Micro-inverter Market with COVID-19 Impact by Offering, Communication Technology, Type, Power Rating, Connection Type, Sales Channel, Application (Residential, Commercial, and PV Power Plant), and Geography - Global Forecast to 2025

Micro-inverter Market

Micro-inverter Market and Top Companies

Enphase Energy : Enphase Energy designs, develops, and sells micro-inverter systems for residential and commercial end users in the US and internationally. The company offers its products such as AC modules, micro-inverters, battery energy storage systems, accessories, and supportive software applications. It also provides IQ Envoy—a communication gateway.

Darfon Electronics: Darfon Electronics offers micro-inverters through its US-based subsidiary, Darfon Solar. Its product portfolio consists of an extensive range of micro-inverters, storage solutions, and monitoring systems. Darfon Solar offers G640 micro-inverter series. These micro-inverters are well-suited for residential and commercial applications. The company also provides data loggers, programmable logic controller (PLC) boxes, and ComBox. The cloud-based monitoring systems offered by Darfon enable users to efficiently troubleshoot problems in PV systems, thereby resulting in low maintenance costs.

Altenergy Power System: Altenergy Power System, also known as APsystems, is a global company that develops, manufactures, and markets micro-inverters. The micro-inverters offered by the company are based on its proprietary solar technology. APsystems offers advanced solar micro-inverters for use in residential and commercial applications. It offers QS1, YC600, and YC1000 micro-inverters, as well as an energy monitoring & analysis (EMA) web portal and mobile apps to monitor and control the panel-by-panel performance of solar systems. Its proprietary system architecture combines highly efficient power inversion systems with user-friendly monitoring interfaces to offer reliable and intelligent energy solutions that ensure maximum output of solar arrays.

ReneSola : ReneSola is a leading manufacturer and supplier of green energy products. Its micro-inverter solution is branded as Micro Replus and comprises micro-inverters, Micro Replus Gateway (MRG), and monitoring software. The micro-inverters offered by ReneSola are designed to improve the reliability of solar PV harvesting in residential applications. Its LED portfolio includes LED outdoor lighting, LED indoor lighting, compact fluorescent lamps (CFL), and LED retrofit lamps.

Chilicon Power: Chilicon Power develops, manufactures, and sells advanced micro-inverters. The offerings of the company include CP-720 and CP-250E micro-inverters, and a gateway. The micro-inverters of Chilicon Power can replace large central inverters. They integrate with advanced networking technologies and web-based software to enable a new level of intelligence and connectivity for solar arrays. The CP-720 inverter of the company offers sustainable power production of 720 watts AC, which acts as a well-scaled output power that is compatible with 60-cell, 72-cell, or 96-cell modules up to 840 W DC.

Micro-inverter Market and Top Applications

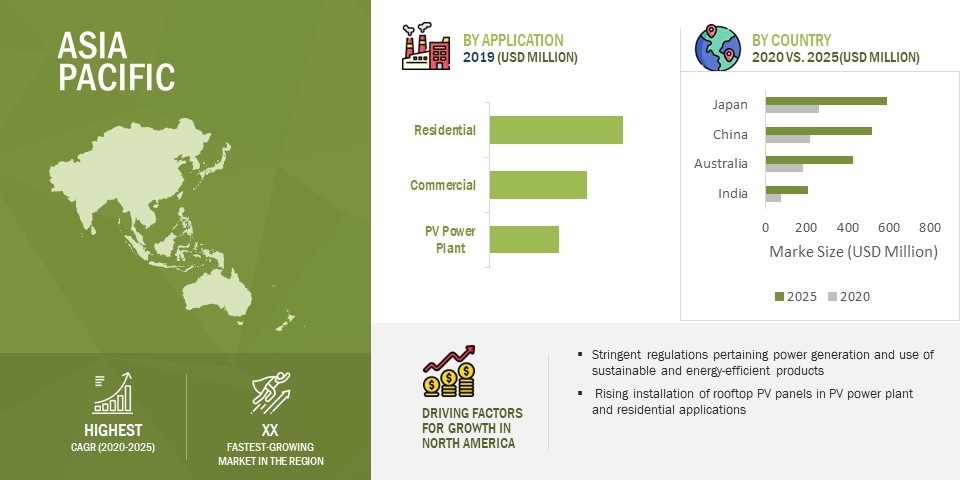

- Residential: PV installations in the residential sector have been increasing tremendously and are projected to continue in the coming years. Solar inverter systems at residential levels have also become critical due to the increased adoption of residential-scale PV. Micro-inverters are mainly used in residential applications. Owing to its features such as great scalability and flexibility and because they are easy to install as compared to conventional string or central inverter technology, these micro-inverters are well suited in residential solar rooftop PV installations.

- Commercial: A commercial-scale PV system is among the most familiar ways to enhance the company’s green credentials, as well as reduce electricity bills. Installing a solar PV system at a commercial level not only protects against the ever-rising retail energy prices but can also provide financial incentives by selling power to the grid. Mostly college and school campuses, as well as commercial buildings, hotels, and farms, have rooftop and ground solar PV installations. A micro-inverter helps in increasing the amount of energy harvested from an array in commercial applications. In addition, the lower voltages of micro-inverters make them a safer choice for commercial applications.

- PV Power Plant: PV power plants are a relatively newer application segment for micro-inverters. It accounts for a smaller share than residential and commercial applications. The number of solar panels installed in a PV plant is huge, and it may not be convenient and cost-efficient to integrate micro-inverters for each panel. Also, most micro-inverters are single phased and are not suitable for this application as the electricity generated is transmitted directly to the grid, which requires a three-phase connection. However, a few manufacturers, such as Altenergy Power Systems, have expanded their micro-inverter product portfolio and offer three-phase micro-inverters that can handle up to 3–4 modules per unit, which is suitable for PV power plant applications.

Micro-inverter Market and Top Types

- Single Phase: Most micro-inverters available in the market, at present, are single phased. New homes and small businesses adopt single-phase micro-inverters, wherein single-phase electric power is transmitted via 2 wires—active and neutral. Electricity from the solar PV system flows through one active wire, while the neutral wire is connected to the ground (earth) at the switchboard.

- Three Phase: A three-phase micro-inverter is invented recently. These inverters are specifically designed to supply three-phase electric power and are mostly suitable for PV power plant applications. In conventional micro-inverter designs that work on single-phase power, the energy from the panel must be stored during the period when the voltage is passing through zero, which it does twice per cycle. In contrast, in a three-phase system, throughout the cycle, one of the three wires has a positive or negative voltage, and thus the need for storage can be greatly reduced by transferring the output of the panel to different wires during each cycle.

[179 Pages Report] Micro-inverter market is projected to grow from USD 2.5 billion in 2020 to USD 6.5 Billion by 2025, at a CAGR of 20.8 % between 2020-2025. Micro-inverters offer several benefits and have gained traction over the past few years. One of the main advantages of micro-inverter systems is that each panel is monitored and optimized individually to generate maximum power. The significant rise in demand for micro-inverters can be attributed to a growing number of solar rooftop installations in residential and commercial applications.

