Motion Control Market by Offering (Actuators & Mechanical Systems, Motors, Motion Controllers, Drives, Sensor & Feedback Devices, Software & Services), System (Open-loop, Closed-loop), Industry and Region (2022-2027)

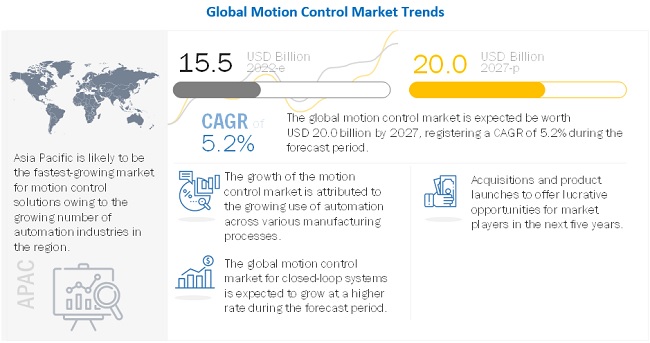

The global motion control market size is projected to reach USD 20.0 billion by 2027, at a CAGR of 5.2% during the forecast period.

Growing demand for industrial robots in manufacturing processes and ease of use and integration of components within motion control systems are few of the primary factor driving the market growth. Moreover, adoption of Industry 4.0 by manufacturing firms is one of the opportunity for the growth of motion control industry.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on the Global Motion Control Market

Motion control products were in high demand prior to the outbreak of the COVID-19 scenario as companies were looking to automate their manufacturing facilities to compete in the market.

However, due to the sudden outbreak of COVID-19, the market has witnessed a huge hit in 2020. In the realistic scenario in the post-COVID-19 period, the market is expected to reach USD 15.5 billion in 2022.

The outbreak of the COVID-19 pandemic has increased the need for automation, digitalization, and artificial intelligence (AI) in the manufacturing sector to improve resilience to future pandemics. Due to the disruptions in the supply chain and the suspension of manufacturing activities attributed to social distancing norms, several industry players are looking for different solutions to avoid such situations in the future. The adoption of automation and robotics in such a situation can reduce dependence on human labor, increase productivity, and reduce the chances of plant shutdowns. The adoption of automation along with other technologies, such as digitization and AI, will help industries continue their production without the need for human supervision.

Motion Control Market Segmnt Overview

Drives are the fastest growing segment in motion control market during forecasted period

Drives offer a wide range of advantages for automatic machining systems, including superior positioning, speed, and motion control. Drives offer a way to control the speed of electric motors.

In applications where the load is subject to change, speed control provides an excellent way to save energy. The use of drives enables a more detailed and precise motor control, which improves the productivity of machines and equipment. Drives find applications in every area where a motor is required. Drives allow changing the positioning and speed according to the needs of the manufacturers. They also help automate the manufacturing process by providing the flexibility of making changes according to the needs of the manufacturing environment.

Motion control systems are extensively used in automotive industry in 2021

Automotive is one of the fastest-growing industries, among others in the market. Motion control is also used in the automotive test system for performance testing, structural testing, durability testing, component testing, etc. Components such as servo valves, actuators, and controllers are mainly used for this purpose.

In the current highly competitive world, the companies in the automotive industry are experimenting by integrating new technologies that have the potential to boost the production process. Technological innovations such as electric- and gas-powered vehicles lead to infrastructural changes in the automotive industry; also, the latest machines and equipment have eliminated the need for human operators for most of the crucial processes in the automotive industry. The global automotive industry is growing rapidly due to the emergence of new concept vehicles that employ eco-friendly technologies.

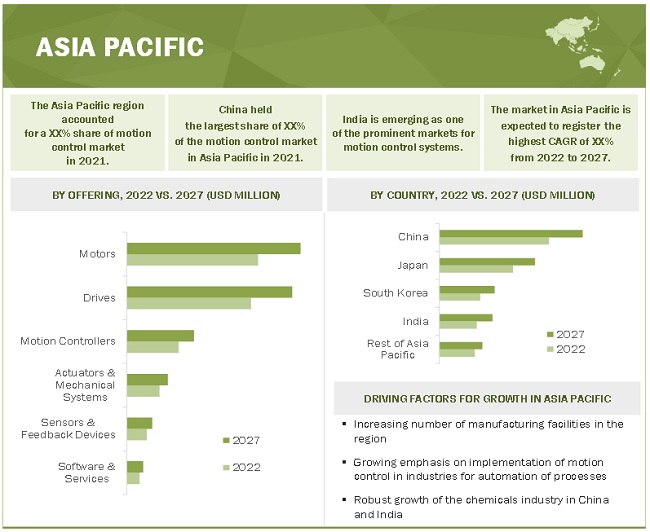

Asia Pacific is expected to hold the largest market of motion control during forecasted period

The increasing automation activities in several industries, such as the use of customized robots for different applications, high growth in machine tool production, and other sectors related to the production of smartphones and automobiles, which include electronics assembly and semiconductor machinery, are some of the reasons for the growth of the motion control products market in Asia Pacific.

China, Japan, and India are the major markets for motion control in Asia Pacific. These countries have a considerable market size and scope for developing the motion control industry. Some of the key players in the motion control market in Asia Pacific are Yaskawa Electric Corporation (Japan), OMRON Corporation (Japan), and Mitsubishi Electric Corporation (Japan).

The countries in the Asia Pacific market considered in this study have the presence of a large number of small- and mid-sized enterprises (SMEs). However, during the outbreak of COVID-19, the manufacturing industries had impacted negatively in the region. Social distancing norms and low product demand have forced industry players to limit production. Further, the restrictions on the export of products had led to a decline in the sale of motion control products. As the neighboring countries have been linked to one another through trade relations and supply chains, the entire region was adversely affected by the outbreak of COVID-19 in 2020.

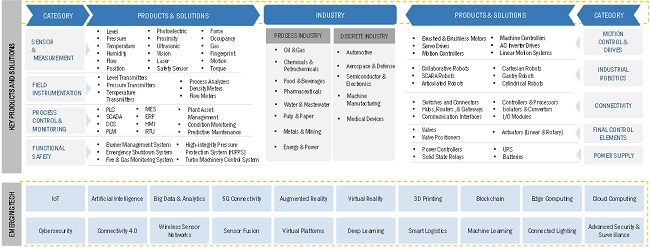

Motion Control Market Ecosystem

To know about the assumptions considered for the study, download the pdf brochure

Top Motion Control Companies - Key Market Players

The motion control market is dominated by a few globally established players such as

