Mining Automation Market by Offering (Equipment (Autonomous Hauling/Mining Truck, Autonomous Drilling Rig), Software (Remote Operating and Monitoring System), Communication Systems), Technique, Workflow, Region - Global Forecast, 2027

Updated on : May 08, 2023

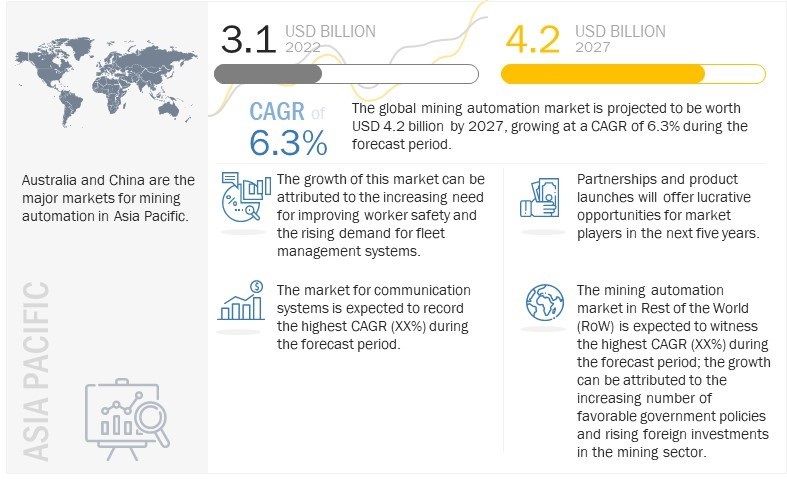

The global mining automation market in terms of revenue was estimated to be worth USD 3.1 billion in 2022 and is poised to reach USD 4.2 billion by 2027, growing at a CAGR of 6.3% from 2022 to 2027. The new research study consists of an industry trend analysis of the market.

Growing necessity for improving worker operator safety in mines, increasing focus on reducing operational costs, and surging demand for fleet management and remote operating and monitoring systems are the major factors driving the growth of the mining automation Industry .

Mining Automation Market Forecast to 2027

To know about the assumptions considered for the study, Request for Free Sample Report

Latest Technological Trends in Mining Automation Market

Rising demand for Digital Twin technology

Planning mining operations and schedules are becoming increasingly effective with the application of virtual simulations. With the help of Digital Twin, miners can simulate the entire work environment to create short-term and long-term schedules with accurate time estimates for multiple operations such as drilling, extracting, and crushing. Additionally, virtual simulation of the entire work process including equipment and machinery will provide on-site workers the flexibility to test new methodologies for crucial activities and that too without any additional cost, as every test will be executed in a digital simulation. Digital Twin simulations can be used to predict results and project future scenarios, thereby enabling operators to control the actual environment through the digital replica. By taking full control of machinery and equipment, people can be replaced with complete automation facilitated by a virtual simulation which enables efficient mapping of route, timing, and manner. Digital Twin also provides on-site worker with the ability to create accurate virtual training simulations for new employees to tackle various types of scenarios that can be created virtually.

Mining Automation Market Dynamics

DRIVERS : Rising focus on reducing operating costs

Constantly fluctuating commodity prices in recent years have put additional pressure on the profit margins of mining companies. Increasing expenses on exploration activities and the need to carry out non-stop production to meet the global energy demands have encouraged mining companies to embrace innovative technologies. To maximize productivity gains, companies are directing their investment towards advanced automation technologies, such as AHS for driverless trucks, automated drilling systems (ADS), and real-time monitoring of assets. By using advanced automation technologies for mining, companies are witnessing a significant fall in their operating costs. Thus, mining companies are focusing on deploying automation to reduce operating costs.

RESTRAINT: Negative impact of automated mining on host countries

Increasing implementation of automation solutions in the mining industry has affected the engagement of local communities. According to a study by the International Institute for Sustainable Development (IISD), the rising adoption of automation solutions in mining will potentially reduce the contribution of mines to government revenue, especially in low- and middle-income host countries. This reduction in contribution might also affect adversely the GDP of the host countries.

OPPORTUNITIES : Evolution of smart connected mines

Connected mining refers to the application of technology to achieve better productivity and safety as well as reduce operational costs for a mine site. Thus, connected mining, a combination of IT, automation, and instrumentation technologies, is a result of the advancements in the existing technologies present in the mining industry. This integrated operations technology makes the process of mine surveying, planning, exploration, extraction, and analysis faster and easier with software providing real-time information, thereby providing a realistic image of the mine environment and the availability of resources.

CHALLENGES: Rising protests by local communities for stricter environmental laws against mining

Destruction and drastic modification of the pre-mined landscape leads to massive loss of habitat and results in endangerment of several species of flora and fauna. According to the estimates of the International Energy Agency (IEA), for meeting the Paris Agreement goals, a quadrupling of mineral requirements for clean energy technologies will be necessary by 2040. Several regulations and codes, such as the Federal Mining Code (FMC) and the General Environmental Law No. 25,675, are in place for ascertaining the effects of mining on the surrounding environment. Local communities are demanding newer, more stricter laws against mining activities to protect the environment.

Mining equipment held the largest share of the mining automation market in 2021

Workplace safety has always been a concern for the mining industry. With increasing research & development (R&D) investment and technological advancements, unmanned or autonomous equipment are being developed which reduce the frequency of hazardous incidents while increasing efficiency and productivity. Moreover, the integration of innovative equipment allows mining companies to reduce operating costs by a significant percentage by minimizing downtime and improving asset utilization rate. With the successful implementation of autonomous haul trucks in mine sites, mining equipment manufacturing companies are beginning to innovate their product offerings. The new unmanned vehicle technology would enable mining operators to improve their productivity further.