Micro-Inverter Market Forecast to 2025

To know about the assumptions considered for the study, Request for Free Sample Report

Micro-inverters are a relatively newer concept compared to other solar technologies. It was commercialized in 2008 by Enphase Energy (US). It is also called a plug-and-play compact solar inverter system installed beneath every solar panel. Their primary function is to convert the direct current (DC) power generated through the panel into alternate current (AC) at each panel level and transmit it further for direct use or to a grid.

Micro-inverter is an emerging solar inverter technology. The growing energy and power industry have led to an increasing need for efficient, inexpensive inverter systems. Micro-inverters can efficiently meet this requirement and are currently tested and the most adopted types in the solar sector. The growing deployment of solar PV panels for residential and commercial applications across the world drives the market for micro-inverters. Moreover, micro-inverters have several inherent benefits that make them popular in various industries.

Micro-Inverter Market Dynamics:

Driver: Technical advantages of micro-inverters over conventional solar inverters

Micro-inverters have several technical advantages over other conventional string and central solar inverters. Micro-inverter delivers a maximum potential output of the photovoltaic (PV) system. The main advantage is their ability to maintain a robust and consistent flow of power despite the shading of one or more of its panels; this has increased micro-inverters popularity among end users. Hence, micro-inverters are largely deployed with solar panels. Additionally, micro-inverters provide other benefits, which are listed below:

- Micro-inverters can produce power from solar panels using maximum power point tracking (MPPT) technology to maximize power production from each solar panel.

- Micro-inverters can substantially increase the efficiency of solar power systems immediately and maintain the level of efficiency over a long period. Most micro-inverters come with a 25-year warranty, whereas a standard string inverter holds only 10 years of warranty.

- Micro-inverters are small and compact, thus eliminating the need for separate cooling systems as central inverters.

Restraint: Higher installation and maintenance costs of micro-inverters

Though micro-inverters have several advantages over conventional central and string inverter systems, the cost incurred during installation and maintenance is one of the major factors restraining the market. Micro-inverters are premium products available at a high-end price. A micro-inverter system includes one micro-inverter per module, a communication gateway, expensive AC trunk cables, and custom tools. The limited current of an AC trunk cable limits the number of inverters connected to the same cable trunk. Moreover, a micro-inverter system costs ~USD 100. As these inverters are well known for operating individual panels and are installed on one panel each, it involves a greater number of micro-inverter installations and a higher expense than that incurred for a string inverter on a standard solar installation.

Opportunity: Technological innovations in inverters to improve their capabilities

Increased electricity requirements and the related rise in electricity costs have led to a demand for the development of efficient solar inverter technologies. Thus, new inverter technologies are being developed and introduced to cater to customers' unmet requirements. Over the years, micro-inverters have been developed using various architectures to improve their performance. In addition, several micro-inverter manufacturers have adopted partnership and collaboration strategies to expand their business operations, diversify their product offerings, enhance their technology portfolio, and improve overall performance. A few major players in the micro-inverter market collaborate with various companies to enhance their product offerings by inculcating new technologies in their products.

Challenge: Pricing pressure on manufacturers of micro-inverters

Solar PV systems are witnessing increased global demand as they generate green power to reduce dependence on grid power. With decreasing prices of solar modules, micro-inverters account for a large share of the overall installation costs of these modules. This results in downward price pressure on manufacturers of micro-inverters. As the overall costs of residential, commercial, industrial, and utility-based solar systems are reducing, inverter companies are bound to reduce the prices of their products. Solar module manufacturers are enduring more pressure than manufacturers of micro-inverters in terms of reduction in the costs of their products. Manufacturers of micro-inverters find it difficult to accommodate this change and allow price drops in their inverters. These price drops can be primarily attributed to the development of low-cost equipment and compressed profit margins, which are indicators of the overall price decline in micro-inverters in the coming future.

Micro-inverter Market Segment Insights:

The overall micro-inverter market has been segmented based on offering, type, communication technology, connection type, power rating, sales channel, application, and region

The micro-inverter market has been segmented based on connection type

Into grid-tied and standalone types. The market for grid-tied is expected to contribute the largest market share in the said market. At present, most of the micro-inverters attached to solar panels for residential, commercial, and utility applications are attached or connected to a grid. Grid-tied systems are more favorable for end users than stand-alone systems as the surplus electricity generated by these inverters is provided to grids. When solar systems do not generate electricity, it is drawn from grids to avoid using costly batteries. Therefore, micro-inverters having grid-tied connections are expected to dominate the market during the forecast period.

Based on communication technology, the wired segment registers the largest share during the forecast period

Based on communication technology, the micro-inverter market has been classified into wired & wireless types. Most of the micro-inverters are wired. Power-line communication (PLC) is one of the most commonly adopted communication technologies for transmitting module performance data between the solar panel and communication gateway device. PLC is the most preferred technology as it does not require additional wires to transmit data; it uses the same AC wiring infrastructure. Also, this technology is considerably more effective at home networks. Moreover, micro-inverters connected via wireless technologies are costlier than those connected through wireless technologies. The market for wireless technology is expected to be lower than wired technology throughout the forecast period, and the cost of wireless technology is also anticipated to rise further

Based on application, the residential segment held the leading share of the market during the forecast period

The micro-inverter market is segmented into residential, commercial, and PV Power plants. Micro-inverters are mainly adopted for residential applications. Residential solar rooftop PV installations have witnessed significant growth over the last few years. Towering energy costs, coupled with supportive government policies worldwide, have led to the increasing adoption of energy conservation measures for controlling energy expenditure in residential applications. Countries such as the US, Australia, and the Netherlands have widely adopted micro-inverters over conventional inverters, which are among the prominent markets for residential rooftop PV installations. In addition, countries such as India, Mexico, the UK, and Brazil are witnessing significant growth in the residential solar market. These factors are expected to create a huge demand for micro-inverters.

Based on offering, the hardware segment accounted largest market share

Hardware offerings provided by micro-inverter solution providers mainly include capacitors, sensors, microcontroller units (MCUs), and other electric components. These devices are considered the main components of the micro-inverter system as they help convert DC power from a panel to AC power. The AC power is transmitted through wires and cables for use in residential or commercial applications. Micro-inverters can be directly integrated into solar panels and monitor each panel. Thus, the hardware segment contributed the largest market share.

Indirect sales channel to register for the largest share throughout the forecast period

Manufacturers mainly provide micro-inverters to end users through indirect sales channels or third-party providers. Most key players in the market have well-established sales networks and distribute their products worldwide. Micro-inverter systems are mainly adopted in residential and commercial applications. End users may lack the expertise required to integrate micro-inverters into solar panels; thus, installations are mostly done by system integrators or third-party providers. Owing to these factors, the indirect sales channel segment is expected to grow at a higher CAGR during the forecast period

Based on power rating, between 250 W and 500 W segments witnessed strong growth in the market during the forecast period

By power rating, the market has been classified below 250 W, between 250 W and 500 W, and above 500W. Micro-inverters between 250W and 500W are expected to grow at the highest CAGR during the forecast period. Micro-inverters with a power output rating between 250 and 500 watts are suitable for residential and commercial applications. Residential solar PV systems are installed mostly on the rooftop; they offer the benefits of feed-in tariffs and net metering. Solar PV systems are increasingly being installed globally for residential applications, and a similar trend will likely be observed during the forecast period. Governments of different countries, such as China, the US, and Germany, encourage rooftop PV installations for residential users.

