Military Vehicle Electrification Market Size, Share & Industry Growth Analysis Report by Technology, System (Power Generation, Cooling Systems, Energy Storage, Traction Drive Systems, Power Conversion, Transmission System), Platform, Mode of Operation and Region - Global Forecast to 2027

Updated on : May 09, 2023

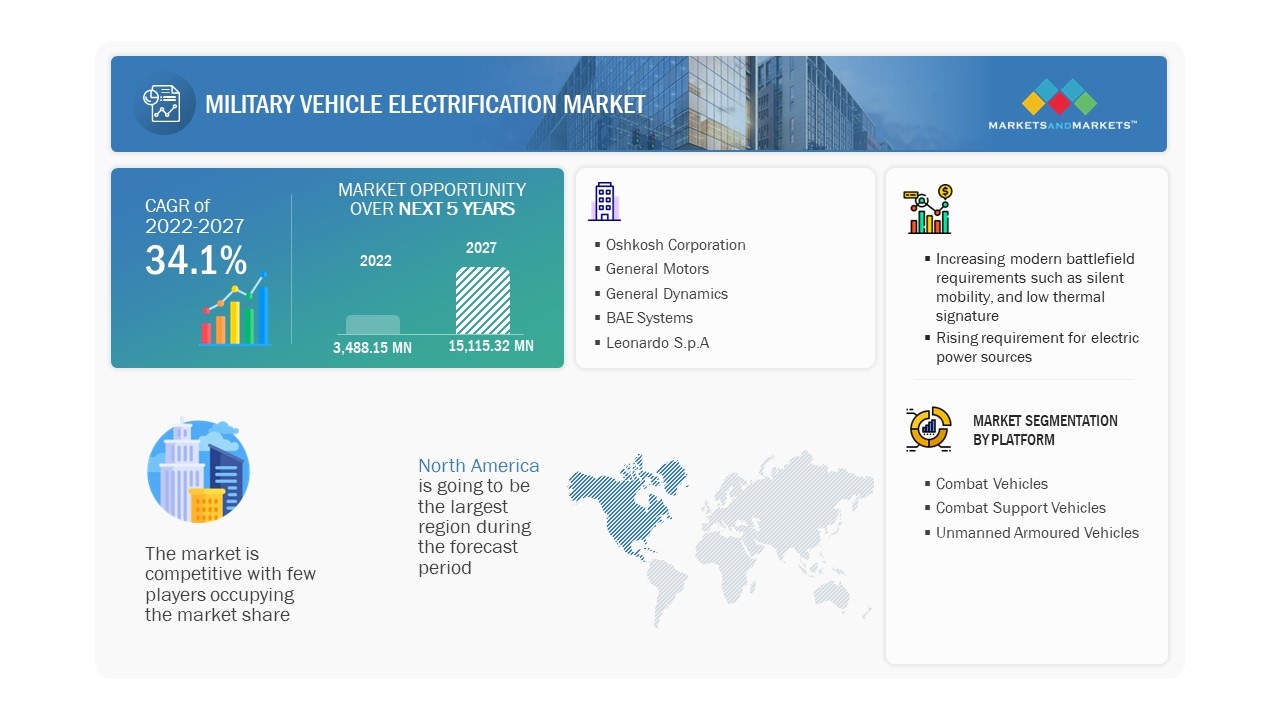

[256 Pages Report] The Military Vehicle Electrification Market will be USD 3.5 billion in 2022 and is projected to be USD 15.1 billion by 2027 at a CAGR of 34.1% from 2022 to 2027.

Demand for the electrification of military vehicles among defense forces is high due to military upgrades as well as new procurement programs, particularly in developed and emerging economies such as the US, India, and China, among others. It has applications in surveillance & stealth modes, combat vehicles, utility trucks, logistics & transportation, and armored vehicles, among others.

There have been major developments in computing, communication, display technologies, and Vetronics. Such products and services play an important role in ensuring real-time situational awareness during critical missions, significantly improving combat power and reducing casualties. An internal power source in a vehicle is required to enable the utilization of all the devices installed and to supply power to them on active battlefields. This also helps in stealth and surveillance operations, increasing the success rate due to the rising focus of defense forces on interconnecting tanks, helicopters, military vehicles, artillery, and support vehicles, which is expected to boost Military Vehicle Electrification Industry growth during the forecast period.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Driver: Increasing modern battlefield requirements such as silent mobility, and low thermal signature

Hybrid electric and fully electric military vehicles yield great operational benefits, such as facilitating extended range and improving the onboard power capability for electrified armor, jammers, and directed-energy weapons. Other advantages of the MVE include reduced fuel consumption, reduced acoustic and thermal signature, silent mobility, and lower maintenance and logistics footprint. Hybridization of combat and tactical vehicles improves camouflaging by reducing thermal and acoustic emissions, which delivers added tactical advantage and improves stealth capability.

Biden's government initiative to run a net zero-emission department by 2050, which involves a zero-emission non-tactical fleet, is a major boost to MVEs.

Restraint: Enhancement in the power-weight ratio

The power-to-weight ratio is the amount of power a vehicle has in relation to its weight. Thus, the weight is inversely proportional to the power supplied to the engine. The higher the weight, the lower the performance. Due to the developments in technologies, military vehicles have advanced due to the increasing safety features, mobility, and convenience which have been added. The incorporation of heavy battery cells into vehicles is expected to make them even bulkier. Thus, the weight of vehicles has increased significantly with respect to their performance. The difference between a battery-powered vehicle running on fossil fuels is significant. The weight of a diesel-filled tank as against the battery cell-powered tank, is approximately 100 times higher than the latter but fails to deliver the same efficiency.

Opportunity: Demand for power resources.

Military vehicles have extreme power demands. Requirements such as acceleration, top vehicle speed, and braking system depend upon the available horsepower from the prime mover and the energy storage device required for usage when needed for vehicle mobility. The demand for silent monitoring power is needed to be established for longer periods, at the same time, taking into account the efficiency of the system and the demand for and supply of energy. Similarly, a high voltage power pulse is required to power the Electro-Thermal Chemical/Ignition (ETC)/(ETI), the Electro Magnetic gun, and the Electro Magnetic Armor (EMA).

The hybrid electric platform is the most suitable type for vehicles for the incorporation of the demand for power for both continuous and pulsed loads. The global demand for power is increasing, and this applies to the military sector too. The need for components offering parallel operations with lower power consumption, as well as a reduction in size and weight, has resulted in the increasing demand for power resources. On the other hand, the continuous upgrade of military electronics requires upgrades of Vetronic systems as well in order to match the design requirements of the supportive electronic systems and equipment.

As onboard technology becomes increasingly sophisticated along with new technologies, revolutionary designs are expected to be the first to adopt them. In military applications, these could be the key features that lead the way for the rest of the market.

Challenge: Life and durability of integrated systems

The key concerns of modernizing military vehicles are their weight and power. Military vehicles should be resilient enough to withstand the standard demands of the industry. Modern military vehicles are required to be reliable for operation on rough terrain, should be functional in extreme temperatures, and be water-resistant. Internal electronic materials such as connectors, headers, and terminals are designed to be rugged.

The series includes connectors designed for the truck, bus, and off-highway sectors, such as the HD30 series, which are constructed from metal shells to meet the needs of the heavy-duty and transportation industry. The connectors operate at high temperatures and do not exhibit mechanical or physical damage after sinusoidal vibration levels owing to the increase in the number of components needed to perform vital functions. The complexity involved in reducing the size and weight of digital battlefield products is expected to make the manufacturing process increasingly expensive. Industry players need to install sophisticated machinery and invest in R&D activities to increase device efficiency. Undertaking efforts to minimize the associated weight and size of devices while maintaining their advanced features may create barriers to the growth of the military vehicle electrification market.

Based on technology, the fully electric vehicle segment is projected to grow at the highest CAGR during the forecast period.

Based on technology, the military vehicle electrification market is segmented into hybrid and fully electric vehicles. Hybrid and fully electric vehicles are still in the developmental stages, and as of now, none of the militaries has active fleets of fully electric vehicles. Manufacturers, industry players, and governments are investing in R&D to enable the electrification of military vehicles. The fully electric segment is projected to grow at the highest CAGR during the forecast period due to the development of alternate sources other than ICE engines, increasing the efficiency of vehicles.

Based on systems, the power conversion segment is projected to lead the market during the forecast period.

Based on system, the military vehicle electrification market has been segmented into power generation, cooling systems, energy storage, traction drive systems, power conversion systems, and transmission system. The power conversion segment is projected to lead the market during the forecast period. The high voltage current requirements in today's vehicles are creating technical challenges for power conversion. Power conversion systems are required to convert the energy stored in the energy management systems to power so that it can be used for onboard vehicle systems. The power conversion system has variants, namely, Dc-Dc converters, power inverters, and onboard chargers. In November 2021, The Defense Innovation Unit (DIU) and the Project Manager Transportation Systems (PM TS) of the US Army's Program Executive Office for Combat Support & Combat Service Support (PEO CS&CSS) were working together to develop a hybrid conversion kit for tactical vehicles. The FMTV, the Army's standard two-and-a-half to ten-ton trucks, will be the initial target of the effort's integration of an idle-reduction capability.

