Military Drone Market Size, Share & Industry Growth Analysis Report by Platform, Type (Fixed Wing, Rotary Wing, And Hybrid), Application, Mtow, Propulsion (Turbo Engine, Piston Engine and Battery), Operation Mode, Speed, Launching Mode & Region - Global Growth Driver and Industry Forecast to 2027

Updated on : April 03, 2023

The Global Military Drone Market Size was valued at $12.0 Billion in 2022 and is projected to reach $17.0 Billion by 2027 at a CAGR (Compound Annual Growth Rate) of 7.3%. Military drones equipped with sensors, transmitters, and weapons can be guided autonomously, by remote control, or both. They are used for strategic and combat zone reconnaissance, and can also designate targets for precision-guided munitions or directly deploy them. This report offers insights into market trends, drivers, challenges, and opportunities in the military drone industry.

The earliest UAVs were known as remotely piloted vehicles (RPVs) or drones. They were small radio-controlled aircraft first used during World War II for target training for fighters and antiaircraft guns. Today, all major military powers and even some militia groups employ battlefield surveillance UAVs to extend the view of the ground and naval forces and to enhance the reach and accuracy of their supporting fire.

To know about the assumptions considered for the study, Request for Free Sample Report

Military drone market Dynamics:

Driver: Increasing government funding for military drones

The government funding for military drones is increasing to enhance the efficiency of military operations. This will boost demand and increase the production of military drones. According to a report published by the Bard College Center for the Study of the Drone, in 2019, the US Navy’s funding for unmanned systems increased by USD 1 billion (38%) and the US Army’s funding increased by USD 719 million (73%) when compared to 2018. The US Department of Defense (DOD) also requested approximately USD 9.39 billion for drones and associated technologies in the fiscal year 2019, representing a significant expansion of 26% in drone spending over the 2018 budget, which was USD 7.5 billion. The DOD has been allocated about USD 7.5 billion in the fiscal year 2021 for a variety of robotic platforms and related technologies, according to a recent study by the Association for Unmanned Vehicle Systems International. Most of the global defense spending is attributed to the development and procurement of drones.

Restraint: Lack of trained personnel top operate drone

Unlike conventional aircraft, military drones need to ensure the reliability of the entire unmanned aerial system, which includes UAVs, ground control stations, and communication equipment. Drones can fly at different altitudes and require skilled pilots to control and operate them. The number of pilots available for high precision operations is comparatively low. An increase in drone adoption in the military drone verticals adds to the growing need for skilled drone pilots. Presently, to reduce the number of accidents caused due to the poor control skills of drone operators, efforts are underway to improve the autonomy of these systems.

Opportunity: Use of UAVs for cargo delivery in military operation

Various new military applications are being uncovered wherein UAVs can be used. One of these applications involves the use of UAVs for the delivery of military cargo. Drones can be used to resupply soldiers on the battlefield. The idea of using UAVs for cargo delivery in the military sector came from the commercial sector, where drones are being used to deliver products to customers by companies such as Amazon. Currently, a major portion of military supplies is transported through road convoys, making the convoys vulnerable to enemy attacks. UAVs, on the other hand, take aerial routes, which can be changed so that the risks of enemy attacks on convoys can be reduced. The use of UAVs for military cargo delivery also eliminates high-risk situations for soldiers in convoys. Deliveries using UAVs will be faster and safer as compared to traditional road convoys.

The first military cargo delivery using drones was carried out by the US Marine Corps in 2012: it successfully used an unmanned K-MAX helicopter to deliver a cumulative of 2 million kilograms (4.4 million lbs.) of supplies to soldiers in Afghanistan. Though the delivery was successful, the use of UAVs for cargo delivery in the defense sector is not widespread. Researchers are trying to develop drones that can deliver supplies to soldiers in any location. For instance, the US military is developing a drone—the Joint Tactical Aerial Resupply Vehicle (JTARV)—capable of resupplying soldiers on the battlefield. The DeltaQuad Pro by Vertical Technologies—designed to carry industrial cargo over a 150 km range—is a military drone featuring a payload drop mechanism and advanced long-range communication systems.

Challenge: Issue with safety and security of UAVs

The security of UAVs during military operations is a major concern for militaries. UAVs operate remotely or autonomously. In both cases, there is a possibility of hacking flight control systems of UAVs and taking control of their operations. For instance, in July 2012, a team from Texas University was able to take control of a UAV using GPS spoofing devices that cost only USD 1,000, thereby disrupting operations of the UAV, and sending it off course. The US also wants to avoid incidents like the 2011 Iranian capture and eventual reverse engineering of the classified Lockheed Martin RQ-170. Manufacturers of military UAVs have to ensure that the control systems of UAVs cannot be hacked easily to make them more secure to use.

Based on type, the fixed wing military drone segment is projected to grow at the highest CAGR during the forecast period.

The military drone market Share has been segmented based on type into fixed wing, rotary wing, and hybrid. The fixed-wing segment has been further divided into conventional take-off and landing (CTOL) and vertical take-off and landing (VTOL), while the rotary wing segment has been classified into single rotor and multirotor.

Fixed-wing drones make use of wings to move upward from the ground during take-off, just like airplanes. They require engines to offer them a forward thrust, while wings offer them the required vertical lift to fly. Fixed-wing UAVs can fly longer than rotary-wing drones. They are most distinct in terms of their payloads, endurance ranges, and applications. The drawback of fixed-wing drones is the requirement of runways for their landing or take-off. Some examples of fixed-wing UAVs are MQ-9 Reaper and MQ-1 Predator from General Atomics (US) and RQ-4 Global Hawk from Northrop Grumman Corporation (US). Fixed-wing drones are further classified into conventional take-off and landing (CTOL) UAVs and vertical take-off and landing (VTOL) UAVs. The fixed-wing segment is projected to grow from USD 11,310 million in 2021 to USD 15,940 million by 2027, at a CAGR of 7.1% during the forecast period.

Based on operation mode, remotely piloted segment is estimated to account for the largest share in 2022.

Based on operation mode, the military drone market Report has been classified into remotely piloted, optionally piloted, and fully autonomous. The remotely piloted segment is projected to grow at a significant rate during the forecast period. The growth of this segment can be attributed to the cost-effective usage of remotely piloted drones in several applications, ranging from defense operations to surveys. Optionally piloted drones deliver high maneuverability and are equipped with advanced technologies. They have comparatively low maintenance costs. These drones are anticipated to be substituted by fully autonomous drones in the coming years as they have high payload capacity, enhanced propulsion power, and long endurance, as well as can operate without any human involvement.

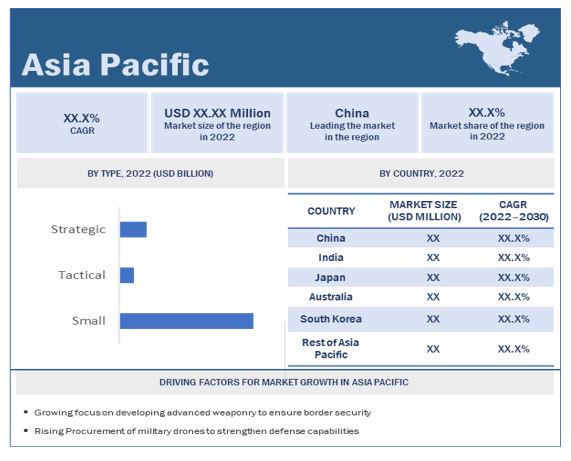

The Asia Pacific region is projected to Grow at highest CAGR during the forecast period

Asia Pacific military drone market outlook is expected to witness substantial growth and register the highest CAGR during the forecast period. The market growth in this region can be attributed to the rise in military spending of countries to enhance their defense capabilities. Political tensions in Asia Pacific countries have led to the deployment of drones to safeguard the security of their borders. This serves to be one of the most significant factors driving the growth of the market in this region. China is developing innovative technologies to manufacture low-cost drones.

