Motor Monitoring Market by Offering (Hardware, Software, Services), Monitoring Process (Online, Portable), End-User Industry (Oil & Gas, Power Generation, Metals & Mining, Chemicals, Automotive), Deployment and Region - Global Forecast to 2026

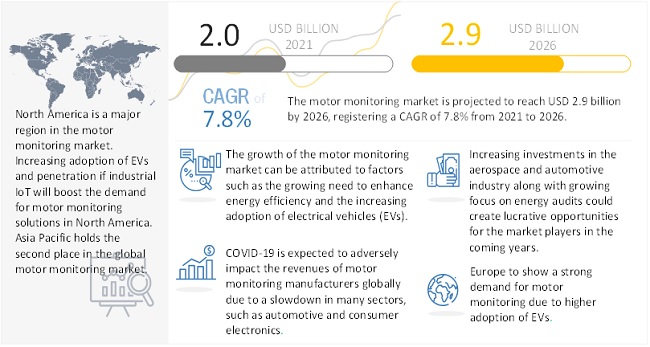

The global motor monitoring market in terms of revenue was estimated to worth $2.0 billion in 2021 and is poised to reach $2.9 billion by 2026, growing at a CAGR of 7.8 % from 2021 to 2026. Motor monitoring is increasingly being installed and is showing robust growth.

To know about the assumptions considered for the study, Request for Free Sample Report

Impact of COVID-19 on motor monitoring market

COVID-19 has slowed the growth of the Motor monitoring, as countries were forced to implement lockdowns during the first half of 2020. Strict guidelines were issued by governments and local authorities, and all non-essential operations were halted. This adversely affected the Motor monitoring owing to less focus on development of end user’s industry.

In addition, production and supply chain delays were also witnessed during the second quarter which poised a challenge to the Motor monitoring.

Motor monitoring Market Dynamics

Driver: Growing demand for predictive maintenance and analytics

Predictive maintenance is gaining recognition as one of the more easily exploited applications of digitalization. Predictive maintenance (PdM) is a strategy for predicting when equipment will break and replacing the component before it fails. This aids in the reduction of downtime and the extension of component life. Preventing production line downtime with predictive maintenance can save millions of dollars in lost output. While still in its early stages, predictive maintenance is proving to be of great importance to the projects by providing a fresh stream of data for both OEMs and end users. Predictive maintenance is critical for the safety of motors and their components, such as motor controllers and bearings. Predictive maintenance entails measuring the motor's functioning parameters under full load, as well as the effective temperature and wetness conditions, while it is in use.

Predictive maintenance has a number of benefits for industry, including reducing the amount of time spent on asset upkeep, reduced downtime means fewer lost production hours, and maximizing the life of existing assets to reduce the cost of spare parts

Restraints: Limited technical know-how to manage monitoring solutions

The growing adoption of predictive maintenance and other monitoring solutions is compelling enterprises to appoint a dedicated data analysis team. This team should know motors well, along with their operation in a particular machine, to get the correct information on the health of motors. This will, in turn, increase the indirect cost to companies. Moreover, motor manufacturing companies do not readily provide the monitoring solutions; thus, to avail monitoring solutions, industries have to look for other companies that have expertise in providing monitoring solutions. This, sometimes, could add to the overall cost structure, apart from investments in motor installation. To monitor the data points coming from motor monitoring, different skill sets are required, which demands the training of staff as well as setting up a standard procedure for motor monitoring. The lack of skilled professionals at reasonable costs is expected to be the major factor restraining market growth during the forecast period.

Opportunities: Growing focus on energy audits and regulations worldwide

An energy audit is a standard set by the government, which regulates the energy audit of various electrical equipment. It provides comprehensive and systematic methods such as, energy cost optimization, safety aspects, and improving the operating and maintenance practices of the industrial systems. It also helps with energy cost availability, decisions on energy mix, power conservation, and reliable energy supply.

This type of implementation is mandatory in North America, Europe, and Asia. In Asia, energy audits are imposed in several countries, such as China and India. In the Middle East & Africa, few countries such as Tunisia and Algeria require energy audits for the high electricity consumption in all sectors. In Europe, the industrial sector and manufacturing plants have to undergo mandatory energy audits. Manufacturing units and production facilities in industries such as automotive, aerospace and defense, consumer electronics, and medical equipment require power analyzers to help them comply with energy audits. Moreover, in Europe, the Energy Efficiency Directive makes it compulsory for large companies to undertake energy audits every four years. Failure to comply with these obligations leads to penalties. As motors are responsible for almost 70% of energy consumption in any industrial setup, proper monitoring of motors could result in considerable power saving and help industries to comply with the energy audits.

Challenges: Long payback period on investment

A continuous monitoring necessitates a higher initial investment in data gathering and analysis technology, as well as installation. Investments that are majorly considered while calculating the total cost of ownership includes: system engineering and installation; field instrumentation (e.g., sensors, cabling); monitoring and diagnostic system (e.g., hardware and software, installation, software licenses); user training and customer support, if necessary; system maintenance (e.g., sensor replacement, software updates); and required external expertise and support. These software, services, and equipment are costly and also demand skill sets to operate them. So, operators have to invest additionally in training and maintenance of motor control process. The cost incurred depends on the scale of the industry and the level of deployment of control services. While these costs are returned in a comparatively short period of time in case of for large industries, many small and medium-scale industries face the challenge of payback time for control processes. Furthermore, the payback time and return on investment (ROI) depends on the percentage or probable occurrence of motor failures. These factors when taken in account prolong the duration of payback period.

Market Trend

To know about the assumptions considered for the study, download the pdf brochure

By offering, hardware segment is the largest contributor in the motor monitoring market in 2020.

The hardware segment accounted for the largest share of the Motor monitoring market, by offering, in 2020. Hardware segment is projected to account for a larger market share, driven by the government initiatives toward implementing energy audits with an increase in mandatory regulations, growing demand for electric vehicles (EVs), and a growing market for Internet of Things (IoT). Hardware is the most important component of a machine condition monitoring system. The hardware segment mainly includes vibration sensors, infrared sensors, ultrasound detectors, spectrum analyzers, and corrosion probes.

By monitoring process, the online segment is the largest contributor in the motor monitoring market in 2020.

The online segment accounted for the largest share of the motor monitoring market, by monitoring process, in 2020. Majority of projects are undertaken in this segment. Online motor monitoring is particularly useful in plants that are operational throughout a day, mission critical applications and located at remote locations with hazardous environments. The online motor monitoring solutions are consistently available for data collection. This process provides critical information for maintaining the process performance along with the instant alerts for the problems that might go unnoticed in periodic maintenance. Online and remote monitoring eliminates the need for in-person inspections of rotating equipment, which reduces the inherent risks of such operations. The declining costs of sensors and submeters, and the advent of big data analytics, have made online motor monitoring solutions increasingly accurate and affordable. Such factors drive the growth of online motor monitoring market.

By end user, the oil & gas segment is the largest contributor in the motor monitoring market in 2020.

The oil & gas segment accounted for the largest share of the motor monitoring market, by end user, in 2020. The oil & gas companies are looking for new ways to meet the rising energy needs as well as to cut their operating costs and improve efficiency. Oil and gas plants are home to some of the most complicated systems in modern industrial production. Aside from the complication, the financial and environmental repercussions of a failure might be catastrophic. As a result, ensuring high levels of efficiency, safety, and profitability in oil and gas operations is becoming increasingly complex. To meet these demands, the oil & gas players are undertaking a number of developments and focusing on researching new technologies to increase the output. Motor, being one of the key components of the machinery in the oil & gas plants, there is a need for an exclusive monitoring solution that can be implemented. Moreover, as the oil & gas companies are establishing their drilling operations in remote offshore locations, the implementation of proper monitoring solutions becomes necessary in this industry. Oil & gas industry needs motor solutions at every phase of operations whether its upstream, midstream or downstream.

By deployment, the on-premise segment is the largest contributor in the motor monitoring market in 2020

The on-premise accounted for the largest share of the motor monitoring market, by end user, in 2020. An on-premise deployment is a traditional approach to implementing motor monitoring solutions across an enterprise. The on-premises software or solution is installed locally on motors, bearings, shafts, computers, and servers within a company’s premises. Industries get a complete control over the data when they deploy on-premises solutions as the data is physically stored at the premises of the industry. Some of the benefits associated with on-premise deployment include better control over the overall system, as the hardware, data, and software platform is owned and managed by the company, and reduced dependency on external factors such as network and third-party dealers. Hence, the chance of data security is higher in on-premise deployment compared to cloud storage. Therefore, better control over the data in terms of its storage location proves to be one of the major factors driving the industries toward the adoption of on-premises motor monitoring systems.

