Cloud Mobile Backend as a Service (BaaS) Market by Application (Cloud Storage and Backup, User Authentication, Database Management, Push Notification), Platform (Android, iOS) Enterprise Size, Vertical (BFSI, Retail), and Region - Global Forecast to 2025

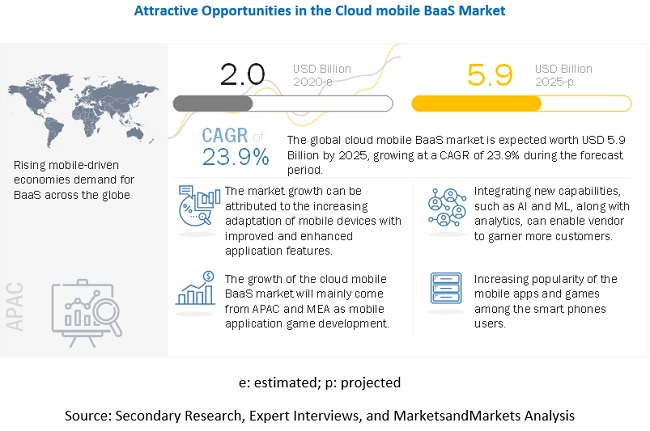

[173 Pages Report] The Cloud mobile BaaS market size is expected to grow from USD 2.0 billion in 2020 to USD 5.9 billion by 2025, at a CAGR of 23.9% during the forecast period. The demand for Cloud mobile BaaS is driven by the Growing mobile app-driven economies demand BaaS, Increasing adoption of mobile devices, and BaaS helps developers concentrate on the frontend for faster development and deployment.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID -19 Impact on Cloud mobile BaaS Market

In the current scenario, The sudden shutdown of offices, schools, colleges, and physical retail stores has massively disrupted operations; this has led to an increase in the demand for digital workplace tools and services. As the COVID-19 pandemic has been spreading all over the globe, most of the people prefer to work from home rather than from a local office, head office, or global branch of an organization and therefore require mobility in terms of access to office resources and data. The demands the additional demand for the cloud technology and cloud services. The COVID-19 wave is expected to continue across the globe, and the impact will be seen till the end of Q4 2020. The impact on the market is expected to reduce as we enter the Q1 2021. Covid-19 impacted the cloud mobile backend as a service market positively as a huge workforce of enterprises across the world are working from home. This demands improved cloud mobile BaaS. The covid-19 pandemic offers ample opportunities for vendors of the cloud mobile BaaS market.

Market Dynamics

Driver: Growing mobile app-driven economies demand BaaS

Since the last decade, the introduction of smartphones and their evolutions changed the way people communicate with each other. The mobile app changed peoples lives, enabling instant communication between manufacturers/developers and end users, marketing activities, and transforming the nations economy. The mobile app brings together app developers and smartphone users. The developers can extend smartphone functionality to promote the product and services, whereas smartphone users use the mobile app as a single place to shop with wide and easy to access. It has benefits such as improved communication channels, reduced transactional costs, and customer loyalty gaining. The increasing adoption of mobile apps plays an important role in the economy. As per MindSea, in 2019, 204 billion mobile apps were downloaded (excluding reinstallation and app updates) across the world. With this increase, demand for BaaS also is expected to increase, as it helps develop and keep running them..

Restraint: Higher CAPEX demand for BaaS

Developing BaaS within enterprise premises requires a higher cost of initial investment, time, and efforts. Due to this, enterprises move to BaaS. But Capital Expenditure (CAPEX) needed for cloud mobile BaaS systems requires a high cost that is the initial purchase of BaaS. The complexities, such as mode of deployment, upgradation, and infrastructure cost, restrict the adoption of BaaS. SMEs also face budget constraints to transform IT infrastructure. Therefore, enterprises are sometimes hesitant to opt for cloud mobile BaaS systems, and this factor is expected to hinder the growth of the cloud mobile BaaS.

Opportunity: Increasing adoption of mobile devices

The adoption of mobile devices, such as laptops, smartphones, and wearables, has increased drastically in recent times, majorly because of their advantages, such as mobility and enhanced features. It is expected that the adoption of mobile devices would increase, especially between the age groups of 1840. As per BuildFire, there are 2.7 billion smart phone user while 1.35 billion tablet users across the globe and growing with 2% per year. The region-wise social media penetration rate across various regions, a number of global smartphone users across the major countries, adoption of cloud infrastructure and services, and global data traffic via smartphones are increasing tremendously. The increase in the use of smartphones and the creation of user-friendly mobile apps and social media platforms are expected to increase the amount of data generated from the social media. AI technology is used by large enterprises to understand, generate, and analyze trends, likes, or dislikes of their customers and understand the topics, which attract maximum attention in real time. Hence, increasing engagement of users on social media using mobile devices is considered the most important driver for the growth of the cloud mobile BaaS market.

Challenge: Security and privacy concerns for confidential data and business processes

Maintaining the privacy and confidentiality of enterprise-level data, especially financial data, plays a crucial role in enterprises. Hence, companies are reluctant to move their confidential data as well as business operations to the cloud and prefer using on-premises or traditional proposal management methods, which inhibit the growth of the cloud mobile BaaS market. Enterprises are extremely sensitive when it comes to their communication channels, as it directly affects the security and privacy of the organizational data. In the cloud mobile backend as a service market, this security-related concern is substantial as the customers business is fully dependent on the security and privacy of organizational data. In case of any disruption to enterprise data, the clients business will suffer a major setback. Therefore, cloud mobile BaaS needs to be monitored continuously to minimize risks and improve the security features of it. Cloud mobile BaaS must ensure the safety of sensitive data while interacting via different systems, such as Android, Windows, and IoS.