To know about the assumptions considered for the study, download the pdf brochure

Top Military Drone Companies - Key Market Players

The military drone companies are dominated by a few globally established players such as Northrop Grumman Corporation (US), Raytheon Technologies Corporation (US), Israel Aerospace Industries Ltd. (Israel), General Atomics Aeronautical Systems (GA-ASI) (US), and Teledyne FLIR LLC (US). These players have adopted various growth strategies such as contracts, joint ventures, partnerships & agreements, acquisitions, and new product launches to further expand their presence in the military drone market statistics.

Military Drone Market Report Scope:

|

Report Metric |

Details |

| Estimated Market Size | USD 12.0 Billion |

| Projected Market Size | USD 17.0 Billion |

| Growth Rate | 7.3% |

|

Forecast period |

2022-2027 |

|

Market size available for years |

2019-2027 |

|

Base year considered |

2021 |

|

Forecast units |

Value (USD) |

|

Segments covered |

By Platform, By Type, By Application, By MTOW, By Propulsion, By Operation Mode, By Speed, By Launching Mode, and By Region |

|

Geographies covered |

|

|

Companies covered |

Northrop Grumman Corporation (US), Raytheon Technologies Corporation (US), Israel Aerospace Industries Ltd. (Israel), General Atomics Aeronautical Systems (GA-ASI) (US), and Teledyne FLIR LLC (US) |

|

Companies covered (Drone start-ups and military drone ecosystem) |

Dynetics, Inc. (US), Robotican Corporation (Israel), Volansi, Inc. (US), Griffon Aerospace (US) |

This research report categorizes the military drone market trends based on platform, type, application, mtow, propulsion, operation mode, speed, launching mode, and region

By Platform

-

Small

- Nano

- Micro

- Mini

-

Tactical

- Close Range

- Short Range

- Medium Range

- Long Range

-

Strategic

- High Altitude Long Endurance (HALE)

- Medium Altitude Long Endurance (MALE)

By Type

- Fixed Wing

- Rotary Wing

- Hybrid

By Application

-

Unmanned Combat Aerial Vehicles (UCAVs)

- Lethal

- Stealth

- Target

- Intelligence, Surveillance, and Reconnaissance (ISR)

- Delivery

By Mtow

- <150 Kg

- 150-1,200 Kg

- >1,200 Kg

By Propulsion

- Turbo Engine

- Piston Engine

- Battery

By Operation Mode

- Remotely Piloted

- Optionally Piloted

- Fully Autonomous

By Speed

-

Subsonic

- <50 Km/hr

- 51-300 Km/hr

- >300 Km/hr

- Supersonic

By Launching Mode

- Vertical Take-off

- Automatic Take-off and Landing

- Catapult Launcher

- Hand Launched

By Region

- North America

- Europe

- Asia Pacific

- Middle East

- Latin America

- Africa

Recent Developments

- In March 2022, Gambit is an Autonomous Collaborative Platform (ACP) designed through digital engineering to speed its time to market and lower acquisition costs. The jet-powered platform is being built for air dominance and will heavily leverage advances in artificial intelligence and autonomous systems.

- In December 2021, The Mojave is an unmanned aerial vehicle (UAV) capable of short takeoff and landing (STOL). Mojave essentially takes a Gray Eagle fuselage and adds enlarged wings with high-lift devices and a Rolls Royce 450-horsepower turboprop engine. The UAS is based on the avionics and flight control systems of the MQ-9 Reaper and the MQ-1C Gray Eagle- Extended Range.

- In October 2021, Teledyne FLIR Defense, a part of Teledyne FLIR LLC, announced the launch of the ION M640x tactical Unmanned Aerial System (UAS). The UAS builds on the capabilities of the ION M440 (a Blue sUAS) and will provide military and other government customers with best-in-class capabilities for their unique missions.

- In March 2021, the Boeing MQ-28 Ghost Bat, previously known as the Boeing Airpower Teaming System (ATS) and the Loyal Wingman project, completed its first test flight.

- In January 2021, Long Runner is a strategic UAV controlled by satellite communication with a precise automated take-off and landing (ATOL) capability. This innovative capability offers utmost operational flexibility by eliminating the need for a ground control station and flight crew to be allocated at the aircraft's forward base.

Frequently Asked Questions (FAQs):

What is the current size of the military drone market?

The military drone market is projected to grow from USD 12.0 billion in 2022 to USD 17.0billion by 2027, at a CAGR of 7.3%

Who are the winners in the military drone market?

Northrop Grumman Corporation (US), Raytheon Technologies Corporation (US), Israel Aerospace Industries Ltd. (Israel), General Atomics Aeronautical Systems (GA-ASI) (US), and Teledyne FLIR LLC (US).

What are some of the technological advancements in the market?

- Several technological advancement has been taking place such as AI in military drones. This new technology enables drones to perform all tasks, from their launch and navigation to data acquisition, data transmission, and data analysis. The incorporation of AI in drones will also reduce the number of skills required by UAV pilots.

-

Signals intelligence (SIGINT) is “a category of intelligence comprising either individually or in combination all communications intelligence, electronic intelligence, and foreign instrumentation signals intelligence, however transmitted”.

What are the factors driving the growth of the market?

Increasing government funding for military drones, growing prominence of intensified military training, and growing use of UAVs for marine border patrolling some factors that driving the growth of the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 38)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

1.2.2 MARKETS COVERED

FIGURE 1 MILITARY DRONE MARKET SEGMENTATION

1.2.3 REGIONAL SCOPE

1.2.4 YEARS CONSIDERED

1.3 CURRENCY & PRICING

1.4 USD EXCHANGE RATES

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

FIGURE 2 MILITARY DRONE MARKET TO GROW SLOWER THAN PREVIOUS ESTIMATES

2 RESEARCH METHODOLOGY (Page No. - 43)

2.1 RESEARCH DATA

FIGURE 3 RESEARCH PROCESS FLOW

FIGURE 4 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key Insights from primary sources

2.1.2.2 Key data from primary sources

2.2 FACTOR ANALYSIS

2.2.1 INTRODUCTION

2.2.2 DEMAND-SIDE INDICATORS

2.2.3 SUPPLY-SIDE INDICATORS

2.3 RESEARCH APPROACH AND METHODOLOGY

2.3.1 BOTTOM-UP APPROACH

2.3.1.1 Market size estimation & methodology

2.3.1.2 Regional split of military drone market

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.4 DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.5 RESEARCH ASSUMPTIONS

