Management System Certification Market by Certification Type (Product Certification and Management System Certification), Service Type, Verticals, and Region [2021-2026]

Updated on : April 26, 2023

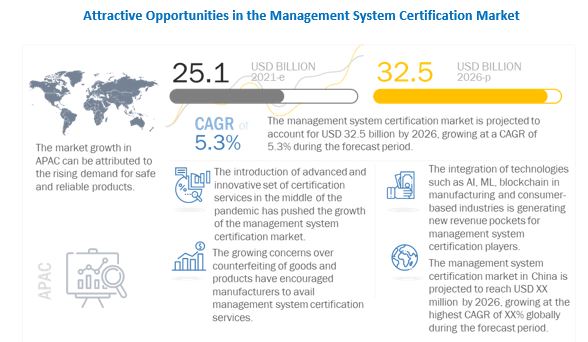

The Management system certification market is expected to grow at a CAGR of 5.3 %, from USD 25.1 billion in 2021 to USD 32.5 billion in 2026. The primary reasons for this rise in demand for test and measurement products in healthcare and IT & telecommunications industry.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on global Management system certification market, in 2021

The pandemic hit the global economy at large during the start of 2020 and has created unprecedented turmoil and change for individuals and organizations across the world. The pandemic has led to the closure of workplaces, restrictions on travel, and the creation of the work-from-home option for almost all employees, which has created challenges for businesses to operate. In the realistic approach, it has been assumed that the first three quarters of FY 20–21 have witnessed low growth in the market, followed by a steady recovery during the last quarter of FY 20–21. In the most realistic scenario, the management system certification market is expected to grow at a CAGR of 5.31% during 2021–2026. The market is expected to witness a single-digit growth in FY 20–21 due to the COVID-19 pandemic. The companies providing certification services across a wide range of application areas witnessed moderate growth rates until 2019; however, the pandemic has further restricted the market growth, leading to decreased adoption for both product certification and management system certification services across the world.

Management system certification market Dynamics

Driver: Increasing focus on manufacturing companies to improve customer retention

Quality products help companies to not only achieve customer satisfaction and retention but also reduce the risk and costs associated with product recalls. Companies gain a competitive edge by following quality management standards. Additionally, major certifications offered by recognized and credible authorities help such companies to improve their business credibility and overall efficiency. Companies communicate with customers via adverts and marketing strategies through which they assure customers about product quality. As a result, many people go for branded and certified products. Thus, branded companies earn better revenues. Moreover, governments encourage the use of certified products and services to ensure the safety of people. For instance, food product companies in India having the Food Safety and Standards Authority of India (FSSAI) certification authenticate that their products are manufactured under strict regulations and are safe to consume. Thus, the strong focus of manufacturing companies to deliver high-quality goods and services to sustain their market position has helped management system certification players to capture almost all industries.

Restraint: Varied standards and regulations across countries

With globalization in trade, distinct local regulations and standards across various regions are likely to create barriers to the acceptance of products internationally. This creates conflicts between the local and international standards, thereby hindering market growth. Variations in regulatory standards across different geographies also lead to discrepancies in tax rates, thereby resulting in additional costs for companies (hiring local staff to handle tax-related issues, etc.). Certification companies are subject to local laws and must abide by the regulations and norms of countries in which they operate; this may hamper their efficiency. Also, risks such as product failure and irregular functioning related to standardization and the quality of certification services provided by certification companies always exist. For instance, the norms for automotive emissions across Europe and APAC are varied, which creates ambiguity for the market players in terms of adopting emission standards, which, in turn, leads to longer lead time, inefficiency, and other business-related issues.

Opportunity: Introduction of digital certification services after outbreak of COVID-19

The certification market has witnessed considerable changes in terms of revenue shift from developed countries to smaller economies. For instance, smaller economies like Bangladesh and Nepal are focusing on improving their certification services for sectors like medical and life sciences so that the medical devices are tested and operate safely without causing any disruption while treating patients. Across economies such as China, South Korea, and Japan, governments have shifted from physical platforms to digital platforms to enable improvements in core structures and services required for the public. Due to the COVID-19 pandemic, it has become difficult to physically certify products, and hence, many companies are shifting towards digital certification, wherein a product is certified by looking at a monitor screen, and defects are detected by looking at the product on the screen. For instance, Entrust security has started offering digital certification services to meet a full range of enterprise requirements. With unique features, including strong encryption and browser trust, its certification provides enhanced security and ensures compliance with regulations such as ISO 9000 and ISO 9001.

Globally, many certification players still offer traditional services that are analog in nature. Although new market opportunities are generated by improved digitalized services, a few services like certification of food and beverage products are still being offered using the traditional market approach. Key players operating in the management system certification industry offer a wide range of services such as digital audits, remote audits, online sampling, and recertification services. For instance, amidst the pandemic, TÜV SÜD launched a comprehensive portfolio of virtual certification services to meet the changing needs of businesses. Combining digital, real-time, and remote capabilities, the company provides alternatives to in-person services without diminishing the integrity or the quality-of-service level.

Challenge: Challenges in providing certification services for evolving technologies for smaller market players

Globalization has led to the penetration of multiple technologies across different end-use applications. Technology has brought numerous changes in day-to-day operations and activities for personal and professional uses. This incredible pace of technology-driven change and the profound impact that technology is bringing about for businesses is noteworthy. Cognitive, blockchain, cybersecurity, and digital reality technologies are expected to become macro forces and will directly impact the way TIC players perceive the market today. The new digital experience is expected to bring new market challenges in the near future for management system certification players. For instance, the augmented reality (AR) and virtual reality (VR) testing ecosystem is witnessing a highly competitive consumer landscape; brands are continuously trying to differentiate themselves and drive more customer engagement. The certification of AR/VR technology is a challenge due to the presence of an immersive component that makes it difficult for automated or lab testing. Hardware certification helps manufacturers to ensure that the device is working properly, fits in the body of the target demographic, and also makes sure that it is compatible with other devices needed to run the simulation. The adoption of certification services based on evolving technologies is creating a challenge for smaller players operating in the management system certification ecosystem.

On the other hand, the integration of emerging technologies with various products in automotive, IT & telecommunications for the certification of products is also going to be a challenge for emerging and smaller players operating in the global management system certification business. Backed by high profit margins, major players in the management system certification business can easily incorporate new and emerging technologies within the existing service offerings for use across multiple application areas. For instance, Bureau Veritas, in early 2018, launched Origin, the world’s first traceability label to give consumers in the food & beverages, consumer goods, and retail industries complete end-to-end proof of a product’s journey. Origin offers a smart and practical way for consumers to access information on each stage of a product’s journey. Shoppers flash a QR code in-store to see the full history of each product and make informed purchase decisions. Therefore, the integration of evolving technologies with the existing service offerings, or certification of products across different applications, is expected to be a challenge for smaller management system certification players in the near future.

