Mice Model Market by Model Types & Services (Inbred Mice, Genetically Engineered Mice), Technology (Microinjection, Nuclear Transfer, CRISPR/CAS9), Application (PDx Models, Drug Discovery), End User (Pharma, Biotech, CROs, CDMOs) - Global Forecast to 2028

Updated on : May 04, 2023

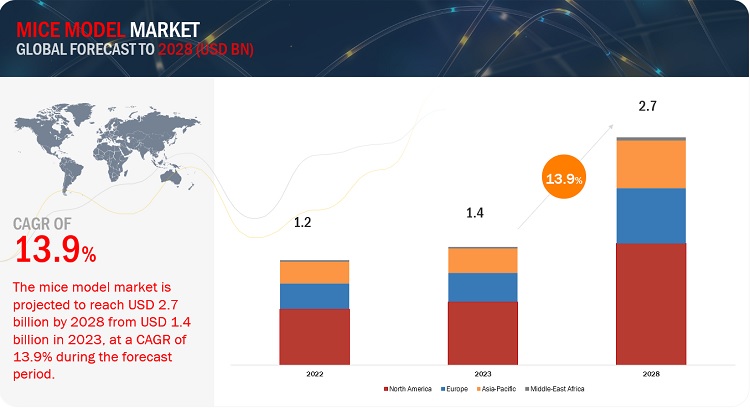

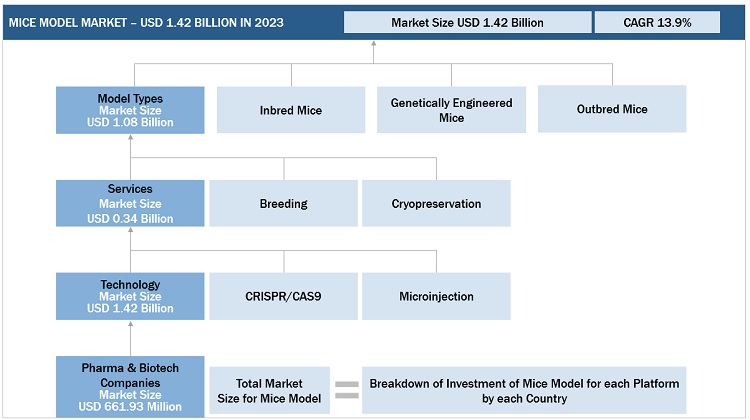

The global mice model market in terms of revenue was estimated to be worth $1.4 billion in 2023 and is poised to reach $2.7 billion by 2028, growing at a CAGR of 13.9% from 2023 to 2028. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. The key factors driving the growth of the market are rise in the investment and advancements in the mouse model technology, increasing implications of mouse clinical trials (MCTs) for more predictive outcomes, and increasing demand for personalized medicine. However, in December 2022, the U.S.FDA announcement of no longer requiring all drugs to be tested on animals before human trials and development of alternative animal testing methods is causing hurdles in the market.

Attractive Opportunities in the Mice Model Market

To know about the assumptions considered for the study, Request for Free Sample Report