- ABB Ltd. (Switzerland),

- FANUC Corporation (Japan),

- Parker Hannifin Corporation (US),

- Rockwell Automation, Inc. (US),

- Siemens AG (Germany),

- Yaskawa Electric Corporation (Japan),

- Mitsubishi Electric Corporation (Japan),

- Robert Bosch GmbH (Germany),

- Altra Industrial Motion Corp. (US) and

- Novanta Inc. (US).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Motion Control Market Scope

|

Report Metric |

Details |

| Market Growth Rate | CAGR of 5.2% |

| Market Size Value in 2027 | USD 20.0 billion |

| Market Size Value in 2022 | USD 15.5 billion |

|

Market size availability for years |

2018–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Value (USD Million) and Volume (Thousand Units) |

|

Segments covered |

By offering, by system, by industry |

|

Geographies covered |

Asia Pacific, Europe, North America, and Rest of the World |

|

Companies covered |

The major market player include ABB Ltd. (Switzerland), FANUC Corporation (Japan), Parker Hannifin Corporation (US), Rockwell Automation, Inc. (US), Siemens AG (Germany), Yaskawa Electric Corporation (Japan), Mitsubishi Electric Corporation (Japan), Robert Bosch GmbH (Germany), Altra Industrial Motion Corp. (US) and Novanta Inc. (US) (total 25 companies) |

Motion Control Market Dynamics

DRIVERS: Increasing demand for industrial robots by manufacturers

The use of robotics has increased at a significant rate in manufacturing facilities. They are deployed for material handling, processing operations, and assembly & inspection.

Robotics makes use of many motion control solutions for proper functionality. The demand for industrial robots is growing as they help in reducing the complexity of manufacturing processes. All industrial robots are equipped with some form of motion control, which helps increase their performance, reduce cost, and conduct new functionalities in manufacturing processes. Industrial robots perform various functions such as assembling, packaging, picking and placing, and palletizing. To perform such functions, the motion controller must be interfaced with the robot controller. Electronic components such as DC motors, servo motors, and motion controllers often play a significant role in robot motion control.

RESTRAINT: High replacement and maintenance costs of motion control systems

Many components are required to design a motion control system, which directly impacts the cost of replacement and maintenance of a machine. The more types of components, the more expensive is the spare parts inventory.

Some motors have physical contact with a commutator due to which their replacement cost is high. However, the benefits associated with the implementation of motion control for automation far outweigh these limitations.

OPPORTUNITIES: Deployment of integrated communications systems across industries

Industrial communication systems exchange data and information in real time. Most real-time Ethernet standards require a special IP with MAC extensions that enable the communication protocols to plan, prioritize, and synchronize the cyclical data exchange between the controller and the field device network.

With rapidly growing industries, such as medical and semiconductor & electronics, manufacturers are focusing on developing new variants of motion controllers that can be used efficiently according to meet region-, industry-, and application-specific requirements. For example, Beckhoff offers the EP7402 controller for brushless DC motors used in motor-driven rollers.

These controllers are used for optimal conveyor control through zero-pressure accumulation logic in its firmware and programming in the TwinCAT 3 engineering environment and high-performance EtherCAT industrial Ethernet communication. Thus, the rising use of advanced communications systems is expected to create a significant need for motion control products and solutions.

CHALLENGES: Designing compact and low-cost motion control systems

The challenge for the system integrators and OEMs is designing machines that are compact and less expensive. This challenge is impacted by the availability of components used to design the machine.

A motion control system comprises components such as stand-alone indexers, PC-based motion controllers or PLCs, stepper or servo motor drives, motors, and accessories, such as encoders, proximity sensors, cable harnesses, and other associated mounting hardware.

The smaller the machine, the greater the available space on a factory floor or laboratory bench, and the larger the machine, the more complex the design. This leads to a greater probability of problems that may arise and require time to troubleshoot and be resolved by field service staff during the initial setup.

Motion Control Market Categorization

The study categorizes the motion control market based on offerinf, system, application, industry at the regional and global level.

By Offering

-

Actuators & Mechanical Systems

- Pneumatic

- Hydraulic

- Electromechanical

- Drives

-

Motors

- Servo Motor

- Stepper Motor

- Motion Controllers

- Sensors and Feedback Devices

- Software & Services

By System

- Open-loop System

- Closed-loop System

By Application

- Metal Cutting

- Metal Forming

- Material Handling

- Packaging & Labelling

- Robotics

- Others (semiconductor & electronics, and rubber & plastics)

By Industry

- Aerospace & Defense

- Automotive

- Semiconductor & Electronics

- Metals & Machinery Manufacturing

- Food & Beverages

- Medical

- Printing & Paper

- Pharmaceuticals & Cosmetics

- Others (Textile, Plastic & Rubber, Furniture & Wood, and Oil & Gas)

By Region

- North America

- Europe

- Asia Pacific

-

Rest of the World

- Middle East & Africa

- South America

Recent Developments in Motion Control Industry

- In February 2022, Siemens launched a Simatic Drive Controller for CPUs. This new controller combines a Simatic S7-1500 controller with motion control technology and safety functionality with a Sinamics S120 drive control in one device, thereby saving space.

- In January 2022, Mitsubishi Electric Automation, Inc. launched MELSERVO-J5D servo amplifiers, which are used for medium-to-large servo applications that require multiple drive units capable of managing regenerative energy.

- In June 2020, Parker Hannifin extended its Parker Servo Drive (PSD) family of products with the launch of a fully programmable drive. The programmable PSD is an intelligent standalone servo drive, which is fully programmable via IEC 61131-3 with runtime based on the widely distributed CODESYS V3.

Frequently Asked Questions (FAQ):

What is the total CAGR expected to be recorded for the motion control market during forecasted?

The global motion control market is forecaseted to reach USD 20.0 billion in 2027, growing at a CAGR of 5.2% from 2022–2027. This growth attributed by the elevation adoption of robotics in manufacturing industry and rising adoption of motion control system in assembly lines in production processes.

What are some of the technology trends of motion control market?

The recent trends of the motion control market include Artificial Intelligence (AI), simulation and digital twinning, frameless motors, predictive maintenance, IIoT sensors, and motion out-of-the-box devices.

What are some of the safety mandates for the motion control market?

Safety standards in North America and Europe are followed strictly. In the European Economic Area (EEA)—including European Union Member States and three other countries—the member countries must follow minimum machine safety requirements. Machinery and equipment that do not meet the minimum safety requirements cannot be sold in EEA member countries. In the EEA region, many industrial safety and machine safety directives are present. The Machinery Directive and the Use of Work Equipment by Workers at Work Directive are the most relevant directives.

Who are the winners in the global motion control market?

ABB Ltd. (Switzerland), Siemens (Germany), FANUC (Japan), Yaskawa (Japan), and Mitsubishi Electric Corporation (Japan), fall under the winner category in the motion control market. These companies employ a number of growth strategies, such as product launches and developments, agreements, partnerships, collaborations, acquisitions, and expansions, to gain a competitive edge and expand their product portfolio and distribution network in motion control market.

Which region will lead the motion control market in the future?

