TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 45)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES, 2019–2021

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

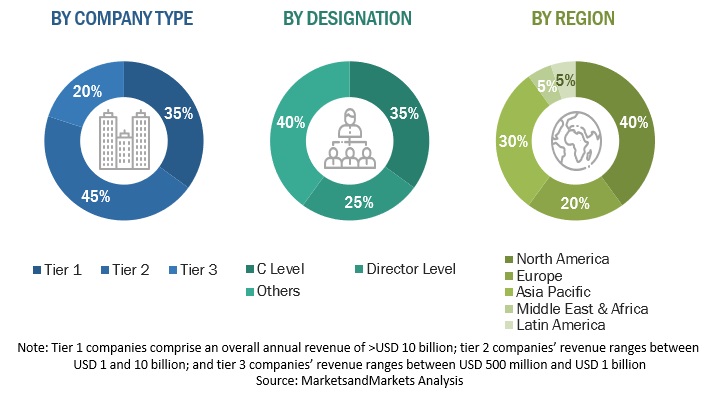

2 RESEARCH METHODOLOGY (Page No. - 51)

2.1 RESEARCH DATA

FIGURE 1 MARKET RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

TABLE 2 PRIMARY SOURCES

2.1.2.1 Breakup of primary profiles

2.1.2.2 Key industry insights

2.2 DATA TRIANGULATION

FIGURE 2 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 3 TOP-DOWN AND BOTTOM-UP APPROACHES

2.3.1 TOP-DOWN APPROACH

2.3.2 BOTTOM-UP APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE): REVENUE OF SOLUTIONS/SERVICES OF LOCATION ANALYTICS

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY:-APPROACH 2 - BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE OF ALL LOCATION ANALYTICS SOLUTIONS/SERVICES

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 3 - BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM ALL LOCATION ANALYTICS SOFTWARE/SERVICES

FIGURE 7 SIZE ESTIMATION METHODOLOGY: APPROACH 4 - BOTTOM-UP (DEMAND-SIDE): SHARE OF LOCATION ANALYTICS THROUGH OVERALL LOCATION ANALYTICS SPENDING

2.4 MARKET FORECAST

TABLE 3 FACTOR ANALYSIS

2.5 KEY COMPANY EVALUATION MATRIX

FIGURE 8 COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.6 STARTUP/SME EVALUATION MATRIX METHODOLOGY

FIGURE 9 STARTUP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.7 ASSUMPTIONS

2.8 LIMITATIONS

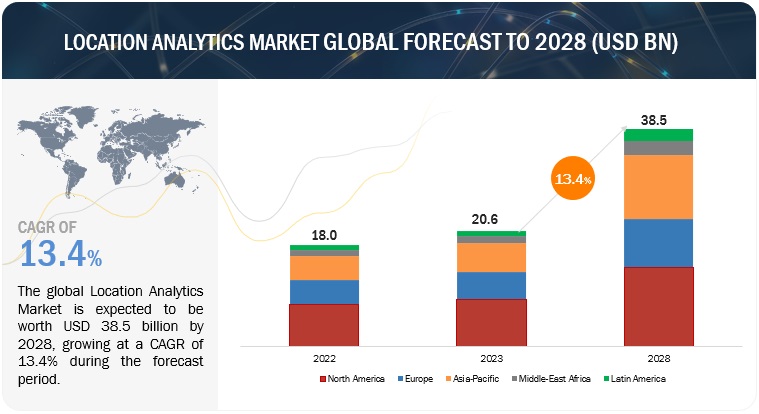

3 EXECUTIVE SUMMARY (Page No. - 64)

TABLE 4 LOCATION ANALYTICS MARKET AND GROWTH RATE, 2016–2021 (USD MILLION AND Y-O-Y GROWTH)

TABLE 5 MARKET AND GROWTH RATE, 2022–2027 (USD MILLION AND Y-O-Y GROWTH)

3.1 OVERVIEW OF RECESSION

FIGURE 10 MARKET TO WITNESS DECLINE IN Y-O-Y GROWTH IN 2022

FIGURE 11 SOLUTIONS SEGMENT TO ACCOUNT FOR A LARGER MARKET SIZE IN 2022

FIGURE 12 GEOCODING & REVERSE GEOCODING SOLUTIONS TO ACCOUNT FOR LARGEST MARKET SIZE IN 2022

FIGURE 13 PROFESSIONAL SERVICES TO ACCOUNT FOR LARGER MARKET SHARE IN 2022

FIGURE 14 CONSULTING SERVICES TO ACCOUNT FOR LARGER MARKET SHARE IN 2022

FIGURE 15 CLOUD DEPLOYMENT TO ACCOUNT FOR LARGER MARKET SIZE IN 2022

FIGURE 16 OUTDOOR LOCATION TO ACCOUNT FOR LARGER MARKET SIZE IN 2022

FIGURE 17 REMOTE MONITORING APPLICATION TO ACCOUNT FOR LARGEST MARKET SHARE IN 2022

FIGURE 18 LARGE ENTERPRISES TO ACCOUNT FOR A LARGER MARKET SHARE IN 2022

FIGURE 19 HEALTHCARE, PHARMA, AND LIFE SCIENCES VERTICAL TO ACCOUNT FOR LARGEST MARKET IN 2022

FIGURE 20 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET IN 2022

4 PREMIUM INSIGHTS (Page No. - 72)

4.1 ATTRACTIVE OPPORTUNITIES FOR LOCATION ANALYTICS MARKET PLAYERS

FIGURE 21 NEED TO ANALYZE OPTIMUM ROUTES TO DESTINATION LOGISTICS COMPANY WITH EFFICIENT ALTERNATE ROUTES TO DRIVE MARKET

4.2 MARKET: TOP THREE VERTICALS

FIGURE 22 RETAIL SEGMENT TO BE LARGEST VERTICAL DURING FORECAST PERIOD

4.3 MARKET, BY REGION

FIGURE 23 NORTH AMERICA TO ACCOUNT FOR LARGEST REGIONAL MARKET IN 2022

4.4 NORTH AMERICA: MARKET, BY APPLICATION AND VERTICAL

FIGURE 24 RISK MANAGEMENT APPLICATION AND RETAIL VERTICAL TO ACCOUNT FOR LARGEST RESPECTIVE SHARES IN NORTH AMERICA IN 2022

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 74)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 25 LOCATION ANALYTICS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Growth in adoption of spatial data and analytical tools across several verticals

