Microgrid Controller Market by Connectivity (Grid Connected, Off-grid Connected), Offering (Hardware, Software, Services), End-use application (Commercial & Industrial, Remote Areas, Utilities) and Geography - Global Forecast to 2027

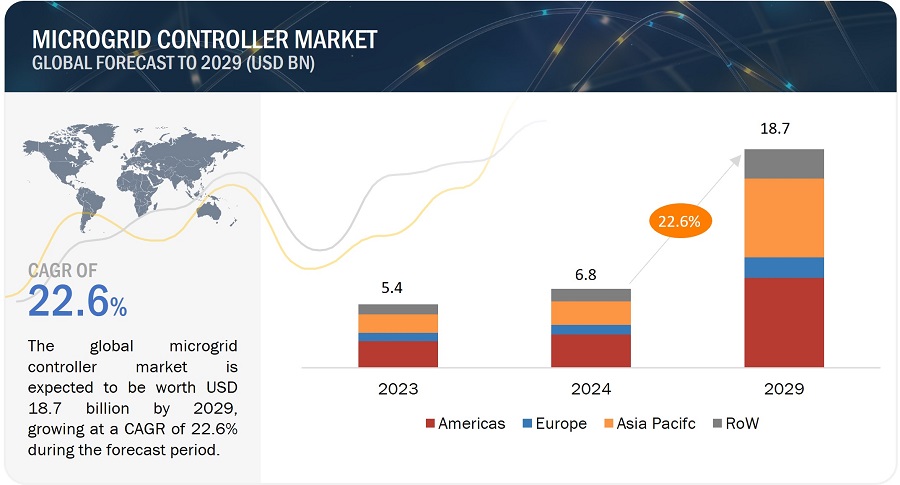

[240 Pages Report] The global microgrid controller market size is estimated to be USD 4.2 Billion in 2022 and is projected to reach USD 11.5 Billion by 2027, at a CAGR of 22.3% during the forecast period.

Some of the major factors contributing to the growth of microgrid controller market includes the increasing emphasis on decarbonization by end users and governments, optimization of energy assets and improved efficiency of microgrids using microgrid controllers, and growing need for reliable, uninterrupted power supply.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics:

Drivers: Growing need for reliable, uninterrupted power supply

For over a century, massive grids were built that connected power plants to homes and businesses through wires that traversed thousands of miles. Electricity generated by large, remote power plants, which are connected to centralized power grids and use fossil fuels, is transmitted across different regions and countries. However, the shortcomings of these power plants in terms of inefficient power transmission have become increasingly evident. Conventional grids are largely dependent on fossil fuels for electricity generation, leading to pollution and global warming. These grids are also vulnerable to natural calamities that usually result in network malfunctioning or blackouts. For instance, Hurricane Sandy in the US and Typhoon Haiyan in the Philippines resulted in mass blackouts in major areas, such as New York and the islands of Leyte. For several days after the calamities, these areas lost access to electricity, leading to the growing demand for self-power generating plants or microgrids. Due to hurricanes, heat waves, windstorms, wildfires, and other extreme weather events in 2020, electric utility customers in the US spent significantly more time in the dark. In 2020, utility customers experienced 1.33 billion outages, an increase of 73% over roughly 770 million in 2019, according to PowerOutage US.

Restraints: Dynamic government policies, regulations, and standards worldwide

Microgrid technology, being relatively new, is still too dynamic and volatile for regulatory frameworks. For instance, regulations and policies overseeing the integration of microgrids into the wider grid are still under development. The current framework structure poses some barriers to the acceptance of microgrids. For example, IEEE Standard 1547 requires grid-connected power inverters to shut down on detecting grid faults. This standard is driving R&D on static switches that can disconnect and reconnect in sub-cycle times. Research into standards for the operation of microgrids is being conducted, and a new generation of energy management systems is being designed to meet the challenges, especially the requirements of IEC 61970. Under these circumstances, designing a microgrid controller that can comply with different standards is challenging for manufacturers.

Opportunities: Modernization of aging grid infrastructure

The current energy demand requires an infrastructure that is more robust, resilient, and reliable in achieving high performance and causes fewer outages over a long period. Microgrids will give a huge advantage to the current need for electricity, being a resilient and reliable solution to the old-aged electricity infrastructure. These will present opportunities to the microgrid controller market. Over the next decade, China plans to invest USD 6 trillion in infrastructure as part of its urbanization development plan. These factors will provide huge opportunities for microgrid control system providers like ABB (Switzerland), Schneider Electric (France), and Siemens (Germany).

Challenges: Interoperability and compatibility issues due to large number of components/devices

Microgrids comprise several hardware and software components, making it complex to plan and handle for efficient operations. These devices may come from different vendors, creating compatibility and interoperability issues. Interoperability is a critical parameter as it allows technologies from different vendors to plug and play and interact on a common network. Having a common standard/protocol is important to support automated resource coordination.

Microgrid configuration consists of the interface of devices, systems, and persons between the microgrid and electric power system (EPS) across the point of common coupling (PCC), where interoperability is required for data exchange. Thus, interoperability requirements are more extensive when microgrid functions are considered as connected to and operated as part of the EPS rather than as an island. Furthermore, while adding new components in a microgrid, operational methodologies and protocols, appropriate secure communications, and standards and codes that specify operational requirements, and protocols and safety need to be developed and updated on time as testing is necessary to validate the viability, functionality, consistency, reliability, compatibility, and interoperability of utility grids with other microgrid systems. A microgrid control system needs to match up with all these additions in the microgrids from time to time.

