Lithium Iron Phosphate Batteries Market by Industry (Automotive, Power, Industrial, Consumer Electronics, Aerospace, Marine), Application (Portable, Stationary), Voltage (Low, Medium, High), Capacity, Design & Region - Global forecast to 2028

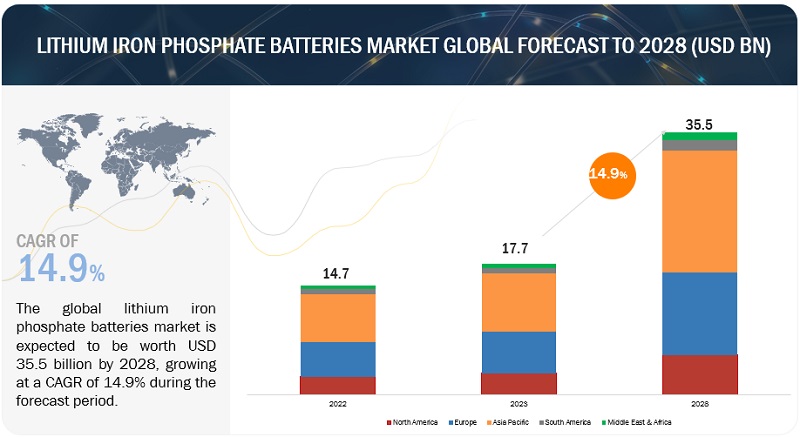

[290 Pages Report] The global Lithium iron phosphate batteries market is estimated to grow from USD 17.7 billion in 2023 to USD 35.5 billion by 2028; it is expected to record a CAGR of 14.9% during the forecast period. Recently regions has witnessed a rapid growth in lithium iron phosphate batteries demand in recent years due to the increased adoption by EV manufacturers and rising industrial automation. The market for lithium iron phosphate batteries is projected to benefit greatly from rising investment by key global players.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Lithium Iron Phosphate Batteries Market Dynamics

Driver: Increasing adoption of lithium iron phosphate batteries by EV manufacturers

Lithium-ion and lithium iron phosphate (LFP) batteries dominate the current EV battery landscape. Although LFP batteries have been around for years, they have always played a minor role in the EV sector. However, the number of EVs expected to adopt LFP batteries in 2022 is projected to reach new heights. As of 2021, the share of the LFP batteries in the global EV market has reached ~14%, an increase of 5.2% from 2020. This development can be attributed to the properties and characteristics of the LFP batteries, such as enhanced charge efficiency, relatively better discharge capabilities, and lesser energy density,, compared to than conventional Li-ion batteries.

EV manufacturers across the worldwide are also planning to make tremendous high investments in the procurement of batteries and the manufacturing of EVs, for the next ten years. These measures adopted by global EV manufacturers are largely driven by environmental concerns and, government policies, and supported by rapid technological advances advancements that have improved reduced the battery cost, range, and charging time of these batteries. For instance, Daimler, a leading player in the global EV market, has proposed an investment of ~USD 30 billion, specifically for acquiring batteries. Similarly, Hyundai and its affiliate Kia are expected to invest USD 20 billion over five years in electric and self-driving vehicles, as well as and batteries. In addition, favorable government policies and the rapid development of EV charging infrastructure are expected to further fuel the adoption of EVsel the adoption of EVs, consequently boosting the demand for LFP batteries

Restraint: Risks associated with Safety issues and disposal of spent lithium-based batteries

Lithium-based batteries are classified as hazardous waste due to their ignitability, reactivity, and toxicity when improperly disposed of. Even seemingly discharged batteries can still pose a danger if they contain a significant charge. These batteries contain hazardous chemicals, including acids and heavy metals like mercury and lead. There have been incidents, such as a 2007 fire caused by lithium-based batteries, resulting in the closure of major motorways in the UK. To handle spent batteries safely, it is necessary to store them in watertight containers away from flammable materials and have appropriate fire extinguishing equipment nearby. Unplanned discharges from residual charges in spent batteries can harm the ecosystem. Proper labeling and storage are essential, especially for small batteries that can be accidentally ingested. Large lithium iron phosphate batteries may be mistaken for lead-acid batteries and require separate storage. Government regulations govern the storage and transportation of spent batteries due to these risks.

