Micro-Electro-Mechanical System (MEMS) Market Size, Share & Industry Growth Analysis Report by Sensor Type (Inertial, Pressure, Microphone, Micxrospeaker, Environmental Sensor, Optical Sensor), Actuator Type(Optical, Inkjet Head, Microfluidics and RF), Vertical and Region - Global Growth Driver and Industry Forecast to 2028

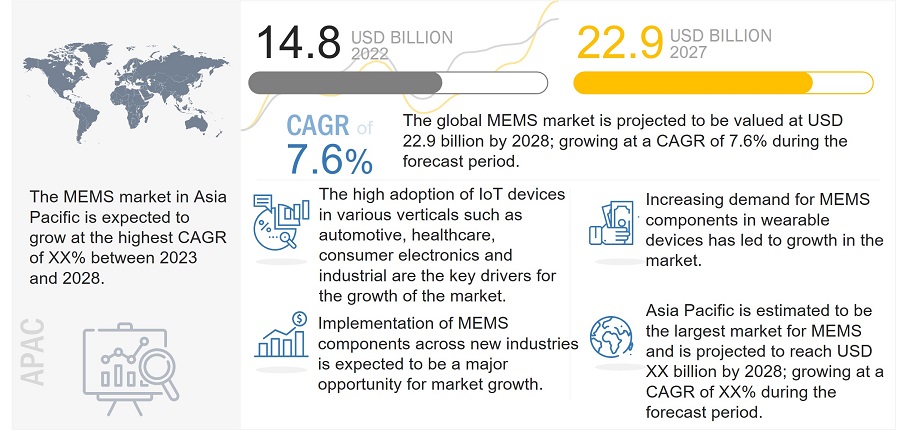

According to MarketsandMarkets, the MEMS market is projected to grow from USD 14.8 billion in 2022 to USD 22.9 billion by 2028, registering a CAGR of 7.6% during the forecast period. Cloud computing is a well-researched domain for various computational means. The use of MEMS technology in cloud computing ensures high-level security, contrary to the conventional methods of securing data. Key factors driving the MEMS market include the growing use of radio-frequency microelectromechanical system (MEMS), increasing demand for IoT devices, and rising demand for consumer electronics. Players in the MEMS market adopted growth strategies such as product launches, partnerships, collaborations, and strategic alliances to cater to the growing demand for MEMS systems and expand their global footprint to all the major regions.

The objective of the report is to define, describe, and forecast the MEMS market based on sensor type, actuator type, vertical, and region.

Micro-Electro-Mechanical System (MEMS) Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

MEMS Market Dynamics

Driver: Growing use of radio-frequency microelectromechanical system (MEMS)

MEMS-based switches are expected to substitute existing products and be used in new applications, such as smartphones and consumer electronics devices. RF MEMS is also expected to replace the electromechanical relay (EMR) as it is comparatively slow, large, consumes more DC power, and has a short operating life. It will be used in telecommunications, aerospace, defense, and many other applications. The benefits of RF MEMS switch over EMR are that a MEMS switch is 1,000x faster and at least 90% smaller, virtually has no power consumption, can survive more than 3 billion switching operations, and handles relatively high incident RF power.

Additionally, to achieve the performance goals of 5G, network infrastructure will need to be considerably denser than the 4G LTE network. Carriers plan to use many small cells with phased array antennas connected to a local processing resource. It will also depend on the frequency the carrier is using in the particular region. RF MEMS technology can provide significant value when used in the RF front end as part of a phased array. 5G infrastructure vendors are implementing RF MEMS tuners for use in RF phase shifter circuits attached to each element in the array. RF MEMS technology can deliver half the insertion loss through the phase shifter compared to Silicon-on-Insulator (SOI) technology for sub-6 GHz 5G frequencies. Thus, as RF MEMS technology can offer several benefits compared with present technologies in the market, its use is growing across several verticals at a significant rate.

Restraint: High production and testing costs associated with microelectromechanical system (MEMS) devices

The cost of research and development for designing new Micro-Electro-Mechanical System components is high. Additionally, fabrication cleanrooms and foundry facilities require high upfront setup costs. For new players operating at smaller production scales, the costs of fabrication and assembly units are extremely high due to lower economies of scale. As a result, MEMS is unsuitable for niche applications unless cost is not an issue. Testing equipment to characterize the quality and performance is also expensive, making it a significant investment for any player to establish its position in the micro-electro-mechanical system market.

