Modular Data Center Market by Component (Solutions (All-in-One Modules and Individual Modules) and Services), Organization Size, Vertical (BFSI, IT & Telecom, Media & Entertainment, Healthcare) and Region - Global Forecast to 2030

Updated on : April 25, 2023

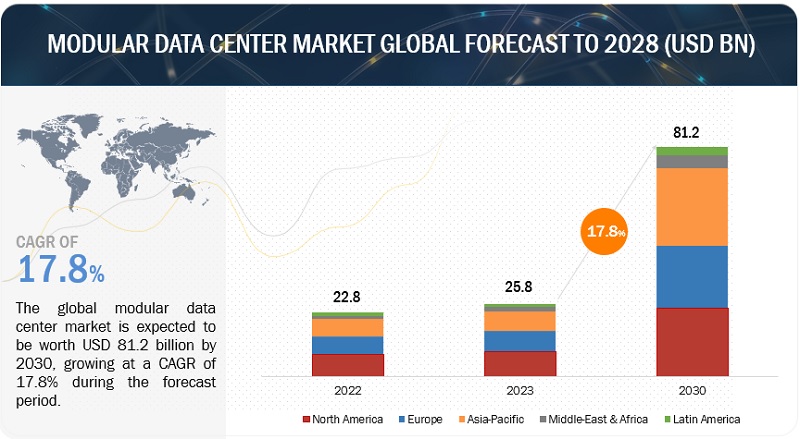

The Modular Data Center Market size was estimated at USD 23.0 billion in 2022 and is projected to be worth USD 88.5 billion by 2030 to grow at a CAGR of 18.4% during the forecast period. Modular data centers are manufactured by integrating prefabricated modules built inside a factory and shipped to the client site, where they are assembled, deployed, and commissioned. Some of the driving forces of this market include surge in customized data center requirements from vendors and enterprises, rise in demand for rapidly scalable and deployable data centers, high demand for eco-friendly (green) data centers, data center prompt initiatives to eradicate unprecedented critical infrastructure inefficiencies, disaster recovery management, among others.

To know about the assumptions considered for the study, Request for Free Sample Report

Modular data center Market Dynamics

Driver: How does a rapidly scalable and deployable data center become a driving force for the market mentioned above

Modular data centers are easily scalable owing to their modularity, which provides an effective way for the addition and removal of data center components. They are also easily portable, unlike the rigidly designed traditional data centers, which further adds to their popularity with small and mid-sized enterprises (SMEs). The scalable nature of these data centers, coupled with a compact size, provides an attractive offering to mobile network providers, who utilize distributed data centers as a platform to run the network function virtualization. Moreover, modular data centers save a significant amount of time to be deployed. Modular data centers have built-in IT space and cooling and power capabilities within the data center itself. The scalability and adaptability of the data center allow the company to build rapidly and just in time to meet their customer’s exact specifications at scale. Similarly, the data center scalability is also bringing the benefit of high-density, energy efficiency (green data center), as well as the ability to experience cost-efficiency over the lifetime of data center investment.

Restraint : How does the transportation of modular data centers create trouble for manufacturers

Prefabricated modules are large and heavy, and although mobile, they do pose some hindrances when it comes to placement and relocation. Modules may be too heavy to place on the roof of a building or may present logistical challenges in tight city streets. The transportation of data center modules to a site is generally by truck. In most countries and regions, transportation by truck on public roads is regulated. Along with adherence to speeds and right of way, over-the-road regulations govern the weights and dimensions of vehicles, including the cargo they carry, as a matter of public safety. Standards imposed on truck and cargo weights and dimensions reflect the capabilities of roads, bridges, and other structures to safely accommodate all vehicles that use the roadway system legally.

Opportunities : How can the deployment of modular data centers in disaster-prone areas turn out as an opportunity for the aforesaid market

Disaster recovery is a major concern for data center providers and users across the globe. Modular data centers are a cost-effective alternative for disaster recovery and can be deployed in environments where traditional data centers cannot be deployed. Modular data centers are weatherproof and soundproof and can sustain extreme temperatures in outdoor as well as indoor environments. Modular data centers can act as temporary data centers in situations where the main data center has been affected by natural calamities or other disasters or where the expertise to build a data center is unavailable. Moreover, customers from various industries demand data center solutions in rough, hazardous terrains such as deserts and cold and harsh environments.

Challenge : How can operating an effective cooling system be a challenge for the market’s vendors

The modular data centers’ cooling systems are typically in-built and containerized. However, room-based cooling and row-based cooling are challenging to adopt, which prove to be the most useful when an organization wants to scale up its existing data center with modular data centers. Modular data centers, in recent years, have become extremely powerful and are widely used for enterprise data requirements. They can support densities of 20–30 kW or higher and end up generating high levels of heat per square foot. The high levels of heat generated pressurize the overall resource spent on Heating, Ventilation, and Air conditioning (HVAC) systems and services in modular data center systems, thereby increasing data center costs. High heat density levels force organizations to expand their cooling infrastructure and increase their air-conditioning capabilities. Despite this increased air conditioning, it is challenging to avoid the temporary failure of the data center due to overheating.

Support and maintenance service segment to grow at the highest CAGR during the forecast period

Support and maintenance service includes several onsite and offsite services. The onsite maintenance services include support activities, such as device repair and replacement, and various de-installation services, such as disk wiping, the un-racking of devices, and resale and recycling of these devices. Remote support services include speed problem determination and remote troubleshooting. Support & maintenance services provide the necessary systems to continuously monitor the data center, resulting in optimized performance and increased efficiency. These services provide preventive maintenance to mitigate the risks of interrupting availability. Maintenance & support services help end users understand the changing business conditions, client insights, market trends, and service inconveniences to help smoothen the support process within organizations. This service is inevitable for modular data center(s) as regular maintenance, audit, replacement, and repair of cabinets are crucial and critical for the efficient, effective, and consistent functioning of a data center.

SMEs to grow at a higher CAGR during the forecast period

Organizations with an employee strength of less than 1,000 are termed SMEs. These enterprises are adopting low-cost and easily scalable solutions. Several SMEs profiled under Company profiling in our report offer innovative modular data center solutions such as extensive usage of solar power and construction of prefabricated data centers on the moon and under the sea. Modular data centers provide added benefits as they can be deployed at a lower cost than traditional systems. Moreover, the rapid deployment capabilities of these systems help in the rapid expansion of data center infrastructure. Modular data centers are based on a standardized design and can be easily maintained and operated. These benefits drive the adoption of modular data centers among SMEs. Small and mid-sized data centers are driven by the need to make optimum use of their existing data center space. Organizations are shifting to high-density data centers that can serve higher data loads by packing multiple servers in a constrained space

To know about the assumptions considered for the study, download the pdf brochure

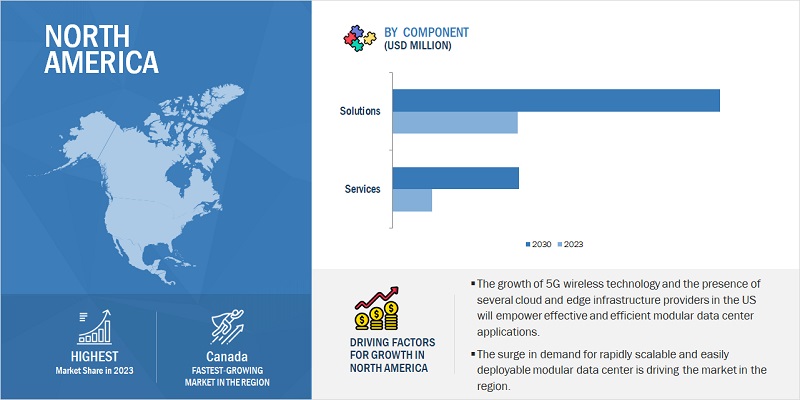

North America to hold the largest market size during the forecast period

The global modular data center market by region covers 5 major geographic regions, namely, North America, Asia Pacific (Asia Pacific), Europe, Middle East and Africa (MEA), and Latin America. North America. This region is expected to have the largest regional market in 2022 due to technological advancements, a large number of early adopters, and the presence of major market players. Moreover, this region has the largest number of cloud service providers, which is expected to result in increased investments related to the technological development of the existing infrastructure, contributing to the growth in the number of modular data center deployments. The increasing influence of data center regulatory standards, green data center popularity and demand, cloud data traffic, and the adoption of IoT and edge computing are factors acting as a catalyst driving the market growth in North America. The presence of a large number of modular data center vendors, with the rising data center infrastructure installations and upgrades, further adds to the growth of the market in the region.