Opportunities: Transition from conventional power generation to renewable generation

The world is undergoing a rapid transition from conventional power generation toward renewable generation because of factors such as the increasing trend of decarbonization and a sharp decline in the cost of sustainable energy sources such as solar and wind. Renewable energy sources are intermittent and to overcome this, a need for energy storage technologies is generated; a need for energy storage technologies is generated to overcome this. The battery energy storage systems store excess power generated by renewable energy sources during off-load periods. They also reduce emissions, . and The growth of renewable energy generation is also driving the fueling the adoption of battery storage solutions. Lithium iron phosphate batteries are mainly used in energy storage applications owing to their safety feature use nature and high thermal stability. In addition, these batteries are not prone to catching fire or releasing harmful gases even if they get overheated. They use a high current for fast charging, which makes them suitable for energy storage applications. Further, the demand for lithium iron phosphate batteries in utility energy storage projects is increasing due to their declining cost of lithium iron phosphate batteries, coupled with the development of the energy storage space.

Challenges: Technological drawbacks of LFP batteries

Lithium iron phosphate batteries exhibit lower energy density compared to other lithium-ion batteries, which is a significant consideration in the current context where small and lightweight batteries are preferred for electric vehicles (EVs). To achieve higher energy densities exceeding 300 Wh/kg and 800 Wh/L, the electrode powder particles need to be reduced in size to pack more densely. This increases the contact surface area, improving the cell's charging rate and energy density. However, it also leads to more unwanted reactions, accelerated battery material degradation, and reduced lifespan. Coating the particles with an ultrathin buffer layer is a solution, but the challenge lies in ensuring high conductivity and chemical inertness of these layers..

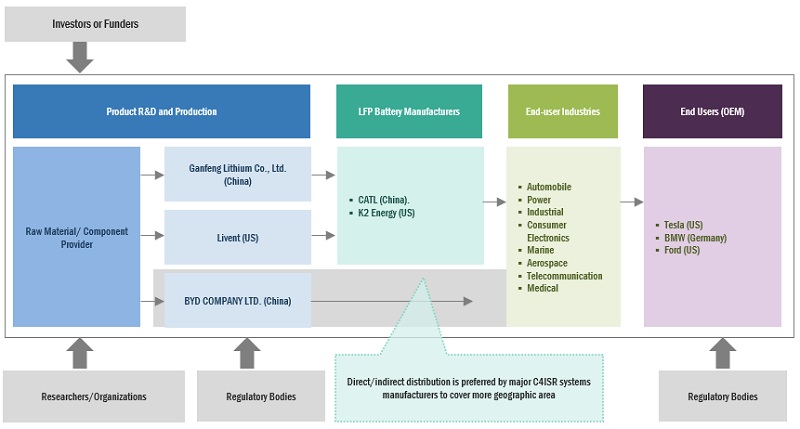

Lithium iron phosphate batteries Market Ecosystem

Prominent companies in this market include well-established, financially stable manufacturers of Lithium iron phosphate batteries systems and components. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include BYD Company Ltd. (China), Contemporary Amperex Technology Co., Limited. (China), Gotion, Inc. (US), CALB (China), and A123 Systems LLC (US).

The medium segment, by voltage, is expected to be the second largest market during the forecast period.

This report segments the lithium iron phosphate batteries market based on voltage into different types: low (Below 12V), medium (12–36V), and high (Above 36V). The medium (12–36V) segment is expected to be the second largest market during the forecast period. The high-power voltage makes these batteries ideal for usage in industries such as electrical vehicles, oil & gas, medical, telecom, and solar energy storage. The growing EV market and the rising adoption of energy storage systems have increased the need for batteries with high power voltage that can keep the devices running for long hours and, at the same time, provide enhanced safety due to low thermal runway, which may result in a fire in the case of excessive overheating. These batteries are often grouped to form modules, and these modules are used in applications requiring heavy loads such as EVs, industrial applications, robots, medical applications, hybrid trucks, trains, and power backup.