5.2.1.2 Rise in use of location-based applications among consumers

5.2.1.3 Greater organizational need to gain competitive advantage across verticals

5.2.2 RESTRAINTS

5.2.2.1 Legal concerns associated with geoprivacy and confidential data

5.2.2.2 High initial cost of deployment

5.2.3 OPPORTUNITIES

5.2.3.1 Increase in adoption in small and medium-sized enterprises

5.2.3.2 Growth in penetration of advanced technologies

5.2.4 CHALLENGES

5.2.4.1 Lack of uniform regulatory norms

5.2.4.2 Lack of skilled workforce

5.3 CASE STUDY ANALYSIS

5.3.1 BANKING & FINANCIAL SERVICES

5.3.1.1 Use case 1: CARTO helped Mastercard with data monetization

5.3.1.2 Use case 2: Esri helped retail bank improve business performance

5.3.1.3 Use case 3: Quadrant helped optimize ATM locations

5.3.1.4 Use case 4: Quadrant improved targeted advertising

5.3.2 INSURANCE USE CASES

5.3.2.1 Use case 1: CARTO modeled platforms to detect fraud

5.3.2.2 Use case 2: Gravy Analytics worked with insurance companies to predict risks

5.3.2.3 Use case 3: Esri helped risk managers build profitable portfolios

5.3.3 RETAIL

5.3.3.1 Use case 1: CARTO used location analytics to select sites for brick-and-mortar workspaces

5.3.3.2 Use case 2: Xtract.io assisted companies in expanding into new markets

5.3.3.3 Use case 3: Cisco DNA Spaces’ location-based services were used by retailers to acquire new customers and increase loyalty

5.3.4 HEALTHCARE

5.3.4.1 Use case 1: Quuppa Intelligent Locating System solution was used to ensure reduced hospital infections

5.3.4.2 Use case 2: Spatial modeling was useful for identifying root causes of health issues

5.3.5 REAL ESTATE

5.3.5.1 Use case 1: Jones Lang LaSalle used CARTO-designed platform for site planning

5.3.5.2 Use case 2: Tinsa Digital used CARTO’s platform for managing real estate portfolio

5.3.5.3 Use case 3: CARTO-powered platform enabled OneMap’s customers to leverage location data

5.3.6 ENERGY & UTILITY

5.3.6.1 Use case 1: MapLarge Platform assisted oil & gas companies in fulfilling growing resource demand

5.3.6.2 Use case 2: MapLarge Platform helped manage outages

5.3.7 HOSPITALITY

5.3.7.1 Use case 1: Skyhook LI has been implemented for loyalty management

5.3.7.2 Use case 2: Skyhook’s solutions helped gain competitive insights

5.3.8 MEDIA & ENTERTAINMENT

5.3.8.1 Use case 1: CARTO Platform analyzed ad campaigns for geomarketing

5.3.9 TRANSPORTATION & LOGISTICS

5.3.9.1 Use case 1: CARTO’s logistics analytics helped in supply chain optimization

5.3.10 GOVERNMENT

5.3.10.1 Use case 1: Quuppa Intelligent Locating System enhanced access control

5.3.10.2 Use case 2: Quuppa Intelligent Locating System helped law enforcement and corrections

5.4 PATENT ANALYSIS

5.4.1 METHODOLOGY

5.4.2 DOCUMENT TYPE

TABLE 6 PATENTS FILED, 2019–2022

5.4.3 INNOVATION AND PATENT APPLICATIONS

FIGURE 26 ANNUAL NUMBER OF PATENTS GRANTED, 2019–2022

5.4.3.1 Top applicants

FIGURE 27 TOP TEN PATENT APPLICANT COMPANIES, 2019–2022

5.5 MARKET ECOSYSTEM

TABLE 7 ECOSYSTEM MAPPING

5.6 SUPPLY CHAIN ANALYSIS

FIGURE 28 SUPPLY CHAIN ANALYSIS

5.7 PRICING MODEL ANALYSIS

TABLE 8 AVERAGE SELLING PRICING ANALYSIS, 2022

5.8 TRENDS/DISRUPTIONS IMPACTING BUYERS/CLIENTS

FIGURE 29 TRENDS/DISRUPTIONS IMPACTING BUYERS/CLIENTS

5.9 PORTER’S FIVE FORCES ANALYSIS

FIGURE 30 PORTER’S FIVE FORCES ANALYSIS

TABLE 9 PORTER’S FIVE FORCES ANALYSIS

5.9.1 THREAT OF NEW ENTRANTS

5.9.2 THREAT OF SUBSTITUTES

5.9.3 BARGAINING POWER OF SUPPLIERS

5.9.4 BARGAINING POWER OF BUYERS

5.9.5 INTENSITY OF COMPETITIVE RIVALRY

5.10 REGULATORY IMPLICATIONS

5.10.1 GENERAL DATA PROTECTION REGULATION

5.10.2 PERSONAL DATA PROTECTION ACT

5.10.3 CALIFORNIA CONSUMER PRIVACY ACT

5.11 TECHNOLOGIES IN LOCATION ANALYTICS

5.11.1 BLUETOOTH

5.11.2 GLOBAL POSITIONING SYSTEM

5.11.3 RADIO-FREQUENCY IDENTIFICATION

5.11.4 WI-FI

5.11.5 NEAR-FIELD COMMUNICATION

5.11.6 BEACON

6 LOCATION ANALYTICS MARKET, BY COMPONENT (Page No. - 101)

6.1 INTRODUCTION

FIGURE 31 LOCATION ANALYTICS SERVICES TO GROW AT A HIGHER CAGR THAN SOLUTIONS DURING FORECAST PERIOD

TABLE 10 MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 11 MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

6.1.1 COMPONENT: MARKET DRIVERS

6.2 SOLUTIONS

6.2.1 COMPANIES INVEST IN GEOSPATIAL ANALYTICS SOLUTIONS TO UNDERSTAND BUSINESS TRENDS AND INCREASE PRODUCTIVITY

TABLE 12 LOCATION ANALYTICS SOLUTIONS MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 13 LOCATION ANALYTICS SOLUTIONS MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 14 LOCATION ANALYTICS SOLUTIONS MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 15 LOCATION ANALYTICS SOLUTIONS MARKET, BY TYPE, 2022–2027 (USD MILLION)

6.2.2 GEOCODING & REVERSE GEOCODING

6.2.2.1 ADOPTION OF GEOCODING & REVERSE GEOCODING SOLUTIONS TO HELP TRANSFORM LOCATION DATA

TABLE 16 GEOCODING & REVERSE GEOCODING SOLUTIONS MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 17 GEOCODING & REVERSE GEOCODING SOLUTIONS MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.3 DATA INTEGRATION & ETL

6.2.3.1 ABILITY TO EXTRACT GEOGRAPHIC DATA FROM ANY SOURCE SYSTEM TO INCREASE ADOPTION OF LOCATION ANALYTICS

TABLE 18 DATA INTEGRATION & ETL SOLUTIONS MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 19 DATA INTEGRATION & ETL SOLUTIONS MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.4 REPORTING & VISUALIZATION