To know about the assumptions considered for the study, download the pdf brochure

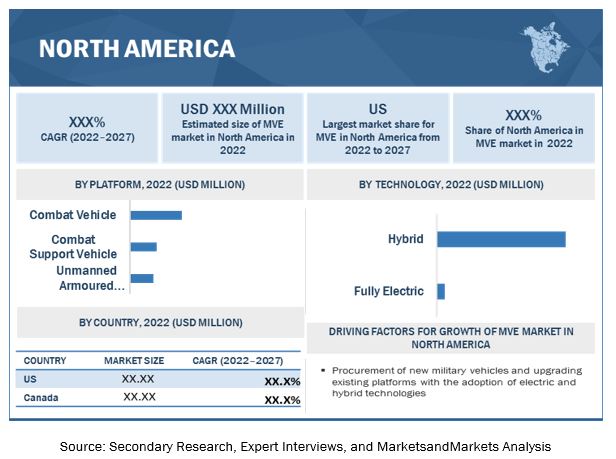

The North American region is projected to lead the Military vehicle electrification market in the forecast period

The North American Military Vehicle Electrification market is projected to lead the market during the forecast period. The growth of the North American Military Vehicle Electrification market is primarily driven by strong political support in the North American region for the adoption of advanced military capabilities, including modernizing military vehicles and upgrading their integrated systems. Another driving factor is that most leading manufacturers and developers of military systems and technologies are concentrated in this region, with clear policies laid out for dealing with the governments on defense matters.

Military Vehicle Electrification Industry Companies: Top Key Market Players

The Military Vehicle Electrification Companies is dominated by globally established players such as General Motors (US), General Dynamics (US), Oshkosh Corporation (US), BAE Systems (UK), Leonardo S.p.A (Italy) and Textron Systems (US).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2019–2027 |

|

Base year considered |

2019 |

|

Forecast period |

2022-2027 |

|

Forecast units |

Value (USD Billion and Million) |

|

Segments covered |

By Technology, By Platform, By System, By Mode of Operation, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Companies covered |

General Motors (US), General Dynamics (US), Oshkosh Corporation (US), BAE Systems (UK), Textron Systems (US), among others. Total 25 Market Players |

The study categorizes the Military Vehicle Electrification market based on Technology, Platform, System, Mode of Operation, and Region.

|

Aspect |

Details |

|

By Technology |

|

|

By Platform |

|

|

By System |

|

|

By Mode of Operation |

|

|

By Region |

|

Recent Developments

- In October 2022, the Defense Innovation Unit (DIU) chose GM Defense, a subsidiary of General Motors provided, a battery pack prototype for evaluation on Department of Defense systems. The DIU's demand for a scalable design that may be applied to tactical military vehicles is satisfied by the Ultium Platform. The aim of GM Defence, was to use GM's cutting-edge technologies for international defense and government customers, is aligned with DIU, a Department of Defense institution to accelerate the adoption of commercial technology across the US military.

- In July 2022, The US Army chose GM Motors to supply a battery-electric vehicle for testing and demonstration. The GMC HUMMER EV, which is built on GM's Ultium Platform, will be used by GM Defense to satisfy the US Army's needs.

- In July 2022, Detroit Arsenal (ACC- DTA), the US Army Contracting Command, announced that it awarded Oshkosh Defense, a wholly owned subsidiary of Oshkosh Corporation, an order valued at USD 130 Million to upgrade 95 additional Stryker Double-V Hull Infantry Carrier Vehicles (ICVVA1) with the 30 mm Medium Caliber Weapon System (MCWS) and electrification of the component.

- In May 2022, BAE Systems planned to provide power and propulsion technology to the heavy-duty industrial vehicle market. The company's electric drive system provides a revolutionary design that will help industrial vehicle original equipment manufacturers (OEMs) get their electric vehicles (EVs) to market faster and at a lower installed cost.

- In February 2021, USD 46 million contract was awarded to Elbit Systems to provide an army in the Asia Pacific region with a 6x6 armor personnel carrier equipped with an electric drive, fire control equipment, and stabilizing systems.

- In December 2020, Honeywell was awarded a USD 1 billion contract by the US Army to build an automobile gas turbine 1500 engine modification for the main battle tank, which will propel the platform's march toward electrification.

- In December 2020, US Army awarded General Dynamics a USD 4.6 billion contract to build M1A2 SEPv3 Abrams Main Battle Tanks in the most recent configuration. The contract included modification and upgradation of communication, lethality, reliability, fire control, sustainment, and fuel efficiency.

- In July 2020, The US Army's Rapid Capabilities and Critical Technologies Office (RCCTO) gave BAE Systems a USD 32 million prototype contract to attach a Hybrid Electric Drive (HED) system to a Bradley Fighting Vehicle.

- In June 2020, The US army awarded GM Defense a USD 214.3 million contract for the creation and upkeep of new Infantry Squad vehicles based on GM's Chevrolet Colorado ZR2 model.

Frequently Asked Questions (FAQ):

Which are the major segments which are expected to have a promising market share in the future?

The unmanned armored vehicle segment is projected to grow fast in the upcoming years due to the need to reduce human loss and increase operational capabilities during critical missions.

What are some of the drivers fuelling the growth of the military vehicle electrification market?

Global Military vehicle electrification market is characterized by the following drivers:

-

Increasing oil prices and emission regulations

One of the factors driving the industry's growing shift toward electrification is the necessity for worldwide accountability regarding emission control and regulatory actions. The need to cut pollutants and conserve fuel is making it difficult to increase vehicle efficiency while keeping additional expenses within acceptable bounds. These elements encourage the use of biofuels, alternative fuels, and battery-powered cars.

-

Evolution of advanced hybrid propulsion systems

Developments in military ground vehicles are increasing rapidly, exploring progressed power alternatives, including hydrogen fuel cells, electric motors, and hybrid electric motors. Commercial vehicle manufacturers and auto specialists from defense organizations are developing innovative technologies and designs to provide added advantages to militaries in reaching high quality and low fuel consumption.. These developments are attributable to the increments in defense budget plans by different nations and the increase in R&D activities due to the significant interest in the proposed motors.

Before making a purchase, I would like to understand the research technique used to determine the market size and segmentation splits. Can you explain this to me in more detail?

Yes, during a scheduled call, a thorough explanation of the research technique can be given. Additionally, it will allow us to respond fully to all of your questions. For an overview and basic information: Several strategies have been used to comprehend the complete picture of this sector, including:

- Top-down approach (Based on the global market)

- Primary interviews with industry experts

- Data triangulation

What kind of information is included in the competitive landscape section?

The company profiles section provides business overview insights about the company's revenue mix, business revenue mix, business segments, financials, and geographic presence. The company profiles section also includes information on product offerings, SWOT analysis, key developments associated with the company, and MnM view to elaborate analyst view on the company.

Which are the top players in the market?

The Top 5 players in the Military Vehicle Electrification market consist of Oshkosh Corporation (US), General Motors (US), General Dynamics (US), BAE Systems (UK), Leonardo S.p.A (Italy). They have an established portfolio of reputable products and services, a robust market presence, strong business strategies, a significant market share, products with wider applications, broader geographical use cases, and a larger product footprint.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 39)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 INCLUSIONS AND EXCLUSIONS

TABLE 1 MILITARY VEHICLE ELECTRIFICATION MARKET: INCLUSIONS AND EXCLUSIONS

1.4 CURRENCY

1.5 USD EXCHANGE RATES

1.6 MARKET SCOPE

1.6.1 MARKETS COVERED

FIGURE 1 MILITARY VEHICLE ELECTRIFICATION MARKET SEGMENTATION

1.6.2 YEARS CONSIDERED

1.6.3 REGIONAL SCOPE

1.7 LIMITATIONS

1.8 MARKET STAKEHOLDERS

1.9 SUMMARY OF CHANGES

FIGURE 2 MILITARY VEHICLE ELECTRIFICATION MARKET TO GROW AT HIGHER RATE COMPARED TO PREVIOUS ESTIMATES

2 RESEARCH METHODOLOGY (Page No. - 45)

2.1 RESEARCH DATA

FIGURE 3 RESEARCH PROCESS FLOW

FIGURE 4 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Primary sources

2.1.3 MILITARY VEHICLE ELECTRIFICATION PRIMARY DATA

2.2 RESEARCH APPROACH & METHODOLOGY

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Market size estimation

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3 MARKET TRIANGULATION

2.3.1 TRIANGULATION THROUGH SECONDARY RESEARCH

FIGURE 7 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

FIGURE 8 ASSUMPTIONS FOR THE RESEARCH STUDY ON THE MILITARY VEHICLE ELECTRIFICATION MARKET

2.5 RISK ANALYSIS

3 EXECUTIVE SUMMARY (Page No. - 52)

FIGURE 9 COMBAT VEHICLES ACCOUNTED FOR LARGEST SHARE OF MVE MARKET IN 2022

FIGURE 10 MANNED MODE TO ACCOUNT FOR LARGEST SHARE OF MVE MARKET IN 2022

FIGURE 11 POWER CONVERSION SYSTEM TO ACCOUNT FOR LARGEST SHARE OF MVE MARKET IN 2022

FIGURE 12 FULLY ELECTRIC TECHNOLOGY TO ACCOUNT FOR HIGHEST CAGR

FIGURE 13 NORTH AMERICA TO ACCOUNT FOR HIGHEST MARKET SHARE

4 PREMIUM INSIGHTS (Page No. - 56)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR PLAYERS IN MILITARY VEHICLE ELECTRIFICATION MARKET

