Manufacturing Execution Systems Market by Offering (Software, Services), Deployment (On-premises, On-demand, Hybrid), Process Industry (Oil & Gas, Pharmaceuticals & Life Sciences), Discrete Industry (Automotive, Aerospace) - Global Forecast to 2027

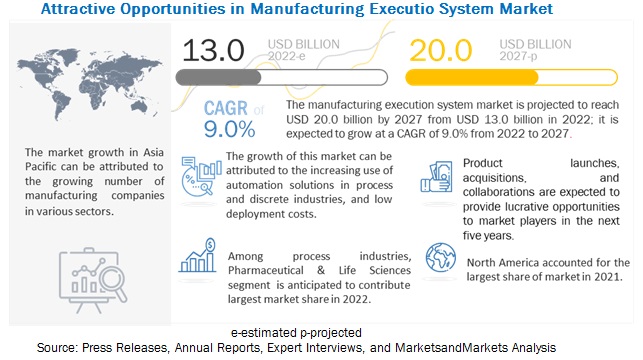

[226 Pages Report] “The manufacturing execution systems market is projected to grow at a significant rate from 2022 to 2027.”

The global manufacturing execution systems market size is expected to grow from USD 13.0 billion in 2022 to USD 20.0 billion by 2027, at a CAGR of 9.0%. The use of hybrid deployment type for manufacturing execution systems market and an inclination towards services to fuel the growth of manufacturing execution systems industry.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact

The market growth of manufacturing execution systems market decreased in 2020 due to the COVID-19 outbreak. This caused major halts in different functions of various industries like manufacturing plants not operation, low productivity in manufacturing units etc. This affected the revenues of various key market players in 2020-2021. The pandemic also let to closure of various manufacturing facilities as well as suspension of production activities across various various industries globally. The post pandemic phase also led to considerable change in various operations of end-user industries such as oil & gas, power generation, and automotive, among others. For COVID-19 many operations and guidelines has been issued for smoother operations which will help manufacturing execution systems market to grow in 2022 compared to 2020 and 2021.

Market Dynamics

Driver: Requirement for mass production and connected supply chain to serve growing population

The need for a connected supply chain in manufacturing industries is a key driver for the MES market. Efficient information flow across the factory is an important factor for enabling efficient production activities. IoT systems can be used by manufacturers for location tracking, monitoring inventory, and reporting of manufactured products passing through the supply chain process. Connected manufacturing solutions also help in the easy flow of information throughout the entire supply chain, which makes it easy for companies to respond to the changing market conditions. Real-time information helps manufacturers in lowering inventory costs, identifying risk issues, and achieving production according to market needs. The increase in manufacturing activities globally for mass production, along with quality improvement, is driving the need for advanced tools and software systems. This need can be catered to with advanced production systems and methods offered by manufacturing execution systems.

Restraint:Requirement of significant capital investments and upgradation & maintenance costs

The investment cost of MES includes consultation, acquisition, adjustment, implementation, and running costs, which subsequently increase the expenditures of a company.

As the deployment of MES varies industry-wise, the capital investments for MES are also high as they include several services tied with this system. The costs related to MES mainly include deployment and running costs, which subsequently increase the expenditures of a company. The complexity of the software and additional expenses such as custom integration can make MES quite expensive. Hence, these companies must carry out an in-depth analysis of their return on investments before implementing MES. Moreover, it is not feasible for several small companies to upgrade or replace their existing MES owing to the high costs of advanced MES. Thus, the cost is a key factor that could obstruct the growth of the MES market.

Opportunity :Growing scope of manufacturing execution systems in raising energy efficiency and sustainable production

Manufacturing execution systems are being implemented by various large businesses and SMEs as they help enhance manufacturing processes. The capability of these systems to increase production, reduce cost, improve quality, and enable product tracking and data collection in real-time helps increase production efficiency. This factor is expected to encourage the adoption of these systems to increase profits. The implementation of manufacturing execution systems also leads to reductions in energy consumption and waste during the manufacturing process. For example, while using an MES solution on a shop floor, additional IT resources are not required, and the need for paperwork and physical storage space is eliminated.

Challenge:Complexities in deployment of MES in various industries

The deployment of MES is complex because every such system is different according to the individual industry requirements . Also the process involved in manufacturing and production activities also differ from industry to industry. Different phases such as Implementation, staging, and shifting to the production floor are involved in the manufacturing process. Implementation at these different phases gets complicated due to the complexity of the hardware infrastructure of production or shop floor.Hence, it is tough for the manufacturing execution system to adapt to different situation at different phases and perform efficiently, as it needs various modifications during installations. The implementation process of a manufacturing execution system requires approximately four years. The first year focuses on making manufacturing and business processes suitable for the system. The second-year specifically focuses on the investment for solutions such as DCS, PLM, or ERP that would assist in controlling and monitoring the raw materials in the production area. In the third year, the company is ready for implementation to maintain electronic records instead of paper batch. The final year focuses on the integration of manufacturing execution systems with solutions such as ERP. The complexity of the processes involved in the implementation of manufacturing execution systems with every system of a production floor and the time-consuming process of implementation are the major challenges for the MES market.

“Hybrid Deployment is expected to have highest CAGR of the manufacturing execution systems market during the forecast period.”

The application of hybrid deployment of manufacturing execution systems has increased in the oil & gas sector due to the growing importance of tracking real-time information about the operations in oil and gas fields. Also, a hybrid manufacturing execution system provides extra storage capacity, thus ensuring the safety of data. Hence, the market for hybrid deployment in oil & gas industry is expected to grow at the highest CAGR during 2022 and 2027.

To know about the assumptions considered for the study, download the pdf brochure

“The manufacturing execution systems market in Asia Pacific to grow at the highest CAGR during the forecast period.”

The demand for manufacturing execution systems is very high in Asia Pacific due to countries like China, Japan, South Korea and India. It is the fastest-growing market for manufacturing execution systems. China and India are the fastest-growing economies in the world due to rapid industrialization aswell as focus on manufacturing activities in industries such as automotive, consumer electronics and so on. China is expected to grow at the highest rate due to surging demand for manufacturing units in the country. This is ultimately expected to provide tremendous opportunities for MES software. Furthermore, along with automotive and consumer electronics, there has been a increasing focus on establishing a number of manufacturing plants in industries such as textiles, power, and pharmaceuticals where manufacturing execution systems have supreme demand. China and India are the growth engines for the MES market in Asia Pacific.

Key Market Players

The manufacturing execution systems companies have implemented various types of organic as well as inorganic growth strategies, such as product launches, product developments, partnerships, and acquisitions to strengthen their offerings in the market. The major players are Siemens(US), Dassault Systemes(US) SAP (US), Rockwell Automation (US) and Honeywell International(US), among others.

The study includes an in-depth competitive analysis of these key players in the manufacturing execution systems market with their company profiles, recent developments, and key market strategies.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

:

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Years considered |

2018–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Value (USD million/Billion) |

|

Segments covered |

Offering, Deployment Type, Process Industry, Discrete Industry and Region |

|

Regions covered |

North America, Asia Pacific, Europe, and Rest of the World |

|

Companies covered |

Siemens (US) , Rockwell Automation(US) , SAP(US), Dassault Systemes(France) and Honeywell International(US), |

In this report, the overall Manufacturing Execution Systems Market has been segmented based on monitoring technique, offering, deployment type, monitoring process, industry and region.

