Medical Device Testing Market with COVID-19 impact, By Services (Testing, Inspection , Certification), Sourcing , Technology (Active Implant, IVD, Orthopedic & Dental, Opthalmic, Vascular), Class, Testing, Region) - Global Forecast to 2025

The global medical device testing market is expected to grow USD 11.8 billion by 2025, at a CAGR of 4.8% during the forecast period.

The harmonization of standards, growing consumption of medical devices in emerging countries, increasing need of validation and verification for medical devices, the imposition of rigorous government regulations, the growing trend of outsourcing medical device testing services and standards across medical devices are a few of the driving factors for the market. The COVID-19 outbreak in 2019 further accentuated the development of advanced low-cost medical devices. These devices need to comply with stringent regulations regarding medical devices, hence, manufacturers are investing heavily in testing their devices.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on Medical Device Testing Market

The COVID-19 crisis has led to global health and economic pandemic. This has resulted in a number of businesses shutting down their manufacturing plants and halting most of their operations. During this crisis, the main objective of companies is to sustain their businesses by finding safe ways to continue their manufacturing operations or explore other sustainable ways to get their revenue streams flowing. The demand for medical device TIC services has always been on the rise as these services play a vital role across the world in protecting consumers from poor quality, unsafe medical device products. The pandemic has increased the demand for TIC services in the medical sector. For instance, the recent COVID-19 outbreak has led to increased demand for hygienic masks, and countries such as France, Spain, and Mexico have published relevant standards and specification, namely the UNE 0065, UNE 0064-1, UNE 0064-2, and AFNOR-SPEC-S76 standards, which are to be met before a mask is being sold. Additionally, TIC market players providing services to the medical industry have started remote inspections of medical equipment to maintain the continuity of health and safety compliance and avoid any possible physical contact.

Drivers Increasing need for validation and verification of medical devices

Manufacturing companies across the globe are planning to invest more on automation post COVID-19 also the need for automated quality assurance has increased as industries have realized its importance in manufacturing processes. This need is however further elevated due to the COVID-19 outbreak due to less intervention by human involved in the process. This has resulted in the widespread acceptance of machine vision as an integral part of long-term automation development processes.

Restraints Barriers to the local development of medical devices

While the promotion of standards and control of medical devices are essential, excessive regulations, particularly to the domestic context, can also act as a barrier to local innovation of these devices. It can potentially hinder domestic innovation by subjecting new technologies to a lengthy and expensive licensing procedure, subsequently increasing the cost and the time that local manufacturers have to spend in addition to the manufacturing cost of the medical equipment. A few products, which are of significant value to low-income countries, may be removed from the market due to the perceived risks associated with their use.

Opportunity: Development in AI and IoT in various medical devices

The global medical device testing market is witnessing a series of developments in the field of drug-device combination, personalized medicine, and the elevated adaption of various portable and wearable medical devices. Technological advancements such as the implementation of IoT and AI in various devices is a key growth parameter for the global medical device testing service market. These devices need to comply with stringent regulations, hence, manufacturers are investing heavily in testing their devices

Challenge: Long lead time for overseas qualifications

In the present globalized world, where countries are dependent on each other and engage in mutual trading and exchange of goods and services, the import and export of products are affected by the time-consuming process of overseas acceptance of products. Doing business in the overseas market is a major concern for companies due to the long lead time required for overseas qualification tests. With the delay in the importing and exporting of products, risks such as the loss of customers, quality of products, and wastage of time are likely to affect the functioning of businesses. The lead time for overseas qualification tests needs to reduce. With the decreasing number of barriers to international trade, the lead time for overseas qualification tests is also increasing. Thus, the long lead time for overseas qualification tests is a major challenge for the medical device testing market in most applications.

FIGURE 25 TYPICAL PRODUCT LIFECYCLE FOR A MEDICAL DEVICE

To know about the assumptions considered for the study, download the pdf brochure

Testing Services, by service type held the largest share in the global medical device testing market in 2019

There is an increasing demand for TIC services in medical devices, owing to the rising demand for good quality and standard products across the industry. In the market, testing services ensure the products have met the required quality, safety, and performance regulatory standards. A few of the major examples of testing services are electromedical device testing, biocompatibility testing, clinical research services assessing the final product to investigate the faulty material, and testing the performance of medical devices and the electrical safety of devices. Testing services are carried out in laboratories and research sites. Testing services assist manufacturers in improving the marketability of their medical devices and in lowering costs in the pre-production phase (e.g. R&D, the selection of suppliers, etc. However, the Certification services tend to grow at a higher CAGR during the forecast period as certifications ensure that the manufacturers of the medical products have followed the standards and quality and safety norms during the production process.

Outsourcing, by sourcing type will grow at a higher CAGR during the forecast period

Many large firms are increasingly outsourcing medical device testing services as the increased regulations make it costly to conduct in-house tests, thereby helping firms reduce the overall cost of testing.

The demand for outsourcing TIC services to third-party vendors is increasing for technologies, such as active implant medical devices, owing to the capital-intensive nature of in-house TIC activities. However, the in-house sourcing type held the major share of the global medical device testing market in 2019.

The demand for class III medical device is high due to the associated risk factor involved in these devices

The class III medical device testing market is projected to grow at the highest CAGR from 2020 to 2025. There is an increasing need for classifying medical devices due to the presence of potential risks associated with medical devices and concerned patients. Class III medical devices are used to sustain or support human life. Class III devices are generally the high-risk devices and are therefore subject to the highest level of regulatory control. Class III devices must typically be approved by the FDA before they are marketed. Class III devices include replacement heart valves, implantable pacemakers, and pulse generators. However, Class II devices held the largest share of the global market in 2019.

IVD adds significant value to the treatment process and medical diagnosis, and is projected to hold the largest share in the by technology, medical device testing market during the forecast period

IVD adds significant value to the treatment process and medical diagnosis, which simultaneously increases the well-being of public health. These devices help detect infections, diagnose medical conditions, and monitor drug therapies. IVD medical devices include various devices, but not limited to HIV hepatitis detection devices, infectious disease detection devices, blood glucose monitors, human leukocyte antigen detection devices, cancer markers, clinical chemistry devices, COVID-19 test kits, pregnancy test kits, coagulation test systems, urine test strips, and receptacles manufactured specifically for medical specimens. However, the active implant medical device technology tend to grow at a higher CAGR during the forecast period because of there direct impact on safety and health of personnel.