2.6 RISKS

3 EXECUTIVE SUMMARY (Page No. - 51)

FIGURE 8 BY PLATFORM, STRATEGIC SEGMENT PROJECTED TO LEAD MARKET FROM 2022 TO 2027

FIGURE 9 BY APPLICATION, ISR SEGMENT PROJECTED TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

FIGURE 10 BY SPEED, SUBSONIC SEGMENT PROJECTED TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

FIGURE 11 BY TYPE, FIXED-WING SEGMENT PROJECTED TO DOMINATE MARKET DURING FORECAST PERIOD

FIGURE 12 BY LAUNCHING MODE, AUTOMATIC TAKE-OFF AND LANDING SEGMENT PROJECTED TO LEAD MARKET DURING FORECAST PERIOD

FIGURE 13 BY OPERATION MODE, OPTIONALLY PILOTED SEGMENT PROJECTED TO DOMINATE MARKET DURING FORECAST PERIOD

FIGURE 14 BY PROPULSION, TURBO ENGINE SEGMENT PROJECTED TO LEAD MARKET DURING FORECAST PERIOD

FIGURE 15 BY MTOW, >1,200 KG SEGMENT PROJECTED TO DOMINATE MARKET DURING FORECAST PERIOD

FIGURE 16 NORTH AMERICA ESTIMATED TO ACCOUNT FOR LARGEST MARKET SHARE IN 2022

4 PREMIUM INSIGHTS (Page No. - 56)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR PLAYERS IN MILITARY DRONE MARKET

FIGURE 17 INCREASING GOVERNMENT FUNDING ON MILITARY DRONES TO DRIVE MARKET

4.2 SMALL MILITARY DRONE MARKET, BY PLATFORM

FIGURE 18 MINI DRONE SEGMENT PROJECTED TO LEAD MARKET DURING FORECAST PERIOD

4.3 TACTICAL MILITARY DRONE MARKET, BY PLATFORM

FIGURE 19 LONG RANGE SEGMENT PROJECTED TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

4.4 STRATEGIC MILITARY DRONE MARKET, BY PLATFORM

FIGURE 20 HALE SEGMENT PROJECTED TO LEAD MARKET DURING FORECAST PERIOD

4.5 UCAVS MILITARY DRONE MARKET, BY APPLICATION

FIGURE 21 LETHAL SEGMENT PROJECTED TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

4.6 MILITARY DRONE MARKET, BY SUBSONIC SPEED

FIGURE 22 100-300 KM SEGMENT PROJECTED TO LEAD MARKET DURING FORECAST PERIOD

4.7 MILITARY DRONE MARKET, BY PROPULSION

FIGURE 23 TURBO ENGINE SEGMENT PROJECTED TO DOMINATE MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 60)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 24 MILITARY DRONE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Increasing government funding for military drones

TABLE 1 DEFENSE SPENDING OF MAJOR ECONOMIES

5.2.1.2 Growing prominence of intensified military training

TABLE 2 NUMBER OF ACTIVE CONFLICTS ACROSS THE GLOBE

FIGURE 25 NUMBER OF COUNTRIES DEVELOPING, ACQUIRING, AND USING ARMED DRONES, 2000-2020

5.2.1.3 Growing use of UAVs for marine border patrolling

5.2.1.4 Rising focus on advanced C4ISR capabilities

5.2.2 RESTRAINTS

5.2.2.1 Lack of trained personnel to operate drones

5.2.2.2 Concern and call to ban fully autonomous drones

5.2.3 OPPORTUNITIES

5.2.3.1 State policies aimed at boosting domestic manufacturers

5.2.3.2 Use of UAVs for cargo delivery in military operations

5.2.3.3 Technological advancements in drone payloads

5.2.3.4 Full-scale conversion of drones for simulation of war scenario

5.2.4 CHALLENGES

5.2.4.1 Issues with safety and security of UAVs

5.2.4.2 Lack of sustainable power sources to improve drone endurance

TABLE 3 ENDURANCE-BASED MAPPING OF POWER SOURCES

5.3 MILITARY DRONE MARKET ECOSYSTEM

5.3.1 PROMINENT COMPANIES

5.3.2 PRIVATE AND SMALL ENTERPRISES

5.3.3 START-UPS

5.3.4 END USERS

FIGURE 26 MILITARY DRONE MARKET ECOSYSTEM MAP

TABLE 4 MILITARY DRONE MARKET ECOSYSTEM

5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMER'S BUSINESSES

5.4.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR MILITARY DRONE MARKET

FIGURE 27 REVENUE SHIFT IN MILITARY DRONE MARKET

5.5 TECHNOLOGY ANALYSIS

5.5.1 AI IN MILITARY DRONES

TABLE 5 COMPANIES DEVELOPING DRONE SOFTWARE WITH AI

TABLE 6 COMPANIES DEVELOPING DRONE EQUIPMENT WITH AI

5.5.2 MID-AIR REFUELING OF DRONES

5.5.3 SPY DRONES

5.5.4 UNMANNED COMBAT AERIAL VEHICLES

5.5.5 ANTI-UAV DEFENSE SYSTEMS

5.6 VALUE CHAIN ANALYSIS OF MILITARY DRONE MARKET

FIGURE 28 VALUE CHAIN ANALYSIS

5.7 PORTER’S FIVE FORCES ANALYSIS

TABLE 7 MILITARY DRONE MARKET: PORTER’S FIVE FORCE ANALYSIS

FIGURE 29 MILITARY DRONES MARKET: PORTER’S FIVE FORCE ANALYSIS

5.7.1 THREAT OF NEW ENTRANTS

5.7.2 THREAT OF SUBSTITUTES

5.7.3 BARGAINING POWER OF SUPPLIERS

5.7.4 BARGAINING POWER OF BUYERS

5.7.5 INTENSITY OF COMPETITIVE RIVALRY

5.8 KEY STAKEHOLDERS AND BUYING CRITERIA

5.8.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 30 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE APPLICATIONS

TABLE 8 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE APPLICATIONS (%)

5.8.2 BUYING CRITERIA

FIGURE 31 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

TABLE 9 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

5.9 TRADE DATA ANALYSIS

TABLE 10 US, CHINA, AND ISRAEL: IMPORT AND EXPORT STATISTICS FOR MILITARY DRONE

5.10 KEY CONFERENCES AND EVENTS IN 2022–2023

TABLE 11 MILITARY DRONE MARKET: CONFERENCES AND EVENTS

5.11 OPERATIONAL DATA

FIGURE 32 ACTIVE FLEET OF DRONES USED BY US NAVY AND MARINE (BY UNITS)

FIGURE 33 ACTIVE FLEET OF DRONES USED BY US AIR FORCE (BY UNITS)

5.12 PRICING ANALYSIS

5.12.1 AVERAGE SELLING PRICE OF KEY PLAYERS, BY APPLICATION

FIGURE 34 AVERAGE SELLING PRICES OF KEY PLAYERS FOR TOP 3 APPLICATIONS

TABLE 12 AVERAGE SELLING PRICES OF KEY PLAYERS FOR TOP 3 APPLICATIONS (USD MILLION)