Regional Insights:

The Asia Pacific region is projected to grow at the highest CAGR during the forecast period

The market in Asia Pacific mainly comprises potential economies such as China and India. The micro-inverter market in the Asia Pacific is growing rapidly with the increasing adoption of commercial solar PV systems for industrial, residential, and other applications.

Micro-Inverter Market by Region

To know about the assumptions considered for the study, download the pdf brochure

The prevailing energy trends in India and China and the ongoing implementation of various policies fuel the micro-inverter market in the Asia Pacific. China is the world’s largest PV module producer. The Government of China has set ambitious renewable energy generation targets. It offers support in the form of policies and incentives, such as feed-in tariffs, to fuel the growth of the micro-inverter market in China. Moreover, the country is home to several leading micro-inverter manufacturers, such as Renesola, Envertech, and Zhejiang Snadi Electric. These factors are expected to drive the growth of the micro-inverter market in China.

The North American region contributes a major share of the micro-inverter market

North America to attribute the largest share of the micro-inverter market. The high number of micro-inverter installations in the region, mainly in the US and Canada, can be attributed to the growth of the micro-inverter market. The US was the first to exhibit wide-scale adoption of micro-inverter technology, especially for residential applications. In addition, favorable economic conditions, the growing solar PV market, and the regulatory framework encouraging solar electricity generation in the residential sector in the US and other countries of the region are other factors supporting the market growth in the region. In light of the factors above, several domestic and international manufacturers are prompted to enhance their regional micro-inverter offerings.

Key Market Players:

Some of the major players in the micro-inverter market are Enphase Energy (US), Darfon Electronics (Taiwan), Altenergy Power System (US), ReneSola (China), and AEconversion (Germany). These players have adopted various growth strategies such as contracts, joint ventures, partnerships & agreements, acquisitions, and new product launches to expand their presence in the micro-inverter market further.

Enphase Energy designs, develops, and sells micro-inverter systems for residential and commercial end users in the US and internationally. The company offers AC modules, micro-inverters, battery energy storage systems, accessories, and supportive software applications. It also provides IQ Envoy—a communication gateway. The portfolio of micro-inverter systems offered by the company consists of IQ 7 series, IQ 6 series, and M250-72. Its semiconductor-based micro-inverter systems convert direct current (DC) to alternating current (AC) at the individual solar module level. These systems facilitate cloud-based monitoring through IQ Envoy. It also provides these systems to large installers through original equipment manufacturers and strategic partners.

Altenergy Power System, also known as APsystems, is a global company that develops, manufactures, and markets micro-inverters. The micro-inverters offered by the company are based on its proprietary solar technology. APsystems offers advanced solar micro-inverters for use in residential and commercial applications. It offers QS1, YC600, and YC1000 micro-inverters, an energy monitoring & analysis (EMA) web portal, and mobile apps to monitor and control the panel-by-panel performance of solar systems. Its proprietary system architecture combines highly efficient power inversion systems with user-friendly monitoring interfaces to offer reliable and intelligent energy solutions that ensure maximum output of solar arrays.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Years considered |

2017–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Value (USD million and USD billion), Volume (GW) |

|

Segments covered |

Offering, Communication Technology, Type, Power Rating, Connection Type, Sales Channel, Application, and Region |

|

Regions covered |

North America, APAC, Europe, and RoW |

|

Companies covered |

Enphase Energy (US), Altenergy Power System (US), Darfon Electronics (Taiwan), ReneSola (China), AEconversion (Germany), and Chilicon Power (US) A total of 20 players covered. |

In this report, the overall micro-inverter market has been segmented based on Offering, Communication Technology, Type, Power Rating, Connection Type, Sales Channel, Application, and Region

Micro-Inverter Market, by Offering

- Hardware

- Software & Services

Micro-Inverter Market, by Communication Technology

- Wired

- Wireless

Micro-Inverter Market, by Type

- Single Phase

- Three Phase

Micro-Inverter Market, by Power Rating

- Below 250 W

- Between 250 W and 500 W

- Above 500 W

Micro-Inverter Market, by Connection Type

- Stand-alone

- Grid-tied

Micro-Inverter Market, by Sales Channel

- Direct

- Indirect

Micro-Inverter Market, by Application

- Residential

- Commercial

- PV Power Plant

Geographic Analysis

- North America (US, Canada, and Mexico)

- Europe (UK, Germany, France, Netherlands, and Rest of Europe)

- Asia Pacific (China, Japan, India, Australia, and Rest of APAC)

- Rest of the World (South America and Middle East & Africa)

Micro-Inverter Market Highlights:

What is new?

- Major developments that can change the business landscape as well as market forecasts.

The micro-inverter industry has witnessed numerous technological advancements in terms of offerings over the years. Substantial investments have been made in developing micro-inverters research & development and upgrades. R&D in software technologies and data analytics has enhanced micro-inverters design over the years.

- Addition/refinement in segmentation–Increase the depth or width of market segmentation.

-

Micro-Inverter Market, by offering

- Hardware

- Software

- Services

-

Micro-Inverter Market, By Communication Technology

- Wired

- Wireless

-

Micro-Inverter Market, By Power Rating

- Below 250 W

- Between 250 W and 500 W

- Above 500 W

-

Micro-Inverter Market, By Connection Type

- Grid-tied

- Standalone

-

Micro-Inverter Market, By Type

- Three Phase

- Single Phase

-

Micro-Inverter Market, By Sales Channel

- Direct

- Indirect

-

Micro-Inverter Market, by Application

- Residential

- Commercial

- PV Power Plant

- Coverage of new market players and change in the market share of existing players of the micro-inverter market

Company profiles: Company profiles give a glimpse of the key players in the market with respect to their business overviews, financials, product offerings, recent developments undertaken by them, and MnM view. In the new edition of the report, we have a total of 25 players (15 major, 10 Startups/SME). Moreover, the share of companies operating in the micro-inverter and start-up matrix has also been provided in the report.

- Updated financial information and product portfolios of players operating in the micro-inverter market

Newer and improved representation of financial information: The edition of the report provides financial information in the context of the micro-inverter market for each listed key player in the graphical representation in a single diagram (instead of multiple tables). This would help to easily analyze the present status of profiled companies in terms of their financial strength, profitability, key revenue-generating region/country, business segment focus in terms of the highest revenue-generating segment, and investment in research and development activities.

- Updated market developments of the profiled players

Recent Developments: Updated market developments such as sales contracts, product launches, partnerships & agreements, and acquisitions have been mapped.

- Any new data points/analysis (frameworks) which was not present in the previous version of the report

- Competitive benchmarking of startups /SMEs covers employee details, financial status, the latest funding round, and total funding.

- Technology analysis and case studies are added in this edition of the report to give the technological perspective and the significance of the advancements in the micro-inverter market

- We have included patent registrations to overview R&D activities in the micro-inverter market.

- The startup evaluation matrix is added in this report, covering drone startups.

- The new edition of the report consists of trends/disruptions in customer business, tariff & regulatory landscape, pricing analysis, and a market ecosystem map to better understand the micro-inverter market dynamics.

