Metalized Flexible Packaging Market by Material Type (Aluminum Foil Based, Metalized Film), Structure, Pacakging Type (Pouches, Bags, Wraps), End-Use Industry (Food, Beverage, Personal Care, Pharmaceuticals, Pet Food), Region - Global Forecast to 2025

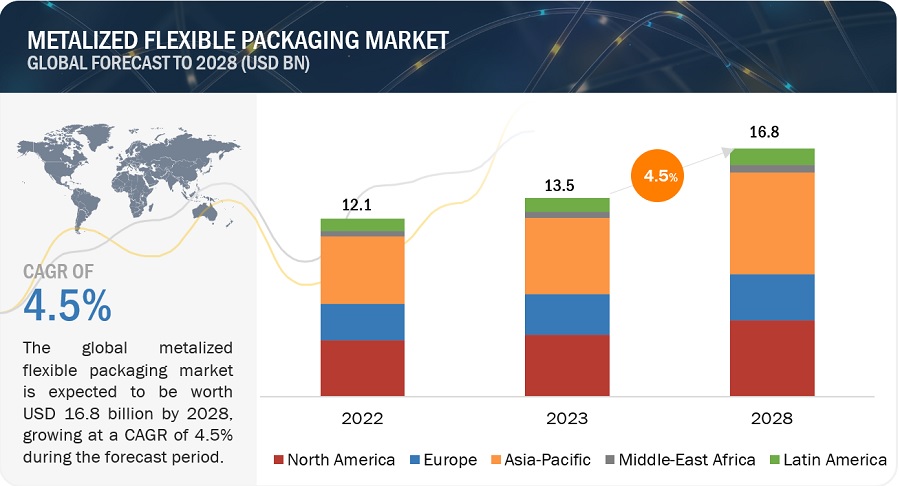

[175 Pages Report] In 2020, the global metalized flexible packaging market size is estimated at USD 4.5 billion and projected to reach USD 5.8 billion by 2025, at a CAGR of 5.3% from 2020 to 2025. The major drivers for the market include an increase in demand for longer shelf life of products and increasing demand for customer-friendly packaging. However, volatile raw material cost restrains the market growth. Moreover, sustainable and new metalized flexible packaging are expected to propel the market for metalized flexible packaging

To know about the assumptions considered for the study, Request for Free Sample Report

Covid-19 Impact On The Global Metalized flexible packaging Market

The global metalized flexible packaging market is expected to witness a moderate decrease in its growth rate in 2020-2021, as the packaging industry witness a significant decline in its production. However, there seems an increase in the demand for metalized flexible packaging for food, beverage, and pharmaceutical applications for product packaging, during COVID-19.

- People are resorting to panic-buying and bulk stocking due to the fear of lockdowns. More people are ordering daily staples and fresh food through online channels, which leads to an increase in the demand for flexible plastic packaging. FMCG companies are responding by demanding more of flexible plastic packaging products.

- The demand for flexible packaging in the pharmaceutical industry, is expected to remain robust as hospitals, drugs, manufacturers are responding to the crisis. The demand for household essentials, healthcare, and medical goods is not expected to decrease dramatically, and retail distribution for these types of products through online delivery can be expected to increase.

Metalized flexible packaging Market Dynamics

Driver: Demand for longer shelf life of products

The increasingly busy lifestyle of consumers and the consequent demand for convenient food packaging is driving the demand for metalized flexible packaging. Metalized flexible packaging helps increase the product life and reduce the use of preservatives. The food & beverages industry is shifting from traditional packaging formats to lightweight and easy-to-handle packaging. Metalized flexible packaging helps cater to this demand as they are lightweight compared to rigid packaging and eliminate the use of glass and cans which increases the weight of packaging. Gain or loss of moisture affects the texture and quality of food as well as pharmaceutical product. It can also aggravate degradation of products which has fat content. Highly flavored food items such as coffee are likely to lose aroma, and bland foods are likely to absorb odor. To avoid the loss of aroma and to avoid odor, metalized films are used as they provide protection against oxygen, moisture, vapor, and aroma. The use of metalized films in food packaging helps in increasing the shelf life of the food products, which directly helps in the reduction of wastage of food.

Restraints: Volatile raw material cost

The largest component of costs involved in making metalized flexible packaging is attributable to raw materials. The polymers used in the metalized flexible packaging are derived from petroleum. Given the volatile trend in crude oil and demand for polymers for various applications, the pressure on input costs can be expected to fluctuate. The fluctuating raw material prices can affect the profitability of the manufacturers restraining the growth of metalized flexible packaging.

Opportunities: Suatainabel and new metalized flexible packaging solutions

Dynamic industry changes, such as the introduction of new regulatory initiatives, have encouraged manufacturers to develop new packaging options. Growing concerns regarding the use of bio-degradable metalized flexible packaging and its impact on the environment have also driven manufacturers to develop sustainable packaging options that are safe and secure. Due to stringent government regulations, changing consumer preferences, and environmental pressures, manufacturers are steering their strategies towards developing recyclable and sustainable solutions. For instance, Celplast Metalized Products Limited (Canada) has developed a variety of sustainable solutions such as Post-Consumer Recycled (PCR) Metalized Polyester and High Barrier Metalized PLA Compostable Film. Camvac Limited (UK) also designed an eco-friendly alternative to metalized polyester which is fully biodegradable and home compostable.

Challenges: Recyclability of metalized flexible packaging

The recyclability of metalized flexible packaging is an environmental and social issue and is also the major challenge faced by the packaging industry. The process of recycling multiple-layer metalized flexible packaging is complex as it involves more steps compared to the mono-layer metalized flexible packaging. Multi-layer metalized flexible packaging involves a mix of polymer types and metal, which makes it difficult to sort from bulk waste. Each layer needs to be analyzed, identified, and recycled individually. During the recycling process, polypropylene (PE) films and other plastics used for metalized flexible packaging are stuck in the machine, causing disruption, thus resulting in an increase in production expenses and time.

Based on material type, the aluminum foil based flexible packaging segment is projected to lead the market during the forecast period

Based on material type, the aluminum foil based flexible packaging segment is estimated to account for the largest share of the metalized flexible packaging market in 2019. Aluminum foil based packaging offers excellent barrier performance against water vapor & gases, good metal bond strength, glossy appearance, good lamination bond strength, and good thermal & mechanical properties. Aluminum foil based flexible packaging is used in packaging for snacks, frozen foods, sweets and pastries, frozen desserts, coffee pouches, and so on. Stand-up pouches allow printing of high-quality, glossy graphics on the package, which makes them attractive and appealing to customers. Such factors are expected to drive the demand for aluminum foil based flexible packaging.

Based on packaging type, the pouches segment is expected to be the fastest growing segment in the market

Pouches is expected to account for the highest market share of the global metalized flexible packaging market by the packaging type during the forecast period. pouches are easier to handle and are preferred for the space they provide for accommodating product information and branding. They can be supplied in a wide range of configurations to make transportation of food products easier. Flat pouches used for medical products are also quite popular in storage and sampling at medical facilities. Improved strength, chemical and erosion-resistance, and barrier properties will lead to its expanding applications in pharmaceutical packaging. Pouches are also used for ready-to-eat or half-cooked meals, in which prepared or ready-to-cook food is completely sealed for a long period under unrefrigerated storage. Pouches with gusseted bottom are called retort stand-up pouches, are sealed and then heated to a very high temperature to kill any bacteria inside them, thus preventing the contamination of food for a period of time.

Based on the end-use industry, the food segment is projected to lead metalized flexible packaging market during 2020-2025

The food segment is estimated to account for the largest share of the global metalized flexible packaging market in 2019. Changing lifestyles and busy schedules of the working population have driven the market for on-the-go flexible packaging products in the food & beverage sector. The consumption of food products depends on the needs and preferences of consumers for snacks, ready-to-eat meals, and other varieties of food. Metalized flexible packaging also reduces leakage and extends the shelf-life of products. Food products are the biggest consumer flexible plastic packaging, owing to their convenience and portability. The primary functions of food & beverage packaging are to reduce food loss and to increase the shelf-life of food products. One of the major transformations in the food industry is the reduction in the amount of packaging to reduce packaging waste without compromising on the safety and hygiene of food products.

