Managed Network Services Market by Type ( Managed LAN, Managed Wi-Fi, Managed WAN, Managed Network Security, Managed VPN, Network Monitoring), Organization Size (Large Enterprises and SMEs), Deployment Mode, Vertical, and Region - Global Forecast to 2026

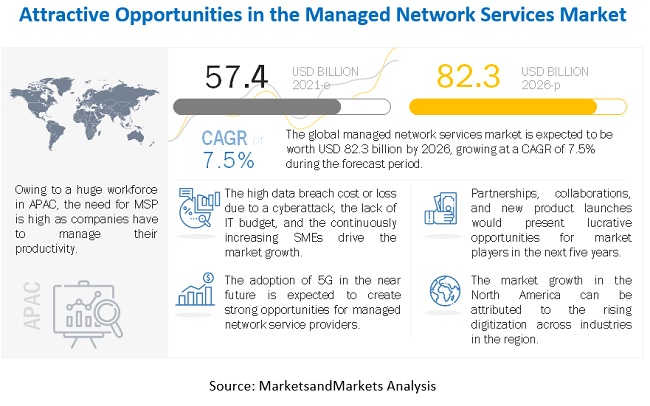

At a Compound Annual Growth Rate (CAGR) of 7.5% over the forecast period, the size of the global managed network Services market is expected to increase from USD 57.4 billion in 2021 to USD 82.3 billion by 2026. The presence of various key players in the ecosystem has led to competitive and diverse market. Businesses rely on outsourced network management to generate efficiencies, resulting in better usage of resources and reduced expenditure. Organizations turn to MSPs for help rather than struggling to keep pace with technology. With managed network services, global network services are made available for organizations that do not have global resources available internally, eliminating the hassle of building, monitoring, and maintaining their network and giving them the freedom to focus on the core business. Hence, managed network services are an attractive alternative to the costly, time-consuming business of in-house network management services, which are difficult to install and manage for SMEs where cost is a significant factor.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 has not only affected the healthcare sector but also impacted the global economy. It has had a significant economic impact on various financial and industrial sectors, such as energy, oil and gas, transportation and logistics, manufacturing, and aviation. It is predicted that the global economy will go into recession due to the loss of trillions of dollars. With the increasing number of countries imposing and extending lockdowns, economic activities are declining, which would impact the global economy. Every individual and government, irrespective of federal, state, central, local, and provinces, has been in constant touch with one other in the society to provide and get real-time information on COVID-19.

COVID-19 cases are growing day-by-day, as several infected cases have been on the rise. In line with individuals, COVID-19 has a massive impact on large enterprises and SMEs. Core industries, such as manufacturing, automotive, textile, transportation and logistics, travel and hospitality, and consumer goods, have been closed due to country-level lockdown across the globe. This would have a substantial impact on the global economy in terms of the decline in GDP. Since ages, SMEs are acting as the backbone of the economy. In the current situation, SMEs are the most affected due to the COVID-19 pandemic.

Market Dynamics

Driver: Increasing trend of digital transformation across the globe

Digital transformation drives the demand for greater agility in networks that support businesses to deliver superior customer experience. Several enterprises globally plan to adopt new digital technologies as part of the digital transformation trend. As businesses move forward with their digital efforts, every organization tapped a managed network services provider for its digital transformation journey. Partnerships with the specific managed network service provider who can understand the needs and opportunities of companies lead enterprises to bridge the skill gap and enter new markets with innovative solutions. Managed network service providers have the depth and breadth of skill sets needed to support several facets of digital transformation. Hence, various companies opt for managed network service providers. The increasing trend for digital transformation is expected to boost the global MNS market. Advancements in cloud technologies, the increased penetration of mobile devices, the readiness of people to adopt new technologies, and the initiatives undertaken by multinational companies are the major factors driving digital across the world.

Restraint: Increase in regulations and compliances

In recent years, the need for meeting regulatory and compliance needs is constantly increasing due to the changes in business needs, the growth in data breaches and cyberattacks, and the rise in data security concerns. Companies have to strive to survive in the market by taking measures to meet regulatory needs and prevent financial penalties, prevent customer and revenue losses, and avoid exposure to legal actions. MNS market caters to various verticals such as BFSI, IT and ITeS, manufacturing, healthcare and life sciences, and retail and consumer goods. Different industries require regulations and compliances, which can act as restraint for the MNS market.

Opportunity: Increasing demand for managed network services among small and medium sized enterprises

Managed network services offer great scope for SMEs to grow and realize business goals. IT spending among SMEs is predicted to significantly increase, depicting SMEs are under constant pressure to expand by implementing innovative and enhanced IT services. In Europe, according to a study, the CAGR for IT spend by SMEs in Europe, Middle East, and Africa (EMEA) between 2018 and 2023 is expected to be 3.8% compared to 2.7% for the overall market; they accounted for 35.8% of IT spending in EMEA in 2019. The rise in the IT spend by SMEs will fuel the demand for MSPs, as SMEs are adopting cloud, automating services, and exploring advanced digital technologies. These technologies have provided managed network services to smaller businesses cost-effectively and efficiently. Managed network service providers offer solutions to help SMEs manage TCO, reduce CAPEX and OPEX, support newer applications in demand, connect efficiently with customers and partners, and sustain their business operations. Managed network service providers offer cost-effective and reliable services that secure network functions, which, in turn, has helped SMEs in scaling up and focusing more on their core businesses. Today, SMEs rely on these service providers to connect to multiple sites and manage their networks robustly. These service providers are opening new opportunities for SMEs to remain competitive, expand, and grow their businesses.

