Milking Robots Market by System Type (Single-stall Unit, Multi-stall Unit, Automated Milking Rotary), Herd Size (Below 100, Between 100 and 1,000, Above 1,000), Offering (Hardware, Software, Services) and Region - Global Forecast to 2027

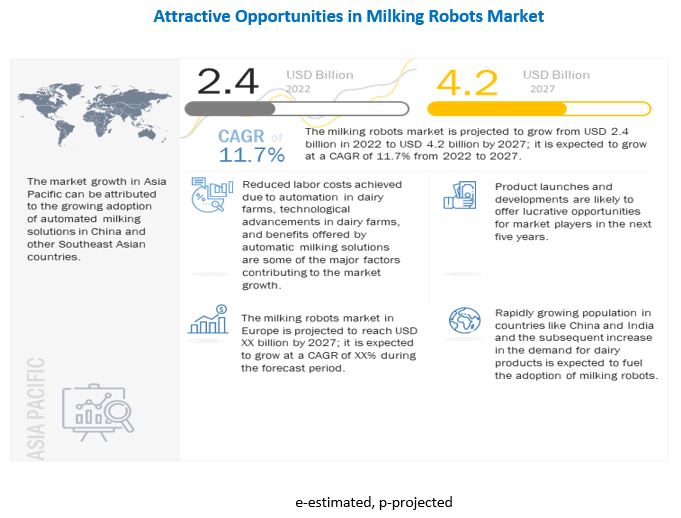

The milking robots market is projected to reach USD 4.2 billion by 2027, at a CAGR of 11.7% during the forecast period.

Reduced labor costs due to automation in dairy farms and the growing awareness about the benefits of using automated milking solutions such as milking robots especially in large farms are some of the major factors driving the market growth.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact

Due to COVID-19, businesses globally have been adversely impacted with revenue losses and disrupted supply chains as factory shutdowns and quarantine measures have been implemented worldwide, restricting movement and business activities. However, the shortage of labor in farms due to lockdowns has marginally increased the demand for service robots such as milking robots.

The milking robots market witnessed a marginal growth in 2020. However, the market has witnessed robust growth from 2021 owing to the relaxation of lockdowns and commencement of businesses globally.

Milking Robots Market Dynamics

Driver: Reduced labor costs due to automation in dairy farms

Dairy farming is labor-intensive. Increasing demand for dairy products and the subsequent increase in the number of dairy farms globally is expected to increase the labor and operational costs. According to the US Department of Agriculture Economic Research (USDA), farm wages increased to an annual average of USD 24.77 per hour in 2019 from USD 13.32 per hour in 2017. Growing farm income is a key factor contributing to the increasing farm wages in the US. The net farm income witnessed a 25.1% growth from 2020 to 2021.

The adoption of milking automation technologies, such as milking robots, can be instrumental in decreasing labor costs in dairy farms by significantly increasing milk yield. The use of milking robots not only reduces manual effort but also increases the number of times an individual animal can be milked, thereby increasing the yield. With the farmer's presence being no longer mandatory at regular milking times, the labor and operational costs are expected to decrease due to the adoption of milking robots industry.

Restraint: High initial investment

The high initial investment is a major factor impeding the milking robots market growth. The adoption of hardware components and technologies such as automation and control devices and sensing and monitoring devices not only incur upfront installation costs but also contribute to operational expenses. Along with hardware components, cloud-based or on-premise software solutions and various services such as maintenance and support services, connectivity services, system integration and consulting services, managed services and assisted professional services also significantly contribute to the high cost of milking robots.

Moreover, the majority of the farm owners globally own small to medium-sized farms, and investing extensively on advanced and automated solutions may lead to financial losses. This is highly prevalent in emerging economies such as India, Brazil, and China, where the herd size on farms is relatively low, and the livestock industry is unorganized.

Opportunity: Growing demand for dairy products and subsequent increase in number of dairy farms globally

According to the Food and Agricultural Organization (FAO) of the UN, the total number of cattle all over the world was 1.68 billion in 2018, and it is estimated to reach 2.0 billion by 2021. The growing demand for milking robots market can be majorly attributed to the growing number of dairy cattle to fulfill the surging demand for dairy products, such as butter, cheese, curd, and yogurt, globally. According to FAO’s 2021 estimates, global milk production increased from 916 million tonnes in 2020 to 928 million tonnes in 2021.

The increasing demand for dairy products is expected to provide ample growth opportunities for milking robots market players offering milking robots. Furthermore, as the herd size of dairy farms increases, it becomes difficult to carry out the milking process efficiently. Hence, the increasing herd size of dairy farms provides growth opportunities for the players for automatic milking solutions such as milking robots. The complete milking process can be made more efficient by deploying milking robots on large farms to achieve higher milk yield and economies of scale.

Challenge: Integration of milking robots with grazing systems and lack of standardization

Grazing dairies with pasture access witness additional complications when being integrated with a milking robot. Initially, the cow must be enticed to the barn from pastures for milking and then back to the field for grazing. The management of the herd movement in and out of the pasture for milking is a major challenge faced by farmers in implementing robotic milking systems.

Furthermore, the behavioral difference among individual animals is another major difficulty faced while milking animals using milking robots. Owing to behavioral difference among cows, it is difficult to milk all the animals of the herd with the same frequency, which may hamper milk yield. Furthermore, the adoption of milking robots is not suitable for all cows, especially for cows with poor udder shape and teat position.

Hardware segment to dominate the milking robots market during forecast period

Increasing adoption of milking robots, growing preference for automated hardware and systems, technological advancements by key players to introduce innovative products, growing demand for dairy products and subsequent increase in the number of dairy cows globally are some of the major factors driving demand for milking robots hardware.

Moreover, the increasing awareness about remote monitoring of dairy cows, identification and tracking of dairy cows with the help of sensor technology, and behavior monitoring and control of livestock on dairy farms are expected to fuel the demand for sensing and monitoring solutions for dairy farming during the forecast period.

Automated milking rotaries to register the highest CAGR in the milking robots market during the forecast period

The market for automated milking rotaries is expected to grow at the highest CAGR during the forecast period as these machines not only facilitate the milking of large herds but are also flexible enough to operate in different farming practices, ranging from free stall and loose housing to pasture-based dairying. Some of the benefits offered by automated milking rotaries include less dependency on manual labor and subsequently reduced labor cost, and increased milk yields due to more frequent milking.