Android platform segment to hold the largest market share among services during the forecast period

By platform, the Cloud mobile BaaS market is segmented into Android, iOS, and others ( Windows, Blackberry, Titanium, HTML, and Node.js). iOS platform is expected to grow at the highest CAGR during the forecast period, while the Android platform is expected to hold the largest market size. The factor driving the adoption of the cloud mobile BaaS solution is an increasing number of mobile devices with platforms, such as Android, iOS, and Windows Phone.

By vertical, BFSI vertical to register the largest market size during the forecast period

By vertical, The cloud mobile backend as a service market is sub-segmented as BFSI; IT and ITeS; manufacturing; healthcare and pharmaceuticals; retail and eCommerce; media, entertainment, and gaming; telecommunications; and others (transportation and logistics, travel and hospitality, energy and utilities, and government and public sector). BFSI; retail and eCommerce, and media, entertainment, and gaming verticals are expected to grow at the significant CAGRs due to extensive usage and dependency in the cloud that needs BaaS to take care of backend functionality.

To know about the assumptions considered for the study, download the pdf brochure

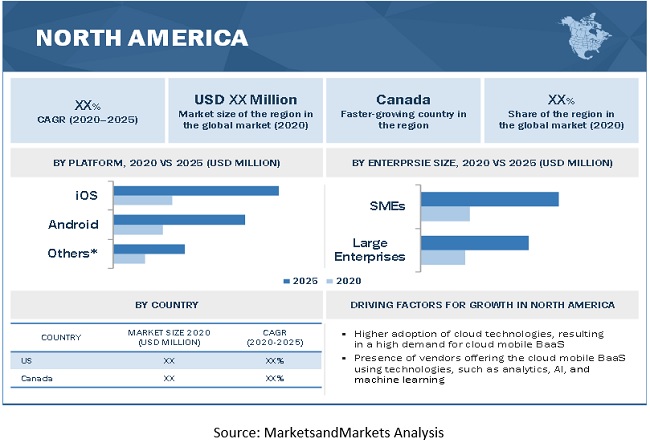

North America to hold the largest market size during the forecast period

The North American Cloud mobile BaaS market is already mature for Cloud mobile BaaS, and a significant number of new installations of Cloud mobile BaaS and upgrade of the existing data center infrastructure systems have taken place to date. Currently, the United States (US) holds the highest share in the cloud mobile backend as a service market as it is home to large telecom giants, well-established suppliers, as well as end-user industries that continuously adapt to newer technologies for improved business productivity and work efficiency.

Market Players:

Market players profiled in this report include Microsoft (US), IBM (US), Oracle (US), Temenos (Switzerland), AWS (US), Google (US), PROGRESS (US), Kii (US), ProgrammableWeb (US), Appcelerator (France), EXADEL (US), 8Base (US), Back4App (US), Built.io (US), Backendless (US), Couchbase (US), Kumulos (US), Kuzzle (France), BaaSBox (Italy), Loopback (US), and PubNub (US). These players offer various Cloud mobile BaaS solutions to cater to the demands and needs of the market. Major growth strategies adopted by the players include partnerships, acquisitions, collaborations and agreements, and new product launches/product enhancements.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

20182025 |

|

Base year considered |

2019 |

|

Forecast period |

20202025 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Applications (Cloud storage and Backup, User authentication, Database Management, Push Notifications, and Others (social integration, geographic location, testing, communications, predictions, usage analytics, mobile backend game service, and professional services)), Platform (Android, iOS, Others (Windows, Blackberry, Titanium, HTML, and Node.js)), Enterprise size , Verticals, and geographic |

|

Geographies covered |

North America, APAC, Europe, Latin America, and MEA |

|

Companies covered |

Microsoft (US), IBM (US), Oracle (US), Temenos (Switzerland), AWS (US), Google (US), PROGRESS (US), Kii (US), ProgrammableWeb (US), Appcelerator (France), EXADEL (US), 8Base (US), Back4App (US), Built.io (US), Backendless (US), Couchbase (US), Kumulos (US), Kuzzle (France), BaaSBox (Italy), Loopback (US), and PubNub (US) |

This research report categorizes the Cloud mobile BaaS market based on functions, types (solutions and services), enterprise size, deployment modes, verticals, and regions.

Based on applications, the Cloud mobile Backend As A Service Market has been segmented as follows:

- Cloud storage and Backup

- User authentication

- Database Management

- Push Notifications

- Others (social integration, geographic location, testing, communications, predictions, usage analytics, mobile backend game service, and professional services)

Based on platforms, the Cloud mobile BaaS market has been segmented as follows

- Android

- iOS

- others ( Windows, Blackberry, Titanium, HTML, and Node.js).

Based on enterprise size, the Cloud mobile Backend As A Service market has been segmented as follows

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

Based on verticals, the Cloud mobile BaaS market has been segmented as follows

- BFSI

- IT and ITeS

- Manufacturing

- Healthcare and pharmaceuticals

- Retail and eCommerce

- Media, entertainment

- Gaming

- Telecommunications

- Others (transportation and logistics, travel and hospitality, energy and utilities, and government and public sector)

Based on regions, the Cloud mobile Backend As A Service market has been segmented as follows:

- North America

- US

- Canada

- Europe

- UK

- Rest of Europe

- APAC

- China

- Rest of APAC

- MEA

- Gulf Cooperation Council (GCC)

- Rest of MEA

- Latin America

- Brazil

- Rest of Latin America

Recent Developments

- In Septemebr 2020, Microsoft has added chat tools to its Azure Communications service. The company enables developers to add chat tools to existing applications and improve business interactions among the employees and customers.

- In September 2019, Oracle launched the updated version of Oracle Mobile Cloud service. The updated version can be integrated with Oracle data centers, which helps migrate Oracle Mobile Hub..

- In October 2019, Temenos acquired Kony, a cloud-based enterprise mobility solution provider company. With this acquisition of Kony, Temenos becomes one of the major players in the cloud mobile SaaS market. This acquisition added additional functionality and ease of generating customer journeys.

Frequently Asked Questions (FAQ):

What are the opportunities in the Cloud mobile BaaS market?

