, OSRAM, Lumileds, Seoul Semiconductor, Samsung, MLS, Cree, EVERLIGHT, NationStar, and LITE-ON. These suppliers have their manufacturing facilities spread across various countries across Asia Pacific, Europe, North America, and RoW. LED packages supplied by these companies are used by end-use industries such as consumer electronics, automotive, industrial, real estate, and few others. Covid-19 not only impacted the operations of the LED packaging market players, but also affected the businesses of companies from the above-mentioned industries. A decline in demand for display panels from the automotive and consumer electronics industries is also anticipated. Also, consumers have reduced their spending on expensive products, such as high-end smartphones and OLED TVs. Product features are being considered as a second priority, and basic functionalities are being preferred. All these factors are expected to negatively impact the LED packaging market.

LED packaging Market Dynamics

Driver: Surged demand for LED packages in display panel market

The flourishing market for display panels has led industry-leading players to optimize their display technologies such as OLEDs, quantum dot LEDs, and microLEDs. Samsung (South Korea) focuses on developing quantum dot LEDs and microLEDs, while LG (South Korea) emphasizes the development of OLEDs. Increasing demand for bright and power-efficient display panels for use in smartwatches and mobile devices are the key factors fueling the growth of the market for microLEDs. Leading LED packaging manufacturers are enhancing their microLED technological capabilities through partnerships and expansions. In October 2020, Lextar (Taiwan) partnered with X Display (US), a leading provider of microLED technologies, to co-develop microLED packages to meet the increasing demand for them from customers. Moreover, in March 2018, NationStar (China) established a dedicated microLED research center in China.

Restraint: Limited demand for new technology-based products due to higher pricing for OLED or QD-based LED

Currently prices of end use product segment such as OLED or QD LED-based technology products like smart TVs are on relatively higher side which led to the limited adoption of LED packaging in this segment. End users in the display market are expected to shift from LED-backlit LCD technology-based TVs to OLED or QD LED-based TVs once the prices of these TVs are comparable with their conventional counterparts. As consumers are reluctant to change their conventional high-end electronics products this has resulted in resulting in limited demand for new technology-based products. Further, increasing pricing war in the LED packaging market has put immense pressure on LED manufacturers to develop innovative or special lighting solutions to boost their new revenue stream.

Opportunity: Development of human-centric lighting solutions and horticulture lights

Lighting solutions have a biological and emotional impact on human beings. Human-centric lighting solutions can be envisioned to encourage the well-being, mood, and health of individuals as they can be adjusted in terms of directions, correlated color temperatures (CCTs), and illuminance. These lighting solutions can improve concentration, safety, and efficiency in workplaces and educational environments. In healthcare applications, human-centric lighting solutions can support healing processes, prevent chronic diseases in individuals with irregular daily routines, and improve the overall sense of well-being among patients. The increasing demand for human-centric lighting solutions has created new growth prospects for the manufacturers of LED packaging. Leading LED packaging manufacturers such as OSRAM (Germany) and Seoul Semiconductor (South Korea) are developing packages that support the tuning of light according to circadian rhythms and the emotional requirements of humans.

Challenges: Lack of common open standards for LED Packaging

The setting up of a general lighting standardization for LEDs has been initiated by several organizations such as the Zhaga Consortium (US) as the lack of common open standards has resulted in the development of inefficient LEDs. Manufacturers of LED packages are not able to benefit from the economies of scale, while the designers and manufacturers of LED fixtures are not able to design their products with efficiency owing to the lack of extensive coordination among various component suppliers. As such, it becomes necessary to establish a common standard for all light sources being developed globally. In relation to the initiative toward the setting up open standards, the Lighting Industry Association (UK) launched an independent verification program for LED production in December 2020. This program defines the standards for products equipped with LEDs in the country. It is expected that over the coming years, a set of common standards will be made available to LED manufacturers so that they can develop and offer equally efficient LEDs across the world.

LED Packaging Market: Ecosystem

The popularity of SMD LED packages used in luminaires is growing continuously due to the superior energy efficiency

The growth of SMD LED packages can be attributed to the steep fall in the price of SMD LEDs making them affordable for consumers. The increasing demand for energy efficient SMD LEDs from major brands for use in backlighting applications is expected to contribute to the growth of the market. In the surface-mount method of manufacturing electronic circuits, different components are directly mounted on the surface of the printed circuit board (PCB), and the device made with this technique is called the surface-mount device (SMD). The surface-mount method is largely used in the industry because of its various advantages such as increased packing density, lower cost of production, components can be mounted on both sides of the board, and smaller PCBs can be used for electronic systems.

High Brightness LED packages to witness highest growth during the forecast period

The applications of high-brightness LED light sources in general lighting and automobiles (for both exterior and interior uses) are expected to drive the growth of the market for high-power LED packages in the near future. Also, the use of high-brightness LEDs in premium smartphones for flash lighting is also expected to support market growth during the forecast period. High-power LED packages, often referred to as W-class power LED packages, have power levels greater than 1 W. These LED packages find applications where high-luminescence or bright directional light is required, such as for flash lighting and in automobiles and general lighting. W-class power LED package is expected to be the core part of future lighting. Major companies in the world are investing in research and development of W-class power packaging technology and have also applied for various patents related to the new structure and new technology.

Technological upgrades in flash LEDs such as programmable flash LED and dual flash LED to catalyze demand for LED packages

The growth of the LED packaging market for flash lighting applications can be attributed to the rising integration of flash LEDs in smartphones. Flash LEDs have features such as high optical computability, minimized heat radiation, excellent pulsing capacity, robust luminosity, and efficient module transfer for higher light output. Besides this, flash LEDs are being used as AF illuminator or autofocus assist lamp in low-light and low-contrast conditions. In addition, technological upgrades in flash LEDs such as the programmable flash LED and dual flash LED would catalyze the demand for LED packages for flash lighting applications.

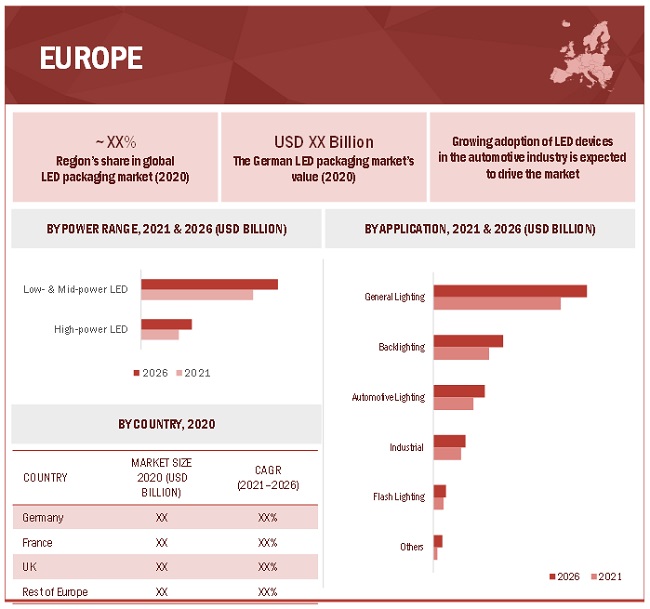

Europe likely to be the second largest market for LED packaging by 2026.