APAC is expected to lead the motion control market during the forecast period, owing to the rising adoption of automation technologies, such as robots, across several industries, increasing production of machine tools, and surging use of smartphones and automobiles, which require motion control systems to assemble electronics and semiconductor machinery. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 30)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION AND SCOPE

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

1.3.2 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 34)

2.1 RESEARCH DATA

FIGURE 1 MOTION CONTROL MARKET: RESEARCH DESIGN

2.1.1 SECONDARY & PRIMARY RESEARCH

2.1.2 SECONDARY DATA

2.1.2.1 Major secondary sources

2.1.2.2 Secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Primary interviews with experts

2.1.3.2 Key data from primary sources

2.1.3.3 Key industry insights

2.1.3.4 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

FIGURE 2 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE): REVENUE OF PRODUCTS/SOLUTIONS/SERVICES IN MOTION CONTROL MARKET

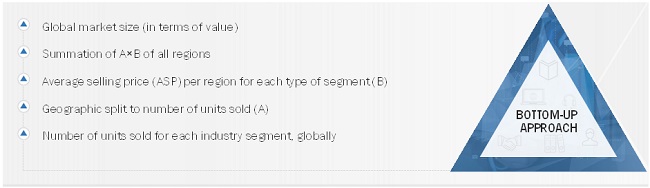

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for arriving at market share by bottom-up analysis (demand side)

FIGURE 3 MARKET: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for capturing market share by top-down analysis (supply side)

FIGURE 4 MARKET: TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN & DATA TRIANGULATION

FIGURE 5 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 45)

FIGURE 6 PRE- AND POST-COVID-19 ANALYSES OF MOTION CONTROL MARKET

3.1 REALISTIC SCENARIO

3.2 PESSIMISTIC SCENARIO

3.3 OPTIMISTIC SCENARIO

FIGURE 7 MOTORS TO ACCOUNT FOR LARGEST SHARE OF MARKET IN 2027

FIGURE 8 CLOSED-LOOP SYSTEMS TO DOMINATE MARKET THROUGHOUT FORECAST PERIOD

FIGURE 9 AUTOMOTIVE INDUSTRY TO HOLD LARGEST SHARE OF MARKET DURING FORECAST PERIOD

FIGURE 10 ASIA PACIFIC WOULD BE FASTEST-GROWING MARKET FOR MOTION CONTROL SYSTEMS DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 50)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR MARKET

FIGURE 11 GROWING ADOPTION OF AUTOMATION ACROSS VARIOUS MANUFACTURING PROCESSES TO DRIVE DEMAND FOR MOTION CONTROL SYSTEMS

4.2 MOTION CONTROL MARKET, BY OFFERING

FIGURE 12 DRIVES TO EXHIBIT HIGHEST CAGR IN MARKET BETWEEN 2022 AND 2027

4.3 MARKET, BY INDUSTRY

FIGURE 13 AUTOMOTIVE INDUSTRY TO HOLD LARGEST SHARE OF MOTION CONTROL MARKET IN 2027

4.4 MOTION CONTROL MARKET, BY SYSTEM

FIGURE 14 CLOSED-LOOP SYSTEMS TO ACCOUNT FOR MAJOR SHARE OF MARKET DURING FORECAST PERIOD

4.5 MOTION CONTROL MARKET, BY REGION

FIGURE 15 ASIA PACIFIC TO CAPTURE LARGEST SHARE OF MARKET IN 2027

5 MARKET OVERVIEW (Page No. - 53)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Surging adoption of automation in manufacturing facilities to ensure employee health and safety after COVID outbreak

5.2.1.2 Growing need for high-precision automated processes in manufacturing sector

5.2.1.3 Rising focus of governments on enforcing stringent measures to ensure workplace safety

5.2.1.4 Increasing demand for industrial robots by manufacturers

5.2.1.5 Accelerating utilization of IIoT devices integrated with motion control systems

5.2.2 RESTRAINT

5.2.2.1 High replacement and maintenance costs of motion control systems

5.2.3 OPPORTUNITIES

5.2.3.1 Adoption of Industry 4.0 by manufacturing firms

5.2.3.2 Integration of motion control systems with programmable logic controllers (PLCs) and human–machine interface (HMI) software solutions

5.2.3.3 Deployment of integrated communications systems across industries

5.2.4 CHALLENGES

5.2.4.1 Designing compact and low-cost motion control systems

5.2.4.2 Lack of skilled workforce in automation field

5.3 VALUE CHAIN ANALYSIS

FIGURE 16 VALUE CHAIN ANALYSIS: MAXIMUM VALUE IS ADDED DURING MANUFACTURING AND ASSEMBLY STAGE

5.4 TECHNOLOGY ANALYSIS

5.4.1 ARTIFICIAL INTELLIGENCE

5.4.2 SIMULATION & DIGITAL TWINNING

5.4.3 FRAMELESS MOTORS

5.4.4 PREDICTIVE MAINTENANCE

5.4.5 IIOT SENSORS

5.4.6 MOTION OUT-OF-THE-BOX

5.5 MOTION CONTROL MARKET: ECOSYSTEM

FIGURE 17 MARKET ECOSYSTEM

5.6 INDUSTRIAL SAFETY STANDARDS

5.6.1 IEC 61508

5.6.2 IEC 61511

5.6.3 IEC 62061

5.6.4 IEC 62443

5.7 CASE STUDY

5.7.1 USE CASE 1: NIDEC MOTOR CORPORATION

5.7.2 USE CASE 2: NIDEC MOTOR CORPORATION

5.7.3 USE CASE 3: MITSUBISHI ELECTRIC

5.8 PATENT ANALYSIS

5.9 PRICING ANALYSIS

6 MOTION CONTROL MARKET, BY OFFERING (Page No. - 66)

6.1 INTRODUCTION

FIGURE 18 MARKET SEGMENTATION, BY OFFERING

FIGURE 19 MOTORS SEGMENT TO HOLD LARGEST SHARE OF MOTION CONTROL MARKET FROM 2022 TO 2027

TABLE 1 MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 2 MARKET, BY OFFERING, 2022–2027 (USD MILLION)

6.2 ACTUATORS & MECHANICAL SYSTEMS

6.2.1 ELECTRIC

6.2.1.1 Electric actuators are in demand for robotic applications owing to their high efficiency in motion control

6.2.2 HYDRAULIC

6.2.2.1 Hydraulic actuators are more useful in heavy industrial applications

6.2.3 PNEUMATIC

6.2.3.1 Pneumatic actuators are designed for harsh environments

6.2.4 OTHERS

TABLE 3 MOTION CONTROL MARKET FOR ACTUATORS & MECHANICAL SYSTEMS, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 4 MARKET FOR ACTUATORS & MECHANICAL SYSTEMS, BY INDUSTRY, 2022–2027 (USD MILLION)

TABLE 5 MARKET FOR ACTUATORS & MECHANICAL SYSTEMS, BY REGION, 2018–2021 (USD MILLION)

TABLE 6 MARKET FOR ACTUATORS & MECHANICAL SYSTEMS, BY REGION, 2022–2027 (USD MILLION)