The market for system certification to grow at the highest CAGR Management system certification market, by certification type, in 2026

The Management system certification market for system certification is expected to grow at the highest CAGR during the forecast period. Business organizations worldwide require management systems to ensure their success. These systems are critical as they provide policies and processes to ensure that business organizations achieve their objectives with minimized business risks. Certified management systems ensure that business organizations are on par with internationally recognized standards. A wide range of the key players operating in the TIC ecosystem, including Bureau Veritas, SGS, INTERTEK, DEKRA, TÜV SÜD, DNV, etc., offer management system certification services. These players help companies improve their organizational performance and mitigate operational risks through certification to the international standards published by various bodies such as ISO. Business organizations can also train their internal staff to develop their competencies in terms of a range of topics related to the required international standards. The management systems are used in aerospace, agriculture and food, automotive, medical and life sciences, and consumer goods and retail applications.

The market for the certification and verification services to grow at the highest CAGR during the forecast period

The market for certification and verification services is expected to grow at the highest CAGR during the forecast period. Certification services function as an indicator of the safety, reliability, and quality of products. The products without certification can be used for a short period owing to their cost-effective manufacturing. Uncertified products are usually developed from sub-standard components expected to fail the testing of the safety and quality standards. Products that meet the certification requirements are safe to use. They are tested to meet the highest standards for safeguarding the health and safety of users. Certification services are available to all industries, ranging from small consumer electronics to aerospace. For instance, certification services used for agricultural products and food items check the quality of seeds and crops. The seed certification includes the seed source verifications, field inspections, seed quality analysis, seed genetic purity evaluations, and seed treatments, along with their bagging and tagging, as well as issuing relevant certificates. Verification services check the uniformity, completeness, and accuracy of products in terms of efficiency and performance at each stage and between each stage of the product development lifecycle. They evaluate products during each production phase to ensure that they meet the compliances formulated in the previous phases. For instance, Intertek provides various verification services, including document verifications, initial production checks, in-production checks, and import and export verifications.

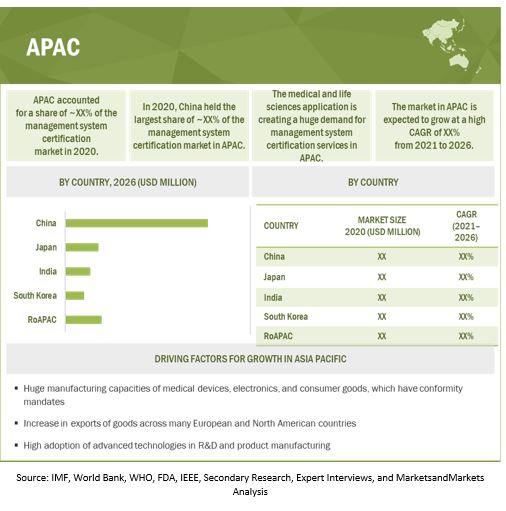

APAC to hold the largest share of Management system certification market in 2020

The market for APAC is expected to hold the largest market share. APAC is projected to be the fastest-growing market for management system certification during the forecast period. With three of the top 10 largest economies in the world—China, India, and Japan—the Asia Pacific region presents a high potential for the growth of the market. In this report, the market in the Asia Pacific mainly constitutes Japan, China, India, South Korea, and Rest of APAC. Australia, Singapore, Thailand, and Indonesia are the main countries studied and categorized under Rest of APAC. Some key OEMs and manufacturers of semiconductor devices such as STMicroelectronics, Huawei and Infineon Technologies and consumer goods and electronic products are based in APAC. The growing demand for management system certification is attributed to the increasing number of manufacturers who constantly focus on upgrading the existing and developing next-generation telecommunication devices. Furthermore, increasing penetration of wireless communication technologies is boosting demand for product and management system certifications from the IT & telecommunications sector.

Key Market Players

A few key players in management system certification companies are SGS (Switzerland), Bureau Veritas (France), INTERTEK (UK), TÜV SÜD (Germany), Eurofins Scientific (Luxembourg), TÜV Rheinland (Germany), DEKRA (Germany), DNV GL (Norway), and Applus+ (Spain).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2017–2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021–2026 |

|

Forecast units |

USD |

|

Segments covered |

By certification type, by services type and by application |

|

Geographies covered |

Asia Pacific, Europe, North America |

|

Companies covered |

SGS Group, Bureau Veritas, Intertek |

This research report categorizes the Management system certification market based on offering, end-use application, and region.

Management System Certification Market, By Certification Type

- Product Certification

- System Certification

Management System Certification Market, By Service Type

- Certification and Verification

- Training and Business Assurance

Management System Certification Market, By Application

- Consumer Goods & Retail

- Agriculture and Food

- Construction and Infrastructure

- Energy and Power

- Industrial and Manufacturing

- Medical and Life Sciences

- Oil & Gas and Petroleum

- Automotive

- Aerospace

- Marine

- IT and Telecom

Management System Certification Market, By Geography

-

North America

-

- US

- Canada

- Mexico

-

-

Europe

-

- UK

- Germany

- France

- Italy

- Rest of Europe

-

-

Asia Pacific (APAC)

-

- China

- Japan

- India

- South Korea

- Australia

- Rest of APAC

-

-

Rest of the World (RoW)

-

- Middle East and Africa (MEA)

- South America

-

Recent Developments

- In December 2020, SGS acquired RGIPL (Singapore), a Singapore-based provider of geoengineering solutions for activities such as soil investigation, instrumentation and monitoring, and geotechnical engineering for the construction and infrastructure industry. This acquisition enabled SGS to offer quality, safety, and compliance services for critical infrastructure and construction fields with the support provided by RGIPL.

- In December 2020, Bureau Veritas launched a complete portfolio of services dedicated to Electric Vehicle Charging Stations (EVCS), covering the full lifecycle—from design, construction, and commissioning to operations.

- In August 2020, Intertek announced to expand its presence in the APAC market by providing the assurance, testing, and certification services for 5G products. The expansion allows manufacturers from a variety of industries in the APAC region to test and validate the next generation of mobile and the Internet of Things (IoT) devices according to requirements of various global markets, including those specific to the US standards.

Frequently Asked Questions (FAQ):

What is current size of global Management system certification market?

The global Management system certification market is estimated to be around USD 25.1 billion in 2021 and projected to reach USD 32.5 billion by 2026 at a CAGR of 5.31%.

What is COVID-19 impact on global Management system certification market?

The requirement of Management system certification in different body temperature measuring sensors and COVID-19 diagnostic kits might drive the management system certification market. However, companies might find it challenging to cope with increased business requirements and may have to increase the management system certification services. This sudden demand will require them to increase their services, which might hamper the quality of these services. It would be challenging for the management system certification players to maintain the quality to meet the required demands.

Where will all these developments take the industry in the mid-to-long term?

Technology will continue to play a critical role in the Management system certification ecosystem. Key players operating in the Management system certification marketplace are integrating emerging technologies within their existing ecosystem, which has helped to improve Management system certification services.

Who are the winners of global Management system certification market?

Companies such as SGS (Switzerland), Bureau Veritas (France), Intertek (UK), TÜV NORD (Germany), TÜV SÜD (Germany), Eurofins Scientific (Luxembourg), TÜV Rheinland (Germany), DEKRA (Germany), DNV GL (Norway), and UL (US) are among a few key players in this market.

