Location-based Services (LBS) and Real-Time Location Systems (RTLS) Market by Component (Platforms, Services, and Hardware), Location Type, Application (Tracking & Navigation, Marketing & Advertising), Vertical and Region - Global Forecast to 2027

location-based services (LBS) and RTLS market size

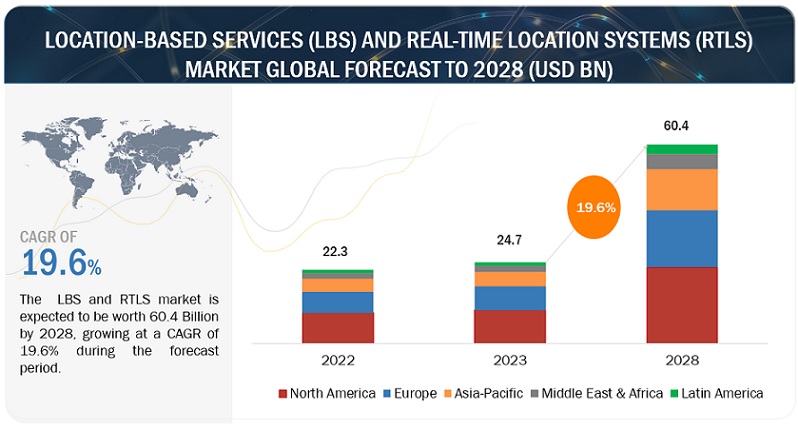

The location-based services (LBS) and RTLS market size is anticipated to increase from USD 22.3 billion in 2022 to USD 50.2 billion by 2027 With a CAGR of 17.6% during the forecast period

To know about the assumptions considered for the study, Request for Free Sample Report

Location-Based Service (LBS) and Real-Time Location Systems (RTLS) Market Dynamics

Driver: Growing demand for LBS and RTLS for industry applications

The development of platforms that offer improved accuracy is the result of the improvements in LBS and RILS technologies during the past ten years. better effectiveness and reduced prices for RTLS goods and services. The usage of RTLS increased across a number of verticals, including healthcare, industrial manufacturing, logistics, process industries (mining, oil and gas), and defense as a result of all these advancements. The benefits of tracking, monitoring, and analysing the precise location and movements of their assets are now being recognized by more sectors. These advantages include improved workflow, simpler processes, and higher production.

The penetration of LBS and RTLS solutions into several industries, including industrial manufacturing and consumer goods, is anticipated in order to create a more established tracking and locating technology. The surge in the use of LBS and RTLS solutions is a result of the requirement for high operational excellence, increased resource utilisation, and improved productivity in a company for a sustainable future. The decreased capital expenditure made feasible by the adoption of these solutions is the main driver of the rising demand for advanced asset tracking solutions. These solutions allow businesses to manage the assets for improved productivity at lower costs, in addition to tracking assets and staff.

Restraint: High cost of installation and maintenance restricts market growth

RTLS systems can be highly expensive to install, costing anything between USD 2 and $5 million. This varies depending on the installation region and the different businesses. The hardware cost of Wi-Fi-based RTLS is higher than that of UWB-enabled systems, but the installation cost is lower. The upkeep of Wi-Fi and RFID-based systems is more expensive than that of systems based on UWB and BLE, for example. The cost of the RTLS systems' hardware, software, infrastructure wiring, and electricity can be partly blamed for their high cost. While wiring, power, and the installation of RTLS components greatly increase the overall cost, the infrastructure is expensive. Many RTLS companies are facing various issues in terms of deployment and technology, as many projects are failing because they require significant engineering efforts and on-site preferences. Installation of RTLS systems requires qualified personnel to be present on the site at the time of installation.

Opportunity: Focus on IoT in healthcare

The use of loT solutions powered by technologies like RFID tags, GPS, and RTLS is gaining traction due to a number of factors. widespread use of IP networks. decreasing equipment costs and fresh business prospects all help to fuel the growing demand for loT solutions. These tools assist in tracking physical assets to enhance corporate operations and cut costs in a variety of sectors and government agencies. In general, the term "loT" is used to refer to any technology that enables networked devices to share data and carry out tasks on their own, without the need for human intervention. The adoption of loT has been among the fastest in the healthcare sector.