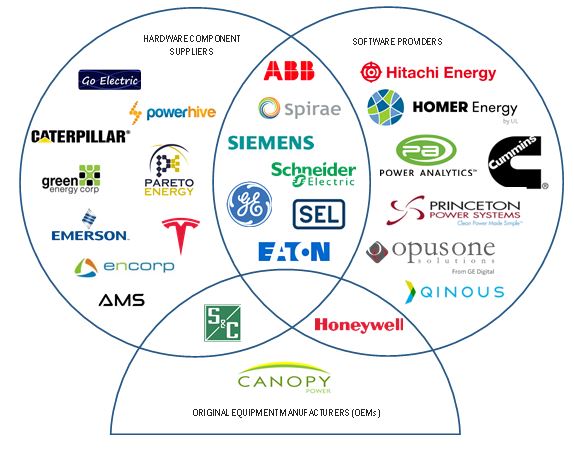

Microgrid Controller Market Ecosystem

Grid-connected microgrids likely to dominate the market during the forecast period

Grid-connected microgrids will lead the microgrid controller industry during the forecast period. Grid-connected microgrids consist of multiple generators, distribution systems, and sophisticated controls. These technologies not only improve grid resiliency, improve power quality, and reduce their environmental impact, but also have a number of other advantages, resulting in increased demand. The expansion of utility-based grid networks globally, as well as the large-scale exploitation of renewable energy sources, like offshore wind, are driving the growth of this segment.

Hardware segment to account for largest market share of microgrid controller market during the forecasting period

The key drivers for the growth of the market for the hardware segment include the growing number of microgrid projects worldwide, decreasing costs of energy storage and renewable sources of energy, and increasing government initiatives to promote the use of clean energy and minimize greenhouse gas (GHG) emissions. Microgrids generate electricity from different energy sources such as renewable energy sources (solar, wind, photovoltaic (PV) cells, etc.) and non-renewable energy sources (fuel cells, diesel generators, combined heat and power (CHP) and micro-CHP, microturbines, etc.).

The remote areas end-use application is expected to account the largest share of the microgrid controller market in 2022

Based on end-use application, the market has been segmented into utilities, commercial & industrial, institutes & campuses, remote areas, military, governments, and healthcare. Key factors driving the demand for microgrids for rural electrification are the growing government support and the surge in the deployment of microgrid projects in remote areas. According to the International Energy Association, ~1 billion people in remote areas worldwide face electricity scarcity due to the high costs of fossil fuels used for electricity generation and challenges in terms of electricity transmission to remote areas. This has led governments of different countries to increase their investments in electricity infrastructures to provide efficient, low-cost, and clean electricity to end users. This, in turn, has led to an increased demand for microgrids from remote areas.

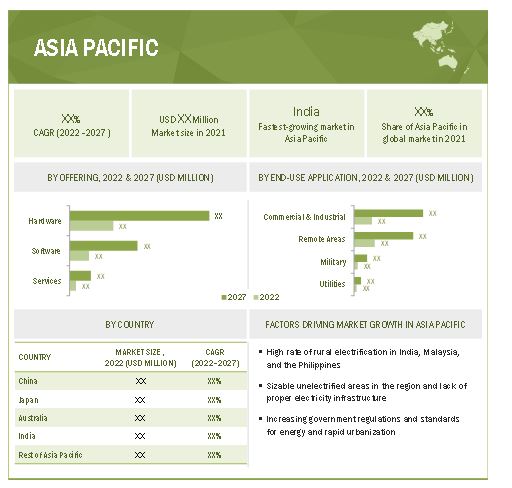

Asia Pacific is likely to be the fastest growing market during the forecast period between 2022 and 2027.

To know about the assumptions considered for the study, download the pdf brochure

The Asia Pacific accounted for the second largest share in the microgrid controller market in 2021 and is expected to be the fastest growing market during the forecast period. The market's growth in Asia Pacific can be attributed to the high rate of rural electrification in several economies such as India, Malaysia, and the Philippines. A large number of unelectrified islands in Indonesia and the Philippines and the lack of proper electricity infrastructure in emerging economies have led to the demand for cost-effective microgrids in the region. This is expected to contribute to the growth of the market in Asia Pacific during the forecast period.

Key Market Players

Major players in the microgrid controller companies are Schneider Electric (France), General Electric (GE) (US), Siemens (Germany), Eaton Corporation (US), ABB (Switzerland), and Schweitzer Engineering Laboratories (US).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

| Estimated Market Size | USD 4.2 Billion |

| Projected Market Size | USD 11.5 Billion |

| Growth Rate | CAGR of 22.3% |

|

Market Size Availability for Years |

2018–2027 |

|

Base Year |

2021 |

|

Forecast Period |

2022–2027 |

|

Forecast Units |

Value (USD Million/Billion) |

|

Segments Covered |

By Connectivity, Offering, End-use Application, and Region |

|

Geographies Covered |

Americas, Europe, Asia Pacific, and RoW |

|

Companies Covered |

The major players include are Schneider Electric (France), General Electric (US), ABB (Switzerland), Siemens (Germany), Schweitzer Engineering Laboratories (US), Eaton Corporation (Ireland), Honeywell International (US), Caterpillar Inc. (US), S&C Electric (US), and Power Analytics (US) |

This research report categorizes the microgrid controller market, by connectivity, offering, end-use application, and region available at the regional and global level

Based on Connectivity:

- Grid Connected

- Off-grid

Based on Offering:

- Hardware

- Software

- Services

Based on End-use Application:

- Commercial & Industrial

- Remote Areas

- Military

- Government

- Utilities

- Institutes & Campuses

- Healthcare

Based on the Region

- Americas (North America, South America)

- Europe

- Asia Pacific

- RoW (Middle East & Africa)

Recent Developments

- In March 2022, SEL has introduced two new field-upgradable cards for its SEL-751 Feeder Protection Relay, along with several enhancements that will increase its application range.