Opportunities: Advancements in sensor fusion technology

Sensor fusion is the combination of different data from sensors that may result in complex analysis, which is not possible with the use of sensors singularly and/or separately. Sensor fusion technology is increasingly being used in consumer electronics such as smartphones, wearable devices, and tablets. In the automotive vertical, this technology is used in advanced driver-assisted systems, electronic stability control systems, collision avoidance systems, and parking assist systems. Along with traditional applications, sensor fusion is also being used in sports and biomedical applications. Sensor fusion enables context awareness, which can be used with the Internet of Things (IoT). The IoT allows users and things to be connected anytime, anywhere, for anything using any network or service. The technology creates a large source of information for humans in which objects around know what users like, want, and then act accordingly without unambiguous instructions. Context-aware communication and computing are key technologies enabling intelligent interactions in IoT architecture.

To add a few applications, the smart home is an exciting prospect for sensor fusion technology. Smart homes are expected to have various sensors ranging from temperature and humidity sensors to CCTV cameras and motion detectors. Integrating all such sensor technologies can result in better security and more comfort. Smart transportation applications for sensor fusion include vehicle tracking, speed detectors, traffic density detector, and vehicle routing. Thus, advancements in sensor fusion technology are expected to create lucrative opportunities for the players in the micro-electro-mechanical system market.

Challenges: High complexity issues attributed to miniaturization of devices

With the advent of new compact and portable devices, MEMS manufacturers face the challenge of meeting the customers’ changing needs. The system integrators prefer combining combo sensors with standalone MEMS to reduce the system’s overall size. These sensors combine two or more sensors, such as a gyroscope, accelerometer, magnetometer, pressure sensor, and compass, in a single device, thus offering a compact and cost-effective solution for integrators. The adoption of combo sensors leads to changes in the design of components and systems, reducing the overall system’s MEMS (Micro-Electro-Mechanical System) Market size and dimensions.

However, one of the major challenges for further implementing MEMS into mainstream applications is to stabilize and standardize the fabrication techniques.

Consumer Electronics Vertical to acquire significant share in MEMS (Micro-Electro-Mechanical System) market report

Consumer electronics holds a significant share in the MEMS vertical segment. MEMS are driving the emergence of innovative wearable gadgets. These systems are mainly used in electronic equipment including wearable devices; smartphones, tablets, laptops; portable navigation devices; portable media players; digital cameras; and gaming consoles; as well as e-readers. A few of the most commonly used MEMS in consumer electronics include accelerometers, gyroscopes, magnetic compass, pressure sensors, temperature, and humidity sensors, MEMS microphones, MEMS micro-mirror, bulk acoustic wave (BAW) filters and duplexers, RF switches, TCXO oscillators, ambient light sensor and proximity sensors, microdisplays, and magnetometers.

Inertial Sensor to command largest share in MEMS market

Inertial sensors accounted largest Micro-Electro-Mechanical System (MEMS) Industry share. This growth is attributed to the increased usage of inertial sensors such as accelerometers, gyroscopes, magnetometers, and inertial combo sensors in automotive applications such as electronic stability control (ESC), traction control system (TCS), and anti-lock braking system (ABS), as well as in consumer and wearable applications for location-based services, gaming, and built-in compass app providing screen orientation and for undoing actions by shaking the wearable and electronic devices.

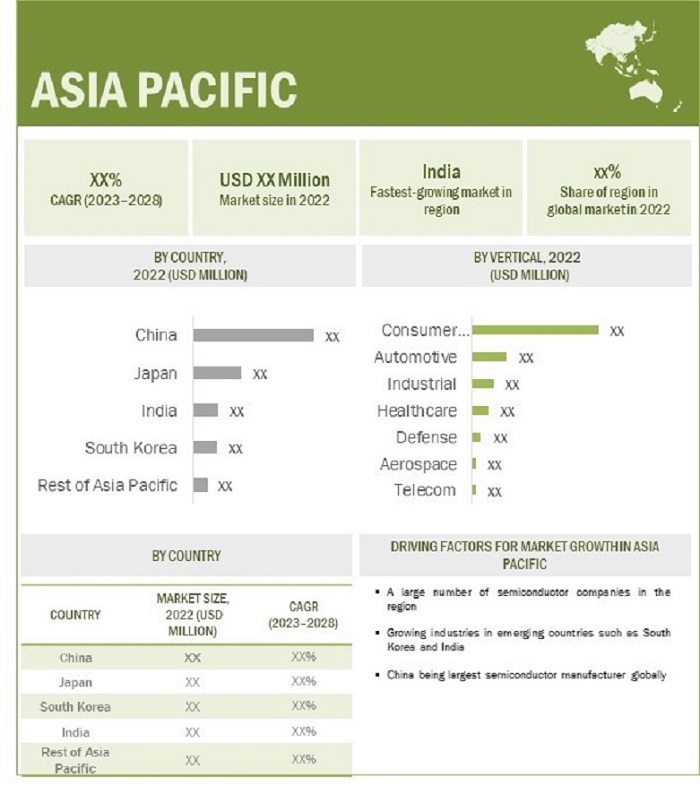

MEMS (Micro-Electro-Mechanical System) market to witness highest demand from Asia Pacific

The dominant position of China in the Asia Pacific MEMS market can be attributed to the deployment of MEMS technology in consumer electronics, automotive, and other verticals. The Asia Pacific market is further segmented into China, Japan, South Korea, India, and the Rest of Asia Pacific. Asia Pacific is a major market for consumer electronics, automobiles, and industrial. This region has become a global focal point for large investments and business expansion opportunities.

