MEA Cloud Computing Market by Type (Service Model (IaaS, PaaS, and SaaS) and Service Type), Deployment Model (Public and Private), Organization Size, Vertical, and Region (Middle East, and Africa) - Forecast to 2026

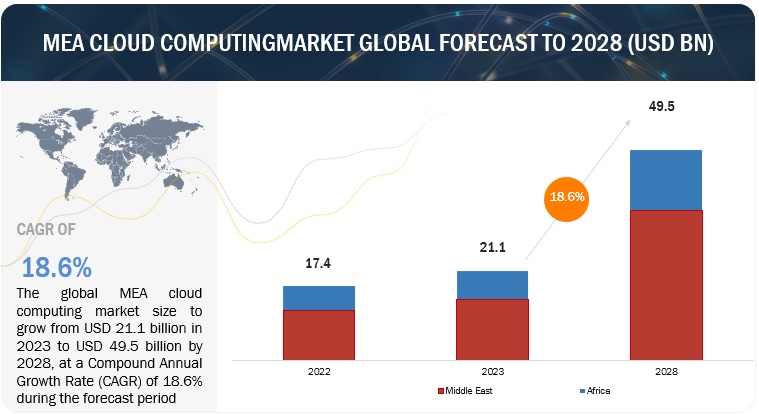

[252 Pages Report] The MEA cloud computing market size is expected to grow from USD 14.2 billion in 2021 to USD 31.4 billion by 2026, at a Compound Annual Growth Rate (CAGR) of 17.2% during the forecast period. The MEA cloud computing market will continue to grow post-COVID-19 as more businesses across the region plan to migrate its IT infrastructure to cloud, boost business operations, and improvise processes. While technology spending in UAE and Saudi Arabia has increased, the setback due to the recent COVID-19 pandemic is imminent.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Drivers: Business expansion by market leaders in the Middle East and Africa to cater to untapped clientele

Industry giants, including IBM, Oracle, AWS, and Google, are expanding their business in MEA by launching region-specific initiatives. Cloud adoption in the region is continuously growing and generating new opportunities for CSPs. Cloud vendors are focused on exploring the potential for further expansion. For instance, in June 2019, Microsoft opened data centers in Dubai and Abu Dhabi to expand its footprint and serve regional customers with cloud computing services. In July 2020, Oracle launched a regional hub for its cloud data center in MEA in Jeddah, Saudi Arabia. In December 2020, the company announced its intention to open up an Oracle Cloud Infrastructure (OCI) data center in Israel. In July 2019, AWS opened the first AWS Middle East Region in Bahrain and signed agreements with regional government offices, including Kuwait’s Ministry of Commerce and Industry (MOCI) and the Information and eGovernment Authority Bahrain. Google caters to region-specific client base with its complete cloud solutions and services via Google Cloud regions. Google Cloud regions are specially designed to provide faster service in a given location so organizations can deliver their products and services more reliably and at higher speeds. Google is planning to expand in Doha, Qatar in 2021. These growth strategies adopted by the tech giants are driving to improve the overall cloud state in MEA

Restraints: Lack of technical expertise among enterprises in technologically developing geographies

Enterprises are rapidly moving toward digitalization by adopting emerging technologies to automate and accelerate their business processes efficiently. Cloud has become an essential part of enterprises’ IT strategy due to its benefits such as low costs and enhanced business agility. Though there are lots of developments by cloud vendors and governments in regions, cloud spending in MEA is among the lowest across the globe. One of the most significant reasons behind the slowdown of cloud adoption in the region is skill gap. There is a huge gap between the demand and supply for cloud computing-related professionals and expertise. The adoption of cloud computing services increases the demand for technically skilled labor and efficient change management to implement and run cloud services in enterprises effectively. Mostly, employees are reluctant to upgrade their skillsets and accept changes, which hinder enterprises’ transition process. These days enterprises are more focused on driving profits rather than upgrading employee skills by providing appropriate training. Companies are resistant to adopt the maturation process and willing to stick to traditional infrastructures or software services to avoid initial costs. These factors result in skills shortage and may lead to business saturation, as competitors might invest huge amounts in upgrading their business processes and service offerings. These factors might lead to customer and profit loss for companies not adopting new changes and would enable competitors to increase their market shares and customer base.

Challenges: Rising number of clouds cyberattacks and security breach incidents

Data security is one of the most important aspects of business continuity. In today’s digital world, access to critical information leads to a number of challenges. One of these challenges is that enterprises storing sensitive data are the major targets for cybercriminals. Unfortunately, data centers that handle crucial customers’ data are no exception. Cyberattacks are one of the fastest-growing causes of data center outages. Cyberattacks and ransomware attacks are responsible for increased downtime as they interrupt business operations.

Cloud computing solutions help enterprises improve business by providing several benefits such as cost optimization, reliability, manageability, agility, and strategic edge, along with the security for critical data. Although there have been various advancements and developments related to cloud technologies, achieving high levels of security and interoperability has been major hurdles. According to the 2020 Trustwave Global Security Report, cloud services are the third most targeted environment by cybercriminals. Another research study report by Cybersecurity Insiders mentions that the major cloud security threats are unauthorized access, insecure interfaces/APIs, and misconfiguration of the cloud platform. These hurdles are affecting the growth of cloud solutions. The amount of data that is hosted over the cloud infrastructure has grown exponentially. This has increased the risk of data being accessed by an unauthorized external entity. Hence, the growth of the market may be challenged by the rising threat of security breaches in cloud systems.

In MEA, the number of cyberattacks is noticeably increased during the COVID-19 pandemic. According to Kaspersky, one of the global providers of cybersecurity solutions, in 2020, cyberattacks in the UAE increased over 190% after enterprises adopted WFH models due to lockdown caused by COVID-19. Kaspersky mentioned that cyberattacks against remote access protocols in the UAE reached USD 15.8 million in 2020. Followed by the Middle East, Africa is also facing severe cyberattacks in recent times. These attacks illustrate the rising significance of cyber threats to African national security.

Opportunities: Increase in adoption of hybrid cloud services

Enterprises that have their existing infrastructure are moving toward the adoption of cloud computing services and willing to adopt the hybrid approach so that they could reap the benefits of on-premises and cloud services. SMEs are largely adopting cloud computing services due to their major benefits, such as no initial infrastructure setup costs and the on-demand availability of compute services. These factors are contributing to the growth of hybrid cloud services in enterprises. The hybrid cloud offers the benefit of enhanced workload management, increased security and compliance, and efficient integration within DevOps teams. It also offers the flexibility of switching from on-premises to cloud or between clouds and has the required scalability to gain a competitive edge over other companies. These factors are creating increased opportunities for the hybrid CSP.

According to one of the leading providers of cloud-based solutions, Nutanix mentioned in the survey that the adoption of hybrid cloud and services is increased in the past few years. Nutanix’s global Enterprise Cloud Index shows that 22% of enterprise workloads in the Middle East are running in hybrid cloud environments compared to 17% in EMEA and 19% globally. The survey also mentioned that private and hybrid cloud accounts for 50% of enterprise workloads.