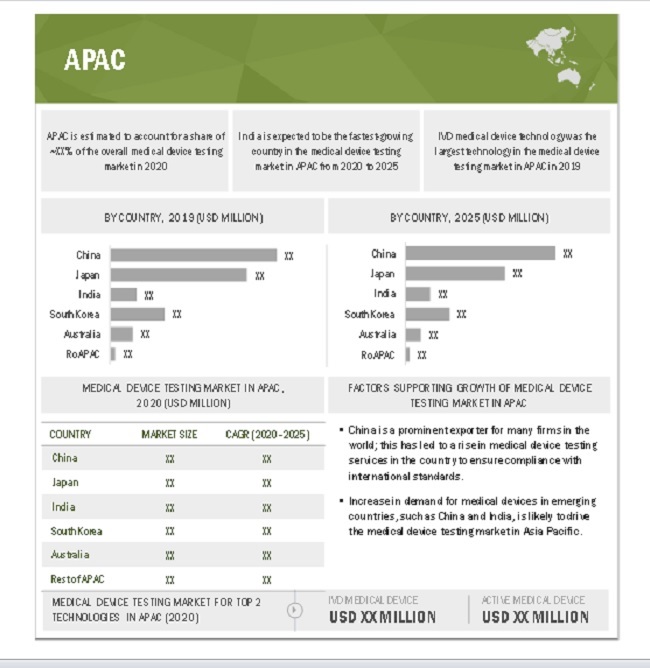

Asia Pacific is projected to grow at the highest CAGR during the forecast period

The medical device testing market in APAC is growing rapidly because of the rising per capita income among the middle class. Moreover, there is growing consumer awareness regarding the importance of certification. The market in India is projected to growing at the highest CAGR during the forecast period. North America, however, holds the largest share in the global market as Strict regulations have been established by the governments to maintain quality and safety standards in the industry, which drives the need for TIC services in North America.

INDIA ACCOUNTED FOR THE LARGEST SHARE OF THE APAC MACHINE VISION MARKET IN 2019

Source: Press Releases, Investor Relation Presentations, Annual Reports, Expert Interviews, and MarketsandMarkets Analysis

Key Market Players

The medical device testing market is dominated by a few globally established players such as SGS (Switzerland), Eurofins Scientific (UK), Bureau Veritas (UK), Intertek (UK), TάV SάD (UK), and DEKRA (UK).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

:

|

Report Metric |

Details |

| Estimated Value | USD 9.3 Billion |

| Expected Value | USD 11.8 Billion |

| Growth Rate | CAGR of 4.8% |

|

Market size available for years |

20202025 |

|

Base year |

2019 |

|

Forecast period |

20202025 |

|

Units |

Value, USD |

|

Segments covered |

By Service type, By Sourcing type, By Device class, By Technology |

|

Geographic regions covered |

North America, APAC, Europe, and RoW |

|

Companies covered |

SGS (Switzerland), Eurofins Scientific (UK), Bureau Veritas (UK), Intertek (UK), TάV SάD (UK), DEKRA (UK), BSI (UK), TάV Rheinland (UK), UL (US), ASTM (US), Elements Material Technology (UK), Envigo (US), Avomeen Analytical Services (US), Gateway Analytical (US), Medistri SA (Switzerland), North American Science Associates (US), Pace Analytical Services (US), Wuxi Apptec (China), Toxikon (US), Charles River Laboratories (US), Medical Device Testing services (US), Source Bioscience (UK), NSF International (US), BDC laboratories (US) and Surpass (US) |

This report categorizes the medical device testing market based on service type, sourcing type, device class, technology and region.

Medical Device Testing Market, By Service Type:

- Testing Services

- Inspection Services

- Certification Services

Medical Device Testing Market, By Sourcing Type:

- In-house

- Outsourced

Medical Device Testing Market, By Device Class:

- Class I

- Class II

- Class III

Medical Device Testing Market, By Technology:

- Active Implant Medical Device

- Active Medical Device

- Non-Active Medical Device

- In-vitro Diagnostic Medical Device

- Ophthalmic Medical Device

- Orthopedic and Dental Medical Device

- Vascular Medical Device

- Other Medical Device Technologies

Medical Device Testing Market, by Region:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

- APAC

- China

- Japan

- India

- South Korea

- Australia

- Rest of APAC

- RoW

- South America

- Middle East and Africa

Recent Developments:

- In June 2020, Intertek announced the expansion of its personal protective equipment services to include the pre-certification testing of N95 respirators to requirements set by the National Institute for Occupational Safety and Health (NIOSH). With these new services, Intertek also expanded upon its solutions and resources to support customers and the global community during the COVID-19 pandemic.

- In October 2019, TάV SάD signed a memorandum of understanding (MoU) with the NUS Centre for Additive Manufacturing (AM.NUS) at the National University of Singapore (NUS), to promote R&D activities in the area of 3D printed biomedical implants for clinical trials.

- In May 2019, Intertek announced the expansion of its pharmaceutical services laboratory in Melbourne, near Cambridge, through the acquisition of a new 20,000 sq. ft facility, which will double the footprint of the existing laboratory.

- In February 2019, Bureau Veritas and Microsoft, the leader in productivity platforms and services, announced the conclusion of a global technical and business collaboration for the development of laboratory testing services based on artificial intelligence (AI).

- In January 2018, SGS acquired Laboratoire de Contrτle et dAnalyse (LCA) (Belgium). LCA is a good manufacturing practice (GMP human and veterinary) and ISO 17025-certified lab that provides chemical as well as microbiological testing and consultancy services to national and international pharmaceutical companies, enabling compliance with Belgian and European procedures.

Frequently Asked Questions (FAQ):

What is the current size of the medical device testing market?

The medical device testing market was valued at USD 9.3 billion in 2020 and is projected to reach USD 11.8 billion by 2025; growing at a CAGR of 4.8%

What are some of the new updates in regulations in any segment under medical device testing market?

Due to the impact of COVID-19 on the medtech industry and the implementation of a major overhaul of its regulatory system can cause a detrimental effect on the availability of life-saving medical technologies. Therefore, the EU has been revising the new regulations implementation timelines. According to Medtech Europe, March 2020, the implementation of new In-vitro Diagnostic (IVD) and Medical Devices Regulations is postponed until the situation has stabilized and all healthcare stakeholders can again dedicate the resources needed to properly implement the Regulations in a manageable way.

Who are the winners in the global medical device testing market?

Companies such as SGS, Eurofins Scientific, Bureau Veritas, Intertek, TάV SάD, and DEKRA fall under the winners category. These companies cater to the requirements of their customers by providing customized products. Moreover, these companies have multiple supply contracts with global OEMs and have effective supply chain strategies. Such advantages give these companies an edge over other companies that are component providers.

What is the COVID-19 impact on medical device testing market?

The market for medical device testing is primarily driven by the continuously rising number of COVID-19 cases leading to the increasing number of ICU beds, which leads to the growing demand for COVID-19 priority medical devices. The market is also driven by factors such as the increased requirement for PPE kits and N95 masks globally and rising demand for ventilators for the effective management of critical COVID-19 patients.

What are some of the technological advancements in the market?

