Marine Engines Market by Engine (Propulsion Engine, Auxiliary Engine), Type (Two Stroke, Four Stroke), Power Range (Up to 1,000 hp, 1,001-5,000 hp, 5,001-10,000 hp, 10,001-20,000 hp, Above 20,000 hp), Fuel, Vessel and Region - Global Forecast to 2027

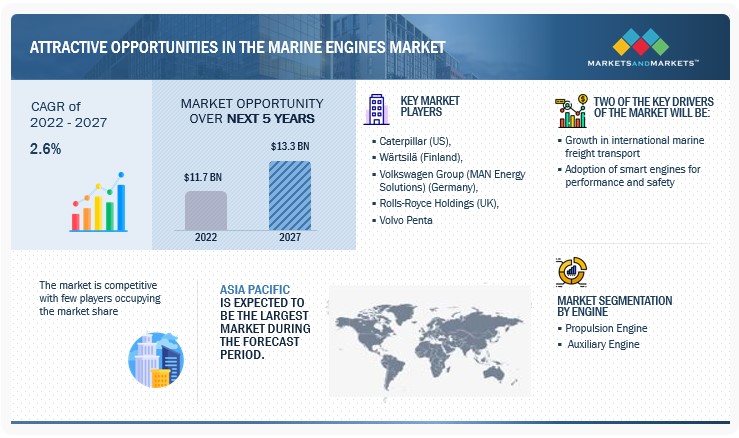

The global marine engines market in terms of revenue was estimated to worth $11.7 billion in 2022 and is poised to reach $13.3 billion by 2027, growing at a CAGR of 2.6 % from 2022 to 2027.

Growth in international marine freight transport, aging fleet, and adoption of smart engines for performance and safety are the driving factors for the marine engines market.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global Marine Engines Market

COVID-19 has unleashed a devastating blow to the global economy and the shipping sector, disrupting supply chains while choking off demand. The COVID-19 pandemic has not only affected the healthcare sector worldwide but also impacted the global economy. The pandemic resulted in a considerable decline in maritime transportation and related activities. It interfered with international trade, creating inefficiencies, delays, and supply chain disruptions on an unprecedented scale. This also had legal consequences, and for shipping, it led to litigations that raised complex international jurisdictional issues. There was, however, a nascent, if asymmetric, recovery, and by the third quarter going into 2021, volumes had rebounded for both containerized trade and dry bulk commodities. The pandemic was a big disruptor that has created challenges but also opportunities for the sector. The impact of COVID-19 has also highlighted the need for better risk management and greater preparedness, and resilience.

In December 2021, the world experienced a resurgence of new cases due to a new virus variant. The new variant, called B.1.1.529 or simply ‘Omicron,’ has spread to more than 101 countries, raising fears of lockdowns and tightening restrictions. However, vaccination has prevented the development of serious illness and decreased the need for hospitalization.

Market Trends

To know about the assumptions considered for the study, download the pdf brochure

Marine Engines Market Dynamics

Driver: Growth in international marine freight transport

Maritime transport is crucial for international trade. The main transport mode for global trade is ocean shipping, and as per UNCTAD, around 80% of the volume of international trade in goods is carried by sea, and the percentage is even higher for most developing countries. This channel of transport is cheaper and more feasible for international trade than road, rail, and air transport. Global maritime is expected to further swell at a moderate annual rate from 2022 to 2026. The growth of the global shipping fleet showed similar trends. Maritime trade bounced back in 2021 owing to the unlocking of pent-up demand, as well as restocking and building inventory. The sudden boost in demand in 2021 after the grim situation in 2020 due to the pandemic resulted into shortages of shipping capacity and of containers and equipment forcing many shipowners to resort to procuring newbuild or used retrofitted vessels to bridge this demand-supply gap.

Asia Pacific has emerged as a global manufacturing hub in recent times, owing to its wealth of raw materials and manpower. Thus, the demand for container ships is significantly high in this region, owing to an increase in the export of manufactured and raw goods. The year 2021 saw increased oil demand due to the reopening of economies, increase in OPEC production and the expansion of Asian economies. This growth is ongoing and may lead to an increase in demand for very large crude carriers. Natural gas offers a low carbon source of energy and as economies transition toward their goal of decarbonization, the global gas trade is also set to increase. The dry bulk maritime trade is expected to show similar trends, as it accounted for nearly three quarters of total maritime trade volumes during 2020-2021 and its share expected to expand further.

Restraints: Stringent environmental regulations to decarbonize shipping

The Paris Agreement has targets to reduce global warming to well below 2°C and pursue 1.5°C. However, despite a temporary dip in carbon dioxide and other greenhouse gas emissions caused by the COVID-19 pandemic, the world is still heading toward a temperature rise in excess of 3°C this century. In terms of CO2 emissions per ton cargo transported one kilometer, shipping is recognized as the most efficient form of commercial transport. However, the enormous scale of the industry means that it is nevertheless a significant contributor to the world’s total greenhouse gas emissions. Greenhouse gas emissions from shipping must be gradually phased out to avoid the risk of sanctions and the costs of not acting in the face of climate change. At the regulatory level, the shipping industry is addressing climate issues through the 1973/1978 International Convention for the Prevention of Pollution from Ships (MARPOL). On January 1, 2020, IMO issued a regulation that requires bunker fuels to have a sulfur content not exceeding 0.5%. Limiting SOx emissions from ships is important to improve air quality and to ensure human as well as environmental well-being. Furthermore, in June 2021, the IMO adopted amendments to the Annex VI of the MARPOL Convention, which introduced new mandatory regulations to further reduce the greenhouse gas emissions from shipping and require owners to set energy efficiency targets.

The path toward shipping decarbonization not only involves technological upgrades and improvement of ship design, but also the use of alternative fuels and the use of engines that are compatible with such fuels. As a result of the new IMO emission requirements, shipping companies faced with low earnings and uncertainties about compliance with the norms and postponed placing orders for new vessels. Also, the new regulations will require replacing some of the existing fleet that will entail significant costs upon the operators. This may affect the orders for new vessels, which may ultimately impact and restrain the growth of the marine engines market as well.

Opportunities: Rise of e-commerce and online trade

The pandemic saw a shift in the way consumers purchased goods. The pandemic has accelerated the shift away from physical stores to digital shopping by roughly five years. Consumers sought a safe way to cater to their requirements, which led to a sharp spike in online retail sales activity. The surge in trade is welcome, but it is swelling at such a rate and scale that shipping services and port operations are often not able to keep up, resulting in logistical bottlenecks. The whole industry is suffering shortages of shipping capacity, containers, and other equipment. Reducing logistical bottlenecks and supply chain uncertainties is essential for retailers to keep more inventory in hand. As a result, e-commerce fulfillment is providing new business opportunities to maritime trade, including shipping, warehousing, and distribution facilities at seaports. Maritime transport, especially at a global scale, is more feasible and cheaper compared to air, rail, and road transport. This trend of growth in e-commerce has also accelerated digitalization in the marine industry. The rise of e-commerce and online trade is, therefore, expected to boost maritime trade and the demand for vessels, which, in turn, will present an opportunity for the growth of the marine engines market.

Challenges: Structural factors increasing maritime transport costs

Shipping and port prices are expected to be driven by structural factors such as port infrastructure, economies of scale, trade imbalances, trade facilitation, and shipping connectivity in the longer term. Developing countries, especially the ones with a poor shipping and port infrastructure, may experience the highest maritime transport costs in the coming years. Such structurally weak developing countries will also need help to mitigate transition costs and the lower connectivity that would result from decarbonizing maritime transport. Hence, improving structural determinants such as port infrastructure, trade facilitating environment, and shipping connectivity will substantially bring down maritime transport costs.

