Metering Pumps Market Type (Diaphragm, Piston/Plunger), End-Use Industry (Water Treatment, Petrochemicals, Pharmaceuticals, Oil & Gas, Food & Beverages, Automotive), Pump drive (Motor, Solenoid, Pneumatic) and Region - Global Forecast to 2027

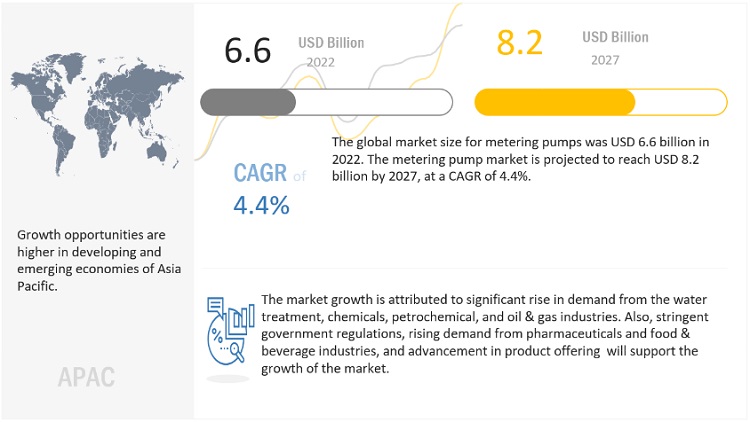

The metering pumps market is projected to reach USD 8.2 Billion by 2027, at a CAGR of 4.4%. A metering pump is a chemical injection positive displacement device that can vary capacity manually or automatically as per the requirement. The characteristics of metering pumps, such as accuracy and uninterrupted operations without frequent monitoring, are driving the demand for metering pumps across industries, especially in water treatment, and chemical processing industries.

Attractive Opportunities in the Metering Pumps Market

e- Estimated, p- Projected

To know about the assumptions considered for the study, Request for Free Sample Report

Metering Pumps Market Dynamics

Driver: Stringent regulations for wastewater treatment and increasing capacity additions

According to the United Nations (UN), the use of water is increasing by 1% every year, and there are around 2.2 billion people have no access to safe drinking water. Also, according to an estimation over 80% of wastewater is discharged into the environment without getting treated. According to the UN World Water Development Report, the manufacturing industry requires 19% of freshwater for various operations, which is projected to increase to 24% by 2050. The requirement for freshwater especially across manufacturing industries is increasing rapidly. Therefore, countries are establishing stringent regulations to minimize water pollution. Also, according to the UN World Water Development Report 2021, Africa’s freshwater is estimated to be nearly 9% of the world’s total. But, it is unevenly distributed, with the six most water-rich countries in Central & Western Africa holding about 54% of the continent’s total water resources and the 27 most water-poor countries holding only 7%. Thus, rising freshwater requirements and uneven distribution of resources have increased stress on other countries to establish stringent regulations to minimize water pollution and increase freshwater capacity.

Restraint: Raw material price fluctuations

The cost of metering pumps is majorly based on the operating range and material of construction (MoC). The main components of metering pumps are metal, polymers, and alloys, among others. Therefore, fluctuations in the prices of these materials make it challenging for manufacturers to procure high-quality raw materials and manage delivery schedules imposed by suppliers. Sometimes, it also results in additional costs for metering pumps.

For instance, steel prices increased by 1.4 to 1.8 times from July 2016 to July 2018, which decreased till December 2019. However, Covid 19 disrupted the supply chain across the globe, which in turn, affected the prices of raw materials. These fluctuations in prices make it challenging to meet the commitments of the buyers, and lead to high losses for manufacturers, which restrain the market growth of metering pumps.

Opportunities: Increasing expansions and joint ventures of Industries and increasing preference of customers for digital pumping solutions.

The last decade shows rapid industrialization. The companies are adopting strategies to increase their production capacities and focussing on expansions and joint ventures. Rapid industrialization, improving living standards, a huge population base, and low-cost labor in the Asia Pacific have motivated companies to establish their facilities in this region and cater to the demand. As new production units are set up, the demand for metering pumps is expected to increase. The end users are looking forward to pumping systems with digital pumping solutions. The digital mechanisms have built-in process controllers, diagnostic capabilities, and variable speed drives. They aid in monitoring flow control, increasing the reliability and efficiency of operations. These pumps offer increased accuracy, process control, and significant cost savings with digital monitoring technologies.

Challenges: The increased customization demands of end-use industries and very less scope for product differentiation

The metering pump configuration is different for different industries. The discharge, flow rate, and pressure depend on the end-use industries. Hence, to meet process requirements, companies need to customize the units. This makes it difficult for companies to attain economies of scale. Moreover, local manufacturers sometimes cannot provide customizable products due to a lack of technology and skills. One more challenge is product differentiation. All the leading companies produce similar types of metering pumps with variations in the material of construction and design parameters. They are currently focusing on developing innovative products that can stand out and fulfill the requirements of end users

Ecosystem Diagram

By Type, the Diaphragm pump is segmented for the largest market share in 2021

The metering pump market is divided into three segments. They are the diaphragm, piston/plunger, and others. The diaphragm segment accounted for the largest market share in terms of value in 2021. These pumps have more advantages like efficiency in operations, safety, and precision. The market growth during the forecast period will be mainly driven by the increasing demand from the pharmaceutical & medical industries and increasing R&D activities.

By end-use industry, the water treatment segment accounted for the largest share in 2021

The market is segmented by end-use industries like water treatment, petrochemicals, oil and gas. chemical processing, food and beverages, pharmaceuticals, pulp and paper, textile, automotive, and others. The water treatment operations require metering pumps the most and this segment has the largest market share in 2021. The increasing demand for freshwater across industries, and for day-to-day purposes is estimated to drive the demand for metering pumps in the water-treatment industry.

By category, the motor-driven segment accounted for the largest share in 2021

The market is also segmented as motor-driven metering pumps, solenoid-driven metering pumps, pneumatic-driven motoring pumps, and others. The motor-driven segment accounted for the largest market share in 2021. These pumps are used in low-pressure ranges. The stroke rates and length of motor-driven metering pumps can be adjusted as required. The demand for these pumps is driven mainly by the chemical and wastewater treatment industries.

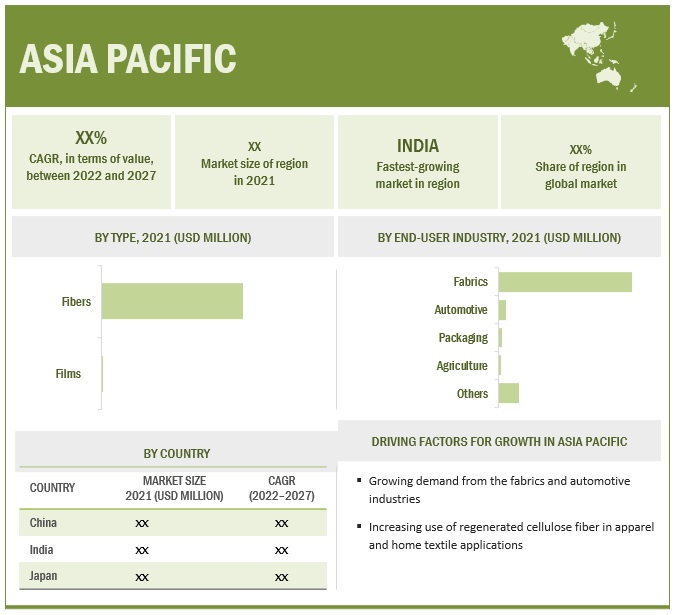

APAC accounted for the highest market share in 2021.

Asia Pacific accounted for the highest market share in the metering pump market in 2021. The rising demand is due to the developing oil & gas refineries, increasing chemical production, and growing investments in desalination plants. The ongoing investments in the development of the pharmaceutical and food & beverage industries will support the growth of the market. The demand for clean water is also increasing due to urbanization and the growing population.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The leading players in the metering pumps market are IDEX Corporation (US), LEWA (Germany), Ingersoll Rand (US), Dover Corporation (US), ProMinent (Germany), Grundfos (Denmark), SEKO (Italy), and Watson-Marlow Fluid Technology Group (UK).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2021–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Value (USD Billion) and Volume (Unit) |

|

Segments covered |

Type, End-Use industry, Pump Drive, and Region |

|

Geographies covered |

North America, Asia Pacific, Europe, South America, and Middle East & Africa. |

|

Companies covered |

IDEX Corporation (US), LEWA (Germany), Ingersoll Rand (US), Dover Corporation (US), ProMinent (Germany), SEKO (Italy), and Watson-Marlow Fluid Technology Group (UK) are the top manufacturers covered in the metering pumps market. |

This research report categorizes the metering pumps market based on type, end-use industry, pump drive, and region.

