Machine Control System Market by Type (Total Stations, GNSS, Laser Scanners, Sensors), Equipment (Excavators, Loaders, Graders), Vertical (Infrastructure, Commercial, Residential, Industrial) and Region - Global Forecast to 2028

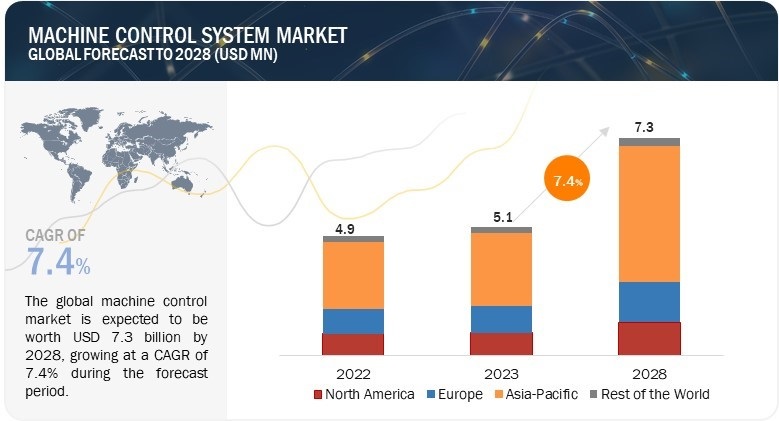

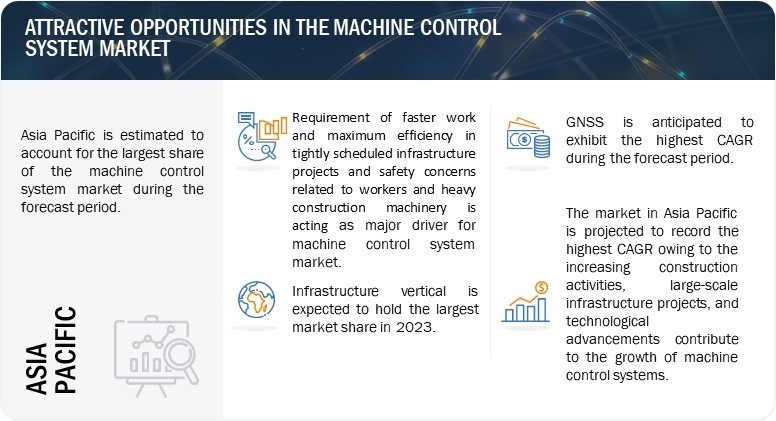

[200 Pages Report] The global machine control system market size is projected to grow from USD 5.1 billion in 2023 to USD 7.3 billion by 2028 at a CAGR of 7.4% during the forecast period. The growth of the machine control system market is majorly driven by the safety concerns related to workers and heavy construction machinery and anticipated demand from growing construction industry.

Machine Control System Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Machine Control System market Dynamics

Driver: Safety concerns associated with workers and heavy construction machinery

The implementation of machine control systems in heavy construction equipment significantly enhances safety for workers on construction sites. One of the main safety concerns in the heavy construction industry is the risk of accidents and collisions between machinery and workers. Machine control systems address this concern by providing operators with real-time feedback on the location of workers and potential obstacles. By incorporating proximity sensors or cameras, these systems can alert operators of potential collisions, reducing the risk of accidents and injuries. In addition, limited visibility that operators may face due to blind spots in large construction equipment. Machine control systems help overcome this issue by incorporating additional sensors and cameras that provide operators with a comprehensive view of their surroundings. This improved visibility enables operators to navigate the construction site safely and avoid accidents caused by inadequate sightlines.

Restraint: Requirement of high initial investments

Machine control systems involve the integration of advanced technologies and hardware components. These technologies, such as GNSS receivers, sensors, controllers, and displays, are critical for precise positioning, guidance, and control of heavy construction machinery. The development, production, and integration of these advanced technologies incur significant research and development (R&D) costs, which contribute to the overall investment. Moreover, machine control systems require specialized software algorithms and user interfaces to process data, provide real-time feedback, and facilitate seamless communication between the operator and the machinery. Developing and implementing these software components involves substantial investment in terms of software development, testing, and customization.