- In April 2022, Schneider Electric launched the EcoStruxure Energy Hub, a self-service IoT SaaS solution for managing digitalized electrical and energy systems.

- In Dec 2021, The National Office of Electricity and Drinking Water (ONEE) in Morocco commissioned Siemens and Atos to collaborate on a large smart grid management project.

- In Oct 2021, Eaton Corporation partnered with Enel X (Italy), the Enel Group’s advanced energy services business line, for a second joint microgrid project in Puerto Rico.

- In June 2021, ABB partnered with Axpo (Switzerland) to develop modular plants in Italy to produce green hydrogen to offer an optimum operational model to produce affordable and green hydrogen.

- In January 2021, SEL has launched the SEL-3350 Automation Controller. It is designed to complement the SEL-3355 and SEL-3360 Automation Controllers and has a lower price point and smaller 1U form factor.

Frequently Asked Questions (FAQs):

Who are the key players in the microgrid controller market? What are the major growth strategies they had taken to strengthen their position in the market?

Major companies operating in the microgrid controller market includes Schneider Electric (France), General Electric (US), ABB (Switzerland), Siemens (Germany), Schweitzer Engineering Laboratories (US), Eaton Corporation (Ireland), Honeywell International (US), Caterpillar Inc. (US), S&C Electric (US), and Power Analytics (US). They offer advanced microgrid controllers in several countries to meet their customers' needs. These players competed in the market through product launches, acquisitions, collaborations, contracts, and agreements.

What are the new opportunities for emerging players in microgrid controller value chain?

Existing players have several new opportunities in the microgrid controller value chain. Among these are microgrid controllers, renewable energy storage systems, and smart microgrids that integrate technology and data management, as well as innovative hardware and software solutions.

Which end-use application of microgrid controller market expected to drive the growth of the market in the next five years?

Over the forecast period, the Commercial & Industrial end-use application is expected to grow at a faster rate. To maintain smooth operations and reduce downtime, increase productivity, and reduce equipment damage during industrial operations, uninterrupted power is necessary. Government initiatives to promote clean energy use and minimize greenhouse gas (GHG) emissions are also driving the growth of the microgrid controller market for commercial and industrial end-use application.

Which Region To offer lucrative growth for Microgrid Controller Market By 2027?

It is expected that the Americas will lead the microgrid controller market during the forecast period. In contrast, the Asia Pacific region is expected to see the highest growth rate between 2022 and 2027.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 29)

1.1 STUDY OBJECTIVES

1.2 DEFINITION AND SCOPE

1.2.1 INCLUSIONS AND EXCLUSIONS: OFFERING SEGMENT

1.2.2 INCLUSIONS AND EXCLUSIONS: OTHER SEGMENTS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 MARKET SEGMENTATION

1.3.2 REGIONAL SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 34)

2.1 RESEARCH DATA

FIGURE 2 MICROGRID CONTROLLER MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Major secondary sources

2.1.1.2 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Breakdown of primaries

2.1.2.2 Key data from primary sources

2.1.3 SECONDARY AND PRIMARY RESEARCH

2.1.3.1 Key industry insights

2.2 MARKET SIZE ESTIMATION

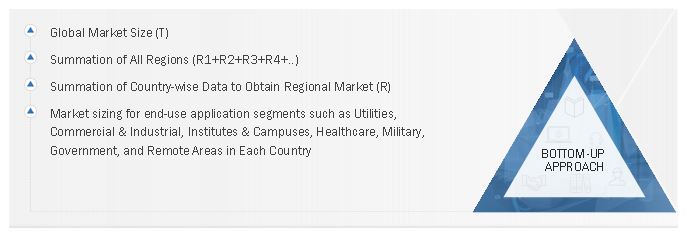

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for capturing market share by bottom-up analysis

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.1.2 Approach for capturing microgrid controller company-specific information

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for capturing market share by top-down analysis

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 5 DATA TRIANGULATION METHODOLOGY

2.4 GROWTH FORECAST ASSUMPTIONS

TABLE 1 MARKET: KEY FORECAST ASSUMPTIONS

2.5 RESEARCH ASSUMPTIONS

FIGURE 6 KEY ASSUMPTIONS: MACRO- AND MICRO-ECONOMIC ENVIRONMENT

3 EXECUTIVE SUMMARY (Page No. - 44)

FIGURE 7 MARKET, 2018–2027 (USD MILLION)

FIGURE 8 GRID-CONNECTED SEGMENT TO RECORD HIGHER GROWTH RATE DURING FORECAST PERIOD

FIGURE 9 HARDWARE SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE FROM 2022–2027

FIGURE 10 MICROGRID CONTROLLERS FOR REMOTE AREAS TO HOLD LARGEST MARKET SHARE IN 2022

FIGURE 11 MARKET IN ASIA PACIFIC TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 49)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR KEY MARKET PLAYERS IN MARKET

FIGURE 12 INCREASING NEED FOR RELIABLE, UNINTERRUPTED POWER SUPPLY TO DRIVE MARKET GROWTH

4.2 MARKET, BY OFFERING

FIGURE 13 HARDWARE TO HOLD LARGEST MARKET SHARE BETWEEN 2022 AND 2027

4.3 MARKET, BY CONNECTIVITY

FIGURE 14 GRID-CONNECTED MICROGRIDS TO ACCOUNT FOR LARGER MARKET SHARE FROM 2022 TO 2027

4.4 MARKET, BY END-USE APPLICATION

FIGURE 15 COMMERCIAL & INDUSTRIAL SEGMENT TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 52)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 16 MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Decarbonization being increasingly emphasized by different end users and governments