The capacity to collect data and monitor activity from other locations is the main benefit of loT. Accurate location information from RTLS can assist healthcare facilities boost efficiency, capacity, productivity, and throughput while lowering waste and unnecessary costs by enabling the best alignment of resources, personnel, and patients. Operational performance may be improved, maintenance costs can be decreased, and delays in problem solving can be minimised when operational data can be linked and coupled with people and things. Additionally, improved diagnostic equipment connectivity enables practitioners to collect and retrieve data that may be linked with patient records.

Challenge: Hindrance in RTLS supply chain

To stop the spread of COVID-19, many nations have imposed or are still enforcing lockdowns. The supply chains of several markets have been impacted by this, including the RTLS industry for healthcare. For RTLS manufacturers, manufacturing and selling their products is becoming more difficult as a result of this supply chain obstruction. For example, Honeywell has acknowledged that there are a few modest production and lead time issues. Although the company is working to increase capacity, there is a backlog in demand, therefore it is allocating orders based on first-in, first-out priority. Similar to these companies, Zebra Technologies was unable to finish all of its orders in the first quarter due to global supply chain problems, less than anticipated Chinese demand, and other factors.

By Component, the Services segment to have a higher growth during the forecast period

The LBS and RTLS platform's services can be divided into three categories: application support and maintenance, consultancy, and training. These services are necessary for the effective operation of RTLS and LBS. The complexity of the application and the kind of technology being used affect the general cost of installing LBS systems. Costs for middleware, services, hardware, and software are included in this amount.

Services are crucial to the whole implementation of LBS and RTLS, particularly for RTLS. Before installing RTLS, it is essential to understand the installation and maintenance requirements in order to estimate the precise time and financial commitments needed to instal a platform. For instance, some RTLS instals may take months and hinder the functioning of current systems, which can reduce staff productivity in settings like hospitals. On the other hand, other technologies, like Wi-Fi-based RTLS, can be integrated with the building's existing wireless network infrastructure and hence take less time to deploy. In addition to installation and maintenance services, the services category also includes professional services including consultation, Rol analysis, and site inspection.

By Location Type, the Outdoor segment to dominate the market during the forecast period

Outdoor positioning uses style mapping, which enables navigation services, combined with GPS, satellites, IR-based remote sensing, and other positioning technologies to find data, assets, or people in an open area. To track distant objects or people from any area, outdoor positioning is employed. The main outside positioning technologies are wireless networks, cellular networks, and GNSS. The GPS GNSS is the most widely used GNSS used on mobile devices. Based on differential GPS, aided GPS, and high-accuracy GPS chips, numerous locating strategies and methodologies have been created.

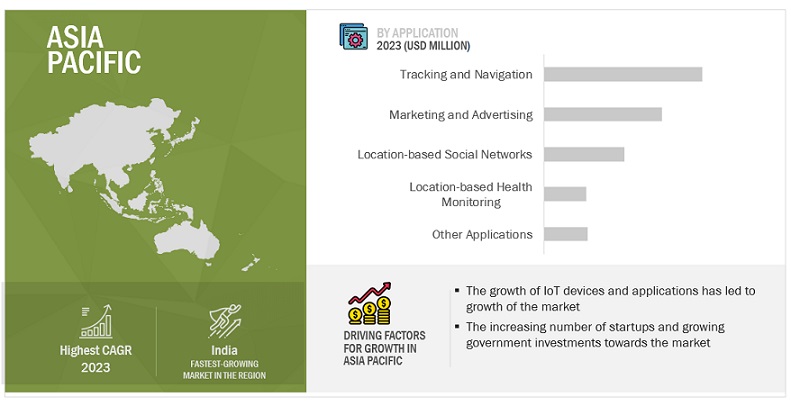

APAC to grow at the highest CAGR during the forecast period

Significant growth prospects are expected in the APAC LBS and RTLS industry during the next five years. The presence of a sizable population, evolving technology, and rapid economic development in nations like China, India, Australia, Japan, Singapore, and Hong Kong are the primary driving forces behind the expansion of the LBS and RTLS business in the region.