Metering pumps Market, By Type

- Diaphragm Pumps

- Piston/Plunger Pumps

- Others (Peristaltic and Syringe)

Metering pumps Market, By End Use Industry

- Water Treatment

- Petrochemicals, & Oil & Gas

- Chemical Processing

- Pharmaceuticals

- Food & Beverages

- Pulp & Paper

- Automotive

- Textile

- Others (Mining, Agriculture, Construction)

Metering pumps Market, By Pump Drive

- Motor-driven

- Pneumatic

- Solenoid-driven

- Others (peristaltic pumps and others)

Metering pumps Market, By Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

Recent Developments

- In September 2020, Ingersoll Rand Inc. acquired a France-based peristaltic pump manufacturer, Albin Pump SAS.

- In February 2021, PROMINENT GMBH extended the performance range of the DULCO flex Control to complete the product family of peristaltic metering pumps.

- In September 2021, SEKO S.P.A. declared that Dolphin Solutions Ltd have agreed to sell all the assets and intellectual property relating to their Excel range of soap dispensers to SEKO UK Ltd.

- In September 2022, Idex Corporation acquired Muon BV and its subsidiaries (Muon Group). The deal aims to build a strong base for ongoing growth.

- In March 2022, Idex Corporation acquired KZValve. KZValve specializes in manufacturing electric valves and controllers for several end markets, including agriculture, emergency fire services, and water filtration.

- In June 2021, Idex Corporation acquired Airtech Group.

- In January 2021, Idex Corporation acquired Abel Pumps, L.P., and its affiliates (ABEL) in a USD 103.5 million deal.

- In December 2021, IDEX Corporation has drawn up plans to invest Rs 500 crore in the next three-to-five-year time in its India operations. The company is setting up a new factory at Sanand Gujarat.

- In March 2022, Graco recently expanded its business in the hose pump line. The Solo Tech-range now includes models for hygienic applications and additional sizes for industrial installations.

- In August 2022, Graco Inc. announces the purchase of approximately Twenty acres of land adjacent to the Company's existing Anoka facility. This will be used for future expansion of business.

- In July 2020 LEWA expanded its portfolio to include various models of the proven non-Seal canned motor pumps from NIKKISO Co. Ltd.

- In August 2021, The Watson-Marlow Fluid Technology Group (WMFTG) launched the Qdos Conveying Wave Technology (CWT) pump which extends the capabilities of peristaltic pump technology and offers longer service life than traditional tube-based designs.

- In June 2021, Watson-Marlow Fluid Technology introduced the Flexicon PF7+, a peristaltic filling pump that provides a no-waste solution and 21 CFR compliance for critical aseptic final fill applications.

- In January 2020, Watson-Marlow Fluid Technology Group (WMFTG) launched its new BioPure silicone transfer tubing to provide a safe, reliable, and value-based solution for a wide range of bioprocess fluid transfer applications.

- In September 2021, Watson-Marlow Fluid Technology Group (WMFTG) added to its Qdos chemical metering pump series with four configurable outputs to help users eliminate the need for additional PLCs and provide extra flexibility when communicating with SCADA or other external monitoring systems.

- In April 2020, the company established a new production facility at Aflex, Yorkshire, with an investment of USD 25.3 Million.

- In April 2022, Dover Corporation announced the establishment of the Pump Solutions Group (PSG) within its Fluid Solutions platform.

- In August 2022, Grundfos launched a further expansion of range extra-large CR pumps, taking current energy efficiency and performance standards for vertical multi-stage in-line pumps to the next level.

- In December 2021 Grundfos released its CR 255 model. It is Grundfos largest vertical multistage inline pump to date, it has greater energy efficiency and better performance standards.

- In August 2022 Grundfos A/s is expected to add around 17,000 new square meters to the existing plant in Serbia.

Frequently Asked Questions (FAQ):

What are the major drivers driving the growth of the metering pump Market?

The major drivers influencing the growth of the metering pump market are increasing capacity additions and stringent regulations regarding wastewater treatment. Increasing pharmaceutical production and preferences for digitization in pumps are also a few driving factors.

What are the major challenges in the metering pump Market?

The major challenge in the metering pump Market is the growing demand for customization of products and very less scope for product differentiation.

What are the restraining factors in the metering pump Market?

The major restraining factors faced by the metering pump Market are rising oil prices, economic slowdown, raw material price fluctuations, and the impact of covid-19.

What is the key opportunity in the metering pump Market?

The increasing capacity expansions, joint ventures, and growing preference for digital solutions in pumping are major opportunities that can be explored further.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 44)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

FIGURE 1 METERING PUMPS MARKET SEGMENTATION

1.3.1 REGIONS COVERED

1.4 YEARS CONSIDERED

1.5 CURRENCY CONSIDERED

1.6 RESEARCH LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 49)

2.1 RESEARCH DATA

FIGURE 2 METERING PUMPS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Critical secondary inputs

2.1.1.2 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Critical primary inputs

2.1.2.2 Key data from primary sources

2.1.2.3 Key industry insights

2.1.2.4 Breakdown of primary interviews

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS

2.2 MARKET SIZE ESTIMATION APPROACH

2.2.1 TOP-DOWN MARKET SIZE ESTIMATION: ASCERTAINING METERING PUMPS SHARE IN GLOBAL PUMPS MARKET TO ESTIMATE OVERALL MARKET SIZE

FIGURE 4 APPROACH 1 - MARKET SIZE ESTIMATION: DEMAND-SIDE ANALYSIS

2.2.2 BOTTOM-UP MARKET SIZE ESTIMATION: MARKET SIZE OF INDIA AND ASCERTAINING ITS SHARE IN GLOBAL MARKET

FIGURE 5 APPROACH 2 - MARKET SIZE ESTIMATION: DEMAND-SIDE ANALYSIS

2.3 DATA TRIANGULATION

FIGURE 6 METERING PUMPS MARKET: DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 57)

FIGURE 7 DIAPHRAGM PUMPS ACCOUNTED FOR LARGEST MARKET SHARE IN 2021

FIGURE 8 WATER TREATMENT LED METERING PUMPS MARKET IN 2021

FIGURE 9 MOTOR-DRIVEN SEGMENT ACCOUNTED FOR LARGEST SHARE OF METERING PUMPS MARKET IN 2021

FIGURE 10 ASIA PACIFIC WAS LARGEST METERING PUMPS MARKET IN 2021

4 PREMIUM INSIGHTS (Page No. - 61)

4.1 SIGNIFICANT OPPORTUNITIES FOR PLAYERS IN METERING PUMPS MARKET

FIGURE 11 INCREASING APPLICATIONS IN WATER TREATMENT, PHARMACEUTICAL, AND FOOD & BEVERAGE INDUSTRIES TO DRIVE MARKET

4.2 ASIA PACIFIC METERING PUMPS MARKET, BY TYPE AND COUNTRY, 2021

FIGURE 12 DIAPHRAGM PUMPS SEGMENT AND CHINA ACCOUNTED FOR LARGEST SHARES

4.3 METERING PUMPS MARKET, BY KEY COUNTRIES

FIGURE 13 INDIA TO REGISTER HIGHEST CAGR

5 MARKET OVERVIEW (Page No. - 63)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN METERING PUMPS MARKET

5.2.1 DRIVERS

5.2.1.1 Stringent regulations for wastewater treatment and increasing capacity additions

TABLE 1 INDUSTRIAL DEMAND FOR WATER, BY CONTINENT

5.2.1.2 Increase in production capacity of pharmaceuticals in Asia Pacific along with the spread of COVID-19

5.2.1.3 Suitability, high efficiency, and high performance of diaphragm pumps

5.2.2 RESTRAINTS

5.2.2.1 Economic slowdown, declining oil prices, and impact of COVID-19 on industry

5.2.2.2 Fluctuations in raw material price

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing capacity expansions and joint venture activities by end users in high-growth markets