6.2.4.1 REPORTING & VISUALIZATION SOLUTIONS TO OFFER DETAILED SIMPLIFIED ANALYSIS OF COMPLEX DATA FOR CUSTOMERS

TABLE 20 REPORTING & VISUALIZATION SOLUTIONS MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 21 REPORTING & VISUALIZATION SOLUTIONS MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.5 THEMATIC MAPPING & SPATIAL ANALYSIS

6.2.5.1 THEMATIC MAPPING & SPATIAL ANALYTICS TO PROVIDE RAPID VISUAL REPRESENTATIONS OF GEOGRAPHICAL DATA

TABLE 22 THEMATIC MAPPING & SPATIAL ANALYSIS SOLUTIONS MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 23 THEMATIC MAPPING & SPATIAL ANALYSIS SOLUTIONS MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.6 OTHER SOLUTIONS

TABLE 24 OTHER LOCATION ANALYTICS SOLUTIONS MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 25 OTHER LOCATION ANALYTICS SOLUTIONS MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3 SERVICES

6.3.1 DEMAND FOR SERVICES TO GROW WITH INCREASE IN SOLUTION ADOPTION AMONG ORGANIZATIONS

FIGURE 32 MANAGED SERVICES TO GROW AT A HIGHER CAGR DURING FORECAST PERIOD

TABLE 26 LOCATION ANALYTICS SERVICES MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 27 LOCATION ANALYTICS SERVICES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 28 LOCATION ANALYTICS SERVICES MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 29 LOCATION ANALYTICS SERVICES MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3.2 MANAGED SERVICES

6.3.2.1 Pre- and post-deployment questions across technology domains to support adoption

TABLE 30 MANAGED SERVICES MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 31 MANAGED SERVICES MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3.3 PROFESSIONAL SERVICES

6.3.3.1 Professional services to help organizations implement, integrate, and optimize location analytics solutions

TABLE 32 PROFESSIONAL SERVICES MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 33 PROFESSIONAL SERVICES MARKET, BY REGION, 2022–2027 (USD MILLION)

FIGURE 33 SUPPORT & MAINTENANCE SERVICES TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 34 PROFESSIONAL SERVICES MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 35 PROFESSIONAL SERVICES MARKET, BY TYPE, 2022–2027 (USD MILLION)

6.3.3.2 Consulting

TABLE 36 CONSULTING SERVICES MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 37 CONSULTING SERVICES MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3.3.3 Support & maintenance

TABLE 38 SUPPORT & MAINTENANCE SERVICES MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 39 SUPPORT & MAINTENANCE SERVICES MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3.3.4 Deployment & integration

TABLE 40 DEPLOYMENT & INTEGRATION SERVICES MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 41 DEPLOYMENT & INTEGRATION SERVICES MARKET, BY REGION, 2022–2027 (USD MILLION)

7 LOCATION ANALYTICS MARKET, BY LOCATION TYPE (Page No. - 119)

7.1 INTRODUCTION

FIGURE 34 OUTDOOR LOCATION ANALYTICS TO ACCOUNT FOR LARGER MARKET SIZE DURING FORECAST PERIOD

TABLE 42 MARKET, BY LOCATION TYPE, 2016–2021 (USD MILLION)

TABLE 43 MARKET, BY LOCATION TYPE, 2022–2027 (USD MILLION)

7.1.1 LOCATION TYPE: MARKET DRIVERS

7.2 INDOOR LOCATION

7.2.1 ADVANCED TECHNOLOGIES TO BE USED FOR INDOOR LOCATION TRACKING

TABLE 44 INDOOR MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 45 INDOOR MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3 OUTDOOR LOCATION

7.3.1 OUTDOOR LOCATION ANALYTICS TO MONITOR IMMOVABLE ASSETS TO REDUCE COSTS

TABLE 46 OUTDOOR MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 47 OUTDOOR MARKET, BY REGION, 2022–2027 (USD MILLION)

8 LOCATION ANALYTICS MARKET, BY DEPLOYMENT MODE (Page No. - 124)

8.1 INTRODUCTION

8.1.1 DEPLOYMENT MODE: MARKET DRIVERS

FIGURE 35 ON-PREMISE DEPLOYMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 48 MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 49 MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

8.2 ON-PREMISES

8.2.1 RAPID ACCEPTANCE OF CLOUD COMPUTING SOLUTIONS TO AFFECT GROWTH OF ON-PREMISES DEPLOYMENT

TABLE 50 ON-PREMISES MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 51 ON-PREMISES MARKET, BY REGION, 2022–2027 (USD MILLION)

8.3 CLOUD

8.3.1 ADOPTION OF CLOUD-BASED SOLUTIONS TO DRIVE MARKET GROWTH

TABLE 52 CLOUD-BASED MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 53 CLOUD-BASED MARKET, BY REGION, 2022–2027 (USD MILLION)

9 LOCATION ANALYTICS MARKET, BY ORGANIZATION SIZE (Page No. - 129)

9.1 INTRODUCTION

9.1.1 ORGANIZATION SIZE: MARKET DRIVERS

FIGURE 36 SMALL & MEDIUM-SIZED ENTERPRISES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 54 MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 55 MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

9.2 SMALL & MEDIUM-SIZED ENTERPRISES

9.2.1 ADOPTION OF NEW TECHNOLOGIES TO ENHANCE BUSINESS PROCESSES TO BOOST MARKET

TABLE 56 SMALL & MEDIUM-SIZED ENTERPRISES MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 57 SMALL & MEDIUM-SIZED ENTERPRISES MARKET, BY REGION, 2022–2027 (USD MILLION)

9.3 LARGE ENTERPRISES

9.3.1 GROWTH IN ADOPTION OF LOCATION ANALYTICS AMONG LARGE ENTERPRISES TO PROVIDE BETTER NAVIGATION AND TRACKING ABILITY

TABLE 58 LARGE ENTERPRISES MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 59 LARGE ENTERPRISES MARKET, BY REGION, 2022–2027 (USD MILLION)

10 LOCATION ANALYTICS MARKET, BY APPLICATION (Page No. - 134)

10.1 INTRODUCTION

10.1.1 APPLICATION: MARKET DRIVERS

FIGURE 37 SALES & MARKETING OPTIMIZATION APPLICATION TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 60 MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 61 MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.2 RISK MANAGEMENT

10.2.1 LOCATION ANALYTICS TO IMPROVE DATA QUALITY AND STREAMLINE BUSINESS PROCESSES

TABLE 62 RISK MANAGEMENT ANALYTICS MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 63 RISK MANAGEMENT ANALYTICS MARKET, BY REGION, 2022–2027 (USD MILLION)