Underground mining technique held the larger share of the mining automation market in 2021

The primary objective of operating an underground mine is to extract the maximum amount of ore with minimum tailing. Equipment used in the underground mining technique include underground load-haul-dump (LHD) loaders, articulated trucks, tunnel boring machines, roadheaders, tunneling jumbos, and underground drills. The rising application of metals, minerals, coal, ores, and others, in various end-user industries, such as energy & power, automotive, and construction are driving underground exploration and mining activities worldwide.

Mine development held the largest share of the mining automation market in 2021

Before any production process commences, mine development needs to be done efficiently through the establishment of strong roads and multipurpose buildings for mining vehicles to navigate seamlessly and for equipment storage. Increasing demand for underground mining for coal and other mineral deposits is emphasizing the necessity for efficient mine development, as tunnel boring done during mine development phase is essential for underground mining.

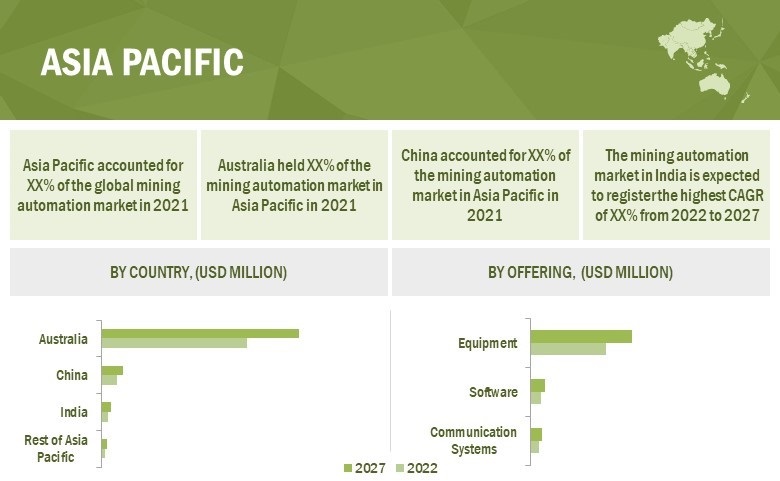

Asia Pacific held the largest share of the mining automation market in 2021

Asia Pacific is estimated to become the largest market for mining equipment and implementation of mining automation technologies globally. The reason for this trend is the increased use of automated mining equipment by leading exploration and mining companies such as Rio Tinto (UK), FMG (Australia) Group, and BHP Billiton (Australia). Moreover, the increasing digitization of mines and the globalization of economies have attracted significant investments from mining companies across the world.

Mining Automation Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Mining Automation Companies - Key Market Players

The mining automation Companies is dominated by a few globally established players such as Caterpillar (US), Komatsu (Japan), Hexagon AB (Sweden), Epiroc AB (Sweden), and Sandvik AB (Sweden).

Mining Automation Market Report Scope :

|

Report Metric |

Details |

| Estimated Market Size | USD 3.1 Billion |

| Projected Market Size | USD 4.2 Billion |

| Growth Rate | 6.3% CAGR |

|

Historical Data Available for Years |

2018–2027 |

|

Base Year Considered |

2021 |

|

Forecast Period |

2022–2027 |

|

Units |

Value (USD Million/Billion) |

|

Segments Covered |

|

|

Region Covered |

|

|

Market Leaders |

|

| Key Market Driver | Rising focus on reducing operating costs |

| Key Market Opportunity | Evolution of smart connected mines |

| Largest Growing Region | Asia Pacific |

Mining Automation Market Highlights

This research report segments the mining automation market based on offering, technique, and workflow, and region.

|

Report Metric |

Details |

|

By Offering: |

|

|

By Technique: |

|

|

By Workflow: |

|

|

By Region: |

|

Recent Developments in Mining Automation Market :

- In September 2022, Caterpillar introduced the 789 mining truck to provide enhanced efficiency, improved cab comfort, and better connectivity. The new model offers the ability to move more material with up to 9% less fuel consumption.

- In August 2022, Epiroc AB acquired RNP Mexico, which develops, manufactures, and sells rock drills and related components to customers in the construction and mining industry in Latin America.

- In June 2022, Liebherr Group announced the unveiling of a new model of mid-class mining excavator, namely, the T 274, at Bauma 2022. The T 274 displayed Liebherr Mining’s new Technology Product Portfolio, which was launched at MINExpo in 2021. The T 274 features Liebherr’s Trolley Assist System and is expected to provide benefits such as fast cycle times, low fuel consumption, and higher productivity.

- In June 2022, Hexagon AB introduced the Life-of-Mine smart platform, which connects sensors, software, cloudware, and infield applications. The platform helps in connecting the mine to a boardroom through a single onboard ecosystem comprising an antenna and a smart computer. The solution is aimed to connect key mining workflows together to promote digital transformation for enhancing safety and productivity.

Frequently Asked Questions (FAQs):

What is the total CAGR expected to be recorded for the mining automation market during 2022-2027?

The global mining automation market is expected to record a CAGR of 6.3% from 2022–2027.

What are the driving factors for the mining automation market?

Rising necessity for improving worker safety, growing need for reducing operating costs, and increasing global demand for fleet management systems are key driving factors.

Which are the significant players operating in the mining automation market?

Caterpillar (US), Komatsu (Japan), Hexagon AB (Sweden), Epiroc AB (Sweden), and Sandvik AB (Sweden) are some of the major companies operating in the mining automation market.

Which region will lead the mining automation market in the future?