FIGURE 14 INCREASING MODERN BATTLEFIELD REQUIREMENTS TO DRIVE MARKET

4.2 MILITARY VEHICLE ELECTRIFICATION MARKET, BY COMBAT VEHICLES

FIGURE 15 WEAPON SYSTEM ARMORED PERSONNEL CARRIERS PROJECTED TO LEAD DURING FORECAST PERIOD

4.3 MILITARY VEHICLE ELECTRIFICATION MARKET, BY COMBAT SUPPORT VEHICLES

FIGURE 16 REPAIR AND RECOVERY VEHICLES SEGMENT PROJECTED TO LEAD DURING FORECAST PERIOD

4.4 MILITARY VEHICLE ELECTRIFICATION MARKET, BY ENERGY STORAGE

FIGURE 17 BATTERIES SEGMENT PROJECTED TO LEAD DURING FORECAST PERIOD

4.5 MILITARY VEHICLE ELECTRIFICATION MARKET, BY BATTERIES (2022)

FIGURE 18 LITHIUM-ION/LITHIUM-POLYMER BATTERIES TO ACCOUNT FOR LARGEST MVE MARKET SHARE IN 2022

4.6 MILITARY VEHICLE ELECTRIFICATION MARKET, BY SUPPLY TRUCKS

FIGURE 19 AMMUNITION REPLENISHMENT VEHICLES TO LEAD MVE MARKET

5 MARKET OVERVIEW (Page No. - 60)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN MVE MARKET

5.2.1 DRIVERS

5.2.1.1 Increase in modern battlefield requirements

5.2.1.2 Rise in requirement for electric power sources

5.2.1.3 Rise in demand for autonomous military vehicles

5.2.1.4 Increase in budget allocation for hybrid electric vehicles

TABLE 2 DEFENSE EXPENDITURE BY MAJOR COUNTRIES (USD TRILLION)

5.2.1.5 Evolution of advanced hybrid propulsion systems

5.2.2 RESTRAINTS

5.2.2.1 Enhancement in power-weight ratio

5.2.2.2 Limited range of military electric vehicles

5.2.2.3 High cost of fuel cell electric vehicles

5.2.3 OPPORTUNITIES

5.2.3.1 Demand for power resources

5.2.3.2 Development of hydrogen-fuel-cell-powered military vehicles

5.2.3.3 Development of advanced power electronics components

5.2.4 CHALLENGES

5.2.4.1 Life and durability of integrated systems

5.2.4.2 Range and charging limits

5.3 MARKET ECOSYSTEM

5.3.1 PROMINENT COMPANIES

5.3.2 PRIVATE AND SMALL ENTERPRISES

5.3.3 END USERS

FIGURE 21 MVE MARKET ECOSYSTEM MAP

TABLE 3 MILITARY VEHICLE ELECTRIFICATION MARKET ECOSYSTEM

5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

5.4.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR MILITARY VEHICLE ELECTRIFICATION MANUFACTURERS

FIGURE 22 REVENUE SHIFT IN MILITARY VEHICLE ELECTRIFICATION MARKET

5.5 TECHNOLOGY ANALYSIS

5.5.1 ADDITIVE MANUFACTURING—HIGH POWER DENSITY MACHINES

5.5.2 INTEGRATION OF ADVANCED WEAPON SYSTEMS

5.6 VALUE CHAIN ANALYSIS

FIGURE 23 SUPPLY CHAIN ANALYSIS: MVE MARKET

5.7 PORTER’S FIVE FORCES ANALYSIS

TABLE 4 MVE MARKET: PORTER’S FIVE FORCES ANALYSIS

FIGURE 24 MVE MARKET: PORTER’S FIVE FORCES ANALYSIS

5.7.1 THREAT OF NEW ENTRANTS

5.7.2 THREAT OF SUBSTITUTES

5.7.3 BARGAINING POWER OF SUPPLIERS

5.7.4 BARGAINING POWER OF BUYERS

5.7.5 INTENSITY OF COMPETITIVE RIVALRY

5.8 KEY STAKEHOLDERS & BUYING CRITERIA

5.8.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 25 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP-THREE SOLUTIONS

TABLE 5 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP-THREE PLATFORM TYPES (%)

5.8.2 BUYING CRITERIA

FIGURE 26 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

TABLE 6 KEY BUYING CRITERIA FOR TOP-THREE PLATFORMS

5.9 KEY CONFERENCES & EVENTS IN 2022–2023

TABLE 7 MVE MARKET: CONFERENCES & EVENTS

5.10 TARIFF AND REGULATORY LANDSCAPE

5.10.1 NORTH AMERICA

5.10.2 EUROPE

5.10.3 ASIA PACIFIC

5.10.4 MIDDLE EAST

5.11 TRADE ANALYSIS

5.12 PRICING ANALYSIS

FIGURE 27 COST COMPARISON OF ELECTRIC VEHICLE POWERTRAIN COMPONENTS: 2017 VS. 2025

FIGURE 28 COST STRUCTURE OF BATTERY ELECTRIC VEHICLE

6 INDUSTRY TRENDS (Page No. - 80)

6.1 INTRODUCTION

6.2 TECHNOLOGY TRENDS

6.2.1 BATTERY SOURCES AND TYPES

6.2.1.1 Lithium-ion batteries

6.2.1.2 Lead-acid batteries

6.2.1.3 Nickel-metal hydride batteries

6.2.1.4 Solid-state batteries

TABLE 8 COMPARISON BETWEEN BATTERIES

6.2.2 ADVANCED INTEGRATED COMMUNICATION AND NETWORK SYSTEMS

6.3 USE CASE ANALYSIS

6.3.1 HIGHLAND SYSTEM (UKRAINE) DEVELOPS FIRST HYBRID ARMORED CATERPILLAR VEHICLE

6.3.2 ELECTRIC HYBRID PROPULSION SYSTEM FOR ARMORED COMBAT VEHICLE

6.3.3 US ARMY TO ADOPT ELECTRIC COMBAT VEHICLE

6.4 IMPACT OF MEGATRENDS

6.4.1 AUTONOMOUS VEHICLES IN THE MILITARY SECTOR

6.4.2 POLICIES SUPPORTING BATTERY AND HYDROGEN TECHNOLOGIES

6.5 INNOVATION & PATENT REGISTRATIONS

TABLE 9 IMPORTANT INNOVATIONS & PATENT REGISTRATIONS, 2010-2021

7 MILITARY VEHICLE ELECTRIFICATION MARKET, BY PLATFORM (Page No. - 86)

7.1 INTRODUCTION

FIGURE 29 MVE MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 10 MILITARY VEHICLE ELECTRIFICATION MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 11 MILITARY VEHICLE ELECTRIFICATION MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

7.2 COMBAT VEHICLES

TABLE 12 COMBAT VEHICLES: MILITARY VEHICLE ELECTRIFICATION MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 13 COMBAT VEHICLES: MILITARY VEHICLE ELECTRIFICATION MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

7.2.1 MAIN BATTLE TANKS

7.2.1.1 Increasing demand for MBTs in cross-country operations

7.2.2 INFANTRY FIGHTING VEHICLES

7.2.2.1 Procurement of IFVs by emerging economies leading to increasing demand

7.2.3 WEAPON SYSTEM ARMORED PERSONNEL CARRIERS (APCS)

7.2.3.1 Increased demand for weapon system armored personnel carriers

7.2.4 ARMORED AMPHIBIOUS VEHICLES (AAVS)

7.2.4.1 Increasing demand for troop carriers on battlefields from sea to land

7.2.5 MINE-RESISTANT AMBUSH PROTECTED (MRAP) VEHICLES

7.2.5.1 Use of MRAPS for protection of troops from IEDS and mines

7.2.6 LIGHT ARMORED VEHICLES (LAVS)

7.2.6.1 Increasing use of LAVS for border patrolling and surveillance activities

7.2.7 SELF-PROPELLED HOWITZERS (SPHS)

7.2.7.1 Increasing demand for self-propelled howitzers (SPHS) on battlefields

7.2.8 MORTAR CARRIERS

7.2.8.1 Demand for military vehicles with mortars and dedicated compartments for mortar storage

7.2.9 AIR DEFENSE VEHICLES

7.2.9.1 Adoption of vehicle-mounted anti-aircraft guns for air defense roles

7.3 COMBAT SUPPORT VEHICLES

TABLE 14 COMBAT SUPPORT VEHICLES: MILITARY VEHICLE ELECTRIFICATION MARKET SIZE, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 15 COMBAT SUPPORT VEHICLES: MILITARY VEHICLE ELECTRIFICATION MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