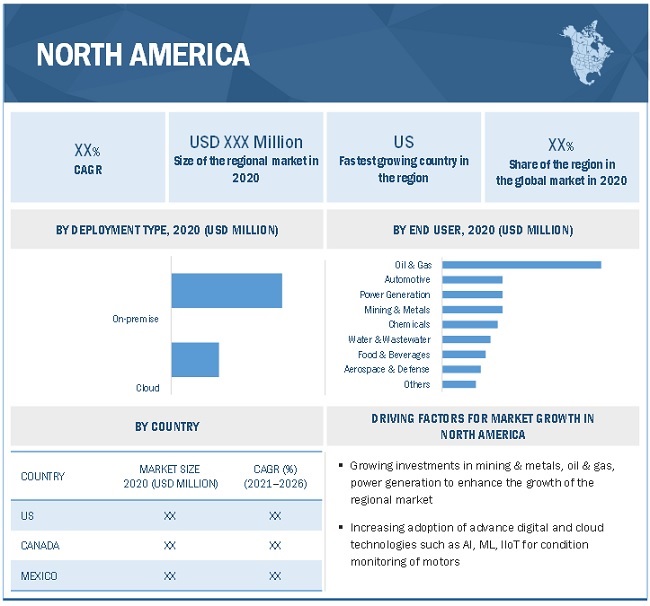

North America has strong demand for motor monitoring market which is further growing due to increasing maritime trade and growth of electric vehicles and government policies

North America held 33.7% share of the global motor monitoring market in 2020. The scope of the regional market includes the US, Canada, and Mexico. The growth of this region is supported by an increase in demand for electric vehicles (EVs) and rising investment in infrastructure development in various end user industry of motor monitoring. For instance, According to the International Energy Agency’s World Energy Investment 2021 report, the utilities in North America invested approximately USD 85 billion in power generation infrastructure and USD 246 billion in oil & gas activities in 2020. Similarly, According to LMC International, of the total car sales, EV and hybrid sales in North America are expected to account for 7% and 20%, respectively, by 2030.

The leading players in the motor monitoring market include General Electric (US), Siemens (Germany), ABB (Switzerland), Honeywell (US), and Schneider Electric (France).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market Size available for years |

2019–2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021–2026 |

|

Forecast units |

Value (USD) |

|

Segments covered |

By Offering, Deployment, Monitoring Process, and End user |

|

Geographies covered |

Asia Pacific, North America, Middle East & Africa, South America, and Europe |

|

Companies covered |

ABB (Switzerland), General Electric (US), Siemens (Germany), Honeywell (US), Schneider Electric (France), Banner Engineering (Us), National Instruments (US), SKF (Sweden), Emerson (US), Rockwell Automation (US), Qualitrol (US), WEG (Brazil), Mitsubishi Electric (Japan), Eaton (Ireland), Advantech (Taiwan), Dynapar (US), KCF Technologies (US), Phoenix Contact (Germany), Allied Reliability (US), KOCAR- Electrical Engineering Institute (Croatia) |

|

|

|

This research report categorizes the motor monitoring market based by offering, deployment, monitoring process, and end-user industry.

Based on offering:

-

Hardware

- Vibration Sensors

- Infrared Sensors

- Corrosion Probes

- Ultrasound Detectors

- Spectrum Analyzers

- Others

-

Software

- Analytics Software

- Diagnostic Software

-

Services

- Training Services

- Data Analysis Services

- Technical Support & Maintenance Services

Based on deployment:

- On-premise

- Cloud

Based on monitoring process:

- Online

- Offline/Portable

Based on End user:

- Automotive

- Oil & gas

- Metals & mining

- Power Generation

- Water & wastewater treatment

- Food & beverages

- Chemicals

- Others – Agriculture and Electronics & Semiconductors

Based on the region:

- North America

- Asia Pacific

- Europe

- South America

- Middle East & Africa

Recent Developments

- In March 2021, General Electric launched CONNECTIX, a software suite and expert services. It includes operations, maintenance, and services tools, and solutions which help to optimize operations and enable predictive maintenance and cyber-secure service solutions.

- In September 2021, Siemens and Empolis entered into a collaboration agreement in order to digitalize and structure the organizational knowledge for drive systems. The collaboration of Siemens and Empolis strengthens the foundation for insight generation in SIDRIVE IQ with the help of Empolis Intelligent Views Platform’s knowledge graphs.

- In August 2020, ABB received a contract from Södra to provide 70 ABB Ability Smart Sensors in order to measure vibrations and performance of numerous motors installed on a pulp dryer.

- In December 2019, SFK entered into a partnership with Nornickel Harjavalta. SFK provided condition monitoring and lubrication management to support a continuous improvement process. Nornickel has also decided to deploy condition monitoring system, SKF Enlight ProCollect, in the rest of their plant following a successful pilot project in 2021.

Frequently Asked Questions (FAQ):

What is the current size of the motor monitoring market?

The current market size of global motor monitoring market is estimated to be USD 2.0 billion in 2021.

What are the major drivers for motor monitoring market?

There is a constant demand for energy savings across different industries worldwide. Various government and international organizations work to increase awareness and assist in energy savings. For example, The European Commission created four scenarios in 2017 to review higher objectives for EU's 2030 energy efficiency target. The analysis compared the effects of energy efficiency improvements at various levels of ambition by 2030 to a 2007 baseline. Each scenario modeled produced a positive change in GDP, ranging from a 0.1% rise in GDP in the least ambitious scenario to a 2.0% increase in GDP in the most aggressive scenario for energy efficiency. Motor monitorings play an important role in increasing the efficiency of systems by helping to analyze the distortion in power supply. Thus, the increase in focus on energy savings will drive the demand for motor monitoring.

Which is the fastest-growing region during the forecasted period in motor monitoring market?

Asia Pacific is the fastest-growing region during the forecasted period. The growth of this region is supported by an increase in demand for electric vehicles (EVs) and a rise in stringent government policies. For instance, in April 2021, the government of China mandated that a certain percent of all vehicles sold by a manufacturer each year must be battery powered. Furthermore, to avoid financial penalties, manufacturers must earn a stipulated number of points in a year, which are awarded for each EV produced. By 2030, the targeted sales for EVs in China are aimed to account for 40% of all car sales. Furthermore, global auto manufacturers such as BMW, Tesla, and Volkswagen are establishing their manufacturing facilities in Asia Pacific as this region offers lucrative opportunities. Thus, increasing investments in major end-use industries are likely to drive the market for motor monitoring during the forecast period.

Which is the fastest-growing segment, by end user during the forecasted period in motor monitoring market?

Oil & gas is to be the fastest-growing segment by end user. The oil & gas segment accounted for the largest share of the motor monitoring market, by end user, in 2020. The oil & gas segment held a 20.7% share of the motor monitoring market in 2020. The oil & gas companies are looking for new ways to meet the rising energy needs as well as to cut their operating costs and improve efficiency. Oil and gas plants are home to some of the most complicated systems in modern industrial production. Aside from the complication, the financial and environmental repercussions of a failure might be catastrophic. As a result, ensuring high levels of efficiency, safety, and profitability in oil and gas operations is becoming increasingly complex. To meet these demands, the oil & gas players are undertaking a number of developments and focusing on researching new technologies to increase the output. Motor, being one of the key components of the machinery in the oil & gas plants, there is a need for an exclusive monitoring solution that can be implemented. Moreover, as the oil & gas companies are establishing their drilling operations in remote offshore locations, the implementation of proper monitoring solutions becomes necessary in this industry. Oil & gas industry needs motor solutions at every phase of operations whether its upstream, midstream or downstream. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 42)

1.1 STUDY OBJECTIVES

1.2 DEFINITION

1.3 INCLUSIONS AND EXCLUSIONS

1.3.1 MOTOR MONITORING MARKET, BY OFFERING

TABLE 1 MOTOR MONITORING MARKET, BY OFFERING: INCLUSIONS & EXCLUSIONS

1.4 MARKET SCOPE

1.4.1 MARKETS COVERED

1.4.2 REGIONAL SCOPE

1.5 YEARS CONSIDERED

1.6 CURRENCY

1.7 LIMITATIONS

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 47)

2.1 RESEARCH DATA

FIGURE 1 MOTOR MONITORING MARKET: RESEARCH DESIGN

2.2 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 2 DATA TRIANGULATION METHODOLOGY

2.2.1 SECONDARY DATA

2.2.1.1 Key data from secondary sources

2.2.2 PRIMARY DATA

2.2.2.1 Key data from primary sources

2.2.2.2 Breakdown of primaries

2.3 IMPACT OF COVID-19 ON MOTOR MONITORING INDUSTRY

2.4 SCOPE

FIGURE 3 MAIN METRICS CONSIDERED WHILE ANALYZING AND ASSESSING DEMAND FOR MOTOR MONITORING MARKET

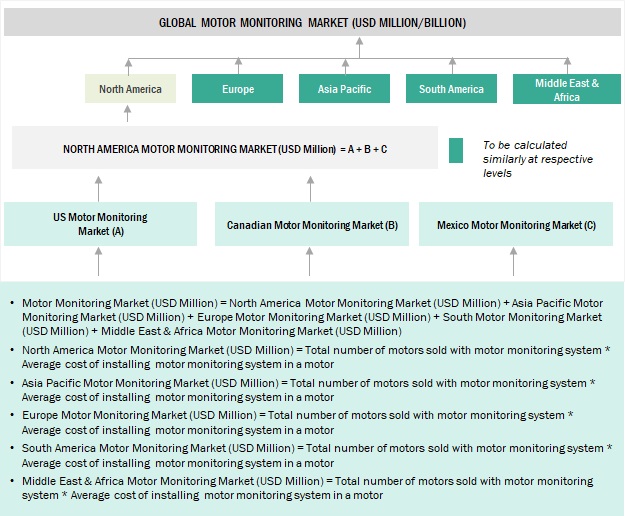

2.5 MARKET SIZE ESTIMATION

2.5.1 BOTTOM-UP APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.5.2 TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.5.3 DEMAND-SIDE ANALYSIS