To know about the assumptions considered for the study, download the pdf brochure

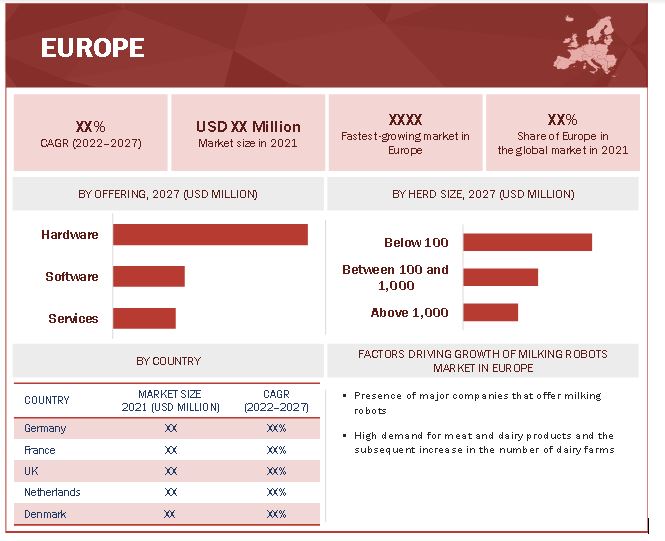

Europe accounted for the largest market share in 2021 owing to the widespread automation of dairy farms in Western Europe. DeLaval (Sweden), Dairymaster (Ireland), and Lely (Netherlands) are some of the major players in the milking robots market in Europe. These companies provide milking robots to end-users globally. The increasing trend of automation, and the presence of several market players are some of the major factors contributing to the market growth in Europe.

Key Market Players

The major players in the milking robots companies are DeLaval (Sweden), GEA Group (Germany), Lely (Netherlands), BouMatic (US), and Fullwood JOZ (UK).

Milking Robots Market Report Scope

|

Report Metric |

Details |

| Estimated Market Size | USD 2.4 Billion |

| Projected Market Size | USD 4.2 Billion |

| Growth Rate | CAGR of 11.7% |

|

Market size available for years |

2018–2027 |

|

On Demand Data Available |

2030 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Value (USD Million/USD Billion) |

|

Segments covered |

|

|

Geographies covered |

|

| Market Leaders |

|

| Top Companies in North America | BouMatic (US), AMS Galaxy (USA) |

| Key Market Driver | Reduced labor costs due to automation in dairy farms |

|

Key Market Opportunity |

Growing demand for dairy products and subsequent increase in number of dairy farms globally |

| Largest Growing Region | Asia Pacific |

| Largest Market Share Segment | Hardware Segment |

| Highest CAGR Segment | Automated Milking Rotaries |

The study segments the milking robots market based on offering, system type, and herd size at the regional and global level.

Milking Robots Market By Offering

- Hardware

- Software

- Services

By System Type

- Single-stall Unit

- Multi-stall Unit

- Automated Milking Rotary

By Herd Size

- Below 100

- Between 100 and 1,000

- Above 1,000

Milking Robots Market By Region

- Americas

- Europe

- Asia Pacific

- Rest of the World

Recent Developments

- In August 2022, DeLaval launched Flow-Responsive Milking, an advanced milking technology that reduces the milking time up to 10% by altering the vacuum applied to the milk flow profile. The technology also supports good udder health and animal welfare.

- In October 2021, BouMatic announced the acquisition of SAC Group, a leading producer of milking systems for cows, sheep, and goats. SAC Group would operate as a wholly owned subsidiary of BouMatic post the acquisition. With this acquisition, BouMatic aims to strengthen its position in the market and enhance its product portfolio related to milking solutions.

- In July 2021, GEA Group announced the launch of the newer versions of DairyRobot R9500 milking robot and DairyProQ automatic milking systems. Adoption of these machines facilitate increased number of milking and reduce up to 35% of cost. DairyRobot R9500 is also integrated with the company’s new software package that enables seamless group milking.

- In March 2021, Lely unveiled its sampler for milking robots market. This device can be integrated with milking robots for collecting milk samples. The company currently offers this device in countries in EU and North America.

- In December 2020, BouMatic launched an updated management system called OneView for its Gemini milking robot. OneView provides users easy access to the robot and an overview of the herd, cow, and robot performance.

- In September 2018, Fullwood announced a long-term strategic partnership with Afimilk, a leading provider of automated dairy farming systems. According to the partnership, Fullwood can leverage on Afimilk’s portfolio of automated solutions and emerging technologies to develop an advanced range of milking solutions.

Frequently Asked Questions (FAQ):

What is the current size of the global milking robots market?

The milking robots market is estimated to be worth USD 2.4 billion in 2022 and is projected to reach USD 4.2 billion by 2027, at a CAGR of 11.7% during the forecast period. Reduced labor costs due to automation in dairy farms and the growing awareness about the benefits of using automated milking solutions such as milking robots, especially in large farms are some of the major factors driving the market growth

Who are the winners in the global milking robots market?

Companies such as DeLaval (Sweden), GEA Group (Germany), Lely (Netherlands), BouMatic (US), and Fullwood JOZ (UK), fall under the winners category.

What is the COVID-19 impact on milking robots market?

Due to COVID-19, businesses globally have been adversely impacted with revenue losses and disrupted supply chains as factory shutdowns and quarantine measures have been implemented worldwide, restricting movement and business activities. However, the shortage of labor in farms due to lockdowns has marginally increased the demand for service robots such as milking robots.

What are the opportunities pertaining to the milking robots market?

Growing demand for dairy products and subsequent increase in number of dairy farms globally, increasing adoption of milking robots in developing countries, and increasing government investments are expected to provide ample growth opportunities for market players developing milking robots.

What are the strategies adopted by key players?