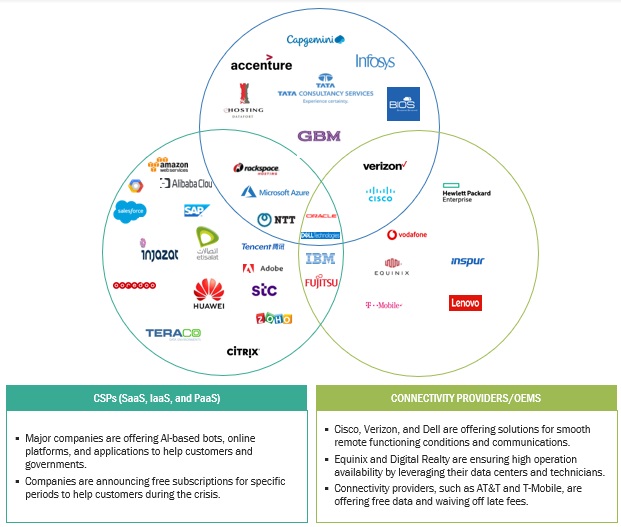

MEA Cloud Computing Market Ecosystem

To know about the assumptions considered for the study, download the pdf brochure

Based on service model, SaaS segment to be a larger contributor to the MEA cloud computing market growth during the forecast period

SaaS is a cloud-based method of providing software to users. Users can subscribe to an application rather than purchasing it once and installing it. Users can log into and use a SaaS application from any compatible device over the internet. The actual application runs in cloud servers instead of each user having to install the software on their device. For large organizations, updating software was a time-consuming process. Over the time, software updates became available for download through the internet, with companies purchasing additional licenses rather than additional disks. However, a copy of the software still needed to be installed on all devices that require access to the software. SaaS reduced the time and the cost related to any upgrade requirements. This model deploys, reduces costs, scales, and upgrades business applications more rapidly than maintaining on-premises systems and software. It offers enterprise applications such as ERM, CRM, HCM, SCM, and collaboration. It benefits organizations by reduced time for installation, low cost, scalability, integration with other applications, rapid up gradation of software, and easy access and simplicity in use for end users. The majority of enterprises across verticals have adopted the WFH model to safeguard employee well-being and maintain operational efficiency, surging the demand for SaaS-based collaboration solutions. Some of the pioneers Microsoft, Salesforce, SAP, Oracle, Adobe, and IBM offer SaaS business applications for various departments.

Based on service type, the consulting segment to be a larger contributor to the MEA cloud computing market during the forecast period

Consulting is a professional services practice for enterprise infrastructure. It involves advising customers to manage the organization’s IT infrastructure and improving infrastructure performance, including security and workflow processes. Cloud professional service vendors offer consulting services to users that have limited awareness related to the upgradation of current enterprise infrastructure. Users wishing to upgrade their infrastructure can harness the expertise of cloud professional service providers specializing in the deployment of cloud-based systems across industry-specific use cases, which helps in implementing the right mix of services. The implementation of cloud-based systems can be a costly process for some companies; therefore, it is of utmost importance that end users’ companies are aware of the exact business requirements. Consulting services help in effective implementation of cloud systems, and the demand for consulting services is expected to continue soon.

Based on deployment model, the public cloud segment to be a larger contributor to the MEA cloud computing growth during the forecast period

The public cloud is defined as computing services offered by third-party providers over the public internet, making them available to anyone who wants to use or purchase them. The public cloud refers to computing that shares resources, such as storage, compute, and networking, with external entities outside the organization depending on the demand. In the public deployment model, various resources, such as applications, storage, virtual servers, and hardware, are available to client enterprises over the internet. The services offered over the public deployment model are either free or offered under a subscription model. It helps organizations meet their demand for scalability, provides a pay-per-use pricing strategy and ease of deployment. The public cloud is typically designed with built-in redundancies to prevent data loss. Service providers may store replicated files across data centers to ensure disaster recovery is smooth and fast. Data stored on a public cloud platform is generally regarded as safe from most hazards. However, enterprises can utilize public clouds to make their operations significantly more efficient. For instance, enterprises can store non-sensitive content, online document collaboration, and webmail in the public cloud. AWS, Microsoft, IBM, and Google are some of the largest providers of the public cloud.

Based on organization size, the large enterprises segment to be a larger contributor to the MEA cloud computing growth during the forecast period

The trend of digitalization has been increasing extensively among large enterprises. The growing connectivity of bandwidth and mobility trends can be seen more among large enterprises due to the presence of a huge workforce. The increasing demand from employees for access to computing resources and applications, from anywhere and at any time, has made it complex for enterprises to store their data properly, maintain and manage their data centers, and focus on their core business operations. Large enterprises also generate huge amounts of critical business data on a regular basis. Hence, it has become important for them to store and manage their data securely at a centralized location, manage their scalability, and avoid redundancy and duplication of the data. Large enterprises in BFSI, telecommunication, retail and eCommerce, and manufacturing verticals cannot afford to lose customers due to network issues. However, large enterprises are opting to deploy cloud infrastructure services. Organizations are expected to soon start opting for private and hybrid cloud deployments, as these deployments have an increasing penetration in the cloud landscape and can help organizations serve their clients by delivering better service quality.

Based on verticals, the BFSI segment to be a larger contributor to the MEA cloud computing growth during the forecast period

The digital environment surrounding financial institutions is exploding at a never seen before pace. There are two reasons responsible for this growth; firstly, the rising customer preferences toward customized banking, and secondly, the strong penetration of technology. With new players entering the BFSI vertical, the delivery medium is becoming more digital. Private clouds allow more than one system to operate at high transaction volumes without loading the network or slowing the process, ensuring a better customer experience. Advancements in cloud applications are terminating the odds of data confidentiality, data security, regulatory compliances, and the quality of service. The BFSI vertical is rapidly leveraging the online platforms to facilitate services and improve its customer experience while simplifying access related to accounts and finances. Hence, cloud applications have helped banks and other financial institutions in boosting their performance and increasing their efficiency.

Middle East to grow at the highest CAGR during the forecast period

Countries in the Middle East are investing in cloud computing projects and cloud applications to develop and build knowledge-based economies. Cloud computing features that benefit the Middle East countries include on-demand resource availability, scalability, multi-user access to cloud-based applications, self-service computation, cloud storage, and utility subscription models. This section of the report segments the cloud applications industry in the Middle East, based on countries such as Saudi Arabia, UAE, Qatar, and other countries (Israel, Oman, Kuwait, and Bahrain).

