Commercial Touch Display Market by Product (Monitors, Signage Displays, POS Terminals, Open Frame Touchscreen Displays, and Medical Displays), Touch Technology, Resolution, Application, Size, Aspect Ratio, Industry, and Geography - Global Forecast to 2025

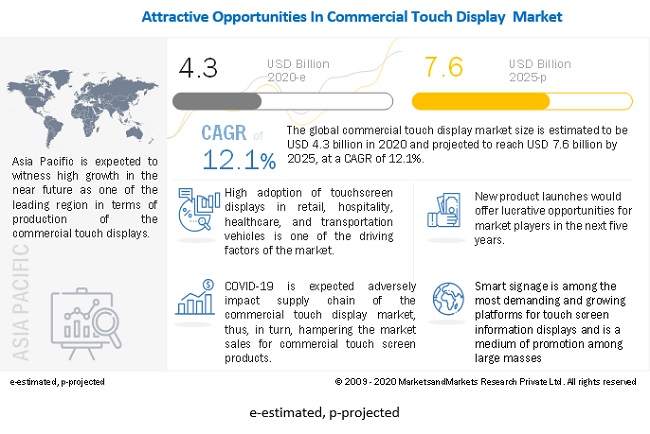

[194 Pages Report] The global commercial touch display market size was valued at USD 4.3 billion in 2020 and is projected to reach USD 7.6 billion by 2025. It is expected to grow at a CAGR of 12.1% during the forecast period.

High adoption of touchscreen displays in retail, hospitality, healthcare, and transportation verticals, dynamic nature of touchscreen displays leads to enhanced customer experience, and rapid adoption of technologically advanced, energy-efficient, attractive, and high-end-specification display products are the key driving factors for the commercial touch display market.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics:

Driver:Rapid adoption of technologically advanced, energy-efficient, attractive, and high-end specification display products

The touch screen display market has witnessed tremendous technological advancements in the past few years. Display devices have changed from being bulky, space-consuming equipment to slim, bezel-less gadgets. They now offer much higher resolutions, better contrast ratios, and consume lower power than that of traditional display devices. The competitive market has seen manufacturers launch products with attractive aesthetics and high-end specifications. Moreover, with the rising demand for touchscreen display products, there has been a huge reduction in the final price of various displays and technologies. Touchscreen display products such as kiosks, monitors, and signage solutions are in demand due to the declining prices of displays and touchscreen panels. Increased panel size and resolution have improved the overall performance of these displays and offer enhanced view. Thesea dvancements are expected to increase the demand for touch screen displays.

Restraint: Adverse impact of COVID-19

The COVID-19 pandemic has further accelerated in terms of intensity and expandedits reach globally. The suspension of business activity on account of the coronavirus pandemic, coupled with the cancellations of all sorts of activities where large number of people gather—from shopping malls to sporting events to conventions—has created uncertainties form any companies involved in unattended retailing. Moreover,coronavirus causes supply chain disruptions for manufacturers of touchscreen displays or kiosks as this virus gets spread easily by coming in contact with the affected people or material used by them. The widespread outbreak of COVID-19 has resulted in disruptions in global supply chains, border restrictions, and travel restrictions by government bodies. Stringent measures are resulting in a significant decline in global commercial activities, impacting the demand from the retail, transportation, hospitality, sports & entertainment sectors, as well as global economic growth, which is hampering the growth of the commercial touch display market.

Opportunity: Integration of artificial intelligence in touchscreen display devices

With rapid technological advancements, companies have started focusing more on providing a variety of additional features in touchscreen devices. Researchers associated with different companies focus on integrating new technologies in conventional touchscreen display devices, including kiosks, signage displays, medical devices, and outdoor touchscreens, to make them user-friendly and interactive. Artificial intelligence(AI) is one such technology that provides huge opportunities for the touchscreen display market to grow. AI-based touch screen devices can easily translate data from one language into other languages and capable of fetching user-specific data. Therefore, various companies focus on integrating AI in touchscreen display devices to witness accelerated demand for commercial touch display devices.