What are some features of management system certification?

The management system certification market holds some advantages in terms of higher margins and relatively lower capital expenditure than other business verticals. Players in this market tend to enter into long-term contracts and framework agreements, which help them to increase sales and revenue. The management system certification market is expected to remain a little bit resilient in the 2021 economic cycle owing to the uncertainty of the long-term impact of the COVID-19 pandemic. Growing globalized need to establish regulatory norms or standards for materials, products, systems, and processes; ever-increasing trade flows; globally integrating supply chains; and increased corporate outsourcing of R&D activities and quality assurance work to third parties have supported the long-term expansion of the management system certification market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 33)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION AND SCOPE

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 MANAGEMENT SYSTEM CERTIFICATION MARKET 35

1.3.2 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 38)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH DESIGN 38

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primaries

2.1.2.4 List of primary respondents

2.2 MARKET SIZE ESTIMATION

FIGURE 3 PROCESS FLOW OF MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for arriving at market size by bottom-up analysis

FIGURE 4 MARKET: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for capturing market size by top-down analysis

FIGURE 5 MARKET: TOP-DOWN APPROACH

2.2.3 SUPPLY-SIDE ANALYSIS

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE): ILLUSTRATION OF REVENUE ESTIMATION OF KEY MARKET PLAYERS IN MANAGEMENT SYSTEM CERTIFICATION MARKET

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.4 LIMITATIONS

TABLE 1 STUDY LIMITATIONS

2.5 RESEARCH ASSUMPTION

TABLE 2 STUDY ASSUMPTIONS

2.6 RISK ASSESSMENT

TABLE 3 RISKS

3 EXECUTIVE SUMMARY (Page No. - 49)

FIGURE 8 MANAGEMENT SYSTEM CERTIFICATION MARKET: PRE- AND POST-COVID-19 SCENARIO ANALYSIS, 2017–2026 (USD BILLION)

3.1 REALISTIC SCENARIO

3.2 OPTIMISTIC SCENARIO (POST-COVID-19)

3.3 PESSIMISTIC SCENARIO (POST-COVID-19)

FIGURE 9 MARKET, BY CERTIFICATION TYPE, 2021 VS. 2026

FIGURE 10 MARKET, BY APPLICATION, 2021 VS. 2026

FIGURE 11 APAC TO EXHIBIT HIGHEST CAGR IN MARKET DURING 2021–2026

4 PREMIUM INSIGHTS (Page No. - 53)

4.1 RISING DEMAND OF FOR SAFE AND RELIABLE PRODUCTS DRIVING THE MARKET

FIGURE 12 RAPID PENETRATION OF ADVANCED TECHNOLOGIES IN MANUFACTURING PLANTS ACROSS MULTIPLE INDUSTRIES TO CREATE DEMAND FOR MANAGEMENT SYSTEMS AND PRODUCT CERTIFICATION SERVICES DURING FORECAST PERIOD

4.2 MANAGEMENT SYSTEM CERTIFICATION MARKET, BY SERVICE TYPE

FIGURE 13 CERTIFICATION AND VERIFICATION SERVICES TO ACCOUNT FOR LARGER SHARE OF MARKET THAN TRAINING AND BUSINESS ASSURANCE SERVICES IN 2021

4.3 MARKET, BY APPLICATION

FIGURE 14 CONSUMER GOODS AND RETAIL APPLICATION LIKELY TO CAPTURE LARGEST SIZE OF MARKET IN 2021

4.4 MARKET IN NORTH AMERICA, BY APPLICATION & COUNTRY (2021)

FIGURE 15 MEDICAL & LIFE SCIENCES SEGMENT AND THE US HELD LARGEST MARKET SHARES OF NORTH AMERICA MARKET IN 2021

4.5 MARKET, BY CERTIFICATION TYPE

FIGURE 16 PRODUCT CERTIFICATION LIKELY TO CAPTURE LARGEST SIZE OF MARKET IN 2021

4.6 MARKET, BY REGION

FIGURE 17 MARKET SHARE, BY COUNTRY 2020

5 MARKET OVERVIEW (Page No. - 57)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 18 MANAGEMENT SYSTEM CERTIFICATION MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

