Marine VFD Market by Type (AC Drive, DC Drive), Voltage (Low Voltage, Medium Voltage), Application (Pump, Fan, Compressor, Propeller (With Shaft Generator, Without Shaft Generator), Crane & Hoist), and Region - Global Forecast to 2026

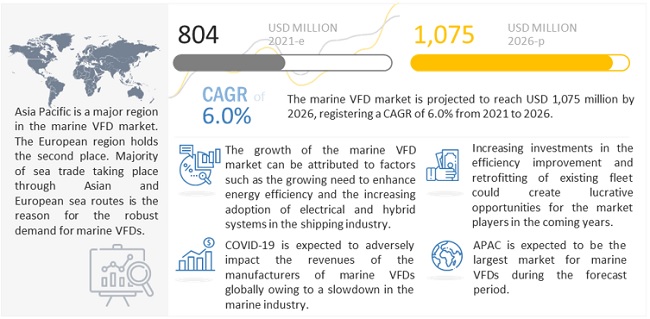

[225 Pages Report] The Global marine VFD market is expected to grow from an estimated USD 804 million in 2021 to USD 1,075 million by 2026, at a CAGR of 6.0% during the forecast period. Marine VFD are increasingly being installed and is showing robust growth.

To know about the assumptions considered for the study, Request for Free Sample Report

Impact of COVID-19 on marine VFD market

COVID-19 has slowed the growth of the marine VFD market, as countries were forced to implement lockdowns during the first half of 2020. Strict guidelines were issued by governments and local authorities, and all non-essential operations were halted. This adversely affected the marine VFD market owing to less focus on development of shipbuilding industry.

In addition, production and supply chain delays were also witnessed during the second quarter which poised a challenge to the marine VFD market.

Marine VFD Market Dynamics

Driver: Rising need for energy efficient systems in ships

There has been a constant development of technologies across all industries to achieve greater efficiency. Energy efficiency is a major concern for every industry. According to IEA, the international shipping industry accounted for 2% of the global energy-related CO2 emission in 2019. To accomplish the International Maritime Organization’s aim of carbon neutrality in the second half of the century, ambitious and tangible strategies are required. The priority is to reduce carbon intensity in the short term, for example through energy-efficient measures and slow steaming. The Energy Efficiency Design Index (EEDI) and the Ship Energy Efficiency Management Plan (SEEMP) are the two rules now in place to encourage increased shipping efficiency. The IMO enforces both, with the EEDI focusing on energy efficiency criteria for new ships and the SEEMP on ship operational efficiency. From 2015 to 2025, the EEDI demands an annual efficiency increase of roughly 1.5% for the new global fleet. With all these regulations in place and growing concern over CO2 emissions, energy-efficient systems are gaining more momentum. The use of VFDs can reduce the energy consumption of systems by as much as 60%.

Restraints: Increased maintenance cost of systems after VFD implementation

The typical cost of adding a VFD to a commonly applicable system is USD 200 to USD 500 per horsepower. The cost of adding VFD to all systems is much higher than other energy-saving methods The cost of VFD, in the long run, can prove to be economical but at the time of installation, the cost is quite high in comparison to other traditional methods. The companies may refrain from putting a huge amount of money initially required to install VFD systems. Because various drive types have different system components, the foundation, and wiring, and the cooling costs can also be different, adding to the overall installation cost. For the installation of VFDs, skilled technicians are required, which adds to the cost of installation. Another consideration is the cost of the replacement of parts five or 10 years after the system is installed. With the rapid technological changes in solid-state electronics, controllers are being retired approximately four to five years after their introduction. Also, the average lifespan of a VFD drive is seven to 10 years, which further depends on the application and external conditions.

Opportunities: Implementation of remote monitoring in VFDs creates new opportunities to increase efficiency of systems

Drives can be subject to several harmful external effects, including environmental damage, impaired power quality, and application abuse. This will result in a shutdown and may result in loss to the end user. To keep an eye on these external conditions and minimize downtime, enterprises are looking for solutions that integrate remote monitoring. The remote monitoring of marine VFDs plays an important role in determining the deterioration status of VFDs. In addition, end users can remotely troubleshoot minor failures of marine VFDs, reducing unplanned downtime and improving efficiency. By continuously collecting data and pushing it into the cloud, the performance of the drive can be view and analyzed. A standard dashboard and pre-configured trend graphs and reports are available that display the real-time historical performance of the drive. Thus, the potential problems can be predicted more accurately, saving a considerable amount of money.

Challenges: Low quality products related to VFD is hampering marine VFD market

The organized sector mainly targets industrial buyers and maintains higher product quality by following various industrial standards for VFDs, while the unorganized sector offers a cheaper alternative to entering the low-priced and local untapped markets. Local manufacturers in most countries target the unorganized sector and compete strongly with global suppliers in the respective markets. Leading market players are currently facing strong competition from such unorganized new players in the market, supplying cheap and low-quality products. The unorganized players are not bound to maintain certain quality thus offer comparatively lower prices, which attracts several small buyers.

To know about the assumptions considered for the study, download the pdf brochure

By type, the AC drive segment is the largest contributor in the marine VFD market in 2020.

The AC drive segment accounted for the largest share of the marine VFD market, by type, in 2020. The AC drive segment is projected to account for a larger market share, driven by the increasing demand for energy-efficient solutions. An AC drive is used to control the speed of an electric motor by changing the frequency and voltage of electric supply to the motor.

By voltage, the low voltage segment is the largest contributor in the marine VFD market in 2020.

The pump voltage segment accounted for the largest share of the marine VFD market, by voltage, in 2020. Majority of projects are undertaken in this segment. The low voltage segment accounted for a larger share, owing to the increased use of low-voltage motors in the marine industry across applications such as cranes, pumps, fans, and hoists. The increasing use of variable drives to improve the efficiency of various small components across a system equipped with motors to improve the efficiency of such systems has boosted the market for low-voltage drives. However, the medium voltage segment is expected to grow at a higher rate during the forecast period, as medium-voltage VFDs help in higher energy savings compared with low-voltage VFDs. The use of medium-voltage drives is gaining importance for larger applications as propulsion systems, shaft generators, etc.

By application, the pump segment is the largest contributor in the marine VFD market in 2020.