Challenge:Production of equipment that withstand all weather c onditions in outdoor applications

Touchscreen display devices used for outdoor applications have to be durable and should match environment conditions and requirements of the applications. They have to be adjustable in various lighting conditions with security glass having anti-reflective and ultraviolet(UV) filter so rcoatingtoguaranteeoptimalprotectionagainstsolarbeamsandmustalsoremainreadableinbrightsunlight. In case of supermarkets, they need to have high-end audio and video capabilities for promotional applications and should also be designed with anti-scratch coating so that it can be operated by untrained customers that are likely to use cards, keys, and other hard objects that could scratch the surface. Inregions with excessive snowfall or rainfall, interactive products need to have a fully ruggedized casing with standard powerful ventilation systems for protection against rain, dust, and very cold environments. Implementing such features would increase the product price and also the maintenance cost. Therefore, developing robust equipment is considered to be challenging for the commercial touch display providers.

Indoor application to account for a larger share of the commercial touc market by 2025

Indoor commercial displays are used at sports stadiums, indoor arenas, airports, bus/railstations, retail stores, schools, hotels, restaurants, and so on. They act as a communication media between the customer and the service providers to various industries. Indoor displays find significant use in healthcare, education, corporate and broadcast, and retail industries. The growth of the indoor displays is driven by the adoption of immersive and highly interactive display technologies in these industries.Indoor displays are generally based on LCD, OLED, or fine-pixel LED technology and require no additional protective features to make them waterproof and operational at high temperatures. Indoor menu boards of hotels and restaurants can be easily modified and updated by eliminating the costs of static menu boards. Interactive screens also influence customers’ purchase decisions. The use of indoor digital menu boards helps improve operational efficiency and customer experience

28-65 inches commercial touch displays to witness the highest CAGR in commercial touch display market during the forecast period

The market for 28–65” displays is expected to grow at the highest CAGR from 2020 to 2025 owing to the high demand from several educational institutes and government and corporate offices. These sectors use 28–65” touch displays to deliver presentations in boardrooms and trade shows and facilitate the understanding of the target audience and help them in making sound business decisions. These large-sized displays are very expensive. Hence, they are primarily used in industrial applications and in some niche applications. However, improved product performance and reduced cost are expected to open up new application areas for these displays in the corporate, educational, hospitality, and retail sectors during the forecast period.

Wide aspect ratio accounted for the largest market share in 2019

Displays with a wide aspect ratio is expected to dominate the commercial touch display market, interms of value and growth rate, owing to the increasing demand for wide-screen displays with higher resolution for better viewing experience. Providers of commercial touch displays are focusing on developing wide-screen displays to make viewing high-definition (HD) imagery an extremely robust experience, bringing life to the images that are displayed on a screen. Also, the 16:9 aspect ratio is optimized for the content having are solution of HD and above. Hence, to correctly experience the graphics on a computer game, a user must have an HD 16:9 wide-screen monitor. Similarly, using a wide screen, users can view more due to higher resolutions and larger viewable areas, helping maximize productivity. Also, wide-screen monitors tend to be very thin and can help free up space constrained in office spaces.

APAC to witness the highest CAGR in commercial touch display market during the forecast period

The commercial touch display market in APAC is expected to grow at the highest CAGR during the forecast period owing to the rapid growth of its retail industry and the shifting focus from product-centric to customer-centric approach due to increasing competition and changing customer behavior in high-potential markets such as China, Japan, South Korea, and India. The growth of this market can also be attributed to advancements in technology and the emergence of new use cases such as collaboration displays, smart mirrors, and smart signage in the region. The booming retail sector and long-term investments in infrastructure development in the region would further facilitate the adoption of touch displays in industries such as transportation, retail, sports & entertainment, and educationin APAC. Moreover, the economic growth in APAC is attracting more investments from display suppliers to set up new businesses. APAC is one of the potential markets providing growth opportunities for players offering commercial touch displays; as a result, many companies are planning to establish their facilities in this region.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Samsung Electronics (South Korea), Leyard Optoelectronics (Planar) (China), LG Electronics (South Korea), Innolux Corporation (Taiwan), and BOE Technology (China) are among the major players in the commercial touch display market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market Size Availability for Years |

2017–2025 |

|

Base Year |

2019 |

|

Forecast Period |

2020–2025 |

|

Forecast Units |

Value (USD) |

|

Segments Covered |

By product, touch technology, size, resolution, application, aspect ratio, industry, and region |

|

Geographies Covered |

North America, Europe, APAC, and RoW |

|

Companies Covered |

Samsung Electronics (South Korea), Leyard Optoelectronics (Planar) (China), LG Electronics (South Korea), Innolux Corporation (Taiwan), BOE Technology (China), Sharp (Foxconn) (Japan), NEC Corporation (Japan), Qisda Corp. (Taiwan), AU Optronics (Taiwan), and Panasonic (Japan). |