Asia Pacific is expected to witness the fastest growth in the metalized flexible packaging market during the forecast period

The Asia Pacific metallized flexible packaging market is projected to witness the highest growth during the forecast period. This growth can be attributed to mainly due to the rapid expansion of end-use industries such as food & beverages, healthcare, and personal care. Factors such as rising disposable income, changing lifestyles, and growing middle-class population are expected to drive the demand for packaging, which, in turn, is expected to support the growth of the metallized flexible packaging market. Moreover, the rising demand for ready-to-eat food, convenience food, and processed & semi-processed food offer growth opportunities for the metallized film market in APAC.

The Europe metallized flexible packaging market is expected to witness to lead the market in the next five years. The major factor behind Europes high market share is the high demand for lightweight, consumer-friendly, and easy to handle products. Growing focus on sustainability, increased need for extended shelf life, rising standards of hygiene, and consumer focus on ease of use are the key drivers of the market in the region.

Key Market Players

Major companies such as Amcor Limited (Australia), Mondi Group (UK), Sealed Air Corp.(US), Sonoco Products Company (US), Polyplex Corporation Limited (India), Huhtamaki (Finland), Transcontinental Inc. (Canada) and Cosmo Films Ltd. (India) and among others. These players have been focusing on developmental strategies, investments & expansions, including capacity addition in existing production facilities, product launches, and mergers & acquisitions which have helped them expand their businesses in untapped and potential markets. These players have adopted growth strategies to strengthen their market positions and expand their presence across regions. These companies have a major geographic presence in the North American, European, and Asia Pacific regions and are undertaking organic and inorganic expansion strategies to increase their market shares.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

20182025 |

|

Base year considered |

2019 |

|

Forecast period |

20202025 |

|

Forecast units |

Value (USD Million) and Volume (Kiloton) |

|

Segments covered |

Material Type, Packaging Type, Structure, End-Use Industry and Region |

|

Regions covered |

North America, Europe, Asia Pacific, South America, and Middle East & Africa |

|

Companies covered |

Major companies such as Amcor Limited (Australia), Mondi Group (UK), Sealed Air Corp.(US),Sonoco Products Company (US), Polyplex Corporation Limited (India), Huhtamaki (Finland), Transcontinental Inc. (Canada) and Cosmo Films Ltd. (India) and among others |

On the basis of material type:

- Aluminium Foil based Flexible Packaging

- Metalized Film Flexible Packaging

On the basis of structure:

- Laminated Structures

- Mono Extruded Structures

- Others (Co-Extruded Structures and Insulated Structures)

On the basis of packaging type:

- Pouches

- Bags

- Wraps

- Rollstock

- Others (Sachets, and Stick Packs)

On the basis of end-use industry:

- Food

- Beverages

- Personal Care

- Pharmaceuticals

- Pet food

- Others (Agriculture, Oil & Lubricant And Consumer Goods)

On the basis of Region:

- North America

- Asia Pacific

- Europe

- Middle East & Africa

- South America

Recent Developments

- In March 2020, Huhtamaki acquired the full ownership of its joint venture company Laminor S.A. (Brazil), which specializes in high-quality tube laminates, particularly for oral care applications. The joint venture was set up with Bemis Company (which is now a part of Amcor) in 2002. The acquisition enables Huhtamaki to expand its tube laminate business, an important part of the Groups flexible packaging offering.

- In November 2019, Constantia Flexibles opened the worlds first plant designed to produce more sustainable and recyclable flexible packaging only in India. Production focus at the plant lies on the more environmentally friendly packaging family, EcoLam.

- In June 2019, Amcor completed the acquisition of Bemis Company Inc (Bemis), a US-based manufacturer of flexible packaging products. This strategic combination establishes Amcor as the global leader in consumer packaging with a comprehensive global footprint, scale in every region and industry leading R&D capabilities.

- In January 2019, Taghleef completed the acquisition of Biofilm, one of Latin Americas leading producers of BOPP films for flexible packaging, labels and industrial applications. By finalizing this transaction, Taghleef secured its position as a leading supplier of BOPP films in Latin America and throughout the world, increasing annual production capacity to more than 500,000 tons.

Frequently Asked Questions (FAQ):

What are metalized flexible packaging?

Metalized flexible films are polymer film which is coated with a thin layer of metal which are used in the packaging application. Metallized flexible packaging films are used as barrier materials for food & beverage, personal healthcare and pharmaceutical products. Metallized flexible films provides packaging a metallic gloss similar to that of a standard aluminum foil, but at reduced weight and cost. These films can be customized according to the requirement in several end-use industries.

What are the major driving factors for metalized flexible packaging?

The major drivers for the market include an increase in demand for longer shelf life of products and increasing demand for customer-friendly packaging.

What is the major end-use industry of metalized flexible packaging?

Based on end-use industry, the metalized flexible packaging market is segmented into food, beverage, pharmaceuticals, personal care, pet food and others. Out of these categories, food is the most widely used in food end-use industry followed by beverages.

What is a major material type used in metalized flexible packaging?

Based on material type, the metalized flexible packaging market is segmented into aluminum foil based flexible packaging and metalized film flexible packaging. The Aluminum foil based packaging offers excellent barrier performance against water vapor & gases, good metal bond strength, glossy appearance, good lamination bond strength, and good thermal & mechanical properties. It is used in packaging for snacks, frozen foods, sweets and pastries, frozen desserts, coffee pouches, and so on. Stand-up pouches allow printing of high-quality.

Who are the leading metalized flexible packaging provider in the world?

Major companies such as Amcor Limited (Australia), Mondi Group (UK), Sealed Air Corp. (US), Sonoco Products Company (US), Polyplex Corporation Limited (India), Huhtamaki (Finland), Transcontinental Inc. (Canada) and Cosmo Films Ltd. (India) and among others. These players have been focusing on developmental strategies, investments & expansions, including capacity addition in existing production facilities, product launches, and mergers & acquisitions which have helped them expand their businesses in untapped and potential markets. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 38)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

FIGURE 1 MARKET SEGMENTATION

1.4 REGIONS COVERED

1.5 METALIZED FLEXIBLE PACKAGING MARKET: INCLUSIONS AND EXCLUSIONS

FIGURE 2 YEARS CONSIDERED FOR THE STUDY

1.6 CURRENCY

1.7 UNIT CONSIDERED

1.8 STAKEHOLDERS

1.9 LIMITATIONS AND RISKS

2 RESEARCH METHODOLOGY (Page No. - 41)

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primary interviews

2.1.2.3 Key industry insights

2.2 BASE NUMBER CALCULATION

FIGURE 3 BASE NUMBER CALCULATION APPROACH 1

FIGURE 4 BASE NUMBER CALCULATION APPROACH 2

FIGURE 5 BASE NUMBER CALCULATION APPROACH 3

FIGURE 6 BASE NUMBER CALCULATION APPROACH 4

2.3 FORECAST NUMBER CALCULATION

2.4 MARKET ENGINEERING PROCESS

2.4.1 TOP-DOWN APPROACH

FIGURE 7 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.4.2 BOTTOM-UP APPROACH

FIGURE 8 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.5 MARKET BREAKDOWN AND DATA TRIANGULATION

2.6 ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 49)

FIGURE 9 DISRUPTION IN SUPPLY CHAIN TO RESTRAIN MARKET GROWTH

FIGURE 10 ASIA PACIFIC TO BE THE FASTEST-GROWING MARKET

FIGURE 11 POUCHES PACKAGING TYPE TO LEAD THE MARKET

FIGURE 12 FOOD END-USE INDUSTRY TO LEAD THE METALIZED FLEXIBLE PACKAGING MARKET

4 PREMIUM INSIGHTS (Page No. - 52)

4.1 ATTRACTIVE OPPORTUNITIES IN METALIZED FLEXIBLE PACKAGING MARKET

FIGURE 13 INCREASING DEMAND FROM THE POUCHES SEGMENT TO OFFER LUCRATIVE GROWTH OPPORTUNITIES FOR MARKET PLAYERS

4.2 METALIZED FLEXIBLE PACKAGING MARKET, BY MATERIAL TYPE

FIGURE 14 METALIZED FILM TO BE THE FASTEST-GROWING MATERIAL TYPE

4.3 METALIZED FLEXIBLE PACKAGING MARKET, BY STRUCTURE

FIGURE 15 LAMINATED STRUCTURES SEGMENT TO LEAD THE MARKET

4.4 METALIZED FLEXIBLE PACKAGING MARKET, BY END-USE INDUSTRY AND REGION

FIGURE 16 EUROPE TO ACCOUNT FOR THE LARGEST MARKET SHARE

5 MARKET OVERVIEW (Page No. - 54)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN METALIZED FLEXIBLE PACKAGING MARKET