Innovative surgical interventions such as autonomous surgical robots and intelligent balloon catheters are likely to enhance the outcome of complex surgeries and enable the introduction of new forms of minimally invasive surgeries. Similarly, the COVID-19 outbreak has accentuated the use of AI-technology by sequencing the coronavirus genome quicker with AI-enabled tools. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 29)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 MARKET SEGMENTATION

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 34)

2.1 RESEARCH DATA

FIGURE 2 MEDICAL DEVICE TESTING MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Major secondary sources

2.1.1.2 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primaries

2.1.3 SECONDARY AND PRIMARY RESEARCH

2.1.3.1 Key industry insights

2.2 MARKET SIZE ESTIMATION

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: REVENUE OF MARKET PLAYERS

2.2.1 BOTTOM-UP APPROACH

FIGURE 4 MARKET: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 5 MARKET: TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 44)

3.1 IMPACT OF COVID-19 ON MARKET

FIGURE 7 MARKET, PRE-COVID-19 VS. POST-COVID-19 IMPACT

3.1.1 PRE-COVID-19 SCENARIO

3.1.2 POST-COVID-19 SCENARIO

FIGURE 8 TESTING SERVICE MARKET FOR ACTIVE IMPLANT MEDICAL DEVICE TECHNOLOGY IS EXPECTED TO EXHIBIT HIGHEST GROWTH RATE DURING FORECAST PERIOD

FIGURE 9 MARKET FOR CERTIFICATION SERVICES TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 10 CLASS II MEDICAL DEVICES ARE EXPECTED TO HOLD LARGEST MARKET SIZE DURING FORECAST PERIOD

FIGURE 11 NORTH AMERICA LED MARKET IN 2019

4 PREMIUM INSIGHTS (Page No. - 49)

4.1 MEDICAL DEVICE TESTING MARKET, 20202025 (USD BILLION)

FIGURE 12 NEED FOR VERIFICATION AND VALIDATION PROCESSES IN MEDICAL DEVICES IS EXPECTED TO DRIVE MARKET GROWTH DURING FORECAST PERIOD

4.2 MARKET, BY TECHNOLOGY

FIGURE 13 IVD MEDICAL DEVICE TO LEAD MARKET DURING FORECAST PERIOD

4.3 MARKET, BY DEVICE CLASS

FIGURE 14 MARKET FOR CLASS III MEDICAL DEVICES IS EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4.4 MARKET, BY SOURCING TYPE

FIGURE 15 OUTSOURCED TYPE IS LIKELY TO WITNESS HIGHER CAGR DURING FORECAST PERIOD

4.5 MARKET, BY REGION

FIGURE 16 NORTH AMERICA IS EXPECTED TO HOLD LARGEST SHARE IN 2020

5 MARKET OVERVIEW (Page No. - 52)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 MARKET DYNAMICS

5.2.1 DRIVERS

FIGURE 18 MARKET: DRIVERS AND THEIR IMPACT

5.2.1.1 Rising need for more stringent regulatory standards in new medical devices

5.2.1.2 Increasing need for validation and verification of medical devices

5.2.1.3 Imposition of rigorous government regulations

TABLE 1 COMMON FRAMEWORK FOR MEDICAL DEVICE REGULARIZATION

5.2.1.4 Growing trend of outsourcing medical device testing services

5.2.2 RESTRAINTS

FIGURE 19 MARKET: RESTRAINTS AND THEIR IMPACT

5.2.2.1 Barriers to local development of medical devices

5.2.3 OPPORTUNITIES

FIGURE 20 MARKET: OPPORTUNITIES AND THEIR IMPACT

5.2.3.1 Integration of mobile and medical devices

TABLE 2 LIST OF STANDARDS RELATED TO WIRELESS MEDICAL DEVICES

5.2.3.2 Consolidation of fragmented market

5.2.3.3 Rapid advancements in medical technologies

5.2.3.4 Development in IoT and AI in various medical devices

5.2.4 CHALLENGES

FIGURE 21 MEDICAL DEVICE TESTING MARKET: CHALLENGES AND THEIR IMPACT

5.2.4.1 Complex nature of global supply chains

5.2.4.2 Long lead time for overseas qualification tests

6 INDUSTRY TRENDS (Page No. - 61)

6.1 VALUE CHAIN ANALYSIS

FIGURE 22 VALUE CHAIN ANALYSIS OF MEDICAL DEVICE TESTING ECOSYSTEM, 2019

6.1.1 CORE INDUSTRY SEGMENTS FOR OVERALL MEDICAL DEVICE TESTING ECOSYSTEM

6.1.1.1 TIC standards and regulatory bodies

6.1.1.2 Companies offering TIC services

6.1.1.3 Technologies for end-user applications

6.2 FACTOR ANALYSIS

FIGURE 23 MEDICAL DEVICE MARKET: FORECAST FOR GROWTH (2016-2020)

6.3 INDUSTRY TRENDS

FIGURE 24 COMMERCIALIZATION OF IOT TECHNOLOGY AND ADOPTION OF AI IN HEALTHCARE: LEADING TRENDS AMONG KEY MARKET PLAYERS

6.4 PATENT ANALYSIS

TABLE 3 TOTAL NUMBER OF PATENTS FILLED AND GRANTED BY MAJOR MEDICAL DEVICE COMPANIES (20022015)

FIGURE 25 TYPICAL PRODUCT LIFECYCLE FOR MEDICAL DEVICE

7 MEDICAL DEVICE TESTING MARKET, BY TESTING (Page No. - 67)

7.1 ELECTROMAGNETIC COMPATIBILITY

TABLE 4 COMMON STANDARDS FOR MEDICAL DEVICE REGULARIZATION IN EUROPEAN NATIONS

7.2 ELECTRICAL SAFETY

7.3 WIRELESS CONNECTIVITY (2G/3G/4G-LTE, WI-FI, BLUETOOTH, AND NFC)

TABLE 5 COMMON WIRELESS STANDARDS AND RF FREQUENCIES FOR WIRELESS MEDICAL PRODUCT DESIGN

7.4 ENVIRONMENTAL TESTING

7.5 MECHANICAL TESTING

7.6 CHEMICAL, PHYSICAL, AND BIOCOMPATIBILITY TESTING

7.7 CYBERSECURITY TESTING

TABLE 6 MEMORANDA OF UNDERSTANDING ON CYBERSECURITY IN MEDICAL DEVICES

8 MEDICAL DEVICE TESTING MARKET, BY SERVICE TYPE (Page No. - 73)

8.1 INTRODUCTION

FIGURE 26 MARKET FOR CERTIFICATION SERVICES TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 7 MARKET, BY SERVICE TYPE, 20172019 (USD MILLION)

TABLE 8 MARKET, BY SERVICE TYPE, 20202025 (USD MILLION)