The pump segment accounted for the largest share of the marine VFD market, by application, in 2020. The pump is the component which is extensively used for various purposes onboard a ship and is critical for proper functioning of any ship. Vessels consist of different types of fluids that move within different machines and systems. These fluids are used for cooling, heating, and lubrication, and as fuels. Various types of pumps, which can be driven independently by a ship's power supply or attached to the machine itself, are used to circulate these liquids. Broadly, two types of pumps are used in ships: positive displacement pumps and dynamic pressure pumps. The type of pump is chosen according to the type and characteristics of the fluid to be pumped or circulated. A 10% reduction in pump speed can translate into energy savings of 27%. Thus, the scope of energy savings is more in the pump application

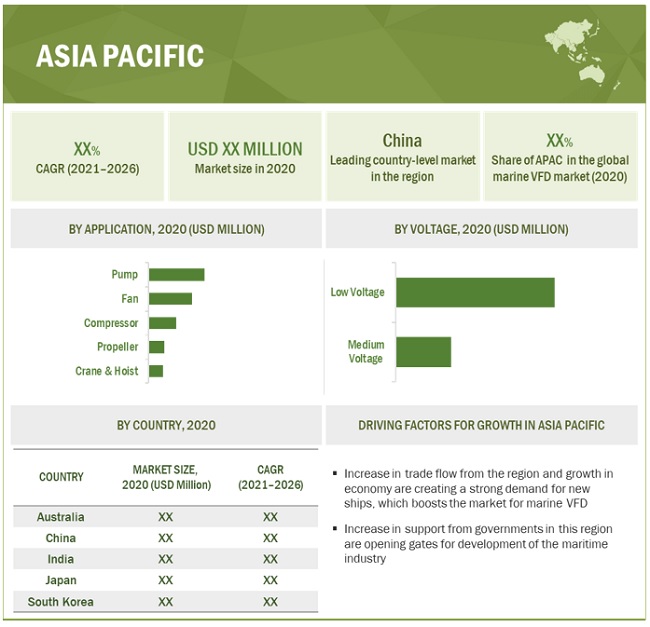

Asia Pacific has strong demand for marine VFD which is further growing due to increasing maritime trade and growth of shipbuilding industry

Asia Pacific accounted for the largest share of the marine VFD market amongst all regions in 2020. The region has been segmented by country into China, India, Japan, South Korea, Australia, and Rest of Asia Pacific. The continuous significance of Asia as a manufacturing hub has boosted the intra-Asian container trade boom, with South-East Asia playing an increasingly important role. In 2019, according to the United Nations Conference on Trade and Development (UNCTAD), intraregional commerce, primarily intra-Asian flows, and South-South trade together accounted for about 40% of the overall containerized trade. According to data published by UNCTAD, about half of the countries in the top 20 ship-owning countries—classified by carrying capacity in deadweight tonnes—were in Asia as of January 1, 2020.

The leading players in the marine VFD market include Siemens (Germany), Danfoss (Denmark), General Electric (US), ABB (Switzerland), Rockwell Automation (US).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market Size available for years |

2016–2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021–2026 |

|

Forecast units |

Value (USD) |

|

Segments covered |

By Type, Voltage, and Application |

|

Geographies covered |

Asia Pacific, North America, Middle East & Africa, South America, and Europe |

|

Companies covered |

General Electric (US), Danfoss (Denmark), Siemens (Germany), Rockwell Automation (US), ABB (Switzerland), C G Power And Industrial Solutions (India), Mitsubishi Electric (Japan), WEG (Brazil), Yaskawa (Japan), Parker Hannifin (US), Invertek Drives (UK), Bosch (Germany), Schneider Electric (France), NIDEC (Japan), Honeywell (US), Johnson Controls (Ireland), TMEIC (Japan), Hitachi Industrial Equipment System Co. (Japan), Ingeteam (Spain), Emerson (US), Fuji Electric (Japan) |

This research report categorizes the marine VFD market based by type, voltage, and application.

Based on type, the marine VFD market has been segmented as follows:

- AC Drive

- DC Drive

Based on Voltage, the marine VFD market has been segmented as follows:

- Low Voltage

- Medium Voltage

Based on Application, the marine VFD market has been segmented as follows:

- Pump

- Fan

- Compressor

- Propeller

- With Shaft Generator

- Without Shaft Generator

- Crane & Hoist

Based on the region, the marine VFD market has been segmented as follows:

- North America

- Asia Pacific

- Europe

- South America

- Middle East & Africa

Recent Developments

- In April 2021, ABB secured a contract from the Spanish shipbuilder Astilleros Gondán to supply an all-electric power solution for a fleet of fast 40 m urban passenger ferries operating on Lisbon’s Tagus River.

- In December 2020, Cochin Shipyard selected Siemens to implement advanced marine solutions for India’s first fleet of 23 boats equipped with electric propulsion and battery integrated technology.

- In August 2020, the first of six Arctic and Offshore Patrol Ships (AOPS) – HMCS Harry DeWolf – were delivered to the Royal Canadian Navy (RCN). GE’s Power Conversion business was the designer and provider of the high-voltage electric power system (HV) and electric propulsion drivetrains, with specialist capability for operations in multi-year ice, for the Arctic Offshore Patrol Ship (AOPS) Harry DeWolf class vessels.

- In January 2019, Danfoss Editron partnered with Kongsberg Evotec, a part of the Kongsberg Maritime International Technology Group, to develop a fully electric-powered marine winch. Marine winches are components on vessels used in offshore industries such as fishing, research, and seismic.

Frequently Asked Questions (FAQ):

What is the current size of the marine VFD market?

The current market size of global Marine VFD market is estimated to be USD 804 million in 2021.

What are the major drivers for marine VFD market?

There has been a noticeable demand for energy efficient systems in the shipping industry due to factors such as the need to reduce carbon emissions, reduce wastage of energy, etc. Various government policies are in place to support the initiative towards more energy efficient shipping. Many multinational shipping companies are taking initiatives to cut down their carbon footprint to contribute to a greener planet and sustainability. Also, commercial shipping companies as well as naval forces across the world are adopting electric and hybrid engines onboard ships. For instance, GE signed a contract in 2019 to provide a full spectrum of gas turbine and electric drive propulsion solutions, including mechanical drive, hybrid electric drive (HED), and integrated full electric propulsion (IFEP), to ROK Navy.

Which is the fastest-growing region during the forecasted period in marine VFD market?

Asia Pacific is the fastest-growing region during the forecasted period. The increasing trade through sea routes and robust growth of ship building industry in countries like China, Japan, South is driving the market for marine VFD in Asia Pacific. In 2019, according to the United Nations Conference on Trade and Development (UNCTAD), intraregional commerce, primarily intra-Asian flows, and South-South trade together accounted for about 40% of the overall containerized trade. According to data published by UNCTAD, about half of the countries in the top 20 ship-owning countries—classified by carrying capacity in deadweight tonnes—were in Asia as of January 1, 2020.

Which is the fastest-growing segment, by application during the forecasted period in marine VFD market?

Pump is to be the fastest-growing segment by component. The pump is the component which is extensively used for various purposes onboard a ship and is critical for proper functioning of any ship. A 10% reduction in pump speed can translate into energy savings of 27%. Thus, the scope of energy savings is more in the pump application. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 33)

1.1 OBJECTIVES OF THE STUDY

1.2 DEFINITION

1.3 INCLUSIONS AND EXCLUSIONS

1.3.1 MARINE VFD MARKET, BY VOLTAGE: INCLUSIONS AND EXCLUSIONS

1.3.2 MARKET, BY TYPE: INCLUSIONS AND EXCLUSIONS

1.3.3 MARKET, BY APPLICATION: INCLUSIONS AND EXCLUSIONS

1.4 MARKET SCOPE

1.4.1 MARKET SEGMENTATION

1.4.2 REGIONAL SCOPE

1.5 YEARS CONSIDERED FOR THE STUDY

1.6 CURRENCY

1.7 LIMITATIONS

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 38)

2.1 RESEARCH DATA

FIGURE 1 MARKET: RESEARCH DESIGN

2.2 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 2 DATA TRIANGULATION METHODOLOGY