Challenge: managed network services providers struggling with marketing and sales efforts

Managed network service providers face challenges with marketing and sales efforts, thus hampering business growth. According to a survey conducted by Datto, Datto’s 2018 State of the MSP Report, marketing and sales is the biggest challenge faced by any MSP, which includes lead generation; recruiting quality, technical, sales, and marketing candidates; cold calling; and market differentiation. The company has surveyed 2,300 MSPs worldwide to understand the pain points of MSPs. With the increasing number of cyberattacks, MSPs need to strengthen their security infrastructure, along with their security staff. Datto’s 2018 State of the MSP reports say that it is a great opportunity for MSPs to educate their clients and offer them tools they require to safeguard their data. According to a survey, 53% of MSPs considered marketing and sales as a top challenge, while ~41% and ~28% of MSPs considered staffing and training and ransomware and cybersecurity as a critical challenge.

The managed network security to record a higher growth rate during the forecast period

In the Managed Network Services market by type, the managed network security is expected to record a higher growth rate during the forecast period. The threats to systems and data impede business innovation, limit productivity, and damage compliance efforts. Managed network security services protect enterprise perimeter from all manner of security threats. MSPs employ strong security controls and safeguards to protect enterprise network services and customer information from external exploits, and continuously verify technologies and security operational processes through internal and external compliance audits.

To know about the assumptions considered for the study, download the pdf brochure

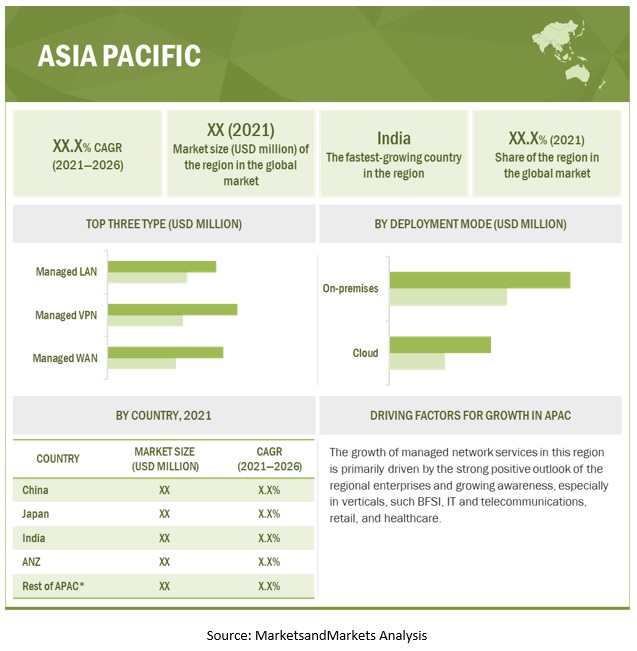

APAC to account for the highes market growth during the forecast period

APAC is expected to grow at the highest CAGR during the forecast period. Major countries, such as China, India, Australia, and Japan, would witness high growth rates in this region. The region demonstrates a combination of high-growth population, developing economies, and the increasing adoption of mobile and internet. The enormous population in the region has led to an extensive pool of subscriber base for companies. The vast and diverse geographies and the wide adoption of smart devices and internet mandate the need for reliable and secure internet connectivity, driving the market for managed network services.

Market Players

The report covers the competitive landscape and profiles major market players, as IBM (US), Cisco (US), Ericsson (Sweden), Verizon (US), Huawei (China), AT&T (US), BT Group (UK), Telefonica (Spain), T-Systems (Germany), NTT (Japan), Orange (France), Vodafone (UK), Fujitsu (Japan), Lumen (US), Masergy (US), Colt Technology Services (UK), Telstra (Australia), CommScope (US), Singtel (Singapore), GTT Communications (US), Global Cloud Xchange (UK), Brennan IT (Australia), Sify (India), Aryaka Networks (US), SCloudX (US), Optanix (US), DXC Technology (US), Oman Data Park (Oman), Servsys (US), FlexiWAN (Israel), Bigleaf (US), Wipro (India) and Comarch (Poland). These players have adopted several organic and inorganic growth strategies, including new product launches, partnerships and collaborations, and acquisitions, to expand their offerings and market shares in the global Managed Network Services market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2017-2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021-2026 |

|

Forecast units |

Value (USD Billion) |

|

Segments covered |

By Type, Deployment Mode, Organisation Size, Verticals |

|

Regions covered |

North America, Europe, APAC, MEA, and Latin America |

|

Companies covered |

IBM (US), Cisco (US), Ericsson (Sweden), Verizon (US), Huawei (China), AT&T (US), BT Group (UK), Telefonica (Spain), T-Systems (Germany), NTT (Japan), Orange (France), Vodafone (UK), Fujitsu (Japan), Lumen (US), Masergy (US), Colt Technology Services (UK), Telstra (Australia), CommScope (US), Singtel (Singapore), GTT Communications (US), Global Cloud Xchange (UK), Brennan IT (Australia), Sify (India), Aryaka Networks (US), SCloudX (US), Optanix (US), DXC Technology (US), Oman Data Park (Oman), Servsys (US), FlexiWAN (Israel), Bigleaf (US), Wipro (India) and Comarch (Poland) |

This research report categorizes the managed network services to forecast revenue and analyze trends in each of the following submarkets:

Based on Type:

- Managed LAN

- Managed Wi-Fi

- Managed VPN

- Managed WAN

- Network Monitoring

-

Managed Network Security

- Managed Firewall

- Managed IDS/IPS

- Other Managed Network Security

Based on Deployment Mode:

- On-Premises

- Cloud

Based on Organisation Size:

- Small and Medium Enterprises

- Large Enterprises

Based on Verticals:

- Banking, Financial Services and Insurance

- Retail and Ecommerce

- IT and Telecom

- Manufacturing

- Government

- Education

- Healthcare

- Media and Entertainment

- Other Verticals

Based on regions:

- North America

- Europe

- APAC

- MEA

- Latin America

Recent Developments:

- In April 2021, South Korea, Asia’s fourth-largest economy, and Cisco, a worldwide leader in technology, announced the launch of a collaborative framework under Cisco’s Country Digital Acceleration (CDA) program to accelerate digitization across the country and power an inclusive recovery from the COVID-19 pandemic.