8.2 IMPACT OF COVID-19 ON MEDICAL DEVICE TESTING CERTIFICATION SERVICE MARKET

TABLE 9 MEDICAL DEVICE TESTING CERTIFICATION SERVICE MARKET, 20172025 (USD MILLION)

FIGURE 27 MEDICAL DEVICE TESTING CERTIFICATION SERVICE MARKET (20172025)

8.3 TESTING SERVICES

8.3.1 TESTING SERVICES ENSURE PRODUCTS HAVE MET REQUIRED QUALITY, SAFETY, AND PERFORMANCE REGULATORY STANDARDS

TABLE 10 MARKET FOR TESTING SERVICES, BY TECHNOLOGY, 20172019 (USD MILLION)

TABLE 11 MARKET FOR TESTING SERVICES, BY TECHNOLOGY, 20202025 (USD MILLION)

8.4 INSPECTION SERVICES

8.4.1 INSPECTION SERVICES IN MARKET INVOLVE EXAMINATION OF TRADED GOODS AND COMMODITIES FROM MANUFACTURING TO FINAL PRODUCT STORAGE

TABLE 12 MARKET FOR INSPECTION SERVICES, BY TECHNOLOGY, 20172019 (USD MILLION)

TABLE 13 MARKET FOR INSPECTION SERVICES, BY TECHNOLOGY, 20202025 (USD MILLION)

8.5 CERTIFICATION SERVICES

8.5.1 CERTIFICATIONS ENSURE THAT MANUFACTURERS OF MEDICAL PRODUCTS HAVE FOLLOWED STANDARDS AND QUALITY AND SAFETY NORMS DURING PRODUCTION PROCESS

TABLE 14 MARKET FOR CERTIFICATION SERVICES, BY TECHNOLOGY, 20172019 (USD MILLION)

TABLE 15 MARKET FOR CERTIFICATION SERVICES, BY TECHNOLOGY, 20202025 (USD MILLION)

8.6 OTHERS

TABLE 16 MARKET FOR OTHER SERVICE TYPES, BY TECHNOLOGY, 20172019 (USD MILLION)

TABLE 17 MARKET FOR OTHER SERVICE TYPES, BY TECHNOLOGY, 20202025 (USD MILLION)

9 MEDICAL DEVICE TESTING MARKET, BY SOURCING TYPE (Page No. - 82)

9.1 INTRODUCTION

FIGURE 28 MARKET FOR OUTSOURCED SOURCING TYPE IS EXPECTED TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 18 MARKET, BY SOURCING TYPE, 20172019 (USD MILLION)

TABLE 19 MARKET, BY SOURCING TYPE, 20202025 (USD MILLION)

9.2 IN-HOUSE

9.2.1 IN-HOUSE CAPABILITIES IN TERMS OF TECHNOLOGY, TEST & MEASUREMENT EQUIPMENT AND SKILLED PERSONNEL ARE REQUIRED TO PERFORM MEDICAL DEVICE TESTING ACTIVITIES

TABLE 20 MARKET FOR IN-HOUSE SOURCING TYPE, BY DEVICE CLASS, 20172019 (USD MILLION)

TABLE 21 MARKET FOR IN-HOUSE SOURCING TYPE, BY DEVICE CLASS, 20202025 (USD MILLION)

9.3 OUTSOURCED

9.3.1 OVERALL OUTSOURCED MEDICAL DEVICE TESTING MARKET IS HIGHLY FRAGMENTED WITH LARGE NUMBERS OF SMALL- AND MEDIUM-SIZED PLAYERS

TABLE 22 MARKET FOR OUTSOURCING TYPE, BY DEVICE CLASS, 20172019 (USD MILLION)

TABLE 23 MARKET FOR OUTSOURCING TYPE, BY DEVICE CLASS, 20202025 (USD MILLION)

9.4 IMPACT OF COVID-19 ON OUTSOURCING SERVICES

TABLE 24 MEDICAL DEVICE TESTING OUTSOURCING MARKET, 20172025 (USD MILLION)

FIGURE 29 MEDICAL DEVICE TESTING OUTSOURCING MARKET (20172025) (USD MILLION)

10 MEDICAL DEVICE TESTING MARKET, BY DEVICE CLASS (Page No. - 88)

10.1 INTRODUCTION

10.2 REGIONAL CLASS DIFFERENTIATION

10.2.1 US

10.2.1.1 Class I: General controls

10.2.1.2 Class II: General controls with special controls

10.2.1.3 Class III: General controls, special controls, and pre-market approval

10.2.2 EUROPEAN UNION AND EUROPEAN FREE TRADE ASSOCIATION

10.2.3 CANADA

10.2.4 AUSTRALIA

10.3 CLASS DIFFERENTIATION CONSIDERED IN THIS STUDY

FIGURE 30 CLASS II MEDICAL DEVICES TO HOLD LARGEST MARKET SIZE DURING FORECAST PERIOD

TABLE 25 MARKET, BY DEVICE CLASS, 20172019 (USD MILLION)

TABLE 26 MARKET, BY DEVICE CLASS, 20202025 (USD MILLION)

10.4 IMPACT OF COVID-19 ON CLASS III MEDICAL DEVICES

TABLE 27 CLASS III MEDICAL DEVICE TESTING MARKET, 20172025 (USD MILLION)

FIGURE 31 CLASS III MARKET, 20172025 (USD MILLION)

10.5 CLASS I

10.5.1 CLASS I MEDICAL DEVICES HAVE MINIMUM POTENTIAL TO HARM USERS

TABLE 28 MARKET FOR CLASS I DEVICES, BY SOURCING TYPE, 20172019 (USD MILLION)

TABLE 29 MARKET FOR CLASS I DEVICES, BY SOURCING TYPE, 20202025 (USD MILLION)

10.6 CLASS II

10.6.1 CLASS II MEDICAL DEVICES MUST HAVE SPECIAL LABELLING AND SHOULD MEET PERFORMANCE STANDARDS AND POST-MARKET SURVEILLANCE REQUIREMENTS

TABLE 30 MARKET FOR CLASS II DEVICES, BY SOURCING TYPE, 20172019 (USD MILLION)

TABLE 31 MARKET FOR CLASS II DEVICES, BY SOURCING TYPE, 20202025 (USD MILLION)

10.7 CLASS III

10.7.1 CLASS III MEDICAL DEVICES SUPPORT OR SUSTAIN HUMAN LIVES

TABLE 32 MARKET FOR CLASS III DEVICES, BY SOURCING TYPE, 20172019 (USD MILLION)

TABLE 33 MARKET FOR CLASS III DEVICES, BY SOURCING TYPE, 20202025 (USD MILLION)

11 MEDICAL DEVICE TESTING MARKET, BY TECHNOLOGY (Page No. - 96)

11.1 INTRODUCTION

FIGURE 32 MARKET FOR ACTIVE IMPLANT MEDICAL DEVICE TECHNOLOGY IS EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 34 MARKET, BY TECHNOLOGY, 20172019 (USD MILLION)