6.3 DRIVES

6.3.1 RISING ADOPTION OF DRIVES TO INCREASE MACHINE PRODUCTIVITY

TABLE 7 MOTION CONTROL MARKET FOR DRIVES, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 8 MARKET FOR DRIVES, BY INDUSTRY, 2022–2027 (USD MILLION)

TABLE 9 MARKET FOR DRIVES, BY REGION, 2018–2021 (USD MILLION)

TABLE 10 MARKET FOR DRIVES, BY REGION, 2022–2027 (USD MILLION)

6.4 MOTORS

TABLE 11 MOTION CONTROL MARKET FOR MOTORS, BY TYPE, 2018–2021 (USD MILLION)

TABLE 12 MARKET FOR MOTORS, BY TYPE, 2022–2027 (USD MILLION)

TABLE 13 MARKET FOR MOTORS, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 14 MARKET FOR MOTORS, BY INDUSTRY, 2022–2027 (USD MILLION)

TABLE 15 MARKET FOR MOTORS, BY REGION, 2018–2021 (USD MILLION)

TABLE 16 MARKET FOR MOTORS, BY REGION, 2022–2027 (USD MILLION)

6.4.1 SERVO MOTORS

6.4.1.1 Servo motors offer high torque and high accuracy positioning through closed-loop feedback system

6.4.2 STEPPER MOTORS

6.4.2.1 Stepper motors are increasingly adopted in medical devices due to their cost-effectiveness

6.5 MOTION CONTROLLERS

6.5.1 RISING ADOPTION OF MOTION CONTROLLERS OWING TO THEIR HIGH ACCURACY 77

TABLE 17 MOTION CONTROL MARKET FOR MOTION CONTROLLERS, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 18 MARKET FOR MOTION CONTROLLERS, BY INDUSTRY, 2022–2027 (USD MILLION)

TABLE 19 MARKET FOR MOTION CONTROLLERS, BY REGION, 2018–2021 (USD MILLION)

TABLE 20 MARKET FOR MOTION CONTROLLERS, BY REGION, 2022–2027 (USD MILLION)

6.6 SENSORS & FEEDBACK DEVICES

6.6.1 INCREASING DEPLOYMENT OF SENSORS & FEEDBACK DEVICES IN MACHINES FOR ERROR DETECTION

TABLE 21 MOTION CONTROL MARKET FOR SENSORS & FEEDBACK DEVICES, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 22 MARKET FOR SENSORS & FEEDBACK DEVICES, BY INDUSTRY, 2022–2027 (USD MILLION)

TABLE 23 MARKET FOR SENSORS & FEEDBACK DEVICES, BY REGION, 2018–2021 (USD MILLION)

TABLE 24 MARKET FOR SENSORS & FEEDBACK DEVICES, BY REGION, 2022–2027 (USD MILLION)

6.7 SOFTWARE & SERVICES

6.7.1 ACCELERATING USE OF SOFTWARE TO AUTOMATE VARIOUS TASKS INVOLVED IN RUNNING AND MONITORING OF DEVICES

TABLE 25 MOTION CONTROL MARKET FOR SOFTWARE & SERVICES, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 26 MARKET FOR SOFTWARE & SERVICES, BY INDUSTRY, 2022–2027 (USD MILLION)

TABLE 27 MARKET FOR SOFTWARE & SERVICES, BY REGION, 2018–2021 (USD MILLION)

TABLE 28 MARKET FOR SOFTWARE & SERVICES, BY REGION, 2022–2027 (USD MILLION)

7 MOTION CONTROL MARKET, BY SYSTEM (Page No. - 84)

7.1 INTRODUCTION

FIGURE 20 CLOSED-LOOP SYSTEMS TO HOLD LARGER SHARE OF MARKET DURING FORECAST PERIOD

TABLE 29 MARKET, BY SYSTEM, 2018–2021 (USD MILLION)

TABLE 30 MARKET, BY SYSTEM, 2022–2027 (USD MILLION)

7.2 OPEN-LOOP

7.2.1 OPEN-LOOP SYSTEM HAS EASIER LAYOUT AND IS MORE ECONOMICAL

TABLE 31 MOTION CONTROL MARKET FOR OPEN-LOOP, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 32 MARKET FOR OPEN-LOOP, BY INDUSTRY, 2022–2027 (USD MILLION)

7.3 CLOSED-LOOP

7.3.1 CLOSED-LOOP SYSTEMS ARE HIGHLY ADOPTED IN AUTOMATED MOTION CONTROL SOLUTIONS

TABLE 33 MARKET FOR CLOSED-LOOP, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 34 MARKET FOR CLOSED-LOOP, BY INDUSTRY, 2022–2027 (USD MILLION)

8 MOTION CONTROL MARKET, BY APPLICATION (Page No. - 89)

8.1 INTRODUCTION

8.2 METAL CUTTING

8.2.1 ACCELERATING UTILIZATION OF SMART ACTUATORS IN METAL CUTTING TO BOOST MARKET GROWTH

8.3 METAL FORMING

8.3.1 SURGING ADOPTION OF MOTION CONTROL SOLUTIONS TO ENHANCE EFFICIENCY

8.4 MATERIAL HANDLING

8.4.1 INCREASING USE OF ROBOTS TO FUEL MARKET GROWTH

8.5 PACKAGING & LABELLING

8.5.1 RISING IMPLEMENTATION OF MOTION CONTROL SOLUTIONS IN ASSEMBLY LINES TO BOOST MARKET GROWTH

8.6 ROBOTICS

8.6.1 ELEVATING ADOPTION OF ROBOTICS IN MANUFACTURING INDUSTRIES TO BOOST MARKET GROWTH

8.7 OTHERS

9 MOTION CONTROL MARKET, BY INDUSTRY (Page No. - 92)

9.1 INTRODUCTION

FIGURE 21 MARKET SEGMENTATION, BY INDUSTRY

FIGURE 22 AUTOMOTIVE INDUSTRY TO HOLD LARGEST SHARE OF MOTION CONTROL MARKET IN 2027

TABLE 35 MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 36 MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

9.2 AEROSPACE & DEFENSE

9.2.1 INCREASED USE OF MOTION CONTROL SYSTEMS TO MANUFACTURE AIRCRAFT SPARE PARTS DRIVES MARKET GROWTH

9.2.2 IMPACT OF COVID-19 ON AEROSPACE & DEFENSE INDUSTRY

TABLE 37 MOTION CONTROL MARKET FOR AEROSPACE & DEFENSE, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 38 MARKET FOR AEROSPACE & DEFENSE, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 39 MARKET FOR AEROSPACE & DEFENSE, BY SYSTEM, 2018–2021 (USD MILLION)

TABLE 40 MARKET FOR AEROSPACE & DEFENSE, BY SYSTEM, 2022–2027 (USD MILLION)

TABLE 41 MARKET FOR AEROSPACE & DEFENSE, BY REGION, 2018–2021 (USD MILLION)

TABLE 42 MARKET FOR AEROSPACE & DEFENSE, BY REGION, 2022–2027 (USD MILLION)