- In April 2021, AT&T would provide ERIKS the global WAN across 17 countries. ERIKS is a Dutch based company, which builds digital capacities. AT&T will migrate ERIKS’ US transport-network to a fully AT&T Managed network.

- In March 2020, Ericsson and Omani Communication Service Provider partnership would allow Omantel to increase operational network efficiency and further enhance customer experiences for subscribers. The company has been an Omantel managed services partner since 2016.

Frequently Asked Questions (FAQ):

What is the projected market value of the global managed network services market?

The global Managed Network Services Market size is expected to grow from USD 57.4 Billion in 2021 to USD 82.3 Billion by 2026, at a Compound Annual Growth Rate (CAGR) of 7.5% during the forecast period.

Which region have the highest market share in the Managed Network Service market?

North America is expected to hold the largest market size in the global Managed Network Services market during the forecast period. North America is a frontrunner in terms of technology adoption and digitization of society. Enterprises and service providers in this region are continuously changing their network infrastructure to cope with advanced technologies. The rapid changes in the IT infrastructure, such as cloud and virtualization, have significantly increased the pressure on network administrators to manage the network infrastructure.

Which deployment mode is expected to hold a higher growth rate during the forecast period?

In the Managed Network Services market by Deployment Mode, cloud is expected to have a higher growth rate. Cloud-managed network service providers manage an enterprise’s technology infrastructure or end-user systems. Services are provided using the subscription model. MSPs monitor and manage servers and other hardware, software, and applications.

Who are the major vendors in the Managed Network Services market?

Major vendors in the Managed Network Service market are IBM (US), Cisco (US), Ericsson (Sweden), Verizon (US), Huawei (China), AT&T (US), BT Group (UK), Telefonica (Spain), T-Systems (Germany), NTT (Japan), Orange (France), Vodafone (UK), Fujitsu (Japan), Lumen (US), Masergy (US), Colt Technology Services (UK), Telstra (Australia), CommScope (US), Singtel (Singapore), GTT Communications (US), Global Cloud Xchange (UK), Brennan IT (Australia), Sify (India), Aryaka Networks (US), SCloudX (US), Optanix (US), DXC Technology (US), Oman Data Park (Oman), Servsys (US), FlexiWAN (Israel), Bigleaf (US), Wipro (India) and Comarch (Poland). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 25)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 REGIONS COVERED

1.6.3 YEARS CONSIDERED FOR THE STUDY

1.7 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES, 2018–2020

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 35)

2.1 RESEARCH DATA

FIGURE 6 MANAGED NETWORK SERVICES MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primary profiles

TABLE 2 PRIMARY RESPONDENTS: MARKET

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 7 RESEARCH METHODOLOGY: APPROACH

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE): REVENUE OF SERVICES OF THE MANAGED NETWORK SERVICES MARKET

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY- APPROACH 1 BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF MANAGED NETWORK SERVICES VENDORS

FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY: ILLUSTRATION OF COMPANY REVENUE ESTIMATION IN MANAGED NETWORK SERVICES

2.4 MARKET FORECAST

TABLE 3 FACTOR ANALYSIS

2.5 ASSUMPTIONS FOR THE STUDY

2.6 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 46)

FIGURE 11 MARKET: HOLISTIC VIEW

FIGURE 12 MARKET: GROWTH TRENDS

FIGURE 13 ASIA PACIFIC TO GROW AT THE HIGHEST RATE DURING THE FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 50)

4.1 BRIEF OVERVIEW OF THE MANAGED NETWORK SERVICES MARKET

FIGURE 14 COMPLEX IT ENVIRONMENT OF ORGANIZATIONS DUE TO THE ADVENT OF THE CLOUD AND DIGITAL TRANSFORMATION TO FUEL THE GROWTH OF MANAGED NETWORK SERVICES

4.2 NORTH AMERICAN MARKET, BY DEPLOYMENT MODE AND TOP THREE TYPES

FIGURE 15 MANAGED WAN AND ON-PREMISES SEGMENTS TO ACCOUNT FOR LARGE MARKET SHARES IN NORTH AMERICA IN 2021

4.3 EUROPEAN MARKET, BY DEPLOYMENT MODE AND TOP THREE TYPES

FIGURE 16 MANAGED WAN AND ON-PREMISES SEGMENTS TO ACCOUNT FOR LARGE MARKET SHARES IN EUROPE IN 2021

4.4 ASIA PACIFIC MARKET, BY DEPLOYMENT MODE AND TOP THREE TYPES

FIGURE 17 MANAGED LAN AND ON-PREMISES SEGMENTS TO ACCOUNT FOR LARGE MARKET SHARES IN APAC IN 2021

5 MARKET OVERVIEW AND MARKET TRENDS (Page No. - 53)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 18 MANAGED NETWORK SERVICES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Need to unburden the IT staff

5.2.1.2 New connectivity demands increase complications in the IT environment

5.2.1.3 Saving capital expenditure and operational expenditure by adopting managed network services

5.2.1.4 Increasing trend of digital transformation across the globe

FIGURE 19 IMPACT OF DIGITAL TRANSFORMATION ACROSS INDUSTRIES, CUMULATIVE VALUE 2016–2025 (USD BILLION)

5.2.1.5 Rise in demand for secure IT infrastructure during the COVID-19 pandemic

FIGURE 20 ADOPTION OF THE HYBRID WORK MODEL IS INEVITABLE

5.2.2 RESTRAINTS

5.2.2.1 Concerns over data privacy and security

FIGURE 21 PERCEIVED THREATS IN ENTERPRISES

FIGURE 22 GLOBAL SCENARIO: DATA LEAK SCENARIO

5.2.2.2 Increase in regulations and compliances

5.2.3 OPPORTUNITIES

5.2.3.1 Exponential growth in the global IP traffic and cloud traffic

5.2.3.2 Opportunity to provide value-added services above and beyond core network infrastructure and become true business partners