By Offering

- Software

- Services

By Deployment Type

- On-premises

- On-demand

- Hybrid

By Process Industry

- Food & Beverages

- Oil & Gas

- Chemicals

- Pulp & Paper

- Pharmaceuticals & Life Sciences

- Energy & Power

- Water & Wastewater Management

- Others

By Discrete Industry

- Automotive

- Aerospace

- Medical devices

- Consumer packaged goods

- Others

By Region

-

North America

- US

- Canada

- Mexico

-

Europe

- UK

- Germany

- France

- Italy

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

-

Rest of the World

- Middle East

- Africa

- South America

See Also:

- US Manufacturing Execution Systems Market to Grow at a CAGR 9.4% from 2022 to 2027

- Germany Manufacturing Execution Systems Market to Grow at a CAGR 9.5% from 2022 to 2027

Recent Developments

- In May 2021, Siemens launched a new Opcenter Execution Discrete 4.1, which provides powerful MES capabilities, complete integration of regulatory and quality requirements, synchronized production processes for optimal supply-chain management, and sustained reductions in maintenance and operation costs.

- In November 2021, Rockwell Automation launched new remote access solution which comprises robust security capabilities including multi-factor authentication as well as encrypted protocols. The remote access solution can position OEMs to fulfill current and future remote support requirements.

- In April 2021, SAP implemented DMC in cooperation with the TU Vienna Pilot Factory in its production and assembly lines, which have already been digitalized by SAP company using SAP S4 and SAP ME.

Frequently Asked Questions (FAQ):

What is the market size of manufacturing execution systems market expected in 2022?

The manufacturing execution systems market is expected to be valued at USD 13 billion in 2022.

What is the total CAGR expected to be recorded for the manufacturing execution systems market during 2022?2027?

The global manufacturing execution systems market is expected to record a CAGR of 9.0% from 2022–2027.

Does this report include the impact of COVID-19 on the manufacturing execution systems market?

Yes, the report includes the impact of COVID-19 on the manufacturing execution systems market. It illustrates the post- COVID-19 market scenario.

Which are the top players in the manufacturing execution systems market?

The major vendors operating in the manufacturing execution systems market include Siemens, Dassault Systemes, SAP, Rockwell Automation and Honeywell International among others.

Which major countries are considered in the North America region?

The report includes an analysis of the US, Canada, and Mexico countries. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 30)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION AND SCOPE

1.3 INCLUSIONS AND EXCLUSIONS

1.4 STUDY SCOPE

1.4.1 MARKETS COVERED

FIGURE 1 MANUFACTURING EXECUTION SYSTEMS MARKET SEGMENTATION

1.4.2 YEARS CONSIDERED

1.5 CURRENCY

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 34)

2.1 INTRODUCTION

FIGURE 2 MANUFACTURING EXECUTION SYSTEMS MARKET: RESEARCH DESIGN

2.2 RESEARCH DATA

2.2.1 SECONDARY DATA

2.2.1.1 List of major secondary sources

2.2.1.2 Key data from secondary sources

2.2.2 PRIMARY DATA

2.2.2.1 Primary interviews with experts

2.2.2.2 Key data from primary sources

2.2.2.3 Key industry insights

2.2.2.4 Breakdown of primaries

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

2.3.1.1 Approach for arriving at market size using bottom-up analysis

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

2.3.2.1 Approach for capturing market size using top-down analysis

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION

2.5 RESEARCH ASSUMPTIONS AND LIMITATIONS

2.5.1 RESEARCH ASSUMPTIONS

2.5.2 LIMITATIONS

2.6 RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 45)

FIGURE 7 IMPACT ANALYSIS OF COVID-19 ON MANUFACTURING EXECUTION SYSTEMS MARKET

TABLE 1 REALISTIC SCENARIO (POST-COVID-19): MANUFACTURING EXECUTION SYSTEMS MARKET, 2022–2027 (USD MILLION)

TABLE 2 OPTIMISTIC SCENARIO (POST-COVID-19): MANUFACTURING EXECUTION SYSTEMS MARKET, 2022–2027 (USD MILLION)

TABLE 3 PESSIMISTIC SCENARIO (POST-COVID-19): MANUFACTURING EXECUTION SYSTEMS MARKET, 2022–2027 (USD MILLION)

FIGURE 8 ON-PREMISES DEPLOYMENT TO HOLD LARGEST MARKET SHARE IN 2022

FIGURE 9 PHARMACEUTICALS & LIFE SCIENCES SEGMENT TO HOLD LARGEST MARKET SHARE FOR PROCESS INDUSTRY (2022–2027)

FIGURE 10 AUTOMOTIVE INDUSTRY HELD LARGEST SHARE OF MARKET FOR DISCRETE INDUSTRY IN 2021

FIGURE 11 NORTH AMERICA ACCOUNTED FOR LARGEST SHARE OF MANUFACTURING EXECUTION SYSTEMS MARKET IN 2021

4 PREMIUM INSIGHTS (Page No. - 50)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN MANUFACTURING EXECUTION SYSTEMS MARKET

FIGURE 12 INCREASING USE OF INDUSTRIAL AUTOMATION IN PROCESS AND DISCRETE INDUSTRIES TO BOOST GROWTH

4.2 MANUFACTURING EXECUTION SYSTEMS MARKET, BY OFFERING

FIGURE 13 SERVICES SEGMENT ACCOUNTED FOR LARGER SHARE OF OVERALL MARKET IN 2021

4.3 MANUFACTURING EXECUTION SYSTEMS MARKET, BY DEPLOYMENT

FIGURE 14 ON-PREMISES DEPLOYMENT TO HOLD LARGEST SHARE OF MANUFACTURING EXECUTION SYSTEMS MARKET

4.4 MANUFACTURING EXECUTION SYSTEMS MARKET, BY DISCRETE INDUSTRY

FIGURE 15 AUTOMOTIVE SEGMENT TO DOMINATE MANUFACTURING EXECUTION SYSTEMS MARKET FOR DISCRETE INDUSTRY

4.5 MANUFACTURING EXECUTION SYSTEMS MARKET, BY REGION

FIGURE 16 ASIA PACIFIC EXPECTED TO WITNESS HIGHEST CAGR IN MANUFACTURING EXECUTION SYSTEMS MARKET

5 MARKET OVERVIEW (Page No. - 53)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 MANUFACTURING EXECUTION SYSTEMS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Requirement for mass production and connected supply chain to serve growing population