9.3 AUTOMOTIVE

9.3.1 TECHNOLOGICAL INNOVATIONS IN AUTOMOTIVE INDUSTRY TO BOOST DEMAND FOR MOTION CONTROL SYSTEMS

9.3.2 IMPACT OF COVID-19 ON AUTOMOTIVE SECTOR

TABLE 43 MOTION CONTROL MARKET FOR AUTOMOTIVE, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 44 MARKET FOR AUTOMOTIVE INDUSTRY, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 45 MARKET FOR AUTOMOTIVE, BY SYSTEM, 2018–2021 (USD MILLION)

TABLE 46 MARKET FOR AUTOMOTIVE, BY SYSTEM, 2022–2027 (USD MILLION)

TABLE 47 MARKET FOR AUTOMOTIVE, BY REGION, 2018–2021 (USD MILLION)

TABLE 48 MARKET FOR AUTOMOTIVE, BY REGION, 2022–2027 (USD MILLION)

9.4 SEMICONDUCTOR & ELECTRONICS

9.4.1 HIGH ADOPTION OF ROBOTICS IN SEMICONDUCTOR & ELECTRONICS INDUSTRY STIMULATES NEED FOR MOTION CONTROL SYSTEMS

9.4.2 IMPACT OF COVID-19 ON SEMICONDUCTOR & ELECTRONICS INDUSTRY

TABLE 49 MOTION CONTROL MARKET FOR SEMICONDUCTOR & ELECTRONICS, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 50 MARKET FOR SEMICONDUCTOR & ELECTRONICS, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 51 MARKET FOR SEMICONDUCTOR & ELECTRONICS, BY SYSTEM, 2018–2021 (USD MILLION)

TABLE 52 MARKET FOR SEMICONDUCTOR & ELECTRONICS, BY SYSTEM, 2022–2027 (USD MILLION)

TABLE 53 MARKET FOR SEMICONDUCTOR & ELECTRONICS, BY REGION, 2018–2021 (USD MILLION)

TABLE 54 MARKET FOR SEMICONDUCTOR & ELECTRONICS, BY REGION, 2022–2027 (USD MILLION)

9.5 METALS & MACHINERY MANUFACTURING

9.5.1 ELEVATED DEPLOYMENT OF AUTOMATED TECHNOLOGIES ON ASSEMBLY LINES TO ENHANCE PRODUCTION PROCESS TO FUEL NEED FOR MOTION CONTROL SYSTEMS

9.5.2 IMPACT OF COVID-19 ON METALS & MACHINERY MANUFACTURING INDUSTRY

TABLE 55 MOTION CONTROL MARKET FOR METALS & MACHINERY MANUFACTURING, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 56 MARKET FOR METALS & MACHINERY MANUFACTURING INDUSTRY, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 57 MARKET FOR METALS & MACHINERY MANUFACTURING, BY SYSTEM, 2018–2021 (USD MILLION)

TABLE 58 MARKET FOR METALS & MACHINERY MANUFACTURING, BY SYSTEM, 2022–2027 (USD MILLION)

TABLE 59 MARKET FOR METALS & MACHINERY MANUFACTURING, BY REGION, 2018–2021 (USD MILLION)

TABLE 60 MARKET FOR METALS & MACHINERY MANUFACTURING, BY REGION, 2022–2027 (USD MILLION)

9.6 FOOD & BEVERAGES

9.6.1 RAPID TECHNOLOGICAL DEVELOPMENTS FOSTER MOTION CONTROL REQUIREMENTS IN FOOD & BEVERAGES INDUSTRY

9.6.2 IMPACT OF COVID-19 ON FOOD & BEVERAGES INDUSTRY

TABLE 61 MOTION CONTROL MARKET FOR FOOD & BEVERAGES, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 62 MARKET FOR FOOD & BEVERAGES, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 63 MARKET FOR FOOD & BEVERAGES, BY SYSTEM, 2018–2021 (USD MILLION)

TABLE 64 MARKET FOR FOOD & BEVERAGES, BY SYSTEM, 2022–2027 (USD MILLION)

TABLE 65 MARKET FOR FOOD & BEVERAGES, BY REGION, 2018–2021 (USD MILLION)

TABLE 66 MARKET FOR FOOD & BEVERAGES, BY REGION, 2022–2027 (USD MILLION)

9.7 MEDICAL

9.7.1 STRONG FOCUS ON OF MANUFACTURERS ON DEVELOPING MINIATURE AND CUSTOMIZED PRODUCTS TO DRIVE NEED FOR MOTION CONTROL MARKET IN MEDICAL INDUSTRY

9.7.2 IMPACT OF COVID-19 ON MEDICAL INDUSTRY

TABLE 67 MARKET FOR MEDICAL, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 68 MARKET FOR MEDICAL, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 69 MARKET FOR MEDICAL, BY SYSTEM, 2018–2021 (USD MILLION)

TABLE 70 MARKET FOR MEDICAL, BY SYSTEM, 2022–2027 (USD MILLION)

TABLE 71 MARKET FOR MEDICAL, BY REGION, 2018–2021 (USD MILLION)

TABLE 72 MARKET FOR MEDICAL, BY REGION, 2022–2027 (USD MILLION)

9.8 PRINTING & PAPER

9.8.1 ELEVATED USE OF 3D PRINTING TECHNOLOGY TO ACCELERATE DEMAND FOR MOTION CONTROL SOLUTIONS IN PRINTING & PAPER INDUSTRY

9.8.2 IMPACT OF COVID-19 ON PRINTING & PAPER INDUSTRY

TABLE 73 MOTION CONTROL MARKET FOR PRINTING & PAPER, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 74 MARKET FOR PRINTING & PAPER, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 75 MARKET FOR PRINTING & PAPER, BY SYSTEM, 2018–2021 (USD MILLION)

TABLE 76 MARKET FOR PRINTING & PAPER, BY SYSTEM, 2022–2027 (USD MILLION)

TABLE 77 MARKET FOR PRINTING & PAPER, BY REGION, 2018–2021 (USD MILLION)

TABLE 78 MARKET FOR PRINTING & PAPER, BY REGION, 2022–2027 (USD MILLION)

9.9 PHARMACEUTICALS & COSMETICS

9.9.1 ESCALATED ADOPTION OF ROBOTIC TECHNOLOGY IN MEDICAL DEVICES AND COSMETIC PRODUCT MANUFACTURING TO FUEL MOTION CONTROL MARKET GROWTH

9.9.2 IMPACT OF COVID-19 ON PHARMACEUTICALS & COSMETICS INDUSTRY

TABLE 79 MARKET FOR PHARMACEUTICALS & COSMETICS, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 80 MARKET FOR PHARMACEUTICALS & COSMETICS, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 81 MOTION CONTROL MARKET FOR PHARMACEUTICALS & COSMETICS, BY SYSTEM, 2018–2021 (USD MILLION)

TABLE 82 MARKET FOR PHARMACEUTICALS & COSMETICS, BY SYSTEM, 2022–2027 (USD MILLION)