By industry, the power segment is expected to be the third largest during the forecast period

This report segments the lithium iron phosphate batteries market based on industry into seven segments: automotive, power, industrial, consumer electronics, aerospace, marine, and others. The power industry is working on generating renewable energy and storing it for multiple uses. This stored energy is produced, controlled, and distributed using smart grid technology. Attributes such as low cost, less space required for installation, high life cycle, safety, and less prone to the thermal runway are a few of the driving factors for the adoption of lithium iron phosphate batteries in smart grids and renewable energy storage systems. Lithium iron phosphate batteries are more resistive toward extreme temperatures, which means the battery capacity is slightly reduced, whereas, in the case of lead-acid batteries, it is reduced by 50%..

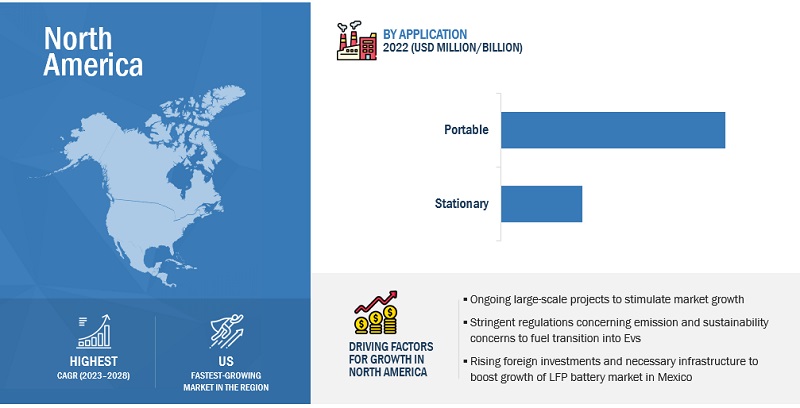

“North America”: The third largesty in the lithium iron phosphate batteries market”

North America is expected to third largest region in the lithium iron phosphate batteries market between 2023–2028, followed by the South America, and Middle East & Africa. This can be majorly attributed to the support provided by the North American Free Trade Agreement (NAFTA). The region is also among the largest markets for EVs. Various automotive companies such as Tesla Motors Inc. (US), General Motors Corp. (US), and Mitsubishi Motors Corp. (Japan) are actively working in the field of EVs in the US and Canada, leading to the rapid adoption of lithium iron phosphate batteries. The US is enriched with ample lithium deposits that can be very well exploited in the future to produce lithium iron phosphate batteries. This, in turn, is driving the demand for lithium iron phosphate batteries in the region..

Key Market Players

The lithium iron phosphate batteries market is dominated by a few major players that have a wide regional presence. The major players in the lithium iron phosphate batteries market include BYD Company Ltd. (China), Contemporary Amperex Technology Co., Limited. (China), Gotion, Inc. (US), CALB (China), and A123 Systems LLC (US). Between 2018 and 2022, Strategies such as contracts, agreements, partnership, product launches, and expansions are followed by these companies to capture a larger share of the lithium iron phosphate batteries market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2017–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD Million/USD Billion), Volume (Units) |

|

Segments covered |

Lithium iron phosphate batteries market by design, industry, capacity, voltage, application and region. |