10.3 EMERGENCY RESPONSE MANAGEMENT

10.3.1 LOCATION ANALYTICS SIGNIFICANT IN COORDINATING CRISIS RESPONSE BETWEEN SERVICES AND EMERGENCY DEPARTMENTS

TABLE 64 EMERGENCY RESPONSE MANAGEMENT MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 65 EMERGENCY RESPONSE MANAGEMENT MARKET, BY REGION, 2022–2027 (USD MILLION)

10.4 CUSTOMER EXPERIENCE MANAGEMENT

10.4.1 LOCATION ANALYTICS TO PROVIDE USER INFORMATION AND USER EXPERIENCE DATA

TABLE 66 CUSTOMER EXPERIENCE MANAGEMENT ANALYTICS MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 67 CUSTOMER EXPERIENCE MANAGEMENT ANALYTICS MARKET, BY REGION, 2022–2027 (USD MILLION)

10.5 REMOTE MONITORING

10.5.1 REMOTE MONITORING BY LOCATION ANALYTICS TO IMPROVE SYSTEM PERFORMANCE

TABLE 68 REMOTE MONITORING ANALYTICS MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 69 REMOTE MONITORING ANALYTICS MARKET, BY REGION, 2022–2027 (USD MILLION)

10.6 SUPPLY CHAIN PLANNING

10.6.1 LOCATION ANALYTICS TO IMPROVE PERFORMANCE OF ORDER-PICKING AND STOCK-TAKING PROCESS

TABLE 70 SUPPLY CHAIN PLANNING ANALYTICS MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 71 SUPPLY CHAIN PLANNING ANALYTICS MARKET, BY REGION, 2022–2027 (USD MILLION)

10.7 SALES & MARKETING

10.7.1 LOCATION ANALYTICS TO PROVIDE USER INFORMATION AND EXPERIENCE DATA TO UNDERSTAND CUSTOMER BEHAVIOR

TABLE 72 SALES & MARKETING ANALYTICS MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 73 SALES & MARKETING ANALYTICS MARKET, BY REGION, 2022–2027 (USD MILLION)

10.8 LOCATION SELECTION & OPTIMIZATION

10.8.1 LOCATION ANALYTICS TO AID IN UNDERSTANDING BUSINESS GROWTH

TABLE 74 LOCATION SELECTION & OPTIMIZATION ANALYTICS MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 75 LOCATION SELECTION & OPTIMIZATION ANALYTICS MARKET, BY REGION, 2022–2027 (USD MILLION)

10.9 OTHER APPLICATIONS

TABLE 76 OTHER APPLICATIONS MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 77 OTHER APPLICATIONS MARKET, BY REGION, 2022–2027 (USD MILLION)

11 LOCATION ANALYTICS MARKET, BY VERTICAL (Page No. - 146)

11.1 INTRODUCTION

FIGURE 38 HEALTHCARE, PHARMA, AND LIFE SCIENCES VERTICAL TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 78 LOCATION ANALYTICS MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 79 MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

11.1.1 VERTICAL: MARKET DRIVERS

11.2 RETAIL

11.2.1 LOCATION ANALYTICS SOLUTIONS TO AID CUSTOMER EXPERIENCE

TABLE 80 RETAIL VERTICAL MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 81 RETAIL VERTICAL MARKET, BY REGION, 2022–2027 (USD MILLION)

11.3 MANUFACTURING

11.3.1 LOCATION ANALYTICS SOLUTIONS TO SUPPORT INCREASING PRODUCTIVITY

TABLE 82 MANUFACTURING VERTICAL MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 83 MANUFACTURING VERTICAL MARKET, BY REGION, 2022–2027 (USD MILLION)

11.4 GOVERNMENT & DEFENSE

11.4.1 DATA SECURITY AND SAFETY TO BE KEY FACTOR FOR MARKET GROWTH

TABLE 84 GOVERNMENT & DEFENSE VERTICAL MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 85 GOVERNMENT & DEFENSE VERTICAL MARKET, BY REGION, 2022–2027 (USD MILLION)

11.5 MEDIA & ENTERTAINMENT

11.5.1 ADOPTION OF TECHNOLOGIES TO HELP VENDORS GROW OPERATIONAL PROFITABILITY

TABLE 86 MEDIA & ENTERTAINMENT VERTICAL MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 87 MEDIA & ENTERTAINMENT VERTICAL MARKET, BY REGION, 2022–2027 (USD MILLION)

11.6 TRANSPORTATION & LOGISTICS

11.6.1 DEMAND FOR AUTOMOTIVE VEHICLES TO DRIVE MARKET GROWTH

TABLE 88 TRANSPORTATION & LOGISTICS VERTICAL MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 89 TRANSPORTATION & LOGISTICS VERTICAL MARKET, BY REGION, 2022–2027 (USD MILLION)

11.7 ENERGY & UTILITY

11.7.1 GIS TO AID ELECTRIC UTILITY COMPANIES IN DATA MANAGEMENT, PLANNING AND ANALYSIS, AND SITUATIONAL AWARENESS

TABLE 90 ENERGY & UTILITY VERTICAL MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 91 ENERGY & UTILITY VERTICAL MARKET, BY REGION, 2022–2027 (USD MILLION)

11.8 TELECOM & IT

11.8.1 RAPID ADOPTION OF DIGITAL TECHNOLOGY TO BOOST MARKET GROWTH

TABLE 92 TELECOM & IT VERTICAL MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 93 TELECOM & IT VERTICAL MARKET, BY REGION, 2022–2027 (USD MILLION)

11.9 BANKING & FINANCIAL SERVICES

11.9.1 LOCATION ANALYTICS TO FACILITATE DIGITAL PORTFOLIO MANAGEMENT FROM DATA REPOSITORY

TABLE 94 BANKING & FINANCIAL SERVICES VERTICAL MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 95 BANKING & FINANCIAL SERVICES VERTICAL MARKET, BY REGION, 2022–2027 (USD MILLION)

11.1 INSURANCE

11.10.1 LOCATION ANALYTICS TO PROVIDE ACCURATE INSIGHTS TO CUSTOMERS

TABLE 96 INSURANCE VERTICAL MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 97 INSURANCE VERTICAL MARKET, BY REGION, 2022–2027 (USD MILLION)

11.11 HEALTHCARE, PHARMA, AND LIFE SCIENCES

11.11.1 LOCATION ANALYTICS TO AID HEALTHCARE PROFESSIONALS IN CLASSIFYING HEALTH TRENDS

TABLE 98 HEALTHCARE, PHARMA, AND LIFE SCIENCES VERTICAL MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 99 HEALTHCARE, PHARMA, AND LIFE SCIENCES VERTICAL MARKET, BY REGION, 2022–2027 (USD MILLION)

