Mulch Films Market by Type (Clear/Transparent, Black, Colored, and Degradable), Application (Agricultural Farms, and Horticulture), Element (LLDPE, LDPE, HDPE, EVA, PLA, and PHA), & by Region - Global Trends and Forecast to 2020

Market Segmentation

| Report Metrics | Details |

|

Market size available for years |

2015 - 2020 |

|

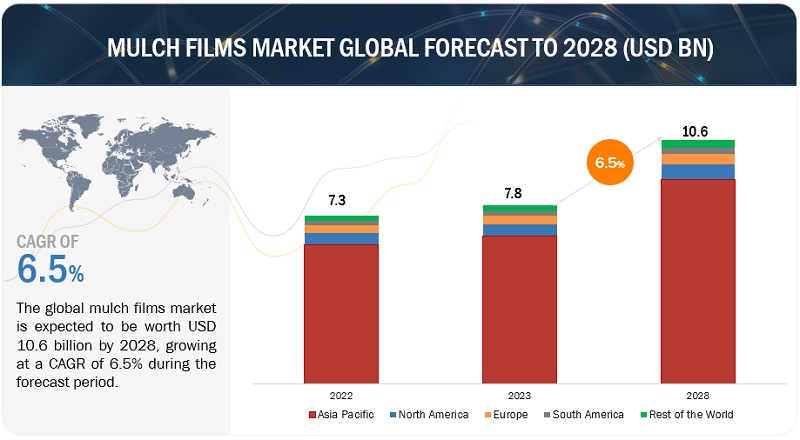

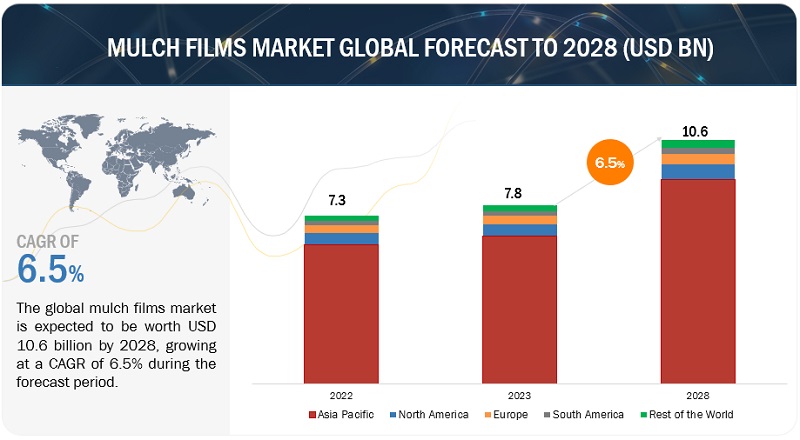

CAGR % |

6.5 |

Top 10 companies in Mulch Films Market

The mulch films market, in terms of value, is projected to reach USD 4.07 Billion by 2020, at a CAGR of around 6.5% from 2015 to 2020. The mulch film market is segmented on the basis of type, element, application, and region. The black mulch film segment is projected to account for the largest share in the market during the forecast period. The rise in population and the increase in the per capita income of consumers are some of the factors driving this market. Furthermore, market players are responding to these new opportunities of increasing crop output by expanding their global presence and product lines. The base year considered for this report is 2014 and the forecast period is from 2015 to 2020.

This research study involved the extensive usage of secondary sources to identify and collect information useful for this technical, market-oriented, and commercial study of the mulch films market. The primary sources were mainly several industry experts from core and related industries and preferred suppliers, manufacturers, distributors, service providers, technology developers, alliances, and standard organizations related to all the segments of this industry’s value chain. In-depth interviews have been conducted with various primary respondents, including key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants among other experts to obtain and verify critical qualitative and quantitative information as well as to assess future prospects.