Product launches and developments, expansions, acquisitions, partnerships, collaborations, and agreements are the major organic and inorganic growth strategies adopted by key players in the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 28)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.2.2 INCLUSIONS AND EXCLUSIONS AT COMPANY LEVEL

1.2.3 INCLUSIONS AND EXCLUSIONS AT OFFERING LEVEL

1.2.4 INCLUSIONS AND EXCLUSIONS AT HERD SIZE LEVEL

1.2.5 INCLUSIONS AND EXCLUSIONS AT SYSTEM TYPE LEVEL

1.2.6 INCLUSIONS AND EXCLUSIONS AT REGIONAL LEVEL

1.3 STUDY SCOPE

FIGURE 1 MILKING ROBOTS MARKET: SEGMENTATION

1.3.1 REGIONAL SCOPE

1.3.2 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

1.5 UNIT CONSIDERED

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 34)

2.1 RESEARCH DATA

FIGURE 2 MILKING ROBOTS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Major secondary sources

2.1.1.2 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Primary interviews with experts

2.1.2.2 List of primary interview participants

2.1.2.3 Breakdown of primaries

2.1.2.4 Primary sources

2.1.2.5 Key industry insights

2.1.3 SECONDARY AND PRIMARY RESEARCH

2.2 MARKET SIZE ESTIMATION

2.2.1 TOP-DOWN APPROACH

FIGURE 3 TOP-DOWN APPROACH

2.2.1.1 Approach to derive market share by using top-down analysis

2.2.2 BOTTOM-UP APPROACH

2.2.2.1 Approach to derive market share by using bottom-up analysis

FIGURE 4 BOTTOM-UP APPROACH

FIGURE 5 MARKET SIZE ESTIMATION: SUPPLY-SIDE ANALYSIS

FIGURE 6 MARKET SIZE ESTIMATION: DEMAND-SIDE ANALYSIS

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 7 MARKET BREAKDOWN AND DATA TRIANGULATION

2.4 GROWTH FORECAST ASSUMPTIONS

TABLE 1 MARKET GROWTH ASSUMPTIONS

2.5 RESEARCH ASSUMPTIONS

FIGURE 8 RESEARCH ASSUMPTIONS

2.6 RISK ASSESSMENT

TABLE 2 RISK ASSESSMENT: MILKING ROBOTS MARKET

3 EXECUTIVE SUMMARY (Page No. - 47)

FIGURE 9 MARKET, 2022–2027 (USD MILLION)

FIGURE 10 ABOVE 1,000 SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 11 HARDWARE SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

FIGURE 12 AUTOMATED MILKING ROTARY SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 13 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 51)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR PLAYERS IN MARKET

FIGURE 14 REDUCED LABOR COSTS ACHIEVED DUE TO AUTOMATION IN DAIRY FARMS TO CONTRIBUTE TO MILKING ROBOTS MARKET GROWTH

4.2 MARKET, BY OFFERING

FIGURE 15 HARDWARE SEGMENT TO HOLD LARGEST SHARE OF MARKET DURING FORECAST PERIOD

4.3 MARKET, BY HERD SIZE

FIGURE 16 BELOW 100 SEGMENT TO HOLD LARGEST SHARE OF MARKET DURING FORECAST PERIOD

4.4 MARKET, BY SYSTEM TYPE

FIGURE 17 SINGLE-STALL UNIT SEGMENT TO ACCOUNT FOR LARGEST SHARE OF MARKET DURING FORECAST PERIOD

4.5 EUROPE: MARKET, BY OFFERING AND COUNTRY, 2021

FIGURE 18 HARDWARE AND GERMANY HELD LARGEST SHARES OF MILKING ROBOTS MARKET IN EUROPE, BY OFFERING AND COUNTRY, RESPECTIVELY, IN 2021

5 MARKET OVERVIEW (Page No. - 54)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN MARKET

5.2.1 DRIVERS

5.2.1.1 Reduced labor costs due to automation in dairy farms

5.2.1.2 Technological advancements in dairy farms

5.2.1.3 Benefits offered by automatic milking solutions

FIGURE 20 MILKING ROBOT SHIPMENTS, 2018–2027 (THOUSAND UNITS)

FIGURE 21 IMPACT ANALYSIS OF DRIVERS ON MARKET

5.2.2 RESTRAINTS

5.2.2.1 High initial investment

5.2.2.2 Gradual transition to vegan diet affecting market growth in Europe

FIGURE 22 TOTAL NUMBER OF PARTICIPANTS IN VEGANUARY PROGRAM, 2014–2022

5.2.2.3 Dearth of skill and limited understanding of technology among farmers

FIGURE 23 IMPACT ANALYSIS OF RESTRAINTS ON MILKING ROBOTS MARKET

5.2.3 OPPORTUNITIES

5.2.3.1 Growing demand for dairy products and subsequent increase in number of dairy farms globally

FIGURE 24 MILK PRODUCTION, BY REGION, 2020 AND 2021 (MILLION TONS)

TABLE 3 PER CAPITA CONSUMPTION OF PROCESSED AND FRESH DAIRY PRODUCTS IN MILK SOLIDS, BY REGION, 2030 (KG PER CAPITA)

FIGURE 25 CATTLE INVENTORY OF MAJOR COUNTRIES IN 2021 (MILLION UNITS)

5.2.3.2 Growing adoption of milking robots in developing countries

5.2.3.3 Increasing investments by governments

FIGURE 26 IMPACT ANALYSIS OF OPPORTUNITIES IN MILKING ROBOTS MARKET

5.2.4 CHALLENGES

5.2.4.1 Integration of milking robots with grazing systems and lack of standardization

5.2.4.2 Trade barriers and stringent government regulations

FIGURE 27 IMPACT ANALYSIS OF CHALLENGES IN MARKET

5.3 VALUE CHAIN ANALYSIS

FIGURE 28 MARKET: VALUE CHAIN ANALYSIS

TABLE 4 MARKET: VALUE CHAIN ANALYSIS

5.4 MARKET: ECOSYSTEM

FIGURE 29 MARKET: ECOSYSTEM

5.5 KEY TECHNOLOGY TRENDS

5.5.1 AUTOMATIC CATTLE TRAFFIC MANAGEMENT

5.5.2 PARLOR MONITORING

5.5.3 ADVANCED LINERS AND CLUSTERS

5.5.4 ADD-ON ROBOTIC SOLUTIONS

5.6 PRICING ANALYSIS

FIGURE 30 ASP TREND FOR MILKING ROBOTS

5.7 PATENT ANALYSIS

TABLE 5 PATENTS FILED DURING REVIEW PERIOD, 2011—2021

FIGURE 31 NUMBER OF PATENTS GRANTED WORLDWIDE FOR MILKING ROBOTS, 2010–2022

FIGURE 32 TOP 10 PATENT APPLICANTS

TABLE 6 TOP 20 PATENT OWNERS DURING REVIEW PERIOD, 2011—2021

TABLE 7 KEY PATENTS RELATED TO MILKING ROBOTS

5.8 PORTER’S FIVE FORCES ANALYSIS

FIGURE 33 MILKING ROBOTS MARKET: PORTER’S FIVE FORCES ANALYSIS

FIGURE 34 IMPACT OF PORTER’S FIVE FORCES ON MARKET, 2021

TABLE 8 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.8.1 THREAT OF NEW ENTRANTS