5.2.3.2 Growing preference of end users for digital pumping solutions and advanced pumps

5.2.4 CHALLENGES

5.2.4.1 Growing customization demands from end-use industries

5.2.4.2 Low scope of product differentiation

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 15 METERING PUMPS MARKET: PORTER’S FIVE FORCES ANALYSIS

5.3.1 BARGAINING POWER OF SUPPLIERS

5.3.2 BARGAINING POWER OF BUYERS

5.3.3 INTENSITY OF COMPETITIVE RIVALRY

5.3.4 THREAT OF NEW ENTRANTS

5.3.5 THREAT OF SUBSTITUTES

TABLE 2 METERING PUMPS MARKET: PORTER’S FIVE FORCES ANALYSIS

5.4 ECOSYSTEM ANALYSIS

FIGURE 16 METERING PUMPS ECOSYSTEM

5.5 SUPPLY CHAIN ANALYSIS

TABLE 3 PROCUREMENT CHANNEL ANALYSIS BY END USER VS. SUPPLY CHAIN PHASE

5.6 REGULATORY LANDSCAPE

TABLE 4 HYDRAULIC INSTITUTE (HI), STANDARDS

5.7 TECHNOLOGY ANALYSIS

5.8 AVERAGE SELLING PRICE TREND

FIGURE 17 AVERAGE SELLING PRICE (USD/UNIT) OF METERING PUMPS, BY REGION

FIGURE 18 PRICING FACTOR ANALYSIS BY TYPE OF END USER

5.9 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

FIGURE 19 GROWING ADOPTION OF INDUSTRY 4.0 AND DIGITIZATION TO BRING IN CHANGE IN FUTURE REVENUE MIX

TABLE 5 SHIFTS IMPACTING YC AND YCC

5.10 MACROECONOMIC OVERVIEW

5.10.1 GLOBAL GDP OUTLOOK

TABLE 6 WORLD GDP GROWTH PROJECTION

5.11 IMPORT AND EXPORT DATA: KEY COUNTRIES

TABLE 7 INTENSITY OF TRADE, BY KEY COUNTRY

5.12 CASE STUDY

5.12.1 MANUFACTURING COMPANY INSTALLS MEASURING PUMP TO INCREASE ACCURACY, SAVE DOWNTIME, AND ADDRESS HOSE BLOWOUT ISSUES

5.13 PATENT ANALYSIS

FIGURE 20 NUMBER OF GRANTED PATENTS PER YEAR

FIGURE 21 JURISDICTION VS. GRANTED PATENTS TILL DATE

TABLE 8 NUMBER OF GRANTED PATENTS, BY KEY PLAYERS

TABLE 9 PATENT DETAILS OF KEY PLAYERS

6 METERING PUMPS MARKET, BY TYPE (Page No. - 87)

6.1 INTRODUCTION

FIGURE 22 DIAPHRAGM PUMPS DOMINATED METERING PUMPS MARKET IN 2022

TABLE 10 METERING PUMPS MARKET SIZE, BY TYPE, 2017–2020 (UNIT)

TABLE 11 METERING PUMPS MARKET SIZE, BY TYPE, 2021–2027 (UNIT)

TABLE 12 METERING PUMPS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 13 METERING PUMPS MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

6.2 DIAPHRAGM PUMPS

6.2.1 SAFE, PRECISE, AND EFFICIENT OPERATIONS

TABLE 14 DIAPHRAGM METERING PUMPS MARKET SIZE, BY REGION, 2017–2020 (UNIT)

TABLE 15 DIAPHRAGM METERING PUMPS MARKET SIZE, BY REGION, 2021–2027 (UNIT)

TABLE 16 DIAPHRAGM METERING PUMPS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 17 DIAPHRAGM METERING PUMPS MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

6.3 PISTON/PLUNGER PUMPS

6.3.1 HIGHLY EFFICIENT AND LOW MAINTENANCE CHARACTERISTICS

TABLE 18 PISTON/PLUNGER METERING PUMPS MARKET SIZE, BY REGION, 2017–2020 (UNIT)

TABLE 19 PISTON/PLUNGER METERING PUMPS MARKET SIZE, BY REGION, 2021–2027 (UNIT)

TABLE 20 PISTON/PLUNGER METERING PUMPS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 21 PISTON/PLUNGER METERING PUMPS MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

6.4 OTHERS

TABLE 22 OTHER TYPE METERING PUMPS MARKET SIZE, BY REGION, 2017–2020 (UNIT)

TABLE 23 OTHER TYPE METERING PUMPS MARKET SIZE, BY REGION, 2021–2027 (UNIT)

TABLE 24 OTHER TYPE METERING PUMPS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 25 OTHER TYPE METERING PUMPS MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

7 METERING PUMPS MARKET, BY PUMP DRIVE (Page No. - 95)

7.1 INTRODUCTION

FIGURE 23 MOTOR-DRIVEN PUMPS DOMINATED METERING PUMPS MARKET IN 2022

TABLE 26 METERING PUMPS MARKET SIZE, BY PUMP DRIVE, 2017–2020 (UNIT)

TABLE 27 METERING PUMPS MARKET SIZE, BY PUMP DRIVE, 2021–2027 (UNIT)

TABLE 28 METERING PUMPS MARKET SIZE, BY PUMP DRIVE, 2017–2020 (USD MILLION)

TABLE 29 METERING PUMPS MARKET SIZE, BY PUMP DRIVE, 2021–2027 (USD MILLION)

7.2 MOTOR-DRIVEN METERING PUMPS

7.2.1 ROBUST AND RELIABLE, WITH LOW SUPERVISION REQUIREMENTS

TABLE 30 MOTOR-DRIVEN METERING PUMPS MARKET SIZE, BY REGION, 2017–2020 (UNIT)

TABLE 31 MOTOR-DRIVEN METERING PUMPS MARKET SIZE, BY REGION, 2021–2027 (UNIT)

TABLE 32 MOTOR-DRIVEN METERING PUMPS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 33 MOTOR-DRIVEN METERING PUMPS MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

7.3 SOLENOID-DRIVEN METERING PUMPS

7.3.1 HIGHLY EFFICIENT, WITH LOW MAINTENANCE REQUIREMENTS

TABLE 34 SOLENOID-DRIVEN METERING PUMPS MARKET SIZE, BY REGION, 2017–2020 (UNIT)

TABLE 35 SOLENOID-DRIVEN METERING PUMPS MARKET SIZE, BY REGION, 2021–2027 (UNIT)

TABLE 36 SOLENOID-DRIVEN METERING PUMPS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 37 SOLENOID-DRIVEN METERING PUMPS MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

7.4 PNEUMATIC-DRIVEN METERING PUMPS

7.4.1 COMPACT AND RELIABLE

TABLE 38 PNEUMATIC-DRIVEN METERING PUMPS MARKET SIZE, BY REGION, 2017–2020 (UNIT)

TABLE 39 PNEUMATIC-DRIVEN METERING PUMPS MARKET SIZE, BY REGION, 2021–2027 (UNIT)

TABLE 40 PNEUMATIC-DRIVEN METERING PUMPS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 41 PNEUMATIC-DRIVEN METERING PUMPS MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

7.5 OTHERS

TABLE 42 OTHER METERING PUMPS MARKET SIZE, BY REGION, 2017–2020 (UNIT)

TABLE 43 OTHER METERING PUMPS MARKET SIZE, BY REGION, 2021–2027 (UNIT)

TABLE 44 OTHER METERING PUMPS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 45 OTHER METERING PUMPS MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

8 METERING PUMPS MARKET, BY END-USE INDUSTRY (Page No. - 105)

8.1 INTRODUCTION

FIGURE 24 WATER TREATMENT TO REMAIN LARGEST END-USE INDUSTRY DURING FORECAST PERIOD

TABLE 46 METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (UNIT)

TABLE 47 METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (UNIT)

TABLE 48 METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 49 METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

8.2 WATER TREATMENT

8.2.1 GROWING ENVIRONMENTAL REGULATIONS AND INVESTMENT IN WATER INFRASTRUCTURAL DEVELOPMENT

TABLE 50 METERING PUMPS MARKET SIZE IN WATER TREATMENT, BY REGION, 2017–2020 (UNIT)

TABLE 51 METERING PUMPS MARKET SIZE IN WATER TREATMENT, BY REGION, 2021–2027 (UNIT)

TABLE 52 METERING PUMPS MARKET SIZE IN WATER TREATMENT, BY REGION, 2017–2020 (USD MILLION)

TABLE 53 METERING PUMPS MARKET SIZE IN WATER TREATMENT, BY REGION, 2021–2027 (USD MILLION)

8.3 PETROCHEMICALS AND OIL & GAS

8.3.1 TURMOIL IN OIL & GAS INDUSTRY TO SIGNIFICANTLY IMPACT MARKET

FIGURE 25 GLOBAL CRUDE OIL PRODUCTION, 2018–2021 (MILLION BARRELS PER DAY)

TABLE 54 METERING PUMPS MARKET SIZE IN PETROCHEMICAL AND OIL & GAS, BY REGION, 2017–2020 (UNIT)

TABLE 55 METERING PUMPS MARKET SIZE IN PETROCHEMICAL AND OIL & GAS, BY REGION, 2021–2027 (UNIT)

TABLE 56 METERING PUMPS MARKET SIZE IN PETROCHEMICAL AND OIL & GAS, BY REGION, 2017–2020 (USD MILLION)

TABLE 57 METERING PUMPS MARKET SIZE IN PETROCHEMICAL AND OIL & GAS, BY REGION, 2021–2027 (USD MILLION)

8.4 CHEMICAL PROCESSING

8.4.1 STEADY GROWTH OF CHEMICAL INDUSTRY IN DEVELOPING REGIONS

TABLE 58 METERING PUMPS MARKET SIZE IN CHEMICAL PROCESSING, BY REGION, 2017–2020 (UNIT)