Mice model Market Dynamics

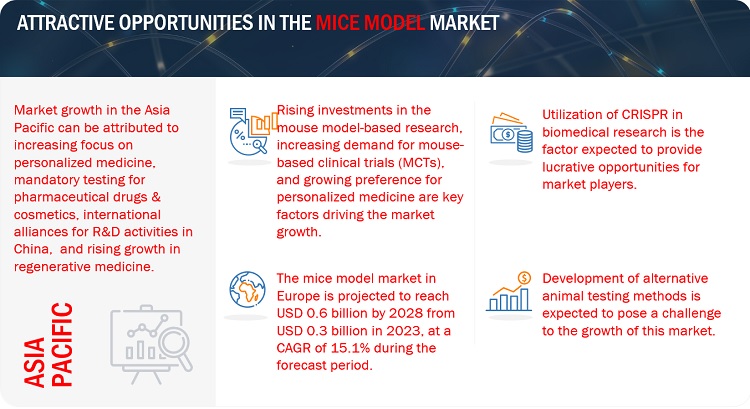

DRIVER: Rising investments in mouse model-based research

Rising investments in research & development for the mouse model market is a crucial factor driving the market growth. In recent years, the R&D expenditure in the US has increased exponentially. The United States (US) medical & health research and development (R&D) investment reached $245.1 billion in 2020, an 11.1% increase from 2019. According to the EU, in 2022, the total R&D investment from the top 2500 companies worldwide was EUR 1093.9 billion, an amount equivalent to 86% of the world’s business funded R&D. Over 60% of NIH extramural funding involves animal models, and approximately 80% to 90% of these are mouse models of human disease (Source: Oxford University Press). The increasing funding for these research processes can also be credited to the rising support from government organizations and biopharmaceutical companies worldwide for research projects related to humanized and knockout mice models. For instance, in April 2022, the Medical Research Council (MRC) launched the National Mouse Genetics Network, which marked a significant Euro 22 million investment in mouse genetics for modelling human disease (Source: UK Research and Innovation). This Network established the focus on mouse genetics for disease modeling which is expected to improve diagnosis & treatment by driving the integration of mouse genetics, cell and tissue systems, and deep phenotyping with human or clinical genomics and pathology.

RESTRAINT: Introduction of 3D-printed mouse models

In recent years, there has been a rise in the demand for 3D-printed mouse models, which are used as an alternative to traditional mouse models. These models are also cost-affordable as compared to humanized mouse models. For instance, in February 2023, research was conducted for an inexpensive 3D-printed mouse model for treating Distraction Osteogenesis (DO). This innovation created a new opportunity for 3D printing applications in the mouse model market. This research has provided reproducible and reliable osteogenesis and holds great promise to accelerate research and improve clinical outcomes for patients undergoing long bone DO. (Source: National Center of Biotechnology Information). 3D printing has also significantly impacted the quality, efficiency, and reproducibility of preclinical magnetic resonance imaging. It has vastly expanded the ability to produce MR-compatible parts that readily permit customization of animal handling, promptly achieve consistent positioning of anatomy and RF coils, and accelerate throughput. It enables the rapid and cost-effective creation of parts customized to a specific imaging study, animal species, animal weight, or even one unique animal not routinely used in preclinical research.

OPPORTUNITY: Utilization of CRISPR in biomedical research

CRISPR is now a revolutionary technology for gene editing. Using the Cas9 enzyme differentiates CRISPR from other forms of genetic modification. This technology edits and rearranges genes by cutting out damaged or unwanted parts of the DNA, allowing the remaining DNA to be rearranged in a new way. This fast, precise, and easy-to-use technology is considered a revolutionary tool in research, and there is intense interest in validating its therapeutic usage in humans. CRISPR was used to work in mouse and human cells and has already been applied to various biological systems and disease areas. The clustered, regularly interspaced short palindromic repeats (CRISPR) system, derived from the adaptive immune system of prokaryotes, is a breakthrough genome editing technology that can be applied to various research. CRISPR is used in the development of genetically modified mice strains, making the process not only quicker but also less expensive.

CHALLENGE: Development of alternative animal testing methods

The rapid growth in efficient and reliable alternatives to animal testing poses a challenge for the market. Moreover, increasing pressure from animal rights activists has forced research institutes and companies to seek options to minimize the use of testing in research.

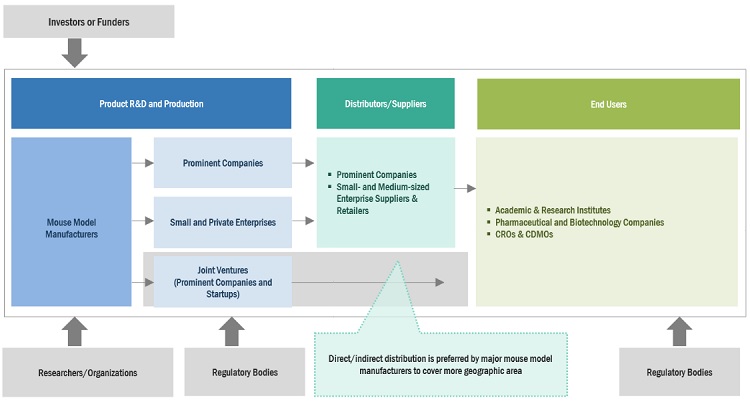

Mice Model Market Ecosystem

Prominent companies in the market include well established, financially stable manufacturers of mice models and services. These companies have been operating in the market for several years and posees diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include Charles River Laboratories (US), The Jackson Laboratory (US), Inotiv (US), genOway (France), and Taconic Biosciences, Inc. (US).