Asia Pacific is expected to lead the mining automation market during the forecast period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 32)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 INCLUSIONS AND EXCLUSIONS

TABLE 1 MINING AUTOMATION MARKET: INCLUSIONS AND EXCLUSIONS

1.4 STUDY SCOPE

1.4.1 MARKETS COVERED

FIGURE 1 MINING AUTOMATION MARKET: SEGMENTATION

FIGURE 2 MARKET: REGIONAL SCOPE

1.4.2 YEARS CONSIDERED

1.5 CURRENCY CONSIDERED

1.6 LIMITATIONS

1.7 MARKET STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 37)

2.1 RESEARCH DATA

FIGURE 3 MINING AUTOMATION MARKET: RESEARCH DESIGN

2.1.1 SECONDARY AND PRIMARY RESEARCH

2.1.2 SECONDARY DATA

2.1.2.1 Major secondary sources

2.1.2.2 Key data from secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Primary interviews with experts

2.1.3.2 Key data from primary sources

2.1.3.3 Key insights

2.1.3.4 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE): REVENUE GENERATED BY COMPANIES FROM SALES OF MINING AUTOMATION PRODUCTS

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Arriving at market size through bottom-up approach (demand side)

FIGURE 5 BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Arriving at market size through top-down approach (supply side)

FIGURE 6 TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 7 MARKET BREAKDOWN AND DATA TRIANGULATION

2.4 ASSUMPTIONS

FIGURE 8 ASSUMPTIONS FOR RESEARCH STUDY

2.5 LIMITATIONS AND RISK ASSESSMENT

TABLE 2 LIMITATIONS AND ASSOCIATED RISKS

3 EXECUTIVE SUMMARY (Page No. - 48)

FIGURE 9 EQUIPMENT SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

FIGURE 10 UNDERGROUND MINING TECHNIQUE SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

FIGURE 11 MINE DEVELOPMENT SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 12 ASIA PACIFIC HELD LARGEST SHARE OF MINING AUTOMATION MARKET IN 2021

4 PREMIUM INSIGHTS (Page No. - 52)

4.1 ATTRACTIVE OPPORTUNITIES FOR MINING AUTOMATION MARKET PLAYERS

FIGURE 13 INCREASING NEED FOR WORKER SAFETY AND NEED TO ACHIEVE REDUCTION IN OPERATING COSTS TO DRIVE MARKET

4.2 MARKET, BY OFFERING

FIGURE 14 COMMUNICATION SYSTEMS SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

4.3 MARKET, BY TECHNIQUE

FIGURE 15 UNDERGROUND MINING SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

4.4 MARKET, BY WORKFLOW

FIGURE 16 MINE DEVELOPMENT SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

4.5 MARKET, BY GEOGRAPHY

FIGURE 17 AUSTRALIA HELD LARGEST SHARE OF MINING AUTOMATION MARKET IN 2021

5 MARKET OVERVIEW (Page No. - 55)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 18 MINING AUTOMATION MARKET : DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Intensifying need to improve worker safety in mines

5.2.1.2 Growing requirement to increase productivity in mining operations

5.2.1.3 Rising focus on reducing operating costs

5.2.1.4 Surging demand for fleet management systems

FIGURE 19 ANALYSIS OF IMPACT OF DRIVERS ON MARKET

5.2.2 RESTRAINTS

5.2.2.1 Depletion of natural resources

5.2.2.2 Negative impact of automated mining on host countries

FIGURE 20 ANALYSIS OF IMPACT OF RESTRAINTS ON MARKET

5.2.3 OPPORTUNITIES

5.2.3.1 Digital transformation of global mining industry

5.2.3.2 Evolution of smart connected mines

FIGURE 21 ANALYSIS OF IMPACT OF OPPORTUNITIES ON MARKET

5.2.4 CHALLENGES

5.2.4.1 Integrating information technology with operational technology

5.2.4.2 Rising protests by local communities for stricter environmental laws against mining

5.2.4.3 Lack of skilled personnel to operate automated mining equipment

FIGURE 22 ANALYSIS OF IMPACT OF CHALLENGES ON MINING AUTOMATION MARKET

5.3 VALUE CHAIN ANALYSIS

FIGURE 23 VALUE CHAIN ANALYSIS

5.4 ECOSYSTEM ANALYSIS

FIGURE 24 MINING MARKET: ECOSYSTEM

TABLE 3 COMPANIES AND THEIR ROLE IN MINING AUTOMATION ECOSYSTEM

5.5 PRICING ANALYSIS

5.5.1 AVERAGE SELLING PRICE OF EQUIPMENT OFFERED BY KEY PLAYERS

FIGURE 25 AVERAGE SELLING PRICE OF EQUIPMENT OFFERED BY KEY PLAYERS

TABLE 4 AVERAGE SELLING PRICE OF EQUIPMENT OFFERED BY KEY PLAYERS

5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

FIGURE 26 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

5.7 TECHNOLOGY ANALYSIS

5.7.1 ARTIFICIAL INTELLIGENCE (AI)

5.7.2 DIGITAL TWIN

5.7.3 INTERNET OF THINGS (IOT)

5.7.4 SATCOM

5.7.5 CLOUD COMPUTING

5.8 PORTER’S FIVE FORCES ANALYSIS

TABLE 5 MINING AUTOMATION MARKET: PORTER’S FIVE FORCES ANALYSIS

5.8.1 THREAT OF NEW ENTRANTS

5.8.2 THREAT OF SUBSTITUTES

5.8.3 BARGAINING POWER OF SUPPLIERS

5.8.4 BARGAINING POWER OF BUYERS

5.8.5 INTENSITY OF COMPETITIVE RIVALRY

5.9 KEY STAKEHOLDERS AND BUYING CRITERIA

5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 27 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS, BY OFFERING