TABLE 35 MARKET, BY TECHNOLOGY, 20202025 (USD MILLION)

11.2 IMPACT OF COVID-19 ON ACTIVE IMPLANT MEDICAL DEVICE MARKET

TABLE 36 ACTIVE IMPLANT MEDICAL DEVICE MARKET, 20172025 (USD MILLION)

FIGURE 33 ACTIVE IMPLANT MEDICAL DEVICE MARKET (20172025) (USD MILLION)

11.3 ACTIVE IMPLANT MEDICAL DEVICE

11.3.1 CERTIFICATION OF AIMD IS NECESSARY DUE TO ITS DIRECT IMPACT ON SAFETY AND HEALTH OF PERSONNEL

TABLE 37 MARKET FOR ACTIVE IMPLANT MEDICAL DEVICE, BY SERVICE TYPE, 20172019 (USD MILLION)

TABLE 38 MARKET FOR ACTIVE IMPLANT MEDICAL DEVICE, BY SERVICE TYPE, 20202025 (USD MILLION)

TABLE 39 MARKET FOR ACTIVE IMPLANT MEDICAL DEVICE, BY REGION, 20172019 (USD MILLION)

TABLE 40 MARKET FOR ACTIVE IMPLANT MEDICAL DEVICE, BY REGION, 20202025 (USD MILLION)

11.4 ACTIVE MEDICAL DEVICE

11.4.1 ACTIVE MEDICAL DEVICES ARE CONSIDERED TO BE MEDIUM- TO HIGH-RISK MEDICAL DEVICES

TABLE 41 MARKET FOR ACTIVE MEDICAL DEVICE, BY SERVICE TYPE, 20172019 (USD MILLION)

TABLE 42 MARKET FOR ACTIVE MEDICAL DEVICE, BY SERVICE TYPE, 20202025 (USD MILLION)

TABLE 43 MARKET FOR ACTIVE MEDICAL DEVICE, BY SOURCING TYPE, 20172019 (USD MILLION)

TABLE 44 MARKET FOR ACTIVE MEDICAL DEVICE, BY SOURCING TYPE, 20202025 (USD MILLION)

TABLE 45 MARKET FOR ACTIVE MEDICAL DEVICE, BY REGION, 20172019 (USD MILLION)

TABLE 46 MARKET FOR ACTIVE MEDICAL DEVICE, BY REGION, 20202025 (USD MILLION)

11.5 NON-ACTIVE MEDICAL DEVICE

11.5.1 NON-ACTIVE MEDICAL DEVICES CONSIST OF LOW-RISK ITEMS

TABLE 47 MARKET FOR NON-ACTIVE MEDICAL DEVICE, BY SERVICE TYPE, 20172019 (USD MILLION)

TABLE 48 MARKET FOR NON-ACTIVE MEDICAL DEVICE, BY SERVICE TYPE, 20202025 (USD MILLION)

TABLE 49 MARKET FOR NON-ACTIVE MEDICAL DEVICE, BY SOURCING TYPE, 20172019 (USD MILLION)

TABLE 50 MARKET FOR NON-ACTIVE MEDICAL DEVICE, BY SOURCING TYPE, 20202025 (USD MILLION)

TABLE 51 MARKET FOR NON-ACTIVE MEDICAL DEVICE, BY REGION, 20172019 (USD MILLION)

TABLE 52 MARKET FOR NON-ACTIVE MEDICAL DEVICE, BY REGION, 20202025 (USD MILLION)

11.6 IN-VITRO DIAGNOSTIC MEDICAL DEVICE

11.6.1 IVD MEDICAL DEVICE TECHNOLOGY ADDS SIGNIFICANT VALUE TO TREATMENT PROCESS AND MEDICAL DIAGNOSIS

TABLE 53 MARKET FOR IN-VITRO DIAGNOSTIC MEDICAL DEVICE, BY SERVICE TYPE, 20172019 (USD MILLION)

TABLE 54 MARKET FOR IN-VITRO DIAGNOSTIC MEDICAL DEVICE, BY SERVICE TYPE, 20202025 (USD MILLION)

TABLE 55 MARKET FOR IN-VITRO DIAGNOSTIC MEDICAL DEVICE, BY SOURCING TYPE, 20172019 (USD MILLION)

TABLE 56 MARKET FOR IN-VITRO DIAGNOSTIC MEDICAL DEVICE, BY SOURCING TYPE, 20202025 (USD MILLION)

TABLE 57 MARKET FOR IN-VITRO DIAGNOSTIC MEDICAL DEVICE, BY REGION, 20172019 (USD MILLION)

TABLE 58 MARKET FOR IN-VITRO DIAGNOSTIC MEDICAL DEVICE, BY REGION, 20202025 (USD MILLION)

11.7 OPHTHALMIC MEDICAL DEVICE

11.7.1 MARKET IN APAC IS EXPECTED TO GROW AT HIGHEST CAGR FOR OPHTHALMIC MEDICAL DEVICES

TABLE 59 MARKET FOR OPHTHALMIC MEDICAL DEVICE, BY SERVICE TYPE, 20172019 (USD MILLION)

TABLE 60 MARKET FOR OPHTHALMIC MEDICAL DEVICE, BY SERVICE TYPE, 20202025 (USD MILLION)

TABLE 61 MARKET FOR OPHTHALMIC MEDICAL DEVICE, BY SOURCING TYPE, 20172019 (USD MILLION)

TABLE 62 MARKET FOR OPHTHALMIC MEDICAL DEVICE, BY SOURCING TYPE, 20202025 (USD MILLION)

TABLE 63 MARKET FOR OPHTHALMIC MEDICAL DEVICE, BY REGION, 20172019 (USD MILLION)

TABLE 64 MARKET FOR OPHTHALMIC MEDICAL DEVICE, BY REGION, 20202025 (USD MILLION)

11.8 ORTHOPEDIC AND DENTAL MEDICAL DEVICE

11.8.1 ORTHOPEDIC AND DENTAL MEDICAL DEVICES ARE TRENDING TOWARD LOW-COST IMPLANTS, INSTRUMENTATION, AND DELIVERY SYSTEMS

TABLE 65 MARKET FOR ORTHOPEDIC AND DENTAL MEDICAL DEVICE, BY SERVICE TYPE, 20172019 (USD MILLION)

TABLE 66 MARKET FOR ORTHOPEDIC AND DENTAL MEDICAL DEVICE, BY SERVICE TYPE, 20202025 (USD MILLION)

TABLE 67 MARKET FOR ORTHOPEDIC AND DENTAL MEDICAL DEVICE, BY SOURCING TYPE, 20172019 (USD MILLION)