Organizations in Saudi Arabia and the UAE have adopted cloud-based applications at an initial stage; hence, they are dominating the other countries in terms of development. In recent years, Qatar has emerged with a high adoption rate and is expected to witness the highest growth rate. In today’s era of globalization, it has become important for enterprises in Qatar to remain ahead of their competitors in the technological space. For such organizations, outsourcing services to a third-party managed service provider is a profitable option. Hence, enterprises in the Middle East have moved toward adopting cloud applications to reduce costs and save time

Key Market Players

The MEA cloud computing market is dominated by companies such as Microsoft (US), AWS (US), IBM (US), Google (US), Alibaba Cloud (China), Oracle (US), SAP (Germany), Salesforce (US), Etisalat (UAE), BIOS Middle East Group (UAE), eHosting DataFort (UAE), Injazat Data Systems (UAE), STC Cloud (Saudi Arabia), Insomea Computer Solutions (Tunisia), CloudBox Tech (SA), Ooredoo (Qatar), Gulf business Machines (UAE), Intertec Systems (UAE), Fujitsu (Japan), Huawei (China), Comprehensive Computing Innovations (Lebanon), Compro (Turkey), Teraco Data Environment (SA), Liquid Intelligence Technologies (SA), Zonke Tech (SA), Cloud4Rain (Egypt), Infosys (India), TCS(India), Malomatia (Qatar), Cicso (US), and Orixcom (UAE). These vendors have a large customer base and strong geographic footprint along with organized distribution channels, which helps them to increase revenues.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2016-2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021-2026 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

Type (Service Model and Service Type), Deployment Model, Organization Size, Verticals, and Regions |

|

Regions covered |

Middle East and Africa |

|

Companies covered |

Microsoft (US), AWS (US), IBM (US), Google (US), Alibaba Cloud (China), Oracle (US), SAP (Germany), Salesforce (US), Etisalat (UAE), BIOS Middle East Group (UAE), eHosting DataFort (UAE), Injazat Data Systems (UAE), STC Cloud (Saudi Arabia), Insomea Computer Solutions (Tunisia), CloudBox Tech (SA), Ooredoo (Qatar), Gulf business Machines (UAE), Intertec Systems (UAE), Fujitsu (Japan), Huawei (China), Comprehensive Computing Innovations (Lebanon), Compro (Turkey), Teraco Data Environment (SA), Liquid Intelligence Technologies (SA), Zonke Tech (SA), Cloud4Rain (Egypt), Infosys (India), TCS(India), Malomatia (Qatar), Cicso (US), and Orixcom (UAE) |

This research report categorizes the MEA cloud computing market to forecast revenue and analyze trends in each of the following submarkets:

Based on the type:

- Service Model

- Service Type

Based on the service model:

- IaaS

- PaaS

- SaaS

Based on the service type:

- Consulting

- Integration and optimization

- Implementation and migration

- Application and modernization

Based on the Deployment Model:

- Public Cloud

- Private Cloud

Based on the Organization Size:

- Large Enterprises

- SMEs

Based on the vertical:

- BFSI

- Energy and Utilities

- Government and Public Sector

- Healthcare and Life Sciences

- Manufacturing

- Retail and Consumer Goods

- Telecommunications

- Other Verticals

Based on regions:

- Middle East

- Saudi Arabia

- UAE

- Qatar

- Rest of Middle East

- Africa

- South Africa

- Egypt

- Rest of Africa

Recent Developments

In January 2021, Microsoft launched new cloud service, Microsoft Cloud for Financial Services. It delivers differentiated customer experiences, improves employee collaboration and productivity, and manages risks and modernizes core systems.

Frequently Asked Questions (FAQ):

What is the projected market value of the MEA cloud computing market?

The MEA cloud computing market size is expected to grow from USD 14.2 billion in 2021 to USD 31.4 billion by 2026, at a Compound Annual Growth Rate (CAGR) of 17.2% during the forecast period.

Which region has the highest market share in the MEA cloud computing market?

Middle East region has the higher market share in the MEA cloud computing market.

Which service model is expected to witness high adoption in the coming years?

IaaS is expected to witness the highest rate adoption in the coming five years, as large enterprises are investing more in this service model.

Which are the major vendors in the MEA cloud computing market?

Microsoft, IBM, Google, AWS, Alibaba Cloud, Oracle, Salesforce, and SAP are major vendors in MEA cloud computing market.

What are some of the drivers in MEA cloud computing market?

COVID-19 pandemic boosted the adoption of cloud computing solutions across the Middle East and Africa

Business expansion by market leaders in the Middle East and Africa to cater to untapped clientele .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 35)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 YEARS CONSIDERED FOR THE STUDY

1.7 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2018–2020

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 46)

2.1 RESEARCH DATA

FIGURE 6 MEA CLOUD COMPUTING MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primary profiles

FIGURE 7 BREAKUP OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

TABLE 2 PRIMARY RESPONDENTS: MARKET

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 9 MEA CLOUD COMPUTING MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 1 (SUPPLY SIDE): REVENUE OF MEA CLOUD COMPUTING FROM VENDORS

FIGURE 11 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH (SUPPLY SIDE): COLLECTIVE REVENUE OF MEA CLOUD COMPUTING VENDORS

FIGURE 12 MARKET SIZE ESTIMATION METHODOLOGY – (SUPPLY SIDE): ILLUSTRATION OF VENDOR REVENUE ESTIMATION

FIGURE 13 MARKET SIZE ESTIMATION METHODOLOGY – (SUPPLY SIDE): CAGR PROJECTIONS FROM SUPPLY SIDE

FIGURE 14 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 2 (DEMAND SIDE): REVENUE GENERATED FROM VERTICALS (1/2)

FIGURE 15 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 2 (DEMAND SIDE): REVENUE GENERATED FROM VERTICALS (2/2)

2.4 MARKET FORECAST

TABLE 3 FACTOR ANALYSIS

2.5 RESEARCH ASSUMPTIONS

2.6 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 59)

FIGURE 16 MEA CLOUD COMPUTING MARKET: REGIONAL SNAPSHOT

FIGURE 17 TOP-GROWING SEGMENTS IN THE MARKET

FIGURE 18 SOFTWARE AS A SERVICE SEGMENT TO HOLD THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

FIGURE 19 CONSULTING SEGMENT TO HOLD THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

FIGURE 20 PUBLIC CLOUD SEGMENT TO HOLD A LARGER MARKET SIZE DURING THE FORECAST PERIOD

FIGURE 21 BANKING, FINANCIAL SERVICES AND INSURANCE VERTICAL TO HOLD THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

FIGURE 22 MEA CLOUD COMPUTING MARKET: REGIONAL SNAPSHOT

4 PREMIUM INSIGHTS (Page No. - 65)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN THE MARKET

FIGURE 23 INCREASING NEED TO SHIFT ENTERPRISE WORKLOADS TO CLOUD FOR DRIVING BUSINESS EFFICIENCY AND LOWER CAPEX TO DRIVE THE MARKET GROWTH

4.2 MIDDLE EAST CLOUD COMPUTING MARKET, BY SERVICE MODEL AND COUNTRY

FIGURE 24 SOFTWARE AS A SERVICE SEGMENT TO HOLD THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD IN THE MIDDLE EAST IN 2021