6 INDUSTRY TRENDS (Page No. - 83)

6.1 INTRODUCTION

6.2 EMERGING TECHNOLOGY TRENDS

6.2.1 SYNTHETIC APERTURE RADAR

6.2.2 SIGINT BY DRONES

6.2.3 ELECTRONIC WARFARE USING MILITARY DRONES

6.2.4 MANNED-UNMANNED TEAMING (MUM-T)

6.2.5 EO/IR SYSTEMS

6.2.6 TARGET DRONES

6.2.7 ENDURANCE

6.2.8 HYPERSONIC ARMED DRONES

6.3 USE CASE ANALYSIS

6.3.1 AEROVIRONMENT’S MARITIME INITIATIVE

TABLE 13 AEROVIRONMENT UAS FOR MARITIME COUNTER-TRAFFICKING OPERATIONS

6.3.2 TURKISH-MADE DRONES HELP SINK MOSKVA, FLAGSHIP OF RUSSIAN BLACK SEA FLEET

TABLE 14 BIG GUNS AND SMALL DRONES: DEVASTATING COMBO USED BY UKRAINE TO FIGHT OFF RUSSIA

6.3.3 NAGORNO-KARABAKH CONFLICT

TABLE 15 NAGORNO-KARABAKH CONFLICT INDICATED INCREASING IMPORTANCE OF ARMED DRONES ALONG WITH OTHER WEAPONS AND HIGHLY TRAINED GROUND FORCES

6.3.4 TEAR GAS BY DRONE

TABLE 16 EXPERIMENTING WITH DRONES FOR TEAR GAS DROP

6.4 IMPACT OF MEGATRENDS

6.5 MATURITY MAPPING OF DRONE TECHNOLOGIES

FIGURE 35 MATURITY STAGES OF DRONE TECHNOLOGIES

6.6 PATENT ANALYSIS

TABLE 17 PATENTS RELATED TO MILITARY DRONES GRANTED BETWEEN 2018 AND 2022

7 MILITARY DRONE MARKET, BY PLATFORM (Page No. - 93)

7.1 INTRODUCTION

FIGURE 36 BY PLATFORM, STRATEGIC SEGMENT PROJECTED TO DOMINATE MARKET FROM 2022 TO 2027

TABLE 18 MILITARY DRONE MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 19 MILITARY DRONES MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

7.2 SMALL

7.2.1 GROWING ADOPTION OF SMALL MILITARY DRONES FOR ISR APPLICATIONS WORLDWIDE

TABLE 20 SMALL MILITARY DRONE MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 21 SMALL MILITARY DRONES MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

7.2.2 NANO

7.2.3 MICRO

7.2.4 MINI

7.3 TACTICAL

7.3.1 GROWING NEED FOR REAL-TIME SURVEILLANCE DATA BY MILITARIES

TABLE 22 TACTICAL MILITARY DRONE MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 23 TACTICAL MILITARY DRONES MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

7.3.2 CLOSE RANGE

7.3.3 SHORT RANGE

7.3.4 MEDIUM RANGE

7.3.5 LONG RANGE

7.4 STRATEGIC

7.4.1 INCREASING DEPLOYMENT OF STRATEGIC DRONES OWING TO HIGH PAYLOAD CARRYING CAPACITY

TABLE 24 STRATEGIC MILITARY DRONE MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 25 STRATEGIC MILITARY DRONES MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

7.4.2 HALE

7.4.3 MALE

8 MILITARY DRONE MARKET, BY APPLICATION (Page No. - 99)

8.1 INTRODUCTION

FIGURE 37 BY APPLICATION, ISR SEGMENT PROJECTED TO LEAD MARKET FROM 2022 TO 2027

TABLE 26 MILITARY DRONE MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 27 MILITARY DRONES MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

8.2 UCAVS

8.2.1 EMERGENCE OF UCAVS AS GENUINE MILITARY FORCE MULTIPLIERS

TABLE 28 UCAVS MILITARY DRONE MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 29 UCAVS MILITARY DRONES MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

8.2.2 LETHAL/COMBAT

8.2.3 STEALTH

8.2.4 TARGET

8.3 ISR

8.3.1 GROWING DEMAND FOR ADVANCED SURVEILLANCE

8.4 DELIVERY

8.4.1 DRONES UTILIZED FOR DELIVERY OF MEDICAL AIDS, FOOD SUPPLIES, AND AMMUNITIONS ON BATTLEFIELDS

9 MILITARY DRONE MARKET, BY MTOW (Page No. - 104)

9.1 INTRODUCTION

FIGURE 38 BY MTOW, >1,200 KG SEGMENT ANTICIPATED TO LEAD MARKET DURING FORECAST PERIOD

TABLE 30 MILITARY DRONE MARKET, BY MTOW, 2019–2021 (USD MILLION)

TABLE 31 MILITARY DRONES MARKET, BY MTOW, 2022–2027 (USD MILLION)

9.2 <150 KG

9.2.1 GROWING USE OF LOW-WEIGHT NANO AND MICRO DRONES FOR SURVEILLANCE IN URBAN BATTLEFIELDS AND CONFINED SPACES

9.3 150–1,200 KG

9.3.1 GROWING USE OF UAVS WITH 150–1,200 KG MTOW IN MILITARY APPLICATIONS

9.4 >1,200 KG

9.4.1 INCREASING USE OF HIGH PAYLOAD CAPACITY COMBAT DRONES BY ARMED FORCES WITH PRECISION-GUIDED AMMUNITIONS

10 MILITARY DRONE MARKET, BY SPEED (Page No. - 107)

10.1 INTRODUCTION

FIGURE 39 BY SPEED, SUBSONIC SEGMENT ESTIMATED TO HOLD LARGER MARKET SHARE IN 2022

TABLE 32 MILITARY DRONE MARKET, BY SPEED, 2019–2021 (USD MILLION)

TABLE 33 MILITARY DRONES MARKET, BY SPEED, 2022–2027 (USD MILLION)

10.2 SUBSONIC

10.2.1 DEVELOPMENT OF SUBSONIC AERIAL TARGET DRONES WITH ANTI-CRUISE MISSILE CAPABILITIES

TABLE 34 SUBSONIC MILITARY DRONES MARKET, BY SPEED, 2019–2021 (USD MILLION)

TABLE 35 SUBSONIC MILITARY DRONES MARKET, BY SPEED, 2022–2027 (USD MILLION)

10.2.2 <100 KM/HR

10.2.3 100–300 KM/HR

10.2.4 >300 KM/HR

10.3 SUPERSONIC

10.3.1 RISING NEED TO DEVELOP HIGH-SPEED AERIAL COMBAT VEHICLES

11 MILITARY DRONE MARKET, BY TYPE (Page No. - 111)

11.1 INTRODUCTION

FIGURE 40 BY TYPE, FIXED-WING SEGMENT PROJECTED TO DOMINATE MARKET FROM 2022 TO 2027

TABLE 36 MILITARY DRONE MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 37 MILITARY DRONES MARKET, BY TYPE, 2022–2027 (USD MILLION)

11.2 FIXED WING

11.2.1 DEMAND FOR LONG-RANGE AND HIGH-SPEED MILITARY DRONES TO BOOST SEGMENT

11.3 ROTARY WING

11.3.1 RISING ADOPTION OF ROTARY WING DRONES FOR ISR APPLICATIONS

11.4 HYBRID

11.4.1 HYBRID DRONES CAN CARRY HEAVY PAYLOADS

12 MILITARY DRONE MARKET, BY OPERATION MODE (Page No. - 114)

12.1 INTRODUCTION

FIGURE 41 BY OPERATION MODE, OPTIONALLY PILOTED SEGMENT PROJECTED TO DOMINATE MARKET FROM 2022 TO 2027

TABLE 38 MILITARY DRONE MARKET, BY OPERATION MODE, 2019–2021 (USD MILLION)

TABLE 39 MILITARY DRONES MARKET, BY OPERATION MODE, 2022–2027 (USD MILLION)