Key Market Players

The modular data center market comprises major solution providers, such as DELL Technologies (US), Vertiv Co. (US), Hewlett Packard Enterprises (US), Huawei Technologies Co. Ltd. (China), International Business Machines Corporation (US), BaseLayer Technology, LLC. (US), Eltek AS (Norway), Cannon Technologies Ltd. (UK), Oracle (US), Microsoft (US), AWS (US), Meta (US), Apple (US), Rittal GmbH & Co. KG (Germany), BladeRoom Group Ltd (UK), Edge Mission Critical Systems LLC (US), Eaton Corporate PLC (Ireland), Rahi Systems Pvt Ltd. (US), STULZ GmbH (Germany), Fiberhome Networks (China), ScaleMatrix Holdings Inc. (US), Schneider Electric SE (France), Cupertino Electric Inc. (US), Shenzhen KSTAR Science and Technology Co. Ltd. (China), Asperitas (Netherlands), Shenzhen CONSNANT Technology Co. Ltd. (China), Retex (Spain), ICTroom Company BV (Netherlands), Box Modul AB (Sweden), and PCX Corporation LLC (US).

The study includes an in-depth competitive analysis of these key players in the modular data center market with their company profiles, recent developments, and key market strategies.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size value in 2022 |

USD 23.0 Billion |

|

Market size value in 2030 |

USD 88.5 Billion |

|

Growth rate |

CAGR of 18.4% |

|

Segments covered |

Component, Organization Size, Vertical, and Region |

|

Geographies covered |

North America, Asia Pacific, Europe, Latin America, and the Middle East and Africa |

|

Companies covered |

DELL Technologies (US), Vertiv Co. (US), Hewlett Packard Enterprises (US), Huawei Technologies Co. Ltd. (China), International Business Machines Corporation (US), BaseLayer Technology, LLC. (US), Eltek AS (Norway), Cannon Technologies Ltd. (UK), Oracle (US) and many more. |

This research report categorizes the modular data center market based on applications, rack units, organization size, vertical, and region.

Based on components, the modular data center market has been segmented as follows:

-

Solutions

- All-in-one Modules

-

Individual Modules

- IT Module

- Power Module

- Cooling Module

-

Services

- Design and Consulting

- Integration and Deployment

- Support and Maintenance

Based on organization size, the market has been segmented as follows

- Small and Medium-sized Enterprises

- Large Enterprises

Based on verticals, the modular data center market has been segmented as follows:

- BFSI

- IT and Telecommunication

- Media and Entertainment

- Healthcare

- Government and Defense

- Retail

- Manufacturing

- Others (Energy, education, transportation and logistics)

Based on regions, the modular data center market has been segmented as follows:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

Asia Pacific

- China

- Japan

- Australia and New Zealand

- Rest of Asia Pacific

-

Middle East and Africa

- KSA (Kingdom of Saudi Arabia)

- United Arab Emirates (UAE)

- South Africa

- Rest of Middle East and Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In June 2022, Schneider Electric launched launched its easy modular data center all-in-one solution in Europe. This new easy prefabricated solution is standardized and pre-tested. It offers reduced lead times and faster speed to market. Its modular design provides a more robust and predictable TCO, costing approximately 15% less than traditional ETO (Engineer to order) offers.

- In June 2022, Oracle Cloud Infrastructure (OCI) extended its distributed cloud services with dedicated regions and previewed the Compute [email protected] With a new, smaller infrastructure footprint and lower price, OCI Dedicated Regions brings the full public cloud to more customers and customer data centers. On average, the new OCI Dedicated Region requires 60-75% less data center space and power, with a lower entry price of around USD 1 million per year for a typical customer.

- In March 2021, Huawei launched a new smart modular data center solution named Modular DC 5.0 with SmartLi UPS inside for small and edge computing scenarios, including three products designed for different industrial needs in retail, manufacturing, and telecom.

Frequently Asked Questions (FAQ):

What is a modular data center?

As per Delta Electronics, Modular data centers are designed to deal with changes in servers such as cloud computing, virtualization, centralization, and high density, improve the operation efficiency of data centers, reduce energy consumption and achieve the goal of rapid expansion and zero interference. Modular data centers are comprised of various modules with independent functions and a unified input/output interface. Modules in different compartments can make duplications for each other, and a fully functional data center is established through a combination of related modules.

Characteristics of modular data centers include an infrastructure that is integrated, standardized, optimized, and intelligent which provides a computing environment of high availability. Modular data centers will meet the urgent needs of the IT department in the future, such as standardization, module, virtual design, dynamic IT infrastructure (flexibility and high usage rate of resources), 24/7 smart operations management (process automation, smart data center), business continuity support (disaster recovery and high availability), shared IT service (inter-business and shared infrastructure, information, application), quick response to the changing needs in business (on-demand supply of resources), green data centers (energy-saving and carbon-reduction), and so on. Moreover, modular data centers are usually housed inside containers and have more than ten servers.

What are the top companies providing modular data center solutions and services?

The top modular data center vendors comprise Dell Technologies, Vertiv, HPE, Huawei, IBM, Schneider Electric, Rittal, BaseLayer, and Eaton, among others. These vendors have adopted different organic and inorganic growth strategies, such as new product launches, partnerships and collaborations, and mergers and acquisitions, to expand their offerings in the modular data center market.

What are the top industries adopting modular data centers?

The following are major industries adopting modular data centers; BFSI, IT and Telecommunications, Government and Defense, among others.

Which region is expected to hold the largest market size during the forecast period?

North America is forecasted to hold the largest market size during the forecast period due to major cloud providers and vendors offering edge technologies, IoT, and HPC (High-Performance Computing), to boost the regional market growth

What are the various trends in the modular data center market?

Drivers:

- Increased demand for rapidly scalable and deployable data centers

- Growing need for energy-efficient data centers

- Easy implementation of redundant data centers

- Easy compliance in modular data centers

Opportunities:

- Deployment in disaster-prone areas

- Demand from colocation providers for modular data centers

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 43)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

FIGURE 1 MODULAR DATA CENTER MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATE, 2017–2021

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 48)

2.1 RESEARCH DATA

FIGURE 2 MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

TABLE 2 LIST OF KEY PRIMARY INTERVIEW PARTICIPANTS

2.1.2.1 Breakdown of primaries

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

FIGURE 4 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 5 MODULAR DATA CENTER MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

2.3.1 TOP-DOWN APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (TOP-DOWN) REVENUE GENERATION FROM MODULAR DATA CENTER VENDORS

2.3.2 BOTTOM-UP APPROACH

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (BOTTOM-UP)

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH FROM SUPPLY SIDE - COLLECTIVE REVENUE OF VENDORS

FIGURE 9 ILLUSTRATIVE EXAMPLE OF REVENUE ESTIMATION

FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY: CAGR PROJECTIONS FROM SUPPLY SIDE

2.4 MARKET FORECAST

TABLE 3 FACTOR ANALYSIS

2.5 ASSUMPTIONS

2.6 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 62)