TABLE 83 MARKET FOR PHARMACEUTICALS & COSMETICS, BY REGION, 2018–2021 (USD MILLION)

TABLE 84 MARKET FOR PHARMACEUTICALS & COSMETICS, BY REGION, 2022–2027 (USD MILLION)

9.10 OTHERS

9.10.1 IMPACT OF COVID-19 ON OTHER INDUSTRIES

TABLE 85 MOTION CONTROL MARKET FOR OTHERS, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 86 MARKET FOR OTHERS, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 87 MARKET FOR OTHERS, BY SYSTEM, 2018–2021 (USD MILLION)

TABLE 88 MARKET FOR OTHERS, BY SYSTEM, 2022–2027 (USD MILLION)

TABLE 89 MARKET FOR OTHERS, BY REGION, 2018–2021 (USD MILLION)

TABLE 90 MARKET FOR OTHERS, BY REGION, 2022–2027 (USD MILLION)

10 GEOGRAPHIC ANALYSIS (Page No. - 121)

10.1 INTRODUCTION

FIGURE 23 MOTION CONTROL MARKET, BY COUNTRY

FIGURE 24 ASIA PACIFIC TO LEAD OF MARKET THROUGHOUT FORECAST PERIOD

TABLE 91 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 92 MARKET, BY REGION, 2022–2027 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 25 NORTH AMERICA: MOTION CONTROL MARKET SNAPSHOT

TABLE 93 MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 94 MARKET IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 95 MARKET IN NORTH AMERICA, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 96 MOTION CONTROL MARKET IN NORTH AMERICA, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 97 MARKET IN NORTH AMERICA, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 98 MARKET IN NORTH AMERICA, BY INDUSTRY, 2022–2027 (USD MILLION)

10.2.1 COVID-19 IMPACT ON NORTH AMERICA

10.2.2 US

10.2.2.1 Rising adoption of advanced technologies in manufacturing industry in US to boost motion control market growth

10.2.3 CANADA

10.2.3.1 Increasing utilization of automated tools in manufacturing facilities in Canada to fuel demand for motion control systems

10.2.4 MEXICO

10.2.4.1 Growing focus of manufacturing firms to set up production facilities in Mexico to drive growth of market

10.3 EUROPE

FIGURE 26 EUROPE: MOTION CONTROL MARKET SNAPSHOT

TABLE 99 MARKET IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 100 MARKET IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

10.3.1 IMPACT OF COVID-19 ON MARKET IN EUROPE

10.3.2 UK

10.3.2.1 Surging demand for electric vehicles to stimulate demand for motion control systems

10.3.3 FRANCE

TABLE 101 MOTION CONTROL MARKET IN EUROPE, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 102 MARKET IN EUROPE, BY INDUSTRY, 2022–2027 (USD MILLION)

TABLE 103 MARKET IN EUROPE, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 104 MARKET IN EUROPE, BY OFFERING, 2022–2027 (USD MILLION)

10.3.3.1 Rising focus and support of French government to incorporate innovative technologies in industrial processes to fuel market growth

10.3.4 GERMANY

10.3.4.1 Increasing adoption of motion control technologies in German automotive industry fosters market growth

10.3.5 REST OF EUROPE

10.4 ASIA PACIFIC

FIGURE 27 ASIA PACIFIC: MOTION CONTROL MARKET SNAPSHOT

TABLE 105 MARKET IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 106 MARKET IN ASIA PACIFIC, BY COUNTRY, 2022–2027 (USD MILLION)

10.4.1 IMPACT OF COVID-19 ON MARKET IN ASIA PACIFIC

10.4.2 CHINA

10.4.2.1 Thriving robotics industry to propel market growth in China

10.4.3 JAPAN

10.4.3.1 Increasing production of automobiles to accelerate growth of market in Japan

TABLE 107 MOTION CONTROL MARKET IN ASIA PACIFIC, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 108 MARKET IN ASIA PACIFIC, BY INDUSTRY, 2022–2027 (USD MILLION)

TABLE 109 MARKET IN ASIA PACIFIC, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 110 MARKET IN ASIA PACIFIC, BY OFFERING, 2022–2027 (USD MILLION)

10.4.4 INDIA

10.4.4.1 Growing manufacturing sector as outcome of Make in India initiative pushes market growth

10.4.5 SOUTH KOREA

10.4.5.1 Increasing automation of manufacturing processes to propel adoption of motion control solutions

10.4.6 REST OF ASIA PACIFIC

10.5 REST OF THE WORLD (ROW)

10.5.1 COVID-19 IMPACT ON ROW

TABLE 111 MOTION CONTROL MARKET IN ROW, BY REGION, 2018–2021 (USD MILLION)

TABLE 112 MARKET IN ROW, BY REGION, 2022–2027 (USD MILLION)

TABLE 113 MARKET IN ROW, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 114 MARKET IN ROW, BY INDUSTRY, 2022–2027 (USD MILLION)

TABLE 115 MARKET IN ROW, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 116 MARKET IN ROW, BY OFFERING, 2022–2027 (USD MILLION)

10.5.2 MIDDLE EAST & AFRICA

10.5.3 SOUTH AMERICA

11 COMPETITIVE LANDSCAPE (Page No. - 144)

11.1 OVERVIEW

11.2 REVENUE ANALYSIS OF TOP FIVE COMPANIES

FIGURE 28 MOTION CONTROL MARKET: REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2017–2021

