Machine Safety Market Size, Share and Industry Growth Analysis Report by Component (Presence detection Sensors, Safety Controllers/Modules/Relays, Programmable Safety Systems, Emergency Stop Controls, Two-Hand Safety Controls), offerings, Industry & Region - Global Growth Driver and Industry Forecast to 2028

Machine Safety Market

Machine Safety Market and Top Companies

- Schneider Electric offers a diversified machine safety solutions under its Industrial Automation business segment. The company provides SIL 3 function safety solutions that ensure the fail-safe performance of controllers for energize-to-trip and de-energize-to-trip applications. Triconex, a brand of Schneider Electric, provides Trident safety instrumented systems with SIL 3 certification. These safety systems feature high scalability, with applications as low as 32 I/O points per system to as high as 40,000 I/O points. Schneider Electric has a strong portfolio of machine safety-certified emergency stop devices and safety instrumented systems.

- Honeywell offers a wide range of solutions related to machine safety through its Safety and Productivity segment. The company offers safety systems and solutions such as integrated control and safety systems, distributed control systems, control monitoring and safety systems, and industrial wireless solutions in the control, monitoring, and safety systems category. The company has recently launched various products to diversify its machine safety product portfolio. The launches are a result of extensive R&D conducted by the company.

- ABB is one of the leader in power and automation technology companies. It focuses on increasing profitability by strengthening competitiveness, driving organic growth, and lowering risks. ABB has launched the innovation & expansion plan (PIE) to drive profitable growth for its businesses. The company is primarily focusing on organic growth through product launches and developments and expansion of its safety product portfolio.

- Siemens is mainly engaged in the electrical engineering and electronics business. The company is a leading supplier of power transmission, power generation, and infrastructure solutions, coupled with automation, drive, and software solutions. Company provides machine safety-certified SIL-rated products for pressure, temperature, flow, and level measurements for both process and factory automation. It has also launched various innovative machine safety solutions. Safety technology products offered by the company comply with the latest safety standards and have been certified for international applicability. The SIRIUS portfolio of the company features 2 safe evaluation devices—safety relays and modular safety systems.

- Rockwell Automation is a leading provider of industrial automation and information solutions. The company offers a diverse set of products and services, including industrial control components, information software, sensing devices, and industrial security solutions. Rockwell Automation offers machine safety solutions through its Control Products & Solutions segment. The company offers machine safety products such as safety connection systems, safety drives, safety I/O modules, emergency stop devices, presence sensing safety devices, safety programmable controllers, safety relays, and safety switches.

Machine Safety Market Component

- Presense Sensing Safety Sensors: Sensor deployed in a safety system are developed and designed to ensure a safe output based on the signals received from the logic circuits. Safety edges, laser scanners, safety light curtains, safety mats, and optoelectronic devices (including hand detection and single & multi-beam) are some of the types of presence sensing sensors.

- Programmable safety systems: Programmable safety systems are highly reliable logic solvers, which provide both fail-safe and fault-tolerant operations. The market for programmable safety systems is anticipated to grow at a fast rate in the coming years as manufacturers are replacing the existing systems with PLCs to comply with strict machine safety regulatory standards. Programmable safety systems are an integral part of safety instrumented systems.

- Safety controllers/modules/relays: Numerous safety devices in machine safety require safety controllers/modules/relays to shut down equipment in case of any emergency. Safety relays are devices that implement safety functions. It provides the means to effectively and quickly remove power from machines or equipment in case of an emergency shutdown situation, thereby reducing risks to an acceptable level.

- Safety interlock switches: Safety interlock switches are designed to protect operators and equipment in automation plants. Electromechanical, hinge pin, limit, non-contact, tongue, and trapped key are the different types of safety interlock switches. These components are intended to protect equipment and end users from injuries during critical situations. They prevent the restart of a shutdown piece of equipment until the fault that caused the shutdown is corrected.

- Emergency stop controls: Emergency stop controls are crucial elements of the safety-related parts of control systems. These devices provide workers a means of stopping a device during an emergency by pushing a button or pulling a rope. The different types of emergency stop devices include emergency stop buttons, rope pull switches, and flush mount E-stops.