5.2.3.3 Increasing demand for managed network services among small and medium-sized enterprises

5.2.4 CHALLENGES

5.2.4.1 Monitoring complex, multi-technology physical and virtual networks across customer networks

5.2.4.2 Managed network service providers struggling with marketing and sales efforts

5.3 USE CASES

TABLE 4 USE CASE 1: BRENNAN IT

TABLE 5 USE CASE 2: FUJITSU

TABLE 6 USE CASE 3: NTT

TABLE 7 USE CASE 4: ARYAKA NETWORKS

TABLE 8 USE CASE 5: SIFY

5.4 ECOSYSTEM

TABLE 9 MANAGED NETWORK SERVICES MARKET: ECOSYSTEM

5.5 PORTER’S FIVE FORCES MODEL

TABLE 10 IMPACT OF EACH FORCE ON THE MARKET

5.5.1 THREAT OF NEW ENTRANTS

5.5.2 THREAT OF SUBSTITUTES

5.5.3 BARGAINING POWER OF SUPPLIERS

5.5.4 BARGAINING POWER OF BUYERS

5.5.5 DEGREE OF COMPETITION

5.6 PATENT ANALYSIS

FIGURE 23 TOP TEN COMPANIES WITH THE HIGHEST NUMBER OF PATENT APPLICATIONS

TABLE 11 TOP TWENTY PATENT OWNERS (UNITED STATES)

FIGURE 24 NUMBER OF PATENTS GRANTED IN A YEAR OVER THE LAST TEN YEARS

5.7 VALUE CHAIN ANALYSIS

FIGURE 25 MANAGED NETWORK SERVICES MARKET: VALUE CHAIN

5.8 COVID-19 MARKET OUTLOOK FOR THE MARKET

FIGURE 26 NEED TO UNBURDEN THE IT STAFF TO ACCELERATE THE GROWTH OF THE MARKET

FIGURE 27 KEY ISSUES: CONCERNS OVER DATA PRIVACY AND SECURITY TO RESTRICT THE MARKET GROWTH

5.8.1 TRENDS/DISRUPTIONS IMPACTING BUYERS

FIGURE 28 REVENUE SHIFT IN THE MARKET

5.9 TECHNOLOGICAL ANALYSIS

5.9.1 BIG DATA AND ANALYTICS

5.9.2 CLOUD COMPUTING

5.9.3 ARTIFICIAL INTELLIGENCE

5.9.4 MACHINE LEARNING

5.10 REGULATORY LANDSCAPE

5.10.1 HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT

5.10.2 HEALTH LEVEL SEVEN

5.10.3 DIGITAL IMAGING AND COMMUNICATIONS IN MEDICINE

5.10.4 GENERAL DATA PROTECTION REGULATION

5.10.5 GRAMM–LEACH–BLILEY ACT

5.10.6 INTERNATIONAL ORGANIZATION FOR STANDARDIZATION 27001

6 MANAGED NETWORK SERVICES MARKET, BY TYPE (Page No. - 74)

6.1 INTRODUCTION

6.1.1 TYPE: MARKET DRIVERS

6.1.2 TYPE: COVID-19 IMPACT

FIGURE 29 MANAGED NETWORK SECURITY SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 12 MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 13 MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

6.2 MANAGED LAN

TABLE 14 MANAGED LAN: MANAGED NETWORK SERVICES MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 15 MANAGED LAN: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.3 MANAGED WI-FI

TABLE 16 MANAGED WI-FI: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 17 MANAGED WI-FI: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.4 MANAGED VPN

TABLE 18 MANAGED VPN: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 19 MANAGED VPN: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.5 MANAGED WAN

TABLE 20 MANAGED WAN: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 21 MANAGED WAN: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.6 NETWORK MONITORING

TABLE 22 NETWORK MONITORING: MANAGED NETWORK SERVICES MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 23 NETWORK MONITORING: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.7 MANAGED NETWORK SECURITY

TABLE 24 MANAGED NETWORK SECURITY: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 25 MANAGED NETWORK SECURITY: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.7.1 MANAGED FIREWALL

6.7.2 MANAGED IDS/IPS

6.7.3 OTHER MANAGED NETWORK SECURITY

7 MANAGED NETWORK SERVICES MARKET, BY ORGANIZATION SIZE (Page No. - 85)

7.1 INTRODUCTION

7.1.1 ORGANIZATION SIZE: MARKET DRIVERS

7.1.2 ORGANIZATION SIZE: COVID-19 IMPACT

FIGURE 30 SMALL AND MEDIUM-SIZED ENTERPRISES SEGMENT TO RECORD A HIGHER CAGR DURING FORECAST PERIOD

TABLE 26 MARKET SIZE, BY ORGANIZATION SIZE, 2017–2020 (USD MILLION)

TABLE 27 MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

7.2 SMALL AND MEDIUM-SIZED ENTERPRISES

TABLE 28 SMALL AND MEDIUM-SIZED ENTERPRISES: MANAGED NETWORK SERVICES MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 29 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.3 LARGE ENTERPRISES

TABLE 30 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 31 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8 MANAGED NETWORK SERVICES MARKET, BY DEPLOYMENT MODE (Page No. - 90)

8.1 INTRODUCTION

8.1.1 DEPLOYMENT MODE: MARKET DRIVERS

8.1.2 DEPLOYMENT MODE: COVID 19 IMPACT

FIGURE 31 CLOUD SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 32 MARKET SIZE, BY DEPLOYMENT MODE, 2017–2020 (USD MILLION)

TABLE 33 MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

8.2 ON-PREMISES

TABLE 34 ON-PREMISES: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 35 ON-PREMISES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8.3 CLOUD

TABLE 36 CLOUD: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 37 CLOUD: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9 MANAGED NETWORK SERVICES MARKET, BY VERTICAL (Page No. - 95)

9.1 INTRODUCTION

9.1.1 VERTICALS: MARKET DRIVERS

9.1.2 VERTICALS: COVID-19 IMPACT

FIGURE 32 HEALTHCARE VERTICAL TO RECORD THE HIGHEST GROWTH RATE DURING THE FORECAST PERIOD

TABLE 38 MARKET SIZE, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 39 MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