5.8.2 THREAT OF SUBSTITUTES

5.8.3 BARGAINING POWER OF SUPPLIERS

5.8.4 BARGAINING POWER OF BUYERS

5.8.5 INTENSITY OF COMPETITIVE RIVALRY

5.9 KEY STAKEHOLDERS & BUYING CRITERIA

5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 35 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR MILKING MANAGEMENT

TABLE 9 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR MILKING MANAGEMENT (%)

5.9.2 BUYING CRITERIA

FIGURE 36 KEY BUYING CRITERIA FOR MILKING MANAGEMENT

TABLE 10 KEY BUYING CRITERIA FOR MILKING MANAGEMENT

5.10 CASE STUDIES

5.10.1 INCREASE IN MILK YIELD IN FOLSOM DAIRY FARM (CANADA)

TABLE 11 LELY ASTRONAUT A5 MILKING ROBOTS IMPROVED FARM PRODUCTIVITY

5.10.2 ENHANCEMENT OF OVERALL MILKING PROCESS IN NEWLANDS FAMILY FARM (US)

TABLE 12 DELAVAL VMS V300 MILKING ROBOTS ENHANCED OVERALL MILKING PROCESS

5.10.3 IMPROVEMENT IN LABOR EFFICIENCY IN VAN ADRICHEM’S FAMILY DAIRY FARM (AUSTRALIA)

TABLE 13 LELY ASTRONAUT MILKING ROBOTS IMPROVED LABOR EFFICIENCY

5.11 TRADE DATA

TABLE 14 MILKING MACHINES, EXPORT DATA FOR MAJOR COUNTRIES, 2017–2021 (USD MILLION)

FIGURE 37 MILKING MACHINES: EXPORT DATA FOR MAJOR COUNTRIES, 2017–2021

TABLE 15 MILKING MACHINES: IMPORT DATA FOR MAJOR COUNTRIES, 2017–2021 (USD MILLION)

FIGURE 38 MILKING MACHINES: IMPORT DATA FOR MAJOR COUNTRIES, 2017–2021

5.12 REGULATORY ENVIRONMENT

5.12.1 TARIFFS

TABLE 16 MFN TARIFFS FOR MILKING MACHINES EXPORTED BY FRANCE

5.12.2 REGULATIONS

5.12.2.1 North America

5.12.3 STANDARDS

5.12.3.1 International Organization of Standardization (ISO)

5.13 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

FIGURE 39 REVENUE SHIFTS FOR MARKET

5.14 KEY CONFERENCES & EVENTS, 2022–2023

TABLE 17 MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

6 MILKING ROBOTS MARKET, BY OFFERING (Page No. - 78)

6.1 INTRODUCTION

TABLE 18 MARKET, BY OFFERING, 2018–2021 (USD MILLION)

FIGURE 40 SERVICES SEGMENT EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 19 MARKET, BY OFFERING, 2022–2027 (USD MILLION)

6.2 HARDWARE

TABLE 20 HARDWARE: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 21 HARDWARE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 22 HARDWARE: MARKET, BY HERD SIZE, 2018–2021 (USD MILLION)

TABLE 23 HARDWARE: MARKET, BY HERD SIZE, 2022–2027 (USD MILLION)

TABLE 24 HARDWARE: MARKET, BY SYSTEM TYPE, 2018–2021 (USD MILLION)

TABLE 25 HARDWARE: MARKET, BY SYSTEM TYPE, 2022–2027 (USD MILLION)

TABLE 26 HARDWARE: MARKET, BY REGION, 2018–2021 (USD MILLION)

FIGURE 41 EUROPE TO BE LARGEST MARKET FOR HARDWARE DURING FORECAST PERIOD

TABLE 27 HARDWARE: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.1 AUTOMATION AND CONTROL DEVICES

TABLE 28 AUTOMATION & CONTROL DEVICES: MILKING ROBOTS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 29 AUTOMATION & CONTROL DEVICES: MARKET, BY TYPE, 2022–2027 (USD MILLION)

6.2.1.1 Robotic arm devices

6.2.1.1.1 Facilitate milking with high speed and accuracy

6.2.1.2 Control and display units

6.2.1.2.1 Act as user interface for operators

6.2.1.3 Milk meters

6.2.1.3.1 Deliver accurate data related to milk yield to improve farm profitability

6.2.1.4 Milk analyzers

6.2.1.4.1 Used to measure fat content in milk samples

6.2.1.5 Cleaning and detection systems

6.2.1.5.1 Facilitate positioning and orientation of individual teats

6.2.1.6 Others

6.2.2 SENSING AND MONITORING DEVICES

TABLE 30 SENSING & MONITORING DEVICES: MARKET, BY TYPE, 2018–2021 (USD MILLION)

FIGURE 42 CAMERA SYSTEMS SEGMENT TO GROW AT HIGHEST CAGR IN MARKET FOR SENSING & MONITORING DEVICES DURING FORECAST PERIOD

TABLE 31 SENSING & MONITORING DEVICES: MARKET, BY TYPE, 2022–2027 (USD MILLION)

6.2.2.1 Sensors

6.2.2.1.1 Wide range of sensors used for different milking applications

6.2.2.1.2 Temperature sensors

6.2.2.1.2.1.1 Used to monitor body temperature of cows

6.2.2.1.3 Environmental sensors

6.2.2.1.3.1.1 Facilitate optimum milk production by regulating environmental variables inside farm

6.2.2.2 RFID tags and readers

6.2.2.2.1 Instrumental in tracking and monitoring cattle

6.2.2.3 Camera systems

6.2.2.3.1 Monitor animal health and movement on dairy farms

6.2.2.4 Others

6.3 SOFTWARE

TABLE 32 SOFTWARE: MILKING ROBOTS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 33 SOFTWARE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 34 SOFTWARE: MARKET, BY HERD SIZE, 2018–2021 (USD MILLION)