4.3 AFRICA CLOUD COMPUTING MARKET, BY SERVICE MODEL AND COUNTRY

FIGURE 25 SOFTWARE AS A SERVICE SEGMENT TO HOLD THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD IN AFRICA IN 2021

4.4 MEA CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2021 VS. 2026

FIGURE 26 SOFTWARE AS A SERVICE SEGMENT TO HOLD THE LARGEST MARKET SHARE DURING THE FORECAST PERIOD

4.5 MARKET, BY SERVICE TYPE, 20201 VS. 2026

FIGURE 27 CONSULTING SEGMENT TO HOLD THE LARGEST MARKET SHARE DURING THE FORECAST PERIOD

4.6 MARKET, BY DEPLOYMENT MODEL, 2021

FIGURE 28 PUBLIC CLOUD SEGMENT TO HOLD A LARGER MARKET SHARE IN 2021

4.7 MARKET, BY ORGANIZATION SIZE, 2021

FIGURE 29 LARGE ENTERPRISES SEGMENT TO HOLD A LARGER MARKET SHARE IN 2021

4.8 MEA CLOUD COMPUTING MARKET, BY VERTICAL, 2021 VS. 2026

FIGURE 30 BANKING, FINANCIAL SERVICES AND INSURANCE VERTICAL TO HOLD THE LARGEST MARKET SHARE DURING THE FORECAST PERIOD

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 69)

5.1 INTRODUCTION

FIGURE 31 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: MEA CLOUD COMPUTING MARKET

5.1.1 DRIVERS

5.1.1.1 COVID-19 pandemic boosted the adoption of cloud computing solutions across the Middle East and Africa

5.1.1.2 Business expansion by market leaders in the Middle East and Africa to cater to untapped clientele

5.1.1.3 Growing investments in cutting-edge technologies and governmental initiatives toward digital transformation

5.1.2 RESTRAINTS

5.1.2.1 Lack of technical expertise among enterprises in technologically developing geographies

5.1.2.2 Difficulty in addressing governance and compliance requirements

5.1.3 OPPORTUNITIES

5.1.3.1 Increase in adoption of hybrid cloud services

5.1.3.2 Rise in number of small and medium-sized enterprises to create new revenue opportunities for cloud vendors

FIGURE 32 TREND OF CLOUD SPENDS BY LARGE ENTERPRISE IN 2021

FIGURE 33 TREND OF CLOUD SPENDS BY SMALL AND MEDIUM-SIZED ENTERPRISE IN 2021

5.1.3.3 Telecom service providers leveraging existing infrastructure to offer cloud-based services

5.1.3.4 Incorporation of artificial intelligence and machine learning in cloud computing solutions

5.1.4 CHALLENGES

5.1.4.1 Fear of vendor lock-in

5.1.4.2 Rising number of clouds cyberattacks and security breach incidents

5.1.4.3 Compatibility complexities with legacy systems

5.2 COVID-19-DRIVEN MARKET DYNAMICS

5.2.1 DRIVERS AND OPPORTUNITIES

5.2.2 RESTRAINTS AND CHALLENGES

5.3 COVID-19 IMPACT

FIGURE 34 COVID-19 ANALYSIS

5.3.1 REGIONAL INSIGHTS

5.3.2 VERTICAL INSIGHTS

5.4 CASE STUDY ANALYSIS

5.4.1 CASE STUDY 1: CLOUD SERVICE DEPLOYMENT

5.4.2 CASE STUDY 2: CONNECTIVITY

5.4.3 CASE STUDY 3: CLOUD MIGRATION

5.4.4 CASE STUDY 4: PERFORMANCE ENHANCEMENT WITH CLOUD PLATFORM

5.5 VALUE CHAIN ANALYSIS

FIGURE 35 VALUE CHAIN ANALYSIS: MEA CLOUD COMPUTING MARKET

5.6 ECOSYSTEM

FIGURE 36 ECOSYSTEM: MARKET

TABLE 4 MEA CLOUD COMPUTING MARKET: ECOSYSTEM

5.7 TECHNOLOGY ANALYSIS

5.7.1 BLOCKCHAIN

5.7.2 MACHINE LEARNING

5.7.3 INTERNET OF THINGS

5.7.4 AUGMENTED REALITY

5.7.5 ARTIFICIAL INTELLIGENCE

5.8 PRICING ANALYSIS

5.8.1 INTRODUCTION

TABLE 5 IAAS PRICING STRUCTURE

5.8.2 PRICING PLANS FROM VENDORS

5.8.2.1 Ooredoo

TABLE 6 OOREDOO PRICING STRUCTURE

5.8.2.2 Microsoft

TABLE 7 MICROSOFT PRICING STRUCTURE: SALES

5.8.2.3 Oracle

TABLE 8 ORACLE: CLOUD ACCESS SECURITY BROKER - IAAS

TABLE 9 ORACLE: CLOUD ACCESS SECURITY BROKER - SAAS

5.9 REVENUE SHIFT – YC/YCC SHIFT

FIGURE 37 YC/YCC SHIFT

5.10 PATENT ANALYSIS

FIGURE 38 TOP FIVE PATENT OWNERS IN THE UNITED STATES

FIGURE 39 DOCUMENT COUNT

5.11 PORTER’S FIVE FORCES ANALYSIS

FIGURE 40 MEA CLOUD COMPUTING: PORTER’S FIVE FORCES ANALYSIS

TABLE 10 CLOUD COMPUTING SOFTWARE: PORTER’S FIVE FORCES ANALYSIS

5.11.1 THREAT OF NEW ENTRANTS

5.11.2 THREAT OF SUBSTITUTES

5.11.3 BARGAINING POWER OF SUPPLIERS

5.11.4 BARGAINING POWER OF BUYERS

5.11.5 INTENSITY OF COMPETITIVE RIVALRY

5.12 REGULATIONS

5.12.1 MIDDLE EAST AND AFRICA

6 MEA CLOUD COMPUTING MARKET, BY TYPE (Page No. - 93)

6.1 INTRODUCTION

6.2 SERVICE MODEL

FIGURE 41 SOFTWARE AS A SERVICE SEGMENT TO HAVE THE LARGEST MARKET SIZE IN 2021

6.2.1 SERVICE MODELS: MARKET DRIVERS

6.2.2 SERVICE MODELS: COVID-19 IMPACT

TABLE 11 MARKET SIZE, BY SERVICE MODEL, 2016–2020 (USD MILLION)

TABLE 12 MARKET SIZE, BY SERVICE MODEL, 2021–2026 (USD MILLION)

6.2.3 INFRASTRUCTURE AS A SERVICE

6.2.3.1 Adoption of IaaS is noticeably increasing in MEA among large enterprises due to security and reduced cost of hardware resources

TABLE 13 INFRASTRUCTURE AS A SERVICE: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 14 INFRASTRUCTURE AS A SERVICE: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.2.4 PLATFORM AS A SERVICE

