Wafer Cleaning Equipment Market with COVID-19 impact analysis by Equipment Type (Single-wafer Spray System, Batch Spray Cleaning System, and Scrubbers), Application, Technology, Operation Mode, Wafer Size, and Geography - Global Forecast to 2025

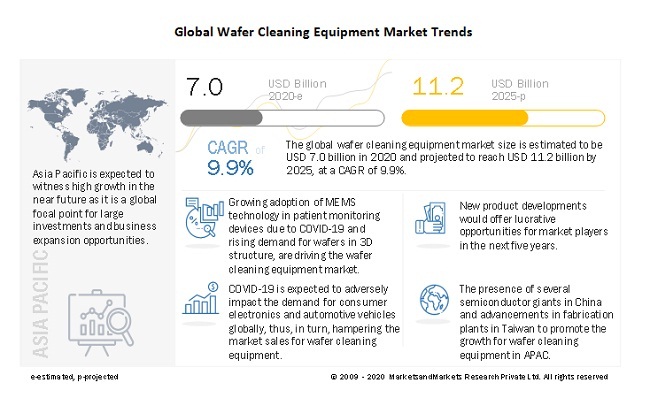

[281 Pages Report] The global wafer cleaning equipment market is estimated to be USD 11.2 billion by 2025 from USD 7.0 billion in 2020, at a CAGR of 9.9% between 2020 to 2025.

The growth of the wafer cleaning equipment market is fueled by growing adoption of MEMS technology in conventional and modern applications, increasing number of critical steps in the wafer cleaning sequence, rising demand for wafers in 3D structure, and increasing adoption of silicon-based sensors, chips, and diodes in IoT applications.

COVID-19 Impact on the Global Wafer Cleaning Equipment Market

The wafer cleaning equipment market includes major Tier 1 and 2 suppliers like SCREEN Holdings Co., Ltd., Tokyo Electron Limited, Applied Materials, LAM Research, Shibaura Mechatronics Corporation, PVA TePLA AG, Entregris Inc., Semes Co. Ltd., Modutek Corporation, and Veeco Instruments. These suppliers have their manufacturing facilities spread across various countries across Asia Pacific, Europe, North America, South America, and RoW. The wafer cleaning equipment manufactured by these companies are used by end-use industries such as automotive, consumer electronics, healthcare, and few others. Covid-19 not only impacted the operations of the various semiconductor equipment manufacturing industries, but also affected the businesses of companies from the above-mentioned industries. The low demand for consumer electronic devices due to lockdown measures had a global impact on the wafer cleaning equipment market. The continuous fall in the global demand and export shipments for automotive vehicles is also expected to negatively impact the wafer cleaning equipment market. However, the market for wafer cleaning equipment is expected to rebound owning to increasing demand from the healthcare sector. Increasing demand for personal monitoring devices is expected to drive the market even during these times of pandemic.

Wafer Cleaning Equipment Market Dynamics

Driver: Growing adoption of MEMS technology in patient monitoring devices to help revive the market during the COVID-19 pandemic

The demand for micro-electro-mechanical systems (MEMS) is increasing owing to their growing adoption in conventional and modern applications, such as medical devices, communication systems, automotive sensor devices, and inertial sensing systems. The miniature design of MEMS is a major contributing factor to its adoption in various applications. Due to their smaller size, MEMS can be used in almost all electronic devices, which is further pushing the demand for MEMS in the semiconductor market. MEMS technology has captured the largest market share of consumer electronics and automotive industries and gaining momentum in industrial, healthcare, and smart farming applications. MEMS devices have experienced a surge in demand from the healthcare sector during the ongoing COVID-19 pandemic, owning to its increasing application for portable patient monitoring devices used by healthcare workers and medical institutions globally.

Restraint: Environmental concerns owning to emission of hazardous chemicals and gases during wafer cleaning process

Wafer cleaning is one of the most basic and recurrent steps in the semiconductor industry to meet the rising demand for superior quality semiconductor devices. However, constantly shrinking dimensions of devices have resulted in the establishment of rigid standards regarding acceptable levels of impurities. In the wafer fabrication and cleaning processes, some of the toxic chemicals and acids such as antimony (Sb), antimony trioxide (SbO3), arsenic pentafluoride (AsF5), arsenic (As), boron trichloride (BCl3), boron trifluoride (BF3), chlorine (Cl), germane (GeH4), hydrogen sulfide (H2S), hydrogen peroxide (H2O2), and oxidized carbon are used. All these chemicals are hazardous and toxic and have an adverse impact on human health and the environment. Hence, their usage and applications are to be performed in a controlled environment.