This research report categorizes the commercial touch display market, by product, touch technology, size, resolution, application, aspect ratio, industry, and region

Based on Product:

- Monitors

- Signage Displays

- Open Frame Touchscreen Displays

- PoS Terminals

- Medical Displays

Based on Touch Technology:

- Resistive

- Capacitive

- Surface Acoustic Wave

- Infrared

Based on the Application:

- Indoor

- Outdoor

Based on the Resolution:

- HD

- FHD

- 4K

Based on the Aspect Ratio:

- Wide

- Square

Based on the Size:

- 7-27”

- 28-65”

- >65”

Based on Industry:

- Retail, Hospitality, and BFSI

- Corporate

- Transportation

- Sports & Entertainment

- Healthcare

- Education

Based on the region

- North America

- Europe

- APAC

- RoW (South America, Middle East & Africa)

Recent Developments

- In March 2020, NEC Corporation and Sharp Corporation agreed to create a joint venture by combining NEC Display Solutions, Ltd. (NDS), a subsidiary of NEC, with Sharp, for the production and development of visual solutions. The Sharp–NEC joint venture will allow both the companies to build upon their strengths and address the visualization needs of their global customers.

- In March 2020, Elo partnered with Intuiface, a no-code platform provider dedicated to the creation, deployment, and analysis of interactive digital experiences for physical spaces. By combining Intuiface’s content delivery software with Elo’s touchscreen technology, agencies, integrators, and enterprises can create best-in-class interactive digital experiences rivalling the quality and innovation of custom software development projects.

- In January 2020, Samsung Electronics introduced the latest retail innovative solution to help brick and mortar retailers to reinvent the in-store experience of its customers, powered by its latest display solutions, mobile devices, and behavior-sensing technologies.

- January 2020, ViewSonic unveiled the latest line of the ELITE XG-Series of gaming monitors, including the 55-inch XG550, the 27-inch curved screen XG270QC, and the G-SYNC compatible 27-inch XG270. These 3 monitors come with ELITE Ally, a USB-connected touchscreen device that allows users to quickly access on-screen display settings.

- In November 2019, Leyard and Planar launched the Planar VS Series, a full-featured series of rental and staging LED video wall displays built for easy assembly and transport, adaptability to diverse environments and fast serviceability.

Frequently Asked Questions (FAQ):

Which are the major companies in the commercial touch display market? What are their major strategies to strengthen their market presence?

The major companies in the commercial touch display market are - Samsung Electronics (South Korea), Leyard Optoelectronics (Planar) (China), LG Electronics (South Korea), Innolux Corporation (Taiwan), BOE Technology (China. Players in this market have adopted product launches and developments, expansions, acquisitions, and agreements strategies to increase their market share.

Which is the potential market for commercial touch display market in terms of the region?

The commercial touch display market in APAC is expected to grow at the highest CAGR during the forecast period owing to the rapid growth of its retail industry and the shifting focus from product-centric to customer-centric approach due to increasing competition and changing customer behavior in high-potential markets such as China, Japan, South Korea, and India. The growth of this market can also be attributed to advancements in technology and the emergence of new use cases such as collaboration displays, smart mirrors, and smart signage in the region. The booming retail sector and long-term investments in infrastructure development in the region would further facilitate the adoption of touch displays in industries such as transportation, retail, sports & entertainment, and educationin APAC.

What are the opportunities for new market entrants?

There are significant opportunities in the commercial touch display market such as growing smart signage applications, growth opportunity in retail, healthcare, and entertainment applications, integration of artificial intelligence in touchscreen display devices,and emerging use cases—collaboration displays and smart mirrors.

Which end-user industries are expected to drive the growth of the market in the next five years?

The retail, hospitality, and BFSI industry is expected to continue to hold the largest share of the market for commercial touch displays. These displays are increasingly being adopted in retail stores to provide product information and buyers can purchase these products without visiting a retail store.They also provide in-store product information and promotional displays of products and services to attract customers. These activities help improve the brand loyalty of customers as the products are easily available with complete information.

Which products is expected to hold the largest share of the market by 2025?