5.2.1 DRIVERS

5.2.1.1 Rising global population and improving economic conditions of developing countries

5.2.1.2 Demand for longer shelf life of products

5.2.1.3 Increasing demand for customer-friendly packaging

5.2.2 RESTRAINTS

5.2.2.1 Volatile raw material costs

5.2.2.2 Stringent government rules and regulations regarding the raw materials used for food packaging

5.2.3 OPPORTUNITIES

5.2.3.1 Sustainable and new metalized flexible packaging solutions

5.2.4 CHALLENGES

5.2.4.1 Recyclability of metalized flexible packaging

5.2.4.2 Issues in product injection

5.3 PORTERS FIVE FORCES ANALYSIS

FIGURE 18 METALIZED FLEXIBLE PACKAGING MARKET: PORTERS FIVE FORCES ANALYSIS

5.3.1 BARGAINING POWER OF SUPPLIERS

5.3.2 THREAT OF NEW ENTRANTS

5.3.3 THREAT OF SUBSTITUTES

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 ECOSYSTEM

FIGURE 19 METALIZED FLEXIBLE PACKAGING ECOSYSTEM

5.5 AVERAGE SELLING PRICE ANALYSIS

TABLE 1 AVERAGE PRICES OF METALIZED FLEXIBLE PACKAGING, BY REGION (USD/KG)

5.6 METALIZED FLEXIBLE PACKAGING PATENT ANALYSIS

5.6.1 METHODOLOGY:

5.6.2 DOCUMENT TYPE

FIGURE 20 GRANTED PATENTS ARE 16% OF THE TOTAL COUNT IN LAST 6 YEARS

FIGURE 21 PUBLICATION TRENDS - LAST 6 YEARS

5.6.3 INSIGHT

FIGURE 22 JURISDICTION ANALYSIS

5.6.4 TOP APPLICANTS

5.6.5 LIST OF PATENTS BY TOYOTA MOTOR CO. LTD.

5.6.6 LIST OF PATENTS BY APPLIED MATERIALS INC.

5.6.7 LIST OF PATENTS BY TORAY INDUSTRIES, INC.

5.6.8 LIST OF PATENTS BY TIANJIN XIANGLIDA PACKING PRODUCTS CO. LTD.

5.7 TECHNOLOGY ANALYSIS

5.7.1 TECHNOLOGIES FOR METALIZED FILM STRUCTURES

5.8 TRADE ANALYSIS

TABLE 2 MAJOR IMPORT PARTNERS METALIZED FLEXIBLE PACKAGING

5.9 IMPACT OF COVID-19

TABLE 3 INTERIM ECONOMIC OUTLOOK FORECAST, 2019-2021 (PERCENTAGE)

5.9.1 FOOD & BEVERAGE INDUSTRY

5.9.2 PHARMACEUTICAL INDUSTRY

5.9.3 PERSONAL CARE INDUSTRY

5.9.4 PET FOOD INDUSTRY

5.10 VALUE CHAIN ANALYSIS

5.11 REGULATION & TARIFF LANDSCAPE

TABLE 4 REGULATORY LANDSCAPE, REGION-WISE/COUNTRY-WISE

6 METALIZED FLEXIBLE PACKAGING MARKET, BY MATERIAL TYPE (Page No. - 73)

6.1 INTRODUCTION

FIGURE 23 ALUMINUM FOIL-BASED FLEXIBLE PACKAGING SEGMENT TO LEAD METALIZED FLEXIBLE PACKAGING MARKET

TABLE 5 METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL TYPE, 20182025 (KILOTON)

TABLE 6 METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL TYPE, 20182025 (USD MILLION)

6.2 ALUMINUM FOIL-BASED FLEXIBLE PACKAGING

6.2.1 HIGH BARRIER, GOOD THERMAL, AND MECHANICAL PROPERTIES OF ALUMINUM FOILS TO DRIVE THE MARKET

6.2.2 ALUMINUM PAPER

6.2.3 ALUMINUM PAPER POLYMER

6.2.4 ALUMINUM POLYMER

6.3 METALIZED FILM FLEXIBLE PACKAGING

6.3.1 GROWING DEMAND FOR READY-TO-EAT FOOD AND LONGER SHELF LIFE OF PACKAGED PRODUCTS TO BOOST THE MARKET

6.3.2 MET PP/PE

6.3.3 MET PET/PE

6.3.4 OTHERS

7 METALIZED FLEXIBLE PACKAGING MARKET, BY STRUCTURE (Page No. - 78)

7.1 INTRODUCTION

FIGURE 24 LAMINATED STRUCTURES SEGMENT TO WITNESS THE HIGHEST CAGR

TABLE 7 METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY STRUCTURE, 20182025 (KILOTON)

TABLE 8 METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY STRUCTURE, 20182025 (USD MILLION)

7.2 LAMINATED STRUCTURES

7.2.1 HIGH BARRIER PROPERTIES OF LAMINATED FILMS TO DRIVE THE MARKET

7.3 MONO EXTRUDED STRUCTURES

7.3.1 SUSTAINABILITY AND RECYCLABILITY TO BOOST DEMAND FOR MONO EXTRUDED STRUCTURES

7.4 OTHERS

8 METALIZED FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE (Page No. - 82)

8.1 INTRODUCTION

FIGURE 25 POUCHES SEGMENT TO WITNESS THE FASTEST GROWTH

TABLE 9 METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 20182025 (KILOTON)

TABLE 10 METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 20182025 (USD MILLION)

8.2 BAGS

8.2.1 INCREASING DEMAND FOR BAGS IN HEALTHCARE AND FOOD SECTORS DRIVING THE MARKET

TABLE 11 METALIZED FLEXIBLE PACKAGING MARKET SIZE IN BAGS, BY REGION, 20182025 (KILOTON)

TABLE 12 METALIZED FLEXIBLE PACKAGING MARKET SIZE IN BAGS, BY REGION, 20182025 (USD MILLION)

8.3 POUCHES

8.3.1 EASE OF USE, LOW WEIGHT, AND RISING POPULARITY OF READY-TO-EAT FOODS TO DRIVE THE SEGMENT

8.3.2 STAND-UP POUCHES

8.3.3 FLAT POUCHES

TABLE 13 METALIZED FLEXIBLE PACKAGING MARKET SIZE IN POUCHES, BY REGION, 20182025 (KILOTON)

TABLE 14 METALIZED FLEXIBLE PACKAGING MARKET SIZE IN POUCHES, BY REGION, 20182025 (USD MILLION)

8.4 WRAPS

8.4.1 EUROPE IS THE LARGEST MARKET FOR WRAPS SEGMENT

TABLE 15 METALIZED FLEXIBLE PACKAGING MARKET SIZE IN WRAPS, BY REGION, 20182025 (KILOTON)

TABLE 16 METALIZED FLEXIBLE PACKAGING MARKET SIZE IN WRAPS, BY REGION, 20182025 (USD MILLION)

8.5 ROLLSTOCK

8.5.1 ASIA PACIFIC IS THE FASTEST-GROWING MARKET FOR ROLLSTOCK SEGMENT

TABLE 17 METALIZED FLEXIBLE PACKAGING MARKET SIZE IN ROLLSTOCK, BY REGION, 20182025 (KILOTON)

TABLE 18 METALIZED FLEXIBLE PACKAGING MARKET SIZE IN ROLLSTOCK, BY REGION, 20182025 (USD MILLION)