The Australian Federal Government, Facebook, Dominos, and Willis RE are a few of the prominent users of the enterprise location intelligence platform offered by Pitney Bowes. Pitney Bowes is a multinational shipping and mailing business that offers financial, logistical, and technological services globally. Some of the factors driving the growth of the market in fast developing economies like China and India include the rising desire to enhance supply chain operations and the initiatives taken by the governments of these nations to standardise LBS and RTLS technologies.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The report includes the study of key players Location-Based Service (LBS) and Real-Time Location Systems (RTLS) market. It profiles major vendors in the Location-Based Service (LBS) and Real-Time Location Systems (RTLS) market. The major vendors in the Location-Based Service (LBS) and Real-Time Location Systems (RTLS) market are AiRISTA Flow (US), Apple (US), Aruba Networks (US), CenTrak (US), Cisco (US), Ericsson (US), ESRI (US), GE Healthcare (US), Google (US), HERE (Netherlands), IBM (US), KDDI (Japan), Leantegra (US), Microsoft (US), Navigine (US), NTT Docomo (Japan), Oracle (US), Qualcomm (US), Quuppa (Finland), Sewio Republic (Czech Republic), Spime (US), Identec Group (Liechtenstein), Infor (US), TeleTracking Technologies (US), MYSPHERA (Spain), Stanley Healthcare (US), Teldio (Canada), TomTom (Netherlands), Ubisense (UK), Zebra Technologies (UK). These players have adopted various strategies to grow in the global offering Location-Based Service (LBS) and Real-Time Location Systems (RTLS) market. The study includes an in-depth competitive analysis of these key players in the offering Location-Based Service (LBS) and Real-Time Location Systems (RTLS) market with their company profiles, recent developments, and key market strategies.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market value in 2027 |

USD 50.2 Billion |

|

Market value in 2022 |

USD 22.3 Billion |

|

Market Growth Rate |

17.6% CAGR |

|

Largest Market |

Asia Pacific |

|

Market size available for years |

2017-2027 |

|

Base year considered |

2021 |

|

Segments covered |

By component, deployment mode, organization size, vertical, and region |

|

Regions covered |

North America, Europe, Asia Pacific, and Rest of World |

|

Companies covered |

AiRISTA Flow (US), Apple (US), Aruba Networks (US), CenTrak (US), Cisco (US), Ericsson (US), ESRI (US), GE Healthcare (US), Google (US), HERE (Netherlands), IBM (US), KDDI (Japan), Leantegra (US), Microsoft (US), Navigine (US), NTT Docomo (Japan), Oracle (US), Qualcomm (US), Quuppa (Finland), Sewio Republic (Czech Republic), Spime (US), Identec Group (Liechtenstein), Infor (US), TeleTracking Technologies (US), MYSPHERA (Spain), Stanley Healthcare (US), Teldio (Canada), TomTom (Netherlands), Ubisense (UK), Zebra Technologies (UK). |

This research report categorizes the Location-Based Service (LBS) and Real-Time Location Systems (RTLS) market to forecast revenues and analyze trends in each of the following subsegments:

By Component:

- Platform

-

Services

- Deployment and Integration

- Application Support and Maintenance

- Consulting and Training

- Hardware

By Location Type:

- Outdoor

- Indoor

By Application:

- Tracking and Navigation

- Marketing and Advertising

- Location-based Social Networks

- Location-based Health Monitoring

- Others

By Vertical:

- Retail

- Government

- Manufacturing

- Tourism and Hospitality

- Healthcare and Life Sciences

- Media and Entertainment

- Others

By Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- Rest of Europe

-

Asia Pacific

- China

- Japan

- Rest of Asia Pacific

-

Rest of the World

- Middle East

- Africa

- Latin America

Recent Developments:

- In September 2021, BT and Oracle partnered to optimize its network resources and accelerate the introduction of a new 5G offering in the market. The solution will enable BT to test and implement 5G services quickly and seamlessly.

- In September 2021, Ericsson's new Cloud Connect service is an integrated component of the Ericsson IoT Accelerator. This makes it easy for enterprises to securely connect cellular devices to public cloud IoT endpoints such as AWS IoT Core.

- In July 2021, IBM and Atos collaborated and built a secure infrastructure for the Dutch Ministry of Defence. This infrastructure supports advanced technologies and infrastructure services and safeguards related systems.