11.3 MARKET SHARE ANALYSIS OF PLAYERS, 2021

TABLE 117 MARKET SHARE OF TOP FIVE PLAYERS IN THE MARKET IN 2021

11.4 COMPANY EVALUATION QUADRANT, 2021

11.4.1 STAR

11.4.2 EMERGING LEADER

11.4.3 PERVASIVE

11.4.4 PARTICIPANT

FIGURE 29 MOTION CONTROL MARKET (GLOBAL) COMPANY EVALUATION QUADRANT, 2021

11.5 COMPETITIVE SITUATIONS AND TRENDS

11.5.1 PARTNERSHIPS, COLLABORATIONS, ACQUISITIONS

TABLE 118 PARTNERSHIPS, COLLABORATIONS, AND ACQUISITIONS, 2019–2021

11.5.2 PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 119 PRODUCT LAUNCHES AND DEVELOPMENTS, 2019–2022

12 COMPANY PROFILES (Page No. - 152)

12.1 INTRODUCTION

12.2 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

12.2.1 ABB LTD.

TABLE 120 ABB: BUSINESS OVERVIEW

FIGURE 30 ABB: COMPANY SNAPSHOT

TABLE 121 ABB: PRODUCT OFFERING

12.2.2 FANUC CORPORATION

TABLE 122 FANUC CORPORATION: BUSINESS OVERVIEW

FIGURE 31 FANUC CORPORATION: COMPANY SNAPSHOT

12.2.3 MITSUBISHI ELECTRIC CORPORATION

TABLE 123 MITSUBISHI ELECTRIC: BUSINESS OVERVIEW

FIGURE 32 MITSUBISHI ELECTRIC: COMPANY SNAPSHOT

12.2.4 SIEMENS

TABLE 124 SIEMENS: BUSINESS OVERVIEW

FIGURE 33 SIEMENS: COMPANY SNAPSHOT

12.2.5 YASKAWA ELECTRIC CORPORATION

TABLE 125 YASKAWA ELECTRIC: BUSINESS OVERVIEW

FIGURE 34 YASKAWA ELECTRIC: COMPANY SNAPSHOT

12.2.6 ALTRA INDUSTRIAL MOTION CORP.

TABLE 126 ALTRA INDUSTRIAL MOTION: BUSINESS OVERVIEW

FIGURE 35 ALTRA INDUSTRIAL MOTION: COMPANY SNAPSHOT

12.2.7 ROBERT BOSCH GMBH

TABLE 127 ROBERT BOSCH: BUSINESS OVERVIEW

FIGURE 36 ROBERT BOSCH: COMPANY SNAPSHOT

12.2.8 PARKER HANNIFIN CORP

TABLE 128 PARKER HANNIFIN CORP: BUSINESS OVERVIEW

FIGURE 37 PARKER HANNIFIN CORP: COMPANY SNAPSHOT

12.2.9 ROCKWELL AUTOMATION, INC.

TABLE 129 ROCKWELL AUTOMATION: BUSINESS OVERVIEW

FIGURE 38 ROCKWELL AUTOMATION: COMPANY SNAPSHOT

12.2.10 NOVANTA INC.

TABLE 130 NOVANTA INC.: BUSINESS OVERVIEW

FIGURE 39 NOVANTA INC.: COMPANY SNAPSHOT

12.3 OTHER KEY PLAYERS

12.3.1 DOVER MOTION

12.3.2 OMRON

12.3.3 ALLIED MOTION TECHNOLOGIES INC.

12.3.4 AMETEK

12.3.5 ADTECH (SHENZHEN) TECHNOLOGY CO. LTD.

12.3.6 POWERTEC INDUSTRIAL MOTORS INC.

12.3.7 DELTA ELECTRONICS

12.3.8 BAUMUELLER

12.3.9 MOONS’

12.3.10 ELMO MOTION CONTROL

12.3.11 ABSOLUTE MACHINE TOOLS

12.3.12 IQ CONTROL

12.3.13 APPTRONIK

12.3.14 GALIL

12.3.15 TRINAMIC

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

13 ADJACENT & RELATED MARKETS (Page No. - 198)

13.1 INTRODUCTION

13.2 LIMITATIONS

13.3 ENCODER MARKET, BY APPLICATION

13.3.1 INTRODUCTION

FIGURE 40 ENCODER MARKET, BY APPLICATION

TABLE 131 ENCODER MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 132 ENCODER MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

13.4 INDUSTRIAL

13.4.1 INDUSTRIAL APPLICATION SEGMENT TO HOLD LARGEST SHARE OF ENCODER MARKET

TABLE 133 ENCODER MARKET FOR INDUSTRIAL APPLICATION, BY ENCODER TYPE, 2017–2020 (USD MILLION)

TABLE 134 ENCODER MARKET FOR INDUSTRIAL APPLICATION, BY ENCODER TYPE, 2021–2026 (USD MILLION)

TABLE 135 ENCODER MARKET FOR INDUSTRIAL APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 136 ENCODER MARKET FOR INDUSTRIAL APPLICATION, BY REGION, 2021–2026 (USD MILLION)

13.5 HEALTHCARE

13.5.1 HEALTHCARE APPLICATION TO WITNESS SIGNIFICANT GROWTH DURING FORECAST PERIOD

TABLE 137 ENCODER MARKET FOR HEALTHCARE APPLICATION, BY ENCODER TYPE, 2017–2020 (USD MILLION)

TABLE 138 ENCODER MARKET FOR HEALTHCARE APPLICATION, BY ENCODER TYPE, 2021–2026 (USD MILLION)

TABLE 139 ENCODER MARKET FOR HEALTHCARE APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 140 ENCODER MARKET FOR HEALTHCARE APPLICATION, BY REGION, 2021–2026 (USD MILLION)

13.6 CONSUMER ELECTRONICS

13.6.1 TECHNOLOGICAL INNOVATIONS TO DRIVE GROWTH OF CONSUMER ELECTRONICS APPLICATION SEGMENT

TABLE 141 ENCODER MARKET FOR CONSUMER ELECTRONICS APPLICATION, BY ENCODER TYPE, 2017–2020 (USD MILLION)

TABLE 142 ENCODER MARKET FOR CONSUMER ELECTRONICS APPLICATION, BY ENCODER TYPE, 2021–2026 (USD MILLION)

TABLE 143 ENCODER MARKET FOR CONSUMER ELECTRONICS APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 144 ENCODER MARKET FOR CONSUMER ELECTRONICS APPLICATION, BY REGION, 2021–2026 (USD MILLION)

13.7 AUTOMOTIVE

13.7.1 INCREASING INTEGRATION OF ADVANCED TECHNOLOGIES INTO AUTOMOBILES HAS DRIVEN DEMAND FOR ENCODERS IN AUTOMOTIVE APPLICATIONS

TABLE 145 ENCODER MARKET FOR AUTOMOTIVE APPLICATION, BY ENCODER TYPE, 2017–2020 (USD MILLION)

TABLE 146 ENCODER MARKET FOR AUTOMOTIVE APPLICATION, BY ENCODER TYPE, 2021–2026 (USD MILLION)

TABLE 147 ENCODER MARKET FOR AUTOMOTIVE APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 148 ENCODER MARKET FOR AUTOMOTIVE APPLICATION, BY REGION, 2021–2026 (USD MILLION)

13.8 POWER

13.8.1 INCREASING COMPLEXITY IN POWER APPLICATIONS TO BOOST GROWTH OF ENCODER MARKET

TABLE 149 ENCODER MARKET FOR POWER APPLICATION, BY ENCODER TYPE, 2017–2020 (USD MILLION)

TABLE 150 ENCODER MARKET FOR POWER APPLICATION, BY ENCODER TYPE, 2021–2026 (USD MILLION)

TABLE 151 ENCODER MARKET FOR POWER APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 152 ENCODER MARKET FOR POWER APPLICATION, BY REGION, 2021–2026 (USD MILLION)

13.9 FOOD AND BEVERAGES

13.9.1 INTEGRATION OF IO-LINK TECHNOLOGY INTO ENCODERS TO BOOST GROWTH OF FOOD AND BEVERAGES APPLICATION SEGMENT DURING FORECAST PERIOD

TABLE 153 ENCODER MARKET FOR FOOD AND BEVERAGES APPLICATION, BY ENCODER TYPE, 2017–2020 (USD MILLION)

TABLE 154 ENCODER MARKET FOR FOOD AND BEVERAGES APPLICATION, BY ENCODER TYPE, 2021–2026 (USD MILLION)