Opportunity: Rising trend of 3D modeling and scanning across industries

Construction activities such as planning, monitoring individual machine performance, and managing onsite communications require a large variety of surveying technologies and efficient systems to share and utilize the information at a construction site. Before the commencement of a construction project, surveyors collect information on the existing infrastructure through aerial images, ground surveys, and cadastral data. This information is then combined with environmental and other background data. 3D modeling is becoming an integral part of these early phases to enable swift design and conception of the project. The 3D models of construction projects are developed with the help of GNSS, total stations, theodolites, UAVs, and laser scanners.

Challenge: Sustaining reliability and accuracy in data provided by machine control systems based on GNSS technology

In industries such as construction and agriculture, drilling and piling, paving, grading, and construction positioning solutions, among many others, require advanced machine-guided technology in which 3D view and GNSS satellite technologies are utilized for effective operations. However, signal interference which can arise from atmospheric conditions, multipath reflections, and electronic interference. These interferences can disrupt the GNSS signals, leading to inaccuracies in the positioning data received by the machine control system. Additionally, signal blockage can occur in areas with dense foliage, urban environments, or around tall structures, causing degraded signal quality and unreliable positioning data. The geometry of the satellites in view is another factor that affects accuracy, as an unfavorable arrangement can introduce errors or uncertainties.

GNSS is expected to grow at the highest CAGR during the forecast period.

GNSS (Global Navigation Satellite System) is expected to witness the highest CAGR for machine control system industry during the forecast period. GNSS technology offers precise positioning capabilities, enabling machine control systems to accurately locate and control heavy machinery. This level of accuracy is crucial in industries such as construction, agriculture, and mining, where precise positioning is essential for tasks like grading, excavation, or crop management. Furthermore, GNSS systems provide global coverage, allowing machine control systems to operate effectively in various geographical locations. This global reach makes GNSS a versatile and widely applicable technology across industries, driving its adoption and contributing to market growth.

Excavators are expected to account for the largest share of the market during the forecast period.

Excavators are expected to witness largest share during the forecast perios is attributed to the wide use of excavators in various infustries such as construction, mining, and infrastructure development. They play a crucial role in tasks like excavation, trenching, grading, and material handling. The versatility and extensive application of excavators across different sectors contribute to their dominant presence in the machine control system market. Furthermore, machine control systems offer significant benefits when integrated with excavators. These systems provide real-time positioning and control, allowing operators to accurately and efficiently perform excavation tasks. Machine control systems enhance the precision and productivity of excavators by providing automated guidance, accurate depth control, and intelligent control features. This integration helps optimize performance, reduce errors, and enhance overall operational efficiency.

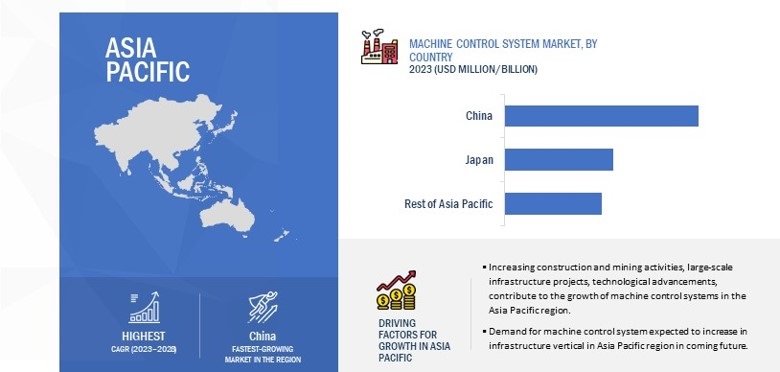

The machine control system market in Asia Pacific is projected to grow at the highest CAGR during the forecast period.