- In June 2020, Google Maps released beta of Cloud-based maps styling features which is a new set of capabilities to help customize, manage, and deploy maps from Google cloud console.

Frequently Asked Questions (FAQ):

How is the Location-Based Service (LBS) and Real-Time Location Systems (RTLS) market expected to grow in the next five years?

According to MarketsandMarkets, the Location-Based Service (LBS) and Real-Time Location Systems (RTLS) market size is expected to grow USD 22.3 billion in 2022 to USD 50.2 billion by 2027, at a Compound Annual Growth Rate (CAGR) of 17.6% during the forecast period.

Which region has the largest market share in the Location-Based Service (LBS) and Real-Time Location Systems (RTLS) market?

North America is estimated to hold the largest market share in Location-Based Service (LBS) and Real-Time Location Systems (RTLS) market in 2022. North America is one of the technologically advanced markets in the world.

What are the major factors driving Location-Based Service (LBS) and Real-Time Location Systems (RTLS) market?

The major drivers Location-Based Service (LBS) and Real-Time Location Systems (RTLS) market are increasing demand for RTLS solutions based in UWB, increasing demand for geo-marketing, increasing competitiveness of LBS and RTLS market, and growth demanding for LBS and RTLS for industry applications.

Who are the major vendors in Location-Based Service (LBS) and Real-Time Location Systems (RTLS) market?

Major vendors in Location-Based Service (LBS) and Real-Time Location Systems (RTLS) market include AiRISTA Flow (US), Apple (US), Aruba Networks (US), CenTrak (US), Cisco (US), Ericsson (US), ESRI (US), GE Healthcare (US), Google (US), HERE (Netherlands), IBM (US), KDDI (Japan), Leantegra (US), Microsoft (US), Navigine (US), NTT Docomo (Japan), Oracle (US), Qualcomm (US), Quuppa (Finland), Sewio Republic (Czech Republic), Spime (US), Identec Group (Liechtenstein), Infor (US), TeleTracking Technologies (US), MYSPHERA (Spain), Stanley Healthcare (US), Teldio (Canada), TomTom (Netherlands), Ubisense (UK), Zebra Technologies (UK).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

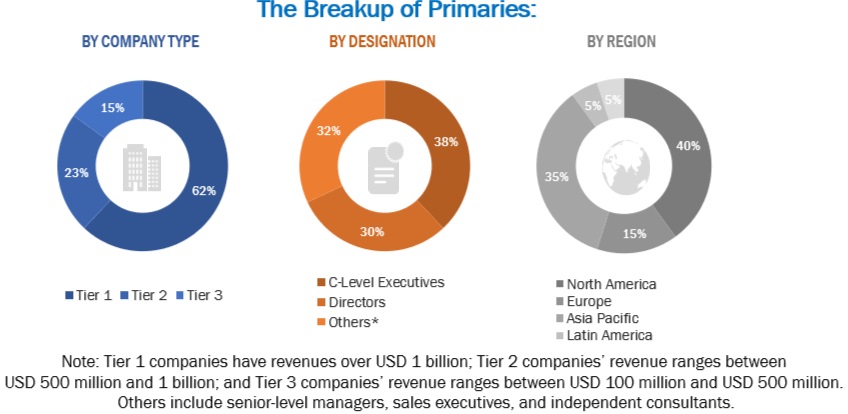

The study involved four major activities in estimating the current size of the Location-Based Service (LBS) and Real-Time Location Systems (RTLS) market. Exhaustive secondary research was done to collect information on the industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and sub segments of the Location-Based Service (LBS) and Real-Time Location Systems (RTLS) market.

Secondary Research

In the secondary research process, various secondary sources were referred to, for identifying and collecting information for this study. Secondary sources include annual reports; press releases and investor presentations of companies; and white papers, certified publications, and articles from recognized associations and government publishing sources. Moreover, journals such as the International Journal of Computer Science, Information Technology, and Security (IJCSITS); Journal of Location Based Services; and associations, such as The International RFID Business Association (RFIDba), Location Based Marketing Association (LBMA), and The International Map Industry Association (IMIA), have also been referred to for consolidating this report.

