Microphone Market by Technology (MEMS, Electret), MEMS Type (Analog, Digital), Communication Technology (Wired, Bluetooth, Wi-Fi, AirPlay), SNR (Low <59 dB, Medium 60-64 dB, High >64 dB), Application & Region - Global Forecast to 2028

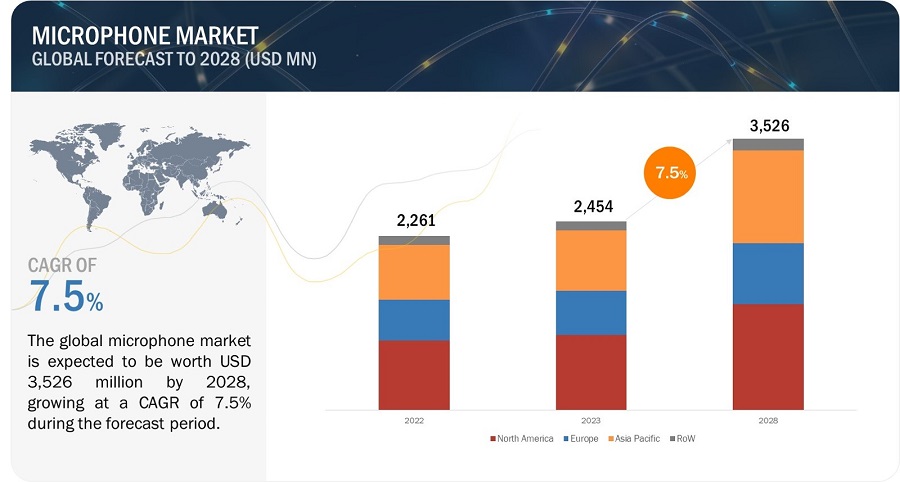

[223 Pages Report] The global microphone market is expected to be valued at USD 2,454 million in 2023 and is projected to reach USD 3,526 million by 2028; it is expected to grow at a CAGR of 7.5% from 2023 to 2028. Continuous advancements in audio technology, including noise cancellation, beamforming, and high-fidelity audio capture, are boosting the demand for high-quality microphones in various industries, such as broadcasting, recording, gaming, and telecommunication. The growing trend of intelligent home automation and voice-controlled systems creates a demand for microphones in-home devices such as smart speakers, security systems, thermostats, and lighting control systems.

Microphone Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Microphone Market dynamics

Driver: Increasing demand for consumer electronics

The growing popularity of consumer electronics such as smartphones, laptops, tablets, and wearable devices is a significant driver for the microphone market. These devices require built-in microphones for voice input, voice recognition, video recording, and telecommunication purposes. The rising demand for smartphones with advanced features and voice-controlled virtual assistants like Siri, Google Assistant, and Alexa fuels the demand for high-quality microphones.

Restraint: Compatibility issues in the Microphone

Compatibility issues in the microphone market refer to the challenge of ensuring seamless connectivity and compatibility between microphones and various devices and platforms. As technology advances, there is an increasing variety of devices with different connectivity options, such as USB, XLR, wireless, and proprietary connectors. Each connectivity option may require a specific type of microphone or adapter for proper functionality. Ensuring compatibility across this wide range of devices and platforms can significantly challenge microphone manufacturers.

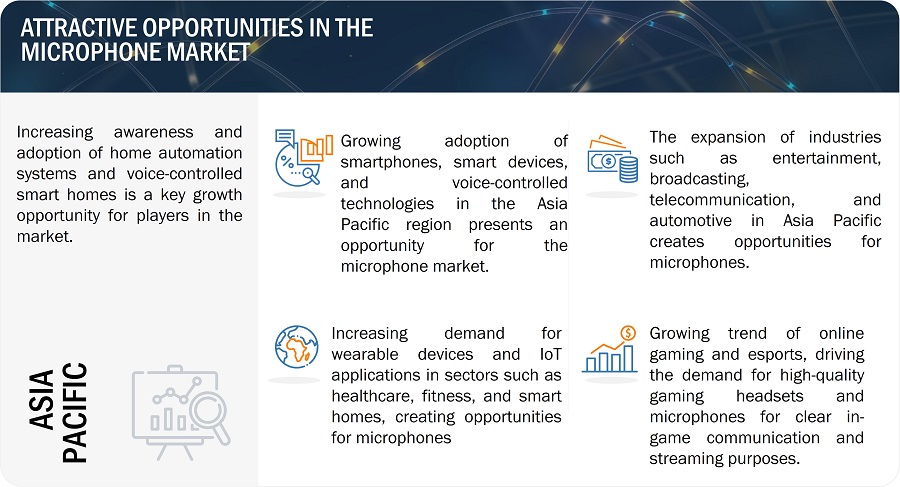

Opportunity: Increasing demand for wearable and hearable devices

The increasing demand for wearable devices and hearables presents significant opportunities for microphone manufacturers. Wearable devices, such as smartwatches, fitness trackers, and AR glasses, are becoming more prevalent in various industries, including healthcare, fitness, communication, and entertainment. These devices often incorporate microphones to enable voice commands, phone calls, voice search, voice assistants, and other voice-controlled functionalities.

Challenge: Competition from established microphone manufacturers

The microphone market is characterized by intense competition, driven by the presence of established manufacturers and the entry of new companies into the industry. The microphone market is saturated with multiple manufacturers offering a wide range of products. This saturation makes it challenging for individual companies to differentiate their offerings and attract customers.

Microphone Market Ecosystem

The microphone market is dominated by established and financially sound manufacturers with extensive experience in the industry. These companies have diversified product portfolios, cutting-edge technologies, and strong global sales and marketing networks. Leading players in the market include Knowles Electronics LLC from the US, Goertek from China, AAC Technologies from China, TDK Corporation from Japan, and Infineon Technologies from Germany.

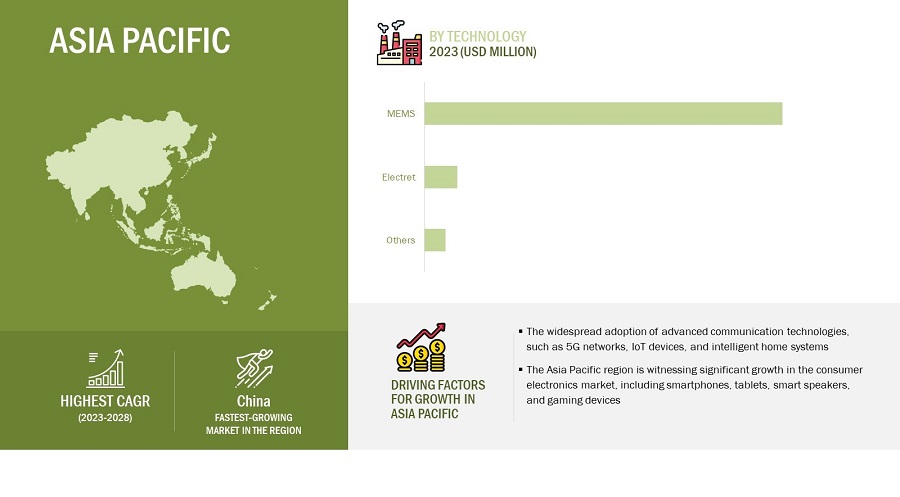

MEMS Microphones are expected to hold the highest market share during the forecast period

MEMS (Micro-Electro-Mechanical System) microphones are poised to experience the highest growth rate in the audio industry due to several key factors. MEMS microphones offer significant advantages over traditional electret condenser microphones in terms of size, power consumption, and durability. Their compact size allows for seamless integration into various electronic devices, including smartphones, wearables, and Internet of Things (IoT) devices. Additionally, MEMS microphones consume lower power, making them ideal for battery-powered applications and enabling extended device usage. Moreover, the increasing adoption of MEMS microphones in emerging markets, such as automotive and healthcare, contribute to their rapid growth. In the automotive sector, MEMS microphones are used for in-car communication, active noise cancellation, and voice recognition systems, enhancing the overall driving experience. In healthcare, MEMS microphones find applications in hearing aids, medical devices, and telemedicine solutions, facilitating better diagnostics and patient care.