FIGURE 19 MANAGEMENT SYSTEM CERTIFICATION SERVICES MARKET: DRIVERS AND THEIR IMPACT

5.2.1.1 Growing investments in latest technologies such as AI, ML, cloud computing, and big data

5.2.1.2 Increasing focus of manufacturing companies to improve customer retention

5.2.1.3 Growing illicit trade of forged and pirated goods

5.2.2 RESTRAINTS

FIGURE 20 MARKET: RESTRAINTS AND THEIR IMPACT

5.2.2.1 Varied standards and regulations across countries

5.2.3 OPPORTUNITIES

FIGURE 21 MARKET: OPPORTUNITIES AND THEIR IMPACT

5.2.3.1 Introduction of digital certification services after outbreak of COVID-19

5.2.4 CHALLENGES

FIGURE 22 MARKET: CHALLENGES AND THEIR IMPACT

5.2.4.1 Challenges in providing certification services for evolving technologies for smaller market players

5.3 IMPACT OF COVID-19 ON MARKET

5.3.1 IMPACT ON VALUE CHAIN

FIGURE 23 VALUE CHAIN ANALYSIS: MANAGEMENT SYSTEM CERTIFICATION MARKET

5.3.2 IMPACT ON MARKET

5.3.3 PARENT MARKET TRENDS

TABLE 4 MAJOR TRENDS IN MARKET

5.3.3.1 Impact analysis of emerging technologies on certification market

FIGURE 24 KEY TECHNOLOGIES

TABLE 5 EMERGING TECHNOLOGIES IMPACT ANALYSIS, 2020

5.4 AVERAGE SELLING PRICE (ASP) TRENDS

5.4.1 AVERAGE SELLING PRICE OF IMPORTANT ISO CERTIFICATION

5.5 MANAGEMENT SYSTEM CERTIFICATION MARKET: PATENT ANALYSIS

5.6 TRADE ANALYSIS

5.6.1 EXPORT SCENARIO OF INSTRUMENTS AND APPLIANCES USED IN MEDICAL, SURGICAL, DENTAL, OR VETERINARY SCIENCES

FIGURE 25 EXPORT OF INSTRUMENTS AND APPLIANCES USED IN MEDICAL, SURGICAL, DENTAL, OR VETERINARY SCIENCES, 2015–2019

5.6.2 IMPORT SCENARIO OF INSTRUMENTS AND APPLIANCES USED IN MEDICAL, SURGICAL, DENTAL, OR VETERINARY SCIENCES

FIGURE 26 IMPORT OF INSTRUMENTS AND APPLIANCES USED IN MEDICAL, SURGICAL, DENTAL, OR VETERINARY SCIENCES, 2015–2019

5.7 LIST OF KEY PLAYERS

FIGURE 27 KEY MARKET PLAYERS, 2020

5.7.1 MARKET PENETRATION OF KEY SERVICES IN DEMAND POST COVID-19

FIGURE 28 MARKET PENETRATION OF KEY SERVICES

5.7.2 DEMAND-SIDE ANALYSIS

5.7.3 SUPPLY-SIDE ANALYSIS

5.8 TARIFF AND REGULATORY LANDSCAPE

5.8.1 REGULATIONS PERTAINING TO MAJOR MANAGEMENT SYSTEM CERTIFICATIONS

TABLE 6 STANDARDS AND DESCRIPTION

5.9 MANAGEMENT SYSTEM CERTIFICATION ECOSYSTEM

FIGURE 29 ECOSYSTEM: MANAGEMENT SYSTEM CERTIFICATION MARKET

TABLE 7 MARKET: ROLE OF KEY PLAYERS ACROSS VALUE CHAIN

5.9.1 REGULATORY BODIES

5.9.2 SERVICE PROVIDERS

5.9.3 END USERS

5.10 MANAGEMENT SYSTEM CERTIFICATION MARKET: PORTER’S FIVE FORCES ANALYSIS

FIGURE 30 MARKET: IMPACT OF FORCES ON MARKET

TABLE 8 MARKET: PORTER’S FIVE FORCES ANALYSIS, 2020

5.10.1 THREAT OF NEW ENTRANTS

5.10.2 THREAT OF SUBSTITUTES

5.10.3 BARGAINING POWER OF SUPPLIERS

5.10.4 BARGAINING POWER OF BUYERS

5.10.5 DEGREE OF COMPETITION

5.11 CASE STUDIES

5.11.1 TÜV SÜD

TABLE 9 TÜV SÜD PROVIDED CUSTOMIZED CERTIFICATION SERVICE TO DEICHMANN

5.11.2 INTERTEK

TABLE 10 INTERTEK PROVIDED QUALITY MANAGEMENT SYSTEM CERTIFICATION TO EMESEC INCORPORATED

6 MANAGEMENT SYSTEM CERTIFICATION MARKET, BY CERTIFICATION TYPE (Page No. - 78)

6.1 INTRODUCTION

FIGURE 31 MARKET, BY CERTIFICATION TYPE, 2021 VS. 2026 (USD BILLION)

TABLE 11 MARKET, BY CERTIFICATION TYPE, 2017–2020 (USD BILLION)

TABLE 12 MARKET, BY CERTIFICATION TYPE, 2021–2026 (USD BILLION)

6.2 PRODUCT CERTIFICATION

6.2.1 PRODUCT CERTIFICATION ENABLES INCREASED MARKETABILITY OF PRODUCTS

6.3 SYSTEM CERTIFICATION

6.3.1 SYSTEM CERTIFICATION HELPS BUSINESS ORGANIZATIONS IN ACHIEVING THEIR OBJECTIVES WITH MINIMIZED RISKS

TABLE 13 MANAGEMENT CERTIFICATION SERVICES FOR VARIOUS KEY APPLICATIONS

7 MANAGEMENT SYSTEM CERTIFICATION MARKET, BY SERVICE TYPE (Page No. - 82)

7.1 INTRODUCTION

FIGURE 32 CERTIFICATION AND VERIFICATION SEGMENT TO LEAD MARKET FROM 2021 TO 2026

TABLE 14 MARKET, BY SERVICE TYPE, 2017–2020 (USD MILLION)

TABLE 15 MARKET, BY SERVICE TYPE, 2021–2026 (USD MILLION)

7.2 CERTIFICATION AND VERIFICATION

7.2.1 MANDATORY CERTIFICATION SERVICES FOR AGRICULTURAL PRODUCTS DRIVE REQUIREMENT FOR CERTIFICATION AND VERIFICATION SERVICES

7.3 TRAINING AND BUSINESS ASSURANCE

7.3.1 ASSURANCE SERVICES PROVIDE RELIABILITY AND OPERATIONAL GUARANTEE TO MANUFACTURERS

8 MANAGEMENT SYSTEM CERTIFICATION MARKET, BY APPLICATION (Page No. - 86)

8.1 INTRODUCTION

FIGURE 33 MARKET, BY APPLICATION, 2021 VS. 2026 (USD MILLION)

TABLE 16 MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 17 MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

8.2 CONSUMER GOODS AND RETAIL

8.2.1 INCREASED COMPLEXITY OF CONSUMER PRODUCTS DRIVES DEMAND FOR CERTIFICATION SERVICES GLOBALLY

8.3 AGRICULTURE AND FOOD

8.3.1 STRINGENT FOOD SAFETY NORMS AND SURGED DEMAND FOR QUALITY FOOD PRODUCTS ARE MET THROUGH CERTIFICATION SERVICES

8.4 CONSTRUCTION AND INFRASTRUCTURE

8.4.1 SURGED REQUIREMENT FOR HIGH-QUALITY INFRASTRUCTURE AND RAPID ADVANCEMENTS IN BUILDING INFRASTRUCTURE MODELLING CREATE OPPORTUNITY FOR CERTIFICATION SERVICE PROVIDERS

8.5 ENERGY AND POWER

8.5.1 ESCALATED NEED FOR ENERGY WORLDWIDE AND HIGH ADOPTION OF EMERGING TECHNOLOGIES IN ENERGY GENERATION CREATE ENORMOUS OPPORTUNITIES FOR CERTIFICATION SERVICES

8.6 INDUSTRIAL AND MANUFACTURING

8.6.1 ACCELERATED REQUIREMENT FOR SAFE AND QUALITY PRODUCTS STIMULATE GROWTH OF MARKET FOR CERTIFICATION SERVICES

8.7 MEDICAL AND LIFE SCIENCES

8.7.1 ESCALATED NEED FOR HIGH-QUALITY MEDICAL DEVICES TO MINIMIZE PATIENT SAFETY RISKS WILL BOOST DEMAND FOR CERTIFICATION SERVICES

8.8 OIL & GAS AND PETROLEUM

8.8.1 IMMENSE OPPORTUNITY WITH DEVELOPMENT OF ENHANCED SERVICE OFFERINGS FOR OIL & GAS AND PETROLEUM INDUSTRY PLAYERS WILL FOSTER MARKET GROWTH

8.9 AUTOMOTIVE

8.9.1 HUGE DEMAND FOR HIGH-QUALITY AUTOMOBILE PARTS PUSHES MARKET GROWTH

8.1 AEROSPACE

8.10.1 CONTINUOUS EVOLUTION OF TECHNOLOGY IN AEROSPACE INDUSTRY SUPPORTS MARKET GROWTH FOR CERTIFICATION SERVICES

8.11 MARINE

8.11.1 STRINGENT IMO REGULATIONS PROPEL GROWTH OF MARKET FOR CERTIFICATION SERVICES RELATED TO MARINE EQUIPMENT

TABLE 18 MARINE EQUIPMENT CLASSIFICATION BY IMO

TABLE 19 CONFORMITY ASSESSMENT PROCEDURES ACCORDING TO MED

8.12 IT AND TELECOM

8.12.1 MANDATORY CERTIFICATION OF TELECOMMUNICATION EQUIPMENT PROMOTES MARKET GROWTH

9 GEOGRAPHIC ANALYSIS (Page No. - 95)

9.1 INTRODUCTION

FIGURE 34 MARKET SEGMENTATION, BY REGION

FIGURE 35 MARKET IN APAC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 20 MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 21 MARKET, BY REGION, 2021–2026 (USD MILLION)