FIGURE 11 MODULAR DATA CENTER MARKET: GLOBAL SNAPSHOT

FIGURE 12 HIGH-GROWTH SEGMENTS IN MARKET

FIGURE 13 INDIVIDUAL MODULES SEGMENT TO HOLD LARGER MARKET SIZE BY 2030

FIGURE 14 TOP VERTICALS IN MARKET, 2022 VS. 2030

FIGURE 15 MARKET: REGIONAL SNAPSHOT

4 PREMIUM INSIGHTS (Page No. - 66)

4.1 MODULAR DATA CENTER MARKET: BRIEF OVERVIEW

FIGURE 16 DATA CENTER MODERNIZATION AND COST REDUCTION TO DRIVE GROWTH

4.2 MARKET, BY COMPONENT, 2022

FIGURE 17 SOLUTIONS SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2022

4.3 MARKET, BY SOLUTIONS, 2022 VS. 2030

FIGURE 18 INDIVIDUAL MODULES SEGMENT TO ACCOUNT FOR LARGER SHARE BY 2030

4.4 MARKET, BY SERVICES, 2022 VS. 2030

FIGURE 19 SUPPORT & MAINTENANCE SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE BY 2030

4.5 MARKET, BY ORGANIZATION SIZE, 2022

FIGURE 20 LARGE ENTERPRISES SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2022

4.6 MARKET, BY VERTICAL, 2022 VS. 2030

FIGURE 21 BFSI VERTICAL TO ACCOUNT FOR LARGEST MARKET SHARE BY 2030

4.7 MARKET: REGIONAL SCENARIO, 2022–2030

FIGURE 22 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENTS IN NEXT EIGHT YEARS

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 70)

5.1 MARKET DYNAMICS

FIGURE 23 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: MODULAR DATA CENTER MARKET

5.1.1 DRIVERS

5.1.1.1 Increased demand for rapidly scalable and deployable data centers

FIGURE 24 CONSTRUCTION TIMELINE OF MODULAR AND TRADITIONAL DATA CENTERS

5.1.1.2 Growing need for energy-efficient data centers

5.1.1.3 Easy implementation of redundant data centers

5.1.1.4 Easy compliance in modular data centers

5.1.1.5 Proliferation of data center colocation facilities globally

5.1.1.6 Data center optimization initiatives to address critical infrastructure inefficiencies

5.1.2 RESTRAINTS

5.1.2.1 Transportation of modular data centers

TABLE 4 ROADWAY TRANSPORTATION WEIGHT AND SIZE LIMITS

5.1.2.2 Vendor lock-ins limit buying options

5.1.2.3 Emergence of HCI

5.1.3 OPPORTUNITIES

5.1.3.1 Deployment in disaster-prone areas

TABLE 5 NEMA ENCLOSURE RATINGS

5.1.3.2 Demand from colocation providers for modular data centers

5.1.3.3 Demand for data centers on the Moon

5.1.3.4 Demand for underwater data centers

5.1.3.5 Demand for data centers in space

5.1.3.6 Establishment of data centers in Iceland

5.1.4 CHALLENGES

5.1.4.1 Implementing effective cooling systems

TABLE 6 AMERICAN SOCIETY OF HEATING, REFRIGERATION, AND AIR CONDITIONING ENGINEERS THERMAL GUIDELINE VALUES

5.1.4.2 Reliance on PUE as sole efficiency measure

5.2 PORTER’S FIVE FORCES ANALYSIS

FIGURE 25 MODULAR DATA CENTER MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 7 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.2.1 THREAT OF NEW ENTRANTS

5.2.2 THREAT OF SUBSTITUTES

5.2.3 BARGAINING POWER OF SUPPLIERS

5.2.4 BARGAINING POWER OF BUYERS

5.2.5 DEGREE OF COMPETITION

5.3 KEY STAKEHOLDERS & BUYING CRITERIA

5.3.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP END USERS

TABLE 8 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP END USERS (%)

5.3.2 BUYING CRITERIA

FIGURE 27 KEY BUYING CRITERIA FOR TOP END USERS

TABLE 9 KEY BUYING CRITERIA FOR TOP END USERS

5.4 MODULAR DATA CENTER: ADOPTION TREND BY CLOUD PROVIDERS

TABLE 10 LIST OF MAJOR CLOUD PROVIDERS

5.5 TREND ANALYSIS: MODULAR DATA CENTER PROVIDERS AND OPERATORS

5.5.1 INSIGHTS ON KEY DATA CENTER MANUFACTURERS

5.5.2 INSIGHTS ON KEY DATA CENTER OPERATORS

5.6 VALUE CHAIN

FIGURE 28 MODULAR DATA CENTER MARKET: VALUE CHAIN

5.7 ECOSYSTEM

FIGURE 29 MARKET: ECOSYSTEM

TABLE 11 MARKET: ECOSYSTEM

5.8 TECHNOLOGICAL ANALYSIS

5.8.1 TECHNOLOGY TO DEPLOY MODULAR DATA CENTERS

5.8.1.1 Deployment advancements with pod-based approach to data centers

5.8.2 TECHNOLOGIES IN UNINTERRUPTED POWER SUPPLY

5.8.2.1 Online double conversion technology

5.8.2.2 Offline standby technology

5.8.2.3 Line-interactive technology

5.8.3 TECHNOLOGIES IN POWER DISTRIBUTION UNITS

5.8.3.1 Intelligent power distribution units/Smart power distribution units

5.8.3.1.1 Monitored power distribution units

5.8.3.1.2 Switched power distribution units

5.8.4 TECHNOLOGIES IN MONITORING

5.8.4.1 Data center infrastructure management

5.8.5 TECHNOLOGIES IN COOLING AND THERMAL MANAGEMENT

5.8.5.1 In-rack cooling

5.8.5.2 Air cooling

5.8.5.3 Liquid cooling

5.8.5.4 Fire suppression

5.8.6 OTHER INNOVATIVE TECHNOLOGIES IN MODULAR DATA CENTERS

5.8.6.1 Smart Materials in Manufacturing

5.8.6.2 IPv6

5.8.6.3 Solid State Drives

5.8.6.4 Bare Metal Hypervisors

5.9 PRICING ANALYSIS

5.9.1 AVERAGE SELLING PRICE TREND

TABLE 12 PRICING ANALYSIS OF MODULAR DATA CENTER VENDORS (1/2)

TABLE 13 PRICING ANALYSIS OF MODULAR DATA CENTER VENDORS (2/2)

5.10 CASE STUDY ANALYSIS

5.10.1 CASE STUDY 1: ENERGY

5.10.2 CASE STUDY 2: IT

5.10.3 CASE STUDY 3: AEROSPACE

5.10.4 CASE STUDY 4: WHOLESALE

5.11 PATENT ANALYSIS

FIGURE 30 NUMBER OF PATENTS PUBLISHED, 2011-2021

FIGURE 31 TOP PATENT OWNERS (GLOBAL)

5.12 REGULATORY LANDSCAPE

5.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 14 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 15 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 16 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 17 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.12.2 KEY ASSOCIATIONS AND REGULATORY STANDARDS