Based on communication technology, the wired market for microphones to hold the second highest market share during the forecast period

Wired microphones have a long-standing reputation for reliability and stability. They offer a consistent and secure connection between the microphone and the audio system, ensuring uninterrupted audio transmission without the risk of wireless interference or signal dropouts. Wired microphones typically offer high-quality audio performance with minimal signal degradation or loss. They provide a direct and unaltered audio signal, resulting in accurate sound reproduction and clarity. This makes wired microphones ideal for critical applications such as studio recordings, live performances, and broadcast environments.

Industrial application for microphone market to hold the second highest market share

The increasing adoption of industrial automation and Internet of Things (IoT) technologies in manufacturing and industrial settings creates a demand for microphones. Microphones are used for audio sensing, voice control, and communication in smart factories, industrial robots, and automated systems. Microphones play a crucial role in industrial safety and security applications. They detect and monitor sounds such as alarms, sirens, machine malfunctions, and abnormal noise levels, ensuring a safe and secure working environment. These factors, along with advancements in microphone technology, increased focus on workplace safety and efficiency, and the need for intelligent industrial systems, drive the growth of the microphone market in the industrial sector.

Microphone market in Asia Pacific to hold the highest CAGR during the forecast period

The rise in disposable income and urbanization in many countries within the Asia Pacific region has fueled the demand for consumer electronics and audio equipment. As more people in the region can afford these devices, the market for microphones used in these products experiences significant growth.

The adoption of voice-enabled devices and applications is increasing in the Asia Pacific region. Smart speakers, virtual assistants, voice-controlled home automation systems, and voice recognition technology are gaining popularity. These devices and applications heavily rely on microphones for accurate voice capture and command recognition, leading to a growing microphone market.

Microphone Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The microphone companies is dominated by players such as Knowles Electronics LLC (US), Goertek (China), AAC Technologies (China), TDK Corporation (Japan), Infineon Technologies (Germany), and others.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2019-2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023-2028 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments Covered |

By SNR, By Technology, By MEMS Type, By Communication Technology, and By Application |

|

Geographies covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies covered |

The major market players include Knowles Electronics LLC (US), Goertek (China), AAC Technologies (China), TDK Corporation (Japan), Infineon Technologies (Germany), STMicroelectronics (Switzerland), ZillTek Technology Corp. (Taiwan), Hosiden Corporation (Japan), Sonion (Denmark), Cui Devices (US). (Total of 25 players are profiled) |

Microphone Market Highlights

The study categorizes the microphone market based on the following segments:

|

Segment |

Subsegment |

|

Microphone market, by SNR |

|

|

Microphone market, by technology |

|

|

Microphone market, by MEMS type |

|

|

Microphone market, by communication technology |

|

|

Microphone market, by application |

|

|

Microphone market, By Region |

|

Recent Developments

- In February 2023, AAC Technologies launched a complete set of automotive MEMS microphone modules to accelerate its automotive business. With an SNR ratio of 63 dB to 70 dB, these microphones can meet the application needs of different levels and scenarios.

- In February 2023, Infineon introduced the latest addition to the XENSIV MEMS microphone product portfolio, the ultra-low power digital microphone IM69D128S. The microphone is designed for applications that require a high signal-to-noise ratio (SNR) / low microphone self-noise, long battery life, and high reliability.

- In January 2023, TDK Corporation made an announcement regarding the release of the InvenSense T5838 and T5837 MEMS microphones. These microphones, namely the T5837 and T5838, are PDM MEMS microphones that boast the industry’s most energy-efficient Pulse Density Modulation (PDM) multi-mode functionality. Additionally, they possess a remarkably high acoustic overload point.

- In January 2023, Knowles introduced its latest series of SiSonic MEMS microphones: Titan (Digital), Falcon (Differential Analog), and Robin (Single Ended Analog). The new trio of microphones provides advanced performance capabilities for space-constrained Ear and wearable applications like True Wireless Stereo (TWS) earbuds, smart watches, Augmented Reality (AR) glasses, and Virtual Reality (VR) headsets.

- In December 2022, Knowles introduced two MEMS microphone solutions optimized for over-the-counter (OTC) hearing aids. These address the value-based segment of the OTC hearing aid category with reliable performance and lower power consumption than comparable commercial microphones.

- As a part of the SmartSound family of performance products for mobile, TWS, IoT, and other consumer devices, TDK Corporation unveiled the T5828 Sound Wire MEMS microphone in January 2022. These microphones, belonging to a range of high-performance options, redefine the limits of acoustic performance and deliver advanced features within compact package sizes.

Frequently Asked Questions (FAQ):

What are the major driving factors and opportunities in the microphone market?

Some of the major driving factors for the growth of this market include Increasing demand for consumer electronics, Growing adoption of voice-controlled applications, Advancements in automotive technology, and Adoption of video conferencing and remote collaborations. Moreover, Increasing demand for wearable devices and hearables, Advancements in microphone technology, Growth of video content creation and streaming are some of the key opportunities for the 5G Testing market.

Which region is expected to hold the highest market share?

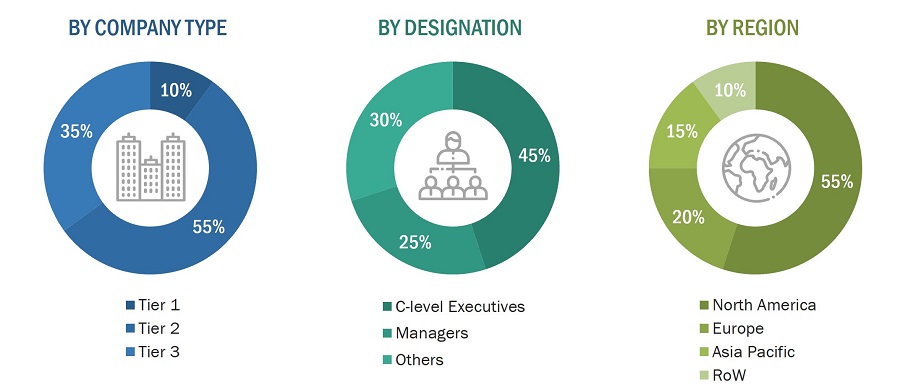

The market in North America will dominate the market share in 2023, showcasing strong demand for microphones in the region. Strong research and development, the presence of a leading microphone and consumer electronics manufacturers, and investments and funding are key factors driving the growth of the microphone market in the region.

Who are the leading players in the global microphone market?

Companies such as Knowles Electronics LLC (US), Goertek (China), AAC Technologies (China), TDK Corporation (Japan), and Infineon Technologies (Germany) are the leading players in the market. Moreover, these companies rely on strategies that include new product launches and developments, partnerships and collaborations, and acquisitions. Such advantages give these companies an edge over other companies in the market.