Opportunity: Rising demand for wafers in 3D structure

Since 3D devices are becoming more popular, the demand for silicon wafers for use in 3D applications is also increasing at a rapid rate. 3D devices, to perform seamlessly, require silicon-made structures. The 3D structure consists of transistors and 3D chips. This 3D structure requires high-quality silicon wafers that are cleaned with high precision. The growing utilization of silicon wafers in 3D devices is expected to increase the demand for advanced wafer cleaning equipment offering extremely clean wafers for high-precision 3D technology applications such as 3D ICs and NAND flash memory.

Challenge: Delaying of investment plans for capacity expansion by wafer manufacturers due to COVID-19

Prior to COVID-19, the growing demand for wafers led to an increase in the adoption of wafer cleaning equipment to carry out the fabrication and cleaning process of wafers thoroughly and effectively. However, the coronavirus pandemic has added to the challenge for wafer manufacturers to expand their facilities. Globally, the investment plans for semiconductor industries having a dedicated fabrication facility has halted, owing to the weakening financial position of the manufacturers.

LED application segment is expected to witness the second fastest market growth during the forecast period

LED application segment is expected to witness the second fastest market growth during the forecast period. Increasing adoption of smartphones and growing deployment of electronic components in automobiles are the major factors driving the growth of the wafer cleaning equipment market for LED application. The market for LEDs is increasing significantly, and a similar trend is expected to be observed during the forecast period. As a result, the demand for wafer cleaning equipment is also expected to increase in the near future. With the increase in the spread of COVID-19, there is an expansion in the healthcare facilities to accommodate a large number of patients globally. This has increased the demand of LED for a short duration, which is expected to drive the wafer demand, gradually increasing the market for wafer cleaning equipment once the manufacturing process regains smoothly.

Batch spray cleaning system to account for largest market share of wafer cleaning equipment market in 2025

Batch spray cleaning system expected to dominate the wafer cleaning equipment market in 2025. Growth of this segment can be attributed to the various benefits provided by the system which includes processing multiple wafers all at a time, saving time and cleaning cost. Batch processing is adopted for volume manufacturing which helps attain economies of scale. A batch spray cleaning system is capable to perform functions of both a single wafer processing system and a batch immersion processing system, which gives it a far-out advantage and the ability to yield large batches with a high throughput or small batches with short cycle times.

300 mm wafer size expected to witness largest market share in 2020

Based on wafer size, 300 mm wafer is expected to account for a share of 52% in the wafer cleaning equipment market. The growth can be attribute d to the growing use of these wafers LEDs, MEMS, ICs, among many other electronic and semiconductor devices. Though the market for ICs is impacted due to global impact on consumer electronics, owning to the widespread coronavirus pandemic, the market for 300 mm wafers is expected to witness a low impact because of its use in MEMS for patient monitoring. Also, 300 mm wafers are increasingly being adopted in LED applications due their greater yield as compared with other wafer dimensions.

Asia Pacific is leading the wafer cleaning equipment market, globally, by market share, in 2019

The advancements in capabilities of semiconductor equipment manufacturing industry in Asian economies such as China, Japan, South Korea, and Taiwan drives the wafer cleaning equipment market in the region. The region has also emerged as a central point for increasing investments and business expansion capabilities for major key players from the wafer cleaning equipment market. Favorable economic conditions and cheap labor costs in the region are the key driving factors for increasing business opportunities. Moreover, high presence of wafer and IC manufacturing firms in the region contribute to the growth of the wafer cleaning equipment market.

The recent COVID-19 pandemic is expected to impact the global wafer cleaning equipment industry. The entire supply chain is disrupted due to limited supply of parts. For instance, the outbreak of COVID-19 in China resulted in lockdown measures which included the shutdown of manufacturing facilities and warehouses and affected the global exports and shipments of various industries. The lockdown also led to a fall in the domestic and export demand for consumer electronics, automotive vehicles, and other industrial equipment and devices as the impact of COVID-19 spreads to other countries.