Open frame touchscreen displays accounted for the largest share of the commercial touch display market in 2019, and a similar trendis likely to be observed in the coming years owing to the high demand for these products to install at several places, such as retail stores, airports, hospitals, school campuses, government offices, and entertainment places. These displays are used for various functions, such as ticketing,food vending, cash dispensing,and check-in. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

1 INTRODUCTION

1.1 STUDY OBJECTIVES

1.2 DEFINITION

1.3 STUDY SCOPE

FIGURE 1 COMMERCIAL TOUCH DISPLAY MARKET SEGMENTATION

FIGURE 2 YEARS CONSIDERED

1.4 CURRENCY

1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

2.1 RESEARCH DATA

FIGURE 3 RESEARCH DESIGN

2.1.1 SECONDARY DATA

FIGURE 4 KEY DATA FROM SECONDARY SOURCES

2.1.2 PRIMARY DATA

FIGURE 5 KEY DATA FROM PRIMARY SOURCES

2.2 MARKET SIZE ESTIMATION

FIGURE 6 BOTTOM-UP APPROACH

FIGURE 7 TOP-DOWN APPROACH

FIGURE 8 MARKET SIZE ESTIMATION

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 9 MARKET BREAKDOWN

2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 10 RESEARCH STUDY ASSUMPTION

3 EXECUTIVE SUMMARY

FIGURE 11 COMMERCIAL TOUCH DISPLAY MARKET, 2017–2025 (USD BILLION)

FIGURE 12 ANALYSIS OF PRE-AND POST-COVID-19 IMPACT ON COMMERCIAL TOUCH DISPLAY MARKET

3.1 REALISTIC SCENARIO

3.2 PESSIMISTIC SCENARIO

3.3 REALISTIC SCENARIO

FIGURE 13 MARKET, BY PRODUCT

FIGURE 14 MARKET, BY TOUCH TECHNOLOGY

FIGURE 15 MARKET, BY APPLICATION

FIGURE 16 MARKET, BY SIZE

FIGURE 17 MARKET, BY RESOLUTION

FIGURE 18 MARKET, BY INDUSTRY

FIGURE 19 MARKET, BY ASPECT RATIO

FIGURE 20 COMMERCIAL TOUCH DISPLAY MARKET, BY REGION

4 MARKET OVERVIEW

4.1 DRIVERS

4.2 OPPORTUNITIES

4.3 RESTRAINTS

4.4 CHALLENGES

5 INDUSTRY TRENDS

5.1 VALUE CHAIN ANALYSIS

FIGURE 21 VALUE CHAIN OF COMMERCIAL TOUCH DISPLAY ECOSYSTEM

5.2 INDUSTRY TRENDS

6 OPERATING SYSTEM TRENDS

FIGURE 22 OPERATING SYSTEM MARKET SHARE

6.1 LINUX OPERATING SYSTEM

6.2 WINDOWS OPERATING SYSTEM

6.3 ANDROID OPERATING SYSTEM

TABLE 1 ADOPTION ANALYSIS

7 TOUCH DISPLAY MARKET, BY PRODUCT

7.1 INTRODUCTION

FIGURE 23 COMMERCIAL TOUCH DISPLAY MARKET, BY PRODUCT, 2017–2025 (USD MILLION)

7.2 MONITORS

FIGURE 24 COMMERCIAL TOUCH DISPLAY MARKET FOR MONITORS, 2017–2025 (USD MILLION)

TABLE 2 MARKET FOR MONITORS, BY INDUSTRY, 2017–2025 (USD MILLION)

TABLE 3 MARKET FOR MONITORS, BY REGION, 2017–2025 (USD MILLION)

TABLE 4 COMMERCIAL TOUCH DISPLAY MARKET FOR MONITORS, BY TOUCH TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 5 MARKET FOR MONITORS, BY RESOLUTION, 2017–2025 (USD MILLION)

TABLE 6 MARKET FOR MONITORS, BY SIZE, 2017–2025 (USD MILLION)

TABLE 7 MARKET FOR MONITORS, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 8 MARKET FOR MONITORS, BY ASPECT RATIO, 2017–2025 (USD MILLION)

7.3 SIGNAGE DISPLAYS

FIGURE 25 COMMERCIAL TOUCH DISPLAY MARKET FOR SIGNAGE DISPLAYS, 2017–2025 (USD MILLION)