FIGURE 17 GLOBAL SOLAR PV AND WIND INSTALLATIONS IN GIGAWATTS (GW), 2018–2027

FIGURE 18 GLOBAL INVESTMENTS IN CLEAN ENERGY AND ENERGY EFFICIENCY, 2018–2021

5.2.1.2 Optimization of energy assets and improved efficiency of microgrids using microgrid controllers

FIGURE 19 FUNCTIONS OF MICROGRID CONTROLLERS

5.2.1.3 Growing need for reliable, uninterrupted power supply

5.2.1.4 Surge in use of microgrids for rural electrification

5.2.2 RESTRAINTS

5.2.2.1 High cost of microgrid controllers

5.2.2.2 Dynamic government policies, regulations, and standards worldwide

5.2.3 OPPORTUNITIES

5.2.3.1 Increase in number of microgrid projects for different industries

5.2.3.2 Rise in energy demand and need for expansion of renewable energy in Asia Pacific

5.2.3.3 Growing investor interest in EaaS business model to minimize costs

TABLE 2 BUSINESS MODEL OF MAJOR COMPANIES IN MICROGRID ECOSYSTEM

5.2.3.4 Encouragement from governments to develop microgrid projects

5.2.3.5 Modernization of aging grid infrastructure

5.2.4 CHALLENGES

5.2.4.1 Interoperability and compatibility issues due to large number of components/devices

5.2.4.2 Operational, technological, and security risks associated with microgrids

5.3 VALUE CHAIN ANALYSIS

FIGURE 20 VALUE CHAIN ANALYSIS: MARKET

5.4 MARKET: ECOSYSTEM

TABLE 3 MARKET: ECOSYSTEM

FIGURE 21 KEY PLAYERS IN MARKET ECOSYSTEM

5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

FIGURE 22 REVENUE SHIFT FOR MARKET

5.6 KEY TECHNOLOGY TRENDS

5.6.1 BLOCKCHAIN-BASED MICROGRIDS/BLOCKCHAIN MICROGRIDS

5.6.2 SMART MICROGRIDS

5.6.3 ADVENT OF AI-BASED MICROGRIDS

5.7 PATENT ANALYSIS

FIGURE 23 NUMBER OF PATENTS GRANTED FOR MARKET, 2011–2021

FIGURE 24 REGIONAL ANALYSIS OF PATENTS GRANTED FOR MICROGRIDS, 2011–2021

TABLE 4 LIST OF FEW PATENTS IN MARKET, 2020–2022

5.8 KEY CONFERENCES AND EVENTS, 2022–2024

5.8.1 MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

5.9 TARIFFS AND REGULATORY LANDSCAPE

5.9.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 5 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.9.2 CODES AND STANDARDS RELATED TO MICROGRIDS

TABLE 6 CODES AND STANDARDS RELATED TO MICROGRIDS

6 MICROGRID CONTROLLER MARKET, BY CONNECTIVITY (Page No. - 76)

6.1 INTRODUCTION

FIGURE 25 MARKET, BY CONNECTIVITY

TABLE 7 MARKET, BY CONNECTIVITY, 2018–2021 (USD MILLION)

FIGURE 26 GRID-CONNECTED MICROGRIDS TO RECORD HIGHEST GROWTH RATE DURING FORECAST PERIOD

TABLE 8 MARKET, BY CONNECTIVITY, 2022–2027 (USD MILLION)

6.2 GRID-CONNECTED

6.2.1 EXPANSION OF UTILITY GRID TRANSMISSION LINES AND SURGE IN USE OF RENEWABLE POWER SOURCES

6.3 OFF-GRID

6.3.1 GROWING OFF-GRID SOLAR PROJECTS TO CREATE NEW MARKET OPPORTUNITIES

7 MICROGRID CONTROLLER MARKET, BY OFFERING (Page No. - 81)

7.1 INTRODUCTION

FIGURE 27 MARKET, BY OFFERING

TABLE 9 MARKET, BY OFFERING, 2018–2021 (USD MILLION)

FIGURE 28 SOFTWARE TO RECORD HIGHEST GROWTH RATE DURING FORECAST PERIOD

TABLE 10 MARKET, BY OFFERING, 2022–2027 (USD MILLION)

7.2 HARDWARE

7.2.1 HARDWARE IS CRUCIAL FOR MICROGRID CONTROLLERS

7.3 SOFTWARE

7.3.1 SOFTWARE HELPS IN OPTIMAL SCHEDULING AND MANAGEMENT OF MICROGRIDS

7.4 SERVICES

7.4.1 SERVICES INCLUDE CONSULTING, MAINTENANCE, AND TRAINING

8 MICROGRID CONTROLLER MARKET, BY END-USE APPLICATION (Page No. - 86)

8.1 INTRODUCTION

FIGURE 29 MARKET, BY END-USE APPLICATION

TABLE 11 MARKET, BY END-USE APPLICATION, 2018–2021 (USD MILLION)

FIGURE 30 COMMERCIAL & INDUSTRIAL SEGMENT TO RECORD HIGHEST GROWTH RATE DURING FORECAST PERIOD

TABLE 12 MARKET, BY END-USE APPLICATION, 2022–2027 (USD MILLION)

8.2 COMMERCIAL & INDUSTRIAL

8.2.1 REQUIREMENT FOR UNINTERRUPTED ELECTRICITY SUPPLY IN COMMERCIAL & INDUSTRIAL SECTOR

TABLE 13 COMMERCIAL & INDUSTRIAL: MARKET, BY REGION, 2018–2021 (USD MILLION)