To know about the assumptions considered for the study, download the pdf brochure

The growth of the European LED packaging market can be attributed to the huge automotive and general lighting sectors, technological advancements in these industries, and the increasing demand for emerging technologies such as micro-LED in backlighting applications. The German government is focusing on energy-efficient lighting and is continuously striving to reduce lighting energy consumption across the country. This is expected to drive the demand for LED packages for the general lighting application in the country. Currently, there is ongoing research on future lighting for smart homes in Germany. The German Ministry of Education and Research (BMBF) is funding the OpenLicht research project as part of its “Optical Technologies – Made in Germany” program. The project is dedicated to creating an open development platform for smart lights and lighting systems that can be used intuitively.

Germany, the UK, and France are some of the key European countries that contributed significantly to the use of LED packages in 2021. Germany is one of the leading automotive manufacturing countries in the world, and LED packages have a major application in the automotive industry for OLED displays, head-up displays, and exterior and interior lighting. In Western European countries, the market for energy-efficient lighting solutions and technologies is growing. Historical buildings and architectural sites and the hospitality business in the country generate high demand for energy-efficient lighting systems, which largely contribute to the demand for LED packages. OSRAM (Germany) and Lumileds (Netherlands) are some of the major manufacturers present in this region.

Key Market Players

The LED packaging companies such as Nichia (Japan), OSRAM (Germany), Lumileds (Netherlands), Seoul Semiconductor (South Korea), and Samsung (South Korea). These companies focus on adopting both organic and inorganic growth strategies, such as product launches and developments, partnerships, agreements, collaborations, contracts, joint ventures, expansions, and mergers and acquisitions to strengthen their position in the market.

Recent Developments

- In November 2020, Lumileds and BIOS Lighting (US), a recognized innovator in the biological application of LED lighting partnered to create a new SkyBlue LED that doubles previously available chip performance.

- In October 2020, Cree entered into a definitive agreement to sell its LED Products business unit to SMART Global Holdings (US), a designer and manufacturer of specialty memory, storage, and hybrid solutions for the electronics industry, for USD 300 million.

- In September 2020, OSRAM launched Oslon P1616 SFH 4737, the world’s smallest broadband infrared LED that makes mobile spectroscopy a reality. It’s extremely compact dimension of 1.6mm x 1.6mm x 0.9mm makes it ideal for smartphones.

- In August 2020, Lumileds launched a very small and powerful LUXEON Rubix – a new color LED building block – designed to deliver maximum flux at drive currents up to 3A accompanied by unmatched design flexibility.

- In March 2020, EVERLIGHT launched the new ELUC3535NUB series of UV-C LED products for applications such as medical treatment, water or air purification, and sterilization of viruses and bacteria. A rapid growth in the demand for these UV-C LED products is expected due to the COVID-19 pandemic.

- In February 2020, Samsung launched the LM281B+ Pro, a reliability-plus version of its most popular LED package platform, referred to as 2835 LEDs. The LM281B+ Pro delivers an exceptionally higher degree of reliability and is resistant to variations in humidity, temperature, and sulfurization.

- In December 2019, Cree entered into a patent licensing agreement with Advanced Optoelectronic Technology (Taiwan), an organization focusing on the research and development, manufacturing, and distribution of SMD LEDs.

- In October 2019, Nichia launched the NF2W757G-MT, a tunable white mid-power LED to its 3030 LED line. The NF2W757G-MT uses the standard 757 packages with new patented technology to allow users a smooth transition in correlated color temperature (CCT) from 6,500 to 2,700K.

Frequently Asked Questions (FAQ):

How is the market landscape and competitive scenario in the LED packaging market?

The global LED packaging market is fragmented owing to the presence of several players. The market was dominated by Nichia (Japan), OSRAM (Germany), Lumileds (Netherlands), Seoul Semiconductor (South Korea), and Samsung (South Korea).

What is the growth potential in the LED packaging market?

The global LED packaging market size is estimated to be USD 17.6 billion in 2021 and is projected to reach 22.1 billion by 2026, at a CAGR of 4.6% during the forecast period. The market has a promising growth potential due to several factors, including the risen demand for IoT-enabled lighting fixtures and smart lighting solutions, surged demand for LED packages in display panel market, increased demand for UV LED-based disinfection systems amid COVID-19, and recent government initiatives and regulations promoting use of LEDs for energy efficiency and environmental benefits.

Who are the winners in the global LED packaging market? What are the key strategies adopted my major players in the LED packaging market?

Companies such as Nichia (Japan), OSRAM (Germany), Lumileds (Netherlands), Seoul Semiconductor (South Korea), and Samsung (South Korea) fall under the winner’s category. These companies cater to the requirements of their customers by providing efficient LED packages with a presence in majority of countries. The companies operating in LED packaging market are actively involved in strategies such as product launches and developments, partnerships, agreements, collaborations, contracts, joint ventures, and mergers and acquisitions

What are the opportunities for the existing players and for those who are planning to enter various stages of the LED packaging value chain?

There are various opportunities for the existing players to enter the value chain of the LED packaging industry. Some of these include the growing use of LED packages in automotive lighting applications owing to technology trends such as heads-up display and digital matrix LED (DML) headlights, increased requirement for micro-LED packages in display panel market, and development of human-centric lighting solutions and horticulture lights.

What is the COVID-19 impact on LED packaging market?

Leading LED package providers, such as OSRAM (Germany) and Seoul Semiconductor (South Korea), have incurred significant losses owing to the pandemic. Both companies have reported a decline of approximately 9% and 10%, respectively, in their 2020 half-year revenue as compared to the previous year. Governments worldwide have cut down their spending on various areas to focus on improving healthcare infrastructure, and therefore, the demand for LED packages from national lighting projects is expected to shrink.

What are some of the key industry trends in the LED packaging market?