Smaller economies, such as Suriname, Guyana, and Romania, usually lack liner shipping connectivity, have a lower quality of port infrastructure, and inadequate trade facilitation measures. These shortcomings hamper the growth of maritime trade in such countries. Upgradation of ports to enable better shipping services and permit larger vessels to have shorter waiting times before entering ports will lower transport costs, offering a boost to maritime trade in such countries. Also, bilateral trade imbalances also affect the costs and overall trade. For instance, for sailings from high-demand to low-demand countries, many vessels have to return with empty containers having a negative impact on the shipping costs. Such factors hinder the growth of international maritime trade, thereby posing a challenge for marine engines market growth.

Marine Engines Market Share

The marine engines market share refers to the percentage of the entire market owned by specific companies that provide marine engine solutions. Marine engines power boats, ships, and other maritime vessels. The marine engine market is being pushed by factors such as the expansion of the shipping industry, rising demand for recreational boats, and the need for fuel-efficient and ecologically friendly engines. A few key players dominate the worldwide marine engine industry, including Caterpillar Inc., MAN SE, Wärtsilä Corporation, and Mitsubishi Heavy Industries Ltd. These companies are investing in R&D to improve their marine engine solutions, increase their market presence, and remain competitive. The market is divided into three sections: fuel type, power range, and vessel type.

By Engine, the propulsion engine segment is expected to make the largest contribution to the marine engines market during the forecast period.

The propulsion engine segment held the largest share of the marine engines market in 2021, and a similar trend is likely to continue in the near future. Propulsion engines are the main supporting system of a ship and are an integral part of the ship’s propulsion mechanism. Marine propulsion engines are a very important asset of ships as they are the prime mover of the ship. Thus, the demand for propulsion engines across various engine types is high and expected to increase further. Propulsion engines are further divided into gas turbines, diesel engines, steam turbines, and dual-fuel engines. All the vessels, from a small passenger ferry to very large container ships, require a propulsion or a main engine to direct the vessel’s movement through the water. Full-scale resumption of global maritime trade, growth of the shipbuilding industry, and the replacement of aging fleet with new build vessels are expected to drive the propulsion engine segment of the marine engines market during the forecast period.

By Power Range, the above 20,000 HP segment is expected to be the largest segment during 2022-2027.

The above 20,000 HP segment accounted for a larger market share in 2021. The above 20,000 HP marine engines mostly have applications for very large vessels, which include large bulk carriers, cargo vessels, containerships, defense vessels, LPG carriers, LNG carriers, and others. They are primarily used as prime moves to facilitate the movement of these ships through the waters. The growth of global maritime trade and the requirement of more and more vessels to cope with tight vessel supply, as well as the requirement to replace some of the existing fleet to comply with the stringent International Maritime Organization (IMO) regulations put in force from January 2020, are expected to drive the growth of the above 20,000 HP segment during the forecast period.

By Type, the two stroke segment is expected to hold the largest market share during the forecast period.

The two stroke segment held a larger share of the marine engines market in 2021. The two-stroke engines can run on low-grade fuels, have better efficiency and high power; and are more reliable. They are preferred as main engines in vessels in case of long journeys via oceans when higher power and efficiency are required. They offer high torque at a low engine speed, which helps boats/vessels cruise at a constant speed without adjusting the engine speed. Two-stroke engines have one revolution of the crankshaft during one power stroke. They also have a larger ratio in terms of power to weight and are slow-speed, crosshead engines. The growth of international maritime trade will lead to an increase in the requirement of prime movers for ocean going vessels, which eventually will drive the demand for two stroke marine engines during the forecast period.

By Fuel, the marine diesel oil segment is expected to dominate the marine engines market during the forecast period.

The largest share of the marine engines market in 2021 was held by the marine diesel oil segment. Marine diesel oil, unlike heavy fuel oil (HFO), does not require heating during storage. The various blending ratios of marine diesel oil can be regulated directly by refinery processes or by mixing ready-made marine fuels. The growing stringency of emission control regulations and continuous revisions in the IMO standards have led to the substitution of bunker oil or heavy fuel oil with low sulfur oils such as marine diesel oil, driving the growth of this segment in the marine engines market during the forecast period.

By Vessel, the bulk carriers segment is expected to hold the largest market share during the forecast period.

The bulk carriers segment held a larger share of the marine engines market in 2021. Bulk carriers are the merchant fleet's workhorses, transporting raw ingredients including grain, iron ore, and coal, as well as products such as bauxite, cement, fertilizers, rice, sugar, and timber to name a few. Bulk carriers can also transport manufactured goods such as steel coils. They are the most environmentally efficient way to move big volumes of dry freight over long distances. As the demand for raw materials, grains, and metals transportation increases, shipping companies will react with a a surge of new orders for dry bulk carriers. The recovery of world trade post 2020 also led to a surge in new orders to address severe fleet capacity constraints and the uptick in freight rates, which may drive the bulk carriers segment of the marine engines market during the forecast period.

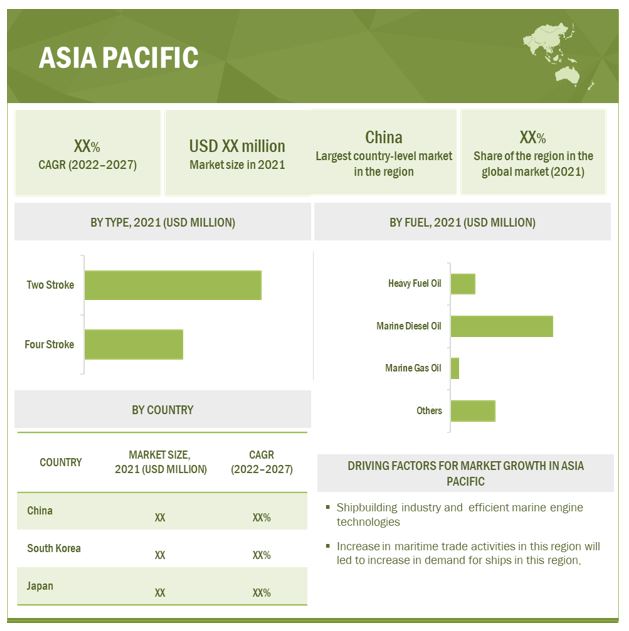

Asia Pacific is expected to be the largest market during the forecast period.

North America, Europe, South America, Asia Pacific, and Middle East & Africa are the major regions considered for the study of the marine engines market. The governments in the region are offering tax rebates to the shipbuilding industry. The growth of the Asia Pacific market is primarily driven by the growth of the regional shipbuilding industry, development of efficient marine engine technologies, and an increase in maritime trade activities in the region.