FIGURE 31 ASIA PACIFIC TO RECORD FASTEST GROWTH DURING FORECAST PERIOD FOR COMMERCIAL & INDUSTRIAL SEGMENT

TABLE 14 COMMERCIAL & INDUSTRIAL: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.3 REMOTE AREAS

8.3.1 SURGE IN DEPLOYMENT OF MICROGRIDS IN REMOTE AREAS DUE TO UNAVAILABILITY OF MAIN UTILITY GRID SYSTEMS

TABLE 15 REMOTE AREAS: MARKET, BY REGION, 2018–2021 (USD MILLION)

FIGURE 32 ASIA PACIFIC TO RECORD HIGHEST CAGR DURING FORECAST PERIOD FOR REMOTE AREAS SEGMENT

TABLE 16 REMOTE AREAS: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.4 MILITARY

8.4.1 WIDE USE OF MICROGRIDS FOR ENERGY SECURITY AND RESILIENCY

TABLE 17 MILITARY: MARKET, BY REGION, 2018–2021 (USD MILLION)

FIGURE 33 MILITARY SEGMENT IN AMERICAS TO ACCOUNT FOR LARGEST SHARE IN 2022

TABLE 18 MILITARY: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.5 GOVERNMENT

8.5.1 DECLINE IN ELECTRICITY PRICES FROM RENEWABLE ENERGY SOURCES

TABLE 19 GOVERNMENT: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 20 GOVERNMENT: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.6 UTILITIES

8.6.1 MICROGRIDS PROVIDE UTILITIES WITH LESS EXPENSIVE ALTERNATIVE

TABLE 21 UTILITIES: MARKET, BY REGION, 2018–2021 (USD MILLION)

FIGURE 34 UTILITIES SEGMENT IN AMERICAS TO RECORD HIGHEST GROWTH DURING FORECAST PERIOD

TABLE 22 UTILITIES: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.7 INSTITUTES & CAMPUSES

8.7.1 INCREASED ADOPTION OF MICROGRIDS TO ENSURE UNINTERRUPTED POWER SUPPLY

TABLE 23 INSTITUTES & CAMPUSES: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 24 INSTITUTES & CAMPUSES: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.8 HEALTHCARE

8.8.1 HOSPITALS ADOPTING MICROGRIDS TO BOOST RESILIENCE AGAINST GRID INSTABILITY

TABLE 25 HEALTHCARE: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 26 HEALTHCARE: MARKET, BY REGION, 2022–2027 (USD MILLION)

9 MICROGRID CONTROLLER MARKET, BY REGION (Page No. - 101)

9.1 INTRODUCTION

FIGURE 35 INDIA TO EXPERIENCE HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 36 AMERICAS ACCOUNTED FOR LARGEST SHARE OF MARKET IN 2022

TABLE 27 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 28 MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 29 MICROGRID INSTALLED CAPACITY, BY REGION, 2018–2021 (MW)

TABLE 30 MICROGRID INSTALLED CAPACITY, BY REGION, 2022–2027 (MW)

9.2 AMERICAS

FIGURE 37 AMERICAS: MICROGRID CONTROLLER MARKET SNAPSHOT

TABLE 31 AMERICAS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 32 AMERICAS: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 33 AMERICAS: MARKET, BY CONNECTIVITY, 2018–2021 (USD MILLION)

TABLE 34 AMERICAS: MARKET, BY CONNECTIVITY, 2022–2027 (USD MILLION)

TABLE 35 AMERICAS: MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 36 AMERICAS: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 37 AMERICAS: MARKET, BY END-USE APPLICATION, 2018–2021 (USD MILLION)

TABLE 38 AMERICAS: MARKET, BY END-USE APPLICATION, 2022–2027 (USD MILLION)

9.2.1 NORTH AMERICA

TABLE 39 NORTH AMERICA: MICROGRID CONTROLLER MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 40 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 41 NORTH AMERICA: MARKET, BY CONNECTIVITY, 2018–2021 (USD MILLION)

TABLE 42 NORTH AMERICA: MARKET, BY CONNECTIVITY, 2022–2027 (USD MILLION)

TABLE 43 NORTH AMERICA: MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 44 NORTH AMERICA: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 45 NORTH AMERICA: MARKET, BY END-USE APPLICATION, 2018–2021 (USD MILLION)

TABLE 46 NORTH AMERICA: MARKET, BY END-USE APPLICATION, 2022–2027 (USD MILLION)

9.2.1.1 US

9.2.1.1.1 Presence of key players and rising use of renewable energy sources

TABLE 47 MICROGRID PROJECTS IN US FROM 2018 TO 2020

TABLE 48 US: MARKET, BY CONNECTIVITY, 2018–2021 (USD MILLION)

TABLE 49 US: MARKET, BY CONNECTIVITY, 2022–2027 (USD MILLION)

TABLE 50 US: MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 51 US: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

9.2.1.2 Rest of North America

TABLE 52 REST OF NORTH AMERICA: MARKET, BY CONNECTIVITY, 2018–2021 (USD MILLION)

TABLE 53 REST OF NORTH AMERICA: MARKET, BY CONNECTIVITY, 2022–2027 (USD MILLION)

TABLE 54 REST OF NORTH AMERICA: MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 55 REST OF NORTH AMERICA: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

9.2.2 SOUTH AMERICA

TABLE 56 SOUTH AMERICA: MICROGRID CONTROLLER MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 57 SOUTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 58 SOUTH AMERICA: MARKET, BY CONNECTIVITY, 2018–2021 (USD MILLION)

TABLE 59 SOUTH AMERICA: MARKET, BY CONNECTIVITY, 2022–2027 (USD MILLION)

TABLE 60 SOUTH AMERICA: MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 61 SOUTH AMERICA: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 62 SOUTH AMERICA: MARKET, BY END-USE APPLICATION, 2018–2021 (USD MILLION)

TABLE 63 SOUTH AMERICA: MARKET, BY END-USE APPLICATION, 2022–2027 (USD MILLION)