TABLE 6 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS, BY OFFERING (%)

5.9.2 BUYING CRITERIA

FIGURE 28 KEY BUYING CRITERIA FOR MINING INDUSTRY

TABLE 7 KEY BUYING CRITERIA FOR MINING INDUSTRY

5.1 CASE STUDY ANALYSIS

5.10.1 ARRIUM MINING USES ROCKWELL AUTOMATION’S CONTROL SYSTEM AND VISUALIZATION SOLUTIONS IN ITS IRON KNOB MINE

5.10.2 BOLIDEN CHOSE KOMATSU TO INTRODUCE AUTOMATED HAULAGE AT SWEDISH MINE

5.10.3 RIO TINTO USES ROCKWELL AUTOMATION’S FACTORYTALK SUITE TO IMPROVE TRANSPARENCY OF MINING OPERATIONS

5.10.4 BARRICK GOLD USES SANDVIK AB’S MINING EQUIPMENT IN ITS VELADERO GOLD MINE IN ARGENTINA

5.10.5 RIO TINTO CHOSE CATERPILLAR TO CREATE CONNECTED VALUE CHAIN IN ITS GUDAI-DARRI MINE

5.11 TRADE ANALYSIS

FIGURE 29 IMPORT DATA FOR SELF-PROPELLED BULLDOZERS, ANGLEDOZERS, GRADERS, LEVELLERS, SCRAPERS, MECHANICAL SHOVELS, EXCAVATORS, SHOVEL LOADERS, TAMPING MACHINES, AND ROADROLLERS, 2017–2021 (USD MILLION)

FIGURE 30 EXPORT DATA FOR SELF-PROPELLED BULLDOZERS, ANGLEDOZERS, GRADERS, LEVELLERS, SCRAPERS, MECHANICAL SHOVELS, EXCAVATORS, SHOVEL LOADERS, TAMPING MACHINES, AND ROADROLLERS, 2017–2021 (USD MILLION)

5.12 PATENT ANALYSIS

FIGURE 31 NO. OF PATENTS GRANTED PER YEAR FROM 2012 TO 2021

FIGURE 32 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

TABLE 8 TOP 20 PATENT OWNERS IN LAST 10 YEARS

5.12.1 LIST OF MAJOR PATENTS

5.13 KEY CONFERENCES & EVENTS, 2022–2023

TABLE 9 MINING AUTOMATION MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

5.14 REGULATION & STANDARDS

5.14.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 10 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 11 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 13 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.14.2 STANDARDS

TABLE 14 MAJOR STANDARDS FOR MINING MACHINERY

6 MINING AUTOMATION MARKET, BY OFFERING (Page No. - 86)

6.1 INTRODUCTION

FIGURE 33 MARKET, BY OFFERING

TABLE 15 MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 16 MARKET, BY OFFERING, 2022–2027 (USD MILLION)

FIGURE 34 COMMUNICATION SYSTEMS SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

6.2 EQUIPMENT

FIGURE 35 MINING AUTOMATION MARKET, BY EQUIPMENT

TABLE 17 MARKET, BY EQUIPMENT, 2018–2021 (USD MILLION)

TABLE 18 MARKET, BY EQUIPMENT, 2022–2027 (USD MILLION)

FIGURE 36 AUTONOMOUS DRILLING RIGS TO ACCOUNT FOR LARGEST SIZE OF MARKET DURING FORECAST PERIOD

6.2.1 AUTONOMOUS HAULING/MINING TRUCKS

6.2.1.1 Automate hauling operations

6.2.2 AUTONOMOUS DRILLING RIGS

6.2.2.1 Autonomously drill holes and simultaneously collect production data

6.2.3 UNDERGROUND LHD LOADERS

6.2.3.1 Help to load and unload materials from transport vehicles

6.2.4 TUNNELING EQUIPMENT

6.2.4.1 Limit disturbance to surrounding ground and produce smooth tunnel wall

6.2.5 SMART VENTILATION SYSTEMS

6.2.5.1 Analyze information collected from various sensors to initiate mine-wide regulation of fresh air

6.2.6 PUMPING STATIONS

6.2.6.1 Help in disposal of accumulated water in mining sites

6.2.7 OTHERS

6.2.7.1 Hybrid shovels

6.2.7.2 Total stations

TABLE 19 EQUIPMENT: MINING AUTOMATION MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 20 EQUIPMENT: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3 SOFTWARE

6.3.1 INTERFACE BETWEEN MINING EQUIPMENT AND OPERATORS

FIGURE 37 MINING AUTOMATION MARKET, BY SOFTWARE

TABLE 21 MARKET, BY SOFTWARE, 2018–2021 (USD MILLION)

TABLE 22 MARKET, BY SOFTWARE, 2022–2027 (USD MILLION)

TABLE 23 SOFTWARE: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 24 SOFTWARE: MARKET, BY REGION, 2022–2027 (USD MILLION)