Key Market Players

The major players in the global marine engines market are Caterpillar (US), Wärtsilä (Finland), Volkswagen Group (MAN Energy Solutions) (Germany), Rolls-Royce Holdings (UK), Volvo Penta (Sweden), Mitsubishi Heavy Industries, Ltd. (Japan), Cummins (US), Hyundai Heavy Industries Co., Ltd. (South Korea), Daihatsu Diesel Mfg. Co., Ltd. (Japan), Deutz AG (Germany), WinGD (Switzerland), Siemens Energy (Germany), Fairbanks Morse (US), Wabtec (GE Transportation) (US), Yanmar (Japan), Isotta Fraschini Motori (Italy), CNPC Jichai Power Company Limited (China), Bergen Engines (Norway), Doosan Infracore (South Kore), Mahindra Powerol (India), IHI Power Systems (Japan), and others.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market Size available for years |

2020–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Engine, Power Range, Type, Fuel, and Vessel |

|

Geographies covered |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies covered |

Caterpillar (US), Wärtsilä (Finland), Volkswagen Group (MAN Energy Solutions) (Germany), Rolls-Royce Holdings (UK), Volvo Penta (Sweden), Mitsubishi Heavy Industries, Ltd. (Japan), Cummins (US), Hyundai Heavy Industries Co., Ltd. (South Korea), Daihatsu Diesel Mfg. Co., Ltd. (Japan), Deutz AG (Germany), WinGD (Switzerland), Siemens Energy (Germany), Fairbanks Morse (US), Wabtec (GE Transportation) (US), Yanmar (Japan), Isotta Fraschini Motori (Italy), CNPC Jichai Power Company Limited (China), Bergen Engines (Norway), Doosan Infracore (South Kore), Mahindra Powerol (India), IHI Power Systems (Japan), and others |

This research report categorizes the marine engines market based on engine, power range, type, fuel, vessel, and region.

Based on Engine:

- Propulsion Engine

- Auxiliary Engine

Based on Power Range:

- Up to 1,000 HP

- 1,001–5,000 HP

- 5,001–10,000 HP

- 10,001–20,000 HP

- Above 20,000 HP

Based on Type:

- Two Stroke

- Four Stroke

Based on Fuel:

- Heavy Fuel Oil

- Marine Diesel Oil

- Marine Gas Oil

- Others (LNG, LPG, hybrid fuels such as LNG-HFO, LNG-IFO, LNG-MDO, LNG-MDO-HFO, LNG-MGO, LNG-MGO-HFO, MGO-HFO, and nuclear fuel)

Based on Vessel:

- Offshore Support Vessels

- Oil Tankers

- Bulk Carriers

- General Cargo

- Container Ships

- Product Tankers

- Tugs

- Others (Bunkering & fleet replenishment vessels, dredger, and landing crafts)

Based on Region:

- North America

- Asia Pacific

- South America

- Europe

- Middle East & Africa

Recent Developments

- In February 2022, MAN Energy Solutions signed a cooperation agreement with Hyundai. Under this agreement, Hyundai will provide OPL solution to shipowners seeking EEXI compliance for their fleet without disrupting their business operations, and it will contribute to net-zero emission goals of maritime industry.

- In February 2022, Volvo Penta signed an agreement with Danfoss’ Editron division. Through this agreement, both the companies aim to work together to boost electrification in the marine sector.

- In December 2021, Caterpillar Marine signed a contract to provide power solutions for Edda Wind’s series of four new Commissioning Service Operation Vessels (CSOVs) and two new Service Operation Vessels (SOVs), which will be delivered between 2022 and 2024.

- In November 2021, Hyundai Heavy Industries (HHI) signed a contract to build the second of three upgraded Aegis-equipped next-generation warships of the South Korean Navy. It is also working on the construction of the first warship. HHI signed a contract worth USD 470 million with the country’s Defense Acquisition Program Administration.

- In August 2021, Rolls Royce Holdings signed an agreement to sell its Bergen Engines, medium-speed liquid fuel and gas engines business, to Langley Holdings, a global engineering group.

Frequently Asked Questions (FAQ):

What is the current size of the marine engines market?

The current market size of global marine engines market is USD 11.5 billion in 2021.

What are the major drivers for marine engines market?

Growth in international marine freight transport, aging fleet, and adoption of smart engines for performance and safety are the major drivers for the marine engines market.

Which is the fastest-growing region during the forecasted period in the marine engines market?

Asia Pacific is the fastest-growing region and its growth is driven by the growth of the regional shipbuilding industry, development of efficient marine engine technologies, and an increase in maritime trade activities.

Which is the largest segment, by vessel, during the forecasted period in marine engines market?

The bulk carriers segment held the largest share of marine engines market, by vessel, during the forecast period, as a result of growing demand for transporting raw materials, grains, and metals in an efficient way over long distances.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 24)

1.1 OBJECTIVES OF STUDY

1.2 DEFINITION

1.3 INCLUSIONS AND EXCLUSIONS

1.3.1 MARINE ENGINES MARKET, BY ENGINE

1.3.2 MARKET, BY TYPE

1.3.3 MARKET, BY POWER RANGE

1.3.4 MARKET, BY FUEL

1.3.5 MARKET, BY VESSEL

1.3.6 MARKET, BY REGION

1.4 MARKET SCOPE

1.4.1 MARKET SEGMENTATION

1.4.2 REGIONS COVERED

1.5 YEARS CONSIDERED FOR STUDY

1.6 CURRENCY

1.7 LIMITATIONS

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 32)

2.1 RESEARCH DATA

FIGURE 1 MARINE ENGINES MARKET: RESEARCH DESIGN

2.2 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 2 DATA TRIANGULATION

2.2.1 SECONDARY DATA

2.2.1.1 Key data from secondary sources

2.2.2 PRIMARY DATA

2.2.2.1 Breakdown of primaries

2.2.2.2 Key data from primary sources

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3.3 DEMAND-SIDE ANALYSIS

FIGURE 6 MAIN METRICS CONSIDERED WHILE ANALYZING AND ASSESSING DEMAND FOR MARINE ENGINES

2.3.3.1 Regional analysis

2.3.3.2 Country analysis

2.3.3.3 Demand-side assumptions

2.3.3.4 Demand-side calculations

2.3.4 SUPPLY-SIDE ANALYSIS

FIGURE 7 KEY STEPS CONSIDERED FOR ASSESSING SUPPLY OF MARINE ENGINES

FIGURE 8 MARKET: SUPPLY-SIDE ANALYSIS

2.3.4.1 Supply-side calculations

2.3.4.2 Supply-side assumptions

2.3.5 FORECAST

3 EXECUTIVE SUMMARY (Page No. - 44)

TABLE 1 MARINE ENGINES MARKET SNAPSHOT

FIGURE 9 ASIA PACIFIC DOMINATED MARKET IN 2021

FIGURE 10 PROPULSION ENGINE SEGMENT TO ACCOUNT FOR LARGER SHARE BETWEEN 2022 AND 2027

FIGURE 11 ABOVE 20,000 HP POWER RANGE SEGMENT TO LEAD MARKET FROM 2022 TO 2027

FIGURE 12 TWO-STROKE ENGINE SEGMENT TO DOMINATE MARKET FROM 2022 TO 2027

FIGURE 13 MARINE DIESEL OIL TO HOLD LARGEST SHARE OF MARKET FROM 2022 TO 2027

FIGURE 14 BULK CARRIERS TO HOLD LARGEST SHARE OF MARKET, FROM 2022 TO 2027

4 PREMIUM INSIGHTS (Page No. - 50)

4.1 ATTRACTIVE OPPORTUNITIES IN MARINE ENGINES MARKET

FIGURE 15 GROWTH OF INTERNATIONAL MARINE FREIGHT TRANSPORT, AGING FLEET, AND ADOPTION OF SMART ENGINES FOR PERFORMANCE AND SAFETY TO DRIVE MARKET BETWEEN 2022 AND 2027

4.2 MARINE ENGINES MARKET, BY REGION

FIGURE 16 ASIA PACIFIC MARKET TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