9.2.2.1 Brazil

9.2.2.1.1 Brazil held largest size of market in South America in 2021

9.2.2.2 Rest of South America

9.3 EUROPE

FIGURE 38 EUROPE: MICROGRID CONTROLLER MARKET SNAPSHOT

TABLE 64 EUROPE: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 65 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 66 EUROPE: MARKET, BY CONNECTIVITY, 2018–2021 (USD MILLION)

TABLE 67 EUROPE: MARKET, BY CONNECTIVITY, 2022–2027 (USD MILLION)

TABLE 68 EUROPE: MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 69 EUROPE: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 70 EUROPE: MARKET, BY END-USE APPLICATION, 2018–2021 (USD MILLION)

TABLE 71 EUROPE: MARKET, BY END-USE APPLICATION, 2022–2027 (USD MILLION)

TABLE 72 MICROGRID PROJECTS IN EUROPE FROM 2018 TO 2021

9.3.1 GERMANY

9.3.1.1 Surging adoption of microgrids due to government initiatives

TABLE 73 GERMANY: MARKET, BY CONNECTIVITY, 2018–2021 (USD MILLION)

TABLE 74 GERMANY: MARKET, BY CONNECTIVITY, 2022–2027 (USD MILLION)

TABLE 75 GERMANY: MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 76 GERMANY: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

9.3.2 FRANCE

9.3.2.1 Increasing government investments to promote adoption of microgrids

TABLE 77 FRANCE: MARKET, BY CONNECTIVITY, 2018–2021 (USD MILLION)

TABLE 78 FRANCE: MARKET, BY CONNECTIVITY, 2022–2027 (USD MILLION)

TABLE 79 FRANCE: MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 80 FRANCE: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

9.3.3 UK

9.3.3.1 Rising use of microgrids to reduce waste heat generated by traditional systems

TABLE 81 UK: MARKET, BY CONNECTIVITY, 2018–2021 (USD MILLION)

TABLE 82 UK: MARKET, BY CONNECTIVITY, 2022–2027 (USD MILLION)

TABLE 83 UK: MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 84 UK: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

9.3.4 REST OF EUROPE

TABLE 85 REST OF EUROPE: MARKET, BY CONNECTIVITY, 2018–2021 (USD MILLION)

TABLE 86 REST OF EUROPE: MARKET, BY CONNECTIVITY, 2022–2027 (USD MILLION)

TABLE 87 REST OF EUROPE: MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 88 REST OF EUROPE: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

9.4 ASIA PACIFIC

FIGURE 39 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 89 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 90 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 91 ASIA PACIFIC: MARKET, BY CONNECTIVITY, 2018–2021 (USD MILLION)

TABLE 92 ASIA PACIFIC: MARKET, BY CONNECTIVITY, 2022–2027 (USD MILLION)

TABLE 93 ASIA PACIFIC: MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 94 ASIA PACIFIC: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 95 ASIA PACIFIC: MARKET, BY END-USE APPLICATION, 2018–2021 (USD MILLION)

TABLE 96 ASIA PACIFIC: MARKET, BY END-USE APPLICATION, 2022–2027 (USD MILLION)

9.4.1 CHINA

9.4.1.1 Increasing government initiatives to promote use of clean energy

TABLE 97 CHINA: MARKET, BY CONNECTIVITY, 2018–2021 (USD MILLION)

TABLE 98 CHINA: MARKET, BY CONNECTIVITY, 2022–2027 (USD MILLION)

TABLE 99 CHINA: MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 100 CHINA: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

9.4.2 JAPAN

9.4.2.1 Growing need for reliable power supply

TABLE 101 JAPAN: MARKET, BY CONNECTIVITY, 2018–2021 (USD MILLION)

TABLE 102 JAPAN: MARKET, BY CONNECTIVITY, 2022–2027 (USD MILLION)

TABLE 103 JAPAN: MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 104 JAPAN: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

9.4.3 AUSTRALIA

9.4.3.1 Rising shift to microgrids due to surging prices of traditional grid electricity

TABLE 105 AUSTRALIA: MARKET, BY CONNECTIVITY, 2018–2021 (USD MILLION)

TABLE 106 AUSTRALIA: MARKET, BY CONNECTIVITY, 2022–2027 (USD MILLION)

TABLE 107 AUSTRALIA: MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 108 AUSTRALIA: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

9.4.4 INDIA

9.4.4.1 India expected to adopt microgrids at higher rate due to various government initiatives

TABLE 109 INDIA: MARKET, BY CONNECTIVITY, 2018–2021 (USD MILLION)

TABLE 110 INDIA: MARKET, BY CONNECTIVITY, 2022–2027 (USD MILLION)

TABLE 111 INDIA: MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 112 INDIA: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

9.4.5 REST OF ASIA PACIFIC

TABLE 113 REST OF ASIA PACIFIC: MARKET, BY CONNECTIVITY, 2018–2021 (USD MILLION)

TABLE 114 REST OF ASIA PACIFIC: MARKET, BY CONNECTIVITY, 2022–2027 (USD MILLION)

TABLE 115 REST OF ASIA PACIFIC: MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 116 REST OF ASIA PACIFIC: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

9.5 ROW

TABLE 117 ROW: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 118 ROW: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 119 ROW: MARKET, BY CONNECTIVITY, 2018–2021 (USD MILLION)

TABLE 120 ROW: MARKET, BY CONNECTIVITY, 2022–2027 (USD MILLION)

TABLE 121 ROW: MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 122 ROW: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 123 ROW: MARKET, BY END-USE APPLICATION, 2018–2021 (USD MILLION)

TABLE 124 ROW: MARKET, BY END-USE APPLICATION, 2022–2027 (USD MILLION)