2.2.1 SECONDARY DATA

2.2.1.1 Key data from secondary sources

2.2.2 PRIMARY DATA

2.2.2.1 Key data from primary sources

2.2.2.2 Breakdown of primaries

FIGURE 3 BREAKDOWN OF PRIMARIES

2.3 IMPACT OF COVID-19

2.4 MARKET SIZE ESTIMATION

2.4.1 BOTTOM-UP APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.4.2 TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.4.3 DEMAND-SIDE ANALYSIS

FIGURE 6 MAIN METRICS CONSIDERED WHILE ANALYZING AND ASSESSING DEMAND FOR MARINE VFD

2.4.3.1 Demand-side calculation

2.4.3.2 Assumptions for demand-side analysis

2.4.4 SUPPLY-SIDE ANALYSIS

FIGURE 7 MARKET SIZE ESTIMATION THROUGH SUPPLY–SIDE ANALYSIS

FIGURE 8 MARKET: SUPPLY-SIDE ANALYSIS

2.4.4.1 Supply-side calculation

2.4.4.2 Assumptions for supply side

2.4.5 FORECAST

3 EXECUTIVE SUMMARY (Page No. - 47)

TABLE 1 SNAPSHOT OF MARKET

FIGURE 9 ASIA PACIFIC DOMINATED MARKET IN 2018

FIGURE 10 AC DRIVE SEGMENT IS EXPECTED TO LEAD MARKET DURING FORECAST PERIOD

FIGURE 11 LOW VOLTAGE SEGMENT IS EXPECTED TO LEAD MARKET DURING FORECAST PERIOD

FIGURE 12 PUMP SEGMENT IS EXPECTED TO LEAD MARKET DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 50)

4.1 ATTRACTIVE OPPORTUNITIES IN MARKET DURING FORECAST PERIOD

FIGURE 13 RISING NEED FOR ENERGY EFFICIENCY IS EXPECTED TO DRIVE MARKET

4.2 MARKET, BY REGION

FIGURE 14 ASIA PACIFIC MARKET IS EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4.3 ASIA PACIFIC MARKET, BY APPLICATION AND COUNTRY

FIGURE 15 PUMP SEGMENT AND CHINA DOMINATED ASIA PACIFIC MARKET IN 2020

4.4 MARKET, BY TYPE

FIGURE 16 AC DRIVE SEGMENT IS EXPECTED TO DOMINATE MARKET DURING FORECAST PERIOD

4.5 MARKET, BY VOLTAGE

FIGURE 17 LOW VOLTAGE SEGMENT IS EXPECTED TO DOMINATE MARKET DURING FORECAST PERIOD

4.6 MARKET, BY APPLICATION

FIGURE 18 PUMP APPLICATION IS EXPECTED TO DOMINATE MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 53)

5.1 INTRODUCTION

5.2 COVID-19 HEALTH ASSESSMENT

FIGURE 19 COVID-19 GLOBAL PROPAGATION

FIGURE 20 COVID-19 PROPAGATION IN SELECTED COUNTRIES

5.3 GLOBAL ROAD TO RECOVERY FROM COVID-19

FIGURE 21 GLOBAL RECOVERY ROAD FROM COVID-19 FROM 2020 TO 2021

5.4 COVID-19 ECONOMIC ASSESSMENT

FIGURE 22 REVISED GDP FORECASTS FOR SELECT G20 COUNTRIES IN 2020

5.5 MARKET DYNAMICS

FIGURE 23 MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.5.1 DRIVERS

5.5.1.1 Rising need for energy-efficient systems in ships

TABLE 2 ENERGY SAVINGS USING VFD 2021

5.5.1.2 Growing shipbuilding industry due to global increase in maritime activities

FIGURE 24 GLOBAL MARITIME TRADE, 2015–2019 (MILLION TONS LOADED)

5.5.2 RESTRAINTS

5.5.2.1 Increased maintenance cost of systems after implementation of VFD

5.5.2.2 Applications with high range of frequency fluctuations

5.5.3 OPPORTUNITIES

5.5.3.1 Implementation of remote monitoring in VFDs creates new opportunities to increase efficiency of systems

5.5.3.2 Surging demand for integration of IoT with marine VFDs

5.5.3.3 Adoption of hybrid and electric propulsion to provide new opportunities for market

FIGURE 25 WORLD FLEET REGISTERED TRADING VESSELS OF 100 GROSS TONS AND OVER (DEADWEIGHT TONNAGE)