7.3.1 SUPPLY TRUCKS

TABLE 16 MILITARY VEHICLE ELECTRIFICATION MARKET, BY SUPPLY TRUCKS, 2019–2021 (USD MILLION)

TABLE 17 MILITARY VEHICLE ELECTRIFICATION MARKET SIZE, BY SUPPLY TRUCKS, 2022–2027 (USD MILLION)

7.3.1.1 Fuel trucks

7.3.1.1.1 Increased use of fuel trucks to supply and transport gas, diesel, or jet fuels

7.3.1.2 Ambulances

7.3.1.3 Ammunition replenishment vehicles

7.3.2 COMMAND AND CONTROL VEHICLES

7.3.3 REPAIR AND RECOVERY VEHICLES

7.3.4 OTHERS

7.4 UNMANNED ARMORED VEHICLES

7.4.1 INCREASED RESEARCH & DEVELOPMENT FOR APPLICATIONS OF UNMANNED ARMORED VEHICLES

8 MILITARY VEHICLE ELECTRIFICATION MARKET, BY MODE OF OPERATION (Page No. - 95)

8.1 INTRODUCTION

FIGURE 30 MVE MARKET, BY MODE OF OPERATION, 2022–2027 (USD MILLION)

TABLE 18 MILITARY VEHICLE ELECTRIFICATION MARKET SIZE, BY MODE OF OPERATION, 2019–2021 (USD MILLION)

TABLE 19 MILITARY VEHICLE ELECTRIFICATION MARKET SIZE, BY MODE OF OPERATION, 2022–2027 (USD MILLION)

8.2 MANNED VEHICLES

8.2.1 INVESTMENTS BY VARIOUS COUNTRIES TO DRIVE MARKET

8.3 AUTONOMOUS/SEMI-AUTONOMOUS VEHICLES

8.3.1 DEVELOPMENT OF UGVS FOR COMBAT SUPPORT VEHICLES EXPECTED TO DRIVE MARKET

9 MILITARY VEHICLE ELECTRIFICATION MARKET, BY SYSTEM (Page No. - 98)

9.1 INTRODUCTION

FIGURE 31 MILITARY VEHICLE ELECTRIFICATION MARKET, BY SYSTEM, 2022–2027 (USD MILLION)

TABLE 20 MILITARY VEHICLE ELECTRIFICATION MARKET, BY SYSTEM, 2019–2021 (USD MILLION)

TABLE 21 MILITARY VEHICLE ELECTRIFICATION MARKET, BY SYSTEM, 2022–2027 (USD MILLION)

9.2 POWER GENERATION

9.2.1 INCREASE IN DEMAND FOR POWER GENERATION SYSTEMS

9.2.2 ENGINES/GENERATORS

9.2.2.1 Hybrid engines/generators

9.2.2.1.1 Demand for robust and durable power generation sources for military vehicles

9.2.2.2 Turbine engines/generators

9.2.2.2.1 Rise in demand for turbine engines/generators

9.2.3 GENERATOR CONTROLLERS

9.2.4 AIR INDUCTION SYSTEMS

9.2.5 TRACTION MOTORS/PROPULSION MOTORS

9.3 COOLING SYSTEMS

9.3.1 NEED FOR COOLING SYSTEMS FOR MAINTENANCE OF ENGINE OPERATION

9.3.2 HEAT EXCHANGERS

9.3.3 FANS

9.4 ENERGY STORAGE SYSTEMS

9.4.1 REQUIREMENT OF BATTERY SYSTEMS FOR UNINTERRUPTED POWER SUPPLY TO VEHICLES

TABLE 22 MILITARY VEHICLE ELECTRIFICATION MARKET, BY ENERGY STORAGE, 2019–2021 (USD MILLION)

TABLE 23 MILITARY VEHICLE ELECTRIFICATION MARKET, BY ENERGY STORAGE, 2022–2027 (USD MILLION)

9.4.2 BATTERIES

9.4.2.1 Increase in demand for lithium-ion batteries for military vehicles

TABLE 24 MILITARY VEHICLE ELECTRIFICATION MARKET, BY BATTERIES, 2019–2021 (USD MILLION)

TABLE 25 MILITARY VEHICLE ELECTRIFICATION MARKET, BY BATTERIES, 2022–2027 (USD MILLION)

9.4.2.2 Lead-acid batteries

9.4.2.3 Nickel-metal hydride batteries

9.4.2.4 Lithium-ion batteries

9.4.2.5 Solid-state batteries

9.4.2.6 Others

9.4.3 FUEL CELLS

9.5 TRACTION DRIVE SYSTEMS

9.5.1 REQUIREMENT OF TRACTION DRIVE SYSTEMS TO INCREASE PROPULSION OF VEHICLES

9.5.2 EX-DRIVES

9.5.3 TRACTION CONTROLLERS

9.5.4 FINAL DRIVES

9.6 POWER CONVERSION

9.6.1 INCREASE IN DEMAND FOR POWER CONVERSION SOLUTIONS FOR ONBOARD VEHICLE MANAGEMENT SYSTEMS

9.6.2 DC-DC CONVERTORS

9.6.3 POWER INVERTERS

9.6.4 ONBOARD CHARGERS (ALTERNATORS)

9.7 TRANSMISSION SYSTEMS

9.7.1 INCREASE IN DEMAND TO REDUCE THERMAL AND ACOUSTIC CHARACTERISTICS

10 MILITARY VEHICLE ELECTRIFICATION MARKET, BY TECHNOLOGY (Page No. - 107)

10.1 INTRODUCTION

FIGURE 32 MILITARY VEHICLE ELECTRIFICATION MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 26 MILITARY VEHICLE ELECTRIFICATION MARKET, BY TECHNOLOGY, 2019–2021 (USD MILLION)

TABLE 27 MILITARY VEHICLE ELECTRIFICATION MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

10.2 HYBRID ELECTRIC VEHICLES

10.2.1 NEED FOR HYBRID ELECTRIC VEHICLES TO INCREASE EFFICIENCY EXPECTED TO DRIVE MARKET

10.3 FULLY ELECTRIC VEHICLES

10.3.1 ADOPTION OF FULLY ELECTRIC VEHICLES FOR NONCOMBAT UTILITY PURPOSES TO DRIVE MARKET GROWTH

11 MILITARY VEHICLE ELECTRIFICATION MARKET, BY REGION (Page No. - 110)

11.1 INTRODUCTION

FIGURE 33 ASIA PACIFIC PROJECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 28 MILITARY VEHICLE ELECTRIFICATION MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 29 MILITARY VEHICLE ELECTRIFICATION MARKET, BY REGION, 2022–2027 (USD MILLION)

11.2 NORTH AMERICA

11.2.1 PESTLE ANALYSIS: NORTH AMERICA

FIGURE 34 NORTH AMERICA: MILITARY VEHICLE ELECTRIFICATION MARKET SNAPSHOT

TABLE 30 NORTH AMERICA: MILITARY VEHICLE ELECTRIFICATION MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 31 NORTH AMERICA: MILITARY VEHICLE ELECTRIFICATION MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 32 NORTH AMERICA: MILITARY VEHICLE ELECTRIFICATION MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 33 NORTH AMERICA: MILITARY VEHICLE ELECTRIFICATION MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 34 NORTH AMERICA: MILITARY VEHICLE ELECTRIFICATION MARKET, BY MODE OF OPERATION, 2019–2021 (USD MILLION)

TABLE 35 NORTH AMERICA: MILITARY VEHICLE ELECTRIFICATION MARKET, BY MODE OF OPERATION, 2022–2027 (USD MILLION)

TABLE 36 NORTH AMERICA: MILITARY VEHICLE ELECTRIFICATION MARKET, BY TECHNOLOGY, 2019–2021 (USD MILLION)

TABLE 37 NORTH AMERICA: MILITARY VEHICLE ELECTRIFICATION MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

11.2.2 US

11.2.2.1 Electric vehicles adopted by US Army as part of climate strategy

TABLE 38 US: MILITARY VEHICLE ELECTRIFICATION MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 39 US: MILITARY VEHICLE ELECTRIFICATION MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 40 US: MILITARY VEHICLE ELECTRIFICATION MARKET, BY MODE OF OPERATION, 2019–2021 (USD MILLION)

TABLE 41 US: MILITARY VEHICLE ELECTRIFICATION MARKET, BY MODE OF OPERATION, 2022–2027 (USD MILLION)

TABLE 42 US: MILITARY VEHICLE ELECTRIFICATION MARKET, BY TECHNOLOGY, 2019–2021 (USD MILLION)