9.5.1 MIDDLE EAST

9.5.1.1 Growth of healthcare sector and rising demand for reliable power supply

TABLE 125 MIDDLE EAST: MICROGRID CONTROLLER MARKET, BY CONNECTIVITY, 2018–2021 (USD MILLION)

TABLE 126 MIDDLE EAST: MARKET, BY CONNECTIVITY, 2022–2027 (USD MILLION)

TABLE 127 MIDDLE EAST: MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 128 MIDDLE EAST: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

9.5.2 AFRICA

9.5.2.1 Surging number of microgrid projects due to various government initiatives

TABLE 129 AFRICA: MARKET, BY CONNECTIVITY, 2018–2021 (USD MILLION)

TABLE 130 AFRICA: MARKET, BY CONNECTIVITY, 2022–2027 (USD MILLION)

TABLE 131 AFRICA: MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 132 AFRICA: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 145)

10.1 INTRODUCTION

10.2 STRATEGIES ADOPTED BY KEY PLAYERS/RIGHT TO WIN

TABLE 133 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN MICROGRID CONTROLLER MARKET

10.3 MARKET RANKING ANALYSIS, 2021

FIGURE 40 RANKING OF KEY PLAYERS IN MARKET, 2021

10.4 KEY COMPANY EVALUATION QUADRANT, 2021

FIGURE 41 MICROGRID CONTROLLER MARKET (GLOBAL): COMPETITIVE LEADERSHIP MAPPING, 2021

10.4.1 STARS

10.4.2 EMERGING LEADERS

10.4.3 PERVASIVE COMPANIES

10.4.4 PARTICIPANTS

10.5 RECENT DEVELOPMENTS

10.5.1 PRODUCT LAUNCHES

TABLE 134 PRODUCT LAUNCHES, 2018–2022

10.5.2 PARTNERSHIPS/COLLABORATIONS/AGREEMENTS

TABLE 135 PARTNERSHIPS/COLLABORATIONS/AGREEMENTS, 2018–2022

10.5.3 OTHERS

TABLE 136 OTHERS, 2018–2022

11 COMPANY PROFILES (Page No. - 172)

(Business Overview, Products/Services/Solutions Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

11.1 KEY PLAYERS

11.1.1 SCHNEIDER ELECTRIC

TABLE 137 SCHNEIDER ELECTRIC: BUSINESS OVERVIEW

FIGURE 42 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

TABLE 138 SCHNEIDER ELECTRIC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 139 SCHNEIDER ELECTRIC: PRODUCT LAUNCHES

TABLE 140 SCHNEIDER ELECTRIC: DEALS

TABLE 141 SCHNEIDER ELECTRIC: OTHERS

11.1.2 GENERAL ELECTRIC

TABLE 142 GENERAL ELECTRIC: BUSINESS OVERVIEW

FIGURE 43 GENERAL ELECTRIC: COMPANY SNAPSHOT

TABLE 143 GENERAL ELECTRIC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 144 GENERAL ELECTRIC: PRODUCT LAUNCHES

TABLE 145 GENERAL ELECTRIC: DEALS

TABLE 146 GENERAL ELECTRIC: OTHERS

11.1.3 ABB

TABLE 147 ABB: BUSINESS OVERVIEW

FIGURE 44 ABB: COMPANY SNAPSHOT

TABLE 148 ABB: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 149 ABB: PRODUCT LAUNCHES

TABLE 150 ABB: DEALS

11.1.4 SIEMENS

TABLE 151 SIEMENS: BUSINESS OVERVIEW

FIGURE 45 SIEMENS: COMPANY SNAPSHOT

TABLE 152 SIEMENS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 153 SIEMENS: PRODUCT LAUNCHES

TABLE 154 SIEMENS: DEALS

11.1.5 EATON CORPORATION

TABLE 155 EATON CORPORATION: BUSINESS OVERVIEW

FIGURE 46 EATON CORPORATION: COMPANY SNAPSHOT

TABLE 156 EATON CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 157 EATON CORPORATION: PRODUCT LAUNCHES

TABLE 158 EATON CORPORATION: DEALS

TABLE 159 EATON CORPORATION: OTHERS

11.1.6 SCHWEITZER ENGINEERING LABORATORIES

TABLE 160 SCHWEITZER ENGINEERING LABORATORIES: BUSINESS OVERVIEW

TABLE 161 SCHWEITZER ENGINEERING LABORATORIES: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 162 SCHWEITZER ENGINEERING LABORATORIES: PRODUCT LAUNCHES

TABLE 163 SCHWEITZER ENGINEERING LABORATORIES: OTHERS

11.1.7 HONEYWELL INTERNATIONAL INC.

TABLE 164 HONEYWELL INTERNATIONAL INC.: BUSINESS OVERVIEW

FIGURE 47 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

TABLE 165 HONEYWELL INTERNATIONAL INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 166 HONEYWELL INTERNATIONAL INC.: PRODUCT LAUNCHES

TABLE 167 HONEYWELL INTERNATIONAL INC.: DEALS

11.1.8 CATERPILLAR INC.

TABLE 168 CATERPILLAR INC.: BUSINESS OVERVIEW

FIGURE 48 CATERPILLAR INC.: COMPANY SNAPSHOT

TABLE 169 CATERPILLAR INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

11.1.9 S&C ELECTRIC COMPANY

TABLE 170 S&C ELECTRIC COMPANY: BUSINESS OVERVIEW

TABLE 171 S&C ELECTRIC COMPANY: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 172 S&C ELECTRIC COMPANY: PRODUCT LAUNCHES