What are some of the technological advancements in the market?

Microphones are integral components in voice recognition systems and NLP applications. Combined with advanced algorithms and AI, microphones capture spoken commands and convert them into text or perform various actions based on voice inputs. Microphones are crucial in capturing immersive audio experiences in AR and VR applications. They enable spatial audio, realistic sound effects, and interactive audio experiences, enhancing overall immersion and user engagement.

What is the impact of the global recession on the market?

The semiconductor industry is expected to face a downturn as the recession looms. Economic downturns can reduce investment in microphone manufacturers’ research and development (R&D) activities. This can result in decreased demand from corporate clients and industries heavily relying on microphones, such as broadcasting, conferences, and professional audio. Recession could reduce budgets for events, concerts, and entertainment productions. This can result in declining demand for microphones used in live performances, conferences, and other related applications. The market growth rate is expected to be lower in 2023 due to declining shipment and sale of smartphonesConsumers may delay purchasing new microphones, and businesses may reduce their investment in audio equipment. Additionally, companies are reducing their R&D budgets, limiting the development of new microphone technologies and product innovations. This can slow down new product releases and technological advancements in the market..

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 33)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION AND SCOPE

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 GEOGRAPHIC SCOPE

1.3.2 YEARS CONSIDERED

1.4 CURRENCY

1.5 PACKAGE SIZE

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 38)

2.1 RESEARCH DATA

FIGURE 2 MICROPHONE MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE): REVENUE GENERATED FROM SALES OF MICROPHONES IN 2021

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (SUPPLY SIDE): ILLUSTRATION OF COMPANY’S REVENUE GENERATED FROM SALES OF MICROPHONES IN 2021

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 4—BOTTOM-UP ESTIMATION OF MICROPHONE MARKET SIZE, BY TECHNOLOGY (MEMS MICROPHONE)

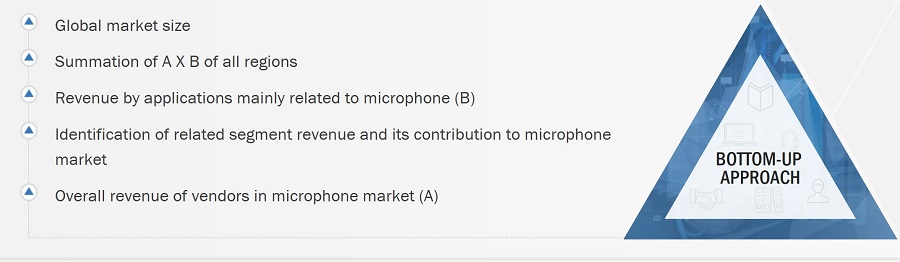

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for estimating market size by bottom-up analysis (demand side)

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

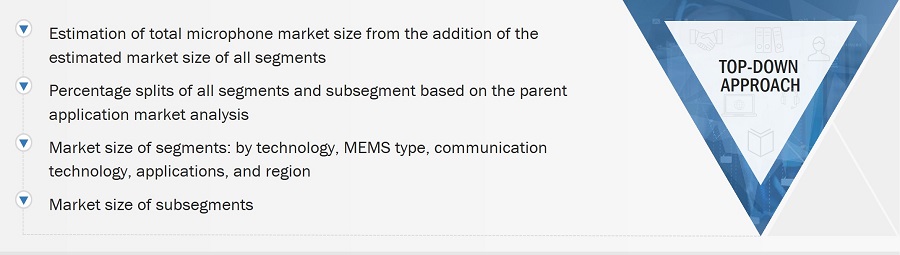

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for estimating market size by top-down analysis (supply side)

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.2.3 MARKET SHARE ESTIMATION

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 8 MARKET BREAKDOWN AND DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

FIGURE 9 ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 48)

3.1 SCENARIO ANALYSIS

FIGURE 10 MICROPHONE MARKET: REALISTIC, PESSIMISTIC, AND OPTIMISTIC RECOVERY SCENARIOS

3.2 POST-COVID-19: REALISTIC SCENARIO

TABLE 1 POST-COVID-19 – REALISTIC SCENARIO: MICROPHONE MARKET

3.3 POST-COVID-19: OPTIMISTIC SCENARIO

TABLE 2 POST-COVID-19 – OPTIMISTIC SCENARIO: MICROPHONE MARKET

3.4 POST-COVID-19: PESSIMISTIC SCENARIO

TABLE 3 POST-COVID-19 – PESSIMISTIC SCENARIO: MICROPHONE MARKET

FIGURE 11 MEMS MICROPHONES TO ACCOUNT FOR LARGEST MARKET SHARE IN 2027

FIGURE 12 CONSUMER ELECTRONICS APPLICATION TO HOLD LARGEST SHARE OF MICROPHONE MARKET IN 2022

FIGURE 13 DIGITAL MEMS MICROPHONES TO EXHIBIT HIGHER CAGR FROM 2022 TO 2027

FIGURE 14 AMERICAS AND ASIA PACIFIC TO BE MOST FAVORABLE REGIONS FOR MICROPHONE MARKET IN 2027

4 PREMIUM INSIGHTS (Page No. - 54)

4.1 ATTRACTIVE OPPORTUNITIES IN MICROPHONE MARKET

FIGURE 15 RISING DEMAND FOR MEMS MICROPHONES FROM CONSUMER ELECTRONICS AND AUTOMOTIVE COMPANIES TO DRIVE MARKET GROWTH FROM 2022 TO 2027

4.2 MICROPHONE MARKET, BY MEMS TYPE

FIGURE 16 DIGITAL MEMS MICROPHONES TO HOLD LARGER MARKET SHARE IN 2027

4.3 MICROPHONE MARKET, BY TECHNOLOGY

FIGURE 17 MEMS TECHNOLOGY TO DOMINATE MICROPHONE MARKET THROUGHOUT FORECAST PERIOD

4.4 MICROPHONE MARKET, BY COMMUNICATION TECHNOLOGY

FIGURE 18 WIRELESS MICROPHONES TO LEAD MARKET FROM 2022 TO 2027

4.5 MICROPHONE MARKET IN AMERICAS, BY APPLICATION AND REGION

FIGURE 19 CONSUMER ELECTRONICS AND NORTH AMERICA TO BE LARGEST SEGMENTS OF MICROPHONE MARKET IN AMERICAS IN 2022

4.6 GEOGRAPHIC ANALYSIS OF MICROPHONE MARKET

FIGURE 20 US TO ACCOUNT FOR LARGEST SHARE OF MICROPHONE MARKET IN 2022

5 MARKET OVERVIEW (Page No. - 57)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 21 MICROPHONE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 High adoption of next-generation consumer electronics