Recent Developments

- In July 2022, Zhejiang Beny Electric (China) launched a micro-inverter series for residential and commercial PV systems. The micro-inverters are in three different versions with a rated power output of 550 volt-amperes (VA), 700 VA, and 2,800 VA. The first two products can be connected to a single panel, while the largest micro-inverter can be connected to four panels.

- In October 2021, Enphase Energy unveiled its all-in-one Enphase Energy System equipped with IQ8 solar microinverters. The new smart micro-inverter, designed for North American customers, can form a microgrid using sunlight and provide backup power during outages, proliferating microinverter installation in the region.

- In September 2021, Altenergy Power System introduced the DS3 series, a single-phase, dual module, microinverter product line for commercial and residential solar applications. This DS3 solar microinverter series is designed to build on the company’s multi-module microinverters. This provides reduced logistics costs, improved communication and connection features, faster installation, and a high MPPT voltage range to ensure greater energy harvesting during low-light conditions.

Frequently Asked Questions (FAQs):

What is the current size of the micro-inverter market?

Micro-inverter market is projected to grow from USD 2.5 billion in 2020 to USD 6.5 Billion by 2025, at a CAGR of 20.8% between 2020-2025.

Who are the winners in the micro-inverter market?

Enphase Energy (US), Darfon Electronics (Taiwan), Altenergy Power System (US), ReneSola (China), and AEconversion (Germany).

What are some of the technological advancements in the market?

Today’s multi-module micro-inverters provide reduced logistics costs, improved communication, and connection features, faster installation, and a high MPPT voltage range to ensure greater energy harvesting during low-light conditions.

What are the factors driving the growth of the market?

Micro-inverters are growing rapidly across many application domains, such as residential, commercial, and PV systems.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 25)

1.1 STUDY OBJECTIVES

1.2 DEFINITION AND SCOPE

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SEGMENTATION

1.3.1 GEOGRAPHIC SCOPE

1.3.2 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 30)

2.1 RESEARCH DATA

FIGURE 1 RESEARCH DESIGN

2.2 SECONDARY AND PRIMARY RESEARCH

2.2.1 SECONDARY DATA

2.2.1.1 Secondary sources

2.2.2 PRIMARY DATA

2.2.2.1 Primary sources

2.2.2.2 Key industry insights

2.2.2.3 Breakdown of primaries

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

FIGURE 2 BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

FIGURE 3 TOP-DOWN APPROACH

FIGURE 4 MICRO-INVERTER MARKET: MARKET SIZE ESTIMATION, BY DEMAND-SIDE APPROACH

2.4 DATA TRIANGULATION

FIGURE 5 DATA TRIANGULATION

2.5 RESEARCH ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 40)

FIGURE 6 MICRO-INVERTER MARKET, 2016–2025

TABLE 1 MARKET, IN TERMS OF VALUE AND VOLUME, 2016–2019

TABLE 2 MARKET, IN TERMS OF VALUE AND VOLUME, 2020–2025

FIGURE 7 MARKET: PRE- AND POST-COVID-19 SCENARIOS

3.1 PRE-COVID-19 SCENARIO

TABLE 3 MARKET, PRE-COVID-19 SCENARIO, 2020–2025

3.2 REALISTIC SCENARIO

TABLE 4 MARKET, POST-COVID-19 REALISTIC SCENARIO, 2020–2025

3.3 PESSIMISTIC SCENARIO

TABLE 5 MARKET, POST-COVID-19 PESSIMISTIC SCENARIO, 2020–2025

3.4 OPTIMISTIC SCENARIO

TABLE 6 MARKET, POST-COVID-19 OPTIMISTIC SCENARIO, 2020–2025

FIGURE 8 GRID-TIED MICRO-INVERTERS TO HOLD LARGER MARKET SHARE IN 2020

FIGURE 9 WIRED COMMUNICATION TECHNOLOGY TO CAPTURE LARGER SIZE OF MARKET IN 2025

FIGURE 10 RESIDENTIAL APPLICATIONS TO SIGNIFICANTLY CONTRIBUTE TO MARKET GROWTH DURING FORECAST PERIOD

FIGURE 11 NORTH AMERICA EXPECTED TO HOLD LARGEST SHARE OF MARKET IN 2020

4 PREMIUM INSIGHTS (Page No. - 47)

4.1 APAC TO PROVIDE LUCRATIVE OPPORTUNITIES FOR MICRO-INVERTER MARKET IN COMING YEARS

FIGURE 12 ATTRACTIVE GROWTH OPPORTUNITIES IN MARKET

4.2 MARKET, BY TYPE (2017–2025)

FIGURE 13 SINGLE-PHASE MARKET TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

4.3 MARKET, BY POWER RATING

FIGURE 14 MICRO-INVERTERS WITH POWER RATING BETWEEN 250 W AND 500 W TO HOLD LARGEST MARKET SHARE IN 2020

4.4 MARKET, BY SALES CHANNEL

FIGURE 15 INDIRECT SALES CHANNELS TO CAPTURE LARGER SHARE OF MARKET IN 2020

4.5 MARKET, BY REGION

FIGURE 16 INDIA TO WITNESS HIGHEST CAGR IN MARKET DURING 2020–2025

5 MARKET OVERVIEW (Page No. - 50)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 MICRO-INVERTER MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Technical advantages of micro-inverters over conventional solar inverters

FIGURE 18 GLOBAL SHIPMENT OF DIFFERENT TYPES OF SOLAR INVERTERS, 2019

5.2.1.2 Significant capital inflows in renewable energy sector

FIGURE 19 GLOBAL INVESTMENTS IN RENEWABLE ENERGY SOURCES, 2018 (USD BILLION)

5.2.1.3 High demand for micro-inverters due to their remote monitoring capabilities

5.2.1.4 Increasing number of residential solar rooftop installations

FIGURE 20 MARKET: IMPACT ANALYSIS OF DRIVERS

5.2.2 RESTRAINTS

5.2.2.1 Decreased demand for micro-inverters with reduced electricity requirement from commercial and industrial end users due to COVID-19 outbreak

5.2.2.2 Higher installation and maintenance costs of micro-inverters

FIGURE 21 MICRO-INVERTER MARKET: IMPACT ANALYSIS OF RESTRAINTS

5.2.3 OPPORTUNITIES

5.2.3.1 Increase in number of solar PV installations owing to incentive schemes by governments of different countries

5.2.3.2 Technological innovations in inverters to improve their capabilities

FIGURE 22 MARKET: IMPACT ANALYSIS OF OPPORTUNITIES

5.2.4 CHALLENGES

5.2.4.1 Pricing pressure on manufacturers of micro-inverters

5.2.4.2 Safety risks associated with high DC voltages

FIGURE 23 MARKET: IMPACT ANALYSIS OF CHALLENGES

5.3 VALUE CHAIN ANALYSIS

FIGURE 24 MARKET: MAJOR VALUE ADDED BY MANUFACTURERS AND COMPONENT PROVIDERS

5.4 ECOSYSTEM

FIGURE 25 MARKET ECOSYSTEM

5.5 TECHNOLOGY ANALYSIS

5.6 CASE STUDY ANALYSIS

5.6.1 ENPHASE INSTALLED 7X M250 MICRO-INVERTERS AND 1X ENVOY-R FOR RESIDENTIAL END USERS AS ENVIRONMENTALLY FRIENDLY SOLAR INVESTMENT