In the last few years, lighting product manufacturers have been emphasizing the vertical integration, focused particularly on packaging, modules, and other lighting technologies. For instance, US-based Cree and China-based MLS have started expanding in the downstream lighting sector after establishing themselves as leading LED chip manufacturers. The growing vertical integration can offer number of opportunities to lighting manufacturers to diversify their product portfolios and ensure their competitive advantage. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 25)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 GENERAL INCLUSIONS AND EXCLUSIONS

1.2.2 INCLUSIONS AND EXCLUSIONS AT COMPANY LEVEL

1.2.3 INCLUSIONS AND EXCLUSIONS AT PACKAGE LEVEL

1.2.4 INCLUSIONS AND EXCLUSIONS AT APPLICATION LEVEL

1.2.5 INCLUSIONS AND EXCLUSIONS AT POWER RANGE LEVEL

1.2.6 INCLUSIONS AND EXCLUSIONS AT WAVELENGTH LEVEL

1.2.7 INCLUSIONS AND EXCLUSIONS AT PACKAGING MATERIAL LEVEL

1.2.8 INCLUSIONS AND EXCLUSIONS AT REGIONAL LEVEL

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 LED PACKAGING MARKET SEGMENTATION

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 31)

2.1 RESEARCH DATA

FIGURE 2 LED PACKAGING MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Primary Participants

2.1.2.3 Breakdown of primary interviews

2.1.3 SECONDARY AND PRIMARY RESEARCH

2.2 MARKET SIZE ESTIMATION

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE): REVENUE GENERATED FROM KEY MARKET PLAYERS IN LED PACKAGING MARKET

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (SUPPLY SIDE): ILLUSTRATION OF REVENUE ESTIMATION OF KEY MARKET PLAYERS IN LED PACKAGING MARKET

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 3—BOTTOM-UP ESTIMATION OF LED PACKAGING MARKET, BY PACKAGE TYPE

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for capturing market size by bottom-up analysis

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for capturing market size by top-down analysis

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS AND LIMITATIONS

2.4.1 ASSUMPTIONS

2.4.2 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 43)

3.1 SCENARIO ANALYSIS

FIGURE 9 COMPARISON OF PRE- AND POST-COVID-19 MARKET SIZE AND CAGR OF LED PACKAGING MARKET, BY SCENARIO, 2017–2026

3.1.1 PRE-COVID-19 SCENARIO

3.1.2 PESSIMISTIC SCENARIO (POST-COVID-19)

3.1.3 OPTIMISTIC SCENARIO (POST-COVID-19)

3.1.4 REALISTIC SCENARIO (POST-COVID-19)

FIGURE 10 SMD LED PACKAGES TO ACCOUNT FOR LARGEST MARKET SIZE IN 2021

FIGURE 11 LED PACKAGING MARKET, BY PACKAGE TYPE, 2021–2026 (MILLION UNITS)

FIGURE 12 GENERAL LIGHTING APPLICATION TO ACCOUNT FOR LARGEST SHARE OF LED PACKAGING MARKET DURING FORECAST PERIOD

FIGURE 13 LED PACKAGING MARKET FOR BACKLIGHTING APPLICATION TO REGISTER HIGHEST CAGR IN APAC FROM 2021 TO 2026

FIGURE 14 LED PACKAGING MARKET IN APAC TO REGISTER HIGHEST CAGR FROM 2021 TO 2026

4 PREMIUM INSIGHTS (Page No. - 50)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN LED PACKAGING MARKET

FIGURE 15 LED PACKAGES TO WITNESS HIGH ADOPTION RATE DURING FORECAST PERIOD

4.2 LED PACKAGING MARKET SIZE, BY INDUSTRY

FIGURE 16 GENERAL LIGHTING APPLICATION TO ACCOUNT FOR LARGEST MARKET SIZE FROM 2021 TO 2026

4.3 LED PACKAGING MARKET, BY POWER RANGE

FIGURE 17 LOW- & MID-POWER LED PACKAGES TO RECORD HIGH ADOPTION IN 2026

4.4 LED PACKAGING MARKET, BY WAVELENGTH

FIGURE 18 DEEP UV SEGMENT TO EXHIBIT HIGHER CAGR DURING FORECAST PERIOD

4.5 LED PACKAGING MARKET, BY PACKAGE TYPE AND REGION

FIGURE 19 SMD SEGMENT AND APAC TO DOMINATE LED PACKAGING MARKET BY 2026

5 MARKET OVERVIEW (Page No. - 53)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 20 LED PACKAGING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Increased demand for disinfection systems amid COVID-19 to drive demand for efficient UV LED packages

5.2.1.2 Surged demand for LED packages in display panel market

FIGURE 21 RISEN DEMAND FOR IOT-ENABLED LIGHTING FIXTURES AND SMART LIGHTING SOLUTIONS

5.2.1.3 Government initiatives and regulations promoting use of LEDs for energy efficiency and environmental benefits

FIGURE 22 LED PACKAGING MARKET DRIVERS: IMPACT ANALYSIS

5.2.2 RESTRAINTS

5.2.2.1 Saturation in LED packaging market owing to presence of large number of manufacturers

FIGURE 23 LED PACKAGING MARKET RESTRAINTS: IMPACT ANALYSIS

5.2.3 OPPORTUNITIES

5.2.3.1 Development of human-centric lighting solutions and horticulture lights

TABLE 1 LIST OF NOTICEABLE INVESTMENTS IN VERTICAL FARMS AND GREENHOUSES

5.2.3.2 Surged adoption of CSP LEDs in automotive lighting applications

5.2.3.3 Preference for UV LED-based curing systems for print label and packaging solutions owing to COVID-19

FIGURE 24 LED PACKAGING MARKET OPPORTUNITIES: IMPACT ANALYSIS

5.2.4 CHALLENGES

5.2.4.1 Lack of common open standards

5.2.4.2 Slowdown in production of manufacturing facilities worldwide caused by COVID-19

FIGURE 25 LED PACKAGING MARKET CHALLENGES: IMPACT ANALYSIS

5.3 PRICE TREND ANALYSIS

FIGURE 26 AVERAGE SELLING PRICES OF SMD, COB, AND CSP LED PACKAGES, 2017–2026

5.4 REGULATORY LANDSCAPE

TABLE 2 RECENT REGULATORY NORMS

5.5 VALUE CHAIN ANALYSIS

FIGURE 27 VALUE CHAIN ANALYSIS: INPUT SUPPLIERS AND LED PACKAGE MANUFACTURERS ADD MAJOR VALUE TO LED PACKAGING

5.6 KEY TECHNOLOGY AND INDUSTRY TRENDS

TABLE 3 DEVELOPMENT OF DEEP UV LED PACKAGING: LEADING TREND AMONG KEY MARKET PLAYERS

5.7 MARKET MAP

FIGURE 28 KEY PLAYERS IN LED PACKAGING MARKET ECOSYSTEM

5.8 TECHNOLOGY ANALYSIS

5.8.1 CHIP-SCALE PACKAGE (CSP) TECHNOLOGY

TABLE 4 COMPARISON OF BENEFITS OF CSP TECHNOLOGY WITH OTHER TECHNOLOGIES

5.9 PATENT ANALYSIS

TABLE 5 SOME KEY INNOVATIONS AND PATENT REGISTRATIONS, 2014–2020

5.10 TRADE ANALYSIS

TABLE 6 EXPORT SCENARIO FOR HS CODE: 854140-BASED PRODUCTS, BY COUNTRY, 2015–2019 (USD THOUSAND)

TABLE 7 IMPORT SCENARIO FOR HS CODE: 854140-BASED PRODUCTS, BY COUNTRY, 2015–2019 (USD THOUSAND)