TABLE 68 MARKET FOR ORTHOPEDIC AND DENTAL MEDICAL DEVICE, BY SOURCING TYPE, 20202025 (USD MILLION)

TABLE 69 MARKET FOR ORTHOPEDIC AND DENTAL MEDICAL DEVICE, BY REGION, 20172019 (USD MILLION)

TABLE 70 MARKET FOR ORTHOPEDIC AND DENTAL MEDICAL DEVICE, BY REGION, 20202025 (USD MILLION)

11.9 VASCULAR MEDICAL DEVICE

11.9.1 CERTIFICATION SERVICE MARKET FOR VASCULAR MEDICAL DEVICES IS EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 71 MARKET FOR VASCULAR MEDICAL DEVICE, BY SERVICE TYPE, 20172019 (USD MILLION)

TABLE 72 MARKET FOR VASCULAR MEDICAL DEVICE, BY SERVICE TYPE, 20202025 (USD MILLION)

TABLE 73 MARKET FOR VASCULAR MEDICAL DEVICE, BY SOURCING TYPE, 20172019 (USD MILLION)

TABLE 74 MARKET FOR VASCULAR MEDICAL DEVICE, BY SOURCING TYPE, 20202025 (USD MILLION)

TABLE 75 MARKET FOR VASCULAR MEDICAL DEVICE, BY REGION, 20172019 (USD MILLION)

TABLE 76 MARKET FOR VASCULAR MEDICAL DEVICE, BY REGION, 20202025 (USD MILLION)

11.10 OTHER MEDICAL DEVICE TECHNOLOGIES

11.10.1 MOBILE DEVICES

11.10.2 MEDICAL DEVICES WITH ANCILLARY MEDICINAL SUBSTANCES

11.10.3 MEDICAL DEVICES UTILIZING ANIMAL ORIGIN

TABLE 77 MARKET FOR OTHER MEDICAL DEVICE TECHNOLOGIES, BY SERVICE TYPE, 20172019 (USD MILLION)

TABLE 78 MARKET FOR OTHER MEDICAL DEVICE TECHNOLOGIES, BY SERVICE TYPE, 20202025 (USD MILLION)

TABLE 79 MARKET FOR OTHER MEDICAL DEVICE TECHNOLOGIES, BY SOURCING TYPE, 20172019 (USD MILLION)

TABLE 80 MARKET FOR OTHER MEDICAL DEVICE TECHNOLOGIES, BY SOURCING TYPE, 20202025 (USD MILLION)

TABLE 81 MARKET FOR OTHER MEDICAL DEVICE TECHNOLOGIES, BY REGION, 20172019 (USD MILLION)

TABLE 82 MARKET FOR OTHER MEDICAL DEVICE TECHNOLOGIES, BY REGION, 20202025 (USD MILLION)

12 GEOGRAPHIC ANALYSIS (Page No. - 120)

12.1 INTRODUCTION

FIGURE 34 GEOGRAPHIC SNAPSHOT: RAPIDLY-GROWING COUNTRIES SUCH AS INDIA, MEXICO, AND CHINA ARE EMERGING AS POTENTIAL NEW MARKETS

12.2 IMPACT OF COVID-19 MEDICAL DEVICE TESTING MARKET IN APAC

TABLE 83 MARKET IN APAC, 20172025 (USD MILLION)

FIGURE 35 MARKET IN APAC, 20172025 (USD MILLION)

TABLE 84 MARKET, BY REGION, 20172019 (USD MILLION)

TABLE 85 MARKET, BY REGION, 20202025 (USD MILLION)

12.3 NORTH AMERICA

FIGURE 36 MARKET SNAPSHOT: NORTH AMERICA

TABLE 86 MARKET IN NORTH AMERICA, BY COUNTRY, 20172019 (USD MILLION)

TABLE 87 MARKET IN NORTH AMERICA, BY COUNTRY, 20202025 (USD MILLION)

TABLE 88 MARKET IN NORTH AMERICA, BY TECHNOLOGY, 20172019 (USD MILLION)

TABLE 89 MARKET IN NORTH AMERICA, BY TECHNOLOGY, 20202025 (USD MILLION)

TABLE 90 MARKET IN NORTH AMERICA, BY SOURCING TYPE, 20172019 (USD MILLION)

TABLE 91 MARKET IN NORTH AMERICA, BY SOURCING TYPE, 20202025 (USD MILLION)

12.3.1 US

12.3.1.1 US is world leader in medical devices in terms of awareness among users about safety and security of medical devices

TABLE 92 MARKET IN US, BY SOURCING TYPE, 20172019 (USD MILLION)

TABLE 93 MARKET IN US, BY SOURCING TYPE, 20202025 (USD MILLION)

12.3.2 CANADA

12.3.2.1 Canada is actively involved in setting up medical device regulations

TABLE 94 MARKET IN CANADA, BY SOURCING TYPE, 20172019 (USD MILLION)

TABLE 95 MARKET IN CANADA, BY SOURCING TYPE, 20202025 (USD MILLION)

12.3.3 MEXICO

12.3.3.1 Mexico is among largest medical device importers globally

TABLE 96 MARKET IN MEXICO, BY SOURCING TYPE, 20172019 (USD MILLION)

TABLE 97 MARKET IN MEXICO, BY SOURCING TYPE, 20202025 (USD MILLION)

12.4 EUROPE

FIGURE 37 MARKET SNAPSHOT: EUROPE

TABLE 98 MARKET IN EUROPE, BY COUNTRY, 20172019 (USD MILLION)

TABLE 99 MARKET IN EUROPE, BY COUNTRY, 20202025 (USD MILLION)

TABLE 100 MARKET IN EUROPE, BY TECHNOLOGY, 20172019 (USD MILLION)

TABLE 101 MARKET IN EUROPE, BY TECHNOLOGY, 20202025 (USD MILLION)

TABLE 102 MARKET IN EUROPE, BY SOURCING TYPE, 20172019 (USD MILLION)

TABLE 103 MARKET IN EUROPE, BY SOURCING TYPE, 20202025 (USD MILLION)

12.4.1 UK

12.4.1.1 market in UK is primarily driven by enforcement of regulatory and industry standards

TABLE 104 MARKET IN UK, BY SOURCING TYPE, 20172019 (USD MILLION)

TABLE 105 MARKET IN UK, BY SOURCING TYPE, 20202025 (USD MILLION)

12.4.2 GERMANY

12.4.2.1 Germany has worldwide strong position in terms of medical devices

TABLE 106 MARKET IN GERMANY, BY SOURCING TYPE, 20172019 (USD MILLION)

TABLE 107 MARKET IN GERMANY, BY SOURCING TYPE, 20202025 (USD MILLION)

12.4.3 FRANCE

12.4.3.1 France has significant demand for medical devices

TABLE 108 MARKET IN FRANCE, BY SOURCING TYPE, 20172019 (USD MILLION)