5.6.2 ENPHASE INSTALLED M215 MICRO-INVERTERS FOR FAT WEST MEATS (US) COMMERCIAL PROJECT, PROVING THEM BETTER THAN DC OPTIMIZERS

5.7 PATENT ANALYSIS

TABLE 7 PATENTS IN MARKET

5.8 PRICING ANALYSIS

5.9 MARKET REGULATIONS

6 MICRO-INVERTER MARKET, BY OFFERING (Page No. - 63)

6.1 INTRODUCTION

FIGURE 26 MARKET, BY OFFERING

FIGURE 27 SOFTWARE & SERVICES SEGMENT TO EXHIBIT HIGHER CAGR IN MARKET, BY OFFERING, FROM 2020 TO 2025

TABLE 8 MARKET, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 9 MARKET, BY OFFERING, 2020–2025 (USD MILLION)

6.2 HARDWARE

6.2.1 HARDWARE COMPONENTS ARE CORE ELEMENTS OF MICRO-INVERTER SYSTEMS

6.3 SOFTWARE & SERVICES

6.3.1 SOFTWARE

6.3.1.1 System monitoring and data analysis are critical functions of software products

6.3.2 SERVICES

6.3.2.1 Installation and maintenance services are crucial for micro-inverter systems

7 MICRO-INVERTER MARKET, BY COMMUNICATION TECHNOLOGY (Page No. - 67)

7.1 INTRODUCTION

FIGURE 28 MARKET, BY COMMUNICATION TECHNOLOGY

FIGURE 29 WIRELESS COMMUNICATION TECHNOLOGY TO EXHIBIT HIGHER CAGR IN MARKET FROM 2020 TO 2025

TABLE 10 MARKET, BY COMMUNICATION TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 11 MARKET, BY COMMUNICATION TECHNOLOGY, 2020–2025 (USD MILLION)

7.2 WIRED

7.2.1 WIRED COMMUNICATION TECHNOLOGY IS PREFERRED FOR MICRO-INVERTERS

TABLE 12 MARKET FOR WIRED COMMUNICATION TECHNOLOGY, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 13 MARKET FOR WIRED COMMUNICATION TECHNOLOGY, BY APPLICATION, 2020–2025 (USD MILLION)

7.3 WIRELESS

7.3.1 WIRELESS COMMUNICATION TECHNOLOGY HAS HIGHER GROWTH PROSPECTS IN NEAR FUTURE

TABLE 14 MARKET FOR WIRELESS COMMUNICATION TECHNOLOGY, BY APPLICATION, 2016–2019 (USD MILLION)

FIGURE 30 RESIDENTIAL APPLICATION TO CONTINUE TO DOMINATE MARKET FOR WIRELESS COMMUNICATION TECHNOLOGY-BASED MICRO-INVERTERS DURING FORECAST PERIOD

TABLE 15 MARKET FOR WIRELESS COMMUNICATION TECHNOLOGY, BY APPLICATION, 2020–2025 (USD MILLION)

8 MICRO-INVERTER MARKET, BY TYPE (Page No. - 73)

8.1 INTRODUCTION

FIGURE 31 MARKET, BY TYPE

FIGURE 32 MARKET FOR SINGLE-PHASE MICRO-INVERTERS TO GROW AT HIGHER CAGR FROM 2020 TO 2025

TABLE 16 MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 17 MARKET, BY TYPE, 2020–2025 (USD MILLION)

8.2 SINGLE PHASE

8.2.1 SINGLE-PHASE INVERTERS PRIMARILY DEPLOYED IN RESIDENTIAL APPLICATIONS

TABLE 18 SINGLE-PHASE MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 19 SINGLE-PHASE MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

8.3 THREE PHASE

8.3.1 PV PLANTS AND COMMERCIAL END USERS ESSENTIALLY EMPLOY THREE-PHASE MICRO-INVERTERS

TABLE 20 THREE-PHASE MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 21 THREE-PHASE MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

9 MICRO-INVERTER MARKET, BY POWER RATING (Page No. - 78)

9.1 INTRODUCTION

FIGURE 33 MARKET, BY POWER RATING

FIGURE 34 BETWEEN 250 AND 500 W SEGMENT TO EXHIBIT HIGHEST CAGR FROM 2020 TO 2025

TABLE 22 MARKET, BY POWER RATING, 2016–2019 (USD MILLION)

TABLE 23 MARKET, BY POWER RATING, 2020–2025 (USD MILLION)

9.2 BELOW 250 W

9.2.1 BELOW 250-WATT MICRO-INVERTERS ARE IDEAL FOR SOLAR PANELS INSTALLED IN RESIDENTIAL APPLICATIONS

9.3 BETWEEN 250 AND 500 W

9.3.1 MICRO INVERTERS WITH POWER RATING RANGING FROM 250 TO 500 WATTS WOULD LEAD MARKET DURING FORECAST PERIOD

9.4 ABOVE 500 W

9.4.1 MICRO INVERTERS WITH POWER RATING OF ABOVE 500 WATTS ARE ADOPTED TO FULFIL ENERGY GENERATION REQUIREMENTS OF LARGE PV SYSTEMS

10 MICRO-INVERTER MARKET, BY CONNECTION TYPE (Page No. - 82)

10.1 INTRODUCTION

FIGURE 35 MARKET, BY CONNECTION TYPE

FIGURE 36 GRID-TIED MICRO-INVERTERS WOULD DOMINATE MARKET DURING FORECAST PERIOD

TABLE 24 MARKET, BY CONNECTION TYPE, 2016–2019 (USD MILLION)

TABLE 25 MARKET, BY CONNECTION TYPE, 2020–2025 (USD MILLION)

10.2 STAND-ALONE

10.2.1 STAND-ALONE SOLAR SYSTEMS ARE MORE ECONOMICAL

10.3 GRID-TIED

10.3.1 GRID-TIED MICRO-INVERTERS ARE LIKELY TO DOMINATE MARKET IN COMING YEARS

11 MICRO-INVERTER MARKET, BY SALES CHANNEL (Page No. - 85)

11.1 INTRODUCTION

FIGURE 37 MARKET, BY SALES CHANNEL

FIGURE 38 INDIRECT SALES CHANNELS TO GROW AT HIGHER CAGR FROM 2020 TO 2025

TABLE 26 MARKET, BY SALES CHANNEL, 2016–2019 (USD MILLION)

TABLE 27 MARKET, BY SALES CHANNEL, 2020–2025 (USD MILLION)

11.2 DIRECT

11.2.1 DIRECT SALES CHANNELS ARE PREFERRED BY COMPANIES HAVING LIMITED DISTRIBUTION NETWORKS

TABLE 28 MARKET FOR DIRECT SALES CHANNELS, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 29 MARKET FOR DIRECT SALES CHANNELS, BY APPLICATION, 2020–2025 (USD MILLION)

11.3 INDIRECT

11.3.1 THIRD-PARTY PROVIDERS ARE PREFERRED FOR PROCUREMENT OF MICRO-INVERTERS

TABLE 30 MARKET FOR INDIRECT SALES CHANNELS, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 31 MARKET FOR INDIRECT SALES CHANNELS, BY APPLICATION, 2020–2025 (USD MILLION)