TABLE 35 SOFTWARE: MARKET, BY HERD SIZE, 2022–2027 (USD MILLION)

TABLE 36 SOFTWARE: MARKET, BY SYSTEM TYPE, 2018–2021 (USD MILLION)

TABLE 37 SOFTWARE: MARKET, BY SYSTEM TYPE, 2022–2027 (USD MILLION)

TABLE 38 SOFTWARE: MARKET, BY REGION, 2018–2021 (USD MILLION)

FIGURE 43 ASIA PACIFIC TO BE FASTEST-GROWING SOFTWARE MARKET DURING FORECAST PERIOD

TABLE 39 SOFTWARE: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3.1 CLOUD-BASED SOFTWARE

6.3.1.1 Offers benefits such as optimized performance and ease of access

6.3.2 ON-PREMISE SOFTWARE

6.3.2.1 Facilitates reuse of servers and storage hardware

6.4 SERVICES

TABLE 40 SERVICES: MILKING ROBOTS MARKET, BY TYPE, 2018–2021 (USD MILLION)

FIGURE 44 MARKET FOR ASSISTED PROFESSIONAL SERVICES TO GROW AT HIGHEST CAGR BETWEEN 2022 AND 2027

TABLE 41 SERVICES: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 42 SERVICES: MARKET, BY HERD SIZE, 2018–2021 (USD MILLION)

TABLE 43 SERVICES: MARKET, BY HERD SIZE, 2022–2027 (USD MILLION)

TABLE 44 SERVICES: MARKET, BY SYSTEM TYPE, 2018–2021 (USD MILLION)

TABLE 45 SERVICES: MARKET, BY SYSTEM TYPE, 2022–2027 (USD MILLION)

TABLE 46 SERVICES: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 47 SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.4.1 SYSTEM INTEGRATION AND CONSULTING SERVICES

6.4.1.1 Enable manufacturers to provide advanced milking solutions

6.4.2 MANAGED SERVICES

6.4.2.1 Include hardware installation, software functioning, and monitoring output of automatic milking solutions

6.4.3 CONNECTIVITY SERVICES

6.4.3.1 Ensure seamless connectivity between device domains and end-users

6.4.4 ASSISTED PROFESSIONAL SERVICES

6.4.4.1 Provide additional information to farmers to improve farm productivity

6.4.4.2 Supply chain management services

6.4.4.2.1 Optimize inventory, transportation, and procurement of raw materials

6.4.4.3 Climate information services

6.4.4.3.1 Keep dairy farmers updated about weather conditions to ensure proper milk yield

6.4.4.4 Others

6.4.5 MAINTENANCE AND SUPPORT SERVICES

6.4.5.1 Include troubleshooting of problems related to hardware and software

7 MILKING ROBOTS MARKET, BY SYSTEM TYPE (Page No. - 96)

7.1 INTRODUCTION

TABLE 48 GLOBAL MARKET, 2018–2021 (THOUSAND UNITS)

TABLE 49 GLOBAL MARKET, 2022–2027 (THOUSAND UNITS)

TABLE 50 MARKET, BY SYSTEM TYPE, 2018–2021 (USD MILLION)

FIGURE 45 AUTOMATED MILKING ROTARY SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 51 MARKET, BY SYSTEM TYPE, 2022–2027 (USD MILLION)

7.2 SINGLE-STALL UNIT

7.2.1 GROWING NUMBER OF SMALL FARMS TO BOOST ADOPTION OF SINGLE-STALL UNITS

TABLE 52 SINGLE-STALL UNIT: MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 53 SINGLE-STALL UNIT: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 54 SINGLE-STALL UNIT: MARKET, BY HERD SIZE, 2018–2021 (USD MILLION)

FIGURE 46 ABOVE 1,000 SEGMENT TO GROW AT HIGHEST CAGR IN MARKET FOR SINGLE-STALL UNITS DURING FORECAST PERIOD

TABLE 55 SINGLE-STALL UNIT: MARKET, BY HERD SIZE, 2022–2027 (USD MILLION)

7.3 MULTI-STALL UNIT

7.3.1 USED IN COMMERCIAL FARMS

TABLE 56 MULTI-STALL UNIT: MILKING ROBOTS MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 57 MULTI-STALL UNIT: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 58 MULTI-STALL UNIT: MARKET, BY HERD SIZE, 2018–2021 (USD MILLION)

TABLE 59 MULTI-STALL UNIT: MARKET, BY HERD SIZE, 2022–2027 (USD MILLION)

7.4 AUTOMATED MILKING ROTARY (AMR)

7.4.1 SUITABLE FOR LARGE FARMS

TABLE 60 AUTOMATED MILKING ROTARY: MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 61 AUTOMATED MILKING ROTARY: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 62 AUTOMATED MILKING ROTARY: MARKET, BY HERD SIZE, 2018–2021 (USD MILLION)

TABLE 63 AUTOMATED MILKING ROTARY: MARKET, BY HERD SIZE, 2022–2027 (USD MILLION)

8 MILKING ROBOTS MARKET, BY HERD SIZE (Page No. - 104)

8.1 INTRODUCTION

TABLE 64 MARKET, BY HERD SIZE, 2018–2021 (USD MILLION)

FIGURE 47 ABOVE 1,000 SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 65 MARKET, BY HERD SIZE, 2022–2027 (USD MILLION)

8.2 BELOW 100

8.2.1 INCUR LOW EQUIPMENT COSTS

TABLE 66 BELOW 100: MARKET, BY SYSTEM TYPE, 2018–2021 (USD MILLION)

TABLE 67 BELOW 100: MARKET, BY SYSTEM TYPE, 2022–2027 (USD MILLION)

TABLE 68 BELOW 100: MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 69 BELOW 100: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 70 BELOW 100: MARKET, BY REGION, 2018–2021 (USD MILLION)

FIGURE 48 BELOW 100 SEGMENT TO GROW AT HIGHEST CAGR IN MARKET IN ASIA PACIFIC DURING FORECAST PERIOD

TABLE 71 BELOW 100: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.3 BETWEEN 100 AND 1,000