TABLE 22 PRODUCT CERTIFICATION MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 23 PRODUCT CERTIFICATION MARKET, BY REGION, 2021–2026 (USD MILLION)

TABLE 24 MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 25 MARKET, BY REGION, 2021–2026 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 36 MANAGEMENT SYSTEM CERTIFICATION MARKET IN NORTH AMERICA, BY COUNTRY

FIGURE 37 NORTH AMERICA: MARKET SNAPSHOT

TABLE 26 MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 27 MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 28 MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 29 MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 30 PRODUCT CERTIFICATION MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 31 PRODUCT CERTIFICATION MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 32 PRODUCT AND MANAGEMENT SYSTEM CERTIFICATION MARKET IN NORTH AMERICA, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 33 MARKET IN NORTH AMERICA, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 34 MARKET IN NORTH AMERICA, BY SERVICE TYPE, 2017–2020 (USD MILLION)

TABLE 35 MARKET IN NORTH AMERICA, BY SERVICE TYPE, 2021–2026 (USD MILLION)

9.2.1 US

9.2.1.1 Surging adoption of management systems based on ISO standards to mitigate business risks and improve production efficiency in US

TABLE 36 MARKET IN US, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 37 MARKET IN US, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 38 MARKET IN US, BY SERVICE TYPE, 2017–2020 (USD MILLION)

TABLE 39 MARKET IN US, BY SERVICE TYPE, 2021–2026 (USD MILLION)

TABLE 40 MARKET IN US, BY CERTIFICATION TYPE, 2017–2020 (USD MILLION)

TABLE 41 MARKET IN US, BY CERTIFICATION TYPE, 2021–2026 (USD MILLION)

9.2.2 CANADA

9.2.2.1 Increasing demand for management system certification from telecommunication and broadband service providers in Canada boosts market growth

TABLE 42 PRODUCT AND MANAGEMENT SYSTEM CERTIFICATION MARKET IN CANADA, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 43 MARKET IN CANADA, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 44 MARKET IN CANADA, BY SERVICE TYPE, 2017–2020 (USD MILLION)

TABLE 45 MARKET IN CANADA, BY SERVICE TYPE, 2021–2026 (USD MILLION)

TABLE 46 CERTIFICATION MARKET IN CANADA, BY CERTIFICATION TYPE, 2017–2020 (USD MILLION)

TABLE 47 CERTIFICATION MARKET IN CANADA, BY CERTIFICATION TYPE, 2021–2026 (USD MILLION

9.2.3 MEXICO

9.2.3.1 Rising demand for compact cars fosters management system certification market growth in Mexico

TABLE 48 PRODUCT AND MANAGEMENT SYSTEM CERTIFICATION MARKET IN MEXICO, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 49 MARKET IN MEXICO, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 50 MARKET IN MEXICO, BY SERVICE TYPE, 2017–2020 (USD MILLION)

TABLE 51 MARKET IN MEXICO, BY SERVICE TYPE, 2021–2026 (USD MILLION)

TABLE 52 CERTIFICATION MARKET IN MEXICO, BY CERTIFICATION TYPE, 2017–2020 (USD MILLION)

TABLE 53 CERTIFICATION MARKET IN MEXICO, BY CERTIFICATION TYPE, 2021–2026 (USD MILLION

9.3 EUROPE

FIGURE 38 EUROPE: MARKET SNAPSHOT

TABLE 54 MARKET IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 55 MARKET IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 56 MARKET IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 57 MARKET IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 58 PRODUCT CERTIFICATION MARKET IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 59 PRODUCT CERTIFICATION MARKET IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 60 PRODUCT AND MANAGEMENT SYSTEM CERTIFICATION MARKET IN EUROPE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 61 MARKET IN EUROPE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 62 MARKET IN EUROPE, BY SERVICE TYPE, 2017–2020 (USD MILLION)

TABLE 63 MARKET IN EUROPE, BY SERVICE TYPE, 2021–2026 (USD MILLION)

9.3.1 UK

9.3.1.1 Rising need to certify consumer goods and medical devices will accelerate growth of market

TABLE 64 MARKET IN UK, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 65 MARKET IN UK, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 66 MARKET IN UK, BY SERVICE TYPE, 2017–2020 (USD MILLION)

TABLE 67 MARKET IN UK, BY SERVICE TYPE, 2021–2026 (USD MILLION)

TABLE 68 CERTIFICATION MARKET IN UK, BY CERTIFICATION TYPE, 2017–2020 (USD MILLION)

TABLE 69 CERTIFICATION MARKET IN UK, BY CERTIFICATION TYPE, 2021–2026 (USD MILLION)

9.3.2 GERMANY

9.3.2.1 Increasing focus on rapid economy recovery and expanding charging infrastructure to facilitate adoption of electric vehicles will spike need for management system certification services

TABLE 70 MARKET IN GERMANY, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 71 MARKET IN GERMANY, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 72 MARKET IN GERMANY, BY SERVICE TYPE, 2017–2020 (USD MILLION)

TABLE 73 MARKET IN GERMANY, BY SERVICE TYPE, 2021–2026 (USD MILLION)

TABLE 74 CERTIFICATION MARKET IN GERMANY, BY CERTIFICATION TYPE, 2017–2020 (USD MILLION)

TABLE 75 CERTIFICATION MARKET IN GERMANY, BY CERTIFICATION TYPE, 2021–2026 (USD MILLION

9.3.3 FRANCE

9.3.3.1 Rising adoption of certification services in medical and life sciences and agriculture and food sectors will drive market growth

TABLE 76 PRODUCT AND MANAGEMENT SYSTEM CERTIFICATION MARKET IN FRANCE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 77 MARKET IN FRANCE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 78 MARKET IN FRANCE, BY SERVICE TYPE, 2017–2020 (USD MILLION)

TABLE 79 MARKET IN FRANCE, BY SERVICE TYPE, 2021–2026 (USD MILLION)

TABLE 80 CERTIFICATION MARKET IN FRANCE, BY CERTIFICATION TYPE, 2017–2020 (USD MILLION)

TABLE 81 CERTIFICATION MARKET IN FRANCE, BY CERTIFICATION TYPE, 2021–2026 (USD MILLION

9.3.4 ITALY

9.3.4.1 Growing requirement for product and management system certification services from consumer goods and aerospace & defense sectors to propel market growth

TABLE 82 PRODUCT AND MANAGEMENT SYSTEM CERTIFICATION MARKET IN ITALY,BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 83 MARKET IN ITALY, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 84 MARKET IN ITALY, BY SERVICE TYPE, 2017–2020 (USD MILLION)

TABLE 85 MARKET IN ITALY, BY SERVICE TYPE, 2021–2026 (USD MILLION)