5.5.4 CHALLENGES

5.5.4.1 Low-quality products related to VFD is hampering market

5.5.4.2 Negative impact of COVID-19 on maritime industry

FIGURE 26 GLOBAL MARITIME TRADE GROWTH (%), 2016–2020

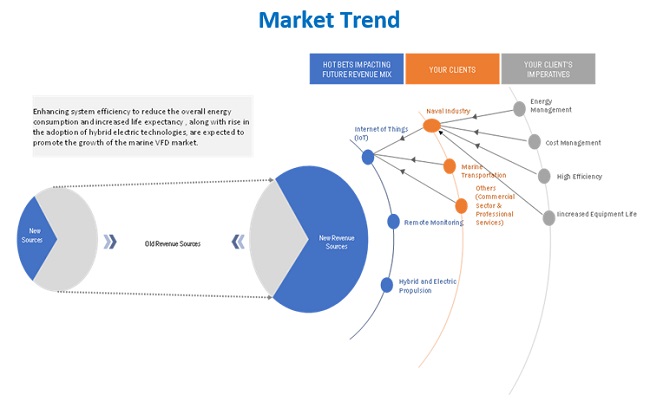

5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

5.6.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR MARINE VFD PROVIDERS

FIGURE 27 REVENUE SHIFT FOR MARKET

5.7 PRICING ANALYSIS

TABLE 3 GLOBAL AVERAGE SELLING PRICE OF MARINE VFD, 2020

5.8 MARKET MAP

TABLE 4 MARKET: ECOSYSTEM

FIGURE 28 MARKET MAP/ECOSYSTEM

5.9 VALUE CHAIN ANALYSIS

FIGURE 29 MARKET VALUE CHAIN ANALYSIS

5.9.1 RAW MATERIAL/COMPONENT PROVIDERS

5.9.2 MARINE VFD MANUFACTURERS

5.9.3 DISTRIBUTORS AND AFTER-SALES SERVICES

5.9.4 END USERS

5.10 TECHNOLOGY ANALYSIS

5.10.1 MARKET BASED ON DIFFERENT TECHNOLOGIES

5.11 MARKET: CODES AND REGULATIONS

TABLE 5 MARKET: CODES AND REGULATIONS

5.12 INNOVATIONS AND PATENT REGISTRATIONS

TABLE 6 MARKET: INNOVATIONS AND PATENT REGISTRATIONS, AUGUST 2014–MAY 2021

5.13 CASE STUDY ANALYSIS

5.13.1 VIKING LINE TAKES TENSION OUT OF HARBOR MOORING FOR M/S GABRIELLA

5.13.1.1 Problem statement

5.13.1.2 Solution

5.13.2 MS CINDERELLA SAVES MORE THAN 1000 TPA MARINE DIESEL WITH NEW VENTILATION CONTROL

5.13.2.1 Problem statement

5.13.2.2 Solution

5.13.3 COMMERCIAL BARGES STAYS AFLOAT WITH HELP OF VFD CONTROL PUMPS

5.13.3.1 Problem statement

5.13.3.2 Solution

5.14 PORTER’S FIVE FORCES ANALYSIS

TABLE 7 MARKET: PORTER’S FIVE FORCES ANALYSIS

FIGURE 30 PORTER’S FIVE FORCES ANALYSIS FOR MARKET

5.14.1 THREAT OF SUBSTITUTES

5.14.2 BARGAINING POWER OF SUPPLIERS

5.14.3 BARGAINING POWER OF BUYERS

5.14.4 THREAT OF NEW ENTRANTS

5.14.5 INTENSITY OF COMPETITIVE RIVALRY

6 MARINE VFD MARKET, BY TYPE (Page No. - 73)

6.1 INTRODUCTION

FIGURE 31 AC DRIVE SEGMENT ACCOUNTED FOR A LARGER MARKET SHARE IN 2020

TABLE 8 MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 9 MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

6.2 AC DRIVE

6.2.1 RISING NEED FOR MORE ENERGY-EFFICIENT SYSTEMS AND ENERGY SAVINGS IS LIKELY TO BOOST DEMAND FOR AC VFDS

TABLE 10 MARKET FOR AC DRIVE, BY REGION, 2016–2019 (USD MILLION)

TABLE 11 MARKET FOR AC DRIVE, BY REGION, 2020–2026 (USD MILLION)

6.3 DC DRIVE

6.3.1 BETTER SPEED REGULATION AND RISING USE OF BATTERIES IN ELECTRICAL SYSTEMS ARE LIKELY TO DRIVE DC DRIVE SEGMENT

TABLE 12 MARKET FOR DC DRIVE, BY REGION, 2016–2019 (USD MILLION)

TABLE 13 MARKET FOR DC DRIVE, BY REGION, 2020–2026 (USD MILLION)

7 MARINE VFD MARKET, BY VOLTAGE (Page No. - 77)

7.1 INTRODUCTION

FIGURE 32 LOW VOLTAGE SEGMENT ACCOUNTED FOR LARGER MARKET SHARE IN 2020

TABLE 14 MARKET SIZE, BY VOLTAGE, 2016–2019 (USD MILLION)

TABLE 15 MARKET SIZE, BY VOLTAGE, 2020–2026 (USD MILLION)

7.2 LOW VOLTAGE (UP TO 1000 V)

7.2.1 INCREASING AUTOMATION AND GROWING DEMAND FOR MORE EFFICIENT SYSTEMS ARE LIKELY TO DRIVE LOW VOLTAGE SEGMENT

TABLE 16 LOW-VOLTAGE MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 17 LOW-VOLTAGE MARKET, BY REGION, 2020–2026 (USD MILLION)

7.3 MEDIUM VOLTAGE (ABOVE 1000 V)

7.3.1 INCREASING ADOPTION OF HYBRID ENGINES AND UPGRADE OF ELECTRICAL INFRASTRUCTURE ARE LIKELY TO DRIVE MEDIUM VOLTAGE SEGMENT

TABLE 18 MEDIUM-VOLTAGE MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 19 MEDIUM-VOLTAGE MARKET, BY REGION, 2020–2026 (USD MILLION)

8 MARINE VFD MARKET, BY APPLICATION (Page No. - 82)

8.1 INTRODUCTION

FIGURE 33 PUMP SEGMENT LED MARKET, BY APPLICATION, IN 2020

TABLE 20 MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 21 MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

8.2 PUMP

8.2.1 SHIFT TOWARD MORE ENERGY-EFFICIENT SHIPS IS LIKELY TO DRIVE MARKET FOR PUMP SEGMENT

TABLE 22 MARKET FOR PUMP, BY REGION, 2016–2019 (USD MILLION)

TABLE 23 MARKET FOR PUMP, BY REGION, 2020–2026 (USD MILLION)

8.3 FAN

8.3.1 MORE EFFICIENT VENTILATION AND COOLING WOULD DRIVE MARKET FOR FAN

TABLE 24 MARKET FOR FAN, BY REGION, 2016–2019 (USD MILLION)

TABLE 25 MARKET FOR FAN, BY REGION, 2020–2026 (USD MILLION)

8.4 COMPRESSOR

8.4.1 GROWING SHIPBUILDING INDUSTRY IS EXPECTED TO FUEL DEMAND FOR COMPRESSORS

TABLE 26 MARKET FOR COMPRESSOR, BY REGION, 2016–2019 (USD MILLION)

TABLE 27 MARKET FOR COMPRESSOR, BY REGION, 2020–2026 (USD MILLION)

8.5 PROPELLER

8.5.1 ADOPTION OF ELECTRIC PROPULSION SYSTEM IS LIKELY TO DRIVE VFD MARKET IN PROPELLER SEGMENT

TABLE 28 MARKET FOR PROPELLER, BY REGION, 2016–2019 (USD MILLION)

TABLE 29 MARKET FOR PROPELLER, BY REGION, 2020–2026 (USD MILLION)

TABLE 30 MARKET FOR PROPELLER WITH SHAFT GENERATOR, BY REGION, 2019–2026 (USD MILLION)

TABLE 31 MARKET FOR PROPELLER WITHOUT SHAFT GENERATOR, BY REGION, 2019–2026 (USD MILLION)

8.6 CRANE & HOIST

8.6.1 INCREASE IN EFFICIENCY AND REDUCED MAINTENANCE COSTS ARE LIKELY TO DRIVE MARKET FOR CRANE & HOIST SEGMENT

TABLE 32 MARKET FOR CRANE & HOIST, BY REGION, 2016–2019 (USD MILLION)

TABLE 33 MARKET FOR CRANE & HOIST, BY REGION, 2020–2026 (USD MILLION)

9 GEOGRAPHIC ANALYSIS (Page No. - 90)

9.1 INTRODUCTION

FIGURE 34 REGIONAL SNAPSHOT: MARKET IN ASIA PACIFIC IS EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 35 MARKET SHARE, IN TERMS OF VALUE, BY REGION, 2020

TABLE 34 MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 35 GLOBAL MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 36 NORTH AMERICA: SNAPSHOT OF MARKET

9.2.1 BY TYPE

TABLE 36 NORTH AMERICA: MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 37 NORTH AMERICA: MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

9.2.2 BY VOLTAGE

TABLE 38 NORTH AMERICA: MARKET SIZE, BY VOLTAGE, 2016–2019 (USD MILLION)

TABLE 39 NORTH AMERICA: MARKET SIZE, BY VOLTAGE, 2020–2026 (USD MILLION)

9.2.3 BY APPLICATION

TABLE 40 NORTH AMERICA: MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 41 NORTH AMERICA: MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 42 NORTH AMERICA: MARKET, BY PROPELLER TYPE, 2019–2026 (USD MILLION)

9.2.4 BY COUNTRY

TABLE 43 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 44 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