Secondary research was mainly used to obtain key information about the industry insights, the market’s monetary chain, the overall pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both demand and supply sides were interviewed to obtain qualitative and quantitative information for the global LBS and RTLS report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), VPs, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations, operating in the global LBS and RTLS market. After the complete market engineering (which included calculations for market statistics, market breakdown, market size estimation, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the numbers arrived at, through our estimation process. Primary research was also conducted to identify the segmentation types, industry trends, key players, competitive landscape of the global LBS and RTLS market, and key market dynamics, such as drivers, restraints, opportunities, industry trends, and key player strategies.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

For the estimation and forecasting of the Location-Based Service (LBS) and Real-Time Location Systems (RTLS) market, many methodologies were used. The first method entails calculating the market's size by adding up the profits that businesses make from the sales of products and services. For crucial insights, this complete process has examined the annual and financial reports of leading market participants and has conducted in-depth interviews with prominent industry figures, including CEOs, VPs, directors, and marketing executives of top businesses. Secondary sources were used to calculate all percentage splits and breakdowns, and primary sources were used to confirm the results. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to arrive at the final quantitative and qualitative data. This data has been consolidated and enhanced with detailed inputs and analysis from MarketsandMarkets.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable.

Report Objectives

- To determine and forecast the global Location-Based Service (LBS) and Real-Time Location Systems (RTLS) market by component, (platforms, services, and hardware), location type, by application, by vertical, and region from 2021 to 2026, and analyze various macroeconomic and microeconomic factors that affect the market growth

- To forecast the size of the market’s segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), and the RoW (Rest of the world).

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the overall digital payment market

- To provide detailed information regarding major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the Location-Based Service (LBS) and Real-Time Location Systems (RTLS) market

- To profile key market players and provide a comparative analysis based on their business overviews, service offerings, regional presence, business strategies, and key financials

- To track and analyze competitive developments, such as mergers and acquisitions, product developments, partnerships and collaborations, and Research and Development (R&D) activities, in the market

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix which gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Top Players in LBS and RTLS Market

Some of the top players in the LBS and RTLS Market are listed below:

- Cisco Systems, Inc.

- Google LLC

- IBM Corporation

- Microsoft Corporation

- Qualcomm Technologies, Inc.

- Zebra Technologies Corporation

- Hewlett Packard Enterprise Company

- HERE Technologies

- Navisite, LLC

- Apple Inc.

It is important to note that the LBS and RTLS market is constantly evolving, and the ranking of players may change based on the emergence of new technologies, acquisitions, and partnerships.

Industries Getting Impacted in the future by LBS and RTLS Market

- Healthcare: LBS and RTLS can improve patient care, tracking, and management in healthcare facilities. RTLS can help healthcare professionals locate medical equipment, patients, and staff in real time. In addition, LBS can be used to send patients reminders to take their medication or to provide personalized health-related information based on their location. For example, the University of California, San Francisco uses LBS to track equipment and manage inventory.

- Retail: LBS can help retailers track customers' in-store behavior and send personalized offers and promotions. By analyzing customer behavior, retailers can improve their marketing and inventory management strategies. For example, Walmart uses LBS to provide real-time inventory tracking for products and Amazon uses LBS to provide location-based offers and promotions to customers.

- Logistics and Transportation: RTLS can be used to track shipments in real-time and optimize transportation routes. By tracking the location of shipments, logistics, and transportation companies can improve their delivery times and reduce costs. For example, DHL uses RTLS to track packages and monitor their delivery routes.

- Hospitality: LBS can be used to improve customer experiences in the hospitality industry. Hotels and resorts can use LBS to send personalized offers and promotions to guests based on their location. For example, Marriott International uses LBS to offer mobile check-in and check-out, room service, and other personalized services to their guests.

- Manufacturing: RTLS can help manufacturers track the location of goods and equipment in real time. This can help them improve their inventory management, reduce downtime, and increase productivity. For example, General Electric uses RTLS to track the location of tools and equipment in their factories.

New Business Opportunities in LBS and RTLS Market

- Asset Tracking: Asset tracking is a growing application of RTLS technology, and it involves the real-time tracking of valuable assets such as equipment, vehicles, and inventory. Companies can use RTLS to monitor the location of their assets and optimize their utilization and maintenance. This presents a significant business opportunity for companies that specialize in RTLS technology and can provide asset-tracking solutions to a wide range of industries.