12.2 REMOTELY PILOTED

12.2.1 INCREASED ADOPTION OF REMOTELY PILOTED DRONES AS MAN-PORTABLE DRONES BY ARMED FORCES

12.3 OPTIONALLY PILOTED

12.3.1 INCREASING USE OF OPTIONALLY PILOTED DRONES USED FOR ISR APPLICATIONS

12.4 FULLY AUTONOMOUS

12.4.1 SURGE IN DEVELOPMENT OF LETHAL AUTONOMOUS WEAPONS SYSTEMS (LAWS)

13 MILITARY DRONE MARKET, BY LAUNCHING MODE (Page No. - 117)

13.1 INTRODUCTION

FIGURE 42 BY LAUNCHING MODE, AUTOMATIC TAKE-OFF AND LANDING SEGMENT PROJECTED TO LEAD MARKET FROM 2022 TO 2027

TABLE 40 MILITARY DRONE MARKET, BY LAUNCHING MODE, 2019–2021 (USD MILLION)

TABLE 41 MILITARY DRONES MARKET, BY LAUNCHING MODE, 2022–2027 (USD MILLION)

13.2 VERTICAL TAKE-OFF

13.2.1 GROWING USE OF ROTARY-WING DRONES TO DRIVE SEGMENT

13.3 AUTOMATIC TAKE-OFF AND LANDING

13.3.1 INCREASING DEMAND FOR HALE AND MALE DRONES TO DRIVE SEGMENT

13.4 CATAPULT LAUNCHER

13.4.1 RISING ADOPTION OF SMALL DRONES FOR ISR ACTIVITIES TO DRIVE DEMAND

13.5 HAND LAUNCHED

13.5.1 GROWING USE OF MINI AND NANO DRONES BY TROOPS DEPLOYED IN HAZARDOUS AREAS TO DRIVE SEGMENT

14 MILITARY DRONE MARKET, BY PROPULSION (Page No. - 121)

14.1 INTRODUCTION

FIGURE 43 BY PROPULSION, BATTERY SEGMENT PROJECTED TO RECORD HIGHEST GROWTH RATE FROM 2022 TO 2027

TABLE 42 MILITARY DRONE MARKET, BY PROPULSION, 2019–2021 (USD MILLION)

TABLE 43 MILITARY DRONES MARKET, BY PROPULSION, 2022–2027 (USD MILLION)

14.2 TURBO ENGINE

14.2.1 HIGH PREFERENCE FOR TURBO ENGINES SUCH AS TURBOJET & TURBOFAN IN HIGH ENDURANCE DRONES

14.3 PISTON ENGINE

14.3.1 LOW COST AND SIMPLE ENGINE DESIGN WIDELY POPULAR IN SMALL DRONES

14.4 BATTERY

14.4.1 FUEL CELL-OPERATED DRONES GAINING POPULARITY IN MILITARY APPLICATIONS

15 REGIONAL ANALYSIS (Page No. - 124)

15.1 INTRODUCTION

FIGURE 44 ASIA PACIFIC PROJECTED TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 44 MILITARY DRONE MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 45 MILITARY DRONES MARKET, BY REGION, 2022–2027 (USD MILLION)

15.2 NORTH AMERICA

15.2.1 PESTLE ANALYSIS: NORTH AMERICA

FIGURE 45 NORTH AMERICA: MILITARY DRONE MARKET SNAPSHOT

TABLE 46 NORTH AMERICA: MILITARY DRONES MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 47 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 48 NORTH AMERICA: MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 49 NORTH AMERICA: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 50 NORTH AMERICA: MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 51 NORTH AMERICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 52 NORTH AMERICA: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 53 NORTH AMERICA: MILITARY DRONE MARKET, BY TYPE, 2022–2027 (USD MILLION)

15.2.2 US

15.2.2.1 High investment and constant innovation in drone technology

TABLE 54 US: MILITARY DRONE MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 55 US: MARKET, BY PLATFORM 2022–2027 (USD MILLION)

TABLE 56 US: MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 57 US: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 58 US: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 59 US MILITARY DRONES MARKET, BY TYPE, 2022–2027 (USD MILLION)

15.2.3 CANADA

15.2.3.1 Developments in UAVS to fuel market growth

TABLE 60 CANADA: MILITARY DRONE MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 61 CANADA: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 62 CANADA: MILITARY DRONES MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 63 CANADA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 64 CANADA: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 65 CANADA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

15.3 EUROPE

15.3.1 PESTLE ANALYSIS: EUROPE

FIGURE 46 EUROPE: MILITARY DRONE MARKET SNAPSHOT

TABLE 66 EUROPE: MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 67 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 68 EUROPE: MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 69 EUROPE: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 70 EUROPE: MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 71 EUROPE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 72 EUROPE: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 73 EUROPE: MILITARY DRONES MARKET, BY TYPE, 2022–2027 (USD MILLION)

15.3.2 RUSSIA

15.3.2.1 Surge in modern military drone procurements to enhance defense capabilities

TABLE 74 RUSSIA: MILITARY DRONE MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 75 RUSSIA: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 76 RUSSIA: MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 77 RUSSIA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 78 RUSSIA: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 79 RUSSIA: MILITARY DRONES MARKET, BY TYPE, 2022–2027 (USD MILLION)

15.3.3 FRANCE

15.3.3.1 Rising focus on developing more advanced military drones

TABLE 80 FRANCE: MILITARY DRONE MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 81 FRANCE: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 82 FRANCE: MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 83 FRANCE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 84 FRANCE: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 85 FRANCE: MILITARY DRONES MARKET, BY TYPE, 2022–2027 (USD MILLION)

15.3.4 UK

15.3.4.1 Focus on technological developments to enhance military drone capabilities

TABLE 86 UK: MILITARY DRONE MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 87 UK: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 88 UK: MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 89 UK: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 90 UK: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 91 UK: MARKET, BY TYPE, 2022–2027 (USD MILLION)

15.3.5 GERMANY

15.3.5.1 Rising demand for military drones from armed forces

TABLE 92 GERMANY: MILITARY DRONE MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 93 GERMANY: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 94 GERMANY: MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 95 GERMANY: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 96 GERMANY: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 97 GERMANY: MARKET, BY TYPE, 2022–2027 (USD MILLION)

15.3.6 UKRAINE

15.3.6.1 Growing procurement of armed drones to enhance military capabilities

TABLE 98 UKRAINE: MILITARY DRONE MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 99 UKRAINE: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 100 UKRAINE: MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 101 UKRAINE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 102 UKRAINE: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 103 UKRAINE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

15.3.7 ITALY

15.3.7.1 Plans to procure advanced components to develop MALE drones

TABLE 104 ITALY: MILITARY DRONE MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 105 ITALY: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 106 ITALY: MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 107 ITALY: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 108 ITALY: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 109 ITALY: MILITARY DRONES MARKET, BY TYPE, 2022–2027 (USD MILLION)

15.3.8 SWEDEN

15.3.8.1 Increased interest in development of drones and associated solutions

TABLE 110 SWEDEN: MILITARY DRONE MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 111 SWEDEN: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 112 SWEDEN: MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 113 SWEDEN: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 114 SWEDEN: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 115 SWEDEN: MARKET, BY TYPE, 2022–2027 (USD MILLION)