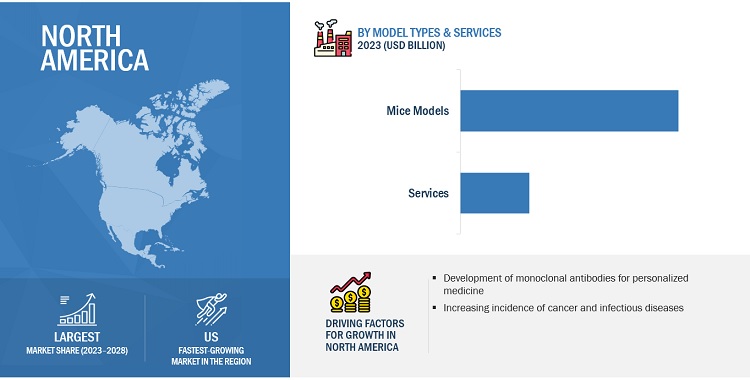

The model types accounted for the largest share of the model types & services segment in mice model market in 2022.

Based on model types & services, the market is categorized into model types, and services. In 2022, the model types segment accounted for the largest share of the market. The availability of various types of mice models due to advancements in biotechnology is further driving the usage of mice as animal models for research activities.

The CRISPR segment dominated the technology segment in mice model market in 2022.

Based on the technology, the segment is categorized into CRISPR/Cas9, microinjection, embryonic stem cell injection, nuclear transfer, and other technologies. In 2022, the CRISPR segment dominated the technology segment with the highest revenue share. Advantages of CRISPR are likely to drive the market growth.

North America was the largest market for mice model market in 2022.

Geographically, the market is segmented into North America, Europe, Asia Pacific, and MEA. The market is dominated by North America in 2022 and this dominance is anticipated to continue throughout the forecast period. The increasing incidence of cancer and infectious diseases and the demand for improved resources (cell lines and animals like mice) in order to improve production efficiency and deliver greater yields of antibodies are expected to drive the market. However, the recent bills promoting the use of alternative technologies for animal testing are negatively impacting the market growth.

To know about the assumptions considered for the study, download the pdf brochure

The prominent players in the mice model market are Charles River Laboratories (US), The Jackson Laboratory (US), Inotiv (US), genOway (France), Taconic Biosciences, Inc. (US), Janvier Labs (France), Harbour BioMed (China), Trans Genic Inc. (Japan), Ingenious Targeting Laboratory (US), PolyGene AG (Switzerland), Aragen Life Sciences Ltd. (India), Cyagen Biosciences (US), Crown Biosciences (US), TransCure bioServices (France), Ozgene Pty. Ltd. (Australia), The Andersons, Inc. (US), Allentown, LLC (US), Innovive (US), Lab Products, LLC. (US), Crescendo Biologics Limited (UK), ImmunoGenes (Hungary), Lexicon Pharmaceuticals, Inc. (US), Horizon Discovery Ltd (UK). Marshall BioResources (US), and Applied StemCell Inc. (US).

Mice Model Market Report Scope

|

Report Metric |

Details |

|

Market Revenue in 2023 |

$1.4 billion |

|

Projected Revenue by 2028 |

$2.7 billion |

|

Revenue Rate |

Poised to grow at a CAGR of 13.9% |

|

Market Driver |

Rising investments in mouse model-based research |

|

Market Opportunity |

Utilization of CRISPR in biomedical research |

This report categorizes the mice model market to forecast revenue and analyze trends in each of the following submarkets:

By Model Types & Services

-

Model Types

- Inbred Mice

- Genetically Engineered Mice

- Outbred Mice

- Hybrid/Congenic Mice

-

Services

- Breeding

- Cryopreservation

- Rederivation

- Quarantine

- Other Services

By Technology

- CRISPR/CAS9

- Microinjection

- Embryonic Stem cell Injection

- Nuclear Transfer

- Other Technologies

By Application

- Drug Discovery & Development

- Basic Research

- PDx Models/Xenografts

By End User

- Academic Institutes & Research Centers

- Pharma & Biotech Companies

- CROs & CDMOs

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe (RoE)

-

Asia Pacific (APAC)

- Japan

- India

- China

- Australia

- South Korea

- Rest of Asia Pacific (RoAPAC)

- Latin America

- Middle East and Africa

Recent Developments

- In April 2019, Charles River acquired Citoxlab to strengthen its portfolio & geographic footprint, enhancing the ability to partner with clients across the drug discovery and development continuum. This acquisition helped Charles River strengthen its position in regulated safety assessment services, non-regulated discovery services, animal research models, and medical device testing.