12 MICRO-INVERTER MARKET, BY APPLICATION (Page No. - 90)

12.1 INTRODUCTION

FIGURE 39 MICRO-INVERTER MARKET, BY APPLICATION

FIGURE 40 RESIDENTIAL APPLICATION TO DOMINATE MARKET DURING FORECAST PERIOD

TABLE 32 MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 33 MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

12.2 RESIDENTIAL

12.2.1 MICRO-INVERTERS PRIMARILY DEPLOYED FOR RESIDENTIAL APPLICATIONS

TABLE 34 MARKET FOR RESIDENTIAL APPLICATIONS, BY TYPE, 2016–2019 (USD MILLION)

TABLE 35 MARKET FOR RESIDENTIAL APPLICATIONS, BY TYPE, 2020–2025 (USD MILLION)

TABLE 36 MARKET FOR RESIDENTIAL APPLICATIONS, BY CONNECTION TYPE, 2016–2019 (USD MILLION)

TABLE 37 MARKET FOR RESIDENTIAL APPLICATIONS, BY CONNECTION TYPE, 2020–2025 (USD MILLION)

TABLE 38 MARKET FOR RESIDENTIAL APPLICATIONS, BY POWER RATING, 2016–2019 (USD MILLION)

TABLE 39 MARKET FOR RESIDENTIAL APPLICATIONS, BY POWER RATING, 2020–2025 (USD MILLION)

TABLE 40 MARKET FOR RESIDENTIAL APPLICATIONS, BY COMMUNICATION TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 41 MARKET FOR RESIDENTIAL APPLICATIONS, BY COMMUNICATION TECHNOLOGY, 2020–2025 (USD MILLION)

TABLE 42 MARKET FOR RESIDENTIAL APPLICATIONS, BY SALES CHANNEL, 2016–2019 (USD MILLION)

TABLE 43 MARKET FOR RESIDENTIAL APPLICATIONS, BY SALES CHANNEL, 2020–2025 (USD MILLION)

FIGURE 41 NORTH AMERICA TO DOMINATE MICRO-INVERTER MARKET FOR RESIDENTIAL APPLICATIONS DURING FORECAST PERIOD

TABLE 44 MARKET FOR RESIDENTIAL APPLICATIONS, BY REGION, 2016–2019 (USD MILLION)

TABLE 45 MARKET FOR RESIDENTIAL APPLICATIONS, BY REGION, 2020–2025 (USD MILLION)

TABLE 46 MARKET IN NORTH AMERICA FOR RESIDENTIAL APPLICATIONS, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 47 MARKET IN NORTH AMERICA FOR RESIDENTIAL APPLICATIONS, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 48 MARKET IN EUROPE FOR RESIDENTIAL APPLICATIONS, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 49 MARKET IN EUROPE FOR RESIDENTIAL APPLICATIONS, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 50 MARKET IN APAC FOR RESIDENTIAL APPLICATIONS, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 51 MARKET IN APAC FOR RESIDENTIAL APPLICATIONS, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 52 MARKET IN ROW FOR RESIDENTIAL APPLICATIONS, BY REGION, 2016–2019 (USD MILLION)

TABLE 53 MARKET IN ROW FOR RESIDENTIAL APPLICATIONS, BY REGION, 2020–2025 (USD MILLION)

12.3 COMMERCIAL

12.3.1 COVID-19 TO ADVERSELY IMPACT COMMERCIAL SECTOR USING MICRO-INVERTERS

FIGURE 42 SINGLE-PHASE MICRO-INVERTERS TO DOMINATE MICRO-INVERTER MARKET FOR COMMERCIAL APPLICATIONS DURING FORECAST PERIOD

TABLE 54 MARKET FOR COMMERCIAL APPLICATIONS, BY TYPE, 2016–2019 (USD MILLION)

TABLE 55 MARKET FOR COMMERCIAL APPLICATIONS, BY TYPE, 2020–2025 (USD MILLION)

TABLE 56 MARKET FOR COMMERCIAL APPLICATIONS, BY CONNECTION TYPE, 2016–2019 (USD MILLION)

TABLE 57 MARKET FOR COMMERCIAL APPLICATIONS, BY CONNECTION TYPE, 2020–2025 (USD MILLION)

TABLE 58 MARKET FOR COMMERCIAL APPLICATIONS, BY POWER RATING, 2016–2019 (USD MILLION)

TABLE 59 MARKET FOR COMMERCIAL APPLICATIONS, BY POWER RATING, 2020–2025 (USD MILLION)

TABLE 60 MARKET FOR COMMERCIAL APPLICATIONS, BY COMMUNICATION TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 61 MARKET FOR COMMERCIAL APPLICATIONS, BY COMMUNICATION TECHNOLOGY, 2020–2025 (USD MILLION)

TABLE 62 MARKET FOR COMMERCIAL APPLICATIONS, BY SALES CHANNEL, 2016–2019 (USD MILLION)

TABLE 63 MARKET FOR COMMERCIAL APPLICATIONS, BY SALES CHANNEL, 2020–2025 (USD MILLION)

TABLE 64 MARKET FOR COMMERCIAL APPLICATIONS, BY REGION, 2016–2019 (USD MILLION)

TABLE 65 MARKET FOR COMMERCIAL APPLICATIONS, BY REGION, 2020–2025 (USD MILLION)

TABLE 66 MARKET IN NORTH AMERICA FOR COMMERCIAL APPLICATIONS, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 67 MARKET IN NORTH AMERICA FOR COMMERCIAL APPLICATIONS, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 68 MARKET IN EUROPE FOR COMMERCIAL APPLICATIONS, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 69 MARKET IN EUROPE FOR COMMERCIAL APPLICATIONS, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 70 MARKET IN APAC FOR COMMERCIAL APPLICATIONS, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 71 MARKET IN APAC FOR COMMERCIAL APPLICATIONS, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 72 MARKET IN ROW FOR COMMERCIAL APPLICATIONS, BY REGION, 2016–2019 (USD MILLION)

TABLE 73 MARKET IN ROW FOR COMMERCIAL APPLICATIONS, BY REGION, 2020–2025 (USD MILLION)

12.4 PV POWER PLANT

12.4.1 INCREASING NUMBER OF GLOBAL PV INSTALLATIONS TO PROPEL MARKET GROWTH

FIGURE 43 GRID-TIED SYSTEMS TO HOLD LARGER SIZE OF MICRO-INVERTER MARKET FOR PV POWER PLANTS DURING FORECAST PERIOD

TABLE 74 MARKET FOR PV POWER PLANT APPLICATIONS, BY TYPE, 2016–2019 (USD MILLION)

TABLE 75 MARKET FOR PV POWER PLANT APPLICATIONS, BY TYPE, 2020–2025 (USD MILLION)

TABLE 76 MARKET FOR PV POWER PLANT APPLICATIONS, BY CONNECTION TYPE, 2016–2019 (USD MILLION)

TABLE 77 MARKET FOR PV POWER PLANT APPLICATIONS, BY CONNECTION TYPE, 2020–2025 (USD MILLION)