5.11 CASE STUDY ANALYSIS

5.11.1 JMGO SELECTED HIGH-BRIGHTNESS LED PACKAGES OF OSRAM FOR ITS LATEST GENERATION OF PROJECTORS

5.11.2 CREE AND ADVANCED OPTOELECTRONIC TECHNOLOGY (AOT) ANNOUNCED PATENT LICENSING AGREEMENT

5.11.3 SIGNIFY PROVIDED PHILIPS GREENPOWER LED TOPLIGHTING TO BVRC TO GROW VEGETABLE SEEDLINGS UNDER ARTIFICIAL LIGHTS

5.11.4 KERNOCK PARK PLANTS INSTALLED PHILIPS GREENPOWER LED TOPLIGHTING AND PRODUCTION MODULE OFFERED BY SIGNIFY

6 LED PACKAGING MARKET, BY PACKAGE TYPE (Page No. - 69)

6.1 INTRODUCTION

FIGURE 29 LED PACKAGING MARKET FOR CSP LEDS TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 8 LED PACKAGING MARKET, BY PACKAGE TYPE, 2017–2020 (USD BILLION)

TABLE 9 LED PACKAGING MARKET, BY PACKAGE TYPE, 2021–2026 (USD BILLION)

TABLE 10 LED PACKAGING MARKET, BY PACKAGE TYPE, 2017–2020 (MILLION UNITS)

TABLE 11 LED PACKAGING MARKET, BY PACKAGE TYPE, 2021–2026 (MILLION UNITS)

6.2 SMD

6.2.1 SMD LEDS ARE VERSATILE AND CAN ACCOMMODATE CHIPS WITH COMPLICATED DESIGNS

TABLE 12 LED PACKAGING MARKET FOR SMD LED, BY REGION, 2017–2020 (USD MILLION)

TABLE 13 LED PACKAGING MARKET FOR SMD LED, BY REGION, 2021–2026 (USD MILLION)

6.3 COB

6.3.1 COB TECHNOLOGY PROVIDES IMPROVED LUMEN-PER-WATT RATIOS AND HEAT EFFICIENCY IN COMPARISON WITH OTHER LED TECHNOLOGIES

TABLE 14 LED PACKAGING MARKET FOR COB LED, BY REGION, 2017–2020 (USD MILLION)

TABLE 15 LED PACKAGING MARKET FOR COB LED, BY REGION, 2021–2026 (USD MILLION)

6.4 CSP

6.4.1 CHIP-SCALE PACKAGES HAVE BECOME POPULAR PACKAGING TREND IN RECENT TIMES

TABLE 16 LED PACKAGING MARKET FOR CSP LED, BY REGION, 2017–2020 (USD MILLION)

TABLE 17 LED PACKAGING MARKET FOR CSP LED, BY REGION, 2021–2026 (USD MILLION)

6.5 OTHERS

TABLE 18 LED PACKAGING MARKET FOR OTHERS, BY REGION, 2017–2020 (USD MILLION)

TABLE 19 LED PACKAGING MARKET FOR OTHERS, BY REGION, 2021–2026 (USD MILLION)

7 LED PACKAGING MARKET, BY APPLICATION (Page No. - 76)

7.1 INTRODUCTION

FIGURE 30 LED PACKAGING MARKET, BY APPLICATION

FIGURE 31 GENERAL LIGHTING APPLICATION IS EXPECTED TO DOMINATE LED PACKAGING MARKET BY 2026

TABLE 20 LED PACKAGING MARKET, BY APPLICATION, 2017–2020 (USD BILLION)

TABLE 21 LED PACKAGING MARKET, BY APPLICATION, 2021–2026 (USD BILLION)

7.2 GENERAL LIGHTING

7.2.1 USE OF ENERGY-EFFICIENT LEDS IN COMMERCIAL BUILDINGS FOR REDUCING GLOBAL CARBON FOOTPRINT TO DRIVE MARKET GROWTH

TABLE 22 LED PACKAGING MARKET FOR GENERAL LIGHTING, BY TYPE, 2017–2020 (USD BILLION)

TABLE 23 LED PACKAGING MARKET FOR GENERAL LIGHTING, BY TYPE, 2021–2026 (USD BILLION)

TABLE 24 LED PACKAGING MARKET FOR GENERAL LIGHTING, BY REGION, 2017–2020 (USD BILLION)

TABLE 25 LED PACKAGING MARKET FOR GENERAL LIGHTING, BY REGION, 2021–2026 (USD BILLION)

TABLE 26 LED PACKAGING MARKET FOR RESIDENTIAL LIGHTING, BY REGION, 2017–2020 (USD BILLION)

TABLE 27 LED PACKAGING MARKET FOR RESIDENTIAL LIGHTING, BY REGION, 2021–2026 (USD BILLION)

TABLE 28 LED PACKAGING MARKET FOR OUTDOOR & COMMERCIAL LIGHTING, BY REGION, 2017–2020 (USD BILLION)

TABLE 29 LED PACKAGING MARKET FOR OUTDOOR & COMMERCIAL LIGHTING, BY REGION, 2021–2026 (USD BILLION)

7.3 AUTOMOTIVE LIGHTING

7.3.1 GROWING DEMAND FOR CENTRAL STACK DISPLAYS AND INSTRUMENT CLUSTER DISPLAYS TO BOOST DEMAND FOR LED PACKAGES

TABLE 30 LED PACKAGING MARKET FOR AUTOMOTIVE LIGHTING, BY TYPE, 2017–2020 (USD BILLION)

TABLE 31 LED PACKAGING MARKET FOR AUTOMOTIVE LIGHTING, BY TYPE, 2021–2026 (USD BILLION)

TABLE 32 LED PACKAGING MARKET FOR AUTOMOTIVE LIGHTING, BY REGION, 2017–2020 (USD BILLION)

TABLE 33 LED PACKAGING MARKET FOR AUTOMOTIVE LIGHTING, BY REGION, 2021–2026 (USD BILLION)

TABLE 34 LED PACKAGING MARKET FOR INTERIOR AUTOMOTIVE LIGHTING, BY REGION, 2017–2020 (USD MILLION)

TABLE 35 LED PACKAGING MARKET FOR INTERIOR AUTOMOTIVE LIGHTING, BY REGION, 2021–2026 (USD MILLION)

TABLE 36 LED PACKAGING MARKET FOR EXTERIOR AUTOMOTIVE LIGHTING, BY REGION, 2017–2020 (USD MILLION)

TABLE 37 LED PACKAGING MARKET FOR EXTERIOR AUTOMOTIVE LIGHTING, BY REGION, 2021–2026 (USD MILLION)

7.4 BACKLIGHTING

7.4.1 INCREASING DEMAND FOR EMERGING DISPLAY TECHNOLOGIES SUCH AS MICRO LED TO STIMULATE MARKET GROWTH

TABLE 38 LED PACKAGING MARKET FOR BACKLIGHTING, BY REGION, 2017–2020 (USD BILLION)