9.2.5 US

9.2.5.1 Growing shipbuilding industry and increasing demand from naval forces are expected to drive marine VFD market in US

TABLE 45 US: MARKET SIZE, BY VOLTAGE, 2016–2019 (USD MILLION)

TABLE 46 US: MARKET SIZE, BY VOLTAGE, 2020–2026 (USD MILLION)

TABLE 47 US: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 48 US: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 49 US: MARKET, BY PROPELLER TYPE, 2019–2026 (USD MILLION)

9.2.6 CANADA

9.2.6.1 Rise in demand for recreational marine activities and government policies to boost shipping industry would drive market

TABLE 50 CANADA: MARKET SIZE, BY VOLTAGE, 2016–2019 (USD MILLION)

TABLE 51 CANADA: MARKET SIZE, BY VOLTAGE, 2020–2026 (USD MILLION)

TABLE 52 CANADA: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 53 CANADA: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 54 CANADA: MARKET, BY PROPELLER TYPE, 2019–2026 (USD MILLION)

9.2.7 MEXICO

9.2.7.1 Development of oil fields and governmental plans for infrastructural development are likely to boost Mexico’s shipping industry

TABLE 55 MEXICO: MARKET SIZE, BY VOLTAGE, 2016–2019 (USD MILLION)

TABLE 56 MEXICO: MARKET SIZE, BY VOLTAGE, 2020–2026 (USD MILLION)

TABLE 57 MEXICO: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 58 MEXICO: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 59 MEXICO: MARKET, BY PROPELLER TYPE, 2019–2026 (USD MILLION)

9.3 ASIA PACIFIC

FIGURE 37 ASIA PACIFIC: SNAPSHOT OF MARKET

9.3.1 BY TYPE

TABLE 60 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 61 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

9.3.2 BY VOLTAGE

TABLE 62 ASIA PACIFIC: MARKET SIZE, BY VOLTAGE, 2016–2019 (USD MILLION)

TABLE 63 ASIA PACIFIC: MARKET SIZE, BY VOLTAGE, 2020–2026 (USD MILLION)

9.3.3 BY APPLICATION

TABLE 64 ASIA PACIFIC: MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 65 ASIA PACIFIC: MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 66 ASIA PACIFIC: MARKET, BY PROPELLER, 2019–2026 (USD MILLION)

9.3.4 BY COUNTRY

TABLE 67 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 68 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

9.3.4.1 China

9.3.4.1.1 Increasing trade flow and robust support from government are likely to boost shipbuilding industry and enhance market growth

TABLE 69 CHINA: MARKET SIZE, BY VOLTAGE, 2016–2019 (USD MILLION)

TABLE 70 CHINA: MARKET SIZE, BY VOLTAGE, 2020–2026 (USD MILLION)

TABLE 71 CHINA: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 72 CHINA: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 73 CHINA: MARKET, BY PROPELLER TYPE, 2019–2026 (USD MILLION)

9.3.4.2 India

9.3.4.2.1 Increasing marine freight traffic and favorable government policies are expected to drive market

TABLE 74 INDIA: MARKET SIZE, BY VOLTAGE, 2016–2019 (USD MILLION)

TABLE 75 INDIA: MARKET SIZE, BY VOLTAGE, 2020–2026 (USD MILLION)

TABLE 76 INDIA: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 77 INDIA: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 78 INDIA: MARKET, BY PROPELLER TYPE, 2019–2026 (USD MILLION)

9.3.4.3 Japan

9.3.4.3.1 Growing financial support provided by government for developing marine industry is expected to drive market

TABLE 79 JAPAN: MARKET SIZE, BY VOLTAGE, 2016–2019 (USD MILLION)

TABLE 80 JAPAN: MARKET SIZE, BY VOLTAGE, 2020–2026 (USD MILLION)

TABLE 81 JAPAN: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 82 JAPAN: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 83 JAPAN: MARKET, BY PROPELLER TYPE, 2019–2026 (USD MILLION)

9.3.4.4 South Korea

9.3.4.4.1 Increasing order for new ships is likely to boost market

TABLE 84 SOUTH KOREA: MARKET SIZE, BY VOLTAGE, 2016–2019 (USD MILLION)

TABLE 85 SOUTH KOREA: MARKET SIZE, BY VOLTAGE, 2020–2026 (USD MILLION)

TABLE 86 SOUTH KOREA: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 87 SOUTH KOREA: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 88 SOUTH KOREA: MARKET, BY PROPELLER TYPE, 2019–2026 (USD MILLION)

9.3.4.5 Australia

9.3.4.5.1 Growing manufacturing of defense and commercial vessels is expected to drive market

TABLE 89 AUSTRALIA: MARKET SIZE, BY VOLTAGE, 2016–2019 (USD MILLION)

TABLE 90 AUSTRALIA: MARKET SIZE, BY VOLTAGE, 2020–2026 (USD MILLION)

TABLE 91 AUSTRALIA: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 92 AUSTRALIA: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 93 AUSTRALIA: MARKET, BY PROPELLER TYPE, 2019–2026 (USD MILLION)

9.3.4.6 Rest of Asia Pacific

9.3.4.6.1 Increasing trade volume in this region and foreign investment in maritime industry to drive market

TABLE 94 REST OF ASIA PACIFIC: MARKET SIZE, BY VOLTAGE, 2016–2019 (USD MILLION)

TABLE 95 REST OF ASIA PACIFIC: MARKET SIZE, BY VOLTAGE, 2020–2026 (USD MILLION)

TABLE 96 REST OF ASIA PACIFIC: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 97 REST OF ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 98 REST OF ASIA PACIFIC: MARKET, BY PROPELLER TYPE, 2019–2026 (USD MILLION)

9.4 EUROPE

FIGURE 38 EUROPE: SNAPSHOT OF MARINE VFD MARKET

9.4.1 BY TYPE

TABLE 99 EUROPE: MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 100 EUROPE: MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

9.4.2 BY VOLTAGE

TABLE 101 EUROPE: MARKET SIZE, BY VOLTAGE, 2016–2019 (USD MILLION)

TABLE 102 EUROPE: MARKET SIZE, BY VOLTAGE, 2020–2026 (USD MILLION)

9.4.3 BY APPLICATION

TABLE 103 EUROPE: MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 104 EUROPE: MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 105 EUROPE: MARKET, BY PROPELLER TYPE, 2019–2026 (USD MILLION)

9.4.4 BY COUNTRY

TABLE 106 EUROPE: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 107 EUROPE: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

9.4.4.1 Italy

9.4.4.1.1 Increasing marine transportation and recreational activities to attract investments for marine VFDs

TABLE 108 ITALY: MARKET SIZE, BY VOLTAGE, 2016–2019 (USD MILLION)

TABLE 109 ITALY: MARKET SIZE, BY VOLTAGE, 2020–2026 (USD MILLION)

TABLE 110 ITALY: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 111 ITALY: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 112 ITALY: MARKET, BY PROPELLER TYPE, 2019–2026 (USD MILLION)

9.4.4.2 Germany

9.4.4.2.1 Government initiatives and friendly policies for shipping industry to attract investments for marine VFDs

TABLE 113 GERMANY: MARKET SIZE, BY VOLTAGE, 2016–2019 (USD MILLION)