In China, there is a huge demand for smartphones, wearable devices, and other connecting devices. Moreover, the Chinese market is expected to grow exponentially due to the availability of leading automotive manufacturing facilities. The developing economy and the growing implementation of MEMS sensors in most verticals are the driving factors for the growth of the micro-electro-mechanical system market in China.

Micro-Electro-Mechanical System (MEMS) Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key market players

Major vendors in the Micro-Electro-Mechanical System (MEMS) Companies analysis include STMicroelectronics (Switzerland), Robert Bosch (Germany), Analog Devices (US), NXP Semiconductors (Netherlands), Texas Instruments (US), Panasonic Corp. (Japan), TE Connectivity (Switzerland), Broadcom (US), Honeywell International (US), and Knowles Corp. LLC (US), among others.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market Size Available for Years |

2019–2028 |

|

Base Year |

2022 |

|

Forecast Period |

2023–2028 |

|

Units |

Value (USD Million/USD Billion) |

|

Segments Covered |

Sensor Type, Actuator Type, Vertical, and Region |

|

Regions Covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies Covered |

STMicroelectronics (Switzerland), Robert Bosch (Germany), Analog Devices (US), NXP Semiconductors (Netherlands), Texas Instruments (US), Panasonic Corp. (Japan), TE Connectivity (Switzerland), Broadcom (US), Honeywell International US), and Knowles Corp. LLC (US). A total of 32 players are profiled in the report. |

Micro-Electro-Mechanical System (MEMS) Market Highlights

This report categorizes the MEMS market based on sensor type, actuator type, vertical, and region.

|

Segment |

Subsegment |

|

By Sensor Type |

|

|

By Actuator Type |

|

|

By Vertical |

|

|

By Region |

|

Recent Developments

- In October 2022, Bosch Sensortec has launched the BMI323, an affordable Inertial Measurement Unit (IMU) with excellent performance and integrated features enabling a shorter development time. The BMI323’s combination of simplicity with an excellent price-performance ratio will open new applications for IMUs. Like its predecessor, BMI160, the new BMI323 is a general-purpose, low-power IMU that combines precise acceleration and angular rate (gyroscopic) measurement with intelligent integrated features that are triggered by motion.

- In February 2022, STMicroelectronics has introduced its third generation of MEMS sensors. The new sensors enable the next leap in performance and features for consumer mobiles and smart industries, healthcare, and retail. To be included in selected variants, extra features include ST’s machine-learning core (MLC) and electrostatic sensing.

- In May 2022, STMicroelectronics has teamed with AWS and Microsoft to expand its reach into the IoT realm. On the AWS front, STMicroelectronics now offers a reference implementation that makes for an easier and more secure connection of IoT devices to the AWS cloud. Meanwhile, in a joint effort with Microsoft, STMicroelectronics has endeavored to strengthen the security of emerging IoT applications.

- In May 2022, Texas Instruments broke down on the first of four potential 300-mm semiconductor manufacturing facilities (Fabs) in Sherman, Texas. Its potential USD 30 billion investment to expand its manufacturing capacity over the long term is the largest private sector economic investment in Texas history.

Frequently Asked Questions (FAQ):

Which are the major companies in the MEMS market? What are their primary strategies to strengthen their market presence?

STMicroelectronics (Switzerland), Robert Bosch (Germany), Texas Instruments (US), Broadcom (US), Qurvo, Inc. (US), are the leading players in the market. These companies have adopted organic and inorganic growth strategies such as product launches, acquisitions, and partnerships to gain a competitive advantage in the market.

Which is the potential market for the consumer electronics vertical in terms of sensor type?

Inertial sensor is a sensor with high growth opportunities owing to advancements in consumer electronics vertical. Major companies that provide consumer electronics vertical are Robert Bosch (Germany), Qurvo, Inc. (US), STMicroelectronics (Switzerland), among others.

What are the opportunities for new market entrants?

Factors such as the advancement in sensor fusion technology and widening application scope of microelectromechanical system (MEMS) technology are creating opportunities for the players in the market.

Which sensor type is expected to drive market growth in the next six years?