|

Geographies covered |

Asia Pacific, North America, Europe, South America, and Middle East & Africa. |

|

Companies covered |

BYD Company Ltd. (China), Contemporary Amperex Technology Co., Limited. (China), Gotion, Inc. (US), CALB (China), A123 Systems LLC (US), Ultralife Corporation (US), K2 Energy (US), Benergy Tech Co. Ltd (Hong Kong), BSL NEW ENERGY TECHNOLOGY CO., LTD (China), Electric Vehicle Power System Technology Co., Ltd (China), Bharat Power Solutions (India), Victron Energy (Netherlands), taicopower (China), EverExceed Industrial Co., Ltd (China), Epec, LLC. (US), Shenzhen Eastar Battery Co., Ltd (China), Shenzhen Cyclen Technology Co., Ltd (China), KAYO Battery (Shenzhen) Company Limited (China), and OptimumNano Energy Co., Ltd. (China), LITHIUMWERKS (Netherlands), RELiON Batteries (US), Karacus Energy Pvt. Ltd. (India), Lohum Cleantech Private Limited (India) and RCRS Innovations Private Limited (India). |

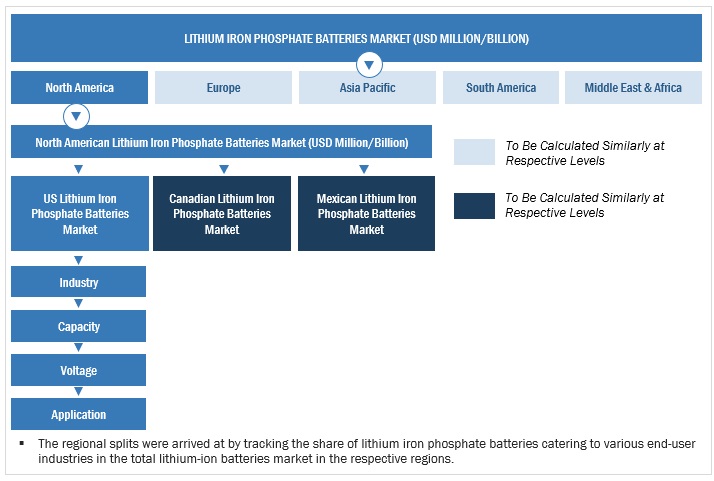

This research report categorizes the lithium iron phosphate batteries market by design, industry, capacity, voltage, application and region.

On the basis of by Design:

- Cells

- Battery Packs

On the basis of by Capacity:

- 0–16,250 mAh

- 16,251–50,000 mAh

- 50,001–100,000 mAh

- 100,001–540,000 mAh

On the basis of by Industry:

- Automotive

- Power

- Industrial

- Consumer Electronics

- Aerospace

- Marine

- Others

On the basis of by Application:

- Portable

- Stationary

On the basis of by Voltage:

- Low (below 12V)

- Medium (12V–36V)

- High (above 36V)

On the basis of Region:

- North America

- South America

- Europe

- Asia Pacific

- Middle East & Africa

Recent Developments

- In March 2023, CATL and the BAIC Group entered into a strategic agreement for commercial collaboration and the deployment of sophisticated technology. according to the agreement, CATL will play a role in the vehicle development and manufacturing of BAIC Group's electric vehicles, as well as supply competitive EV battery goods and services.

- In March 2023, Gotion, Inc. and Edison Power Co., Ltd. signed an agreement to jointly expand the Japanese large storage battery and recycling industry, promote the renewable energy, and introduce Gotion's batteries into the Japanese market. Additionally, the company will also work with Edison Power to establish a circular storage battery recycling system for LFP batteries in Japan..

- In November 2022, BYD Company Ltd. Announced an aim to develop a new power battery production center in Wenzhou, Zhejiang province, China, with an annual capacity of 20 GWh. The first production line is expected to start production in 2024.

- In August 2022, CALB has announced to launch a 350Wh/kg battery containing lithium ferromanganese phosphate with long cruising range to support 4C fast charging, as well as a 400Wh/kg semi-solid battery.

Frequently Asked Questions (FAQ):

What is the current size of the lithium iron phosphate batteries market?

The current market size of the lithium iron phosphate batteries market is USD 14.7 billion in 2022.

What are the major drivers for the lithium iron phosphate batteries market?