4.3 ASIA PACIFIC: MARKET, BY VESSEL AND COUNTRY, 2021

FIGURE 17 OIL TANKERS SEGMENT AND CHINA HELD LARGEST SHARES

4.4 MARKET, BY ENGINE

FIGURE 18 PROPULSION ENGINE TO ACCOUNT FOR LARGER SHARE BY 2027

4.5 MARKET, BY TYPE

FIGURE 19 TWO-STROKE SEGMENT TO DOMINATE MARKET

4.6 MARKET, BY POWER RANGE

FIGURE 20 ABOVE 20,000 HP SEGMENT TO HOLD LARGEST SHARE OF MARKET

4.7 MARKET, BY FUEL

FIGURE 21 MARINE DIESEL OIL SEGMENT TO DOMINATE MARKET

4.8 MARKET, BY VESSEL

FIGURE 22 BULK CARRIERS SEGMENT TO LEAD MARKET

5 MARKET OVERVIEW (Page No. - 55)

5.1 INTRODUCTION

5.2 COVID-19 HEALTH ASSESSMENT

FIGURE 23 GLOBAL PROPAGATION OF COVID-19

FIGURE 24 PROPAGATION OF COVID-19 CASES IN SELECTED COUNTRIES

5.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 25 REVISED GDP FOR SELECTED G20 COUNTRIES IN 2020

5.4 ROAD TO RECOVERY

FIGURE 26 COVID-19 PROPAGATION IN SELECT COUNTRIES

5.5 MARKET DYNAMICS

FIGURE 27 MARINE ENGINES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.5.1 DRIVERS

5.5.1.1 Growth in international marine freight transport

FIGURE 28 GLOBAL MARITIME TRADE VOLUME, 2010 –2020

5.5.1.2 Aging Fleet

FIGURE 29 AGE DISTRIBUTION OF WORLD MERCHANT FLEET, 2021

TABLE 2 AVERAGE AGE OF MERCHANT FLEET, BY VESSEL TYPE, 2020-2021

5.5.1.3 Adoption of smart engines for performance and safety

5.5.2 RESTRAINTS

5.5.2.1 Stringent environmental regulations for decarbonizing shipping

FIGURE 30 TYPICAL CO2 EMISSIONS PER TON OF CARGO TRANSPORTED ONE KILOMETER

FIGURE 31 IMO GLOBAL SULFUR CAP

5.5.2.2 Soaring freight rates and fees

FIGURE 32 INCREASE IN IMPORT PRICES DUE TO HIGH FREIGHT RATES, 2021

5.5.2.3 Dependence on heavy liquid fuels

5.5.3 OPPORTUNITIES

5.5.3.1 Rise of e-commerce and online trade

5.5.3.2 Rising demand for dual-fuel and hybrid engines

5.5.4 CHALLENGES

5.5.4.1 Structural factors increasing maritime transport costs

5.5.4.2 Volatile oil & gas prices

5.6 COVID-19 IMPACT

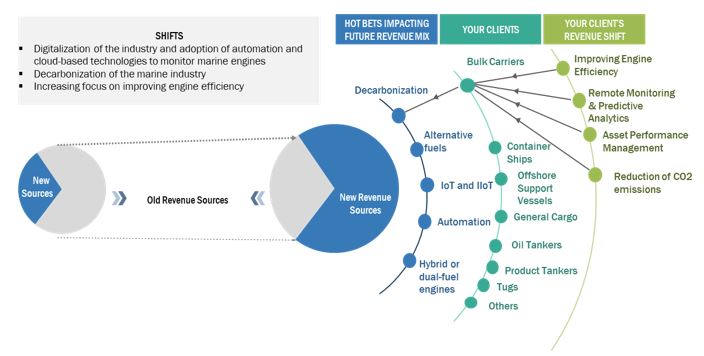

5.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

5.7.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR MARINE ENGINE PROVIDERS

FIGURE 33 REVENUE SHIFT FOR MARINE ENGINE PROVIDERS

5.8 MARKET MAP

FIGURE 34 MARKET MAP: MARKET

TABLE 3 MARKET: ROLE IN ECOSYSTEM

5.9 VALUE CHAIN ANALYSIS

FIGURE 35 VALUE CHAIN ANALYSIS: MARKET

5.9.1 RAW MATERIAL PROVIDERS/SUPPLIERS

5.9.2 COMPONENT MANUFACTURERS

5.9.3 MARINE ENGINE MANUFACTURERS/ASSEMBLERS

5.9.4 DISTRIBUTORS (BUYERS)/END USERS

5.9.5 POST-SALES SERVICES

5.10 TECHNOLOGY ANALYSIS

5.10.1 IOT-CONNECTED MARINE ENGINES

5.10.2 DUAL-FUEL AND HYBRID MARINE ENGINES

5.11 PRICING ANALYSIS

5.11.1 AVERAGE SELLING PRICES OF MARINE ENGINES BY POWER RANGE

TABLE 4 AVERAGE SELLING PRICES OF MARINE ENGINES, 2021

TABLE 5 AVERAGE SELLING PRICES OF MARINE ENGINES, BY POWER RANGE, OF KEY PLAYERS (2021)

FIGURE 36 AVERAGE SELLING PRICES OF KEY PLAYERS BY POWER RANGE

5.12 KEY CONFERENCES & EVENTS IN 2022-2023

TABLE 6 MARINE ENGINES MARKET: DETAILED LIST OF CONFERENCES & EVENTS

5.13 TARIFFS, CODES & REGULATIONS

5.13.1 TARIFFS RELATED TO MARINE ENGINES

TABLE 7 IMPORT TARIFFS FOR HS 840810 MARINE PROPULSION ENGINES IN 2019

5.13.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 8 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 9 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 10 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 11 REST OF WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.13.3 CODES AND REGULATIONS RELATED TO MARINE ENGINES

TABLE 12 MARINE ENGINES: CODES AND REGULATIONS

5.14 INNOVATIONS AND PATENT REGISTRATIONS

TABLE 13 MARINE ENGINES: INNOVATIONS AND PATENT REGISTRATIONS, MARCH 2018–JANUARY 2022

5.15 PORTER’S FIVE FORCES ANALYSIS

FIGURE 37 PORTER’S FIVE FORCES ANALYSIS FOR MARKET

TABLE 14 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.15.1 THREAT OF SUBSTITUTES

5.15.2 BARGAINING POWER OF SUPPLIERS

5.15.3 BARGAINING POWER OF BUYERS

5.15.4 THREAT OF NEW ENTRANTS

5.15.5 INTENSITY OF COMPETITIVE RIVALRY

5.16 KEY STAKEHOLDERS & BUYING CRITERIA

5.16.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 38 INFLUENCE OF KEY STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 VESSEL TYPES

TABLE 15 INFLUENCE OF KEY STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 VESSEL TYPES

5.17 BUYING CRITERIA

FIGURE 39 INFLUENCE OF KEY STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 VESSEL TYPES

TABLE 16 KEY BUYING CRITERIA FOR TOP 3 VESSEL TYPES

5.18 CASE STUDY ANALYSIS

5.18.1 WÄRTSILÄ’S INTEGRATED PROPULSION SYSTEM HELPS SHIPBUILDER DELIVER SISTER SHIP FOR WORLD-CLASS UAE-BASED DREDGER

5.18.1.1 Problem Statement

5.18.1.2 Solution

5.18.2 CUMMINS PROVIDES EFFICIENT TWIN ENGINES SOLUTION FOR A HYBRID TUG FOR THE PORT OF AARHUS, DENMARK

5.18.2.1 Problem Statement

5.18.2.2 Solution

5.18.3 VOLKSWAGEN (MAN ENERGY SOLUTIONS) RETROFITS VERY LARGE GAS CARRIERS (VLGC) WITH DUAL-FUEL PROPULSION ENGINES USING ITS LGIP TECHNOLOGY