11.12 TOURISM & HOSPITALITY

11.12.1 LOCATION ANALYTICS SOLUTIONS TO PROVIDE REAL-TIME DATA FOR GUESTS

TABLE 100 TOURISM & HOSPITALITY VERTICAL MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 101 TOURISM & HOSPITALITY VERTICAL MARKET, BY REGION, 2022–2027 (USD MILLION)

11.13 REAL ESTATE

11.13.1 GEOFENCING-ENABLED LOCATION ANALYTICS TO HELP VISUALIZE CUSTOMER BEHAVIOR

TABLE 102 REAL ESTATE VERTICAL MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 103 REAL ESTATE VERTICAL MARKET, BY REGION, 2022–2027 (USD MILLION)

11.14 EDUCATION

11.14.1 LOCATION ANALYTICS SOLUTIONS TO SUPPORT CAMPUS SAFETY AND SECURITY PURPOSES

TABLE 104 EDUCATION VERTICAL MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 105 EDUCATION VERTICAL MARKET, BY REGION, 2022–2027 (USD MILLION)

12 LOCATION ANALYTICS MARKET, BY REGION (Page No. - 164)

12.1 INTRODUCTION

FIGURE 39 ASIA PACIFIC TO ACHIEVE HIGHEST GROWTH IN MARKET DURING FORECAST PERIOD

FIGURE 40 ASIA PACIFIC TO ACHIEVE HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

TABLE 106 MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 107 MARKET, BY REGION, 2022–2027 (USD MILLION)

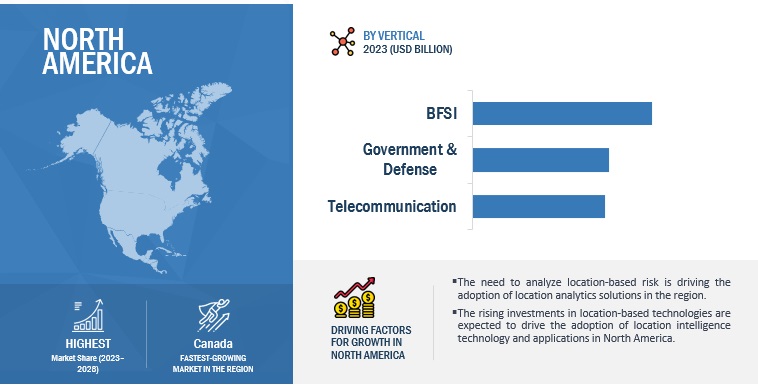

12.2 NORTH AMERICA

12.2.1 NORTH AMERICA: LOCATION ANALYTICS MARKET DRIVERS

12.2.2 NORTH AMERICA: RECESSION IMPACT

12.2.3 NORTH AMERICA: REGULATIONS

12.2.3.1 Health Insurance Portability and Accountability Act of 1996

12.2.3.2 California Consumer Privacy Act

12.2.3.3 Health Information Technology for Economic and Clinical Health Act

12.2.3.4 Sarbanes Oxley Act

12.2.3.5 The United States Securities and Exchange Commission

12.2.3.6 International Organization for Standardization 27001

12.2.3.7 California Consumer Privacy Act

12.2.3.8 Federal Information Security Management Act

12.2.3.9 Payment Card Industry Data Security Standard

12.2.3.10 Federal Information Processing Standards

FIGURE 41 NORTH AMERICA: LOCATION ANALYTICS MARKET SNAPSHOT

TABLE 108 NORTH AMERICA: LOCATION ANALYTICS MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 109 NORTH AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 110 NORTH AMERICA: LOCATION ANALYTICS SERVICES MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 111 NORTH AMERICA: LOCATION ANALYTICS SERVICES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 112 NORTH AMERICA: PROFESSIONAL SERVICES MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 113 NORTH AMERICA: PROFESSIONAL SERVICES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 114 NORTH AMERICA: LOCATION ANALYTICS SOLUTIONS MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 115 NORTH AMERICA: LOCATION ANALYTICS SOLUTIONS MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 116 NORTH AMERICA: MARKET, BY LOCATION TYPE, 2016–2021 (USD MILLION)

TABLE 117 NORTH AMERICA: LOCATION ANALYTICS MARKET, BY LOCATION TYPE, 2022–2027 (USD MILLION)

TABLE 118 NORTH AMERICA: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 119 NORTH AMERICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 120 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 121 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 122 NORTH AMERICA: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 123 NORTH AMERICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 124 NORTH AMERICA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 125 NORTH AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 126 NORTH AMERICA: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 127 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.2.4 US

12.2.4.1 Increase in adoption of geospatial analytics technologies to drive market growth

TABLE 128 US: LOCATION ANALYTICS MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 129 US: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 130 US: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 131 US: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

12.2.5 CANADA

12.2.5.1 Adoption of cloud-based solutions to help enterprises easily run solutions

TABLE 132 CANADA: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 133 CANADA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 134 CANADA: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 135 CANADA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

12.3 EUROPE

12.3.1 EUROPE: MARKET DRIVERS

12.3.2 EUROPE: RECESSION IMPACT

12.3.3 EUROPE: REGULATIONS

12.3.3.1 General Data Protection Regulation

12.3.3.2 European Committee for Standardization

12.3.3.3 European Technical Standards Institute

TABLE 136 EUROPE: LOCATION ANALYTICS MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 137 EUROPE: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 138 EUROPE: LOCATION ANALYTICS SERVICES MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 139 EUROPE: LOCATION ANALYTICS SERVICES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 140 EUROPE: PROFESSIONAL SERVICES MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 141 EUROPE: PROFESSIONAL SERVICES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 142 EUROPE: LOCATION ANALYTICS SOLUTIONS MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 143 EUROPE: LOCATION ANALYTICS SOLUTIONS MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 144 EUROPE: MARKET, BY LOCATION TYPE, 2016–2021 (USD MILLION)

TABLE 145 EUROPE: MARKET, BY LOCATION TYPE, 2022–2027 (USD MILLION)

TABLE 146 EUROPE: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 147 EUROPE: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 148 EUROPE: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 149 EUROPE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 150 EUROPE: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 151 EUROPE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 152 EUROPE: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 153 EUROPE: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 154 EUROPE: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 155 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.3.4 UK

12.3.4.1 Government investments in innovation for smart infrastructure to boost tracking and navigation solutions

TABLE 156 UK: LOCATION ANALYTICS MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 157 UK: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 158 UK: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 159 UK: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

12.3.5 GERMANY

12.3.5.1 Adoption of location intelligence in smart grid development to contribute to market growth

TABLE 160 GERMANY: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 161 GERMANY: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 162 GERMANY: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 163 GERMANY: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