Emerging technologies, such as IoT, AI, and mobility, for real-time data analysis and Rising demand for outsourcing services are expected to create ample opportunities for Cloud mobile BaaS vendors.

What is the competitive landscape in the market?

Cloud mobile BaaS vendors are implementing various growth strategies to increase their market share and offerings in the market. The market size analysis of the key industry players has been done based on various parameters, such as the number of Cloud mobile BaaS stakeholders, depth of product offerings, and the revenue generated.

What are the major factors for the growth of the Cloud mobile BaaS market in North America?

Factors, such as inclination towards IT moderenization for better business efficiency, strong presence of market players, strong economic landscape, and high technology assimilation drives the demand for Cloud mobile BaaSs in North America .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 19)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACTSCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

1.4 STUDY OBJECTIVES

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 REGIONS COVERED

1.6.3 YEARS CONSIDERED

1.7 CURRENCY

TABLE 1 USD EXCHANGE RATE, 20172019

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 29)

2.1 RESEARCH DATA

FIGURE 6 CLOUD MOBILE BACKEND AS A SERVICE MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

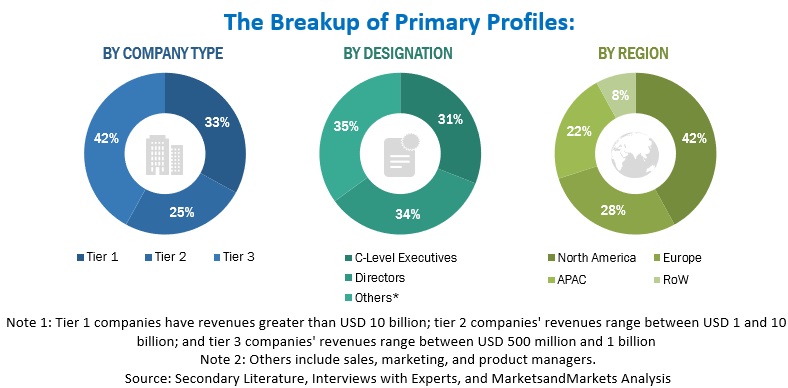

2.1.2.1 Breakup of primary interviews

FIGURE 7 BREAKUP OF PRIMARY INTERVIEWS: BY COMPANY, DESIGNATION, AND REGION

2.1.2.2 Key industry insights

2.2 DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 9 Cloud Mobile BaaS MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY APPROACH 1 (SUPPLY SIDE): ESTIMATED MARKET SIZE THROUGH VENDORS

2.4 MARKET FORECAST

TABLE 2 FACTOR ANALYSIS

2.5 RESEARCH ASSUMPTIONS

2.5.1 SUPPLY SIDE

FIGURE 11 MARKET PROJECTIONS FROM SUPPLY SIDE

2.6 STUDY LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 39)

FIGURE 12 CLOUD MOBILE BACKEND AS A SERVICE MARKET: GLOBAL SNAPSHOT

FIGURE 13 TOP GROWING SEGMENTS IN THE MARKET

TABLE 3 GLOBAL Cloud Mobile Backend As A Service MARKET SIZE AND GROWTH, 20182025 (USD MILLION, Y-O-Y %)

FIGURE 14 NORTH AMERICA TO ACCOUNT FOR THE HIGHEST MARKET SHARE IN 2020

FIGURE 15 MARKET SNAPSHOT, BY APPLICATION (2020)

FIGURE 16 MARKET SNAPSHOT, BY PLATFORM (2020)

FIGURE 17 MARKET SNAPSHOT, BY ENTERPRISE SIZE (2020)

FIGURE 18 Cloud Mobile BaaS MARKET SNAPSHOT, BY VERTICAL (2020)

4 PREMIUM INSIGHTS (Page No. - 44)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN THE CLOUD MOBILE BACKEND AS A SERVICE MARKET

FIGURE 19 RISING MOBILE-DRIVEN ECONOMIES DEMAND FOR BACKEND AS A SERVICE

4.2 MARKET: BY APPLICATION, 2020 VS 2025

FIGURE 20 CLOUD STORAGE AND BACKUP SEGMENT TO HOLD THE HIGHEST MARKET SHARE IN 2020

4.3 MARKET: BY PLATFORM, 2020 VS 2025

FIGURE 21 ANDROID SEGMENT TO HOLD THE HIGHEST MARKET SHARE IN 2020

4.4 MARKET: BY ENTERPRISE SIZE, 2020 VS 2025

FIGURE 22 LARGE ENTERPRISES SEGMENT TO HOLD A LARGER MARKET SIZE IN 2020

4.5 MARKET: BY VERTICAL, 2020 VS 2025

FIGURE 23 BANKING, FINANCIAL SERVICES, AND INSURANCE VERTICAL TO HOLD THE HIGHEST MARKET SHARE IN 2020

4.6 Cloud Mobile Backend As A Service MARKET REGIONAL SCENARIO, 20202025

FIGURE 24 ASIA PACIFIC TO EMERGE AS THE BEST MARKET FOR INVESTMENTS IN THE NEXT FIVE YEARS

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 47)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 25 CLOUD MOBILE BAAS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Growing mobile app-driven economies demand BaaS

5.2.1.2 BaaS helps developers concentrate on the frontend for faster development and deployment

5.2.2 RESTRAINTS

5.2.2.1 Higher CAPEX demand for BaaS

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing adoption of mobile devices