8.3.1 EMPLOY MILKING ROBOTS WITH MULTI-STALL UNITS

TABLE 72 BETWEEN 100 AND 1,000: MILKING ROBOTS MARKET, BY SYSTEM TYPE, 2018–2021 (USD MILLION)

TABLE 73 BETWEEN 100 AND 1,000: MARKET, BY SYSTEM TYPE, 2022–2027 (USD MILLION)

TABLE 74 BETWEEN 100 AND 1,000: MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 75 BETWEEN 100 AND 1,000: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 76 BETWEEN 100 AND 1,000: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 77 BETWEEN 100 AND 1,000: MARKET, BY REGION, 2022–2027(USD MILLION)

8.4 ABOVE 1,000

8.4.1 ADOPT MILKING ROBOTS TO REDUCE LABOR COSTS ON LARGE FARMS

TABLE 78 BETWEEN 100 AND 1,000: MARKET, BY SYSTEM TYPE, 2018–2021 (USD MILLION)

TABLE 79 BETWEEN 100 AND 1,000: MARKET, BY SYSTEM TYPE, 2022–2027 (USD MILLION)

TABLE 80 BETWEEN 100 AND 1,000: MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 81 BETWEEN 100 AND 1,000: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 82 BETWEEN 100 AND 1,000: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 83 BETWEEN 100 AND 1,000: MARKET, BY REGION, 2022–2027 (USD MILLION)

9 MILKING ROBOTS MARKET, BY REGION (Page No. - 114)

9.1 INTRODUCTION

FIGURE 49 MARKET IN INDIA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 84 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 85 MARKET, BY REGION, 2022–2027 (USD MILLION)

9.2 AMERICAS

FIGURE 50 AMERICAS: MARKET SNAPSHOT

TABLE 86 AMERICAS: MARKET, BY HERD SIZE, 2018–2021 (USD MILLION)

TABLE 87 AMERICAS: MARKET, BY HERD SIZE, 2022–2027 (USD MILLION)

TABLE 88 AMERICAS: MARKET, BY SYSTEM TYPE, 2018–2021 (USD MILLION)

TABLE 89 AMERICAS: MARKET, BY SYSTEM TYPE, 2022–2027 (USD MILLION)

TABLE 90 AMERICAS: MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 91 AMERICAS: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 92 AMERICAS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 93 AMERICAS: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.2.1 NORTH AMERICA

TABLE 94 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 95 NORTH AMERICA: MILKING ROBOTS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

9.2.1.1 US

9.2.1.1.1 Increasing labor costs and labor shortage to drive market

9.2.1.2 Canada

9.2.1.2.1 Presence of numerous dairy farms to support market growth

9.2.1.3 Mexico

9.2.1.3.1 Growing trend of importing cattle to stimulate market growth

9.2.2 SOUTH AMERICA

TABLE 96 SOUTH AMERICA: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 97 SOUTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

9.2.2.1 Brazil

9.2.2.1.1 Government initiatives to improve farm productivity to augment market growth

9.2.2.2 Argentina

9.2.2.2.1 Large cattle population and increasing focus on exporting dairy products to drive market

9.2.2.3 Rest of South America

9.3 EUROPE

FIGURE 51 EUROPE: MILKING ROBOTS MARKET SNAPSHOT

TABLE 98 EUROPE: MARKET, BY HERD SIZE, 2018–2021 (USD MILLION)

TABLE 99 EUROPE: MARKET, BY HERD SIZE, 2022–2027 (USD MILLION)

TABLE 100 EUROPE: MARKET, BY SYSTEM TYPE, 2018–2021 (USD MILLION)

TABLE 101 EUROPE: MARKET, BY SYSTEM TYPE, 2022–2027 (USD MILLION)

TABLE 102 EUROPE: MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 103 EUROPE: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 104 EUROPE: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 105 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

9.3.1 GERMANY

9.3.1.1 Large dairy cattle population and government initiatives for sustainable agriculture to support market

9.3.2 FRANCE

9.3.2.1 Increase in average herd size in farms to create demand for milking robots

9.3.3 UK

9.3.3.1 Increasing labor costs to propel demand for milking robots

9.3.4 NETHERLANDS

9.3.4.1 Increasing herd size and labor costs to drive market

9.3.5 DENMARK

9.3.5.1 High cattle population to favor market growth

9.3.6 REST OF EUROPE

9.4 ASIA PACIFIC

FIGURE 52 ASIA PACIFIC: MILKING ROBOTS MARKET SNAPSHOT

TABLE 106 ASIA PACIFIC: MARKET, BY HERD SIZE, 2018–2021 (USD MILLION)

TABLE 107 ASIA PACIFIC: MARKET, BY HERD SIZE, 2022–2027 (USD MILLION)

TABLE 108 ASIA PACIFIC: MARKET, BY SYSTEM TYPE, 2018–2021 (USD MILLION)

TABLE 109 ASIA PACIFIC: MARKET, BY SYSTEM TYPE, 2022–2027 (USD MILLION)

TABLE 110 ASIA PACIFIC: MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 111 ASIA PACIFIC: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 112 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 113 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

9.4.1 CHINA

9.4.1.1 Consolidation of smaller farms to fuel adoption of automated milking solutions

9.4.2 JAPAN

9.4.2.1 Aging workforce to induce demand for advanced milking solutions

9.4.3 AUSTRALIA & NEW ZEALAND

9.4.3.1 High awareness among dairy farmers about benefits of milking robots to spur market growth

9.4.4 INDIA

9.4.4.1 Focus on increasing milk production to drive market

9.4.5 SOUTH KOREA

9.4.5.1 Focus on reducing labor cost to boost adoption of milking robots

9.4.6 REST OF ASIA PACIFIC

9.5 REST OF THE WORLD (ROW)

TABLE 114 REST OF THE WORLD: MARKET, BY HERD SIZE, 2018–2021 (USD MILLION)

TABLE 115 REST OF THE WORLD: MARKET, BY HERD SIZE, 2022–2027 (USD MILLION)

TABLE 116 REST OF THE WORLD: MARKET, BY SYSTEM TYPE, 2018–2021 (USD MILLION)

TABLE 117 REST OF THE WORLD: MARKET, BY SYSTEM TYPE, 2022–2027 (USD MILLION)

TABLE 118 REST OF THE WORLD: MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 119 REST OF THE WORLD: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 120 REST OF THE WORLD: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 121 REST OF THE WORLD: MILKING ROBOTS MARKET, BY REGION, 2022–2027 (USD MILLION)