5.12.2.1 American National Standards Institute

5.12.2.2 International Organization for Standardization

5.12.2.3 European Standards

5.12.2.4 Uptime Institute

5.12.2.5 ENERGY STAR-certified Products

5.12.2.6 National Electrical Manufacturers Association (NEMA)

5.12.2.7 Canadian Standards Association (CSA) Group

5.12.2.8 Electronics Industries Alliance (EIA)

5.12.2.9 Telecommunications Industry Association (TIA)

5.12.2.10 Leadership in Energy and Environmental Design (LEED)

5.12.2.11 Open Compute Project (OCP)

5.12.2.12 Underwriters Laboratories (UL)

5.13 TRENDS/DISRUPTIONS IMPACTING BUYERS

FIGURE 32 TRENDS/DISRUPTIONS IMPACTING BUYERS

5.14 KEY CONFERENCES AND EVENTS IN 2022–2023

TABLE 18 MODULAR DATA CENTER MARKET: DETAILED LIST OF CONFERENCES AND EVENTS, 2022-2023

6 MODULAR DATA CENTER MARKET, BY COMPONENT (Page No. - 105)

6.1 INTRODUCTION

6.1.1 COMPONENT: MARKET DRIVERS

FIGURE 33 SOLUTIONS TO HOLD LARGER MARKET SIZE IN 2022

TABLE 19 MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 20 MARKET, BY COMPONENT, 2022–2030 (USD MILLION)

6.2 SOLUTIONS

6.2.1 NEED FOR FLEXIBLE AND EFFICIENT INFRASTRUCTURE TO SUPPORT MODERN DATA CENTERS

TABLE 21 SOLUTIONS MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 22 SOLUTIONS MARKET, BY REGION, 2022–2030 (USD MILLION)

6.3 SERVICES

6.3.1 HIGHER SPENDING ON MAINTENANCE SERVICES TO REDUCE DATA CENTER DOWNTIME

TABLE 23 SERVICES MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 24 SERVICES MARKET, BY REGION, 2022–2030 (USD MILLION)

7 MODULAR DATA CENTER MARKET, BY SOLUTIONS (Page No. - 110)

7.1 INTRODUCTION

7.1.1 SOLUTIONS: MARKET DRIVERS

FIGURE 34 INDIVIDUAL MODULES TO HOLD LARGER MARKET SIZE IN 2022

TABLE 25 MARKET, BY SOLUTIONS, 2016–2021 (USD MILLION)

TABLE 26 MARKET, BY SOLUTIONS, 2022–2030 (USD MILLION)

7.2 ALL-IN-ONE MODULES

7.2.1 SCALABILITY AND FLEXIBILITY OF IT INFRASTRUCTURE TO ADJUST DESIGN AND SIZE FOR FUTURE DEPLOYMENTS

TABLE 27 ALL-IN-ONE MODULES MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 28 ALL-IN-ONE MODULES MARKET, BY REGION, 2022–2030 (USD MILLION)

7.3 INDIVIDUAL MODULES

TABLE 29 INDIVIDUAL MODULES MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 30 INDIVIDUAL MODULES MARKET, BY REGION, 2022–2030 (USD MILLION)

TABLE 31 INDIVIDUAL MODULES MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 32 INDIVIDUAL MODULES MARKET, BY TYPE, 2022–2030 (USD MILLION)

7.3.1 IT MODULES

7.3.1.1 Deployment of many units at various levels of data center infrastructure

TABLE 33 IT MODULES MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 34 IT MODULES MARKET, BY REGION, 2022–2030 (USD MILLION)

7.3.2 POWER MODULES

7.3.2.1 High demand for power modules from countries with irregular power supply

TABLE 35 POWER MODULES MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 36 POWER MODULES MARKET, BY REGION, 2022–2030 (USD MILLION)

7.3.3 COOLING MODULES

7.3.3.1 Increasing demand to cool data centers

TABLE 37 COOLING MODULES MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 38 COOLING MODULES MARKET, BY REGION, 2022–2030 (USD MILLION)

8 MODULAR DATA CENTER MARKET, BY SERVICES (Page No. - 118)

8.1 INTRODUCTION

8.1.1 SERVICES: MARKET DRIVERS

FIGURE 35 SUPPORT & MAINTENANCE TO HOLD THE LARGEST MARKET SIZE IN 2022

TABLE 39 MARKET, BY SERVICES, 2016–2021 (USD MILLION)

TABLE 40 MARKET, BY SERVICES, 2022–2030 (USD MILLION)

8.2 DESIGN & CONSULTING

8.2.1 HIGH DEMAND FOR END-TO-END CONSULTATIVE APPROACH FOR INFRASTRUCTURE MODERNIZATION

TABLE 41 DESIGN & CONSULTING MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 42 DESIGN & CONSULTING MARKET, BY REGION, 2022–2030 (USD MILLION)

8.3 INTEGRATION & DEPLOYMENT

8.3.1 NEED FOR INTEGRATION OF SEPARATE DATA CENTER MODULES AND EFFECTIVE DEPLOYMENT

TABLE 43 INTEGRATION & DEPLOYMENT MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 44 INTEGRATION & DEPLOYMENT MARKET, BY REGION, 2022–2030 (USD MILLION)

8.4 SUPPORT & MAINTENANCE

8.4.1 HIGH DEMAND FOR REMOTE SUPPORT SERVICES

TABLE 45 SUPPORT & MAINTENANCE MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 46 SUPPORT & MAINTENANCE MARKET, BY REGION, 2022–2030 (USD MILLION)

9 MODULAR DATA CENTER MARKET, BY ORGANIZATION SIZE (Page No. - 124)

9.1 INTRODUCTION

9.1.1 ORGANIZATION SIZE: MARKET DRIVERS

FIGURE 36 LARGE ENTERPRISES TO HOLD LARGER MARKET SIZE IN 2022

TABLE 47 MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 48 MARKET, BY ORGANIZATION SIZE, 2022–2030 (USD MILLION)

9.2 SMES

9.2.1 NEED TO DEPLOY DATA CENTERS AT LOWER COST COMPARED TO TRADITIONAL SYSTEMS

TABLE 49 SMES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 50 SMES: MARKET, BY REGION, 2022–2030 (USD MILLION)

9.3 LARGE ENTERPRISES

9.3.1 NEED FOR EVER-INCREASING DATA STORAGE

TABLE 51 LARGE ENTERPRISES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 52 LARGE ENTERPRISES: MARKET, BY REGION, 2022–2030 (USD MILLION)

10 MODULAR DATA CENTER MARKET, BY VERTICAL (Page No. - 129)

10.1 INTRODUCTION

10.1.1 VERTICAL: MODULAR DATA CENTER MARKET DRIVERS

FIGURE 37 BFSI TO HOLD LARGEST MARKET SIZE IN 2022

TABLE 53 MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 54 MARKET, BY VERTICAL, 2022–2030 (USD MILLION)

10.2 BFSI

10.2.1 FAST GROWTH OF ELECTRONIC BANKING, PAPERLESS STORAGE, AND VIRTUALIZATION

TABLE 55 BFSI: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 56 BFSI: MARKET, BY REGION, 2022–2030 (USD MILLION)

10.3 IT & TELECOM

10.3.1 HIGH DEMAND FOR DATA SECURITY, INTEGRATED PHYSICAL SECURITY, AND PRODUCTIVITY

TABLE 57 IT & TELECOM: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 58 IT & TELECOM: MARKET, BY REGION, 2022–2030 (USD MILLION)

10.4 GOVERNMENT & DEFENSE

10.4.1 INCREASED AWARENESS OF INFORMATION DIGITALIZATION

TABLE 59 GOVERNMENT & DEFENSE: MODULAR DATA CENTER MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 60 GOVERNMENT & DEFENSE: MODULAR DATA CENTER MARKET, BY REGION, 2022–2030 (USD MILLION)

10.5 HEALTHCARE

10.5.1 DEMAND FOR SHIFT OF MANUAL PATIENT RECORDS TO ELECTRONIC STORAGE

TABLE 61 HEALTHCARE: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 62 HEALTHCARE: MARKET, BY REGION, 2022–2030 (USD MILLION)

10.6 RETAIL

10.6.1 NEED TO MAINTAIN CUSTOMER’S PERSONAL, FINANCIAL, AND STOCK DATA

TABLE 63 RETAIL: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 64 RETAIL: MARKET, BY REGION, 2022–2030 (USD MILLION)