2.5.3.1 Regional analysis

2.5.3.2 Country analysis

2.5.3.3 Assumptions for demand side

2.5.3.4 Calculation for demand side

2.5.4 SUPPLY-SIDE ANALYSIS

FIGURE 6 KEY STEPS CONSIDERED FOR ASSESSING SUPPLY OF MOTOR MONITORING

FIGURE 7 MOTOR MONITORING MARKET: SUPPLY-SIDE ANALYSIS

2.5.4.1 Supply-side calculation

2.5.4.2 Assumptions for supply side

FIGURE 8 COMPANY REVENUE ANALYSIS, 2020

2.5.5 FORECAST

3 EXECUTIVE SUMMARY (Page No. - 60)

TABLE 2 SNAPSHOT OF MOTOR MONITORING MARKET

FIGURE 9 NORTH AMERICA ACCOUNTED FOR LARGEST SIZE OF MARKET IN 2020

FIGURE 10 HARDWARE SEGMENT EXPECTED TO CAPTURE LARGEST SIZE OF MARKET DURING THE FORECAST PERIOD

FIGURE 11 ONLINE SEGMENT EXPECTED TO LEAD MARKET DURING FORECAST PERIOD

FIGURE 12 OIL & GAS SEGMENT EXPECTED TO ACQUIRE LARGEST SHARE OF MARKET DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 64)

4.1 ATTRACTIVE OPPORTUNITIES IN MOTOR MONITORING MARKET DURING FORECAST PERIOD

FIGURE 13 RISING NEED FOR ENERGY EFFICIENCY EXPECTED TO DRIVE MARKET GROWTH

4.2 MOTOR MONITORING MARKET, BY REGION

FIGURE 14 ASIA PACIFIC IS EXPECTED TO BE FASTEST-GROWING MARKET FOR MOTOR MONITORING DURING FORECAST PERIOD

4.3 NORTH AMERICA: MOTOR MONITORING MARKET, BY END-USER INDUSTRY AND COUNTRY

FIGURE 15 OIL & GAS SEGMENT AND US DOMINATED MARKET IN NORTH AMERICA IN 2020

4.4 MOTOR MONITORING MARKET, BY OFFERING

FIGURE 16 HARDWARE SEGMENT HELD LARGEST SHARE OF MARKET IN 2026

4.5 MOTOR MONITORING MARKET, BY MONITORING PROCESS

FIGURE 17 ONLINE SEGMENT ACCOUNTED FOR LARGER SHARE OF MARKET IN 2026

4.6 MOTOR MONITORING MARKET, BY END-USER INDUSTRY

FIGURE 18 OIL & GAS SEGMENT EXPECTED TO HOLD LARGEST MARKET SHARE IN 2026

5 MARKET OVERVIEW (Page No. - 68)

5.1 INTRODUCTION

5.2 COVID-19 HEALTH ASSESSMENT

FIGURE 19 COVID-19 GLOBAL PROPAGATION

FIGURE 20 COVID-19 PROPAGATION IN SELECTED COUNTRIES

5.3 ROAD TO RECOVERY

FIGURE 21 RECOVERY ROAD FOR 2020 AND 2021

5.4 COVID-19 ECONOMIC ASSESSMENT

FIGURE 22 REVISED GDP FOR SELECT G20 COUNTRIES IN 2020

5.5 MARKET DYNAMICS

FIGURE 23 MOTOR MONITORING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.5.1 DRIVERS

5.5.1.1 Increasing adoption of industry 4.0 principles in manufacturing sector

FIGURE 24 INDUSTRIAL SENSORS MARKET, 2017–2020

5.5.1.2 Growing demand for predictive maintenance and analytics

5.5.1.3 Surging adoption of motor monitoring in transportation sector, especially in electric vehicles

FIGURE 25 GLOBAL EV (CARS) SALES, 2016–2020 (UNITS)

5.5.1.4 Increasing adoption of wireless technology in motor monitoring

5.5.2 RESTRAINTS

5.5.2.1 Limited technical know-how to manage monitoring solutions

5.5.2.2 Hesitation to adopt monitoring solutions due to high initial investment, especially in developing countries

5.5.3 OPPORTUNITIES

5.5.3.1 Growing focus on energy audits and regulations worldwide

5.5.3.2 Growing demand from aerospace and automotive industries

5.5.3.3 Advent of intelligent transportation system (ITS)

5.5.4 CHALLENGES

5.5.4.1 Long payback period on investment

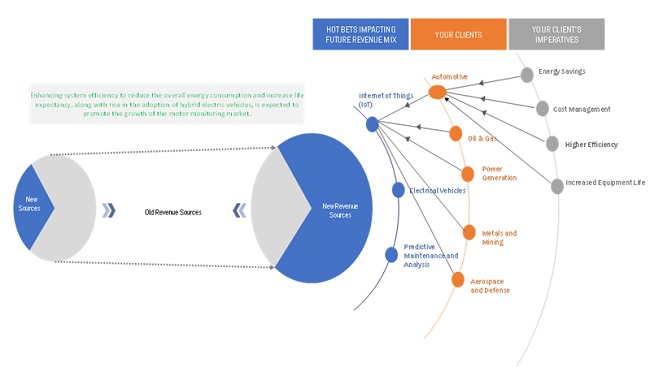

5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

5.6.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR MOTOR MONITORING PROVIDERS

FIGURE 26 REVENUE SHIFT FOR MARKET

5.7 MARKET MAP

TABLE 3 MOTOR MONITORING: ECOSYSTEM

FIGURE 27 MARKET MAP/ECOSYSTEM

5.8 VALUE CHAIN ANALYSIS

FIGURE 28 MOTOR MONITORING MARKET VALUE CHAIN ANALYSIS

5.8.1 RESEARCH, DESIGN, AND DEVELOPMENT

5.8.2 MONITORING SOLUTION DEVELOPMENT

5.8.3 SYSTEM INTEGRATION

5.8.4 SUPPLY AND DISTRIBUTION

5.8.5 END USERS

5.8.6 POST-SALES SERVICES

5.9 TECHNOLOGY ANALYSIS

5.9.1 MOTOR MONITORING MARKET BASED ON DIFFERENT TECHNOLOGIES

5.10 MOTOR MONITORING: CODES AND REGULATIONS

TABLE 4 MOTOR MONITORING: CODES AND REGULATIONS

5.11 INNOVATIONS AND PATENT REGISTRATIONS

TABLE 5 MOTOR MONITORING MARKET: INNOVATIONS AND PATENT REGISTRATIONS, FEBRUARY 2016– FEBRUARY 2021

5.12 CASE STUDY ANALYSIS

5.12.1 EMERSON’S ONLINE MACHINERY HEALTH MONITORING HELPS PHOSPHATE MINE PROTECT CRITICAL ASSETS AND AVOID DOWNTIME

5.12.2 FAULT DETECTION IN COMPONENTS OF SYNCHRONOUS MOTORS WITH PARTIAL DISCHARGE MONITORING

5.12.3 SIEMENS PROVIDED HIGH-PRECISION MOTOR MONITORING FOR ENGINE TEST BENCHES

5.13 PORTER’S FIVE FORCES ANALYSIS

TABLE 6 MOTOR MONITORING MARKET: PORTER’S FIVE FORCES ANALYSIS

FIGURE 29 PORTER’S FIVE FORCES ANALYSIS FOR MARKET

5.13.1 THREAT OF SUBSTITUTES

5.13.2 BARGAINING POWER OF SUPPLIERS

5.13.3 BARGAINING POWER OF BUYERS

5.13.4 THREAT OF NEW ENTRANTS

5.13.5 INTENSITY OF COMPETITIVE RIVALRY

6 MOTOR MONITORING MARKET, BY OFFERING (Page No. - 89)

6.1 INTRODUCTION

FIGURE 30 MOTOR MONITORING MARKET, BY OFFERING

TABLE 7 MOTOR MONITORING MARKET, BY OFFERING, 2019–2026 (USD MILLION)

6.2 HARDWARE

TABLE 8 MOTOR MONITORING HARDWARE MARKET, BY REGION, 2019–2026 (USD MILLION)

TABLE 9 MOTOR MONITORING HARDWARE MARKET, BY TYPE, 2019–2026 (USD MILLION)

6.2.1 VIBRATION SENSORS

6.2.1.1 Vibration sensors are generally used to detect mechanical issues related to motors

6.2.2 INFRARED SENSORS

6.2.2.1 Infrared sensors help in thermal monitoring of motors

6.2.3 CORROSION PROBES

6.2.3.1 Ever-present risk of corrosion in motors to increase corrosion probes demand

6.2.4 ULTRASOUND DETECTORS

6.2.4.1 Ultrasound detectors detect incipient faults in bearings and adequacy of lubricants

6.2.5 SPECTRUM ANALYZERS

6.2.5.1 Spectrum analyzers used to accurately depicts data sensed by current, vibration, and temperature sensors in motor monitoring

6.3 SOFTWARE

6.3.1 SOFTWARE PLAY A CRUCIAL ROLE IN ANALYZING DATA FOR PREDICTIVE MAINTENANCE OF MOTORS

TABLE 10 MOTOR MONITORING SOFTWARE MARKET, BY REGION, 2019–2026 (USD MILLION)