Growing demand for battery-operated material-handling equipment in various industries and rising industrial automation will be major drivers for the lithium iron phosphate batteries market.

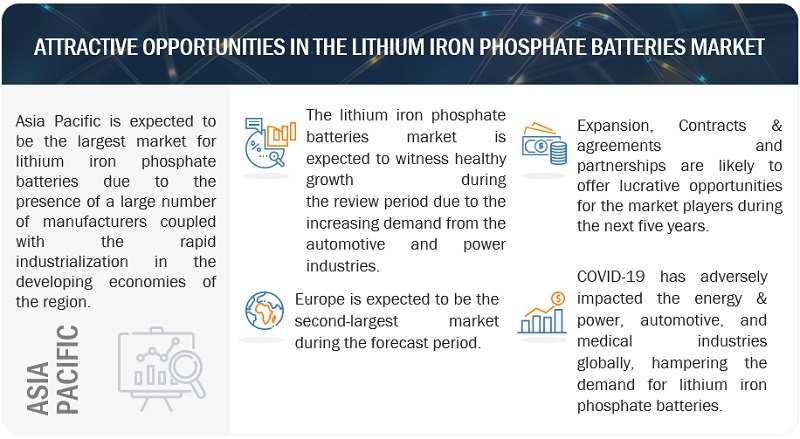

Which is the largest region during the forecasted period in the lithium iron phosphate batteries market?

Asia Pacific is expected to dominate the lithium iron phosphate batteries market between 2023–2028, followed by Europe and North America.

Which is the largest segment, by industry during the forecasted period in the lithium iron phosphate batteries market?

The Automation segment is expected to be the largest market during the forecast period. AHTS vessels are specialized ships designed for various offshore operations in the oil and gas industry, for example, anchor handling, towing and positioning, supply operations, dynamic positioning, firefighting and safety, construction support, and crew accommodation.

Which is the fastest segment, by end-user during the forecasted period in the lithium iron phosphate batteries market?

The offshore wind segment is expected to be the fastest market during the forecast period. The increasing deployment of offshore wind farms would drive the demand for lithium iron phosphate batteriess used during the installation, maintenance, and dismantling of offshore wind farms.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The study involved major activities in estimating the current size of the lithium iron phosphate batteries market. Exhaustive secondary research was done to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

This research study on the lithium iron phosphate batteries market involved the use of extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg, Businessweek, Factiva, IRENA, International Energy Agency, and BP Statistical Review of World Energy, to identify and collect information useful for a technical, market-oriented, and commercial study of the lithium iron phosphate batteries market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

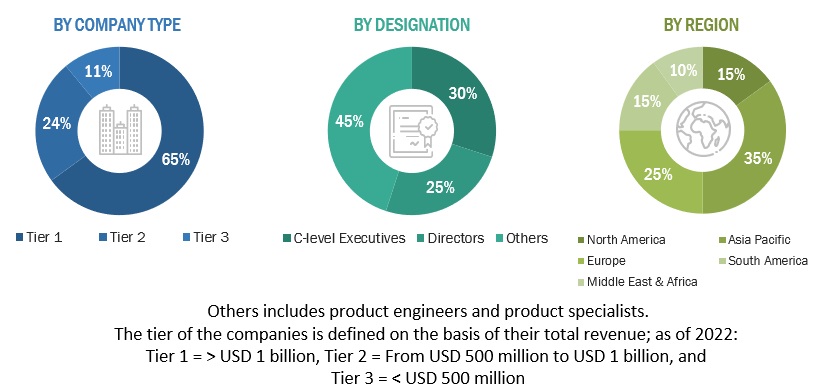

The lithium iron phosphate batteries market comprises several stakeholders such as lithium iron phosphate batteries manufacturers, manufacturing technology providers, and technical support providers in the supply chain. The demand side of this market is characterized by the rising demand for lithium iron phosphate batteries in, automobile, power, industrial, consumer electronics, marine, and aerospace industry. The supply side is characterized by rising demand for contracts from the industrial sector, and mergers & acquisitions among big players. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the lithium iron phosphate batteries market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market share in the respective regions have been determined through both primary and secondary research.