TABLE 9 MARKET FOR SIGNAGE DISPLAYS, BY INDUSTRY, 2017–2025 (USD MILLION)

TABLE 10 MARKET FOR SIGNAGE DISPLAYS, BY REGION, 2017–2025 (USD MILLION)

TABLE 11 MARKET FOR SIGNAGE DISPLAYS, BY TOUCH TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 12 MARKET FOR SIGNAGE DISPLAYS,BY RESOLUTION, 2017–2025 (USD MILLION)

TABLE 13 MARKET FOR SIGNAGE DISPLAYS, BY SIZE, 2017–2025 (USD MILLION)

TABLE 14 MARKET FOR SIGNAGE DISPLAYS, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 15 MARKET FOR SIGNAGE DISPLAYS, BY ASPECT RATIO, 2017–2025 (USD MILLION)

7.4 POS TERMINALS

FIGURE 26 MARKET FOR POS TERMINALS, 2017–2025 (USD MILLION)

TABLE 16 MARKET FOR POS TERMINALS, BY INDUSTRY, 2017–2025 (USD MILLION)

TABLE 17 MARKET FOR POS TERMINALS, BY REGION, 2017–2025 (USD MILLION)

TABLE 18 MARKET FOR POS TERMINALS, BY TOUCH TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 19 MARKET FOR POS TERMINALS, BY RESOLUTION, 2017–2025 (USD MILLION)

TABLE 20 MARKET FOR POS TERMINALS, BY SIZE, 2017–2025 (USD MILLION)

TABLE 21 MARKET FOR POS TERMINALS,BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 22 MARKET FOR POS TERMINALS, BY ASPECT RATIO, 2017–2025 (USD MILLION)

7.5 OPEN FRAME TOUCHSCREEN DISPLAYS

FIGURE 27 MARKET FOR OPEN FRAME TOUCHSCREEN DISPLAYS, 2017–2025 (USD MILLION)

TABLE 23 MARKET FOR OPEN FRAME TOUCHSCREEN DISPLAYS, BY INDUSTRY, 2017–2025 (USD MILLION)

TABLE 24 MARKET FOR OPEN FRAME TOUCHSCREEN DISPLAYS, BY REGION, 2017–2025 (USD MILLION)

TABLE 25 MARKET FOR OPEN FRAME TOUCHSCREEN DISPLAYS, BY TOUCH TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 26 MARKET FOR OPEN FRAME TOUCHSCREEN DISPLAYS, BY RESOLUTION, 2017–2025 (USD MILLION)

TABLE 27 MARKET FOR OPEN FRAME TOUCHSCREEN DISPLAYS, BY SIZE, 2017–2025 (USD MILLION)

TABLE 28 MARKET FOR OPEN FRAME TOUCHSCREEN DISPLAYS, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 29 MARKET FOR OPEN FRAME TOUCHSCREEN DISPLAYS, BY ASPECT RATIO, 2017–2025 (USD MILLION)

7.6 MEDICAL DISPLAYS

FIGURE 28 MARKET FOR MEDICAL DISPLAYS, 2017–2025 (USD MILLION)

TABLE 30 MARKET FOR MEDICAL DISPLAYS, BY INDUSTRY, 2017–2025 (USD MILLION)

TABLE 31 MARKET FOR MEDICAL DISPLAYS, BY REGION, 2017–2025 (USD MILLION)

TABLE 32 MARKET FOR MEDICAL DISPLAYS, BY TOUCH TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 33 COMMERCIAL TOUCH DISPLAY MARKET FOR MEDICAL DISPLAYS, BY RESOLUTION, 2017–2025 (USD MILLION)

TABLE 34 MARKET FOR MEDICAL DISPLAYS, BY SIZE, 2017–2025 (USD MILLION)

TABLE 35 MARKET FOR MEDICAL DISPLAYS, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 36 MARKET FOR MEDICAL DISPLAYS, BY ASPECT RATIO, 2017–2025 (USD MILLION)

8 TOUCH DISPLAY MARKET, BY ASPECT RATIO

8.1 INTRODUCTION

FIGURE 29 MARKET, BY ASPECT RATIO, 2017–2025 (USD MILLION)

8.2 WIDE

FIGURE 30 MARKET FOR WIDE ASPECT RATIO, 2017–2025 (USD MILLION)