- Indoor Navigation: Indoor navigation is another emerging application of LBS technology, and it involves the use of location-based information to navigate indoor spaces. This technology can be used in various industries, such as shopping malls, airports, and hospitals. This presents an opportunity for businesses to create indoor navigation solutions that provide accurate location information to users in complex indoor spaces.

- Geofencing: Geofencing is a location-based technology that allows businesses to create virtual boundaries around physical locations. Companies can use geofencing to send targeted messages, promotions, and other location-based information to customers when they enter or exit a predefined area. This presents a significant business opportunity for companies that can create geofencing solutions that are accurate, reliable, and user-friendly.

- Smart Cities: Smart cities are cities that use advanced technologies to improve the quality of life of their residents. LBS and RTLS technology can play a critical role in creating smart city solutions. For example, RTLS technology can be used to monitor traffic and optimize transportation routes, while LBS technology can be used to provide location-based information to city residents. This presents an opportunity for companies to develop smart city solutions that integrate LBS and RTLS technology.

- Personalized Marketing: LBS technology can be used to provide personalized marketing messages to customers based on their location. Companies can use this technology to send targeted promotions and advertisements to customers when they are in a specific location. This presents a significant business opportunity for companies that can create LBS solutions that are accurate and reliable, while also respecting customer privacy.

Key Challenges for Growing LBS and RTLS Business in the Future Market

- Privacy Concerns: As LBS and RTLS technology rely on collecting and processing location data, there are concerns around privacy and data protection. Businesses must ensure that they comply with applicable laws and regulations and implement robust security measures to protect user data.

- Accuracy and Reliability: LBS and RTLS technology must be accurate and reliable in order to provide value to users. This requires advanced technology and infrastructure, which can be costly to develop and maintain.

- Integration with Existing Systems: LBS and RTLS technology must integrate with existing systems and processes in order to be useful. This can be a complex and time-consuming process, and businesses must be prepared to invest in integration and interoperability solutions.

- Technical Complexity: LBS and RTLS technology are complex and require specialized technical expertise to develop and maintain. Businesses must have access to skilled professionals who can design, develop, and support these solutions.

- Adoption and User Acceptance: LBS and RTLS technology may require changes in user behavior, which can be a barrier to adoption. Businesses must ensure that their solutions are user-friendly and that they provide clear benefits to users in order to drive adoption and acceptance.

- Cost: Implementing LBS and RTLS technology can be costly, and businesses must ensure that their solutions provide a positive return on investment. This requires careful planning and analysis to ensure that the benefits outweigh the costs.

Growth Drivers for LBS and RTLS Business from Macro to Micro

LBS and RTLS Market - Macro-Level Growth Drivers:

- Increasing adoption of IoT (Internet of Things) devices: As more and more devices become connected to the internet, the demand for location-based and real-time location services is likely to increase.

- Growing demand for mobile applications: Mobile applications that leverage location data are becoming increasingly popular, providing opportunities for LBS and RTLS businesses to develop and provide innovative solutions.

- Increasing demand for automation and optimization: As businesses seek to automate and optimize their operations, LBS and RTLS technology can play a critical role in providing real-time insights and data.

- Advancements in technology: Advancements in technology, such as 5G networks and artificial intelligence, are likely to enhance the capabilities of LBS and RTLS solutions and drive growth in the market.

LBS and RTLS Market - Micro-Level Growth Drivers:

- Improved user experience: LBS and RTLS technology can enhance the user experience by providing personalized and relevant information to users, such as location-based promotions and wayfinding services.

- Increased efficiency and productivity: LBS and RTLS technology can improve the efficiency and productivity of businesses by providing real-time insights and data that can be used to optimize operations.

- Better resource management: LBS and RTLS technology can be used to track and manage resources, such as equipment and inventory, reducing waste and improving resource utilization.

- Enhanced safety and security: LBS and RTLS technology can improve safety and security by providing real-time tracking and monitoring of assets, people, and equipment.

Speak to our Analyst today to know more about the "LBS and RTLS Market".

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Location-based Services (LBS) and Real-Time Location Systems (RTLS) Market