10.7 MEDIA & ENTERTAINMENT

10.7.1 NEED FOR MULTIMEDIA STORAGE AND UNINTERRUPTED ACCESS FROM ANYWHERE

TABLE 65 MEDIA & ENTERTAINMENT: MODULAR DATA CENTER MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 66 MEDIA & ENTERTAINMENT: MODULAR DATA CENTER MARKET, BY REGION, 2022–2030 (USD MILLION)

10.8 MANUFACTURING

10.8.1 NEED FOR IT SYSTEMS TO STREAMLINE LOGISTICS AND PRODUCTION PROCESSES

TABLE 67 MANUFACTURING: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 68 MANUFACTURING: MARKET, BY REGION, 2022–2030 (USD MILLION)

10.9 OTHER VERTICALS

TABLE 69 OTHER VERTICALS: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 70 OTHER VERTICALS: MARKET, BY REGION, 2022–2030 (USD MILLION)

11 MODULAR DATA CENTER MARKET, BY REGION (Page No. - 141)

11.1 INTRODUCTION

FIGURE 38 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 71 MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 72 MARKET, BY REGION, 2022–2030 (USD MILLION)

11.2 NORTH AMERICA

11.2.1 NORTH AMERICA: MARKET DRIVERS

FIGURE 39 NORTH AMERICA: MARKET SNAPSHOT

TABLE 73 NORTH AMERICA: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 74 NORTH AMERICA: MARKET, BY COMPONENT, 2022–2030 (USD MILLION)

TABLE 75 NORTH AMERICA: MARKET SIZE, BY SOLUTIONS, 2016–2021 (USD MILLION)

TABLE 76 NORTH AMERICA: MARKET, BY SOLUTIONS, 2022–2030 (USD MILLION)

TABLE 77 NORTH AMERICA: MARKET, BY INDIVIDUAL MODULES, 2016–2021 (USD MILLION)

TABLE 78 NORTH AMERICA: MARKET, BY INDIVIDUAL MODULES, 2022–2030 (USD MILLION)

TABLE 79 NORTH AMERICA: MARKET, BY SERVICES, 2016–2021 (USD MILLION)

TABLE 80 NORTH AMERICA: MARKET, BY SERVICES, 2022–2030 (USD MILLION)

TABLE 81 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 82 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2030 (USD MILLION)

TABLE 83 NORTH AMERICA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 84 NORTH AMERICA: MARKET, BY VERTICAL, 2022–2030 (USD MILLION)

TABLE 85 NORTH AMERICA: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 86 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2030 (USD MILLION)

11.2.2 US

11.2.2.1 High demand for energy-efficient solutions

TABLE 87 US: MODULAR DATA CENTER MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 88 US: MARKET, BY COMPONENT, 2022–2030 (USD MILLION)

TABLE 89 US: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 90 US: MARKET, BY ORGANIZATION SIZE, 2022–2030 (USD MILLION)

11.2.3 CANADA

11.2.3.1 Need for advanced technological tools, cloud platforms, and various other on-demand services

TABLE 91 CANADA: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 92 CANADA: MARKET, BY COMPONENT, 2022–2030 (USD MILLION)

TABLE 93 CANADA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 94 CANADA: MARKET, BY ORGANIZATION SIZE, 2022–2030 (USD MILLION)

11.3 EUROPE

11.3.1 EUROPE: MODULAR DATA CENTER MARKET DRIVERS

TABLE 95 EUROPE: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 96 EUROPE: MARKET, BY COMPONENT, 2022–2030 (USD MILLION)

TABLE 97 EUROPE: MARKET, BY SOLUTIONS, 2016–2021 (USD MILLION)

TABLE 98 EUROPE: MARKET, BY SOLUTIONS, 2022–2030 (USD MILLION)

TABLE 99 EUROPE: MARKET, BY INDIVIDUAL MODULES, 2016–2021 (USD MILLION)

TABLE 100 EUROPE: MARKET, BY INDIVIDUAL MODULES, 2022–2030 (USD MILLION)

TABLE 101 EUROPE: MARKET, BY SERVICES, 2016–2021 (USD MILLION)

TABLE 102 EUROPE: MARKET, BY SERVICES, 2022–2030 (USD MILLION)

TABLE 103 EUROPE: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 104 EUROPE: MARKET, BY ORGANIZATION SIZE, 2022–2030 (USD MILLION)

TABLE 105 EUROPE: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 106 EUROPE: MARKET, BY VERTICAL, 2022–2030 (USD MILLION)

TABLE 107 EUROPE: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 108 EUROPE: MARKET, BY COUNTRY, 2022–2030 (USD MILLION)

11.3.2 UK

11.3.2.1 New eco-design requirements set by European Parliament for servers and data storage products

TABLE 109 UK: MODULAR DATA CENTER MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 110 UK: MARKET, BY COMPONENT, 2022–2030 (USD MILLION)

TABLE 111 UK: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 112 UK: MARKET, BY ORGANIZATION SIZE, 2022–2030 (USD MILLION)

11.3.3 GERMANY

11.3.3.1 Adoption of industry 4.0 and increased digital economy initiatives

TABLE 113 GERMANY: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 114 GERMANY: MARKET, BY COMPONENT, 2022–2030 (USD MILLION)

TABLE 115 GERMANY: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 116 GERMANY: MARKET, BY ORGANIZATION SIZE, 2022–2030 (USD MILLION)

11.3.4 FRANCE

11.3.4.1 Initiatives to implement tax breaks by French government to increase data center investments

TABLE 117 FRANCE: MODULAR DATA CENTER MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 118 FRANCE: MARKET, BY COMPONENT, 2022–2030 (USD MILLION)

TABLE 119 FRANCE: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 120 FRANCE: MARKET, BY ORGANIZATION SIZE, 2022–2030 (USD MILLION)

11.3.5 REST OF EUROPE

TABLE 121 REST OF EUROPE: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 122 REST OF EUROPE: MARKET, BY COMPONENT, 2022–2030 (USD MILLION)

TABLE 123 REST OF EUROPE: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 124 REST OF EUROPE: MARKET, BY ORGANIZATION SIZE, 2022–2030 (USD MILLION)

11.4 ASIA PACIFIC

11.4.1 ASIA PACIFIC: MODULAR DATA CENTER MARKET DRIVERS

FIGURE 40 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 125 ASIA PACIFIC: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 126 ASIA PACIFIC: MARKET, BY COMPONENT, 2022–2030 (USD MILLION)

TABLE 127 ASIA PACIFIC: MARKET, BY SOLUTIONS, 2016–2021 (USD MILLION)

TABLE 128 ASIA PACIFIC: MARKET, BY SOLUTIONS, 2022–2030 (USD MILLION)

TABLE 129 ASIA PACIFIC: MARKET, BY INDIVIDUAL MODULES, 2016–2021 (USD MILLION)

TABLE 130 ASIA PACIFIC: MARKET, BY INDIVIDUAL MODULES, 2022–2030 (USD MILLION)

TABLE 131 ASIA PACIFIC: MARKET, BY SERVICES, 2016–2021 (USD MILLION)

TABLE 132 ASIA PACIFIC: MARKET, BY SERVICES, 2022–2030 (USD MILLION)

TABLE 133 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 134 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2022–2030 (USD MILLION)

TABLE 135 ASIA PACIFIC: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 136 ASIA PACIFIC: MARKET, BY VERTICAL, 2022–2030 (USD MILLION)

TABLE 137 ASIA PACIFIC: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 138 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2030 (USD MILLION)

11.4.2 AUSTRALIA & NEW ZEALAND

11.4.2.1 Government organizations and telcos investing in Australia’s IoT and smart city ecosystem

TABLE 139 ANZ: MODULAR DATA CENTER MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 140 ANZ: MARKET, BY COMPONENT, 2022–2030 (USD MILLION)