TABLE 11 MOTOR MONITORING SOFTWARE MARKET, BY TYPE, 2019–2026 (USD MILLION)

6.3.2 ANALYTICS SOFTWARE

6.3.3 DIAGNOSTIC SOFTWARE

6.4 SERVICES

TABLE 12 MOTOR MONITORING SERVICES MARKET, BY REGION, 2019–2026 (USD MILLION)

TABLE 13 MOTOR MONITORING SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

6.4.1 TRAINING SERVICES

6.4.1.1 Growth in monitoring market will drive demand for training services

6.4.2 DATA ANALYSIS SERVICES

6.4.2.1 Advent of remote monitoring to boost demand for data analysis services

6.4.3 TECHNICAL SUPPORT & MAINTENANCE SERVICES

6.4.3.1 Increasing demand for extending life of motors will boost need for maintenance services

7 MOTOR MONITORING MARKET, BY DEPLOYMENT (Page No. - 97)

7.1 INTRODUCTION

FIGURE 31 MOTOR MONITORING MARKET, BY DEPLOYMENT, 2020

TABLE 14 MARKET, BY DEPLOYMENT, 2019–2026 (USD MILLION)

7.2 ON-PREMISE

7.2.1 SECURITY CONCERNS RELATED TO SENSITIVE DATA AND ABILITY TO ENSURE FULL CONTROL OVER DATA IS EXPECTED TO FUEL DEMAND FOR ON-PREMISE DEPLOYMENT

TABLE 15 MARKET FOR ON-PREMISE DEPLOYMENT, BY REGION, 2019–2026 (USD MILLION)

7.3 CLOUD

7.3.1 EASE OF DEPLOYMENT, COST-EFFECTIVENESS, AND SCALABILITY TO DRIVE DEMAND FOR CLOUD DEPLOYMENT OF MOTOR MONITORING SOLUTIONS

TABLE 16 MARKET FOR CLOUD DEPLOYMENT, BY REGION, 2019–2026 (USD MILLION)

8 MOTOR MONITORING MARKET, BY MONITORING PROCESS (Page No. - 101)

8.1 INTRODUCTION

FIGURE 32 MOTOR MONITORING MARKET, BY MONITORING PROCESS, 2020

TABLE 17 MARKET, BY MONITORING PROCESS, 2019–2026 (USD MILLION)

8.2 ONLINE

8.2.1 ONLINE MONITORING PROCESS IS ESSENTIAL FOR PLANTS RUNNING 24/7, MISSION-CRITICAL APPLICATIONS, AND REMOTE PLANTS

TABLE 18 MARKET FOR ONLINE MONITORING PROCESS, BY REGION, 2019–2026 (USD MILLION)

8.3 OFFLINE/PORTABLE

8.3.1 PORTABLE MONITORING PROCESS IS SIGNIFICANTLY USED IN MOTORS OPERATING IN LESS CRITICAL OR SEMI-CRITICAL OPERATIONS

TABLE 19 MARKET FOR OFFLINE/PORTABLE MONITORING PROCESS, BY REGION, 2019–2026 (USD MILLION)

9 MOTOR MONITORING MARKET, BY END-USER INDUSTRY (Page No. - 105)

9.1 INTRODUCTION

FIGURE 33 MOTOR MONITORING MARKET, BY END-USER INDUSTRY, 2020

TABLE 20 MARKET, BY END-USER INDUSTRY, 2019–2026 (USD MILLION)

9.2 OIL & GAS

9.2.1 REMOTE PLANT LOCATIONS AND HIGH SAFETY STANDARDS REQUIRE MOTOR MONITORING SOLUTIONS

TABLE 21 MARKET FOR OIL & GAS, BY REGION, 2019–2026 (USD MILLION)

9.3 METALS & MINING

9.3.1 CONCERN OVER RELIABILITY AND SAFETY TO DRIVE DEMAND FOR MOTOR MONITORING IN MINING

TABLE 22 MARKET FOR METALS & MINING, BY REGION, 2019–2026 (USD MILLION)

9.4 POWER GENERATION

9.4.1 GROWING DEMAND FOR POWER AND INCREASING PENETRATION OF INFORMATION TECHNOLOGY IN POWER GENERATION TO DRIVE MARKET FOR MOTOR MONITORING

TABLE 23 MARKET FOR POWER GENERATION, BY REGION, 2019–2026 (USD MILLION)

9.5 AUTOMOTIVE

9.5.1 INCREASING DEMAND FOR EVS AND EFFICIENT MANUFACTURING PROCESS TO DRIVE MARKET FOR MOTOR MONITORING

TABLE 24 MARKET FOR AUTOMOTIVE, BY REGION, 2019–2026 (USD MILLION)

9.6 CHEMICALS

9.6.1 NEED TO REDUCE EXPENSIVE DOWNTIME TO AUGMENT DEMAND FOR MOTOR MONITORING SYSTEMS IN CHEMICALS INDUSTRY

TABLE 25 MARKET FOR CHEMICALS, BY REGION, 2019–2026 (USD MILLION)

9.7 WATER & WASTEWATER TREATMENT

9.7.1 INTENSIFYING NEED TO OPTIMIZE WATER SUPPLY AND WASTEWATER TREATMENT PROCESSES IS EXPECTED TO FUEL DEMAND FOR MOTOR MONITORING

TABLE 26 MARKET FOR WATER & WASTEWATER TREATMENT, BY REGION, 2019–2026 (USD MILLION)

9.8 FOOD & BEVERAGES

9.8.1 NEED TO PREVENT EQUIPMENT FAILURE, REDUCE OVERHEAD COST, AND IMPROVE PERFORMANCE OF CRITICAL ASSETS IS EXPECTED TO DRIVE DEMAND FOR MOTOR MONITORING SOLUTIONS

TABLE 27 MARKET FOR FOOD & BEVERAGES, BY REGION, 2019–2026 (USD MILLION)

9.9 AEROSPACE & DEFENSE

9.9.1 NEED TO PREVENT UNPLANNED DOWNTIME IN MISSION-CRITICAL SCENARIOS DUE TO MOTOR FAILURE IN AEROSPACE & DEFENSE INDUSTRY TO FUEL DEMAND FOR MOTOR MONITORING SOLUTIONS

TABLE 28 MARKET FOR AEROSPACE & DEFENSE, BY REGION, 2019–2026 (USD MILLION)

9.10 OTHERS

TABLE 29 MARKET FOR OTHERS, BY REGION, 2019–2026 (USD MILLION)

10 MOTOR MONITORING MARKET, BY REGION (Page No. - 116)

10.1 INTRODUCTION

FIGURE 34 MARKET, BY REGION, 2020

FIGURE 35 ASIA PACIFIC MARKET TO REGISTER HIGHEST CAGR FROM 2021 TO 2026

TABLE 30 MARKET, BY REGION, 2019–2026 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 36 SNAPSHOT: MARKET IN NORTH AMERICA

10.2.1 BY OFFERING

TABLE 31 NORTH AMERICA: MARKET, BY OFFERING, 2019–2026 (USD MILLION)

TABLE 32 NORTH AMERICA: MARKET FOR HARDWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 33 NORTH AMERICA: MARKET FOR SOFTWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 34 NORTH AMERICA: MARKET FOR SERVICES, BY TYPE, 2019–2026 (USD MILLION)

10.2.2 BY DEPLOYMENT

TABLE 35 NORTH AMERICA: MARKET, BY DEPLOYMENT, 2019–2026 (USD MILLION)

10.2.3 BY MONITORING PROCESS

TABLE 36 NORTH AMERICA: MARKET, BY MONITORING PROCESS, 2019–2026 (USD MILLION)

10.2.4 BY END-USER INDUSTRY

TABLE 37 NORTH AMERICA: MARKET, BY END-USER INDUSTRY, 2019–2026 (USD MILLION)

10.2.5 BY COUNTRY

TABLE 38 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

10.2.5.1 US

10.2.5.1.1 Initiatives to promote adoption of Industry 4.0 technologies to drive growth of motor monitoring market in US

10.2.5.1.2 By offering

TABLE 39 US: MARKET, BY OFFERING, 2019–2026 (USD MILLION)

TABLE 40 US: MARKET FOR HARDWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 41 US: MARKET FOR SOFTWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 42 US: MARKET FOR SERVICES, BY TYPE, 2019–2026 (USD MILLION)

10.2.5.1.3 By deployment

TABLE 43 US: MARKET, BY DEPLOYMENT, 2019–2026 (USD MILLION)

10.2.5.1.4 By monitoring process

TABLE 44 US: MARKET, BY MONITORING PROCESS, 2019–2026 (USD MILLION)

10.2.5.1.5 By end-user industry

TABLE 45 US: MARKET, BY END-USER INDUSTRY, 2019–2026 (USD MILLION)

10.2.5.2 Canada

10.2.5.2.1 Growing investments in mining and power generation industries and adoption of advanced technologies to boost demand for motor monitoring solutions in Canada

10.2.5.2.2 By offering

TABLE 46 CANADA: MARKET, BY OFFERING, 2019–2026 (USD MILLION)