TABLE 39 LED PACKAGING MARKET FOR BACKLIGHTING, BY REGION, 2021–2026 (USD BILLION)

7.5 FLASH LIGHTING

7.5.1 TECHNOLOGICAL UPGRADES IN FLASH LEDS SUCH AS PROGRAMMABLE FLASH LED AND DUAL FLASH LED TO CATALYZE DEMAND FOR LED PACKAGES

TABLE 40 LED PACKAGING MARKET FOR FLASH LIGHTING, BY REGION, 2017–2020 (USD MILLION)

TABLE 41 LED PACKAGING MARKET FOR FLASH LIGHTING, BY REGION, 2021–2026 (USD MILLION)

7.6 INDUSTRIAL

7.6.1 SURGING DEMAND FOR SMART LIGHTING SOLUTIONS TO REDUCE OPERATING EXPENSES TO HAVE POSITIVE IMPACT ON LED PACKAGING MARKET

TABLE 42 LED PACKAGING MARKET FOR INDUSTRIAL LIGHTING, BY REGION, 2017–2020 (USD MILLION)

TABLE 43 LED PACKAGING MARKET FOR INDUSTRIAL LIGHTING, BY REGION, 2021–2026 (USD MILLION)

7.7 OTHERS

TABLE 44 LED PACKAGING MARKET FOR OTHER APPLICATIONS, BY REGION, 2017–2020 (USD MILLION)

TABLE 45 LED PACKAGING MARKET FOR OTHER APPLICATIONS, BY REGION, 2021–2026 (USD MILLION)

8 LED PACKAGING MARKET, BY POWER RANGE (Page No. - 90)

8.1 INTRODUCTION

FIGURE 32 LED PACKAGING MARKET, BY POWER RANGE

TABLE 46 LED PACKAGING MARKET, BY POWER RANGE, 2017–2020 (USD BILLION)

TABLE 47 LED PACKAGING MARKET, BY POWER RANGE, 2021–2026 (USD BILLION)

8.2 LOW- & MID-POWER LED PACKAGES

8.2.1 INCREASING DEMAND FOR LOW- & MID-POWER LED PACKAGES FOR GENERAL LIGHTING, BACKLIGHTING, AND AUTOMOTIVE LIGHTING TO DRIVE MARKET GROWTH

TABLE 48 LED PACKAGING MARKET FOR LOW- & MID-POWER LED PACKAGES, BY REGION, 2017–2020 (USD BILLION)

TABLE 49 LED PACKAGING MARKET FOR LOW- & MID-POWER LED PACKAGES, BY REGION, 2021–2026 (USD BILLION)

8.3 HIGH-POWER LED PACKAGES

8.3.1 INCREASING DEMAND FROM SMARTPHONE MANUFACTURERS TO INCLUDE HIGH-POWER LEDS IN A FLASH LIGHTING MODULE TO BOOST MARKET GROWTH

TABLE 50 LED PACKAGING MARKET FOR HIGH-POWER LED PACKAGES, BY REGION, 2017–2020 (USD BILLION)

TABLE 51 LED PACKAGING MARKET FOR HIGH-POWER LED PACKAGES, BY REGION, 2021–2026 (USD BILLION)

9 LED PACKAGING MARKET, BY WAVELENGTH (Page No. - 95)

9.1 INTRODUCTION

TABLE 52 LED PACKAGING MARKET, BY WAVELENGTH, 2017–2020 (USD BILLION)

TABLE 53 LED PACKAGING MARKET, BY WAVELENGTH, 2021–2026 (USD BILLION)

9.2 VISIBLE & INFRARED

9.2.1 INCREASING DEMAND FOR HUMAN-CENTRIC LIGHTING HAS CREATED NEW GROWTH PROSPECTS FOR VISIBLE LED MANUFACTURERS

TABLE 54 LED PACKAGING MARKET FOR VISIBLE & INFRARED LED, BY REGION, 2017–2020 (USD BILLION)

TABLE 55 LED PACKAGING MARKET FOR VISIBLE & INFRARED LED, BY REGION, 2021–2026 (USD BILLION)

9.3 DEEP UV

9.3.1 UV-C LEDS ARE EXPECTED TO REVOLUTIONIZE FUTURE OF STERILIZATION AND DISINFECTION

TABLE 56 LED PACKAGING MARKET FOR DEEP UV LED, BY REGION, 2017–2020 (USD MILLION)

TABLE 57 LED PACKAGING MARKET FOR DEEP UV LED, BY REGION, 2021–2026 (USD MILLION)

10 LED PACKAGING MARKET, BY PACKAGING MATERIAL (Page No. - 100)

10.1 INTRODUCTION

FIGURE 33 LED PACKAGING MARKET, BY PACKAGING MATERIAL

TABLE 58 TYPICAL PACKAGING MATERIALS USED BY KEY LED PACKAGE MANUFACTURERS

10.2 PLASTIC

10.2.1 EMC PLASTICS EXHIBIT HIGH LUMEN MAINTENANCE AND COLOR STABILITY AT HIGH TEMPERATURES

10.3 NANOCERAMICS

10.3.1 NANOCERAMICS HAVE VERY HIGH COMPOSITE THERMAL PERFORMANCE

10.4 CERAMICS

10.4.1 CERAMICS EXHIBIT PROPERTIES SUCH AS OUTSTANDING RESISTANCE, RADIATION PERFORMANCE, AND MINIMUM DETERIORATION FROM ULTRAVIOLET SUBSTANCES

10.4.2 LEDS WITH SINTERED CERAMIC PACKAGE

10.4.3 LEDS WITH CERAMIC SUBSTRATE AND SILICON

10.4.4 LEDS WITH CERAMIC SUBSTRATE AND GLASS

10.5 SILICONE MATERIALS

10.5.1 SILICONES HAVE HIGH TRANSPARENCY IN UV-VISIBLE REGION, CONTROLLED REFRACTIVE INDEX, AND STABLE THERMO-MECHANICAL PROPERTIES

10.6 EPOXY MOLDING COMPOUND

10.6.1 EPOXY MOLDING COMPOUNDS PROTECT LED CHIP AGAINST MOISTURE AND EXTERNAL IMPACTS

10.7 METAL ALLOYS

10.7.1 SILVER ALLOYS OFFER EXCELLENT REFLECTIVE PROPERTIES ACROSS VISIBLE AND NEAR INFRA-RED LIGHT SPECTRUM

10.8 POLYMERS

10.8.1 POLYMERS ARE INCREASINGLY FINDING APPLICATIONS IN LED PACKAGING TO ENHANCE EFFICIENCY AND RELIABILITY OF LED DEVICES