5.18.3.1 Problem Statement

5.18.3.2 Solution

5.18.3.3 ROLLS-ROYCE HOLDINGS’ COMPANY, MTU, SUPPLIES SINGLE-FUEL MARINE GAS ENGINES FOR FERRIES COMMISSIONED IN DUTCH WADDEN SEA

5.18.3.3.1 Problem Statement

5.18.3.3.2 Solution

6 MARINE ENGINES MARKET, BY ENGINE (Page No. - 98)

6.1 INTRODUCTION

FIGURE 40 MARINE ENGINES MARKET, BY ENGINE, 2021

TABLE 17 MARKET SIZE, BY ENGINE, 2020–2027 (USD MILLION)

6.2 PROPULSION ENGINE

TABLE 18 PROPULSION ENGINE: MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

6.3 AUXILIARY ENGINE

TABLE 19 AUXILIARY ENGINE: MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

7 MARINE ENGINES MARKET, BY TYPE (Page No. - 102)

7.1 INTRODUCTION

FIGURE 41 MARKET, BY TYPE, 2021

TABLE 20 MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

7.2 TWO STROKE

TABLE 21 TWO-STROKE MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

7.3 FOUR STROKE

TABLE 22 FOUR-STROKE MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

8 MARINE ENGINES MARKET, BY POWER RANGE (Page No. - 105)

8.1 INTRODUCTION

FIGURE 42 MARINE ENGINES MARKET, BY POWER RANGE, 2021

TABLE 23 MARKET SIZE, BY POWER RANGE, 2020–2027 (USD MILLION)

TABLE 24 MARKET SIZE, BY POWER RANGE, 2020–2027 (UNIT)

8.2 UP TO 1,000 HP

TABLE 25 UP TO 1,000 HP MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 26 UP TO 1,000 HP MARKET SIZE, BY REGION, 2020–2027 (UNIT)

8.3 1,001 - 5,000 HP

TABLE 27 1,001 – 5,000 HP MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 28 1,001 – 5,000 HP MARKET SIZE, BY REGION, 2020–2027 (UNIT)

8.4 5,001 – 10,000 HP

TABLE 29 5,001 – 10,000 HP MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 30 5,001 – 10,000 HP MARKET SIZE, BY REGION, 2020–2027 (UNIT)

8.5 10,001 – 20,000 HP

TABLE 31 10,001 – 20,000 HP MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 32 10,001 – 20,000 HP MARKET SIZE, BY REGION, 2020–2027 (UNIT)

8.6 ABOVE 20,000 HP

TABLE 33 ABOVE 20,000 HP MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 34 ABOVE 20,000 HP MARKET SIZE, BY REGION, 2020–2027 (UNIT)

9 MARINE ENGINES MARKET, BY FUEL (Page No. - 112)

9.1 INTRODUCTION

FIGURE 43 MARKET, BY FUEL, 2021

TABLE 35 MARKET SIZE, BY FUEL, 2020–2027 (USD MILLION)

9.2 HEAVY FUEL OIL

TABLE 36 HEAVY FUEL OIL: MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

9.3 MARINE DIESEL OIL

TABLE 37 MARINE DIESEL OIL: MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

9.4 MARINE GAS OIL

TABLE 38 MARINE GAS OIL: MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

9.5 OTHERS

TABLE 39 OTHER FUELS: MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

10 MARINE ENGINES MARKET, BY VESSEL (Page No. - 117)

10.1 INTRODUCTION

FIGURE 44 MARKET, BY VESSEL, 2021

TABLE 40 MARKET SIZE, BY VESSEL, 2020–2027 (USD MILLION)

10.2 OFFSHORE SUPPORT VESSELS

TABLE 41 OFFSHORE SUPPORT VESSELS: MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

10.3 OIL TANKERS

TABLE 42 OIL TANKERS: MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

10.4 BULK CARRIERS

TABLE 43 BULK CARRIERS: MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

10.5 GENERAL CARGO

TABLE 44 GENERAL CARGO: MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

10.6 CONTAINER SHIPS

TABLE 45 CONTAINER SHIPS: MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

10.7 PRODUCT TANKERS

TABLE 46 PRODUCT TANKERS: MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

10.8 TUGS

TABLE 47 TUGS: MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

10.9 OTHERS

TABLE 48 OTHER VESSELS: MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

11 MARINE ENGINES MARKET, BY REGION (Page No. - 126)

11.1 INTRODUCTION

FIGURE 45 MARKET SHARE, BY REGION, 2021 (%)

FIGURE 46 MARKET IN ASIA PACIFIC TO REGISTER HIGHEST CAGR FROM 2022 TO 2027

TABLE 49 MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

11.2 ASIA PACIFIC

FIGURE 47 ASIA PACIFIC: MARKET SNAPSHOT

11.2.1 BY ENGINE

TABLE 50 ASIA PACIFIC: MARKET SIZE, BY ENGINE, 2020–2027 (USD MILLION)

11.2.2 BY TYPE

TABLE 51 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

11.2.3 BY POWER RANGE

TABLE 52 ASIA PACIFIC: MARKET SIZE, BY POWER RANGE, 2020–2027 (USD MILLION)

TABLE 53 ASIA PACIFIC: MARKET SIZE, BY POWER RANGE, 2020–2027 (UNIT)

11.2.4 BY FUEL

TABLE 54 ASIA PACIFIC: MARKET SIZE, BY FUEL, 2020–2027 (USD MILLION)

11.2.5 BY VESSEL

TABLE 55 ASIA PACIFIC: MARKET SIZE, BY VESSEL, 2020–2027 (USD MILLION)

11.2.6 BY COUNTRY

TABLE 56 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

11.2.7 CHINA

11.2.7.1 Robust shipbuilding industry and economic growth to drive market

11.2.8 BY TYPE

TABLE 57 CHINA: MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

11.2.9 BY FUEL

TABLE 58 CHINA: MARKET SIZE, BY FUEL, 2020–2027 (USD MILLION)

11.2.10 JAPAN

11.2.10.1 Development of efficient marine engine technologies and growth of shipbuilding industry to drive market

11.2.11 BY TYPE

TABLE 59 JAPAN: MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

11.2.12 BY FUEL

TABLE 60 JAPAN: MARKET SIZE, BY FUEL, 2020–2027 (USD MILLION)

11.2.13 SOUTH KOREA

11.2.13.1 Growth of the shipbuilding industry supported by government through tax rebates and tax incentives packages to boost market

11.2.14 BY TYPE

TABLE 61 SOUTH KOREA: MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

11.2.15 BY FUEL

TABLE 62 SOUTH KOREA: MARKET SIZE, BY FUEL, 2020–2027 (USD MILLION)

11.2.16 PHILIPPINES

11.2.16.1 Tax incentives in shipbuilding and ship repair sectors to fuel market growth

11.2.17 BY TYPE

TABLE 63 PHILIPPINES: MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

11.2.18 BY FUEL

TABLE 64 PHILIPPINES: MARKET SIZE, BY FUEL, 2020–2027 (USD MILLION)

11.2.19 VIETNAM

11.2.19.1 Government initiative to make shipbuilding a key export industry to propel marine engines market in the country