TABLE 43 US MILITARY VEHICLE ELECTRIFICATION MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

11.2.3 CANADA

11.2.3.1 Increasing R&D investments to drive market growth

TABLE 44 CANADA: MILITARY VEHICLE ELECTRIFICATION MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 45 CANADA: MILITARY VEHICLE ELECTRIFICATION MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 46 CANADA: MILITARY VEHICLE ELECTRIFICATION MARKET, BY MODE OF OPERATION, 2019–2021 (USD MILLION)

TABLE 47 CANADA: MILITARY VEHICLE ELECTRIFICATION MARKET, BY MODE OF OPERATION, 2022–2027 (USD MILLION)

TABLE 48 CANADA: MILITARY VEHICLE ELECTRIFICATION MARKET, BY TECHNOLOGY, 2019–2021 (USD MILLION)

TABLE 49 CANADA: MILITARY VEHICLE ELECTRIFICATION MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

11.3 EUROPE

11.3.1 PESTLE ANALYSIS: EUROPE

FIGURE 35 EUROPE: MILITARY VEHICLE ELECTRIFICATION MARKET SNAPSHOT

TABLE 50 EUROPE: MILITARY VEHICLE ELECTRIFICATION MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 51 EUROPE: MILITARY VEHICLE ELECTRIFICATION MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 52 EUROPE: MILITARY VEHICLE ELECTRIFICATION MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 53 EUROPE: MILITARY VEHICLE ELECTRIFICATION MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 54 EUROPE: MILITARY VEHICLE ELECTRIFICATION MARKET, BY MODE OF OPERATION, 2019–2021 (USD MILLION)

TABLE 55 EUROPE: MILITARY VEHICLE ELECTRIFICATION MARKET, BY MODE OF OPERATION, 2022–2027 (USD MILLION)

TABLE 56 EUROPE: MILITARY VEHICLE ELECTRIFICATION MARKET, BY TECHNOLOGY, 2019–2021 (USD MILLION)

TABLE 57 EUROPE: MILITARY VEHICLE ELECTRIFICATION MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

11.3.2 UK

11.3.2.1 Electrification trend to be led by modernization programs

TABLE 58 UK: MILITARY VEHICLE ELECTRIFICATION MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 59 UK: MILITARY VEHICLE ELECTRIFICATION MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 60 UK: MILITARY VEHICLE ELECTRIFICATION MARKET, BY MODE OF OPERATION, 2019–2021 (USD MILLION)

TABLE 61 UK: MILITARY VEHICLE ELECTRIFICATION MARKET, BY MODE OF OPERATION, 2022–2027 (USD MILLION)

TABLE 62 UK: MILITARY VEHICLE ELECTRIFICATION MARKET, BY TECHNOLOGY, 2019–2021 (USD MILLION)

TABLE 63 UK: MILITARY VEHICLE ELECTRIFICATION MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

11.3.3 FRANCE

11.3.3.1 Procurement of new-generation combat vehicles to drive MVE market

TABLE 64 FRANCE: MILITARY VEHICLE ELECTRIFICATION MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 65 FRANCE: MILITARY VEHICLE ELECTRIFICATION MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 66 FRANCE: MILITARY VEHICLE ELECTRIFICATION MARKET, BY MODE OF OPERATION, 2019–2021 (USD MILLION)

TABLE 67 FRANCE: MILITARY VEHICLE ELECTRIFICATION MARKET, BY MODE OF OPERATION, 2022–2027 (USD MILLION)

TABLE 68 FRANCE: MILITARY VEHICLE ELECTRIFICATION MARKET, BY TECHNOLOGY, 2019–2021 (USD MILLION)

TABLE 69 FRANCE: MILITARY VEHICLE ELECTRIFICATION MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

11.3.4 GERMANY

11.3.4.1 Increased military funding amidst growing Ukraine-Russia tension

TABLE 70 GERMANY: MILITARY VEHICLE ELECTRIFICATION MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 71 GERMANY: MILITARY VEHICLE ELECTRIFICATION MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 72 GERMANY: MILITARY VEHICLE ELECTRIFICATION MARKET, BY MODE OF OPERATION, 2019–2021 (USD MILLION)

TABLE 73 GERMANY: MILITARY VEHICLE ELECTRIFICATION MARKET, BY MODE OF OPERATION, 2022–2027 (USD MILLION)

TABLE 74 GERMANY: MILITARY VEHICLE ELECTRIFICATION MARKET, BY TECHNOLOGY, 2019–2021 (USD MILLION)

TABLE 75 GERMANY: MILITARY VEHICLE ELECTRIFICATION MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

11.3.5 RUSSIA

11.3.5.1 Increased military spending amidst military campaign in Ukraine

TABLE 76 RUSSIA: MILITARY VEHICLE ELECTRIFICATION MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 77 RUSSIA: MILITARY VEHICLE ELECTRIFICATION MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 78 RUSSIA: MILITARY VEHICLE ELECTRIFICATION MARKET, BY MODE OF OPERATION, 2019–2021 (USD MILLION)

TABLE 79 RUSSIA: MILITARY VEHICLE ELECTRIFICATION MARKET, BY MODE OF OPERATION, 2022–2027 (USD MILLION)

TABLE 80 RUSSIA: MILITARY VEHICLE ELECTRIFICATION MARKET, BY TECHNOLOGY, 2019–2021 (USD MILLION)

TABLE 81 RUSSIA: MILITARY VEHICLE ELECTRIFICATION MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

11.3.6 ITALY

11.3.6.1 Increase in upgrades expected to boost market

TABLE 82 ITALY: MILITARY VEHICLE ELECTRIFICATION MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 83 ITALY: MILITARY VEHICLE ELECTRIFICATION MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 84 ITALY: MILITARY VEHICLE ELECTRIFICATION MARKET, BY MODE OF OPERATION, 2019–2021 (USD MILLION)

TABLE 85 ITALY: MILITARY VEHICLE ELECTRIFICATION MARKET, BY MODE OF OPERATION, 2022–2027 (USD MILLION)

TABLE 86 ITALY: MILITARY VEHICLE ELECTRIFICATION MARKET, BY TECHNOLOGY, 2019–2021 (USD MILLION)

TABLE 87 ITALY: MILITARY VEHICLE ELECTRIFICATION MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

11.3.7 NORWAY

11.3.7.1 Modernization effort by Norwegian Armed Forces to propel demand for MVEs

TABLE 88 NORWAY: MILITARY VEHICLE ELECTRIFICATION MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 89 NORWAY: MILITARY VEHICLE ELECTRIFICATION MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 90 NORWAY: MILITARY VEHICLE ELECTRIFICATION MARKET, BY MODE OF OPERATION, 2019–2021 (USD MILLION)

TABLE 91 NORWAY: MILITARY VEHICLE ELECTRIFICATION MARKET, BY MODE OF OPERATION, 2022–2027 (USD MILLION)

TABLE 92 NORWAY: MILITARY VEHICLE ELECTRIFICATION MARKET, BY TECHNOLOGY, 2019–2021 (USD MILLION)

TABLE 93 NORWAY: MILITARY VEHICLE ELECTRIFICATION MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

11.3.8 REST OF EUROPE

TABLE 94 REST OF EUROPE: MILITARY VEHICLE ELECTRIFICATION MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 95 REST OF EUROPE: MILITARY VEHICLE ELECTRIFICATION MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 96 REST OF EUROPE: MILITARY VEHICLE ELECTRIFICATION MARKET, BY MODE OF OPERATION, 2019–2021 (USD MILLION)

TABLE 97 REST OF EUROPE: MILITARY VEHICLE ELECTRIFICATION MARKET, BY MODE OF OPERATION, 2022–2027 (USD MILLION)

TABLE 98 REST OF EUROPE: MILITARY VEHICLE ELECTRIFICATION MARKET, BY TECHNOLOGY, 2019–2021 (USD MILLION)

TABLE 99 REST OF EUROPE: MILITARY VEHICLE ELECTRIFICATION MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

11.4 ASIA PACIFIC

11.4.1 PESTLE ANALYSIS: ASIA PACIFIC

FIGURE 36 ASIA PACIFIC: MILITARY VEHICLE ELECTRIFICATION MARKET SNAPSHOT

TABLE 100 ASIA PACIFIC: MILITARY VEHICLE ELECTRIFICATION MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 101 ASIA PACIFIC: MILITARY VEHICLE ELECTRIFICATION MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 102 ASIA PACIFIC: MILITARY VEHICLE ELECTRIFICATION MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 103 ASIA PACIFIC: MILITARY VEHICLE ELECTRIFICATION MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 104 ASIA PACIFIC: MILITARY VEHICLE ELECTRIFICATION MARKET, BY MODE OF OPERATION, 2019–2021 (USD MILLION)

TABLE 105 ASIA PACIFIC: MILITARY VEHICLE ELECTRIFICATION MARKET, BY MODE OF OPERATION, 2022–2027 (USD MILLION)

TABLE 106 ASIA PACIFIC: MILITARY VEHICLE ELECTRIFICATION MARKET, BY TECHNOLOGY, 2019–2021 (USD MILLION)