8.6 OTHERS

TABLE 19 METALIZED FLEXIBLE PACKAGING MARKET SIZE IN OTHERS SEGMENT, BY REGION, 20182025 (KILOTON)

TABLE 20 METALIZED FLEXIBLE PACKAGING MARKET SIZE IN OTHERS SEGMENT, BY REGION, 20182025 (USD MILLION)

9 METALIZED FLEXIBLE PACKAGING MARKET, BY END-USE INDUSTRY (Page No. - 90)

9.1 INTRODUCTION

FIGURE 26 FOOD SEGMENT TO LEAD THE METALIZED FLEXIBLE PACKAGING MARKET

TABLE 21 METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY END-USE INDUSTRY, 20182025 (KILOTON)

TABLE 22 METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY END-USE INDUSTRY, 20182025 (USD MILLION)

9.2 FOOD

9.2.1 CHANGING CONSUMER SENTIMENTS, RISING DEMAND FOR GROCERIES, AND FOCUS ON HYGIENE TO DRIVE THE SEGMENT

TABLE 23 METALIZED FLEXIBLE PACKAGING MARKET SIZE IN FOOD, BY REGION, 20182025 (KILOTON)

TABLE 24 METALIZED FLEXIBLE PACKAGING MARKET SIZE IN FOOD, BY REGION, 20182025 (USD MILLION)

9.3 BEVERAGE

9.3.1 INCREASING DEMAND FOR LONGER SHELF LIFE OF BEVERAGES TO PROPEL THE MARKET

TABLE 25 METALIZED FLEXIBLE PACKAGING MARKET SIZE IN BEVERAGE, BY REGION, 20182025 (KILOTON)

TABLE 26 METALIZED FLEXIBLE PACKAGING MARKET SIZE IN BEVERAGE, BY REGION, 20182025 (USD MILLION)

9.4 PERSONAL CARE

9.4.1 RISING DEMAND FOR PERSONAL CARE AND HOUSEHOLD HYGIENE PRODUCTS TO SUPPORT MARKET GROWTH

TABLE 27 METALIZED FLEXIBLE PACKAGING MARKET SIZE IN PERSONAL CARE, BY REGION, 20182025 (KILOTON)

TABLE 28 METALIZED FLEXIBLE PACKAGING MARKET SIZE IN PERSONAL CARE, BY REGION, 20182025 (USD MILLION)

9.5 PHARMACEUTICALS

9.5.1 DEMAND FOR HIGH BARRIER PROPERTIES FOR PROTECTING MEDICAL PRODUCTS DRIVING THE MARKET

TABLE 29 METALIZED FLEXIBLE PACKAGING MARKET SIZE IN PHARMACEUTICALS, BY REGION, 20182025 (KILOTON)

TABLE 30 METALIZED FLEXIBLE PACKAGING MARKET SIZE IN PHARMACEUTICALS, BY REGION, 20182025 (USD MILLION)

9.6 PET FOOD

9.6.1 RISE IN PET E-COMMERCE FUELING MARKET GROWTH IN THIS SEGMENT

TABLE 31 METALIZED FLEXIBLE PACKAGING MARKET SIZE IN PET FOOD, BY REGION, 20182025 (KILOTON)

TABLE 32 METALIZED FLEXIBLE PACKAGING MARKET SIZE IN PET FOOD, BY REGION, 20182025 (USD MILLION)

9.7 OTHERS

TABLE 33 METALIZED FLEXIBLE PACKAGING MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 20182025 (KILOTON)

TABLE 34 METALIZED FLEXIBLE PACKAGING MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 20182025 (USD MILLION)

10 METALIZED FLEXIBLE PACKAGING MARKET, BY REGION (Page No. - 99)

10.1 INTRODUCTION

TABLE 35 INTERIM ECONOMIC OUTLOOK FORECAST, 20192021

FIGURE 27 ASIA PACIFIC TO BE THE FASTEST-GROWING MARKET FOR METALIZED FLEXIBLE PACKAGING

TABLE 36 METALIZED FLEXIBLE PACKAGING MARKET, BY REGION, 20182025 (KILOTON)

TABLE 37 METALIZED FLEXIBLE PACKAGING MARKET, BY REGION, 20182025 (USD MILLION)

TABLE 38 METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL TYPE, 20182025 (KILOTON)

TABLE 39 METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL TYPE, 20182025 (USD MILLION)

10.1.1 METALIZED FLEXIBLE PACKAGING MARKET, BY END-USE INDUSTRY

TABLE 40 METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY END-USE INDUSTRY, 20182025 (KILOTON)

TABLE 41 METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY END-USE INDUSTRY, 20182025 (USD MILLION)

10.1.2 METALIZED FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE

TABLE 42 METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 20182025 (KILOTON)

TABLE 43 METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 20182025 (USD MILLION)

10.1.3 METALIZED FLEXIBLE PACKAGING MARKET, BY STRUCTURE

TABLE 44 METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY STRUCTURE, 20182025 (KILOTON)

TABLE 45 METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY STRUCTURE, 20182025 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 28 NORTH AMERICA: METALIZED FLEXIBLE PACKAGING MARKET SNAPSHOT

10.2.1 NORTH AMERICA: METALIZED FLEXIBLE PACKAGING MARKET, BY COUNTRY

TABLE 46 NORTH AMERICA: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY COUNTRY, 20182025 (KILOTON)

TABLE 47 NORTH AMERICA: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY COUNTRY, 20182025 (USD MILLION)

10.2.2 NORTH AMERICA: METALIZED FLEXIBLE PACKAGING MARKET, BY MATERIAL TYPE

TABLE 48 NORTH AMERICA: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL TYPE, 20182025 (KILOTON)

TABLE 49 NORTH AMERICA: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL TYPE, 20182025 (USD MILLION)

10.2.3 NORTH AMERICA: METALIZED FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE

TABLE 50 NORTH AMERICA: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 20182025 (KILOTON)

TABLE 51 NORTH AMERICA: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 20182025 (USD MILLION)

10.2.4 NORTH AMERICA: METALIZED FLEXIBLE PACKAGING MARKET, BY END-USE INDUSTRY

TABLE 52 NORTH AMERICA: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY END-USE INDUSTRY, 20182025 (KILOTON)

TABLE 53 NORTH AMERICA: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY END-USE INDUSTRY, 20182025 (USD MILLION)

10.2.5 NORTH AMERICA: METALIZED FLEXIBLE PACKAGING MARKET, BY STRUCTURE

TABLE 54 NORTH AMERICA: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY STRUCTURE, 20182025 (KILOTON)

TABLE 55 NORTH AMERICA: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY STRUCTURE, 20182025 (USD MILLION)

10.2.6 US

10.2.6.1 Leading metalized flexible packaging market in North America

10.2.6.2 US: Metalized flexible packaging market, by material type

TABLE 56 US: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL TYPE, 20182025 (KILOTON)

TABLE 57 US: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL TYPE, 20182025 (USD MILLION)

10.2.6.3 US: Metalized flexible packaging market, by packaging type

TABLE 58 US: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 20182025 (KILOTON)

TABLE 59 US: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 20182025 (USD MILLION)

10.2.6.4 US: Metalized flexible packaging market, by end-use industry

TABLE 60 US: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY END-USE INDUSTRY, 20182025 (KILOTON)

TABLE 61 US: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY END-USE INDUSTRY, 20182025 (USD MILLION)

10.2.7 CANADA

10.2.7.1 Increasing government support on manufacturing industry to accelerate demand for metalized flexible packaging

10.2.7.2 Canada: Metalized flexible packaging market, by material type

TABLE 62 CANADA: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL TYPE, 20182025 (KILOTON)

TABLE 63 CANADA: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL TYPE, 20182025 (USD MILLION)

10.2.7.3 Canada: Metalized flexible packaging market, by packaging type

TABLE 64 CANADA: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 20182025 (KILOTON)

TABLE 65 CANADA: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 20182025 (USD MILLION)