9.5.1 AFRICA

9.5.1.1 Investments to improve livestock sector to provide opportunities for market players

9.5.2 MIDDLE EAST

9.5.2.1 Increase in number of livestock farms to propel market growth

10 COMPETITIVE LANDSCAPE (Page No. - 137)

10.1 INTRODUCTION

10.2 STRATEGIES ADOPTED BY KEY PLAYER

TABLE 122 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

FIGURE 53 COMPANIES ADOPTED PRODUCT LAUNCHES AS KEY GROWTH STRATEGY FROM 2018–2022

10.2.1 ORGANIC/INORGANIC GROWTH STRATEGIES

10.2.2 PRODUCT PORTFOLIO

10.2.3 GEOGRAPHIC PRESENCE

10.2.4 MANUFACTURING FOOTPRINT

10.3 MARKET SHARE ANALYSIS, 2021

TABLE 123 MARKET SHARE ANALYSIS OF KEY COMPANIES IN MARKET, 2021

10.4 HISTORICAL REVENUE ANALYSIS, 2017–2021

FIGURE 54 HISTORICAL REVENUE ANALYSIS OF MAJOR COMPANIES IN MILKING ROBOTS MARKET, 2017–2021 (USD BILLION)

10.5 COMPANY EVALUATION QUADRANT

10.5.1 STARS

10.5.2 EMERGING LEADERS

10.5.3 PERVASIVE PLAYERS

10.5.4 PARTICIPANTS

FIGURE 55 MARKET (GLOBAL): COMPANY EVALUATION QUADRANT, 2021

10.6 STARTUP/SME EVALUATION QUADRANT

10.6.1 COMPETITIVE BENCHMARKING

TABLE 124 MILKING ROBOTS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

TABLE 125 COMPETITIVE BENCHMARKING FOR STARTUPS/SMES: OFFERING

TABLE 126 COMPETITIVE BENCHMARKING FOR STARTUPS/SMES: PRODUCT

TABLE 127 COMPETITIVE BENCHMARKING OF STARTUP/SMES: REGION

10.6.2 PROGRESSIVE COMPANIES

10.6.3 RESPONSIVE COMPANIES

10.6.4 DYNAMIC COMPANIES

10.6.5 STARTING BLOCKS

FIGURE 56 MILKING ROBOTS MARKET (GLOBAL): STARTUP/SME EVALUATION QUADRANT, 2021

10.7 COMPANY FOOTPRINT

TABLE 128 COMPANY FOOTPRINT

TABLE 129 COMPANY OFFERING FOOTPRINT

TABLE 130 COMPANY PRODUCT FOOTPRINT

TABLE 131 COMPANY REGION FOOTPRINT

10.8 COMPETITIVE SCENARIOS AND TRENDS

FIGURE 57 COMPETITIVE SCENARIO, 2018—2022

10.8.1 PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 132 PRODUCT LAUNCHES AND DEVELOPMENTS, 2019–2022

10.8.2 DEALS

TABLE 133 DEALS, 2018–2022

10.8.3 OTHERS

TABLE 134 OTHER STRATEGIES (EXPANSIONS)

11 COMPANY PROFILES (Page No. - 155)

11.1 INTRODUCTION

11.2 KEY PLAYERS

(Business overview, Products/Solutions/Services offered, Recent developments, MnM view, Key strengths/Right to win, Strategic choices made, and Weaknesses and competitive threats)*

11.2.1 DELAVAL

TABLE 135 DELAVAL: COMPANY OVERVIEW

FIGURE 58 DELAVAL: COMPANY SNAPSHOT

TABLE 136 DELAVAL: PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 137 DELAVAL: DEALS

TABLE 138 DELAVAL: OTHERS

11.2.2 GEA GROUP

TABLE 139 GEA GROUP: COMPANY OVERVIEW

FIGURE 59 GEA GROUP: COMPANY SNAPSHOT

TABLE 140 GEA GROUP: PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 141 GEA GROUP: OTHERS

11.2.3 LELY

TABLE 142 LELY: COMPANY OVERVIEW

TABLE 143 LELY: PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 144 LELY: OTHERS

11.2.4 BOUMATIC

TABLE 145 BOUMATIC: COMPANY OVERVIEW

TABLE 146 BOUMATIC: PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 147 BOUMATIC: DEALS

11.2.5 FULLWOOD JOZ (SUBSIDIARY OF JOZ)

TABLE 148 FULLWOOD JOZ: COMPANY OVERVIEW

TABLE 149 FULLWOOD JOZ: PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 150 FULLWOOD JOZ: DEALS

11.2.6 MILKOMAX SOLUTIONS LAITIERES INC.

TABLE 151 MILKOMAX SOLUTIONS LAITIERES INC.: COMPANY OVERVIEW

TABLE 152 MILKOMAX SOLUTIONS LAITIERES INC.: DEALS

11.2.7 SYSTEM HAPPEL GMBH

TABLE 153 SYSTEM HAPPEL GMBH: COMPANY OVERVIEW

11.2.8 WAIKATO MILKING SYSTEMS NZ LP

TABLE 154 WAIKATO MILKING SYSTEMS NZ LP: COMPANY OVERVIEW

TABLE 155 WAIKATO MILKING SYSTEMS NZ LP: PRODUCT LAUNCHES AND DEVELOPMENTS

11.2.9 AMS GALAXY USA

TABLE 156 AMS GALAXY USA: COMPANY OVERVIEW

TABLE 157 AMS GALAXY USA: PRODUCT LAUNCHES AND DEVELOPMENTS

11.2.10 DAIRYMASTER

TABLE 158 DAIRYMASTER: COMPANY OVERVIEW

TABLE 159 DAIRYMASTER: DEALS

11.3 OTHER PLAYERS

11.3.1 MIROBOT

11.3.2 MILKPLAN

11.3.3 MILKWELL MILKING SYSTEMS

11.3.4 CONNECTERRA B.V.

11.3.5 ARCNUT TECHNOLOGIES

11.3.6 PROMPT EQUIPMENTS PVT LTD.

11.3.7 AFIMILK LTD.

11.3.8 VANSUN TECHNOLOGIES PRIVATE LIMITED

11.3.9 ADF MILKING LTD

11.3.10 SEZER AGRICULTURE AND MILKING TECHNOLOGIES

11.3.11 STELLAPPS TECHNOLOGIES

11.3.12 YUYAO YUHAI LIVESTOCK MACHINERY TECHNOLOGY CO., LTD.

11.3.13 BEIJING KINGPENG GLOBAL HUSBANDRY TECHNOLOGY CO., LTD.

11.3.14 SHANGHAI RUIKE MACHINERY EQUIPMENT CO., LTD.

11.3.15 DAVIESWAY PTY LTD.

11.3.16 HOKOFARM GROUP

*Details on Business overview, Products/Solutions/Services offered, Recent developments, MnM view, Key strengths/Right to win, Strategic choices made, and Weaknesses and competitive threats might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 188)