Machine Safety Market Technology Trends

- Computer Vision: Computer vision helps in automating production processes by controlling different devices. The use of computer vision increases efficiency as it eliminates the requirement of workers in hazardous areas. For example, in the packaging process, computer vision, with the help of barcodes, analyzes products, classifies them, and packages them.

- Internet of Things (IoT): The use of IoT enables analysis of workplace conditions and helps in keeping workers safer and healthy. IoT analyzes the exposure of workers in hazardous conditions and determines the acceptable limit for exposure levels. Compliance with regulations can be maintained with the help of IoT by monitoring compliance requirements and ensuring its adherence. With the help machine learning algorithm, IoT analyzes data, and checks the pattern of work performed in the plant.

- Machine Learning: The use of automated machine learning in terms of providing safety to workers and machines is currently trending in the industrial sector. It eliminates the need for any worker in hazardous areas for detecting errors and notifying the user of any abnormalities in the functioning. This helps in reducing processing time and provides safety in the plant.

Updated on : May 30, 2023

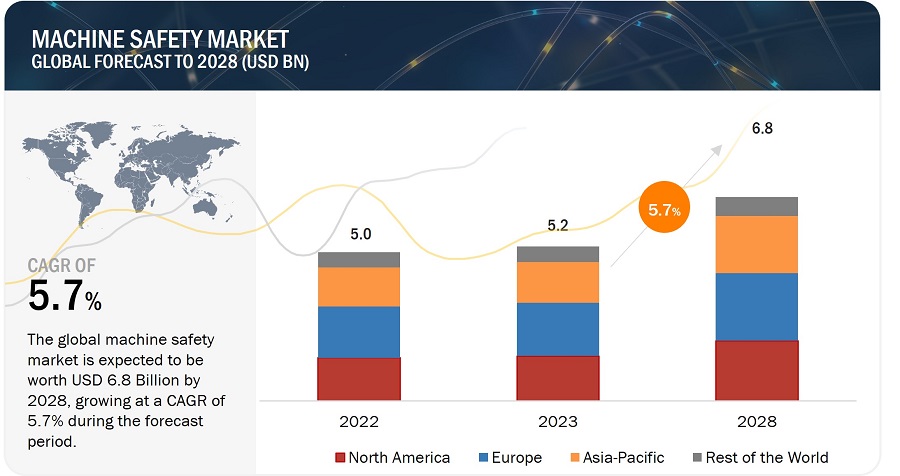

[251 Pages Report] The global machine safety market in terms of revenue was estimated to be worth USD 5.2 billion in 2023 and is poised to reach USD 6.8 billion by 2028, growing at a CAGR of 5.7% from 2023 to 2028. The new research study consists of an industry trend analysis of the market.

Implementing machine safety ensures that safety-critical control and protective systems are appropriately specified, designed, installed, and maintained. Safety devices such as sensors, programmable safety systems, and final elements are integral to safety instrumented systems and industrial control systems. Increasing emphasis on ensuring workplace safety in oil & gas, power generation, food & beverages, automotive, and chemicals industries would increase the demand for machine safety systems in the coming years.

Machine Safety Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Growing demand for safety systems in high-risk industries such as oil and gas, chemical, and mining, where the potential for accidents and injuries is higher. All these factors combined are fueling the growth of the machine safety market, which is expected to continue in the coming years.