TABLE 47 CANADA: MARKET FOR HARDWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 48 CANADA: MARKET FOR SOFTWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 49 CANADA: MARKET FOR SERVICES, BY TYPE, 2019–2026 (USD MILLION)

10.2.5.2.3 By deployment

TABLE 50 CANADA: MARKET, BY DEPLOYMENT, 2019–2026 (USD MILLION)

10.2.5.2.4 By monitoring process

TABLE 51 CANADA: MARKET, BY MONITORING PROCESS, 2019–2026 (USD MILLION)

10.2.5.2.5 By end-user industry

TABLE 52 CANADA: MARKET, BY END-USER INDUSTRY, 2019–2026 (USD MILLION)

10.2.5.3 Mexico

10.2.5.3.1 Increasing investments in metals and mining vertical to fuel demand for motor monitoring solutions in Mexico

10.2.5.3.2 By offering

TABLE 53 MEXICO: MARKET, BY OFFERING, 2019–2026 (USD MILLION)

TABLE 54 MEXICO: MARKET FOR HARDWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 55 MEXICO: MARKET FOR SOFTWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 56 MEXICO: MARKET FOR SERVICES, BY TYPE, 2019–2026 (USD MILLION)

10.2.5.3.3 By deployment

TABLE 57 MEXICO: MARKET, BY DEPLOYMENT, 2019–2026 (USD MILLION)

10.2.5.3.4 By monitoring process

TABLE 58 MEXICO: MARKET, BY MONITORING PROCESS, 2019–2026 (USD MILLION)

10.2.5.3.5 By end-user industry

TABLE 59 MEXICO: MARKET, BY END-USER INDUSTRY, 2019–2026 (USD MILLION)

10.3 ASIA PACIFIC

FIGURE 37 SNAPSHOT: MARKET IN ASIA PACIFIC

10.3.1 BY OFFERING

TABLE 60 APAC: MARKET, BY OFFERING, 2019–2026 (USD MILLION)

TABLE 61 APAC: MARKET FOR HARDWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 62 APAC: MOTOR MONITORING MARKE FOR SOFTWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 63 APAC: MARKET FOR SERVICES, BY TYPE, 2019–2026 (USD MILLION)

10.3.2 BY DEPLOYMENT

TABLE 64 APAC: MARKET, BY DEPLOYMENT, 2019–2026 (USD MILLION)

10.3.3 BY MONITORING PROCESS

TABLE 65 APAC: MARKET, BY MONITORING PROCESS, 2019–2026 (USD MILLION)

10.3.4 BY END-USER INDUSTRY

TABLE 66 APAC: MARKET, BY END-USER INDUSTRY, 2019–2026 (USD MILLION)

10.3.5 BY COUNTRY

TABLE 67 APAC: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

10.3.5.1 China

10.3.5.1.1 Rapid manufacturing growth and increasing high-end automation in China to fuel motor monitoring market growth

10.3.5.1.2 By offering

TABLE 68 CHINA: MARKET, BY OFFERING, 2019–2026 (USD MILLION)

TABLE 69 CHINA: MARKET FOR HARDWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 70 CHINA: MARKET FOR SOFTWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 71 CHINA: MARKET FOR SERVICES, BY TYPE, 2019–2026 (USD MILLION)

10.3.5.1.3 By deployment

TABLE 72 CHINA: MARKET, BY DEPLOYMENT, 2019–2026 (USD MILLION)

10.3.5.1.4 By monitoring process

TABLE 73 CHINA: MARKET, BY MONITORING PROCESS, 2019–2026 (USD MILLION)

10.3.5.1.5 By end-user Industry

TABLE 74 CHINA: MARKET, BY END-USER INDUSTRY, 2019–2026 (USD MILLION)

10.3.5.2 Japan

10.3.5.2.1 Demand from automotive sector to boost motor monitoring market growth

10.3.5.2.2 By offering

TABLE 75 JAPAN: MARKET, BY OFFERING, 2019–2026 (USD MILLION)

TABLE 76 JAPAN: MARKET FOR HARDWARE, BY TYPE 2019–2026 (USD MILLION)

TABLE 77 JAPAN: MARKET FOR SOFTWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 78 JAPAN: MARKET FOR SERVICES, BY TYPE, 2019–2026 (USD MILLION)

10.3.5.2.3 By deployment

TABLE 79 JAPAN: MARKET, BY DEPLOYMENT, 2019–2026 (USD MILLION)

10.3.5.2.4 By monitoring process

TABLE 80 JAPAN: MARKET, BY MONITORING PROCESS, 2019–2026 (USD MILLION)

10.3.5.2.5 By end-user Industry

TABLE 81 JAPAN: MARKET, BY END-USER INDUSTRY, 2019–2026 (USD MILLION)

10.3.5.3 South Korea

10.3.5.3.1 Government policies to boost advanced manufacturing likely to increase demand for motor monitoring

10.3.5.3.2 By offering

TABLE 82 SOUTH KOREA: MARKET, BY OFFERING, 2019–2026 (USD MILLION)

TABLE 83 SOUTH KOREA: MARKET FOR HARDWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 84 SOUTH KOREA: MARKET FOR SOFTWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 85 SOUTH KOREA: MARKET FOR SERVICES, BY TYPE, 2019–2026 (USD MILLION)

10.3.5.3.3 By deployment

TABLE 86 SOUTH KOREA: MARKET, BY DEPLOYMENT, 2019–2026 (USD MILLION)

10.3.5.3.4 By monitoring process

TABLE 87 SOUTH KOREA: MARKET, BY MONITORING PROCESS, 2019–2026 (USD MILLION)

10.3.5.3.5 By end-user Industry

TABLE 88 SOUTH KOREA: MARKET, BY END-USER INDUSTRY, 2019–2026 (USD MILLION)

10.3.5.4 India

10.3.5.4.1 Favorable government initiative for manufacturing sector to increase motor monitoring demand

10.3.5.4.2 By offering

TABLE 89 INDIA: MARKET, BY OFFERING, 2019–2026 (USD MILLION)

TABLE 90 INDIA: MARKET SIZE FOR HARDWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 91 INDIA: MARKET FOR SOFTWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 92 INDIA: MARKET FOR SERVICES, BY TYPE 2019–2026 (USD MILLION)

10.3.5.4.3 By deployment

TABLE 93 INDIA: MARKET, BY DEPLOYMENT, 2019–2026 (USD MILLION)

10.3.5.4.4 By monitoring process

TABLE 94 INDIA: MARKET, BY MONITORING PROCESS, 2019–2026 (USD MILLION)

10.3.5.4.5 By end-user Industry

TABLE 95 INDIA: MARKET, BY END-USER INDUSTRY, 2019–2026 (USD MILLION)

10.3.5.5 Australia

10.3.5.5.1 Increase in minerals and resource mining will drive motor monitoring market growth in Australia

10.3.5.5.2 By offering

TABLE 96 AUSTRALIA: MARKET, BY OFFERING, 2019–2026 (USD MILLION)

TABLE 97 AUSTRALIA: MARKET FOR HARDWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 98 AUSTRALIA: MARKET FOR SOFTWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 99 AUSTRALIA: MARKET FOR SERVICES, BY TYPE, 2019–2026 (USD MILLION)

10.3.5.5.3 By deployment

TABLE 100 AUSTRALIA: MARKET, BY DEPLOYMENT, 2019–2026 (USD MILLION)

10.3.5.5.4 By monitoring process

TABLE 101 AUSTRALIA: MARKET, BY MONITORING PROCESS, 2019–2026 (USD MILLION)

10.3.5.5.5 By end-user industry

TABLE 102 AUSTRALIA: MARKET SIZE, BY END-USER INDUSTRY, 2019–2026 (USD MILLION)

10.3.5.6 Rest of APAC

10.3.5.6.1 By offering

TABLE 103 REST OF APAC: MARKET, BY OFFERING, 2019–2026 (USD MILLION)

TABLE 104 REST OF APAC: MARKET FOR HARDWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 105 REST OF APAC: MARKET FOR SOFTWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 106 REST OF APAC: MARKET FOR SERVICES, BY TYPE, 2019–2026 (USD MILLION)

10.3.5.6.2 By deployment

TABLE 107 REST OF APAC: MARKET, BY DEPLOYMENT, 2019–2026 (USD MILLION)

10.3.5.6.3 By monitoring process

TABLE 108 REST OF APAC: MARKET, BY MONITORING PROCESS, 2019–2026 (USD MILLION)

10.3.5.6.4 By end-user industry

TABLE 109 REST OF APAC: MARKET SIZE, BY END-USER INDUSTRY, 2019–2026 (USD MILLION)

10.4 EUROPE

10.4.1 BY OFFERING

TABLE 110 EUROPE: MARKET, BY OFFERING, 2019–2026 (USD MILLION)

TABLE 111 EUROPE: MARKET FOR HARDWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 112 EUROPE: MARKET FOR SOFTWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 113 EUROPE: MARKET FOR SERVICES, BY TYPE, 2019–2026 (USD MILLION)

10.4.2 BY DEPLOYMENT

TABLE 114 EUROPE: MARKET, BY DEPLOYMENT, 2019–2026 (USD MILLION)

10.4.3 BY MONITORING PROCESS

TABLE 115 EUROPE: MARKET, BY MONITORING PROCESS, 2019–2026 (USD MILLION)