5.2.3.2 Mobile apps and mobile games gaining popularity among the end users

5.2.4 CHALLENGES

5.2.4.1 Security and privacy concerns for confidential data and business processes

5.3 COVID-19-DRIVEN MARKET DYNAMICS

5.3.1 ASSUMPTIONS: COVID-19 IMPACT ON THE CLOUD MOBILE BACKEND AS A SERVICE MARKET

5.3.2 COVID IMPACT: Cloud Mobile Backend As A Service MARKET

5.3.3 DRIVERS AND OPPORTUNITIES

5.3.4 RESTRAINTS AND CHALLENGES

5.4 CASE STUDY ANALYSIS

5.4.1 USE CASE 1: INSURANCE

5.4.2 USE CASE 2: GAMES

5.4.3 USE CASE 3: SMART BUILDING

5.5 CLOUD MOBILE BAAS MARKET: VALUE CHAIN ANALYSIS

FIGURE 26 MARKET: VALUE CHAIN ANALYSIS

5.6 MARKET: TECHNOLOGY ANALYSIS

5.6.1 ARTIFICIAL INTELLIGENCE

5.6.2 ANALYTICS

5.7 MARKET: PRICING ANALYSIS

TABLE 4 MARKET: PRICING ANALYSIS (2019-2020)

5.8 Cloud Mobile Backend As A Service MARKET: COVID-19 IMPACT

5.8.1 ASSUMPTIONS: COVID-19 IMPACT ON THE MARKET

5.8.2 OPERATIONAL DRIVERS: CLOUD MOBILE BAAS MARKET

5.9 REGULATORY POLICIES

5.9.1 INTRODUCTION

5.9.2 GENERAL DATA PROTECTION REGULATION

6 CLOUD MOBILE BACKEND AS A SERVICE MARKET, BY APPLICATION (Page No. - 56)

6.1 INTRODUCTION

FIGURE 27 USER AUTHENTICATION SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

6.1.1 APPLICATION: MARKET DRIVERS

6.1.2 APPLICATION: COVID-19 IMPACT

TABLE 5 MARKET SIZE, BY APPLICATION, 20162019 (USD MILLION)

TABLE 6 MARKET SIZE, BY APPLICATION, 20202025 (USD MILLION)

6.2 CLOUD STORAGE AND BACKUP

TABLE 7 CLOUD STORAGE AND BACKUP: Cloud Mobile BaaS MARKET SIZE, BY REGION, 20162019 (USD MILLION)

TABLE 8 CLOUD STORAGE AND BACKUP: MARKET SIZE, BY REGION, 20202025 (USD MILLION)

6.3 USER AUTHENTICATION

TABLE 9 USER AUTHENTICATION: MARKET SIZE, BY REGION, 20162019 (USD MILLION)

TABLE 10 USER AUTHENTICATION: MARKET SIZE, BY REGION, 20202025 (USD MILLION)

6.4 DATABASE MANAGEMENT

TABLE 11 DATABASE MANAGEMENT: MARKET SIZE, BY REGION, 20162019 (USD MILLION)

TABLE 12 DATABASE MANAGEMENT: CLOUD MOBILE BACKEND AS A SERVICE MARKET SIZE, BY REGION, 20202025 (USD MILLION)

6.5 PUSH NOTIFICATION

TABLE 13 PUSH NOTIFICATION: MARKET SIZE, BY REGION, 20162019 (USD MILLION)

TABLE 14 PUSH NOTIFICATION: MARKET SIZE, BY REGION, 20202025 (USD MILLION)

6.6 OTHER APPLICATIONS

TABLE 15 OTHER APPLICATIONS: MARKET SIZE, BY REGION, 20162019 (USD MILLION)

TABLE 16 OTHER APPLICATIONS: Cloud Mobile BaaS MARKET SIZE, BY REGION, 20202025 (USD MILLION)

7 CLOUD MOBILE BACKEND AS A SERVICE MARKET, BY PLATFORM (Page No. - 64)

7.1 INTRODUCTION

FIGURE 28 IOS SEGMENT TO GROW AT THE HIGHEST CAGR

7.1.1 PLATFORM: MARKET DRIVERS

7.1.2 PLATFORM: COVID-19 IMPACT

TABLE 17 MARKET SIZE, BY PLATFORM, 20162019 (USD MILLION)

TABLE 18 MARKET SIZE, BY PLATFORM, 20202025 (USD MILLION)

7.2 ANDROID

TABLE 19 ANDROID: MARKET SIZE, BY REGION, 20162019 (USD MILLION)

TABLE 20 ANDROID: MARKET SIZE, BY REGION, 20202025 (USD MILLION)

7.3 IOS

TABLE 21 IOS: MARKET SIZE, BY REGION, 20162019 (USD MILLION)

TABLE 22 IOS: Cloud Mobile BaaS MARKET SIZE, BY REGION, 20202025 (USD MILLION)

7.4 OTHER PLATFORMS

TABLE 23 OTHER PLATFORMS: MARKET SIZE, BY REGION, 20162019 (USD MILLION)

TABLE 24 OTHER PLATFORMS: MARKET SIZE, BY REGION, 20202025 (USD MILLION)

8 CLOUD MOBILE BACKEND AS A SERVICE MARKET, BY ENTERPRISE SIZE (Page No. - 70)

8.1 INTRODUCTION

FIGURE 29 SMALL AND MEDIUM-SIZED ENTERPRISES SEGMENT TO GROW AT A HIGHER CAGR

8.1.1 ENTERPRISE SIZE: MARKET DRIVERS

8.1.2 ENTERPRISE SIZE: COVID-19 IMPACT

TABLE 25 MARKET SIZE, BY ENTERPRISE SIZE, 20162019 (USD MILLION)

TABLE 26 MARKET SIZE, BY ENTERPRISE SIZE, 20202025 (USD MILLION)

8.2 SMALL AND MEDIUM-SIZED ENTERPRISES

TABLE 27 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 20162019 (USD MILLION)

TABLE 28 SMALL AND MEDIUM-SIZED ENTERPRISES: Cloud Mobile BaaS MARKET SIZE, BY REGION, 20202025 (USD MILLION)

8.3 LARGE ENTERPRISES

TABLE 29 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 20162019 (USD MILLION)

TABLE 30 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 20202025 (USD MILLION)