10.2.7.4 Canada: Metalized flexible packaging market, by end-use industry

TABLE 66 CANADA: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY END-USE INDUSTRY, 20182025 (KILOTON)

TABLE 67 CANADA: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY END-USE INDUSTRY, 20182025 (USD MILLION)

10.2.8 MEXICO

10.2.8.1 Rising demand for convenience food and changing lifestyles to drive the market

10.2.8.2 Mexico: Metalized flexible packaging market, by material type

TABLE 68 MEXICO: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL TYPE, 20182025 (KILOTON)

TABLE 69 MEXICO: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL TYPE, 20182025 (USD MILLION)

10.2.8.3 Mexico: Metalized flexible packaging market, by packaging type

TABLE 70 MEXICO: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 20182025 (KILOTON)

TABLE 71 MEXICO: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 20182025 (USD MILLION)

10.2.8.4 Mexico: Metalized flexible packaging market, by end-use industry

TABLE 72 MEXICO: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY END-USE INDUSTRY, 20182025 (KILOTON)

TABLE 73 MEXICO: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY END-USE INDUSTRY, 20182025 (USD MILLION)

10.3 EUROPE

FIGURE 29 EUROPE: METALIZED FLEXIBLE PACKAGING MARKET SNAPSHOT

10.3.1 EUROPE: METALIZED FLEXIBLE PACKAGING MARKET, BY COUNTRY

TABLE 74 EUROPE: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY COUNTRY, 20182025 (KILOTON)

TABLE 75 EUROPE: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY COUNTRY, 20182025 (USD MILLION)

10.3.2 EUROPE: METALIZED FLEXIBLE PACKAGING MARKET, BY MATERIAL TYPE

TABLE 76 EUROPE: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL TYPE, 20182025 (KILOTON)

TABLE 77 EUROPE: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL TYPE, 20182025 (USD MILLION)

10.3.3 EUROPE: METALIZED FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE

TABLE 78 EUROPE: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 20182025 (KILOTON)

TABLE 79 EUROPE : METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 20182025 (USD MILLION)

10.3.4 EUROPE: METALIZED FLEXIBLE PACKAGING MARKET, BY END-USE INDUSTRY

TABLE 80 EUROPE: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY END-USE INDUSTRY, 20182025 (KILOTON)

TABLE 81 EUROPE: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY END-USE INDUSTRY, 20182025 (USD MILLION)

10.3.5 EUROPE: METALIZED FLEXIBLE PACKAGING MARKET, BY STRUCTURE

TABLE 82 EUROPE: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY STRUCTURE, 20182025 (KILOTON)

TABLE 83 EUROPE: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY STRUCTURE, 20182025 (USD MILLION)

10.3.6 GERMANY

10.3.6.1 To lead the metalized flexible packaging market in the region

10.3.6.2 Germany: Metalized flexible packaging market, by material type

TABLE 84 GERMANY: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL TYPE, 20182025 (KILOTON)

TABLE 85 GERMANY: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL TYPE, 20182025 (USD MILLION)

10.3.6.3 Germany: Metalized flexible packaging market, by packaging type

TABLE 86 GERMANY: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 20182025 (KILOTON)

TABLE 87 GERMANY: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 20182025 (USD MILLION)

10.3.6.4 Germany: Metalized flexible packaging market, by end-use industry

TABLE 88 GERMANY: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY END-USE INDUSTRY, 20182025 (KILOTON)

TABLE 89 GERMANY: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY END-USE INDUSTRY, 20182025 (USD MILLION)

10.3.7 UK

10.3.7.1 Increase in spending on food packaging products to boost the market

10.3.7.2 UK: Metalized flexible packaging market, by material type

TABLE 90 UK: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL TYPE, 20182025 (KILOTON)

TABLE 91 UK :METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL TYPE, 20182025 (USD MILLION)

10.3.7.3 UK: Metalized flexible packaging market, by packaging type

TABLE 92 UK: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 20182025 (KILOTON)

TABLE 93 UK: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 20182025 (USD MILLION)

10.3.7.4 UK: Metalized flexible packaging market, by end-use industry

TABLE 94 UK: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY END-USE INDUSTRY, 20182025 (KILOTON)

TABLE 95 UK: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY END-USE INDUSTRY, 20182025 (USD MILLION)

10.3.8 FRANCE

10.3.8.1 Rising export of food products increasing the need for metalized flexible packaging

10.3.8.2 France: Metalized flexible packaging market, by material type

TABLE 96 FRANCE: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL TYPE, 20182025 (KILOTON)

TABLE 97 FRANCE: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL TYPE, 20182025 (USD MILLION)

10.3.8.3 France: Metalized flexible packaging market, by packaging type

TABLE 98 FRANCE: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 20182025 (KILOTON)

TABLE 99 FRANCE: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 20182025 (USD MILLION)

10.3.8.4 France: Metalized flexible packaging market, by end-use industry

TABLE 100 FRANCE: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY END-USE INDUSTRY, 20182025 (KILOTON)

TABLE 101 FRANCE: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY END-USE INDUSTRY, 20182025 (USD MILLION)

10.3.9 ITALY

10.3.9.1 Significant growth of healthcare and pharmaceutical industry to drive the demand for metalized flexible packaging

10.3.9.2 Italy: Metalized flexible packaging market, by material type

TABLE 102 ITALY: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL TYPE, 20182025 (KILOTON)

TABLE 103 ITALY: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL TYPE, 20182025 (USD MILLION)

10.3.9.3 Italy: Metalized flexible packaging market, by packaging type

TABLE 104 ITALY: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 20182025 (KILOTON)

TABLE 105 ITALY: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 20182025 (USD MILLION)

10.3.9.4 Italy: Metalized flexible packaging market, by end-use industry

TABLE 106 ITALY: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY END-USE INDUSTRY, 20182025 (KILOTON)

TABLE 107 ITALY: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY END-USE INDUSTRY, 20182025 (USD MILLION)

10.3.10 SPAIN

10.3.10.1 Innovations in packaging techniques offering huge market growth opportunity

10.3.10.2 Spain: Metalized flexible packaging market, by material type

TABLE 108 SPAIN: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL TYPE, 20182025 (KILOTON)

TABLE 109 SPAIN: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL TYPE, 20182025 (USD MILLION)

10.3.10.3 Spain: Metalized flexible packaging market, by packaging type

TABLE 110 SPAIN: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 20182025 (KILOTON)

TABLE 111 SPAIN: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 20182025 (USD MILLION)

10.3.10.4 Spain: Metalized flexible packaging market, by end-use industry

TABLE 112 SPAIN: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY END-USE INDUSTRY, 20182025 (KILOTON)

TABLE 113 SPAIN: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY END-USE INDUSTRY, 20182025 (USD MILLION)

10.3.11 RUSSIA

10.3.11.1 Increase in demand for metalized flexible packaging in various end-use industries to drive the market

10.3.11.2 Russia: Metalized flexible packaging market, by material type

TABLE 114 RUSSIA: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL TYPE, 20182025 (KILOTON)

TABLE 115 RUSSIA: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL TYPE, 20182025 (USD MILLION)

10.3.11.3 Russia: Metalized flexible packaging market, by packaging type

TABLE 116 RUSSIA: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 20182025 (KILOTON)

TABLE 117 RUSSIA: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 20182025 (USD MILLION)

10.3.11.4 Russia: Metalized flexible packaging market, by end-use industry

TABLE 118 RUSSIA: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY END-USE INDUSTRY, 20182025 (KILOTON)

TABLE 119 RUSSIA: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY END-USE INDUSTRY, 20182025 (USD MILLION)

10.3.12 REST OF EUROPE

10.3.12.1 Rest of Europe: Metalized flexible packaging market, by material type

TABLE 120 REST OF EUROPE: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL TYPE, 20182025 (KILOTON)

TABLE 121 REST OF EUROPE: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL TYPE, 20182025 (USD MILLION)

10.3.12.2 Rest of Europe: Metalized flexible packaging market, by packaging type

TABLE 122 REST OF EUROPE: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 20182025 (KILOTON)

TABLE 123 REST OF EUROPE: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 20182025 (USD MILLION)