TABLE 4 WORLD MID-YEAR POPULATION BY AGE, 2021

5.2.1.2 Growing convergence of IT and OT

5.2.1.3 Rising adoption of industrial automation in process and discrete industries

TABLE 5 BENEFITS OF MANUFACTURING EXECUTION SYSTEMS

5.2.1.4 Increasing significance of regulatory compliances

FIGURE 18 IMPACT ANALYSIS OF DRIVERS

5.2.2 RESTRAINTS

5.2.2.1 Requirement of significant capital investments and upgrading & maintenance costs

FIGURE 19 IMPACT ANALYSIS OF RESTRAINTS

5.2.3 OPPORTUNITIES

5.2.3.1 Integration of MES with solutions such as ERP and PLM

5.2.3.2 Growing scope of manufacturing execution systems in raising energy efficiency and sustainable production

5.2.3.3 Application of MES in pharmaceuticals & life sciences industry

FIGURE 20 IMPACT ANALYSIS OF OPPORTUNITIES

5.2.4 CHALLENGES

5.2.4.1 Complexities in deployment of MES in various industries

FIGURE 21 IMPACT ANALYSIS OF CHALLENGES

5.3 VALUE CHAIN ANALYSIS

FIGURE 22 VALUE CHAIN ANALYSIS

5.4 ECOSYSTEM ANALYSIS

FIGURE 23 ECOSYSTEM: MANUFACTURING EXECUTION SYSTEMS MARKET

TABLE 6 MANUFACTURING EXECUTION SYSTEM: ECOSYSTEM

5.5 PRICING ANALYSIS

5.5.1 ASP ANALYSIS OF KEY PLAYERS

FIGURE 24 AVERAGE LICENSE SUBSCRIPTION PRICE FOR MES BASED ON LICENSE TYPE

TABLE 7 APPROXIMATE AVERAGE LICENSE SUBSCRIPTION PRICE FOR MES BASED ON LICENSE TYPE (USD)

5.5.2 ASP TREND

TABLE 8 MANUFACTURING EXECUTION SYSTEM: AVERAGE PRICE ANALYSIS

5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS

FIGURE 25 REVENUE SHIFT IN MANUFACTURING EXECUTION SYSTEMS MARKET

5.7 TECHNOLOGY ANALYSIS

5.7.1 IOT

5.7.2 ARTIFICIAL INTELLIGENCE

5.7.3 PREDICTIVE MAINTENANCE

5.7.4 DIGITAL TWIN

5.8 PORTER’S FIVE FORCES ANALYSIS

TABLE 9 MANUFACTURING EXECUTION SYSTEMS MARKET: PORTER’S FIVE FORCES ANALYSIS

5.9 KEY STAKEHOLDERS AND BUYING CRITERIA

5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 26 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE PROCESS INDUSTRIES

TABLE 10 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE PROCESS INDUSTRIES (%)

5.9.2 BUYING CRITERIA

FIGURE 27 KEY BUYING CRITERIA FOR TOP THREE PROCESS INDUSTRIES

TABLE 11 KEY BUYING CRITERIA FOR TOP THREE PROCESS INDUSTRIES

5.10 CASE STUDY ANALYSIS

TABLE 12 SIEMENS MANUFACTURING EXECUTION SYSTEM ENHANCED ON-TIME DELIVERY AND ELIMINATED MANUAL SCHEDULING LIMITATIONS OF TIMBER MANUFACTURERS

TABLE 13 PHARMACEUTICAL COMPANY AUTOMATES PRODUCTION PROCESS AND ACHIEVES PAPERLESS MANUFACTURING USING MANUFACTURING EXECUTION SYSTEM

TABLE 14 PRODUCTION MONITORING AND DIGITIZATION DURING MANUFACTURING PROCESS USING MANUFACTURING EXECUTION SOFTWARE SOLUTION

5.11 TRADE ANALYSIS

5.11.1 IMPORT SCENARIO

FIGURE 28 IMPORTS, BY KEY COUNTRY, 2017–2021 (USD MILLION)

5.11.2 EXPORT SCENARIO

FIGURE 29 EXPORTS, BY KEY COUNTRY, 2017–2021 (USD MILLION)

5.12 PATENT ANALYSIS

FIGURE 30 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS (2012–2021)

TABLE 15 TOP 20 PATENT OWNERS IN US (2012–2021)

FIGURE 31 NUMBER OF PATENTS GRANTED PER YEAR FROM 2012 TO 2021

TABLE 16 LIST OF SOME PATENTS IN MANUFACTURING EXECUTION SYSTEMS MARKET

5.13 KEY CONFERENCES AND EVENTS (2022–2023)

TABLE 17 MANUFACTURING EXECUTION SYSTEMS MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

5.14 REGULATORY LANDSCAPE

5.14.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS RELATED TO MANUFACTURING EXECUTION SYSTEMS

TABLE 18 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 19 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 20 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.14.2 STANDARDS AND REGULATIONS RELATED TO MANUFACTURING EXECUTION SYSTEMS

5.14.2.1 ASTM

5.14.2.2 ISO

5.14.2.3 MESA

TABLE 21 SAFETY STANDARDS FOR MANUFACTURING EXECUTION SYSTEMS MARKET

6 FUNCTIONS OF MES AND CLASSIFICATION BASED ON ORGANIZATION SIZE (Page No. - 80)

6.1 INTRODUCTION

6.2 FUNCTIONS OF MES

6.2.1 DATA COLLECTION & ACQUISITION

6.2.2 DISPATCHING PRODUCTION

6.2.3 LABOR MANAGEMENT

6.2.4 MAINTENANCE OPERATIONS MANAGEMENT

6.2.5 MOVEMENT, STORAGE, AND TRACKING OF MATERIALS

6.2.6 PERFORMANCE ANALYSIS

6.2.7 PROCESS MANAGEMENT

6.2.8 RESOURCE ALLOCATION AND MANAGEMENT

6.2.9 DISPATCHING AND PRODUCTION

6.2.10 DOCUMENT CONTROL

6.2.11 OPERATIONS SCHEDULING AND MANAGEMENT

6.3 CLASSIFICATION OF MES BASED ON ORGANIZATION SIZE

6.3.1 SMALL AND MEDIUM ENTERPRISES

6.3.2 LARGE ENTERPRISES

7 MANUFACTURING EXECUTION SYSTEMS MARKET, BY OFFERING (Page No. - 83)

7.1 INTRODUCTION

FIGURE 32 SERVICES SEGMENT EXPECTED TO HOLD LARGER SIZE OF MANUFACTURING EXECUTION SYSTEMS MARKET DURING FORECAST PERIOD

TABLE 22 MANUFACTURING EXECUTION SYSTEMS MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 23 MANUFACTURING EXECUTION SYSTEMS MARKET, BY OFFERING, 2022–2027 (USD MILLION)

7.2 SOFTWARE

7.2.1 MES SOFTWARE OFFERS EFFECTIVE AND ERROR-FREE MONITORING OF MANUFACTURING PROCESSES

7.3 SERVICES

7.3.1 IMPLEMENTATION

7.3.1.1 Deployment of MES is a lengthy process

7.3.2 SOFTWARE UPGRADE

7.3.2.1 Requirement for software upgrade for users to support latest industry trends and challenges

7.3.3 TRAINING

7.3.3.1 Substantial training required for understanding manufacturing execution system operations

7.3.4 MAINTENANCE

7.3.4.1 MES maintenance services bring about enhanced accuracy and productivity

8 MANUFACTURING EXECUTION SYSTEMS MARKET, BY DEPLOYMENT (Page No. - 88)

8.1 INTRODUCTION

FIGURE 33 MANUFACTURING EXECUTION SYSTEMS MARKET, BY DEPLOYMENT

TABLE 24 MANUFACTURING EXECUTION SYSTEMS MARKET, BY DEPLOYMENT, 2018–2021 (USD MILLION)