TABLE 141 ANZ: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 142 ANZ: MARKET, BY ORGANIZATION SIZE, 2022–2030 (USD MILLION)

11.4.3 CHINA

11.4.3.1 Demand for data processing and information interaction

TABLE 143 CHINA: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 144 CHINA: MARKET, BY COMPONENT, 2022–2030 (USD MILLION)

TABLE 145 CHINA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 146 CHINA: MARKET, BY ORGANIZATION SIZE, 2022–2030 (USD MILLION)

11.4.4 JAPAN

11.4.4.1 High adoption of 5G and edge computing due to reliable DCI in Japan

TABLE 147 JAPAN: MODULAR DATA CENTER MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 148 JAPAN: MARKET, BY COMPONENT, 2022–2030 (USD MILLION)

TABLE 149 JAPAN: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 150 JAPAN: MARKET, BY ORGANIZATION SIZE, 2022–2030 (USD MILLION)

11.4.5 REST OF ASIA PACIFIC

TABLE 151 REST OF ASIA PACIFIC: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 152 REST OF ASIA PACIFIC: MARKET, BY COMPONENT, 2022–2030 (USD MILLION)

TABLE 153 REST OF ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 154 REST OF ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2022–2030 (USD MILLION)

11.5 MIDDLE EAST & AFRICA

11.5.1 MIDDLE EAST & AFRICA: MODULAR DATA CENTER MARKET DRIVERS

TABLE 155 MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 156 MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2022–2030 (USD MILLION)

TABLE 157 MIDDLE EAST & AFRICA: MARKET, BY SOLUTIONS, 2016–2021 (USD MILLION)

TABLE 158 MIDDLE EAST & AFRICA: MARKET, BY SOLUTIONS, 2022–2030 (USD MILLION)

TABLE 159 MIDDLE EAST & AFRICA: MARKET, BY INDIVIDUAL MODULES, 2016–2021 (USD MILLION)

TABLE 160 MIDDLE EAST & AFRICA: MARKET, BY INDIVIDUAL MODULES, 2022–2030 (USD MILLION)

TABLE 161 MIDDLE EAST & AFRICA: MARKET, BY SERVICES, 2016–2021 (USD MILLION)

TABLE 162 MIDDLE EAST & AFRICA: MARKET, BY SERVICES, 2022–2030 (USD MILLION)

TABLE 163 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 164 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2022–2030 (USD MILLION)

TABLE 165 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 166 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2022–2030 (USD MILLION)

TABLE 167 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 168 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2022–2030 (USD MILLION)

11.5.2 KINGDOM OF SAUDI ARABIA

11.5.2.1 Saudi Vision 2030 initiatives fuel demand for cloud, data centers, and big data

TABLE 169 KSA: MODULAR DATA CENTER MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 170 KSA: MARKET, BY COMPONENT, 2022–2030 (USD MILLION)

TABLE 171 KSA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 172 KSA: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2030 (USD MILLION)

11.5.3 UAE

11.5.3.1 High mobile device per user ratio

TABLE 173 UAE: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 174 UAE: MARKET, BY COMPONENT, 2022–2030 (USD MILLION)

TABLE 175 UAE: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 176 UAE: MARKET, BY ORGANIZATION SIZE, 2022–2030 (USD MILLION)

11.5.4 SOUTH AFRICA

11.5.4.1 High usage of mobile technologies and colocation facilities

TABLE 177 SOUTH AFRICA: MODULAR DATA CENTER MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 178 SOUTH AFRICA: MARKET, BY COMPONENT, 2022–2030 (USD MILLION)

TABLE 179 SOUTH AFRICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 180 SOUTH AFRICA: MARKET, BY ORGANIZATION SIZE, 2022–2030 (USD MILLION)

11.5.5 REST OF MIDDLE EAST & AFRICA

TABLE 181 REST OF MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 182 REST OF MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2022–2030 (USD MILLION)

TABLE 183 REST OF MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 184 REST OF MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2022–2030 (USD MILLION)

11.6 LATIN AMERICA

11.6.1 LATIN AMERICA: MODULAR DATA CENTER MARKET DRIVERS

TABLE 185 LATIN AMERICA: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 186 LATIN AMERICA: MARKET, BY COMPONENT, 2022–2030 (USD MILLION)

TABLE 187 LATIN AMERICA: MARKET, BY SOLUTIONS, 2016–2021 (USD MILLION)

TABLE 188 LATIN AMERICA: MARKET, BY SOLUTIONS, 2022–2030 (USD MILLION)

TABLE 189 LATIN AMERICA: MARKET, BY INDIVIDUAL MODULES, 2016–2021 (USD MILLION)

TABLE 190 LATIN AMERICA: MARKET, BY INDIVIDUAL MODULES, 2022–2030 (USD MILLION)

TABLE 191 LATIN AMERICA: MARKET, BY SERVICES, 2016–2021 (USD MILLION)

TABLE 192 LATIN AMERICA: MARKET, BY SERVICES, 2022–2030 (USD MILLION)

TABLE 193 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 194 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2030 (USD MILLION)

TABLE 195 LATIN AMERICA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 196 LATIN AMERICA: MARKET, BY VERTICAL, 2022–2030 (USD MILLION)

TABLE 197 LATIN AMERICA: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 198 LATIN AMERICA: MARKET, BY COUNTRY, 2022–2030 (USD MILLION)

11.6.2 BRAZIL

11.6.2.1 Largest telecom industry in region

TABLE 199 BRAZIL: MODULAR DATA CENTER MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 200 BRAZIL: MARKET, BY COMPONENT, 2022–2030 (USD MILLION)

TABLE 201 BRAZIL: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 202 BRAZIL: MARKET, BY ORGANIZATION SIZE, 2022–2030 (USD MILLION)

11.6.3 MEXICO

11.6.3.1 Increased opportunities for content delivery providers

TABLE 203 MEXICO: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 204 MEXICO: MARKET, BY COMPONENT, 2022–2030 (USD MILLION)

TABLE 205 MEXICO: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 206 MEXICO: MARKET, BY ORGANIZATION SIZE, 2022–2030 (USD MILLION)

11.6.4 REST OF LATIN AMERICA

TABLE 207 REST OF LATIN AMERICA: MODULAR DATA CENTER MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 208 REST OF LATIN AMERICA: MARKET, BY COMPONENT, 2022–2030 (USD MILLION)

TABLE 209 REST OF LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 210 REST OF LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2030 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 190)

12.1 OVERVIEW

12.2 MARKET EVALUATION FRAMEWORK

FIGURE 41 MARKET EVALUATION FRAMEWORK

12.3 MARKET SHARE ANALYSIS OF TOP PLAYERS

FIGURE 42 MARKET SHARE ANALYSIS OF PLAYERS IN 2021

12.4 HISTORICAL REVENUE ANALYSIS OF TOP MARKET PLAYERS

FIGURE 43 HISTORICAL REVENUE ANALYSIS OF KEY PLAYERS

12.5 COMPANY EVALUATION QUADRANT

TABLE 211 COMPANY EVALUATION QUADRANT: CRITERIA

12.5.1 STARS

12.5.2 PERVASIVE PLAYERS

12.5.3 EMERGING LEADERS

12.5.4 PARTICIPANTS

TABLE 212 GLOBAL COMPANY FOOTPRINT

TABLE 213 COMPANY COMPONENT FOOTPRINT

TABLE 214 COMPANY VERTICAL FOOTPRINT (1/2)

TABLE 215 COMPANY VERTICAL FOOTPRINT (2/2)