TABLE 173 S&C ELECTRIC COMPANY: DEALS

TABLE 174 S&C ELECTRIC COMPANY: OTHERS

11.1.10 POWER ANALYTICS CORPORATION

TABLE 175 POWER ANALYTICS CORPORATION: BUSINESS OVERVIEW

TABLE 176 POWER ANALYTICS CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 177 POWER ANALYTICS CORPORATION: PRODUCT LAUNCHES

TABLE 178 POWER ANALYTICS CORPORATION: DEALS

*Details on Business Overview, Products/Services/Solutions Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

11.2 OTHER PLAYERS

11.2.1 CUMMINS INC.

11.2.2 TESLA ENERGY (SUBSIDIARY OF TESLA)

11.2.3 EMERSON ELECTRIC CO.

11.2.4 PRINCETON POWER SYSTEMS

11.2.5 SPIRAE LLC

11.2.6 HOMER ENERGY

11.2.7 HITACHI ENERGY

11.2.8 PARETO ENERGY

11.2.9 OPUS ONE SOLUTIONS

11.2.10 ENCORP

11.2.11 QINOUS

11.2.12 POWERHIVE

11.2.13 ADVANCED MICROGRID SOLUTIONS

11.2.14 GO ELECTRIC

11.2.15 GREEN ENERGY CORP

12 APPENDIX (Page No. - 234)

12.1 INSIGHTS FROM INDUSTRY EXPERTS

12.2 DISCUSSION GUIDE

12.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.4 CUSTOMIZATION OPTIONS

12.5 RELATED REPORTS

12.6 AUTHOR DETAILS

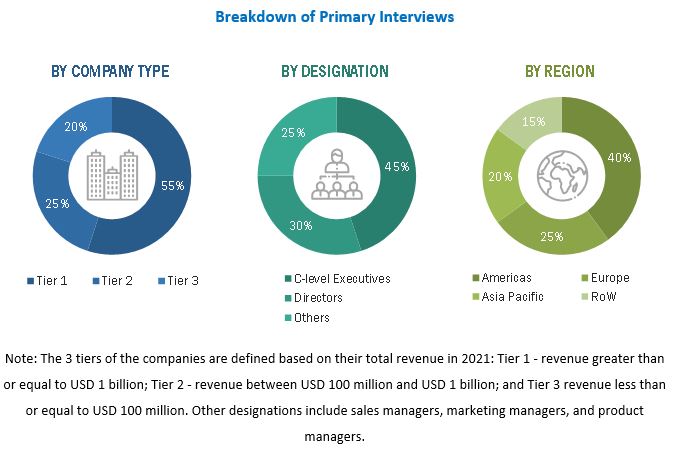

The study involved four major activities for estimating the size of the microgrid controller market. Exhaustive secondary research has been carried out to collect information relevant to the market, its peer markets, and its child market. Primary research has been undertaken to validate key findings, assumptions, and sizing with the industry experts across the value chain of the microgrid controller market. Both top-down and bottom-up approaches have been employed to estimate the complete market size. It has been followed by the market breakdown and data triangulation methods to estimate the size of different segments and subsegments of the market.

Secondary Research

The research methodology that has been used to estimate and forecast the size of the microgrid controller market began with the acquisition of data related to the revenues of key vendor in the market through secondary research. The entire research methodology included the study of annual reports, press releases, and investor presentations of companies; white papers; and certified publications and articles by recognized authors; directories; and databases. The secondary sources used for this research study include government sources; corporate filings such as annual reports, investor presentations, and financial statements; and trade, business, and professional associations. The secondary data was collected and analyzed to arrive at the overall size of the microgrid controller market, which was further validated through primary research.

Primary Research

Extensive primary research was conducted after understanding and analyzing the microgrid controller market scenario through secondary research. Several primary interviews were conducted with key opinion leaders from both the demand-side and supply-side vendors across the 4 major regions—Americas (North America and South America), Europe, Asia Pacific, and Rest of the World (Africa and the Middle East). Approximately 25% of the primary interviews were conducted with the demand side and 75% with the supply side. This primary data was collected mainly through telephonic interviews, which consist of 80% of total primary interviews; however, questionaries and emails were also used to collect the data.

Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales, operations, and administration, were covered to provide a holistic viewpoint in our report. After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The total size of the microgrid controller market has been estimated and validated using both top-down and bottom-up approaches. Furthermore, these methods have also been used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size is as follows:

- Identifying different entities influencing the value chain of the microgrid controller market

- Identifying major companies, system integrators, and service providers operating in the market

- Estimating the size of the microgrid controller market for each region based on demand for microgrid controllers

- Tracking the ongoing and upcoming microgrid projects to forecast the market size based on these developments and other critical parameters

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

- Qualitative aspects such as market drivers, restraints, opportunities, and challenges have been taken into consideration while calculating and forecasting the market size.

Global Microgrid Controller Market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the total market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market was validated using both top-down and bottom-up approaches.

Report Objectives

- To define, describe, segment, and forecast the size of the microgrid controller market, by connectivity, offering, and end-use application, in terms of value

- To forecast the market size for various segments with respect to four main regions—the Americas, Europe, Asia Pacific, and the Rest of the World (RoW)—in terms of value and volume

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the microgrid controller market

- To study the complete value chain and allied industry segments and perform a value chain analysis of the microgrid controller market landscape

- To strategically analyze macro and micromarkets1 with respect to growth trends, prospects, and their contributions to the overall market

- To strategically profile key players in the market and comprehensively analyze their market share/ranking and core competencies2

- To analyze industry trends and patents and innovations in the microgrid controller market

- To analyze competitive developments by players in the microgrid controller market, such as contracts, product launches/developments, expansions, and research and development (R&D) activities.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information:

- Detailed analysis and profiling of additional market players based on various blocks of the value chain.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Microgrid Controller Market