10.4.4 BY END-USER INDUSTRY

TABLE 116 EUROPE: MARKET, BY END-USER INDUSTRY, 2019–2026 (USD MILLION)

10.4.5 BY COUNTRY

TABLE 117 EUROPE: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

10.4.5.1 Germany

10.4.5.1.1 Growing automotive industry and increasing penetration of industrial IoT is likely to fuel growth of motor monitoring market in Germany

10.4.5.1.2 By offering

TABLE 118 GERMANY: MARKET, BY OFFERING, 2019–2026 (USD MILLION)

TABLE 119 GERMANY: MARKET FOR HARDWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 120 GERMANY: MARKET FOR SOFTWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 121 GERMANY: MARKET FOR SERVICES, BY TYPE, 2019–2026 (USD MILLION)

10.4.5.1.3 By deployment

TABLE 122 GERMANY: MARKET, BY DEPLOYMENT, 2019–2026 (USD MILLION)

10.4.5.1.4 By monitoring process

TABLE 123 GERMANY: MARKET, BY MONITORING PROCESS, 2019–2026 (USD MILLION)

10.4.5.1.5 By end-user industry

TABLE 124 GERMANY: MARKET, BY END-USER INDUSTRY, 2019–2026 (USD MILLION)

10.4.5.2 UK

10.4.5.2.1 Push towards clean energy and innovations in automation market will act as a catalyst motor monitoring market

10.4.5.2.2 By offering

TABLE 125 UK: MARKET, BY OFFERING, 2019–2026 (USD MILLION)

TABLE 126 UK: MARKET FOR HARDWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 127 UK: MARKET FOR SOFTWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 128 UK: MARKET FOR SERVICE, BY TYPE, 2019–2026 (USD MILLION)

10.4.5.2.3 By deployment

TABLE 129 UK: MARKET, BY DEPLOYMENT, 2019–2026 (USD MILLION)

10.4.5.2.4 By monitoring process

TABLE 130 UK: MARKET SIZE, BY MONITORING PROCESS, 2019–2026 (USD MILLION)

10.4.5.2.5 By end-user Industry

TABLE 131 UK: MARKET, BY END-USER INDUSTRY, 2019–2026 (USD MILLION)

10.4.5.3 Italy

10.4.5.3.1 Demand from automotive sector to substantiate motor monitoring market growth in Italy

10.4.5.3.2 By offering

TABLE 132 ITALY: MARKET, BY OFFERING, 2019–2026 (USD MILLION)

TABLE 133 ITALY: MARKET FOR HARDWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 134 ITALY: MARKET FOR SOFTWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 135 ITALY: MARKET SIZE, BY OFFERING, BY SERVICE, 2019–2026 (USD MILLION)

10.4.5.3.3 By deployment

TABLE 136 ITALY: MARKET, BY DEPLOYMENT, 2019–2026 (USD MILLION)

10.4.5.3.4 By monitoring process

TABLE 137 ITALY: MARKET, BY MONITORING PROCESS, 2019–2026 (USD MILLION)

10.4.5.3.5 By end-user industry

TABLE 138 ITALY: MARKET, BY END-USER INDUSTRY, 2019–2026 (USD MILLION)

10.4.5.4 France

10.4.5.4.1 Development of EV charging infrastructures and increasing investment in the power generation industry to drive demand for motor monitoring solutions in France

10.4.5.4.2 By offering

TABLE 139 FRANCE: MARKET, BY OFFERING, 2019–2026 (USD MILLION)

TABLE 140 FRANCE: MARKET FOR HARDWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 141 FRANCE: MARKET FOR SOFTWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 142 FRANCE: MARKET FOR SERVICES, BY TYPE, 2019–2026 (USD MILLION)

10.4.5.4.3 By deployment

TABLE 143 FRANCE: MARKET, BY DEPLOYMENT, 2019–2026 (USD MILLION)

10.4.5.4.4 By monitoring process

TABLE 144 FRANCE: MARKET SIZE, BY MONITORING PROCESS, 2019–2026 (USD MILLION)

10.4.5.4.5 By end-user industry

TABLE 145 FRANCE: MARKET, BY END-USER INDUSTRY, 2019–2026 (USD MILLION)

10.4.5.5 Russia

10.4.5.5.1 Government policies to boost EV industry and boost in mining industry likely to fuel demand for motor monitoring in Russia

10.4.5.5.2 By Offering

TABLE 146 RUSSIA: MARKET, BY OFFERING, 2019–2026 (USD MILLION)

TABLE 147 RUSSIA: MARKET FOR HARDWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 148 RUSSIA: MARKET FOR SOFTWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 149 RUSSIA: MARKET FOR SERVICES, BY TYPE, 2019–2026 (USD MILLION)

10.4.5.5.3 By deployment

TABLE 150 RUSSIA: MARKET, BY DEPLOYMENT, 2019–2026 (USD MILLION)

10.4.5.5.4 By monitoring process

TABLE 151 RUSSIA: MARKET SIZE, BY MONITORING PROCESS, 2019–2026 (USD MILLION)

10.4.5.5.5 By end-user industry

TABLE 152 RUSSIA: MOTOR MONITORING MARKET, BY END-USER INDUSTRY, 2019–2026 (USD MILLION)

10.4.5.6 Rest of Europe

10.4.5.6.1 By offering

TABLE 153 REST OF EUROPE: MARKET, BY OFFERING, 2019–2026 (USD MILLION)

TABLE 154 REST OF EUROPE: MARKET FOR HARDWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 155 REST OF EUROPE: MARKET FOR SOFTWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 156 REST OF EUROPE: MARKET FOR SERVICES, BY TYPE, 2019–2026 (USD MILLION)

10.4.5.6.2 By deployment

TABLE 157 REST OF EUROPE: MARKET, BY DEPLOYMENT, 2019–2026 (USD MILLION)

10.4.5.6.3 By monitoring process

TABLE 158 REST OF EUROPE: MARKET SIZE, BY MONITORING PROCESS, 2019–2026 (USD MILLION)

10.4.5.6.4 By end-user industry

TABLE 159 REST OF EUROPE: MARKET, BY END-USER INDUSTRY, 2019–2026 (USD MILLION)

10.5 SOUTH AMERICA

10.5.1 BY OFFERING

TABLE 160 SOUTH AMERICA: MARKET, BY OFFERING, 2019–2026 (USD MILLION)

TABLE 161 SOUTH AMERICA: MARKET FOR HARDWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 162 SOUTH AMERICA: MARKET FOR SOFTWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 163 SOUTH AMERICA: MARKET FOR SERVICES, BY TYPE, 2019–2026 (USD MILLION)

10.5.2 BY DEPLOYMENT

TABLE 164 SOUTH AMERICA: MARKET, BY DEPLOYMENT, 2019–2026 (USD MILLION)

10.5.3 BY MONITORING PROCESS

TABLE 165 SOUTH AMERICA: MARKET, BY MONITORING PROCESS, 2019–2026 (USD MILLION)

10.5.4 BY END-USER INDUSTRY

TABLE 166 SOUTH AMERICA: MARKET, BY END-USER INDUSTRY, 2019–2026 (USD MILLION)

10.5.5 BY COUNTRY

TABLE 167 SOUTH AMERICA: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

10.5.5.1 Brazil

10.5.5.1.1 Increasing investments for industrialization and growing offshore exploration and production activities to fuel market growth

10.5.5.1.2 By Offering

TABLE 168 BRAZIL: MARKET, BY OFFERING, 2019–2026 (USD MILLION)

TABLE 169 BRAZIL: MARKET FOR HARDWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 170 BRAZIL: MARKET FOR SOFTWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 171 BRAZIL: MARKET FOR SERVICES, BY TYPE, 2019–2026 (USD MILLION)

10.5.5.1.3 By Deployment

TABLE 172 BRAZIL: MARKET, BY DEPLOYMENT, 2019–2026 (USD MILLION)

10.5.5.1.4 By Monitoring Process

TABLE 173 BRAZIL: MARKET, BY MONITORING PROCESS, 2019–2026 (USD MILLION)

10.5.5.1.5 By End-user Industry

TABLE 174 BRAZIL: MARKET, BY END-USER INDUSTRY, 2019–2026 (USD MILLION)

10.5.5.2 Argentina

10.5.5.2.1 Growing exploration of gas fields to fuel demand for motor monitoring in Argentina

10.5.5.2.2 By Offering

TABLE 175 ARGENTINA: MARKET, BY OFFERING, 2019–2026 (USD MILLION)

TABLE 176 ARGENTINA: MARKET FOR HARDWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 177 ARGENTINA: MARKET FOR SOFTWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 178 ARGENTINA: MARKET FOR SERVICE, BY TYPE 2019–2026 (USD MILLION)

10.5.5.2.3 By Deployment

TABLE 179 ARGENTINA: MARKET, BY DEPLOYMENT, 2019–2026 (USD MILLION)

10.5.5.2.4 By Monitoring Process

TABLE 180 ARGENTINA: MARKET, BY MONITORING PROCESS, 2019–2026 (USD MILLION)

10.5.5.2.5 By End-user Industry

TABLE 181 ARGENTINA: MARKET, BY END-USER INDUSTRY, 2019–2026 (USD MILLION)