TABLE 216 COMPANY REGION FOOTPRINT

FIGURE 44 MODULAR DATA CENTER (GLOBAL): COMPANY EVALUATION MATRIX, 2019

12.6 SME EVALUATION QUADRANT

TABLE 217 SME COMPANY EVALUATION MATRIX: CRITERIA

12.6.1 PROGRESSIVE COMPANIES

12.6.2 RESPONSIVE COMPANIES

12.6.3 DYNAMIC COMPANIES

12.6.4 STARTING BLOCKS

FIGURE 45 MODULAR DATA CENTER MARKET: SME EVALUATION MATRIX, 2021

12.7 COMPETITIVE BENCHMARKING

TABLE 218 MARKET: DETAILED LIST OF KEY STARTUPS/SMES

TABLE 219 MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS (STARTUPS/SMES)

12.8 COMPETITIVE SCENARIO

12.8.1 PRODUCT/SOLUTION LAUNCHES AND PRODUCT ENHANCEMENTS

TABLE 220 PRODUCT/SOLUTION LAUNCHES AND PRODUCT DEVELOPMENTS, 2020-2022

12.8.2 PARTNERSHIPS AND COLLABORATIONS

TABLE 221 PARTNERSHIPS AND COLLABORATIONS, 2020-2022

12.8.3 ACQUISITIONS

TABLE 222 ACQUISITIONS, 2020-2022

12.8.4 BUSINESS EXPANSIONS

TABLE 223 BUSINESS EXPANSION, 2020-2022

12.8.5 R&D-FOCUSED DEVELOPMENTS

TABLE 224 R&D-FOCUSED DEVELOPMENTS, 2020-2022

13 COMPANY PROFILES (Page No. - 211)

13.1 INTRODUCTION

13.2 KEY PLAYERS

(Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)*

13.2.1 DELL TECHNOLOGIES

TABLE 225 DELL TECHNOLOGIES: BUSINESS OVERVIEW

FIGURE 46 DELL TECHNOLOGIES: COMPANY SNAPSHOT

TABLE 226 DELL TECHNOLOGIES: SOLUTIONS/SERVICES/PLATFORMS OFFERED

TABLE 227 DELL TECHNOLOGIES: PRODUCT LAUNCHES

TABLE 228 DELL TECHNOLOGIES: DEALS

TABLE 229 DELL TECHNOLOGIES: OTHERS

13.2.2 VERTIV

TABLE 230 VERTIV: BUSINESS OVERVIEW

FIGURE 47 VERTIV: COMPANY SNAPSHOT

TABLE 231 VERTIV: SOLUTIONS/SERVICES/PLATFORMS OFFERED

TABLE 232 VERTIV: PRODUCT LAUNCH

TABLE 233 VERTIV: DEALS

13.2.3 HPE

TABLE 234 HPE: BUSINESS OVERVIEW

FIGURE 48 HPE: COMPANY SNAPSHOT

TABLE 235 HPE: SOLUTIONS/SERVICES/PLATFORMS OFFERED

TABLE 236 HPE: PRODUCT LAUNCH

13.2.4 HUAWEI

TABLE 237 HUAWEI: BUSINESS OVERVIEW

FIGURE 49 HUAWEI: COMPANY SNAPSHOT

TABLE 238 HUAWEI: SOLUTIONS/SERVICES/PLATFORMS OFFERED

TABLE 239 HUAWEI: PRODUCT LAUNCH

13.2.5 IBM

TABLE 240 IBM: BUSINESS OVERVIEW

FIGURE 50 IBM: COMPANY SNAPSHOT

TABLE 241 IBM: SOLUTIONS/SERVICES/PLATFORMS OFFERED

TABLE 242 IBM: PRODUCT LAUNCH

13.2.6 BASELAYER

TABLE 243 BASELAYER: BUSINESS OVERVIEW

TABLE 244 BASELAYER: SOLUTIONS/SERVICES/PLATFORMS OFFERED

TABLE 245 BASELAYER: DEALS

13.2.7 ELTEK

TABLE 246 ELTEK: BUSINESS OVERVIEW

FIGURE 51 ELTEK: COMPANY SNAPSHOT

TABLE 247 ELTEK: SOLUTIONS/SERVICES/PLATFORMS OFFERED

TABLE 248 ELTEK: DEALS

13.2.8 CANNON TECHNOLOGIES

TABLE 249 CANNON TECHNOLOGIES: BUSINESS OVERVIEW

TABLE 250 CANNON TECHNOLOGIES: SOLUTIONS/SERVICES/PLATFORMS OFFERED

TABLE 251 CANNON TECHNOLOGIES: PRODUCT LAUNCH

TABLE 252 CANNON TECHNOLOGIES: OTHERS

13.2.9 RITTAL

TABLE 253 RITTAL: BUSINESS OVERVIEW

TABLE 254 RITTAL: SOLUTIONS/SERVICES/PLATFORMS OFFERED

TABLE 255 RITTAL: PRODUCT LAUNCH

TABLE 256 RITTAL: DEALS

13.2.10 SCHNEIDER ELECTRIC

TABLE 257 SCHNEIDER ELECTRIC: BUSINESS OVERVIEW

FIGURE 52 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

TABLE 258 SCHNEIDER ELECTRIC: SOLUTIONS/SERVICES/PLATFORMS OFFERED

TABLE 259 SCHNEIDER ELECTRIC: PRODUCT LAUNCHES

TABLE 260 SCHNEIDER ELECTRIC: DEALS

13.2.11 EATON

TABLE 261 EATON: BUSINESS OVERVIEW

FIGURE 53 EATON: COMPANY SNAPSHOT

TABLE 262 EATON: SOLUTIONS/SERVICES/PLATFORMS OFFERED

TABLE 263 EATON: PRODUCT LAUNCH

TABLE 264 EATON: DEALS

TABLE 265 EATON: OTHERS

13.2.12 ORACLE

TABLE 266 ORACLE: BUSINESS OVERVIEW

FIGURE 54 ORACLE: COMPANY SNAPSHOT

TABLE 267 ORACLE: SOLUTIONS/SERVICES/PLATFORMS OFFERED

TABLE 268 ORACLE: PRODUCT LAUNCH

13.2.13 MICROSOFT

TABLE 269 MICROSOFT: BUSINESS OVERVIEW

FIGURE 55 MICROSOFT: COMPANY SNAPSHOT

TABLE 270 MICROSOFT: SOLUTIONS/SERVICES/PLATFORMS OFFERED

TABLE 271 MICROSOFT: PRODUCT LAUNCH

TABLE 272 MICROSOFT: DEALS

TABLE 273 MICROSOFT: OTHERS

13.2.14 AWS

TABLE 274 AWS: BUSINESS OVERVIEW

FIGURE 56 AWS: COMPANY SNAPSHOT

TABLE 275 AWS: SOLUTIONS/SERVICES/PLATFORMS OFFERED

TABLE 276 AWS: PRODUCT LAUNCHES

TABLE 277 AWS: OTHERS

13.2.15 META (FACEBOOK)

TABLE 278 META (FACEBOOK): BUSINESS OVERVIEW

FIGURE 57 META (FACEBOOK): COMPANY SNAPSHOT

TABLE 279 META (FACEBOOK): SOLUTIONS/SERVICES/PLATFORMS OFFERED

TABLE 280 META (FACEBOOK): PRODUCT LAUNCHES

TABLE 281 META (FACEBOOK): OTHERS

13.2.16 APPLE

TABLE 282 APPLE: BUSINESS OVERVIEW

FIGURE 58 APPLE: COMPANY SNAPSHOT

TABLE 283 APPLE: SOLUTIONS/SERVICES/PLATFORMS OFFERED

TABLE 284 APPLE: OTHERS

*Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)* might not be captured in case of unlisted companies.