9.2 BANKING, FINANCIAL SERVICES AND INSURANCE

TABLE 40 BANKING, FINANCIAL SERVICES AND INSURANCE: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 41 BANKING, FINANCIAL SERVICES AND INSURANCE: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.3 RETAIL AND ECOMMERCE

TABLE 42 RETAIL AND ECOMMERCE: MANAGED NETWORK SERVICES MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 43 RETAIL AND ECOMMERCE: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.4 IT AND TELECOM

TABLE 44 IT AND TELECOM: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 45 IT AND TELECOM: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.5 MANUFACTURING

TABLE 46 MANUFACTURING: MANAGED SECURITY SERVICES MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 47 MANUFACTURING: MANAGED SECURITY SERVICES MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.6 GOVERNMENT

TABLE 48 GOVERNMENT: MANAGED NETWORK SERVICES MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 49 GOVERNMENT: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.7 EDUCATION

TABLE 50 EDUCATION: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 51 EDUCATION: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.8 HEALTHCARE

TABLE 52 HEALTHCARE: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 53 HEALTHCARE: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.9 MEDIA AND ENTERTAINMENT

TABLE 54 MEDIA AND ENTERTAINMENT: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 55 MEDIA AND ENTERTAINMENT:MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.10 OTHER VERTICALS

TABLE 56 OTHER VERTICALS: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 57 OTHER VERTICALS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10 MANAGED NETWORK SERVICES MARKET, BY REGION (Page No. - 110)

10.1 INTRODUCTION

FIGURE 33 NORTH AMERICA TO BE THE LARGEST MARKET DURING THE FORECAST PERIOD

TABLE 58 MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 59 MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.2 NORTH AMERICA

10.2.1 NORTH AMERICA: MANAGED NETWORK SERVICES MARKET DRIVERS

10.2.2 NORTH AMERICA: MARKET REGULATIONS

10.2.3 NORTH AMERICA: IMPACT OF COVID 19

FIGURE 34 NORTH AMERICA: MARKET SNAPSHOT

TABLE 60 NORTH AMERICA: MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 61 NORTH AMERICA: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 62 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2020 (USD MILLION)

TABLE 63 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 64 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2020 (USD MILLION)

TABLE 65 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 66 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 67 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 68 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 69 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

10.2.4 UNITED STATES

TABLE 70 UNITED STATES: MANAGED NETWORK SERVICES MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 71 UNITED STATES: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 72 UNITED STATES: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2020 (USD MILLION)

TABLE 73 UNITED STATES: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 74 UNITED STATES: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2020 (USD MILLION)

TABLE 75 UNITED STATES: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 76 UNITED STATES: MARKET SIZE, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 77 UNITED STATES: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

10.2.5 CANADA

TABLE 78 CANADA: MANAGED NETWORK SERVICES MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 79 CANADA: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 80 CANADA: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2020 (USD MILLION)

TABLE 81 CANADA: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 82 CANADA: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2020 (USD MILLION)

TABLE 83 CANADA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 84 CANADA: MARKET SIZE, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 85 CANADA: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

10.3 EUROPE

10.3.1 EUROPE: MANAGED NETWORK SERVICES MARKET DRIVERS

10.3.2 EUROPE: MARKET REGULATIONS

10.3.3 EUROPE: COVID-19 IMPACT

TABLE 86 EUROPE: MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 87 EUROPE: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 88 EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2020 (USD MILLION)

TABLE 89 EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 90 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2020 (USD MILLION)

TABLE 91 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 92 EUROPE: MARKET SIZE, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 93 EUROPE: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 94 EUROPE: MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 95 EUROPE: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

10.3.4 UNITED KINGDOM

TABLE 96 UNITED KINGDOM: MANAGED NETWORK SERVICES MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 97 UNITED KINGDOM: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 98 UNITED KINGDOM: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2020 (USD MILLION)

TABLE 99 UNITED KINGDOM: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 100 UNITED KINGDOM: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2020 (USD MILLION)

TABLE 101 UNITED KINGDOM: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 102 UNITED KINGDOM: MARKET SIZE, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 103 UNITED KINGDOM: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

10.3.5 GERMANY

TABLE 104 GERMANY: MANAGED NETWORK SERVICES MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 105 GERMANY: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 106 GERMANY: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2020 (USD MILLION)

TABLE 107 GERMANY: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 108 GERMANY: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2020 (USD MILLION)

TABLE 109 GERMANY: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 110 GERMANY: MARKET SIZE, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 111 GERMANY: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

10.3.6 FRANCE

10.3.7 REST OF EUROPE

10.4 ASIA PACIFIC

10.4.1 ASIA PACIFIC: MARKET DRIVERS

10.4.2 ASIA PACIFIC: MARKET REGULATIONS

10.4.3 ASIA PACIFIC: COVID 19 IMPACT

FIGURE 35 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 112 ASIA PACIFIC: MANAGED NETWORK SERVICES MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 113 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 114 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2020 (USD MILLION)

TABLE 115 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 116 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2020 (USD MILLION)

TABLE 117 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 118 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 119 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 120 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 121 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

10.4.4 CHINA

TABLE 122 CHINA: MANAGED NETWORK SERVICES MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 123 CHINA: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 124 CHINA: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2020 (USD MILLION)

TABLE 125 CHINA: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 126 CHINA: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2020 (USD MILLION)

TABLE 127 CHINA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 128 CHINA: MARKET SIZE, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 129 CHINA: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

10.4.5 INDIA

TABLE 130 INDIA: MANAGED NETWORK SERVICES MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 131 INDIA: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 132 INDIA: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2020 (USD MILLION)

TABLE 133 INDIA: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 134 INDIA: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2020 (USD MILLION)

TABLE 135 INDIA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 136 INDIA: MARKET SIZE, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 137 INDIA: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