15.3.9 REST OF EUROPE

15.3.9.1 Surge in border disputes to increase demand for military drones

TABLE 116 REST OF EUROPE: MILITARY DRONE MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 117 REST OF EUROPE: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 118 REST OF EUROPE: MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 119 REST OF EUROPE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 120 REST OF EUROPE: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 121 REST OF EUROPE: MILITARY DRONES MARKET, BY TYPE, 2022–2027 (USD MILLION)

15.4 ASIA PACIFIC

15.4.1 PESTLE ANALYSIS: ASIA PACIFIC

FIGURE 47 ASIA PACIFIC: MILITARY DRONE MARKET SNAPSHOT

TABLE 122 ASIA PACIFIC: MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 123 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 124 ASIA PACIFIC: MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 125 ASIA PACIFIC: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 126 ASIA PACIFIC: MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 127 ASIA PACIFIC: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 128 ASIA PACIFIC: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 129 ASIA PACIFIC: MILITARY DRONES MARKET, BY TYPE, 2022–2027 (USD MILLION)

15.4.2 CHINA

15.4.2.1 Growing focusing on developing advanced weaponry to ensure border security

TABLE 130 CHINA: MILITARY DRONE MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 131 CHINA: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 132 CHINA: MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 133 CHINA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 134 CHINA: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 135 CHINA: MILITARY DRONES MARKET, BY TYPE, 2022–2027 (USD MILLION)

15.4.3 INDIA

15.4.3.1 Rising procurement of military drones to strengthen defense capabilities

TABLE 136 INDIA: MILITARY DRONE MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 137 INDIA: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 138 INDIA: MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 139 INDIA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 140 INDIA: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 141 INDIA: MILITARY DRONES MARKET, BY TYPE, 2022–2027 (USD MILLION)

15.4.4 JAPAN

15.4.4.1 Development of UAVs based on modern technologies for military applications such as ballistic missile tracking

TABLE 142 JAPAN: MILITARY DRONE MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 143 JAPAN: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 144 JAPAN: MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 145 JAPAN: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 146 JAPAN: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 147 JAPAN: MARKET, BY TYPE, 2022–2027 (USD MILLION)

15.4.5 AUSTRALIA

15.4.5.1 High investment in development of military drones

TABLE 148 AUSTRALIA: MILITARY DRONE MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 149 AUSTRALIA: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 150 AUSTRALIA: MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 151 AUSTRALIA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 152 AUSTRALIA: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 153 AUSTRALIA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

15.4.6 SOUTH KOREA

15.4.6.1 Increased defense spending to strengthen missile and combat capabilities of UAVs

TABLE 154 SOUTH KOREA: MILITARY DRONE MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 155 SOUTH KOREA: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 156 SOUTH KOREA: MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 157 SOUTH KOREA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 158 SOUTH KOREA: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 159 SOUTH KOREA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

15.4.7 REST OF ASIA PACIFIC

15.4.7.1 Rising usage of UAVs for air cargo defense operations

TABLE 160 REST OF ASIA PACIFIC: MILITARY DRONE MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 161 REST OF ASIA PACIFIC: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 162 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 163 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 164 REST OF ASIA PACIFIC: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 165 REST OF ASIA PACIFIC: MILITARY DRONES MARKET, BY TYPE, 2022–2027 (USD MILLION)

15.5 MIDDLE EAST

15.5.1 PESTLE ANALYSIS: MIDDLE EAST

FIGURE 48 MIDDLE EAST: MILITARY DRONE MARKET SNAPSHOT

TABLE 166 MIDDLE EAST: MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 167 MIDDLE EAST: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 168 MIDDLE EAST: MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 169 MIDDLE EAST: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 170 MIDDLE EAST: MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 171 MIDDLE EAST: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 172 MIDDLE EAST: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 173 MIDDLE EAST: MARKET, BY TYPE, 2022–2027 (USD MILLION)

15.5.2 ISRAEL

15.5.2.1 Presence of leading military drone manufacturers

TABLE 174 ISRAEL: MILITARY DRONE MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 175 ISRAEL: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 176 ISRAEL: MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 177 ISRAEL: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 178 ISRAEL: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 179 ISRAEL: MILITARY DRONES MARKET, BY TYPE, 2022–2027 (USD MILLION)

15.5.3 TURKEY

15.5.3.1 Growing deployment of UAVs and their subsystems

TABLE 180 TURKEY: MILITARY DRONE MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 181 TURKEY: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 182 TURKEY: MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 183 TURKEY: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 184 TURKEY: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 185 TURKEY: MARKET, BY TYPE, 2022–2027 (USD MILLION)

15.5.4 SAUDI ARABIA

15.5.4.1 Increased adoption of UAVs for military applications

TABLE 186 SAUDI ARABIA: MILITARY DRONE MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 187 SAUDI ARABIA: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 188 SAUDI ARABIA: MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 189 SAUDI ARABIA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 190 SAUDI ARABIA: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 191 SAUDI ARABIA: MILITARY DRONES MARKET, BY TYPE, 2022–2027 (USD MILLION)

15.5.5 UAE

15.5.5.1 Increased procurement of drones to drive market

TABLE 192 UAE: MILITARY DRONE MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 193 UAE: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 194 UAE: MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 195 UAE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 196 UAE: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 197 UAE: MILITARY DRONES MARKET, BY TYPE, 2022–2027 (USD MILLION)

15.5.6 REST OF MIDDLE EAST

15.5.6.1 Rising focus on drone development for military applications

TABLE 198 REST OF MIDDLE EAST: MILITARY DRONE MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 199 REST OF MIDDLE EAST: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 200 REST OF MIDDLE EAST: MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 201 REST OF MIDDLE EAST: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 202 REST OF MIDDLE EAST: MILITARY DRONES MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 203 REST OF MIDDLE EAST: MILITARY DRONES MARKET, BY TYPE, 2022–2027 (USD MILLION)

15.6 LATIN AMERICA

15.6.1 PESTLE ANALYSIS: LATIN AMERICA

FIGURE 49 LATIN AMERICA: MILITARY DRONE MARKET SNAPSHOT

TABLE 204 LATIN AMERICA: MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 205 LATIN AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 206 LATIN AMERICA: MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 207 LATIN AMERICA: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 208 LATIN AMERICA: MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 209 LATIN AMERICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 210 LATIN AMERICA: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 211 LATIN AMERICA: MILITARY DRONES MARKET, BY TYPE, 2022–2027 (USD MILLION)

15.6.2 BRAZIL

15.6.2.1 Procurement of UAVs by Brazilian Air Force for safety and security missions and advanced intelligence gathering

TABLE 212 BRAZIL: MILITARY DRONE MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 213 BRAZIL: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 214 BRAZIL: MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 215 BRAZIL: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 216 BRAZIL: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 217 BRAZIL: MILITARY DRONES MARKET, BY TYPE, 2022–2027 (USD MILLION)

15.6.3 MEXICO

15.6.3.1 Focus on developing drones to monitor and curb forest fires

TABLE 218 MEXICO: MILITARY DRONE MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 219 MEXICO: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 220 MEXICO: MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 221 MEXICO: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 222 MEXICO: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 223 MEXICO: MILITARY DRONES MARKET, BY TYPE, 2022–2027 (USD MILLION)

15.7 AFRICA

15.7.1 PESTLE ANALYSIS: AFRICA

FIGURE 50 AFRICA: MILITARY DRONE MARKET SNAPSHOT

TABLE 224 AFRICA: MARKET, 2019–2021 (USD MILLION)