TABLE 25 MANUFACTURING EXECUTION SYSTEMS MARKET, BY DEPLOYMENT, 2022–2027 (USD MILLION)

8.2 ON-PREMISES DEPLOYMENT

8.2.1 ON-PREMISES DEPLOYMENT PREFERRED IN LARGE ENTERPRISES OWING TO HIGHER COST STRUCTURE

TABLE 26 MANUFACTURING EXECUTION SYSTEMS MARKET FOR ON-PREMISES DEPLOYMENT, BY PROCESS INDUSTRY, 2018–2021 (USD MILLION)

TABLE 27 MANUFACTURING EXECUTION SYSTEMS MARKET FOR ON-PREMISES DEPLOYMENT, BY PROCESS INDUSTRY, 2022–2027 (USD MILLION)

TABLE 28 MANUFACTURING EXECUTION SYSTEMS MARKET FOR ON-PREMISES DEPLOYMENT, BY DISCRETE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 29 MANUFACTURING EXECUTION SYSTEMS MARKET FOR ON-PREMISES DEPLOYMENT, BY DISCRETE INDUSTRY, 2022–2027 (USD MILLION)

8.3 ON-DEMAND DEPLOYMENT

8.3.1 ON-DEMAND DEPLOYMENT PROVIDES REAL-TIME DATA TO IMPROVE PLANT EFFICIENCY FOR MEDIUM AND SMALL ENTERPRISES

TABLE 30 MANUFACTURING EXECUTION SYSTEMS MARKET FOR ON-DEMAND DEPLOYMENT, BY PROCESS INDUSTRY, 2018–2021 (USD MILLION)

TABLE 31 MANUFACTURING EXECUTION SYSTEMS MARKET FOR ON-DEMAND DEPLOYMENT, BY PROCESS INDUSTRY, 2022–2027 (USD MILLION)

TABLE 32 MANUFACTURING EXECUTION SYSTEMS MARKET FOR ON-DEMAND DEPLOYMENT, BY DISCRETE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 33 MANUFACTURING EXECUTION SYSTEMS MARKET FOR ON-DEMAND DEPLOYMENT, BY DISCRETE INDUSTRY, 2022–2027 (USD MILLION)

8.4 HYBRID DEPLOYMENT

8.4.1 HYBRID DEPLOYMENT CATERS TO CUSTOMIZATION REQUIREMENTS OF MANUFACTURING INDUSTRIES

TABLE 34 MANUFACTURING EXECUTION SYSTEMS MARKET FOR HYBRID DEPLOYMENT, BY PROCESS INDUSTRY, 2018–2021 (USD MILLION)

TABLE 35 MANUFACTURING EXECUTION SYSTEMS MARKET FOR HYBRID DEPLOYMENT, BY PROCESS INDUSTRY, 2022–2027 (USD MILLION)

TABLE 36 MANUFACTURING EXECUTION SYSTEMS MARKET FOR HYBRID DEPLOYMENT, BY DISCRETE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 37 MANUFACTURING EXECUTION SYSTEMS MARKET FOR HYBRID DEPLOYMENT, BY DISCRETE INDUSTRY, 2022–2027 (USD MILLION)

9 MANUFACTURING EXECUTION SYSTEMS MARKET, BY PROCESS INDUSTRY (Page No. - 97)

9.1 INTRODUCTION

FIGURE 34 MANUFACTURING EXECUTION SYSTEMS MARKET, BY PROCESS INDUSTRY

FIGURE 35 PHARMACEUTICALS & LIFE SCIENCES TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

TABLE 38 MANUFACTURING EXECUTION SYSTEMS MARKET, BY PROCESS INDUSTRY, 2018–2021 (USD MILLION)

TABLE 39 MANUFACTURING EXECUTION SYSTEMS MARKET, BY PROCESS INDUSTRY, 2022–2027 (USD MILLION)

TABLE 40 MANUFACTURING EXECUTION SYSTEMS MARKET IN PROCESS INDUSTRY, BY DEPLOYMENT, 2018–2021 (USD MILLION)

TABLE 41 MANUFACTURING EXECUTION SYSTEMS MARKET IN PROCESS INDUSTRY, BY DEPLOYMENT, 2022–2027 (USD MILLION)

TABLE 42 MANUFACTURING EXECUTION SYSTEMS MARKET IN PROCESS INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 43 MANUFACTURING EXECUTION SYSTEMS MARKET IN PROCESS INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

9.2 FOOD & BEVERAGES

FIGURE 36 APPLICATION AREAS OF MANUFACTURING EXECUTION SYSTEMS IN FOOD & BEVERAGES INDUSTRY

TABLE 44 MANUFACTURING EXECUTION SYSTEMS MARKET IN FOOD & BEVERAGES, BY DEPLOYMENT, 2018–2021 (USD MILLION)

TABLE 45 MANUFACTURING EXECUTION SYSTEMS MARKET IN FOOD & BEVERAGES, BY DEPLOYMENT, 2022–2027 (USD MILLION)

TABLE 46 MANUFACTURING EXECUTION SYSTEMS MARKET IN FOOD & BEVERAGES, BY REGION, 2018–2021 (USD MILLION)

TABLE 47 MANUFACTURING EXECUTION SYSTEMS MARKET IN FOOD & BEVERAGES, BY REGION, 2022–2027 (USD MILLION)

TABLE 48 MANUFACTURING EXECUTION SYSTEMS MARKET IN FOOD & BEVERAGES, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 49 MANUFACTURING EXECUTION SYSTEMS MARKET IN FOOD & BEVERAGES, BY APPLICATION, 2022–2027 (USD MILLION)

9.2.1 FISH, MEAT & POULTRY

9.2.2 FRUITS & VEGETABLES

9.2.3 DAIRY PRODUCTS

9.2.4 BAKERY PRODUCTS & CONFECTIONERY

9.2.5 SNACKS & BREAKFAST CEREALS

9.2.6 PREPARED MEALS & DISHES

9.2.7 PREPARED ANIMAL FEED

9.2.8 BEVERAGES

9.2.9 OTHERS

9.3 OIL & GAS

9.3.1 MANUFACTURING EXECUTION SYSTEMS ENABLE ENHANCEMENT AND EASE OF COMPLEX FUNCTIONS IN OIL & GAS INDUSTRY

FIGURE 37 HYBRID DEPLOYMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 50 MANUFACTURING EXECUTION SYSTEMS MARKET IN OIL & GAS, BY DEPLOYMENT, 2018–2021 (USD MILLION)

TABLE 51 MANUFACTURING EXECUTION SYSTEMS MARKET IN OIL & GAS, BY DEPLOYMENT, 2022–2027 (USD MILLION)

TABLE 52 MANUFACTURING EXECUTION SYSTEMS MARKET IN OIL & GAS, BY REGION, 2018–2021 (USD MILLION)

TABLE 53 MANUFACTURING EXECUTION SYSTEMS MARKET IN OIL & GAS, BY REGION, 2022–2027 (USD MILLION)