FIGURE 38 ASIA PACIFIC TO ACCOUNT FOR LARGEST SHARE OF MARKET FOR SOFTWARE DURING FORECAST PERIOD

6.3.2 WORKFORCE MANAGEMENT SYSTEMS

6.3.2.1 Help in better shift management

6.3.3 PROXIMITY DETECTION AND COLLISION AVOIDANCE SYSTEMS

6.3.3.1 Help avoid mine fleet traffic incidents by detecting obstacles or machines in path of vehicles

6.3.4 AIR QUALITY AND TEMPERATURE MONITORING SYSTEMS

6.3.4.1 Monitor air quality and alert operators in case of deviation from normal air flow parameters

6.3.5 FLEET MANAGEMENT SYSTEMS

6.3.5.1 Provide real-time visibility to mining operators and facilitate remote monitoring of machine and vehicle fleets

6.3.6 REMOTE OPERATING AND MONITORING SYSTEMS

6.3.6.1 Help to increase efficiency in mining sites through continuous and round-the-clock analysis of real-time data

6.3.7 DATA MANAGEMENT SOLUTIONS

6.3.7.1 Used for validation, sorting, analysis, reporting, and classification of mining data

6.3.8 OTHERS

6.3.8.1 Asset tracking systems

6.3.8.2 Payload monitoring systems

6.4 COMMUNICATION SYSTEMS

FIGURE 39 MINING AUTOMATION MARKET, BY COMMUNICATION SYSTEM

6.4.1 WIRELESS MESH NETWORKS

6.4.1.1 Connect devices at mining sites

6.4.2 NAVIGATION SYSTEMS

6.4.2.1 Improve safety of autonomous vehicles on mining sites

6.4.3 RADIO-FREQUENCY IDENTIFICATION (RFID) TAGS

6.4.3.1 Enable tracking of equipment and personnel at mines

TABLE 25 MARKET, BY COMMUNICATION SYSTEMS, 2018–2021 (USD MILLION)

TABLE 26 MARKET, BY COMMUNICATION SYSTEMS, 2022–2027 (USD MILLION)

TABLE 27 COMMUNICATION SYSTEMS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 28 COMMUNICATION SYSTEMS: MARKET, BY REGION, 2022–2027 (USD MILLION)

7 MINING AUTOMATION MARKET, BY TECHNIQUE (Page No. - 105)

7.1 INTRODUCTION

FIGURE 40 MINING AUTOMATION MARKET, BY TECHNIQUE

7.2 SURFACE MINING TECHNIQUE

7.2.1 USED TO EXTRACT MINERALS AND ORES CLOSE TO EARTH’S SURFACE

7.3 UNDERGROUND MINING TECHNIQUE

7.3.1 USED TO EXTRACT MINERALS AND ORES BURIED DEEP UNDER EARTH’S CRUST

FIGURE 41 UNDERGROUND MINING SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

TABLE 29 MARKET, BY TECHNIQUE, 2018–2021 (USD MILLION)

TABLE 30 MARKET, BY TECHNIQUE, 2022–2027 (USD MILLION)

TABLE 31 UNDERGROUND MINING: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 32 UNDERGROUND MINING: MARKET: BY REGION, 2022–2027 (USD MILLION)

TABLE 33 SURFACE MINING: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 34 SURFACE MINING: MARKET, BY REGION, 2022–2027 (USD MILLION)

8 MINING AUTOMATION MARKET, BY WORKFLOW (Page No. - 110)

8.1 INTRODUCTION

FIGURE 42 MINING AUTOMATION MARKET, BY WORKFLOW

FIGURE 43 MINE DEVELOPMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 35 MARKET, BY WORKFLOW, 2018–2021 (USD MILLION)

TABLE 36 MARKET, BY WORKFLOW, 2022–2027 (USD MILLION)

8.2 MINE DEVELOPMENT

TABLE 37 MINE DEVELOPMENT: MARKET, BY MINE DEVELOPMENT PROCESS, 2018–2021 (USD MILLION)

TABLE 38 MINE DEVELOPMENT: MARKET, BY MINE DEVELOPMENT PROCESS, 2022–2027 (USD MILLION)

8.2.1 TUNNEL BORING

8.2.1.1 Used to construct tunnels for underground mines

8.2.2 CONSTRUCTION OF ACCESS ROADS

8.2.2.1 Help to develop strong roads for heavy mining vehicles

8.2.3 SITE PREPARATION AND CLEARING

8.2.3.1 Involves construction of mining facilities

8.3 MINING PROCESS

FIGURE 44 AUTONOMOUS HAULAGE SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

TABLE 39 MINING PROCESS: MARKET, BY MINING PROCESS, 2018–2021 (USD MILLION)

TABLE 40 MINING PROCESS: MARKET, BY MINING PROCESS, 2022–2027 (USD MILLION)

8.3.1 AUTONOMOUS HAULAGE

8.3.1.1 Improves safety and productivity and reduces maintenance cost and downtime

8.3.2 AUTOMATED DRILLING

8.3.2.1 Rising focus on minimizing mine accidents to create demand for automated drilling

8.4 MINE MAINTENANCE

TABLE 41 MINE MAINTENANCE: MARKET, BY MINE MAINTENANCE PROCESS 2018–2021 (USD MILLION)

TABLE 42 MINE MAINTENANCE: MINING AUTOMATION MARKET, BY MINE MAINTENANCE PROCESS 2022–2027 (USD MILLION)

8.4.1 HEATING, VENTILATION, AND REFRIGERATION (HVAC)

8.4.1.1 Improve ventilation at mine sites

8.4.2 MINE DEWATERING

8.4.2.1 Help in disposal of excess water at mine sites

9 MINING AUTOMATION MARKET, BY REGION (Page No. - 118)

9.1 INTRODUCTION

FIGURE 45 MINING AUTOMATION MARKET IN INDIA EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 43 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 44 MARKET, BY REGION, 2022–2027 (USD MILLION)