Inertial sensors and pressure sensors are expected to remain the major sensor type driving MEMS demand.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

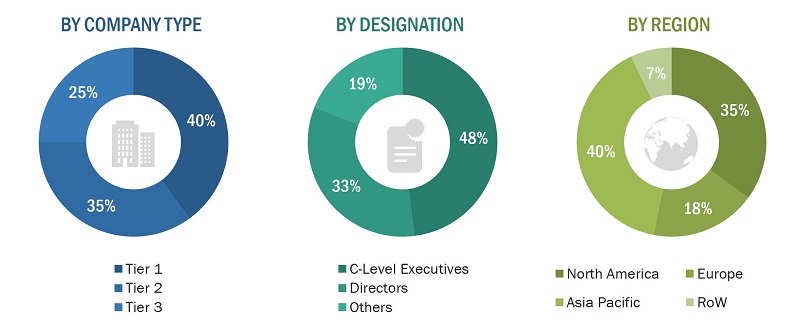

The research process for this study included systematic gathering, recording, and analysis of data about customers and companies operating in the MEMS market. This process involved the extensive use of secondary sources, directories, and databases (Factiva, Oanda, and OneSource) for identifying and collecting valuable information for the comprehensive, technical, market-oriented, and commercial study of the MEMS market. In-depth interviews were conducted with primary respondents, including experts from core and related industries and preferred manufacturers, to obtain and verify critical qualitative and quantitative information as well as to assess growth prospects. Key players in the MEMS market were identified through secondary research, and their market rankings were determined through primary and secondary research. This research included studying annual reports of top players and interviewing key industry experts such as CEOs, directors, and marketing executives.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information important for this study. Secondary sources included corporate filings, such as annual reports, investor presentations, and financial statements; trade, business, and professional associations; white papers, MEMS products related journals, and certified publications; articles by recognized authors; directories; and databases.

Secondary research was conducted to obtain key information about the industry supply chain, market value chain, key players, market classification and segmentation as per Micro-Electro-Mechanical System (MEMS) Market trends to the bottom-most level, geographic markets, and key developments from both market- and technology-oriented perspectives. Data from secondary research was collected and analyzed to determine the overall market size, which was further validated by primary research.

Primary Research

In the primary research process, various primary sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side included industry experts such as CEOs, VPs, marketing directors, technology & innovation directors, and key executives from major companies in the MEMS market.

After going through market engineering (which includes calculations for Micro-Electro-Mechanical System (MEMS) Market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers obtained. Primary research was conducted to identify segmentation types, industry trends, key players, competitive landscape, and key market dynamics such as drivers, restraints, opportunities, and challenges, along with the key strategies adopted by players operating in the market.

To know about the assumptions considered for the study, download the pdf brochure

Market size Estimation

In the complete market engineering process, both top-down and bottom-up approaches were used, along with several data triangulation methods, to estimate and forecast the size of the market and its segments and subsegments listed in the report. Extensive qualitative and quantitative analyses were carried out on the complete market engineering process to list the key information/insights pertaining to the MEMS market.

The key players in the market were identified through secondary research, and their rankings in the respective regions were determined through primary and secondary research. This entire procedure involved the study of the annual and financial reports of top players, as well as interviews with industry experts such as chief executive officers, vice presidents, directors, and marketing executives for quantitative and qualitative key insights. All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and enhanced with detailed inputs and analysis from MarketsandMarkets and presented in this report.

MEMS market: Bottom-up Approach

Data Triangulation

After arriving at the overall size of the MEMS market from the market size estimation process explained above, the total market was split into several segments and subsegments. Where applicable, the market breakdown and data triangulation procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size was validated using top-down and bottom-up approaches.

Report Objectives

- To describe and forecast the MEMS market, in terms of value, based on sensor type, actuator type, and vertical

- To describe and forecast the MEMS market size, in terms of value, with respect to four regions: North America, Europe, Asia Pacific, and the Rest of the World (RoW)

- To provide detailed information about the drivers, restraints, opportunities, and challenges influencing the growth of the MEMS market

- To provide a detailed overview of the supply chain of the MEMS ecosystem

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze opportunities in the market for various stakeholders by identifying the high-growth segments of the market

- To benchmark the market players using the proprietary company evaluation matrix framework, which analyzes the market players on various parameters within the broad categories of business strategy excellence and strength of product portfolios

- To strategically profile the key players and comprehensively analyze their market positions in terms of ranking and core competencies2, along with a detailed competitive landscape of the market

- To analyze competitive developments in the MEMS market, such as acquisitions, product launches, partnerships, expansions, and collaborations

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies.

Product analysis

- Detailed analysis and profiling of additional market players

The following customization options are available for the report:

- Market sizing and forecast for additional countries

- Additional five companies profiling

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Micro-Electro-Mechanical System (MEMS) Market

Good day, I have send this request to know more analysis data for study the trends for MEMS Market.

I need the information about MEMS market to make an investment for manufacturing MEMS-based devices.