12.1 INSIGHTS FROM INDUSTRY EXPERTS

12.2 DISCUSSION GUIDE

12.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.4 CUSTOMIZATION OPTIONS

12.5 RELATED REPORTS

12.6 AUTHOR DETAILS

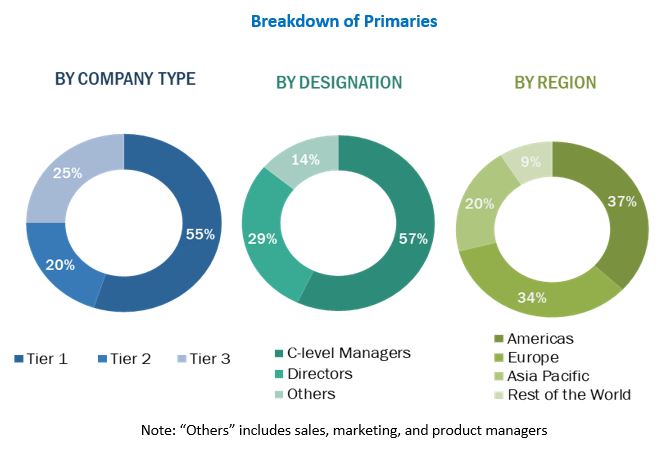

The research study involved 4 major activities in estimating the size of the milking robots market. Exhaustive secondary research has been done to collect important information about the market and peer markets. The validation of these findings, assumptions, and sizing with the help of primary research with industry experts across the value chain has been the next step. Both top-down and bottom-up approaches have been used to estimate the market size. Post which the market breakdown and data triangulation have been adopted to estimate the market sizes of segments and sub-segments.

Secondary Research

In secondary research, various secondary sources have been referred to for obtaining the information that was needed for the study. Various secondary sources that were used for the research include, corporate filings such as annual reports, press releases, investor presentations, and financial statements, trade, business, and professional associations, whitepapers, journals based on milking robots and milking automation, certified publications, and articles from recognized authors and databases.

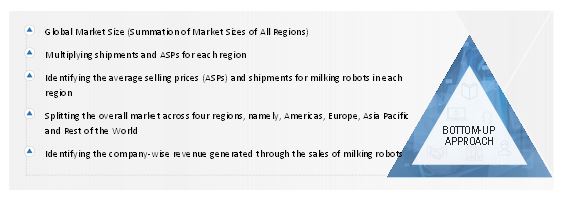

In the milking robots report, the top-down as well as the bottom-up approaches have been used for the estimation of the global market size, along with several other dependent submarkets. The major players in the market were identified with the help of extensive secondary research and their presence in the market was determined using secondary and primary research. All the percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Primary Research

Extensive primary research has been conducted after understanding the milking robots market scenario through secondary research. Several primary interviews have been conducted with key opinion leaders from both demand- and supply-side vendors across 4 major regions-Americas, Europe, Asia Pacific, and the Rest of the World. Approximately 25% of the primary interviews have been conducted with the demand-side vendors and 75% with the supply-side vendors. Primary data has been collected mainly through telephonic interviews, which consist of 80% of the total primary interviews; questionnaires and emails have also been used to collect the data.

After successful interaction with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings of our primary research. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the market engineering process, both top-down and bottom-up approaches along with data triangulation methods have been used to estimate and validate the size of the milking robots market and other dependent submarkets. The research methodology used to estimate the market sizes includes the following:

- Focusing initially on the top-line investments and spending in the ecosystems of various industries

- Tracking further split by identifying the global milking robots shipments

- Building and developing the information related to market revenue offered by the key players in the milking robots ecosystem

- Carrying out multiple on-field discussions with key opinion leaders across each major company involved in the development of milking robots and providers of related software and services.

- Estimating the geographic split using secondary sources based on various factors such as the number of OEMs in a specific country or region, the role of leading players based in this country or region in the market for the development of new and innovative products, and adoption and penetration rates of hardware components, level of services offered, and types of software implemented in a particular country or region

Market Size Estimation Methodology-Bottom-up approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the overall milking robots market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments, the data triangulation and market breakdown procedures have been used, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market size has been validated using both top-down and bottom-up approaches.

The main objectives of this study are as follows:

- To define, analyze, and forecast the milking robots market by offering, system type, and herd size, in terms of value

- To define, analyze, and forecast the global market, in terms of volume

- To forecast the market size for various segments with respect to four main regions, namely, Americas, Europe, Asia Pacific, and Rest of the World

- To provide detailed information regarding the major drivers, restraints, opportunities, and challenges influencing the growth of the market

- To study the complete value chain and related industry segments and perform a value chain analysis of the milking robots market

- To strategically analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To analyze industry trends, pricing data, patents and innovations, and trade data (export and import data), regulatory environment, Porter’s five forces analysis, and the ecosystem related to the market

- To analyze opportunities in the market for various stakeholders by identifying the high-growth segments of the milking robots market

- To strategically profile the key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing the competitive landscape for the market leaders

- To analyze competitive developments such as product launches/developments, expansions, acquisitions, and research and development (R&D) activities carried out by players in the market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Technology Analysis:

- Detailed analysis of robotic milking systems, automated harvesting systems, driverless tractors, and other robots

Country-Wise Information:

- Detailed analysis of various hardware, software, and services of milking robots for each country

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Milking Robots Market

We have already achieved first successes in this market and would like to increase our network and awareness in this area. We are the pioneers with oil-free scroll compressors and want to finally enter the market and support the success of milking robots. What data is available in your report for milking robots ? Have you included country level data for milking robots.