10.4.6 JAPAN

10.4.7 AUSTRALIA AND NEW ZEALAND

10.4.8 REST OF ASIA PACIFIC

10.5 MIDDLE EAST AND AFRICA

10.5.1 MIDDLE EAST AND AFRICA: MANAGED NETWORK SERVICES MARKET DRIVERS

10.5.2 MIDDLE EAST AND AFRICA: MANAGED NETWORK SERVICES REGULATIONS

10.5.3 MIDDLE EAST AND AFRICA: COVID 19 IMPACT

TABLE 138 MIDDLE EAST AND AFRICA: MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 139 MIDDLE EAST AND AFRICA: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 140 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2020 (USD MILLION)

TABLE 141 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 142 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2020 (USD MILLION)

TABLE 143 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 144 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 145 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 146 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 147 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

10.5.4 MIDDLE EAST

TABLE 148 MIDDLE EAST: MANAGED NETWORK SERVICES MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 149 MIDDLE EAST: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 150 MIDDLE EAST: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2020 (USD MILLION)

TABLE 151 MIDDLE EAST: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 152 MIDDLE EAST: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2020 (USD MILLION)

TABLE 153 MIDDLE EAST: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 154 MIDDLE EAST: MARKET SIZE, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 155 MIDDLE EAST: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

10.5.5 AFRICA

TABLE 156 AFRICA: MANAGED NETWORK SERVICES MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 157 AFRICA: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 158 AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2020 (USD MILLION)

TABLE 159 AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 160 AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2020 (USD MILLION)

TABLE 161 AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 162 AFRICA: MARKET SIZE, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 163 AFRICA: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

10.6 LATIN AMERICA

10.6.1 LATIN AMERICA: MANAGED NETWORK SERVICES MARKET DRIVERS

10.6.2 LATIN AMERICA: MARKET REGULATIONS

10.6.3 LATIN AMERICA: COVID-19 IMPACT

TABLE 164 LATIN AMERICA: MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 165 LATIN AMERICA: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 166 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2020 (USD MILLION)

TABLE 167 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 168 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2020 (USD MILLION)

TABLE 169 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 170 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 171 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 172 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 173 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

10.6.4 MEXICO

TABLE 174 MEXICO: MANAGED NETWORK SERVICES MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 175 MEXICO: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 176 MEXICO: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2020 (USD MILLION)

TABLE 177 MEXICO: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 178 MEXICO: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2020 (USD MILLION)

TABLE 179 MEXICO: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 180 MEXICO: MARKET SIZE, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 181 MEXICO: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

10.6.5 BRAZIL

10.6.6 REST OF LATIN AMERICA

11 COMPETITIVE LANDSCAPE (Page No. - 172)

11.1 OVERVIEW

11.2 MARKET EVALUATION FRAMEWORK

FIGURE 36 MARKET EVALUATION FRAMEWORK, 2019–2021

11.3 KEY MARKET DEVELOPMENTS

11.3.1 PRODUCT LAUNCHES

TABLE 182 MANAGED NETWORK SERVICES MARKET: PRODUCT LAUNCHES, JANUARY 2019–JUNE 2021

11.3.2 DEALS

TABLE 183 MARKET: DEALS, JANUARY 2019–MAY 2021

11.3.3 OTHERS

TABLE 184 MARKET: DEALS, SEPTEMBER 2019

11.4 MARKET SHARE ANALYSIS OF TOP PLAYERS

TABLE 185 MANAGED NETWORK SERVICE MARKET: DEGREE OF COMPETITION

FIGURE 37 MARKET SHARE ANALYSIS OF COMPANIES IN THE MARKET

11.5 HISTORICAL REVENUE ANALYSIS

FIGURE 38 HISTORICAL REVENUE ANALYSIS, 2018–2020

11.6 COMPANY EVALUATION MATRIX OVERVIEW

11.7 COMPANY EVALUATION MATRIX METHODOLOGY AND DEFINITIONS

TABLE 186 PRODUCT FOOTPRINT WEIGHTAGE

11.7.1 STARS

11.7.2 EMERGING LEADERS

11.7.3 PERVASIVE PLAYERS

11.7.4 PARTICIPANTS

FIGURE 39 MANAGED NETWORK SERVICES MARKET, COMPANY EVALUATION MATRIX, 2021

11.8 COMPANY PRODUCT FOOTPRINT ANALYSIS

TABLE 187 COMPANY PRODUCT FOOTPRINT

11.9 COMPANY MARKET RANKING ANALYSIS

FIGURE 40 RANKING OF KEY PLAYERS IN THE MARKET, 2021

11.10 STARTUP/SME EVALUATION MATRIX METHODOLOGY AND DEFINITIONS

FIGURE 41 STARTUP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

11.10.1 PROGRESSIVE COMPANIES

11.10.2 RESPONSIVE COMPANIES

11.10.3 DYNAMIC COMPANIES

11.10.4 STARTING BLOCKS

FIGURE 42 MANAGED NETWORK SERVICES MARKET (GLOBAL): STARTUP/SME EVALUATION MATRIX, 2020

12 COMPANY PROFILES (Page No. - 187)

12.1 MAJOR PLAYERS

(Business Overview, Products, Key Insights, Recent Developments, COVID-19 Impact, MnM View)*