TABLE 59 METERING PUMPS MARKET SIZE IN CHEMICAL PROCESSING, BY REGION, 2021–2027 (UNIT)

TABLE 60 METERING PUMPS MARKET SIZE IN CHEMICAL PROCESSING, BY REGION, 2017–2020 (USD MILLION)

TABLE 61 METERING PUMPS MARKET SIZE IN CHEMICAL PROCESSING, BY REGION, 2021–2027 (USD MILLION)

8.5 PHARMACEUTICALS

8.5.1 DOUBLE-DIGIT GROWTH ESTIMATED IN DEVELOPING COUNTRIES

TABLE 62 METERING PUMPS MARKET SIZE IN PHARMACEUTICAL, BY REGION, 2017–2020 (UNIT)

TABLE 63 METERING PUMPS MARKET SIZE IN PHARMACEUTICAL, BY REGION, 2021–2027 (UNIT)

TABLE 64 METERING PUMPS MARKET SIZE IN PHARMACEUTICAL, BY REGION, 2017–2020 (USD MILLION)

TABLE 65 METERING PUMPS MARKET SIZE IN PHARMACEUTICAL, BY REGION, 2021–2027 (USD MILLION)

8.6 FOOD & BEVERAGE

8.6.1 GROWING ADOPTION IN FOOD & BEVERAGE PROCESSING

TABLE 66 METERING PUMPS MARKET SIZE IN FOOD & BEVERAGE, BY REGION, 2017–2020 (UNIT)

TABLE 67 METERING PUMPS MARKET SIZE IN FOOD & BEVERAGE, BY REGION, 2021–2027 (UNIT)

TABLE 68 METERING PUMPS MARKET SIZE IN FOOD & BEVERAGE, BY REGION, 2017–2020 (USD MILLION)

TABLE 69 METERING PUMPS MARKET SIZE IN FOOD & BEVERAGE, BY REGION, 2021–2027 (USD MILLION)

8.7 PULP & PAPER

8.7.1 INCREASE IN PAPER PACKAGING & PRINTING APPLICATION

TABLE 70 METERING PUMPS MARKET SIZE IN PULP & PAPER, BY REGION, 2017–2020 (UNIT)

TABLE 71 METERING PUMPS MARKET SIZE IN PULP & PAPER, BY REGION, 2021–2027 (UNIT)

TABLE 72 METERING PUMPS MARKET SIZE IN PULP & PAPER, BY REGION, 2017–2020 (USD MILLION)

TABLE 73 METERING PUMPS MARKET SIZE IN PULP & PAPER, BY REGION, 2021–2027 (USD MILLION)

8.8 TEXTILE

8.8.1 INCREASING PRODUCTION CAPACITY AND RISING DEMAND FOR PROTECTIVE AND SMART CLOTHING

TABLE 74 METERING PUMPS MARKET SIZE IN TEXTILE, BY REGION, 2017–2020 (UNIT)

TABLE 75 METERING PUMPS MARKET SIZE IN TEXTILE, BY REGION, 2021–2027 (UNIT)

TABLE 76 METERING PUMPS MARKET SIZE IN TEXTILE, BY REGION, 2017–2020 (USD MILLION)

TABLE 77 METERING PUMPS MARKET SIZE IN TEXTILE, BY REGION, 2021–2027 (USD MILLION)

8.9 AUTOMOTIVE

8.9.1 FAST RECOVERY IN AUTOMOTIVE INDUSTRY

TABLE 78 METERING PUMPS MARKET SIZE IN AUTOMOTIVE, BY REGION, 2017–2020 (UNIT)

TABLE 79 METERING PUMPS MARKET SIZE IN AUTOMOTIVE, BY REGION, 2021–2027 (UNIT)

TABLE 80 METERING PUMPS MARKET SIZE IN AUTOMOTIVE, BY REGION, 2017–2020 (USD MILLION)

TABLE 81 METERING PUMPS MARKET SIZE IN AUTOMOTIVE, BY REGION, 2021–2027 (USD MILLION)

8.10 OTHERS

TABLE 82 METERING PUMPS MARKET SIZE IN OTHER INDUSTRIES, BY REGION, 2017–2020 (UNIT)

TABLE 83 METERING PUMPS MARKET SIZE IN OTHER INDUSTRIES, BY REGION, 2021–2027 (UNIT)

TABLE 84 METERING PUMPS MARKET SIZE IN OTHER INDUSTRIES, BY REGION, 2017–2020 (USD MILLION)

TABLE 85 METERING PUMPS MARKET SIZE IN OTHER INDUSTRIES, BY REGION, 2021–2027 (USD MILLION)

9 METERING PUMPS MARKET, BY REGION (Page No. - 124)

9.1 INTRODUCTION

FIGURE 26 INDIA TO BE FASTEST-GROWING METERING PUMPS MARKET

TABLE 86 METERING PUMPS MARKET SIZE, BY REGION, 2017–2020 (UNIT)

TABLE 87 METERING PUMPS MARKET SIZE, BY REGION, 2021–2027 (UNIT)

TABLE 88 HISTORICAL FORECAST: METERING PUMPS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 89 METERING PUMPS MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

9.2 ASIA PACIFIC

FIGURE 27 ASIA PACIFIC: METERING PUMPS MARKET SNAPSHOT

TABLE 90 ASIA PACIFIC: METERING PUMPS MARKET SIZE, BY COUNTRY, 2017–2020 (UNIT)

TABLE 91 ASIA PACIFIC: METERING PUMPS MARKET SIZE, BY COUNTRY, 2021–2027(UNIT)

TABLE 92 ASIA PACIFIC: METERING PUMPS MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 93 ASIA PACIFIC: METERING PUMPS MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 94 ASIA PACIFIC: METERING PUMPS MARKET SIZE, BY TYPE, 2017–2020 (UNIT)

TABLE 95 ASIA PACIFIC: METERING PUMPS MARKET SIZE, BY TYPE, 2021–2027 (UNIT)

TABLE 96 ASIA PACIFIC: METERING PUMPS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 97 ASIA PACIFIC: METERING PUMPS MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 98 ASIA PACIFIC: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (UNIT)

TABLE 99 ASIA PACIFIC: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (UNIT)

TABLE 100 ASIA PACIFIC: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 101 ASIA PACIFIC: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

TABLE 102 ASIA PACIFIC: METERING PUMPS MARKET SIZE, BY PUMP DRIVE, 2017–2020 (UNIT)

TABLE 103 ASIA PACIFIC: METERING PUMPS MARKET SIZE, BY PUMP DRIVE, 2021–2027 (UNIT)

TABLE 104 ASIA PACIFIC: METERING PUMPS MARKET SIZE, BY PUMP DRIVE, 2017–2020 (USD MILLION)

TABLE 105 ASIA PACIFIC: METERING PUMPS MARKET SIZE, BY PUMP DRIVE, 2021–2027 (USD MILLION)

9.2.1 CHINA

9.2.1.1 Strong growth of manufacturing sector

TABLE 106 CHINA: METERING PUMPS MARKET SIZE, BY TYPE, 2017–2020 (UNIT)

TABLE 107 CHINA: METERING PUMPS MARKET SIZE, BY TYPE, 2021–2027 (UNIT)

TABLE 108 CHINA: METERING PUMPS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 109 CHINA: METERING PUMPS MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 110 CHINA: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (UNIT)

TABLE 111 CHINA: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (UNIT)

TABLE 112 CHINA: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 113 CHINA: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

9.2.2 JAPAN

9.2.2.1 Growing investment in chemical and pharmaceutical industries

TABLE 114 JAPAN: METERING PUMPS MARKET SIZE, BY TYPE, 2017–2020 (UNIT)

TABLE 115 JAPAN: METERING PUMPS MARKET SIZE, BY TYPE, 2021–2027 (UNIT)

TABLE 116 JAPAN: METERING PUMPS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 117 JAPAN: METERING PUMPS MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 118 JAPAN: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (\UNIT)

TABLE 119 JAPAN: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (UNIT)

TABLE 120 JAPAN: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 121 JAPAN: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

9.2.3 INDIA

9.2.3.1 Growing FDI in manufacturing industry

FIGURE 28 CLUSTER-WISE DEMAND ANALYSIS FOR METERING PUMPS, 2021

TABLE 122 INDIA: METERING PUMPS MARKET SIZE, BY TYPE, 2017–2020 (UNIT)

TABLE 123 INDIA: METERING PUMPS MARKET SIZE, BY TYPE, 2021–2027 (UNIT)

TABLE 124 INDIA: METERING PUMPS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 125 INDIA: METERING PUMPS MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 126 INDIA: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (UNIT)

TABLE 127 INDIA: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (UNIT)

TABLE 128 INDIA: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 129 INDIA: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