TABLE 107 ASIA PACIFIC: MILITARY VEHICLE ELECTRIFICATION MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

11.4.2 CHINA

11.4.2.1 China positions itself as supply-chain leader in electrification trend

TABLE 108 CHINA: MILITARY VEHICLE ELECTRIFICATION MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 109 CHINA: MILITARY VEHICLE ELECTRIFICATION MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 110 CHINA: MILITARY VEHICLE ELECTRIFICATION MARKET, BY MODE OF OPERATION, 2019–2021 (USD MILLION)

TABLE 111 CHINA: MILITARY VEHICLE ELECTRIFICATION MARKET, BY MODE OF OPERATION, 2022–2027 (USD MILLION)

TABLE 112 CHINA: MILITARY VEHICLE ELECTRIFICATION MARKET, BY TECHNOLOGY, 2019–2021 (USD MILLION)

TABLE 113 CHINA: MILITARY VEHICLE ELECTRIFICATION MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

11.4.3 INDIA

11.4.3.1 Adoption of EVs in Indian Army to lower dependency on fossil fuels

TABLE 114 INDIA: MILITARY VEHICLE ELECTRIFICATION MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 115 INDIA: MILITARY VEHICLE ELECTRIFICATION MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 116 INDIA: MILITARY VEHICLE ELECTRIFICATION MARKET, BY MODE OF OPERATION, 2019–2021 (USD MILLION)

TABLE 117 INDIA: MILITARY VEHICLE ELECTRIFICATION MARKET, BY MODE OF OPERATION, 2022–2027 (USD MILLION)

TABLE 118 INDIA: MILITARY VEHICLE ELECTRIFICATION MARKET, BY TECHNOLOGY, 2019–2021 (USD MILLION)

TABLE 119 INDIA: MILITARY VEHICLE ELECTRIFICATION MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

11.4.4 JAPAN

11.4.4.1 Need to strengthen combat capabilities to boost market

TABLE 120 JAPAN: MILITARY VEHICLE ELECTRIFICATION MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 121 JAPAN: MILITARY VEHICLE ELECTRIFICATION MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 122 JAPAN: MILITARY VEHICLE ELECTRIFICATION MARKET, BY MODE OF OPERATION, 2019–2021 (USD MILLION)

TABLE 123 JAPAN: MILITARY VEHICLE ELECTRIFICATION MARKET, BY MODE OF OPERATION, 2022–2027 (USD MILLION)

TABLE 124 JAPAN: MILITARY VEHICLE ELECTRIFICATION MARKET, BY TECHNOLOGY, 2019–2021 (USD MILLION)

TABLE 125 JAPAN: MILITARY VEHICLE ELECTRIFICATION MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

11.4.5 AUSTRALIA

11.4.5.1 Adoption of hybrid vehicles to support evolving battlefield requirements

TABLE 126 AUSTRALIA: MILITARY VEHICLE ELECTRIFICATION MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 127 AUSTRALIA: MILITARY VEHICLE ELECTRIFICATION MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 128 AUSTRALIA: MILITARY VEHICLE ELECTRIFICATION MARKET, BY MODE OF OPERATION, 2019–2021 (USD MILLION)

TABLE 129 AUSTRALIA: MILITARY VEHICLE ELECTRIFICATION MARKET, BY MODE OF OPERATION, 2022–2027 (USD MILLION)

TABLE 130 AUSTRALIA: MILITARY VEHICLE ELECTRIFICATION MARKET, BY TECHNOLOGY, 2019–2021 (USD MILLION)

TABLE 131 AUSTRALIA: MILITARY VEHICLE ELECTRIFICATION MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

11.4.6 SOUTH KOREA

11.4.6.1 Vision to digitally transform defense sector to drive market

TABLE 132 SOUTH KOREA: MILITARY VEHICLE ELECTRIFICATION MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 133 SOUTH KOREA: MILITARY VEHICLE ELECTRIFICATION MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 134 SOUTH KOREA: MILITARY VEHICLE ELECTRIFICATION MARKET, BY MODE OF OPERATION, 2019–2021 (USD MILLION)

TABLE 135 SOUTH KOREA: MILITARY VEHICLE ELECTRIFICATION MARKET, BY MODE OF OPERATION, 2022–2027 (USD MILLION)

TABLE 136 SOUTH KOREA: MILITARY VEHICLE ELECTRIFICATION MARKET, BY TECHNOLOGY, 2019–2021 (USD MILLION)

TABLE 137 SOUTH KOREA: MILITARY VEHICLE ELECTRIFICATION MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

11.5 MIDDLE EAST

11.5.1 PESTLE ANALYSIS: MIDDLE EAST & AFRICA

FIGURE 37 MIDDLE EAST & AFRICA: MILITARY VEHICLE ELECTRIFICATION MARKET SNAPSHOT

TABLE 138 MIDDLE EAST & AFRICA: MILITARY VEHICLE ELECTRIFICATION MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 139 MIDDLE EAST & AFRICA: MILITARY VEHICLE ELECTRIFICATION MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 140 MIDDLE EAST & AFRICA: MILITARY VEHICLE ELECTRIFICATION MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 141 MIDDLE EAST & AFRICA: MILITARY VEHICLE ELECTRIFICATION MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 142 MIDDLE EAST & AFRICA: MILITARY VEHICLE ELECTRIFICATION MARKET, BY MODE OF OPERATION, 2019–2021 (USD MILLION)

TABLE 143 MIDDLE EAST & AFRICA: MILITARY VEHICLE ELECTRIFICATION MARKET, BY MODE OF OPERATION, 2022–2027 (USD MILLION)

TABLE 144 MIDDLE EAST & AFRICA: MILITARY VEHICLE ELECTRIFICATION MARKET, BY TECHNOLOGY, 2019–2021 (USD MILLION)

TABLE 145 MIDDLE EAST & AFRICA: MILITARY VEHICLE ELECTRIFICATION MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

11.5.2 ISRAEL

11.5.2.1 Military modernization programs and development of capabilities of defense organization to drive market

TABLE 146 ISRAEL: MILITARY VEHICLE ELECTRIFICATION MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 147 ISRAEL: MILITARY VEHICLE ELECTRIFICATION MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 148 ISRAEL: MILITARY VEHICLE ELECTRIFICATION MARKET, BY MODE OF OPERATION, 2019–2021 (USD MILLION)

TABLE 149 ISRAEL: MILITARY VEHICLE ELECTRIFICATION MARKET, BY MODE OF OPERATION, 2022–2027 (USD MILLION)

TABLE 150 ISRAEL: MILITARY VEHICLE ELECTRIFICATION MARKET, BY TECHNOLOGY, 2019–2021 (USD MILLION)

TABLE 151 ISRAEL: MILITARY VEHICLE ELECTRIFICATION MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

11.5.3 TURKEY

11.5.3.1 Focus on strengthening defense capability to fuel market growth

TABLE 152 TURKEY: MILITARY VEHICLE ELECTRIFICATION MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 153 TURKEY: MILITARY VEHICLE ELECTRIFICATION MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 154 TURKEY: MILITARY VEHICLE ELECTRIFICATION MARKET, BY MODE OF OPERATION, 2019–2021 (USD MILLION)

TABLE 155 TURKEY: MILITARY VEHICLE ELECTRIFICATION MARKET, BY MODE OF OPERATION, 2022–2027 (USD MILLION)

TABLE 156 TURKEY: MILITARY VEHICLE ELECTRIFICATION MARKET, BY TECHNOLOGY, 2019–2021 (USD MILLION)

TABLE 157 TURKEY: MILITARY VEHICLE ELECTRIFICATION MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

11.5.4 SAUDI ARABIA

11.5.4.1 Procurement of military combat vehicles and armored personnel vehicles to boost growth

TABLE 158 SAUDI ARABIA: MILITARY VEHICLE ELECTRIFICATION MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 159 SAUDI ARABIA: MILITARY VEHICLE ELECTRIFICATION MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 160 SAUDI ARABIA: MILITARY VEHICLE ELECTRIFICATION MARKET, BY MODE OF OPERATION, 2019–2021 (USD MILLION)

TABLE 161 SAUDI ARABIA: MILITARY VEHICLE ELECTRIFICATION MARKET, BY MODE OF OPERATION, 2022–2027 (USD MILLION)

TABLE 162 SAUDI ARABIA: MILITARY VEHICLE ELECTRIFICATION MARKET, BY TECHNOLOGY, 2019–2021 (USD MILLION)

TABLE 163 SAUDI ARABIA: MILITARY VEHICLE ELECTRIFICATION MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

11.5.5 SOUTH AFRICA

11.5.5.1 Modernization of armed forces to lead growth of military vehicle market

TABLE 164 SOUTH AFRICA: MILITARY VEHICLE ELECTRIFICATION MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 165 SOUTH AFRICA: MILITARY VEHICLE ELECTRIFICATION MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 166 SOUTH AFRICA: MILITARY VEHICLE ELECTRIFICATION MARKET, BY MODE OF OPERATION, 2019–2021 (USD MILLION)