TABLE 225 AFRICA: MARKET, 2022–2027 (USD MILLION)

TABLE 226 AFRICA: MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 227 AFRICA: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 228 AFRICA: MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 229 AFRICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 230 AFRICA: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 231 AFRICA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

16 COMPETITIVE LANDSCAPE (Page No. - 192)

16.1 INTRODUCTION

16.2 COMPANY OVERVIEW

TABLE 232 KEY DEVELOPMENTS OF LEADING PLAYERS IN MILITARY DRONE MARKET (2017–2022)

16.3 RANKING ANALYSIS OF KEY PLAYERS IN MILITARY DRONES MARKET, 2021

16.4 REVENUE ANALYSIS, (2018–2021)

16.5 MARKET SHARE ANALYSIS, 2021

FIGURE 53 MARKET SHARE ANALYSIS, 2021

TABLE 233 MILITARY DRONE MARKET: DEGREE OF COMPETITION

16.6 COMPETITIVE EVALUATION QUADRANT

16.6.1 STARS

16.6.2 EMERGING LEADERS

16.6.3 PERVASIVE COMPANIES

16.6.4 PARTICIPANTS

FIGURE 54 MARKET COMPETITIVE LEADERSHIP MAPPING, 2021

16.7 START-UP/SME EVALUATION QUADRANT

16.7.1 PROGRESSIVE COMPANIES

16.7.2 RESPONSIVE COMPANIES

16.7.3 STARTING BLOCKS

16.7.4 DYNAMIC COMPANIES

FIGURE 55 MILITARY DRONE MARKET (START-UP/SME) COMPETITIVE LEADERSHIP MAPPING, 2021

16.8 COMPETITIVE BENCHMARKING

TABLE 234 MILITARY DRONE MARKET: DETAILED LIST OF KEY START-UPS/SMES

TABLE 235 MILITARY DRONES MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS [START-UPS/SMES]

TABLE 236 MILITARY DRONES MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS [MAJOR PLAYERS]

16.9 COMPETITIVE SCENARIO

16.9.1 MARKET EVALUATION FRAMEWORK

16.9.2 NEW PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 237 NEW PRODUCT LAUNCHES, APRIL 2020–MARCH 2022

TABLE 238 CONTRACTS, PARTNERSHIPS, AND AGREEMENTS, APRIL 2020–JUNE 2022

TABLE 239 CERTIFICATION AND TESTING, SEPTEMBER 2017–JULY 2022

17 COMPANY PROFILES (Page No. - 211)

17.1 INTRODUCTION

17.2 KEY PLAYERS

(Business overview, Products/Services/Solutions offered, and Recent developments)*

17.2.1 NORTHROP GRUMMAN CORPORATION

TABLE 240 NORTHROP GRUMMAN CORPORATION: BUSINESS OVERVIEW

FIGURE 56 NORTHROP GRUMMAN CORPORATION.: COMPANY SNAPSHOT

TABLE 241 NORTHROP GRUMMAN CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 242 NORTHROP GRUMMAN CORPORATION: DEALS

17.2.2 RAYTHEON TECHNOLOGIES CORPORATION

TABLE 243 RAYTHEON TECHNOLOGIES CORPORATION: BUSINESS OVERVIEW

FIGURE 57 RAYTHEON TECHNOLOGIES CORPORATION: COMPANY SNAPSHOT

TABLE 244 RAYTHEON TECHNOLOGIES CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 245 RAYTHEON TECHNOLOGIES CORPORATION: OTHERS

17.2.3 ISRAEL AEROSPACE INDUSTRIES LTD.

TABLE 246 ISRAEL AEROSPACE INDUSTRIES LTD.: BUSINESS OVERVIEW

FIGURE 58 ISRAEL AEROSPACE INDUSTRIES LTD.: COMPANY SNAPSHOT

TABLE 247 ISRAEL AEROSPACE INDUSTRIES LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 248 ISRAEL AEROSPACE INDUSTRIES LTD.: NEW PRODUCT LAUNCHES

TABLE 249 ISRAEL AEROSPACE INDUSTRIES LTD.: DEALS

TABLE 250 ISRAEL AEROSPACE INDUSTRIES LTD.: OTHERS

17.2.4 GENERAL ATOMICS AERONAUTICAL SYSTEMS

TABLE 251 GENERAL ATOMICS AERONAUTICAL SYSTEMS: BUSINESS OVERVIEW

TABLE 252 GENERAL ATOMICS AERONAUTICAL SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 253 GENERAL ATOMICS AERONAUTICAL SYSTEMS: NEW PRODUCT LAUNCHES

TABLE 254 GENERAL ATOMICS AERONAUTICAL SYSTEMS: DEALS

TABLE 255 GENERAL ATOMICS AERONAUTICAL SYSTEMS: OTHERS

17.2.5 TELEDYNE FLIR LLC

TABLE 256 TELEDYNE FLIR LLC: BUSINESS OVERVIEW

FIGURE 59 TELEDYNE FLIR LLC: COMPANY SNAPSHOT

TABLE 257 TELEDYNE FLIR LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 258 TELEDYNE FLIR LLC: NEW PRODUCT LAUNCHES

TABLE 259 TELEDYNE FLIR LLC: DEALS

TABLE 260 TELEDYNE FLIR LLC: OTHERS

17.2.6 AEROVIRONMENT, INC.

TABLE 261 AEROVIRONMENT, INC.: BUSINESS OVERVIEW

FIGURE 60 AEROVIRONMENT, INC.: COMPANY SNAPSHOT

TABLE 262 AEROVIRONMENT, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 263 AEROVIRONMENT, INC.: NEW PRODUCT LAUNCHES

TABLE 264 AEROVIRONMENT, INC.: DEALS

17.2.7 THE BOEING COMPANY

TABLE 265 THE BOEING COMPANY: BUSINESS OVERVIEW

FIGURE 61 THE BOEING COMPANY: COMPANY SNAPSHOT

TABLE 266 THE BOEING COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 267 THE BOEING COMPANY: NEW PRODUCT LAUNCHES

TABLE 268 THE BOEING COMPANY: OTHERS

17.2.8 AIRBUS

TABLE 269 AIRBUS: BUSINESS OVERVIEW

FIGURE 62 AIRBUS: COMPANY SNAPSHOT

TABLE 270 AIRBUS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 271 AIRBUS: DEALS

17.2.9 TEXTRON INC.

TABLE 272 TEXTRON INC.: BUSINESS OVERVIEW

FIGURE 63 TEXTRON INC.: COMPANY SNAPSHOT

TABLE 273 TEXTRON INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 274 TEXTRON INC.: NEW PRODUCT LAUNCHES

TABLE 275 TEXTRON INC.: DEALS

17.2.10 LOCKHEED MARTIN CORPORATION

TABLE 276 LOCKHEED MARTIN CORPORATION: BUSINESS OVERVIEW

FIGURE 64 LOCKHEED MARTIN CORPORATION: COMPANY SNAPSHOT

TABLE 277 LOCKHEED MARTIN CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 278 LOCKHEED MARTIN CORPORATION: DEALS

17.2.11 ELBIT SYSTEMS LTD.

TABLE 279 ELBIT SYSTEMS LTD.: BUSINESS OVERVIEW

FIGURE 65 ELBIT SYSTEMS LTD.: COMPANY SNAPSHOT

TABLE 280 ELBIT SYSTEMS LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 281 ELBIT SYSTEMS LTD.: DEALS

TABLE 282 ELBIT SYSTEMS LTD.: OTHERS

17.2.12 DASSAULT AVIATION

TABLE 283 DASSAULT AVIATION: BUSINESS OVERVIEW

FIGURE 66 DASSAULT AVIATION: COMPANY SNAPSHOT

TABLE 284 DASSAULT AVIATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

17.2.13 BAE SYSTEMS

TABLE 285 BAE SYSTEMS: BUSINESS OVERVIEW

FIGURE 67 BAE SYSTEMS: COMPANY SNAPSHOT

TABLE 286 BAE SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

17.2.14 THALES GROUP

TABLE 287 THALES GROUP: BUSINESS OVERVIEW

FIGURE 68 THALES GROUP: COMPANY SNAPSHOT

TABLE 288 THALES GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 289 THALES GROUP: OTHERS