Key Market Players

The wafer cleaning equipment market is dominated by key global established players such as SCREEN Holdings Co., Ltd. (Japan), Tokyo Electron Limited (Japan), Applied Materials (US), LAM Research (US), and Shibaura Mechatronics Corporation (Japan). These companies have adopted both organic and inorganic growth strategies such as new product launches, partnerships, agreements, mergers and acquisitions, and expansions to strengthen their position in the market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market Size Available for Years |

2016–2025 |

|

Base Year |

2019 |

|

Forecast Period |

2020–2025 |

|

Forecast Unit |

Value (USD Million/Billion) |

|

Segments Covered |

By Equipment, By Wafer Size, By Technology, By Operation Mode, By Application, and By Region |

|

Geographic Regions Covered |

Americas, EMEA, and APAC |

|

Companies Covered |

The major players include SCREEN Holdings Co., Ltd. (Japan), Tokyo Electron Limited (Japan), Applied Materials (US), LAM Research (US), and Shibaura Mechatronics Corporation (Japan). (Total 25 companies) |

This report categorizes the wafer cleaning equipment market based on equipment, wafer size, technology, operation mode, and application at the regional and global level

By Equipment:

- Single Wafer Spray System

- Single Wafer Cryogenic System

- Batch Immersion Cleaning System

- Batch Spray Cleaning System

- Scrubber

By Wafer Size:

- ≤150 mm

- 200 mm

- 300 mm

By Technology:

- Wet Chemical Cleaning Process

- Vapor Dry Cleaning Process

- Aqueous Cleaning Process

- Cryogenic Aerosols Super-Critical Fluid Cleaning Process

- Emerging Technologies

By Operation Mode:

- Automatic

- Semi-Automatic

- Manual

By Application:

- MEMS

- CIS

- Memory

- RF Device

- LED

- Interposer

- Logic

- Others

By Geography

- Americas

- EMEA (Europe, Middle East, and Africa)

- Asia Pacific (APAC)

Recent Developments

- In March 2020, LAM Research launched the Sense.i platform, a completely transformed plasma etch technology and system solution, designed to provide chipmakers with critical etch capabilities and etch profile control for maximum yield and lower wafer cost.

- In January 2020, SCREEN Semiconductor Solutions Co., Ltd. signed an agreement with Applied Materials (US), a manufacturer of semiconductor chips for consumer electronics, to collaborate on process development at Applied Materials’ new R&D facility. The agreement is expected to bring together SCREEN’s expertise in wafer cleaning technology with Applied Materials’ leadership in materials engineering solutions.

- In July 2019, Applied Materials announced a definitive agreement to acquire Kokusai Electric Corporation, a leading company in providing high-productivity batch processing systems and services for memory, foundry, and logic customers, for USD 2.2 billion. The acquisition is likely to help the company to expand its global services business and strengthen customer support capabilities.

- In May 2019, Tokyo Electron launched the CELLESTA Pro SPM single wafer cleaning system for cleaning and wet metal etching. The system is expected to be 1.5 times more productive than its predecessors and would, therefore, help customers boost their cleanroom efficiency.

Frequently Asked Questions (FAQ):

What is the current size of the global wafer cleaning equipment market?

The global wafer cleaning equipment market is estimated to be USD 11.2 billion by 2025 (forecast year) from USD 7.0 billion in 2020 (estimated year), at a CAGR of 9.9% between 2020 to 2025.

What are the key trends boosting the global wafer cleaning equipment market?

Growing adoption of MEMS technology in patient monitoring devices due to COVID-19, increasing demand for NAND memory in smart devices, increasing number of critical steps in the wafer cleaning sequence, and ongoing radical miniaturization of electronic are some of the key factors boosting the market.

Who are the winners in the global wafer cleaning equipment market?

Companies such as SCREEN Holdings Co., Ltd. (Japan), Tokyo Electron Limited (Japan), Applied Materials (US), LAM Research (US), and Shibaura Mechatronics Corporation (Japan) fall under the winner’s category. These companies cater to the requirements of their customers by providing efficient wafer cleaning equipment and solutions with a presence in majority of countries.

What are the opportunities for the existing players and for those who are planning to enter various stages of the wafer cleaning equipment value chain?