TABLE 37 COMMERCIAL TOUCH DISPLAY MARKET FOR WIDE ASPECT RATIO, BY PRODUCT, 2017–2025 (USD MILLION)

8.3 SQUARE

FIGURE 31 MARKET FOR SQUARE ASPECT RATIO, 2017–2025 (USD MILLION)

TABLE 38 MARKET FOR SQUARE ASPECT RATIO, BY PRODUCT, 2017–2025 (USD MILLION)

9 TOUCH DISPLAY MARKET, BY TOUCH TECHNOLOGY

9.1 INTRODUCTION

FIGURE 32 MARKET, TOUCH TECHNOLOGY, 2017–2025 (USD MILLION)

9.2 RESISTIVE

FIGURE 33 MARKET FOR RESISTIVE TOUCH TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 39 MARKET FOR RESISTIVE TOUCH TECHNOLOGY, BY PRODUCT, 2017–2025 (USD MILLION)

9.3 CAPACITIVE

FIGURE 34 MARKET FOR CAPACITIVE TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 40 MARKET FOR CAPACITIVE TOUCH TECHNOLOGY, BY PRODUCT, 2017–2025 (USD MILLION)

9.4 SURFACE ACOUSTIC WAVE

FIGURE 35 MARKET FOR SURFACE ACOUSTIC WAVE TOUCH TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 41 MARKET FOR SURFACE ACOUSTIC WAVE TOUCH TECHNOLOGY, BY PRODUCT, 2017–2025 (USD MILLION)

9.5 INFRARED

FIGURE 36 MARKET FOR INFRARED TOUCH TECHNOLOGY, 2017–2025 (USD MILLION)

TABLE 42 MARKET FOR INFRARED TOUCH TECHNOLOGY, BY PRODUCT, 2017–2025 (USD MILLION)

10 TOUCH DISPLAY MARKET, BY RESOLUTION

10.1 INTRODUCTION

FIGURE 37 COMMERCIAL TOUCH DISPLAY MARKET, BY RESOLUTION, 2017–2025 (USD MILLION)

10.2 HD

FIGURE 38 HD COMMERCIAL TOUCH DISPLAY, 2017–2025 (USD MILLION)

TABLE 43 HD COMMERCIAL TOUCH DISPLAY, BY PRODUCT,2017–2025 (USD MILLION)

10.3 FHD

FIGURE 39 FHD COMMERCIAL TOUCH DISPLAY, 2017–2025 (USD MILLION)

TABLE 44 FHD COMMERCIAL TOUCH DISPLAY, BY PRODUCT, 2017–2025 (USD MILLION)

10.4 4K

FIGURE 40 4K COMMERCIAL TOUCH DISPLAY, 2017–2025 (USD MILLION)

TABLE 45 4K COMMERCIAL TOUCH DISPLAY, BY PRODUCT, 2017–2025 (USD MILLION)

11 TOUCH DISPLAY MARKET, BY APPLICATION

11.1 INTRODUCTION

FIGURE 41 MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

11.2 INDOOR

FIGURE 42 COMMERCIAL TOUCH DISPLAY MARKET FOR INDOOR APPLICATIONS, 2017–2025 (USD MILLION)

TABLE 46 MARKET FOR INDOOR APPLICATIONS, BY PRODUCT, 2017–2025 (USD MILLION)

11.3 OUTDOOR

FIGURE 43 MARKET FOR OUTDOOR APPLICATIONS, 2017–2025 (USD MILLION)

TABLE 47 MARKET FOR OUTDOOR APPLICATIONS, BY PRODUCT, 2017–2025 (USD MILLION)

12 TOUCH DISPLAY MARKET, BY SIZE

12.1 INTRODUCTION

FIGURE 44 MARKET, BY SIZE, 2017–2025 (USD MILLION)

12.2 7-27 INCHES

FIGURE 45 7–27-INCH COMMERCIAL TOUCH DISPLAY, 2017–2025 (USD MILLION)

TABLE 48 7–27-INCH COMMERCIAL TOUCH DISPLAY, BY PRODUCT, 2017–2025 (USD MILLION)

12.3 28-65 INCHES

FIGURE 46 28–65-INCH COMMERCIAL TOUCH DISPLAY, 2017–2025 (USD MILLION)

TABLE 49 28–65-INCH COMMERCIAL TOUCH DISPLAY, BY PRODUCT, 2017–2025 (USD MILLION)