9.4 CHEMICALS

9.4.1 COMPLEX STRUCTURE AND PROCESSES OF CHEMICAL PLANTS NECESSITATE USE OF MES

TABLE 54 MANUFACTURING EXECUTION SYSTEMS MARKET IN CHEMICALS, BY DEPLOYMENT, 2018–2021 (USD MILLION)

TABLE 55 MANUFACTURING EXECUTION SYSTEMS MARKET IN CHEMICALS, BY DEPLOYMENT, 2022–2027 (USD MILLION)

TABLE 56 MANUFACTURING EXECUTION SYSTEMS MARKET IN CHEMICALS, BY REGION, 2018–2021 (USD MILLION)

TABLE 57 MANUFACTURING EXECUTION SYSTEMS MARKET IN CHEMICALS, BY REGION, 2022–2027 (USD MILLION)

9.5 PULP & PAPER

9.5.1 WIDE RANGE OF APPLICATIONS OF MES ENHANCE EFFICIENCY OF PROCESSES IN PULP & PAPER INDUSTRY

FIGURE 38 ON-PREMISES SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN PULP & PAPER DURING FORECAST PERIOD

TABLE 58 MANUFACTURING EXECUTION SYSTEMS MARKET IN PULP & PAPER, BY DEPLOYMENT, 2018–2021 (USD MILLION)

TABLE 59 MANUFACTURING EXECUTION SYSTEMS MARKET IN PULP & PAPER, BY DEPLOYMENT, 2022–2027 (USD MILLION)

TABLE 60 MANUFACTURING EXECUTION SYSTEMS MARKET IN PULP & PAPER, BY REGION, 2018–2021 (USD MILLION)

TABLE 61 MANUFACTURING EXECUTION SYSTEMS MARKET IN PULP & PAPER, BY REGION, 2022–2027 (USD MILLION)

9.6 PHARMACEUTICALS & LIFE SCIENCES

9.6.1 MES ENABLES REAL-TIME DATA MONITORING OF PROCESSES IN PHARMACEUTICALS & LIFE SCIENCES INDUSTRY

TABLE 62 MANUFACTURING EXECUTION SYSTEMS MARKET IN PHARMACEUTICALS & LIFE SCIENCES, BY DEPLOYMENT, 2018–2021 (USD MILLION)

TABLE 63 MANUFACTURING EXECUTION SYSTEMS MARKET IN PHARMACEUTICALS & LIFE SCIENCES, BY DEPLOYMENT, 2022–2027 (USD MILLION)

TABLE 64 MANUFACTURING EXECUTION SYSTEMS MARKET IN PHARMACEUTICALS & LIFE SCIENCES, BY REGION, 2018–2021 (USD MILLION)

TABLE 65 MANUFACTURING EXECUTION SYSTEMS MARKET IN PHARMACEUTICALS & LIFE SCIENCES, BY REGION, 2022–2027 (USD MILLION)

9.7 ENERGY & POWER

9.7.1 INDUSTRIALIZATION AND INCREASING DEMAND FOR ELECTRICITY TO DRIVE MES MARKET IN ENERGY & POWER INDUSTRY

FIGURE 39 HYBRID DEPLOYMENT TO GROW AT HIGHEST RATE IN ENERGY & POWER SECTOR

TABLE 66 MANUFACTURING EXECUTION SYSTEMS MARKET IN ENERGY & POWER, BY DEPLOYMENT, 2018–2021 (USD MILLION)

TABLE 67 MANUFACTURING EXECUTION SYSTEMS MARKET IN ENERGY & POWER, BY DEPLOYMENT, 2022–2027 (USD MILLION)

TABLE 68 MANUFACTURING EXECUTION SYSTEMS MARKET IN ENERGY & POWER, BY REGION, 2018–2021 (USD MILLION)

TABLE 69 MANUFACTURING EXECUTION SYSTEMS MARKET IN ENERGY & POWER, BY REGION, 2022–2027 (USD MILLION)

9.8 WATER & WASTEWATER MANAGEMENT

9.8.1 HYBRID IS FASTEST-GROWING FORM OF DEPLOYMENT IN WATER & WASTEWATER MANAGEMENT

TABLE 70 MANUFACTURING EXECUTION SYSTEMS MARKET IN WATER & WASTEWATER MANAGEMENT, BY DEPLOYMENT, 2018–2021 (USD MILLION)

TABLE 71 MANUFACTURING EXECUTION SYSTEMS MARKET IN WATER & WASTEWATER MANAGEMENT, BY DEPLOYMENT, 2022–2027 (USD MILLION)

TABLE 72 MANUFACTURING EXECUTION SYSTEMS MARKET IN WATER & WASTEWATER MANAGEMENT, BY REGION, 2018–2021 (USD MILLION)

TABLE 73 MANUFACTURING EXECUTION SYSTEMS MARKET IN WATER & WASTEWATER MANAGEMENT, BY REGION, 2022–2027 (USD MILLION)

9.9 OTHERS

TABLE 74 MANUFACTURING EXECUTION SYSTEMS MARKET IN OTHER PROCESS INDUSTRIES, BY DEPLOYMENT, 2018–2021 (USD MILLION)

TABLE 75 MANUFACTURING EXECUTION SYSTEMS MARKET IN OTHER PROCESS INDUSTRIES, BY DEPLOYMENT, 2022–2027 (USD MILLION)

TABLE 76 MANUFACTURING EXECUTION SYSTEMS MARKET IN OTHER PROCESS INDUSTRIES, BY REGION, 2018–2021 (USD MILLION)

TABLE 77 MANUFACTURING EXECUTION SYSTEMS MARKET IN OTHER PROCESS INDUSTRIES, BY REGION, 2022–2027 (USD MILLION)

10 MANUFACTURING EXECUTION SYSTEMS MARKET, BY DISCRETE INDUSTRY (Page No. - 121)

10.1 INTRODUCTION

FIGURE 40 MANUFACTURING EXECUTION SYSTEMS MARKET, BY DISCRETE INDUSTRY

FIGURE 41 AUTOMOTIVE INDUSTRY TO DOMINATE MANUFACTURING EXECUTION SYSTEMS MARKET DURING FORECAST PERIOD

TABLE 78 MANUFACTURING EXECUTION SYSTEMS MARKET, BY DISCRETE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 79 MANUFACTURING EXECUTION SYSTEMS MARKET, BY DISCRETE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 80 MANUFACTURING EXECUTION SYSTEMS MARKET FOR DISCRETE INDUSTRY, BY DEPLOYMENT, 2018–2021 (USD MILLION)

TABLE 81 MANUFACTURING EXECUTION SYSTEMS MARKET FOR DISCRETE INDUSTRY, BY DEPLOYMENT, 2022–2027 (USD MILLION)

TABLE 82 MANUFACTURING EXECUTION SYSTEMS MARKET FOR DISCRETE INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 83 MANUFACTURING EXECUTION SYSTEMS MARKET FOR DISCRETE INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

10.2 AUTOMOTIVE

10.2.1 MANUFACTURING EXECUTION SYSTEMS HELP IN OFFERING REAL-TIME VISIBILITY AND REDUCTION IN PRODUCTION TIME

FIGURE 42 ADVANTAGES OF MES IN AUTOMOTIVE INDUSTRY AT DIFFERENT LEVELS

TABLE 84 MANUFACTURING EXECUTION SYSTEMS MARKET IN AUTOMOTIVE, BY DEPLOYMENT, 2018–2021 (USD MILLION)