10.9 GLASS COMPOSITES

10.9.1 PHOSPHOR-IN-GLASS (PIG) COMPOSITES EXHIBIT EXCELLENT HEAT-RESISTANCE CHARACTERISTICS AND SUPERIOR OPTICAL OUTPUT

10.1 OTHERS

10.10.1 SILICON CARBIDE SUBSTRATE

10.10.1.1 Silicon carbide has started gaining popularity as a material for LED substrates owing to low lattice mismatches seen in silicon carbide

10.10.2 SAPPHIRE SUBSTRATE

10.10.2.1 LED chips manufactured using sapphire substrates are more stable and tend to give reliable light output than other substrates

10.10.3 BONDING WIRE

10.10.3.1 Wire bonding is a LED packaging process that provides electrical interconnection between LED chip and lead frame

10.10.4 GRAPHENE

10.10.4.1 Graphene is one of the trending substrates to be used for LED packages, especially for UV LEDs in UV-C band

11 LED PACKAGING MARKET, BY REGION (Page No. - 106)

11.1 INTRODUCTION

FIGURE 34 GEOGRAPHIC SNAPSHOT OF LED PACKAGING MARKET, 2021–2026

FIGURE 35 APAC TO DOMINATE LED PACKAGING MARKET DURING FORECAST PERIOD

TABLE 59 LED PACKAGING MARKET, BY REGION, 2017–2020 (USD BILLION)

TABLE 60 LED PACKAGING MARKET, BY REGION, 2021–2026 (USD BILLION)

11.2 NORTH AMERICA

FIGURE 36 NORTH AMERICA: SNAPSHOT OF LED PACKAGING MARKET

FIGURE 37 US TO DOMINATE LED PACKAGING MARKET DURING FORECAST PERIOD

TABLE 61 LED PACKAGING MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 62 LED PACKAGING MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 63 LED PACKAGING MARKET IN NORTH AMERICA, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 64 LED PACKAGING MARKET IN NORTH AMERICA, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 65 LED PACKAGING MARKET IN NORTH AMERICA, BY POWER RANGE, 2017–2020 (USD MILLION)

TABLE 66 LED PACKAGING MARKET IN NORTH AMERICA, BY POWER RANGE, 2021–2026 (USD MILLION)

TABLE 67 LED PACKAGING MARKET IN NORTH AMERICA, BY WAVELENGTH, 2017–2020 (USD MILLION)

TABLE 68 LED PACKAGING MARKET IN NORTH AMERICA, BY WAVELENGTH, 2021–2026 (USD MILLION)

TABLE 69 LED PACKAGING MARKET IN NORTH AMERICA, BY PACKAGE TYPE, 2017–2020 (USD MILLION)

TABLE 70 LED PACKAGING MARKET IN NORTH AMERICA, BY PACKAGE TYPE, 2021–2026 (USD MILLION)

TABLE 71 LED PACKAGING MARKET IN NORTH AMERICA FOR AUTOMOTIVE LIGHTING, BY TYPE, 2017–2020 (USD MILLION)

TABLE 72 LED PACKAGING MARKET IN NORTH AMERICA FOR AUTOMOTIVE LIGHTING, BY TYPE, 2021–2026 (USD MILLION)

TABLE 73 LED PACKAGING MARKET IN NORTH AMERICA FOR GENERAL LIGHTING, BY TYPE, 2017–2020 (USD MILLION)

TABLE 74 LED PACKAGING MARKET IN NORTH AMERICA FOR GENERAL LIGHTING, BY TYPE, 2021–2026 (USD MILLION)

11.2.1 US

11.2.1.1 Preference for energy-efficient buildings to create demand for LED packages

11.2.2 CANADA

11.2.2.1 Government initiatives to promote use of EVs to drive demand for LEDs

11.2.3 MEXICO

11.2.3.1 Increasing demand for general and automotive lighting to stimulate demand for LEDs

11.2.4 IMPACT OF COVID-19 ON LED PACKAGING MARKET IN NORTH AMERICA

FIGURE 38 PRE- AND POST-COVID-19 MARKET SCENARIOS FOR LED PACKAGING MARKET IN NORTH AMERICA

11.3 EUROPE

FIGURE 39 EUROPE: SNAPSHOT OF LED PACKAGING MARKET

FIGURE 40 GERMANY TO DOMINATE LED PACKAGING MARKET DURING FORECAST PERIOD

TABLE 75 LED PACKAGING MARKET IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 76 LED PACKAGING MARKET IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 77 LED PACKAGING MARKET IN EUROPE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 78 LED PACKAGING MARKET IN EUROPE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 79 LED PACKAGING MARKET IN EUROPE, BY POWER RANGE, 2017–2020 (USD MILLION)

TABLE 80 LED PACKAGING MARKET IN EUROPE, BY POWER RANGE, 2021–2026 (USD MILLION)

TABLE 81 LED PACKAGING MARKET IN EUROPE, BY WAVELENGTH, 2017–2020 (USD MILLION)

TABLE 82 LED PACKAGING MARKET IN EUROPE, BY WAVELENGTH, 2021–2026 (USD MILLION)

TABLE 83 LED PACKAGING MARKET IN EUROPE, BY PACKAGE TYPE, 2017–2020 (USD MILLION)

TABLE 84 LED PACKAGING MARKET IN EUROPE, BY PACKAGE TYPE, 2021–2026 (USD MILLION)

TABLE 85 LED PACKAGING MARKET IN EUROPE FOR AUTOMOTIVE LIGHTING, BY TYPE, 2017–2020 (USD MILLION)

TABLE 86 LED PACKAGING MARKET IN EUROPE FOR AUTOMOTIVE LIGHTING, BY TYPE, 2021–2026 (USD MILLION)

TABLE 87 LED PACKAGING MARKET IN EUROPE FOR GENERAL LIGHTING, BY TYPE, 2017–2020 (USD MILLION)

TABLE 88 LED PACKAGING MARKET IN EUROPE FOR GENERAL LIGHTING, BY TYPE, 2021–2026 (USD MILLION)

11.3.1 GERMANY

11.3.1.1 Favorable trade scenarios and increasing demand for energy-efficient lighting to stir market growth

11.3.2 FRANCE

11.3.2.1 Growing adoption of LEDs for reducing carbon footprint to bolster market growth

11.3.3 UK

11.3.3.1 Government initiatives for energy efficiency to drive LED packaging market during forecast period

11.3.4 REST OF EUROPE

11.3.4.1 Presence of leading smartphone manufacturers to stimulate market growth

11.3.5 IMPACT OF COVID-19 ON LED PACKAGING MARKET IN EUROPE

FIGURE 41 PRE- AND POST-COVID-19 MARKET SCENARIOS FOR LED PACKAGING MARKET IN EUROPE

11.4 APAC

FIGURE 42 APAC: SNAPSHOT OF LED PACKAGING MARKET

FIGURE 43 LED PACKAGING MARKET IN CHINA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 89 LED PACKAGING MARKET IN APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 90 LED PACKAGING MARKET IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 91 LED PACKAGING MARKET IN APAC, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 92 LED PACKAGING MARKET IN APAC, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 93 LED PACKAGING MARKET IN APAC, BY POWER RANGE, 2017–2020 (USD MILLION)