5.2.1.2 Low cost and compact size of MEMS microphones

5.2.1.3 Increased number of microphones per device

5.2.1.4 Escalated demand for smart wearable devices integrated with advanced microphones

5.2.1.5 Elevated use of piezoelectric MEMS microphones in IoT applications

FIGURE 22 MICROPHONE MARKET DRIVERS AND THEIR IMPACT

5.2.2 RESTRAINTS

5.2.2.1 Critical aspects related to packaging and integration of MEMS technology

5.2.2.2 High cost of electronic stethoscopes

FIGURE 23 MICROPHONE MARKET RESTRAINTS AND THEIR IMPACT

5.2.3 OPPORTUNITIES

5.2.3.1 Implementation of microphones in automotive applications

5.2.3.2 Deployment of microphones in industrial applications

FIGURE 24 MICROPHONE MARKET OPPORTUNITIES AND THEIR IMPACT

5.2.4 CHALLENGES

5.2.4.1 Constraints related to specifications of microphones

5.2.4.2 Limitations in terms of sensitivity, noise, and power consumption

5.2.4.3 Variations in supply and demand due to resurgence of COVID-19 and geopolitical events

5.2.4.4 Incidences of spying through microphone-installed smartphones

FIGURE 25 MICROPHONE MARKET CHALLENGES AND THEIR IMPACT

5.3 VALUE CHAIN ANALYSIS

FIGURE 26 VALUE CHAIN ANALYSIS: MAJOR VALUE ADDED BY ORIGINAL EQUIPMENT MANUFACTURERS

5.4 MARKET MAP

FIGURE 27 KEY PLAYERS IN MICROPHONE ECOSYSTEM

5.5 TECHNOLOGY ANALYSIS

5.5.1 MEMS TECHNOLOGY

TABLE 4 COMPARISON OF BENEFITS OF MEMS TECHNOLOGY WITH OTHER TECHNOLOGIES

5.5.2 OPTICAL MEMS MICROPHONE

5.6 CASE STUDY

5.6.1 SONITUS HELPS DUBLIN CITY TO MONITOR AND MINIMIZE NOISE POLLUTION BY UTILIZING ADVANCED MICROPHONE-ENABLED SOUND LEVEL MONITORS

5.6.2 BRÜEL & KJÆR DEPLOYS MICROPHONE-ENABLED REAL-TIME FLIGHT TRACKING AND NOISE MONITORING SYSTEM AT VIENNA INTERNATIONAL AIRPORT

5.7 AVERAGE SELLING PRICE TREND

FIGURE 28 AVERAGE SELLING PRICE TREND OF MICROPHONES AND MICROPHONE ARRAYS IN VARIOUS APPLICATIONS

6 MICROPHONE MARKET, BY MEMS TYPE (Page No. - 70)

6.1 INTRODUCTION

FIGURE 29 DIGITAL MEMS MICROPHONES TO DOMINATE MARKET THROUGHOUT FORECAST PERIOD

TABLE 5 MICROPHONE MARKET, BY MEMS TYPE, 2018–2021 (USD MILLION)

TABLE 6 MICROPHONE MARKET, BY MEMS TYPE, 2022–2027 (USD MILLION)

TABLE 7 MICROPHONE MARKET, BY MEMS TYPE, 2018–2021 (MILLION UNITS)

TABLE 8 MICROPHONE MARKET, BY MEMS TYPE, 2022–2027 (MILLION UNITS)

6.2 ANALOG

6.2.1 RISING USE OF ANALOG MEMS MICROPHONES IN SECURITY & SURVEILLANCE APPLICATIONS TO ACCELERATE MARKET GROWTH

TABLE 9 ANALOG: MICROPHONE MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 10 ANALOG: MICROPHONE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 11 ANALOG: MICROPHONE MARKET, BY APPLICATION, 2018–2021 (MILLION UNITS)

TABLE 12 ANALOG: MICROPHONE MARKET, BY APPLICATION, 2022–2027 (MILLION UNITS)

TABLE 13 ANALOG: MICROPHONE MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 14 ANALOG: MICROPHONE MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 15 ANALOG: MICROPHONE MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 16 ANALOG: MICROPHONE MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 17 AUTOMOTIVE: ANALOG MICROPHONE MARKET, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 18 AUTOMOTIVE: ANALOG MICROPHONE MARKET, BY REGION, 2022–2027 (USD THOUSAND)

TABLE 19 AUTOMOTIVE: ANALOG MICROPHONE MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 20 AUTOMOTIVE: ANALOG MICROPHONE MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 21 COMMERCIAL SECURITY & SURVEILLANCE: ANALOG MICROPHONE MARKET, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 22 COMMERCIAL SECURITY & SURVEILLANCE: ANALOG MICROPHONE MARKET, BY REGION, 2022–2027 (USD THOUSAND)

TABLE 23 COMMERCIAL SECURITY & SURVEILLANCE: ANALOG MICROPHONE MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 24 COMMERCIAL SECURITY & SURVEILLANCE: ANALOG MICROPHONE MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 25 CONSUMER ELECTRONICS: ANALOG MICROPHONE MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 26 CONSUMER ELECTRONICS: ANALOG MICROPHONE MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 27 CONSUMER ELECTRONICS: ANALOG MICROPHONE MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 28 CONSUMER ELECTRONICS: ANALOG MICROPHONE MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 29 INDUSTRIAL: ANALOG MICROPHONE MARKET, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 30 INDUSTRIAL: ANALOG MICROPHONE MARKET, BY REGION, 2022–2027 (USD THOUSAND)

TABLE 31 INDUSTRIAL: ANALOG MICROPHONE MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 32 INDUSTRIAL: ANALOG MICROPHONE MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 33 MEDICAL: ANALOG MICROPHONE MARKET, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 34 MEDICAL: ANALOG MICROPHONE MARKET, BY REGION, 2022–2027 (USD THOUSAND)

TABLE 35 MEDICAL: ANALOG MICROPHONE MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 36 MEDICAL: ANALOG MICROPHONE MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 37 NOISE MONITORING & SENSING: ANALOG MICROPHONE MARKET, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 38 NOISE MONITORING & SENSING: ANALOG MICROPHONE MARKET, BY REGION, 2022–2027 (USD THOUSAND)

TABLE 39 NOISE MONITORING & SENSING: ANALOG MICROPHONE MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 40 NOISE MONITORING & SENSING: ANALOG MICROPHONE MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

6.3 DIGITAL

6.3.1 INCREASING ADOPTION OF DIGITAL MICROPHONES IN INDUSTRIAL AND CONSUMER ELECTRONICS TO PROPEL MARKET GROWTH

TABLE 41 DIGITAL: MICROPHONE MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 42 DIGITAL: MICROPHONE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 43 DIGITAL: MICROPHONE MARKET, BY APPLICATION, 2018–2021 (MILLION UNITS)

TABLE 44 DIGITAL: MICROPHONE MARKET, BY APPLICATION, 2022–2027 (MILLION UNITS)

TABLE 45 DIGITAL: MICROPHONE MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 46 DIGITAL: MICROPHONE MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 47 DIGITAL: MICROPHONE MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 48 DIGITAL: MICROPHONE MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 49 AUTOMOTIVE: DIGITAL MICROPHONE MARKET, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 50 AUTOMOTIVE: DIGITAL MICROPHONE MARKET, BY REGION, 2022–2027 (USD THOUSAND)

TABLE 51 AUTOMOTIVE: DIGITAL MICROPHONE MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 52 AUTOMOTIVE: DIGITAL MICROPHONE MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 53 COMMERCIAL SECURITY & SURVEILLANCE: DIGITAL MICROPHONE MARKET, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 54 COMMERCIAL SECURITY & SURVEILLANCE: DIGITAL MICROPHONE MARKET, BY REGION, 2022–2027 (USD THOUSAND)