Market Dynamics

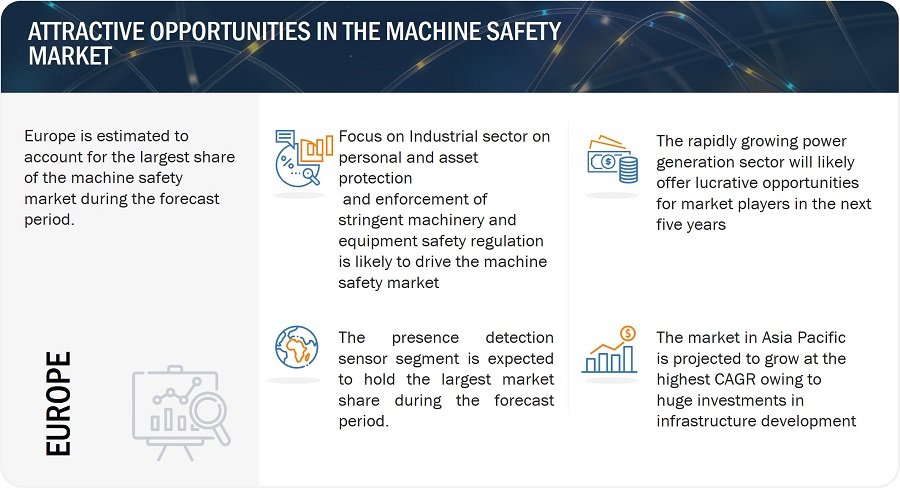

Driver: Increasing demand for modular end effectors by various industries

The industrial sector has long been known for its potential hazards and risks to personnel and assets. With increasing accidents and fatalities caused by machine-related incidents, businesses have started focusing on personnel and asset protection. This trend is driven by several other factors, including the need to comply with government regulations and avoid legal liabilities and the desire to improve workplace safety and productivity. Companies are adopting advanced industrial safety-certified systems in their production lines to reduce industrial accidents. These safety systems, such as physical barriers and safety interlocks, safeguard operators/users from accidents, prevent or minimize the risk of injury or harm, and offer an emergency shutdown solution in case of breakdown or downtime. Manufacturers are increasingly adopting industrial safety products, such as emergency shutdown devices and safety controller modules, to prevent the probability of occurrence of any possible accident and provide an added layer of protection for personnel and assets. Owing to this, process industries are adopting several security technologies and equipment that help reduce workplace accidents. Thus, rising emphasis on implementing proactive safety measures to prevent accidents drives the growth of the machine safety market.

Restraint: Huge capital requirement to install and automate machine safety systems

In an emergency, machine safety systems must be installed to safeguard employees, machines, and production lines. However, the installation, maintenance, and repair costs of machine safety components substantially burden the organization's budget. Though large organizations can manage these expenses, it can be difficult for small and mid-sized organizations. In addition, industrial safety has to comply with regulatory standards. The safety standards are frequently updated according to technological advancements and new mandates, resulting in the obligation on organizations to upgrade their safety systems, incurring additional costs. Usually, investments toward safety equipment are never considered in budget allocations while building plants and production facilities. However, the installation and maintenance of industrial safety systems add a substantial economic burden, restraining the growth of the machine safety market.

Opportunity: Rising use of IIoT to ensure improved performance and extend lifespan of industrial assets

IIoT can provide real-time data on the performance and condition of industrial assets, enabling predictive maintenance and reducing downtime. It helps companies manage their assets better, improve performance, and extend their lifespan. IIoT can also help improve workplace safety by providing real-time data on the condition of machines and equipment. This allows companies to identify potential safety hazards and take corrective/preventive actions before accidents occur. IIoT is offering new opportunities for integrated safety and compliance services. The technology can acquire sensor data and send the collected information to monitoring systems. The data is transmitted through wired and wireless networks that provide real-time analysis, alerts, and possible emergency solutions. Using IIoT, companies can integrate their processes with safety systems and monitor them in real time. Thus, IIoT facilitates quick monitoring, analysis and control, offering effective virtual physical system management, ultimately improving overall performance.

Challenge: Difficulties in designing machine safety products due to ongoing technological advancements

While technological advancements in machines can bring many benefits, they also pose challenges to machine safety. As machines become more advanced, they often become more complex, making it more challenging to ensure they are operating safely. Many modern machines rely on complex systems and software to operate, making integrating safety features into the machine design harder. With so many different types of advanced machines on the market, it can be difficult to establish consistent safety standards and guidelines that apply across various industries and regions. Overall, the continuous technological advances pose challenges for machine safety industry providers that must be addressed through ongoing research, innovation, and collaboration between industry stakeholders and safety regulators. By working together, manufacturers can ensure that advanced machines are designed and operated safely, protecting workers, and preventing accidents and injuries.

Machine Safety Market Ecosystem

Component suppliers and system integrators have witnessed a decline in production activities. Consequently, OEMs have faced a shortage of essential components. The figure below shows the Machine Safety ecosystem.