There are various opportunities for the existing players to enter the value chain of the wafer cleaning equipment industry. Some of these include the expanding semiconductor equipment manufacturing industry in China, rising demand for portable health monitoring solutions due to the Covid-19 pandemic, developing market for consumer electronics, business expansion opportunities available in developing countries such as China and Taiwan, and the advancements in fabrication facilities in Japan and Taiwan.

What is the COVID-19 impact on wafer cleaning equipment market?

The shutdown of manufacturing facilities globally combined with strict restrictions over social movement in various COVID-19 affected countries impacted the operations of semiconductor equipment manufacturing facilities. Additionally, the first quarter of 2020 also witnessed disruption in global supply chain operations and logistics related services due to limited air and road movement. The supply chain of semiconductor equipment is heavily dependent on raw material suppliers, which are unable to function due to lockdowns imposed worldwide. The shortage of even a single component can hold up an entire production line, resulting in inventory and cashflow backlogs. Unless the entire supply chain of semiconductor equipment is operational and functioning smoothly, their production is still challenged and constrained. This decline in production of semiconductor equipment like wafer is consequently expected to affect the revenue of the key players in the wafer cleaning equipment market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The study involved four major activities in estimating the current size of the wafer cleaning equipment market. Exhaustive secondary research has been done to collect information about the market, the peer markets, and the parent market. Validating findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both, top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation methods have been used to estimate the market size of segments and subsegments.

Secondary Research

In the wafer cleaning equipment market report, both top-down and bottom-up approaches have been used to estimate and validate the size of the wafer cleaning equipment market, along with other dependent submarkets. The key players in the wafer cleaning equipment market have been identified through secondary research, and their market ranks have been determined through primary and secondary research. This entire research methodology involved studying annual and financial reports of the top players and interviewing experts (such as CEOs, VPs, directors, and marketing executives) for key insights (both quantitative and qualitative). All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All the possible parameters that may affect the markets covered in this research study have been accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Primary Research

Extensive primary research has been conducted after gaining knowledge about the wafer cleaning equipment market scenario through secondary research. Several primary interviews have been conducted with market experts from both demand (commercial application providers) and supply (equipment manufacturers and distributors) sides across four major regions: Americas, EMEA, and APAC. Approximately 80% and 20% of primary interviews have been conducted with parties from demand and supply sides, respectively.

Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales, operations, and administration, were covered to provide a holistic viewpoint in our report. After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report. The breakdown of the primary respondents is provided below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of wafer cleaning equipment market and its segments. The research methodology used to estimate the market size includes the following:

- Key players in the market have been identified through extensive secondary research

- The supply chain and the size of the wafer cleaning equipment market, in terms of value, have been determined through primary and secondary research processes

- Several primary interviews have been conducted with key opinion leaders related to wafer cleaning equipment market, including key OEMs, IDMs, and Tier I suppliers.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

- Qualitative aspects such as market drivers, restraints, opportunities, and challenges have been taken into consideration while calculating and forecasting the market size.

Global Wafer Cleaning Equipment Market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size—using the market size estimation process explained above—the market has been split into several segments and subsegments. Data triangulation and market breakdown procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for each segment and subsegment of the market. The data has been triangulated by studying various factors and trends from both demand and supply sides of the wafer cleaning equipment market.

Report Objectives

- To define, describe, and forecast the wafer cleaning equipment market, in terms of value, on the basis of equipment, and geography and the wafer market, in terms of value and volume, on the basis of wafer size, and application

- To describe the technologies and processes used in wafer cleaning as well as providing information on operating modes of the wafer cleaning equipment

- To forecast the market size, in terms of value, for various segments with regard to three main regions, namely, America, EMEA, and Asia Pacific (APAC)

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To provide a detailed overview of the value chain in the wafer cleaning equipment market

- To strategically analyze the micromarkets with respect to individual growth trends, future prospects, and contributions to the total market

- To analyze opportunities in the market for various stakeholders by identifying the high-growth segments of the wafer cleaning equipment market

- To strategically profile the key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing the competitive landscape of the market

- To analyze competitive developments such as joint ventures, mergers & acquisitions, product launches & developments, business expansions, and research and development in the wafer cleaning equipment market

Available Customizations:

Along with the market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

- Additional country-level analysis of wafer cleaning equipment market

Growth opportunities and latent adjacency in Wafer Cleaning Equipment Market