9.2.4 SOUTH KOREA

9.2.4.1 Investments in water & wastewater treatment

TABLE 130 SOUTH KOREA: METERING PUMPS MARKET SIZE, BY TYPE, 2017–2020 (UNIT)

TABLE 131 SOUTH KOREA: METERING PUMPS MARKET SIZE, BY TYPE, 2021–2027 (UNIT)

TABLE 132 SOUTH KOREA: METERING PUMPS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 133 SOUTH KOREA: METERING PUMPS MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 134 SOUTH KOREA: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (UNIT)

TABLE 135 SOUTH KOREA: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (UNIT)

TABLE 136 SOUTH KOREA : METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 137 SOUTH KOREA: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

9.2.5 BANGLADESH

9.2.5.1 Healthy growth of manufacturing sector

TABLE 138 BANGLADESH: METERING PUMPS MARKET SIZE, BY TYPE, 2017–2020 (UNIT)

TABLE 139 BANGLADESH: METERING PUMPS MARKET SIZE, BY TYPE, 2021–2027 (UNIT)

TABLE 140 BANGLADESH: METERING PUMPS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 141 BANGLADESH: METERING PUMPS MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 142 BANGLADESH: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (UNIT)

TABLE 143 BANGLADESH: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (UNIT)

TABLE 144 BANGLADESH: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 145 BANGLADESH: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

9.2.6 ASEAN COUNTRIES

9.2.6.1 Investment in oil & gas and chemical industries

TABLE 146 ASEAN COUNTRIES: METERING PUMPS MARKET SIZE, BY TYPE, 2017–2020 (UNIT)

TABLE 147 ASEAN COUNTRIES: METERING PUMPS MARKET SIZE, BY TYPE, 2021–2027 (UNIT)

TABLE 148 ASEAN COUNTRIES: METERING PUMPS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 149 ASEAN COUNTRIES: METERING PUMPS MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 150 ASEAN COUNTRIES: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (UNIT)

TABLE 151 ASEAN COUNTRIES: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (UNIT)

TABLE 152 ASEAN COUNTRIES: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 153 ASEAN COUNTRIES: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

9.2.7 REST OF ASIA PACIFIC

TABLE 154 REST OF ASIA PACIFIC: METERING PUMPS MARKET SIZE, BY TYPE, 2017–2020 (UNIT)

TABLE 155 REST OF ASIA PACIFIC: METERING PUMPS MARKET SIZE, BY TYPE, 2021–2027 (UNIT)

TABLE 156 REST OF ASIA PACIFIC: METERING PUMPS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 157 REST OF ASIA PACIFIC: METERING PUMPS MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 158 REST OF ASIA PACIFIC: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (UNIT)

TABLE 159 REST OF ASIA PACIFIC: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (UNIT)

TABLE 160 REST OF ASIA PACIFIC: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 161 REST OF ASIA PACIFIC: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

9.3 NORTH AMERICA

FIGURE 29 NORTH AMERICA: METERING PUMPS MARKET SNAPSHOT

TABLE 162 NORTH AMERICA: METERING PUMPS MARKET SIZE, BY COUNTRY, 2017–2020 (UNIT)

TABLE 163 NORTH AMERICA: METERING PUMPS MARKET SIZE, BY COUNTRY, 2021–2027 (UNIT)

TABLE 164 NORTH AMERICA: METERING PUMPS MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 165 NORTH AMERICA: METERING PUMPS MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 166 NORTH AMERICA: METERING PUMPS MARKET SIZE, BY TYPE, 2017–2020 (UNIT)

TABLE 167 NORTH AMERICA: METERING PUMPS MARKET SIZE, BY TYPE, 2021–2027 (UNIT)

TABLE 168 NORTH AMERICA: METERING PUMPS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 169 NORTH AMERICA: METERING PUMPS MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 170 NORTH AMERICA: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (UNIT)

TABLE 171 NORTH AMERICA: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (UNIT)

TABLE 172 NORTH AMERICA: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 173 NORTH AMERICA: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

TABLE 174 NORTH AMERICA: METERING PUMPS MARKET SIZE, BY PUMP DRIVE, 2017–2020 (UNIT)

TABLE 175 NORTH AMERICA: METERING PUMPS MARKET SIZE, BY PUMP DRIVE, 2021–2027 (UNIT)

TABLE 176 NORTH AMERICA: METERING PUMPS MARKET SIZE, BY PUMP DRIVE, 2017–2020 (USD MILLION)

TABLE 177 NORTH AMERICA: METERING PUMPS MARKET SIZE, BY PUMP DRIVE, 2021–2027 (USD MILLION)

9.3.1 US

9.3.1.1 Slump in oil & gas and chemical production

TABLE 178 US: METERING PUMPS MARKET SIZE, BY TYPE, 2017–2020 (UNIT)

TABLE 179 US: METERING PUMPS MARKET SIZE, BY TYPE, 2021–2027 (UNIT)

TABLE 180 US: METERING PUMPS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 181 US: METERING PUMPS MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 182 US: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (UNIT)

TABLE 183 US: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (UNIT)

TABLE 184 US: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 185 US: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

9.3.2 CANADA

9.3.2.1 Growing government investments in water & wastewater industry

TABLE 186 CANADA: METERING PUMPS MARKET SIZE, BY TYPE, 2017–2020 (UNIT)

TABLE 187 CANADA: METERING PUMPS MARKET SIZE, BY TYPE, 2021–2027 (UNIT)

TABLE 188 HISTORICAL FORECAST CANADA: METERING PUMPS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 189 CANADA: METERING PUMPS MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 190 CANADA: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (UNIT)

TABLE 191 CANADA: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (UNIT)

TABLE 192 CANADA: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 193 CANADA: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

9.3.3 MEXICO

9.3.3.1 Increasing investments in pharmaceutical industry and growing food & beverage industry

TABLE 194 MEXICO: METERING PUMPS MARKET SIZE, BY TYPE, 2017–2020 (UNIT)

TABLE 195 MEXICO: METERING PUMPS MARKET SIZE, BY TYPE, 2021–2027 (UNIT)

TABLE 196 MEXICO: METERING PUMPS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 197 MEXICO: METERING PUMPS MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 198 MEXICO: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (UNIT)

TABLE 199 MEXICO: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (UNIT)

TABLE 200 MEXICO: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 201 MEXICO: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

9.4 EUROPE

TABLE 202 GDP GROWTH RATE, BY COUNTRY

TABLE 203 EUROPE: METERING PUMPS MARKET SIZE, BY COUNTRY, 2017–2020 (UNIT)

TABLE 204 EUROPE: METERING PUMPS MARKET SIZE, BY COUNTRY, 2021–2027 (UNIT)

TABLE 205 EUROPE: METERING PUMPS MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 206 EUROPE: METERING PUMPS MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 207 EUROPE: METERING PUMPS MARKET SIZE, BY TYPE, 2017–2020 (UNIT)

TABLE 208 EUROPE: METERING PUMPS MARKET SIZE, BY TYPE, 2021–2027 (UNIT)

TABLE 209 EUROPE: METERING PUMPS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 210 EUROPE: METERING PUMPS MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 211 EUROPE: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (UNIT)

TABLE 212 EUROPE: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (UNIT)

TABLE 213 EUROPE: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 214 EUROPE: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

TABLE 215 EUROPE: METERING PUMPS MARKET SIZE, BY PUMP DRIVE, 2017–2020 (UNIT)

TABLE 216 EUROPE: METERING PUMPS MARKET SIZE, BY PUMP DRIVE, 2021–2027 (UNIT)

TABLE 217 EUROPE: METERING PUMPS MARKET SIZE, BY PUMP DRIVE, 2017–2020 (USD MILLION)

TABLE 218 EUROPE: METERING PUMPS MARKET SIZE, BY PUMP DRIVE, 2021–2027(USD MILLION)

9.4.1 GERMANY

9.4.1.1 Strong economic recovery post-COVID-19 pandemic

TABLE 219 GERMANY: METERING PUMPS MARKET SIZE, BY TYPE, 2017–2020 (UNIT)

TABLE 220 GERMANY: METERING PUMPS MARKET SIZE, BY TYPE, 2021–2027 (UNIT)

TABLE 221 GERMANY: METERING PUMPS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 222 GERMANY: METERING PUMPS MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 223 GERMANY: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (UNIT)

TABLE 224 GERMANY: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (UNIT)

TABLE 225 GERMANY: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 226 GERMANY: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

9.4.2 FRANCE

9.4.2.1 Government support to boost manufacturing sector

TABLE 227 FRANCE: METERING PUMPS MARKET SIZE, BY TYPE, 2017–2020 (UNIT)

TABLE 228 FRANCE: METERING PUMPS MARKET SIZE, BY TYPE, 2021–2027 (UNIT)

TABLE 229 FRANCE: METERING PUMPS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 230 FRANCE: METERING PUMPS MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 231 FRANCE: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (UNIT)

TABLE 232 FRANCE: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (UNIT)