To know about the assumptions considered for the study, download the pdf brochure

The target audience for the report includes:

- Raw material suppliers

- R&D institutes

- Technology providers

- Mulch film manufacturers/suppliers

- Plastic film manufacturers/suppliers/processors

- Intermediary suppliers

- Wholesalers

- Dealers

- Retailers

- End users

Get online access to the report on the World's First Market Intelligence Cloud

Request Sample Scope of the Report

:

This report categorizes the global market for mulch films on the basis of type, Application, Element, and Region.

- Market, by Type:

- Clear/Transparent

- Black

- Colored

- Degradable

- Others

- Market, by Application:

- Agricultural farms

- Horticulture

- Market, by Element:

- Linear low-density polyethylene (LLDPE)

- Low-density polyethylene (LDPE)

- High-density polyethylene(HDPE)

- Ethylene-vinyl acetate (EVA)

- Polylactic acid (PLA)

- Polyhydroxyalkanoate (PHA)

- Others

- Market, by Region:

- North America

- Europe

- Asia-Pacific

- Rest of the World (RoW)

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the client-specific scientific needs.

The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the Rest of Europe mulch films market into Turkey, Poland, the Netherlands, and Greece

- Further breakdown of the Rest of Asia-Pacific mulch films market into Indonesia, Myanmar, and Vietnam

- Further breakdown of the Rest of the World mulch films market into Paraguay, Uruguay, and Bolivia

Company Information

- Detailed analysis and profiling of additional market players (up to five)

The global mulch films market has grown exponentially in the last few years. The market size is projected to reach USD 4.07 Billion by 2020, at a CAGR of around 6.5% from 2015 to 2020. Emerging countries such as India and China are the primary targets of the industry. Factors such as increasing demand for food and growing population are the major driving factors for this market.

The market based on type is segmented into clear/transparent, black, colored, degradable, and others. Black mulch accounted for the largest market share and clear/transparent mulch is projected to grow at the highest CAGR during the forecast period due to demand for agricultural crops that has led to the need for higher crop yield. Clear/transparent mulches are transparent to infrared radiation of the sun which helps in keeping the farm soil warm and yields more crop output.

The mulch films market, based on element, is segmented into LLDPE, LDPE, HDPE, EVA, PLA PHA, and others. LLDPE accounted for the largest share of the mulch film market in 2014. LLDPE has a better performance as compared to LDPE and HDPE. The EVA segment is projected to grow with the highest CAGR from 2015 to 2020. EVA films have high flexibility and strong weatherability compared to PE films and PVC films which has led to the growth in demand for EVA. The rise in demand for plastic mulch films will lead to the growth of mulch films in the coming five years.

The market was dominated by the Asia-Pacific region in 2014. This region is also projected to be the fastest-growing market for the period considered. Economic growth, demand for food products, and increase in per capita income are some of the factors driving this market.

The mulch films market is characterized by moderate competition due to the presence of a number of large- and small-scale firms. New product launches, acquisitions, agreements, and expansions are the key strategies adopted by market players to ensure their growth in the market. The market is dominated by players such as BASF SE (Germany), The DOW Chemical Company (U.S.), Berry Plastics Group, Inc. (U.S.), AEP Industries Inc. (U.S.), and RKW Group (Germany). Other major players in the market are Al-Pack Enterprise Ltd (Canada), Armando Alvarz (Spain), Novamont (Italy), and British Polythene Industries Plc (U.K.). Environmental hazards caused due to plastics and high labor cost incurred by manufacturers to remove plastic mulch films after harvest are the restraints in the market.