6.2.4.1 PaaS offers rich tools to end users for developing cloud-based solutions on a uniform platform

TABLE 15 PLATFORM AS A SERVICE: MEA CLOUD COMPUTING MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 16 PLATFORM AS A SERVICE: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.2.5 SOFTWARE AS A SERVICE

6.2.5.1 SaaS is popular among SMEs in MEA as they are able to modernize their businesses with the service model at a low cost

TABLE 17 SOFTWARE AS A SERVICE: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 18 SOFTWARE AS A SERVICE: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.3 PROFESSIONAL SERVICES

FIGURE 42 CONSULTING SEGMENT TO HOLD THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

6.3.1 SERVICE TYPES: MEA CLOUD COMPUTING MARKET DRIVERS

6.3.2 SERVICE TYPES: COVID-19 IMPACT

TABLE 19 MARKET SIZE, BY SERVICE TYPE, 2016–2020 (USD MILLION)

TABLE 20 MARKET SIZE, BY SERVICE TYPE, 2021–2026 (USD MILLION)

6.3.3 CONSULTING

6.3.3.1 Rise in cloud migration is driving the demand for consulting services

TABLE 21 CONSULTING: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 22 CONSULTING: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.3.4 INTEGRATION AND OPTIMIZATION

6.3.4.1 Increased need for reliable data synchronization to enhance operational efficiency will foster integration and optimization services

TABLE 23 INTEGRATION AND OPTIMIZATION: MEA CLOUD COMPUTING MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 24 INTEGRATION AND OPTIMIZATION: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.3.5 IMPLEMENTATION AND MIGRATION

6.3.5.1 Growing trend of expanding business operations while working within the existing infrastructure to drive the cloud migration services

TABLE 25 IMPLEMENTATION AND MIGRATION: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 26 IMPLEMENTATION AND MIGRATION: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.3.6 APPLICATION AND MODERNIZATION

6.3.6.1 Rising need for enhanced productivity with lower costs to foster the demand for application and modernization services

TABLE 27 APPLICATION AND MODERNIZATION: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 28 APPLICATION AND MODERNIZATION: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7 MEA CLOUD COMPUTING MARKET, BY ORGANIZATION SIZE (Page No. - 105)

7.1 INTRODUCTION

FIGURE 43 LARGE ENTERPRISES SEGMENT TO HAVE A LARGER MARKET SIZE IN 2021

7.1.1 ORGANIZATION SIZE: MARKET DRIVERS

7.1.2 ORGANIZATION SIZE: COVID-19 IMPACT

TABLE 29 MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 30 MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

7.2 LARGE ENTERPRISES

7.2.1 VISIONARY LEADERSHIP AND HUGE IT SPENDING ARE FOSTERING THE ADOPTION OF CLOUD COMPUTING IN LARGE ENTERPRISES

TABLE 31 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 32 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.3 SMALL AND MEDIUM-SIZED ENTERPRISES

7.3.1 INCREASED AWARENESS RELATED TO CLOUD BENEFITS AMONG SMALL AND MEDIUM-SIZED ENTERPRISES IS DRIVING ITS ADOPTION

TABLE 33 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 34 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8 MEA CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL (Page No. - 110)

8.1 INTRODUCTION

FIGURE 44 PUBLIC CLOUD SEGMENT TO HAVE A LARGER MARKET SIZE IN 2021

8.1.1 DEPLOYMENT MODELS: MARKET DRIVERS

8.1.2 DEPLOYMENT MODELS: COVID-19 IMPACT

TABLE 35 MARKET SIZE, BY DEPLOYMENT MODEL, 2016–2020 (USD MILLION)

TABLE 36 CLOUD COMPUTING MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

8.2 PUBLIC CLOUD

8.2.1 LOWER COSTS AND EASY DEPLOYMENT ARE THE MAJOR DRIVING FACTORS OF PUBLIC CLOUD ADOPTION

TABLE 37 PUBLIC CLOUD: MEA CLOUD COMPUTING MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 38 PUBLIC CLOUD: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8.3 PRIVATE CLOUD

8.3.1 CORPORATES ARE CHOOSING PRIVATE CLOUD DUE TO SECURITY CONCERNS CAUSED BY THE INCREASING NUMBER OF CYBERATTACKS

TABLE 39 PRIVATE CLOUD: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 40 PRIVATE CLOUD: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9 MEA CLOUD COMPUTING MARKET, BY VERTICAL (Page No. - 115)

9.1 INTRODUCTION

FIGURE 45 RETAIL AND CONSUMER GOODS VERTICAL TO SHOW THE HIGHEST GROWTH RATE DURING THE FORECAST PERIOD

9.1.1 VERTICALS: MARKET DRIVERS

9.1.2 VERTICALS: COVID-19 IMPACT

TABLE 41 MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 42 MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

9.2 BANKING, FINANCIAL SERVICES AND INSURANCE

9.2.1 RISE IN THE DEMAND FOR AGILITY IN BANKING PROCESSES TO BOOST THE CLOUD COMPUTING ADOPTION IN THE BFSI SECTOR

TABLE 43 BANKING, FINANCIAL SERVICES AND INSURANCE: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 44 BANKING, FINANCIAL SERVICES AND INSURANCE: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.3 ENERGY AND UTILITIES

9.3.1 REGULATORY STANDARDS AND THE CONVERGENCE OF IT IN ENERGY AND UTILITIES’ SYSTEMS TO MAXIMIZE THE DEMAND FOR CLOUD COMPUTING SOLUTIONS

TABLE 45 ENERGY AND UTILITIES: MEA CLOUD COMPUTING MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 46 ENERGY AND UTILITIES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.4 GOVERNMENT AND PUBLIC SECTOR

9.4.1 GOVERNMENT INITIATIVES AND INVESTMENTS IN THE LATEST TECHNOLOGIES SUCH AS AI, ML, AND IOT TO FOSTER THE CLOUD ADOPTION

TABLE 47 GOVERNMENT AND PUBLIC SECTOR: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 48 GOVERNMENT AND PUBLIC SECTOR: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.5 HEALTHCARE AND LIFE SCIENCES

9.5.1 INCREASED DEMAND FOR EFFECTIVE SYSTEM MANAGEMENT IN THE HEALTHCARE SECTOR TO BOOST THE DEMAND FOR CLOUD COMPUTING

TABLE 49 HEALTHCARE AND LIFE SCIENCES: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 50 HEALTHCARE AND LIFE SCIENCES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.6 MANUFACTURING

9.6.1 RISING NEED TO MAINTAIN SEAMLESS MANUFACTURING PROCESSES TO AMPLIFY THE DEMAND FOR CLOUD COMPUTING

TABLE 51 MANUFACTURING: MEA CLOUD COMPUTING MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 52 MANUFACTURING: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.7 RETAIL AND CONSUMER GOODS

9.7.1 RETAILERS SHIFTING BUSINESS OPERATIONS ONLINE TO CONTINUE BUSINESSES DURING LOCKDOWN IMPOSED DUE TO COVID-19 IS BOOSTING THE CLOUD COMPUTING DEMAND