TABLE 167 SOUTH AFRICA: MILITARY VEHICLE ELECTRIFICATION MARKET, BY MODE OF OPERATION, 2022–2027 (USD MILLION)

TABLE 168 SOUTH AFRICA: MILITARY VEHICLE ELECTRIFICATION MARKET, BY TECHNOLOGY, 2019–2021 (USD MILLION)

TABLE 169 SOUTH AFRICA: MILITARY VEHICLE ELECTRIFICATION MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

11.6 LATIN AMERICA

11.6.1 PESTLE ANALYSIS: LATIN AMERICA

FIGURE 38 LATIN AMERICA: MILITARY VEHICLE ELECTRIFICATION MARKET SNAPSHOT

TABLE 170 LATIN AMERICA: MILITARY VEHICLE ELECTRIFICATION MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 171 LATIN AMERICA: MILITARY VEHICLE ELECTRIFICATION MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 172 LATIN AMERICA: MILITARY VEHICLE ELECTRIFICATION MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 173 LATIN AMERICA: MILITARY VEHICLE ELECTRIFICATION MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 174 LATIN AMERICA: MILITARY VEHICLE ELECTRIFICATION MARKET, BY MODE OF OPERATION, 2019–2021 (USD MILLION)

TABLE 175 LATIN AMERICA: MILITARY VEHICLE ELECTRIFICATION MARKET, BY MODE OF OPERATION, 2022–2027 (USD MILLION)

TABLE 176 LATIN AMERICA: MILITARY VEHICLE ELECTRIFICATION MARKET, BY TECHNOLOGY, 2019–2021 (USD MILLION)

TABLE 177 LATIN AMERICA: MILITARY VEHICLE ELECTRIFICATION MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

11.6.2 BRAZIL

11.6.2.1 Modernization of armed forces to propel market

TABLE 178 BRAZIL: MILITARY VEHICLE ELECTRIFICATION MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 179 BRAZIL: MILITARY VEHICLE ELECTRIFICATION MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 180 BRAZIL: MILITARY VEHICLE ELECTRIFICATION MARKET, BY MODE OF OPERATION, 2019–2021 (USD MILLION)

TABLE 181 BRAZIL: MILITARY VEHICLE ELECTRIFICATION MARKET, BY MODE OF OPERATION, 2022–2027 (USD MILLION)

TABLE 182 BRAZIL: MILITARY VEHICLE ELECTRIFICATION MARKET, BY TECHNOLOGY, 2019–2021 (USD MILLION)

TABLE 183 BRAZIL: MILITARY VEHICLE ELECTRIFICATION MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

11.6.3 MEXICO

11.6.3.1 Growing economy and increasing defense budget to boost MVE market in Mexico

TABLE 184 MEXICO: MILITARY VEHICLE ELECTRIFICATION MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 185 MEXICO: MILITARY VEHICLE ELECTRIFICATION MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 186 MEXICO: MILITARY VEHICLE ELECTRIFICATION MARKET, BY MODE OF OPERATION, 2019–2021 (USD MILLION)

TABLE 187 MEXICO: MILITARY VEHICLE ELECTRIFICATION MARKET, BY MODE OF OPERATION, 2022–2027 (USD MILLION)

TABLE 188 MEXICO: MILITARY VEHICLE ELECTRIFICATION MARKET, BY TECHNOLOGY, 2019–2021 (USD MILLION)

TABLE 189 MEXICO: MILITARY VEHICLE ELECTRIFICATION MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 170)

12.1 INTRODUCTION

12.2 COMPANY OVERVIEW

TABLE 190 KEY DEVELOPMENTS OF LEADING PLAYERS IN MILITARY VEHICLE ELECTRIFICATION MARKET (2019–2022)

12.3 RANKING ANALYSIS OF KEY PLAYERS IN MILITARY VEHICLE ELECTRIFICATION MARKET, 2021

12.4 REVENUE ANALYSIS, 2021

FIGURE 40 REVENUE ANALYSIS FOR KEY COMPANIES IN MILITARY VEHICLE ELECTRIFICATION MARKET, 2021

12.5 MARKET SHARE ANALYSIS, 2021

FIGURE 41 MARKET SHARE ANALYSIS FOR KEY COMPANIES, 2021

TABLE 191 MILITARY VEHICLE ELECTRIFICATION MARKET: DEGREE OF COMPETITION

12.6 COMPETITIVE EVALUATION QUADRANT

12.6.1 STARS

12.6.2 EMERGING LEADERS

12.6.3 PERVASIVE PLAYERS

12.6.4 PARTICIPANTS

FIGURE 42 MARKET COMPETITIVE LEADERSHIP MAPPING, 2021

12.7 STARTUP/SME EVALUATION QUADRANT

12.7.1 PROGRESSIVE COMPANIES

12.7.2 RESPONSIVE COMPANIES

12.7.3 STARTING BLOCKS

12.7.4 DYNAMIC COMPANIES

FIGURE 43 MILITARY VEHICLE ELECTRIFICATION MARKET (STARTUP/SME) COMPETITIVE LEADERSHIP MAPPING, 2021

12.8 COMPETITIVE BENCHMARKING

TABLE 192 MILITARY VEHICLE ELECTRIFICATION MARKET: KEY STARTUPS/SMES

TABLE 193 MILITARY VEHICLE ELECTRIFICATION MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS [STARTUPS/SMES]

TABLE 194 MILITARY VEHICLE ELECTRIFICATION MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS [MAJOR PLAYERS]