TABLE 114 GERMANY: MARKET SIZE, BY VOLTAGE, 2020–2026 (USD MILLION)

TABLE 115 GERMANY: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 116 GERMANY: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 117 GERMANY: MARKET, BY PROPELLER TYPE, 2019–2026 (USD MILLION)

9.4.4.3 France

9.4.4.3.1 Increase in manufacturing of defense vessels is expected to drive domestic marine VFD market

TABLE 118 FRANCE: MARKET SIZE, BY VOLTAGE, 2016–2019 (USD MILLION)

TABLE 119 FRANCE: MARKET SIZE, BY VOLTAGE, 2020–2026 (USD MILLION)

TABLE 120 FRANCE: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 121 FRANCE: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 122 FRANCE: MARKET, BY PROPELLER TYPE, 2019–2026 (USD MILLION)

9.4.4.4 Netherlands

9.4.4.4.1 Country’s plans to make its maritime industry emissions-free by 2030 would drive domestic marine VFD market

TABLE 123 NETHERLANDS: MARKET SIZE, BY VOLTAGE, 2016–2019 (USD MILLION)

TABLE 124 NETHERLANDS: MARKET SIZE, BY VOLTAGE, 2020–2026 (USD MILLION)

TABLE 125 NETHERLANDS: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 126 NETHERLANDS: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 127 NETHERLANDS: MARKET, BY PROPELLER TYPE, 2019–2026 (USD MILLION)

9.4.4.5 UK

9.4.4.5.1 Government support to boost shipbuilding industry is likely to drive marine VFD market

TABLE 128 UK: MARKET SIZE, BY VOLTAGE, 2016–2019 (USD MILLION)

TABLE 129 UK: MARKET SIZE, BY VOLTAGE, 2020–2026 (USD MILLION)

TABLE 130 UK: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 131 UK: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 132 UK: MARKET, BY PROPELLER TYPE, 2019–2026 (USD MILLION)

9.4.4.6 Russia

9.4.4.6.1 Government policies and funding, along with naval exports, is expected to drive Russian market

TABLE 133 USSIA: MARKET SIZE, BY VOLTAGE, 2016–2019 (USD MILLION)

TABLE 134 RUSSIA: MARKET SIZE, BY VOLTAGE, 2020–2026 (USD MILLION)

TABLE 135 RUSSIA: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 136 RUSSIA: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 137 RUSSIA: MARKET, BY PROPELLER TYPE, 2019–2026 (USD MILLION)

9.4.4.7 Rest of Europe

9.4.4.7.1 Longer coastline and growing shipbuilding industry are expected to drive marine VFD market

TABLE 138 REST OF EUROPE: MARKET SIZE, BY VOLTAGE, 2016–2019 (USD MILLION)

TABLE 139 REST OF EUROPE: MARKET SIZE, BY VOLTAGE, 2020–2026 (USD MILLION)

TABLE 140 REST OF EUROPE: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 141 REST OF EUROPE: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 142 REST OF EUROPE: MARKET, BY PROPELLER TYPE, 2019–2026 (USD MILLION)

9.5 SOUTH AMERICA

FIGURE 39 SOUTH AMERICA: SNAPSHOT OF MARKET

9.5.1 BY TYPE

TABLE 143 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 144 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

9.5.2 BY VOLTAGE

TABLE 145 SOUTH AMERICA: MARKET SIZE, BY VOLTAGE, 2016–2019 (USD MILLION)

TABLE 146 SOUTH AMERICA: MARKET SIZE, BY VOLTAGE, 2020–2026 (USD MILLION)

9.5.3 BY APPLICATION

TABLE 147 SOUTH AMERICA: MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 148 SOUTH AMERICA: MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 149 SOUTH AMERICA: MARKET, BY PROPELLER TYPE, 2019–2026 (USD MILLION)

9.5.4 BY COUNTRY

TABLE 150 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 151 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

9.5.4.1 Brazil

9.5.4.1.1 Increasing demand for offshore and commercial vessels is likely to drive marine VFD market

TABLE 152 BRAZIL: MARKET SIZE, BY VOLTAGE, 2016–2019 (USD MILLION)

TABLE 153 BRAZIL: MARKET SIZE, BY VOLTAGE, 2020–2026 (USD MILLION)

TABLE 154 BRAZIL: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 155 BRAZIL: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 156 BRAZIL: MARKET, BY PROPELLER TYPE, 2019–2026 (USD MILLION)

9.5.4.2 Argentina

9.5.4.2.1 Focus of government on growth of country’s shipbuilding industry is likely to drive domestic marine VFD market

TABLE 157 ARGENTINA: MARKET SIZE, BY VOLTAGE, 2016–2019 (USD MILLION)

TABLE 158 ARGENTINA: MARKET SIZE, BY VOLTAGE, 2020–2026 (USD MILLION)

TABLE 159 ARGENTINA: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 160 ARGENTINA: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 161 ARGENTINA: MARKET, BY PROPELLER TYPE, 2019–2026 (USD MILLION)

9.5.4.3 Rest of South America

9.5.4.3.1 Investments in new shipbuilding capacities and naval exports along with trade exports are likely to boost marine VFD market

TABLE 162 REST OF SOUTH AMERICA: MARKET SIZE, BY VOLTAGE, 2016–2019 (USD MILLION)

TABLE 163 REST OF SOUTH AMERICA: MARKET SIZE, BY VOLTAGE, 2020–2026 (USD MILLION)

TABLE 164 REST OF SOUTH AMERICA: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 165 REST OF SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 166 REST OF SOUTH AMERICA: MARKET, BY PROPELLER TYPE, 2019–2026 (USD MILLION)

9.6 MIDDLE EAST & AFRICA

FIGURE 40 MIDDLE EAST & AFRICA: SNAPSHOT OF MARKET

9.6.1 BY TYPE

TABLE 167 MIDDLE EAST & AFRICA: MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 168 MIDDLE EAST & AFRICA: MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

9.6.2 BY VOLTAGE

TABLE 169 MIDDLE EAST & AFRICA: MARKET SIZE, BY VOLTAGE, 2016–2019 (USD MILLION)

TABLE 170 MIDDLE EAST & AFRICA: MARKET SIZE, BY VOLTAGE, 2020–2026 (USD MILLION)

9.6.3 BY APPLICATION

TABLE 171 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 172 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 173 MIDDLE EAST & AFRICA: MARKET, BY PROPELLER TYPE, 2019–2026 (USD MILLION)

9.6.4 BY COUNTRY

TABLE 174 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 175 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

9.6.4.1 Saudi Arabia

9.6.4.1.1 Increasing focus on shipbuilding industry is expected to drive Saudi Arabian marine VFD market

TABLE 176 SAUDI ARABIA: MARKET SIZE, BY VOLTAGE, 2016–2019 (USD MILLION)

TABLE 177 SAUDI ARABIA: MARKET SIZE, BY VOLTAGE, 2020–2026 (USD MILLION)

TABLE 178 SAUDI ARABIA: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 179 SAUDI ARABIA: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 180 SAUDI ARABIA: MARKET, BY PROPELLER TYPE, 2019–2026 (USD MILLION)