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Units

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.2.1 Breakdown of Primaries

2.2 Factor Analysis

2.2.1 Introduction

2.2.2 Demand-Side Analysis

2.2.2.1 Rising Population

2.2.2.2 Growing Population and Urbanization

2.2.2.3 Water Scarcity: Leading to the Application of Mulch Films

2.2.2.4 Shrinking Arable Land

2.2.2.5 Global Focus on Increasing Agricultural Output

2.2.3 Supply-Side Analysis

2.2.3.1 Cost-Saving Degradable Mulch Films

2.3 Market Size Estimation

2.4 Market Breakdown & Data Triangulation

2.5 Research Assumptions

2.5.1 Assumptions

2.5.2 Limitations

3 Executive Summary (Page No. - 30)

4 Premium Insights (Page No. - 35)

4.1 Attractive Opportunities in the Market

4.2 Black Mulch Film: Leading Segment, By Type

4.3 LLDPE: Largest Market for the Next Five Years

4.4 Asia-Pacific: Fastest-Growing Mulch Films Market

4.5 Life Cycle Analysis, By Region

5 Market Overview (Page No. - 40)

5.1 Introduction

5.2 Evolution

5.3 Market Segmentation

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Adoption of Mulching Technology in Agriculture

5.4.1.2 Controlled Agriculture: Mulch Films in Greenhouses

5.4.1.3 Enhanced Use of Solar Energy to Control Crop Pests

5.4.1.4 Effective Water Use in Crop Cultivation

5.4.2 Restraints

5.4.2.1 High Cost of Installation

5.4.2.2 Adverse Effects of PLAstics on the Environment

5.4.3 Opportunities

5.4.3.1 Innovations in Mulch Films

5.4.3.2 Strong Progress in New and Emerging Markets

5.4.3.3 Increased Use of Degradable Films Globally

5.4.4 Challenges

5.4.4.1 Biodegradable Mulch Films: Crop Yield and Production Costs

5.5 Regulatory Framework

5.5.1 Introduction

5.5.2 North America

5.5.3 Europe

5.5.4 Asia-Pacific

6 Industry Trends (Page No. - 48)

6.1 Introduction

6.2 Market Trends & Insights

6.2.1 Clear/Transparent Films to Be the Fastest-Growing Segment

6.2.2 LLDPE Segment Dominated the Market in 2014

6.3 Value Chain Analysis

6.4 Supply Chain Analysis

6.5 Porter’s Five Forces Analysis

6.5.1 Intensity of Competitive Rivalry

6.5.2 Bargaining Power of Suppliers

6.5.3 Bargaining Power of Buyers

6.5.4 Threat of New Entrants

6.5.5 Threat of Substitutes

7 Mulch Films Market, By Type (Page No. - 56)

7.1 Introduction

7.2 Clear/Transparent

7.3 Black Mulch

7.4 Colored Mulch

7.5 Degradable Mulch

7.6 Others

8 Mulch Films Market, By Application (Page No. - 65)

8.1 Introduction

8.2 Agricultural Farms

8.3 Horticulture

9 Mulch Films Market, By Element (Page No. - 70)

9.1 Introduction

9.2 LLDPE

9.3 LDPE

9.4 HDPE

9.5 EVA

9.6 PLA

9.7 PHA

9.8 Others

10 Mulch Films Market, By Region (Page No. - 80)

10.1 Introduction

10.2 North America

10.2.1 U.S.

10.2.2 Canada

10.2.3 Mexico

10.2.4 Rest of North America

10.3 Europe

10.3.1 Italy

10.3.2 Germany

10.3.3 France

10.3.4 U.K.

10.3.5 Spain

10.3.6 Rest of Europe

10.4 Asia-Pacific

10.4.1 China

10.4.2 India

10.4.3 Japan

10.4.4 New Zealand

10.4.5 Rest of Asia-Pacific

10.5 Rest of the World (RoW)

10.5.1 Brazil

10.5.2 Africa

10.5.3 Others in RoW

11 Competitive Landscape (Page No. - 116)

11.1 Overview

11.2 Mulch Films: Growth Strategies, By Company

11.3 Competitive Situation & Trends

11.4 New Product Launches

11.5 Acquisitions & Mergers

11.6 Agreements

11.7 Expansions & Investments

12 Company Profiles (Page No. - 121)

(Overview, Financial*, Products & Services, Strategy, and Developments)