TABLE 55 COMMERCIAL SECURITY & SURVEILLANCE: DIGITAL MICROPHONE MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 56 COMMERCIAL SECURITY & SURVEILLANCE: DIGITAL MICROPHONE MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 57 COMMERCIAL SECURITY & SURVEILLANCE: DIGITAL MICROPHONE MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 58 COMMERCIAL SECURITY & SURVEILLANCE: DIGITAL MICROPHONE MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 59 CONSUMER ELECTRONICS: DIGITAL MICROPHONE MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 60 CONSUMER ELECTRONICS: DIGITAL MICROPHONE MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 61 INDUSTRIAL: DIGITAL MICROPHONE MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 62 INDUSTRIAL: DIGITAL MICROPHONE MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 63 INDUSTRIAL: DIGITAL MICROPHONE MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 64 INDUSTRIAL: DIGITAL MICROPHONE MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 65 MEDICAL: DIGITAL MICROPHONE MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 66 MEDICAL: DIGITAL MICROPHONE MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 67 MEDICAL: DIGITAL MICROPHONE MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 68 MEDICAL: DIGITAL MICROPHONE MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 69 NOISE MONITORING & SENSING: DIGITAL MICROPHONE MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 70 NOISE MONITORING & SENSING: DIGITAL MICROPHONE MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 71 NOISE MONITORING & SENSING: DIGITAL MICROPHONE MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 72 NOISE MONITORING & SENSING: DIGITAL MICROPHONE MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

7 MICROPHONE MARKET, BY COMMUNICATION TECHNOLOGY (Page No. - 95)

7.1 INTRODUCTION

FIGURE 30 WIRELESS COMMUNICATION TECHNOLOGY TO DOMINATE MICROPHONE MARKET DURING FORECAST PERIOD

TABLE 73 MICROPHONE MARKET, BY COMMUNICATION TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 74 MICROPHONE MARKET, BY COMMUNICATION TECHNOLOGY, 2022–2027 (USD MILLION)

7.2 WIRED COMMUNICATION TECHNOLOGY

7.2.1 ADVENT OF SMART DEVICES TO BOOST DEMAND FOR WIRED MICROPHONES

7.3 WIRELESS COMMUNICATION TECHNOLOGY

7.3.1 USE OF SMARTPHONES AND TABLETS BY MAJORITY OF POPULATION SUPPORTS GROWTH OF WIRELESS MICROPHONE MARKET

TABLE 75 MICROPHONE MARKET, BY WIRELESS COMMUNICATION TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 76 MICROPHONE MARKET, BY WIRELESS COMMUNICATION TECHNOLOGY, 2022–2027 (USD MILLION)

7.3.2 BLUETOOTH

7.3.2.1 Increasing use of Bluetooth microphones in broadcasting applications to accelerate market growth

7.3.3 WI-FI

7.3.3.1 Wi-Fi connectivity feature of microphones boosts their demand in consumer electronics and smart home applications

7.3.4 AIRPLAY

7.3.4.1 AirPlay compatibility feature of Apple iPhone and iPad likely to contribute to microphone market growth

7.3.5 OTHERS

8 MICROPHONE MARKET, BY TECHNOLOGY (Page No. - 100)

8.1 INTRODUCTION

FIGURE 31 MARKET FOR MEMS MICROPHONES TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 77 MICROPHONE MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 78 MICROPHONE MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 79 MICROPHONE MARKET, BY TECHNOLOGY, 2018–2021 (MILLION UNITS)

TABLE 80 MICROPHONE MARKET, BY TECHNOLOGY, 2022–2027 (MILLION UNITS)

8.2 ELECTRET

8.2.1 ELECTRET MICROPHONES SUITABLE FOR ACOUSTIC OR ELECTRICAL APPLICATIONS

TABLE 81 ELECTRET MICROPHONE MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 82 ELECTRET MICROPHONE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 83 ELECTRET MICROPHONE MARKET, BY APPLICATION, 2018–2021 (THOUSAND UNITS)

TABLE 84 ELECTRET MICROPHONE MARKET, BY APPLICATION, 2022–2027 (THOUSAND UNITS)

TABLE 85 ELECTRET MICROPHONE MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 86 ELECTRET MICROPHONE MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 87 ELECTRET MICROPHONE MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 88 ELECTRET MICROPHONE MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 89 AUTOMOTIVE: ELECTRET MICROPHONE MARKET, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 90 AUTOMOTIVE: ELECTRET MICROPHONE MARKET, BY REGION, 2022–2027 (USD THOUSAND)

TABLE 91 AUTOMOTIVE: ELECTRET MICROPHONE MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 92 AUTOMOTIVE: ELECTRET MICROPHONE MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 93 COMMERCIAL SECURITY & SURVEILLANCE: ELECTRET MICROPHONE MARKET, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 94 COMMERCIAL SECURITY & SURVEILLANCE: ELECTRET MICROPHONE MARKET, BY REGION, 2022–2027 (USD THOUSAND)

TABLE 95 COMMERCIAL SECURITY & SURVEILLANCE: ELECTRET MICROPHONE MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 96 COMMERCIAL SECURITY & SURVEILLANCE: ELECTRET MICROPHONE MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 97 CONSUMER ELECTRONICS: ELECTRET MICROPHONE MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 98 CONSUMER ELECTRONICS: ELECTRET MICROPHONE MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 99 CONSUMER ELECTRONICS: ELECTRET MICROPHONE MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 100 CONSUMER ELECTRONICS: ELECTRET MICROPHONE MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 101 INDUSTRIAL: ELECTRET MICROPHONE MARKET, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 102 INDUSTRIAL: ELECTRET MICROPHONE MARKET, BY REGION, 2022–2027 (USD THOUSAND)

TABLE 103 INDUSTRIAL: ELECTRET MICROPHONE MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 104 INDUSTRIAL: ELECTRET MICROPHONE MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 105 MEDICAL: ELECTRET MICROPHONE MARKET, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 106 MEDICAL: ELECTRET MICROPHONE MARKET, BY REGION, 2022–2027 (USD THOUSAND)

TABLE 107 MEDICAL: ELECTRET MICROPHONE MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 108 MEDICAL: ELECTRET MICROPHONE MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 109 NOISE MONITORING & SENSING: ELECTRET MICROPHONE MARKET, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 110 NOISE MONITORING & SENSING: ELECTRET MICROPHONE MARKET, BY REGION, 2022–2027 (USD THOUSAND)

TABLE 111 NOISE MONITORING & SENSING: ELECTRET MICROPHONE MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 112 NOISE MONITORING & SENSING: ELECTRET MICROPHONE MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

8.3 MEMS

8.3.1 HIGH PERFORMANCE AND COMPACT SIZE MAKE MEMS MICROPHONES SUITABLE FOR WEARABLES AND HEARING AIDS

TABLE 113 MEMS MICROPHONE MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 114 MEMS MICROPHONE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 115 MEMS MICROPHONE MARKET, BY APPLICATION, 2018–2021 (MILLION UNITS)

TABLE 116 MEMS MICROPHONE MARKET, BY APPLICATION, 2022–2027 (MILLION UNITS)

TABLE 117 MEMS MICROPHONE MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 118 MEMS MICROPHONE MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 119 MEMS MICROPHONE MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 120 MEMS MICROPHONE MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 121 AUTOMOTIVE: MEMS MICROPHONE MARKET, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 122 AUTOMOTIVE: MEMS MICROPHONE MARKET, BY REGION, 2022–2027 (USD THOUSAND)