9.2 ASIA PACIFIC

FIGURE 46 ASIA PACIFIC: MARKET SNAPSHOT

FIGURE 47 AUSTRALIA TO ACCOUNT FOR LARGEST SHARE OF MARKET IN ASIA PACIFIC DURING FORECAST PERIOD

TABLE 45 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 46 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 47 CHINA: MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 48 CHINA: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 49 INDIA: MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 50 INDIA: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 51 AUSTRALIA: MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 52 AUSTRALIA: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 53 REST OF ASIA PACIFIC: MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 54 REST OF ASIA PACIFIC: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 55 ASIA PACIFIC: MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 56 ASIA PACIFIC: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 57 ASIA PACIFIC: MARKET, BY TECHNIQUE, 2018–2021 (USD MILLION)

TABLE 58 ASIA PACIFIC: MINING AUTOMATION MARKET, BY TECHNIQUE, 2022–2027 (USD MILLION)

9.2.1 AUSTRALIA

9.2.1.1 Increasing number of automation-driven mines to favor market

9.2.2 CHINA

9.2.2.1 Favorable policy framework to drive market

9.2.3 INDIA

9.2.3.1 Increasing focus of government on enhancing potential of mining sector to support market

9.2.4 REST OF ASIA PACIFIC

9.3 EUROPE

FIGURE 48 EUROPE: MINING AUTOMATION MARKET SNAPSHOT

FIGURE 49 TURKEY TO REGISTER HIGHEST CAGR IN MARKET IN EUROPE DURING FORECAST PERIOD

TABLE 59 EUROPE: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 60 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 61 TURKEY: MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 62 TURKEY: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 63 SWEDEN: MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 64 SWEDEN: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 65 REST OF EUROPE: MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 66 REST OF EUROPE: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 67 EUROPE: MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 68 EUROPE: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 69 EUROPE: MARKET, BY TECHNIQUE, 2018–2021 (USD MILLION)

TABLE 70 EUROPE: MARKET, BY TECHNIQUE, 2022–2027 (USD MILLION)

9.3.1 TURKEY

9.3.1.1 Increasing exploration activities to spur market

9.3.2 SWEDEN

9.3.2.1 Adoption of automated solutions by mining companies to boost market

9.3.3 REST OF EUROPE

9.4 NORTH AMERICA

FIGURE 50 NORTH AMERICA: MARKET SNAPSHOT

TABLE 71 NORTH AMERICA: MINING AUTOMATION MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 72 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 73 US: MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 74 US: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 75 CANADA: MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 76 CANADA: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 77 MEXICO: MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 78 MEXICO: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 79 NORTH AMERICA: MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 80 NORTH AMERICA: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 81 NORTH AMERICA: MARKET, BY TECHNIQUE, 2018–2021 (USD MILLION)

TABLE 82 NORTH AMERICA: MARKET, BY TECHNIQUE, 2022–2027 (USD MILLION)

FIGURE 51 MEXICO EXPECTED TO LEAD MARKET IN NORTH AMERICA DURING FORECAST PERIOD

9.4.1 US

9.4.1.1 Increasing focus on improving mining productivity to drive mining automation market

9.4.2 CANADA

9.4.2.1 Presence of major mining companies to augment market

9.4.3 MEXICO

9.4.3.1 Increasing mineral exports and conducive mining environment to accelerate market

9.5 REST OF THE WORLD

FIGURE 52 MIDDLE EAST & AFRICA TO REGISTER HIGHER CAGR IN MINING AUTOMATION MARKET IN REST OF THE WORLD

FIGURE 53 SOUTH AFRICA TO REGISTER HIGHEST CAGR IN MARKET IN MIDDLE EAST & AFRICA DURING FORECAST PERIOD

FIGURE 54 CONGO TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 83 REST OF THE WORLD: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 84 REST OF THE WORLD: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 85 SOUTH AMERICA: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 86 SOUTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 87 MIDDLE EAST & AFRICA: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 88 MIDDLE EAST & AFRICA: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 89 OTHER AFRICAN COUNTRIES: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 90 OTHER AFRICAN COUNTRIES: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 91 SOUTH AMERICA: MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 92 SOUTH AMERICA: MINING AUTOMATION MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 93 MIDDLE EAST: MARKET, BY OFFERING, 2018–2021 (USD THOUSAND)

TABLE 94 MIDDLE EAST: MARKET, BY OFFERING, 2022–2027 (USD THOUSAND)

TABLE 95 AFRICA: MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 96 AFRICA: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 97 REST OF THE WORLD: MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 98 REST OF THE WORLD: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 99 REST OF THE WORLD: MARKET, BY TECHNIQUE, 2018–2021 (USD MILLION)

TABLE 100 REST OF THE WORLD: MARKET, BY TECHNIQUE, 2022–2027 (USD MILLION)

9.5.1 SOUTH AMERICA

9.5.1.1 Bolivia

9.5.1.1.1 Favorable mining policies to boost market

9.5.1.2 Peru

9.5.1.2.1 Increasing investments from mining companies to induce demand for automation technologies

9.5.1.3 Chile

9.5.1.3.1 Increasing lithium extraction activities to offer opportunities for market players

9.5.1.4 Others

9.5.2 MIDDLE EAST

9.5.2.1 Government focus on developing mining sector to support market

9.5.3 AFRICA

9.5.3.1 South Africa

9.5.3.1.1 Surging demand for remote-controlled and unmanned vehicles to drive market

9.5.3.2 Other African countries

9.5.3.2.1 Congo

9.5.3.2.2 Ghana

9.5.3.2.3 Nigeria

10 COMPETITIVE LANDSCAPE (Page No. - 151)

10.1 INTRODUCTION

TABLE 101 KEY STRATEGIES ADOPTED IN MINING AUTOMATION MARKET (2021–2022)