TABLE 86 CERTIFICATION MARKET IN ITALY, BY CERTIFICATION TYPE, 2017–2020 (USD MILLION)

TABLE 87 CERTIFICATION MARKET IN ITALY, BY CERTIFICATION TYPE, 2021–2026 (USD MILLION)

9.3.5 REST OF EUROPE

TABLE 88 MARKET IN ROE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 89 MARKET IN ROE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 90 MARKET IN ROE, BY SERVICE TYPE, 2017–2020 (USD MILLION)

TABLE 91 MARKET IN ROE, BY SERVICE TYPE, 2021–2026 (USD MILLION)

TABLE 92 CERTIFICATION MARKET IN ROE, BY CERTIFICATION TYPE, 2017–2020 (USD MILLION)

TABLE 93 CERTIFICATION MARKET IN ROE, BY CERTIFICATION TYPE, 2021–2026 (USD MILLION)

9.4 APAC

FIGURE 39 APAC: MARKET SNAPSHOT

TABLE 94 MARKET IN APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 95 MARKET IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 96 MARKET IN APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 97 MARKET IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 98 PRODUCT CERTIFICATION MARKET IN APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 99 PRODUCT CERTIFICATION MARKET IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 100 PRODUCT AND MANAGEMENT SYSTEM CERTIFICATION MARKET IN APAC, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 101 MARKET IN APAC, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 102 MARKET IN APAC, BY SERVICE TYPE, 2017–2020 (USD MILLION)

TABLE 103 MARKET IN APAC, BY SERVICE TYPE, 2021–2026 (USD MILLION)

9.4.1 CHINA

9.4.1.1 Flourishing healthcare industry drives demand for product and management system certification services in China

TABLE 104 PRODUCT AND MANAGEMENT SYSTEM CERTIFICATION MARKET IN CHINA, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 105 MARKET IN CHINA, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 106 MARKET IN CHINA, BY SERVICE TYPE, 2017–2020 (USD MILLION)

TABLE 107 MARKET IN CHINA, BY SERVICE TYPE, 2021–2026 (USD MILLION)

TABLE 108 CERTIFICATION MARKET IN CHINA, BY CERTIFICATION TYPE, 2017–2020 (USD MILLION)

TABLE 109 CERTIFICATION MARKET IN CHINA, BY CERTIFICATION TYPE, 2021–2026 (USD MILLION

9.4.2 JAPAN

9.4.2.1 Surging requirement from consumer goods and healthcare industries to drive growth of market

TABLE 110 MARKET IN JAPAN,BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 111 MARKET IN JAPAN, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 112 MARKET IN JAPAN, BY SERVICE TYPE, 2017–2020 (USD MILLION)

TABLE 113 MARKET IN JAPAN, BY SERVICE TYPE, 2021–2026 (USD MILLION)

TABLE 114 CERTIFICATION MARKET IN JAPAN, BY CERTIFICATION TYPE, 2017–2020 (USD MILLION)

TABLE 115 CERTIFICATION MARKET IN JAPAN, BY CERTIFICATION TYPE, 2021–2026 (USD MILLION

9.4.3 INDIA

9.4.3.1 Ongoing initiatives of Government of India to attract FDI into country to foster market growth

TABLE 116 PRODUCT AND MANAGEMENT SYSTEM CERTIFICATION MARKET IN INDIA, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 117 MARKET IN INDIA, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 118 MARKET IN INDIA, BY SERVICE TYPE, 2017–2020 (USD MILLION)

TABLE 119 MARKET IN INDIA, BY SERVICE TYPE, 2021–2026 (USD MILLION)

TABLE 120 CERTIFICATION MARKET IN INDIA, BY CERTIFICATION TYPE, 2017–2020 (USD MILLION)

TABLE 121 CERTIFICATION MARKET IN INDIA, BY CERTIFICATION TYPE, 2021–2026 (USD MILLION)

9.4.4 SOUTH KOREA

9.4.4.1 Surging adoption of certification services in medical and life sciences applications continues to drive market growth in middle of pandemic

TABLE 122 PRODUCT AND MANAGEMENT SYSTEM CERTIFICATION MARKET IN SOUTH KOREA, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 123 MARKET IN SOUTH KOREA, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 124 MARKET IN SOUTH KOREA, BY SERVICE TYPE, 2017–2020 (USD MILLION)

TABLE 125 MARKET IN SOUTH KOREA, BY SERVICE TYPE, 2021–2026 (USD MILLION)

TABLE 126 CERTIFICATION MARKET IN SOUTH KOREA, BY CERTIFICATION TYPE, 2017–2020 (USD MILLION)

TABLE 127 CERTIFICATION MARKET IN SOUTH KOREA, BY CERTIFICATION TYPE, 2021–2026 (USD MILLION

9.4.5 REST OF APAC

TABLE 128 MARKET IN REST OF APAC, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 129 MARKET IN REST OF APAC, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 130 MARKET IN REST OF APAC, BY SERVICE TYPE, 2017–2020 (USD MILLION)

TABLE 131 MARKET IN REST OF APAC, BY SERVICE TYPE, 2021–2026 (USD MILLION)

TABLE 132 CERTIFICATION MARKET IN REST OF APAC, BY CERTIFICATION TYPE, 2017–2020 (USD MILLION)

TABLE 133 CERTIFICATION MARKET IN REST OF APAC, BY CERTIFICATION TYPE, 2021–2026 (USD MILLION)

9.5 ROW

FIGURE 40 ROW: MANAGEMENT SYSTEM CERTIFICATION MARKET SNAPSHOT

TABLE 134 MARKET IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 135 MARKET IN ROW, BY REGION, 2021–2026 (USD MILLION)

TABLE 136 MARKET IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 137 MARKET IN ROW, BY REGION, 2021–2026 (USD MILLION)

TABLE 138 PRODUCT CERTIFICATION MARKET IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 139 PRODUCT CERTIFICATION MARKET IN ROW, BY REGION, 2021–2026 (USD MILLION)

TABLE 140 PRODUCT AND MANAGEMENT SYSTEM CERTIFICATION MARKET IN ROW, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 141 MARKET IN ROW, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 142 MARKET IN ROW, BY SERVICE TYPE, 2017–2020 (USD MILLION)

TABLE 143 MARKET IN ROW, BY SERVICE TYPE, 2021–2026 (USD MILLION)

9.5.1 SOUTH AMERICA

TABLE 144 PRODUCT AND MANAGEMENT SYSTEM CERTIFICATION MARKET IN SOUTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 145 MARKET IN SOUTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 146 MARKET IN SOUTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 147 MARKET IN SOUTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 148 PRODUCT CERTIFICATION MARKET IN SOUTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 149 PRODUCT CERTIFICATION MARKET IN SOUTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

9.5.1.1 Brazil

9.5.1.1.1 Booming medical and life sciences industry to elevate demand for certification services in Brazil

TABLE 150 PRODUCT AND MANAGEMENT SYSTEM CERTIFICATION MARKET IN BRAZIL, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 151 MARKET IN BRAZIL, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 152 MARKET IN BRAZIL, BY SERVICE TYPE, 2017–2020 (USD MILLION)