TABLE 233 FRANCE: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 234 FRANCE: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

9.4.3 UK

9.4.3.1 Growing water treatment and chemical industries

FIGURE 30 UK MANUFACTURING OUTPUT (%): 2020

TABLE 235 UK: METERING PUMPS MARKET SIZE, BY TYPE, 2017–2020 (UNIT)

TABLE 236 UK: METERING PUMPS MARKET SIZE, BY TYPE, 2021–2027 (UNIT)

TABLE 237 UK: METERING PUMPS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 238 UK: METERING PUMPS MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 239 UK: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (UNIT)

TABLE 240 UK: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (UNIT)

TABLE 241 UK: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 242 UK: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

9.4.4 SPAIN

9.4.4.1 Strong focus on revival of economy to propel market

TABLE 243 SPAIN: METERING PUMPS MARKET SIZE, BY TYPE, 2017–2020 (UNIT)

TABLE 244 SPAIN: METERING PUMPS MARKET SIZE, BY TYPE, 2021–2027 (UNIT)

TABLE 245 SPAIN: METERING PUMPS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 246 SPAIN: METERING PUMPS MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 247 SPAIN: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (UNIT)

TABLE 248 SPAIN: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (UNIT)

TABLE 249 SPAIN: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 250 SPAIN: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

9.4.5 ITALY

9.4.5.1 Recovery of manufacturing sector

TABLE 251 ITALY: METERING PUMPS MARKET SIZE, BY TYPE, 2017–2020 (UNIT)

TABLE 252 ITALY: METERING PUMPS MARKET SIZE, BY TYPE, 2021–2027 (UNIT)

TABLE 253 ITALY: METERING PUMPS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 254 ITALY: METERING PUMPS MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 255 ITALY: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (UNIT)

TABLE 256 ITALY: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (UNIT)

TABLE 257 ITALY: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 258 ITALY: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

9.4.6 RUSSIA

9.4.6.1 Recovery of oil prices to boost economy

TABLE 259 RUSSIA: METERING PUMPS MARKET SIZE, BY TYPE, 2017–2020 (UNIT)

TABLE 260 RUSSIA: METERING PUMPS MARKET SIZE, BY TYPE, 2021–2027 (UNIT)

TABLE 261 RUSSIA: METERING PUMPS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 262 RUSSIA: METERING PUMPS MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 263 RUSSIA: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (UNIT)

TABLE 264 RUSSIA: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (UNIT)

TABLE 265 RUSSIA: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 266 RUSSIA: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

9.4.7 TURKEY

9.4.7.1 Expected growth of end-use industries to favor market growth

FIGURE 31 INDUSTRY PRODUCTION OUTPUT INDEX (2015 =100), 2018 TO 2020

TABLE 267 TURKEY: METERING PUMPS MARKET SIZE, BY TYPE, 2017–2020 (UNIT)

TABLE 268 TURKEY: METERING PUMPS MARKET SIZE, BY TYPE, 2021–2027 (UNIT)

TABLE 269 TURKEY: METERING PUMPS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 270 TURKEY: METERING PUMPS MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 271 TURKEY: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (UNIT)

TABLE 272 TURKEY: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (UNIT)

TABLE 273 TURKEY: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 274 TURKEY: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

9.4.8 REST OF EUROPE

TABLE 275 REST OF EUROPE: METERING PUMPS MARKET SIZE, BY TYPE, 2017–2020 (UNIT)

TABLE 276 REST OF EUROPE: METERING PUMPS MARKET SIZE, BY TYPE, 2021–2027 (UNIT)

TABLE 277 REST OF EUROPE: METERING PUMPS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 278 REST OF EUROPE: METERING PUMPS MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 279 REST OF EUROPE: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (UNIT)

TABLE 280 REST OF EUROPE: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (UNIT)

TABLE 281 REST OF EUROPE: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 282 REST OF EUROPE: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

9.5 SOUTH AMERICA

TABLE 283 SOUTH AMERICA: METERING PUMPS MARKET SIZE, BY COUNTRY, 2017–2020 (UNIT)

TABLE 284 SOUTH AMERICA: METERING PUMPS MARKET SIZE, BY COUNTRY, 2021–2027 (UNIT)

TABLE 285 SOUTH AMERICA: METERING PUMPS MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 286 SOUTH AMERICA: METERING PUMPS MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 287 SOUTH AMERICA: METERING PUMPS MARKET SIZE, BY TYPE, 2017–2020 (UNIT)

TABLE 288 SOUTH AMERICA: METERING PUMPS MARKET SIZE, BY TYPE, 2021–2027 (UNIT)

TABLE 289 SOUTH AMERICA: METERING PUMPS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 290 SOUTH AMERICA: METERING PUMPS MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 291 SOUTH AMERICA: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (UNIT)

TABLE 292 SOUTH AMERICA: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (UNIT)

TABLE 293 SOUTH AMERICA: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 294 SOUTH AMERICA: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

TABLE 295 SOUTH AMERICA: METERING PUMPS MARKET SIZE, BY PUMP DRIVE, 2017–2020(UNIT)

TABLE 296 SOUTH AMERICA: METERING PUMPS MARKET SIZE, BY PUMP DRIVE, 2021–2027(UNIT)

TABLE 297 SOUTH AMERICA: METERING PUMPS MARKET SIZE, BY PUMP DRIVE, 2017–2020 (USD MILLION)

TABLE 298 SOUTH AMERICA: METERING PUMPS MARKET SIZE, BY PUMP DRIVE, 2021–2027(USD MILLION)

9.5.1 BRAZIL

9.5.1.1 Rising demand from chemical and oil & gas industries

TABLE 299 BRAZIL: METERING PUMPS MARKET SIZE, BY TYPE, 2017–2020 (UNIT)

TABLE 300 BRAZIL: METERING PUMPS MARKET SIZE, BY TYPE, 2021–2027 (UNIT)

TABLE 301 BRAZIL: METERING PUMPS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 302 BRAZIL: METERING PUMPS MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 303 BRAZIL: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (UNIT)

TABLE 304 BRAZIL: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (UNIT)

TABLE 305 BRAZIL: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 306 BRAZIL: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

9.5.2 ARGENTINA

9.5.2.1 Turmoil in manufacturing sector

TABLE 307 ARGENTINA: METERING PUMPS MARKET SIZE, BY TYPE, 2017–2020 (UNIT)

TABLE 308 ARGENTINA: METERING PUMPS MARKET SIZE, BY TYPE, 2021–2027 (UNIT)

TABLE 309 ARGENTINA: METERING PUMPS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 310 ARGENTINA: METERING PUMPS MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 311 ARGENTINA: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (UNIT)

TABLE 312 ARGENTINA: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (UNIT)

TABLE 313 ARGENTINA: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 314 ARGENTINA: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

9.5.3 REST OF SOUTH AMERICA

TABLE 315 REST OF SOUTH AMERICA: METERING PUMPS MARKET SIZE, BY TYPE, 2017–2020 (UNIT)

TABLE 316 REST OF SOUTH AMERICA: METERING PUMPS MARKET SIZE, BY TYPE, 2021–2027 (UNIT)

TABLE 317 REST OF SOUTH AMERICA: METERING PUMPS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 318 REST OF SOUTH AMERICA: METERING PUMPS MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 319 REST OF SOUTH AMERICA: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (UNIT)

TABLE 320 REST OF SOUTH AMERICA: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (UNIT)

TABLE 321 REST OF SOUTH AMERICA: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 322 REST OF SOUTH AMERICA: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

9.6 MIDDLE EAST & AFRICA

TABLE 323 MIDDLE EAST & AFRICA: METERING PUMPS MARKET SIZE, BY COUNTRY, 2017–2020 (UNIT)

TABLE 324 MIDDLE EAST & AFRICA: METERING PUMPS MARKET SIZE, BY COUNTRY, 2021–2027 (UNIT)

TABLE 325 MIDDLE EAST & AFRICA: METERING PUMPS MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 326 MIDDLE EAST & AFRICA: METERING PUMPS MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 327 MIDDLE EAST & AFRICA: METERING PUMPS MARKET SIZE, BY TYPE, 2017–2020 (UNIT)

TABLE 328 MIDDLE EAST & AFRICA: METERING PUMPS MARKET SIZE, BY TYPE, 2021–2027 (UNIT)

TABLE 329 MIDDLE EAST & AFRICA: METERING PUMPS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 330 MIDDLE EAST & AFRICA: METERING PUMPS MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 331 MIDDLE EAST & AFRICA: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (UNIT)

TABLE 332 MIDDLE EAST & AFRICA: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (UNIT)

TABLE 333 MIDDLE EAST & AFRICA: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 334 MIDDLE EAST & AFRICA: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

TABLE 335 MIDDLE EAST & AFRICA: METERING PUMPS MARKET SIZE, BY PUMP DRIVE, 2017–2020 (UNIT)