System segment to hold largest market share in the year 2022

The machine safety market is experiencing rapid growth as the companies in this market strive to provide safety solutions for machinery and equipment to prevent accidents and injuries at workplaces. A variety of machine safety systems, such as safety controllers/modules/relays, programmable safety systems, safety interlock switches, and emergency stop controls, play a crucial role in protecting personnel and preventing accidents at industrial plants. These systems are constantly upgraded to ensure compliance with the latest safety standards and stay abreast of technology trends. These systems enable workers to carry out their duties safely and efficiently. Adopting safety standards such as ISO 13849 and IEC 61508, which require integrating safety systems into machinery and equipment, has been a driving force behind the growth of the machine safety market.

Programmable safety system segment to hold largest market share in the year 2022

In the forecast period, the programmable safety system is expected to experience the highest CAGR. This growth can be attributed to multiple factors, including the escalating requirement for safety automation across a variety of industries, the increasing demand for safety devices that can be more flexible and customizable, and the growing adoption of Industry 4.0 and Industrial Internet of Things (IIoT) technologies. Programmable safety systems offer several advantages such as enhanced flexibility, simpler customization, and superior integration with other industrial automation systems. Moreover, they allow remote monitoring and control, which can elevate safety levels and reduce the chances of accidents occurring. Overall, due to the rising need for safety automation and the advantages that programmable safety systems offer, these systems are expected to observe robust growth in the future.

Food & beverage industry is expected to register highest CAGR during the forecast period.

The machine safety market is set to experience significant growth in the food and beverage industry, with the highest CAGR projected in this sector. This growth can be attributed to several factors, including the rising demand for packaged and processed foods, the growing focus on ensuring worker safety in the food industry, and the strict safety regulations and standards imposed by regulatory agencies. Given the high-risk nature of the food and beverage industry, ensuring worker safety is crucial in this sector. To mitigate potential hazards associated with operating machinery and equipment, food manufacturers are increasingly adopting machine safety solutions. Moreover, the adoption of automation in the food industry has increased the demand for safety measures that can protect workers from potential risks. Overall, due to the rising demand for worker safety, the adoption of automation, and the need to comply with safety regulations and standards, the food and beverage industry is expected to drive significant growth in the machine safety market.

Machine Safety Market by Region

To know about the assumptions considered for the study, download the pdf brochure

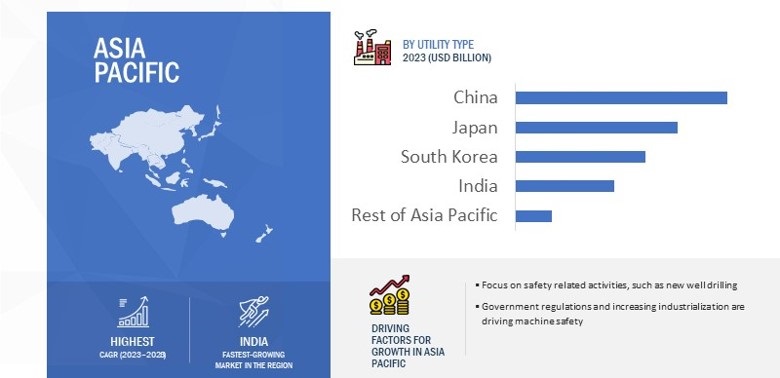

Asia Pacific to grow at highest CAGR during the forecast period

The Asia Pacific region is witnessing significant growth in the machine safety market, fueled by various factors. One key driver is government regulations mandating the implementation of safety measures, which is promoting the adoption of machine safety solutions. Furthermore, with the region's increasing industrialization, there is a growing need for safety systems to protect workers and equipment. The rise in awareness of worker safety and the implementation of Industry 4.0 technologies are also contributing to the demand for machine safety solutions. Overall, these factors are fueling the growth of the machine safety market in the Asia Pacific region.