TABLE 153 MARKET IN BRAZIL, BY SERVICE TYPE, 2021–2026 (USD MILLION)

TABLE 154 CERTIFICATION MARKET IN BRAZIL, BY CERTIFICATION TYPE, 2017–2020 (USD MILLION)

TABLE 155 CERTIFICATION MARKET IN BRAZIL, BY CERTIFICATION TYPE, 2021–2026 (USD MILLION)

9.5.1.2 Argentina

9.5.1.2.1 Increasing demand for improved medical devices drives market growth

TABLE 156 PRODUCT AND MANAGEMENT SYSTEM CERTIFICATION MARKET IN ARGENTINA, BY APPLICATION, 2017–2020 (USD THOUSAND)

TABLE 157 MARKET IN ARGENTINA, BY APPLICATION, 2021–2026 (USD THOUSAND)

TABLE 158 MARKET IN ARGENTINA, BY SERVICE TYPE, 2017–2020 (USD MILLION)

TABLE 159 MARKET IN ARGENTINA, BY SERVICE TYPE, 2021–2026 (USD MILLION)

TABLE 160 CERTIFICATION MARKET IN ARGENTINA, BY CERTIFICATION TYPE, 2017–2020 (USD MILLION)

TABLE 161 CERTIFICATION MARKET IN ARGENTINA, BY CERTIFICATION TYPE, 2021–2026 (USD MILLION)

9.5.1.3 Rest of South America

TABLE 162 PRODUCT AND MANAGEMENT SYSTEM CERTIFICATION MARKET IN REST OF SOUTH AMERICA, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 163 MARKET IN REST OF SOUTH AMERICA, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 164 MARKET IN REST OF SOUTH AMERICA, BY SERVICE TYPE, 2017–2020 (USD MILLION)

TABLE 165 MARKET IN REST OF SOUTH AMERICA, BY SERVICE TYPE, 2021–2026 (USD MILLION)

TABLE 166 CERTIFICATION MARKET IN REST OF SOUTH AMERICA, BY CERTIFICATION TYPE, 2017–2020 (USD MILLION)

TABLE 167 CERTIFICATION MARKET IN REST OF SOUTH AMERICA, BY CERTIFICATION TYPE, 2021–2026 (USD MILLION)

9.5.2 MIDDLE EAST & AFRICA

9.5.2.1 Saudi Arabia

9.5.2.1.1 Increased need for high-quality certified medical devices to fuel demand for certification services

9.5.2.2 United Arab Emirates (UAE)

9.5.2.2.1 Positive reinforcement of government to exhibit rapid market growth during forecast period

9.5.2.3 Qatar

9.5.2.3.1 Considerable demand for certification services from oiI & gas and petroleum industry in Qatar propels market growth

9.5.2.4 Oman

9.5.2.4.1 Huge opportunities in medical and automotive sectors to boost demand for certification services

9.5.2.5 Rest of Middle East and Africa

10 COMPETITIVE LANDSCAPE (Page No. - 177)

10.1 OVERVIEW

FIGURE 41 SERVICE LAUNCHES EMERGED AS KEY STRATEGY ADOPTED BY MARKET PLAYERS FROM JANUARY 2018 TO MAY 2021

10.2 MARKET SHARE AND RANKING ANALYSIS OF KEY COMPANIES, 2020

TABLE 168 MARKET: MARKET SHARE IN 2020

TABLE 169 DEGREE OF COMPETITION

FIGURE 42 RANKING OF TOP PLAYERS IN MARKET

10.3 FIVE-YEAR REVENUE ANALYSIS OF MAJOR PLAYERS IN MARKET

FIGURE 43 MANAGEMENT SYSTEM CERTIFICATION MARKET: FIVE-YEAR REVENUE SNAPSHOT OF MAJOR PLAYERS (USD MILLION)

TABLE 170 COMPANY FOOTPRINT

TABLE 171 COMPANY VERTICAL FOOTPRINT

TABLE 172 COMPANY INDUSTRIAL FOOTPRINT

TABLE 173 COMPANY REGIONAL FOOTPRINT

10.4 COMPANY EVALUATION MATRIX, 2020

10.4.1 STAR

10.4.2 EMERGING LEADER

10.4.3 PERVASIVE

10.4.4 PARTICIPANT

FIGURE 44 MANAGEMENT SYSTEM CERTIFICATION MARKET: COMPANY EVALUATION MATRIX (2020)

10.5 COMPETITIVE BENCHMARKING

10.5.1 STRENGTH OF SERVICE PORTFOLIO (15 COMPANIES)

10.5.2 BUSINESS STRATEGY EXCELLENCE (15 COMPANIES)

10.6 STARTUP/SME EVALUATION MATRIX, 2020

10.6.1 PROGRESSIVE COMPANY

10.6.2 RESPONSIVE COMPANY

10.6.3 DYNAMIC COMPANY

10.6.4 STARTING BLOCK

FIGURE 45 MANAGEMENT SYSTEM CERTIFICATION MARKET: START-UP/SME EVALUATION MATRIX (2020)

10.7 COMPETITIVE SITUATIONS AND TRENDS

TABLE 174 SERVICE LAUNCHES

10.7.1 DEALS

TABLE 175 DEALS

11 COMPANY PROFILES (Page No. - 203)

(Business Overview, Services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