9 CLOUD MOBILE BACKEND AS A SERVICE MARKET, BY VERTICAL (Page No. - 75)

9.1 INTRODUCTION

FIGURE 30 BANKING, FINANCIAL SERVICES, AND INSURANCE VERTICAL TO HOLD THE LARGEST MARKET SIZE IN 2020

9.1.1 VERTICAL: MARKET DRIVERS

9.1.2 VERTICAL: COVID-19 IMPACT

TABLE 31 MARKET SIZE, BY VERTICAL, 20162019 (USD MILLION)

TABLE 32 MARKET SIZE, BY VERTICAL, 20202025 (USD MILLION)

9.2 INFORMATION TECHNOLOGY AND INFORMATION TECHNOLOGY-ENABLED SERVICES

TABLE 33 INFORMATION TECHNOLOGY AND INFORMATION TECHNOLOGY-ENABLED SERVICES: Cloud Mobile BaaS MARKET SIZE, BY REGION, 20162019 (USD MILLION)

TABLE 34 INFORMATION TECHNOLOGY AND INFORMATION TECHNOLOGY-ENABLED SERVICES: MARKET SIZE, BY REGION, 20202025 (USD MILLION)

9.3 BANKING, FINANCIAL SERVICES, AND INSURANCE

TABLE 35 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET SIZE, BY REGION, 20162019 (USD MILLION)

TABLE 36 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET SIZE, BY REGION,20202025 (USD MILLION)

9.4 HEALTHCARE AND PHARMACEUTICALS

TABLE 37 HEALTHCARE AND PHARMACEUTICALS: CLOUD MOBILE BACKEND AS A SERVICE MARKET SIZE, BY REGION, 20162019 (USD MILLION)

TABLE 38 HEALTHCARE AND PHARMACEUTICALS: MARKET SIZE, BY REGION, 20202025 (USD MILLION)

9.5 MEDIA, ENTERTAINMENT, AND GAMING

TABLE 39 MEDIA, ENTERTAINMENT, AND GAMING: MARKET SIZE, BY REGION, 20162019 (USD MILLION)

TABLE 40 MEDIA, ENTERTAINMENT, AND GAMING: MARKET SIZE, BY REGION, 20202025 (USD MILLION)

9.6 RETAIL AND ECOMMERCE

TABLE 41 RETAIL AND ECOMMERCE: MARKET SIZE, BY REGION, 20162019 (USD MILLION)

TABLE 42 RETAIL AND ECOMMERCE: Cloud Mobile BaaS MARKET SIZE, BY REGION, 20202025 (USD MILLION)

9.7 TELECOMMUNICATIONS

TABLE 43 TELECOMMUNICATIONS: MARKET SIZE, BY REGION, 20162019 (USD MILLION)

TABLE 44 TELECOMMUNICATIONS: MARKET SIZE, BY REGION, 20202025 (USD MILLION)

9.8 MANUFACTURING

TABLE 45 MANUFACTURING: MARKET SIZE, BY REGION, 20162019 (USD MILLION)

TABLE 46 MANUFACTURING: MARKET SIZE, BY REGION, 20202025 (USD MILLION)

9.9 OTHER VERTICALS

TABLE 47 OTHER VERTICALS: MARKET SIZE, BY REGION, 20162019 (USD MILLION)

TABLE 48 OTHER VERTICALS: MARKET SIZE, BY REGION, 20202025 (USD MILLION)

10 CLOUD MOBILE BACKEND AS A SERVICE MARKET, BY REGION (Page No. - 87)

10.1 INTRODUCTION

FIGURE 31 NORTH AMERICA TO HOLD THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

TABLE 49 MARKET SIZE, BY REGION, 20162019 (USD MILLION)

TABLE 50 MARKET SIZE, BY REGION, 20202025 (USD MILLION)

10.2 NORTH AMERICA

10.2.1 NORTH AMERICA: Cloud Mobile BaaS MARKET DRIVERS

10.2.2 NORTH AMERICA: COVID-19 IMPACT

10.2.3 NORTH AMERICA: REGULATIONS

FIGURE 32 NORTH AMERICA: MARKET SNAPSHOT

TABLE 51 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 20162019 (USD MILLION)

TABLE 52 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 20202025 (USD MILLION)

TABLE 53 NORTH AMERICA: MARKET SIZE, BY PLATFORM, 20162019 (USD MILLION)

TABLE 54 NORTH AMERICA: MARKET SIZE, BY PLATFORM, 20202025 (USD MILLION)

TABLE 55 NORTH AMERICA: MARKET SIZE, BY ENTERPRISE SIZE, 20162019 (USD MILLION)

TABLE 56 NORTH AMERICA: MARKET SIZE, BY ENTERPRISE SIZE, 20202025 (USD MILLION)

TABLE 57 NORTH AMERICA: CLOUD MOBILE BACKEND AS A SERVICE MARKET SIZE, BY VERTICAL, 20162019 (USD MILLION)

TABLE 58 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 20202025 (USD MILLION)

TABLE 59 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 20162019 (USD MILLION)

TABLE 60 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 20202025 (USD MILLION)

10.2.4 UNITED STATES

TABLE 61 UNITED STATES: Cloud Mobile BaaS MARKET SIZE, BY PLATFORM, 20162019 (USD MILLION)

TABLE 62 UNITED STATES: MARKET SIZE, BY PLATFORM, 20202025 (USD MILLION)

TABLE 63 UNITED STATES: MARKET SIZE, BY ENTERPRISE SIZE, 20162019 (USD MILLION)

TABLE 64 UNITED STATES: MARKET SIZE, BY ENTERPRISE SIZE, 20202025 (USD MILLION)

10.2.5 CANADA

TABLE 65 CANADA: CLOUD MOBILE BACKEND AS A SERVICE MARKET SIZE, BY PLATFORM, 20162019 (USD MILLION)

TABLE 66 CANADA: MARKET SIZE, BY PLATFORM, 20202025 (USD MILLION)

TABLE 67 CANADA: MARKET SIZE, BY ENTERPRISE SIZE, 20162019 (USD MILLION)