TABLE 336 MIDDLE EAST & AFRICA: METERING PUMPS MARKET SIZE, BY PUMP DRIVE, 2021–2027 (UNIT)

TABLE 337 MIDDLE EAST & AFRICA: METERING PUMPS MARKET SIZE, BY PUMP DRIVE, 2017–2020 (USD MILLION)

TABLE 338 MIDDLE EAST & AFRICA: METERING PUMPS MARKET SIZE, BY PUMP DRIVE, 2021–2027 (USD MILLION)

9.6.1 SAUDI ARABIA

9.6.1.1 Growing investments in expansion of desalination capacity

FIGURE 32 COVID-19 PANDEMIC IMPACT ON INDUSTRY OUTPUT, H1-2020 VS. H1-2019

TABLE 339 SAUDI ARABIA : METERING PUMPS MARKET SIZE, BY TYPE, 2017–2020 (UNIT)

TABLE 340 SAUDI ARABIA: METERING PUMPS MARKET SIZE, BY TYPE, 2021–2027 (UNIT)

TABLE 341 SAUDI ARABIA: METERING PUMPS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 342 SAUDI ARABIA: METERING PUMPS MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 343 SAUDI ARABIA: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (UNIT)

TABLE 344 SAUDI ARABIA: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (UNIT)

TABLE 345 SAUDI ARABIA: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 346 SAUDI ARABIA: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

9.6.2 UAE

9.6.2.1 Oil & gas and desalination industries together hold significant market share

TABLE 347 UAE: METERING PUMPS MARKET SIZE, BY TYPE, 2017–2020 (UNIT)

TABLE 348 UAE: METERING PUMPS MARKET SIZE, BY TYPE, 2021–2027 (UNIT)

TABLE 349 UAE: METERING PUMPS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 350 UAE: METERING PUMPS MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 351 UAE: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (UNIT)

TABLE 352 UAE: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (UNIT)

TABLE 353 UAE: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 354 UAE: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

9.6.3 SOUTH AFRICA

9.6.3.1 Steady growth of manufacturing industry

TABLE 355 SOUTH AFRICA: METERING PUMPS MARKET SIZE, BY TYPE, 2017–2020 (UNIT)

TABLE 356 SOUTH AFRICA: METERING PUMPS MARKET SIZE, BY TYPE, 2021–2027 (UNIT)

TABLE 357 SOUTH AFRICA: METERING PUMPS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 358 SOUTH AFRICA: METERING PUMPS MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 359 SOUTH AFRICA: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (UNIT)

TABLE 360 SOUTH AFRICA: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (UNIT)

TABLE 361 SOUTH AFRICA: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 362 SOUTH AFRICA: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

9.6.4 REST OF MIDDLE EAST & AFRICA

TABLE 363 REST OF MIDDLE EAST & AFRICA: METERING PUMPS MARKET SIZE, BY TYPE, 2017–2020 (UNIT)

TABLE 364 REST OF MIDDLE EAST & AFRICA: METERING PUMPS MARKET SIZE, BY TYPE, 2021–2027 (UNIT)

TABLE 365 REST OF MIDDLE EAST & AFRICA: METERING PUMPS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 366 REST OF MIDDLE EAST & AFRICA: METERING PUMPS MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 367 REST OF MIDDLE EAST & AFRICA: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (UNIT)

TABLE 368 REST OF MIDDLE EAST & AFRICA: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (UNIT)

TABLE 369 REST OF MIDDLE EAST & AFRICA: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 370 REST OF MIDDLE EAST & AFRICA: METERING PUMPS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 237)

10.1 INTRODUCTION

FIGURE 33 OVERVIEW OF STRATEGIES ADOPTED BY METERING PUMP MANUFACTURERS

10.1.1 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2021

TABLE 371 METERING PUMPS MARKET: SHARE OF KEY PLAYERS

FIGURE 34 METERING PUMPS: MARKET SHARE ANALYSIS

10.2 KEY PLAYER STRATEGIES

TABLE 372 STRATEGIC POSITIONING OF KEY PLAYERS

10.3 COMPANY EVALUATION QUADRANT

10.3.1 STARS

10.3.2 PERVASIVE PLAYERS

10.3.3 EMERGING LEADERS

10.3.4 PARTICIPANTS

FIGURE 35 METERING PUMPS MARKET: COMPANY EVALUATION QUADRANT, 2021

10.4 START-UP/SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION QUADRANT

10.4.1 RESPONSIVE COMPANIES

10.4.2 DYNAMIC COMPANIES

10.4.3 STARTING BLOCKS

10.4.4 PROGRESSIVE COMPANIES

FIGURE 36 START-UPS AND SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIX, 2021

10.5 REVENUE ANALYSIS OF TOP PLAYERS

FIGURE 37 REVENUE ANALYSIS OF KEY COMPANIES FOR PAST THREE YEARS

10.6 COMPETITIVE BENCHMARKING

TABLE 373 METERING PUMPS MARKET: DETAILED LIST OF KEY PLAYERS

TABLE 374 METERING PUMPS MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS

10.7 COMPETITIVE SITUATION AND TRENDS

10.7.1 PRODUCT LAUNCHES

TABLE 375 METERING PUMPS MARKET: PRODUCT LAUNCHES, 2018 TO 2022

10.7.2 DEALS

TABLE 376 METERING PUMPS MARKET: DEALS, 2018 TO 2022

10.7.3 OTHER DEVELOPMENTS

TABLE 377 METERING PUMPS MARKET: EXPANSIONS, 2018 TO 2022

11 COMPANY PROFILES (Page No. - 252)

11.1 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, MnM view, right to win, Strategic choices made, Weakness/competitive threats) *