TABLE 53 RETAIL AND CONSUMER GOODS: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 54 RETAIL AND CONSUMER GOODS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.8 TELECOMMUNICATIONS

9.8.1 HUGE DATA GENERATION IN THE TELECOMMUNICATION INDUSTRY IS DRIVING THE DEMAND FOR CLOUD-BASED SYSTEMS FOR DATA MANAGEMENT

TABLE 55 TELECOMMUNICATIONS: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 56 TELECOMMUNICATIONS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.9 OTHER VERTICALS

9.9.1 INCREASED RATE OF DIGITALIZATION IN FOSTERING THE CLOUD DEMAND IN OTHER VERTICALS

TABLE 57 OTHER VERTICALS: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 58 OTHER VERTICALS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10 MEA CLOUD COMPUTING MARKET, BY REGION (Page No. - 127)

10.1 INTRODUCTION

FIGURE 46 MIDDLE EAST TO HAVE A LARGER MARKET SIZE DURING THE FORECAST PERIOD

TABLE 59 MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 60 MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.2 MIDDLE EAST

10.2.1 MIDDLE EAST: MARKET DRIVERS

10.2.2 MIDDLE EAST: COVID-19 IMPACT

FIGURE 47 MIDDLE EAST: MARKET SNAPSHOT

TABLE 61 MIDDLE EAST: MEA CLOUD COMPUTING MARKET SIZE, BY SERVICE MODEL, 2016–2020 (USD MILLION)

TABLE 62 MIDDLE EAST: MEA CLOUD COMPUTING MARKET SIZE, BY SERVICE MODEL, 2021–2026 (USD MILLION)

TABLE 63 MIDDLE EAST: MARKET SIZE, BY SERVICE TYPE, 2016–2020 (USD MILLION)

TABLE 64 MIDDLE EAST: MARKET SIZE, BY SERVICE TYPE, 2021–2026 (USD MILLION)

TABLE 65 MIDDLE EAST: MARKET SIZE, BY DEPLOYMENT MODEL, 2016–2020 (USD MILLION)

TABLE 66 MIDDLE EAST: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 67 MIDDLE EAST: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 68 MIDDLE EAST: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 69 MIDDLE EAST: MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 70 MIDDLE EAST: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 71 MIDDLE EAST: MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 72 MIDDLE EAST: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

10.2.3 UNITED ARAB EMIRATES

10.2.3.1 Rapid technological proliferation and huge it spends to drive the growth of cloud computing

10.2.3.2 United Arab Emirates: MEA cloud computing market drivers

10.2.3.3 United Arab Emirates: COVID-19 impact

TABLE 73 UNITED ARAB EMIRATES: MARKET SIZE, BY SERVICE MODEL, 2016–2020 (USD MILLION)

TABLE 74 UNITED ARAB EMIRATES: MARKET SIZE, BY SERVICE MODEL, 2021–2026 (USD MILLION)

TABLE 75 UNITED ARAB EMIRATES: MARKET SIZE, BY SERVICE TYPE, 2016–2020 (USD MILLION)

TABLE 76 UNITED ARAB EMIRATES: MARKET SIZE, BY SERVICE TYPE, 2021–2026 (USD MILLION)

TABLE 77 UNITED ARAB EMIRATES: MARKET SIZE, BY DEPLOYMENT MODEL, 2016–2020 (USD MILLION)

TABLE 78 UNITED ARAB EMIRATES: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 79 UNITED ARAB EMIRATES: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 80 UNITED ARAB EMIRATES: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 81 UNITED ARAB EMIRATES: MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 82 UNITED ARAB EMIRATES: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

10.2.4 SAUDI ARABIA

10.2.4.1 Robust government initiatives and smart city projects in the country to foster cloud computing growth

10.2.4.2 Saudi Arabia: MEA cloud computing market drivers

10.2.4.3 Saudi Arabia: COVID-19 impact

TABLE 83 SAUDI ARABIA: MARKET SIZE, BY SERVICE MODEL, 2016–2020 (USD MILLION)

TABLE 84 SAUDI ARABIA: MARKET SIZE, BY SERVICE MODEL, 2021–2026 (USD MILLION)

TABLE 85 SAUDI ARABIA: MARKET SIZE, BY SERVICE TYPE, 2016–2020 (USD MILLION)

TABLE 86 SAUDI ARABIA: MARKET SIZE, BY SERVICE TYPE, 2021–2026 (USD MILLION)

TABLE 87 SAUDI ARABIA: MARKET SIZE, BY DEPLOYMENT MODEL, 2016–2020 (USD MILLION)

TABLE 88 SAUDI ARABIA: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 89 SAUDI ARABIA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 90 SAUDI ARABIA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 91 SAUDI ARABIA: MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 92 SAUDI ARABIA: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

10.2.5 QATAR

10.2.5.1 Rapid pace of digital transformation and data center development by leading cloud vendors to drive the cloud computing market

10.2.5.2 Qatar: MEA cloud computing market drivers

10.2.5.3 Qatar: COVID-19 impact

TABLE 93 QATAR: MARKET SIZE, BY SERVICE MODEL, 2016–2020 (USD MILLION)

TABLE 94 QATAR: MARKET SIZE, BY SERVICE MODEL, 2021–2026 (USD MILLION)

TABLE 95 QATAR: MARKET SIZE, BY SERVICE TYPE, 2016–2020 (USD MILLION)

TABLE 96 QATAR: MARKET SIZE, BY SERVICE TYPE, 2021–2026 (USD MILLION)

TABLE 97 QATAR: MARKET SIZE, BY DEPLOYMENT MODEL, 2016–2020 (USD MILLION)

TABLE 98 QATAR: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 99 QATAR: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 100 QATAR: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 101 QATAR: MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 102 QATAR: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

10.2.6 REST OF MIDDLE EAST

10.2.6.1 Increasing adoption of cloud across small and medium-sized enterprises in MEA to boost cloud computing in the region

10.2.6.2 Rest of Middle East: MEA cloud computing market drivers

10.2.6.3 Rest of Middle East: COVID-19 impact

TABLE 103 REST OF MIDDLE EAST: MARKET SIZE, BY SERVICE MODEL, 2016–2020 (USD MILLION)

TABLE 104 REST OF MIDDLE EAST: MARKET SIZE, BY SERVICE MODEL, 2021–2026 (USD MILLION)

TABLE 105 REST OF MIDDLE EAST: MARKET SIZE, BY SERVICE TYPE, 2016–2020 (USD MILLION)

TABLE 106 REST OF MIDDLE EAST: MARKET SIZE, BY SERVICE TYPE, 2021–2026 (USD MILLION)

TABLE 107 REST OF MIDDLE EAST: MARKET SIZE, BY DEPLOYMENT MODEL, 2016–2020 (USD MILLION)

TABLE 108 REST OF MIDDLE EAST: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 109 REST OF MIDDLE EAST: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 110 REST OF MIDDLE EAST: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 111 REST OF MIDDLE EAST: MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 112 REST OF MIDDLE EAST: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