10.5.5.3 Rest of South America

10.5.5.3.1 By Offering

TABLE 182 REST OF SOUTH AMERICA: MARKET, BY OFFERING, 2019–2026 (USD MILLION)

TABLE 183 REST OF SOUTH AMERICA: MARKET FOR HARDWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 184 REST OF SOUTH AMERICA: MARKET FOR SOFTWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 185 REST OF SOUTH AMERICA: MARKET FOR SERVICES, BY TYPE, 2019–2026 (USD MILLION)

10.5.5.3.2 By Deployment

TABLE 186 REST OF SOUTH AMERICA: MARKET, BY DEPLOYMENT, 2019–2026 (USD MILLION)

10.5.5.3.3 By Monitoring Process

TABLE 187 REST OF SOUTH AMERICA: MARKET, BY MONITORING PROCESS, 2019–2026 (USD MILLION)

10.5.5.3.4 By End-user Industry

TABLE 188 REST OF SOUTH AMERICA: MARKET, BY END-USER INDUSTRY, 2019–2026 (USD MILLION)

10.6 MIDDLE EAST & AFRICA

10.6.1 BY OFFERING

TABLE 189 MIDDLE EAST & AFRICA: MARKET, BY OFFERING, 2019–2026 (USD MILLION)

TABLE 190 MIDDLE EAST & AFRICA: MARKET FOR HARDWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 191 MIDDLE EAST & AFRICA: MARKET FOR SOFTWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 192 MIDDLE EAST & AFRICA: MARKET FOR SERVICE, BY TYPE, 2019–2026 (USD MILLION)

10.6.2 BY DEPLOYMENT

TABLE 193 MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT, 2019–2026 (USD MILLION)

10.6.3 BY MONITORING PROCESS

TABLE 194 MIDDLE EAST & AFRICA: MARKET, BY MONITORING PROCESS, 2019–2026 (USD MILLION)

10.6.4 BY END-USER INDUSTRY

TABLE 195 MIDDLE EAST & AFRICA: MARKET, BY END-USER INDUSTRY, 2019–2026 (USD MILLION)

10.6.5 BY COUNTRY

TABLE 196 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

10.6.5.1 Saudi Arabia

10.6.5.1.1 Demand from oil & gas industry to drive growth of motor monitoring market in Saudi Arabia

10.6.5.1.2 By offering

TABLE 197 SAUDI ARABIA: MARKET, BY OFFERING, 2019–2026 (USD MILLION)

TABLE 198 SAUDI ARABIA: MARKET FOR HARDWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 199 SAUDI ARABIA: MARKET FOR SOFTWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 200 SAUDI ARABIA: MARKET FOR SERVICES, BY TYPE, 2019–2026 (USD MILLION)

10.6.5.1.3 By deployment

TABLE 201 SAUDI ARABIA: MARKET, BY DEPLOYMENT, 2019–2026 (USD MILLION)

10.6.5.1.4 By monitoring process

TABLE 202 SAUDI ARABIA: MARKET, BY MONITORING PROCESS, 2019–2026 (USD MILLION)

10.6.5.1.5 By end-user industry

TABLE 203 SAUDI ARABIA: MARKET, BY END-USER INDUSTRY, 2019–2026 (USD MILLION)

10.6.5.2 UAE

10.6.5.2.1 Government focus to boost manufacturing sector in UAE is likely to bring revenue for motor monitoring market

10.6.5.2.2 By offering

TABLE 204 UAE: MARKET BY OFFERING, 2019–2026 (USD MILLION)

TABLE 205 UAE: MARKET FOR HARDWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 206 UAE: MARKET FOR SOFTWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 207 UAE: MARKET FOR SERVICES, BY TYPE, 2019–2026 (USD MILLION)

10.6.5.2.3 By deployment

TABLE 208 UAE: MARKET, BY DEPLOYMENT, 2019–2026 (USD MILLION)

10.6.5.2.4 By monitoring process

TABLE 209 UAE: MARKET, BY MONITORING PROCESS, 2019–2026 (USD MILLION)

10.6.5.2.5 By end-user industry

TABLE 210 UAE: MARKET, BY END-USER INDUSTRY, 2019–2026 (USD MILLION)

10.6.5.3 Turkey

10.6.5.3.1 Demand from agriculture industry to bring revenue for motor monitoring market in Turkey

10.6.5.3.2 By offering

TABLE 211 TURKEY: MARKET, BY OFFERING, 2019–2026 (USD MILLION)

TABLE 212 TURKEY: MARKET FOR HARDWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 213 TURKEY: MARKET FOR SOFTWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 214 TURKEY: MARKET FOR SERVICES, BY TYPE, 2019–2026 (USD MILLION)

10.6.5.3.3 By deployment

TABLE 215 TURKEY: MARKET, BY DEPLOYMENT, 2019–2026 (USD MILLION)

10.6.5.3.4 By monitoring process

TABLE 216 TURKEY: MARKET, BY MONITORING PROCESS, 2019–2026 (USD MILLION)

10.6.5.3.5 By end-user industry

TABLE 217 TURKEY: MARKET, BY END-USER INDUSTRY, 2019–2026 (USD MILLION)

10.6.5.4 Qatar

10.6.5.4.1 Rising industrial activities likely to offer growth opportunities for motor monitoring market

10.6.5.4.2 By offering

TABLE 218 QATAR: MARKET, BY OFFERING, 2019–2026 (USD MILLION)

TABLE 219 QATAR: MARKET FOR HARDWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 220 QATAR: MARKET FOR SOFTWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 221 QATAR: MARKET FOR SERVICES, BY TYPE, 2019–2026 (USD MILLION)

10.6.5.4.3 By deployment

TABLE 222 QATAR: MARKET, BY DEPLOYMENT, 2019–2026 (USD MILLION)

10.6.5.4.4 By monitoring process

TABLE 223 QATAR: MARKET, BY MONITORING PROCESS, 2019–2026 (USD MILLION)

10.6.5.4.5 By end-user industry

TABLE 224 QATAR: MARKET, BY END-USER INDUSTRY, 2019–2026 (USD MILLION)

10.6.5.5 South Africa

10.6.5.5.1 Increasing demand from mining industry will substantiate growth of motor monitoring market in South Africa

10.6.5.5.2 By offering

TABLE 225 SOUTH AFRICA: MARKET, BY OFFERING, 2019–2026 (USD MILLION)

TABLE 226 SOUTH AFRICA: MARKET FOR HARDWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 227 SOUTH AFRICA: MARKET FOR SOFTWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 228 SOUTH AFRICA: MARKET FOR SERVICES, BY TYPE, 2019–2026 (USD MILLION)

10.6.5.5.3 By deployment

TABLE 229 SOUTH AFRICA: MARKET, BY DEPLOYMENT, 2019–2026 (USD MILLION)

10.6.5.5.4 By monitoring process

TABLE 230 SOUTH AFRICA: MARKET, BY MONITORING PROCESS, 2019–2026 (USD MILLION)

10.6.5.5.5 By end-user industry

TABLE 231 SOUTH AFRICA: MARKET, BY END-USER INDUSTRY, 2019–2026 (USD MILLION)

10.6.5.6 Rest of MEA

10.6.5.6.1 By offering

TABLE 232 REST OF MEA: MARKET, BY OFFERING, 2019–2026 (USD MILLION)

TABLE 233 REST OF MEA: MARKET FOR HARDWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 234 REST OF MEA: MARKET FOR SOFTWARE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 235 REST OF MEA: MARKET FOR SERVICES, BY TYPE, 2019–2026 (USD MILLION)

10.6.5.6.2 By deployment

TABLE 236 REST OF MEA: MARKET, BY DEPLOYMENT, 2019–2026 (USD MILLION)

10.6.5.6.3 By monitoring process

TABLE 237 REST OF MEA: MARKET, BY MONITORING PROCESS, 2019–2026 (USD MILLION)

10.6.5.6.4 By end-user industry

TABLE 238 REST OF MEA: MARKET, BY END-USER INDUSTRY, 2019–2026 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 213)

11.1 KEY PLAYERS STRATEGIES

TABLE 239 OVERVIEW OF KEY STRATEGIES DEPLOYED BY TOP PLAYERS, AUGUST 2017– SEPTEMBER 2021

11.2 MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS

TABLE 240 MOTOR MONITORING MARKET: DEGREE OF COMPETITION

FIGURE 38 MOTOR MONITORING MARKET SHARE ANALYSIS, 2020

11.3 REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS

FIGURE 39 TOP PLAYERS IN MARKET FROM 2016 TO 2020

11.4 COMPANY EVALUATION QUADRANT

11.4.1 STAR

11.4.2 PERVASIVE

11.4.3 EMERGING LEADER

11.4.4 PARTICIPANT

FIGURE 40 COMPETITIVE LEADERSHIP MAPPING: MOTOR MONITORING MARKET, 2020

11.5 START-UP/SME EVALUATION QUADRANT

11.5.1 PROGRESSIVE COMPANY

11.5.2 RESPONSIVE COMPANY

11.5.3 DYNAMIC COMPANY

11.5.4 STARTING BLOCK

FIGURE 41 MARKET: START-UP/SME EVALUATION QUADRANT, 2020

11.6 MOTOR MONITORING MARKET: COMPANY FOOTPRINT

TABLE 241 BY OFFERING: COMPANY FOOTPRINT

TABLE 242 BY REGION: COMPANY FOOTPRINT

TABLE 243 COMPANY FOOTPRINT

11.7 COMPETITIVE SCENARIO

TABLE 244 MARKET: PRODUCT LAUNCHES, AUGUST 2017– OCTOBER 2020

TABLE 245 MARKET: DEALS, OCTOBER 2020– SEPTEMBER 2021

TABLE 246 MARKET: OTHERS, MARCH 2018 – AUGUST 2020

12 COMPANY PROFILES (Page No. - 229)

12.1 KEY PLAYERS

(Business and financial overview, Products/solutions/services offered, Recent Developments, MNM view)*