TABLE 68 CANADA: MARKET SIZE, BY ENTERPRISE SIZE, 20202025 (USD MILLION)

10.3 EUROPE

10.3.1 EUROPE: Cloud Mobile BaaS MARKET DRIVERS

10.3.2 EUROPE: COVID-19 IMPACT

10.3.3 EUROPE: REGULATIONS

TABLE 69 EUROPE: MARKET SIZE, BY APPLICATION, 20162019 (USD MILLION)

TABLE 70 EUROPE: MARKET SIZE, BY APPLICATION, 20202025 (USD MILLION)

TABLE 71 EUROPE: MARKET SIZE, BY PLATFORM, 20162019 (USD MILLION)

TABLE 72 EUROPE: MARKET SIZE, BY PLATFORM, 20202025 (USD MILLION)

TABLE 73 EUROPE: MARKET SIZE, BY ENTERPRISE SIZE, 20162019 (USD MILLION)

TABLE 74 EUROPE: MARKET SIZE, BY ENTERPRISE SIZE, 20202025 (USD MILLION)

TABLE 75 EUROPE: CLOUD MOBILE BACKEND AS A SERVICE MARKET SIZE, BY VERTICAL, 20162019 (USD MILLION)

TABLE 76 EUROPE: MARKET SIZE, BY VERTICAL, 20202025 (USD MILLION)

TABLE 77 EUROPE: MARKET SIZE, BY COUNTRY, 20162019 (USD MILLION)

TABLE 78 EUROPE: MARKET SIZE, BY COUNTRY, 20202025 (USD MILLION)

10.3.4 UNITED KINGDOM

TABLE 79 UNITED KINGDOM: Cloud Mobile BaaS MARKET SIZE, BY PLATFORM, 20162019 (USD MILLION)

TABLE 80 UNITED KINGDOM: MARKET SIZE, BY PLATFORM, 20202025 (USD MILLION)

TABLE 81 UNITED KINGDOM: MARKET SIZE, BY ENTERPRISE SIZE, 20162019 (USD MILLION)

TABLE 82 UNITED KINGDOM: MARKET SIZE, BY ENTERPRISE SIZE, 20202025 (USD MILLION)

10.3.5 REST OF EUROPE

TABLE 83 REST OF EUROPE: CLOUD MOBILE BACKEND AS A SERVICE MARKET SIZE, BY PLATFORM, 20162019 (USD MILLION)

TABLE 84 REST OF EUROPE: MARKET SIZE, BY PLATFORM, 20202025 (USD MILLION)

TABLE 85 REST OF EUROPE: MARKET SIZE, BY ENTERPRISE SIZE, 20162019 (USD MILLION)

TABLE 86 REST OF EUROPE: MARKET SIZE, BY ENTERPRISE SIZE, 20202025 (USD MILLION)

10.4 ASIA PACIFIC

10.4.1 ASIA PACIFIC: Cloud Mobile BaaS MARKET DRIVERS

10.4.2 ASIA PACIFIC: COVID-19 IMPACT

10.4.3 ASIA PACIFIC: REGULATIONS

FIGURE 33 ASIA PACIFIC: REGIONAL SNAPSHOT

TABLE 87 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 20162019 (USD MILLION)

TABLE 88 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 20202025 (USD MILLION)

TABLE 89 ASIA PACIFIC: MARKET SIZE, BY PLATFORM, 20162019 (USD MILLION)

TABLE 90 ASIA PACIFIC: MARKET SIZE, BY PLATFORM, 20202025 (USD MILLION)

TABLE 91 ASIA PACIFIC: MARKET SIZE, BY ENTERPRISE SIZE, 20162019 (USD MILLION)

TABLE 92 ASIA PACIFIC: CLOUD MOBILE BACKEND AS A SERVICE MARKET SIZE, BY ENTERPRISE SIZE, 20202025 (USD MILLION)

TABLE 93 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 20162019 (USD MILLION)

TABLE 94 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 20202025 (USD MILLION)

TABLE 95 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 20162019 (USD MILLION)

TABLE 96 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 20202025 (USD MILLION)

10.4.4 CHINA

TABLE 97 CHINA: Cloud Mobile BaaS MARKET SIZE, BY PLATFORM, 20162019 (USD MILLION)

TABLE 98 CHINA: MARKET SIZE, BY PLATFORM, 20202025 (USD MILLION)

TABLE 99 CHINA: MARKET SIZE, BY ENTERPRISE SIZE, 20162019 (USD MILLION)

TABLE 100 CHINA: MARKET SIZE, BY ENTERPRISE SIZE, 20202025 (USD MILLION)

10.4.5 REST OF ASIA PACIFIC

TABLE 101 REST OF ASIA PACIFIC: CLOUD MOBILE BACKEND AS A SERVICE MARKET SIZE, BY PLATFORM, 20162019 (USD MILLION)

TABLE 102 REST OF ASIA PACIFIC: MARKET SIZE, BY PLATFORM, 20202025 (USD MILLION)

TABLE 103 REST OF ASIA PACIFIC: MARKET SIZE, BY ENTERPRISE SIZE, 20162019 (USD MILLION)

TABLE 104 REST OF ASIA PACIFIC: MARKET SIZE, BY ENTERPRISE SIZE, 20202025 (USD MILLION)

10.5 MIDDLE EAST AND AFRICA

10.5.1 MIDDLE EAST AND AFRICA: Cloud Mobile BaaS MARKET DRIVERS

10.5.2 MIDDLE EAST AND AFRICA: COVID-19 IMPACT

10.5.3 MIDDLE EAST AND AFRICA: REGULATIONS

TABLE 105 MIDDLE EAST AND AFRICA: MARKET SIZE, BY APPLICATION, 20162019 (USD MILLION)

TABLE 106 MIDDLE EAST AND AFRICA: MARKET SIZE, BY APPLICATION, 20202025 (USD MILLION)

TABLE 107 MIDDLE EAST AND AFRICA: MARKET SIZE, BY PLATFORM, 20162019 (USD MILLION)