TABLE 94 LED PACKAGING MARKET IN APAC, BY POWER RANGE, 2021–2026 (USD MILLION)

TABLE 95 LED PACKAGING MARKET IN APAC, BY WAVELENGTH, 2017–2020 (USD MILLION)

TABLE 96 LED PACKAGING MARKET IN APAC, BY WAVELENGTH, 2021–2026 (USD MILLION)

TABLE 97 LED PACKAGING MARKET IN APAC, BY PACKAGE TYPE, 2017–2020 (USD MILLION)

TABLE 98 LED PACKAGING MARKET IN APAC, BY PACKAGE TYPE, 2021–2026 (USD MILLION)

TABLE 99 LED PACKAGING MARKET IN APAC FOR AUTOMOTIVE LIGHTING, BY TYPE, 2017–2020 (USD MILLION)

TABLE 100 LED PACKAGING MARKET IN APAC FOR AUTOMOTIVE LIGHTING, BY TYPE, 2021–2026 (USD MILLION)

TABLE 101 LED PACKAGING MARKET IN APAC FOR GENERAL LIGHTING, BY TYPE, 2017–2020 (USD MILLION)

TABLE 102 LED PACKAGING MARKET IN APAC FOR GENERAL LIGHTING, BY TYPE, 2021–2026 (USD MILLION)

11.4.1 CHINA

11.4.1.1 Presence of leading display panel manufacturers and LED foundries to boost China’s dominant status

11.4.2 JAPAN

11.4.2.1 Presence of key automotive players to drive market growth

11.4.3 TAIWAN

11.4.3.1 Taiwan—world’s most favorable manufacturing destination for microelectronics industry

11.4.4 SOUTH KOREA

11.4.4.1 Government focus on technological development of semiconductor manufacturing to drive market growth

11.4.5 REST OF APAC

11.4.5.1 Growing demand for energy-efficient lighting to drive market

11.4.6 IMPACT OF COVID-19 ON LED PACKAGING MARKET IN APAC

FIGURE 44 PRE- AND POST-COVID-19 MARKET SCENARIOS FOR LED PACKAGING MARKET IN APAC

11.5 ROW

TABLE 103 LED PACKAGING MARKET IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 104 LED PACKAGING MARKET IN ROW, BY REGION, 2021–2026 (USD MILLION)

TABLE 105 LED PACKAGING MARKET IN ROW, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 106 LED PACKAGING MARKET IN ROW, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 107 LED PACKAGING MARKET IN ROW, BY POWER RANGE, 2017–2020 (USD MILLION)

TABLE 108 LED PACKAGING MARKET IN ROW, BY POWER RANGE, 2021–2026 (USD MILLION)

TABLE 109 LED PACKAGING MARKET IN ROW, BY WAVELENGTH, 2017–2020 (USD MILLION)

TABLE 110 LED PACKAGING MARKET IN ROW, BY WAVELENGTH, 2021–2026 (USD MILLION)

TABLE 111 LED PACKAGING MARKET IN ROW, BY PACKAGE TYPE, 2017–2020 (USD MILLION)

TABLE 112 LED PACKAGING MARKET IN ROW, BY PACKAGE TYPE, 2021–2026 (USD MILLION)

TABLE 113 LED PACKAGING MARKET IN ROW FOR AUTOMOTIVE LIGHTING, BY TYPE, 2017–2020 (USD MILLION)

TABLE 114 LED PACKAGING MARKET IN ROW FOR AUTOMOTIVE LIGHTING, BY TYPE, 2021–2026 (USD MILLION)

TABLE 115 LED PACKAGING MARKET IN ROW FOR GENERAL LIGHTING, BY TYPE, 2017–2020 (USD MILLION)

TABLE 116 LED PACKAGING MARKET IN ROW FOR GENERAL LIGHTING, BY TYPE, 2021–2026 (USD MILLION)

11.5.1 MIDDLE EAST & AFRICA

11.5.1.1 Increasing investments in R&D for smart lighting to drive demand for LEDs

11.5.2 SOUTH AMERICA

11.5.2.1 Growing awareness for reducing energy costs to drive market

11.5.3 IMPACT OF COVID-19 ON LED PACKAGING MARKET IN ROW

FIGURE 45 PRE- AND POST-COVID-19 MARKET SCENARIOS FOR LED PACKAGING MARKET IN ROW

12 COMPETITIVE LANDSCAPE (Page No. - 138)

12.1 INTRODUCTION

FIGURE 46 KEY GROWTH STRATEGIES OF LEADING PLAYERS IN LED PACKAGING MARKET BETWEEN JANUARY 2017 AND DECEMBER 2020

12.2 HISTORICAL REVENUE ANALYSIS OF MAJOR PLAYERS IN LED PACKAGING MARKET

FIGURE 47 REVENUE ANALYSIS FOR KEY COMPANIES FROM 2015 TO 2019 (USD BILLION)

12.3 MARKET SHARE ANALYSIS OF KEY COMPANIES, 2020

TABLE 117 SHARE OF LEADING PLAYERS IN LED PACKAGING MARKET, 2020

TABLE 118 MARKET RANKING ANALYSIS: LED PACKAGING MARKET, 2020

12.4 COMPETITIVE SCENARIO

FIGURE 48 PRODUCT LAUNCHES AND DEVELOPMENTS EMERGED AS KEY STRATEGY ADOPTED BY PLAYERS IN LED PACKAGING MARKET BETWEEN JANUARY 2017 AND DECEMBER 2020

12.4.1 PRODUCT LAUNCHES & DEVELOPMENTS

TABLE 119 PRODUCT LAUNCHES & DEVELOPMENTS, JANUARY 2017–DECEMBER 2020

12.4.2 AGREEMENTS, PARTNERSHIPS, COLLABORATIONS, CONTRACTS & JOINT VENTURES

TABLE 120 AGREEMENTS, PARTNERSHIPS, COLLABORATIONS, CONTRACTS & JOINT VENTURES, JANUARY 2017–DECEMBER 2020

12.4.3 MERGERS & ACQUISITIONS AND EXPANSION

TABLE 121 MERGERS & ACQUISITIONS AND EXPANSION, JANUARY 2017–DECEMBER 2020

12.5 COMPANY EVALUATION MATRIX, 2020

12.5.1 STAR

12.5.2 PERVASIVE

12.5.3 PARTICIPANT

12.5.4 EMERGING LEADER

FIGURE 49 LED PACKAGING MARKET (GLOBAL), COMPANY EVALUATION MATRIX (2020)