11.1 INTRODUCTION

11.2 KEY PLAYERS

11.2.1 SGS GROUP

TABLE 176 SGS GROUP: BUSINESS OVERVIEW

FIGURE 46 SGS GROUP: COMPANY SNAPSHOT

TABLE 177 SGS: DEALS

11.2.2 BUREAU VERITAS

TABLE 178 BUREAU VERITAS: BUSINESS OVERVIEW

FIGURE 47 BUREAU VERITAS: COMPANY SNAPSHOT

TABLE 179 BUREAU VERITAS: SERVICE LAUNCHES

TABLE 180 BUREAU VERITAS: DEALS

11.2.3 INTERTEK

TABLE 181 INTERTEK: BUSINESS OVERVIEW

FIGURE 48 INTERTEK: COMPANY SNAPSHOT

TABLE 182 INTERTEK: SERVICE LAUNCHES

TABLE 183 INTERTEK: DEALS

11.2.4 TÜV RHEINLAND

TABLE 184 TÜV RHEINLAND: BUSINESS OVERVIEW

FIGURE 49 TÜV RHEINLAND: COMPANY SNAPSHOT

TABLE 185 TÜV RHEINLAND: SERVICE LAUNCH

11.2.5 DEKRA SE

TABLE 186 DEKRA SE: BUSINESS OVERVIEW

FIGURE 50 DEKRA SE: COMPANY SNAPSHOT

TABLE 187 DEKRA: SERVICE LAUNCH/EXPANSION

11.2.6 EUROFINS SCIENTIFIC

TABLE 188 EUROFINS SCIENTIFIC: BUSINESS OVERVIEW

FIGURE 51 EUROFINS SCIENTIFIC: COMPANY SNAPSHOT

TABLE 189 EUROFINS SCIENTIFIC: SERVICE LAUNCH

11.2.7 TÜV SÜD

TABLE 190 TÜV SÜD: BUSINESS OVERVIEW

FIGURE 52 TÜV SÜD: COMPANY SNAPSHOT

TABLE 191 TÜV SÜD: DEALS

11.2.8 DNV GL

TABLE 192 DNV GL: BUSINESS OVERVIEW

FIGURE 53 DNV GL: COMPANY SNAPSHOT

TABLE 193 DNV GL: SERVICE LAUNCH

TABLE 194 DNV GL: DEALS

11.2.9 APPLUS+

TABLE 195 APPLUS+: BUSINESS OVERVIEW

FIGURE 54 APPLUS+: COMPANY SNAPSHOT

TABLE 196 APPLUS+: DEALS

11.2.10 ALS LIMITED

TABLE 197 ALS LIMITED: BUSINESS OVERVIEW

FIGURE 55 ALS LIMITED: COMPANY SNAPSHOT

TABLE 198 ALS LIMITED: DEALS

11.2.11 LLOYD’S REGISTER GROUP LIMITED

TABLE 199 LLYOD’S REGISTER: BUSINESS OVERVIEW

FIGURE 56 LLOYD’S REGISTER GROUP LIMITED: COMPANY SNAPSHOT

TABLE 200 LLOYD’S REGISTER: SERVICE LAUNCHES

11.2.12 BRITISH STANDARDS INSTITUTION (BSI)

TABLE 201 BSI: BUSINESS OVERVIEW

FIGURE 57 BSI: COMPANY SNAPSHOT

TABLE 202 BSI: SERVICE LAUNCHES

11.2.13 RINA S.P.A.

TABLE 203 RINA S.P.A.: BUSINESS OVERVIEW

11.2.14 AL BORJ FACILITY MANAGEMENT

TABLE 204 AL BORJ FACILITY MANAGEMENT: BUSINESS OVERVIEW

11.2.15 SIS CERTIFICATIONS

TABLE 205 SIS CERTIFICATIONS: BUSINESS OVERVIEW

FIGURE 58 SIS CERTIFICATIONS: COMPANY SNAPSHOT

11.2.16 FINECERT

TABLE 206 FINCERT: BUSINESS OVERVIEW

11.2.17 UNITED REGISTRAR OF SYSTEMS (URS)

TABLE 207 URS: BUSINESS OVERVIEW

11.2.18 LL-C (CERTIFICATION)

TABLE 208 LL-C: BUSINESS OVERVIEW

11.2.19 GCL INTERNATIONAL

TABLE 209 GCL INTERNATIONAL: BUSINESS OVERVIEW

11.2.20 AURION INTERNATIONAL

TABLE 210 AURION INTERNATIONAL: BUSINESS OVERVIEW

11.2.21 TÜV NORD GROUP

TABLE 211 TÜV NORD GROUP: BUSINESS OVERVIEW

FIGURE 59 TÜV NORD GROUP: COMPANY SNAPSHOT

TABLE 212 TÜV NORD GROUP: SERVICE LAUNCH

11.2.22 IR CLASS

TABLE 213 IRCLASS: BUSINESS OVERVIEW

TABLE 214 IRCLASS: SERVICE LAUNCH

11.2.23 DQS

TABLE 215 DQS: BUSINESS OVERVIEW

11.2.24 SOCOTEC

TABLE 216 SOCOTEC: BUSINESS OVERVIEW

FIGURE 60 SOCOTEC: COMPANY SNAPSHOT

TABLE 217 SOCOTEC: DEALS

11.2.25 ASTM INTERNATIONAL

*Details on Business Overview, Services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 265)

12.1 INSIGHTS OF INDUSTRY EXPERTS

12.2 DISCUSSION GUIDE

12.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.4 AVAILABLE CUSTOMIZATIONS

12.5 RELATED REPORTS

12.6 AUTHOR DETAILS

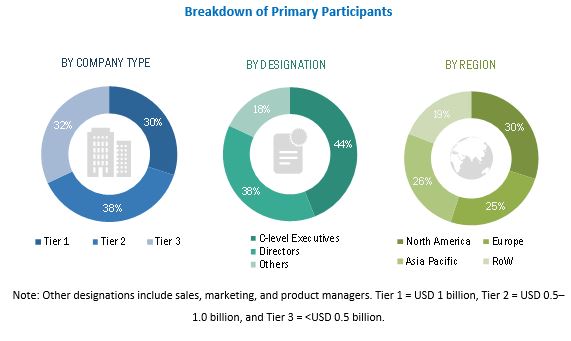

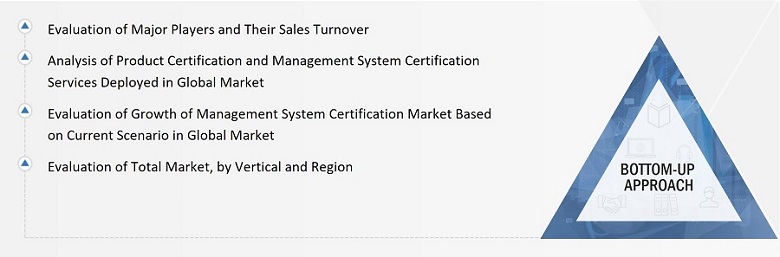

The study involved four major activities in estimating the current size of the Management system certification market. Exhaustive secondary research was done to collect information on the market and its peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation were employed to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information important for this study. These secondary sources include biometric technologies journals and magazines, IEEE journals; annual reports, press releases, and investor presentations of companies; white papers; certified publications and articles from recognized authors; and directories and databases such as Factiva, Hoovers, and OneSource.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information important for this report. The primary sources from the supply side included industry experts such as CEOs, VPs, marketing directors, technology and innovation directors, and related executives from key companies and organizations operating in the Management system certification market. After complete market engineering (including calculations regarding market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information, as well as to verify and validate the critical numbers arrived at.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches were implemented, along with several data triangulation methods, to estimate and validate the size of the Management system certification market and other dependent submarkets listed in this report.

- Key players in the industry and markets were identified through extensive secondary research.

- In terms of value, the industry’s supply chain and market size were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Bottom Up approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the global market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at exact statistics for all segments and subsegments, market breakdown and data triangulation procedures have been employed wherever applicable. The data was triangulated by studying various factors and trends identified from both demand and supply sides in government, consumer electronics, healthcare, banking & finance, travel & immigration, automotive, and military & defense verticals, among others.

Report Objectives

The following are the primary objectives of the study.

- To define, describe, and forecast the Management system certification market based on the product type, service type, verticals and geography

- To forecast the market size of various segments with respect to 4 main regions: North America, Europe, Asia Pacific, and Rest of the World

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To strategically profile the key players and comprehensively analyze their market ranking and core competencies, along with detailing the competitive landscape for market leaders

- To analyze the competitive developments such as agreements, contracts, partnerships, acquisitions, and product launches & developments carried out in the Management system certification market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to a company’s specific needs. The following customization options are available for the report:

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Management System Certification Market