10.3 AFRICA

FIGURE 48 AFRICA: MARKET SNAPSHOT

TABLE 113 AFRICA: MEA CLOUD COMPUTING MARKET SIZE, BY SERVICE MODEL, 2016–2020 (USD MILLION)

TABLE 114 AFRICA: MARKET SIZE, BY SERVICE MODEL, 2021–2026 (USD MILLION)

TABLE 115 AFRICA: MARKET SIZE, BY SERVICE TYPE, 2016–2020 (USD MILLION)

TABLE 116 AFRICA: MARKET SIZE, BY SERVICE TYPE, 2021–2026 (USD MILLION)

TABLE 117 AFRICA: MARKET SIZE, BY DEPLOYMENT MODEL, 2016–2020 (USD MILLION)

TABLE 118 AFRICA: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 119 AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 120 AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 121 AFRICA: MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 122 AFRICA: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 123 AFRICA: MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 124 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

10.3.1 SOUTH AFRICA

10.3.1.1 Growing number of small and medium-sized enterprises in the retail and consumer goods vertical and the ICT industry to boost cloud computing growth

10.3.1.2 South Africa: MEA cloud computing market drivers

10.3.1.3 South Africa: COVID-19 impact

TABLE 125 SOUTH AFRICA: MARKET SIZE, BY SERVICE MODEL, 2016–2020 (USD MILLION)

TABLE 126 SOUTH AFRICA: MARKET SIZE, BY SERVICE MODEL, 2021–2026 (USD MILLION)

TABLE 127 SOUTH AFRICA: MARKET SIZE, BY SERVICE TYPE, 2016–2020 (USD MILLION)

TABLE 128 SOUTH AFRICA: MARKET SIZE, BY SERVICE TYPE, 2021–2026 (USD MILLION)

TABLE 129 SOUTH AFRICA: MARKET SIZE, BY DEPLOYMENT MODEL, 2016–2020 (USD MILLION)

TABLE 130 SOUTH AFRICA: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 131 SOUTH AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 132 SOUTH AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 133 SOUTH AFRICA: MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 134 SOUTH AFRICA: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

10.3.2 EGYPT

10.3.2.1 Strategic partnerships of local cloud vendors with leading cloud service providers are driving cloud computing growth

10.3.2.2 Egypt: MEA cloud computing market drivers

10.3.2.3 Egypt: COVID-19 impact

TABLE 135 EGYPT: MARKET SIZE, BY SERVICE MODEL, 2016–2020 (USD MILLION)

TABLE 136 EGYPT: MARKET SIZE, BY SERVICE MODEL, 2021–2026 (USD MILLION)

TABLE 137 EGYPT: MARKET SIZE, BY SERVICE TYPE, 2016–2020 (USD MILLION)

TABLE 138 EGYPT: MARKET SIZE, BY SERVICE TYPE, 2021–2026 (USD MILLION)

TABLE 139 EGYPT: MARKET SIZE, BY DEPLOYMENT MODEL, 2016–2020 (USD MILLION)

TABLE 140 EGYPT: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 141 EGYPT: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 142 EGYPT: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 143 EGYPT: MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 144 EGYPT: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

10.3.3 REST OF AFRICA

10.3.3.1 High internet penetration and increased awareness related to cloud technologies to foster cloud computing growth

10.3.3.2 Rest of Africa: MEA cloud computing market drivers

10.3.3.3 Rest of Africa: COVID-19 impact

TABLE 145 REST OF AFRICA: MARKET SIZE, BY SERVICE MODEL, 2016–2020 (USD MILLION)

TABLE 146 REST OF AFRICA: MARKET SIZE, BY SERVICE MODEL, 2021–2026 (USD MILLION)

TABLE 147 REST OF AFRICA: MARKET SIZE, BY SERVICE TYPE, 2016–2020 (USD MILLION)

TABLE 148 REST OF AFRICA: MARKET SIZE, BY SERVICE TYPE, 2021–2026 (USD MILLION)

TABLE 149 REST OF AFRICA: MARKET SIZE, BY DEPLOYMENT MODEL, 2016–2020 (USD MILLION)

TABLE 150 REST OF AFRICA: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 151 REST OF AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 152 REST OF AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 153 REST OF AFRICA: MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 154 REST OF AFRICA: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 170)

11.1 INTRODUCTION

FIGURE 49 MARKET EVALUATION FRAMEWORK

11.2 MARKET SHARE OF TOP VENDORS

TABLE 155 MEA CLOUD COMPUTING: DEGREE OF COMPETITION

FIGURE 50 MEA CLOUD COMPUTING MARKET: VENDOR SHARE ANALYSIS

11.3 HISTORICAL REVENUE ANALYSIS OF TOP VENDORS

FIGURE 51 HISTORICAL REVENUE ANALYSIS

11.4 COMPANY EVALUATION QUADRANT

11.4.1 DEFINITIONS AND METHODOLOGY

TABLE 156 COMPANY EVALUATION QUADRANT: CRITERIA

11.4.2 STAR

11.4.3 EMERGING LEADER

11.4.4 PERVASIVE

11.4.5 PARTICIPANT

FIGURE 52 MEA CLOUD COMPUTING MARKET (IAAS): COMPANY EVALUATION QUADRANT, 2021

TABLE 157 COMPANY PRODUCT FOOTPRINT

TABLE 158 COMPANY SERVICE MODEL FOOTPRINT

TABLE 159 COMPANY INDUSTRY VERTICAL FOOTPRINT

TABLE 160 COMPANY REGION FOOTPRINT

11.5 COMPETITIVE SCENARIO

TABLE 161 MARKET: NEW LAUNCHES, NOVEMBER 2019–MAY 2021

TABLE 162 MEA CLOUD COMPUTING MARKET: DEALS, DECEMBER 2019–MAY 2021

12 COMPANY PROFILES (Page No. - 181)

12.1 MAJOR PLAYERS

(Business overview, Platforms, products, and solutions offered, Recent developments, MNM view, Key strengths/right to win, Strategic choices made, and Weaknesses and competitive threats)*