17.2.15 LEONARDO S.P.A.

TABLE 290 LEONARDO S.P.A.: BUSINESS OVERVIEW

FIGURE 69 LEONARDO S.P.A.: COMPANY SNAPSHOT

TABLE 291 LEONARDO S.P.A.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 292 LEONARDO S.P.A.: OTHERS

17.3 OTHER PLAYERS

17.3.1 DYNETICS, INC.

TABLE 293 DYNETICS, INC.: COMPANY OVERVIEW

17.3.2 ROBOTICAN CORPORATION

TABLE 294 ROBOTICAN CORPORATION: COMPANY OVERVIEW

17.3.3 VOLANSI, INC.

TABLE 295 VOLANSI, INC.: COMPANY OVERVIEW

17.3.4 GRIFFON AEROSPACE

TABLE 296 GRIFFON AEROSPACE: COMPANY OVERVIEW

17.3.5 PLATFORM AEROSPACE

TABLE 297 PLATFORM AEROSPACE: COMPANY OVERVIEW

17.3.6 SHIELD AI

TABLE 298 SHIELD AI: COMPANY OVERVIEW

17.3.7 INSTANTEYE ROBOTICS

TABLE 299 INSTANTEYE ROBOTICS: COMPANY OVERVIEW

17.3.8 ATHLON AVIA

TABLE 300 ATHLON AVIA: COMPANY OVERVIEW

17.3.9 SILVERTONE UAV

TABLE 301 SILVERTONE UAV: COMPANY OVERVIEW

17.3.10 BLUEBIRD AERO SYSTEMS LTD.

TABLE 302 BLUEBIRD AERO SYSTEMS LTD.: COMPANY OVERVIEW

*Details on Business overview, Products/Services/Solutions offered, and Recent developments might not be captured in case of unlisted companies.

18 APPENDIX (Page No. - 266)

18.1 DISCUSSION GUIDE

18.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

18.3 AVAILABLE CUSTOMIZATIONS

18.4 RELATED REPORTS

18.5 AUTHOR DETAILS

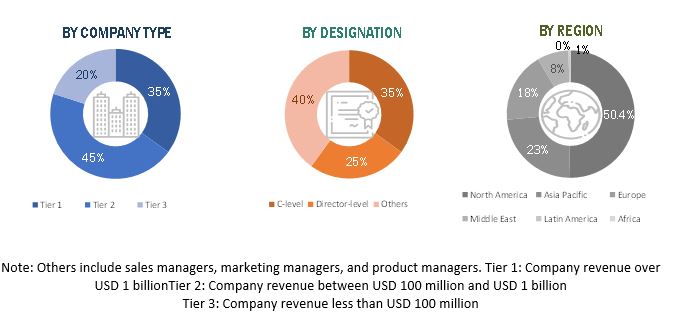

This research study on the military drone market involved extensive use of secondary sources, directories, and databases such as Hoovers, Bloomberg BusinessWeek, and Factiva to identify and collect information relevant to the market. The primary sources considered included industry experts as well as service providers, manufacturers, solution providers, technology developers, alliances, and organizations related to all segments of the value chain of this market. In-depth interviews with various primary respondents, including key industry participants, subject matter experts (SMEs), industry consultants, and C-level executives, were conducted to obtain and verify critical qualitative and quantitative information pertaining to the military drone market as well as assess its growth prospects.

Secondary Research

The secondary sources referred for this research study on the military drone market included financial statements of companies offering delivery drones software, drone transportation and logistics services, and transportation and logistics solution providers, along with various trade, business, and professional associations, among others. The secondary data was collected and analyzed to arrive at the overall size of the military drone market, which was validated by primary respondents.

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included industry experts such as chief X officers (CXOs), vice presidents (VPs), directors, regional managers, and business development and product development teams, distributors, and vendors.

Extensive primary research was conducted to obtain qualitative and quantitative information such as market statistics, average selling price, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to platform, solution, technologies, and regions. Stakeholders from the demand side include logistics companies, end consumers, healthcare industry, and quick-service restaurants who are willing to adopt drone delivery by participating in various trials. These interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market size forecasting, and data triangulation. These interviews also helped analyze the solution, platform, architecture, and deployment segments of the market for six key regions.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the total size of the military drone market. These methods were also used extensively to estimate the size of various segments and subsegments of the market. The research methodology used to estimate the market size includes the following details:

- Key players in this market were identified through secondary research, and their market share was determined through primary and secondary research. This included a study of the annual and financial reports of top market players and extensive interviews of leaders such as Chief Executive Officers (CEOs), directors, and marketing executives of leading companies operating in the military drone market.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Market size estimation methodology: Bottom-up approach

Market size estimation methodology: Top- Down approach

Data Triangulation

After arriving at the overall size of the military drone market using the market size estimation processes explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from demand as well as supply sides of the military drone market.

Report Objectives

- To define, describe, segment, and forecast the size of the military drone market based on solution, platform, architecture, deployment, and region

- To forecast the size of different segments of the market with respect to various regions, including North America, Europe, Asia Pacific, the Middle East, Latin America, and Africa, along with key countries in each of these regions

- To identify and analyze key drivers, opportunities, and challenges influencing the growth of the market

- To identify technology trends that are currently prevailing in the military drone market

- To provide an overview of the tariff and regulatory landscape with respect to the drone regulations across regions

- To analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders by identifying key market trends

- To profile key market players and comprehensively analyze their market share and core competencies2

- To analyze the degree of competition in the market by identifying key growth strategies, such as acquisitions, new product launches, new service launches, contracts, and partnerships, adopted by leading market players

- To identify detailed financial positions, key products, and unique selling points of leading companies in the market

- To provide a detailed competitive landscape of the military drone market, along with a ranking analysis, market share analysis, and revenue analysis of key players

Available customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the market segments at country-level

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Military Drone Market

Dear Madam/Sir, I have been assigned a project as an outsourced contractor to understand global military UAVs and analyze deeper details of the addressable markets for each UAV types. If you bless me with a sample report, I will convince my contractor to purchase the full report in order to conduct my analysis. Thank you in advance. Best regards, Kutay PINARCI

I would like to get some statistical data on the use of drones, their market share, distribution, and economic outlook in Africa, with a strong concentration on the Nigerian market.

I am looking for insights into the drone industry, specifically information about the use of drones in the military and counterdrone markets for a presentation about these subejcts.

To understand the key drivers of the military drone market, particularly in relation to the US defence sector.

I am conducting an analysis for a customer interested in the growth/development of the military UAS technology over the next 10+ years.