12.6 PRODUCT FOOTPRINT ANALYSIS OF TOP PLAYERS

FIGURE 50 PRODUCT FOOTPRINT ANALYSIS OF TOP PLAYERS IN LED PACKAGING MARKET

12.7 MARKET SHARE/RANK

FIGURE 51 MARKET SHARE/RANK ANALYSIS OF TOP PLAYERS IN LED PACKAGING MARKET

12.8 STARTUP/SME EVALUATION MATRIX, 2020

12.8.1 PROGRESSIVE COMPANIES

12.8.2 RESPONSIVE COMPANIES

12.8.3 DYNAMIC COMPANIES

12.8.4 STARTING BLOCKS

FIGURE 52 LED PACKAGING MARKET (GLOBAL), STARTUP/SME EVALUATION MATRIX (2020)

13 COMPANY PROFILES (Page No. - 158)

13.1 INTRODUCTION

(Business Overview, Products/solutions/services Offered, COVID-19-related developments, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

13.2 KEY PLAYERS

13.2.1 NICHIA

13.2.2 OSRAM

FIGURE 53 OSRAM: COMPANY SNAPSHOT

13.2.3 LUMILEDS

13.2.4 SEOUL SEMICONDUCTOR

FIGURE 54 SEOUL SEMICONDUCTOR: COMPANY SNAPSHOT

13.2.5 SAMSUNG

FIGURE 55 SAMSUNG: COMPANY SNAPSHOT

13.2.6 MLS (FOREST LIGHTING)

13.2.7 EVERLIGHT

FIGURE 56 EVERLIGHT: COMPANY SNAPSHOT

13.2.8 CREE

FIGURE 57 CREE: COMPANY SNAPSHOT

13.2.9 NATIONSTAR

13.2.10 LITE-ON

FIGURE 58 LITE-ON: COMPANY SNAPSHOT

13.3 OVERVIEW OF MANUFACTURING CAPABILITIES OF KEY PLAYERS

TABLE 122 MANUFACTURING CAPABILITIES OF KEY MARKET PLAYERS, 2020

13.4 OTHER IMPORTANT PLAYERS

13.4.1 LG INNOTEK

13.4.2 EPISTAR

13.4.3 STANLEY ELECTRIC

13.4.4 HONGLITRONIC

13.4.5 LEXTAR

13.4.6 PROLIGHT

13.4.7 EDISON

13.4.8 SCHOTT

13.4.9 CITIZEN ELECTRONICS

13.4.10 TOYODA GOSEI

13.4.11 TSLC

13.4.12 VIOLUMAS

13.4.13 CRESCENT OPTOELECTRONIC

13.4.14 LUMINUS

13.4.15 PLESSEY

13.5 INPUT SUPPLIERS

13.5.1 FLORY OPTOELECTRONIC MATERIALS

13.5.2 DOW CHEMICAL COMPANY

13.5.3 TDK CORPORATION

13.5.4 BREE OPTRONICS

*Details on Business Overview, Products/solutions/services Offered, COVID-19-related developments, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

14 APPENDIX (Page No. - 201)

14.1 INSIGHTS OF INDUSTRY EXPERTS

14.2 DISCUSSION GUIDE

14.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.4 AVAILABLE CUSTOMIZATIONS

14.5 RELATED REPORTS

14.6 AUTHOR DETAILS

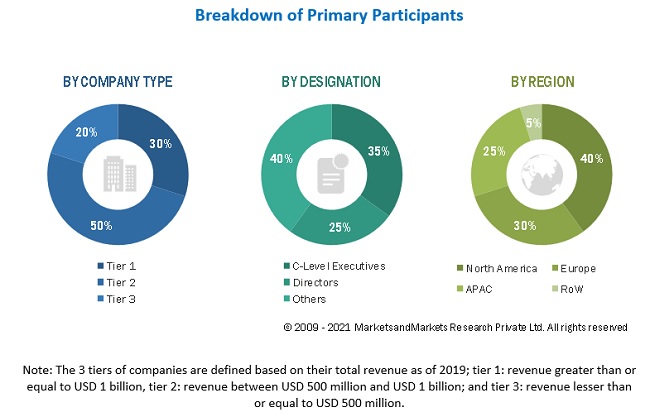

The study involved four major activities in estimating the size of the LED packaging market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market’s size. After that, market breakdown and data triangulation were used to estimate the market sizes of segments and sub-segments.

Secondary Research

In the LED packaging market report, both top-down and bottom-up approaches have been used to estimate and validate the size of the LED packaging market, along with other dependent submarkets. The key players in the LED packaging market have been identified through secondary research, and their market ranks have been determined through primary and secondary research. This entire research methodology involved studying annual and financial reports of the top players and interviewing experts (such as CEOs, VPs, directors, and marketing executives) for key insights (both quantitative and qualitative). All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All the possible parameters that may affect the markets covered in this research study have been accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Primary Research

The LED packaging market supply chain comprises several stakeholders, such as input suppliers, package manufacturers, foundry vendors, distribution channels, and end-users. The demand side of this market is characterized by luminaire manufacturers, automotive lighting manufacturers, display panel manufacturers, UV curing system manufacturers, disinfection system manufacturers, and other related OEMs; while the supply side is characterized by input suppliers and package manufacturers. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales, operations, and administration, were covered to provide a holistic viewpoint in our report. After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report. The breakdown of the primary respondents is provided below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of LED packaging market and its segments. The research methodology used to estimate the market size includes the following:

- Key players in the market have been identified through extensive secondary research

- The supply chain and the size of the LED packaging market, in terms of value, have been determined through primary and secondary research processes

- Several primary interviews have been conducted with key opinion leaders related to LED packaging supply chain, including key package manufacturers, OEMs, and end-users.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

- Qualitative aspects such as market drivers, restraints, opportunities, and challenges have been taken into consideration while calculating and forecasting the market size.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation process explained above—the market has been split into several segments and subsegments. Data triangulation and market breakdown procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for each segment and subsegment of the market. The data has been triangulated by studying various factors and trends from both demand and supply sides of the LED packaging market.

Report Objectives

- To describe and forecast the LED packaging market size, by package type, application, power range, wavelength, packaging material (qualitative), and region, in terms of value

- To describe and forecast the LED packaging market size, by package type, in terms of volume

- To describe and forecast the market size for various segments of the LED packaging market with respect to 4 main regions, namely, North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW), in terms of value

- To provide detailed information regarding drivers, restraints, opportunities, and industry-specific challenges influencing the growth of the LED packaging market

- To study the complete value chain and allied industry segments and perform a value chain analysis of the global LED packaging landscape

- To describe the impact of COVID-19 on the LED packaging market

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze growth opportunities for stakeholders in the LED packaging market

- To strategically profile the key players and comprehensively analyze their position in the LED packaging market in terms of their market share and core competencies and provide details of the competitive landscape for market leaders

- To analyze various developments such as agreements, partnerships, collaborations, contracts, mergers and acquisitions, expansions, and product launches and developments, along with research and development activities, in the LED packaging market

Available Customizations

Along with the market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

- Additional country-level analysis of LED packaging market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in LED Packaging Market