12.1 Introduction

12.2 BASF SE

12.3 Berry PLAstics Group Inc.

12.4 The DOW Chemical Company

12.5 RKW Group

12.6 AEP Industries Inc.

12.7 Armando Alvarez

12.8 Al-Pack Enterprises Ltd

12.9 Novamont

12.10 Ab Rani PLAst Oy

12.11 British Polythene Industries PLC

*Details Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 141)

13.1 Industry Insights From Experts

13.2 Discussion Guide

13.3 Introducing RT: Real-Time Market Intelligence

13.4 Available Customizations

13.5 Related Reports

List of Tables (92 Tables)

Table 1 Market Size, By Type, 2013-2020 (USD Million)

Table 2 Market Size, By Type, 2013-2020 (KT)

Table 3 Clear/Transparent: Mulch Films Market Size, By Region, 2013-2020 (USD Million)

Table 4 Clear/Transparent: Market Size, By Region, 2013-2020 (KT)

Table 5 Black: Mulch Films Market Size, By Region, 2013-2020 (USD Million)

Table 6 Black: Market Size, By Region, 2013-2020 (KT)

Table 7 Colored: Mulch Films Market Size, By Region, 2013-2020 (USD Million)

Table 8 Colored: Market Size, By Region, 2013-2020 (KT)

Table 9 Degradable: Mulch Films Market Size, By Region, 2013-2020 (USD Million)

Table 10 Degradable: Market Size, By Region, 2013-2020 (KT)

Table 11 Others: Mulch Films Market Size, By Region, 2013-2020 (USD Million)

Table 12 Others: Market Size, By Region, 2013-2020 (KT)

Table 13 Mulch Films Market Size, By Application, 2013–2020 (USD Million)

Table 14 Market Size, By Application, 2013–2020 (KT)

Table 15 Mulch Films in Agricultural Farms Market Size, By Region, 2013–2020 (USD Million)

Table 16 Mulch Films in Agricultural Farms Market Size, By Region, 2013–2020 (KT)

Table 17 Mulch Films in Horticulture Market Size, By Region, 2013–2020 (USD Million)

Table 18 Mulch Films in Horticulture Market Size, By Region, 2013–2020 (KT)

Table 19 Mulch Films Market Size, By Element, 2013-2020 (USD Million)

Table 20 Mulch Films Market Size, By Element, 2013-2020 (KT)

Table 21 LLDPE: Mulch Films Market Size, By Region, 2013-2020 (USD Million)

Table 22 LLDPE: Market Size, By Region, 2013-2020 (KT)

Table 23 LDPE: Mulch Films Market Size, By Region, 2013-2020 (USD Million)

Table 24 LDPE: Market Size, By Region, 2013-2020 (KT)

Table 25 HDPE: Mulch Films Market Size, By Region, 2013-2020 (USD Million)

Table 26 HDPE: Market Size, By Region, 2013-2020 (KT)

Table 27 EVA: Mulch Films Market Size, By Region, 2013-2020 (USD Million)

Table 28 EVA: Market Size, By Region, 2013-2020 (KT)

Table 29 PLA: Mulch Films Market Size, By Region, 2013-2020 (USD Million)

Table 30 PLA: Market Size, By Region, 2013-2020 (KT)

Table 31 PHA: Mulch Films Market Size, By Region, 2013-2020 (USD Million)

Table 32 PHA: Market Size, By Region, 2013-2020 (KT)

Table 33 Others: Mulch Films Market Size, By Region, 2013-2020 (USD Million)

Table 34 Others: Market Size, By Region, 2013-2020 (KT)

Table 35 Mulch Films Market Size, By Region, 2013-2020 (USD Million)

Table 36 Market Size, By Region, 2013-2020 (KT)

Table 37 North America: Mulch Films Market Size, By Country, 2013-2020 (USD Million)

Table 38 North America: Market Size, By Country, 2013-2020 (KT)

Table 39 North America: Market Size, By Type, 2013-2020 (USD Million)

Table 40 North America: Market Size, By Type, 2013-2020 (KT)

Table 41 U.S.: Mulch Films Market Size, By Type, 2013-2020 (USD Million)