11.2.20 BY TYPE

TABLE 65 VIETNAM: MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

11.2.21 BY FUEL

TABLE 66 VIETNAM: MARKET SIZE, BY FUEL, 2020–2027 (USD MILLION)

11.2.22 REST OF ASIA PACIFIC

11.2.23 BY TYPE

TABLE 67 REST OF ASIA PACIFIC: MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

11.2.24 BY FUEL

TABLE 68 REST OF ASIA PACIFIC: MARKET SIZE, BY FUEL, 2020–2027 (USD MILLION)

11.3 EUROPE

FIGURE 48 EUROPE: MARKET SNAPSHOT

11.3.1 BY ENGINE

TABLE 69 EUROPE: MARKET SIZE, BY ENGINE, 2020–2027 (USD MILLION)

11.3.2 BY TYPE

TABLE 70 EUROPE: MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

11.3.3 BY POWER RANGE

TABLE 71 EUROPE: MARKET SIZE, BY POWER RANGE, 2020–2027 (USD MILLION)

TABLE 72 EUROPE: MARKET SIZE, BY POWER RANGE, 2020–2027 (UNIT)

11.3.4 BY FUEL

TABLE 73 EUROPE: MARKET SIZE, BY FUEL, 2020–2027 (USD MILLION)

11.3.5 BY VESSEL

TABLE 74 EUROPE: MARKET SIZE, BY VESSEL, 2020–2027 (USD MILLION)

11.3.6 BY COUNTRY

TABLE 75 EUROPE: MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

11.3.7 GERMANY

11.3.7.1 German maritime industry facing challenges such as reduction in CO2 emissions, COVID-19 pandemic, and international competition

11.3.8 BY TYPE

TABLE 76 GERMANY: MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

11.3.9 BY FUEL

TABLE 77 GERMANY: MARKET SIZE, BY FUEL, 2020–2027 (USD MILLION)

11.3.10 ITALY

11.3.10.1 Ro-Ro and passenger cabotage routes to grow, and investments in LNG and hydrogen to drive market

11.3.11 BY TYPE

TABLE 78 ITALY: MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

11.3.12 BY FUEL

TABLE 79 ITALY: MARKET SIZE, BY FUEL, 2020–2027 (USD MILLION)

11.3.13 RUSSIA

11.3.13.1 Increase in shipbuilding activities to drive marine engines market

11.3.14 BY TYPE

TABLE 80 RUSSIA: MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

11.3.15 BY FUEL

TABLE 81 RUSSIA: MARKET SIZE, BY FUEL, 2020–2027 (USD MILLION)

11.3.16 FINLAND

11.3.16.1 Finnish maritime industry moving toward sustainable shipping solutions

11.3.17 BY TYPE

TABLE 82 FINLAND: MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

11.3.18 BY FUEL

TABLE 83 FINLAND: MARKET SIZE, BY FUEL, 2020–2027 (USD MILLION)

11.3.19 FRANCE

11.3.19.1 Growing R&D for green and new technologies in French maritime industry to drive market

11.3.20 BY TYPE

TABLE 84 FRANCE: MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

11.3.21 BY FUEL

TABLE 85 FRANCE: MARKET SIZE, BY FUEL, 2020–2027 (USD MILLION)

11.3.22 REST OF EUROPE

11.3.23 BY TYPE

TABLE 86 REST OF EUROPE: MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

11.3.24 BY FUEL

TABLE 87 REST OF EUROPE: MARKET SIZE, BY FUEL, 2020–2027 (USD MILLION)

11.4 MIDDLE EAST & AFRICA

11.4.1 BY ENGINE

TABLE 88 MIDDLE EAST & AFRICA: MARKET SIZE, BY ENGINE, 2020–2027 (USD MILLION)

11.4.2 BY TYPE

TABLE 89 MIDDLE EAST & AFRICA: MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

11.4.3 BY POWER RANGE

TABLE 90 MIDDLE EAST & AFRICA: MARKET SIZE, BY POWER RANGE, 2020–2027 (USD MILLION)

TABLE 91 MIDDLE EAST & AFRICA: MARKET SIZE, BY POWER RANGE, 2020–2027 (UNIT)

11.4.4 BY FUEL

TABLE 92 MIDDLE EAST & AFRICA: MARKET SIZE, BY FUEL, 2020–2027 (USD MILLION)

11.4.5 BY VESSEL

TABLE 93 MIDDLE EAST & AFRICA: MARKET SIZE, BY VESSEL, 2020–2027 (USD MILLION)

11.4.6 BY COUNTRY

TABLE 94 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

11.4.7 TURKEY

11.4.7.1 Turkish shipbuilders and marine equipment suppliers seeing increase in demand for environment-friendly ships

11.4.8 BY TYPE

TABLE 95 TURKEY: MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

11.4.9 BY FUEL

TABLE 96 TURKEY: MARKET SIZE, BY FUEL, 2020–2027 (USD MILLION)

11.4.10 UAE

11.4.10.1 New laws, as well as a more business-friendly environment in the UAE to provide pull for shipping businesses

11.4.11 BY TYPE

TABLE 97 UAE: MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

11.4.12 BY FUEL

TABLE 98 UAE: MARKET SIZE, BY FUEL, 2020–2027 (USD MILLION)

11.4.13 SOUTH AFRICA

11.4.13.1 Low production cost and increase in manufacturing sector to drive market

11.4.14 BY TYPE

TABLE 99 SOUTH AFRICA: MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

11.4.15 BY FUEL

TABLE 100 SOUTH AFRICA: MARKET SIZE, BY FUEL, 2020–2027 (USD MILLION)

11.4.16 EGYPT

11.4.16.1 Egyptian economy to grow as logistic services through ships increase in the country

11.4.17 BY TYPE

TABLE 101 EGYPT: MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

11.4.18 BY FUEL

TABLE 102 EGYPT: MARKET SIZE, BY FUEL, 2020–2027 (USD MILLION)

11.4.19 REST OF MIDDLE EAST & AFRICA

11.4.20 BY TYPE

TABLE 103 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

11.4.21 BY FUEL

TABLE 104 REST OF MIDDLE EAST & AFRICA: MARKET, BY FUEL, 2020–2027 (USD MILLION)

11.5 NORTH AMERICA

11.5.1 BY ENGINE

TABLE 105 NORTH AMERICA: MARKET SIZE, BY ENGINE, 2020–2027 (USD MILLION)

11.5.2 BY TYPE

TABLE 106 NORTH AMERICA: MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

11.5.3 BY POWER RANGE

TABLE 107 NORTH AMERICA: MARKET SIZE, BY POWER RANGE, 2020–2027 (USD MILLION)

TABLE 108 NORTH AMERICA: MARKET SIZE, BY POWER RANGE, 2020–2027 (UNIT)

11.5.4 BY FUEL

TABLE 109 NORTH AMERICA: MARKET SIZE, BY FUEL, 2020–2027 (USD MILLION)

11.5.5 BY VESSEL

TABLE 110 NORTH AMERICA: MARKET SIZE, BY VESSEL, 2020–2027 (USD MILLION)

11.5.6 BY COUNTRY

TABLE 111 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

11.5.7 US

11.5.7.1 US to invest in shipyards across the country and growth in international trade activities to drive marine engines market

11.5.8 BY TYPE

TABLE 112 US: MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

11.5.9 BY FUEL

TABLE 113 US: MARKET SIZE, BY FUEL, 2020–2027 (USD MILLION)

11.5.10 CANADA

11.5.10.1 The Canadian government continues to invest in building offshore vessels and joint vessels

11.5.11 BY TYPE

TABLE 114 CANADA: MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

11.5.12 BY FUEL

TABLE 115 CANADA: MARKET SIZE, BY FUEL, 2020–2027 (USD MILLION)