TABLE 123 AUTOMOTIVE: MEMS MICROPHONE MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 124 AUTOMOTIVE: MEMS MICROPHONE MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 125 COMMERCIAL SECURITY & SURVEILLANCE: MEMS MICROPHONE MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 126 COMMERCIAL SECURITY & SURVEILLANCE: MEMS MICROPHONE MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 127 COMMERCIAL SECURITY & SURVEILLANCE: MEMS MICROPHONE MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 128 COMMERCIAL SECURITY & SURVEILLANCE: MEMS MICROPHONE MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 129 CONSUMER ELECTRONICS: MEMS MICROPHONE MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 130 CONSUMER ELECTRONICS: MEMS MICROPHONE MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 131 CONSUMER ELECTRONICS: MEMS MICROPHONE MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 132 CONSUMER ELECTRONICS: MEMS MICROPHONE MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 133 INDUSTRIAL: MEMS MICROPHONE MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 134 INDUSTRIAL: MEMS MICROPHONE MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 135 INDUSTRIAL: MEMS MICROPHONE MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 136 INDUSTRIAL: MEMS MICROPHONE MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 137 MEDICAL: MEMS MICROPHONE MARKET, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 138 MEDICAL: MEMS MICROPHONE MARKET, BY REGION, 2022–2027 (USD THOUSAND)

TABLE 139 MEDICAL: MEMS MICROPHONE MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 140 MEDICAL: MEMS MICROPHONE MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 141 NOISE MONITORING & SENSING: MEMS MICROPHONE MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 142 NOISE MONITORING & SENSING: MEMS MICROPHONE MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 143 NOISE MONITORING & SENSING: MEMS MICROPHONE MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 144 NOISE MONITORING & SENSING: MEMS MICROPHONE MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

8.4 OTHERS

TABLE 145 OTHER MICROPHONE MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 146 OTHER MICROPHONE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 147 OTHER MICROPHONE MARKET, BY APPLICATION, 2018–2021 (THOUSAND UNITS)

TABLE 148 OTHER MICROPHONE MARKET, BY APPLICATION, 2022–2027 (THOUSAND UNITS)

TABLE 149 OTHER MICROPHONE MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 150 OTHER MICROPHONE MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 151 OTHER MICROPHONE MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 152 OTHER MICROPHONE MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 153 AUTOMOTIVE: OTHER MICROPHONE MARKET, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 154 AUTOMOTIVE: OTHER MICROPHONE MARKET, BY REGION, 2022–2027 (USD THOUSAND)

TABLE 155 AUTOMOTIVE: OTHER MICROPHONE MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 156 AUTOMOTIVE: OTHER MICROPHONE MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 157 COMMERCIAL SECURITY & SURVEILLANCE: OTHER MICROPHONE MARKET, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 158 COMMERCIAL SECURITY & SURVEILLANCE: OTHER MICROPHONE MARKET, BY REGION, 2022–2027 (USD THOUSAND)

TABLE 159 COMMERCIAL SECURITY & SURVEILLANCE: OTHER MICROPHONE MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 160 COMMERCIAL SECURITY & SURVEILLANCE: OTHER MICROPHONE MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 161 CONSUMER ELECTRONICS: OTHER MICROPHONE MARKET, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 162 CONSUMER ELECTRONICS: OTHER MICROPHONE MARKET, BY REGION, 2022–2027 (USD THOUSAND)

TABLE 163 CONSUMER ELECTRONICS: OTHER MICROPHONE MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 164 CONSUMER ELECTRONICS: OTHER MICROPHONE MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 165 INDUSTRIAL: OTHER MICROPHONE MARKET, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 166 INDUSTRIAL: OTHER MICROPHONE MARKET, BY REGION, 2022–2027 (USD THOUSAND)

TABLE 167 INDUSTRIAL: OTHER MICROPHONE MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 168 INDUSTRIAL: OTHER MICROPHONE MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 169 MEDICAL: OTHER MICROPHONE MARKET, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 170 MEDICAL: OTHER MICROPHONE MARKET, BY REGION, 2022–2027 (USD THOUSAND)

TABLE 171 MEDICAL: OTHER MICROPHONE MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 172 MEDICAL: OTHER MICROPHONE MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 173 NOISE MONITORING & SENSING: OTHER MICROPHONE MARKET, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 174 NOISE MONITORING & SENSING: OTHER MICROPHONE MARKET, BY REGION, 2022–2027 (USD THOUSAND)

TABLE 175 NOISE MONITORING & SENSING: OTHER MICROPHONE MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 176 NOISE MONITORING & SENSING: OTHER MICROPHONE MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

9 MICROPHONE MARKET, BY APPLICATION (Page No. - 136)

9.1 INTRODUCTION

FIGURE 32 MEDICAL SEGMENT TO RECORD HIGHEST CAGR IN MICROPHONE MARKET FROM 2022 TO 2027

TABLE 177 MICROPHONE MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 178 MICROPHONE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 179 MICROPHONE MARKET, BY APPLICATION, 2018–2021 (MILLION UNITS)

TABLE 180 MICROPHONE MARKET, BY APPLICATION, 2022–2027 (MILLION UNITS)

9.2 AUTOMOTIVE

9.2.1 DEPLOYMENT OF MICROPHONES IN ADVANCED DRIVER-ASSISTANCE SYSTEMS TO FOSTER MARKET GROWTH

TABLE 181 AUTOMOTIVE: MICROPHONE MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 182 AUTOMOTIVE: MICROPHONE MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 183 AUTOMOTIVE: MICROPHONE MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 184 AUTOMOTIVE: MICROPHONE MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

9.3 COMMERCIAL SECURITY & SURVEILLANCE

9.3.1 ANTI-THEFT AND VISITOR MANAGEMENT SYSTEMS CONTRIBUTE MOST TO SIGNIFICANT DEMAND FOR MICROPHONES

TABLE 185 COMMERCIAL SECURITY & SURVEILLANCE: MICROPHONE MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 186 COMMERCIAL SECURITY & SURVEILLANCE: MICROPHONE MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 187 COMMERCIAL SECURITY & SURVEILLANCE: MICROPHONE MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 188 COMMERCIAL SECURITY & SURVEILLANCE: MICROPHONE MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

9.4 CONSUMER ELECTRONICS

9.4.1 IOT DEVICES AND VOICE-ACTIVATED SYSTEMS TO PUSH REQUIREMENT FOR MICROPHONES IN CONSUMER ELECTRONICS APPLICATIONS

TABLE 189 CONSUMER ELECTRONICS: MICROPHONE MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 190 CONSUMER ELECTRONICS: MICROPHONE MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 191 CONSUMER ELECTRONICS: MICROPHONE MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 192 CONSUMER ELECTRONICS: MICROPHONE MARKET, BY REGION, 2022–2027 (MILLION UNITS)

9.5 INDUSTRIAL

9.5.1 REQUIREMENT FOR MICROPHONES TO MONITOR NOISE LEVELS IN INDUSTRIAL EQUIPMENT LIKELY TO SUPPORT MARKET GROWTH

TABLE 193 INDUSTRIAL: MICROPHONE MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 194 INDUSTRIAL: MICROPHONE MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 195 INDUSTRIAL: MICROPHONE MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 196 INDUSTRIAL: MICROPHONE MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

9.6 MEDICAL

9.6.1 RISING USE OF MICROPHONE-EMBEDDED MEDICAL DEVICES TO ACCELERATE MARKET GROWTH

TABLE 197 MEDICAL: MICROPHONE MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 198 MEDICAL: MICROPHONE MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 199 MEDICAL: MICROPHONE MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 200 MEDICAL: MICROPHONE MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