9.6.4.2 UAE

9.6.4.2.1 Government investments in naval power and oil & gas exports are expected to drive UAE market

TABLE 181 UAE: MARKET SIZE, BY VOLTAGE, 2016–2019 (USD MILLION)

TABLE 182 UAE: MARKET SIZE, BY VOLTAGE, 2020–2026 (USD MILLION)

TABLE 183 UAE: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 184 UAE: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 185 UAE: MARKET, BY PROPELLER TYPE, 2019–2026 (USD MILLION)

9.6.4.3 Qatar

9.6.4.3.1 Investments in LNG carriers and increasing exports of natural gas and petroleum are expected to create demand for marine VFDs

TABLE 186 QATAR: MARKET SIZE, BY VOLTAGE, 2016–2019 (USD MILLION)

TABLE 187 QATAR: MARKET SIZE, BY VOLTAGE, 2020–2026 (USD MILLION)

TABLE 188 QATAR: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 189 QATAR: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 190 QATAR: MARKET, BY PROPELLER TYPE, 2019–2026 (USD MILLION)

9.6.4.4 South Africa

9.6.4.4.1 Government support and private investments in shipbuilding sector and port upgrades would drive South African marine VFD market

TABLE 191 SOUTH AFRICA: MARKET SIZE, BY VOLTAGE, 2016–2019 (USD MILLION)

TABLE 192 SOUTH AFRICA: MARKET SIZE, BY VOLTAGE, 2020–2026 (USD MILLION)

TABLE 193 SOUTH AFRICA: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 194 SOUTH AFRICA: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 195 SOUTH AFRICA: MARKET, BY PROPELLER TYPE, 2019–2026 (USD MILLION)

9.6.4.5 Rest of Middle East & Africa

9.6.4.5.1 Growing potential for international trade is expected to drive market growth

TABLE 196 REST OF MIDDLE EAST & AFRICA: MARINE VFD MARKET SIZE, BY VOLTAGE, 2016–2019 (USD MILLION)

TABLE 197 REST OF MIDDLE EAST & AFRICA: MARINE VFD MARKET SIZE, BY VOLTAGE, 2020–2026 (USD MILLION)

TABLE 198 REST OF MIDDLE EAST & AFRICA: MARINE VFD MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 199 REST OF MIDDLE EAST & AFRICA: MARINE VFD MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 200 REST OF MIDDLE EAST & AFRICA: MARINE VFD MARKET, BY PROPELLER TYPE, 2019–2026 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 155)

10.1 KEY PLAYER STRATEGIES/RIGHT TO WIN

TABLE 201 OVERVIEW OF STRATEGIES ADOPTED BY TOP PLAYERS, JANUARY 2017–SEPTEMBER 2021

10.2 MARKET SHARE ANALYSIS

TABLE 202 MARINE VFD MARKET: DEGREE OF COMPETITION

FIGURE 41 LEADING PLAYERS IN MARINE VFD MARKET

10.3 REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS

FIGURE 42 TOP FIVE PLAYERS IN MARINE VFD MARKET FROM 2016 TO 2020

10.4 COMPETITIVE SCENARIO

TABLE 203 MARINE VFD MARKET: PRODUCT LAUNCHES, JANUARY 2017–AUGUST 2021

TABLE 204 MARINE VFD MARKET: DEALS, JUNE 2017–AUGUST 2021

TABLE 205 MARINE VFD MARKET: OTHERS, JULY 2017–NOVEMBER 2018

10.5 COMPANY EVALUATION QUADRANT

10.5.1 STAR

10.5.2 EMERGING LEADER

10.5.3 PERVASIVE

10.5.4 PARTICIPANT

FIGURE 43 COMPANY EVALUATION QUADRANT: MARINE VFD MARKET, 2020

10.6 COMPETITIVE BENCHMARKING

TABLE 206 COMPANY PRODUCT FOOTPRINT

TABLE 207 COMPANY APPLICATION FOOTPRINT

TABLE 208 COMPANY VOLTAGE FOOTPRINT

TABLE 209 COMPANY REGION FOOTPRINT

11 COMPANY PROFILES (Page No. - 168)

(Business Overview, Products/solutions offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