- The industry’s value chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Lithium iron phosphate batteries Market Size: Tow-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments, the data triangulation and market breakdown processes have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand- and supply sides. Along with this, the market has been validated using both the top-down and bottom-up approaches.

Market Defenition

Lithium iron phosphate (LiFePO4) batteries are a specific type of rechargeable battery with cathodes composed of lithium iron phosphate. They are a notable segment within the battery market, valued for their high power density, long cycle life, and enhanced safety features. LiFePO4 batteries find extensive applications in various industries, including electric vehicles, renewable energy storage systems, portable electronics, and industrial equipment. The market for lithium iron phosphate batteries is driven by the growing demand for reliable and efficient energy storage solutions, advancements in battery technology, increasing adoption of electric vehicles, and the shift towards renewable energy sources. The market is expected to continue expanding as these batteries offer a compelling alternative to other lithium-ion chemistries.

The growth of the lithium iron phosphate batteries market during the forecast period can be attributed to the growing demand for battery-operated material-handling equipment in various industries and growing rising industrial automation across major countries in North America, South America, Europe, Asia Pacific, and Middle East & Africa.

Key Stakeholders

- Lithium iron phosphate battery manufacturers & providers

- Electric vehicle (EV) manufacturing companies

- Lithium-ion battery manufacturers & providers

- R&D laboratories

- Energy & power sector consulting companies

- Distributors of lithium iron phosphate batteries

- Government and research organizations

- State and national regulatory authorities

Objectives of the Study

- To describe, segment, and forecast the lithium iron phosphate batteries market based on capacity, industry, application, voltage, and region, in terms of value.

- To describe and forecast the market for five key regions: North America, Europe, Asia Pacific, South America, Middle East & Africa, along with their country-level market sizes, in terms of value.

- To provide information on design of lithium iron phosphate batteries

- To provide detailed information regarding key drivers, restraints, opportunities, and challenges influencing the growth of the market.

- To provide the supply chain analysis, trends/disruptions impacting the customer’s business, market map, pricing analysis, and regulatory analysis of the lithium iron phosphate batteries market.

- To analyze opportunities for stakeholders in the lithium iron phosphate batteries market and draw a competitive landscape of the market.

- To strategically analyze the ecosystem, tariffs and regulations, patent landscape, trade landscape, Porter’s five forces, and case studies pertaining to the market under study.

- To benchmark market players using the company evaluation quadrant, which analyzes market players on broad categories of business and product strategies adopted by them.

- To compare key market players with respect to the product specifications and applications.

- To strategically profile key players and comprehensively analyze their market rankings and core competencies.

- To analyze competitive developments, such as contracts & agreements, investments & expansions, mergers & acquisitions, new product launches, partnerships, joint ventures & collaborations, in the lithium iron phosphate batteries market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Product Analysis

- Product Matrix, which provides a detailed comparison of the product portfolio of each company

Company Information

- Detailed analyses and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Lithium Iron Phosphate Batteries Market

For Lithium Iron Phosphate Batteries Market, Marketsandmarkets have profiled top 20 players in terms of their business overview, financial analysis of last 3 years, product offered, new product launched, recent developments including Mergers & Acquisitions and SWOT analysis. Chapter 10 covers the market share analysis for these players and the recent developments took place since 2018 till 2021 for instance in product launches, deals and Partnerships % Collaborations of these companies. Contents of Interim: 1) Market Overview 2) Competitive Landscape (WIP) 3) Company Profiles (WIP) 4) Appendix. For each key player, Marketsandmarkets will provide their manufacturing process, by location (world-wide) and inform which type of production methodology they adopted (i.e., ) Phosphoric acid(wet process & elemental phosphorus process), or Ammonium Dihydrogenphosphate, or Iron Phosphate or Precursor or LFP battery.