12.3.6 FRANCE

12.3.6.1 Government investment in intelligent location technologies to augment market growth

12.3.7 REST OF EUROPE

12.4 ASIA PACIFIC

12.4.1 ASIA PACIFIC: MARKET DRIVERS

12.4.2 ASIA PACIFIC: RECESSION IMPACT

12.4.3 ASIA PACIFIC: REGULATIONS

12.4.3.1 Privacy Commissioner for Personal Data

12.4.3.2 Act on the Protection of Personal Information

12.4.3.3 Critical Information Infrastructure

12.4.3.4 International Organization for Standardization 27001

12.4.3.5 Personal Data Protection Act

FIGURE 42 ASIA PACIFIC: LOCATION ANALYTICS MARKET SNAPSHOT

TABLE 164 ASIA PACIFIC: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 165 ASIA PACIFIC: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 166 ASIA PACIFIC: LOCATION ANALYTICS SERVICES MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 167 ASIA PACIFIC: LOCATION ANALYTICS SERVICES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 168 ASIA PACIFIC: PROFESSIONAL SERVICES MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 169 ASIA PACIFIC: PROFESSIONAL SERVICES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 170 ASIA PACIFIC: LOCATION ANALYTICS SOLUTIONS MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 171 ASIA PACIFIC: LOCATION ANALYTICS SOLUTIONS MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 172 ASIA PACIFIC: MARKET, BY LOCATION TYPE, 2016–2021 (USD MILLION)

TABLE 173 ASIA PACIFIC: MARKET, BY LOCATION TYPE, 2022–2027 (USD MILLION)

TABLE 174 ASIA PACIFIC: LOCATION ANALYTICS MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 175 ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 176 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 177 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 178 ASIA PACIFIC: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 179 ASIA PACIFIC: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 180 ASIA PACIFIC: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 181 ASIA PACIFIC: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 182 ASIA PACIFIC: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 183 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.4.4 CHINA

12.4.4.1 Government initiatives for R&D and investments by global players to drive market

TABLE 184 CHINA: LOCATION ANALYTICS MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 185 CHINA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 186 CHINA: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 187 CHINA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

12.4.5 JAPAN

12.4.5.1 Growth of geospatial analytics in construction to create opportunities for location intelligence technologies

12.4.6 INDIA

12.4.6.1 Adoption of location intelligence to increase profitability and improve customer engagement

12.4.7 REST OF ASIA PACIFIC

12.5 MIDDLE EAST & AFRICA

12.5.1 MIDDLE EAST & AFRICA: MARKET DRIVERS

12.5.2 MIDDLE EAST & AFRICA: RECESSION IMPACT

12.5.3 MIDDLE EAST & AFRICA: REGULATIONS

12.5.3.1 Israeli Privacy Protection Regulations (Data Security), 5777-2017

12.5.3.2 GDPR Applicability in KSA

12.5.3.3 Protection of Personal Information Act (POPIA)

TABLE 188 MIDDLE EAST & AFRICA: LOCATION ANALYTICS MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 189 MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 190 MIDDLE EAST & AFRICA: LOCATION ANALYTICS SERVICES MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 191 MIDDLE EAST & AFRICA: LOCATION ANALYTICS SERVICES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 192 MIDDLE EAST & AFRICA: PROFESSIONAL SERVICES MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 193 MIDDLE EAST & AFRICA: PROFESSIONAL SERVICES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 194 MIDDLE EAST & AFRICA: LOCATION ANALYTICS SOLUTIONS MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 195 MIDDLE EAST & AFRICA: LOCATION ANALYTICS SOLUTIONS MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 196 MIDDLE EAST & AFRICA: MARKET, BY LOCATION TYPE, 2016–2021 (USD MILLION)

TABLE 197 MIDDLE EAST & AFRICA: MARKET, BY LOCATION TYPE, 2022–2027 (USD MILLION)

TABLE 198 MIDDLE EAST & AFRICA: LOCATION ANALYTICS MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 199 MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 200 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 201 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 202 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 203 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 204 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 205 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 206 MIDDLE EAST & AFRICA: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 207 MIDDLE EAST & AFRICA: MARKET, BY REGION, 2022–2027 (USD MILLION)

12.5.4 MIDDLE EAST

12.5.4.1 GIS initiatives undertaken to improve quality of spatial data and facilitate data sharing

TABLE 208 MIDDLE EAST: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 209 MIDDLE EAST: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 210 MIDDLE EAST: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 211 MIDDLE EAST: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

12.5.5 AFRICA

12.5.5.1 Adoption of smartphone users to have significant effect on increasing demand for location intelligence solutions

TABLE 212 AFRICA: LOCATION ANALYTICS MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 213 AFRICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 214 AFRICA: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 215 AFRICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

12.6 LATIN AMERICA

12.6.1 LATIN AMERICA: MARKET DRIVERS

12.6.2 LATIN AMERICA: RECESSION IMPACT

12.6.3 LATIN AMERICA: REGULATIONS

12.6.3.1 Brazil Data Protection Law

12.6.3.2 Argentina Personal Data Protection Law No. 25.326

TABLE 216 LATIN AMERICA: LOCATION ANALYTICS MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 217 LATIN AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 218 LATIN AMERICA: LOCATION ANALYTICS SERVICES MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 219 LATIN AMERICA: LOCATION ANALYTICS SERVICES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 220 LATIN AMERICA: PROFESSIONAL SERVICES MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 221 LATIN AMERICA: PROFESSIONAL SERVICES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 222 LATIN AMERICA: LOCATION ANALYTICS SOLUTIONS MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 223 LATIN AMERICA: LOCATION ANALYTICS SOLUTIONS MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 224 LATIN AMERICA: MARKET, BY LOCATION TYPE, 2016–2021 (USD MILLION)

TABLE 225 LATIN AMERICA: MARKET, BY LOCATION TYPE, 2022–2027 (USD MILLION)

TABLE 226 LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 227 LATIN AMERICA: LOCATION ANALYTICS MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 228 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 229 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 230 LATIN AMERICA: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 231 LATIN AMERICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 232 LATIN AMERICA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 233 LATIN AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 234 LATIN AMERICA: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 235 LATIN AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.6.4 BRAZIL

12.6.4.1 Investments in new spectra to push demand for location intelligence solutions

12.6.5 MEXICO

12.6.5.1 Adoption of location analytics in construction and oil & gas exploration to fuel market growth

12.6.6 REST OF LATIN AMERICA

13 COMPETITIVE LANDSCAPE (Page No. - 228)

13.1 OVERVIEW

13.2 STRATEGIES ADOPTED BY KEY PLAYERS

TABLE 236 OVERVIEW OF STRATEGIES ADOPTED BY KEY LOCATION ANALYTICS VENDORS

13.3 MARKET SHARE ANALYSIS

FIGURE 43 LOCATION ANALYTICS MARKET SHARE ANALYSIS OF KEY PLAYERS

TABLE 237 MARKET: DEGREE OF COMPETITION

13.4 REVENUE ANALYSIS

FIGURE 44 REVENUE ANALYSIS FOR LEADING PLAYERS, 2017–2021 (USD MILLION)