11.5.13 MEXICO

11.5.13.1 Mexican government investing in infrastructure projects across industries for economic recovery

11.5.14 BY TYPE

TABLE 116 MEXICO: MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

11.5.15 BY FUEL

TABLE 117 MEXICO: MARKET SIZE, BY FUEL, 2020–2027 (USD MILLION)

11.6 SOUTH AMERICA

11.6.1 BY ENGINE

TABLE 118 SOUTH AMERICA: MARKET SIZE, BY ENGINE, 2020–2027 (USD MILLION)

11.6.2 BY TYPE

TABLE 119 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

11.6.3 BY POWER RANGE

TABLE 120 SOUTH AMERICA: MARKET SIZE, BY POWER RANGE, 2020–2027 (USD MILLION)

TABLE 121 SOUTH AMERICA: MARKET SIZE, BY POWER RANGE, 2020–2027 (UNIT)

11.6.4 BY FUEL

TABLE 122 SOUTH AMERICA: MARKET SIZE, BY FUEL, 2020–2027 (USD MILLION)

11.6.5 BY VESSEL

TABLE 123 SOUTH AMERICA: MARKET SIZE, BY VESSEL, 2020–2027 (USD MILLION)

11.6.6 BY COUNTRY

TABLE 124 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

11.6.7 BRAZIL

11.6.7.1 Brazil’s significant offshore oil and gas activity creating demand for offshore vessels

11.6.8 BY TYPE

TABLE 125 BRAZIL: MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

11.6.9 BY FUEL

TABLE 126 BRAZIL: MARKET SIZE, BY FUEL, 2020–2027 (USD MILLION)

11.6.10 ARGENTINA

11.6.10.1 Shipbuilding projects in Argentina being key drivers for marine engines market

11.6.11 BY TYPE

TABLE 127 ARGENTINA: MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

11.6.12 BY FUEL

TABLE 128 ARGENTINA: MARKET SIZE, BY FUEL, 2020–2027 (USD MILLION)

11.6.13 REST OF SOUTH AMERICA

11.6.14 BY TYPE

TABLE 129 REST OF SOUTH AMERICA: MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

11.6.15 BY FUEL

TABLE 130 REST OF SOUTH AMERICA: MARKET SIZE, BY FUEL, 2020–2027 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 172)

TABLE 131 OVERVIEW OF KEY STRATEGIES ADOPTED BY TOP PLAYERS, DECEMBER 2020– FEBRUARY 2022

12.1 MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS

TABLE 132 MARKET: DEGREE OF COMPETITION

FIGURE 49 MARKET SHARE ANALYSIS, 2021

12.2 REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS

FIGURE 50 TOP PLAYERS IN MARKET FROM 2017 TO 2021

12.3 COMPANY EVALUATION QUADRANT

12.3.1 STAR

12.3.2 PERVASIVE

12.3.3 EMERGING LEADER

12.3.4 PARTICIPANT

FIGURE 51 COMPETITIVE LEADERSHIP MAPPING: MARKET, 2021

12.4 MARINE ENGINES MARKET: COMPANY FOOTPRINT

TABLE 133 BY VESSEL TYPE: COMPANY FOOTPRINT

TABLE 134 BY POWER RANGE: COMPANY FOOTPRINT

TABLE 135 BY REGION: COMPANY FOOTPRINT

TABLE 136 COMPANY FOOTPRINT

12.5 COMPETITIVE SCENARIO

TABLE 137 MARKET: PRODUCT LAUNCHES, FEBRUARY 2020– MARCH 2021

TABLE 138 MARKET: DEALS, MAY 2020– JANUARY 2021

TABLE 139 MARKET: OTHERS, DECEMBER 2020– FEBRUARY 2022

13 COMPANY PROFILES (Page No. - 187)

13.1 KEY PLAYERS

(Business overview, Products offered, Recent Developments, MNM view)*

13.1.1 CATERPILLAR

TABLE 140 CATERPILLAR: COMPANY OVERVIEW

FIGURE 52 CATERPILLAR: COMPANY SNAPSHOT (2020)

TABLE 141 CATERPILLAR: PRODUCTS OFFERED

TABLE 142 CATERPILLAR: PRODUCT LAUNCHES

TABLE 143 CATERPILLAR: DEALS

TABLE 144 CATERPILLAR: OTHERS

13.1.2 VOLKSWAGEN GROUP (MAN ENERGY SOLUTIONS)

TABLE 145 VOLKSWAGEN GROUP (MAN ENERGY SOLUTIONS): COMPANY OVERVIEW

FIGURE 53 VOLKSWAGEN GROUP (MAN ENERGY SOLUTIONS): COMPANY SNAPSHOT (2020)

TABLE 146 VOLKSWAGEN GROUP (MAN ENERGY SOLUTIONS): PRODUCTS OFFERED

TABLE 147 VOLKSWAGEN GROUP (MAN ENERGY SOLUTIONS): PRODUCT LAUNCHES

TABLE 148 VOLKSWAGEN GROUP (MAN ENERGY SOLUTIONS): DEALS

TABLE 149 VOLKSWAGEN GROUP (MAN ENERGY SOLUTIONS): OTHERS

13.1.3 VOLVO PENTA

TABLE 150 VOLVO PENTA: COMPANY OVERVIEW

FIGURE 54 VOLVO PENTA: COMPANY SNAPSHOT (2021)

TABLE 151 VOLVO PENTA: PRODUCTS OFFERED

TABLE 152 VOLVO PENTA: PRODUCT LAUNCHES

TABLE 153 VOLVO PENTA: DEALS

TABLE 154 VOLVO PENTA: OTHERS

13.1.4 HYUNDAI HEAVY INDUSTRIES CO., LTD.

TABLE 155 HYUNDAI HEAVY INDUSTRIES CO., LTD: COMPANY OVERVIEW

FIGURE 55 HYUNDAI HEAVY INDUSTRIES CO., LTD: COMPANY SNAPSHOT (2020)

TABLE 156 HYUNDAI HEAVY INDUSTRIES CO., LTD: PRODUCTS OFFERED

TABLE 157 HYUNDAI HEAVY INDUSTRIES CO., LTD: DEALS

13.1.5 ROLLS-ROYCE HOLDINGS

TABLE 158 ROLLS-ROYCE HOLDINGS: COMPANY OVERVIEW

FIGURE 56 ROLLS-ROYCE HOLDINGS: COMPANY SNAPSHOT (2020)

TABLE 159 ROLLS-ROYCE HOLDINGS: PRODUCTS OFFERED

TABLE 160 ROLLS-ROYCE HOLDINGS: DEALS

TABLE 161 ROLLS ROYCE HOLDINGS: OTHERS

13.1.6 WÄRTSILÄ

TABLE 162 WÄRTSILÄ: COMPANY OVERVIEW

FIGURE 57 WÄRTSILÄ: COMPANY SNAPSHOT (2021)

TABLE 163 WÄRTSILÄ: PRODUCTS OFFERED

TABLE 164 WÄRTSILÄ: PRODUCT LAUNCHES

TABLE 165 WÄRTSILÄ: DEALS

TABLE 166 WÄRTSILÄ: OTHERS

13.1.7 MITSUBISHI HEAVY INDUSTRIES, LTD.

TABLE 167 MITSUBISHI HEAVY INDUSTRIES, LTD.: COMPANY OVERVIEW

FIGURE 58 MITSUBISHI HEAVY INDUSTRIES, LTD.: COMPANY SNAPSHOT (2020)