Machine Safety Market Key Players

The machine safety companies have implemented various organic and inorganic growth strategies, such as product launches, collaborations, partnerships, and acquisitions, to strengthen their offerings in the market. The major players in the market are Schneider Electric (France), Honeywell International Inc (US), ABB (Switzerland), Rockwell Automation, Inc. (US), Siemens AG (Germany), Omron Corporation (Japan), Keyence Corporation (Japan), Yokogawa Electric Corporation (Japan), Emerson Electric Co. (US), and General Electric (US)

The study includes an in-depth competitive analysis of these key players in the Machine Safety market with their company profiles, recent developments, and key market strategies.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Segment |

Subsegment |

| Estimated Market Size | USD 5.2 Billion |

| Projected Market Size | USD 6.8 Billion |

| Growth Rate | 5.7% |

|

Years Considered |

2019–2028 |

|

Base Year Considered |

2022 |

|

Forecast Period |

2023–2028 |

|

Forecast Units |

Value (USD Million/Billion) |

|

Segments Covered |

Offerings, Components, Industry, and Region |

|

Regions Covered |

North America, Asia Pacific, Europe, and the Rest of the World |

|

Companies Covered |

Emerson Electric Co. (US), Schneider Electric (France), Honeywell International Inc (US), Rockwell Automation, Inc. (US), and Siemens AG (Germany) |

Machine Safety Market Highlights

This report has segmented the overall Machine Safety market based on Offerings, components, industry, and region.

|

Segment |

Subsegment |

|

By Offerings |

|

|

By Components |

|

|

By Industry |

|

|

By Process Industry |

|

|

By Discrete Industry |

|

|

By Region |

|

Recent Developments:

- In May 2022, Emerson introduced the TopWorx DX PST with HART 7. The units enable the digital transformation of process applications by providing valuable valve data and diagnostic information. Operators can access vital valve data, trends, and diagnostics to anticipate and plan maintenance owing to the DX PST's seamless integration with current valves and control systems.

- In October 2021, Emerson introduced valve assemblies that meet the design process requirements of Safety Integrity Level (SIL) 3 according to the International Electrotechnical Commission's IEC 61508 standard. These Fisher Digital Isolation final element solutions serve customers' needs for shutdown valves in critical safety instrumented system (SIS) applications.

- In May 2021, Emerson introduced valve assemblies that meet the design process requirements of Safety Integrity Level (SIL) 3 according to the International Electrotechnical Commission's IEC 61508 standard. These Fisher Digital Isolation final element solutions serve customers' needs for shutdown valves in critical safety instrumented system (SIS) applications.

Frequently Asked Questions (FAQ):

What will be the Machine Safety market size in 2023?

The Machine Safety market is expected to be valued at USD 5.2 billion in 2023.

What CAGR will be recorded for the Machine Safety market from 2023 to 2028?

The global Machine Safety market is expected to record a CAGR of 5.7% from 2023–2028.

Who are the top players in the Machine Safety market?

The major vendors operating in the Machine Safety market include Emerson Electric Co. (US), Schneider Electric (France), Honeywell International Inc (US), Rockwell Automation, Inc. (US), and Siemens AG (Germany).

Which major countries are considered in the North American region?

The report includes an analysis of the US, Canada, Mexico, and the rest of North America.

Which components has been considered under the Machine Safety market?

Presence detection Sensors, Safety Controllers/Modules/Relays, Programmable Safety Systems, Safety Interlock Switches, Emergency Stop Controls, and Two-Hand Safety Controls are considered in the market study.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

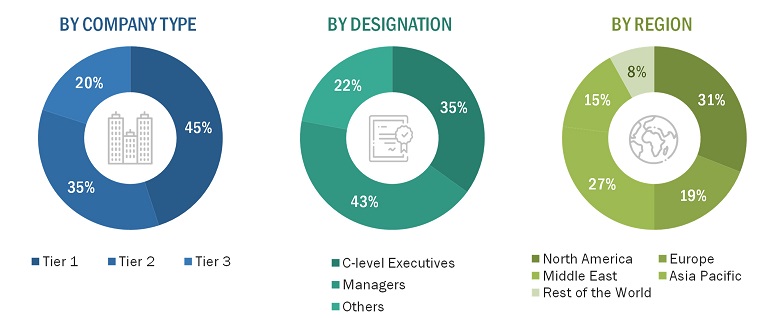

The study involves four major activities for estimating the size of the Machine Safety market. Exhaustive secondary research has been conducted to collect information related to the market. The next step is to validate these findings and assumptions related to the market size with industry experts across the value chain through primary research. Both top-down and bottom-up approaches have been employed to estimate the overall size of the Machine Safety market. After that, market breakdown and data triangulation procedures were used to determine the extent of different segments and subsegments of the market.