12.8.1 MARKET EVALUATION FRAMEWORK

12.8.2 PRODUCT LAUNCHES AND DEVELOPMENT

TABLE 195 PRODUCT LAUNCHES, MAY 2019–AUGUST 2022

12.8.3 DEALS

TABLE 196 DEALS, JANUARY 2019–OCTOBER 2022

12.8.4 OTHERS

TABLE 197 OTHERS, FEBRUARY 2021–AUGUST 2022

13 COMPANY PROFILES (Page No. - 193)

13.1 INTRODUCTION

13.2 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

13.2.1 OSHKOSH CORPORATION

TABLE 198 OSHKOSH CORPORATION: BUSINESS OVERVIEW

FIGURE 44 OSHKOSH CORPORATION: COMPANY SNAPSHOT

TABLE 199 OSHKOSH CORPORATION: PRODUCT/SOLUTIONS/SERVICES OFFERED

TABLE 200 OSHKOSH CORPORATION.: NEW PRODUCT LAUNCHES

TABLE 201 OSHKOSH CORPORATION: DEALS

TABLE 202 OSHKOSH CORPORATION: OTHERS

13.2.2 GENERAL MOTORS

TABLE 203 GENERAL MOTORS: BUSINESS OVERVIEW

FIGURE 45 GENERAL MOTORS: COMPANY SNAPSHOT

TABLE 204 GENERAL MOTORS: PRODUCT/SOLUTIONS/SERVICES OFFERED

TABLE 205 GENERAL MOTORS: DEALS

TABLE 206 GENERAL MOTORS: OTHERS

13.2.3 GENERAL DYNAMICS

TABLE 207 GENERAL DYNAMICS: BUSINESS OVERVIEW

FIGURE 46 GENERAL DYNAMICS: COMPANY SNAPSHOT

TABLE 208 GENERAL DYNAMICS: PRODUCT/SOLUTIONS/SERVICES OFFERED

TABLE 209 GENERAL DYNAMICS: DEALS

13.2.4 BAE SYSTEMS

TABLE 210 BAE SYSTEMS: BUSINESS OVERVIEW

FIGURE 47 BAE SYSTEMS: COMPANY SNAPSHOT

TABLE 211 BAE SYSTEMS: PRODUCT/SOLUTIONS/SERVICES OFFERED

TABLE 212 BAE SYSTEMS: DEALS

TABLE 213 BAE SYSTEMS: OTHERS

13.2.5 LEONARDO S.P.A

TABLE 214 LEONARDO S.P.A: BUSINESS OVERVIEW

FIGURE 48 LEONARDO S.P.A: COMPANY SNAPSHOT

TABLE 215 LEONARDO S.P.A: PRODUCT/SOLUTIONS/SERVICES OFFERED

TABLE 216 LEONARDO S.P.A: DEALS

13.2.6 TEXTRON INC.

TABLE 217 TEXTRON INC.: BUSINESS OVERVIEW

FIGURE 49 TEXTRON INC.: COMPANY SNAPSHOT

TABLE 218 TEXTRON INC.: PRODUCT/SOLUTIONS/SERVICES OFFERED

TABLE 219 TEXTRON INC.: DEALS

13.2.7 ST ENGINEERING

TABLE 220 ST ENGINEERING: BUSINESS OVERVIEW

FIGURE 50 ST ENGINEERING: COMPANY SNAPSHOT

TABLE 221 ST ENGINEERING: PRODUCT/SOLUTIONS/SERVICES OFFERED

TABLE 222 ST ENGINEERING: NEW PRODUCT LAUNCHES

TABLE 223 ST ENGINEERING: OTHERS

13.2.8 QINETIQ GROUP PLC

TABLE 224 QINETIQ GROUP PLC: BUSINESS OVERVIEW

FIGURE 51 QINETIQ GROUP PLC: COMPANY SNAPSHOT

TABLE 225 QINETIQ GROUP PLC: PRODUCT/SOLUTIONS/SERVICES OFFERED

TABLE 226 QINETIQ GROUP PLC: DEALS

13.2.9 POLARIS INDUSTRIES INC.

TABLE 227 POLARIS INDUSTRIES INC.: BUSINESS OVERVIEW

FIGURE 52 POLARIS INDUSTRIES INC.: COMPANY SNAPSHOT

TABLE 228 POLARIS INDUSTRIES INC.: PRODUCT/SOLUTIONS/SERVICES OFFERED

TABLE 229 POLARIS INDUSTRIES INC: NEW PRODUCT LAUNCHES

TABLE 230 POLARIS INDUSTRIES INC: DEALS

13.2.10 ASELSAN A.S.

TABLE 231 ASELSAN A.S.: BUSINESS OVERVIEW

TABLE 232 ASELSAN A.S: PRODUCT/SOLUTIONS/SERVICES OFFERED

TABLE 233 ASELSAN A.S: DEALS

13.2.11 OTOKAR OTOMOTIV VE SAVUNMA SANAYI

TABLE 234 OTOKAR OTOMOTIV VE SAVUNMA SANAYI: BUSINESS OVERVIEW

FIGURE 53 OTOKAR OTOMOTIV VE SAVUNMA SANAYI.: COMPANY SNAPSHOT

TABLE 235 OTOKAR OTOMOTIV VE SAVUNMA SANAYI: PRODUCT/SOLUTIONS/SERVICES OFFERED

TABLE 236 OTOKAR OTOMOTIV VE SAVUNMA SANAYI.: DEALS

13.2.12 RHEINMETALL AG

TABLE 237 RHEINMETALL AG: BUSINESS OVERVIEW

FIGURE 54 RHEINMETALL AG: COMPANY SNAPSHOT

TABLE 238 RHEINMETALL AG: PRODUCT/SOLUTIONS/SERVICES OFFERED

TABLE 239 RHEINMETALL AG.: NEW PRODUCT LAUNCHES

TABLE 240 RHEINMETALL AG.: DEALS

13.2.13 THALES GROUP

TABLE 241 THALES GROUP: BUSINESS OVERVIEW

FIGURE 55 THALES GROUP: COMPANY SNAPSHOT

TABLE 242 THALES GROUP: PRODUCT/SOLUTIONS/SERVICES OFFERED

TABLE 243 THALES GROUP: NEW PRODUCT LAUNCHES

13.2.14 KRAUSS-MAFFEI WEGMANN

TABLE 244 KRAUSS-MAFFEI WEGMANN: BUSINESS OVERVIEW

TABLE 245 KRAUSS-MAFFEI WEGMANN: PRODUCT/SOLUTIONS/SERVICES OFFERED

TABLE 246 KRAUSS-MAFFEI WEGMANN.: DEALS

13.2.15 FLENSBURG FAHRZEUGBAU GMBH

TABLE 247 FLENSBURG FAHRZEUGBAU GMBH: BUSINESS OVERVIEW

TABLE 248 FLENSBURG FAHRZEUGBAU GMBH: PRODUCT/SOLUTIONS/SERVICES OFFERED

13.3 OTHER PLAYERS

13.3.1 ARQUUS DEFENCE

TABLE 249 ARQUUS DEFENCE: COMPANY OVERVIEW

13.3.2 EPSILOR ELECTRIC FUEL LTD

TABLE 250 EPSILOR ELECTRIC FUEL LTD: COMPANY OVERVIEW

13.3.3 NEXTER GROUP

TABLE 251 NEXTER GROUP: COMPANY OVERVIEW

13.3.4 UKROBORONPROM

TABLE 252 UKROBORONPROM: COMPANY OVERVIEW

13.3.5 MILREM ROBOTICS

TABLE 253 MILREM ROBOTICS: COMPANY OVERVIEW

13.3.6 AM GENERAL

TABLE 254 AM GENERAL: COMPANY OVERVIEW

13.3.7 HIGHLAND SYSTEMS

TABLE 255 HIGHLAND SYSTEMS: COMPANY OVERVIEW

13.3.8 ALKE

TABLE 256 ALKE: COMPANY OVERVIEW

13.3.9 MEGA ENGINEERING VEHICLES INC.

TABLE 257 MEGA ENGINEERING VEHICLES INC.: COMPANY OVERVIEW

13.3.10 FNSS

TABLE 258 FNSS: COMPANY OVERVIEW

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

14 APPENDIX (Page No. - 249)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 CUSTOMIZATION OPTIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

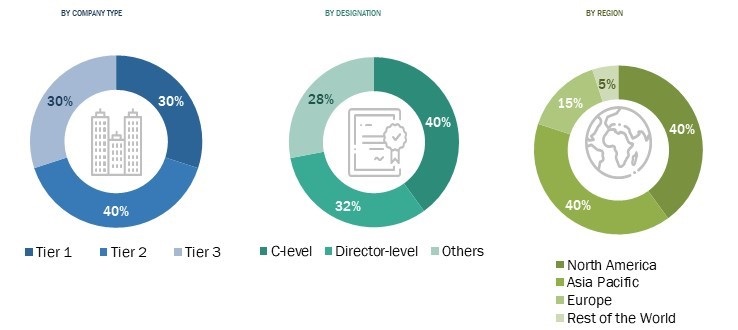

The study involved various activities in estimating the market size for Military Vehicle Electrification. Exhaustive secondary research was undertaken to collect information on the Military Vehicle Electrification market, its adjacent markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both demand- and supply-side analyses were carried out to estimate the overall size of the market. Thereafter, market breakdown and data triangulation procedures were used to estimate the sizes of different segments and subsegments of the Military Vehicle Electrification market.

Secondary Research

The market share of companies in the Military Vehicle Electrification market was determined by using the secondary data acquired through paid and unpaid sources and analyzing product portfolios of major companies operating in the market. These companies were rated based on the performance and quality of their products. These data points were further validated by primary sources.

Secondary sources referred for this research study on the Military Vehicle Electrification market included government sources, such as the US Department of Defense (DoD); federal and state governments of various countries; corporate filings, such as annual reports, investor presentations, and financial statements; and trade, business, and professional associations; among others. Secondary data was collected and analyzed to arrive at the overall size of the Military Vehicle Electrification market, which was further validated by primary respondents.

Primary Research

Extensive primary research was conducted after acquiring information about the current scenario of the Military Vehicle Electrification market through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major regions, namely, North America, Europe, Asia Pacific, the Middle East, and the Rest of the World (RoW). Primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

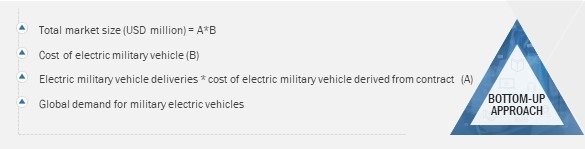

Both top-down and bottom-up approaches were used to estimate and validate the Military Vehicle Electrification market size. These methods were also used extensively to estimate the size of various segments and sub-segments of the market. The research methodology used to estimate the market size included the following steps:

- Key players in the industry and market were identified through extensive secondary research of their product matrix and geographical presence and developments undertaken by them.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Research Approach

Both top-down and bottom-up approaches were used to estimate and validate the total size of the Military Vehicle Electrification market. These methods were also used extensively to estimate the size of various segments and sub-segments of the market. The research methodology used to estimate the market size included the following:

- Key players in the industry and market were identified through extensive secondary research of their product matrix and geographical presence and developments undertaken by them.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Global Military Vehicle Electrification market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall size of the Military Vehicle Electrification market using the market size estimation processes explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from the demand as well as supply sides of the Military Vehicle Electrification market.

Objectives of the Report

- To analyze the size of the military vehicle electrification market and provide projections from 2022 to 2027

- To define, describe, and forecast the size of the market based on system, technology, mode of operation, and platform, along with regional analysis

- To understand the market structure by identifying its various subsegments

- To provide in-depth market intelligence regarding the dynamics (drivers, restraints, opportunities, and challenges) and major factors that influence the growth of the market

- To forecast the size of various segments of the market with respect to major countries such as the US, China, the UK, Saudi Arabia, Germany, France, Russia, India, Japan, South Korea, and Israel, among others

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the market

- To provide a detailed competitive landscape of the market, along with an analysis of the business and corporate strategies adopted by the key players

- To analyze competitive developments of the key players in the market such as contracts, acquisitions, partnerships, expansions, and new product developments

- To strategically profile key market players and comprehensively analyze their core competencies

- To strategically analyze the with respect to individual growth trends, prospects, and their contribution to the overall market

- To profile key market players and comprehensively analyze their market share and core competencies2

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the Military Vehicle Electrification market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the Military Vehicle Electrifications market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Military Vehicle Electrification Market