TABLE 155 ENCODER MARKET FOR FOOD AND BEVERAGES APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 156 ENCODER MARKET FOR FOOD AND BEVERAGES APPLICATION, BY REGION, 2021–2026 (USD MILLION)

13.10 AEROSPACE

13.10.1 PRECISION CONTROL TECHNOLOGY TO PLAY VITAL ROLE IN GROWTH OF AEROSPACE SEGMENT

TABLE 157 ENCODER MARKET FOR AEROSPACE APPLICATION, BY ENCODER TYPE, 2017–2020 (USD MILLION)

TABLE 158 ENCODER MARKET FOR AEROSPACE APPLICATION, BY ENCODER TYPE, 2021–2026 (USD MILLION)

TABLE 159 ENCODER MARKET FOR AEROSPACE APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 160 ENCODER MARKET FOR AEROSPACE APPLICATION, BY REGION, 2021–2026 (USD MILLION)

13.11 PRINTING

13.11.1 NORTH AMERICA TO BE KEY ENCODER MARKET FOR PRINTING APPLICATION

TABLE 161 ENCODER MARKET FOR PRINTING APPLICATION, BY ENCODER TYPE, 2017–2020 (USD MILLION)

TABLE 162 ENCODER MARKET FOR PRINTING APPLICATION, BY ENCODER TYPE, 2021–2026 (USD MILLION)

TABLE 163 ENCODER MARKET FOR PRINTING APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 164 ENCODER MARKET FOR PRINTING APPLICATION, BY REGION, 2021–2026 (USD MILLION)

13.12 TEXTILES

13.12.1 INCREASING APPLICATIONS OF ENCODERS IN WEAVING, KNITTING, PRINTING, AND EXTRUDING PROCESSES TO DRIVE MARKET GROWTH

TABLE 165 ENCODER MARKET FOR TEXTILES APPLICATION, BY ENCODER TYPE, 2017–2020 (USD MILLION)

TABLE 166 ENCODER MARKET FOR TEXTILES APPLICATION, BY ENCODER TYPE, 2021–2026 (USD MILLION)

TABLE 167 ENCODER MARKET FOR TEXTILES APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 168 ENCODER MARKET FOR TEXTILES APPLICATION, BY REGION, 2021–2026 (USD MILLION)

13.13 OTHERS

TABLE 169 ENCODER MARKET FOR OTHER APPLICATIONS, BY ENCODER TYPE, 2017–2020 (USD MILLION)

TABLE 170 ENCODER MARKET FOR OTHER APPLICATIONS, BY ENCODER TYPE, 2021–2026 (USD MILLION)

TABLE 171 ENCODER MARKET FOR OTHER APPLICATIONS, BY REGION, 2017–2020 (USD MILLION)

TABLE 172 ENCODER MARKET FOR OTHER APPLICATIONS, BY REGION, 2021–2026 (USD MILLION)

14 APPENDIX (Page No. - 218)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

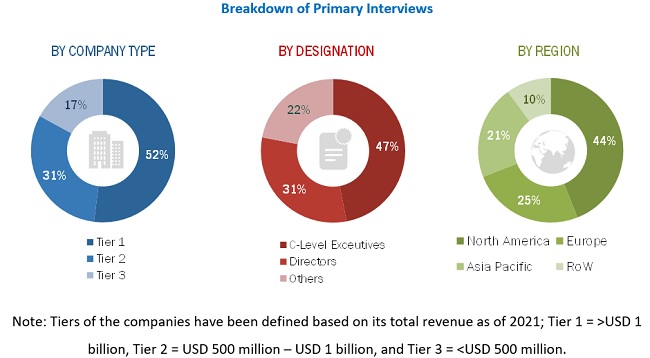

The study involved four major activities in estimating the current size of the motion control market. Exhaustive secondary research has been done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation methods have been used to estimate the market size of segments and subsegments. Two sources of information—secondary and primary—have been used to identify and collect information for an extensive technical and commercial study of the motion control market.

Secondary Research

Secondary sources referred for this study include company websites, magazines, industry news, associations (Motion Control and Motor Association (MCMA), Robotic Industries Association (RIA), International Society of Automation (ISA), Measurement, Control & Automation Association (MCAA), others), and databases (Factiva and Bloomberg). These secondary sources include annual reports, press releases, and investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, trade directories, trade, and databases. The secondary data has been collected and analyzed to arrive at the overall motion control market size, which is further validated by primary research.

Primary Research

Extensive primary research has been conducted after acquiring and understanding of the motion control market scenario. Several primary interviews has been conducted with market experts from both demand-side and supply-side players across four major regions namely North America, Europe, Asisa Pacific and Rest of the World. The primary sources from the supply-side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), and Directors from business development, marketing, product development/innovation teams, and related key executives from motion control vendors. In the canvassing of primaries, various departments within organizations, such as sales, operations, andadministration, were covered to provide a holistic viewpoint in our report.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up approach has been employed to arrive at the overall size of the motion control market from the calculations based on the revenues of key players and their shares in the market. Below is the step wise approach for arriving at market share by bottom-up analysis (demand side)

- Identifying products currently provided or expected to be offered by product providers

- Tracking major motion control product/component manufacturers

- Estimating the size of the motion control market based on demand

- Tracking ongoing and upcoming product launches by companies and forecasting the market based on these developments and other critical parameters

- Conducting multiple discussions with key opinion leaders to understand the demand for motion control and analyzing break-up of the scope of work carried out by each major company; the discussion also includes the impact of COVID-19 on the ecosystem of the motion control market

- Arriving at market estimates by analyzing revenues generated by manufacturers, based on their locations (countries), and then combining country-based data to get a market estimate based on region

- Verifying and crosschecking estimates at every level by discussing with key opinion leaders, including CEOs, directors, and operation managers, and then finally with domain experts at MarketsandMarkets

- Studying various paid and unpaid information sources such as annual reports, press releases, and white papers

Global Motion Control market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the overall market has been split into several segments and subsegments. The market breakdown and data triangulation procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Report Objectives

- To describe and forecast the motion control market, in terms of value, by offering, system, and industry

- To describe and forecast the market, in terms of value, by region—North America, Europe,

- Asia Pacific, and Rest of the World (RoW)

- To provide detailed information regarding factors (drivers, restraints, opportunities, and challenges) influencing market growth

- To provide a detailed overview of the process flow of the motion control market

- To analyze opportunities for stakeholders in the motion control market by identifying its high-growth segments

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To strategically profile key players and comprehensively analyze their market shares and core competencies2 along with detailing the competitive leadership and analyzing growth strategies such as product launches and developments, expansion, acquisitions, agreements, mergers, joint ventures, and partnerships of leading players.

Available Customizations

MarketsandMarkets offers customizations in the reports according to the client’s specific requirements. The available customization options are as follows:

- Additional country level analysis of motion control market

- Detailed analysis and profiling of additional market players (up to 3)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Motion Control Market