TABLE 85 MANUFACTURING EXECUTION SYSTEMS MARKET IN AUTOMOTIVE, BY DEPLOYMENT, 2022–2027 (USD MILLION)

TABLE 86 MANUFACTURING EXECUTION SYSTEMS MARKET IN AUTOMOTIVE, BY REGION, 2018–2021 (USD MILLION)

TABLE 87 MANUFACTURING EXECUTION SYSTEMS MARKET IN AUTOMOTIVE, BY REGION, 2022–2027 (USD MILLION)

10.3 AEROSPACE

10.3.1 SIGNIFICANT DEMAND FOR MES IN AEROSPACE SECTOR IN NORTH AMERICA

FIGURE 43 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE OF MES MARKET IN AEROSPACE INDUSTRY

TABLE 88 MANUFACTURING EXECUTION SYSTEMS MARKET IN AEROSPACE, BY DEPLOYMENT, 2018–2021 (USD MILLION)

TABLE 89 MANUFACTURING EXECUTION SYSTEMS MARKET IN AEROSPACE, BY DEPLOYMENT, 2022–2027 (USD MILLION)

TABLE 90 MANUFACTURING EXECUTION SYSTEMS MARKET IN AEROSPACE, BY REGION, 2018–2021 (USD MILLION)

TABLE 91 MANUFACTURING EXECUTION SYSTEMS MARKET IN AEROSPACE, BY REGION, 2022–2027 (USD MILLION)

10.4 MEDICAL DEVICES

10.4.1 DEPLOYMENT OF MANUFACTURING EXECUTION SYSTEMS ENABLES EFFECTIVE MONITORING OF PLANT OPERATIONS

TABLE 92 MANUFACTURING EXECUTION SYSTEMS MARKET IN MEDICAL DEVICES, BY DEPLOYMENT, 2018–2021 (USD MILLION)

TABLE 93 MANUFACTURING EXECUTION SYSTEMS MARKET IN MEDICAL DEVICES, BY DEPLOYMENT, 2022–2027 (USD MILLION)

TABLE 94 MANUFACTURING EXECUTION SYSTEMS MARKET IN MEDICAL DEVICES, BY REGION, 2018–2021 (USD MILLION)

TABLE 95 MANUFACTURING EXECUTION SYSTEMS MARKET IN MEDICAL DEVICES, BY REGION, 2022–2027 (USD MILLION)

10.5 CONSUMER PACKAGED GOODS

10.5.1 MES USED TO INCREASE PRODUCTION CAPACITY IN CONSUMER PACKAGED GOODS INDUSTRY

FIGURE 44 FACTORS DRIVING DEMAND FOR MANUFACTURING EXECUTION SYSTEMS IN CONSUMER PACKAGED GOODS INDUSTRY

TABLE 96 MANUFACTURING EXECUTION SYSTEMS MARKET IN CONSUMER PACKAGED GOODS, BY DEPLOYMENT, 2018–2021 (USD MILLION)

TABLE 97 MANUFACTURING EXECUTION SYSTEMS MARKET IN CONSUMER PACKAGED GOODS, BY DEPLOYMENT, 2022–2027 (USD MILLION)

TABLE 98 MANUFACTURING EXECUTION SYSTEMS MARKET IN CONSUMER PACKAGED GOODS, BY REGION, 2018–2021 (USD MILLION)

TABLE 99 MANUFACTURING EXECUTION SYSTEMS MARKET IN CONSUMER PACKAGED GOODS, BY REGION, 2022–2027 (USD MILLION)

10.6 OTHERS

TABLE 100 MANUFACTURING EXECUTION SYSTEMS MARKET IN OTHER DISCRETE INDUSTRIES, BY DEPLOYMENT, 2018–2021 (USD MILLION)

TABLE 101 MANUFACTURING EXECUTION SYSTEMS MARKET IN OTHER DISCRETE INDUSTRIES, BY DEPLOYMENT, 2022–2027 (USD MILLION)

TABLE 102 MANUFACTURING EXECUTION SYSTEMS MARKET IN OTHER DISCRETE INDUSTRIES, BY REGION, 2018–2021 (USD MILLION)

TABLE 103 MANUFACTURING EXECUTION SYSTEMS MARKET IN OTHER DISCRETE INDUSTRIES, BY REGION, 2022–2027 (USD MILLION)

11 GEOGRAPHIC ANALYSIS (Page No. - 135)

11.1 INTRODUCTION

FIGURE 45 INDIA AND CHINA HAVE SIGNIFICANT GROWTH PROSPECTS DURING FORECAST PERIOD

TABLE 104 MANUFACTURING EXECUTION SYSTEMS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 105 MANUFACTURING EXECUTION SYSTEMS MARKET, BY REGION, 2022–2027 (USD MILLION)

11.2 NORTH AMERICA

FIGURE 46 NORTH AMERICA: MANUFACTURING EXECUTION SYSTEMS MARKET SNAPSHOT

TABLE 106 MANUFACTURING EXECUTION SYSTEMS MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 107 MANUFACTURING EXECUTION SYSTEMS MARKET IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

11.2.1 US

11.2.1.1 Advancements in MES by several key players to support market growth in US

11.2.2 CANADA

11.2.2.1 Rising deployment of MES in food & beverages industry to propel market growth in Canada

11.2.3 MEXICO

11.2.3.1 Growing implementation of MES by companies in Mexico to support market growth

11.3 EUROPE

FIGURE 47 EUROPE: MANUFACTURING EXECUTION SYSTEMS MARKET SNAPSHOT

TABLE 108 MANUFACTURING EXECUTION SYSTEMS MARKET IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 109 MANUFACTURING EXECUTION SYSTEMS MARKET IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

11.3.1 UK

11.3.1.1 Growth of automotive industry to fuel manufacturing execution systems market in UK

11.3.2 GERMANY

11.3.2.1 Significant presence of automotive manufacturers to support market growth

11.3.3 FRANCE

11.3.3.1 Government plans and initiatives for modernizing manufacturing sector to support market growth in France

11.3.4 ITALY

11.3.4.1 Growth opportunities in Italy due to presence of large industrial base

11.3.5 REST OF EUROPE

11.4 ASIA PACIFIC

FIGURE 48 ASIA PACIFIC: MANUFACTURING EXECUTION SYSTEMS MARKET SNAPSHOT

TABLE 110 MANUFACTURING EXECUTION SYSTEMS MARKET IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 111 MANUFACTURING EXECUTION SYSTEMS MARKET IN ASIA PACIFIC, BY COUNTRY, 2022–2027 (USD MILLION)

11.4.1 CHINA

11.4.1.1 Semiconductor & electronics and automotive industries to contribute to market growth in China

11.4.2 JAPAN

11.4.2.1 Automotive industry to significantly support market growth in Japan

11.4.3 INDIA

11.4.3.1 Growth opportunities in India due to expansion of manufacturing sector

11.4.4 SOUTH KOREA

11.4.4.1 Growing adoption of MES in country for effective monitoring and synchronization of manufacturing activities

11.4.5 REST OF ASIA PACIFIC

11.5 REST OF THE WORLD (ROW)

TABLE 112 MANUFACTURING EXECUTION SYSTEMS MARKET IN ROW, BY REGION, 2018–2021 (USD MILLION)