12.1.1 ABB

TABLE 247 ABB: BUSINESS OVERVIEW

FIGURE 42 ABB: COMPANY SNAPSHOT, 2020

TABLE 248 ABB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 249 ABB: PRODUCT LAUNCHES

TABLE 250 ABB: DEALS

TABLE 251 ABB: OTHERS

12.1.2 GENERAL ELECTRIC

TABLE 252 GENERAL ELECTRIC: BUSINESS OVERVIEW

FIGURE 43 GENERAL ELECTRIC: COMPANY SNAPSHOT, 2020

TABLE 253 GENERAL ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 254 GENERAL ELECTRIC: PRODUCT LAUNCHES

12.1.3 SIEMENS

TABLE 255 SIEMENS: BUSINESS OVERVIEW

FIGURE 44 SIEMENS: COMPANY SNAPSHOT, 2021

TABLE 256 SIEMENS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 257 SIEMENS: PRODUCT LAUNCHES

TABLE 258 SIEMENS: DEALS

12.1.4 HONEYWELL

TABLE 259 HONEYWELL: BUSINESS OVERVIEW

FIGURE 45 HONEYWELL: COMPANY SNAPSHOT, 2020

TABLE 260 HONEYWELL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 261 HONEYWELL: PRODUCT LAUNCHES

TABLE 262 HONEYWELL: OTHERS

12.1.5 SCHNEIDER ELECTRIC

TABLE 263 SCHNEIDER ELECTRIC: BUSINESS OVERVIEW

FIGURE 46 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT, 2020

TABLE 264 SCHNEIDER ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 265 SCHNEIDER ELECTRIC: DEALS

12.1.6 BANNER ENGINEERING

TABLE 266 BANNER ENGINEERING: BUSINESS OVERVIEW

TABLE 267 BANNER ENGINEERING: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 268 BANNER ENGINEERING: PRODUCT LAUNCHES

12.1.7 NATIONAL INSTRUMENTS

TABLE 269 NATIONAL INSTRUMENTS: BUSINESS OVERVIEW

FIGURE 47 NATIONAL INSTRUMENTS: COMPANY SNAPSHOT, 2020

TABLE 270 NATIONAL INSTRUMENTS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 271 NATIONAL INSTRUMENTS: PRODUCT LAUNCHES

TABLE 272 NATIONAL INSTRUMENTS: DEALS

12.1.8 SKF

TABLE 273 SKF: BUSINESS OVERVIEW

FIGURE 48 SKF: COMPANY SNAPSHOT, 2020

TABLE 274 SKF: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 275 SKF: PRODUCT LAUNCHES

TABLE 276 SKF: DEALS

TABLE 277 SKF: OTHERS

12.1.9 EMERSON

TABLE 278 EMERSON: BUSINESS OVERVIEW

FIGURE 49 EMERSON: COMPANY SNAPSHOT, 2020

TABLE 279 EMERSON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 280 EMERSON: PRODUCT LAUNCHES

12.1.10 ROCKWELL AUTOMATION

TABLE 281 ROCKWELL AUTOMATION: BUSINESS OVERVIEW

FIGURE 50 ROCKWELL AUTOMATION: COMPANY SNAPSHOT, 2020

TABLE 282 ROCKWELL AUTOMATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 283 ROCKWELL AUTOMATION: DEALS

12.1.11 QUALITROL

TABLE 284 QUALITROL: BUSINESS OVERVIEW

TABLE 285 QUALITROL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

12.1.12 WEG

TABLE 286 WEG: BUSINESS OVERVIEW

FIGURE 51 WEG: COMPANY SNAPSHOT, 2020

TABLE 287 WEG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 288 WEG: PRODUCT LAUNCHES

TABLE 289 WEG: DEALS

TABLE 290 WEG: OTHERS

12.1.13 MITSUBISHI ELECTRIC

TABLE 291 MITSUBISHI ELECTRIC: BUSINESS OVERVIEW

FIGURE 52 MITSUBISHI ELECTRIC: COMPANY SNAPSHOT, 2020

TABLE 292 MITSUBISHI ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 293 MITSUBISHI ELECTRIC: PRODUCT LAUNCHES

TABLE 294 MITSUBISHI ELECTRIC: DEALS

TABLE 295 MITSUBISHI ELECTRIC

12.1.14 EATON

TABLE 296 EATON: BUSINESS OVERVIEW

FIGURE 53 EATON: COMPANY SNAPSHOT, 2020

TABLE 297 EATON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 298 EATON: PRODUCT LAUNCHES

TABLE 299 EATON: OTHERS

12.1.15 ADVANTECH

TABLE 300 ADVANTECH: BUSINESS OVERVIEW

FIGURE 54 ADVANTECH: COMPANY SNAPSHOT, 2020

TABLE 301 ADVANTECH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 302 ADVANTECH: PRODUCT LAUNCHES

TABLE 303 ADVANTECH: DEALS

12.2 OTHER PLAYERS

12.2.1 DYNAPAR

12.2.2 KCF TECHNOLOGIES

12.2.3 PHOENIX CONTACT

12.2.4 ALLIED RELIABILITY

12.2.5 KONÈAR– ELECTRICAL ENGINEERING INSTITUTE

*Details on Business and financial overview, Products/solutions/services offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 308)

13.1 INSIGHTS OF INDUSTRY EXPERTS

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.4 AVAILABLE CUSTOMIZATIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

This study involved major activities in estimating the current size of the motor monitoring market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and market sizing with industry experts across the value chain through primary research. Country-wise analysis were used to estimate the total market size. After that, the market breakdown and data triangulation were done to estimate the market size of the segments and sub-segments.

Secondary Research

This research study involved the use of extensive secondary sources, directories, and databases, such as Hoover’s, Bloomberg BusinessWeek, Factiva, and OneSource, to identify and collect information useful for a technical, market-oriented, and commercial study of the global power analyzer market. The other secondary sources included press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

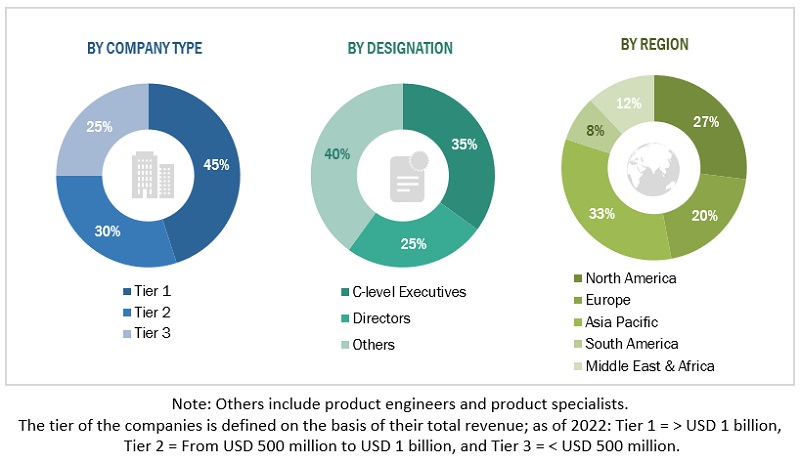

Primary Research

The motor monitoring market comprises several stakeholders, such as product manufacturers, service providers, distributors, and end-users in the supply chain. The demand-side of this market is characterized by its various end-user industries. Moreover, the demand is also driven by the rising demand of increasing energy saving and improving efficiency across every industry. The supply side is characterized by rising demand for contracts from the end user industries, and new product launches. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents is given below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the motor monitoring market ecosystem.

Report Objectives

- To define, describe, and forecast the size of the motor monitoring market by deployment, offering, monitoring process, and end user.

- To estimate and forecast the global motor monitoring market for various segments with respect to 5 main regions, namely, North America, Europe, South America, Middle East & Africa, and Asia Pacific (APAC) in terms of value

- To provide detailed information regarding the drivers, restraints, opportunities, and industry-specific challenges that influence the market growth

- To provide a detailed overview of the motor monitoring value chain, along with industry trends, use cases, security standards, and Porter’s five forces

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contribution to the total market

- To analyze the opportunities in the market for stakeholders by identifying high-growth segments and detail the competitive landscape for market players

- To strategically profile key players and comprehensively analyze their market rankings and core competencies2

- To analyze competitive developments, such as joint ventures, mergers and acquisitions, contracts, and agreements, and new product launches, in the motor monitoring market

- To benchmark players within the market using the proprietary competitive leadership mapping framework, which analyzes market players on various parameters within the broad categories of business strategy excellence and strength of product portfolio

- This report covers the motor monitoring market size in terms of value.

Available Customization

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company

Company Information

- Detailed analyses and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Motor Monitoring Market