13.5 MARKET EVALUATION FRAMEWORK

FIGURE 45 MARKET EVALUATION FRAMEWORK: EXPANSIONS AND CONSOLIDATIONS BETWEEN 2019 AND 2022

13.6 KEY COMPANY EVALUATION QUADRANT

13.6.1 STARS

13.6.2 EMERGING LEADERS

13.6.3 PERVASIVE PLAYERS

13.6.4 PARTICIPANTS

FIGURE 46 KEY LOCATION ANALYTICS MARKET PLAYERS, COMPANY EVALUATION MATRIX, 2022

13.7 KEY PLAYER COMPETITIVE BENCHMARKING

TABLE 238 KEY COMPANY PRODUCT FOOTPRINT

TABLE 239 KEY COMPANY REGIONAL FOOTPRINT

13.8 STARTUP/SME EVALUATION QUADRANT

13.8.1 PROGRESSIVE COMPANIES

13.8.2 RESPONSIVE COMPANIES

13.8.3 DYNAMIC COMPANIES

13.8.4 STARTING BLOCKS

FIGURE 47 STARTUP/SME LOCATION ANALYTICS PLAYERS, COMPANY EVALUATION MATRIX, 2022

13.9 STARTUP/SMES COMPETITIVE BENCHMARKING

TABLE 240 DETAILED LIST OF KEY STARTUPS/SMES

TABLE 241 COMPETITIVE BENCHMARKING OF STARTUPS/SMES

13.10 COMPETITIVE SCENARIO

13.10.1 PRODUCT LAUNCHES

TABLE 242 PRODUCT LAUNCHES, JUNE 2018–AUGUST 2021

13.10.2 DEALS

TABLE 243 DEALS, AUGUST 2019–AUGUST 2021

14 COMPANY PROFILES (Page No. - 260)

(Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)*

14.1 INTRODUCTION

14.2 KEY PLAYERS

14.2.1 IBM

TABLE 244 IBM: BUSINESS OVERVIEW

FIGURE 48 IBM: COMPANY SNAPSHOT

TABLE 245 IBM: PRODUCTS OFFERED

TABLE 246 IBM: SERVICES OFFERED

TABLE 247 IBM: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 248 IBM: DEALS

14.2.2 GOOGLE

TABLE 249 GOOGLE: BUSINESS OVERVIEW

FIGURE 49 GOOGLE: COMPANY SNAPSHOT

TABLE 250 GOOGLE: PRODUCTS OFFERED

TABLE 251 GOOGLE: SERVICES OFFERED

TABLE 252 GOOGLE: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 253 GOOGLE: DEALS

14.2.3 ORACLE

TABLE 254 ORACLE: BUSINESS OVERVIEW

FIGURE 50 ORACLE: COMPANY SNAPSHOT

TABLE 255 ORACLE: PRODUCTS OFFERED

TABLE 256 ORACLE: SERVICES OFFERED

TABLE 257 ORACLE: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 258 ORACLE: DEALS

14.2.4 MICROSOFT

TABLE 259 MICROSOFT: BUSINESS OVERVIEW

FIGURE 51 MICROSOFT: COMPANY SNAPSHOT

TABLE 260 MICROSOFT: PRODUCTS OFFERED

TABLE 261 MICROSOFT: SERVICES OFFERED

TABLE 262 MICROSOFT: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 263 MICROSOFT: DEALS

14.2.5 ESRI

TABLE 264 ESRI: BUSINESS OVERVIEW

TABLE 265 ESRI: PRODUCTS OFFERED

TABLE 266 ESRI: SERVICES OFFERED

TABLE 267 ESRI: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 268 ESRI: DEALS

14.2.6 SAS

TABLE 269 SAS: BUSINESS OVERVIEW

FIGURE 52 SAS: COMPANY SNAPSHOT

TABLE 270 SAS: PRODUCTS OFFERED

TABLE 271 SAS: SERVICES OFFERED

TABLE 272 SAS: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 273 SAS: DEALS

14.2.7 PRECISELY

TABLE 274 PRECISELY: BUSINESS OVERVIEW

TABLE 275 PRECISELY: PRODUCTS OFFERED

TABLE 276 PRECISELY: SERVICES OFFERED

TABLE 277 PRECISELY: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 278 PRECISELY: DEALS

14.2.8 SAP

TABLE 279 SAP: BUSINESS OVERVIEW

FIGURE 53 SAP: COMPANY SNAPSHOT

TABLE 280 SAP: PRODUCTS OFFERED

TABLE 281 SAP: SERVICES OFFERED

TABLE 282 SAP: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 283 SAP: DEALS

14.2.9 CISCO

TABLE 284 CISCO: BUSINESS OVERVIEW

FIGURE 54 CISCO: COMPANY SNAPSHOT

TABLE 285 CISCO: PRODUCTS OFFERED

TABLE 286 CISCO: SERVICES OFFERED

TABLE 287 CISCO: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 288 CISCO: DEALS

14.2.10 TOMTOM

TABLE 289 TOMTOM: BUSINESS OVERVIEW

FIGURE 55 TOMTOM: COMPANY SNAPSHOT

TABLE 290 TOMTOM: PRODUCTS OFFERED

TABLE 291 TOMTOM: SERVICES OFFERED

TABLE 292 TOMTOM: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 293 TOMTOM: DEALS

14.2.11 HEXAGON

TABLE 294 HEXAGON: BUSINESS OVERVIEW

FIGURE 56 HEXAGON: COMPANY SNAPSHOT

TABLE 295 HEXAGON: PRODUCTS OFFERED

TABLE 296 HEXAGON: SERVICES OFFERED

TABLE 297 HEXAGON: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 298 HEXAGON: DEALS

14.2.12 ZEBRA TECHNOLOGIES

TABLE 299 ZEBRA TECHNOLOGIES: BUSINESS OVERVIEW

FIGURE 57 ZEBRA TECHNOLOGIES: COMPANY SNAPSHOT

TABLE 300 ZEBRA TECHNOLOGIES: PRODUCTS OFFERED

TABLE 301 ZEBRA TECHNOLOGIES: SERVICES OFFERED

TABLE 302 ZEBRA TECHNOLOGIES: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 303 ZEBRA TECHNOLOGIES: DEALS

14.2.13 ALTERYX

TABLE 304 ALTERYX: BUSINESS OVERVIEW

FIGURE 58 ALTERYX: COMPANY SNAPSHOT

TABLE 305 ALTERYX: PRODUCTS OFFERED

TABLE 306 ALTERYX: SERVICES OFFERED

TABLE 307 ALTERYX: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 308 ALTERYX: DEALS