TABLE 109 MARKET IN FRANCE, BY SOURCING TYPE, 20202025 (USD MILLION)

12.4.4 ITALY

12.4.4.1 Medical device industry in Italy has witnessed significant growth in past few years

TABLE 110 MARKET IN ITALY, BY SOURCING TYPE, 20172019 (USD MILLION)

TABLE 111 MARKET IN ITALY, BY SOURCING TYPE, 20202025 (USD MILLION)

12.4.5 SPAIN

12.4.5.1 Medical devices are regulated by Spanish Agency of Medicines and Health Products

TABLE 112 MARKET IN SPAIN, BY SOURCING TYPE, 20172019 (USD MILLION)

TABLE 113 MARKET IN SPAIN, BY SOURCING TYPE, 20202025 (USD MILLION)

12.4.6 REST OF EUROPE

TABLE 114 MARKET IN REST OF EUROPE, BY SOURCING TYPE, 20172019 (USD MILLION)

TABLE 115 MARKET IN REST OF EUROPE, BY SOURCING TYPE, 20202025 (USD MILLION)

12.5 APAC

FIGURE 38 MARKET SNAPSHOT: APAC

TABLE 116 MARKET IN APAC, BY COUNTRY, 20172019 (USD MILLION)

TABLE 117 MARKET IN APAC, BY COUNTRY, 20202025 (USD MILLION)

TABLE 118 MARKET IN APAC, BY TECHNOLOGY, 2017-2019 (USD MILLION)

TABLE 119 MARKET IN APAC, BY TECHNOLOGY, 20202025 (USD MILLION)

TABLE 120 MARKET IN APAC, BY SOURCING TYPE, 20172019 (USD MILLION)

TABLE 121 MARKET IN APAC, BY SOURCING TYPE, 20202025 (USD MILLION)

12.5.1 CHINA

12.5.1.1 Market in China has grown in past few years and is likely to witness uptrend in future

TABLE 122 MARKET IN CHINA, BY SOURCING TYPE, 20172019 (USD MILLION)

TABLE 123 MARKET IN CHINA, BY SOURCING TYPE, 20202025 (USD MILLION)

12.5.2 JAPAN

12.5.2.1 Japan has significant demand for TIC services to help comply with international standards

TABLE 124 MARKET IN JAPAN, BY SOURCING TYPE, 20172019 (USD MILLION)

TABLE 125 MARKET IN JAPAN, BY SOURCING TYPE, 20202025 (USD MILLION)

12.5.3 INDIA

12.5.3.1 market in India has witnessed major investments from global market players

TABLE 126 MARKET IN INDIA, BY SOURCING TYPE, 20172019 (USD MILLION)

TABLE 127 MARKET IN INDIA, BY SOURCING TYPE, 20202025 (USD MILLION)

12.5.4 SOUTH KOREA

12.5.4.1 South Korea is dynamic market that is heavily reliant on medical device imports

TABLE 128 MARKET IN SOUTH KOREA, BY SOURCING TYPE, 20172019 (USD MILLION)

TABLE 129 MARKET IN SOUTH KOREA, BY SOURCING TYPE, 20202025 (USD MILLION)

12.5.5 AUSTRALIA

12.5.5.1 Australian government is improving its trade policies to encourage exports

TABLE 130 MARKET IN AUSTRALIA, BY SOURCING TYPE, 20172019 (USD MILLION)

TABLE 131 MARKET IN AUSTRALIA, BY SOURCING TYPE, 20202025 (USD MILLION)

12.5.6 REST OF APAC

TABLE 132 MARKET IN REST OF APAC, BY SOURCING TYPE, 20172019 (USD MILLION)

TABLE 133 MARKET IN REST OF APAC, BY SOURCING TYPE, 20202025 (USD MILLION)

12.6 ROW

TABLE 134 MARKET IN ROW, BY REGION, 20172019 (USD MILLION)

TABLE 135 MARKET IN ROW, BY REGION, 20202025 (USD MILLION)

TABLE 136 MARKET IN ROW, BY TECHNOLOGY, 20172019 (USD MILLION)

TABLE 137 MARKET IN ROW, BY TECHNOLOGY, 20202025 (USD MILLION)

TABLE 138 MARKET IN ROW, BY SOURCING TYPE, 20172019 (USD MILLION)

TABLE 139 MARKET IN ROW, BY SOURCING TYPE, 20202025 (USD MILLION)

12.6.1 SOUTH AMERICA

12.6.1.1 Brazil is largest market for medical devices in South America

TABLE 140 MARKET IN SOUTH AMERICA, BY SOURCING TYPE, 20172019 (USD MILLION)

TABLE 141 MARKET IN SOUTH AMERICA, BY SOURCING TYPE, 20202025 (USD MILLION)

12.6.2 MIDDLE EAST AND AFRICA

12.6.2.1 Market in Africa is mainly led by South Africa, which has recorded significant developments in medical device sector

TABLE 142 MARKET IN MIDDLE EAST AND AFRICA, BY SOURCING TYPE, 20172019 (USD MILLION)

TABLE 143 MARKET IN MIDDLE EAST AND AFRICA, BY SOURCING TYPE, 20202025 (USD MILLION)

13 COMPETITIVE LANDSCAPE (Page No. - 153)

13.1 OVERVIEW

FIGURE 39 COMPANIES ADOPTED PRODUCT DEVELOPMENTS AS KEY GROWTH STRATEGY FROM 2017 TO MID-2020

13.2 KEY PLAYERS IN MEDICAL DEVICE TESTING MARKET

FIGURE 40 TOP 5 PLAYERS SHARES IN MARKET, 2019

13.3 COMPETITIVE LEADERSHIP MAPPING

13.3.1 VISIONARY LEADERS

13.3.2 INNOVATORS

13.3.3 DYNAMIC DIFFERENTIATORS

13.3.4 EMERGING COMPANIES

FIGURE 41 MEDICAL DEVICE TESTING MARKET (GLOBAL) COMPETITIVE LEADERSHIP MAPPING, 2019

13.4 COMPETITIVE SCENARIO

FIGURE 42 MARKET EVOLUTION FRAMEWORK: NEW STANDARD AND CERTIFICATION IS MAJOR STRATEGY ADOPTED BY KEY PLAYERS

13.5 DEVELOPMENTS

13.5.1 NEW STANDARDS AND CERTIFICATION DEVELOPMENTS

TABLE 144 NEW STANDARDS AND CERTIFICATION DEVELOPMENTS (MID-2020)

13.5.2 EXPANSIONS AND SERVICE EXPANSIONS

TABLE 145 EXPANSIONS AND SERVICE EXPANSIONS (MID-2020)

13.5.3 MERGERS AND ACQUISITIONS

TABLE 146 MERGERS AND ACQUISITIONS (2017MID-2020)