Table 42 U.S.: Market Size, By Type, 2013-2020 (KT)

Table 43 Canada: Mulch Films Market Size, By Type, 2013-2020 (USD Million)

Table 44 Canada: Market Size, By Type, 2013-2020 (KT)

Table 45 Mexico: Mulch Films Market Size, By Type, 2013-2020 (USD Million)

Table 46 Mexico: Market Size, By Type, 2013-2020 (KT)

Table 47 Rest of North America: Mulch Films Market Size, By Type, 2013-2020 (USD Million)

Table 48 Rest of North America: Market Size, By Type, 2013-2020 (KT)

Table 49 Europe: Mulch Films Market Size, By Country, 2013-2020 (USD Million)

Table 50 Europe: Market Size, By Country, 2013-2020 (KT)

Table 51 Europe: Market Size, By Type, 2013-2020 (USD Million)

Table 52 Europe: Market Size, By Type, 2013-2020 (KT)

Table 53 Italy: Mulch Films Market Size, By Type, 2013-2020 (USD Million)

Table 54 Italy: Market Size, By Type, 2013-2020 (KT)

Table 55 Germany: Mulch Films Market Size, By Type, 2013-2020 (USD Million)

Table 56 Germany: Market Size, By Type, 2013-2020 (KT)

Table 57 France: Mulch Films Market Size, By Type, 2013-2020 (USD Million)

Table 58 France: Market Size, By Type, 2013-2020 (KT)

Table 59 U.K.: Mulch Films Market Size, By Type, 2013-2020 (USD Million)

Table 60 U.K.: Market Size, By Type, 2013-2020 (KT)

Table 61 Spain: Mulch Films Market Size, By Type, 2013-2020 (USD Million)

Table 62 Spain: Market Size, By Type, 2013-2020 (KT)

Table 63 Rest of Europe: Mulch Films Market Size, By Type, 2013-2020 (USD Million)

Table 64 Rest of Europe: Market Size, By Type, 2013-2020 (KT)

Table 65 Asia-Pacific: Mulch Films Market Size, By Country, 2013-2020 (USD Million)

Table 66 Asia-Pacific: Market Size, By Country, 2013-2020 (KT)

Table 67 Asia-Pacific: Market Size, By Type, 2013-2020 (USD Million)

Table 68 Asia-Pacific: Market Size, By Type, 2013-2020 (KT)

Table 69 China: Mulch Films Market Size, By Type, 2013-2020 (USD Million)

Table 70 China: Market Size, By Type, 2013-2020 (KT)

Table 71 India: Mulch Films Market Size, By Type, 2013-2020 (USD Million)

Table 72 India: Market Size, By Type, 2013-2020 (KT)

Table 73 Japan: Mulch Films Market Size, By Type, 2013-2020 (USD Million)

Table 74 Japan: Market Size, By Type, 2013-2020 (KT)

Table 75 New Zealand: Mulch Films Market Size, By Type, 2013-2020 (USD Million)

Table 76 New Zealand: Market Size, By Type, 2013-2020 (KT)

Table 77 Rest of Asia-Pacific: Mulch Films Market Size, By Type, 2013-2020 (USD Million)

Table 78 Rest of Asia-Pacific: Market Size, By Type, 2013-2020 (KT)

Table 79 RoW: Mulch Films Market Size, By Country, 2013-2020 (USD Million)

Table 80 RoW: Market Size, By Country, 2013-2020 (KT)

Table 81 RoW: Market Size, By Type, 2013-2020 (USD Million)

Table 82 RoW: Market Size, By Type, 2013-2020 (KT)

Table 83 Brazil: Mulch Films Market Size, By Type, 2013-2020 (USD Million)

Table 84 Brazil: Market Size, By Type, 2013-2020 (KT)

Table 85 Africa: Mulch Films Market Size, By Type, 2013-2020 (USD Million)

Table 86 Africa: Market Size, By Type, 2013-2020 (KT)