12.1.1 CISCO

TABLE 188 CISCO: BUSINESS OVERVIEW

FIGURE 43 CISCO: COMPANY SNAPSHOT

TABLE 189 CISCO: PRODUCTS OFFERED

TABLE 190 CISCO: MARKET: PRODUCT LAUNCHES

TABLE 191 CISCO: MARKET: DEALS

12.1.2 ERICSSON

TABLE 192 ERICSSON: BUSINESS OVERVIEW

FIGURE 44 ERICSSON: COMPANY SNAPSHOT

TABLE 193 ERICSSON: PRODUCTS OFFERED

TABLE 194 ERICSSON: MANAGED NETWORK SERVICES MARKET: PRODUCT LAUNCHES

TABLE 195 ERICSSON: MARKET: DEALS

12.1.3 AT&T

TABLE 196 AT&T: BUSINESS OVERVIEW

FIGURE 45 AT&T: COMPANY SNAPSHOT

TABLE 197 AT&T: PRODUCTS OFFERED

TABLE 198 AT&T: MARKET: DEALS

12.1.4 BT GROUP

TABLE 199 BT GROUP: BUSINESS OVERVIEW

FIGURE 46 BT GROUP: COMPANY SNAPSHOT

TABLE 200 BT GROUP: PRODUCTS OFFERED

TABLE 201 BT GROUP: MARKET: PRODUCT LAUNCHES

TABLE 202 BT GROUP: MARKET: DEALS

12.1.5 VERIZON

TABLE 203 VERIZON: BUSINESS OVERVIEW

FIGURE 47 VERIZON: COMPANY SNAPSHOT

TABLE 204 VERIZON: PRODUCTS OFFERED

TABLE 205 VERIZON: MANAGED NETWORK SERVICES MARKET: PRODUCT LAUNCHES

TABLE 206 VERIZON: MARKET: DEALS

TABLE 207 VERIZON: MARKET: OTHERS

12.1.6 IBM

TABLE 208 IBM: BUSINESS OVERVIEW

FIGURE 48 IBM: COMPANY SNAPSHOT

TABLE 209 IBM: PRODUCTS OFFERED

TABLE 210 IBM: MARKET: PRODUCT LAUNCHES

TABLE 211 IBM: MARKET: DEALS

12.1.7 HUAWEI

TABLE 212 HUAWEI: BUSINESS OVERVIEW

FIGURE 49 HUAWEI: COMPANY SNAPSHOT

TABLE 213 HUAWEI: PRODUCTS OFFERED

TABLE 214 HUAWEI: MANAGED NETWORK SERVICES MARKET: DEALS

12.1.8 TELEFONICA

TABLE 215 TELEFONICA: BUSINESS OVERVIEW

FIGURE 50 TELEFONICA: COMPANY SNAPSHOT

TABLE 216 TELEFONICA: PRODUCTS OFFERED

TABLE 217 TELEFONICA: MARKET: DEALS

12.1.9 T-SYSTEMS

TABLE 218 T-SYSTEMS: BUSINESS OVERVIEW

FIGURE 51 T-SYSTEMS: COMPANY SNAPSHOT

TABLE 219 T-SYSTEMS: PRODUCTS OFFERED

TABLE 220 T-SYSTEMS: MARKET: DEALS

TABLE 221 T-SYSTEMS: MARKET: OTHERS

12.1.10 NTT

TABLE 222 NTT: BUSINESS OVERVIEW

FIGURE 52 NTT: COMPANY SNAPSHOT

TABLE 223 NTT: PRODUCTS OFFERED

TABLE 224 NTT: MANAGED NETWORK SERVICES MARKET: DEALS

TABLE 225 NTT: MARKET: OTHERS

12.1.11 ORANGE BUSINESS SERVICES

12.1.12 VODAFONE

12.1.13 FUJITSU

12.1.14 LUMEN

12.1.15 MASERGY

12.1.16 COLT TECHNOLOGY SERVICES

12.1.17 TELSTRA

12.1.18 SINGAPORE TELECOMMUNICATIONS LIMITED

12.1.19 GTT COMMUNICATIONS

12.1.20 GLOBAL CLOUD XCHANGE

12.1.21 BRENNAN IT

12.1.22 SIFY

12.1.23 ARYAKA NETWORKS

12.1.24 DXC TECHNOLOGY

12.1.25 WIPRO

12.1.26 COMARCH

12.1.27 COMMSCOPE

*Details on Business Overview, Products, Key Insights, Recent Developments, COVID-19 Impact, MnM View might not be captured in case of unlisted companies.

12.2 STARTUP/SME PLAYERS

12.2.1 INTRODUCTION

12.2.2 SCLOUDX

12.2.3 OPTANIX

12.2.4 SERVSYS

12.2.5 FLEXIWAN

12.2.6 OMAN DATA PARK

12.2.7 BIGLEAF NETWORKS

13 ADJACENT MARKET (Page No. - 250)

13.1 INTRODUCTION

13.1.1 LIMITATIONS

13.1.2 NETWORK MANAGEMENT SYSTEM

13.1.2.1 Market definition

13.1.2.2 Network management system market, by component

TABLE 226 NETWORK MANAGEMENT SYSTEM MARKET SIZE, BY COMPONENT, 2017–2024 (USD MILLION)

13.1.2.3 Network management system market, by deployment mode

TABLE 227 NETWORK MANAGEMENT SYSTEM MARKET SIZE, BY DEPLOYMENT MODE, 2017–2024 (USD MILLION)

13.1.2.4 Network management system market, by organization size

TABLE 228 NETWORK MANAGEMENT SYSTEM MARKET SIZE, BY ORGANIZATION SIZE, 2017–2024 (USD MILLION)

13.1.2.5 Network management system market, by vertical

TABLE 229 NETWORK MANAGEMENT SYSTEM MARKET SIZE, BY VERTICAL, 2017–2024 (USD MILLION)

13.1.3 WAN OPTIMIZATION MARKET

13.1.3.1 Market definition

13.1.3.2 WAN optimization market, by component

TABLE 230 WAN OPTIMIZATION MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

13.1.3.3 WAN optimization market, by end user

13.1.3.3.1 Small and medium-sized enterprises

TABLE 231 SMALL AND MEDIUM-SIZED ENTERPRISES: WAN OPTIMIZATION MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

13.1.3.3.2 Large enterprises

TABLE 232 LARGE ENTERPRISES: WAN OPTIMIZATION MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

13.1.3.4 WAN optimization market, by vertical

13.1.3.4.1 Banking, financial services, and insurance

TABLE 233 BANKING, FINANCIAL SERVICES, AND INSURANCE: WAN OPTIMIZATION MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