14 COMPANY PROFILES (Page No. - 163)

(Business Overview, Services Offered, Recent Developments, SWOT Analysis, and MnM View)*

14.1 KEY PLAYERS

14.1.1 SGS

FIGURE 43 SGS: COMPANY SNAPSHOT

14.1.2 EUROFINS SCIENTIFIC

FIGURE 44 EUROFINS SCIENTIFIC: COMPANY SNAPSHOT

14.1.3 BUREAU VERITAS

FIGURE 45 BUREAU VERITAS: COMPANY SNAPSHOT

14.1.4 INTERTEK

FIGURE 46 INTERTEK: COMPANY SNAPSHOT

14.1.5 TάV SάD

FIGURE 47 TάV SάD: COMPANY SNAPSHOT

14.1.6 DEKRA

FIGURE 48 DEKRA: COMPANY SNAPSHOT

14.1.7 BSI

FIGURE 49 BSI: COMPANY SNAPSHOT

14.1.8 TάV RHEINLAND

FIGURE 50 TάV RHEINLAND: COMPANY SNAPSHOT

14.1.9 UL

14.1.10 ASTM

FIGURE 51 ASTM: COMPANY SNAPSHOT

14.2 RIGHT-TO-WIN

14.3 START-UP ECOSYSTEM

14.3.1 ELEMENT MATERIAL TECHNOLOGY (EXOVA)

14.3.2 ENVIGO

14.3.3 AVOMEEN ANALYTICAL SERVICES

14.3.4 GATEWAY ANALYTICAL

14.3.5 MEDISTRI SA

14.4 OTHER KEY PLAYERS

14.4.1 NORTH AMERICAN SCIENCE ASSOCIATES (NAMSA)

14.4.2 PACE ANALYTICAL SERVICES

14.4.3 WUXI APPTEC

14.4.4 TOXIKON

14.4.5 CHARLES RIVER LABORATORIES

14.4.6 MEDICAL DEVICE TESTING SERVICES

14.4.7 SOURCE BIOSCIENCE

14.4.8 NSF INTERNATIONAL

14.4.9 BDC LABORATORIES

14.4.10 SURPASS

*Details on Business Overview, Services Offered, Recent Developments, SWOT Analysis, and MnM View might not be captured in case of unlisted companies.

15 APPENDIX (Page No. - 210)

15.1 INSIGHTS OF INDUSTRY EXPERTS

15.2 DISCUSSION GUIDE

15.3 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

15.4 AVAILABLE CUSTOMIZATIONS

15.5 RELATED REPORTS

15.6 AUTHOR DETAILS

The study involved the estimation of the current size of the Medical Device Testing Market. Exhaustive secondary research was done to collect information on the market, peer market, parent market and the impact of COVID-19 outbreak in the said market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chains through primary research. The bottom-up approach was employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

The secondary sources referred to for this research study include medical industry organizations such as the International Organization for Standardization (ISO) (Switzerland), Canadian Standards Association (CSA) International (Canada), ASTM International (US), International Safe Transit Association (ISTA) (US), European Telecommunications Standards Institute (ETSI), American National Standards Institute (ANSI) (US), Hong Kong Certification Body Accreditation Scheme (HKCAS) (Hong Kong) ; corporate filings (such as annual reports, investor presentations, and financial statements); and trade, business, and medical associations. Secondary data has been collected and analyzed to arrive at the overall market size, which is further validated by primary research.

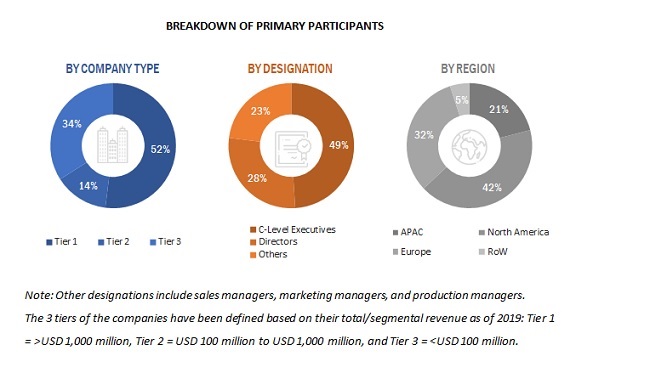

Primary Research

Extensive primary research has been conducted after acquiring an understanding of medical device testing, inspection and certification market scenario through secondary research. Several primary interviews have been conducted with market experts from both the demand and supply-side (players across four major regions, namely, North America, Europe, Asia Pacific, and Rest of the World (Middle East & Africa and South America). Approximately 70% and 30% of primary interviews have been conducted from the demand and supply side, respectively. Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales, operations, and administration, were covered to provide a holistic viewpoint in our report.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts opinions, has led us to the findings as described in the remainder of this report.

BREAKDOWN OF PRIMARY PARTICIPANTS

To know about the assumptions considered for the study, download the pdf brochure

Note: Other designations include sales managers, marketing managers, and production managers.

The 3 tiers of the companies have been defined based on their total/segmental revenue as of 2019: Tier 1 = > USD 1,000 million, Tier 2 = USD 100 million to USD 1,000 million, and Tier 3 = < USD 100 EM million.

Market Size Estimation

The bottom-up approach has been used to estimate and validate the size of the medical device testing market.

- In this approach, the segment revenue of the key players within the market is analyzed and total market is considered at a country and regional level.

- Extensive secondary and primary research has been carried out to understand the global market scenario for various types of medical device testing technologies and methods.

- Several primary interviews have been conducted for key insights from industry experts (such as CEOs, VPs, directors, and marketing executives) for key insights (quantitative and qualitative).

- Qualitative aspects such as market drivers, restraints, opportunities, and challenges have been taken into consideration while calculating and forecasting the market size.

Data Triangulation

After arriving at the overall market size using the estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures have been employed, wherever applicable. The data have been triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

To define and describe the medical device testing market, by, technology, sourcing type, service type, device class, and region

- To forecast the market size, in terms of value, for various segments with regard to 4 main regions, namely, North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

- To provide detailed information regarding the major factors influencing the growth of the medical device testing market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To study the complete value chain and allied industry segments, and perform a value chain analysis of the medical device testing landscape

- To analyze the opportunities in the market for various stakeholders by identifying the high-growth segments of the medical device testing market

- To profile the key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing the competitive landscape for the market leaders

- To analyze competitive developments, such as partnerships and joint ventures, mergers and acquisitions, new service launcehes, expansions, and research and development, in the medical device testing market

- To analyze the impact of COVID-19 on the medical device testing market through secondary and primary research for both pre- and post-COVID-19 scenarios

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to a companys specific needs. The following customization options are available for this report.

Company Information

- Detailed analysis and profiling of additional 5 market players

Growth opportunities and latent adjacency in Medical Device Testing Market