14.2.14 HERE

TABLE 309 HERE: BUSINESS OVERVIEW

TABLE 310 HERE: PRODUCTS OFFERED

TABLE 311 HERE: SERVICES OFFERED

TABLE 312 HERE: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 313 HERE: DEALS

14.2.15 PURPLE

TABLE 314 PURPLE: BUSINESS OVERVIEW

TABLE 315 PURPLE: PRODUCTS OFFERED

TABLE 316 PURPLE: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 317 PURPLE: DEALS

14.2.16 GALIGEO

TABLE 318 GALIGEO: BUSINESS OVERVIEW

TABLE 319 GALIGEO: PRODUCTS OFFERED

TABLE 320 GALIGEO: PRODUCT LAUNCHES AND ENHANCEMENTS

14.2.17 CARTO

14.2.18 TIBCO

14.2.19 MAPLARGE

14.2.20 SPARKGEO

14.2.21 ASCENT CLOUD

14.2.22 FOURSQUARE

14.2.23 LEPTON SOFTWARE

14.3 STARTUPS/SMES

14.3.1 GEOMOBY

14.3.2 QUUPPA

14.3.3 CLEVERMAPS

14.3.4 INDOORATLAS

14.3.5 SEDIMENTIQ

14.3.6 ARIADNE MAP

14.3.7 LOCALE.AI

14.3.8 GEOBLINK

14.3.9 NRBY

14.3.10 MAPIDEA

14.3.11 GAPMAPS

14.3.12 LOCATIONSCLOUD

*Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)* might not be captured in case of unlisted companies.

15 ADJACENT/RELATED MARKETS (Page No. - 338)

15.1 GEOSPATIAL IMAGERY ANALYTICS MARKET

15.1.1 MARKET DEFINITION

15.1.1.1 Geospatial Imagery Analytics Market, by Type

TABLE 321 GEOSPATIAL IMAGERY ANALYTICS MARKET, BY TYPE, 2018–2026 (USD MILLION)

15.1.1.2 Geospatial Imagery Analytics Market, by Collection Medium

TABLE 322 GEOSPATIAL IMAGERY ANALYTICS MARKET, BY COLLECTION MEDIUM, 2018–2026 (USD MILLION)

15.1.1.3 Geospatial Imagery Analytics Market, by Application

TABLE 323 GEOSPATIAL IMAGERY ANALYTICS MARKET, BY APPLICATION, 2018–2026 (USD MILLION)

15.1.1.4 Geospatial Imagery Analytics Market, by Deployment Mode

TABLE 324 GEOSPATIAL IMAGERY ANALYTICS MARKET, BY DEPLOYMENT MODE, 2018–2026 (USD MILLION)

15.1.1.5 Geospatial Imagery Analytics Market, by Organization Size

TABLE 325 GEOSPATIAL IMAGERY ANALYTICS MARKET, BY ORGANIZATION SIZE, 2018–2026 (USD MILLION)

15.1.1.6 Geospatial Imagery Analytics Market, by Industry Vertical

TABLE 326 GEOSPATIAL IMAGERY ANALYTICS MARKET, BY INDUSTRY VERTICAL, 2018–2026 (USD MILLION)

15.1.1.7 Geospatial Imagery Analytics Market, by Region

TABLE 327 NORTH AMERICA: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY TYPE, 2018–2026 (USD MILLION)

TABLE 328 NORTH AMERICA: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 329 NORTH AMERICA: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY COLLECTION MEDIUM, 2018–2026 (USD MILLION)

TABLE 330 NORTH AMERICA: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY DEPLOYMENT MODE, 2018–2026 (USD MILLION)

TABLE 331 NORTH AMERICA: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY ORGANIZATION SIZE, 2018–2026 (USD MILLION)

TABLE 332 EUROPE: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY TYPE, 2018–2026 (USD MILLION)

TABLE 333 EUROPE: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 334 EUROPE: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY DEPLOYMENT MODE, 2018–2026 (USD MILLION)

TABLE 335 EUROPE: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY ORGANIZATION SIZE, 2018–2026 (USD MILLION)

TABLE 336 ASIA PACIFIC: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY TYPE, 2018–2026 (USD MILLION)

TABLE 337 ASIA PACIFIC: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 338 ASIA PACIFIC: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY COLLECTION MEDIUM, 2018–2026 (USD MILLION)

TABLE 339 ASIA PACIFIC: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY DEPLOYMENT MODE, 2018–2026 (USD MILLION)

TABLE 340 ASIA PACIFIC: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY ORGANIZATION SIZE, 2018–2026 (USD MILLION)

15.2 INDOOR LOCATION MARKET

15.2.1 MARKET DEFINITION

15.2.1.1 Indoor Location Market, by Component

TABLE 341 INDOOR LOCATION MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 342 INDOOR LOCATION MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

15.2.1.2 Indoor Location Market, by Service

TABLE 343 INDOOR LOCATION MARKET, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 344 INDOOR LOCATION MARKET, BY SERVICE, 2022–2027 (USD MILLION)

15.2.1.3 Indoor Location Market, by Deployment Mode

TABLE 345 INDOOR LOCATION MARKET, BY DEPLOYMENT MODE, 2017–2021 (USD MILLION)

TABLE 346 INDOOR LOCATION MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

15.2.1.4 Indoor Location Market, by Organization Size

TABLE 347 INDOOR LOCATION MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 348 INDOOR LOCATION MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

15.2.1.5 Indoor Location Market, by Technology

TABLE 349 INDOOR LOCATION MARKET, BY TECHNOLOGY, 2017–2021 (USD MILLION)

TABLE 350 INDOOR LOCATION MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

15.2.1.6 Indoor Location Market, by Application

TABLE 351 INDOOR LOCATION MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 352 INDOOR LOCATION MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

15.2.1.7 Indoor Location Market, by Vertical

TABLE 353 INDOOR LOCATION MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

TABLE 354 INDOOR LOCATION MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

15.2.1.8 Indoor Location Market, by Region

TABLE 355 INDOOR LOCATION MARKET, BY REGION, 2017–2021(USD MILLION)

TABLE 356 INDOOR LOCATION MARKET, BY REGION, 2022–2027 (USD MILLION)

16 APPENDIX (Page No. - 354)

16.1 DISCUSSION GUIDE

16.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

16.3 CUSTOMIZATION OPTIONS

16.4 RELATED REPORTS

16.5 AUTHOR DETAILS

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Location Analytics Market

looking for market outlook and forecast for global location analytics market