12.4 ABOVE 65 INCHES

FIGURE 47 ABOVE 65-INCH COMMERCIAL TOUCH DISPLAY,2017–2025 (USD MILLION)

TABLE 50 ABOVE 65-INCH COMMERCIAL TOUCH DISPLAY MARKET, BY PRODUCT, 2017–2025 (USD MILLION)

13 TOUCH DISPLAY MARKET, BY INDUSTRY

13.1 INTRODUCTION

FIGURE 48 MARKET, BY INDUSTRY, 2017–2025 (USD MILLION)

13.2 RETAIL, HOSPITALITY, AND BFSI

FIGURE 49 MARKET FOR RETAIL, HOSPITALITY, AND BFSI INDUSTRY, 2017–2025 (USD MILLION)

TABLE 51 MARKET FOR RETAIL, HOSPITALITY, AND BFSI INDUSTRY, BY PRODUCT, 2017–2025 (USD MILLION)

13.3 TRANSPORTATION

FIGURE 50 MARKET FOR TRANSPORTATION INDUSTRY, 2017–2025 (USD MILLION)

TABLE 52 MARKET FOR TRANSPORTATION INDUSTRY, BY PRODUCT, 2017–2025 (USD MILLION)

13.4 HEALTHCARE

FIGURE 51 MARKET FOR HEALTHCARE INDUSTRY, 2017–2025 (USD MILLION)

TABLE 53 MARKET FOR HEALTHCARE INDUSTRY, BY PRODUCT, 2017–2025 (USD MILLION)

13.5 CORPORATE

FIGURE 52 MARKET FOR CORPORATE INDUSTRY, 2017–2025 (USD MILLION)

TABLE 54 MARKET FOR CORPORATE INDUSTRY, BY PRODUCT, 2017–2025 (USD MILLION)

13.6 SPORTS & ENTERTAINMENT

FIGURE 53 MARKET FOR SPORTS & ENTERTAINMENT INDUSTRY, 2017–2025 (USD MILLION)

TABLE 55 MARKET FOR SPORTS & ENTERTAINMENT INDUSTRY, BY PRODUCT, 2017–2025 (USD MILLION)

13.7 EDUCATION

FIGURE 54 MARKET FOR EDUCATION INDUSTRY, 2017–2025 (USD MILLION)

TABLE 56 MARKET FOR EDUCATION INDUSTRY, BY PRODUCT, 2017–2025 (USD MILLION)

14 GEOGRAPHIC ANALYSIS

14.1 GEOGRAPHIC SNAPSHOT

FIGURE 55 MARKET, BY REGION

FIGURE 56 COMMERCIAL TOUCH DISPLAY MARKET, BY REGION, 2017–2025 (USD MILLION)

14.2 NORTH AMERICA

FIGURE 57 MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 57 MARKET IN NORTH AMERICA, BY PRODUCT, 2017–2025 (USD MILLION)

14.3 EUROPE

FIGURE 58 MARKET IN EUROPE, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 58 MARKET IN EUROPE, BY PRODUCT, 2017–2025 (USD MILLION)

14.4 APAC

FIGURE 59 MARKET IN APAC, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 59 MARKET IN APAC, BY PRODUCT, 2017–2025 (USD MILLION)

14.5 ROW

FIGURE 60 MARKET IN ROW, BY REGION, 2017–2025 (USD MILLION)

TABLE 60 MARKET IN ROW, BY PRODUCT, 2017–2025 (USD MILLION)