10.2 REVENUE ANALYSIS OF TOP FIVE PLAYERS

FIGURE 55 TOP FIVE PLAYERS IN MARKET, 2017–2021

10.3 MARKET SHARE ANALYSIS

TABLE 102 MARKET: MARKET SHARE OF KEY COMPANIES

10.4 COMPANY EVALUATION QUADRANT, 2021

10.4.1 STARS

10.4.2 EMERGING LEADERS

10.4.3 PERVASIVE PLAYERS

10.4.4 PARTICIPANTS

FIGURE 56 MARKET (GLOBAL): COMPANY EVALUATION QUADRANT, 2021

10.5 SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION QUADRANT, 2021

10.5.1 PROGRESSIVE COMPANIES

10.5.2 RESPONSIVE COMPANIES

10.5.3 DYNAMIC COMPANIES

10.5.4 STARTING BLOCKS

FIGURE 57 MARKET (GLOBAL): SME EVALUATION QUADRANT, 2021

10.6 MINING AUTOMATION MARKET: COMPANY FOOTPRINT

TABLE 103 EQUIPMENT: COMPANY FOOTPRINT

TABLE 104 SOFTWARE: COMPANY FOOTPRINT

TABLE 105 REGION: COMPANY FOOTPRINT

10.7 COMPETITIVE BENCHMARKING

TABLE 106 MARKET: DETAILED LIST OF KEY STARTUPS/SMES

TABLE 107 MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

10.8 COMPETITIVE SCENARIOS AND TRENDS

10.8.1 PRODUCT LAUNCHES

TABLE 108 MARKET: PRODUCT LAUNCHES, FEBRUARY 2021–SEPTEMBER 2022

10.8.2 DEALS

TABLE 109 MARKET: DEALS, MAY 2021–JULY 2022

10.8.3 OTHERS

TABLE 110 MINING AUTOMATION MARKET: OTHERS, SEPTEMBER 2021–AUGUST 2022

11 COMPANY PROFILES (Page No. - 174)

(Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)*

11.1 KEY PLAYERS

11.1.1 CATERPILLAR

TABLE 111 CATERPILLAR: BUSINESS OVERVIEW

FIGURE 58 CATERPILLAR: COMPANY SNAPSHOT

TABLE 112 CATERPILLAR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 113 CATERPILLAR: PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 114 CATERPILLAR: DEALS

11.1.2 KOMATSU

TABLE 115 KOMATSU: BUSINESS OVERVIEW

FIGURE 59 KOMATSU: COMPANY SNAPSHOT

TABLE 116 KOMATSU: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 117 KOMATSU: PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 118 KOMATSU: DEALS

TABLE 119 KOMATSU: OTHERS

11.1.3 SANDVIK AB

TABLE 120 SANDVIK AB: BUSINESS OVERVIEW

FIGURE 60 SANDVIK AB: COMPANY SNAPSHOT

TABLE 121 SANDVIK AB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 122 SANDVIK AB: DEALS

11.1.4 EPIROC AB

TABLE 123 EPIROC AB: BUSINESS OVERVIEW

FIGURE 61 EPIROC AB: COMPANY SNAPSHOT

TABLE 124 EPIROC AB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 125 EPIROC AB: DEALS

11.1.5 HEXAGON AB

TABLE 126 HEXAGON AB: BUSINESS OVERVIEW

FIGURE 62 HEXAGON AB: COMPANY SNAPSHOT

TABLE 127 HEXAGON AB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 128 HEXAGON AB: PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 129 HEXAGON AB: DEALS

11.1.6 HITACHI

TABLE 130 HITACHI: BUSINESS OVERVIEW

FIGURE 63 HITACHI: COMPANY SNAPSHOT

TABLE 131 HITACHI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 132 HITACHI: PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 133 HITACHI: DEALS

11.1.7 RPMGLOBAL

TABLE 134 RPMGLOBAL: BUSINESS OVERVIEW

FIGURE 64 RPMGLOBAL: COMPANY SNAPSHOT

TABLE 135 RPMGLOBAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 136 RPMGLOBAL: PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 137 RPMGLOBAL: DEALS

TABLE 138 RPMGLOBAL: OTHERS

11.1.8 TRIMBLE INC.

TABLE 139 TRIMBLE INC.: BUSINESS OVERVIEW

FIGURE 65 TRIMBLE INC.: COMPANY SNAPSHOT

TABLE 140 TRIMBLE INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 141 TRIMBLE INC.: PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 142 TRIMBLE INC.: DEALS

11.1.9 ROCKWELL AUTOMATION, INC.

TABLE 143 ROCKWELL AUTOMATION, INC.: BUSINESS OVERVIEW

FIGURE 66 ROCKWELL AUTOMATION, INC.: COMPANY SNAPSHOT

TABLE 144 ROCKWELL AUTOMATION, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

11.1.10 SIEMENS

TABLE 145 SIEMENS: BUSINESS OVERVIEW

FIGURE 67 SIEMENS: COMPANY SNAPSHOT

TABLE 146 SIEMENS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 147 SIEMENS: DEALS

11.1.11 LIEBHERR GROUP

TABLE 148 LIEBHERR GROUP: BUSINESS OVERVIEW

FIGURE 68 LIEBHERR GROUP: COMPANY SNAPSHOT

TABLE 149 LIEBHERR GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 150 LIEBHERR GROUP: PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 151 LIEBHERR GROUP: DEALS