TABLE 168 MITSUBISHI HEAVY INDUSTRIES, LTD.: PRODUCTS OFFERED

TABLE 169 MITSUBISHI HEAVY INDUSTRIES, LTD.: DEALS

TABLE 170 MITSUBISHI HEAVY INDUSTRIES, LTD.: OTHERS

13.1.8 CUMMINS

TABLE 171 CUMMINS: COMPANY OVERVIEW

FIGURE 59 CUMMINS: COMPANY SNAPSHOT (2021)

TABLE 172 CUMMINS: PRODUCTS OFFERED

TABLE 173 CUMMINS: PRODUCT LAUNCHES

TABLE 174 CUMMINS: DEALS

13.1.9 DAIHATSU DIESEL MFG. CO., LTD.

TABLE 175 DAIHATSU DIESEL MFG., CO. LTD.: COMPANY OVERVIEW

FIGURE 60 DAIHATSU DIESEL MFG. CO. LTD: COMPANY SNAPSHOT (2021)

TABLE 176 DAIHATSU DIESEL MFG. CO., LTD.: PRODUCTS OFFERED

TABLE 177 DAIHATSU DIESEL MFG. CO., LTD.: OTHERS

13.1.10 DEUTZ AG

TABLE 178 DEUTZ AG: COMPANY OVERVIEW

FIGURE 61 DEUTZ AG: COMPANY SNAPSHOT (2020)

TABLE 179 DEUTZ AG: PRODUCTS OFFERED

TABLE 180 DEUTZ AG: OTHERS

13.1.11 WINGD

TABLE 181 WINGD: COMPANY OVERVIEW

TABLE 182 WINGD: PRODUCTS OFFERED

TABLE 183 WINGD: PRODUCT LAUNCHES

TABLE 184 WINGD: DEALS

TABLE 185 WINGD: OTHERS

13.1.12 SIEMENS ENERGY

TABLE 186 SIEMENS ENERGY: COMPANY OVERVIEW

FIGURE 62 SIEMENS ENERGY: COMPANY SNAPSHOT (2021)

TABLE 187 SIEMENS ENERGY: PRODUCTS OFFERED

TABLE 188 SIEMENS ENERGY: OTHERS

13.1.13 FAIRBANKS MORSE

TABLE 189 FAIRBANKS MORSE: COMPANY OVERVIEW

TABLE 190 FAIRBANKS MORSE: PRODUCTS OFFERED

TABLE 191 FAIRBANKS MORSE: DEALS

13.1.14 WABTEC (GE TRANSPORTATION)

TABLE 192 WABTEC (GE TRANSPORTATION).: COMPANY OVERVIEW

FIGURE 63 WABTEC (GE TRANSPORTATION): COMPANY SNAPSHOT (2020)

TABLE 193 WABTEC (GE TRANSPORTATION): PRODUCTS OFFERED

TABLE 194 WABTEC (GE TRANSPORTATION): DEALS

TABLE 195 WABTEC (GE TRANSPORTATION): OTHERS

13.1.15 YANMAR

TABLE 196 YANMAR: COMPANY OVERVIEW

FIGURE 64 YANMAR: COMPANY SNAPSHOT (2020)

TABLE 197 YANMAR: PRODUCTS OFFERED

TABLE 198 YANMAR: PRODUCT LAUNCHES

TABLE 199 YANMAR: DEALS

*Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

13.2 OTHER PLAYERS

13.2.1 ISOTTA FRASCHINI MOTORI

13.2.2 CNPC JICHAI POWER COMPANY LIMITED

13.2.3 BERGEN ENGINES

13.2.4 DOOSAN INFRACORE

13.2.5 MAHINDRA POWEROL

13.2.6 IHI POWER SYSTEMS

14 APPENDIX (Page No. - 257)

14.1 INSIGHTS FROM INDUSTRY EXPERTS

14.2 DISCUSSION GUIDE

14.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.4 AVAILABLE CUSTOMIZATIONS

14.5 RELATED REPORTS

14.6 AUTHOR DETAILS

This study involved four major activities in estimating the current size of the marine engines market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and market sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were used to estimate the total market size. After that, the market breakdown and data triangulation were done to estimate the market size of the segments and sub-segments.

Secondary Research

The research study on the marine engines market involved the extensive use of secondary sources, directories, and databases, such as Hoovers, Bloomberg, Businessweek, Factiva, International Energy Agency, International Maritime Organization, United Nations Conference on Trade and Development, The Shipbuilders’ Association of Japan, US Environmental Protection Agency, and BP Statistical Review of World Energy, to identify and collect information useful for this technical, market-oriented, and commercial study. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

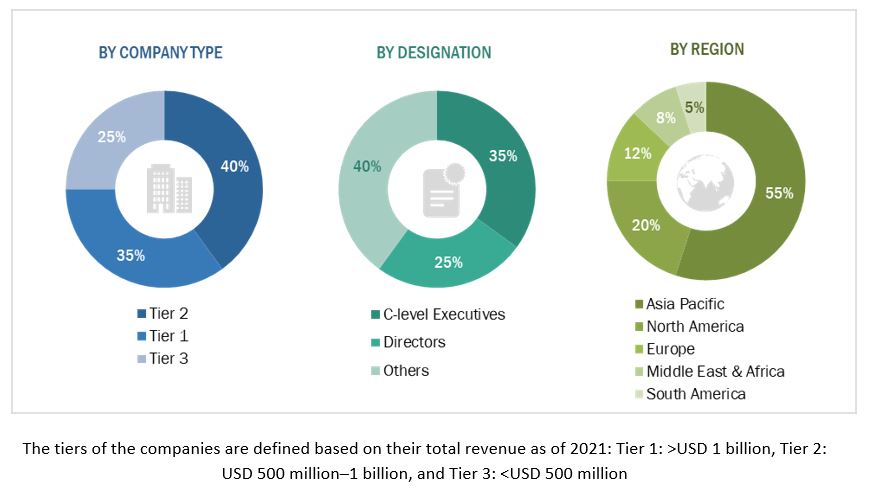

Primary Research

Primary sources included several industry experts from core and related industries, preferred suppliers, manufacturers, distributors, service providers, standard and certification agencies of companies, and organizations related to all the segments of this industry’s value chain. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents is given below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the global marine engines market and its dependent submarkets. These methods were also used extensively to estimate the size of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market share in the respective regions have been determined through both primary and secondary research.

- The industry’s value chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Marine Engines Market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained below, the total market has been split into several segments and subsegments. The data triangulation and market breakdown procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated using both top-down and bottom-up approaches.

Report Objectives

- To define, describe, segment, and forecast the marine engines market by engine, power range, type, fuel, vessel, and region based on market size and volume

- To forecast the market size for five key regions: North America, South America, Europe, Asia Pacific, and the Middle East & Africa, along with their key countries

- To provide detailed information about the key factors such as drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze the subsegments with respect to individual growth trends, prospects, and contributions of each segment to the overall market size

- To analyze market opportunities for stakeholders and details of the competitive landscape for market leaders

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

- To analyze competitive developments, such as sales contracts, agreements, investments, expansions, new product launches, alliances, mergers, partnerships, joint ventures, collaborations, and acquisitions, in the marine engines market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the client’s specific needs. The following customization options are available for this report:

Geographic Analysis

- Further breakdown of region or country-specific analysis

Company Information

- Detailed analyses and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Marine Engines Market