TABLE 108 MIDDLE EAST AND AFRICA: MARKET SIZE, BY PLATFORM, 20202025 (USD MILLION)

TABLE 109 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ENTERPRISE SIZE, 20162019 (USD MILLION)

TABLE 110 MIDDLE EAST AND AFRICA: CLOUD MOBILE BACKEND AS A SERVICE MARKET SIZE, BY ENTERPRISE SIZE, 20202025 (USD MILLION)

TABLE 111 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 20162019 (USD MILLION)

TABLE 112 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 20202025 (USD MILLION)

TABLE 113 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 20162019 (USD MILLION)

TABLE 114 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 20202025 (USD MILLION)

10.5.4 GULF COOPERATION COUNCIL

TABLE 115 GULF COOPERATION COUNCIL: Cloud Mobile BaaS MARKET SIZE, BY PLATFORM, 20162019 (USD MILLION)

TABLE 116 GULF COOPERATION COUNCIL: MARKET SIZE, BY PLATFORM, 20202025 (USD MILLION)

TABLE 117 GULF COOPERATION COUNCIL: MARKET SIZE, BY ENTERPRISE SIZE, 20162019 (USD MILLION)

TABLE 118 GULF COOPERATION COUNCIL: MARKET SIZE, BY ENTERPRISE SIZE, 20202025 (USD MILLION)

10.5.5 REST OF MIDDLE EAST AND AFRICA

TABLE 119 REST OF MIDDLE EAST AND AFRICA: CLOUD MOBILE BACKEND AS A SERVICE MARKET SIZE, BY PLATFORM, 20162019 (USD MILLION)

TABLE 120 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY PLATFORM, 20202025 (USD MILLION)

TABLE 121 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY ENTERPRISE SIZE, 20162019 (USD MILLION)

TABLE 122 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY ENTERPRISE SIZE, 20202025 (USD MILLION)

10.6 LATIN AMERICA

10.6.1 LATIN AMERICA: Cloud Mobile BaaS MARKET DRIVERS

10.6.2 LATIN AMERICA: COVID-19 IMPACT

10.6.3 LATIN AMERICA: REGULATIONS

TABLE 123 LATIN AMERICA: MARKET SIZE, BY APPLICATION, 20162019 (USD MILLION)

TABLE 124 LATIN AMERICA: MARKET SIZE, BY APPLICATION, 20202025 (USD MILLION)

TABLE 125 LATIN AMERICA: MARKET SIZE, BY PLATFORM, 20162019 (USD MILLION)

TABLE 126 LATIN AMERICA: MARKET SIZE, BY PLATFORM, 20202025 (USD MILLION)

TABLE 127 LATIN AMERICA: MARKET SIZE, BY ENTERPRISE SIZE, 20162019 (USD MILLION)

TABLE 128 LATIN AMERICA: CLOUD MOBILE BACKEND AS A SERVICE MARKET SIZE, BY ENTERPRISE SIZE, 20202025 (USD MILLION)

TABLE 129 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 20162019 (USD MILLION)

TABLE 130 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 20202025 (USD MILLION)

TABLE 131 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 20162019 (USD MILLION)

TABLE 132 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 20202025 (USD MILLION)

10.6.4 BRAZIL

TABLE 133 BRAZIL: Cloud Mobile BaaS MARKET SIZE, BY PLATFORM, 20162019 (USD MILLION)

TABLE 134 BRAZIL: MARKET SIZE, BY PLATFORM, 20202025 (USD MILLION)

TABLE 135 BRAZIL: MARKET SIZE, BY ENTERPRISE SIZE, 20162019 (USD MILLION)

TABLE 136 BRAZIL: MARKET SIZE, BY ENTERPRISE SIZE, 20202025 (USD MILLION)

10.6.5 REST OF LATIN AMERICA

TABLE 137 REST OF LATIN AMERICA: CLOUD MOBILE BACKEND AS A SERVICE MARKET SIZE, BY PLATFORM, 20162019 (USD MILLION)

TABLE 138 REST OF LATIN AMERICA: MARKET SIZE, BY PLATFORM, 20202025 (USD MILLION)

TABLE 139 REST OF LATIN AMERICA: MARKET SIZE, BY ENTERPRISE SIZE, 20162019 (USD MILLION)

TABLE 140 REST OF LATIN AMERICA: MARKET SIZE, BY ENTERPRISE SIZE, 20202025 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 126)

11.1 INTRODUCTION

11.2 MARKET EVALUATION FRAMEWORK

FIGURE 34 MARKET EVALUATION FRAMEWORK

11.3 MARKET SHARE OF TOP VENDORS

FIGURE 35 VENDOR MARKET SHARE ANALYSIS

11.4 REVENUE ANALYSIS OF TOP VENDORS

FIGURE 36 REVENUE ANALYSIS (2016-2019)

11.5 COMPANY EVALUATION QUADRANT

11.5.1 DEFINITIONS AND METHODOLOGY

TABLE 141 COMPANY EVALUATION QUADRANT: CRITERIA

11.5.2 STAR

11.5.3 EMERGING LEADER

11.5.4 PERVASIVE

11.5.5 PARTICIPANT

FIGURE 37 CLOUD MOBILE BACKEND AS A SERVICE (GLOBAL): COMPANY EVALUATION QUADRANT, 2020

11.6 SME EVALUATION QUADRANT

11.6.1 DEFINITIONS AND METHODOLOGY

TABLE 142 SME EVALUATION QUADRANT: CRITERIA

11.6.2 PROGRESSIVE VENDORS

11.6.3 RESPONSIVE VENDORS

11.6.4 DYNAMIC VENDORS

11.6.5 STARTING BLOCKS

FIGURE 38 Cloud Mobile BaaS MARKET (GLOBAL): SME EVALUATION QUADRANT, 2020

12 COMPANY PROFILES (Page No. - 133)

12.1 INTRODUCTION

(Business Overview, Products & Services, Key Insights, Recent Developments, MnM View)*