TABLE 113 MANUFACTURING EXECUTION SYSTEMS MARKET IN ROW, BY REGION, 2022–2027 (USD MILLION)

11.5.1 MIDDLE EAST

11.5.1.1 Oil & gas industry to create substantial growth opportunities for market in Middle East

11.5.2 AFRICA

11.5.2.1 Mining industry to be major contributor to growth of MES market in Africa

11.5.3 SOUTH AMERICA

11.5.3.1 Rising FDI and growing manufacturing sector to propel market growth in South America

12 COMPETITIVE LANDSCAPE (Page No. - 150)

12.1 OVERVIEW

12.2 KEY PLAYER STRATEGIES/RIGHT-TO-WIN

TABLE 114 OVERVIEW OF STRATEGIES DEPLOYED BY KEY MES PROVIDERS

12.3 TOP 5 COMPANY REVENUE ANALYSIS

FIGURE 49 5 YEARS REVENUE ANALYSIS OF TOP 5 PLAYERS

12.4 MARKET SHARE ANALYSIS

TABLE 115 MARKET SHARE OF TOP FIVE PLAYERS IN MANUFACTURING EXECUTION SYSTEMS MARKET IN 2021

12.5 COMPETITIVE EVALUATION QUADRANT

12.5.1 STAR

12.5.2 EMERGING LEADER

12.5.3 PERVASIVE

12.5.4 PARTICIPANT

FIGURE 50 COMPANY EVALUATION QUADRANT, 2021

12.6 SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION QUADRANT, 2021

12.6.1 PROGRESSIVE COMPANY

12.6.2 RESPONSIVE COMPANY

12.6.3 DYNAMIC COMPANY

12.6.4 STARTING BLOCK

FIGURE 51 MANUFACTURING EXECUTION SYSTEMS MARKET (GLOBAL) SME EVALUATION QUADRANT, 2021

12.7 MANUFACTURING EXECUTION SYSTEMS MARKET: COMPANY FOOTPRINT

TABLE 116 OVERALL COMPANY FOOTPRINT

TABLE 117 COMPANY DEPLOYMENT FOOTPRINT

TABLE 118 COMPANY PROCESS INDUSTRY FOOTPRINT

TABLE 119 COMPANY REGION FOOTPRINT

12.8 COMPETITIVE BENCHMARKING

TABLE 120 MANUFACTURING EXECUTION SYSTEMS MARKET: LIST OF KEY STARTUPS/SMES

TABLE 121 MANUFACTURING EXECUTION SYSTEMS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

12.9 COMPETITIVE SCENARIO

TABLE 122 MANUFACTURING EXECUTION SYSTEMS MARKET: PRODUCT LAUNCHES, 2020−2021

TABLE 123 MANUFACTURING EXECUTION SYSTEMS MARKET: DEALS, 2020–2021

13 COMPANY PROFILES (Page No. - 165)

(Business Overview, Products/solutions/services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