Asia Pacific is likely to be the fastest-growing region in the machine control system market. the region is witnessing significant economic growth, accompanied by rapid urbanization and infrastructure development. Countries like China, India, and Southeast Asian nations are investing heavily in construction projects, transportation networks, and smart city initiatives. These developments drive the demand for machine control systems to improve efficiency, productivity, and precision in construction and infrastructure activities. Furthermore, the agricultural sector in the Asia Pacific region is experiencing a shift towards precision agriculture practices. Farmers are adopting technologies like GPS-guided machinery, drones, and sensor-based systems to optimize crop management, increase yield, and reduce resource usage. Machine control systems enable precise guidance and control of agricultural machinery, enhancing productivity and sustainability in the sector.

Machine Control System Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The machine control system companies have implemented various types of organic as well as inorganic growth strategies, such as product launches, product developments, partnerships and, collaborations, to strengthen their offerings in the market. The major players are Topcon (Japan), Trimble Inc. (US), Hexagon AB (Sweden), MOBA Mobile Automation AG (Germany), Hemisphere GNSS, Inc. (US), Komatsu (Japan), Caterpillar (US), and and EOS Positioning Systems, Inc. (US).

The study includes an in-depth competitive analysis of these key players in the machine control system market with their company profiles, recent developments, and key market strategies.

Machine Control System Market Report Scope :

|

Report Metric |

Details |

| Estimated Market Size | USD 5.1 billion in 2023 |

| Projected Market Size | USD 7.3 billion by 2028 |

| Growth Rate | CAGR of 7.4% |

|

Years considered |

2019–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD million/billion) |

|

Segments covered |

|

|

Regions covered |

|

|

Companies covered |

Topcon (Japan), Trimble Inc. (US), Hexagon AB (Switzerland), MOBA Mobile Automation AG (Germany), Hemisphere GNSS, Inc. (US), and EOS Positioning Systems, Inc. (US). A total of 25 players covered. |

Final Report Title Machine Control System Market Highlights

|

Segment |

Subsegment |

|

By Type |

|

|

By Equipment |

|

|

By Vertical |

|

|

By Region |

|

Recent Developments

- In March 2023, Topcon (Japan) has unveiled a new global navigation satellite system (GNSS) option for its MC-Mobile compact machine control solution. This latest addition to their compact solutions range enables contractors to seamlessly integrate their compact machines into existing GNSS-powered fleets.

- In October 2022, Leica Geosystems, a division of Hexagon AB (Sweden), has introduced the Leica iCON site excavator, a cutting-edge solution for machine control. This innovative technology empowers compact excavators to effortlessly and precisely execute designs.

- In December 2021, Trimble unveiled the Trimble R750 GNSS Modular Receiver, a base station designed for application in civil construction, geospatial, and agricultural fields. This new modular receiver enhances performance, offering contractors, surveyors, and enhances accuracy and dependability for positioning purposes while operating in the field.

Frequently Asked Questions (FAQ):

What is a machine control system?

The machine control systems are deployed to precisely position earthwork machinery based on the design model and help machine operators place the required equipment at the right location.

What is the current size of the global machine control system market?

The global machine control system market is estimated to be around USD 5.1 billion in 2023 and projected to reach USD 7.3 billion by 2028 at a CAGR of 7.4%.

Who are the top 5 players in the machine control system market?

The major vendors operating in the machine control system market include Topcon (Japan), Trimble Inc. (US), Hexagon AB (Sweden), MOBA Mobile Automation AG (Germany), and Hemisphere GNSS, Inc. (US).

Which major countries are considered in the North American region?

The report includes an analysis of the US, Canada, and Mexico countries.

Which are the major verticals in which machine control systems are used?