10.3.12.3 Rest of Europe: Metalized flexible packaging market, by end-use industry

TABLE 124 REST OF EUROPE: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY END-USE INDUSTRY, 20182025 (KILOTON)

TABLE 125 REST OF EUROPE: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY END-USE INDUSTRY, 20182025 (USD MILLION)

10.4 ASIA PACIFIC

FIGURE 30 ASIA PACIFIC: METALIZED FLEXIBLE PACKAGING MARKET SNAPSHOT

10.4.1 ASIA PACIFIC: METALIZED FLEXIBLE PACKAGING MARKET, BY COUNTRY

TABLE 126 ASIA PACIFIC: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY COUNTRY, 20182025 (KILOTON)

TABLE 127 ASIA PACIFIC: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY COUNTRY, 20182025 (USD MILLION)

10.4.2 ASIA PACIFIC: METALIZED FLEXIBLE PACKAGING MARKET, BY MATERIAL TYPE

TABLE 128 ASIA PACIFIC: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL TYPE, 20182025 (KILOTON)

TABLE 129 ASIA PACIFIC: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL TYPE, 20182025 (USD MILLION)

10.4.3 ASIA PACIFIC: METALIZED FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE

TABLE 130 ASIA PACIFIC: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 20182025 (KILOTON)

TABLE 131 ASIA PACIFIC: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 20182025 (USD MILLION)

10.4.4 ASIA PACIFIC: METALIZED FLEXIBLE PACKAGING MARKET, BY END-USE INDUSTRY

TABLE 132 ASIA PACIFIC: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY END-USE INDUSTRY, 20182025 (KILOTON)

TABLE 133 ASIA PACIFIC: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY END-USE INDUSTRY, 20182025 (USD MILLION)

10.4.5 ASIA PACIFIC: METALIZED FLEXIBLE PACKAGING MARKET, BY STRUCTURE

TABLE 134 ASIA PACIFIC: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY STRUCTURE, 20182025 (KILOTON)

TABLE 135 ASIA PACIFIC: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY STRUCTURE, 20182025 (USD MILLION)

10.4.6 CHINA

10.4.6.1 To lead the market in Asia Pacific

10.4.6.2 China: Metalized flexible packaging market, by material type

TABLE 136 CHINA: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL TYPE, 20182025 (KILOTON)

TABLE 137 CHINA: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL TYPE, 20182025 (USD MILLION)

10.4.6.3 China: Metalized flexible packaging market, by packaging type

TABLE 138 CHINA: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 20182025 (KILOTON)

TABLE 139 CHINA: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 20182025 (USD MILLION)

10.4.6.4 China: Metalized flexible packaging market, by end-use industry

TABLE 140 CHINA: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY END-USE INDUSTRY, 20182025 (KILOTON)

TABLE 141 CHINA: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY END-USE INDUSTRY, 20182025 (USD MILLION)

10.4.7 INDIA

10.4.7.1 Increasing demand in food and pharmaceutical sectors to drive the market

10.4.7.2 India: Metalized flexible packaging market, by material type

TABLE 142 INDIA: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL TYPE, 20182025 (KILOTON)

TABLE 143 INDIA: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL TYPE, 20182025 (USD MILLION)

10.4.7.3 India: Metalized flexible packaging market, by packaging type

TABLE 144 INDIA: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 20182025 (KILOTON)

TABLE 145 INDIA: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 20182025 (USD MILLION)

10.4.7.4 India: Metalized flexible packaging market, by end-use industry

TABLE 146 INDIA: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY END-USE INDUSTRY, 20182025 (KILOTON)

TABLE 147 INDIA: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY END-USE INDUSTRY, 20182025 (USD MILLION)

10.4.8 JAPAN

10.4.8.1 Increasing government initiatives to drive the market in Japan

10.4.8.2 Japan: Metalized flexible packaging market, by material type

TABLE 148 JAPAN: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL TYPE, 20182025 (KILOTON)

TABLE 149 JAPAN: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL TYPE, 20182025 (USD MILLION)

10.4.8.3 Japan: Metalized flexible packaging market, by packaging type

TABLE 150 JAPAN: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 20182025 (KILOTON)

TABLE 151 JAPAN: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 20182025 (USD MILLION)

10.4.8.4 Japan: Metalized flexible packaging market, by end-use industry

TABLE 152 JAPAN: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY END-USE INDUSTRY, 20182025 (KILOTON)

TABLE 153 JAPAN: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY END-USE INDUSTRY, 20182025 (USD MILLION)

10.4.9 SOUTH KOREA

10.4.9.1 Change in lifestyle to boost the market in the country

10.4.9.2 South Korea: Metalized flexible packaging market, by material type

TABLE 154 SOUTH KOREA: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL TYPE, 20182025 (KILOTON)

TABLE 155 SOUTH KOREA: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL TYPE, 20182025 (USD MILLION)

10.4.9.3 South Korea: Metalized flexible packaging market, by packaging type

TABLE 156 SOUTH KOREA: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 20182025 (KILOTON)

TABLE 157 SOUTH KOREA: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 20182025 (USD MILLION)

10.4.9.4 South Korea: Metalized flexible packaging market, by end-use industry

TABLE 158 SOUTH KOREA: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY END-USE INDUSTRY, 20182025 (KILOTON)

TABLE 159 SOUTH KOREA: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY END-USE INDUSTRY, 20182025 (USD MILLION)

10.4.10 REST OF ASIA PACIFIC

10.4.10.1 Rest of Asia Pacific: Metalized flexible packaging market, by material type

TABLE 160 REST OF ASIA PACIFIC: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL TYPE, 20182025 (KILOTON)

TABLE 161 REST OF ASIA PACIFIC: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL TYPE, 20182025 (USD MILLION)

10.4.10.2 Rest of Asia Pacific: Metalized flexible packaging market, by packaging type

TABLE 162 REST OF ASIA PACIFIC: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 20182025 (KILOTON)

TABLE 163 REST OF ASIA PACIFIC: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 20182025 (USD MILLION)

10.4.10.3 Rest of Asia Pacific: Metalized flexible packaging market, by end-use industry

TABLE 164 REST OF ASIA PACIFIC: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY END-USE INDUSTRY, 20182025 (KILOTON)

TABLE 165 REST OF ASIA PACIFIC: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY END-USE INDUSTRY, 20182025 (USD MILLION)

10.5 MIDDLE EAST & AFRICA

FIGURE 31 MIDDLE EAST & AFRICA METALIZED FLEXIBLE PACKAGING MARKET SNAPSHOT

TABLE 166 MIDDLE EAST & AFRICA METALIZED FLEXIBLE PACKAGING MARKET, BY COUNTRY, 2018-2025 (KILOTON)

TABLE 167 MIDDLE EAST & AFRICA METALIZED FLEXIBLE PACKAGING MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

10.5.1 MIDDLE EAST & AFRICA: METALIZED FLEXIBLE PACKAGING MARKET, BY MATERIAL TYPE

TABLE 168 MIDDLE EAST & AFRICA: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL TYPE, 20182025 (KILOTON)

TABLE 169 MIDDLE EAST & AFRICA: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL TYPE, 20182025 (USD MILLION)

10.5.2 MIDDLE EAST & AFRICA: METALIZED FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE

TABLE 170 MIDDLE EAST & AFRICA: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 20182025 (KILOTON)

TABLE 171 MIDDLE EAST & AFRICA: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 20182025 (USD MILLION)

10.5.3 MIDDLE EAST & AFRICA: METALIZED FLEXIBLE PACKAGING MARKET, BY END-USE INDUSTRY

TABLE 172 MIDDLE EAST & AFRICA: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY END-USE INDUSTRY, 20182025 (KILOTON)

TABLE 173 MIDDLE EAST & AFRICA: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY END-USE INDUSTRY, 20182025 (USD MILLION)

10.5.4 MIDDLE EAST & AFRICA: METALIZED FLEXIBLE PACKAGING MARKET, BY STRUCTURE

TABLE 174 MIDDLE EAST & AFRICA: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY STRUCTURE, 20182025 (KILOTON)