12.2 MICROSOFT

FIGURE 39 MICROSOFT: COMPANY SNAPSHOT

12.3 ORACLE

FIGURE 40 ORACLE: COMPANY SNAPSHOT

12.4 TEMENOS

FIGURE 41 TEMENOS: COMPANY SNAPSHOT

12.5 AWS

FIGURE 42 AWS: COMPANY SNAPSHOT

12.6 IBM

FIGURE 43 IBM: COMPANY SNAPSHOT

12.7 GOOGLE

FIGURE 44 GOOGLE: COMPANY SNAPSHOT

12.8 PROGRESS

FIGURE 45 PROGRESS: COMPANY SNAPSHOT

12.9 KII

12.10 PROGRAMMABLEWEB

12.11 APPCELERATOR

FIGURE 46 APPCELERATOR: COMPANY SNAPSHOT

12.12 EXADEL

12.13 8BASE

12.14 BACK4APP

12.15 BUILT.IO

12.16 BACKENDLESS

12.17 COUCHBASE

12.18 KUMULOS

12.19 KUZZLE

12.20 BAASBOX

12.21 LOOPBACK

12.22 TWENTY57

12.23 PUBNUB

12.24 HACKERBAY

12.25 HASURA

12.26 OURSKY

12.27 MONGODB

*Details on Business Overview, Products & Services, Key Insights, Recent Developments, MnM View might not be captured in case of unlisted companies.

13 ADJACENT MARKET (Page No. - 158)

13.1 INTRODUCTION

13.2 CLOUD COMPUTING MARKET

13.2.1 CLOUD COMPUTING MARKET: DEFINITION

TABLE 143 CLOUD COMPUTING MARKET SIZE, BY SERVICE MODEL, 20202025 (USD BILLION)

TABLE 144 CLOUD COMPUTING MARKET SIZE, BY INFRASTRUCTURE AS A SERVICE, 20202025 (USD BILLION)

TABLE 145 CLOUD COMPUTING MARKET SIZE, BY PLATFORM AS A SERVICE, 20202025 (USD BILLION)

TABLE 146 CLOUD COMPUTING MARKET SIZE, BY SOFTWARE AS A SERVICE, 20202025 (USD BILLION)

TABLE 147 CLOUD COMPUTING MARKET SIZE, BY DEPLOYMENT MODEL,20202025 (USD BILLION)

TABLE 148 CLOUD COMPUTING MARKET SIZE, BY ORGANIZATION SIZE, 20202025 (USD BILLION)

TABLE 149 CLOUD COMPUTING MARKET SIZE, BY VERTICAL, 20202025 (USD BILLION)

13.3 CLOUD APPLICATIONS MARKET

13.3.1 CLOUD APPLICATIONS MARKET: DEFINITION

TABLE 150 CLOUD APPLICATIONS MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

TABLE 151 CLOUD APPLICATIONS MARKET SIZE, BY ORGANIZATION SIZE, 20182025 (USD MILLION)

TABLE 152 CLOUD APPLICATIONS MARKET SIZE, BY VERTICAL, 20182025 (USD MILLION)

14 APPENDIX (Page No. - 164)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

The study consists of four major activities to estimate the current market size of the Cloud mobile BaaS market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the Cloud mobile backend as a service market.

Secondary research

In the secondary research process, various secondary sources such as D&B Hoovers and Bloomberg BusinessWeek have been referred to for identifying and collecting information for this study. Secondary sources included annual reports; press releases and investor presentations of companies; white papers and articles by recognized authors; gold standard and silver standard websites; regulatory bodies; and databases.

Primary research

Various primary sources from both the supply and demand sides of the Cloud mobile BaaS market were interviewed to obtain qualitative and quantitative information for this study. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various vendors who provide Cloud mobile BaaS solutions and associated service providers operating in the targeted regions. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

The following is the breakup of primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market size estimation

For estimating and forecasting the Cloud mobile backend as a service market and its other dependent submarkets, the top-down and bottom-up approaches were used. The bottom-up procedure was used to arrive at the overall market size of the global Cloud mobile BaaS market using key companies revenue and their offerings in the market. The research methodology used to estimate the market size included the following:

- The key players in the market were identified through extensive secondary research.

- The market size, in terms of value, was determined through primary and secondary research processes.

- All percentage shares, splits, and breakups were determined using secondary sources and verified through primary sources.

Data triangulation

With data triangulation and validation through primary interviews, the exact value of the overall parent market size was determined and confirmed using this study. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report objectives

- To determine and forecast the global Cloud mobile BaaS market based on applications, platform, enterprise size, verticals, and regions from 2020 to 2025, and analyze the various macro and microeconomic factors that affect the market growth

- To forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To provide detailed information regarding the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the Cloud mobile backend as a service market

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the total Cloud mobile BaaS market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the Cloud mobile backend as a service market

- To profile key market players comprising top vendors and startups; provide a comparative analysis based on business overviews, regional presence, product offerings, business strategies, and key financials; and illustrate the markets competitive landscape

- To track and analyze competitive developments, such as mergers and acquisitions, product developments, partnerships and collaborations, and Research and Development (R&D) activities, in the market

Available customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Product analysis

- Product matrix provides a detailed comparison of the product portfolio of each company

Geographic analysis

- Further breakup of the North American Cloud mobile BaaS market

- Further breakup of the European market

- Further breakup of the APAC market

- Further breakup of the MEA market

- Further breakup of the Latin American Cloud mobile backend as a service market

Company information

- Detailed analysis and profiling of additional market players up to 5

Growth opportunities and latent adjacency in Cloud Mobile Backend as a Service (BaaS) Market

What are the benefits of the Backend as a Service BaaS model for Web and mobile applications?

Gather insights into BaaS industry

Interested in backend providers helping with In-App monetization/retailing capabilities, any views on current valuation of mBaaS players