13.1.3.4.2 Healthcare

TABLE 234 HEALTHCARE: WAN OPTIMIZATION MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

13.1.3.4.3 Information technology and telecom

TABLE 235 INFORMATION TECHNOLOGY AND TELECOM: WAN OPTIMIZATION MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

13.1.3.4.4 Manufacturing

TABLE 236 MANUFACTURING: WAN OPTIMIZATION MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

13.1.3.4.5 Retail

TABLE 237 RETAIL: WAN OPTIMIZATION MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

13.1.3.4.6 Media and entertainment

TABLE 238 MEDIA AND ENTERTAINMENT: WAN OPTIMIZATION MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

13.1.3.4.7 Energy

TABLE 239 ENERGY: WAN OPTIMIZATION MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

13.1.3.4.8 Education

TABLE 240 EDUCATION: WAN OPTIMIZATION MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

13.1.3.5 WAN optimization market, by region

13.1.3.5.1 Europe

TABLE 241 EUROPE: WAN OPTIMIZATION MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 242 EUROPE: WAN OPTIMIZATION MARKET SIZE, BY SOLUTION, 2018–2025 (USD MILLION)

TABLE 243 EUROPE: WAN OPTIMIZATION MARKET SIZE, BY SERVICE, 2018–2025 (USD MILLION)

TABLE 244 EUROPE: WAN OPTIMIZATION MARKET SIZE, BY END USER, 2018–2025 (USD MILLION)

TABLE 245 EUROPE: WAN OPTIMIZATION MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 246 EUROPE: WAN OPTIMIZATION MARKET SIZE, BY VERTICAL, 2018–2025 (USD MILLION)

TABLE 247 EUROPE: WAN OPTIMIZATION MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

14 APPENDIX (Page No. - 263)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

This research study involved extensive secondary sources, directories, and databases, such as D&B Hoovers, DiscoverOrg, Factiva, vendor data sheets, product demos, Cloud Computing Association (CCA), Vendor Surveys, Asia Cloud Computing Association, and The Software Alliance. All these sources were referred to identify and collect information useful for this technical, market-oriented, and commercial study of the MNS market. Primary sources were several industry experts from the core and related industries, preferred software providers, hardware manufacturers, distributors, service providers, technology developers, alliances, and organizations related to all segments of the industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information, and assess the market’s prospects.

Secondary Research

The market size of companies offering managed network services was derived based on the secondary data available through paid and unpaid sources and by analyzing the product portfolios of key companies in the ecosystem and rating the companies based on their product capabilities and business strategies. In the secondary research process, various sources were referred to, for identifying and collecting information for the study. Secondary sources included annual reports, press releases, and investor presentations of companies and product data sheets; white papers; journals; certified publications; and articles from recognized authors, government websites, directories, and databases.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and product development/innovation teams; related key executives from managed service vendors, industry associations, and independent consultants; and key opinion leaders. Primary interviews were conducted to gather insights, such as market statistics, latest trends disrupting the market, new use cases implemented, data of revenue collected from products and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped understand various trends related to technology, service type, deployment, and region. Demand-side stakeholders, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Security Officers (CSOs), the installation teams of governments/end users using managed services, and digital initiatives project teams, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current use of services, which would affect the overall MNS market.

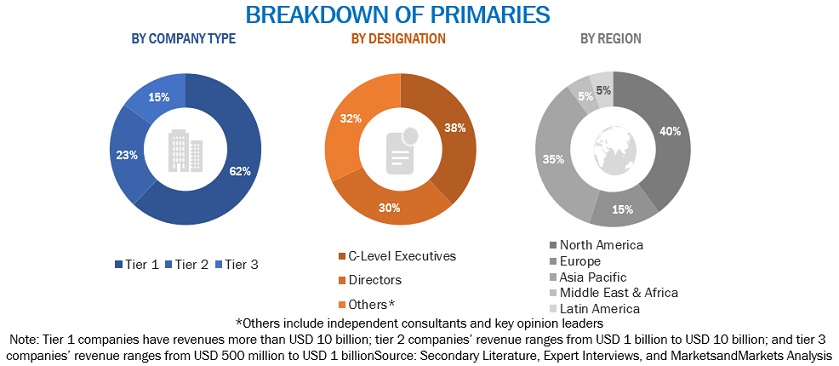

Given below is the breakup of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted for the estimation and forecasting of the managed network services market. The key players in the market were identified through secondary research and their revenue contribution in the respective regions was determined through primary and secondary research. The entire procedure included the study of annual and financial reports of top market players and extensive interviews for key insights from industry leaders, such as CEOs, VPs, directors, and marketing executives. All percentage splits and breakups were determined using secondary sources and verified through primary sources. All the possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to arrive at the final quantitative and qualitative data. This data is consolidated and added with detailed inputs and analysis from MarketsandMarkets.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and sub segments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and sub segment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the managed network services market based on segments based on Type, Deployment Mode, Organisation Size with regions covered.

- To forecast the size of the market segments with respect to five regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America.

- To provide detailed information related to the major factors (drivers, opportunities, threats, and challenges) influencing the growth of the market.

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the global managed network services market.

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the global market.

- To profile the key market players, such as top and emerging vendors; provide a comparative analysis based on their business overviews, regional presence, product offerings, and business strategies; and illustrate the market’s competitive landscape.

- To track and analyze competitive developments in the market, such as new product launches, product enhancements, partnerships, acquisitions, and agreements and collaborations

Available customizations

Along with the market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company information

- Detailed analysis and profiling of additional market players (Up to 5)

Geographic Analysis

- Further breakdown of the European Managed Network Services Market

- Further breakdown of the APAC Market

- Further breakdown of the MEA Market

- Further breakdown of the Latin American Market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Managed Network Services Market

Gather insights into how big the managed service market is for MSP's who provide private connectivity, like MPLS.

Interested in the Components segmentation of this market for our planning exercise.

Interested in market share data globally and in US for LAN WAN infrastructure managed service provider.