TABLE 175 MIDDLE EAST & AFRICA: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY STRUCTURE, 20182025 (USD MILLION)

10.5.5 UAE

10.5.5.1 Growing healthcare and food sectors to fuel demand

10.5.5.2 UAE: Metalized flexible packaging market, by material type

TABLE 176 UAE: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL TYPE, 20182025 (KILOTON)

TABLE 177 UAE: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL TYPE, 20182025 (USD MILLION)

10.5.5.3 UAE: Metalized flexible packaging market, by packaging type

TABLE 178 UAE: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 20182025 (KILOTON)

TABLE 179 UAE: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 20182025 (USD MILLION)

10.5.5.4 UAE: Metalized flexible packaging market, by end-use industry

TABLE 180 UAE: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY END-USE INDUSTRY, 20182025 (KILOTON)

TABLE 181 UAE: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY END-USE INDUSTRY, 20182025 (USD MILLION)

10.5.6 SAUDI ARABIA

10.5.6.1 Rising demand for convenient packaging fueling the market

10.5.6.2 Saudi Arabia: Metalized flexible packaging market, by material type

TABLE 182 SAUDI ARABIA: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL TYPE, 20182025 (KILOTON)

TABLE 183 SAUDI ARABIA: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL TYPE, 20182025 (USD MILLION)

10.5.6.3 Saudi Arabia: Metalized flexible packaging market, by packaging type

TABLE 184 SAUDI ARABIA: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 20182025 (KILOTON)

TABLE 185 SAUDI ARABIA: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 20182025 (USD MILLION)

10.5.6.4 Saudi Arabia: Metalized flexible packaging market, by end-use industry

TABLE 186 SAUDI ARABIA: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY END-USE INDUSTRY, 20182025 (KILOTON)

TABLE 187 SAUDI ARABIA: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY END-USE INDUSTRY, 20182025 (USD MILLION)

10.5.7 SOUTH AFRICA

10.5.7.1 Growth in pharmaceutical industry to fuel the market

10.5.7.2 South Africa: Metalized flexible packaging market, by material type

TABLE 188 SOUTH AFRICA: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL TYPE, 20182025 (KILOTON)

TABLE 189 SOUTH AFRICA: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL TYPE, 20182025 (USD MILLION)

10.5.7.3 South Africa: Metalized flexible packaging market, by packaging type

TABLE 190 SOUTH AFRICA: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 20182025 (KILOTON)

TABLE 191 SOUTH AFRICA: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 20182025 (USD MILLION)

10.5.7.4 South Africa: Metalized flexible packaging market, by end-use industry

TABLE 192 SOUTH AFRICA: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY END-USE INDUSTRY, 20182025 (KILOTON)

TABLE 193 SOUTH AFRICA: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY END-USE INDUSTRY, 20182025 (USD MILLION)

10.5.8 REST OF MIDDLE EAST & AFRICA

10.5.8.1 Rest of Middle East & Africa: Metalized flexible packaging market, by material type

TABLE 194 REST OF MIDDLE EAST & AFRICA: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL TYPE, 20182025 (KILOTON)

TABLE 195 REST OF MIDDLE EAST & AFRICA: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL TYPE, 20182025 (USD MILLION)

10.5.8.2 Rest of Middle East & Africa: Metalized flexible packaging market, by packaging type

TABLE 196 REST OF MIDDLE EAST & AFRICA: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 20182025 (KILOTON)

TABLE 197 REST OF MIDDLE EAST & AFRICA: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 20182025 (USD MILLION)

10.5.8.3 Rest of Middle East & Africa: Metalized flexible packaging market, by end-use industry

TABLE 198 REST OF MIDDLE EAST & AFRICA: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY END-USE INDUSTRY, 20182025 (KILOTON)

TABLE 199 REST OF MIDDLE EAST & AFRICA: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY END-USE INDUSTRY, 20182025 (USD MILLION)

10.6 SOUTH AMERICA

FIGURE 32 SOUTH AMERICA METALIZED FLEXIBLE PACKAGING MARKET SNAPSHOT

TABLE 200 SOUTH AMERICA: METALIZED FLEXIBLE PACKAGING MARKET, BY COUNTRY, 20182025 (KILOTON)

TABLE 201 SOUTH AMERICA: METALIZED FLEXIBLE PACKAGING MARKET, BY COUNTRY, 20182025 (USD MILLION)

10.6.1 SOUTH AMERICA: METALIZED FLEXIBLE PACKAGING MARKET, BY MATERIAL TYPE

TABLE 202 SOUTH AMERICA: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL TYPE, 20182025 (KILOTON)

TABLE 203 SOUTH AMERICA: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL TYPE, 20182025 (USD MILLION)

10.6.2 SOUTH AMERICA: METALIZED FLEXIBLE PACKAGING MARKET, BY PACKAGING TYPE

TABLE 204 SOUTH AMERICA: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 20182025 (KILOTON)

TABLE 205 SOUTH AMERICA: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 20182025 (USD MILLION)

10.6.3 SOUTH AMERICA: METALIZED FLEXIBLE PACKAGING MARKET, BY END-USE INDUSTRY

TABLE 206 SOUTH AMERICA: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY END-USE INDUSTRY, 20182025 (KILOTON)

TABLE 207 SOUTH AMERICA: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY END-USE INDUSTRY, 20182025 (USD MILLION)

TABLE 208 SOUTH AMERICA: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY STRUCTURE, 20182025 (KILOTON)

TABLE 209 SOUTH AMERICA: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY STRUCTURE, 20182025 (USD MILLION)

10.6.4 BRAZIL

10.6.4.1 Growing demand from food & beverage sector fueling the market

10.6.4.2 Brazil: Metalized flexible packaging market, by material type

TABLE 210 BRAZIL: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL TYPE, 20182025 (KILOTON)

TABLE 211 BRAZIL: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL TYPE, 20182025 (USD MILLION)

10.6.4.3 Brazil: Metalized flexible packaging market, by packaging type

TABLE 212 BRAZIL: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 20182025 (KILOTON)

TABLE 213 BRAZIL: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 20182025 (USD MILLION)

10.6.4.4 Brazil: Metalized flexible packaging market, by end-use industry

TABLE 214 BRAZIL: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY END-USE INDUSTRY, 20182025 (KILOTON)

TABLE 215 BRAZIL: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY END-USE INDUSTRY, 20182025 (USD MILLION)

10.6.5 ARGENTINA

10.6.5.1 Government investments in various end-use sectors driving the market

10.6.5.2 Argentina: Metalized flexible packaging market, by material type

TABLE 216 ARGENTINA: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL TYPE, 20182025 (KILOTON)

TABLE 217 ARGENTINA: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL TYPE, 20182025 (USD MILLION)

10.6.5.3 Argentina: Metalized flexible packaging market, by packaging type

TABLE 218 ARGENTINA: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 20182025 (KILOTON)

TABLE 219 ARGENTINA: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 20182025 (USD MILLION)

10.6.5.4 Argentina: Metalized flexible packaging market, by end-use industry

TABLE 220 ARGENTINA: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY END-USE INDUSTRY, 20182025 (KILOTON)

TABLE 221 ARGENTINA: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY END-USE INDUSTRY, 20182025 (USD MILLION)

10.6.6 REST OF SOUTH AMERICA

10.6.6.1 Rest of South America: Metalized flexible packaging market, by material type

TABLE 222 REST OF SOUTH AMERICA: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL TYPE, 20182025 (KILOTON)

TABLE 223 REST OF SOUTH AMERICA: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY MATERIAL TYPE, 20182025 (USD MILLION)

10.6.6.2 Rest of South America: Metalized flexible packaging market, by packaging type

TABLE 224 REST OF SOUTH AMERICA: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 20182025 (KILOTON)

TABLE 225 REST OF SOUTH AMERICA: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY PACKAGING TYPE, 20182025 (USD MILLION)

10.6.6.3 Rest of South America: Metalized flexible packaging market, by end-use industry

TABLE 226 REST OF SOUTH AMERICA: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY END-USE INDUSTRY, 20182025 (KILOTON)