TABLE 78 MARKET FOR PV POWER PLANT APPLICATIONS, BY POWER RATING, 2016–2019 (USD MILLION)

TABLE 79 MARKET FOR PV POWER PLANT APPLICATIONS, BY POWER RATING, 2020–2025 (USD MILLION)

TABLE 80 MARKET FOR PV POWER PLANT APPLICATIONS, BY COMMUNICATION TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 81 MARKET FOR PV POWER PLANT APPLICATIONS, BY COMMUNICATION TECHNOLOGY, 2020–2025 (USD MILLION)

TABLE 82 MARKET FOR PV POWER PLANT APPLICATIONS, BY SALES CHANNEL, 2016–2019 (USD MILLION)

TABLE 83 MARKET FOR PV POWER PLANT APPLICATIONS, BY SALES CHANNEL, 2020–2025 (USD MILLION)

TABLE 84 MARKET FOR PV POWER PLANT APPLICATIONS, BY REGION, 2016–2019 (USD MILLION)

TABLE 85 MARKET FOR PV POWER PLANT APPLICATIONS, BY REGION, 2020–2025 (USD MILLION)

TABLE 86 MARKET IN NORTH AMERICA FOR PV POWER PLANT APPLICATIONS, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 87 MARKET IN NORTH AMERICA FOR PV POWER PLANT APPLICATIONS, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 88 MARKET IN EUROPE FOR PV POWER PLANT APPLICATIONS, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 89 MARKET IN EUROPE FOR PV POWER PLANT APPLICATIONS, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 90 MARKET IN APAC FOR PV POWER PLANT APPLICATIONS, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 91 MARKET IN APAC FOR PV POWER PLANT APPLICATIONS, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 92 MARKET IN ROW FOR PV POWER PLANT APPLICATIONS, BY REGION, 2016–2019 (USD MILLION)

TABLE 93 MARKET IN ROW FOR PV POWER PLANT APPLICATIONS, BY REGION, 2020–2025 (USD MILLION)

13 GEOGRAPHIC ANALYSIS (Page No. - 114)

13.1 INTRODUCTION

FIGURE 44 GEOGRAPHIC SNAPSHOT: MICRO-INVERTER MARKET IN INDIA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 94 MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 95 MARKET, BY REGION, 2020–2025 (USD MILLION)

13.2 NORTH AMERICA

FIGURE 45 NORTH AMERICA: SNAPSHOT OF MICRO-INVERTER MARKET

FIGURE 46 MARKET: PRE- AND POST-COVID-19 SCENARIOS IN NORTH AMERICA

TABLE 96 MARKET: PRE- AND POST-COVID-19 SCENARIOS IN NORTH AMERICA, 2016–2025 (USD MILLION)

TABLE 97 MARKET IN NORTH AMERICA, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 98 MARKET IN NORTH AMERICA, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 99 MARKET IN NORTH AMERICA, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 100 MARKET IN NORTH AMERICA, BY APPLICATION, 2020–2025 (USD MILLION)

13.2.1 US

13.2.1.1 Market in US to be adversely impacted by COVID-19

TABLE 101 MARKET IN US, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 102 MARKET IN US, BY APPLICATION, 2020–2025 (USD MILLION)

13.2.2 CANADA

13.2.2.1 Micro-FiT program to support PV installations would contribute to market growth in Canada

TABLE 103 MARKET IN CANADA, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 104 MARKET IN CANADA, BY APPLICATION, 2020–2025 (USD MILLION)

13.2.3 MEXICO

13.2.3.1 Clean energy reforms to fuel market growth in Mexico

TABLE 105 MARKET IN MEXICO, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 106 MARKET IN MEXICO, BY APPLICATION, 2020–2025 (USD MILLION)

13.3 EUROPE

FIGURE 47 EUROPE: SNAPSHOT OF MICRO-INVERTER MARKET

TABLE 107 MARKET IN EUROPE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 108 MARKET IN EUROPE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 109 MARKET IN EUROPE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 110 MARKET IN EUROPE, BY APPLICATION, 2020–2025 (USD MILLION)

13.3.1 GERMANY

13.3.1.1 Germany to emerge as largest micro-inverter market in Europe during forecast period

TABLE 111 MARKET IN GERMANY, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 112 MARKET IN GERMANY, BY APPLICATION, 2020–2025 (USD MILLION)

13.3.2 UK

13.3.2.1 Encouragement by UK government to promote use of new energy technologies to fuel market growth

TABLE 113 MARKET IN UK, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 114 MARKET IN UK, BY APPLICATION, 2020–2025 (USD MILLION)

13.3.3 FRANCE

13.3.3.1 Increased adoption of automation technologies in various industries to fuel growth of market in France

TABLE 115 MARKET IN FRANCE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 116 MARKET IN FRANCE, BY APPLICATION, 2020–2025 (USD MILLION)

13.3.4 NETHERLANDS

13.3.4.1 Residential and commercial applications contribute significantly to market growth in Netherlands

TABLE 117 MARKET IN NETHERLANDS, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 118 MARKET IN NETHERLANDS, BY APPLICATION, 2020–2025 (USD MILLION)

13.3.5 REST OF EUROPE

TABLE 119 MARKET IN REST OF EUROPE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 120 MARKET IN REST OF EUROPE, BY APPLICATION, 2020–2025 (USD MILLION)

13.4 APAC

FIGURE 48 APAC: SNAPSHOT OF MICRO-INVERTER MARKET

FIGURE 49 MARKET: PRE- AND POST-COVID-19 SCENARIOS IN APAC

TABLE 121 MARKET: PRE- AND POST-COVID-19 SCENARIOS IN APAC, 2020–2025 (USD MILLION)

TABLE 122 MARKET IN APAC, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 123 MARKET IN APAC, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 124 MARKET IN APAC, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 125 MARKET IN APAC, BY APPLICATION, 2020–2025 (USD MILLION)

13.4.1 CHINA

13.4.1.1 Market growth in china anticipated to be negatively impacted by COVID-19 outbreak

TABLE 126 MARKET IN CHINA, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 127 MARKET IN CHINA, BY APPLICATION, 2020–2025 (USD MILLION)

13.4.2 JAPAN

13.4.2.1 Establishment of floating power plants in Japan to support market growth

TABLE 128 MICRO-INVERTER MARKET IN JAPAN, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 129 MARKET IN JAPAN, BY APPLICATION, 2020–2025 (USD MILLION)

13.4.3 INDIA

13.4.3.1 Growth of market in India expected to be hampered by rapid spread of coronavirus

TABLE 130 MARKET IN INDIA, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 131 MARKET IN INDIA, BY APPLICATION, 2020–2025 (USD MILLION)

13.4.4 AUSTRALIA

13.4.4.1 Heightened demand from residential applications to support growth of market in Australia

TABLE 132 MARKET IN AUSTRALIA, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 133 MARKET IN AUSTRALIA, BY APPLICATION, 2020–2025 (USD MILLION)

13.4.5 REST OF APAC

TABLE 134 MARKET IN REST OF APAC, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 135 MARKET IN REST OF APAC, BY APPLICATION, 2020–2025 (USD MILLION)

13.5 ROW

TABLE 136 MICRO-INVERTER MARKET IN ROW, BY REGION, 2016–2019 (USD MILLION)