13.1 KEY PLAYERS

13.1.1 SIEMENS

TABLE 124 SIEMENS: BUSINESS OVERVIEW

FIGURE 52 SIEMENS: COMPANY SNAPSHOT

TABLE 125 SIEMENS: PRODUCT OFFERINGS

TABLE 126 SIEMENS: PRODUCT LAUNCHES

TABLE 127 SIEMENS: DEALS

TABLE 128 SIEMENS: OTHERS

13.1.2 DASSAULT SYSTÈMES

TABLE 129 DASSAULT SYSTÈMES: BUSINESS OVERVIEW

FIGURE 53 DASSAULT SYSTÈMES: COMPANY SNAPSHOT

TABLE 130 DASSAULT SYSTÈMES: PRODUCTS OFFERED

TABLE 131 DASSAULT SYSTÈMES: PRODUCT LAUNCHES

TABLE 132 DASSAULT SYSTÈMES: DEALS

13.1.3 SAP

TABLE 133 SAP: BUSINESS OVERVIEW

FIGURE 54 SAP: COMPANY SNAPSHOT

TABLE 134 SAP: PRODUCT OFFERINGS

TABLE 135 SAP: OTHERS

13.1.4 ROCKWELL AUTOMATION

TABLE 136 ROCKWELL AUTOMATION: BUSINESS OVERVIEW

FIGURE 55 ROCKWELL AUTOMATION: COMPANY SNAPSHOT

TABLE 137 ROCKWELL AUTOMATION: PRODUCT OFFERINGS

TABLE 138 ROCKWELL AUTOMATION: PRODUCT LAUNCHES

TABLE 139 ROCKWELL AUTOMATION: DEALS

TABLE 140 ROCKWELL AUTOMATION: OTHERS

13.1.5 HONEYWELL INTERNATIONAL

TABLE 141 HONEYWELL INTERNATIONAL: BUSINESS OVERVIEW

FIGURE 56 HONEYWELL INTERNATIONAL: COMPANY SNAPSHOT

TABLE 142 HONEYWELL INTERNATIONAL: PRODUCT OFFERINGS

TABLE 143 HONEYWELL INTERNATIONAL: DEALS

13.1.6 ABB

TABLE 144 ABB: BUSINESS OVERVIEW

FIGURE 57 ABB: COMPANY SNAPSHOT

TABLE 145 ABB: PRODUCT OFFERINGS

TABLE 146 ABB: OTHERS

13.1.7 AVEVA

TABLE 147 AVEVA: BUSINESS OVERVIEW

FIGURE 58 AVEVA: COMPANY SNAPSHOT

TABLE 148 AVEVA: PRODUCT OFFERINGS

TABLE 149 AVEVA: PRODUCT LAUNCHES

TABLE 150 AVEVA: DEALS

13.1.8 GENERAL ELECTRIC

TABLE 151 GENERAL ELECTRIC: BUSINESS OVERVIEW

FIGURE 59 GENERAL ELECTRIC: COMPANY SNAPSHOT

TABLE 152 GENERAL ELECTRIC: PRODUCT OFFERINGS

13.1.9 EMERSON ELECTRIC

TABLE 153 EMERSON ELECTRIC: BUSINESS OVERVIEW

FIGURE 60 EMERSON ELECTRIC: COMPANY SNAPSHOT

TABLE 154 EMERSON ELECTRIC: PRODUCT OFFERINGS

TABLE 155 EMERSON ELECTRIC: DEALS

13.1.10 APPLIED MATERIALS

TABLE 156 APPLIED MATERIALS: BUSINESS OVERVIEW

FIGURE 61 APPLIED MATERIALS: COMPANY SNAPSHOT

TABLE 157 APPLIED MATERIALS: PRODUCT OFFERINGS

13.1.11 ORACLE

TABLE 158 ORACLE: BUSINESS OVERVIEW

FIGURE 62 ORACLE: COMPANY SNAPSHOT

TABLE 159 ORACLE: PRODUCT OFFERINGS

13.2 OTHER PLAYERS

13.2.1 42Q

TABLE 160 42Q: COMPANY OVERVIEW

13.2.2 AEGIS SOFTWARE CORPORATION

TABLE 161 AEGIS SOFTWARE CORPORATION: COMPANY OVERVIEW

13.2.3 CRITICAL MANUFACTURING

TABLE 162 CRITICAL MANUFACTURING: COMPANY OVERVIEW

13.2.4 EPICOR SOFTWARE CORPORATION

TABLE 163 EPICOR SOFTWARE CORPORATION: COMPANY OVERVIEW

13.2.5 EYELIT

TABLE 164 EYELIT: COMPANY OVERVIEW

13.2.6 FORCAM

TABLE 165 FORCAM: COMPANY OVERVIEW

13.2.7 IBASET

TABLE 166 IBASET: COMPANY OVERVIEW

13.2.8 LIGHTHOUSE SYSTEMS

TABLE 167 LIGHTHOUSE SYSTEMS: COMPANY OVERVIEW

13.2.9 MPDV

TABLE 168 MPDV: COMPANY OVERVIEW

13.2.10 MIRACOM

TABLE 169 MIRACOM: COMPANY OVERVIEW

13.2.11 PARSEC AUTOMATION

TABLE 170 PARSEC AUTOMATION: COMPANY OVERVIEW

13.2.12 PLEX

TABLE 171 PLEX: COMPANY OVERVIEW

13.2.13 TEBIS

TABLE 172 TEBIS: COMPANY OVERVIEW

13.2.14 THROUGHPUT CONSULTING

TABLE 173 THROUGHPUT CONSULTING: COMPANY OVERVIEW

*Details on Business Overview, Products/solutions/services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

14 ADJACENT MARKET (Page No. - 210)

14.1 SCADA MARKET

14.1.1 INTRODUCTION

FIGURE 63 SCADA MARKET, BY OFFERING

FIGURE 64 SERVICES TO HOLD LARGEST SHARE OF SCADA MARKET DURING FORECAST PERIOD

TABLE 174 SCADA MARKET, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 175 SCADA MARKET, BY OFFERING, 2021–2026 (USD MILLION)

14.1.2 HARDWARE

TABLE 176 SCADA MARKET FOR HARDWARE, BY END USER, 2017–2020 (USD MILLION)

TABLE 177 SCADA MARKET FOR HARDWARE, BY END USER, 2021–2026 (USD MILLION)

TABLE 178 SCADA MARKET FOR HARDWARE, BY REGION, 2017–2020 (USD MILLION)

TABLE 179 SCADA MARKET FOR HARDWARE, BY REGION, 2021–2026 (USD MILLION)

14.1.2.1 Client, servers, and controllers are key hardware components of SCADA systems

FIGURE 65 TYPICAL SCADA HARDWARE OFFERINGS

14.1.3 SOFTWARE

14.1.3.1 Software plays critical role in SCADA system architectures

FIGURE 66 ADVANTAGES OF SOFTWARE OFFERINGS

TABLE 180 SCADA MARKET FOR SOFTWARE, BY END USER, 2017–2020 (USD MILLION)

TABLE 181 SCADA MARKET FOR SOFTWARE, BY END USER, 2021–2026 (USD MILLION)

TABLE 182 SCADA MARKET FOR SOFTWARE, BY REGION, 2017–2020 (USD MILLION)

TABLE 183 SCADA MARKET FOR SOFTWARE, BY REGION, 2021–2026 (USD MILLION)

14.1.4 SERVICES

14.1.4.1 SCADA services are a significant component of SCADA offerings

FIGURE 67 ADVANTAGES OF SCADA SYSTEM SERVICES

TABLE 184 SCADA MARKET FOR SERVICES, BY END USER, 2017–2020 (USD MILLION)

TABLE 185 SCADA MARKET FOR SERVICES, BY END USER, 2021–2026 (USD MILLION)

TABLE 186 SCADA MARKET FOR SERVICES, BY REGION, 2017–2020 (USD MILLION)

TABLE 187 SCADA MARKET FOR SERVICES, BY REGION, 2021–2026 (USD MILLION)

15 APPENDIX (Page No. - 220)

15.1 INSIGHTS OF INDUSTRY EXPERTS

15.2 DISCUSSION GUIDE

15.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.4 AVAILABLE CUSTOMIZATIONS

15.5 RELATED REPORTS

15.1 AUTHOR DETAILS

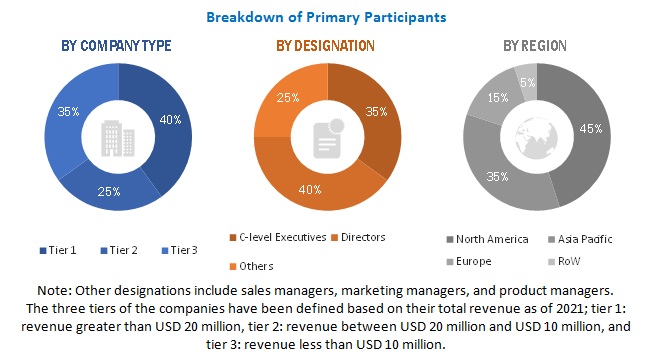

The study involves four major activities for estimating the size of the manufacturing execution systems market. Exhaustive secondary research has been conducted to collect information related to the market. The next step has been the validation of these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both top-down and bottom-up approaches have been employed to estimate the overall size of the manufacturing execution systems market. After that, market breakdown and data triangulation procedures have been used to determine the extent of different segments and subsegments of the market.

Secondary Research

Secondary sources referred to for this research study included corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers; certified publications; articles by recognized authors; directories; and databases. The secondary data was collected and analyzed to arrive at the overall market size, which was further validated through primary research.

Primary Research

Extensive primary research has been conducted after gaining knowledge about the current scenario of the manufacturing execution systems market through secondary research. Several primary interviews have been conducted with experts from both demand and supply sides across four major regions—North America, Europe, Asia Pacific, and RoW. This primary data has been collected through questionnaires, e-mails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches have been implemented, along with several data triangulation methods, to estimate and validate the size of the manufacturing execution systems market and other dependent submarkets listed in this report.

- The key players in the industry and markets have been identified through extensive secondary research.

- Both the supply chain of the industry and the market size, in terms of value, have been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size, the total market has been split into several segments. To complete the overall market engineering process and arrive at exact statistics for all segments, the market breakdown and data triangulation procedures have been employed wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Study Objectives:

- To describe and forecast the overall manufacturing execution systems market based on offering, deployment type, process industry, and discrete industry in terms of value.

- To describe and forecast the market for four key regions: North America, Europe, Asia Pacific, and Rest of the World (RoW), along with their respective countries, in terms of value

- To describe applications and procurement types of manufacturing execution systems

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the market

- To provide a comprehensive overview of the value chain of manufacturing execution systems ecosystem

- To analyze the impact of COVID-19 on the market

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of the market

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies2

- To analyze competitive developments such as product launches and developments, acquisitions, collaborations, agreements, and partnerships in the manufacturing execution systems market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company's specific needs. The following customization options are available for this report:

- Company Information: Detailed analysis and profiling of additional five market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Manufacturing Execution Systems Market

Looking for market reports that include, quantify, and segment Redzone Business Systems.