11.1.1 INGERSOLL RAND, INC.

TABLE 378 INGERSOLL RAND, INC.: COMPANY OVERVIEW

FIGURE 38 INGERSOLL RAND, INC.: COMPANY SNAPSHOT

TABLE 379 INGERSOLL RAND, INC.: DEALS

11.1.2 PROMINENT GMBH

TABLE 380 PROMINENT GMBH: COMPANY OVERVIEW

FIGURE 39 PROMINENT GMBH: COMPANY SNAPSHOT

TABLE 381 PROMINENT GMBH: DEALS

TABLE 382 PROMINENT GMBH: PRODUCT LAUNCHES

11.1.3 SEKO S.P.A.

TABLE 383 SEKO S.P.A: COMPANY OVERVIEW

FIGURE 40 SEKO S.P.A: COMPANY SNAPSHOT

TABLE 384 SEKO S.P.A.: DEALS

TABLE 385 SEKO S.P.A.: PRODUCT LAUNCH

11.1.4 IDEX CORPORATION

TABLE 386 IDEX CORPORATION: COMPANY OVERVIEW

FIGURE 41 IDEX CORPORATION: COMPANY SNAPSHOT

TABLE 387 IDEX CORPORATION: DEALS

TABLE 388 IDEX CORPORATION.: OTHERS

11.1.5 GRACO, INC.

TABLE 389 GRACO, INC.: COMPANY OVERVIEW

FIGURE 42 GRACO, INC.: COMPANY SNAPSHOT

TABLE 390 GRACO INC.: PRODUCT LAUNCH

TABLE 391 GRACO INC.: OTHERS

11.1.6 LEWA GROUP

TABLE 392 LEWA GROUP: COMPANY OVERVIEW

TABLE 393 LEWA GROUP: PRODUCT LAUNCH

TABLE 394 LEWA GROUP: OTHERS

11.1.7 WATSON-MARLOW FLUID TECHNOLOGY GROUP (WMFTG)

TABLE 395 WATSON-MARLOW FLUID TECHNOLOGY GROUP: COMPANY OVERVIEW

FIGURE 43 WATSON-MARLOW FLUID TECHNOLOGY GROUP: COMPANY SNAPSHOT

TABLE 396 WATSON-MARLOW FLUID TECHNOLOGY GROUP: PRODUCT LAUNCH

TABLE 397 WATSON-MARLOW FLUID TECHNOLOGY GROUP: OTHERS

11.1.8 DOVER CORPORATION

TABLE 398 DOVER CORPORATION: COMPANY OVERVIEW

FIGURE 44 DOVER CORPORATION: COMPANY SNAPSHOT

TABLE 399 DOVER CORPORATION: DEALS

TABLE 400 DOVER CORPORATION: PRODUCT LAUNCH

TABLE 401 DOVER CORPORATION: OTHERS

11.1.9 GRUNDFOS A/S

TABLE 402 GRUNDFOS A/S: COMPANY OVERVIEW

FIGURE 45 GRUNDFOS A/S: COMPANY SNAPSHOT

TABLE 403 GRUNDFOS A/S: DEALS

TABLE 404 GRUNDFOS A/S: PRODUCT LAUNCH

TABLE 405 GRUNDFOS A/S: OTHERS

11.1.10 AVANTOR, INC.

TABLE 406 AVANTOR: COMPANY OVERVIEW

FIGURE 46 AVANTOR: COMPANY SNAPSHOT

11.1.11 ENELSA ENDÜSTRIYEL ELEKTRONIK

TABLE 407 ENELSA ENDUSTRIYEL ELEKTRONIK: COMPANY OVERVIEW

11.2 OTHER PLAYERS

11.2.1 SWELORE ENGINEERING PVT. LTD.

TABLE 408 SWELORE ENGINEERING PVT. LTD.: COMPANY OVERVIEW

11.2.2 SPX FLOW, INC.

TABLE 409 SPX FLOW, INC.: COMPANY OVERVIEW

11.2.3 VERDER GROUP

TABLE 410 VERDER GROUP: COMPANY OVERVIEW

11.2.4 WANNER ENGINEERING INC.

TABLE 411 WANNER ENGINEERING INC.: COMPANY OVERVIEW

11.2.5 BLUE-WHITE INDUSTRIES LTD.

TABLE 412 BLUE-WHITE INDUSTRIES LTD.: COMPANY OVERVIEW

11.2.6 SHREE RAJESHWARI ENGINEERING WORKS PVT. LTD.

TABLE 413 SHREE RAJESHWARI ENGINEERING WORKS PVT. LTD.: COMPANY OVERVIEW

11.2.7 INITIATIVE ENGINEERING

TABLE 414 INITIATIVE ENGINEERING: COMPANY OVERVIEW

11.2.8 TAPFLO GROUP

TABLE 415 TAPFLO GROUP: COMPANY OVERVIEW

11.2.9 AALBORG INSTRUMENTS & CONTROLS, INC.

TABLE 416 AALBORG INSTRUMENTS & CONTROLS, INC.: COMPANY OVERVIEW

11.2.10 INTEGRA

TABLE 417 INTEGRA: COMPANY OVERVIEW

11.2.11 ETATRON D. S.

TABLE 418 ETATRON D. S.: COMPANY OVERVIEW

11.2.12 MINIMAX PUMPS PVT. LTD.

TABLE 419 MINIMAX PUMPS PVT. LTD.: COMPANY OVERVIEW

*Details on Business Overview, Products Offered, Recent Developments, MnM view, Right to win, Strategic choices made, Weakness/competitive threats might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 298)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 CUSTOMIZATION OPTIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

Overview of Dosing Pumps Market

The Dosing Pumps Market refers to the global market for pumps that are used to inject precise amounts of fluids into a system. These pumps are used in a variety of industries including water treatment, chemical processing, and food and beverage production.

Dosing pumps are a type of metering pump, which means they are used to accurately measure and dispense small volumes of fluids. However, not all metering pumps are dosing pumps, as some are designed for continuous flow applications.

The growth of the dosing pumps market is expected to positively impact the overall metering pumps market, as dosing pumps are a specialized type of metering pump that offer precision and accuracy. As industries continue to demand more accurate dosing of chemicals and other fluids, the demand for dosing pumps is likely to increase.

Futuristic Growth Use-Cases

Some potential futuristic growth use-cases for dosing pumps include the integration of IoT technology for remote monitoring and control, as well as the use of smart pumps that can adjust dosing levels based on real-time data. Additionally, the growing demand for green technology and renewable energy sources may create new opportunities for dosing pumps in applications such as biofuel production and water treatment for agricultural irrigation.

Top Players in Dosing Pumps Market

Some of the top players in the dosing pumps market include Grundfos, SEKO, IDEX Corporation, Lewa GmbH, ProMinent GmbH, and Watson-Marlow Fluid Technology Group.

Impact on Other Industries

The Dosing Pumps Market is expected to have a significant impact on several industries in the future. Some of these industries include:

1. Chemical Industry: Dosing pumps are used extensively in the chemical industry for accurate dosing of chemicals in various applications. The growth of the dosing pumps market is expected to positively impact the chemical industry as it will enhance the efficiency and accuracy of dosing operations.

2. Water Treatment Industry: Dosing pumps are used extensively in the water treatment industry for the accurate dosing of chemicals used in the treatment process. The growth of the dosing pumps market is expected to positively impact the water treatment industry as it will improve the efficiency and accuracy of chemical dosing operations.

3. Food and Beverage Industry: Dosing pumps are used in the food and beverage industry for accurate dosing of flavors, colors, and preservatives in various products. The growth of the dosing pumps market is expected to positively impact the food and beverage industry as it will enhance the accuracy and efficiency of dosing operations.

4. Pharmaceutical Industry: Dosing pumps are used in the pharmaceutical industry for the accurate dosing of active pharmaceutical ingredients in various drug formulations. The growth of the dosing pumps market is expected to positively impact the pharmaceutical industry as it will improve the accuracy and efficiency of dosing operations.

Speak to our Analyst today to know more about Dosing Pumps Market!

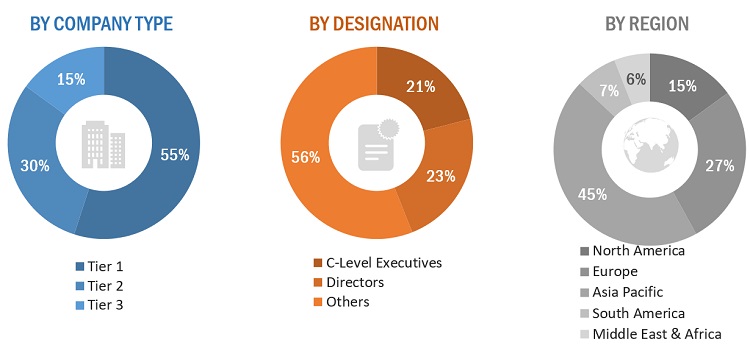

The study involved four major activities for estimating the current size of the global metering pumps market. Exhaustive secondary research was carried out to collect information on the market, the peer product market, and the parent product group market. The next step was to validate these findings, assumptions, and sizes with the industry experts across the value chain of metering pumps through primary research. Both the top-down and bottom-up approaches were employed to estimate the overall size of the metering pumps market. After that, market breakdown and data triangulation procedures were used to determine the size of different segments and sub-segments of the market.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Factiva, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to, to identify and collect information for this study on the metering pumps market. These secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; regulatory bodies, trade directories, and databases.

Primary Research

The metering pumps market comprises several stakeholders in the supply chain, which include suppliers, processors, and end-product manufacturers. Various primary sources from the supply and demand sides of the markets have been interviewed to obtain qualitative and quantitative information. The primary participants from the demand side include key opinion leaders, executives, vice presidents, and CEOs of companies in the metering pumps market. Primary sources from the supply side include associations and institutions involved in the metering pumps industry, key opinion leaders, and processing players.

Following is the breakdown of primary respondents—

Breakdown of Primary Interviews

Note: The three tiers of the companies were decided based on their revenues in 2021.

Tier 1 companies: overall revenue higher than USD 1 billion, Tier 2 companies: revenue between USD 500 million and USD 1 billion, and Tier 3 companies: revenue less than USD 500 million

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the size of the global metering pumps market. These approaches were also used extensively to estimate the size of various segments of the market. The research methodology used to estimate the market size included the following details:

- The key players were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage split and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and sub-segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments of the metering pumps market. The data was triangulated by studying various factors and trends from both the demand- and supply-side.

In addition, the market size was validated by using both the top-down and bottom-up approaches. Then, it was verified through primary interviews. Hence, for every data segment, there are three sources—top-down approach, bottom-up approach, and expert interviews. The data were assumed to be correct when the values arrived at from the three sources matched.

Report Objectives

- To define, analyze, and project the size of the metering pumps market in terms of value and volume based on type, end-use indsutry and region

- To project the size of the market and its segments with respect to the five main regions, namely, North America, Europe, Asia Pacific, Middle East & Africa, and South America

- To provide detailed information about the key factors, such as drivers, restraints, opportunities, and challenges, influencing the growth of the market

- To strategically analyze the micromarkets with respect to individual growth trends, COVID-19 pandemic impact, prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a detailed competitive landscape of the market leaders

- To analyze the competitive developments, such as new product launches, expansions, and acquisitions, in the metering pumps market

- To strategically profile the key players operating in the market and comprehensively analyze their market shares and core competencies

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations as per the specific needs of the companies. The following customization options are available for the report:

Product Analysis:

- Product Matrix which gives a detailed comparison of the product portfolio of each company

Regional Analysis:

- Further breakdown of the Rest of APAC market

- Further breakdown of Rest of Europe market

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Metering Pumps Market

Information on Metering pumps market size in the water treatment application.

Competative profiles needed for europe and america

Metering Pumps market report

Information on Metering pumps, disinfection techniques such as UV, Ozone, ClO2 and electrolysis for water treatment applications.

Interested in Dosing Pump market

General information on the growth of metering pumps market