9.7 NOISE MONITORING & SENSING

9.7.1 IMPLEMENTATION OF MICROPHONES IN DRONES AND NOISE MONITORING & SENSING SOLUTIONS TO FACILITATE MARKET GROWTH

TABLE 201 NOISE MONITORING & SENSING: MICROPHONE MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 202 NOISE MONITORING & SENSING: MICROPHONE MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 203 NOISE MONITORING & SENSING: MICROPHONE MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 204 NOISE MONITORING & SENSING: MICROPHONE MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

10 GEOGRAPHIC ANALYSIS (Page No. - 151)

10.1 INTRODUCTION

FIGURE 33 MICROPHONE MARKET, BY REGION (2022–2027)

TABLE 205 MICROPHONE MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 206 MICROPHONE MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 207 MICROPHONE MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 208 MICROPHONE MARKET, BY REGION, 2022–2027 (MILLION UNITS)

10.2 AMERICAS

FIGURE 34 AMERICAS: MICROPHONE MARKET SNAPSHOT

TABLE 209 AMERICAS: MICROPHONE MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 210 AMERICAS: MICROPHONE MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 211 AMERICAS: MICROPHONE MARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 212 AMERICAS: MICROPHONE MARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 213 AMERICAS: MICROPHONE MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 214 AMERICAS: MICROPHONE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 215 AMERICAS: MICROPHONE MARKET, BY APPLICATION, 2018–2021 (MILLION UNITS)

TABLE 216 AMERICAS: MICROPHONE MARKET, BY APPLICATION, 2022–2027 (MILLION UNITS)

TABLE 217 NORTH AMERICA: MICROPHONE MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 218 NORTH AMERICA: MICROPHONE MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 219 NORTH AMERICA: MICROPHONE MARKET, BY COUNTRY, 2018–2021 (MILLION UNITS)

TABLE 220 NORTH AMERICA: MICROPHONE MARKET, BY COUNTRY, 2022–2027 (MILLION UNITS)

10.2.1 US

10.2.1.1 High adoption of premium electronic products to promote microphone demand in US

10.2.2 CANADA

10.2.2.1 Canada’s preference for innovative products contributes to microphone market growth

10.2.3 MEXICO

10.2.3.1 Booming electronics manufacturing industry in Mexico to create lucrative opportunities for microphone providers

10.2.4 SOUTH AMERICA

10.2.4.1 Integration of microphones into fitness and sports wearables to propel market growth

10.3 EUROPE

FIGURE 35 EUROPE: MICROPHONE MARKET SNAPSHOT

TABLE 221 EUROPE: MICROPHONE MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 222 EUROPE: MICROPHONE MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 223 EUROPE: MICROPHONE MARKET, BY COUNTRY, 2018–2021 (MILLION UNITS)

TABLE 224 EUROPE: MICROPHONE MARKET, BY COUNTRY, 2022–2027 (MILLION UNITS)

TABLE 225 EUROPE: MICROPHONE MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 226 EUROPE: MICROPHONE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 227 EUROPE: MICROPHONE MARKET, BY APPLICATION, 2018–2021 (MILLION UNITS)

TABLE 228 EUROPE: MICROPHONE MARKET, BY APPLICATION, 2022–2027 (MILLION UNITS)

10.3.1 FRANCE

10.3.1.1 Consumer preference for smart devices to fuel demand for microphones

10.3.2 GERMANY

10.3.2.1 Autonomous vehicles and in-vehicle communication systems to stimulate demand for microphones

10.3.3 UK

10.3.3.1 Developed market for security & surveillance solutions to boost demand for microphones

10.3.4 REST OF EUROPE

10.4 ASIA PACIFIC

FIGURE 36 ASIA PACIFIC: MICROPHONE MARKET SNAPSHOT

TABLE 229 ASIA PACIFIC: MICROPHONE MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 230 ASIA PACIFIC: MICROPHONE MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 231 ASIA PACIFIC: MICROPHONE MARKET, BY COUNTRY, 2018–2021 (MILLION UNITS)

TABLE 232 ASIA PACIFIC: MICROPHONE MARKET, BY COUNTRY, 2022–2027 (MILLION UNITS)

TABLE 233 ASIA PACIFIC: MICROPHONE MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 234 ASIA PACIFIC: MICROPHONE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 235 ASIA PACIFIC: MICROPHONE MARKET, BY APPLICATION, 2018–2021 (MILLION UNITS)

TABLE 236 ASIA PACIFIC: MICROPHONE MARKET, BY APPLICATION, 2022–2027 (MILLION UNITS)

10.4.1 CHINA

10.4.1.1 Rising use of microphones in consumer electronics to accelerate market growth

10.4.2 JAPAN

10.4.2.1 Thriving automobile and electronics industries to boost demand for microphones

10.4.3 SOUTH KOREA

10.4.3.1 Security & surveillance application to contribute most to microphone market growth

10.4.4 REST OF ASIA PACIFIC

10.5 ROW

TABLE 237 ROW: MICROPHONE MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 238 ROW: MICROPHONE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 239 ROW: MICROPHONE MARKET, BY APPLICATION, 2018–2021 (THOUSAND UNITS)

TABLE 240 ROW: MICROPHONE MARKET, BY APPLICATION, 2022–2027 (THOUSAND UNITS)

11 COMPETITIVE LANDSCAPE (Page No. - 174)

11.1 OVERVIEW

11.2 MARKET SHARE ANALYSIS, 2021

TABLE 241 MICROPHONE MARKET: DEGREE OF COMPETITION

11.3 COMPANY EVALUATION QUADRANT

11.3.1 STARS

11.3.2 EMERGING LEADERS

11.3.3 PERVASIVE PLAYERS

11.3.4 PARTICIPANTS

FIGURE 37 MICROPHONE MARKET (GLOBAL): COMPANY EVALUATION QUADRANT, 2021

11.4 COMPETITIVE SCENARIO

TABLE 242 MICROPHONE MARKET: PRODUCT LAUNCHES, JANUARY 2020–MAY 2022

TABLE 243 MICROPHONE MARKET: TOP DEALS AND OTHER DEVELOPMENTS, JANUARY 2020–MAY 2022

12 COMPANY PROFILES (Page No. - 180)

(Business overview, Products offered, Product launches, Deals, MNM view)*

12.1 KEY PLAYERS

12.1.1 KNOWLES CORPORATION

TABLE 244 KNOWLES CORPORATION: BUSINESS OVERVIEW

FIGURE 38 KNOWLES CORPORATION: COMPANY SNAPSHOT

12.1.2 GOERTEK

TABLE 245 GOERTEK: BUSINESS OVERVIEW

FIGURE 39 GOERTEK: COMPANY SNAPSHOT

12.1.3 AAC TECHNOLOGIES

TABLE 246 AAC TECHNOLOGIES: BUSINESS OVERVIEW

FIGURE 40 AAC TECHNOLOGIES: COMPANY SNAPSHOT

12.1.4 TDK CORPORATION

TABLE 247 TDK CORPORATION: BUSINESS OVERVIEW

FIGURE 41 TDK CORPORATION: COMPANY SNAPSHOT

12.1.5 INFINEON TECHNOLOGIES

TABLE 248 INFINEON TECHNOLOGIES: BUSINESS OVERVIEW

FIGURE 42 INFINEON TECHNOLOGIES: COMPANY SNAPSHOT

12.1.6 STMICROELECTRONICS

TABLE 249 STMICROELECTRONICS: BUSINESS OVERVIEW

FIGURE 43 STMICROELECTRONICS: COMPANY SNAPSHOT

12.1.7 ZILLTEK TECHNOLOGY CORP.

TABLE 250 ZILLTEK TECHNOLOGY CORP.: BUSINESS OVERVIEW

FIGURE 44 ZILLTEK TECHNOLOGY CORP.: COMPANY SNAPSHOT

12.1.8 HOSIDEN CORPORATION

TABLE 251 HOSIDEN CORPORATION: BUSINESS OVERVIEW

FIGURE 45 HOSIDEN CORPORATION: COMPANY SNAPSHOT

12.1.9 GETTOP ACOUSTIC CO., LTD.

TABLE 252 GETTOP ACOUSTIC CO., LTD.: BUSINESS OVERVIEW

FIGURE 46 GETTOP ACOUSTIC CO., LTD.: COMPANY SNAPSHOT

12.1.10 BSE CO., LTD

TABLE 253 BSE CO., LTD.: BUSINESS OVERVIEW

*Details on Business overview, Products offered, Product launches, Deals, MNM view might not be captured in case of unlisted companies.