Table 87 Others in RoW: Mulch Films Market Size, By Type, 2013-2020 (USD Million)

Table 88 Others in RoW: Market Size, By Type, 2013-2020 (KT)

Table 89 New Product Launches, 2012–2013

Table 90 Acquisitions & Mergers, 2012-2015

Table 91 Agreements, 2011

Table 92 Expansions & Investments, 2010-2016

List of Figures (47 Figures)

Figure 1 Market Segmentation

Figure 2 Mulch Films: Research Design

Figure 3 Global Population is Projected to Reach ~9.5 Billion By 2050

Figure 4 Global Population Dynamics: Rising Urban Population, 1950–2030 (%)

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Data Triangulation Methodology

Figure 8 Mulch Films Market Growth Trend (2015 vs 2020)

Figure 9 Mulch Films Market Snapshot (USD Million): EVA Segment is Projected to Grow Rapidly During Forecast Period (2015 vs 2020)

Figure 10 Black Mulch to Account for the Largest Share in the Market Through 2020

Figure 11 Agriculture Farms Segment to Be Valued Higher in Market Through 2020

Figure 12 Mulch Films Market Share (Value), By Region, 2014

Figure 13 Attractive Opportunities in Mulch Films Market, 2015–2020

Figure 14 Black Mulch is Projected to Be the Largest Segment (2015–2020)

Figure 15 EVA Segment is Projected to Be Fastest-Growing From 2015 to 2020

Figure 16 Agricultural Farms Segment Accounted for Largest Share in the Asia-Pacific Market, 2014

Figure 17 European Mulch Film Market is Matured

Figure 18 Evolution of Mulch Films Market

Figure 19 Market Segmentation

Figure 20 Adoption of Mulching Technology Drives the Market

Figure 21 Clear/Transparent Segment to Dominate the Market By 2020

Figure 22 LLDPE Segment is Projected to Account for the Maximum Share of the Market By 2020

Figure 23 Mulch Films Value Chain Analysis

Figure 24 Mulch Films Supply Chain Analysis

Figure 25 Porter’s Five Forces Analysis

Figure 26 Clear/Transparent Mulch Market to Witness Fastest Growth From 2015 to 2020 (USD Million)

Figure 27 Agricultural Farms Segment to See Faster Growth in the Market, 2015–2020 (USD Million)

Figure 28 LLDPE is Projected to Account for the Largest Market By 2020

Figure 29 Asia-Pacific Mulch Films Market to Witness Fastest Growth Between 2015 and 2020 (USD Million)

Figure 30 Regional Snapshot: Asia-Pacific to Be the Most Attractive Market for Mulch Films, 2015-2020

Figure 31 North America Mulch Films Market Snapshot: U.S. Accounted for the Largest Share, 2014

Figure 32 European Mulch Films Market: Italy Accounted for the Largest Share, 2014

Figure 33 Asia-Pacific Mulch Films Market Snapshot: China Accounted for the Largest Market Share (2014)

Figure 34 Expansions & Investments: Leading Approach of Key Companies

Figure 35 Expanding Revenue Base Through Expansions, 2011–2015

Figure 36 Expansions & Investments: the Key Strategy, 2011–2015

Figure 37 Geographic Revenue Mix of Top Mulch Films Manufacturers

Figure 38 BASF SE: Company Snapshot

Figure 39 BASF SE: SWOT Analysis

Figure 40 Berry PLAstics Group Inc.: Company Snapshot

Figure 41 Berry PLAstics Group Inc.: SWOT Analysis

Figure 42 The DOW Chemical Company: Company Snapshot

Figure 43 The DOW Chemical Company: SWOT Analysis

Figure 44 RKW Group: SWOT Analysis

Figure 45 AEP Industries Inc.: Company Snapshot

Figure 46 AEP Industries Inc.: SWOT Analysis

Figure 47 British Polythene Industries PLC: Company Snapshot

Growth opportunities and latent adjacency in Mulch Films Market