Significant verticals for machine control system are infrastructure, commercial, residential, industrial

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

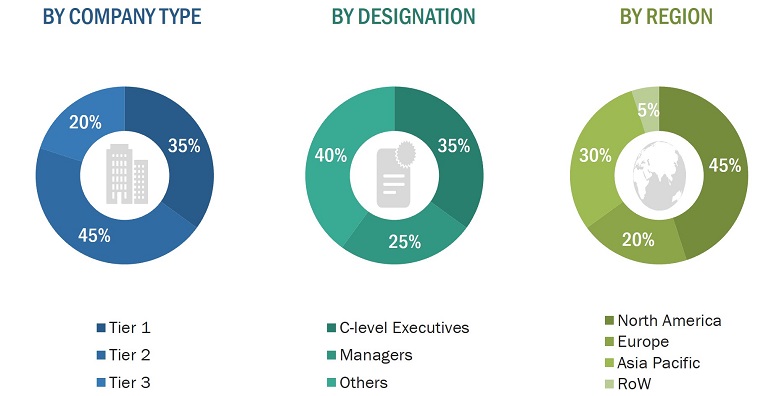

The study involves four major activities for estimating the size of the machine control system market. Exhaustive secondary research has been conducted to collect information related to the market. The next step has been the validation of these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both top-down and bottom-up approaches have been employed to estimate the overall size of the machine control system market. After that, market breakdown and data triangulation procedures have been used to determine the extent of different segments and subsegments of the market.

Secondary Research

Secondary sources referred to in this research study include corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers, certified publications, articles from recognized authors; directories; and databases. The secondary data has been collected and analyzed to arrive at the overall market size estimations, which has been further validated by primary research.

Primary Research

In the primary research process, a number of primary sources from both supply and demand sides have been interviewed to obtain the qualitative and quantitative information pertaining to this report. Several primary interviews have been conducted with market experts from both demand (agriculture and construction companies) and supply sides (machine control system manufacturers and distributors). This primary data has been collected through questionnaires, emails, and telephonic interviews. Approximately 25% of the primary interviews have been conducted with the demand side and 75% with the supply side. This primary data has been collected mainly through telephonic interviews, which accounted for 80% of the total primary interviews. Additionally, questionnaires and emails were used to collect the data.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches have been implemented, along with several data triangulation methods, to estimate and validate the size of the machine control system market and other dependent submarkets listed in this report.

- The key players in the industry and markets have been identified through extensive secondary research.

- Both the supply chain of the industry and the market size, in terms of value, have been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size, the total market has been split into several segments. To complete the overall market engineering process and arrive at exact statistics for all segments, the market breakdown and data triangulation procedures have been employed wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Market Definition

Machine control systems (MCS) are deployed to precisely position earthwork machinery on the basis of the design model. Machine control enables the integration of positioning tools into construction machinery. A machine control system not only guides operators in excavating, grading, dredging, or piling activities but also improves productivity by 30–50% than conventional digging operations. Various machine control systems, such as global navigation satellite systems (GNSS), laser scanners, total stations, and sensors, are available. Machine control systems are easy to use, fully upgradable, and flexible enough to meet a wide range of job site requirements in various verticals such as commercial and industrial. The scope of this report is limited to the earthwork or construction work that takes place at the initial stage of the construction of a plant or factory of any industry.

Key Stakeholders

- Manufacturers and vendors of machine control systems

- Construction equipment manufacturers

- Original equipment manufacturers

- Suppliers of raw materials and manufacturing equipment

- Research organizations

- R&D institutes

- Machine control system software and service providers

- Technology standards organizations, forums, alliances, and associations

Study Objectives:

- To describe and forecast the machine control system market, in terms of value, by type, equipment, and vertical

- To describe and forecast the market, in terms of value, for four main regions: North America, Europe, Asia Pacific, and Rest of the World

- To provide detailed information regarding the major drivers, restraints, opportunities, and challenges influencing the growth of the market

- To study the complete value chain of the machine control system market ecosystem, along with market trends and use cases

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall machine control system market

- To profile key players and comprehensively analyze their market position in terms of revenue and core competencies

- To provide a detailed competitive landscape of the market

- To analyze competitive developments such as agreements, partnerships, collaborations, product launches, and ongoing R&D in the market

- To benchmark market players using the Company Evaluation Quadrant, which includes an analysis of the market players on the basis of various parameters within the product footprint and market share/rank

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company's specific needs. The following customization options are available for this report:

Company Information:

- Detailed analysis and profiling of additional five market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Machine Control System Market