12.1.1 MICROSOFT

TABLE 163 MICROSOFT: BUSINESS OVERVIEW

FIGURE 53 MICROSOFT: COMPANY SNAPSHOT

TABLE 164 MICROSOFT: MEA CLOUD COMPUTING MARKET: NEW LAUNCHES

TABLE 165 MICROSOFT: MARKET: DEALS

12.1.2 IBM

TABLE 166 IBM: BUSINESS OVERVIEW

FIGURE 54 IBM: COMPANY SNAPSHOT

TABLE 167 IBM: MARKET: NEW LAUNCHES

TABLE 168 IBM: MARKET: DEALS

12.1.3 GOOGLE

TABLE 169 GOOGLE: BUSINESS OVERVIEW

FIGURE 55 GOOGLE: COMPANY SNAPSHOT

TABLE 170 GOOGLE: MEA CLOUD COMPUTING MARKET: NEW LAUNCHES

TABLE 171 GOOGLE: MARKET: DEALS

12.1.4 ALIBABA CLOUD

TABLE 172 ALIBABA CLOUD: BUSINESS OVERVIEW

FIGURE 56 ALIBABA CLOUD: COMPANY SNAPSHOT

TABLE 173 ALIBABA: MARKET: NEW LAUNCHES

TABLE 174 ALIBABA: MARKET: DEALS

12.1.5 AWS

TABLE 175 AWS BUSINESS OVERVIEW

FIGURE 57 AWS: COMPANY SNAPSHOT

TABLE 176 AWS: MARKET: NEW LAUNCHES

TABLE 177 AWS: MEAMARKET: DEALS

12.1.6 ORACLE

TABLE 178 ORACLE: BUSINESS OVERVIEW

FIGURE 58 ORACLE: COMPANY SNAPSHOT

TABLE 179 ORACLE: MEA CLOUD COMPUTING MARKET: NEW LAUNCHES

TABLE 180 ORACLE: MARKET: DEALS

12.1.7 SAP

TABLE 181 SAP: BUSINESS OVERVIEW

FIGURE 59 SAP: COMPANY SNAPSHOT

TABLE 182 SAP: MARKET: NEW LAUNCHES

TABLE 183 SAP: MARKET: DEALS

12.1.8 SALESFORCE

TABLE 184 SALESFORCE: BUSINESS OVERVIEW

FIGURE 60 SALESFORCE: COMPANY SNAPSHOT

TABLE 185 SALESFORCE: UTING MARKET: NEW LAUNCHES

TABLE 186 SALESFORCE: MARKET: DEALS

12.1.9 ETISALAT

TABLE 187 ETISALAT: BUSINESS OVERVIEW

FIGURE 61 ETISALAT: COMPANY SNAPSHOT

TABLE 188 ETISALAT: MEA CLOUD COMPUTING MARKET: NEW LAUNCHES

TABLE 189 ETISALAT: MARKET: DEALS

12.1.10 BIOS MIDDLE EAST GROUP

TABLE 190 BIOS MIDDLE EAST GROUP: BUSINESS OVERVIEW

TABLE 191 BIOS MIDDLE EAST GROUP: MARKET: BUSINESS EXPANSION

TABLE 192 BIOS MIDDLE EAST GROUP: MARKET: DEALS

12.1.11 EHOSTING DATAFORT

12.1.12 INJAZAT DATASYSTEMS

12.1.13 STC CLOUD

12.1.14 OOREDOO

12.1.15 GULF BUSINESS MACHINES

12.1.16 INTERTEC SYSTEM

12.1.17 FUJITSU

12.1.18 HUAWEI

12.1.19 CISCO

12.1.20 INFOSYS

12.1.21 TCS

12.1.22 COMPRO

12.1.23 TERACO DATA ENVIRONMENT

12.1.24 LIQUID INTELLIGENT TECHNOLOGIES

12.1.25 COMPREHENSIVE COMPUTING INNOVATIONS

12.1.26 INSOMEA COMPUTER SOLUTIONS

12.1.27 CLOUDBOX TECH

12.1.28 ZONKE TECH

12.1.29 CLOUD4RAIN

12.1.30 MALOMATIA

12.1.31 ORIXCOM

*Details on Business overview, Platforms, products, and solutions offered, Recent developments, MNM view, Key strengths/right to win, Strategic choices made, and Weaknesses and competitive threats might not be captured in case of unlisted companies.

13 ADJACENT MARKET (Page No. - 243)

13.1 INTRODUCTION

13.2 SERVERLESS ARCHITECTURE MARKET

TABLE 193 SERVERLESS ARCHITECTURE MARKET SIZE, BY SERVICE TYPE, 2018–2025 (USD MILLION)

TABLE 194 SERVERLESS ARCHITECTURE MARKET SIZE, BY DEPLOYMENT MODEL, 2018–2025 (USD MILLION)

TABLE 195 SERVERLESS ARCHITECTURE MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

TABLE 196 SERVERLESS ARCHITECTURE MARKET SIZE, BY VERTICAL, 2018–2025 (USD MILLION)

TABLE 197 SERVERLESS ARCHITECTURE MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

14 APPENDIX (Page No. - 245)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

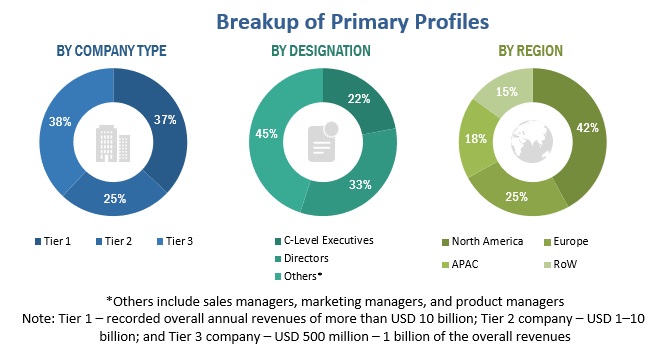

The study involved 4 major activities to estimate the current market size of MEA cloud computing. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information for this study. The secondary sources included annual reports, press releases, and investor presentations of companies; whitepapers; certified publications; and articles from recognized associations, such as data center knowledge and government publishing sources. The research study involved the use of extensive secondary sources, directories, and databases, such as D&B Hoovers, DiscoverOrg, Factiva, Bloomberg BusinessWeek, Statista.com, Cloud Computing Association, The Software Alliance, CCA, MENA Cloud Alliance, International Trade Administration (ITA), Telecommunications Industry Association, United Nations Economic and Social Commission for Asia and the Pacific (ESCAP), Arab Information and Communication Technology Organization (AICTO) to identify and collect information useful for this technical, market-oriented, and commercial study of the MEA cloud computing market. Secondary research was mainly used to obtain key information about the industry’s value chain, the total pool of key players, market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply-side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations providing MEA cloud computing solutions. The primary sources from the demand side included the end-users of event management software solutions, which included Chief Information Officers (CIOs), IT technicians and technologists, and IT managers at public and investor-owned utilities.

The following figure depicts the breakup of the primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the MEA cloud computing market. They were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakup procedures were employed, wherever applicable. The data was triangulated by studying several factors and trends from both, the demand and supply sides, in the MEA cloud computing market.

Report Objectives

- To describe and forecast the MEA cloud computing market based on types (service models and service types), deployment models, organization size, verticals, and regions

- To forecast the market size of regional segments: Middle East (United Arab Emirates, Saudi Arabia, Qatar, Rest of Middle East) and Africa (South Africa, Egypt, and Rest of Africa)

- To strategically analyze the market’s subsegments with respect to individual growth trends, prospects, and contributions to the total market

- To provide detailed information related to major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for major players

- To comprehensively analyze the core competencies of key players

- To track and analyze COVID-19 and competitive developments, such as mergers and acquisitions, new product developments, and partnerships and collaborations, in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs and on best effort basis for profiling of additional market players.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in MEA Cloud Computing Market