15 COMPETITIVE LANDSCAPE

15.1 LEADING MARKET PLAYERS

FIGURE 61 COMMERCIAL TOUCH DISPLAY MARKET: LEADING PLAYERS

15.2 MARKET SHARE ANALYSIS

15.3 COMPETITIVE SITUATION AND TRENDS

FIGURE 62 MARKET: COMPETITIVE SITUATIONS AND TRENDS

FIGURE 63 MARKET: COMPETITIVE SITUATIONS AND TRENDS

15.4 COMPETITIVE LEADERSHIP MAPPING

15.4.1 VISIONARY LEADERS

15.4.2 DYNAMIC DIFFERENTIATORS

15.4.3 INNOVATORS

15.4.4 EMERGING COMPANIES

FIGURE 64 MARKET (GLOBAL) COMPETITIVE LEADERSHIP MAPPING, 2019

16 COMPANY PROFILES

16.1 SAMSUNG ELECTRONICS

FIGURE 65 SAMSUNG ELECTRONICS: COMPANY OVERVIEW

16.2 LEYARD OPTOELECTRONIC(PLANAR)

FIGURE 66 LEYARD OPTOELECTRONICS (PLANAR): COMPANY OVERVIEW

16.3 LG ELECTRONICS

FIGURE 67 LG ELECTRONICS: COMPANY OVERVIEW

16.4 SHARP(FOXCONN)

FIGURE 68 SHARP (FOXCONN): COMPANY OVERVIEW

16.5 NEC CORP.

FIGURE 69 NEC CORPORATION: COMPANY OVERVIEW

16.6 ELO TOUCH SOLUTIONS

FIGURE 70 ELO TOUCH SOLUTIONS: COMPANY OVERVIEW

16.7 VIEWSONIC

FIGURE 71 VIEWSONIC: COMPANY OVERVIEW

16.8 AU OPTRONICS

FIGURE 72 AU OPTRONICS: COMPANY OVERVIEW

16.9 INNOLUX

FIGURE 73 INNOLUX: COMPANY OVERVIEW

16.10 BOE TECHNOLOGY

FIGURE 74 BOE TECHNOLOGY: COMPANY OVERVIEW

16.11 OTHER KEY PLAYERS

16.11.1 PANASONIC

16.11.2 QISDA CORP

16.11.3 GESTURETEK

16.11.4 HORIZON DISPLAY

16.11.5 TIANMA MICROELECTRONICS

16.11.6 TRULY INTERNATIONAL

16.11.7 EGAN VISUAL

16.11.8 BAANTO INTERNATIONAL

16.11.9 CRYSTAL DISPLAY SYSTEMS

16.11.10 BARCO

17 APPENDIX

17.1 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

17.2 MARKETSANDMARKETS KNOWLEDGE STORE: SNAPSHOT

17.3 AUTHOR DETAILS

The study has involved four major activities in estimating the size of the commercial toouch display market. Exhaustive secondary research has been done to collect information on the market, the peer market, and the parent market. To validate these findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the total market size. After that, market breakdown and data triangulation methods have been used to estimate the market for segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg BusinessWeek, and Factiva have been referred to identify and collect information for this study. These secondary sources included annual reports, press releases and investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard and silver-standard websites, regulatory bodies, trade directories, and databases.

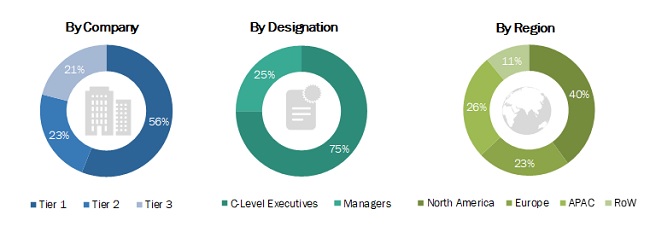

Primary Research

Extensive primary research has been conducted after understanding and analyzing the commercial touch display market through secondary research. Several primary interviews have been conducted with key opinion leaders from both the demand-side and supply-side vendors across four major regions—North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW). Various primary sources from both the supply and demand sides of the market have been interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents is as follows—

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the commercial touch display market. These methods have also been used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size is as follows:

- Key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- Revenue of various commercial touch display manufacturers is considered to arrive at global numbers.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size from the estimation process explained earlier, the global market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the commercial touch display market has been validated using both the top-down and bottom-up approaches.

Report Objectives

- To describe and forecast the commercial touch display market, by product, by touch technology, by application, by size, by resolution, by aspect ratio, by industry, and geography, in terms of value

- To describe and forecast the market for various segments with regard to 4 main regions—North America, Asia Pacific (APAC), Europe, Rest of the World (RoW), in terms of value

- To provide detailed information regarding drivers, restraints, opportunities, and challenges pertaining to the market

- To study a complete display value chain and analyze the current and future market trends

- To strategically analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments in the commercial touch display market

- To strategically profile key players, along with detailing the competitive landscape for market leaders

- To analyze strategic approaches in the market such as product launches and developments, acquisitions, collaborations, contracts, expansions, and partnerships

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information:

- Detailed analysis and profiling of additional market players based on various blocks of the value chain.

Growth opportunities and latent adjacency in Commercial Touch Display Market