TABLE 152 LIEBHERR GROUP: OTHERS

11.1.12 SANY GROUP

TABLE 153 SANY GROUP: BUSINESS OVERVIEW

FIGURE 69 SANY GROUP: COMPANY SNAPSHOT

TABLE 154 SANY GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 155 SANY GROUP: PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 156 SANY GROUP: DEALS

TABLE 157 SANY GROUP: OTHERS

11.1.13 AUTONOMOUS SOLUTIONS INC.

TABLE 158 AUTONOMOUS SOLUTIONS INC.: BUSINESS OVERVIEW

TABLE 159 AUTONOMOUS SOLUTIONS INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 160 AUTONOMOUS SOLUTIONS INC.: DEALS

11.1.14 AB VOLVO

TABLE 161 AB VOLVO: BUSINESS OVERVIEW

FIGURE 70 AB VOLVO: COMPANY SNAPSHOT

TABLE 162 AB VOLVO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

11.1.15 SYMBOTICWARE INC.

TABLE 163 SYMBOTICWARE INC.: BUSINESS OVERVIEW

TABLE 164 SYMBOTICWARE INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

11.2 OTHER PLAYERS

11.2.1 MICROMINE

TABLE 165 MICROMINE: COMPANY OVERVIEW

11.2.2 REMOTE CONTROL TECHNOLOGIES (RCT)

TABLE 166 REMOTE CONTROL TECHNOLOGIES (RCT): COMPANY OVERVIEW

11.2.3 REUTECH MINING

TABLE 167 REUTECH MINING: COMPANY OVERVIEW

11.2.4 AAMCOR LLC

TABLE 168 AAMCOR LLC: COMPANY OVERVIEW

11.2.5 3D-P

TABLE 169 3D-P: COMPANY OVERVIEW

11.2.6 CR MINING

TABLE 170 CR MINING: COMPANY OVERVIEW

11.2.7 ATDI

TABLE 171 ATDI: COMPANY OVERVIEW

11.2.8 CIGEN

TABLE 172 CIGEN: COMPANY OVERVIEW

11.2.9 GROUNDHOG

TABLE 173 GROUNDHOG: COMPANY OVERVIEW

11.2.10 HAULTRAX

TABLE 174 HAULTRAX: COMPANY OVERVIEW

*Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)* might not be captured in case of unlisted companies.

12 ADJACENT & RELATED MARKETS (Page No. - 232)

12.1 INTRODUCTION

12.2 LIMITATIONS

12.3 SMART FACTORY MARKET, BY REGION

12.3.1 INTRODUCTION

12.4 ASIA PACIFIC

TABLE 175 ASIA PACIFIC: SMART FACTORY MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 176 ASIA PACIFIC: SMART FACTORY MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 177 ASIA PACIFIC: SMART FACTORY MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 178 ASIA PACIFIC: SMART FACTORY MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 179 ASIA PACIFIC: SMART FACTORY MARKET, BY SOLUTION, 2018–2021 (USD MILLION)

TABLE 180 ASIA PACIFIC: SMART FACTORY MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

12.4.1 CHINA

12.4.1.1 Increasing labor costs in China leading to adoption of advanced automation solutions

12.4.2 JAPAN

12.4.2.1 Ongoing developments in smart manufacturing processes to boost market growth

12.4.3 INDIA

12.4.3.1 Make in India campaign to encourage adoption of automation solutions in manufacturing industry

12.4.4 REST OF ASIA PACIFIC

13 APPENDIX (Page No. - 238)

13.1 INSIGHTS FROM INDUSTRY EXPERTS

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.4 CUSTOMIZATION OPTIONS

13.5 RELATED REPORTS

The study involved four major activities in estimating the current size of the mining automation market. Exhaustive secondary research has been done to collect information on the market, peer market, and parent market. To validate these findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Finally, both top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation methods have been used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to identify and collect information relevant to this study. The secondary sources include annual reports, press releases, and investor presentations of companies; white papers, certified publications, and articles from recognized authors; directories; and databases. Secondary research has been mainly conducted to obtain key information about the industry’s supply chain, value chain of the market, total pool of key players, market classification and segmentation according to industry trends, geographic markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both supply and demand sides have been interviewed to obtain the qualitative and quantitative information relevant to this report. Primary sources from the supply side include experts such as CEOs, VPs, marketing directors, technology and innovation directors, application developers, application users, and related executives from various key companies and organizations operating in the mining automation ecosystem. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches have been used to estimate and validate the size of the overall mining automation market and the market based on segments. The research methodology used to estimate the market size has been given below:

- Major players operating in the mining automation market have been identified and considered for the report through extensive secondary research.

- The supply chain and market size of the mining automation market, both in terms of value and units, have been estimated/determined through secondary and primary research processes.

- All estimations and calculations, including percentage share, revenue mix, splits, and breakdowns have been determined through use of secondary sources which are further verified through primary sources.

Global mining automation market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market has been validated using both top-down and bottom-up approaches.

Report Objectives:

- To describe and forecast the mining automation market, in terms of value, based on offering, technique, and workflow

- To forecast the market size, in terms of value, for four main regions—North America, Europe, Asia Pacific (APAC), and the Rest of World (RoW)

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the market growth

- To provide a detailed overview of the value chain of the mining automation ecosystem

- To strategically analyze micro markets with respect to individual growth trends, prospects, and contributions to the total market

- To analyze the opportunities in the market for stakeholders and details of the competitive landscape of the market

- To strategically profile the key players and comprehensively analyze their market position in terms of ranking and core competencies

- To analyze the major growth strategies implemented by key market players, such as contracts, agreements, acquisitions, product launches, expansions, and partnerships

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports according to the client’s specific requirements. The available customization options are as follows:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Mining Automation Market