- In June 2020, Charles River Laboratories established two new offices in China and Singapore, combined with its existing locations in Japan, Taiwan, India, and South Korea. These offices support sales and project management for biologics research.

- In January 2022, Inotiv completed the acquisition of Orient BioResource Center, Inc. from Orient Bio, Inc., a preclinical CRO and animal model supplier based in Seongnam, South Korea. Orient BioResource Center is a primate quarantine & holding facility located near Alice, Texas.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the mice model market?

The mice model market boasts a total revenue value of $2.7 billion by 2028.

What is the estimated growth rate (CAGR) of the mice model market?

The global mice model market has an estimated compound annual growth rate (CAGR) of 13.9% and a revenue size in the region of $1.4 billion in 2023.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

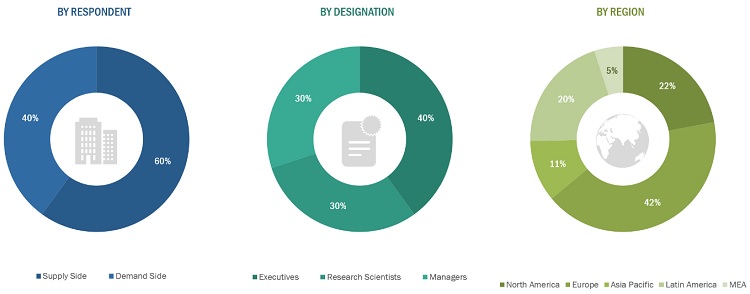

This study involved four major activities in estimating the current size of the mice model market. Exhaustive secondary research was carried out to collect information on the market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate the market size of segments.

Secondary Research

Secondary research was used mainly to identify and collect information for the extensive, technical, market-oriented, and commercial study of the mice model market. The secondary sources used for this study include some of the key secondary sources referred to for this study include publications from government sources such as International Mouse Phenotyping Consortium (IMPC), Association for Assessment and Accreditation of Laboratory Animal Care International (AAALAC), European Molecular Biology Laboratory - European Bioinformatics Institute (EMBL-EBI), Swiss Laboratory Animal Science Association (SGV), Medical Research Council (MRC), Asian Mouse Mutagenesis Resource Association (AMMRA), Annual Reports, Press Releases, Expert Interviews, and MarketsandMarkets Analysis. These sources were also used to obtain key information about major players, market classification, and segmentation according to industry trends, regional/country-level markets, market developments, and technology perspectives.

Primary Research

In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify the critical qualitative and quantitative information as well as assess prospects of the market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

To know about the assumptions considered for the study, download the pdf brochure

| COMPANY NAME |

DESIGNATION |

|

Khaleel Ahmed |

Business Development Executive |

|

Adriano Flora |

Director of Business Development |

|

Hendrick Claeys |

Sales Director |

|

David Edgar |

Business Development Executive |

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the mice model market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research

- The revenues generated from the mice model business of leading players have been determined through primary and secondary research

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Global Market: Bottom Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Market Size: Top Down Approach

Data Triangulation

After arriving at the overall market size from the market size estimation process, the total market was split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all segments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Mice models are the representation of human diseases or syndromes in mice, which are the most popular mammalian models for the study of human disease and health. Mice share more than 95% of the human DNA and are biologically very similar to humans. They can get many of the same diseases as humans for the same genetic reasons.

Key Stakeholders

- Manufacturers and distributors of mice model products

- Pharmaceutical and biotechnology companies

- Market research and consulting firms

- R&D centers

- Researchers and scientists

- Academic & research institutes

Report Objectives

- To define, describe, and forecast the mice model market based on model types & services, technologies, application, and end user.

- To provide detailed information regarding the major factors influencing the growth of the market (such as drivers, restraints, challenges, opportunities, and trends)

- To strategically analyse micro markets with respect to individual growth trends, future prospects, and contributions to the overall mice model market

- To analyse opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To strategically profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies

- To track and analyze competitive developments such as acquisitions, product launches, expansions, agreements, partnerships, and R&D activities in the mice model market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for this report:

Company Information

- Twenty five company profiles

Regional Analysis

- Breakdown of RoW into Latin America and Middle East & Africa

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Mice Model Market