11.1 MAJOR PLAYERS

11.1.1 ABB

TABLE 210 ABB: COMPANY OVERVIEW

FIGURE 44 ABB: COMPANY SNAPSHOT

TABLE 211 ABB: PRODUCTS/SOLUTIONS OFFERED

TABLE 212 ABB: DEALS

11.1.2 GENERAL ELECTRIC

TABLE 213 GENERAL ELECTRIC: COMPANY OVERVIEW

FIGURE 45 GENERAL ELECTRIC: COMPANY SNAPSHOT

TABLE 214 GENERAL ELECTRIC: PRODUCTS/SOLUTIONS OFFERED

TABLE 215 GENERAL ELECTRIC: DEALS

11.1.3 DANFOSS

TABLE 216 DANFOSS: COMPANY OVERVIEW

FIGURE 46 DANFOSS: COMPANY SNAPSHOT

TABLE 217 DANFOSS: PRODUCTS/SOLUTIONS OFFERED

TABLE 218 DANFOSS: PRODUCT LAUNCHES

TABLE 219 DANFOSS: DEALS

TABLE 220 DANFOSS: OTHERS

11.1.4 ROCKWELL AUTOMATION

TABLE 221 ROCKWELL AUTOMATION: COMPANY OVERVIEW

FIGURE 47 ROCKWELL AUTOMATION: COMPANY SNAPSHOT

TABLE 222 ROCKWELL AUTOMATION: PRODUCTS/SOLUTIONS OFFERED

TABLE 223 ROCKWELL AUTOMATION: PRODUCT LAUNCHES

TABLE 224 ROCKWELL AUTOMATION: DEALS

11.1.5 SIEMENS

TABLE 225 SIEMENS: COMPANY OVERVIEW

FIGURE 48 SIEMENS: COMPANY SNAPSHOT

TABLE 226 SIEMENS: PRODUCTS/SOLUTIONS OFFERED

TABLE 227 SIEMENS: PRODUCT LAUNCHES

TABLE 228 SIEMENS: DEALS

11.1.6 CG POWER AND INDUSTRIAL SOLUTIONS

TABLE 229 CG POWER AND INDUSTRIAL SOLUTIONS: COMPANY OVERVIEW

FIGURE 49 CG POWER AND INDUSTRIAL SOLUTIONS: COMPANY SNAPSHOT

TABLE 230 CG POWER AND INDUSTRIAL SOLUTIONS: PRODUCTS/SOLUTIONS OFFERED

11.1.7 MITSUBISHI ELECTRIC

TABLE 231 MITSUBISHI ELECTRIC: COMPANY OVERVIEW

FIGURE 50 MITSUBISHI ELECTRIC: COMPANY SNAPSHOT

TABLE 232 MITSUBISHI ELECTRIC: PRODUCTS/SOLUTIONS OFFERED

TABLE 233 MITSUBISHI ELECTRIC: PRODUCT LAUNCHES

TABLE 234 MITSUBISHI ELECTRIC: DEALS

11.1.8 WEG

TABLE 235 WEG: COMPANY OVERVIEW

FIGURE 51 WEG: COMPANY SNAPSHOT

TABLE 236 WEG: PRODUCTS/SOLUTIONS OFFERED

TABLE 237 WEG: PRODUCT LAUNCHES

11.1.9 YASKAWA

TABLE 238 YASKAWA: COMPANY OVERVIEW

FIGURE 52 YASKAWA: COMPANY SNAPSHOT

TABLE 239 YASKAWA: PRODUCTS/SOLUTIONS OFFERED

TABLE 240 YASKAWA: PRODUCT LAUNCHES

TABLE 241 YASKAWA: DEALS

TABLE 242 YASKAWA: OTHERS

11.1.10 PARKER HANNIFIN

TABLE 243 PARKER HANNIFIN: COMPANY OVERVIEW

FIGURE 53 PARKER HANNIFIN: COMPANY SNAPSHOT

TABLE 244 PARKER HANNIFIN: PRODUCTS/SOLUTIONS OFFERED

TABLE 245 PARKER HANNIFIN: DEALS

11.1.11 INVERTEK DRIVES

TABLE 246 INVERTEK DRIVES: COMPANY OVERVIEW

TABLE 247 INVERTEK DRIVES: PRODUCTS/SOLUTIONS OFFERED

TABLE 248 INVERTEK DRIVES: DEALS

11.1.12 BOSCH

TABLE 249 BOSCH: COMPANY OVERVIEW

FIGURE 54 BOSCH: COMPANY SNAPSHOT

TABLE 250 BOSCH: PRODUCTS/SOLUTIONS OFFERED

TABLE 251 BOSCH: DEALS

11.1.13 FUJI ELECTRIC

TABLE 252 FUJI ELECTRIC: COMPANY OVERVIEW

FIGURE 55 FUJI ELECTRIC: COMPANY SNAPSHOT

TABLE 253 FUJI ELECTRIC: PRODUCTS/SOLUTIONS OFFERED

TABLE 254 FUJI ELECTRIC: DEALS

11.1.14 SCHNEIDER ELECTRIC

TABLE 255 SCHNEIDER ELECTRIC: COMPANY OVERVIEW

FIGURE 56 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

TABLE 256 SCHNEIDER ELECTRIC: PRODUCTS/SOLUTIONS OFFERED

TABLE 257 SCHNEIDER ELECTRIC: DEALS

11.1.15 NIDEC

TABLE 258 NIDEC: COMPANY OVERVIEW

FIGURE 57 NIDEC: COMPANY SNAPSHOT

TABLE 259 NIDEC: PRODUCTS/SOLUTIONS OFFERED

TABLE 260 NIDEC: DEALS

TABLE 261 NIDEC: OTHERS

11.2 OTHER KEY PLAYERS

11.2.1 HONEYWELL

TABLE 262 HONEYWELL: COMPANY SNAPSHOT

11.2.2 JOHNSON CONTROLS

TABLE 263 JOHNSON CONTROLS: COMPANY SNAPSHOT

11.2.3 TMEIC

TABLE 264 TMEIC: COMPANY SNAPSHOT

11.2.4 HITACHI INDUSTRIAL EQUIPMENT SYSTEMS CO.

TABLE 265 HITACHI INDUSTRIAL EQUIPMENT SYSTEMS CO: COMPANY SNAPSHOT

11.2.5 INGETEAM

TABLE 266 INGETEAM: COMPANY SNAPSHOT

11.2.6 EMERSON

TABLE 267 EMERSON: COMPANY SNAPSHOT

*Details on Business Overview, Products/solutions offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 219)

12.1 INSIGHTS OF INDUSTRY EXPERTS

12.2 DISCUSSION GUIDE

12.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.4 AVAILABLE CUSTOMIZATIONS

12.5 RELATED REPORTS

12.6 AUTHOR DETAILS

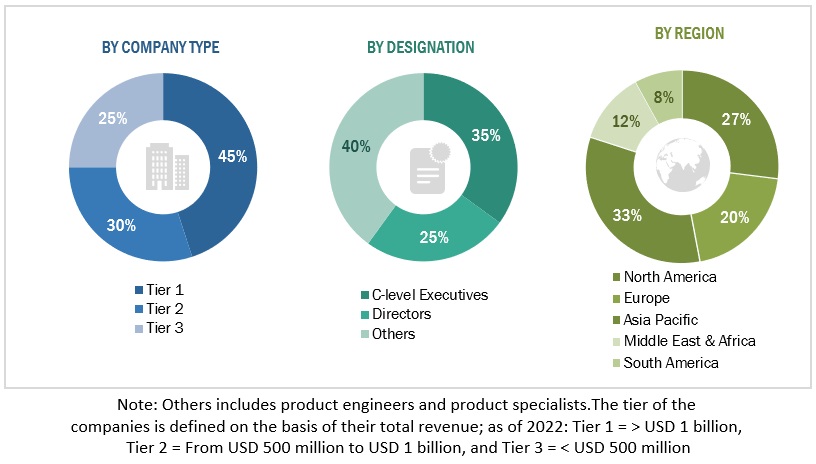

This study involved major activities in estimating the current size of the marine VFD market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and market sizing with industry experts across the value chain through primary research. Country-wise analysis were used to estimate the total market size. After that, the market breakdown and data triangulation were done to estimate the market size of the segments and sub-segments.

Secondary Research

This research study involved the use of extensive secondary sources, directories, and databases, such as Hoover’s, Bloomberg BusinessWeek, Factiva, and OneSource, to identify and collect information useful for a technical, market-oriented, and commercial study of the global marine VFD market. The other secondary sources included press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

The marine VFD market comprises several stakeholders, such as product manufacturers, service providers, distributors, and end-users in the supply chain. The demand-side of this market is characterized by its various end-user industries. Moreover, the demand is also driven by the rising demand of increasing efficiency of systems in a ship. The supply side is characterized by rising demand for contracts from the shipping sector, and mergers & acquisitions among big players. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents is given below:

To know about the assumptions considered for the study, download the pdf brochure

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the marine VFD market ecosystem.

Report Objectives

- To define, describe, and forecast the size of the marine VFD market by type, voltage, and application.

- To estimate and forecast the global marine VFD market for various segments with respect to 5 main regions, namely, North America, Europe, South America, Middle East & Africa, and Asia Pacific (APAC) in terms of value

- To provide detailed information regarding the drivers, restraints, opportunities, and industry-specific challenges that influence the market growth

- To provide a detailed overview of the marine VFD value chain, along with industry trends, use cases, security standards, and Porter’s five forces

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contribution to the total market

- To analyze the opportunities in the market for stakeholders by identifying high-growth segments and detail the competitive landscape for market players

- To strategically profile key players and comprehensively analyze their market rankings and core competencies2

- To analyze competitive developments, such as joint ventures, mergers and acquisitions, contracts, and agreements, and new product launches, in the marine VFD market

- To benchmark players within the market using the proprietary competitive leadership mapping framework, which analyzes market players on various parameters within the broad categories of business strategy excellence and strength of product portfolio

- This report covers the marine VFD market size in terms of value.

Available Customization

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company

Company Information

- Detailed analyses and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Marine VFD Market