TABLE 137 MARKET IN ROW, BY REGION, 2020–2025 (USD MILLION)

TABLE 138 MARKET IN ROW, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 139 MARKET IN ROW, BY APPLICATION, 2020–2025 (USD MILLION)

13.5.1 MIDDLE EAST & AFRICA

13.5.1.1 Rise in number of solar PV projects to unfold new growth opportunities in Middle Easter & African market

TABLE 140 MARKET IN MIDDLE EAST & AFRICA, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 141 MARKET IN MIDDLE EAST & AFRICA, BY APPLICATION, 2020–2025 (USD MILLION)

13.5.2 SOUTH AMERICA

13.5.2.1 Increased solar power generation in Brazil and Argentina to significantly contribute to market growth in South America

TABLE 142 MARKET IN SOUTH AMERICA, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 143 MARKET IN SOUTH AMERICA, BY APPLICATION, 2020–20125 (USD MILLION)

14 COMPETITIVE LANDSCAPE (Page No. - 143)

14.1 OVERVIEW

14.2 MARKET SHARE ANALYSIS, 2019

FIGURE 50 MARKET: MARKET SHARE ANALYSIS (2019)

14.3 COMPANY EVALUATION MATRIX, 2019

14.3.1 STAR

14.3.2 PERVASIVE

14.3.3 EMERGING LEADER

14.3.4 PARTICIPANT

FIGURE 51 MICRO-INVERTER MARKET (GLOBAL) COMPANY EVALUATION MATRIX, 2019

14.4 COMPETITIVE SITUATIONS AND TRENDS

14.4.1 PRODUCT DEVELOPMENTS

14.4.2 AGREEMENTS, COLLABORATIONS, AND PARTNERSHIPS

15 COMPANY PROFILES (Page No. - 148)

15.1 KEY PLAYERS

(Business overview, Products offered, Recent developments, SWOT analysis, MNM view)*

15.1.1 ENPHASE ENERGY

FIGURE 52 ENPHASE ENERGY: COMPANY SNAPSHOT

15.1.2 DARFON ELECTRONICS

FIGURE 53 DARFON ELECTRONICS: COMPANY SNAPSHOT

15.1.3 ALTENERGY POWER SYSTEM

15.1.4 RENESOLA

FIGURE 54 RENESOLA: COMPANY SNAPSHOT

15.1.5 CHILICON POWER

15.1.6 AECONVERSION

15.1.7 ENVERTECH

15.1.8 SENSATA TECHNOLOGIES

FIGURE 55 SENSATA TECHNOLOGIES: COMPANY SNAPSHOT

15.1.9 NORTHERN ELECTRIC & POWER

15.1.10 SPARQ SYSTEMS

*Business overview, Products offered, Recent developments, SWOT analysis, MNM view might not be captured in case of unlisted companies.

15.2 RIGHT-TO-WIN

15.3 OTHER PLAYERS

15.3.1 SARONIC (EU) POWER TECH

15.3.2 ENLUXSOLAR

15.3.3 U R ENERGY

15.3.4 BRAVO SOLAR

15.3.5 GRACE RENEWABLE ENERGY

15.3.6 SOLAR PANELS PLUS

15.3.7 ZHEJIANG SANDI ELECTRIC

15.3.8 STMICROELECTRONICS

15.3.9 TEXAS INSTRUMENTS

15.3.10 JINKOSOLAR

16 APPENDIX (Page No. - 172)

16.1 INSIGHTS OF INDUSTRY EXPERTS

16.2 DISCUSSION GUIDE

16.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

16.4 AVAILABLE CUSTOMIZATIONS

16.5 RELATED REPORTS

16.6 AUTHOR DETAILS

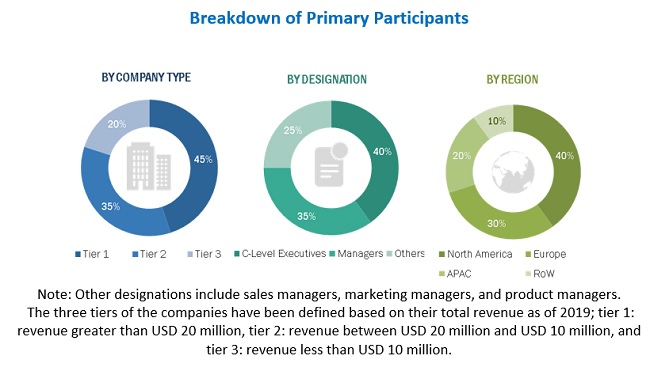

The study involves four major activities for estimating the size of the micro-inverter market. Exhaustive secondary research has been conducted to collect information related to the market. The next step has been the validation of these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both top-down and bottom-up approaches have been employed to estimate the overall size of the micro-inverter market. After that, market breakdown and data triangulation procedures have been used to determine the extent of different segments and subsegments of the market.

Secondary Research

Secondary sources referred to in this research study include corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers, certified publications, articles from recognized authors; directories; and databases. The secondary data has been collected and analyzed to arrive at the overall market size estimations, which has been further validated by primary research.

Primary Research

In the primary research process, a number of primary sources from both supply and demand sides have been interviewed to obtain the qualitative and quantitative information pertaining to this report. Several primary interviews have been conducted with market experts from both demand and supply sides (micro-inverter manufacturers and distributors). This primary data has been collected through questionnaires, emails, and telephonic interviews. Approximately 20% of the primary interviews have been conducted with the demand side and 80% with the supply side. This primary data has been collected mainly through telephonic interviews, which accounted for 80% of the total primary interviews. Additionally, questionnaires and emails were used to collect the data.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches have been implemented, along with several data triangulation methods, to estimate and validate the size of the micro-inverter market and other dependent submarkets listed in this report.

- The key players in the industry and markets have been identified through extensive secondary research.

- Both the supply chain of the industry and the market size, in terms of value and volume, have been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size, the total market has been split into several segments. To complete the overall market engineering process and arrive at exact statistics for all segments, the market breakdown and data triangulation procedures have been employed wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Study Objectives:

- To describe and forecast the micro-inverter market, in terms of value, by type, offering, communication technology, sales channel, application, connection type, power rating

- To forecast the global micro-inverter market in terms of number of installations (GW)

- To describe and forecast the micro-inverter market, in terms of value, for various segments with respect to 4 main regions—North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW), along with their respective countries

- To provide detailed information regarding major factors, namely, drivers, restraints, opportunities, and challenges influencing the growth of the micro-inverter market

- To study and analyze the influence of COVID-19 on the micro-inverter market during the forecast period

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To study the complete value chain of the micro-inverter ecosystem, along with market trends and use cases

- To analyze opportunities in the market for various stakeholders by identifying high-growth segments of the micro-inverter ecosystem

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies2, along with detailing the competitive landscape for market leaders

- To benchmark market players using competitive leadership mapping, which analyzes players based on various parameters within the broad business categories and product strategies

- To analyze strategic approaches such as product developments, collaborations, agreements, and partnerships in the micro-inverter market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company's specific needs. The following customization options are available for this report:

- Company Information: Detailed analysis and profiling of additional five market players

Growth opportunities and latent adjacency in Micro-inverter Market