13.3 OTHER COMPANIES

13.3.1 EDGE MCS

13.3.2 STULZ

13.3.3 CUPERTINO ELECTRIC, INC.

13.3.4 KSTAR

13.3.5 ASPERITAS

13.3.6 CONSNANT

13.3.7 RETEX

13.3.8 ICTROOM

13.3.9 BOX MODUL

13.3.10 PCX

13.3.11 BLADEROOM

13.3.12 RAHI SYSTEMS

13.3.13 FIBERHOME

13.3.14 SCALEMATRIX

13.3.15 EQUINIX

13.3.16 365 DATA CENTERS

13.3.17 CORESITE

13.4 INNOVATIVE COMPANIES

13.4.1 LONESTAR

13.4.2 ORBITSEDGE

13.4.3 COMPASS DATACENTERS

13.4.4 CLOUD CONSTELLATION

13.4.5 DARTPOINTS

14 ADJACENT MARKETS (Page No. - 284)

14.1 INTRODUCTION

14.1.1 RELATED MARKETS

TABLE 285 RELATED MARKETS

14.2 LIMITATIONS

14.3 DATA CENTER RACK MARKET

14.3.1 INTRODUCTION

14.3.2 MARKET OVERVIEW

14.3.3 DATA CENTER RACK MARKET, BY RACK TYPE

TABLE 286 DATA CENTER RACK MARKET, BY RACK TYPE, 2018–2021 (USD MILLION)

TABLE 287 DATA CENTER RACK MARKET, BY RACK TYPE, 2022–2027 (USD MILLION)

14.3.3.1 OPEN FRAME

TABLE 288 OPEN FRAME: DATA CENTER RACK MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 289 OPEN FRAME: DATA CENTER RACK MARKET, BY REGION, 2022–2027 (USD MILLION)

14.3.3.2 CABINETS

TABLE 290 CABINETS: DATA CENTER RACK MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 291 CABINETS: DATA CENTER RACK MARKET, BY REGION, 2022–2027 (USD MILLION)

14.3.4 DATA CENTER RACK MARKET, BY RACK HEIGHT

TABLE 292 DATA CENTER RACK MARKET, BY RACK HEIGHT, 2018–2021 (USD MILLION)

TABLE 293 DATA CENTER RACK MARKET, BY RACK HEIGHT, 2022–2027 (USD MILLION)

14.3.4.1 42U and Below

TABLE 294 42U AND BELOW: DATA CENTER RACK MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 295 42U AND BELOW: DATA CENTER RACK MARKET, BY REGION, 2022–2027 (USD MILLION)

14.3.4.2 43U Up to 52U

TABLE 296 43U UP TO 52U: DATA CENTER RACK MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 297 43U UP TO 52U: DATA CENTER RACK MARKET, BY REGION, 2022–2027 (USD MILLION)

14.3.4.3 Above 52U

TABLE 298 ABOVE 52U: DATA CENTER RACK MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 299 ABOVE 52U: DATA CENTER RACK MARKET, BY REGION, 2022–2027 (USD MILLION)

14.3.5 DATA CENTER RACK MARKET, BY RACK WIDTH

TABLE 300 DATA CENTER RACK MARKET, BY RACK WIDTH, 2018–2021 (USD MILLION)

TABLE 301 DATA CENTER RACK MARKET, BY RACK WIDTH, 2022–2027 (USD MILLION)

14.3.5.1 19 inch

TABLE 302 19 INCH: DATA CENTER RACK MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 303 19 INCH: DATA CENTER RACK MARKET, BY REGION, 2022–2027 (USD MILLION)

14.3.5.2 23 inch

TABLE 304 23 INCH: DATA CENTER RACK MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 305 23 INCH: DATA CENTER RACK MARKET, BY REGION, 2022–2027 (USD MILLION)

14.3.5.3 Other Rack Widths

TABLE 306 OTHER RACK WIDTHS: DATA CENTER RACK MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 307 OTHER RACK WIDTHS: DATA CENTER RACK MARKET, BY REGION, 2022–2027 (USD MILLION)

14.3.6 DATA CENTER RACK MARKET, BY VERTICAL

TABLE 308 DATA CENTER RACK MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 309 DATA CENTER RACK MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 310 BFSI: DATA CENTER RACK MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 311 BFSI: DATA CENTER RACK MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 312 IT & TELECOM: DATA CENTER RACK MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 313 IT & TELECOM: DATA CENTER RACK MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 314 GOVERNMENT & DEFENSE: DATA CENTER RACK MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 315 GOVERNMENT & DEFENSE: DATA CENTER RACK MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 316 RETAIL: DATA CENTER RACK MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 317 RETAIL: DATA CENTER RACK MARKET, BY REGION, 2022–2027 (USD MILLION)

14.3.7 DATA CENTER RACK MARKET, BY REGION

TABLE 318 DATA CENTER RACK MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 319 DATA CENTER RACK MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 320 NORTH AMERICA: DATA CENTER RACK MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 321 NORTH AMERICA: DATA CENTER RACK MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 322 EUROPE: DATA CENTER RACK MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 323 EUROPE: DATA CENTER RACK MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 324 ASIA PACIFIC: DATA CENTER RACK MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 325 ASIA PACIFIC: DATA CENTER RACK MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

15 APPENDIX (Page No. - 299)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 CUSTOMIZATION OPTIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

The study involved four major activities in estimating the current market size for modular data center hardware, platform, and services. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakup and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Bloomberg and BusinessWeek, have been referred to identify and collect information for this study. The secondary sources included annual reports, press releases, and investor presentations of companies; white papers; journals; and certified publications and articles from recognized authors, directories, and databases.

Primary Research

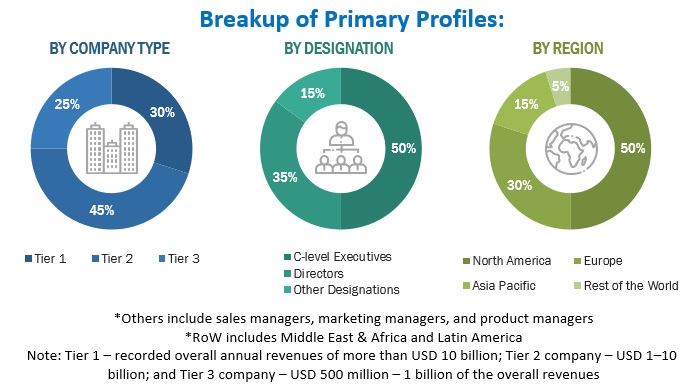

Various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Chief Marketing Officers (CMO), Chief Technology Officers (CTOs), Chief Operating Officers (COOs), Vice Presidents (VPs), Managing Directors (MDs), technology and innovation directors, and related key executives from various leading companies and organizations operating in the modular data center market along with the associated service providers, and system integrators operating in the targeted regions. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. Following is the breakup of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

For making market estimates and forecasting the modular data center market, and the other dependent submarkets, the top-down and bottom-up approaches were used. The bottom-up procedure was used to arrive at the overall market size of the global modular data center market using key companies’ revenue and their offerings in the market. The research methodology used to estimate the market size includes the following:

- The key players in the market have been identified through extensive secondary research.

- The market size, in terms of value, has been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Data Triangulation

With data triangulation and validation through primary interviews, the exact value of the overall parent market size was determined and confirmed using this study. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To define, describe, and forecast the global modular data center market based on solution, service, organization size, vertical, and region

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze micro markets with respect to individual growth trends, future prospects, and contribution to the total market

- To forecast the market size with respect to five main regions - North America, Europe, Asia Pacific (Asia Pacific), the Middle East and Africa (MIDDLE EAST AND AFRICA), and Latin America

- To profile the key players and comprehensively analyze their core competencies2

- To track and analyze the competitive developments, such as joint ventures, mergers and acquisitions, new product developments, COVID-19-related developments, and research and development (R&D) activities, in the global modular data center market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players up to 5

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Modular Data Center Market