12.2 OTHER COMPANIES

12.2.1 SONION

12.2.2 CUI DEVICES

12.2.3 NEOMEMS TECHNOLOGIES

12.2.4 SUZHOU MINXIN MICROELECTRONICS TECHNOLOGY CO., LTD.

12.2.5 VESPER TECHNOLOGIES

12.2.6 SENSIBEL

12.2.7 PUI AUDIO, INC.

12.2.8 KINGSTATE ELECTRONICS CORPORATION

12.2.9 MERRY ELECTRONICS CO., LTD.

12.2.10 HARMONY ELECTRONICS CORPORATION

12.2.11 DB UNLIMITED

12.2.12 PARTRON CO. LTD.

12.2.13 GMEMS TECHNOLOGIES, INC.

12.2.14 KAIYUAN COMMUNICATION TECHNOLOGY (XIAMEN) CO., LTD.

12.2.15 STETRON

13 APPENDIX (Page No. - 215)

13.1 INSIGHTS FROM INDUSTRY EXPERTS

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.4 AVAILABLE CUSTOMIZATION

13.5 RELATED REPORT

13.6 AUTHOR DETAILS

The study involved four major activities in estimating the current size of the microphone market. Exhaustive secondary research was done to collect information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources for this research study included corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers; certified publications; articles by recognized authors; directories; and databases. The secondary data was collected and analyzed to determine the overall market size, further validated through primary research.

List of major secondary sources

|

SOURCE |

WEB LINK |

|

Federal Communications Commission (FCC) |

|

|

European Telecommunications Standards Institute (ETSI) |

|

|

International Electrotechnical Commission (IEC) |

https://www.iec.ch/ |

|

Federal Agency for Technical Regulation and Metrology (Rosstandart) |

https://www.gost.ru/ |

|

China Electronics Standardization Institute (CESI) |

https://www.cesi.cn/ |

|

Ministry of Internal Affairs and Communications (MIC) |

https://www.soumu.go.jp/ |

Primary Research

Extensive primary research was conducted after gaining knowledge about the current scenario of the microphone market through secondary research. Several primary interviews were conducted with experts from both the demand and supply sides across four major regions—North America, Europe, Asia Pacific, and RoW. This primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the microphone market and its various dependent submarkets. The key players in the market were identified through secondary research, and their market share in the respective regions was determined through primary and secondary research. This entire procedure involved the study of annual and financial reports of top players and extensive interviews with industry leaders such as chief executive officers (CEOs), vice presidents (VPs), directors, and marketing executives. All percentage shares and breakdowns were determined using secondary sources and verified through primary sources. All the possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Bottom-Up Approach

The bottom-up approach was used to arrive at the overall size of the microphone market from the revenues of the key players and their shares in the market. The overall market size was calculated based on the revenues of the key players identified in the market.

- Identifying various applications using or expected to implement microphone

- Analyzing each application, along with the major related companies and microphone providers

- Estimating the microphone market for applications

- Understanding the demand generated by companies operating across different applications

- Tracking the ongoing and upcoming implementation of projects based on microphone technology by applications and forecasting the market based on these developments and other critical parameters

- Carrying out multiple discussions with the key opinion leaders to understand the type of microphone-based products designed and developed. This information would help analyze the breakdown of the scope of work carried out by each major company in the microphone market.

- Arriving at the market estimates by analyzing microphone companies as per their countries and subsequently combining this information to arrive at the market estimates by region

- Verifying and cross-checking the estimates at every level through discussions with the key opinion leaders, including CXOs, directors, and operations managers, and finally with domain experts at MarketsandMarkets

- Studying various paid and unpaid sources of information, such as annual reports, press releases, white papers, and databases

Top-Down Approach

In the top-down approach, the overall market size has been used to estimate the size of the individual markets (mentioned in the market segmentation) through percentage splits from secondary and primary research.

To calculate the market size of specific segments, the most appropriate immediate parent market size has been used to implement the top-down approach. The top-down approach was implemented for the data extracted from the secondary research to validate the market size obtained.

Each company’s market share was estimated to verify the revenue shares used earlier in the top-down approach. The overall parent market size and individual market sizes were determined and confirmed in this study by the data triangulation method and the validation of data through primaries. The data triangulation method used in this study is explained in the next section.

- Focusing on top-line investments and expenditures being made in the ecosystems of various applications. Additionally, listing key developments, analyzing updated technology in the marketplace, as well as evaluating the market by further splitting it into various technology

- Building and developing the information related to the market revenue generated by key microphone manufacturers

- Conducting multiple on-field discussions with the key opinion leaders involved in the development of microphone products in various applications

- Estimating geographic splits using secondary sources based on various factors, such as the number of players in a specific country and region, the offering of microphone, and the level of solutions offered in different applications

- The impact of the recession on the steps mentioned above has also been considered.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the overall market has been split into several segments and subsegments. The data triangulation procedure has been employed wherever applicable to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Additionally, the market size has been validated using top-down and bottom-up approaches.

Market Definition

A microphone is an electronic device that converts sound waves into an electrical signal. Microphones work based on the principle of transduction, where they convert sound waves (acoustic energy) into electrical signals (electrical energy). This conversion process involves a diaphragm or a membrane that vibrates in response to sound waves. The diaphragm’s vibrations cause a corresponding variation in an electrical signal, typically voltage or current, representing the captured sound. It is commonly used for capturing audio in various applications, such as voice recording, live performances, broadcasting, communication devices, and audio production.

Key Stakeholders

- Microphone Manufacturers

- Suppliers and Distributors

- Microphone Vendors

- System Integrators

- Professional Audio Industry

- Consumers

- Regulatory Authorities

- Industry Associations and Standards Organizations

- Research Institutions

Report Objectives

- To define, describe, and forecast the microphone market based on technology, MEMS type, communication technology, application, and region.

- To forecast the shipment data of the microphone market based on technology and consumer electronics applications.

- To forecast the size of the market segments for four major regions—North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To study the complete value chain and allied industry segments and perform a value chain analysis of the market

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

- To analyze the opportunities in the market for stakeholders and describe the competitive landscape of the market

- To analyze competitive developments such as joint ventures, collaborations, agreements, contracts, partnerships, mergers & acquisitions, product developments, and research & development (R&D) in the market

- To analyze the impact of the recession on the microphone market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players (up to 5)

- Additional country-level analysis of the microphone market

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the microphone market.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Microphone Market