Secondary Research

Secondary sources referred to for this research study included corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers; certified publications; articles by recognized authors; directories; and databases. The secondary data has been collected and analyzed to arrive at the overall market size, which has been further validated through primary research.

Primary Research

Extensive primary research has been conducted after gaining knowledge about the current scenario of the Machine Safety market through secondary research. Several primary interviews have been conducted with experts from the demand and supply sides across four major regions—Americas, Europe, Asia Pacific, and RoW. This primary data has been collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches have been implemented, along with several data triangulation methods, to estimate and validate the size of the Machine Safety market and other dependent submarkets listed in this report.

- The key players in the industry and markets have been identified through extensive secondary research.

- The supply chain of the industry and the market size, in terms of value, have been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Machine Safety Market: Top-Down Approach

- In the top-down approach, the overall market size has been used to estimate the size of the individual markets (mentioned in the market segmentation) through percentage splits obtained from secondary and primary research.

- For the calculation of the Machine Safety market segments, the market size obtained by implementing the bottom-up approach has been used to implement the top-down approach, which has then been later confirmed with the primary respondents across different regions.

- The bottom-up approach has also been implemented for the data extracted from secondary research to validate the market size of various segments.

- The market share of each company has been estimated to verify the revenue shares used earlier in the bottom-up approach. With the help of data triangulation and validation of data through primaries, the size of the overall Machine Safety and each individual markets have been determined and confirmed in this study.

Data Triangulation

After arriving at the overall market size, the total market has been split into several segments. The market breakdown and data triangulation procedures have been employed wherever applicable to complete the overall market engineering process and arrive at exact statistics for all segments. The data has then been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Market Definition

A machine safety system is a set of measures and components designed to ensure the safety of operators and other personnel working with or near machines. These systems typically include physical guards, safety interlocks, emergency stops, warning signs, and other devices intended to prevent or minimize the risks of injury or harm.The primary goal of a machine safety system is to prevent accidents and injuries by reducing or eliminating the potential hazards associated with operating machines. The machine safety market is likely to witness significant growth in the coming years because it is essential for companies in the automotive, food & beverage, oil & gas, power generation, and chemical industries to invest in safety measures to reduce the risk of accidents and promote a safe working environment. Schneider Electric (France), Honeywell International Inc. (US), ABB (Switzerland), Rockwell Automation, Inc. (US), Siemens AG (Germany), Omron Corporation (Japan), Keyence Corporation (Japan), Yokogawa Electric Corporation (Japan), Emerson Electric Co. (US), and General Electric (US) are among a few key companies in this market.

Key Stakeholders

- Original equipment manufacturers (OEMs)

- Providers of technology solutions

- Research institutes

- Market research and consulting firms

- Forums, alliances, and associations related to Machine Safety

- Technology investors

- Governments and financial institutions

- Analysts and strategic business planners

- Existing end users and prospective ones

Report Objectives:

- To describe and forecast the Machine Safety market in terms of value based on offerings, components and industry

- To describe and forecast the Machine Safety market size in terms of value with respect to 4 main regions, namely, North America, Europe, Asia Pacific, and the Rest of the World (RoW)

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the machine safety market

- To provide a detailed overview of the supply chain of the s ecosystem

- To analyze opportunities in the market for various stakeholders by identifying the high-growth segments of the market

- To analyze the probable impact of the recession on the market in future

- To benchmark the market players using the proprietary company evaluation matrix framework, which analyzes the market players on various parameters within the broad categories of market ranking/share and product portfolio

- To analyze competitive developments such as acquisitions, product launches, partnerships, expansions, and collaborations undertaken in the Machine Safety market

Available Customization:

With the given market data, MarketsandMarkets offers customizations according to the company's specific needs. The following customization options are available for this report:

Company Information:

- Detailed analysis and profiling of additional five market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Machine Safety Market