TABLE 227 REST OF SOUTH AMERICA: METALIZED FLEXIBLE PACKAGING MARKET SIZE, BY END-USE INDUSTRY, 20182025 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 193)

11.1 OVERVIEW

11.2 MARKET EVALUATION FRAMEWORK

11.3 REVENUE ANALYSIS OF TOP PLAYERS

11.4 MARKET RANKING

FIGURE 33 MARKET RANKING OF KEY PLAYERS

11.5 COMPETITIVE EVALUATION QUADRANT (TIER 1)

11.5.1 STAR

11.5.2 EMERGING LEADERS

11.5.3 PERVASIVE

FIGURE 34 METALIZED FLEXIBLE PACKAGING MARKET (TIER 1) COMPETITIVE LEADERSHIP MAPPING, 2019

11.5.4 PRODUCT FOOTPRINT

11.6 COMPETITIVE LEADERSHIP MAPPING (START-UP/SMES)

11.6.1 PROGRESSIVE COMPANIES

11.6.2 RESPONSIVE COMPANIES

11.6.3 STARTING BLOCKS

11.6.4 DYNAMIC COMPANIES

FIGURE 35 METALIZED FLEXIBLE PACKAGING MARKET (START-UP/SMSE) COMPETITIVE LEADERSHIP MAPPING, 2019

11.7 KEY MARKET DEVELOPMENTS

11.7.1 INVESTMENT & EXPANSION

TABLE 228 INVESTMENT & EXPANSION, 20172020

11.7.2 MERGER & ACQUISITION

TABLE 229 MERGER & ACQUISITION, 2017-2020

11.7.3 NEW PRODUCT/TECHNOLOGY LAUNCH

TABLE 230 NEW PRODUCT/TECHNOLOGY LAUNCH, 2017-2020

12 COMPANY PROFILES (Page No. - 200)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, Winning Imperatives, Threat from Competition, Current Focus and Strategies, and Right to Win)*

12.1 AMCOR LIMITED

FIGURE 36 AMCOR LIMITED: COMPANY SNAPSHOT

FIGURE 37 AMCOR LIMITED: SWOT ANALYSIS

12.2 MONDI GROUP

FIGURE 38 MONDI GROUP: COMPANY SNAPSHOT

FIGURE 39 MONDI GROUP: SWOT ANALYSIS

12.3 SONOCO PRODUCTS COMPANY

FIGURE 40 SONOCO PRODUCTS COMPANY: COMPANY SNAPSHOT

FIGURE 41 SONOCO PRODUCTS COMPANY: SWOT ANALYSIS

12.4 SEALED AIR CORP.

FIGURE 42 SEALED AIR CORP.: COMPANY SNAPSHOT

FIGURE 43 SEALED AIR CORP.: SWOT ANALYSIS

12.5 HUHTAMAKI

FIGURE 44 HUHTAMAKI: COMPANY SNAPSHOT

FIGURE 45 HUHTAMAKI: SWOT ANALYSIS

12.6 TRANSCONTINENTAL INC.

FIGURE 46 TRANSCONTINENTAL INC.: COMPANY SNAPSHOT

FIGURE 47 TRANSCONTINENTAL INC.: SWOT ANALYSIS

12.7 COSMO FILMS LTD.

FIGURE 48 COSMO FILMS LTD: COMPANY SNAPSHOT

FIGURE 49 COSMO FILMS LTD: SWOT ANALYSIS

12.8 POLYPLEX CORPORATION LIMITED

FIGURE 50 POLYPLEX CORPORATION LIMITED: COMPANY SNAPSHOT

FIGURE 51 POLYPLEX CORPORATION LIMITED: SWOT ANALYSIS

12.9 UFLEX LIMITED

FIGURE 52 UFLEX LIMITED: COMPANY SNAPSHOT

FIGURE 53 UFLEX LIMITED: SWOT ANALYSIS

12.10 JINDAL POLY FILMS LIMITED

FIGURE 54 JINDAL POLY FILMS LIMITED: COMPANY SNAPSHOT

FIGURE 55 JINDAL POLY FILMS LIMITED: SWOT ANALYSIS

12.11 ESTER INDUSTRIES LIMITED

FIGURE 56 ESTER INDUSTRIES LIMITED: COMPANY SNAPSHOT

12.12 CLONDALKIN GROUP

12.13 CONSTANTIA FLEXIBLES GROUP

12.14 TAGHLEEF INDUSTRIES

12.15 POLINAS

12.16 DUNMORE

12.17 CELPLAST METALLIZED PRODUCTS LIMITED

12.18 ULTIMET FILMS

12.19 ACCRUED PLASTIC LTD.

12.20 ALL FOILS, INC.

12.21 OTHER PLAYERS

12.21.1 SRF LIMITED

12.21.2 MANUCOR S.P.A.

12.21.3 KLΦCKNER PENTAPLAST GROUP

12.21.4 DMG POLYPACK PVT. LTD.

12.21.5 KAVERI METALLISING & COATING INDUSTRIES PVT. LTD.

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, Winning Imperatives, Threat from Competition, Current Focus and Strategies, and Right to Win might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 242)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

The study involved four major activities in estimating the current impact of modifiers market size. Exhaustive secondary research was carried out to collect information on the market, peer markets, and the parent market. The next step was to validate the findings obtained from secondary sources, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary data includes company information acquired from annual reports, press releases, investor presentations; white papers; and articles from recognized authors. In the market engineering process (including calculations for market statistics, market breakdown, market size estimations, market forecast, and data triangulation), both top-down and bottom-up approaches were extensively used, along with several data triangulation methods to obtain, verify, and validate the market revenues arrived at. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list key information/insights throughout the report.

Primary Research

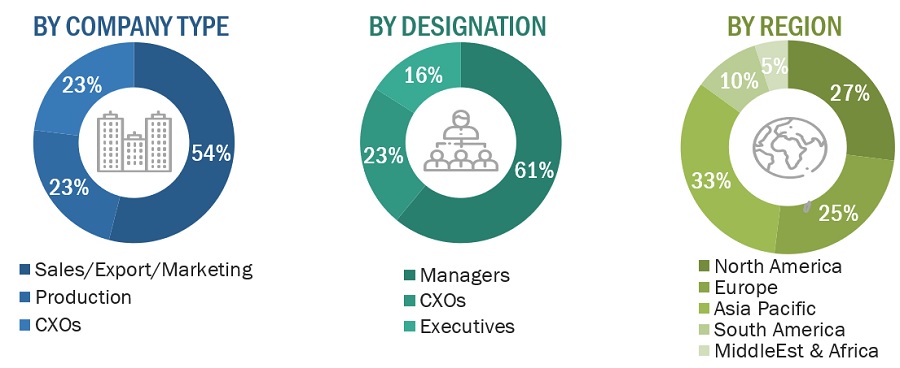

The metalized flexible packaging market comprises stakeholders such as producers, suppliers, and distributors, and regulatory organizations in the supply chain. The demand side of this market is characterized by developments in end-use industries such as food, beverage, pharmaceuticals , personal care, pet food, and others. The supply side is characterized by market consolidation activities undertaken by metalized flexible packaging manufacturers. Several primary sources from the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation:

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the metalized flexible packaging market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size included the following:

- Key players in the industry and markets were identified through extensive secondary research.

- The industrys supply chain and market size, in terms of volume, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size-ing the market size estimation process explained above-the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the market size for metalized flexible packaging, in terms of value and volume

- To provide detailed information regarding the major factors (drivers, restraints, opportunities, and challenges) influencing the market

- To estimate and forecast the metalized flexible packaging market size based on material type, packaging type, structure and end-use industry

- To analyze and forecast the metalized flexible packaging market based on five key

regions Asia Pacific (APAC), North America, Europe, the Middle East & Africa, and South America - To analyze the opportunities in the market for stakeholders and present a competitive landscape for market leaders

- To strategically profile the key players in the market and comprehensively analyze their core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Structure Analysis

- A further breakdown of the structure segment of the metalized flexible packaging market with respect to a particular packaging type

Company Information

- Detailed analysis and profiles of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Metalized Flexible Packaging Market